By Mia Goulart, Senior Staff Writer

Life without a smart phone is hard to imagine for many of us. Every answer at our fingertips—any person a few digits away. Technology is intertwined with nearly every aspect of our lives, and yet, few think about the infrastructure that supports it.

Enter, data centers. That is, large groups of networked computer servers used by organizations for the remote storage, processing or distribution of large amounts of information. Chicago Industrial Properties recently spoke with Craig Huffman, Co-Founder &

CEO of Metro Edge Development Partners to find out more about what will be one of the biggest projects of its kind: Metro Edge’s $257 million, 200,000-squarefoot, five-story facility to be built in West Side Chicago.

The project has been a few years in the making. Metro Edge started the process of securing the site in the Illinois Medical District (IMD) a few months after the onset of COVID-19, and from there began working on securing the rights to build. Recently Metro Edge fi-

By Mia Goulart, Senior Staff Writer

By Mia Goulart, Senior Staff Writer

Chicago Industrial Properties recently consulted SparrowHawk Founder Alfredo Gutierrez to discuss the current outlook,

PRSRT STD U.S. Postage PAID CHICAGO, IL PERMIT NO. 3223 INVESTMENT (continued on page 6) Investment & Finance: Will rising interest rates and surging inflation spell trouble for the sector? Not according to SparrowHawk VOL.33 NO.1 JANUARY 2023 THE LEADING NEWS SOURCE FOR INDUSTRIAL REAL ESTATE PROFESSIONALS & USERS CRE MARKETPLACE (pg.11): CONSTRUCTION COMPANIES/GENERAL CONTRACTORS FINANCE & INVESTMENT FIRMS I t’s a pivotal moment for the U.S. economy. Will surging inflation and geopolitical shifts spell trouble for the sector? Not necessarily.

DATA CENTER (continued on page 8)

“Data is the new gold”: Metro Edge to build $257 million data center in the IMD, one of the year’s biggest projects

ReJournal 10 x 13 print ad.pdf 1 12/21/20 9:14 AM

Chicagoland’s

Union Electrical Team

LEARN MORE AT POWERINGCHICAGO.COM C M Y CM MY CY CMY K

PUBLISHER

Mark Menzies menzies@rejournals.com 708.622.0074

SENIOR STAFF WRITER

Mia Goulart mia.goulart@rejournals.com

VICE PRESIDENT OF SALES & MW CONFERENCE SERIES MANAGER

Ernie Abood eabood@rejournals.com

VICE PRESIDENT OF SALES

Frank E. Biondo Frank.biondo@rejournals.com

CLASSIFIED DIRECTOR

Susan Mickey smickey@rejournals.com

ADVERTISING SUPPORT Hayley Myers hayley.myers@rejournals.com

DIRECTOR, NATIONAL EVENTS & MARKETING

Alyssa Gawlinski agawlinski@rejournals.com

CONTENTS

1“Data is the new gold”: Metro Edge to build $257 million data center in the IMD, one of the year’s biggest projects Chicago Industrial Properties recently spoke with Craig Huffman, Co-Founder & CEO of Metro Edge Development Partners to find out more about what will be one of the biggest projects of its kind: Metro Edge’s $257 million, 200,000-squarefoot, five-story facility to be built in West Side Chicago.

1Investment & Finance: Will rising interest rates and surging inflation spell trouble for the sector? Not according to SparrowHawk It’s a pivotal moment for the U.S. economy. Will surging inflation and geopolitical shifts spell trouble for the sector? Not necessarily.

4Solid end to the year: Chicago a top market for new construction and sales volume Even in the face of a weakening economy, including a potential recession, the year concluded as one of the strongest on record for the sector as demand for space continued to fuel rent growth.

7The beginning of a slowdown in Chicago? After a prosperous run, the inevitable is approaching, as the market has started to slowdown

BUILD-TO-SUIT, SPEC & BUSINESS PARKS

Chicago Industrial Properties® (ISSN 1546-377X) is published bi-monthly for $59 per year by Real Estate Publishing Corporation, 1010 Lake St Suite 210, Oak Park, IL 60301. Contact the subscription department at 312.933.8559 to subscribe. © 2023 by Real Estate Publishing Corporation. All rights reserved. No part of this publication can be reproduced or transmitted in any form or by any means, electronic or mechanical including photocopying, recording or by any information storage or retrieval system.

2023

EDITORIAL BOARD

Jeanne Rogers

Arthur J. Rogers & Co.

Corey Chase Newmark

Jerry Rotunno Associated Bank

Joe Pomerenke

Arco/Murray National Construction Company, Inc

Dan Fogarty

Stotan Industrial

Adam Moore

First Industrial Realty Trust Inc.

Ron Behm

Colliers International

Adam Roth

NAI Hiffman

Mike Yungerman

Opus Group

Glen Missner

The Missner Group

3 JANUARY 2023 CHICAGO INDUSTRIAL PROPERTIES

11

CONSTRUCTION COMPANIES/ GENERAL CONTRACTORS FINANCE & INVESTMENT FIRMS More Information and Registration

Solid end to the year: Chicago a top market for new construction and sales volume

By Mia Goulart, Senior Staff Writer

Even in the face of a weakening economy, including a potential recession, the year concluded as one of the strongest on record for the sector as demand for space continued to fuel rent growth.

Industrial rent growth maintained its upward climb in markets across the U.S., with national in-place rents for space increasing 6.5% year-over-year, and through port markets led the nation in both new leases and in-place rent growth, Chicago was among the top metros in terms of new construction.

In fact, Chicago is where much of all new supply is being focused—26 million square feet at year-end—along with a handful of other locations including Phoenix, Dallas-Fort Worth, Houston and the Inland Empire.

Nationwide, CommercialEdge reported more than 742.3 million square feet (4% of existing product) under construction at year-end, the preceding markets accounting for more than one-fourth.

Not only was Chicago a leader in new construction, but it also led charts in terms of sales volume, with a total of $3.78 billion at the end of November. It was not, however, the only market

in the region to surpass the $1 billion mark: Indianapolis sales totaled $1.19 billion at year-end; the Twin Cities, $1.033; and Columbus, $1.031.

Finally, as for rent growth, it was Detroit that claimed the sharpest rent growth in the Midwest. With rents increasing 6.2% year-over-year, it ended the year as the second-priciest market in the region for in-place leases at

$6.13 per square foot, outpacing the rate of $5.59 per square foot in Chicago. Chicago was No. 1 in the Midwest for new leases with an average of nearly $7.50 per square foot.

But just how long can the region’s hot streak continue? Can the same good fortune be expected from 2023? Buyers and sellers have pulled back in recent months due to a wobbly economy, and new construction starts were pulled back in the final months of 2022, reported CoStar.

That said, roughly 687 million square feet of space is under construction in the U.S.—the fastest pace of growth in more than three decades, based on the company’s latest report—including sizable manufacturing projects by the computer chip industry to drive national economic growth.

CoStar is tracking more than 18 electric vehicle, battery and semiconductor plants scheduled to open across the U.S. over the next few years, which are expected to generate millions of square feet of leasing.

4 CHICAGO INDUSTRIAL PROPERTIES JANUARY 2023

only was Chicago a leader in new construction, but it also led charts in terms of sales volume, with a total of $3.78 billion at the end of November."

"Not

including how to parse truth from tale when it comes to investing in today’s market.

The Concern

Much of the concern has less to do with volatile economic factors, but the lack of clarity surrounding them, Gutierrez said. The economy is murky, and everyone seems to have a different opinion regarding what might or might not happen. It’s true that some of the traditional items the real estate industry looks to are in flux—like the 10-Year T—but no one knows for sure how things will play out. Still, whatever does happen will have an impact, and lenders, in particular, are widening their spreads to give themselves room if there’s an upward shift.

“Because of this, no one knows exactly how to underwrite a deal. From the matrix of traditional cap rate underwriting, if you only took a property’s first-year NOI, the majority of deals don’t pen out in terms of what they’re truly worth. Meaning cap rates as a function may have moved up, due to what’s happening in the economy, but so have rental rates resulting in value to be captured in the future.”

Real estate values haven’t deteriorated, and much of the investment community has shifted their focus to three-year windows as opposed to 12 months because of rent inflation, which Gutierrez said is predicted to continue to significantly inflate as a result of low vacancy and limited supply of space. New buildings are quickly absorbed, as the sector continues to see positive absorption.

“Everyone’s predicting there’s going to continue to be upward pressure on rents, making way for a landlord’s market,” Gutierrez said. “But is that enough to justify the potential cap rate increase? There’s just not enough clarity. No one has a crystal ball, so there’s a little skittishness in the market but property values based on price per square foot continues to be maintained.”

What Sets Industrial Apart

Each sector is different, and thus, it’s fair to wonder if the above economic concerns will have different effects on each. That said, Gutierrez said no. It’s important to focus on the basics and fundamentals.

“Industrial continues to have legs to it,” he said. “It’s a favored sector. Commercial real estate traditionally has been highly levered. Whether its 50–60%, the leverage is a part of the investment and in the low interest rate environment real estate values benefited. We had almost zero cost of capital for many years and even with relatively flat rental rate escalation cap rates con-

tinued to decrease, and lenders spread decreased. Now we are seeing the opposite situation and a lot of cash buyers who see the value due to extremely high rental rate growth and potential to add leverage later. Historically life companies and banks based their interest rates upon the 10-Year Treasuries. The 10- Year Treasuries being a longer-term number and while the Fed fund rates have significantly increased the 10 year doesn’t move basis point by basis point, it does move in tandem to some degree. We did see the 10 Year Treasuries push 3.75%–4% with a 200 basis point spread on it for the lender, lenders are quoting 6% interest rates. A traditional highly leveraged buyer can’t buy deals at 4% yield because the equa-

tion doesn’t work with negative leverage. We have seen the 10-year rate pull back significantly even in the face of rising Fed Funds which have resulted in an inverted yield curve and the 10year T currently at about 3.4%. When the lenders narrow the spreads, you will see debt at sub 5%. With double digit rent inflation leverage deals will trade and strong returns will continue even if the CAP rate move up slightly.”

Now there is a cost, and Gutierrez said the short term objective is to get the industry on the same page. Unfortunately, it is like turning a big ship, it takes time, and slowly, it will turn.

Another thing worth noting is the Fed’s recent adjustment of interest rates but less aggressive, as they’ve scripted a 5% interest rate to offset the risk of flaring inflation.

“I think you’re going to see inflation quickly come into line,” Gutierrez said. “Current inflation isn’t an interest rate issue, but rather a supply issue brought about by the pandemic. It’s solving itself and as supply grows, you’ll start to see downward pressure on price of commodity goods.”

Information Overload

There is so much information out there—every article slightly different—contributing further to the previously-mentioned lack of clarity. When asked for insight by investors with regard to trying to navigate the space in the current market, Gutierrez emphasized patience. 2H2022 came with a lot of speculation and worry, but the fundamentals speak for themselves.

“The fundamentals in the sector are stronger than I’ve ever seen them in my 35-year career,” he said. “Low vacancy, good product, the growth of e-commerce and reshoring are all positive for owners of industrial real estate. We just have to step back. Those of us that have been in the business for long enough realize we need to do our job to increase NOI and, as a result, increase value. It’s important to be patient, pay attention to the fundamentals and remind ourselves that it’s still a strong market.”

6 CHICAGO INDUSTRIAL PROPERTIES JANUARY 2023

INVESTMENT (continued from page 1)

"The fundamentals in the sector are stronger than I’ve ever seen them in my 35-year career. Low vacancy, good product, the growth of e-ecommerce and reshoring are all positive for owners of industrial real estate."

The beginning of a slowdown in Chicago?

By Mia Goulart, Senior Staff Writer

After a prosperous run, the inevitable is approaching, as the market has started to slowdown.

The signs? Well, Savills’ Q4 2022 Industrial Report found that (1) while vacancy remains well below the long-term average, it has risen for two consecutive quarters, closing the year at 4.6%, and (2) demand seems to be lessening, though asking-rate growth has not yet abated, increasing 3.7% over the quarter to $5.60 per square foot. Rates have risen slightly over the past two years due to strong occupier demand and upward pressure from inflation.

Savills said, too, that another factor with potential to alter market fundamentals is the high volume of construction. After setting the record for ongoing construction in Q3 2022, Chicago beat its own record. Industrial property construction exceeded 38 million square feet, increasing almost 16% in Q4. Impressive, but many wonder whether current levels of construction

are sustainable and if market dynamics will be altered by overbuilding.

Still, Q4 remained just as active in terms of user activity. Tenneco sold and

leased

Regarding e-commerce, it’s not farfetched to say what’s happening within this sector might be a warning sign, according to Savills. Following a recent, yet steady decline in sales growth, Amazon abandoned several existing and planned facilities across North America, and Walmart and Nordstrom, for example, have announced significant layoffs.

Chicago has seen an upward trend of direct space, but a shift in sublet supply has yet to occur, hovering at 4.8 million square feet—below the five-year average of 5.7 million square feet.

All this said, Chicago metrics remain comparatively better than markets along the East and West Coasts, and the sector itself remains one of the safest during this time, compared to office and retail where demand appears to have been more fundamentally altered by the effects of the pandemic.

7 JANUARY 2023 CHICAGO INDUSTRIAL PROPERTIES

back its 1,000,000-square-foot facility at 7450 McCormick Boulevard within North Cook. Uline renewed their lease of 502,000 square feet at 11290 80th Avenue in Kenosha.

nalized agreements with Corgan, Clune Construction, Power Construction and Ujamaa Construction to design and build the facility, and the project is expected to have full entitlements within the next few months and break ground shortly thereafter. The facility has already secured 50% preleasing.

The benefits to this type of project are vast, as are the benefits of its future location within the IMD. The Affordable Care Act (2010) required the digitization of medical records, among other things, which sparked the need for this kind of facility. Several healthcare buildings in and around the IMD will utilize the

new facility, but it’s not just healthcare. The high-performance facility will also address the needs of local and regional financial, educational and government organizations.

Technology is the root of it, and it’s no surprise the pandemic accelerated its

adoption. We’re more dependent on it than we were just a year ago, let alone 10. Data centers are the infrastructure needed to support the adoption of new technology. It’s the storage of data, but also the connectivity that supports companies providing basic functions, according to Huffman.

For over 45 years, DarwinPW Realty/CORFAC International has been a leader in industrial and commercial real estate. The company specializes in brokerage, property management, investment and development services primarily in the Midwest. DarwinPW Realty’s highly qualified professionals are problem solvers and utilize a breadth of tools and knowledge to serve our clients best.

8 CHICAGO INDUSTRIAL PROPERTIES JANUARY 2023

DATA CENTER (continued from page 1)

630.782.9520 | darwinpw.com

of excellence.

The origin

facilities

reliable

"These

are an important part of ensuring that technology is

and accessible for the masses."

“Regardless of industry, these facilities are an important part of ensuring that technology is reliable and accessible for the masses,” Huffman said.

Chicago, specifically, is a prime location in terms of connectivity, making it especially desirable for this type of venture.

“Chicago is an attractive site because we’re in the middle of the country and have great fiber,” Huffman said. “Fiber and power are the determining factors with regard to whether or not a data

center can be developed in a particular location.”

Yet this isn’t the first of its kind in the area. In fact, there are quite a few data centers around Chicagoland. What sets this one apart? There are few in urban settings, like this one, and as technology continues to evolve, more of this kind are needed. But they’re not cheap, and though demand is greater than supply, it takes years of planning to get them out of the ground.

And while it’s also worth mentioning that these centers don’t create as many jobs compared to other, more labor-intensive facilities, the jobs are future facing—and higher paying. It’s estimated that artificial intelligence will eliminate a substantial number of manual jobs over the next decade, and data centers are part of the new economy. Technology has reduced the number of jobs, but it’s part of the broader societal shift.

The construction of this particular data center will support over 200 construction jobs and, once completed, over 70 full-time jobs in a variety of fields including data center engineers, electricians, tech support personnel, and operations.

Driving forward with a new modern facility.

Principle has been selected to build a new 31,200 SF new truck maintenance facility at 2570 Millennium Dr. in Elgin. The building will house a 15,400 SF warehouse, a 9,800 SF truck maintenance area, and 6,000 square feet of office space. The office area will have five offices, open office areas, a conference room, separate break rooms for drivers, mechanics and office staff, an IT-room, and two multi-fixture restrooms. Principle is also constructing a 972 SF mezzanine storage area and amenities for truckers using the facilities, including showers and rest areas.

9450 West Bryn Mawr Avenue, Suite #120 • Rosemont, IL 60018 (847) 615-1515 fax (847) 615-1598

31,200 SF New facility

9 JANUARY 2023 CHICAGO INDUSTRIAL PROPERTIES

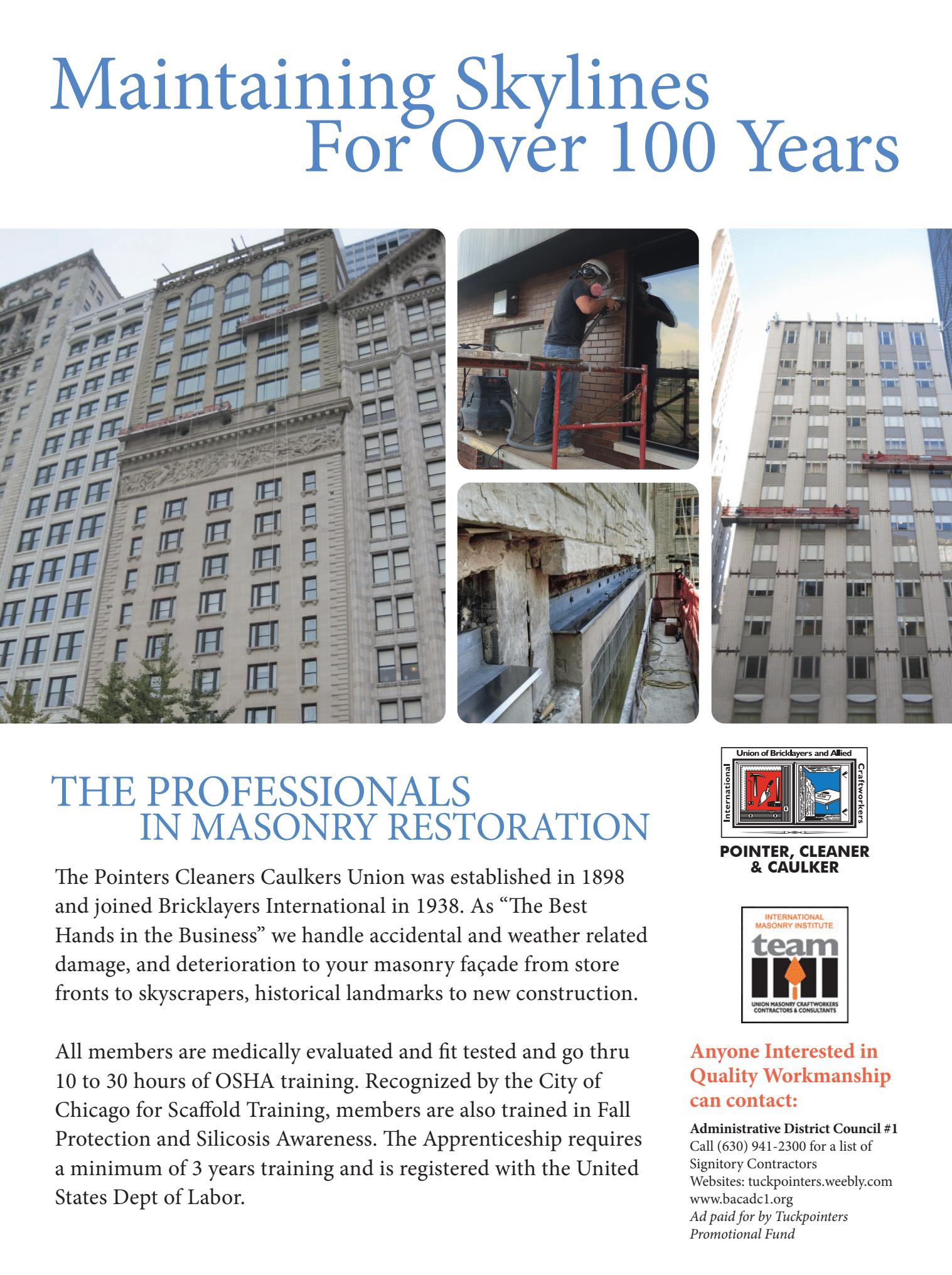

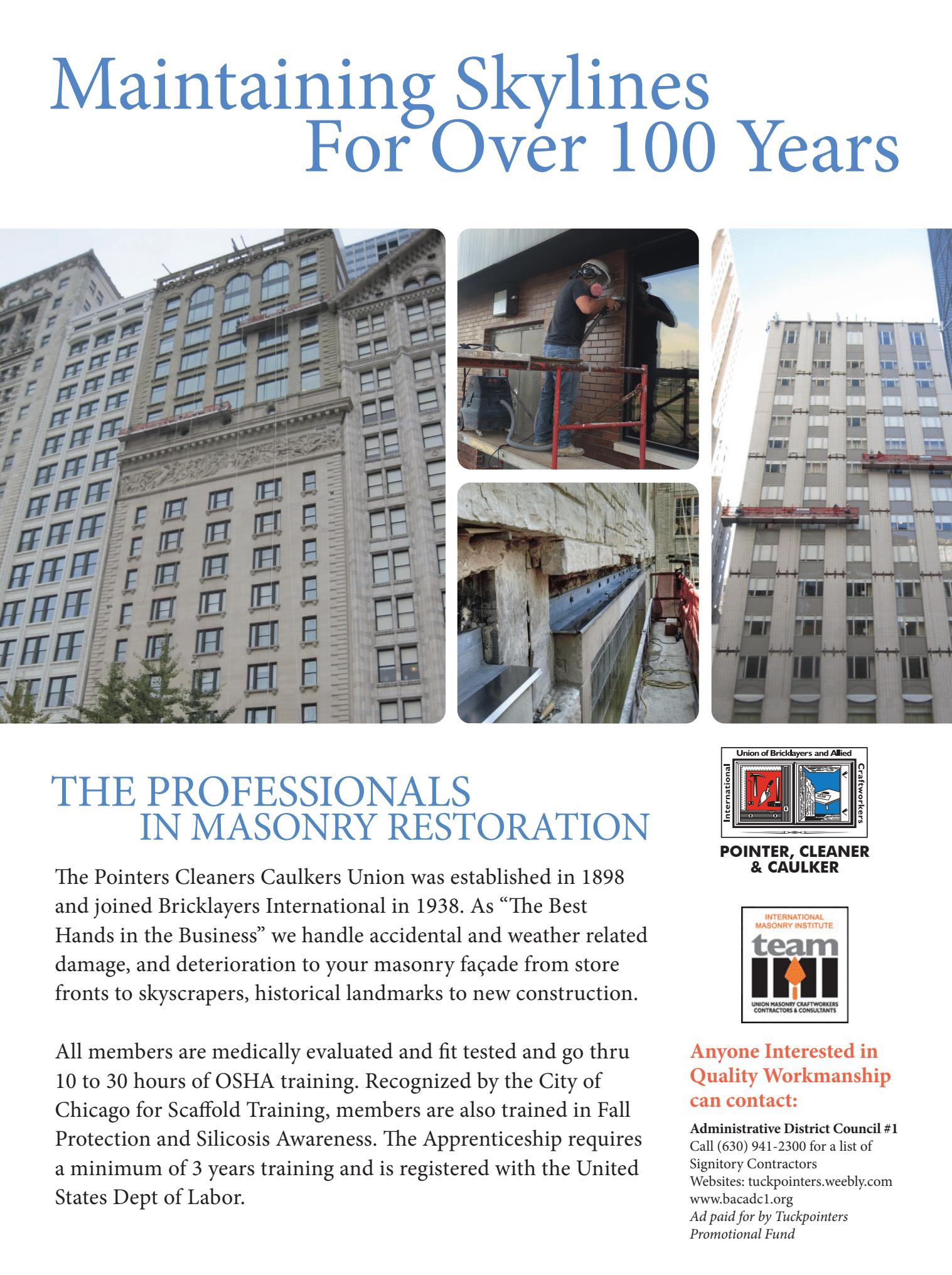

PCC2022 IREJ Nov Ad (f).indd 1 11/28/22 1:55 PM

What to know about the new Greater Chicagoland Economic Partnership

By Mia Goulart, Senior Staff Writer

By Mia Goulart, Senior Staff Writer

“Northeastern Illinois is stronger when it works together as one,” is the reason behind the first-of-its-kind economic collaboration to boost shared prosperity throughout Chicagoland.

As stated on the Chicago Metropolitan Agency for Planning (CMAP) website, elected officials from the region recently announced the Greater Chicagoland Economic Partnership between Chicago and surrounding counties of Cook, DuPage, Kane, Kendall, Lake, McHenry and Will.

Meant to improve the region’s global competitiveness by presenting a common pitch to the outside world, rather than competing with each other, the collaboration will focus on promoting the region’s benefits to build a competitive global identity, according to CMAP.

The group, however, will have a limited time and budget to prove itself successful, with the group staked to get $3

million over a three-year pilot period, during which they hope to (1) generate 150 pro-Chicago area decisions and 500 shared new investment opportunities, (2) create a common pitchbook and

(3) expand the city’s development unit to include suburban work.

WBC will manage the new partnership with other county groups, according to

Crain’s. WBC Executive Vice President of Business Development and Global Strategy Kyle Schulz said officials have learned that cooperation is better than opposition, which has been a roadblock for various projects in the past, like the once-proposed Illiana Expressway.

The list of pros seems never ending.

The Chicago Tribune reported that the partnership also has the potential to stop the poaching of corporate headquarters between the region, citing the city’s history of poaching outlying companies, like McDonald’s from Oak Brook in 2018.

To CMAP, President of CEO of World Business Chicago said: “The Greater Chicagoland Economic Partnership will not only move the Chicagoland forward, but become its distinctive competitive advantage, helping existing firms expand in the region and attract new corporations. The region’s future is bright.”

10 CHICAGO INDUSTRIAL PROPERTIES JANUARY 2023

CIP MARKETPLACE

CONSTRUCTION COMPANIES/GENERAL CONTRACTORS

ALSTON CONSTRUCTION COMPANY

1901 Butterfield Road, Suite 1020

Downers Grove, IL 60515

P: 630.437.5810 Website: alstonco.com

Key Contact: Greg Kolinski, Director of Business Development, gkolinski@alstonco.com

Services Provided: Alston offers a diverse background of design-build experience, general contracting and construction management of industrial, commercial, healthcare, retail, and municipal projects.

Company Profile: Alston Construction’s success begins and ends with our approach to planning, scheduling, and choosing the right team. We have been adhering to an open and collaborative approach since our founding more than 35 years ago.

Notable/Recent Projects: Project Heartland 1.5 Million SF build to suit distribution facility for Proctor & Gamble in Morris, IL. Lakeshore Manor 210 unit senior living facility in Northwest Indiana. Dynamic Foods 3PL 500,000 SF build to suit distribution and packaging facility in Wilmington, IL. Brown Deer Distribution Center 420,000SF two building speculative distribution center in Milwaukee, WI. 106,000 SF meat packaging facility in Northwest Indiana.

MCSHANE CONSTRUCTION COMPANY

9500 West Bryn Mawr Avenue Ste. 200

Rosemont, IL 60018

P: 847.292.4300 | F: 847.292.4310 Website: www.mcshaneconstruction.com

Key Contacts: Mat Dougherty, PE, President, mdougherty@mcshane.com

Services Provided: McShane Construction Company offers more than 35 years of experience providing design-build, design-assist and general construction services on a national basis

The firm’s diverse expertise includes build-to-suit and speculative warehouse, distribution and manufacturing facilities, as well as multifamily, commercial and institutional developments.

Company Profile: Headquartered in Rosemont, Illinois with regional offices in Auburn, Alabama, Irvine, California, Phoenix, Arizona, Madison, Wisconsin and Nashville, Tennessee, McShane Construction Company provides comprehensive construction services on a local, regional and national basis for a wide variety of market segments. The firm is recognized as one of the Chicago area’s most diversified and active contracting organizations with a reputation built on honesty, integrity and dependability.

Recent/Notable Project: Industry Center at Melrose Park – the construction of three speculative industrial buildings in Melrose Park, Illinois. The new development incorporates a total of 651,617 square feet.

MERIDIAN DESIGN BUILD

9550 W. Higgins Road, Suite 400 Rosemont, IL 60018

P: 847.374.9200 | F: 847.374.9222 Website: meridiandb.com

Key Contacts: Paul Chuma, President; Howard Green, Executive Vice President Services Provided: Meridian Design Build provides construction and design/ build construction services on a national basis with a primary focus on industrial, office, medical office, retail and food and beverage work.

Company Profile: With a team of in-house professional project managers, Meridian has extensive experience coordinating the design and construction of new buildings, tenant improvements, and additions/ renovations from 15,000 square feet to 1,000,000+ square feet. Meridian Design Build has been a Member of the U.S. Green Building Council since 2007.

Notable/Recent Projects: Clarius Park Joliet Building #2, Joliet, IL - 906,517 sf speculative industrial facility for Clarius Partners. Commerce Park Chicago Building B, Chicago, IL602,545 sf speculative multi-tenant industrial facility for NorthPoint Development. Halsted Delivery Station, Chicago, IL - 112.000 sf package delivery station on a 17-acre redevelopment site for Prologis.

SUMMIT DESIGN + BUILD, LLC

1036 W. Fulton Market, Suite 500 Chicago, IL 60607

P: 312.229.4630

Website: summitdb.com

Key Contacts: Adam Miller, President, amiller@summitdb.com; Deanna Pegoraro, Vice President, dpegoraro@summitdb.com; Jon Silvers, Business Development, jsilvers@summitdb.com

Services Provided: Summit Design + Build, LLC is a provider of full service general contracting, construction management and design/ build construction services for the commercial, industrial, multifamily residential, office/tenant interiors, hospitality and institutional markets.

Company Profile: Located in Chicago’s Fulton Market and with regional offices in Tampa, FL, Austin, TX and North Carolina, Summit Design + Build has been involved in the design and construction of over 400 buildings and spaces totaling more than 10 million square feet over the firm’s 18 year history.

Notable/Recently Completed Projects: Eli’s Cheesecake (Industrial), 2217 Loomis (Industrial), 1436 W Randolph (Adaptive Reuse Hotel), 718 Main (Multifamily), Prenuvo (Medical TI), 5691 N Ridge Ave (Multifamily).

VICTOR CONSTRUCTION

2000 Center Dr., Suite East C219 Hoffman Estates, IL 60192

P: 847.392.6900

Website: victorconstruction.com

Key Contact: Zak Schuttler, President, ZakS@victorconstruction.com Services Provided:Victor Construction Co., Inc. manages projects from ground-up site developments to interior buildouts, specializing in retail, industrial, and commercial markets.

Company Profile: Victor Construction Co., Inc. remains a family-owned and operated General Contractor. Having been in business since 1954, our firm has extensive experience managing every aspect of interior construction for the corporate, manufacturing, industrial, and retail sectors. Notable/Recent Projects: Owens + Minor Distribution – 600K SqFt distribution facility that involved a full LED lighting upgrade, new HVLS fans, 200K SqFt section that required new cooling for medical distribution, an office renovation of 20K SqFt, and a new exterior employee pavilion.

FINANCE & INVESTMENT FIRMS

CENTERPOINT PROPERTIES

1808 Swift Drive

Oak Brook, IL 60523

P: 630.586.8000 Website: centerpoint.com

Key Contacts: Bob Chapman, Chief Executive Officer, bchapman@centerpoint.com; Jim Clewlow, Chief Investments Officer, jclewlow@centerpoint.com Services Provided: CenterPoint Properties is an innovator in the investment, development and management of industrial real estate and multimodal transportation infrastructure. CenterPoint acquires, develops, redevelops, manages, leases and sells state-of-the-art warehouse, distribution and manufacturing facilities near major transportation nodes. Our experts focus on rail and portproximate distribution infrastructure assets.

Company Profile: CenterPoint Properties continuously reimagines what’s possible by creating ingenious solutions to the most complex industrial property, logistics and supply chain problems. With an agile team, substantial access to capital and industry-leading expertise, we provide our customers with a competitive edge and ensure their success — no matter how great the challenge.

MARQUETTE BANK

10000 W. 151st Street

Orland Park, IL 60462

P: 708-364-9131 Website: emarquettebank.com

Key Contact: Gene Malfeo, Senior Vice President, gmalfeo@emarquettebank.com Services Provided: Full line of Commercial, Business and Real Estate loans customized to your individual needs including: commercial and residential construction loans, commercial mortgages, equipment loans and working capital lines of credit.

Company Profile: Marquette Bank started in Chicagoland in 1945 and is still locally-owned/operated. Expect quick decisions, competitive rates, easy application and personal service. Personal/business banking and lending, home mortgages, land trust services, estate planning, insurance services, wealth management and multifamily lending.

MAVERICK COMMERCIAL MORTGAGE

853 N. Elston Avenue Chicago, IL 60642

P: 312.268.6000 | C: 312.953.4344 Website: mavcm.com

Key Contacts: Ben Kadish, President, ben.kadish@mavcm.com; Services Provided: Maverick finances all commercial real estate properties for builders, developers, investors and owner-occupied properties. For apartment loans, Maverick has access to every multifamily program available for property owners as we are a correspondent for Fannie Mae and Freddie Mac execution along with Freddie Mac small loan program. CMBS fixed and floating rate non-recourse loans available. Bank, portfolio, and debt fund non-recourse construction and permanent financing available on a national basis.

Company Profile: Maverick Commercial Mortgage, Inc. is a boutique firm focused on middle market borrowers for properties in Chicago and surrounding areas, with a focus on Illinois, Indiana, Wisconsin, Iowa, Missouri, Michigan, and Kentucky. We are a niche lending source for Manufactured Housing Community mortgages and portfolio loans across the country with fundings in excess of $80,000,000 for MHC product on an annual basis. Significant financings for 2022 include a $63,000,000 single asset mortgage on an Illinois manufactured housing community, a $14,000,000 first mortgage on a Home Depot store in Chicago and several industrial building loans on the south and northwest side of the city of Chicago.

Service Territory: Midwest for general mortgage loans, and national for MHC financing.

UNION NATIONAL BANK

101 E. Chicago St.

Elgin, IL 60120

P: 847.888.7500 | F: 847.888.2662 Website: unbelgin.com

Key Contacts: Anthony Catanese, Business Development Manager, afcatanese@unbelgin.com; Jill Markowski, Director, jemarkowski@unbelgin.com; Jay Deihs, Sr. VP, jddeihs@unbelgin.com

Services Provided: Loans customized to meet the individualized needs of our borrowers.

Servicing investors and small business owners.

Company Profile: Privately-held, Commercial Bank. 110 years old. Providing Personal service throughout the Chicago Metro area. Known for fast response time and experience in Commercial & Investment Real Estate lending.

Service Territory: Chicagoland including NE Illinois collar counties.

FOR ADVERTISING OPPORTUNITIES IN THIS SECTION, PLEASE CONTACT SUSAN MICKEY AT SMICKEY@REJOURNALS.COM OR 773.575.9030

We’ve got Chicago covered SullivanRoofing.com 847.908.1000 IL License Number 104-011830 installation MILL ION sq ft installation 185 MILL ION installation MILL ION sq ft square feet of roofing installation 185 MILL ION of roofing installation 185 MILL ION sq ft of roofing installation 185 MILL ION sq ft Zurich HQ, Schaumburg Audi, Highland Park Knoch Knolls Nature Center, Naperville Fashion Outlets, Rosemont

By Mia Goulart, Senior Staff Writer

By Mia Goulart, Senior Staff Writer

By Mia Goulart, Senior Staff Writer

By Mia Goulart, Senior Staff Writer