SEPTEMBER-OCTOBER 2023 PARCELindustry.com HOW TO AVOID THE BIGGEST MISTAKES SHIPPERS MAKE. PAGE 20 MASTERING PEAK SEASON COSTS ACROSS THE ENTIRE SUPPLY CHAIN. PAGE 28 5 KEY STEPS FOR AN OPTIMAL WAREHOUSE SLOTTING STRATEGY. PAGE 24 25 BOOTHS TO STOP AND SEE AT PARCEL FORUM ‘23 PAGES 32-34 REGISTER TODAY! SEE YOU AT PARCEL FORUM IN NASHVILLE! MADMEN3 PRSRT STD US POSTAGE PAID MADMEN3 SEPTEMBER-OCTOBER 2023 PARCELindustry.com CLICKHERETOSUBSCRIBE

18 A VIEW FROM WASHINGTON: A FEW KEY POLICY ISSUES FACING PARCEL SHIPPERS IN THE 2024 ELECTION YEAR

By Andrew M. Danas

By Andrew M. Danas

20 THE BIGGEST MISTAKES SHIPPERS MAKE

By Josh Dunham

24 THE 5 STEPS TO AN OPTIMAL SLOTTING STRATEGY

By Sebastian Saunders

By Sebastian Saunders

28 PARCEL AND BEYOND: MASTERING PEAK SEASON COSTS ACROSS THE ENTIRE SUPPLY CHAIN

40 CARRIER MIX OPTIMIZATION — WHEN AND WHY IT’S WORTH IT (EVEN FOR SMBS!)

By Josh Taylor and Zareh Ambarsoom

By Josh Taylor and Zareh Ambarsoom

44 OPTIMIZING YOUR WAREHOUSE NETWORK: HOW TO SELECT THE RIGHT LOCATION

By Kelton Kosik

SPONSORED CONTENT

By Britain Pavlic,

Christian

Nixel, Tom Stretar, and Nate Rosier

30 IS AMAZON’S BUY WITH PRIME RIGHT FOR YOUR BUSINESS?

By Caleb Nelson

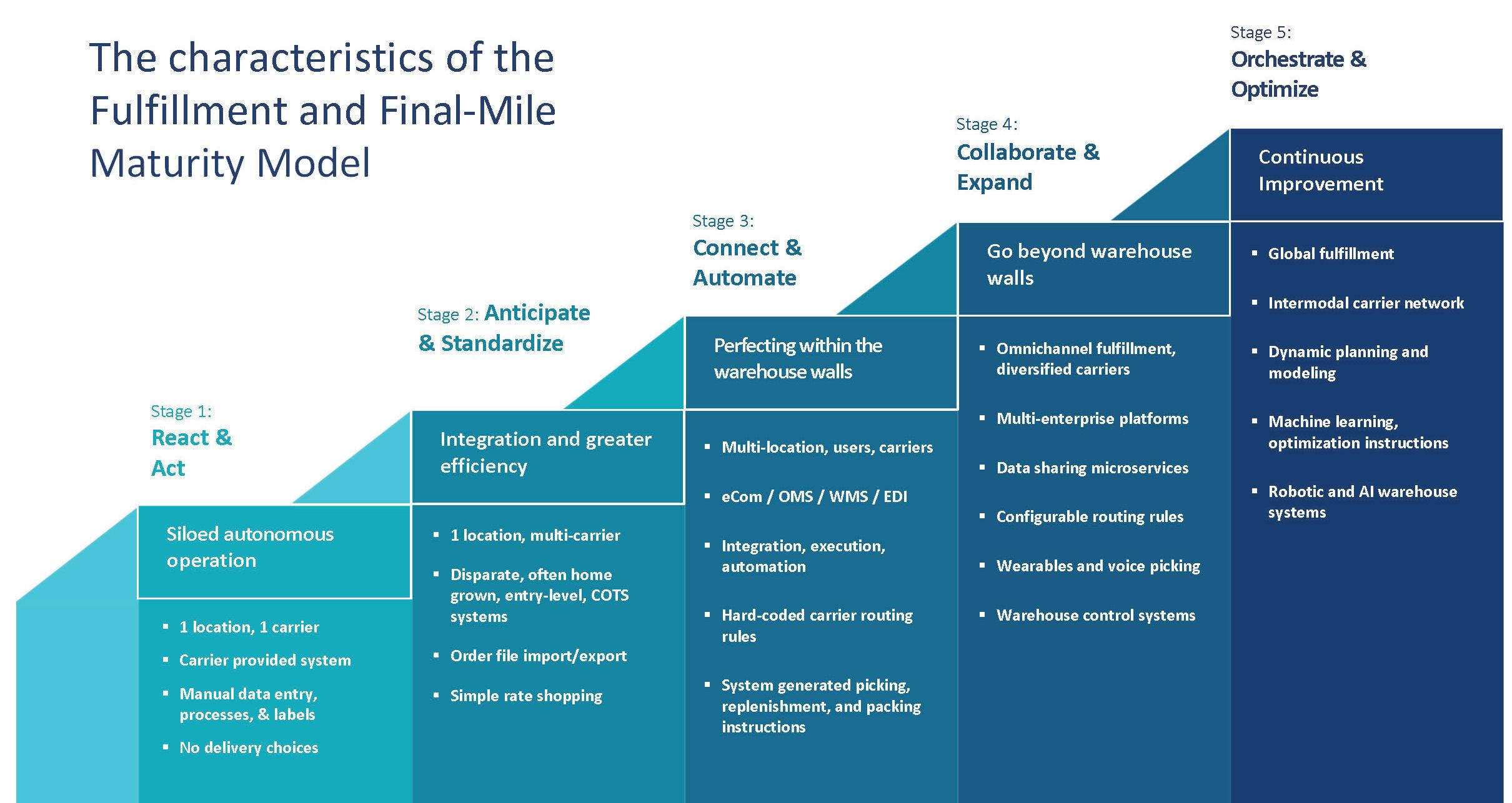

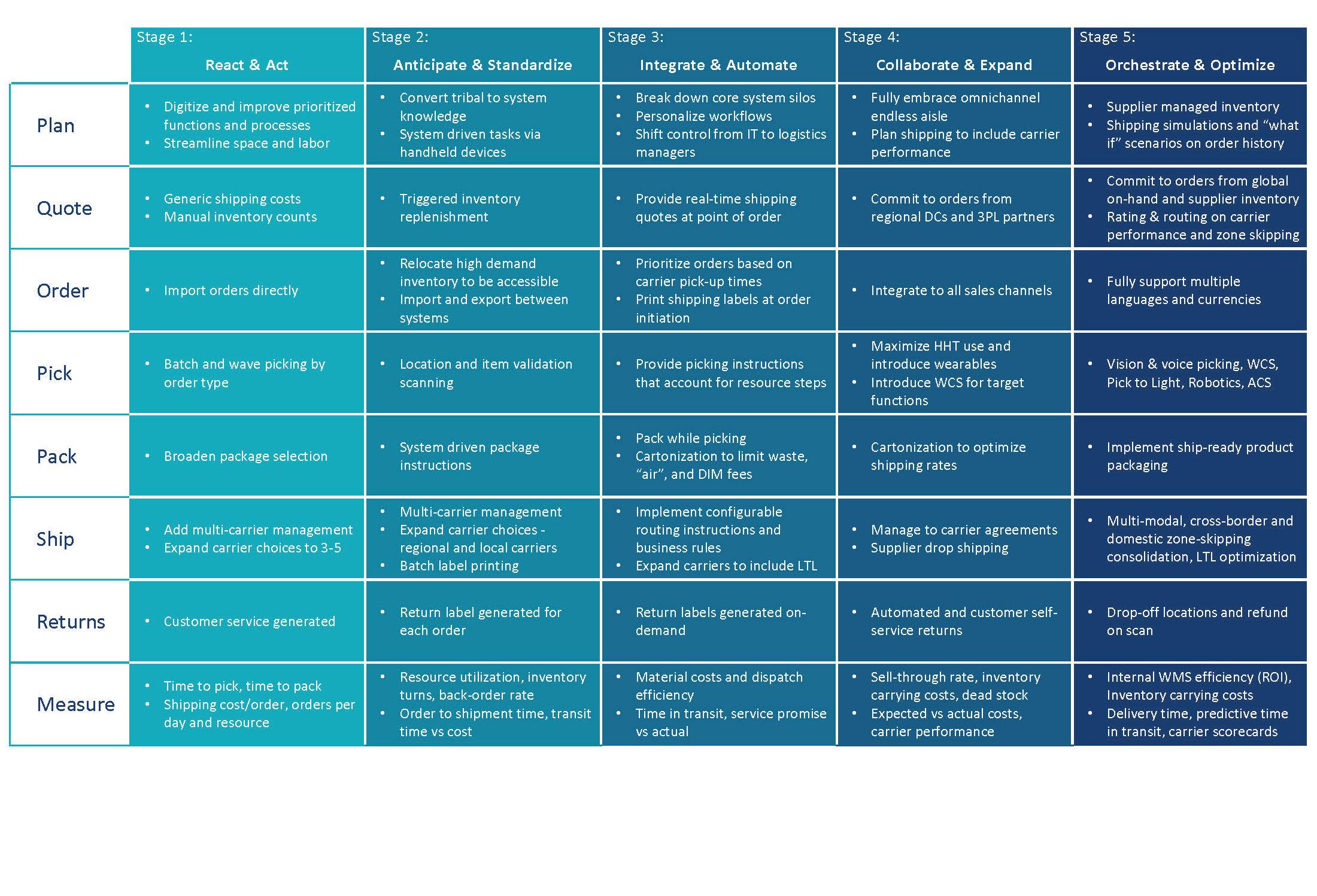

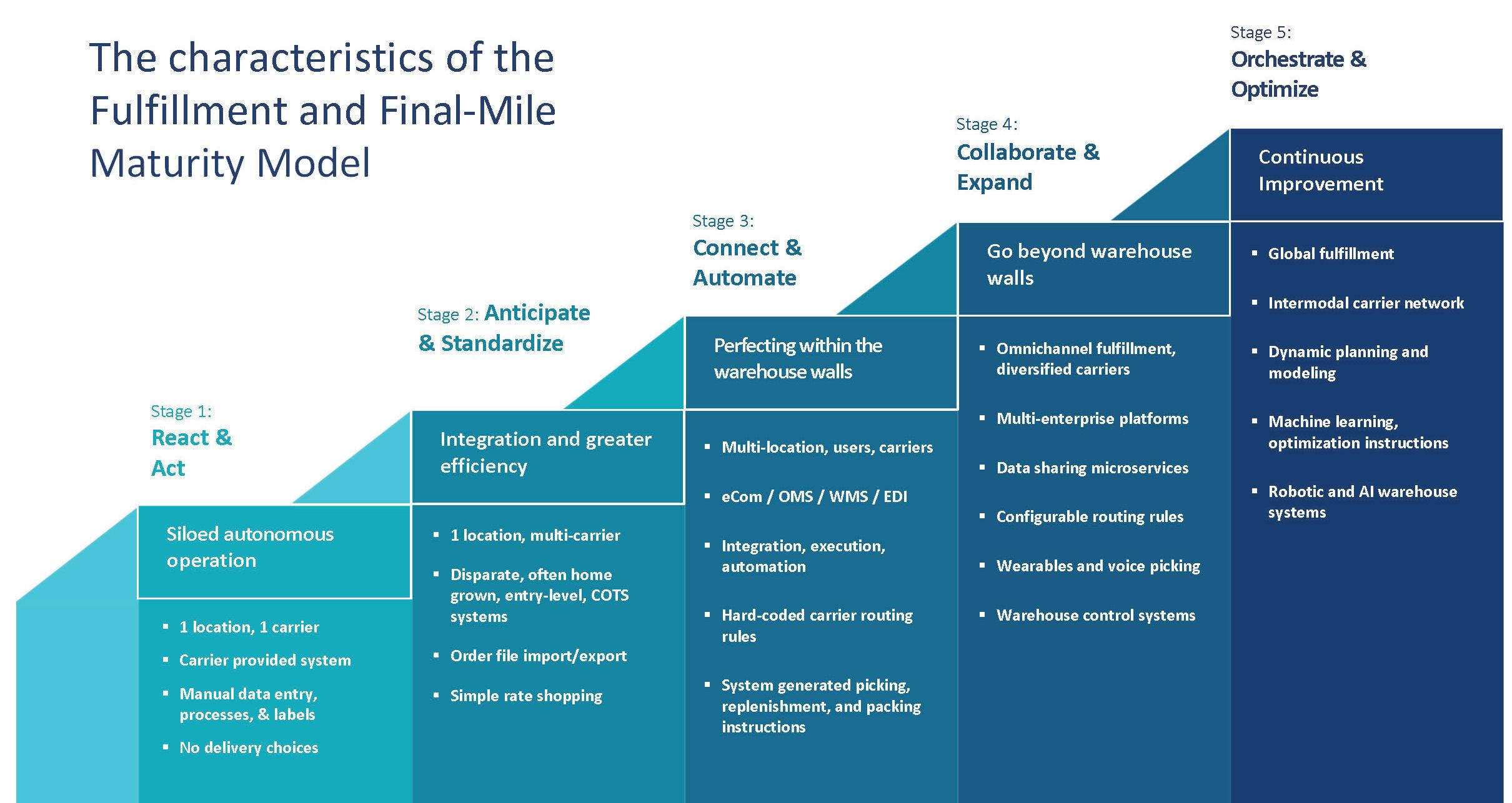

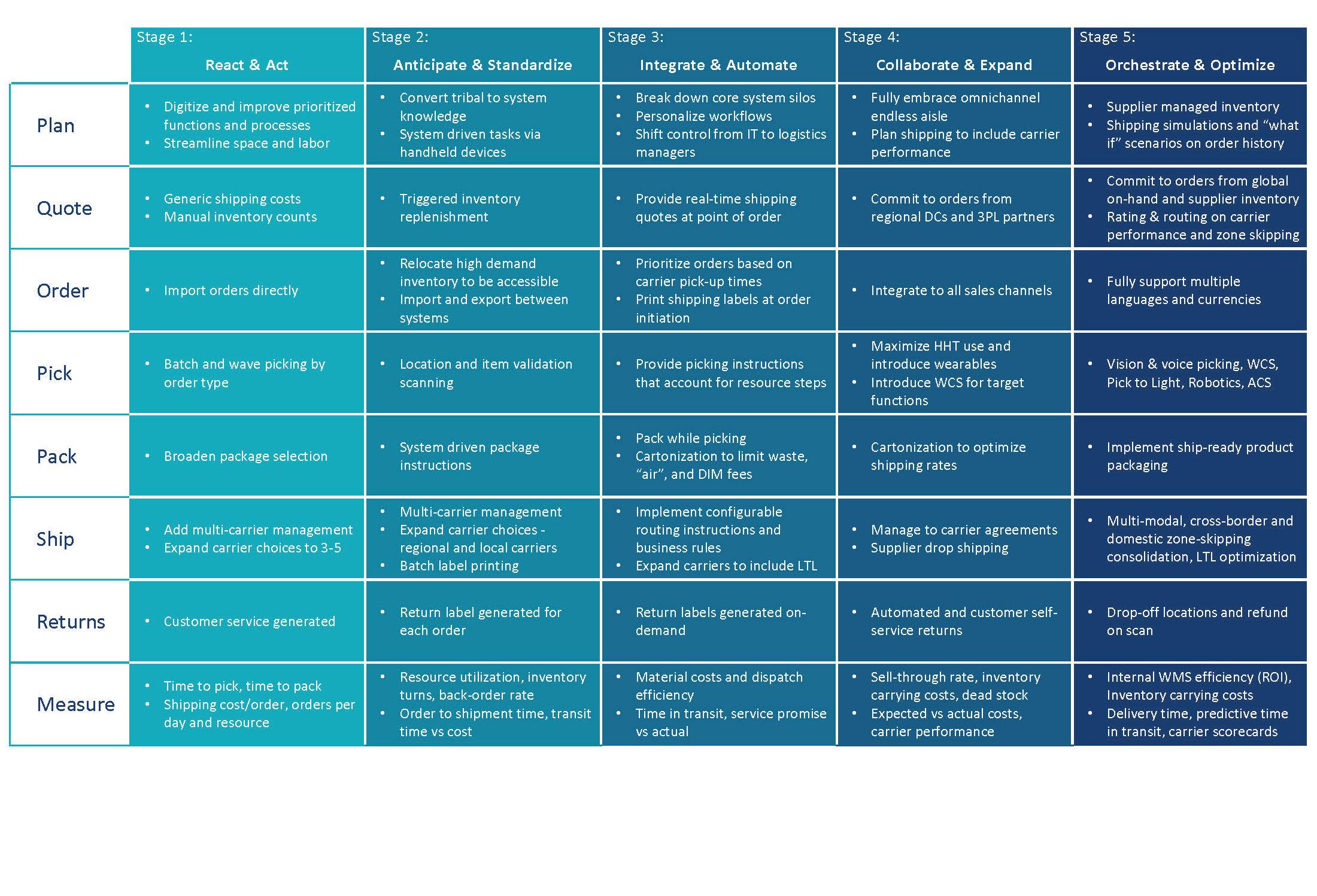

36 HOW A FULFILLMENT AND FINAL-MILE MATURITY MODEL CAN HELP ACHIEVE ORDER AND DELIVERY EXCELLENCE

By Mark Picarello

By Mark Picarello

15 PROTECTIVE AND EFFICIENT: PREVENTING TRANSIT PARCEL DAMAGE WITH RIGHT-SIZE AUTOMATED PACKAGING

32 STOP AND SEE AT PARCEL FORUM ‘23

20 18 24 28 40 /// CONTENTS Volume 30 | Issue 4 06 EDITOR’S NOTE Heading into Peak on a High Note By Amanda Armendariz 08 SUPPLY CHAIN SUCCESS Parcel Costs: Current Conditions and Future Expectations By

10 PARCEL COUNSEL Anatomy of a Lawsuit: How to Understand What a Lawyer Is Talking About By Brent Wm. Primus,

12 REVERSE LOGISTICS The Growth in ESG Reporting and What It Means to Reverse Logistics By Tony Sciarrotta 14 OPERATIONAL EFFICIENCIES You Don’t Know What You Don’t Know By Susan Rider 16 INDUSTRY INSIGHT Leveraging Machine Learning for Streamlined Supply Chains: A Game-Changer in the Era of Disruptions

Mark Taylor

JD

By Hannah Testani

GET OUR NEWSLETTER? SUBSCRIBE FOR FREE 4 PARCELindustry.com SEPTEMBER-OCTOBER 2023

PRESIDENT CHAD GRIEPENTROG

PUBLISHER KEN WADDELL EDITOR

AMANDA ARMENDARIZ [ amanda.c@rbpub.com ]

AUDIENCE DEVELOPMENT MANAGER RACHEL CHAPMAN [ rachel@rbpub.com ]

CREATIVE DIRECTOR KELLI COOKE

ADVERTISING KEN WADDELL (m) 608.235.2212 [ ken.w@rbpub.com ]

JOSH VOGT [ josh@rbpub.com ]

PARCEL (ISSN 1081-4035) is published 7 times a year by MadMen3. All material in this magazine is copyrighted 2023 © by MadMen3. All rights reserved. Nothing may be reproduced in whole or in part without written permission from the publisher. Any correspondence sent to PARCEL, MadMen3 or its staff becomes the property of MadMen3. The articles in this magazine represent the views of the authors and not those of MadMen3 or PARCEL. MadMen3 and/or PARCEL expressly disclaim any liability for the products or services sold or otherwise endorsed by advertisers or authors included in this magazine.

SUBSCRIPTIONS: Free to qualified recipients: $12 per year to all others in the United States. Subscription rate for Canada or Mexico is $35 for one year and for elsewhere outside of the United States is $55. Back-issue rate is $5.

Send subscriptions or change of address to: PARCEL, P.O. Box 259098 Madison WI 53725-9098

Allow six weeks for new subscriptions or address changes.

REPRINTS: For high-quality reprints, please contact our exclusive reprint provider, ReprintPros, 949.702.5390, www.ReprintPros.com.

P.O. Box 259098 Madison WI 53725-9098

p: 608.241.8777

f: 608.241.8666

PARCELindustry.com

SEPTEMBER-OCTOBER 2023 PARCELindustry.com 5 SUBSCRIBE FOR FREE!

HEADING INTO PEAK ON A HIGH NOTE

By Amanda Armendariz

overcome, as shippers will need to balance these new costs with customer expectations. Luckily, many of you who are reading this will also be attending our annual show, the PARCEL Forum, held this year in Nashville. This conference is one of the best ways for industry professionals like you to connect with peers and discuss how other shippers are handling increasing costs and ever-changing customer preferences. I’m so excited to see many of you there, and as you flip through this issue, you’ll notice that we have quite a few writers who are also speaking at the show. I hope that this gives both attendees and non-attendees alike a glimpse into what we cover at the forum, and you’ll see why, year after year, people say this is the must-attend event for anyone in the small-package industry.

EDITOR’S

PICK

Here are some of the most-read articles on our site in recent weeks. If you haven’t already checked them out, you might want to — there is some great information in there!

Don’t Put All Your Packages in One Truck

By Joe Wilkinson

By Joe Wilkinson

While preparing for peak season is always a bit stressful, to say the least, most of us are still feeling a lot more optimistic than we were when a UPS/Teamsters strike seemed to be a very real possibility. Thankfully, an agreement was reached, causing most of the parcel industry to breathe a collective sigh of relief.

Of course, once that initial euphoria wore off, it’s likely that the vast majority of us realized that while a strike was averted, UPS is going to attempt to recoup some of the costs this agreement will bring about. The easiest way to do that, of course, is to pass them on to shippers, who will, in turn, have to pass them on to consumers. So while we’re thankfully not facing a work stoppage at the busiest time of the year, there are still some challenges to

One quick note: we usually run our carrier satisfaction survey in this issue, but we had so much great content we simply couldn’t fit everything into 48 pages. However, I know this survey is a popular one with our readers, so don’t worry; we’ve pushed the results online. Simply visit PARCELindustry. com/2023CarrierSatisfactionSurvey for the full story.

As always, thanks for reading PARCEL, and I look forward to connecting with you in Nashville!

The Shift in FedEx’s Focus: Farewell to Lightweight Packages?

By Jack McCrum

By Jack McCrum

GRI Announcements: More Than Meets the Eye

By Mingshu Bates

6 PARCELindustry.com SEPTEMBER-OCTOBER 2023

EDITOR’S NOTE

SUBSCRIBE FOR FREE!

PARCEL COSTS: CURRENT CONDITIONS AND FUTURE EXPECTATIONS

By Mark Taylor

By Mark Taylor

The last three years have been a rollercoaster in our industry, with higher demand and costs than we have ever seen. So where are we now, and where are we going with parcel costs in the future?

There are several current factors that will impact us:

1. The US macro environment will drive costs up, as fuel and labor remain elevated. However, inflation is predicted to stabilize to near four percent.

2. The outcome of the UPS/Teamsters negotiation: Thankfully, an agreement between the Teamsters and UPS has been reached. But UPS’s cost to serve will increase; more concessions and higher wages in the contract mean more cost to UPS. The company’s focus on margin means that these costs will be passed on to shippers, and, ultimately, consumers.

3. FedEx’s operational changes: FedEx is combining its divided business units. These changes are meant to increase efficiency and decrease costs. However, that will not necessarily be passed on to shippers and, ultimately, consumers. FedEx will look towards these decreased costs

to improve margin.

4. The competitive environment: One downward force on parcel rates could be the competitive environment. The USPS is offering its Ground Advantage program, which will attract new volume. Amazon continues to move a larger percentage of its own volume, reducing its spend with UPS. There’s less overall volume to be had, so competition should increase.

Historical Trends

in Price

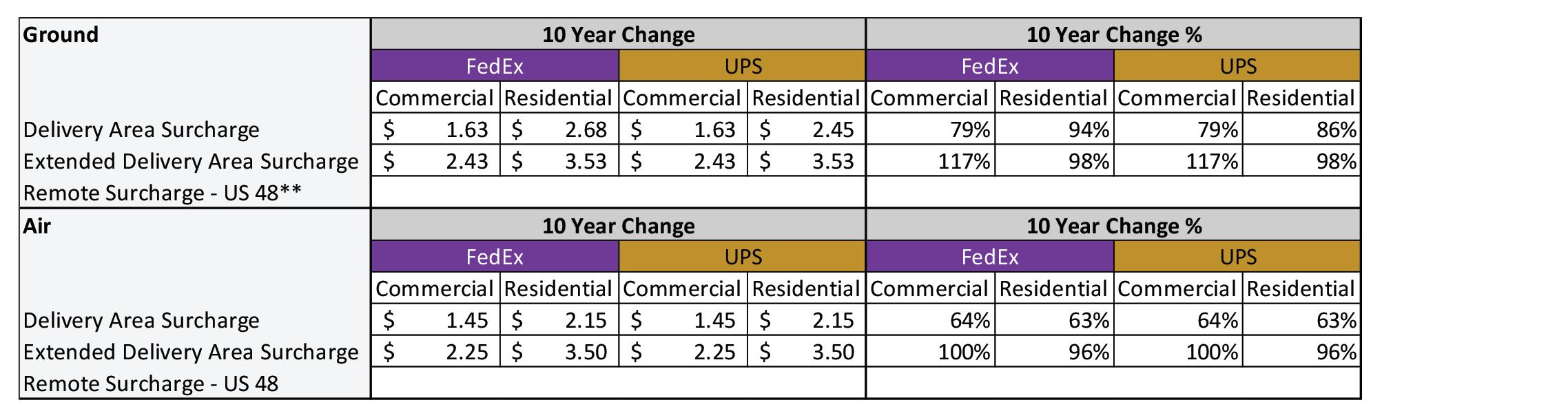

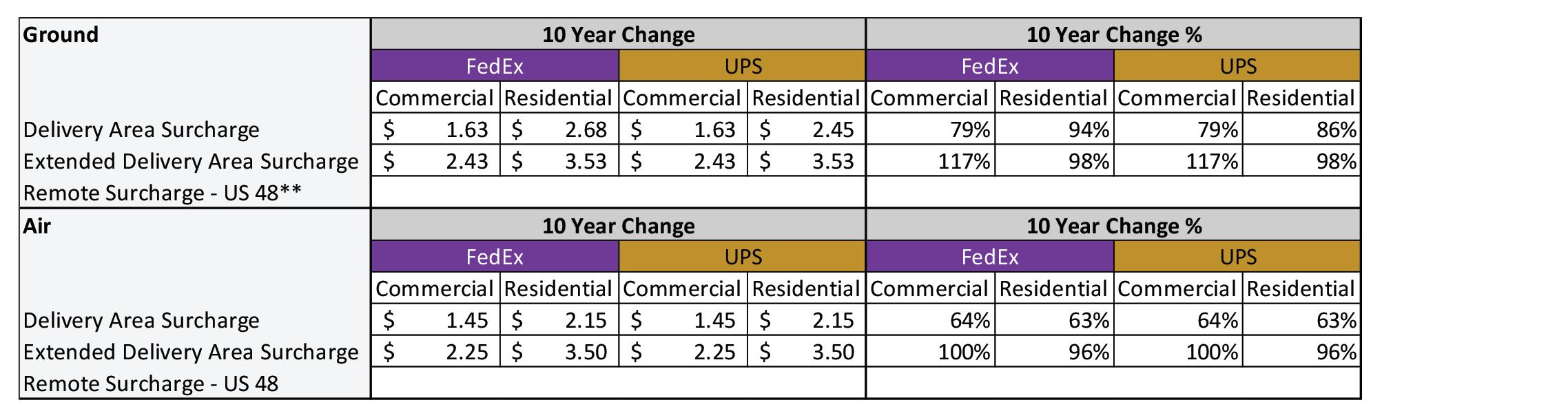

Increases: Looking over the past 10 years of surcharge increases, the highest ones have to do with residential shipping and size.

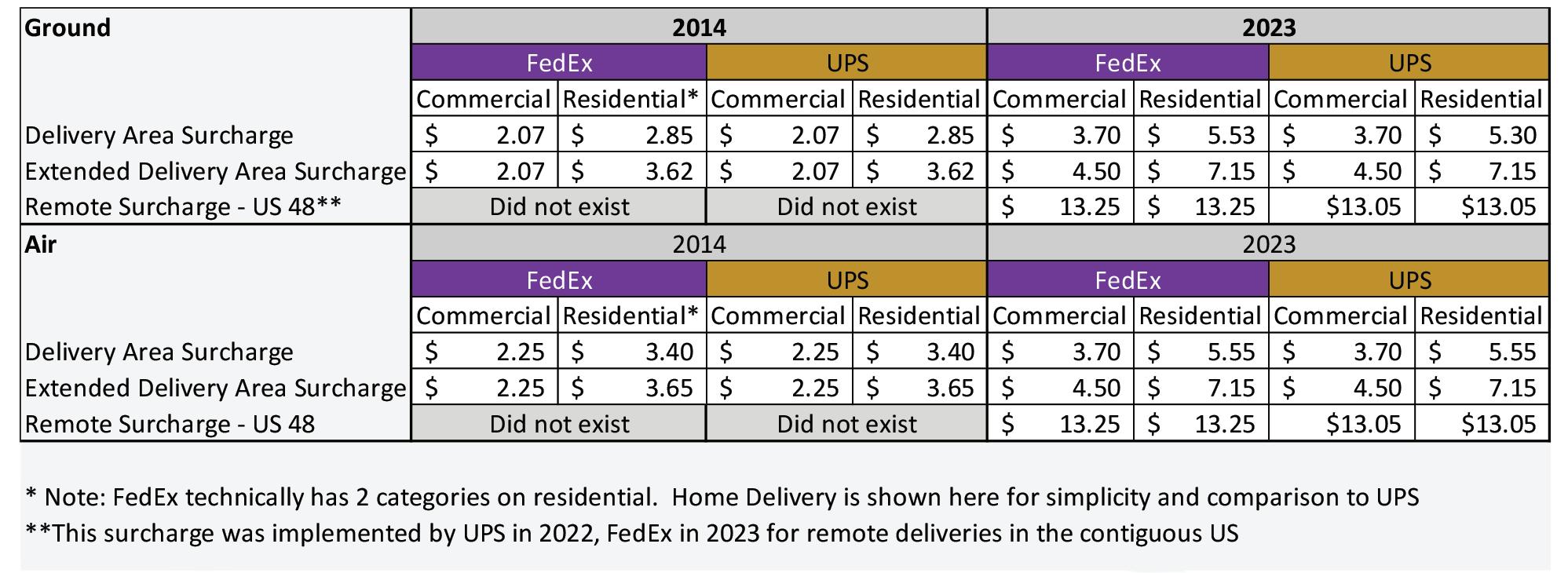

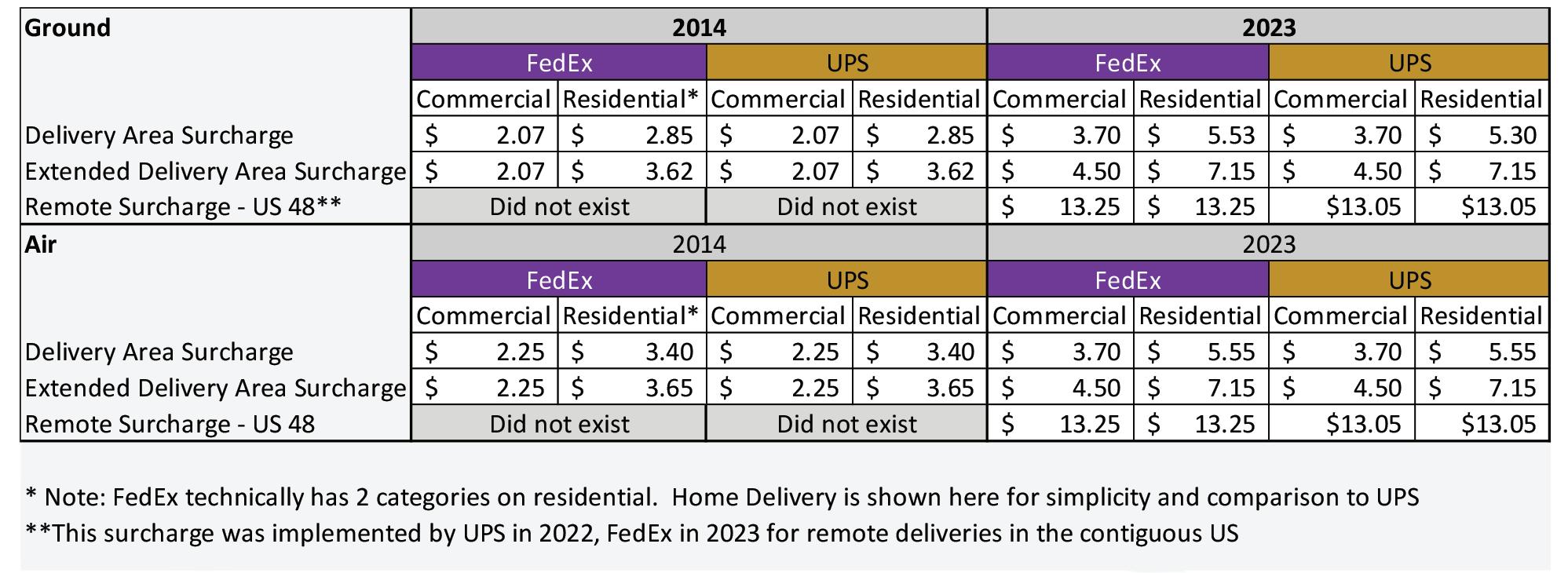

One example surcharge tells the story of what has happened in the past 10 years. Delivery Area Surcharge (DAS) was imposed to help carriers recoup costs for addresses in low density or rural areas. Figures 1 and 2 show how this charge has changed in 10 years.

Delivery Area Surcharge has had an average increase of over five percent each year, whereas Extended Delivery Area Surcharge (EDAS) has an average of over eight percent. UPS and FedEx have both added a category of DAS that

did not exist two years ago. This Remote Surcharge is over $9 more expensive per package than the other DAS charges — plus, its implementation increases the overall scope of ZIP Codes that can be charged for delivery area. Additionally, the list of DAS/EDAS grows every year. This exemplifies carrier changes: they increase the fees for the current surcharges, add additional categories, and increase the underlying scope and application of the surcharges.

What are the expectations for transportation rates and surcharges for the 2024 GRI? My prediction is that UPS & FedEx will increase their transportation rates by 5.9%. Down from last year’s 6.9%, but still elevated from the previous decade-plus long trend of 4.9%. Where you will see a bigger increase will be in the surcharges.

As the example above indicated, EDAS increased by an average of eight percent over the last 10 years, much higher than the typical 4.9% increase of transportation rates. Other surcharges will follow this same trend. On some surcharges, we will see double digit increases. In particular, look for increases that typically apply to residential deliveries for e-commerce. DAS, EDAS, and residential surcharges will all have high increases. It would not be surprising to see a 15% increase on surcharges for 2024. So now what?

Read your agreements.

Understanding your increase begins with a careful read of your agreements. Even if you

8 PARCELindustry.com SEPTEMBER-OCTOBER 2023

SUPPLY CHAIN SUCCESS

Figure 1

have rate caps, you may still have exposure to the full GRI on any unprotected services. More often than not, the area of greatest exposure is in your surcharges, as they typically do not have caps.

Do the math. Summarize your spend for each service level and apply either 5.9% or your agreements’ rate cap(s) to determine a quick and dirty estimate of your GRI costs on transportation. On surcharges, a rough-cut number would be a 15% increase. Of course, this is in no way comprehensive, and calculating accurate impacts requires a much more detailed model.

Get help. Reach out to industry consultants for a more accurate picture of the GRI impacts to your specific

agreements. Analysts can apply your shipping data against the expected GRI changes to give accurate impacts and targets for your negotiation or mitigation. Negotiate or alternate. Once you determine the biggest areas of increase for your program, reach out to your carrier(s) to negotiate. If items cannot be negotiated, then evaluate

alternative carriers like USPS and regional carriers that tend to have fewer surcharge costs.

Mark Taylor is the Sr. Director of Transportation Solutions Consulting at Körber. With over 24 years of experience, he leads Körber’s team in consulting on all modes of shipping. With a background that includes operations, transportation network engineering, new service development and parcel spend management, he brings a unique perspective to managing transportation programs. His experience includes multiple perspectives: as a carrier, shipper, and a third-party consultant. Some of the customers he has worked with include GAP, Fossil, Finish Line, and more.

SEPTEMBER-OCTOBER 2023 PARCELindustry.com 9

2 SUBSCRIBE FOR FREE!

Figure

ANATOMY OF A LAWSUIT: HOW TO UNDERSTAND WHAT A LAWYER IS TALKING ABOUT

By Brent Wm. Primus, JD

At some point in my career, I realized that the meaning of terms used in almost any conversation with a lawyer are not at all self-explanatory. Similarly, articles in the press will often use legal terms on the assumption that the readers know what they mean but actually might not.

At the same time, clients and readers are reluctant to ask about something they may feel they are supposed to know. With that in mind, this installment of PARCEL Counsel will explore some of the most common terms used in legal proceedings.

Nature of Suit or Proceeding

In business matters, a lawsuit for the recovery of monetary damages is the most typical type of legal proceeding. One party, the plaintiff, is attempting to recover money from another party, the defendant. The two basic reasons, causes of action, are either for a breach of contract or for a tort. A tort is a civil wrong not involving a breach of contract, for instance, negligence.

Other proceedings seek equitable or injunctive relief. An injunction is a court order which requires someone either to do something or to stop doing something which they are already doing or threatening to do. The latter is also called a restraining order. Injunctive relief can be either temporary or permanent in nature.

An example of a permanent injunction would be a permanent restraining order prohibiting a company from engaging in interstate motor carrier operations without the proper Federal Motor Carrier Safety Administration (FMCSA) operating authority.

In addition to court proceedings there are also regulatory proceedings before an administrative agency. In transportation, an agency such as the FMCSA could initiate the proceedings to promulgate a new regulation or clarify an existing regulation. Or, one or more carriers, brokers, or shippers could initiate proceedings to resolve a dispute by filing a Petition specifying the relief they are seeking.

Jurisdiction and Venue

Jurisdiction is the term used to describe a particular court’s legal authority to decide a case. A court must have both personal jurisdiction, the authority to decide cases involving the parties to the proceeding, and subject matter jurisdiction, the authority to decide cases involving the issues in the proceeding.

Venue is the term used to describe the particular location and court, tribunal or agency which will decide a case. Although a court might have jurisdiction over a particular proceeding, it does not necessarily mean that the court would be the proper venue for the proceeding. For instance, in a loss and damage claim arising out of an interstate shipment

any U.S. District Court would have jurisdiction to hear the matter but only certain ones would be the proper venue. For example, the U.S. District Court located at the origin point of the shipment would be a court where the suit would be properly venued.

Initiation of Suit

In general, court proceedings are initiated by the service of a Summons and Complaint. For State Court matters, the exact procedures vary from state to state. In Federal Court, the attorney for the plaintiff prepares the complaint and files it with the Court who then prepares and issues the summons.

The complaint will specify the claims being made by the plaintiff. The summons will state that the defendant is required to submit a formal Answer in response to the complaint to be served upon the plaintiff and filed with the court by the date specified in the summons.

In the next installment of PARCEL Counsel, we will look at the terms that come into play once the proceedings have been commenced.

Brent Wm. Primus, J.D., is the CEO of Primus Law Office, P.A. and the Senior Editor of transportlawtexts, inc. Previous columns, including those of William J. Augello, may be found in the “Content Library” on PARCELindustry.com. Your questions are welcome at brent@ primuslawoffice.com.

10 PARCELindustry.com SEPTEMBER-OCTOBER 2023

PARCEL COUNSEL

SUBSCRIBE FOR FREE!

THE GROWTH IN ESG REPORTING AND WHAT IT MEANS TO REVERSE LOGISTICS

By Tony Sciarrotta

ESG reporting refers to the disclosure of data covering the company’s operations in environmental, social, and corporate governance. According to financial firm Morningstar, the number of public companies publishing such reports grew from fewer than 20 in the early 1990s to more than 10,000 companies today, and about 90% of the Fortune Global 500 have set carbon emission targets, up from 30% in 2009.

Consulting firm PwC reports that ESG reports enable companies to be more transparent about the risks and opportunities they face.

Many of these reports incorporate reverse logistics goals and data to present and report a circular view. For example, Reverse Logistics Association (RLA) member Best Buy’s 2022 ESG report noted that it repaired more than 1.7 million devices in FY22, keeping products in the “use” phase. Best Buy also highlighted its trade-in program, which resells products in good working condition. Items include phones, laptops, tablets, cameras, smartwatches, and video game consoles. In FY22, customers traded in more than 650,000 devices, and collectively over two million pounds found a “second life” through trade-in and repair programs.

Another RLA member, Amazon, noted in its ESG report that its Product Lifecycle Support (PLS) programs helped avoid 7.5 million returned units in the US and Europe in 2022. These programs include original equipment manufacturer (OEM) support and OEM repair, where customers can go straight to the manufacturer for support, and parts replacement, where customers can request available components to replace damaged or missing parts, free of charge. In addition, in 2022, 31% of units in Europe and 29% of units in the US that could not be resold as “new” were relisted on Amazon Warehouse, an online platform that resells used and open-boxed items. Also, a global warehouse damage-reduction plan resulted in an eight percent decrease in damaged items worldwide in 2022. While not required yet, many companies are incorporating these ESG reports into their financial filings. The US Securities and Exchange Commission (SEC) is expected to adopt final rules requiring detailed disclosure by companies of climate-related risks and opportunities by the end of 2023. However, developing and passing standards and uniform measurement methods may

take longer. Currently, there are US government hearings on potential SEC ESG rules. However, the National American Manufacturing Association has pushed back on the hearings in a letter, “The SEC has proposed prescriptive, inflexible ESG mandates that will dramatically increase costs for manufacturers while providing minimal benefit for investors.”

Regardless of any potential government delays, more companies are embracing ESG reports. Uniform measurement methods will be required, so that good data will be necessary. As a result, companies can measure relevant KPIs such as return volumes and costs, provide insight into potential investments, and build a loyal customer base that can drive sales.

Similarly, the Reverse Logistics Association’s Standards Committee is working on several projects, including benchmarking, 12N SmartQR Labels, and more. To find out more, visit RLA.org.

Tony Sciarrotta is Executive Director of the Reverse Logistics Association. The RLA offers various tools, white-papers, and monthly webinars that provide best practices in managing reverse logistics.

12 PARCELindustry.com SEPTEMBER-OCTOBER 2023

REVERSE LOGISTICS

SUBSCRIBE FOR FREE!

OPERATIONALEFFICIENCIES YOU DON’T KNOW WHAT YOU DON’T KNOW

By Susan Rider

The title quote has always proven true. It’s impossible for anyone to know everything about what is going on in the industry. What’s coming at you? The latest trends? Better solutions to age-old problems? Many stay informed by reading publications such as this, and others gain additional knowledge by attending conferences and shows.

Throughout my career, the PARCEL Forum has always had a plethora of informative speakers and information for the small-package industry. Attendees have told me they were able to save their companies millions of dollars from tips given out at the conference. It’s not too late to plan on attending; visit PARCELForum.com for more information.

At the show, there are many ways to learn: the educational tracts that are divided by interest, the exhibit hall floor, the facility tours, and the chance to connect with your peers.

Some of the simplest conversations can spark new ideas. For instance, at one of the lunches, there was a shipper who had to ship chocolate in the summer, wondering what type of packaging would preserve the product and reduce damages. At the same table, there was a meat packaging executive who shared how they keep the meat cold through transit. Ideas abound; all you must do is take advantage of them.

When consultants walk facilities, they throw out suggestions that they have seen work. The forum is your chance to talk to consultants, executives, and peers one on one. Share ideas, ask questions, and get a resource for the future. If you are too busy and can’t go this year, maybe someone in your company deserves this opportunity.

If you’re a newcomer to PARCEL Forum this year, make sure you attend all the events, including the first-timer event. It will be loaded with tips on how to network, gather information, and obtain the resources you are looking for.

Once you find something on the vendor exhibit floor, you’ll have to plead your case to the executives to budget

the money for your purchase. Below are some tips on how to do it:

1. Know your executive and what is important.

Remember who you are presenting to so that you don’t get caught off guard. If you present to the CFO, this person will be all about the return on investment and numbers. A CFO is going to want to see strong justification and return. Because some CFOs don’t understand supply chain lingo, make sure you present in a way that he/she can understand the information. For example, if you are presenting a PTL system for order picking, it may be beneficial to give a brief statement of the benefits and how it works before proceeding with the project details. Focus on dollars and percentages.

2. Deal in facts and proof points.

Executives want to hear about valid claims on return. Saying that the system will give between 10-40% gain probably will not be accepted. They will want the numbers to be more concrete. There may be case studies similar to yours that would prove the return. Ask the vendor to partner with you on the information but ensure the information is accurate.

3. Stay high-level but have the detail if needed.

Most executives do not want to hear about all the implementation or installation details. They want to know the high-level scope

and return on investment, whether monetary or customer service oriented. Make sure you have the details available should questions be asked, but don’t focus the presentation on the details.

4. Introduce the problem and opportunities.

Before you jump right into the project, introduce the problem. For example, “We are running out of space and if there is not a redesign within the next 12 months, we won’t be able to ship the volumes projected for this year.” Ears will definitely perk up with that introduction! Put it in terms they will understand. Once you present the problem, you can then focus on explaining the solution or opportunity for improvement.

5. Summarize the request and need.

At the end, give a recap of the total presentation and summarize with an investment strategy. Spread the cost out on a spreadsheet. Many people do not get the project approved because they do not show the cash outlay when it happens.

My belief is we are never too old to stop learning, and with technology moving so fast, this holds true! See you in Nashville!

14 PARCELindustry.com SEPTEMBER-OCTOBER 2023

Susan Rider, President of Rider & Associates, Supply Chain Consultant, and Executive Life Coach can be reached at susanrider@msn.com.

SUBSCRIBE FOR FREE!

Protective and Efficient: Preventing Transit Parcel Damage with Right-Size Automated Packaging

The convenience of online shopping has led to an exponential increase in the number of parcels shipped globally. With this surge in shipping comes an increased risk of parcel damage during transit. A study by Power Reviews revealed that a staggering 81% of consumers have returned online merchandise due to it being damaged or defective. While parcel damage is disappointing to customers, it also poses a substantial financial burden on retailers. The average retailer incurs an astonishing $165 million in returns for every $1 billion in sales. In total, returns account for a colossal $816 billion in lost sales in the U.S. alone.

There are several factors that contribute to an increased risk of parcel damage during transit, such as:

1. Boxes not properly packaged: When items are not adequately secured in their boxes, they are more likely to move around during transit, increasing the risk of damage.

2. Inefficient handling by warehouse workers: Manual packers may not always choose the optimal box size for each item. This leaves excess space in the box, which can cause contents to shift in transit. Again, these inadequate packaging practices can lead to a greater risk of damage.

3. Improper labeling: Fragile items need to be appropriately labeled as such to ensure that they are handled with care throughout the shipping process.

To address the issue of parcel damage and its associated costs, many organizations are turning to automation. The CVP Impack and CVP Everest auto-boxing solutions from Sparck Technologies offer numerous benefits that significantly reduce the risk of damage during transit:

1. Right-sized packaging: Utilizing on demand 3D scanning technology, Sparck’s CVP automated packaging solutions create a fit-to-size box for each single- and multi-item order. This approach reduces the chance of items bouncing around and mitigates the risk of damage, thereby safeguarding the contents during transit.

2. Automated printing technology: With Sparck’s CVP machines, there’s a print-on-box technology feature, allowing organizations to print the word “fragile” or other relevant messaging on boxes when necessary. This ensures warehouse workers and shipping carriers are aware of the delicate nature of the package and encourages them to handle it with care.

3. DIM weight savings: Automated packaging solutions optimize DIM weight by reducing unnecessary space and packaging materials, resulting in cost savings for the retailer.

The financial losses and customer dissatisfaction associated with parcel damage can have detrimental effects on a business. However, automated packaging solutions offer an innovative solution to minimize the risk of damage during transit while maximizing the customer experience. By investing in cuttingedge packaging technology, organizations can prevent parcel damage while streamlining their shipping processes, decreasing returns, and ultimately saving valuable time and resources.

Contact the Sparck Technologies team today to learn how you can safeguard your shipments.

APPLICATION ARTICLE

sales.packaging@sparcktechnologies.com 800.983.8157 https://sparcktechnologies.com

INDUSTRY INSIGHT

LEVERAGING MACHINE LEARNING FOR STREAMLINED SUPPLY CHAINS: A GAME CHANGER IN THE ERA OF DISRUPTIONS

By Hannah Testani

By Hannah Testani

In a world of escalating costs and consistent supply chain disruptions, businesses, particularly in shipping, are under mounting pressure. Creativity is called upon as companies look for novel ways to cut costs and eliminate inefficiencies. Emerging as a beacon in this challenging landscape is machine learning, particularly its application in anomaly detection. Offering a new layer of actionable intelligence, it promises transformative potential to those willing to harness its power.

Machine learning, a unique technology within the wider realm of artificial intelligence, enables software to learn based on continuous data influx. Anomaly detection, a subset of machine learning, interprets voluminous data streams into meaningful patterns, unveiling deviations or anomalies from predicted norms. This “smart” technology promises to redefine our understanding of anomalies, putting them in context and suggesting next steps to mitigate further exposure.

From health imaging to banking fraud detection, machine learning anomaly detection finds diverse applications. However, its utility in the supply chain industry cannot be overstated. It’s a tool that breathes life into data, transforming abstract numbers into lucid visuals, providing business owners with actionable insights.

Picture a sophisticated logistics intelligence tool tirelessly sifting through your company’s historical and

current data, identifying anomalies and recommending strategic improvements. It’s like an ever-vigilant sentinel, perpetually observing, learning, and evolving. Take, for example, a global retail shipper who embarked on an e-commerce initiative for a recently procured business line. Unbeknownst to them, the packaging for a few of their SKUs fell within the large package and additional handling dimensions, leading to unexpected costs.

The e-commerce launch, initially viewed as a potential revenue stream, suddenly became a financial drain due to these unforeseen charges. Machine learning takes it a step further by pinpointing exactly what the issue is and how it impacts the business financially, generating precise data for corrective action. Anomaly detection in this scenario revealed that the newly initiated shipments were getting burdened with hefty large-package surcharges and additional handling fees. This surge in fees caused the cost per shipment to skyrocket by over 250%. Having identified the problem, the shipper promptly adjusted their shipping settings for the affected SKUs. They offered customers the choice to pick up in-store or pay an additional, transparent shipping charge if they chose parcel carrier delivery. With machine learning and AI identifying the source of the excessive costs and aiding in

quick resolution, the shipper was able to save over $1.5M annually! Now that’s the power of smart technology at work.

One of the defining features of machine learning is its ability to perpetually evolve, refining its algorithms for higher accuracy. This constant evolution allows machine learning anomaly detection to surpass its “personal best,” optimizing speed and detail in data analysis. With this tool, business owners can be armed with valuable insights for strategic decisions like freight network optimization.

In the era of supply chain disruption, anomaly detection is a trusted ally. It dissects seemingly overwhelming problems into manageable chunks, isolating exceptions and presenting specific issues for resolution, rather than a list of vague guidance.

By integrating machine learning anomaly detection into the supply chain systems, shippers can maximize the value derived from their data. The tool can aggregate data from all systems, analyze it in real-time, and identify helpful or detrimental patterns. The benefits of real-time data analysis are manifold. Not only can it provide a rapid response to deviations, but it also enables early detection, prevention, and resolution of potential disruptions.

Furthermore, machine learning anomaly detection brings clarity amidst the chaos. It generates clear, concise reports and key

16 PARCELindustry.com SEPTEMBER-OCTOBER 2023

performance indicators (KPIs) that can be easily understood and acted upon. By defining targets and variant thresholds, shippers can manage exceptions effectively, even in intricate processes.

One cannot underestimate the power of real-time alerts, especially in the fast-paced freight industry. Real-time alerts are a tool for rapid intervention when anomalies occur, ensuring the problem does not spiral out of control. Pair this with an expert who handles reporting, tracking, and correction recommendations, and you have a fail-safe system to maintain operational excellence, even amidst disruptions.

The power of anomaly detection has been proven in several instances. For example, a global retail and e-commerce company had mistakenly shipped all shipments at 5,00 pounds instead of 5.00 pounds due to a typographical error. Real-time anomaly detection identified the error, allowing the company to rectify the issue and save thousands of dollars in unnecessary fees.

Machine learning brings a sea of possibilities to the table. Shippers can better anticipate demand, optimize inventory levels, and gain insights into consumer behavior and preferences. With machine learning, they can navigate the complex carrier landscape effectively, quickly detect anomalies, and ensure accurate invoicing.

In today’s dynamic supply chain environment, marked by persistent fluctuations and uncertainties, shippers must adopt both proactive and reactive strategies. By harnessing machine learning, businesses can unlock unprecedented agility and adaptability, enabling them to address these evolving challenges promptly and efficiently.

By leveraging machine learning, shippers can gain valuable insights, optimize processes, and make real-time informed decisions. The adoption of machine learning equips shippers with the tools to achieve operational excellence, improve customer satisfaction, and drive business success.

Hannah Testani is CEO of Intelligent Audit. On Tuesday, September 12, she will be discussing “The Power of Pristine and Structured Data: How to Make Machine Learning Your Strongest Tool” at the PARCEL Forum in Nashville. During this session, she will examine the significance of clean, normalized, and organized data, and how it can help supply chain professionals shift from a reactive approach to a more proactive strategy in these uncertain times. Visit PARCELForum.com for more information.

SUBSCRIBE FOR FREE!

Presidential election years influence policymaking in Washington just as they do headlines. It is thus not too soon to take stock of what federal policy changes may be on the horizon for parcel shippers in 2024. Although intervening events can change priorities, for the 2024 election cycle, parcel shippers should be aware of possible policy changes affecting international trade; employment classifications; competition law; and transport safety and licensing regulations. Each of these potential changes could affect both the cost of shipping parcels and the methods of doing so.

Congress

A cursory glance at current bills in Congress show proposals seeking to provide authority to the United States Postal Service to mail alcoholic beverages; address supply chain congestion and competition issues; review Chinese investments in US ports; increase the criminal penalties for mail fraud misrepresenting countries of origin; establish a national motor carrier safety selection standard for entities that contract with motor carriers transporting goods; establish and strengthen cybersecurity standards; and change infrastructure funding. Most bills do not become law and, with the exception of mandatory

A VIEW FROM WASHINGTON : A

Few Key Policy Issues

Facing Parcel Shippers in the 2024 Election Year

By Andrew M. Danas

funding bills, the window for enacting substantive law in a divided Congress is likely to close by late spring of 2024.

Two proposed bills, the Import Security and Fairness Act (S. 2004) and the De Minimis Reciprocity Act of 2023 (S.1969), merit a closer look. If enacted, they have the potential of affecting all parcel shippers by changing the current de minimis standards under which small packages can be imported into the United States without the payment of customs duties.

The current $800 de minimis standard has enabled e-commerce retailers to facilitate the purchase and import of products online with a direct shipment to the US consumer as opposed to the processing of containerloads of imported goods through Customs.

Although taking slightly different approaches, each of these two bills would address perceived abuses of the current de minimis threshold by imposing limits on both how and who can use the standard, as well as the requirement of additional information for shipments entitled to de minimis treatment.

Being “tough on unfair trade” may have bipartisan support in an election year. All parcel shippers should thus keep on their radar screen the Congressional treatment of de minimis imports and how possible changes could affect distribution strategies and costs.

Executive Branch

In Presidential election years, federal agencies rush to enact regulatory changes in the event that there is a new occupant in the White House. The ancient Greeks consulted the Oracle at Delphi for future prophecies. A review of the Unified Agenda of Regulatory and Deregulatory Actions is the Washington equivalent.

Published each fall and spring in the Federal Register, the Unified Agenda provides public notice about upcoming possible regulatory and deregulatory actions by federal administrative agencies. The Spring 2023 Unified Agenda can be found at Reginfo.gov (https://www.reginfo.gov/public/do/ eAgendaMain).

There are several regulatory proposals on the horizon that may affect the costs, operations, and competitive number of carriers providing services to parcel shippers.

For example, one long overdue Federal Motor Carrier Safety Administration (FMCSA) proposal would implement the increased regulatory and financial responsibility requirements for motor carrier brokers and freight forwarders as required by MAP 21, enacted in 2012. The FMCSA is now stating that it anticipates a final rule by February 2024.

The FMCSA has also stated that it may initiate a new rulemaking that

18 PARCELindustry.com SEPTEMBER-OCTOBER 2023

would consider methods for ensuring that new motor carrier applicants are knowledgeable about safety requirements before they are granted authority as new entrants. The FMCSA also states that it will be seeking information on how it might use data and resources to identify unfit motor carriers and remove them from operation more effectively.

Each of these proposals has the potential to tighten regulatory standards and reduce the number of competitors in the motor carrier industry.

Employment and non-compete issues are also key policy issues for 2024. Worker classification as either independent contractors or employees is a long-running policy dispute that has a direct impact on worker status and benefits, especially for drivers for motor carriers and delivery companies and the related costs of transporting goods. The Department of Labor has stated that it intends to issue a final rule as to the classification of independent contractors

under the Fair Labor Standards Act by August 2023.

The Federal Trade Commission’s proposed Non-Compete Clause regulation essentially prohibiting the use of non-compete clauses in employment relationships may also be issued as a final regulation. If adopted as proposed, it will have widespread consequences on employer-employee relations; competition between companies; and the protection of trade secrets in an employment context.

Supreme Court

Finally, the Supreme Court also has a role in determining federal policy. In this context, parcel shippers should keep an eye on whether the Supreme Court will decide in 2024 to resolve a federal appellate court conflict about the scope of motor carrier federal preemption statutes.

In June 2022, the Supreme Court refused to consider a Ninth Circuit decision that held that state law personal injury claims against a broker for the

allegedly negligent hiring of a motor carrier involved in an accident were not pre-empted by federal law. Since then, the federal courts in the Seventh and Eleventh Circuits have issued directly contrary decisions concluding that such negligent hiring claims are pre-empted. Whether the Supreme Court will choose to resolve this conflict in the next year is of significant importance to any company shipping packages by motor carrier or using the services of a broker in doing so.

Stay tuned!

Andrew M. Danas is a partner in the Washington, D.C. law firm of Grove, Jaskiewicz and Cobert, LLP. Visit www.gjcobert.com or contact him at adanas@danaslaw.com. The information contained in this article is intended to be general background information. It does not constitute and should not be relied upon as legal advice. Readers should contact a qualified attorney should they have a specific legal question.

SEPTEMBER-OCTOBER 2023 PARCELindustry.com 19

SUBSCRIBE FOR FREE!

BY JOSH DUNHAM

THE BIGGEST MISTAKES SHIPPERS MAKE

During the course of my career, an uncomfortable conversation has occurred again and again. It is one most shippers know all too well.

That conversation is one which historically occurred with a parcel consultant and that now happens increasingly frequently within businesses when shippers digest the results of their own shipping analytics. I am talking about when they first learn of it — the big mistake that led to out of control shipping costs.

On some occasions, the big mistake is the cumulative impact of many smaller errors. At other times, it is a large and overt misstep — for example, shipping an entire product line at a loss because the packaging is now “oversized” under newly introduced, but overlooked, carrier rules. But in all cases, the reaction is largely the same.

First there is disbelief, then anger. Remorse comes later.

It is often painful to witness these moments. When an operations profes-

sional finds out their operation lost $2 million dollars because it missed an opportunity to secure savings or didn’t see a fine-print clause in their carrier contract, the news hits hard.

In addition to the obvious unnecessary spending, the opportunity cost must also be considered. How could those funds have helped the business? How did they impact coworkers?

Given the complex nature of parcel contracts and the web of ever-changing surcharges, new rules, and fees the carriers roll out on a continual basis, even the best shippers know such heartache all too well. But as with all endeavors, we can learn from our “mistakes” and missed opportunities — particularly in a field like ours in which the inherent complexity of parcel shipping has prevented transparency for decades.

Now things are changing. Advanced machine learning, data analytics, and artificial intelligence make it possible to know like never before and in real time where and how shippers can immediately take proactive steps to save money. When looked at in the aggregate,

these outputs also reveal where shipping operations typically lose money.

What quickly emerges is a trend line, one that reveals the biggest mistakes shippers make — the broadly applicable areas where companies that lack shipping intelligence and visibility over their shipping spend lose out most frequently. If they sound familiar, you are not alone.

Shippers don’t know their shipping vital factors: Even today, many shipping operations do not know the fundamental and most vital metrics that must be monitored to not only effectively negotiate with carriers, but actively manage costs. These include total parcel shipping spend, surcharge spend, the average cost per shipment, the average weight of shipments, the impact of minimum charges, and the average zone. Without this intelligence, shippers are operating blind.

Shippers create inaccurate annual budgets: More than a

20 PARCELindustry.com SEPTEMBER-OCTOBER 2023

few shippers fall victim to a common mistake each year — taking the carriers’ annual general rate increases

(GRIs) at face value. Unfortunately, rate cards only tell part of the story. Hidden fees, surcharges, and new rules quietly included in carrier contracts can radically impact costs. This year is no exception. FedEx and UPS introduced a record GRI for 2023 — 6.9% — but our analysis last fall, using real shipping data from the $1BN+ spend under management on our platform, showed that less than five percent of UPS customers will see their shipping costs increase by 6.9% percent or less this year. On average,

US businesses will pay 10.2% more to ship via UPS in 2023 than they did last year, and FedEx customers will pay 9.1% more.

Shippers rely on relationships when negotiating: Many carrier reps are good friends, but they come to the negotiations table armed with data. Data and analytics are absolutely crucial for shippers not only to get the best discounts, but to know where you are in relation to additional tiers and volume discounts. It is imperative to

Advanced machine learning, data analytics, and artificial intelligence make it possible to know like never before and in real time where and how shippers can immediately take proactive steps to save money.

SUBSCRIBE FOR FREE!

know your shipping data better than the carrier does.

Shippers fail to educate senior leaders on the impact of parcel shipping: It’s no secret that shipping acumen and performance can dramatically impact the bottom line, but it impacts top-line results as well — for example, enabling businesses to offer discounted shipping to attract customers. Notably, this mistake is most often made because shippers lack the data visualization tools needed to inform the C-suite.

Shippers set it and forget it: It’s tempting to negotiate a carrier contract once a year and consider the job done, but shippers should continually be on the lookout for opportunities to negotiate new terms and conditions. The most overt example is when discounts negotiated on surcharges expire before the contract does. Carriers count on shippers to lose track

of them and gain significant additional revenue as a result.

Shippers enrich consultants: The gain share model used by most parcel consultants creates a vicious cycle of payment fatigue. Savings are secured early in the relationship, but consulting fees continue for typically three years and often increase as a result of factors the consultant had no part of. Shippers today have the ability to gain real data and intelligence without paying someone else to provide guidance based on trends, hypotheticals, or general best practices.

Shippers allow themselves to become victims of vendor lock-in: Ideally, shipping operations create a platform that enables them to be carrier-agnostic, or in the absence of that, have the ability to divert parcel shipping volume to alternatives, including regional shipping companies, when needed. Notably, this is something

that must be strategically planned for. It does not happen overnight.

The pandemic and the rapid increase in e-commerce that accompanied it focused significant, and long overdue, attention on the crucially important role that parcel shipping operations play in business today. Mistakes will of course continue to be made — to err is human — but as an industry, we have an opportunity to eliminate the unforced errors that have, for some, long been considered part and parcel of our field.

Josh Dunham is the co-founder and CEO of Reveel, founded in 2006 to help shippers level the playing field for carriers. The company’s Shipping Intelligence Platform provides shippers with the actionable insights they need to make decisions that optimize their operations and deliver opportunities to save money.

THE 5 STEPS TO AN OPTIMAL SLOTTING STRATEGY

By Sebastian Saunders

Facility slotting is a dynamic process. Facilities that implement logical slotting, based on the right operating and layout strategy, and maintain it on an ongoing basis are always more productive with respect to both direct and indirect labor.

In an analysis of the distribution of paid hours across all direct labor functions over the past six years, we have consistently found that for conventional operations, selection hours alone make up anywhere between 53% to 58% of the total, and travel time can represent 28% to 33% of direct labor hours.

Therefore, your pick line length is the enemy and has straightforward productivity implications. It should be measured and refined as seasonality or business changes, especially considering that industry staffing challenges remain the top ranked issue over the past six years surveyed. This battle to reduce travel time and expedite shipping can be seen through the new material handling (MH) solution technologies such as AMRs, GTP, and other automation solutions.

In fact, using the grocery industry as an example, item proliferation continued to rapidly expand up until March 2020. Items had increased by 9,400 SKUs, or 9.4%, per annum, leading into COVID-19. In 2021, our annual survey showed a sharp decline of roughly 6,400 fewer items across all departments in SKUs carried, as compared to the previous year. This represented a drop in items of just over 20%.

In 2022, item counts bounced right back by 22%, which is very close to the pre-COVID-19 levels. How many companies did a slotting assessment and/or re-slotted their warehouses during these periods?

It can easily be said that slotting can have a major influence on resource requirements and operating costs as items come in and out on a frequent basis. As a result, keeping a close eye on selection rates, replenishments, etc. as a gauge of bottom-line productivity continues to be highly recommended to improve overall warehouse efficiencies.

A further example would be in a pick and pass environment where you have conveyors with batch carts or something similar; you can spend up to 60% of direct labor time picking and packing.

Typically, pick and pass expected rates are between 65LPH/ picker to 130LPH/picker. If your rates are below these, this suggests that there is an opportunity to re-slot this area and/ or consider the introduction of a GTP solution with very few conveyors and no carts, which could increase your overall rates by a minimum of 200LPH/picker to 300+LPH/picker.

Slotting/Re-Slotting Business Case

In our experience, optimizing how items are slotted in your facility can result in a minimum of five to 20% productivity improvement in selection and up to a seven to 10% improvement in direct labor throughput. This not only helps deal with the lack of available labor and overtime, but it also increases your facility capacity/lifetime while reducing your operating costs, order turnaround time, and damages and worker’s comp claims.

To maximize these opportunities, developing the right slotting strategy is the key starting point. Just buying a software solution is not good enough.

The slotting strategy, also known as operating strategy, is predicated on the appropriate material handling and layout concept, while application of the layout concept is determined by the specific warehouse dimensions and set of constraints for a given operation.

As such there is an inherent suitability of certain strategy alternatives over others for a given operation, which is not immediately obvious without a rigorous comparative evaluation of viable alternatives — regarding both material handling layout concepts and their corresponding operating or slotting strategy options.

So, What Is Slotting?

It’s a tactical execution that can best be described as the placement of stock keeping units (SKUs) in a storage location. These locations can be on the floor, in shelving units, racks, case flow lanes, etc. These locations are usually labeled for trackability and tied into a database that has some basic information such as SKU characteristics, quantity on hand, and average sales.

What Is Optimal Slotting?

Optimal slotting incorporates forecasted and historical sales,

24 PARCELindustry.com SEPTEMBER-OCTOBER 2023

inventory levels, growth, numbering, hit rates, priority, cube, weight, ergonomics, etc., and is paired with the right slotting strategy that best addresses the key operational layout issues of a particular facility. This allows you to gain productivity savings on all direct labor functions (receiving, put away, replenishments, selection, and packing).

The gains available when implementing optimal slotting paired with the right strategy result in direct labor savings ranging from seven to 10% depending on the operation; in some cases, it is much greater.

Learn more about warehouse slotting at PARCEL Forum ’23

Nashville with Keith Swiednicki on Tuesday, September 12.

Stage 1: Data Collection and Verification (DV)

During the first stage, it’s extremely important to collect all the necessary data files and variables, such as item files, order files, inventory files, pack size, etc.

In our experience, many companies are unable to provide clean accurate data or just don’t have what is required. The absence of key data and/or the use of bad data will always result in an incorrect solution. This can be quite expensive, especially if you’re looking for some type of warehouse automation solution.

A few key variables that are often missing are case cube, dimensions, and inner packs. It’s very difficult to set up a slotting strategy without these variables.

After all the data files have been collected, the next important step is to verify the integrity of the data itself. One good example of the implications of not doing this step is when a vendor uses existing data slot files to determine elevations and capacities and doesn’t visit and audit the operations to ensure the data is correct. This usually results in an incorrect assessment of improvement opportunities.

Stage 2: Pre-Simulation (aka Pre-Slot)

To begin the pre-simulation stage, detailed analysis of each SKU must be performed. Specifically: SKU sales (lines, units, case, and cube movement), inventory levels, and dimensional data. This stage can also incorporate rules to ensure that unique complexities of your operation are adhered to, like weight restrictions. Additional examples of these complexities are vendor pallet heights and pallet weight, date- or lot-sensitive products, fire protection, chemical protection, etc.

Once analyzed, we must determine what the slot type should be for each item, and then each specific item is assigned its optimal slot type. These slot types can be as small as shelving units or as large as multiple deep and multiple faced full pallet slots. Stage 2 will also consider hybrid and fully automated material handling solutions, as a comparative to the traditional conventional solutions.

SEPTEMBER-OCTOBER 2023 PARCELindustry.com 25

SUBSCRIBE FOR FREE!

Stage 3: Slot Refinement (aka Messaging)

While the pre-simulation stage may have yielded the optimal slot type for each item, the pre-simulation slot types rarely fit existing warehouse layouts and equipment. Assuming we are not designing a new Greenfield facility, we must then proceed to the slot refinement stage.

At this stage, the slot types and/or layouts must be adjusted to ensure a good fit between the assigned slot types and the slots available in the facility. This is a tedious, often overlooked task and is typically not done when buying an off-the-shelf software maintenance solution.

Also, a site visit is always needed to meet with operators to review any items that may have special handling requirements.

Stage 4: Final Slotting

After the sum of all the assigned slot types correctly fit the given warehouse layout, the fourth slotting stage can begin. In this stage, items are assigned an actual new slot or position number that is based on a combination of agreed to criteria.

These criteria ensure that the most efficient warehouse operating system possible will be put into effect — providing optimal slotting for a given point in time.

There are three basic methods for final slotting: the customer receiving method, the warehouse shipping method, and a hybrid of the two. Typically, the third practice generates the greatest savings and is what we recommend.

Stage 5: Slot Maintenance/Slotting Tools

Finally, the slot maintenance stage would be the ongoing process of keeping the warehouse at peak operating efficiency. Reports of changes and additions to the final slotting will allow you and your employees to keep the slotting continually up to date. This should only be done after the strategy and material handling solution has been determined.

Slot maintenance reports are essential to pinpoint problem areas and summarize overall operations. These reports generated by your WMS or standalone will provide the analytical and support tools needed to easily keep your facility up to date.

Many imprudent companies stop after completion of the final slotting stage and suffer the consequences later, when the delicate balance achieved during final slotting is degraded over time.

What Is the Time Frame for All This?

10-12 weeks to develop the right operating and layout strategy 3-4 weeks to move from strategy to final slotting

To implement varies by customer and complexity

Sebastian Saunders is Director KSi (Keith Swiednicki International). Sebastian develops and implements customized supply chain technology solutions and practices which support KSi’s clients’ business strategies, by identifying and implementing the most profit-efficient solutions that will maximize output and minimize cost.

PARCEL & BEYOND: MASTERING PEAK SEASON COSTS ACROSS THE ENTIRE SUPPLY CHAIN

By Britain Pavlic, Christian Nixel, Tom Stretar, Nate Rosier

By Britain Pavlic, Christian Nixel, Tom Stretar, Nate Rosier

Does peak season always seem to arrive before you have time to build a comprehensive plan? Supply chain leaders face a variety of challenges during peak season, including surges in cost, and often fail to adequately prepare. The American Journal of Transportation reports that regarding freight outlook, 42% of surveyed supply chain professionals do not believe peak season 2023 will be better than peak season 2022.

While transportation tends to be the highest-cost area for supply chains, minimizing spend during peak season is not just a transportation play — it is a supply chain play. All areas of the supply chain, including transportation, labor, network planning, warehousing, and inventory, need to be optimized for an organization to have its most successful peak season — keeping the cost down while also exceeding customer expectations.

Drive Down Your Parcel Costs

Transportation is responsible for a large sum of supply chain costs, even outside of peak season with increased volumes and tightened timelines. This is exacerbated during peak season for a variety of reasons.

Peak spot rates – Shippers have a tendency to optimize their capacity for the year, not just for peak season. This

leaves them with higher volumes to ship in a shorter period of time, leading to a higher dependency on peak spot rates, which are notorious for depleting a transportation budget.

Online shopping – As consumers lean into online shopping, e-commerce orders continue to surge. With online shopping comes several increases in cost, including shorter delivery windows, higher return rates, higher last-mile delivery costs, and increased handling.

Tightened capacity – Tight carrier capacity during peak season is unavoidable, as demand — and therefore shipping volume — skyrockets. Because of this, carriers will often increase their prices, giving another hit to your transportation budget.

Some of these cost contributors are unavoidable, but not all. There are several avenues for reducing transportation spend and creating a more profitable peak season.

Spot rate negotiation – Lock in optimal contract rates through pre-peak season freight bids. Freight brokers and 3PLs can typically offer the best shipping rates.

Higher projected volumes – Obtain higher parcel discounts by providing higher projected volumes to the carrier.

Route and mode optimization – Coordinate with customers, suppliers, and freight brokers to consolidate shipments that are going to the same location. This will reduce the number of trips being taken and cut down on costs.

Invest in technology – The right transportation management system can track shipments, optimize routes, and reduce manual processes, which all contribute to lower transportation spend.

Get Your Warehouse Costs in Check

The people, processes, and technology in the warehouse take the brunt of peak season’s force. There are several areas of the warehouse that are particularly impacted and can contribute to increased costs for the overall supply chain.

Inventory levels – Nearly every organization will see a rise in order volumes during peak season. Because of this, warehouses will have to increase their inventory levels to meet the higher demand. Inventory is a huge investment for warehouses, and the more you have to store and handle, the more it will impact your budget.

Increased labor – With higher order volumes comes an increased workload. To accommodate, warehouse leaders will need to hire additional staff and pay for overtime needs, which will increase labor costs.

Shipment frequency – Higher peak season demand leads to more frequent inbound and outbound shipments, which means higher receiving, handling, and storage costs for the warehouse operator.

Throughput demand – During peak season, customers often require faster order turnaround times. This will mean expedited processing and shipping for the warehouse, which will drive up costs.

There are a few ways to prepare warehouse operations to better handle these changes without seeing a surge in costs.

Optimize facility design – Design your facility in a way that increases picking and packing efficiency to cut down on labor costs during peak and low volume situations.

Implement technology – Implement the right warehouse

28 PARCELindustry.com SEPTEMBER-OCTOBER 2023

management system (WMS) to streamline operations, optimize inventory levels, automate picking and packing, and reduce errors, thus decreasing operational costs. Core WMS capabilities will support order consolidation, optimal shipper selection through rate shopping, and accurate dimensional weights for calculating rates.

Leverage labor management (LM) – Reduce labor costs by implementing LM strategies such as flexible scheduling, cross-training, seasonal hires, and incentive-based pay.

Improve inventory management – Leverage demand forecasting tools to better predict inventory needs. This will decrease the cost of storing and handling inventory.

Optimize packaging – Work with suppliers to optimize packaging to lower the amount of material needed and cut down on packaging costs.

Flex Your Supply Chain Network

Supply chain networks are incredibly complex, requiring flexibility to handle the swiftness of change leading up to and during peak season. There are a few areas of the supply chain network that can contribute to increased costs.

Supply chain disruptions – From unexpected weather events to geopolitical tensions, pathway blockages, and more, having to address unexpected supply chain disruptions at the last minute and without a defined contingency plan can lead to costly decisions.

Supply shortages – When demand gets too high, supply is likely to fall short. Supply shortages have particularly

impacted industries like automotive, food and beverage, furniture, and consumer electronics.

A supply chain network should be able to handle any unforeseen challenges while still meeting customer expectations. There are a few ways to make this a reality.

Foster agility – Create an agile, adaptable supply chain to keep operations running smoothly and costs down. This could mean diversifying distribution centers, building in extra capacity and more.

Create visibility – Increase visibility throughout the supply chain to identify and correct potential disruptions in advance, avoiding higher, retroactive costs down the road.

Optimize your distribution center (DC) network – Strategically place DCs near your customers to decrease transportation costs and reduce your liability for unforeseen weather or geopolitical events that could impact shipments traveling a long distance.

Peak season cost reduction is an incredibly important focus for parcel leaders, but it doesn’t stop there. When organizations make peak season planning an initiative for the entire supply chain, they will see lower costs, happier customers, and higher profitability all around.

SEPTEMBER-OCTOBER 2023 PARCELindustry.com 29

Britain Pavlic, Christian Nixel, Tom Stretar, and Nate Rosier are thought leaders and subject matter experts at enVista. For more information, visit www.envistacorp.com.

SUBSCRIBE FOR FREE!

BY CALEB NELSON

IS AMAZON’S BUY WITH PRIME RIGHT FOR YOUR BUSINESS?

In January of 2023, Amazon announced the expansion of Buy With Prime (BWP), a program allowing eligible retailers to sell through Amazon Prime on their own websites, with shoppers using their Prime account for payment, and Amazon completing the fulfillment with its two-day Prime guarantee.

Though it might have come in quietly, many believe this could grow into a widely used offering and could even be a step towards Amazon competing directly with FedEx and UPS as a carrier. I wrote more on that in the article “Buy With Prime: Is Amazon Rivaling FedEx and UPS?” in the March/April edition of PARCEL (visit PARCELindustry.com/ BuyWithPrime to read).

As a follow-up to that article, let’s take a deeper look at what Buy With Prime means for shippers, who it does (or doesn’t) make sense for, and ways it can be successfully implemented as part of a multi-carrier strategy.

Pros and Cons of Buy With Prime

Let’s revisit the pros of Buy With Prime; the first being the “Prime” logo itself. Fifty-nine percent of American

households have a Prime membership. With no shortage of members, the ease of a one-click checkout and free two-day delivery promise led to a 25% increase in sales conversions during BWP’s beta testing. For some businesses, the sales boosts might cover some of the cons of BWP (more on that later).

Additionally, BWP presents a unique carrier diversification opportunity. Amazon functions differently than FedEx or UPS. It still doesn’t have network-wide pickup capabilities, meaning BWP orders have to be pre-shipped to an Amazon facility. This has an upside, as it allows shippers to pre-determine an amount of volume to give to Amazon, meaning they can meticulously select the right amount of volume to take from another carrier without losing volume-based discounts.

And what are Buy With Prime’s cons?

First, it’s expensive. BWP service fees can account for a little over five percent of an order’s value, plus an additional $5.38 for the fulfillment. Couple this with the $0.78 per cubic foot monthly storage fees — and the cost of shipping units to Amazon in the first place — and it becomes evident how the cost of selling w/ BWP can eat into margins.

This is Amazon’s incentive.

Much of its focus with the Fulfillment by Amazon (FBA) program is that Amazon sellers shouldn’t have to worry about fulfillment — and most don’t want to. For an entrepreneur with a product, shipping units to an FBA warehouse and selling on Amazon is the fastest way to go to market; much faster than incorporating 3PLs or setting up their own logistics network. In exchange for the convenience, Amazon charges significant fees. From Sifted’s data, FBA fees usually account for 30-50% of an item’s sale value.

Is BWP Right for You?

Whether or not a business should implement Buy With Prime varies a bit case by case, and depends on each organization’s specific goals. For many FBA-exclusive sellers, it’s a no-brainer. Setting up a simple website can give them better access to customer information, a more personalized, branded buying experience, and even increase their storage capacity limits at Amazon facilities.

For larger businesses, it might be a bit trickier. FBA sellers pay a premium for Amazon’s fulfillment services so they

30 PARCELindustry.com SEPTEMBER-OCTOBER 2023

don’t have to invest in their own, saving time and money in establishing carrier or 3PL partners and/or building their own facilities. If a larger business has already done this work and made these investments, it might not make sense to pay Amazon’s prices. However, this isn’t black and white, as a business might determine that the sales boost from the BWP checkout could outweigh the higher fulfillment costs.

In the end, it comes down to what each business is looking for. If one wants the cheapest fulfillment possible, BWP isn’t their best choice. However, if a business is looking to boost sales, and determines that the boost in conversions BWP could provide would outweigh the higher fulfillment costs, they should explore it. Perhaps a business is less concerned about costs and more concerned about a resilient, multi-carrier mix. Integrating w/ BWP could be an easy way to implement another fast, dependable “carrier” and create swimlanes in case of capacity constraints.

Implementation

If a business decides to move forward with BWP, there are a few things they can do to ensure success. First, for those that don’t already sell on Amazon, they’ll need to create an Amazon Supply Chain account. This will also allow them to fulfill other non-Prime-eligible products through Amazon Multi-Channel Fulfillment (MCF). Then, they’ll need to integrate Amazon Pay for order processing.

Once all the technical hurdles have been cleared, they’ll need to determine how much volume they should fulfill through BWP orders. Giving BWP an equal split of shipments will likely drop them out of volume-based discount tiers with their other carrier(s). With a keen knowledge of their carrier contracts and shipping data to know where their volumes stand, they can determine precisely how much volume to peel away and pre-assign to BWP without dropping a discount tier. In some cases, dropping a tier might be inevitable, but some of the other benefits (sales increases, resilience, etc.) might

outweigh these costs. Again, it depends where each business’s priorities lie.

Unfortunately, Amazon Seller Central doesn’t provide much visibility into storage and fulfillment fees for Amazon’s FBA, MCF, or BWP services at the time of writing this. Data-savvy businesses can still find that information, or use one of a few emerging software tools, to fully measure how much fulfillment through Amazon is costing them. They can then compare how these fees stack up to their traditional carrier or 3PL costs, compare the difference to any boost in sales they’ve seen, and confidently know whether or not they should continue their BWP operations.

Amazon continues to drive change in the industry. Like anything, confident, data-driven decisions can ensure a shipper’s success amid these changes.

SUBSCRIBE FOR FREE!

Caleb Nelson is Chief Growth Officer at Sifted, a Logistics Intelligence software company.

There are many PARCEL Forum exhibitors who will help with your shipping and supply chain challenges that you should stop and see. Here are a select group of 25 exhibitors that you need to make sure to stop by, talk with, and find out more about how their solutions and expertise can be the answer to your problems.

WE care about YOUR shipping costs as much as you do. It just makes cents (and dollars) to stop by and get to know the folks at Advanced Carrier Technologies (ACT). We are passionate about helping you reach and surpass your savings goals, using your data to find innovative approaches to reduce shipping costs. Teamwork, commitment, knowledge, experience. Work with ACT and find the savings you need. www.Go-ACT.com

For 30 years, AFMS has helped over 3,000 companies reduce their shipping costs by 15-25%. Specializing in transportation benchmarking, carrier contract negotiations, full RFP & RFQ support for carrier optimization & invoice auditing; all modes of transportation. Our expert team of former carrier pricing executives & strategists from UPS, FedEx, DHL, USPS, Hyundai, US Lines, Panalpina, Topocean & the major LTL carriers have over 500 years of combined industry experience. AFMS will provide a FREE full shipping analysis & shipping profile of where you stand in the market today. (See page 23) www.afms.com

BlueCrest provides comprehensive data-through-delivery technology solutions, changing how business is done within the postal and parcel industry. Building upon its long history of innovation and deep industry knowledge, BlueCrest is there as a partner to its worldwide client base delivering efficient results and continuous service excellence. The BlueCrest family of brands includes Fluence Automation, BCC Software, and Window Book, providing a best-in-class suite of solutions including high-speed inkjet printers, inserters, and mail sorters, parcel automation, postal optimization and productivity improvement software, and parts and service. www.bluecrestinc.com & https://parcels.bluecrestinc.com

BrightDrop is a tech company revolutionizing commercial delivery and logistics. Its portfolio of electric delivery vehicles, smart eCarts, and software solutions are designed to create a smarter, safer, more sustainable future. BrightDrop is a wholly owned subsidiary of General Motors. For more information, visit gobrightdrop.com

Celebrating 100 years in 2023, CT Logistics is a global solutions provider helping clients to more effectively source, execute, pay, and analyze parcel and non-parcel transportation expense. CT offers a number of unique delivery models and options for large-volume shippers to outsource freight audit and payment, or a dynamic software platform that can be utilized to perform this function in-house. Comprehensive global spend visibility is driven by a powerful, customized business intelligence platform coupled with a deep suite of advisory services to more effectively negotiate large-scale shipping agreements. www.ctlogistics.com

Designed Conveyor Systems (DCS) has over 40 years of experience serving major clients in multiple industries by providing material handling solutions, full-scale warehouse operations, and conveyor designs custom crafted for their needs. DCS does not sell ready-made conveyor systems but builds relationships that empower collaboration to craft custom warehouse designs together. DCS utilizes consulting, engineering design, project management, installation services, and client support to ensure our customers can keep their promises to deliver on time. www.designedconveyor.com

DMW&H is a premier automated material handling systems integrator headquartered in Northern NJ. At DMW&H, we focus on your business, your needs, and your challenges — today, tomorrow, and beyond. Then, we create your optimal facility solution using the most efficient equipment options. By choosing to partner with us, you’ll have direct access to not only competitive services and pricing, but also to the industry’s best talent, in a company with an exemplary reputation and a true passion for helping you overcome your business challenges. www.dmwandh.com

32 PARCELindustry.com JANUARY-FEBRUARY 2022

PARCEL FORUM

STOP AND SEE AT

‘23

BOOTH # 1215

BOOTH # 915

1206

BOOTH # 726 BOOTH # 801 BOOTH #

BOOTH # 103 BOOTH # 100

BOOTH # 901

Stop by booth #901 to test out your gaming skills in our arcade with our popular racing simulator and claw machine. Plus, don’t forget to register to win a NES Classic. Eii has expertise in parcel sorting applications to help your business grow. Our dedicated team will help consult, design, and install custom automation based on your needs as well as provide support throughout the process. If you’re looking to start out with automation, integrate and close gaps in existing automation we have solutions for you! Learn more at https://www.eii-online.com/parcel-forum-2023/.

BOOTH # 724

Visit our team to learn why our customers have placed their trust in Ensign for over 30 years. We specialize in designing and manufacturing custom material handling equipment. Offering the safest and most dynamic high-speed parcel unloaders for the parcel handling industry, our machines easily integrate into new and existing sorting lines and can be designed for any type of transportation containers; gaylords, plastic totes, carts, hampers. These systems quickly deliver polybags, boxes, envelopes, and mixed materials onto conveyors, chutes, and tables without causing damage to the contents inside. www.ensignequipment.com

BOOTH # 907

Logistics data. All companies that ship products have it, but not all companies can effectively use it and act on it in a timely manner. Why? Leveraging logistics data for operational improvements is challenging without the right tools, integrations, and partners. Visit us in booth #907 and learn how to overcome data-related challenges to optimize your shipping operations. Enveyo is the only logistics optimization tech provider at PARCEL Forum with a single platform that enables: shipment analytics & BI, predictive modeling, multi-carrier TMS, real-time delivery alerts, and freight audit & recovery. www.enveyo.com

BOOTH #

707

BOOTH #

We offer the largest network of carriers and services to over 220 countries and territories. We have a deep industry knowledge of global regulations and a dedicated customer service team that provides customized end to end solutions. With ePost Global, you’ll find everything you need to reach new markets and expand what’s possible for your business. You deserve the TOTAL PACKAGE for all your international e-commerce shipping. epostglobalshipping.com