Busy? That’s an understatement for the Omaha commercial real estate market

By Dan Rafter, Editor

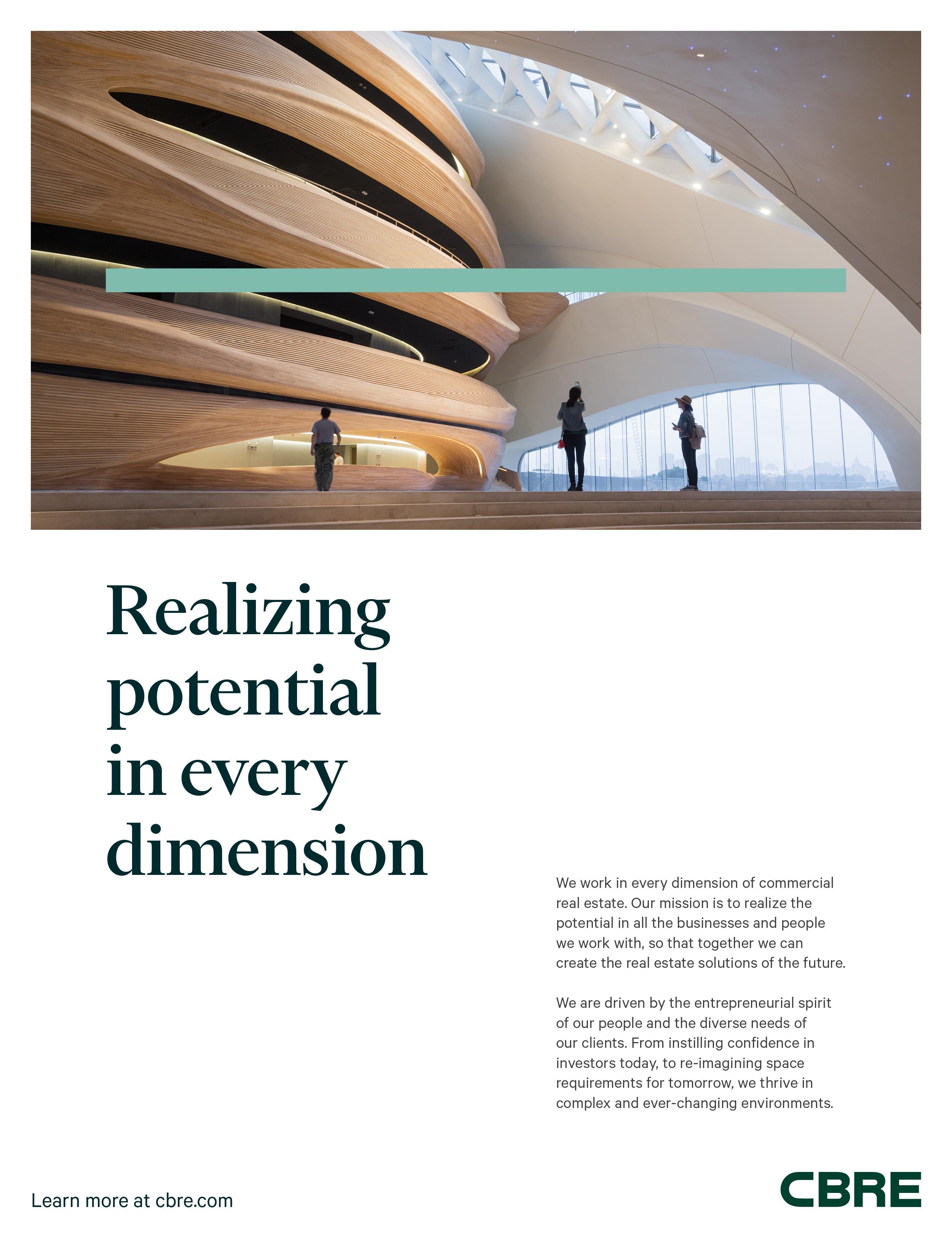

Pandemics, soaring inflation and rising interest rates. Omaha’s commercial real estate market has remained resilient during all of them.

Why? What makes Omaha’s commercial real estate market such a strong one? Why has demand for multifamily, industrial and retail properties in this city remained so high for investors? Why has leasing and sales activity remained so strong throughout most of Omaha’s commercial sectors?

The commercial pros working this market point to a pro-business government that encourages devel opment and entices companies to open national or regional headquarters here. They also cite the strong

workforce in Omaha and the commitment city leaders have to constantly improving the neighborhoods that make up Omaha.

That last point is especially important today. Several high-profile commercial developments are springing up across Omaha and its suburbs. These new office towers, mixed-use developments and multifamily prop erties are pumping new dollars into the city. And they are attracting new residents and companies.

So even though the national economy is far from stable today, Omaha’s commercial real estate market is show ing few signs of slowing.

OMAHA

FINANCE

Financing pros: Interest-rate hike means a slowdown in commercial deals is inevitable

By Dan Rafter, Editor

In its efforts to curb rising inflation, the Fed eral Reserve on Sept. 21 raised its benchmark interest rate by three-quarters of a percentage point. The Fed said that it plans to boost this rate in the future to fight inflation.

The Fed also said it will continue to enact hikes until its benchmark rate hits 4.6% in 2023.

This move, of course, sent another ripple of concern through the commercial real estate industry, with CRE professionals wondering how many commercial deals the higher inter est rates might scuttle.

MINNESOTA | MISSOURI | NEBRASKA | OHIO | TENNESSEE | WISCONSIN | THE DAKOTAS | ILLINOIS | INDIANA | IOWA | KANSAS | KENTUCKY | MICHIGAN WWW.REJOURNALS.COM VOLUME 34 ISSUE 5 SEPTEMBER/OCTOBER 2022

FINANCE (continued on page 27)

(continued on page 21)

CRE MARKETPLACE PAGE 53: ARCHITECTS/DESIGN-BUILD FIRMS BROKERAGE FIRMS DEVELOPERS LAW FIRMS ECONOMIC DEVELOPMENT CORPORATIONS

The Heartwood Preserve is another major mixed-use development that is providing a boost to Omaha’s commercial real estate market.

Financing Special O er

Multifamily

Commercial Real Estate Lending Capital Markets Now’s the time to refinance your Multifamily Real Estate Loan. Get a 3.95% interest rate for 1 year on a 5/1 ARM commercial multifamily loan. Rate will adjust to a xed 4.95% for years 2-5. Apply by 10/21/22 and receive a refund of the underwriting and documentation fee. BankFinancial’s Multifamily 3.95% Loan Special • 5/1 ARM at 3.95% Intro Rate with Zero Points • Loan Amount: $750,000 to $3,000,000 • Purpose: Loan Balance Refinance • Properties: 5+ Units • LTV: Up to 65% / 30-Year Amortization Also Available: • Cash-Out Investment Equity Loan • LTV Up to 80% (Dual Note) • Interest-Only Lines of Credit • Loan Amounts Up to $10,000,000 *Initial loan rate is fixed at 3.95% for the first year: rate will then adjust to a fixed 4.95% for years 2 through 5. Loan application, including the underwriting and documentation fee, must be received by 10/21/22 to be eligible for a credit of up to $3,950 at closing. Loan transaction must close on or before 12/16/22 to get the 3.95% intro rate promotion. All loans subject to credit and collateral approval. Exclusive Rate 3.95%* Contact us to learn more today! 1.833.894.6999 | BankFinancial.com

1032 W. 43RD ST. | CHICAGO, IL 50 S. FAIRBANK ST. | ADDISON, IL 4400 HOMERLEE AVE. | EAST CHICAGO, IN BREAKING NEW GROUND... The Missner Group and Realterm announce a partnership that will deliver 460,000 square feet of Class-A industrial real estate to the Chicagoland market. Together we aim to deliver facilities of superior quality, all while enhancing the surrounding communities. 130,000 SF 250,000 SF78,000 SF A DEVELOPMENT OF missnergroup.com | realterm.com

Busy? That’s an understatement for the Omaha commercial real estate market: Pandemics, soaring inflation and rising interest rates. Omaha’s commercial real estate market has remained resilient during all of them.

Financing pros: Interest-rate hike means a slowdown in commercial deals is inevitable: In its efforts to curb rising inflation, the Federal Reserve on Sept. 21 raised its benchmark interest rate by three-quarters of a percentage point. The Fed also said that it plans to boost this rate in the future to fight inflation. This set off a new round of worries in the commercial real estate market.

Colliers pros: Momentum still strong in Cleveland’s commercial real estate market: Like in many major cities, Cleveland’s commercial real estate market is thriving. Demand is soaring for industrial space and multifamily units. Retailers are opening new locations. Healthcare providers continue to open new clinics and emergency care centers across the Cleveland area. And even the office market is showing some positive signs.

Poised for a bright future: Columbus’ CRE market remains a resilient one: A booming industrial market. A multifamily sector that remains hot. And retail and office sectors that, despite challenges, are showing positive signs. That’s what the brokers working in Columbus and its suburbs say they see today in this Ohio city’s commercial real estate market.

Challenging times? They’re nothing new for a resilient Detroit: How busy has the multifamily sector been? Just ask Greg Coulter, managing member and founder of Income Property Organization in Bloomfield Hills, Michigan. He says that he’s never seen more activity in this sector.

No huge drop-off coming: Multifamily market expected to remain hot into 2023: Renters and investors are still seeking out multifamily space. And the demand for apartment living is showing no signs of slowing, according to Kia Crooms, area vice president of the Midwestern region for King of Prussia, Pennsylvania-based Morgan Properties.

If you’re looking for outstanding space, check out HoosierSites.com. Hoosier Energy will become your secret source for finding the perfect existing facility or shovel-ready site. Great locations with access to highways, runways, rail and ports. But the best part is our flexibility in creating competitive rates for new and expanding businesses. For many decision-makers, when space starts feeling like the final frontier, Hoosier Energy becomes their first thought.

Supply chain issues. A labor shortage. An increasingly competitive market: Can modular construction provide the relief developers seek? Developers face plenty of challenges today: It’s difficult to find experienced labor. Material costs keep rising. And supply chain disruptions mean that it can be difficult to get everything from insulation to concrete and steel to construction sites on time.

4 | Midwest Real Estate News | September/October 2022 | www.rejournals.com

DEPARTMENTS 6 Editor’s Letter 41 Development Showcase: Minneapolis’ Alvera 53 Directory Listings PRIME INDUSTRIAL LOCATIONS WITH POWER, ACCESS AND INCENTIVES. SPACED OUT?

HOOSIER ENERGY RURAL ELECTRIC COOPERATIVE IS AN EQUAL OPPORTUNITY EMPLOYER FEATURES 1 1 18 8 14 33 36 The Midwest’s commercial real estate publication, providing useful, unbiased and accurate coverage of the industry and its professionals since 1985. WWW.REJOURNALS.COM Publisher | Mark Menzies menzies@rejournals.com Editor | Dan Rafter drafter@rejournals.com ADVERTISING Vice President of Sales & MW Conference Series Manager | Ernest Abood eabood@rejournals.com Vice President of Sales | Frank E. Biondo frank.biondo@rejournals.com Vice President of Sales | Marianne Grierson mgrierson@rejournals.com Classified Director | Susan Mickey smickey@rejournals.com EVENTS/CONFERENCES Support Specialist, Media & Events | Hayley Myers hayley.myers@rejournals.com Midwest Real Estate News brings real estate leaders together to explore the challenges and opportunities unique to their markets. ADDRESS 1010 Lake St Suite 210, Oak Park, IL 60301 Midwest Real Estate News® (ISSN 0893-2719) is published bimonthly by Real Estate Publishing Corp., Oak Park, Il 60301 (rejournals.com). Current and back issues and additional resourc es, including subscription request forms and an editorial calendar, are available on the internet at rejournals.com. Subscriptions: Within U.S.: 1 year, $69; 2 years, $89; 3 years, $109. Single copies, $10.00. Subscription information: Haley Myers 1010 Lake St Suite 210, Oak Park, IL 60301 708-622-0074. ©2022 Real Estate Publishing Corp. 8

Chicagoland’s Union Electrical Team LEARN MORE AT POWERINGCHICAGO.COM

The office market’s challenges are unrelenting

By Dan Rafter, Editor

The office market had already been struggling. But an un certain economy has only brought more challenges for this sector. A new report found that demand for office space continued to fall throughout last sum mer, thanks in part to rising interest rates and persistent inflation.

That’s the bad news from the latest VTS Office Demand Index, or VODI.

According to VTS, Chicago, Boston and New York City saw the largest declines in demand for office space in July. That’s partly because these cities have a large number of finance, insurance and real estate companies, sectors that are particularly sensitive to rising interest rates.

VTS’ VODI score, a measure of office demand, tracks tenant tour require ments, both in-person and virtual, of office properties in key U.S. markets. You can consider it an early indicator of upcoming office leasing activity. It’s also the only commercial real estate index that tracks new tenant demand. It’s not a crystal ball, of course, but it is a good indicator of what’s coming next when it comes to demand for office space.

And the report covering the recently concluded summer season is yet one more indication that the office mar ket’s challenges might be lasting well into the new year.

According to VTS, across the United States, new demand for office space fell 11 VODI points to 52 in July. That represents a 17.5% month-overmonth drop, pushing the index to its lowest level since February of 2021.

“We’re used to seeing demand for office space cool in summer months, but not at this rate,” said Nick Romi to, chief executive officer of VTS, in a written statement. “Unique to 2022 is an economic outlook that is continu ally shifting and is likely contributing to a reduction in new office demand, as uncertainty causes some potential tenants to delay or reconsider their current office space needs.”

Demand for office space in Chicago

dropped 29.9%, falling to below half its pre-pandemic pace, VTS said. Chi cago had a VODI score of 47 this July, while its average pre-pandemic VODI score was 100.

Of course, you probably don’t need a VODI score to tell you that the office

sector continues to face hurdles. Many companies are still trying to finalize their back-to-the-office plans, and most are turning to a hybrid ap proach, letting employees work part of the time from home and part of the time in the office.

This means that many companies no longer need as much office space. As these companies move to smaller space – often of a higher class – it will keep the vacancy rate in the office sector high.

Add to that the challenges of rising in terest rates and inflation and it’s clear that the future remains murky for the office sector.

The good news? The number of peo ple working in offices has been rising. It’s not at pre-pandemic levels yet, that’s true. But there is some posi tive momentum. And the owners of Class-A office space are finding that their properties are often in demand from companies wanting to upgrade to better office space to help entice their workers back.

The only certainty now, though, is that the office sector will continue to rebound at a slower pace in what is hopefully becoming a post-pandemic environment.

Midwest Real Estate News | September/October 2022 | www.rejournals.com6 FROM THE EDITOR

“The good news? The number of people working in offices has been rising. It’s not at pre-pandemic levels yet, that’s true. But there is some positive momentum.”

Colliers pros: Momentum still strong in Cleveland’s commercial real estate market

By Dan Rafter, Editor

Like in most major cities across the Midwest, Cleve land’s commercial real estate market is thriving. Demand is soaring for industrial space and multifamily units. Retailers are opening new locations here. Health care providers continue to open new locations across the Cleveland area. And even the office market is showing some positive signs.

Not to say there aren’t any challeng es. No one knows exactly how rising interest rates might slow deal velocity in Cleveland and its suburban areas. Developers and contractors continue to struggle with supply shortages and the rising costs of materials. And many major employers in the area still haven’t finalized their back-to-

work plans, keeping the office sector in its COVID limbo.

But three CRE pros from the Cleveland office of Colliers said that leasing activity is strong in most commercial sectors today in their market. And in even better news, these pros are pre dicting that the rest of 2022 and the beginning of next year will be strong in Cleveland, too.

What’s behind the commercial real estate momentum in this key Midwest city? You can credit Cleveland’s ideal location in the center of the country, its strong workforce, pro-business environment and investors’ insatiable demand for commercial real estate assets.

Industrial keeps booming

Tim Breckner, senior vice president with Colliers in Cleveland, specializes in the industrial sector. That’s a big plus: Industrial real estate remains the darling of investors today. And de mand for industrial space is slowing no signs of falling, either across the country or in the Cleveland market.

As of the second quarter of this year, the industrial vacancy rate in the Cleveland market had fallen to 4.2%, according to Colliers’ research. Breck ner said that this is the lowest this vacancy rate has been since Colliers first started tracking it.

The second quarter again saw posi tive net absorption in the Cleveland

industrial market. Breckner said that Cleveland hasn’t seen negative ab sorption in the industrial sector since the second quarter of 2019.

“It seems like COVID was a big factor for increasing industrial de mand even further,” Breckner said.

“Things were already trending in this direction. People were already ordering everything online. But after COVID, people started ordering even more frequently online. They grew comfortable ordering clothes, foods, consumables, whatever they needed. That is a big part of why demand has only grown for industrial space since the pandemic started.”

Another positive for Cleveland’s industrial market? The city and its

Midwest Real Estate News | September/October 2022 | www.rejournals.com8

CLEVELAND

Euclid Grand is an example of the modern apartment units residents are seeking in downtown Cleveland.

surrounding areas did not have much spec industrial construction until recent years. This mean there hasn’t been an overabundance of supply in the area. Once developers started building new modern industrial space, then, the de mand for it remained high.

And this new spec space has filled quickly, often while the facilities are still under construction.

Breckner said that end users are looking for specific amenities when it comes to new industrial space today. This includes higher clear heights, with some of the new product entering the market boasting clear heights of 40 feet. At the minimum, new facilities must have clear heights of at least 30 feet, Breckner said.

Users also expect wider column spac ing inside facilities, more docks and more room to park trailers, Breckner said.

“We have what I consider to be a lot of spec space under construction today,” Breckner said. “But for the most part, this space is filling quickly. We are not seeing any high vacancy rates. Demand

is so high that landlords are becom ing more strategic when it comes to who they lease to. They are seeking full-building users. If they can’t get that, they only want to split their buildings up among two users instead of chopping it up for several users. Landlords can be more selective in this market, too.”

While the Cleveland-area industrial market continues to thrive, it does face challenges, Breckner said. Not surprisingly, these challenges come down to rising interest rates and sup ply chain disruptions.

Breckner said that developers are still struggling to get the materials they need to build industrial space. He said that today dock equipment and the panels for overhead doors have

www.rejournals.com | September/October 2022 | Midwest Real Estate News 9

BOLD RESULTS PITTSBURGH • CLEVELAND • CHICAGO • COLUMBUS PROPERTY TAX SAVINGS WE KNOW HOW TO GET RESULTS BECAUSE WE KNOW PROPERTY TAX LAW. We are the property tax law firm. It’s all we do, with more than 40 years of experience and billions in assessment reductions nationwide. Contact Kieran Jennings and the team at Siegel Jennings for a no-fee, no-risk review of your portfolio 216-763-1004 • siegeltax.com SIEGEL JENNINGS PROPERTY TAX LAW CLEVELAND The 200 Public Square office building in downtown Cleveland is in the middle of a major renovation that will include updates to its lobby area. (continued on page 10)

become especially difficult to get. These materials have also become more expensive.

The rising cost of materials means that industrial space itself might continue to get more expensive for end users. As Breckner says, asking rates for industrial spaces in the Cleveland area were up again this quarter. They’re also up on a yearover-year basis, he said.

Despite these potential headwinds, Breckner said he doesn’t expect demand for industrial space in the Cleveland market to slow any time soon.

“It comes down to the way people shop now,” he said. “They go online to buy anything they need. People also don’t consider all the returns they make. Those returns also go back through a chain of warehous es. It’s almost a two-fold increase, then, because of the way people’s shopping habits have changed. You buy something. You send it back. In each direction, it goes through a warehouse or series of warehous es.”

An uncertain office sector

As it is in most cities, the office sec tor in Cleveland remains in a state of uncertainty. Many of the area’s bigger employers are still finalizing back-towork plans. And many of the area’s office workers continue to work from home, at least two to three days a week.

This has left Cleveland – and especial ly the city’s downtown office market – with a higher vacancy rate. Again, this is hardly unusual; Most major cities across the United States face the same challenges with their office space.

Brian Hurtuk, managing director with the Cleveland office of Colliers, said that most companies with office

space in downtown Cleveland are operating on a new normal: They are encouraging their office workers to come into the office at least three days a week.

This means that on any given week day, about 60% of the normal work force is traveling into downtown Cleveland, Hurtuk said.

Midwest Real Estate News | September/October 2022 | www.rejournals.com10 CLEVELAND

CLEVELAND (continued from page 9) K&D offers luxury downtown living, sophisticated suburban living, senior/affordable housing, commercial/retail leasing - as well as employment opportinities at all of our communities! Visit our website for info about all of our locations throughout Northeast Ohio at... www.KandD.com NOW RENTING! FIRST MOVE-INS BEGIN OCTOBER 1, 2022! LIVING OPTIONS TO SUIT EVERY LIFESTYLE Reflective Sophistication. Uncompromising Convenience. 55 Public Square | Cleveland, OH 44113 | 216.621.5005 | www.ResidencesAt55.com 202 BRAND NEW, LUXURY 1 & 2 BEDROOM SUITES AND 2 & 3 BEDROOM PENTHOUSES! Fahrenheit Restaurant Attached to the Building with Rooftop Dining! Located Minutes from the Warehouse District, E. 4th Street, Professional Sporting Venues, JACK Cleveland Casina, Playhouse Square, Public Square, Dining, Entertainment... everything that Downtown has to offer! 24/7 Fitness Center, Community Lounge, Convenience Market with Cafe, Smart Apartment App Feature, Package Room, Bike Storage, Pet Washing Facility, Attached Garage Parking, Pet Friendly! Left: The 200 Public Square office building in downtown Cleveland is in the middle of a major renovation that will include updates to its lobby area. Right: The view from 200 Public Square in downtown Cleveland.

“We have a long way to go, then, before we get to a more normal office environment,” he said.

In the suburbs, the equation is a bit different. Hurtuk said that on any given weekday in Cleveland’s subur ban communities, about 75% of the normal workforce heads into offices.

Why the difference here? The subur ban office market is dominated by smaller, more flexible companies that began asking their workers to return to the office sooner than have the larger, national companies that dot the downtown office market.

The suburban office market is also filled with buildings that are typically smaller. If workers are worried, say, about crowding into an elevator, they can take the stairs. Suburban office buildings don’t tend to be as vertical as those in downtown Cleveland.

“The interesting thing is the busi nesses downtown -- professional firms, law firms, accounting firms, banks and insurance companies -- are doing well financially,” Hurtuk said. “Companies are paying rent

on time. Very few companies of any significance have said that they are going to give space back to the mar ket. No one of significance has put a big block of space back on the market for sublease.”

Before the pandemic hit, the Cleve land office market was seeing high vacancy rates in all classes of build

Unmatched Expertise

The

ings. Some of the market’s higher-end office buildings were even generating more than $30 a square foot in asking rates.

Today? Asking rents have taken a hit of about 10% overall. And tenants in the market are asking for economic relief from landlords and building owners, Hurtuk said.

Hurtuk said that tenants are also asking for a greater amount of tenant improvement dollars when moving to a new office space or renewing their leases in an existing building. Overall, building owners are giving tenants almost 20% more for tenant improvements than they were before the pandemic.

“There are some positives in the mar ket,” Hurtuk said. “The higher-end buildings are seeing more activity. And there are other buildings in the market that are building momentum, too. We are not jumping up and down with joy about the office market, but we are also not standing on window ledges. We are cautiously encour aged. The more we have office work ers back downtown every day, the better it is for everybody.”

Many companies that are looking for new office space are targeting build ings with robust amenity packages, Hurtuk said. That’s one way for them to attract workers back to the office, at least on a part-time basis.

Contact the Cooper Multifamily

www.rejournals.com | September/October 2022 | Midwest Real Estate News 11

CLEVELAND

Team: Colliers | Cleveland 200 Public Square, Suite 1200 Cleveland, OH 44114 +1 216 239 5060 colliers.com/Cleveland

experts of the Colliers Cooper Multifamily Team in Cleveland have been sharing their comprehensive real estate knowledge with clients for more than 40 years. Masters of their craft helping sellers maximize sales proceeds and investment returns.

“The higher-end buildings are seeing more activity. And there are other buildings in the market that are building momentum.”

(continued on page 12)

Amenities that matter today include

restaurants that serve healthy food, fitness centers

offer the latest exercise equipment, ample and easy-to-access parking and con ference rooms fitted with the latest technology.

Hurtuk points to 200 Public Square in Cleveland as an example. That iconic Cleveland office building is in the mid dle of a $6 million capital campaign spent on conference rooms, a cafete ria, fitness center and refreshed lobby area.

Getting people back into the office has become a priority for many em ployers in Cleveland, Hurtuk said. They realize that younger workers need to be around those with more experience. Mentoring doesn’t work remotely. They also realize that brainstorming new ideas and crafting creative business strategies is more likely when workers are in the office.

“I’m hoping that more organizations will encourage and entice their

workers back to the office on a daily basis,” Hurtuk said.

More people are returning to down town Cleveland, Hurtuk said. But this activity tends to be clustered on Tues days, Wednesdays and Thursdays, he said. Mondays and Fridays remain far quieter than they were before the pandemic.

“It has been a big change,” Hurtuk said. “Just two short years ago, every one was coming into the office every day. Now everyone is trying to figure out what they need for office space.

What is the secret sauce? Right now, we have not seen any announce ments or grumblings of significant downsizings or give-backs of space. So that’s a positive.”

Demand still rising for multifamily space

Along with the industrial sector, the multifamily space has been thriving in Cleveland, with demand for apart ment units high before, during and after the pandemic.

Just ask Gary Cooper, senior vice

president with the Cleveland office of Colliers. He specializes in the multi family sector and says that the apart ment market has remained resilient throughout the Cleveland market.

“It’s been another good year,” Cooper said. “Occupancies and rent growth have both remained strong. Everyone thought we’d hit a wall or show some cracks in the multifamily market. But we aren’t seeing those cracks. People are bullish moving forward.”

The only slight concern? Cooper said that the Cleveland market is showing

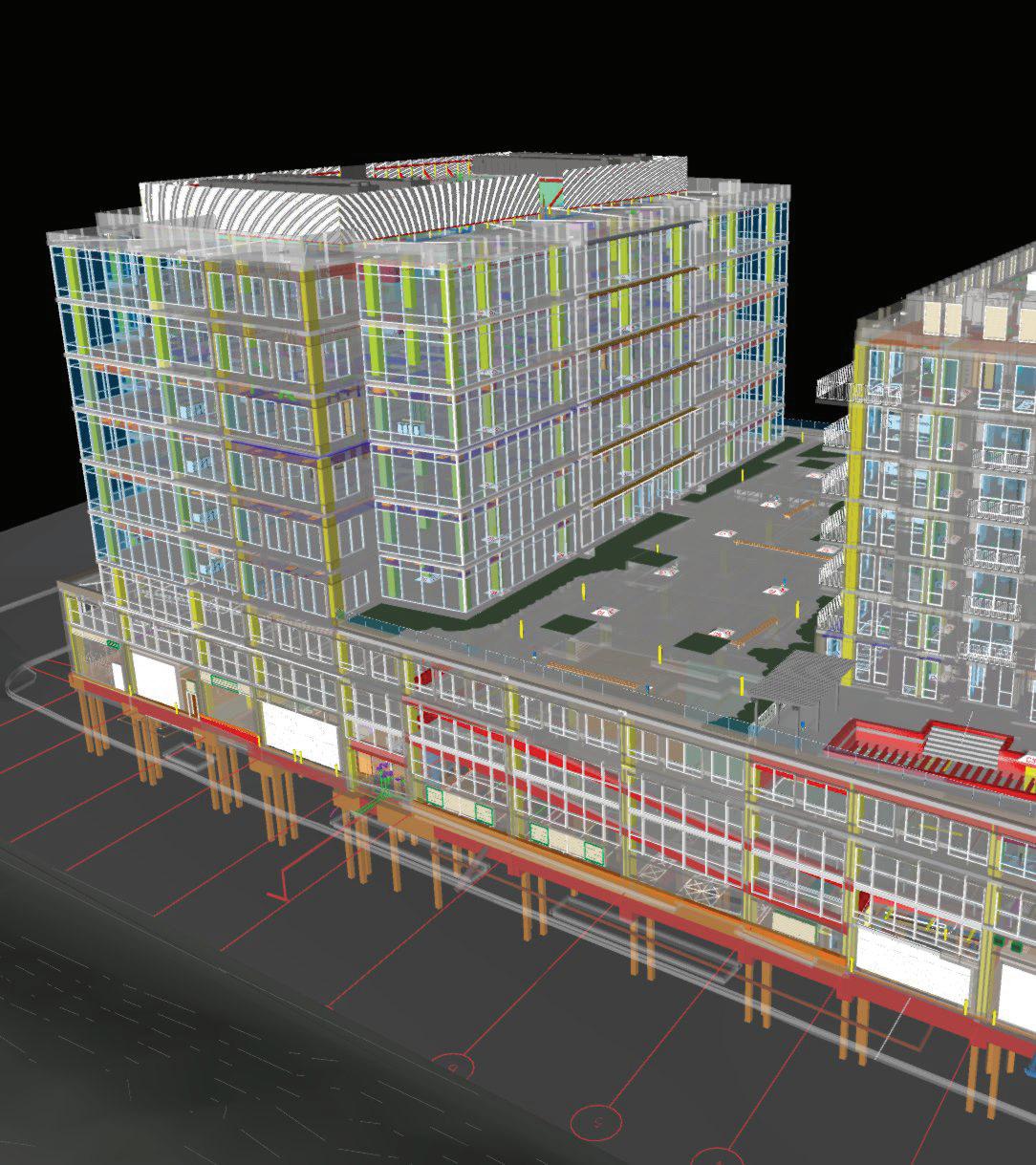

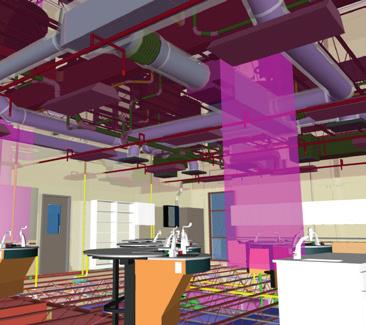

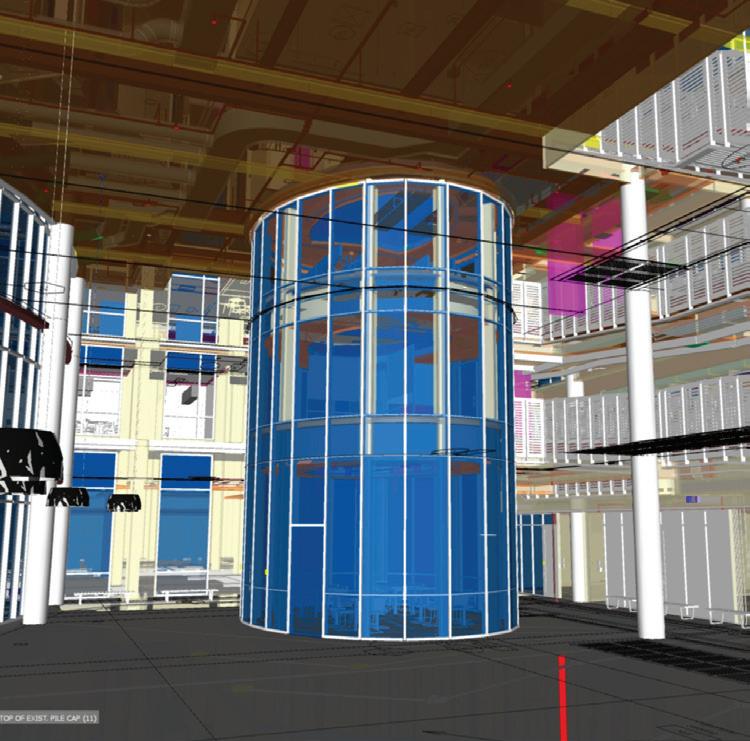

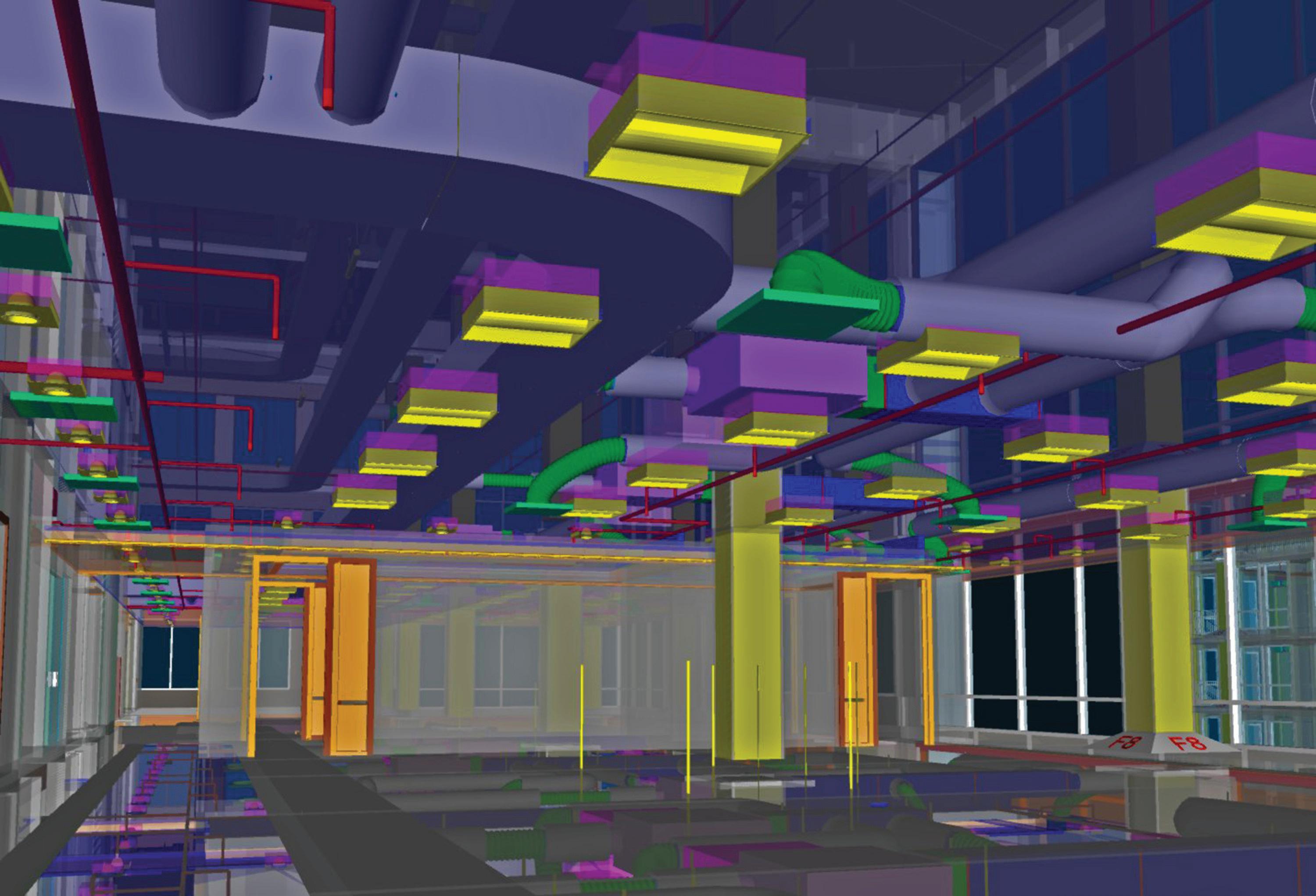

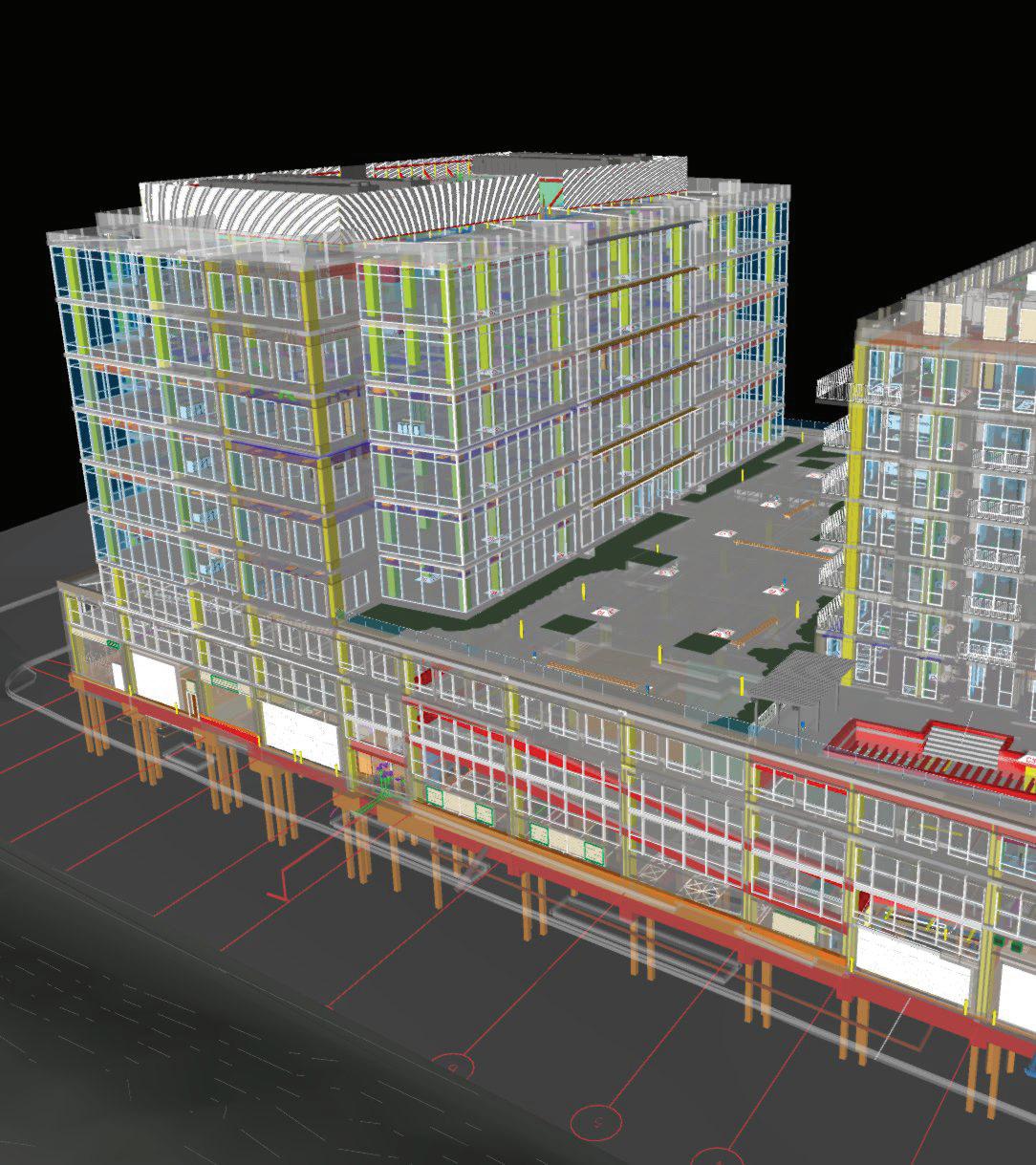

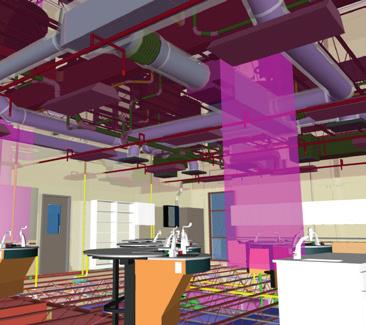

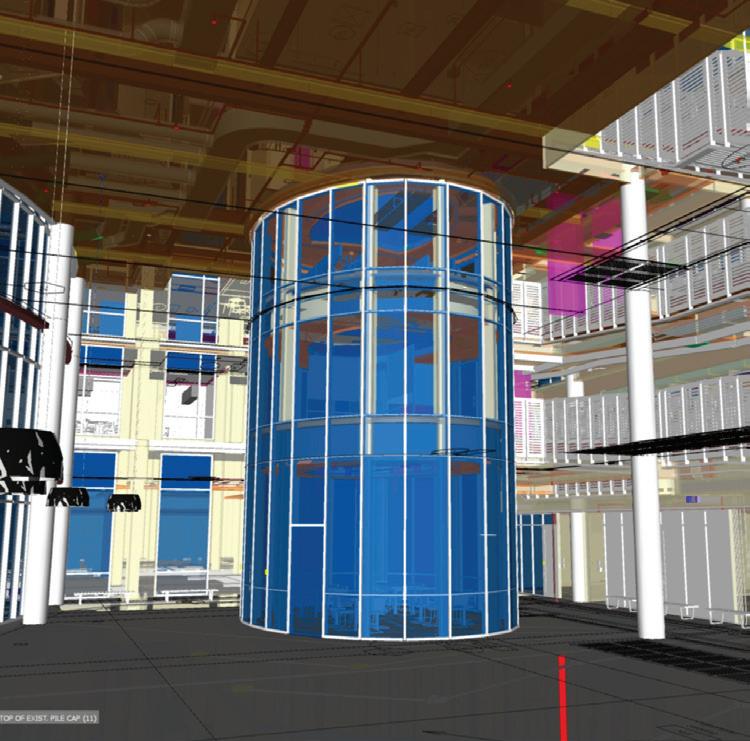

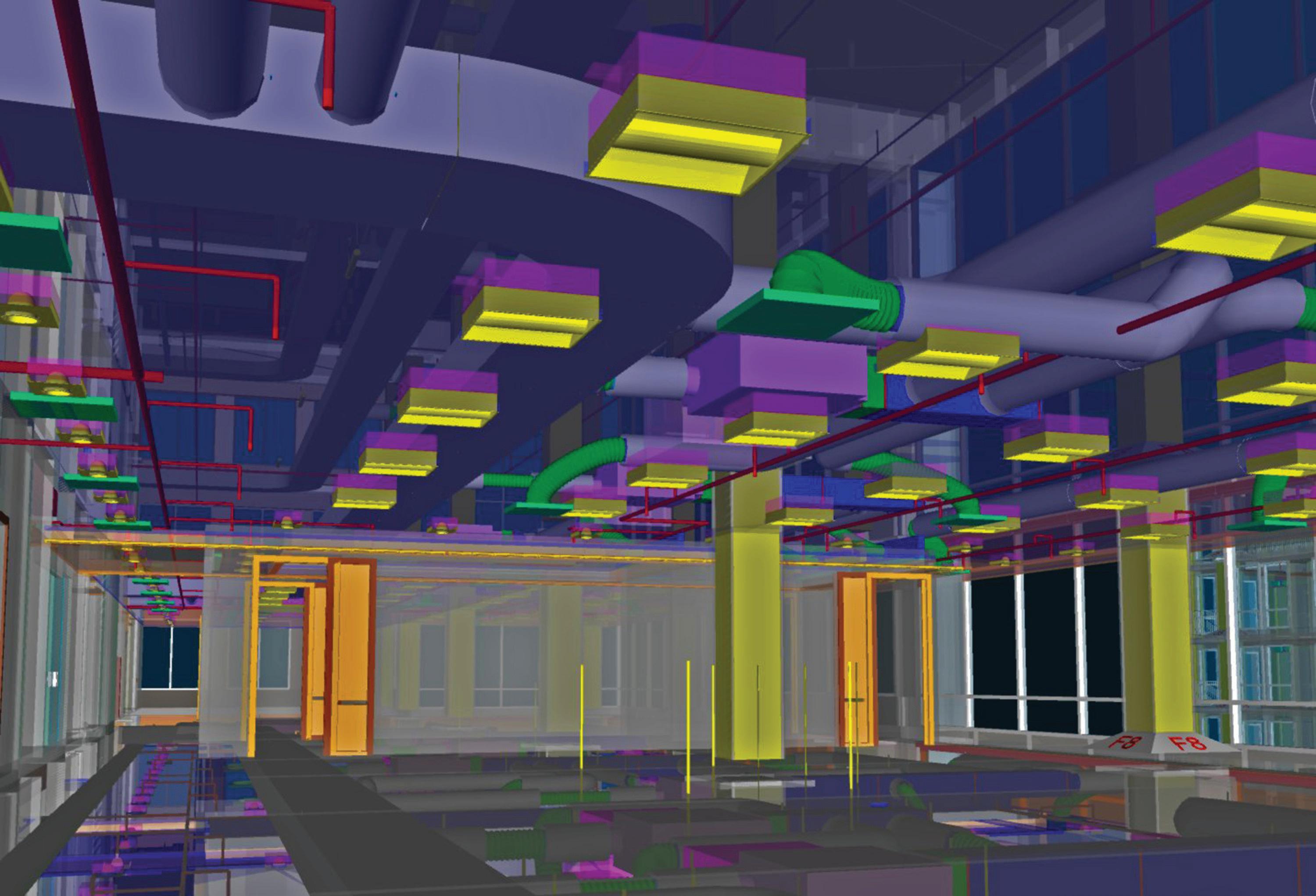

MIKE FURLONG, CM-BIM Managing Principal

Midwest Real Estate News | September/October 2022 | www.rejournals.com12

330.414.9970 | mike.furlong@ipsvdc.com | www.ipsvdc.com • BIM Coordination Services • Site Logistics • 3D Content Creation • Revit® • Navisworks® • 3D Studio Max • Residential Design Integrated Project Solutions We protect your future project investments through BIM/VDC to improve construction coordination schedule, reduce unexpected challenges & improve your BOTTOM LINE! CLEVELAND

on-site

that

CLEVELAND (continued from page 11)

“It’s been another good year. Occupancies and rent growth have both remained strong. People are bullish moving forward.”

a bit of rent fatigue in workforce and lower-income apartment buildings. These buildings are also seeing a small amount of collection issues, he said.

“The economy can be challenging for many people today,” Cooper said. “When you look at some people, we go to the gas pump and complain. But we are still able to buy food. For a lot of folks, to spend $200 more a month on fuel alone forces them to make some difficult choices. Then there are the rising food costs and utility bill costs. That is where we are starting to see a bit of rent fatigue. People are getting pounded from every level, every time they go to the pump or the grocery store or the home-improvement store. They are facing sticker shock today.”

Not as many renters in the workforce housing or low-income end of the market fell behind on their payments during the height of COVID, Cooper

said. Stimulus checks and enhanced unemployment checks helped them pay their bills. Now those financial safety nets have disappeared while inflation is boosting prices, making it more difficult for some to pay their rent each month.

Still, Cooper said that the situation is far rosier than what some predicted at the start of the pandemic. Back then, people worried that as many as 40% of renters would stop paying their rents. That, obviously, never happened.

What has led to the long hot streak in demand for multifamily, both in Cleveland and across the country? Cooper points in part to the soaring prices of single-family homes. The National Association of REALTORS® reported that the median sales price of an existing home hit $403,800 in July, up 10.8% from a year earlier. Last month, the median sales price hit an all-time high of $413,800.

At the same time, new apartment product comes with higher-quality finishes and amenities, Cooper said. It featured high-end kitchens and bathrooms.

“When you combine the economic fundamentals and the rental product that has been out there, you have a perfect recipe for continuing de mand,” Cooper said.

Cooper said that demand is so high in certain Cleveland submarkets that it’s difficult for renters to find space. This is especially true in many of Cleveland’s nearby suburban com munities.

“You go to properties and they say they have nothing to show you,” Coo per said. “They say they are full and they’ve even rented out the model. If there are occupancy challenges, it is usually property specific. A certain property might have maintenance is sues, a bad roof or structural issues.

But demand for most multifamily properties is very high today.”

The strength of the multifamily mar ket in downtown Cleveland is a sur prise to many, Cooper said. People still want to rent in downtown, even if workers aren’t yet coming back to their downtown offices in strong numbers, he said.

“You would think that the slowdown in office workers would lead to a slowdown in demand for downtown multifamily. But we haven’t seen that,” Cooper said. “We are seeing nothing but continued demand. How many people can pay $1,800 a month for a one-bedroom apartment in downtown Cleveland? When will this market hit a wall? I don’t know. We haven’t seen it yet.”

COLUMBUS

Poised for a bright future: Columbus’ CRE market remains a resilient one

By Dan Rafter, Editor

Abooming industrial mar ket. A multifamily sector that remains hot. And retail and office sectors that, despite challeng es, are showing positive signs. That’s what the brokers working in Columbus and its suburbs say they see today in this Ohio city’s commercial real estate market.

And in even better news? Local bro kers say they expect the rest of this year and the beginning of 2023 to be strong, too, with few signs of any slowdown in Columbus’ commercial sectors.

Consider real estate firm CASTO, which primarily focuses on retail and multifamily. Eric Leibowitz, vice presi dent of development and leasing with the company, said that CASTO has been extremely busy this year and last, and that vacancy rates at the properties it owns in the Columbus market remain low.

“The Columbus market has been strong for a long time, other than

the blip that was the start of COVID,” Leibowitz said. “We have great eco nomic engines here in Columbus. We are the state capital. We have strong educational facilities, most notably Ohio State University. And companies want to locate here.”

A good example is the announcement by technology company Intel that it has selected a portion of the New Albany International Business Park in

New Albany, Ohio, as the location for a more than $20 billion chip-manufac turing facility. New Albany is located about 14 miles from Columbus.

Intel plans to build two factories here by 2025. The project is expected to generate thousands of construction and manufacturing jobs.

“The Intel announcement has created a lot of buzz,” Leibowitz said. “This

will be a big positive for the region. To what extent, we are waiting for that. But we all expect Intel’s project to be very positive for the Columbus area.”

Leibowitz said that he isn’t surprised by Intel’s decision. Many large cor porations are considering Columbus for either their headquarters or new facilities. As Leibowitz says, the qual ity of life in Columbus is strong, with plenty of entertainment and cultural

Midwest Real Estate News | September/October 2022 | www.rejournals.com14

CASTO is transforming space in Columbus’ Harrison West neighborhood into Thurber Village, a mixed-use project that will include a CVS, Lucky’s Market and 225 apartment units with structured parking.

Eric Leibowitz

“People want to stay in the Columbus area. We are seeing great activity at our multifamily properties”

options. Columbus is also a pro-busi ness community, with the city willing to take the necessary steps to create a welcoming environment for compa nies making the move here.

This high quality of life has provided a boost to the Columbus-area mul tifamily market. As Leibowitz says, demand for apartment living in the Columbus market is still strong and outpacing the supply of rental units.

“People want to stay in the Columbus area,” Leibowitz said. “There was certainly some pent-up demand for multifamily space. And our multifam ily division has been great at both urban redevelopment and finding the right opportunities in the suburban markets. We are seeing great activity at our multifamily properties.”

And while multifamily has been strong, as it has been across the country, Leibowitz said that Colum bus’ retail sector is performing well, too. He said that those retailers that reacted quickly during the pandemic

to make it easier to get their products and services to customers performed well during COVID and are succeed ing today.

Those that were slow to react to the changing shopping and dining habits of consumers during the pandemic?

They haven’t fared nearly as well, Leibowitz said.

“The retailers that we lost during

COVID were ones that we were prob ably going to lose anyway,” he said. “COVID might have expedited it, but they probably weren’t going to survive much longer. Several of our retailers found efficiencies and got better and stronger because they had to.”

Those efficiencies mostly centered around making it easier for wary consumers to shop and dine during

the pandemic. Restaurants and re tailers offered curbside pickup and enhanced their delivery options. They boosted their online presences and made ordering from their websites even easier.

And the savviest of these retailers have only continued offering these services as the Columbus area con tinues to move past the pandemic.

“The retailers who survived across the board made it easy for people to order online and schedule things like curbside pickup regardless of these consumers’ age or generation,” Lei bowitz said. “During the pandemic, we worked hard to accommodate our tenants however we could. Our job was to help them be as successful as possible. We saw a lot of creativity during the pandemic. And we’ve seen some positives come out of it both from an operational and relationships perspective.”

Certain retailers, though, have been more successful than others. One

www.rejournals.com | September/October 2022 | Midwest Real Estate News 15

nmrk.com At Newmark, we know clients’ commercial real estate needs vary by place and we take the time to tailor solutions to what the market demands. Whether through leasing, capital markets, valuation and advisory or property management, we adapt to the future and engineer strategies that address what comes next. Our Tailored Insight Empowers Your Real Estate Potential Columbus, Ohio t 614-883-1200 CASTO’s Hamilton Quarter project in New Albany, Ohio. COLUMBUS

segment that remains particularly strong is grocery-anchored retail, Leibowitz said. People need food, of course, so they continued to go to grocery stores even during the height of the pandemic. Grocery stores also appeal to those people who still enjoy going into stores instead of buying all their products online.

Retailers located near grocery stores also benefit from the spillover of supermarkets. Customers are more likely to run into a hardware store, clothing store, pet store or other retailer if they are already shopping at a grocery store in the same retail center.

“In my opinion, during the pandemic, people were looking for opportunities to get out of the house, to have a mundane task feel normal,” Leibowitz said. “That could have meant going to a hardware store or grocery store.”

A mirror to national trends?

Grant Fitzgerald, regional manager of Marcus & Millichap’s Columbus and Cleveland offices, agreed that 2022

has been a particularly strong year for the Columbus commercial real estate market.

“Things are as busy as ever,” Fitz gerald said. “Across the country, 2022 has been a record year for deal velocity in commercial real estate. Columbus is no different.”

And like in other cities, the multifamily and industrial markets are especially strong in Columbus, Fitzgerald said.

What is somewhat surprising is the strength of Columbus’ retail market, Fitzgerald said.

“Retail is doing very well in some instances,” he said. “Quality retail, especially, is doing well here. Really, Columbus is mirroring many of the trends you read about nationally.”

Fitzgerald said that demand for multi family is strong among both investors and renters in Columbus for many of the same reasons that this demand is high across the country. As Fitzgerald says, three of the country’s largest generations are simultaneously in the renter pool in the United States today.

Millennials and Generation Z are both actively seeking apartments, Fitzger ald said, something that isn’t surpris ing. But at the same time, many Baby Boomers are choosing to downsize and become renters by choice.

That has boosted the demand for multifamily space significantly, Fitz gerald said.

“It is extremely challenging to build multifamily at the rate at which we need it,” Fitzgerald said. “Part of the reason for the demand in Columbus, when compared to coastal markets, is that you can build things in a rea sonable timeframe here. The supply has attracted investors to Columbus. It’s a steady market, too, with strong, consistent employment. That has helped bring investors to Columbus for decades.”

The industrial market in and around Columbus has been strong for years. That hasn’t changed.

Columbus’ location in the center of the country helps. Companies need

to get their products to consumers quickly today. Having distribution centers and warehouses in the coun try’s center helps them accomplish this. It makes sense, then, that com panies are turning to markets like Columbus as they open more distri bution centers.

Columbus, though, also boasts other attributes that make it an attractive destination for industrial users. It has a strong transportation infrastruc ture. And Fitzgerald said that the city is friendly to businesses. It also has a highly educated workforce.

“Industrial has been so hot for so long that in some ways it is cooling off. But this is happening in a very small and healthy way,” Fitzgerald said. “You read news stories about Amazon giv ing back space and it sounds bad. But that’s just a drop in the bucket. The short-term and long-term strength of the Columbus industrial market is very good. Columbus continues to attract large corporations.”

A bright future

Fitzgerald said that he expects a bright future for Columbus’ CRE market. For one thing, 2020 made it clear that it is no longer necessary for people to live in the more expensive coastal markets of the country. As people began working remotely, they could live anywhere. Markets like Columbus became more attractive because of their cost of living and high quality of life.

“For the price of a 400-square-foot palatial closet in Manhattan you could get a 2,000-square-foot Class-A apartment building in Columbus’ Short North neighborhood and have a much higher quality of life,” Fitz gerald said. “Columbus is a desirable market for people. You get more bang for your buck.”

Like other real estate firms in Colum bus, CASTO has been busy planning and creating new mixed-use develop ments in the market. One of the big gest is Hamilton Quarter, located just a couple of miles from the location of the new Intel development in New Albany, Ohio.

This project includes the corporate headquarters building of Big Lots, a Target store, a medical facility and about 700 apartment units.

Midwest Real Estate News | September/October 2022 | www.rejournals.com16

COLUMBUS Experience Thrive Communities info@thrivecos.com | thrivecos.com

CASTO’s Hamilton Quarter project includes a significant amount of retail.

“It is the definition of mixed-use,” Leibowitz said. “This is a place where people can get everything they need. It’s one-stop shopping. You can get your groceries and your soft goods. There are great restaurants nearby. We have multifamily housing. It’s a great blend of uses.”

This good news, though, doesn’t mean that real estate firms don’t face chal lenges today. New construction can be especially difficult with the continuing supply chain disruptions. It is difficult to get many materials on time today, and the price of those materials con tinues to rise.

CASTO is dealing with this by involving its construction groups into leasing conversations earlier. This way, these construction professionals can explain that if a project needs to be delivered on a certain date, they need to order specific materials on a certain date, too.

As Leibowitz said, it’s all about coordi nating schedules more efficiently.

“The way CASTO has been set up for many years has prepared us for pret

ty much anything,” Leibowitz said. “The way we are operating now is not different than the way in which we op erated four or five or 10 years ago. We are adjusting based on what is going on around us. We have everything in house. We can coordinate within our own building, which makes the entire process easier.”

Rising interest rates, of course, are a concern, too. As Fitzgerald says, high er rates will slow some deals. But Fitz gerald isn’t predicting that these rates

will cause any significant downward trend in the local CRE market.

“There is quite a lot of money out there,” Fitzgerald said. “The average person’s cash-in-hand is high com pared to where it’s been in any other downward economy before. People have money in their bank accounts. Funds have money. Wealthy individ uals have a lot of liquid cash. Rising interest rates will make the cost of capital more expensive. But if people have a lot of money out there ready to

go, this won’t make as big of an impact as if people needed every dollar they had.”

At the same time, commercial real es tate remains an attractive investment. When compared to other investments, commercial real estate remains a safe and steady option, Fitzgerald said.

“Commercial real estate is outperform ing other assets,” he said. “Until that is no longer true, people will continue putting their money in real estate.”

www.rejournals.com | September/October 2022 | Midwest Real Estate News 17

COLUMBUS

Grant Fitzgerald

“Commercial real estate is outperforming other assets. Until that is no longer true, people will continue putting their money in real estate.”

Challenging times? They’re nothing new for a resilient Detroit

By Dan Rafter, Editor

By Dan Rafter, Editor

How busy has the multifamily sector been? Just ask Greg Coulter, managing member and founder of Income Prop erty Organization in Bloom field Hills, Michigan. He says that he’s never seen more activity in this sector.

And that’s pretty impressive, consid ering how long Coulter has worked in commercial real estate.

“I’ve been doing this for 31 years. I’ve never seen anything like what we’ve had in this sector in the last 24 months,” Coulter said. “Cap rates are at all-time lows. Demand is high. Cap ital is out there everywhere you look. It’s been incredible in multifamily.”

And the best news? There are few signs that demand for multifamily space, both among renters looking for a place to live and investors searching for a safe harbor for their dollars, is ready to slow anytime soon.

Don’t expect, then, new sales and development of multifamily space to suddenly slowdown in the com ing months.

The threat of rising interest rates?

This doesn’t mean that rising inter est rates aren’t a concern. Coulter said that in the last 60 days, ac quisition activity in the multifamily sector has tightened slightly. But still, demand for multifamily assets remains high among investors, even with the economic uncertainty now plaguing the country, Coulter said.

Coulter points to his hometown market of Detroit. In Detroit’s Mid town, Corktown and CBD areas, de mand for multifamily space, both among renters and investors, con tinues to soar. Monthly apartment rents are still rising and cap rates remain low.

In the more tertiary markets of Detroit, though -- those city neighbor hoods located farther from the CBD and downtown -- demand is slowing slightly. Coulter said delinquencies are higher in these areas, making multifamily properties here less de sirable to investors.

But “less desirable” doesn’t mean “undesirable,” even in the city’s ter tiary markets.

“The tertiary markets are seeing more multifamily properties up for sale,” Coulter said. “And these properties have more issues when it comes to delinquencies and collections. But still, the demand for these properties is there. It might not be as high as in the areas around the CBD, but people are still buying these properties.”

What’s behind the continued demand among investors and renters for mul tifamily space? Coulter points to in

terest rates first. Yes, rates have risen recently. And that does throw some uncertainty into even the strong mul tifamily sector.

But historically, interest rates remain low. This makes it more affordable for investors to purchase multifamily as sets. And the demand for rental units remains high, meaning that investors continue to make solid returns on their multifamily assets.

“People always need a place to live,” Coulter said. “That still holds true. There is a lot of capital out there look ing for a home. Investors still see the long-term prospects for multifamily as being solid.”

Also interesting has been the perfor mance of monthly apartment rents. Apartment rents continue to increase on a year-over-year basis across the country. Coulter says that in Detroit, monthly apartment rents are up 3%

Midwest Real Estate News | September/October 2022 | www.rejournals.com18

DETROIT

Ford’s tech campus project in Detroit’s Corktown neighborhood will transform the formerly vacant Michigan Central Station.

to 4% when compared to a year ear lier. In the suburbs, apartment rents are up 3.5% to 9% year-over-year, depending on the community.

Because demand for apartment units has been so high for so long, it can prove challenging for renters to find units. The National Multifamily Housing Council says that the Unit ed States would need more than 4 million additional apartment units to meet the demand that consumers have for multifamily space.

And in most major markets across the United States, there is nowhere near enough apartment units to meet the demand for them.

“They are working on bringing new units to market, but you can only build so fast,” Coulter said.

In the Detroit market, builders are adding new apartment projects in communities such as Auburn Hills, Rochester Hills, Troy, Royal Oak, Novi and Westville. And in Detroit itself, developers are repositioning outdat ed industrial facilities, turning them into trendy multifamily spaces.

What does the future hold for the multifamily market, in Detroit and across the country? Coulter said that he expects demand for apartments to remain strong among both renters and investors.

“I think interest rates will go up some

more in the next 12 months. But the demand for multifamily space is still high and the supply is still low,” Coulter said. “We had a little blip, a little slowdown just now because in terest rates rose so fast. I think that was a shock to people. But it seems like the multifamily market is heating up again already. I think the popula tion is already getting over the higher interest rates. I think demand for multifamily space, then, will remain high. I see no reason why that won’t be the case.”

A diversified economy is key

Andrew Farbman, chief executive officer of Southfield, Michigan-based Farbman Group, said that Detroit today benefits from a diversified economy.

As Farbman says, Detroit ranks as one of the mortgage-lending capitals of the country, with three of the largest producers of residential loans based in southeastern Michigan. At the same time, the Detroit market has benefitted from the rising demand in autonomous and electric vehicles, with major auto makers working on this technology here.

Another positive? Ford is getting clos er to occupying its new space in De troit’s Corktown neighborhood. The auto giant purchased the formerly vacant Michigan Central Station and plans to transform it into a campus dedicated to new technology.

“Once that opens, it will be a signif icant driver in that marketplace,” Farbman said. “Detroit is fortunate that we now have three submarkets – Corktown, Milwaukee Junction and

Eastern Market – all finding their foot ing in the tech hub. Watching them compete for tech businesses has

www.rejournals.com | September/October 2022 | Midwest Real Estate News 19

DETROIT • Asbestos / Lead /Mold Consulting • Building & Infrastruc ture E valuations • Construction Materials Testing • Environmental Services • Geotechnical Ser vices • Indoor Air Qualit y Consulting We Provide: (continued on page 20) A rendering of Vernor Plaza, one of the public spaces of Ford’s Michigan Central project.

DETROIT

been interesting. Hopefully, they are all successful. They all have former loft buildings that can be converted to new-age loft office space and res idential. It’s an interesting time here.”

The Detroit market is fortunate, too, in that the problems facing the of fice sector across the country aren’t having as much of an impact here. Farbman says that the office sector is not as significant a portion of the user base in downtown Detroit as it is in the downtowns of other major Midwest cities.

“We are seeing less of an impact here from the work-from-home movement going on with some of the younger workforce,” Farbman said. “Detroit is healthier today and is moving along on its path of becoming a true 24hour global city. It is fun to see.”

The Detroit market is benefitting, too, from the number of national banks that are expanding their presences in Southeastern Michigan. Old National Bank and Citizens Bank have each ex panded their footprint in the market.

As in most markets, the multifam ily and industrial sectors are the strongest today in the Detroit area,

Farbman said. And even with the challenges of rising interest rates and construction costs, industrial, at least, looks to remain strong through out the rest of the year and into 2023.

“No matter what town you are in, the industrial market and the growth of the industrial market has been fairly rampant,” Farbman said. “Occupan cies are at historical highs. Demand seems infinite when you are showing industrial space. The amount of activ ity in that sector is shocking. We’ve seen rents take a nice move forward in industrial, too. We are seeing some new developers focusing on our mar ket than we had seen in the past. That is exciting to see.”

Multifamily remains strong in the Detroit market, too, Farbman said. However, when it comes to valuation, Detroit and southeastern Michigan tend to trail other Midwest apartment markets, Farbman said.

That is slowly changing, though. Farb man said that a greater number of in stitutional investors are sinking their money into Detroit-area apartment developments. That is pushing values a bit higher today, he said.

The challenge for investors is that the supply of multifamily properties in Detroit and its surrounding commu

nities is still too low to meet the de mand for them. And Farbman doesn’t see this changing soon.

“It is still so hard to find good infill sites,” Farbman said. “You do see more multifamily product coming in the edge cities and in some of the growth pockets of western Wayne and western Oakland counties. Those communities continue to grow in pop ulation, so they need new multifamily product. The growth of multifamily supply, then, is not as dramatic in the Detroit market as it is in some of the other communities we cover, but it is happening.”

The good news in the office sector is that most employers in Southeastern Michigan are back to work today, Farbman said. This doesn’t mean that the amount of office traffic is the same today as it was before the pandemic hit. But many companies have made their post-pandemic work plans here, and that certainty has helped the office sector in Detroit and its nearby communities.

Farbman said that office activity in downtown Detroit has rebounded faster than it has in larger cities such as Chicago.

“Detroit’s resiliency is partly be cause a good portion of the city is

not mass-transit-focused,” Farbman said. “The cities that rely heavily on mass-transit systems have been the slowest to recover when it comes to the office market. Our office market is also spread out a bit, with a smaller concentration of our office space in Detroit proper. That has helped as of fice space in suburban markets tends to have lower vacancies right now.”

The retail sector in the Detroit mar ket is firmly in rebound mode, too, Farbman said. This is especially true of infill locations in busy city and sub urban neighborhoods.

“I am bullish on retail in general,” Farbman said. “The location and land are so reusable and adaptable.”

As Farbman says, the pandemic did slow some of the momentum that Detroit, and specifically its CBD, had been seeing. But commercial real es tate activity in the city is picking back up again, he said.

“Detroit has seen plenty of tough times in the past,” Farbman said. “We are a tough city, and we work hard to recover from those challenging times. That is happening now.”

Midwest Real Estate News | September/October 2022 | www.rejournals.com20

DETROIT

(continued from page 19)

Elton Park Corktown Apartments is one of the newer, and more popular, apartment developments in the Detroit market.

A solid office sector

The performance of Omaha’s office sec tor is a prime example of the strength of the city’s CRE market.

Sam Noddle with Omaha’s Noddle Companies said that the office market in Omaha is busy today, with leasing activity high all the way from downtown Omaha to the urban core neighbor hoods to the suburbs.

And if that sector, which is struggling so much across the country, is holding its own? That’s a sure sign that Omaha’s entire CRE market is performing well.

“I would say that we are shocked at how busy the office market is in Omaha,” Noddle said. “All of our office space is leasing. Like with all markets, we are seeing companies looking for more valuable tenant improvement packages. And the cost of construc tion has gone up so much. But we are

Noddle points to the thriving Aksar ben Village mixed-use development, of which Noddle Companies has played a key role in developing and managing. Toast, a merchant proces sor for food and beverage companies, recently signed a 50,000-square-foot lease in the village. This lease means that for the first time all the office

“What we have noticed is that a lot of officer users still want office space, and for the most part they still want the same amount of space,” Noddle said. “They need a place for their team to huddle and work. But they are designing the space differently. They want more collaborative space. Workstations are designed for threeand four-day workweeks. But they

Amenities matter, too, as companies look for anything they can offer to entice their employees back to the office. That’s a positive for Omaha developments like Askarben Village, Noddle said. The village, for instance, offers a food hall with a wide variety of vendors. There’s a dog park with a bar that operates out of an old Air stream trailer.

The retailers that occupy Aksarben Village give office workers plenty of options, too. Noddle points to the yoga studio that holds outdoor class es, the running shop, bookstore and flower shop.

“All of these retailers and amenities have made it so easy to lease office space in Aksarben Village,” Noddle said. “Office workers want to be around this kind of atmosphere.”

Noddle said that Omaha’s retail mar ket has remained solid, too. Again, he pointed to Aksarben Village. There is only about 5,000 square feet of space left to lease there, all of it retail.

T h e W a t e r f o r d B u i l d i n g 1 9 2 n d S t r e e t & W e s t D o d g e

T ' S A B O U T M O R

H A N B

W h e n y o u d e v e l o p , l e a s e a n d m a n a g e b u i l d i n g s a s a l o n g t e r m o w n e r , y o u ' r e n o t j u s t i n v e s t i n g i n r e a l e s t a t e . Y o u ' r e i n v e s t i n g i n a c o m m u n i t y

F r o m C l a s s A o f f i c e p a r k s w i t h r o o m t o g r o w a n d a m e n i t i e s

l i k e f i t n e s s c e n t e r s a n d f l e x i b l e c o l l a b o r a t i o n s p a c e s t o m o d e r n w a r e h o u s e s w i t h E S F R f i r e s u p r e s s i o n s y s t e m s a n d 3 2 f o o t c l e a r h e i g h t s , R & R i s u n i q u e l y a b l e t o h e l p o u r c u s t o m e r s f i n d t h e r i g h t s p a c e s t h a t e m p o w e r g r o w t h f o r b o t h t h e i r b u s i n e s s a n d f o r g r e a t e r O m a h a

T h a t ' s q u a l i t y y o u c a n t r u s t

T a l k t o o u r t e a m o f O m a h a w o r k s p a c e e x p e r t s t o d a y :

www.rejournals.com | September/October 2022 | Midwest Real Estate News 21

OMAHA (continued from page 1) (continued on page 22) W E ' R E P R O U D L Y I N V E S T I N G I N O M A H A ' S F U T U R E . I

E T

U I L D I N G S .

MIKE

HOMA President, Nebraska Division COOPER WILSON Manager, Brokerage & Development RRREALTY.COM/NEBRASKA | (402) 885 4002

OMAHA

The Aksarben Village mixed-use development in Omaha features apartments, office space, retail, restaurants and public parks.

Noddle said that this space probably could have been leased, but that Noddle is waiting for the right retail for this location.

Noddle said that this space doesn’t need more restaurants. Instead, Nod dle is looking for something different, preferably a fashion-based retail use, something that is missing from the village now.

The goal, Noddle said, is to bring in retailers that provide excitement to the community. The fact that Noddle can be so selective? That, too, speaks to the strength of the commercial real estate market in Omaha.

“People are more excited about being out there right now,” Noddle said. “Since the COVID restrictions have been lifted, sales in our food hall have grown tremendously. They are up about 40% year-to-date. The bar that we opened last year is extremely busy. We have noticed a lot more ex citement in the air. People are eager to get out there and be social again.”

Another major project in Omaha is the Builder’s District, also being developed by Noddle Companies. Kiewit, when it moved its headquar ters to 15th and Mike Fahey streets in Omaha, provided the impetus for this project. The goal here is to populate the area surrounding this building with multifamily units, office space, retail and an urban park.

The project will cover about six city blocks and will include a 130,000-square-foot office building made primarily of timber. Noddle says that the project will include sports courts, giving people space to play volleyball and pickleball.

Noddle expects to break ground on the project early next year.

“I am cautiously optimistic when it comes to the commercial real estate market here,” Noddle said.

Noddle did say that the cost of con struction and materials remains a challenge for companies like Noddle Companies. The long lead times be tween ordering materials and receiv ing them is a problem, too.

“It doesn’t matter what it is, a heat pump, an electrical panel or even a door,” Noddle said. “There was a door system we were going to buy. The price was crazy and it had a 16-week lead time. That has certainly changed the way we are thinking about deals. The costs of construction and lead times are definitely impacting this business.”

Not enough product out there?

Brian Kuehl, a broker with Omaha’s Investors Realty, agreed that the retail market in the city and suburbs has been resilient. He pointed to the steady absorption levels in this sector during the last two years.

Kuehl said that the retail vacancy rate throughout the Omaha market

is about 5%. At the same time, retail asking rents are on the rise.

“There is actually a bit of a lack of product out there to lease,” Kuehl said. “There is some pent-up demand from businesses that are frankly run ning out of space.”

Part of this can be traced to the pan demic. Construction stopped during the earlier days of COVID. Then supply shortages hit. The cost to deliver new construction is now high. This has re sulted in a slowdown in the amount of new retail space being built through out the Omaha market, Kuehl said.

And Kuehl hasn’t seen many signs that supply chain issues are easing. He said that the bids that Investors Realty solicits for general contractors are about 20% to 30% higher than they historically have been.

“I don’t see a real softening,” Kuehl said. “You hear chatter that the supply chain situation has gotten a little bit better. But that has not trickled down to Main Street yet.”

Even with these challenges, though, the retail sector has remained solid throughout the Omaha market, Kuehl said, with plenty of demand for retail space.

Kuehl said that the most successful of retailers have embraced the om nichannel approach, relying on both their websites and brick-and-mortar locations to keep sales strong. Retail ers have also embraced many of the conveniences they launched during

the pandemic, including curbside and in-store pick-up options and enhanced delivery.

What has changed today is that shop pers, even though they can buy plenty of goods online, are also eager to get into physical stores and socialize again. That has led to a growth in ex periential retail in the Omaha market, with concepts like pickleball venues, indoor mini golf and high-end bowling alleys rising in popularity.

“People want to be entertained,” Kuehl said. “They want an experience. We are seeing people come back out. People are shopping in person again.”

Earlier this year, Omaha officials approved the initial route for a new downtown streetcar that will travel from the city’s riverfront to 42nd Street. The route will also travel along Farnam Street with loops around the city’s Chi Health Center.

Kuehl said that the streetcar system will provide another boost to Omaha’s retail sector. He says to expect new mixed-use development along the streetcar route.

Heartwood Preserve is another major development that is boosting the entire Omaha commercial real estate market, Kuehl said. This 500-acre mixed-use project in west Omaha fea tures, or will feature, seniors housing, multifamily, single-family homes, re tail and office uses. Open green space will also be a key at this development located on the former Boys Town site in Omaha.

Then there is Mutual of Omaha, which is building a new skyscraper at 1614 Dodge St. in downtown Omaha. The expected completion of this project is 2026.

“There is a little bit of everything out there,” Kuehl said. “The market seems pretty darn strong.”

Kuehl credits much of the success of Omaha’s retail sector to the desirability of the city itself. Plenty of people have moved into Omaha and its suburbs in recent years. And as more people ar rive, they need more restaurants and shops to serve them.

“The residential market has been very strong, very robust here,” Kuehl said.

Midwest Real Estate News | September/October 2022 | www.rejournals.com22 OMAHA

OMAHA

(continued from page 21)

The Mercantile, a mixed-use project developed by Hines, will feature apartment buildings, a boutique hotel, office buildings and a landscaped boulevard.

(continued on page 24)

village pointe campus: NEBRASKA MEDICINE MEDICAL OFFICE BUILDING At Noddle Companies, we believe each project can help shape a community. As a Commercial Real Estate Developer, Property Manager, and Investment Company, we are proud of the work we do in the Omaha Metro. to our clients, teammates, and community at large for allowing us to be part of our growing city. THANK YOU COMMUNITY. 2285 South 67th Street Suite 250 Omaha, NE 68106 info@noddlecompanies.com 402.496.1616

noddle

homes: DEWEY ROWnoddle homes: ROWHAUS

builder’s

district: 1501 MIKE FAHEY

“As the number of rooftops expands, you need neighborhood and service retail. Our residential market might slow down a bit because of the change in interest rates and construction costs. But it has been so strong for so long.”

Kuehl is seeing positives in the downtown retail market, too. As in most cities, Omaha’s downtown was hit harder than other areas of the market during the pandemic. But many employers have started bring ing people back to the office. While foot traffic in downtown Omaha is not back to normal levels yet, Kuehl

said, more people are visiting down town again.

That is good news for retailers, he said.

“We were different than a lot of other states,” Kuehl said. “Nebraska kind of kept going even during COVID. We were not quite as stringent with our shutdowns or lockdowns as some other states were. We were not shut down as long as other parts of the country. I think that has helped our downtown a bit. We are seeing traffic rebounding in downtown.”

No slowdown in industrial

As it is in most markets across the country, the industrial sector is boom ing in Omaha and its surrounding com munities. And also as in most markets, there is little indication that the sector is heading for a slowdown in the near future.

Denny Sciscoe, director of industrial services at Cushman & Wakefield/The Lund Company, said that demand for industrial space in the Omaha market is just as high this year as it was last year, and 2021 was a banner year.

This is no surprise. Sciscoe said that the industrial market in Omaha has been on a hot streak since 2017. De mand for industrial space among end users and investors has only grown since the start of COVID, he said.

Part of the reason for this strong sector? Supply. There isn’t enough industrial space in the Omaha market to meet the demand for it.

“Back in 2017, 2018 and 2019, we had hardly any new industrial development going on,” Sciscoe said. “This year, we are developing about 2 million square feet of industrial space. We are trying to catch up, but we are still behind. People come through the chamber of commerce and are told that the space they are looking for doesn’t exist. When we do add the supply, that only increases the demand, believe it or not, because it is actually available, it is property that people can lease.”

Sciscoe says that the Omaha market has never seen as much spec indus trial construction as it is seeing now. But no one is worried about filling this space, he said, as most new buildings are leased before construction is fin ished.

“We are in uncharted territory,” Scis coe said.

Much of the demand for new industrial space is fueled by the growth in ecom merce, of course. But the onshoring movement has helped, too. During COVID, many companies realized that they could no longer rely on the “justin-time” model of shipping products. They needed more warehouse space and manufacturing facilities in the United States.

When companies bring manufacturing facilities back to the United States, they gain more control over their sup ply chain, Sciscoe said.

The future looks bright for Omaha’s industrial market, Sciscoe said. The growth in ecommerce that was hap

OMAHA (continued from page 22) LEASING TENANT REP INVESTMENT SALES DEVELOPMENT

pening before the pandemic only accelerated during COVID, he said. Consumers today are comfortable or dering anything online, and this trend is not going to change.

“It seems like we experienced about five years of expected ecommerce growth in just 12 months,” Sciscoe said. “The pandemic accelerated the growth of ecommerce more than any one expected.”

Omaha also boasts several advan tages that make it a strong market for industrial end users. As Sciscoe says, the city’s population contin ues to grow, and companies like to locate their distribution centers and warehouses near growing population centers.

Omaha benefits, too, from a strong highway system, with busy Inter state-80 running through it. Land prices aren’t overly expensive here and the labor pool is deep and strong.

“It’s also about timing,” Sciscoe said. “All the primary markets were first when companies were looking for warehouse and distribution center space. Then the secondary markets got filled in, places like St. Louis and Louisville. Now it is the tertiary markets’ turn in this cycle. The time has come, we have the Amazons and Facebooks and Googles here. It’s the evolution of the cycle that we are in.”

One headwind that the industrial market is facing? Not surprisingly, Sciscoe points to rising interest rates.

Higher rates have not slowed the leasing side of the market, Sciscoe said. But it has slowed activity from the capital markets side. There has been some slowdown in the number of investors looking to buy or sell buildings, Sciscoe said.

“Everyone has sort of hit pause for a bit,” he said. “Once interest rates go up, cap rates tend to go up and that means lower sales prices for sellers. Everyone is adjusting to this new norm. It will take some time to adjust to the new normal. I think it will take one or two new sales to reset the market.”

A busy future

Brinker Harding, senior vice president with the Omaha office of Colliers, said that the development activity happening in the Omaha market is unusual because it is taking place everywhere.

“If you go from the Missouri River to the east, the Elkhorn River on the west and all the way from south Omaha to north Omaha, there are projects happening in every submar ket that are exciting,” Harding said.

“There is so much going on still, in spite of what we are seeing with the headwinds of rising interest rates and soaring inflation.”

Brinker said that the many projects taking place in the downtown Omaha area have provided an especially sig nificant boost to the area economy. The RiverFront project in downtown is a good example: It combined three

separate parks into one large public green space. This, of course, has at tracted plenty of retailers and restau rants to this slice of downtown.

There’s also The Mercantile, a mixeduse project overlooking Heartland of America Park lake in downtown

Omaha. The project, developed by Hines, will feature apartment buildings, a boutique hotel, office buildings and a landscaped boulevard. Hines will also build a 720-car parking structure that will be owned by the City of Omaha.

Baird Holm LLP is consistently ranked as one of the Midwest’s Top Firms for Real Estate. Our real estate and finance team has the experience necessary to counsel owners, developers and lenders in complex property, development and financing matters.

Our distinctions include:

• Ranked Band 1 (highest tier) in Chambers and Partners real estate category

One attorney in the Omaha Real Estate Hall of Fame

Two attorneys in the American College of Real Estate Lawyers

Four real estate attorneys in the Best Lawyers in America

Five Chambers-ranked real estate and land use attorneys

bairdholm.com

1700 Farnam Street, Suite 1500 • Omaha, NE 68102 • 402.344.0500

•

•

•

•

(continued on page 26)

Brinker said that this activity doesn’t surprise him. Developers have been busy in Omaha for several years now.

Like others working this market, Brink er cites the office sector as a solid one in Omaha. Office vacancies remain reasonable here, even with all the new office construction taking place, he said.

“I think the strength of our office market is a reaction to what happened during COVID,” Brinker said. “How Omaha and the state of Nebraska reacted to COVID put us in a desirable position as it relates to the potential growth of our market. And because of how we were able to position our selves coming out of COVID is in large part helping us against the headwinds of rising interest rates and inflation. I think we were proactive enough to anticipate what the issues might be without overreacting to those issues.”

It helps, too, that Omaha remains

attractive to companies seeking to expand to new locations, Brinker said.

“We have a very vibrant downtown and very busy midtown and suburban areas, too,” he said. “There is a great variety in where you can live and where you can work. We have a downtown environment that has been exploding with multifamily and commercial and retail development. That is very attrac tive to many people.”

Like other brokers, though, Brinker does have concerns about how rising interest rates and inflation might im pact commercial real estate deals. He says that Omaha is seeing a bit of a slowdown in building permits already.

Even the city’s red-hot single-family housing market is slowing, Brinker said. Homes that went on the market recently were regularly generating eight offers in the first 24 hours of going up for sale. That has eased up

a bit, though the housing market re mains solid, Brinker said.

But even with these challenges, Brink er said that he expects demand for commercial real estate to remain high in Omaha. He also expects renters to continue to seek out multifamily units here, companies to hunt for distribution and warehouse space in the Omaha market and retailers to open new locations in what has been a steadily growing city.

“There are so many good things hap pening in Omaha,” Brinker said. “We have such a robust economy. It will continue to grow. One of the things that make us such an attractive com munity is the willingness of the people who live here to continue to invest here. And it’s not only that they want to invest in commercial real estate, they want to invest in the community. We have an incredible philanthropic community here. That interest that people have in investing in Omaha, both in bricks-and-mortar and com munity projects, is what makes Omaha really strong.”

Midwest Real Estate News | September/October 2022 | www.rejournals.com26 OMAHA

OMAHA (continued from page 25) Since 1975, Investors Realty, Inc. has been helping clients buy, sell, lease, and manage commercial real estate in the Omaha Metro area. We’ve earned a reputation for providing straightforward advice, developing innovative solutions, and delivering results. TRUSTED. INDEPENDENT. LOCALLY-OWNED. OFFICE | INDUSTRIAL | LAND | RETAIL | INVESTMENT PROPERTY • FACILITIES MANAGEMENT | PROJECT MANAGEMENT 12500 I Street Ste 160 Omaha, NE 68137 402.330.8000 investorsomaha.com

“How Omaha and the state of Nebraska reacted to COVID put us in a desirable position as it relates to the potential growth of our market.”

We spoke to commercial financing pro fessionals about the Fed’s move and what it might mean for their business. The consensus? Expect a slowdown in activity as investors determine how best to operate in an environment of higher interest rates.

Chad Kiner Managing Director Walker & Dunlop Columbus, Ohio

Chad Kiner Managing Director Walker & Dunlop Columbus, Ohio

Let’s start by addressing the big question: What impact has rising interest rates had on the demand for commercial financing?

Chad Kiner: It has certainly impacted demand. Everything rolls downhill. You have the rising interest rates along with the higher costs of construction materials and labor. Everything has bubbled up to a point where it is now starting to affect the liquidity of banks and life insurance companies.

Last December was our first real taste of construction costs going up. But in

terest rates were still low at that point. When you add in the complexity of an environment in which rates are rising, the uncertainty of what tomorrow looks like, you start to see a pullback in liquidity.

Even with rising rates, are investors still interested in commercial real estate?

Kiner: Rising costs, rising rates and compressed cap rates are all the in gredients from an investor perspective in which you should stay away from real estate. But for the right asset classes, mainly multifamily and in dustrial, there is still a lot of investor appetite. There is uncertainty in the stock market, too. The stock market has performed poorly this year. That

makes commercial real estate an investment opportunity that is still attractive.

From an institutional perspective, the funds, endowments and life insurance companies, real estate will remain a part of their portfolios. We see the appetite for those investment vehi cles continuing to grow. It is sort of counterintui tive to what is happening in the market, but we still see a lot of appetite for investment dollars com ing into the right asset classes.

Not all commercial real estate assets, though, are viewed as favorably by investors, especially today, right?

Kiner: Hotels, retail and certain por tions of office are still looked at as very challenging asset classes today.

www.rejournals.com | September/October 2022 | Midwest Real Estate News 27FINANCE