As you read this, it’s likely that you’re in the midst of preparing for (a hopefully very successful) peak season. Even in the heat of summer, when backyard barbeques and poolside Saturdays are at the forefront of our minds and the hustle and bustle of the holiday season seems like it’s years away, successful shippers know that now is the time to be ramping up for the peak shipping season. No one wants to get caught unawares, and nowhere is the phrase “If you’re not early, you’re late” more applicable than it is for shippers. Luckily, since you’re reading PARCEL, you already have a leg up on the competition. This issue should help you prepare for not only the 2023 peak season, but also help you optimize your parcel operation

for the long term. Shippers are constantly being met with a barrage of challenges, but with those challenges come opportunities. Yes, factors like customers’ changing preferences and expectations certainly keep shippers on their toes, but being able to meet and exceed these expectations offers an opportunity to cement your business at the top of consumers’ minds. And while you’re meeting and exceeding your goals, we’ll be right alongside you. After all, it’s our goal to be your industry partner, giving you the information you need to stay thriving and profitable in this ever-changing industry, from the 2023 peak season and beyond.

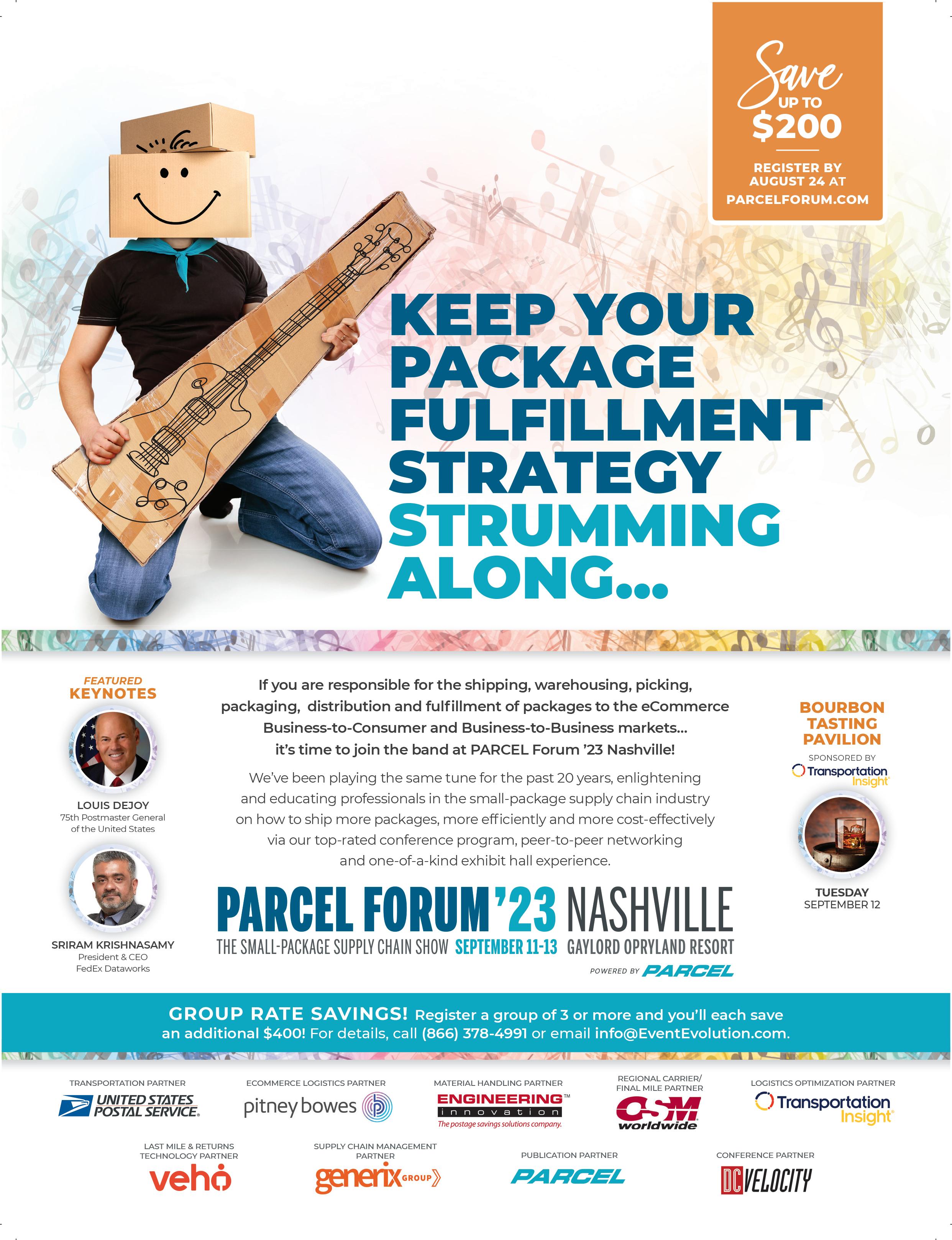

I hope to see many of you at this year’s PARCEL Forum, held September 11-13 in Nashville. There’s no better place to connect with fellow shippers than at our annual conference. The educational sessions are top-notch, and the networking opportunities abound, giving you the chance to meet with other industry professionals and discuss the challenges and opportunities faced as a small-package shipper.

As always, thanks for reading PARCEL.

Rising returns volumes have leveled off, but the costs of returns continue to climb according to the Reverse Logistics Association’s (RLA) quarterly returns index. For Q1 and Q2, the returns costs index was 156.8 and 174.8, respectively. A reading above 50 indicates growth. The index notes that the Q3 outlook is also for the continued cost increase.

Commentary from the quarterly index survey, not surprisingly, places the blame on economics and inflation. Indeed, transportation and labor costs have greatly increased since the pandemic began in 2020. Parcel carriers such as FedEx, UPS, and USPS pick up and deliver the bulk of returns. Parcel rates and surcharges have also jumped since the start of the pandemic.

In January this year, UPS and FedEx increased their average rates to a historic high of 6.9%. There are also additional surcharges.

For example, some UPS returns surcharges per package:

UPS Returns: Print Return Label - $0.50

UPS Returns: Electronic Return Label - $1.00

UPS Returns: Print and Mail Return Label - $2.25

UPS Returns Plus: 1 UPS Pick-up Attempt - $4.00

UPS Returns Plus: 3 UPS Pick-up Attempts - $5.25

UPS Returns Plus: Call Tag - $5.75

Some of FedEx returns surcharges per package:

FedEx Print Return Label - $1.05

FedEx Email Return Label - $1.05

FedEx Return Pick-up - $4.00

FedEx Call Tag - $7.35 - $8.40

In addition, labor costs have increased. Dispositioning of returns, that is, determining if a returned item can be

resold, recycled, or donated, tends to be a labor-intensive task. Turnover rates are often high. In 2021, the US Bureau of Labor Statistics (BLS) found that the average turnover rate for warehouse workers was 43%.

As such, the cost to attract and train workers and pay a higher rate to retain them is also rising. According to BLS data, transportation and warehouse workers’ average hourly pay for June was $29.07, up from $28.98 in May and up from $27.70 in June 2022.

Transportation and labor costs are major contributors to the cost of returns. A study by Pitney Bowes in 2022 found that returns cost retailers up to 21% of the item’s original value when shipping, processing, and restocking are considered.

1. Review returns policies –Many retailers are rethinking ‘free returns policies’ instead of charging a surcharge or restocking fee.

2. Invest in technology –Optimize return receiving and restocking; Artificial intelligence, data, and machine learning can track returns and identify conditions or problems that lead to increases in returns; Inventory and warehouse management systems can streamline the restocking process and speed up resales; Customer relationship management systems can track the entire post-sales process, keeping the customer informed of shipment

and delivery status, and possibly even deliver post-sale messaging.

3. Rethink your shipping partner relationship – Maybe it’s time to renegotiate your carrier contract or develop a new transportation strategy, such as pick-up returns at consumers’ doors, bulk pick-ups at stores, or other strategies.

4. Don’t forget secondary markets – Recommerce, donations, or recycling are options to avoid leaving money on the table.

5. Outsourcing returns management – Accepting, restocking, and reselling returned products can consume a lot of a company’s time and resources, so outsourcing these processes to those specializing in reverse logistics may reduce the cost of returns.

Before retailers and other shippers can mitigate the costs of their returns, they must know what their actual costs are. Identifying returns costs across the entire organization is an important first step for businesses, and the RLA offers a calculator to help determine savings. For more information, please visit us at RLA.org.

Tony Sciarrotta is Executive Director of the Reverse Logistics Association. The RLA offers various tools, white-papers, and monthly webinars that provide best practices in managing reverse logistics.

We last looked at this topic in the November 2008 issue of PARCEL. As reported there, a Google search using the term “transportation law” yielded over 12,000,000 results. The same search now yields 1,010,000,000 results! Whatever the reasons underlying this dramatic increase, one thing is clear — this is too much information to be helpful.

The starting point for actual useful information is an understanding of what comprises “transportation law.” There are two broad categories. The first is comprised of statutes, regulations, and international treaties.

Statutes are laws passed by either Congress at the federal level or by an individual state. For parcel shippers, the laws passed by Congress governing interstate commerce are the most significant. These statutes directly govern the conduct of transportation providers such as motor carriers and air carriers and also intermediaries such as transportation brokers and air freight forwarders. The rights and obligations of their shipper customers are also affected as these statutes deal with matters such as liability for loss and damage to cargo.

Regulations are rules passed by federal or state administrative agencies which have the responsibility for administering a certain set of laws. For example, the Federal Motor Carrier Safety Administration (FMCSA) and its predecessor agency, the Interstate Commerce Commission (ICC), have promulgated a set of rules relating to interstate commerce.

For the parcel shipper, the federal statutes and regulations are more relevant to the relationship between the transportation providers and the shipper. This is because in 1994, Congress passed the Federal Aviation Administration Authorization Act (FAAAA) which preempted, or

took away, the ability of states to regulate a carrier’s “rates, routes, or services.”

Two international treaties apply for international shipments: The Montreal Convention for air and the Carriage of Goods by Sea Act (COGSA) for ocean.

WHEN ONE IS TRYING TO FIND “TRANSPORTATION LAW” TO UNDERSTAND OR SOLVE A PROBLEM, THE MOST IMPORTANT PRINCIPLE IS TO GO TO THE ACTUAL SOURCE, I.E., THE LANGUAGE OF THE STATUTE, REGULATION, OR TREATY ITSELF.

The second broad category of transportation law is the decisions of courts and administrative agencies. These include the decisions of the U.S. District Courts, U.S. Courts of Appeal, and the United States Supreme Court. With respect to states, these are the decisions of each of the 50 states within their own court systems.

While the text of a statute or regulation is the ultimate source as to what they actually say, the decisions of courts and administrative agencies interpreting the statutes and regulations cannot be relied upon to the same extent. This is because court decisions could be wrongly decided, could be overruled by later decisions, or in conflict with what other courts have said to answer the same question.

To sort through this, one needs to know that there is a ranking order of the courts. For instance, within the

federal system, decisions of the United States Supreme Court take precedence over a differing decision of a lower federal court, e.g., a Circuit Court of Appeals or a U.S. District Court.

The following government websites will take you to the actual sources:

(1) The United States Code (statutes): http://uscode.house. gov/search/criteria.shtml

(2) The Code of Federal Regulations: http://www.gpo. gov/fdsys/browse/collectionCfr. action?collectionCode=CFR

(3) Federal Motor Carrier Safety Administration (FMCSA) for laws relating specifically to transportation: https://www.fmcsa.dot.gov

(4) One free website for legal information is that of the Cornell University School of Law Legal Information Institute, www.law.cornell.edu. Cornell’s website has a vast number of legal opinions, statutes, regulations and publications.

And finally, I have to add that just because someone writes something and posts it on the internet, with others then reposting it multiple times, doesn’t make it actually so!

All for now!

Brent Wm. Primus, J.D., is the CEO of Primus Law Office, P.A. and the Senior Editor of transportlawtexts, inc. Previous columns, including those of William J. Augello, may be found in the “Content Library” on PARCELindustry.com. Your questions are welcome at brent@ primuslawoffice.com.

When you are working in the supply chain, July is when you start planning and getting ready for Christmas. Yes, it’s hard to think about Christmas when the heat index is approaching 100-plus degrees, but the success of your company’s supply chain warrants a focus on preparation.

It’s time to get your ducks in a row and ready for the Christmas rush. Many of you have already started receiving inventory for the Christmas season. Where are you storing these items? Are there any forecasts that come along with items being received? If so, you can make sure they are being slotted according to projected volumes. Of course, there will always be the outliers, or an item unexpectedly becomes the next hot thing, but if you can get 80% of the items slotted by projected velocity, it will save you big in productivity cost.

Have you checked with HR? Are they ready to gear up for the Christmas rush with part-time help? Can you get creative in finding a dependable and productive labor pool? HR must be your friend in distribution, therefore, it’s imperative to meet with them and do some job fairs at the colleges, high schools, and trade centers. One company I recently worked with set up a table at the sports park in order to recruit part-time workers. They picked up 10 truly dependable part-time workers from this effort.

Check your supplies (boxes, tape, box cutters, dunnage). This may sound minimal, but what happens when you run out of shipping boxes? If you have material handling equipment being installed or expected before the rush, check with the suppliers and make sure it’s on time and won’t hold up your throughput. Production and delivery times have not recovered from the COVID shutdown. Many have improved, but they are still not back to their pre-COVID delivery times.

Hopefully, if your company has purchased new software in 2023, it is installed and debugged so you’re ready to hit the ground running during the Christmas rush. If you are in the midst of installing and it has been delayed,

right now is when you make the hard decision: Do you move forward, potentially putting the Christmas rush in jeopardy, or do you put the project on hold?

Installing new software during Christmas rush has been done before, but everyone will tell you it’s not advisable. Do a once-over of your facility or network, much like a pilot does before a plane takes off. Look at everything from the receiving docks through the shipping docks with a critical eye. Do things need to be adjusted, fixed, or streamlined?

Meet with your maintenance personnel and make sure the packing stations, conveyor, and any automation equipment are ready for action. Have you tested the level of redundancy at every critical step in your facility? Simple things, like toner in the printer for the pack station, available paper, etc. take time and create bottlenecks when the volumes increase.

Meet with your front-line managers, ask them to review areas in their department, and make sure they’re ready: barcodes should be readable, labels are fixed, packaging areas are stocked — all the little things that take time and money from day to day operation.

Readjusting slotting is usually a great move to increase productivity by 10% or more. Check with merchandising and see if they can send you a list of incoming products by date so you can start planning. Most companies don’t make this information available to the distribution center, but it’s

extremely helpful in planning, and someone in merchandising has this information.

Meet with the IT personnel and see if there are any projects affecting your facility that would hamper throughput. In many companies, the left hand isn’t always talking to the right hand. An IT department of a top company planned an upgrade for October and shut the distribution center down for over 24 hours. Not a good thing to happen during peak season! Make sure your barcode readers are working properly and you have enough for the temporary people you’ll need for the holiday season. If you have Voice, do the same preparation.

Training is important for the temporary employees. Make sure the training tools are in multiple languages and are simple and concise so everyone can understand. Allow the temps to take a picture of the instructions so if they are out on the floor and forget, they can reference the information. If you don’t have a laminated cheat sheet, now’s the time to get those done.

In a world when AI is dominating conversations and everyone is talking about autonomous robots, I’m suggesting you get down to the basics. Because at our level in supply chain, that’s where it starts and where you set up your facility for success!

Susan Rider, President of Rider & Associates, Supply Chain Consultant, and Executive Life Coach can be reached at susanrider@msn.com.When seeking a solution to handle your parcel sortation, it is crucial to question the conventional choices and find a solution that aligns with your distinct business needs. Features like customization, efficiency, and flexibility are non-negotiables. With the options on the market today, there is no reason why you should settle for a system that can only handle one type of product or one that can’t give your operation room to grow. EuroSort’s suite of automated sortation systems allows you the ability to choose your throughput rate, customize your sorter layout, and handle all your pick mix efficiently, all on one machine.

Unlike linear sorters and other loop sortation options, EuroSort sorters give you the ability to choose the layout that is optimum for your needs, which maximizes space efficiency. Our sorters can be built within any existing space — around existing constraints, such as columns, mezzanines, or floor elevations, without the need for floor reinforcement or flattening. Seamless integration within your existing MHE eliminates the need for expensive expansions, rework, or recontrolling.

With conveyor-based systems, the conveyor transfer and the associated hassle of items being stuck between conveyors or sucked into the drive unit are eliminated by the EuroSort’s innovative tray designs. The EuroSort heavy-duty nonmagnetic trays play a crucial role in accurate and safe sortation, providing a secure space to transport various item sizes, shapes, and weights. The Cross Tray XL is EuroSort’s newest solution for handling the widest variety of product mix, quickly and efficiently. Small, fragile items, large cartons, and everything in between, sort accurately to their destinations with ease on our proven, secure tray design.

EuroSort’s variety of automated sorter choices allows you to choose the throughput level that is best for your operation. Getting the right system eliminates the unnecessary expense of a one-size-fits-all option. With the available throughput of between 1,000 and 35,000 items an hour, there is a sorter choice for your exact throughput demand.

As the parcel industry constantly evolves and packing materials undergo changes, it’s crucial that your long-term investment can readily adapt to the shifting demands. Our robust advanced sorter technology has been created to seamlessly adjust to handle new, dynamic parcel shipping demands, giving you peace of mind in the face of the challenges that lie ahead. Whether you need to upgrade an existing facility or design an entirely new system, our team of sortation experts is ready to guide you through our flexible suite of solutions for efficient, accurate, and safe package sortation. Learn why EuroSort is the trusted choice by post offices, final mile carriers, freight consolidators, and retailers worldwide.

The Universal Postal Union (UPU), in its October, 2022, presentation, Trends and Drivers of International Postal Exchanges, reported a 77% decline in international small packages crossing borders within the postal network from 2020 to 2022. This is consistent with the decline in international small package volume decrease handled by the USPS. [Emphasis added.]

A May, 2023, USPS Office of Inspector General (OIG) report, The International Package Market — Trends And Opportunities For The Postal Service, stated, “Even in an uncertain global economy, international ecommerce is expected to continue to increase at rates of up to 20 percent annually until 2030.” [Emphasis added.]

As we all know, e-commerce volumes increased dramatically during the global pandemic as traditional retail stores were shuttered. Some of that uptick in volume has been lost as consumers returned to their traditional markets for goods — but not all of it has gone away.

Consumers and businesses in different countries and regions do not act the same. E-commerce has not grown consistently around the world. Other than consumer preferences, government regulations and policies affect the growth — or lack of growth — in cross-border e-commerce. Customs duties and other taxes on imported goods make them more expensive. Complicated regulatory requirements can inhibit companies from selling into other countries. Advanced Electronic Data (AED) requirements, to combat illicit goods and terrorism, present a challenge to postal operators in developing countries. Certainly, the more stringent rules for advance customs information in the EU have had air carriers, postal operators, mail service providers, and mailers scrambling to meet these requirements.

And still, an increase of up to 20% annually in international e-commerce is predicted. This does not mean that all of this will travel through the international postal network, nor does it mean every country will see a 20% increase in inbound and outbound e-commerce. Some

analysts contend that we are seeing a shift to regional, not global, cross-border.

So, if there are more packages being shipped globally, why is the USPS seeing a 77% decrease in international package volumes, about the same as in the worldwide postal network? Some of that is indeed volume lost to the USPS, particularly for outbound mail. Some of the decrease, however, is a shift of volume from mail imported via the postal network, i.e., from a postal operator in another country, to items imported via a commercial company and entered as domestic mail with the USPS.

In fact, the USPS has had a Global Direct Entry (GDE) for 10 years to allow vetted consolidators to enter items from other countries into the US mail stream for domestic delivery. The proportion of packages that had entered the US via the postal network that are now arriving commercially and being mailed domestically is unclear, as is the effect on the USPS’s finances.

The equivalent to mail from other countries posted here as domestic mail for US delivery is happening to US outbound mail. It is shipped by a commercial company — a consolidator, an e-commerce platform, a private delivery company, etc. — to another country and entered into the postal system in that country. This mail volume and revenue is lost to the USPS. Alternatively, large e-commerce platforms are able to create regional warehouses closer to their more major international markets, which also removes goods from the international postal network.

Commercial customs clearance has required the information now included in postal AED for some time. In addition, commercial customs clearance allows duty and taxes to be paid by the sender or a broker on the sender’s behalf. This is known a DDP — Delivery Duty Paid. Traditionally, goods delivered by the international postal network have been DDU or Delivery Duty Unpaid, requiring the recipient to pay any duty and taxes. Although there are now some exceptions to this, many recipients are unaware of these fees and refuse to accept delivery. As more and more countries are levying duty and sales taxes on small packages, there are very real advantages to DDP solutions providing an advantage to commercial clearance. (The USPS is working on a DDP solution.)

As USPS postage prices have increased for international packages, the cost advantage enjoyed by the USPS has decreased or even disappeared. With the additional DDP advantage of commercial clearance, the USPS is no longer as competitive for international fulfillment of packages to other countries. The OIG’s report makes it clear that the USPS faces many challenges in maintaining robust international package services for both inbound and outbound mail.

Merry Law is President of WorldVu LLC and the editor of Guide to Worldwide Postal-Code and Address Formats. She is a member of the UPU’s Addressing Work Group and of the U.S. International Postal and Delivery Services Federal Advisory Committee.

Companies are currently wrestling with one key question: what will this year’s peak season look like and how will it differ from years past? In anticipation of potential economic disruptions, consumers are tightening their belts and being more cautious with their discretionary spending. Moreover, retailers are faced with the added challenge of dealing with excess inventory as a result of an accumulation of retail goods during a period of irregular consumer activity.

Logistics experts have predicted that future peak seasons, including this year, will be on par with pre-pandemic levels. However, there is a shift in consumer spending, with more people now diversifying their expenses to include experiences like vacations, sporting events, concerts, in addition to the usual material goods.

In the midst of constantly shifting consumer demands, one crucial aspect that companies may unwittingly overlook during this peak season is the accurate prediction of resource requirements. This includes anticipating the necessary number of workers or the ideal quantity of inventory to order. The ability of companies to remain flexible and adaptable during this period is paramount to their ultimate success.

Automated packaging solutions such as Sparck Technologies’ CVP fit-to-size boxing solutions provide businesses the reliability, speed, and productivity necessary to effortlessly handle any peak period. Sparck Technologies’ CVP Impack and CVP Everest auto-boxing machines provide consistent throughput regardless of labor availability and reduce companies’ dependency on the labor market.

With the ability to tailor-make up to 1,100 boxes per hour of single- or multi-item orders, the CVP Impack and CVP Everest offer high-volume throughput combined with unparalleled flexibility. Both machines measure, construct, seal, weigh, and label each variable dimension order of either hard or soft goods in a custom fit-to-size box.

At a rate much faster than manual packing, automated packaging systems allow organizations to scale up or scale down with just one or two operators, depending on order volume. Additionally, fit-to-size boxes offer savings on shipping, transportation, and material costs, as the solutions can create over 44 million unique box sizes on demand.

Given the current economic outlook, it is crucial for companies to optimize their resources, including staff and packaging materials. Automation enables companies to effectively adjust to changing consumer buying patterns throughout the year. For instance, companies can expand their capacities during peak seasons like back to school, Black Friday, Cyber Monday, and the holiday season. Since many shippers may not have enough physical space or available labor to create additional packing stations for short periods of work, finding an alternative and sustainable solution is vital.

Automated packaging solutions can be your key to managing peak season 2023 and beyond. Contact the Sparck Technologies team today to learn how to enhance your peak season preparation.

During the 2022 peak holiday season, FedEx’s on-time delivery fell through the floor. It was a crazy time with nonexistent capacity and overwhelming demands on parcel carriers. Still, FedEx struggled more than most, leaving a long-lasting impression on shippers. FedEx has struggled since then to improve performance and win back shippers’ confidence. Finally, we’re starting to reap the fruits of those labors.

The journey started in earnest during the summer of 2022, when FedEx announced a $2 billion investment in a five-year march toward greater efficiency, reduced redundancy, and increased customer satisfaction. This transformation — known as FedEx 2.0 — is a strategic approach that aims to enable the company to better serve its customers and adapt to the industry’s changing landscape.

FedEx 2.0 focuses on four key areas: network optimization, technology innovation, process improvement, and customer-centricity. By optimizing its network, FedEx aims to improve efficiency and reduce costs while also expanding its global reach and capabilities. This initiative includes investments in new aircraft, ground vehicles, and facilities; partnerships with other transportation providers; and perhaps most importantly, removing redundancies and consolidating operations of overlapping networks. According to Jenny Robertson, FedEx’s SVP of Marketing, the company will close at least 100 facilities by 2027. This change has been years, if not decades, in coming. Running separate Ground and Express networks on routes

designed based on years-ago demand has resulted in inefficiencies, poor service, and customer dissatisfaction for years. However, while inefficiencies certainly exist in FedEx’s multiple networks, one has to question if the closing of 100+ facilities can be accomplished without negative impacts on service.

FedEx is investing heavily in digital solutions that give customers greater visibility and control over their shipments. This push for technological innovation includes mobile apps, real-time tracking, and advanced analytics that help customers make more informed decisions.

Process improvement, streamlining operations, and reducing inefficiencies are also priorities of FedEx 2.0. Initiatives include the implementation of LEAN principles, automation of processes, and the use of data analytics to identify areas for improvement.

Finally, customer-centricity is at the forefront of FedEx 2.0. The company is committed to providing customers with a seamless and reliable experience from the moment they place an order until the shipment arrives at the destination. This includes investments in customer service and initiatives designed to improve the overall customer experience.

Overall, FedEx 2.0 represents a significant transformation for the company, aimed at meeting

the changing needs of its customers and staying ahead of the competition. As the industry continues to evolve, it will be interesting to see how FedEx adapts and innovates to remain relevant and competitive. Some key areas to watch include the expansion of e-commerce and sustainability initiatives, the growth of international markets, and the integration of emerging technologies like automation and robotics.

More recently, FedEx announced its intention to consolidate several operating companies to streamline operations and enhance efficiency. The company’s decision to reduce its active companies is a strategic move welcomed by industry observers, who view it as a necessary step toward achieving long-term growth and sustainability.

The consolidation process has FedEx combining its multiple operating companies, including FedEx Express, FedEx Ground, FedEx Services, and others under the Federal Express Corporation. This integration aims to simplify the company’s internal operations and improve the customer experience. The move will also enable FedEx to leverage its vast network of distribution channels and infrastructure. Notably, FedEx Freight will continue to operate its LTL services as a standalone company, perhaps because there is less overlap between the LTL network and services than with the other operating companies — meaning there

is less fat to cut and fewer synergies to exploit. There could be other reasons. Recall that UPS divested itself of its LTL network in 2021. While profitability remains strong, FedEx Freight has recently been parking trucks, furloughing employees, and is planning to close facilities in the face of falling demand.

Furthermore, the consolidation will allow for more brand synergy, thus enhancing the company’s brand identity. By presenting a unified FedEx brand, the company expects to resonate more with its customers, enhance loyalty, and reinforce its position as an industry leader. The consolidation also aims to create cost synergies by reducing duplication of resources and eliminating wasteful expenses (something begun in February 2023, when FedEx cut approximately 10% of its officers and directors). The company will be able to provide better services to its customers, helping them save on their transportation and logistics costs.

The consolidation process also provides FedEx with an opportunity to revamp its organizational structure and implement new policies to enhance operational efficiency. The company has embraced new technologies that have enabled it to automate some of its operations, resulting in quicker delivery times and improved customer satisfaction. The company has also implemented best practices and standards across its operating companies, resulting in enhanced consistency and quality of service.

Overall, the consolidation of FedEx’s operating companies is a much needed and overdue strategy. By creating a more unified company, FedEx is improving efficiencies, creating cost synergies that will enable it to be a more effective competitor in the logistics market, and, one hopes, enhancing its brand identity. The consolidation process has also allowed the company to revamp its organizational structure, embrace new technologies, and implement best practices to improve operational efficiency. That’s the plan, anyway. Will FedEx be able to pull it off? We’re talking about a five-year plan, costing $2 billion and touching every part of the company. It’s an ambitious plan and epic paradigm shift unfolding in a dynamic market. And FedEx has the people and the capital to make it happen. But FedEx has fumbled several good passes over the past few years. I’m optimistic. But I’ll also be watching carefully over the next six to 12 months, as should you.

Before manufacturers were able to apply strategic sourcing practices to their operational expenses with the same discipline they used to buy the “direct supplies” used on the factory floor, procurement departments referred to off-contract purchases as “maverick spending.” A catch-all term, it referred to spending that failed to leverage the organization’s negotiating power, or, even worse, purchases made by employees without knowing if the price was advantageous or even acceptable.

In purchasing parlance, maverick spending was the antithesis of efforts to bring spending under management — a long-standing effort that became possible for entire industries when Software-as-a-Service-based e-procurement applications enabled organizations to gain visibility over their purchases and aggregate them to create value-based, preferred contracts. Once in place, these contracts made it possible to optimize spend — a reality that led to the rise of chief procurement officers and ultimately made such sourcing agreements table stakes in many industries.

Today we are a similar, but even more striking, evolution in parcel shipping. Shippers, erroneously thought to oversee a cost center of business

for far too long, are increasingly appreciated as strategists who oversee a business function that has the ability to dramatically impact the revenues not only of e-commerce companies and omnichannel retailers, but businesses in innumerable industries.

Regrettably, though, for many organizations, parcel shipping remains the last frontier of spend optimization efforts, with shippers at many companies continuing to engage in “maverick spending,” in which they have little real insight into their own shipping activity, are unaware of hidden costs in their carrier agreements, do not know how the rates they pay compare with those of their competitors, and consequently have no ability to use shipping performance as a competitive differentiator. Not surprisingly, carriers have aggressively safeguarded this lack of transparency with a litany of hidden fees, complex rules, numerous surcharges, and contracts comprised of numerous fine-print details.

Despite this, more shippers are showing in very real terms how a more strategic approach to parcel shipping is not only helping their organizations save money, but also driving top-line results. Just as procurement professionals did a decade ago, these shippers are embracing the visibility SaaS-based

applications make possible and then applying the resulting intelligence to their efforts. Broadly applicable, these efforts deserve a closer look and offer a sampling of the many ways shippers can impact businesses. Examples include:

Shippers are educating executives and advocating on the importance of the parcel shipping function: With the Census Bureau of the Department of Commerce estimating that US retail e-commerce sales for the first quarter of 2023 reached $272.6 billion, or 15.1% of total sales, it is clear parcel shippers play a central role in the fulfillment process for a significant portion of the economy. They are driving this point home with senior leaders; not only are the costs involved significant — in some cases, shipping costs amount to 10% or more of a business’s revenue — but they are a core consideration for consumers.

Strategic shippers are dispelling the myth of free shipping, underscoring their impact on sales and comparing their performance with peers: Shippers know from experience that demonstrating their value by showing how they slow cost increases is a losing battle, especially when carriers’ rates perpetually increase. Instead, they are showing how their costs compare with peers or competitors that have a similar shipping profile. They are also advocating for, and educating business leaders on,

how their efforts enable the organization to offer lower shipping costs — a win that can play a crucial role in consumers’ buying decisions online and significantly boost top-line results.

They are creating budgets with unprecedented accuracy: For decades, the major carriers have introduced their general rate increases annually, with the new rate cards typically going into effect in early January. More than a few shippers have taken the increases at face value only to have their budgets fall victim to a litany of surcharges, new rules on everything from zones to package dimensions, and fees that result in dramatically higher costs. (Notably, our data scientists found that fewer than five percent of businesses will see their shipping costs increase by 6.9% or less — the record-breaking rate increases announced by FedEx and United Parcel Service (UPS) for 2023. On average, those that ship via UPS will pay 10.2% more in 2023 than they did in 2022, and most FedEx customers will pay 9.1% more in 2023, with some shippers seeing

increases of 21% or more.) Instead, savvy shippers are using models to create budgets with unprecedented precision.

Shippers are moving beyond relationship-based negotiations to secure and save with competitive carrier contracts: Historically, shippers negotiated with their carrier rep to get the “best” deal possible. Now strategic shippers are not only analyzing their contracts with far greater rigor — and negotiating based on fact rather than perception — but they are negotiating more frequently throughout the year and more effectively, with many securing savings far in excess of past expectations. Just as importantly, many are also moving to a carrier-agnostic model in which they can switch carriers if needed, or alternatively utilize a mix of partners, including regional transportation companies.

They are proactively looking for savings opportunities: Traditionally, shippers learned of problems — for example, an entire product line being subject to overage charges for packaging that was slightly too large — only after

receiving their quarterly invoice. Now shippers are using technology to alert them not only when issues arise, but when opportunities to actively lower their costs present themselves.

With such strategies in place, today’s shippers are proactively working to make sure that parcel shipping does not remain the last frontier of spend optimization for long. Instead, they are realizing a future where the crucially important impact of shipping acumen, the role it plays in online retailers’ fulfillment operations, and its impact on business operations in companies of all kinds is not only known and valued but expanded up — developments that promise the beginning of a golden era.

Josh Dunham is the co-founder and CEO of Reveel, founded in 2006 to help shippers level the playing field for carriers. The company’s Shipping Intelligence Platform provides shippers with the actionable insights they need to make decisions that optimize their operations and deliver opportunities to save money.

Parcel shippers use warehouses to satisfy customers and keep costs low. A warehouse network is two or more distribution centers that have a mission governing what products flow through it and when.

Often, warehouse missions cover a specific geographic territory. These territories can range from very large (North America, Latin America, EMEA, etc.), down to regions, states, ZIP Codes, and individual customer locations.

Where a company decides to set its territorial boundaries depends on product attributes like weight and density, shipping costs, customer urgency, procurement economics, and inventory stocking strategies. Shippers avoid shipping from out of territory warehouses to save freight and to serve customers faster.

Traditionally, customer territories were pre-established on shortest distance to customers or on highest (least time in transit) service levels. These fixed territories matched up well with high package volumes, sales rep territories, operating budgets, and the need for organizational simplicity.

Warehouse networks are routinely optimized to account for customer locations, lead times, transportation costs, labor rates, and the price of fuel. This optimization leads to ongoing market competitiveness and ensures cost and service leadership.

Since its inception, Amazon has invested billions in automation, stood up a last-mile delivery fleet, and increased its network to include over 1,000 locations. Amazon routinely shipped items across the country no matter where an item was stored. This provided a high level of customer satisfaction but added significant cost when out-of-territory shipments were necessary.

Further complicating Amazon’s operations was the computational complexity of rebalancing and managing inventory across an increasing number of warehouse locations. Realistically, all items can’t be stored in the same warehouse, and multi-item orders often require multiple shipments from multiple warehouses to fulfill an order.

Recently, as post-pandemic demand decreased and inflationary pressures grew, Amazon decided to overhaul its network. Its goal was to aggressively cut costs, better serve Prime members

with same-day service, and optimize its delivery infrastructure while leveraging its massive warehouse footprint.

Amazon’s first step was to carve the US into eight regions, storing many commonly ordered items in each region so shipping can stay as localized as possible. In a letter to shareholders, Amazon CEO Andrew Jassy said, “Each of these regions has broad, relevant selection to operate in a largely self-sufficient way, while still being able to ship nationally when necessary.”

Secondly, Amazon is placing inventory closer to the customers. This slotting initiative is improving regional depth and breadth while addressing seasonality and obsolescence. This greatly diminishes out-of-territory shipments.

Thirdly, by making out-of-territory deliveries the exception, parcel zones can be shaved, re-handling minimized, and more internal local delivery resources utilized. So far, Amazon has seen a 15% reduction in the distance items travel from warehouses to customers and a more than 12% decrease in handling “touches.”

Lastly, regional network retailers and e-tailers like Amazon will begin prioritizing in-region items on their websites. These items may be promoted directly through search results, by the resulting lower price of a regional-only shipment, by lead time, or, in the worst case, no availability. This will further limit the supply and demand for out-of-territory shipments.

Together these changes allow regional warehouses to operate autonomously. Shorter travel distances will lead to lower cost to serve, less impact on the environment, and customers getting their orders faster.

An interconnected regional strategy shares many similarities with warehousing best practices. Many companies strive to have a one order, one box or a single warehouse fulfillment strategy. This doesn’t differ based on the underlying warehouse network.

In-region shipments will decrease the distance to the customer due to a tighter geographic service territory and expanded stocking breadth. For shippers considering this strategy, cost analysis should be performed and the zone savings documented.

A primary flaw of a regional strategy is the heavy dependence on more accurate forecasting and the resulting inventory strat-

egy. Customer service and lead times will be negatively affected if companies strictly follow in-region fulfillment policies that are coupled with poor fill rates. In today’s competitive environment, this will lead to customer attrition and defections.

A second flaw of a regional strategy is serving customers on the borders of a territory. For these customers, it may be cost advantageous to ship from a warehouse in another territory.

Current best practice allows for dynamically determined warehouse territories on an order-by-order basis. This order fulfillment innovation solves for more complicated fulfillment decision factors such as minimizing total order cost, low local inventory availability, order criticality, and customer satisfaction.

Amazon’s switch to interconnected regional warehouses shows the importance of having a sound warehouse network strategy that balances cost and service. Shippers should do the following to determine benefits and costs:

First, shippers should identify hard and costly to serve customer regions. Drill downs should be performed to identify root causes such as item breadth and depth, customer demands, poor fill rates, carriers, etc.

Next, parcel shippers should benchmark KPIs and leverage customer feedback to regularly assess their network operations. Inventory performance (fill rates), zones, split shipments, and cost to serve are ones to focus on.

Do we know enough about our cost competitiveness and performance to identify areas of concern?

What is the size of the gap between our current and desired performance?

How do we close that gap?

How can we reduce customer lead times?

How much do out-of-network shipments cost the company?

Do we have warehouses that are taking on more volume than they can handle?

Next, shippers should quantify the economics of operating multiple warehouses and the dependency on other warehouses to satisfy a customer order. Shippers should also evaluate the feasibility and value of regionally segregating inventory.

Finally, parcel shippers should understand customer lead times and their ability to generate additional sales. Amazon’s move to regional networks was driven by a desire to reduce the average zone and lead time to customers.

Jeff Haushalter is a Partner at Chicago Consulting. He designs supply chains for manufacturers, distributors, and retailers that reduce cost and improve service. He can be reached at jeff@chicago-consulting.com

Athird-party logistics (3PL) provider typically offers services that include receiving, storing, and managing inventory, as well as picking and packing orders to ship to your customers. The 3PL can have a single location or several, and most 3PLs typically serve multiple clients. Some are geared specifically towards explicit industries or commodities, and some cover a large array of products. The 3PL can complement the existing operation by serving areas that are unfulfilled or replace the entire operation, eliminating the need to manage many aspects of one’s supply chain. Due to the purchasing power and varying degrees of sizes, weights, and commodities, it’s also common that the 3PL will have partnerships with multiple carriers, often within parcel, postal, and freight, providing shipping options that may be otherwise unattainable.

Choosing to outsource perhaps the most critical part of one’s operation to a 3PL is an important decision that should be evaluated based on several factors, since it’s a great option for some, but may not be a good decision for others. Start-up

or expansion costs associated with warehousing, distribution, labor, and infrastructure can be overwhelming, especially for small- to mid-market companies. Larger firms may find greater value in utilizing a 3PL to expand operations into new markets, improving transit times and reducing shipping costs due to the shorter linehaul.

In either case, determining if there is a need for distribution from a specific location or locations, and what is driving that decision, is a good initial step.

While most 3PLs can manage a variety of commodities, some 3PLs specialize in specific types. Some are equipped for cold fulfillment, with warehouses that can store and ship food and products that need refrigeration. Other 3PLs store and ship hazardous materials, parts, apparel, high-SKU-count product lines, low-SKU-count product lines, valuable goods, etc. Narrowing the list is a good starting point to ensure that the 3PLs’ specialties align with one’s needs.

Suitable origin point(s) is another criterion that tends to be high on the decision-making list. In the US, most companies can effectively serve 95% to 99% of their clients in two days with three distribution centers and in three days with two DCs. In recent years, it has become more common to have an east coast and a west coast presence, at a minimum, to eliminate four-to-five-day deliveries, often carrying into the following week. Others may choose to utilize additional DCs, located strategically to offer next-day or two-day delivery, as the pressure to improve delivery time continues. Rather than dealing with purchasing or building a facility and managing the associated operating expenditures, many companies have found that a 3PL is the more viable option.

How a 3PL operates is important to establish upfront, including something as simple as cutoff times for that day’s pick and pack. How quickly are the shipments picked, packed, and processed? Orders should go directly to fulfillment warehouses, just as they would to company-operated DCs.

Pros to Utilizing a 3PL:

The need to manage labor and the operations is reduced, as is the need to hire and train new employees. A reputable 3PL will have knowledgeable employees, including onsite logistics experts.

Based on the anticipated growth, the increased revenue could significantly improve profits. The 3PL process can reduce the cost of labor, and reduce shipping costs, due to the origin point being in closer proximity to the client base.

Customer experience may improve. With additional facilities, time in transit should improve, due to the shorter distance and additional carriers being available based on capabilities.

Many 3PLs will offer additional services to help manage the distribution process, which can improve customer service.

Cons to Utilizing a 3PL:

Losing visibility and “ownership” of the goods and processes can be a deal-breaker for some. Although one can typically monitor inventory levels, incoming shipments,

delivery performance, and more in real time, there is an undisputable loss of control when outsourcing.

Choosing the right 3PL could be a learning process with some trial and error. Not all 3PL providers will meet one’s expectations (are the expectations realistic?).

The initial investment in a 3PL partnership will impact profits, especially if the alternative is to keep the operation as-is. If utilizing a 3PL doesn’t result in increasing inventory volumes and sales, it may be simply an added expenditure.

Some 3PLs’ expectations will not align that of their customers. Their inefficiency could reflect poorly upon your organization. Customers care about the end result, not who manages the distribution. Setting the expectations of the services that are needed is critical during the decision-making process.

The agreement should be well-defined and clearly address the time period of the arrangement, renewal expectations, and termination options for both parties, including when price increases will occur and at what levels. Liabilities for damages and the percentage of shrinkage loss must be clearly addressed. The typical insurance that each party will maintain should be included. How inventory will be managed, and all the clauses related to it, should also be defined in the contract. IT services that will be used throughout the period, including costs, should be established, and the contract should highlight the methods that will be used to settle any legal affairs.

Expectations about service performance, carrier options, packaging, and any such details should be clearly established. Will a single account manager be assigned for the duration of the agreement? Can either party hire employees from each other or can the 3PL sell other services to your client base? Will the 3PL be permitted to advertise your business name on various marketing platforms?

It’s also important to examine the financial and overall health of the 3PL. For example, is the 3PL asset-based or non-asset based? Asset-based 3PLs have more direct control over issues that may be encountered. Is the 3PL paying its carrier invoices? If they get shut off, you can get shut off, even if you’re shipping on your own carrier agreement.

Partnering with a quality 3PL provider can significantly improve the success of an organization. However, it’s extremely important to properly assess and evaluate the options before deciding if it’s the right decision and which partner is the best option.

Thomas Andersen (MBA) is a Partner and Executive Vice President of Supply Chain and Logistics Services at LJM Group, where he helps optimize carrier contracts for high-volume shippers. He retains over 20 years of parcel management experience, including five years as a Senior Pricing Manager with DHL Express. He can be reached at tandersen@ myljm.com or at 631.844.9500.

We all know that things are going to be getting busier and busier in the next few months, so if you have been thinking about making improvements to your material handling, now would be a great time. From equipment to supplies, these 8 companies have ideas and solutions that may be just the answer you are looking for. Take a moment to review all the possibilities and connect with these companies.

For over 50 years, Caljan has helped parcel carriers handle loose-loaded cargo more efficiently. Caljan delivers on a strong tradition of innovation in loading, unloading, and automatic labeling with an unrelenting focus on product safety. Automating the goods/in out process can be a significant driver of efficiency. From our core Performer telescopic conveyor to our new Autoloader, Caljan offers highly configurable solutions that can be tailored to meet the needs of your operation. Safety and sustainability always come standard. Contact us today to learn more.

Designed Conveyor Systems (DCS) has 40 years of experience serving major clients in multiple industries by providing material handling solutions, full-scale warehouse operations, and conveyor designs custom crafted for their needs. DCS does not sell ready-made conveyor systems but builds relationships that empower collaboration to craft custom warehouse designs together. DCS utilizes consulting, engineering design, project management, installation services, and client support to ensure our customers can keep their promises to deliver on time.

DMW&H is a premier Automated Material Handling Systems Integrator headquartered in Northern NJ. Our employees have recognized us as one of the best places to work in New Jersey for nine continuous years. As a leading automation company, DMW&H specializes in the design, integration, installation, and support of innovative distribution centers’ material handling systems. We’ll design and deliver a material handling solution that will transcend your strategic, operational, and financial goals. |

Since 2006, Engineering Innovation, Inc. (Eii) has continued to be a market leader in automation solutions for rapid package and mail processing. We offer custom processing solutions for postal, distribution, fulfillment, warehousing, and reverse logistics applications. As demands increase, accuracy and efficiency become more important than ever before. Eii develops custom equipment to accomplish your processing goals. Uncover increased efficiency, maximized throughput, reduced error, and decreased training time. We bring a wide range of automated capabilities to the table. From barcode scanning and handling packages of all sizes to efficient sorting, precise dimensioning, labeling, and optical character recognition, we’ve got it all.

For over 30 years, Ensign has designed and manufactured custom material handling equipment. Offering the safest and most dynamic high-speed parcel unloaders for the parcel handling industry, our machines easily integrate into new and existing sorting lines and can be designed for any type of transportation containers; gaylords, plastic totes, carts, hampers. Control configurations range from simple manual controls to fully automated including AGV loading integration. Advanced discharging technology automatically modulates the flow of parcels into sorting systems. These systems quickly deliver polybags, boxes, envelopes, and mixed materials onto conveyors, chutes, and tables without causing damage to the contents inside.

EuroSort specializes in high-speed shipping sortation that delivers a strong ROI, handles a wide range of packages, and can be scaled to any operation. Our solutions are in use at some of the largest carriers, consolidators, final mile delivery hubs, and middle mile cross-dock facilities due to the flexible product size, customizable layouts, and incredible reliability. Whether you are looking for a simple endof-line carrier sort, or a 1,200 destination DDU sort, EuroSort has the solution for you. Contact us today!

Shurtape Technologies, LLC, is an industry-leading, global manufacturer and marketer of adhesive tape and consumer home and office products, available under recognizable brand names such as Duck®, FrogTape®, T-REX®, Painter’s Mate®, Shurtape® and Kip®. Shurtape packaging solutions include hot melt, acrylic, and water-activated tapes that are designed to withstand the rigors of the supply chain. ShurSEAL® Automated and Manual Packaging Solutions are purpose-built to keep lines running at peak production. For secure seals, every time.

| https://www.shurtape.com/direct |

Sparck Technologies’ fit-to-size automated packaging will transform your order-packing process. Say goodbye to excessive labor, waste, and costs. With over 40 million unique box sizes, automated packaging gives you unparalleled flexibility. Sparck Technologies’ CVP automated boxing solutions can create up to 1,100 perfectly sized boxes per hour, making labor and peak periods a breeze. Fit-to-size auto-boxing single- or multi-item orders can improve throughput and cut expenses. Say hello to a 50% reduction in shipping volume.

| https://sparcktechnologies.com | sales.packaging@sparcktechnologies.com

Operational optimization that allows consistent delivery of accurate quantities of the right items to customers is a year-round goal for any distribution center operation manager. Difficulty in achieving this consistency is heightened during the peak seasons, where many industries drive their annual profitability. While some peak seasons are well-defined and anchored to specific dates, others can include a high degree of variability in phase and amplitude. Identifying, understanding, and preparing for peak season shifts and how they will impact your operations is key to ensuring you are prepared to successfully tackle your highest demand periods. This includes creating a strategic plan of attack informed by data that factors in your team, assets, and the tools needed to get the job done.

As usual, the first step to solving a problem is identifying if you have one. When it comes to managing peak season optimization, this includes understanding timing and determining the impacts your peak shifts have on your order profile, volume, inventory, lead times, and other key operational drivers. Once you define and quantify the impact, it becomes easier to

create a management and optimization plan. Evaluating historical trends and reflecting on data from previous years, overlaid with a good set of design criteria and assumptions, will provide a solid picture of what your next peak season will entail. To create an accurate historical roadmap, consider an analysis based on the following questions:

What items drove the demand?

How many units were ordered?

In what frequency were units ordered?

In what mode were they shipped?

What customers or segments of customers drove the shift in demand?

How many days of supply were on hand for impacted items? Was it enough?

Where were the gaps and what would have been enough to supply the demand?

Once you can define and quantify what your business and operations will be facing, you will be ready to create a plan to successfully manage the impacts. While there are a variety of factors to consider, a focus on three primary areas can drive significant readiness to optimize distribution center operations during peak seasons:

Storage/Space

Staffing

Material Handling Equipment (MHE)

Let’s dig into each and how strategic preparation can help drive peak season readiness.

Having the right amount of inventory at the right time is essential for executing a successful peak season. A detailed inventory analysis, evaluated with an informed set of assumptions on what the future could bring, is the basis for a strong warehouse strategy. These key metrics are guides to determine the space needed for inventory and how it varies during peak season. Once you have a clear picture of inventory fluctuations, you can create a plan to manage the shifts and changes seamlessly.

To accommodate peak season inventory, many operators invest in temporary outside storage (which could include outside public/commercial storage providers or dedicated on-site solutions). Others choose to expand, creating the needed square footage to accommodate their highest inventory peaks. Determining the right solution

for your operation means identifying the “sweet spot” between the cost of outside storage (and all the extra touches that path requires) and the cost of adding and managing extra in-house storage capacity. This “sweet spot” varies by operation, and the analysis to determine the best solution should take into consideration factors such as the cost of expansion versus outside storage costs, the complexity in identifying and managing the off-site inventory, and additional transportation, staffing, and shifts in material handling costs.

Another way to combat space and storage constraints is to optimize your current inventory storage configuration with the goals of increasing storage capacity and minimizing outside storage requirements. This can be particularly challenging for operations that have significant peak seasons (meaning the peak-to-average ratio is large and/or occurs in shorter, more condensed windows). But, it can be particularly effective for those who experience more moderate and consistent

peak season fluctuations.

Space optimization can also be achieved by removing old/discontinued or slower moving inventory ahead of peak season. A strategic inventory rationalization process can free up significant primary real estate ahead of seasonal high points.

Staffing

Being able to meet customer demand is only possible if you have the appropriate personnel (and/or automation technology) in place ahead of peak season. Today’s hiring market and record-low level of unemployment mean securing the right number of employees for short seasonal tenures can be particularly challenging. Creating a Data-Driven Staffing Plan

To be effective, a staffing plan should be developed months ahead of the peak season. To make informed staffing decisions, consider how many full-time equivalent employees (FTEs) will be required and map out how long you will need them and what skills they will need.

The calculations used to create the plan should consider estimates of pro-

ductivity by task, considering the level of automation/mechanization of each process. That estimated productivity, computed with the anticipated volume to handle, will result in the number of operators needed. The next step would be to identify which tasks can be performed by full-time employees (FTEs) versus seasonal staff. It is important to consider that typically temporary labor will not have the same experience as full-time team members and therefore training could take longer. A good practice is to delegate simpler tasks to the temporary workforce, so permanent staff can focus on the more complex/ critical assignments.

Outside of increasing staff, an optimized shift configuration can help maximize team productivity, improve morale and can be one of simplest ways to increase processing power during peak seasons. Shift configuration can help optimize the use of material handling equipment, defining what operators will use what equipment for what tasks/ processes and how long each will need

to be performed during the working day/ week. There are a wide range of shift configurations to consider from single shift to 24/7 rotating, over-time, four-on/ four-off, and more. Each has pros and cons to consider as you evaluate the goals and constraints of the operation.

Operation and flow optimization have a direct impact on staffing level requirements. Re-slotting, zoning, adoption of fast-forward pick areas, slapper lines, cross docking, and expedited receiving zones are examples of effective strategies that typically don’t require a high capital investment, but that can help maximize productivity resulting in less labor hours.

Having the right tools to execute a job is a direct complement to optimizing the effectiveness of the personnel required to use them. As a result, MHE plays a major role in both space and staffing requirements when it comes to planning for peak seasons.

Often, a more highly automated solution will require a higher level of investment, which can typically be offset by a decrease in labor and space. Finding the right level of automation/mechanization should be rooted in evaluating the alternatives available to determine a fit for your operational and business goals. From conventional solutions that usually require more manual steps to mechanized options that reduce operational costs, the right answer is different for every operation. Ultimately, the cost and savings are intimately related to the order and inventory profile, as well as the length and severity of designated peak seasons. For example, it may be more difficult to justify expensive equipment that will only be utilized for short periods of time during the year.

Not all MHE solutions need to be capital-intensive or permanent. Many operations are able to scale up and down, leveraging their existing MHE during

peak seasons. Forklifts, tractor trailers, pack stations, and even autonomous mobile robots (AMRs) are technologies that can fluctuate as demand changes.

Reflection is the key to preparation when it comes to optimizing operations to meet peak season demands, and considering the right metrics makes all the difference. Take a look at past seasons to analyze what went well, what went wrong, and dig into the data to get a true picture that can guide planning. By tapping into performance insights and applying them to examine opportunities to optimize storage/space, staffing, and material handling equipment, distribution center operations managers can gain significant visibility that can be applied to maximize the production potential and profitability of peak seasons.

Every parcel supply chain is a little different. And ideas that work for one business may or may not be the answer for yours. If it is time for a change, getting a fresh professional opinion can get your supply chain challenges back on track and get your operation shipping more packages, more effectively and more efficiently. Here are 5 companies that are ready to help. Check them out and find the one that can help you take your business to the next level.

We help our clients become smarter consumers of freight services resulting in average client savings of over 17%. We care about YOUR shipping costs as much as you do. We are passionate and data driven. Using our proprietary CarrierCop© software and our team’s years of experience, we will find the savings you desire. You are the boss, you make all final decisions, let us work for you, and focus our energies on bringing you the savings you need.

For over 30 years, AFMS is the leading transportation price benchmarking firm in North America and Europe with business intelligence analytics focused on reducing transportation costs through carrier contract negotiations and automated freight audit & recovery. The pedigree of the AFMS senior management team is unparalleled in our consulting space, with over 500 years of combined industry experience from carriers like UPS, FedEx, and DHL. Our inside pricing knowledge is why some of the largest shippers in the US and Europe use AFMS to benchmark and help negotiate their shipping contracts.

CT Logistics is celebrating our 100th anniversary in the freight audit & payment industry. We are a global logistics supply chain provider, delivering impactful cost reduction solutions. When leveraging CT, you’ll have experienced assets available 24/7 for services including: freight audit & payment, TMS, managed freight, bid management, benchmarking, peer group comparison and expert spend analytics. CT customizes all solutions to minimize your costs & save your company money. CT’s staff includes knowledgeable Professional Services teams for consulting & advice. CT’s business intelligent platform provides global supply chain visibility with graphical dashboards. CT is ISO 9001:2015 & SOC certified.

Software alone cannot deliver the best shipping strategy, but the best shipping strategists can. Green Mountain, founded in 1999, brings deep industry expertise and technology together to create a powerful and unmatched parcel spend management solution. We’ve applied nearly 25 years of experience and lessons learned to create highly accurate and proven processes for the audit and pay, cost allocation, and overall strategic management of your transportation network. With a real industry expert and true strategic partner like Green Mountain by your side, curbing increasing transportation costs and gaining visibility into critical optimization opportunities has never been easier.

greenmountaintechnology.com/PARCEL | contact@greenmountaintechnology.com

Feel trapped in a vicious cycle of hiring parcel consultants? Have you: hired a consultant with a multi-year gain share agreement — experienced payment fatigue — tried to DIY but spend got out of control — had to do it all over again? Our customers asked us for a better way, and we listened. We took 17 years of consulting expertise and codified it into an easy-to-use software app. Analysis that used to take weeks using a consultant can now be done in minutes — and no multi-year gainshare contracts. Reveel is like the Turbo-Tax for parcel consulting.

The ever-growing popularity of online shopping has also dramatically increased the number of returns retailers need to mitigate. Not only expensive for the retailer, with the need to hold additional inventory and the cost per package, returns are also costly for the carriers if they are to pick up from consumers. They can also be frustrating for consumers as they must navigate multiple processes and act as a logistics provider by bringing their returns to a location that is more convenient for the retailer or carrier than it is for the consumer. Not to mention, there is a significant environmental impact in the reverse logistics process.

Retailers need to take a hard look at every aspect of their reverse logistics process and implement structural changes to see better outcomes. Those that don’t have the capabilities internally to rectify these challenges need to align with strategic partners that offer the innovative technology solutions that can. As we look ahead, here are a few things to consider:

Changing our mindset. First, consumers need to collectively reduce returns by more closely aligning what they order online with what they’ll actually use, and refrain from ordering things that they intend to return. At the same time, retailers need to optimize returns processes and technologies. The expansion of e-commerce should also bring about seeing returns as

a strategic lever, similar to how companies used faster delivery to drive customer experience and revenue.

Changing returns policies. Return policies matter and should be strategically implemented, considering 73% of consumers say that a return policy has stopped them from buying an item from a particular brand. Some retailers have taken the drastic approach of charging restocking fees to deter returns. Other retailers are looking at returns from a loyalty perspective; the more loyal the consumer, the more lenient the policy. This is a better strategy to retain lifetime customers. Companies like DSW, Best Buy, and Saks are beginning to segment returns into tiers and rewarding their best consumers. For example, the best customers — based on how much they spend with the retailer annually and how often they return — get perks like free shipping and unlimited returns. Measuring customer acquisition costs (CAC) will be on the top of the list for those entering these waters.

Addressing shrinkage. Theft from retail stores is only part of the problem. Shrinkage includes inventory loss from other sources like returns fraud and human error. The current returns process has too many touchpoints where shrinkage can happen. For example, when items are inside a sealed box, bad-acting consumers can return a brick instead of a remote control. Retailers may not notice they did not receive

their remote control for several weeks, and too many touches have happened by that time to truly understand who did what when. This causes up to two percent inventory loss annually. The future of returns is box-less and label-less returns pickups from consumers’ doorsteps, where pictures are taken of the item itself to start the product verification process.

New technologies are a gamechanger. Data-driven solutions that provide insight into each individual customer’s shopping habits are also emerging. Companies like Appriss are applying their technology to the retail world and are successfully curbing excess and fraudulent returns. This is how forward-thinking retailers are ensuring that abusive returners don’t ruin policies for everyone, while also reducing shipping costs and greenhouse gas emissions (with returns making up 25% of all e-commerce emissions).

The right return policy. Retailers need to be cognizant of keeping existing customers and capturing potential customers while also making sure they don’t lose money in the process. So what is the right return policy? It comes down to understanding why brands are making returns difficult in the first place, what works best for that brand, and the underlying costs that lie outside the operational boundaries.

Retailers need to remove the idea of mitigating returns as a whole. It’s not realistic, and even with best efforts, the rate of returns has managed to only increase over time. Retailers typically place the focus on returns in two strategic buckets: ease and hurdles. In reality, there should be one bucket: the consumer. Returns have a huge influence on the consumer’s buying decision. The returns process is a reflection of the shopping experience itself, a shadow of the brand or retailer. An efficient and transparent returns policy can strengthen a brand’s reputation promoting loyal patronage, as 92% of consumers who have a positive return experience revisit brands for another purchase. Additionally, things like where customers return items matter. Consumers don’t want to have to bring returns back to a logistics provider. In fact, 32% say that was the most inconvenient part of the returns experience.

Returns are a part of shopping culture and play a major impact on purchasing decisions. It’s improbable that we are ever going to eliminate them. But we can take a different approach to how we manage them by transforming the problem into a solution that recaptures customers/dollars, data-driven decisions, and waste reduction, while improving supply chain efficiencies. Looking ahead, the retail winners will be those who place the customer first and reap the rewards as they adapt their reverse supply chains to their strategic advantage.

Christian Piller is co-founder and Chief Commercial Officer of Pollen Returns, a technology-led business that empowers D2C retailers to leverage their current inventory for better planning and capital utilization through quicker recovery of returns. Pollen Returns is a venture-backed company that is currently available in any US market and will be expanding overseas to Europe in the near future.

Consumers need to collectively reduce returns by more closely aligning what they order online with what they’ll actually use, and refrain from ordering things that they intend to return. At the same time, retailers need to optimize returns processes and technologies.

— CHRISTIAN PILLER

— CHRISTIAN PILLER

FedEx 2.0 focuses on four key areas: network optimization, technology innovation, process improvement, and customercentricity. By optimizing its network, FedEx aims to improve efficiency and reduce costs while also expanding its global reach and capabilities.

— JOE WILKINSON

— JOE WILKINSON

Recently, as post-pandemic demand decreased and inflationary pressures grew, Amazon decided to overhaul its network. Its goal was to aggressively cut costs, better serve Prime members with same-day service, and optimize its delivery infrastructure while leveraging its massive warehouse footprint.

— JEFF HAUSHALTERChoosing to outsource perhaps the most critical part of one’s operation to a 3PL is an important decision that should be evaluated based on several factors, since it’s a great option for some, but may not be a good decision for others.

— THOMAS ANDERSENHistorically, shippers negotiated with their carrier rep to get the “best” deal possible. Now strategic shippers are not only analyzing their contracts with far greater rigor — and negotiating based on fact rather than perception — but they are negotiating more frequently throughout the year and more effectively, with many securing savings far in excess of past expectations.

— JOSH DUNHAM

— JOSH DUNHAM

The first step to solving a problem is identifying if you have one. When it comes to managing peak season optimization, this includes understanding timing and determining the impacts your peak shifts have on your order profile, volume, inventory, lead times, and other key operational drivers.

— MAURICIO CASTELLANOS