Regency Centers (Regency or the Company) is committed to transparent, systematic, and reliable disclosure. This annual Corporate Responsibility Report, covering our 2022 calendar year (2022 Report), contains qualitative and quantitative data highlighting our commitment to Environmental, Social, and Governance (ESG) factors. Throughout, we share our vision and progress toward operating a more sustainable business and disclose areas for potential improvement. We also include key highlights and progress from prior years.

Unless otherwise stated, the data in this 2022 Report covers activities between January 1, 2022, through December 31, 2022, and represents all Regency-owned business activities, including directly-and indirectlyowned subsidiaries and joint ventures.

We have a company-wide approach to recording, measuring, and reporting ESG performance. Across the Company, we capture data on corporate giving, GHG emissions, energy use, water, waste, electric vehicle charging, employee retention and diversity, and other social stats. We use the data to inform and assist the development of our ESG program. Recognizing the increasing importance of ESG data for stakeholders, in 2022, we undertook a data governance project to improve the quality and rigor of our data collection process and disclosures. While we have taken reasonable steps — and used what we consider to be reliable processes and controls — it is possible that the information in this 2022 Report could be incomplete. In cases where we become aware of updates to data from previous years, we consider providing updated data in subsequent reports if the changes result in a discrepancy that we believe is material. In these cases, we provide

details in the footnotes of our data tables and Appendix. We continue to take steps to enhance our informationgathering processes and systems, and will make every effort to update information in a timely manner, as appropriate. Additional information on our approach to corporate responsibility, specifically our reporting definitions, methodology, and reporting changes, are detailed within the Appendix and Frameworks section.

Regency Centers’ environmental sustainability data is calculated in accordance with the Greenhouse Gas Emissions Protocol (GHG Protocol) and the U.S. Environmental Protection Agency (EPA) guidelines. We use the control approach to set organizational boundary and define operational boundary/control as common areas and vacant spaces. For this report, Scope 1 (direct) and Scope 2 (indirect) emissions are from sources within our operational boundary and primarily relate to energy used for exterior parking lot lighting, common areas, and maintaining the inside of vacant tenant spaces. Scope 3 covers emissions from sources we do not directly control and are reported based on data availability. As for waste, we do not generate the majority of waste at our properties considered within our operational control boundary; however, we are responsible for its disposal method.

We align our data collection, measurement, and reporting activities with industry-leading standards and frameworks, including the GHG Protocol, Global Reporting Initiative™ (GRI) Sustainability Reporting Guidelines, the Sustainability Accounting Standards Board (SASB) Standards, the Task Force on ClimateRelated Financial Disclosures (TCFD), and the United Nations Sustainable Development Goals (UN SDGs).

Certain statements in this 2022 Report may be “forwardlooking statements.” These statements are based on the current expectations of Regency and are subject to uncertainty and changes in circumstances. These statements are not guarantees of future results or occurrences. Actual results and financial conditions may differ materially from those anticipated or expected from or represented by these statements due to a variety of factors including, among others: socio-demographic and economic trends, energy prices, technological innovations, climate-related conditions and weather events, legislative and regulatory changes and other unforeseen events or conditions, the potential impacts of climate change on our business and our ability to mitigate them, and the precautionary statements included in this Report and those contained in Regency Centers’ Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings with the U.S. Securities and Exchange Commission (SEC). Any forward-looking statements made by or on behalf of Regency Centers speak only as to the date they are made, and Regency Centers does not undertake to update forward-looking statements to reflect the impact of circumstances or events that arise after the date the forward-looking statements were made.

This Report and the content of our website, including other reports posted there relating to corporate responsibility, are not filings made with the SEC and are not, and shall not be deemed to be, incorporated by reference into any filings Regency Centers has made or will make with the SEC. In addition, while this Report describes potential future events that may be significant, the significance of those potential events should not be read as equating to materiality as the concept is used in Regency Centers’ filings with the SEC.

At Regency, doing what is right for our employees, our communities, and our stakeholders is core to Our Values. The Company takes pride in being an ESG leader in the REIT industry, the principles of which form a foundational strategy for the Company and are embodied throughout our organization. Throughout 2022, we continued to evolve and enhance our corporate responsibility initiatives, which are centered around four main pillars: our people, our communities, ethics & governance, and environmental stewardship.

Last year, we made meaningful progress on our strategy relating to environmental stewardship. In 2022, after a year of data-gathering and verification as well as operational planning, we established an absolute short-term (2030) Scope 1 and 2 greenhouse gas (GHG) emissions reduction target, which was endorsed by the Science Based Targets initiative (SBTi). We also set a long-term (2050) target to achieve net zero Scope 1 and 2 GHG emissions. We have a plan to achieve our goals, with the primary drivers through 2030 being further improvements in energy efficiency within our portfolio as well as design and construction of additional on-site renewable energy projects at our properties. We have also committed to adding more electric vehicle (EV) charging stations to our common areas, which will help to enable and support the decarbonization of our communities.

We’ve also continued to make progress on our strategy and initiatives related to Diversity, Equity & Inclusion (DEI). Over the last three years, we’ve placed a greater focus on this area, including the enhancement of our recruiting, employee development, and talent management processes. During 2022, we took another step forward by committing to the MLT Black Equity at Work Certification Program, a rigorous framework that addresses mechanisms that contribute to greater racial equity at our workplace.

Additionally, the Company has supported the creation of employee resource groups (ERGs), training, and other programs to promote inclusivity. Our ERGs allow our employees to focus on topics of importance to the members of those groups, and develop initiatives to benefit themselves, the Company, and the communities in which we live. We currently have two ERGs established — Women’s Initiative Network (WIN) and Ethnic Diversity Group for Everyone (EDGE) — and have seen great engagement by the participants of these programs.

The strength of Regency’s corporate responsibility program is reflected in various accomplishments over the last year. We reached another milestone in our philanthropic efforts in 2022 with $1.5 million donated by both the Company and our employees, in addition to approximately 1,850 employee volunteer hours. We further improved Board diversity from 36% to 45%

of seats held by women or ethnically diverse directors following the recent addition of Ms. Kristin Campbell in early 2023, and we were recognized for company diversity with another year of inclusion in the 2022 Bloomberg Gender Equality Index. We were honored for a fourth consecutive year on Newsweek’s 2022 “Most Responsible Companies” list, ranked among the top 100 companies in the U.S., and named among the “250 Best-Managed Companies of 2022” by the Wall Street Journal.

On the environmental side, we earned a Green Star from Global Real Estate Sustainability Benchmark (GRESB) for the 8th consecutive year and an “A” for public disclosure, and also received an “A” rating in the MSCI ESG Ratings assessment. We are also recognized as a Green Lease Leader in sustainable leasing, with a Gold designation. Strengthening the “green” provisions in our leases will remain a priority for Regency in coming years, as we look to partner with our tenants to both measure and help reduce their consumption of GHG-emitting energy at our properties (the largest driver of our Scope 3 emissions).

Regency’s 2022 Corporate Responsibility Report highlights our many initiatives and achievements during the last year, but even more important, we are extremely proud of our very long track record of adhering to our Core Values each and every day, doing what is right, for our employees, our communities, and our stakeholders.

Our people are our greatest asset, and we believe a talented team from differing backgrounds and experiences makes us better.

We believe in acting with unwavering standards of honesty and integrity.

We promote philanthropic ideals and strive for the betterment of our neighborhoods by giving our time and financial support.

Our duty is to balance purpose and profit, being good stewards of capital and the environment for the benefit of all our stakeholders.

When we are passionate about what we do, it is reflected in our performance.

When we listen to each other and our customers, we will succeed together.

400+ National Properties

8,000+ Total Tenants

Regency Centers (NASDAQ:REG), headquartered in Jacksonville, Florida, is a preeminent national owner, operator, and developer of shopping centers located in suburban trade areas with compelling demographics. Our portfolio includes thriving properties merchandised with highly productive grocers, restaurants, service providers, and best-in-class retailers that connect to their neighborhoods, communities, and customers. Operating as a fully integrated real estate company, Regency Centers is a qualified real estate investment trust (REIT) that is selfadministered, self-managed, and an S&P 500 Index member.

Established a ScienceBased Target for GHG Emissions Reduction Across Our Scope 1 & 2 by 2030

36% Generated

3,479 MWh of On-Site Renewable Energy

Reduced Like-for-Like Water Consumption by 7%

Diverted

29% of Waste to Landfill

Employee Engagement

87% Board Diversity*

48% of Total Employee Promotions Were Women

$1.5M Given to Support Our Local Communities

95% Participation in Our 2022 United Way® Campaign

9 Years Average Director Tenure

20% NEO Total Incentive Compensation Incorporates ESG Appointed Director with C-Suite

ESG Responsibility

Regency’s Core Values, including the importance that we place on Corporate Responsibility, are at the foundation of who we are and what we do. We know that alignment of strategy and sustainable outcomes is critical to the long-term success of our Company and the environment. Therefore, management of ESG issues is integral to operating our business and is embedded within our corporate strategy and objectives.

Our Board of Directors (Board) is responsible for the oversight of our ESG strategy, initiatives, and business alignment; and has delegated to its Nominating and Governance Committee oversight of Regency’s Corporate Responsibility (or ESG) program. Our President and CEO, Lisa Palmer, has ultimate senior management responsibility for the Company’s ESG program — including oversight of our management-led Corporate Responsibility Committee — and is the primary decisionmaker on all ESG matters. Regency’s Corporate Responsibility Committee comprises senior leaders from key areas of our business and is tasked with working with the Company’s Executive Committee to ensure that our ESG strategy and near- and long-term objectives are embedded throughout the Company’s business decisions, processes, and activities.

In 2022, the Nominating and Governance Committee was briefed regularly on our strategic sustainability initiatives, our goal-setting process, progress toward developing goals aligned with SBTi and TCFD, performance against metrics and targets, sustainability reporting, and the landscape of shifting ESG expectations and practices among our investors and other stakeholders.

Our Corporate Responsibility approach and communications are focused on topics that are most relevant to our Company and key stakeholders. To ensure proper strategic direction, we conducted a materiality assessment in 2020 to identify and better understand our stakeholders’ ESG priorities. The materiality assessment, conducted with the help of an experienced third party, collected feedback from a range of internal and external stakeholders and benchmarked best practices. We also reviewed key topics raised through our stakeholder engagement and outreach and discussed and prioritized these with important internal and external stakeholders. The results from the assessment, shown in our materiality matrix, identified People, Communities, Ethics and Governance, and Environmental Stewardship and are the four components that guide our corporate responsibility strategy and reporting.

In order to successfully own, operate and develop high-quality shopping centers, we actively engage with a wide variety of stakeholders to thoughtfully consider their views and feedback. Our stakeholders, both internal and external, are crucial to our success in achieving long-term value creation. Through our stakeholder engagement, we are living one of our Core Values that “We Are Better Together.” When we listen to each other, we succeed together.

EMPLOYEES

• Board meetings, at least four times per year

• Board committee meetings

• Detailed written materials before every board & committee meeting

• Executive sessions among independent directors

• Frequent board member meetings with management

VENDORS & CONTRACTORS

• Vendor & contractor due diligence process

• Vendor & contractor principles

• Dedicated co-investment portfolio management team

• Proactive & regular one-on-one dialogue

• Property tours

• Periodic business reviews

• Annual meetings

COMMUNITIES & LOCAL GOVERNMENTS

• Philanthropy & community support programs

• Matched employee donations & volunteer hours

• Local government engagement on major redevelopment projects and sustainability topics

• Membership on civic boards

• Participation with industry groups

• Dialogue through open houses & town halls

• Quarterly company-wide town hall meetings

• Virtual meetings

• Annual engagement survey & feedback on results

• Performance evaluations

• Employee committees & DEI resource groups

• Ethics hotline/whistleblower policy

• Service awards

• Volunteer program

• Training & professional development

• Employee intranet

TENANTS

• Dedicated tenant resource website

• Tenant sustainability guide

• One-on-one dialogue with tenants & portfolio management team

• Direct feedback via tenant survey & focus groups

SHAREHOLDERS, BONDHOLDERS, LENDERS, & CREDIT RATING AGENCIES

• Press releases

• SEC filings

• Quarterly written business updates

• Quarterly earnings calls

• Sell-side analyst conferences

• One-on-one meetings & calls

• Property tours

ENVIRONMENTAL STEWARDSHIP APPENDIX (REPORTING FRAMEWORKS)

Our Corporate Responsibility program is built on four pillars: our people, our communities, ethics and governance, and environmental stewardship. It is guided by our focus on three overarching concepts: longterm value creation, the importance of maintaining and nurturing our culture, and protecting and enhancing Regency’s brand and reputation. With these pillars in mind, we develop near-and long-term goals aligned with each to ensure that our ESG initiatives remain at the forefront of our business.

Our Corporate Responsibility Policies and Practices explain how our commitment to sustainability naturally flows from our Core Values and addresses our expectations and requirements with respect to key dimensions of sustainability.

ESG success and progress are the responsibility of our entire organization. Our overarching goal is to maintain the ESG leadership position by moving the needle on existing initiatives and implementing new ones to monitor overall progress and drive continuous improvement. As an extension to our Named Executive Officers' annual incentive program, starting in 2022, our ESG Reporting Team collaborated with our Sustainability Team to ensure that Regency’s Environmental objectives and performance were embedded in every Property Manager's year-end performance targets. These moves reflect the growing importance of individual contribution to, and responsibility for, the Company’s overall ESG performance.

As part of the Board’s succession planning, at least 33% of its members will be gender or ethnically diverse (i.e., members of underrepresented minorities)

10% like-for-like reduction in water consumption based on operational control* (2)

Achieve a 35% waste diversion rate across all of our operating properties based on operational control (2)

Install electric vehicle charging stations at 50% or more of our properties (4)

*From the base year 2019.

(1) Reflects Board composition as of 12/31/2022.

(2) For more details regarding Regency’s GHG emissions, energy, water and waste boundaries and calculation methodologies, see About Our Report on page 3 and footnotes included within Environmental Stewardship and Appendix, starting on pages 37 and 50, respectively.

(3) Goal revised after the publication of our 2021 Corporate Responsibility Report to clarify intent of purchased electricity based on operational control. For comparison, on-site renewable of absolute energy consumption based on operational control was 5% for 2022. On-site renewable energy figures correspond to Regency owned solar and purchased grid electricity consumed by Regency within operational boundary and exclude electricity that our tenants consume. For more details regarding Regency’s purchased electricity and on-site renewable energy calculation methodologies, see footnotes included within Environmental Stewardship and Appendix, starting on pages 37 and 50, respectively.

(4) For more details regarding Regency’s EV charging stations boundary, including historical figures, see footnotes included within Environmental Stewardship and Appendix, starting on pages 37 and 50, respectively.

OUR COMMUNITIES

ETHICS AND GOVERNANCE

ENVIRONMENTAL STEWARDSHIP APPENDIX (REPORTING FRAMEWORKS)

Received Green Star “A” for public disclosure and 3-star rating

Received an MSCI ESG Rating of “A”

Named Green Lease Leader Gold level by the Institute for Market Transformation and the U.S. Department of Energy

Endorsed by the Science Based Targets initiative (SBTi)

Received the Healthiest Companies Award with recognition at Platinum Level

Rated currently with the highest score of “1” in ISS’ Environmental and Governance

QualityScore categories

Ranked Top 75 on Newsweek’s Most Responsible Companies List

Included in the Bloomberg Gender-Equality Index

Pledged to advance diversity and inclusion in our workplace

Recognized as one of the top ten Best Places to Work by the Jacksonville Business Journal

Our people are our most important asset. We strive to employ the best talent, ensuring that our people are engaged, safe, healthy, and supported for the best performance possible. We actively work to advance diversity, equity, and inclusion.

At Regency, we believe that a talented team of professionals from differing backgrounds and experiences makes us better, and we are committed to cultivating an inclusive culture and advancing DEI in our organization, operations, and communities. We also believe that an inclusive environment where differences are valued and embraced strengthens decision-making and enables us to live our Core Values more effectively.

Over the past several years, we have become more intentional in advancing and sustaining meaningful DEI change. Aligned with our three-year DEI strategic roadmap, Regency continues to focus on increasing diversity across our organization, enabling our employees to grow and succeed, and promoting and advancing diversity initiatives in our operations and broader communities.

Regency announced in early 2022 its participation in the Management Leadership for Tomorrow (MLT) Black Equity Certification Program. As one of the few publicly traded companies committed, Regency was the first REIT to receive plan approval under the program. The program, aligned with our DEI strategy, will help increase diverse representation across our organization and further promote and advance diversity throughout our communities. To further support our DEI initiatives, we have scaled up our hiring efforts across traditional channels and are excited to announce an expanded partnership with the University of North Florida. Brought to us through our ERGs connection, the University of North Florida helps proactively strengthen efforts to expand our early-incareer outreach and talent diversity. We’re excited about this partnership and continue to look for additional opportunities to bring real-estate career awareness to a diverse pool of qualified candidates.

As a company that invests in our communities as part of our purpose, we aim to advance DEI in society, helping to tackle drivers of systemic disparities through our philanthropic efforts. In 2022, we reevaluated our philanthropic program to identify key focus areas to support this initiative. As we move into 2023, we aim to hone our program efforts further.

Furthermore, our leadership has maintained multi-year partnerships implementing consistent and transparent messaging surrounding DEI inside and outside the Company. For example, Regency’s CEO, Lisa Palmer, is one of the fortyone female CEOs in the S&P 500 and a signatory to the CEO Action for Diversity & Inclusion pledge that sets a clear “tone at the top” commitment. Additionally, Regency continues to enhance its partnership with the National Diversity Council and Nareit Foundation Dividends Through Diversity, Equity & Inclusion Charitable Campaign.

As part of our commitment to the CEO Action for Diversity & Inclusion, during our Days of Understanding in 2022, Lisa had the opportunity to participate in a fireside chat with former NFL player, N.Y. Times best-selling author and prominent media commentator Emmanuel Acho. Employees company-wide had the chance to join the special recorded session. Opportunities like these allow Regency to join other organizations nationwide to recognize the power of meaningful conversations.

To supplement the quantitative disclosure on this page and in our Appendix, starting on page 50, we publish our most recently filed U.S. Federal Employer Information Report (Form EEO-1) on our Corporate Responsibility webpage. While we make the EEO-1 report available, we believe the data presented in this 2022 Report is the most meaningful measure of our diversity performance.

We recognize that Regency has an opportunity to extend our influence by focusing on diversity and inclusion in our supply chain and with our vendors. As a first step, we have established a Supplier Diversity Task Force to create tracking and reporting structures to capture supplier diversity data.

Our strategy for attracting, inspiring, and retaining the best people includes rewarding our employees fairly and equitably. At Regency, we conduct analyses of pay and compensation practices in consultation with third-party experts. Through pay and policy adjustments, we correct for unintended and unwarranted pay differentials and, where appropriate, adjust to ensure market competitiveness as part of our annual and ongoing reviews. Our latest pay analysis confirms that — considering relevant factors such as position, tenure, experience, and location — Regency pays its employees fairly and equitably regardless of race, ethnicity, or gender. We are deeply committed to helping our employees understand our talent and pay practices to ensure trust and accountability. As such, we conduct periodical Manager Compensation Training to provide greater awareness of our compensation philosophy.

As gender inequality in the workplace remains a global issue, we strive to enable women to reach their full career potential while staying committed to fostering an environment that supports them in the workplace. Over the years, we have worked diligently to improve gender equality. Today, we are proud to report that 60% of our employees in 2022 were women, and 24% (1) were in leadership positions. In addition, there was no pay gap. In fact, women at our Company earned approximately 1% more than men. This means that employees in the same role earned the same wage regardless of gender. While we are incredibly proud of this progress, we know we can do more to increase female representation at the leadership level and intend to continue measuring and reporting on our gender equality annually.

Regency is committed to a workplace free from discrimination and harassment, and is focused on advancing fundamental human rights. Anti-discrimination and anti-harassment training is provided to all employees at orientation and annually thereafter. Our Human Rights Policy documents our support for the United Nations Universal Declaration of Human Rights and its associated Principles. We also publish policies prohibiting forced labor, child labor, modern slavery, and supporting freedom of association.

Our Core Values place strong importance on our people, which are our greatest assets. We strongly believe this makes us an employer of choice. We understand the importance of attracting and retaining the best talent to build long-term value. We strive to offer some of the most competitive pay and benefits in the industry in which we operate and are continually looking at new opportunities to ensure that we attract and retain our people.

Our annual employee engagement survey provides an avenue for feedback to understand what we are doing right and, importantly, what we could do better. Survey results are reviewed company-wide and within every department to help set goals for improvement. In 2022, 91% of employees participated in our company-wide survey, providing valuable insight into employee sentiment, and our average employee engagement score was 87%. Key strengths identified across the Company included confidence in leadership and diversity awareness, whereas identified opportunities for improvement included quality communication and inclusion.

92% AGREED

We have implemented various changes in response to the feedback we received, most notably the launch of a new inclusivity program, Coffee30, whereby teams utilize a “coffee break” to engage in non-work-related discussions. This program creates a casual environment offering a platform for employees to share and support one another –embracing a culture where employees feel they belong and can be themselves. We continue to look for more opportunities to understand employee sentiment around our culture of belonging and aim to develop more programs to support this initiative.

Average Employee Tenure 8 Years

"I believe a diverse workforce is important to achieving our organizational goals."

Employee Development Training for 2022

We strive to provide an environment where our people are connected to their teams, passionate about what they do, and supported to deliver their best efforts and results. From individual contributors to managers and senior leaders, we want to empower our employees to take control of their career growth and realize their full potential through meaningful training and development opportunities. Professional training and development remain key elements of our talent attraction and retention approach, which includes a mix of on-the-job learning, coaching, and leadership and skills training.

Every employee receives an annual performance assessment and career development discussion. In addition, occupational education, interpersonal skills, and training through programs such as LinkedIn Learning® and Crucial Conversations® are provided to all employees to help them communicate effectively,

maximize their potential, and excel in their roles. Furthermore, we continue to invest in talent through partnering with various external organizations, including Generation W and Jacksonville Women’s Leadership Forum, to bring further awareness and support to DEI. Our leaders are also supported through Leadership Essentials, Leading with Integrity, Hiring Dos and Don’ts, and other in-house designed tools and training to effectively manage employees in a hybrid environment.

We also support further education and development through our educational assistance program and support for specialized certifications. In 2022, Regency increased its tuition reimbursement support and provided reimbursement to about 3.5% of our employees.

Total Development Training Hours

13,657

Avg Hours of Training Per Employee

31

Regency's top priority is our people's safety, health, and well-being. Our Benefits Committee strives to provide a benefits package that is comprehensive, competitive, and thoughtfully designed to attract and retain the best in the business, with allowances for parental leave and volunteer time off. We evaluate our benefit offerings yearly and look for opportunities to align further with our employees' needs. In 2022, we expanded our dental benefits to three preventive care cleanings per year and periodontal implants as a ‘Major’ added coverage. Furthermore, shortterm disability weekly payout and paid parental leave increased.

We host an annual Health Fair and have a partnership that offers biometric screening and incentives for employees to maintain a healthy lifestyle. Virgin Pulse®, a complimentary online platform, provides our employees with access to tools that focus on health and wellness education and awareness.

Regency strives to ensure that our people are safe at all sites, centers, and corporate and regional offices. We articulate these expectations through our Health and Safety Policy. Through these measures, we strive for zero injuries, occupational diseases, lost days, absenteeism, and fatalities related to workplace accidents or injuries. Our commitment to safety also extends outside of the Company, as we strive to ensure contractors who perform work on our sites engage in safe working practices and implement policies to support these practices.

In 2022, Regency received its 14th annual 'First Coast Healthiest Companies' Award from Jacksonville, Florida's First Coast Worksite Wellness Council. This marks Regency's eighth consecutive year of winning Platinum – the highest honor.

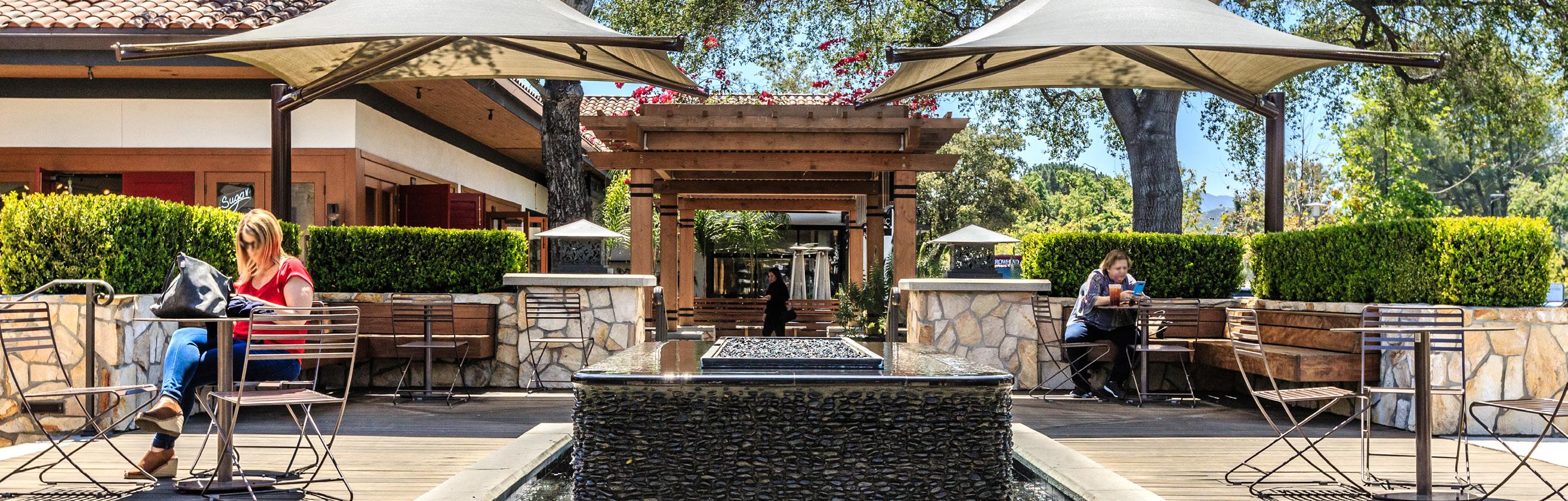

For Regency, the community is where the rubber meets the road when it comes to putting Our Values into action. Not only do we serve the surrounding neighborhoods with retail that is reflective of their lifestyles and interests, but we also aim to create inclusive and welcoming spaces. Our teams are directly sourced from these communities to deepen local expertise and understanding, and our charitable efforts and contributions are laser-focused on opportunities unique to their markets.

For 60 years, Regency Centers has been a committed and active participant in the communities where we live, work, and play. Connecting with our communities is an extension of our people. We leverage our long-standing partnerships, dedicated employees, and company resources to build community support. We give to a wide range of nonprofit community programs, seeking to support as many aspects of our diverse communities as possible.

For example, 2022 marked the third year of Regency Centers’ ouRCommunities program. This effort affords our employees the opportunity to participate in selecting an organization to receive a gift to support work furthering a cause that is important to them and makes a difference in our communities. Each organization is required to create a proposal which is then submitted and voted on by our employees. Three candidates are selected, and funds are distributed in accordance with their vote counts. Our 2022 recipients consisted of Quigley House: an advocacy and education group focused on survivors of domestic abuse; Blessings in a Backpack: an initiative dedicated to food-insecure households requiring assistance outside of school-provided meals; and Comfort Zone Camp (CZC): a nonprofit bereavement organization for children who have experienced the death of a parent, sibling, primary caregiver, or person of significance. It was a record year for submissions, and efforts are underway in 2023 to expand and improve upon this impactful program.

Through our continued relationship with groups like Habitat for Humanity®, The United Way®, and YMCA®, our employees clocked in approximately 1,850 volunteer hours and a record-breaking donation total of $1.5 million in 2022. This includes a dollar-for-dollar corporate match of additional charitable donations from our employees. Although Regency is made up of less than 500 people, we are proud to serve as an example of a small group making big differences with the right focus and energy. Our passion for giving is an integral part of our culture and operations that will continue to guide our business decisions and behaviors.

Just as every community has attributes that make it unique, each can benefit from different kinds of support to make it a great place to live, work, play, and do business. Regency Centers’ proprietary Fresh Look® strategy places great importance on the merchandising mixture of local and family-owned businesses in our portfolio. It is important that our centers are not just reflective in design and appeal, but also in the services they offer that are unique to the cultures and lifestyles that surround them. However, even a local favorite can use some assistance from time to time, and Regency has developed methods to assist those in need.

One of the many new elements developed out of the COVID-19 lockdowns was our Merchant Success Toolkit. This award-winning strategic document outlines best practices across multiple market channels and tips on using them specifically for retail and in our centers. Over the years, we have added, honed, and sharpened the content to ensure it is accurate and effective, with a constant promotional campaign both inside and outside of our portfolio. In special cases, Regency provides third-party mentorship to a retail specialist who can help guide our tenants through a customized format to move forward on a better path.

Acquired in 2016, The Crossing Clarendon in Arlington, VA, is a great example of how our community-centric actions are taking shape in real time. Although many of these elements can be found in various centers across our portfolio, this property demonstrates how they can be seamlessly interwoven for overall success at one location.

Last March, for Women’s History Month, the center was host to the Women’s History Hunt: a geocaching activity hosted by Rosie Riveters. Their mission is to engage and inspire young girls in science, technology, engineering, and math (STEM). Participants had to locate containers hidden across the area, each of which included an informative puzzle featuring a fun fact about a significant woman in STEM.

We support both local and national programs dedicated to the conservation of natural resources. Regency welcomes new employees with a cultural gift that speaks to each of the elements of our wellness program — “Live Well. Work Well. Be Well.” — supporting physical, emotional, financial, and community health. The gift includes, among other things, a voucher to plant a tree. The trees are planted by a partner organization, which manages multiple reforestation projects around the world. This initiative ensures that the people we welcome into our workplace are aware of our culture and commitment to the environment with an opportunity to contribute. In 2022, we planted 88 trees, and when mature, they will absorb approximately 4,200 pounds of carbon dioxide from the atmosphere annually. (1)

(equivalent to removing 2 cars) (2)

Furthermore, as a part of our ecological awareness efforts, Regency collaborates with the Alveole social beekeeping company. Alveole partners with hundreds of other companies and schools for these installations, whose buzzing occupants collect nectar and pollen from flowers within a three-mile radius of the property. The bees serve as a valuable learning tool and provide the surrounding community a greater tie to nature and some locally sourced honey.

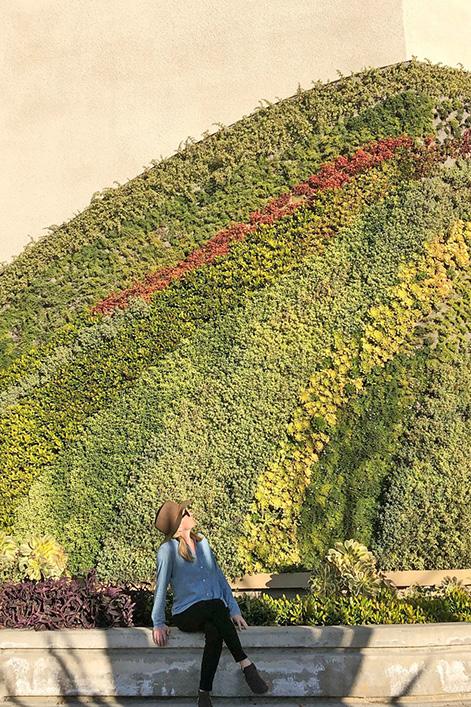

Ensuring access to nature's benefits to enhance our communities' daily lives is important to Regency. Through our development and re-development, we find opportunities to design spaces that include lush green landscaping, updated and modern architecture, improved community connectivity through branded crosswalks and signage, as well as enhanced water features and updated playground equipment for children.

(1) Source: US Department of Agriculture (2) Source: US Environmental Protection Agency

Regency strives to provide a safe and secure experience for customers and merchants. Top-quality tenants draw customers; however, a safe environment retains their continued business.

Nationally, our market presence stretches across 22 offices, over 400 centers, and 51 million square feet. We host more than 8,000 tenants that serve an average of 130,000 people per location. Our efforts and operations touch a lot of lives in more ways than just shopping, and we take that responsibility seriously.

Regency’s in-house Property Operations team handles day-to-day oversight of center maintenance, security, and tenant relations. These professionals are located in each of our office locations, providing valuable boots-on-the-ground service. Our Property Operations team uses the Regency Playbook, a nationally mandated Crisis Management Program and protocol. It is used in every market and has proven to be a critical and effective method of ensuring the right people across seven departments access the required information as quickly as possible. It has been used to communicate everything from natural disasters to active shooters, and is reviewed on an annual basis to improve its effectiveness and the security of our shoppers and the integrity of our tenants.

Our Property Operations team also performs frequent activities for the benefit of our centers, including:

Frequent property inspections to identify property-level areas for improvement.

Capital surveys and budget exercises for the purpose of identifying areas for capital repairs, replacements, or improvements to be included in the capital plan.

Annual Stewardship

Reporting facilitated by Risk Management is conducted as a supplemental property inspection that’s performed by a third party on a sample of properties each year, in order to further identify areas of improvement that mitigate potential liabilities.

It is important that our tenants and the communities they serve feel welcome and comfortable at our centers. To contribute to our overarching goal of tenant satisfaction, we regularly communicate with our tenants via one-on-one conversations to better understand their unique needs. Our teams leverage insights from these dialogues to adapt and better serve individual tenants whenever possible.

Our most recent tenant satisfaction survey solicited feedback from a multitude of tenants across our portfolio in areas such as property maintenance, communication, store performance, and overall satisfaction. While the survey demonstrated a higher-than-average volume of participation, we aim to continue seeking new ways to increase tenant participation and improve satisfaction.

Regency’s operations play both direct and indirect roles in the local economies of the communities in which we operate. In 2022, Regency incurred approximately $195 million in real estate property taxes, ~$1.8 million in franchise taxes, and ~$190,000 in transfer taxes. A majority of these tax revenues directly benefit our local communities, including the funding of infrastructure improvements (i.e. roads, water, sewer), public services (i.e. law enforcement, fire protection, libraries) and public schools.

The presence of our shopping centers provides socioeconomic benefits as amenities and gathering spaces for our surrounding communities, and indirectly benefits surrounding residential property values while providing a source of sales tax revenue from retail stores. Our centers are also a source of job creation, starting with the initial construction of the center through to its completion and ongoing operations –ranging from construction jobs to retail store employees to the leasing and property management functions.

2022 Real Estate Taxes ~$195M

2022 Franchise Taxes

~$1.8M

2022 Transfer Taxes

~$190K

As stewards of our investors’ capital, we are committed to best-in-class corporate governance. We place great emphasis on our culture and Core Values, the integrity and transparency of our reporting, and our governance structure to build shareholder value for the long term.

We believe effective corporate governance is a cornerstone of our business decision-making and is a material contributor to creation of long-term shareholder value. Our Board guides our strategy and has ultimate oversight responsibility for the affairs of the Company, with management having day-to-day responsibility for operations and implementation of our strategy. Of our eleven Board members, nine are independent, and every member must stand for election annually. The Board’s oversight responsibility is fulfilled either directly or through its four standing committees: Audit, Investment, Compensation, and Nominating and Governance. The charters for each of these Board committees, as well as the Corporate Governance Guidelines that detail the governance philosophy and practices of our Board, can be found on the Investors Page of our website, as can our most recent proxy statement.

As delegated by our Board, the Audit Committee provides oversight of Regency’s financial statements and disclosures, internal controls, the engagement of our external auditors, oversight of risk assessment and management relating to our cybersecurity program, and other matters that could impact the financial performance of the Company. Our management-led Cyber Risk Committee has responsibility relating to our cybersecurity program and provides reports to the Audit Committee at each of its meetings and more frequently as necessary or appropriate.

Our Investment Committee, to the extent delegated by the Board, provides oversight of Regency’s capital allocation strategy.

Our Nominating and Governance Committee provides oversight of the Company’s governance structure, together with our Corporate Responsibility program and ESG strategy and initiatives. The committee also provides oversight of risks and opportunities associated with public company governance matters, the Company’s ethics and compliance program, political spending and lobbying (which has been de minimis in recent years), health and safety, our diversity and inclusion program, as well as risks related to the environmental impacts of our centers, such as those relating to climate change.

Our Compensation Committee provides oversight of all executive and director compensation, and management succession planning and development. To ensure that corporate responsibility is embedded in our business strategy and performance expectations, in 2021, the committee implemented an ESG compensation metric as a key component of our NEOs annual incentive program. During 2022, our Compensation Committee regularly reviewed progress against the ESG objectives, which was measured both quantitatively and qualitatively, and determined that the executive team achieved their objectives in this area.

was valued at 20% of each of our Named Executive Officer’s 2022 total annual incentive compensation.”

The mix of skills, experience, backgrounds, tenures, and competencies, as well as the continuity of our Board, has been integral over time to the success of our Company. To ensure that this mix is maintained and enhanced, our Board has established a formal succession planning process. A review of the Board succession plan is part of the annual agendas of both the Nominating and Governance Committee, and the full Board.

Our Nominating and Governance Committee evaluates each director candidate's specific personal and professional attributes versus those of existing Board members, to ensure diversity of competencies, experience, personal history, and background

through skills and expertise across the full Board. While our Nominating and Governance Committee has not adopted a formal diversity policy in connection with the evaluation of director candidates or the selection of nominees, active and intentional consideration is also given to diversity in terms of gender, ethnic background, age, and other similar attributes that could contribute to Board perspective and effectiveness. With the recent addition of Ms. Campbell in early 2023, our Board has four female directors (36%) and one ethnically diverse director, for an aggregate representation of diversity on our Board of 45%.

4 Women

7 Men

1 Ethnically Diverse

45% Gender or

Principal of Harborview Associates, LLC

Lead Director of the Board and Director of Civeo Corporation

Executive Vice President, General Counsel and Chief ESG Officer of Hilton Worldwide Holdings Inc.

Executive Vice President and General Manager, IT Asset Lifecycle Management of Iron Mountain

Chief Executive Officer and Managing Director of Consumer Equity Partners

Founding Partner of Bloomberg Beta

Principal of Linneman Associates

Managing Partner of High Rise Capital Partners, LLC

Chief Executive Officer and Founding Partner of Asland Capital Partners Director Since 2014 2001 2023 2018 2019 2019 2017 2011 2018 2021 1993 Skills/ Experience Business “C Suite Leadership” Real Estate/REIT Capital Markets Consumer Retail Corporate Governance/ Public Board Financial/ Accounting (1) Human Capital Technology/ CyberRisk ESG

Executive Chairman of the Board and Former Chief Executive Officer of Regency Centers Corporation

* Board composition is based on director nominee for 2023 election year. (1) All of Regency’s directors are “financially literate” as defined by the SEC rules. REGENCY CENTERS 2022 CORPORATE RESPONSIBILITY REPORT ETHICS AND GOVERNANCE OUR COMMUNITIES ENVIRONMENTAL STEWARDSHIP APPENDIX (REPORTING FRAMEWORKS) OUR PEOPLE CORPORATE RESPONSIBILITY 33 | REGENCY OVERVIEW ABOUT OUR REPORT

Bryce Blair C. Ronald Blankenship

Kristin A. Campbell

Deirdre J. Evens

Thomas W. Furphy

Karin M. Klein

Peter D. Linneman

David P. O’Connor

Lisa Palmer James H. Simmons, III

Martin E. Stein, Jr.

Bryce Blair C. Ronald Blankenship

Kristin A. Campbell

Deirdre J. Evens

Thomas W. Furphy

Karin M. Klein

Peter D. Linneman

David P. O’Connor

Lisa Palmer James H. Simmons, III

Martin E. Stein, Jr.

At Regency, we have lived our Core Values for 60 years by successfully meeting our commitments to our stakeholders. We hold ourselves to this high standard every day. From an Ethics and Compliance standpoint, we are guided by one of our six Core Values: “We Do What Is Right.” This means that we believe in acting with unwavering standards of honesty and integrity.

As delegated by our Board, the Nominating and Governance Committee has oversight responsibility for the Company’s corporate Ethics and Compliance program. Management’s Executive Committee (which consists of our CEO and the other three most senior executives) has established a Compliance Committee, which is comprised of senior leaders from key areas of our business, to ensure that our ethics and compliance program, and the values underlying it, are embedded throughout the Company’s business decisions, processes, and activities. The Compliance Committee meets at least quarterly, and its Chair reports regularly to our CEO and the Board’s Nominating and Governance Committee. Updates are also provided to the Nominating and Governance Committee at its quarterly meetings.

The key policy document embodying our Core Value of “We Do What Is Right” is Regency Centers' Code of Business Ethics and Conduct (Code of Conduct), which reinforces our culture of honesty and integrity. Of course, the Code of Conduct requires that all directors, officers, and full and part-time employees comply with applicable laws, rules, and regulations, but as mandated by our Core Values, our Code of Conduct goes well beyond mere compliance with law and requires adherence to our higher standards. The Code of Conduct also provides specific guidance in particular areas, such as our stance against bribery and corruption, and our approach to topics such as political contributions; each of which management’s Executive Committee must approve (and which have been de minimis in recent years). In addition, our Ethics and Compliance program requires that every new employee is trained in our Code of Conduct as part of their new-hire orientation when they join the Company, and receive refresher training annually thereafter.

To supplement our Code of Conduct and transparently inform our stakeholders on key issues, we have documented our Corporate Responsibility Policies and Practices, including our:

Human Rights Policy

Freedom of Association Policy

Forced Labor, Child Labor, and Modern Slavery Policy

DEI Practices

Health and Safety Practices

Anti-Money Laundering Policy

Anti-corruption

Whistleblower Reporting

Business Continuity and Crisis Management

Our expectations related to Ethics and Compliance are reinforced in both mandatory and discretionary online training and learning opportunities, which are periodically refreshed and reviewed to ensure the content remains relevant and appropriate.

In 2022, the following training was provided to our employees:

Code of Business Ethics & Conduct

Harassment Prevention, such as sexual harassment and age discrimination

Cybersecurity, including advanced cybersecurity training such as spear phishing and social-engineered tricks

EEO/Diversity

Antitrust (tailored based on the employees’ respective roles)

Speak Up

It is important that our employees believe we are living our Core Values every day. As such, we ask our employees every year as part of our engagement survey to rate whether our senior leadership demonstrates integrity. In 2022, Regency’s engagement score in this key area was 89%.

Regency Centers strongly encourages all employees to report any concerns or improper conduct to their manager, Human Resources, Legal, Internal Audit, or anonymously through our Regency Alert Line. Our Alert Line is an ethics hotline managed by an independent third party and is available either by phone or online 24 hours a day, seven days a week. In addition, “Speak Up” training is conducted annually to ensure our employees know the numerous reporting channels available to them. All concerns and inquiries submitted through the Regency Alert Line are provided to a group consisting of senior Human Resources, Internal Audit, and Legal personnel for evaluation and investigation, and are reported to the Nominating and Governance Committee of the Board. We make clear that there will be no retaliation of any kind against anyone reporting suspected unethical, illegal, or unsafe behavior. We have zero tolerance for retaliatory actions.

We strive to ensure that those third parties we work with have a similar commitment to doing what is right through our Vendor and Contractor Due Diligence Process and Principles. Our team works closely with our vendors and contractors to monitor performance and identify and address any activity that does not adhere to our high ethical standards.

Cybersecurity risks require heightened attention and prevention. We have developed a comprehensive cybersecurity governance structure and policy approach to provide oversight, management, awareness, and training in this crucial area.

At the Board level, our Audit Committee is delegated oversight authority over Regency’s cybersecurity program, with management’s Cyber Risk Committee having responsibility for the implementation of Regency’s cybersecurity programs and initiatives. The Cyber Risk Committee reports to the Audit Committee at each of its regular meetings, and more frequently if necessary or appropriate. The Cyber Risk Committee has implemented a robust Cyber Risk Management and Data Breach Preparedness Policy to address the potential for cyber incidents and how to address them.

People are the most significant risk to a company’s cybersecurity, as they are susceptible to increasingly sophisticated hackers and cyber-attacks. To address this risk and prepare our people, we ensure onboarding includes robust cyber-awareness training, ongoing regular and unscheduled phish testing to reinforce the awareness of the cyber threat landscape, and annual refresher training with advanced users undertaking specialized training. Furthermore, we engage a vendor to conduct third-party cyber due diligence and audits, to test the cyber-preparedness of the key vendors and contractors we do business with.

Regency is committed to minimizing the impact of an unplanned business interruption. We have established a Business Continuity Committee, comprised of a cross-functional group of senior managers, to develop and execute strategies and processes to assess our risk and recover operations, data, and full functionality in the event of an unplanned interruption. We conduct annual Business Impact Analyses, and each of our geographic locations develops a custom Business Continuity Plan to ensure recovery as soon as reasonably possible for their critical business functions. Our local teams test their respective plans to ensure they are effective and fit for purpose. These activities complement the emergency preparedness planning performed by our Operations personnel at our properties.

Through our thoughtful approach to these issues, we strive to ensure that Regency Centers can withstand unexpected events, such as a pandemic, severe weather, or an unplanned technology-driven business interruption. We do our best to operate and provide essential goods and services to our communities during uncertain times.

We believe sustainability is in our Company’s best interest through every touchpoint. We look to address material environmental topics through our environmental commitments, supporting us in our achievement of key strategic objectives in our operations and development projects.

At Regency, we strive to integrate sustainable practices throughout our business and believe that sustainability is in the best interest of our stakeholders and the environment. Our approach to environmental stewardship focuses on integrating management responsibilities across our operations and development projects to address material environmental risks and issues.

We accomplish this by focusing on eight strategic priorities:

Our formal climate strategy work began in 2008, and in 2014 we became the first U.S. REIT and the second U.S. Corporation to issue a Green Bond for financing environmentally sustainable projects. In 2017, we developed our own Green Building Standard that, to date, is applied to all ground-up development and major redevelopment projects, ensuring that all of our construction projects achieve a higher level of green building performance. In addition, we set initial 10-year environmental targets, which were achieved ahead of schedule, and in 2018 we re-set new goals. In 2019, we developed and implemented a Tenant Sustainability Guide. In 2020, we incorporated a sustainability metric into our amended and extended credit facility agreement as added incentive to reduce Scope 1 and 2 GHG emissions. In 2021 and 2022, we continued to achieve our goal of reducing Scope 1 and 2 GHG emissions, introduced property-level climate risk reports into our due diligence process for all new investments, and released a standalone climate change risk report aligned with TCFD. Furthermore, in 2022, we developed a net-zero Scope 1 and 2 GHG emissions goal and an interim Science-based goal endorsed by SBTi.

More than ever, we recognize that climate change is one of the most significant issues facing our society and future generations. As a long-term owner, operator, and developer of real estate, we acknowledge the potential for climate change to have a material impact on our properties, people, and long-term success. The frequency or intensity of extreme weather events, sea-level rise, and other climate changes may continue to increase. Regency wants to ensure that our properties can safely, sustainably, and responsibly withstand the test of time. In addition to understanding the impacts, we also aim to do our part to reduce the impacts of climate change.

Climate-related analyses and actions are a key focus of our Corporate Responsibility Program. Our Board regularly reviews our Corporate Responsibility Program, including our efforts to analyze the impact of, and respond to, climate change. Ultimate responsibility for assessing and mitigating climate-related risks and opportunities is with our President and CEO, with ongoing oversight by our Corporate Responsibility Committee.

We align and disclose climate risks under various reporting frameworks, including TCFD and CDP.

Greenhouse Gas Emissions

Renewable Energy Waste Management Water Conservation

Green Building

Greenhouse Gas Emissions

Renewable Energy Waste Management Water Conservation

Green Building

To understand our exposure to climate-related impacts, in 2018, we analyzed the sea-level rise risks to our properties in Florida. As a result, we identified that a small number of our assets would be at higher risk in the long term and, as such, factored the results into our insurance and property management strategies.

Beginning in 2020, we built on that work, expanding our analysis to our entire portfolio and business over the medium and long term (2030-2100). Our analysis looked at two scenarios: one assuming lower levels of GHG emissions that will limit average temperature increases to 1.5°C to 2°C degrees (a “sustainable growth” scenario), and another where GHG emissions continue to rise at a higher level of 6°C degrees (a “current trends” scenario). The work provided a better understanding of the risks and opportunities at both the portfolio and geographic market levels under the two different climate scenarios and over the medium and long term.

To help expand our understanding at the property level, in 2021, we partnered with an experienced consultant to perform climate-risk analyses on any properties we are considering for new investment, and in 2022, on all properties in our portfolio progressively over the next four years. These reports identify the risk level of the site within five specific perils: storm (including hurricanes and strong winds), heat, drought, fire, and flood (pluvial and fluvial).

For each hazard, our consultant analyzes the modeled frequency and severity of extreme events in the past and future to create a 1-100 rating relative to the data coverage area. The screening and reports include property-level climate risk data projecting 50 years into the future under multiple scenarios, including RCP4.5 and RCP8.5.

Storm: number of high wind, wet or snowy events

Heat: the number of extreme heat days experienced each year

Drought: water supply stress

Fire: annual risk of burning events

Flood: coastal flooding, flooding from other bodies of water, and surface water floods

Risk management is embedded into everything we do, and our risk management practices are set out in our Corporate Responsibility Policies and Practices. Our risk management practices stem from a philosophy of pursuing sustainable growth and creating economic value while managing appropriate risks and opportunities.

Our 2018 sea level rise analysis informed how we manage risks to our Florida properties. The results from our 2020 work, described in the graphic below, updated that analysis and now informs climate risk management across our entire portfolio. It is also integrated into strategic planning, acquisition decisions, property management, and capital allocation project planning, and guides our ongoing property-level analyses.

Regency is focused on maintaining resilience at our properties and our business. We strive to implement leading construction and operational practices as well as robust planning for a swift recovery from any incident. According to the UN Intergovernmental Panel on Climate Change (IPCC AR5), the physical risks of climate change are varied and widespread. Regency’s operations may be subject to disruption from natural or human causes beyond its control, including physical risks from hurricanes, severe storms, floods, heat waves, other forms of severe weather, wildfires, and sea level rise; as well as transitional risks, such as policy and legal, market, and reputational.

Scenario review: analysis of the indicators in each scenario and their potential impact on Regency.

Vulnerability score development: based on exposure, sensitivity, and adaptive capacity.

We took the following steps to evaluate the impacts of climate change and its potential effect on our properties: 1 3 5

Indicator identification: where we looked at factors such as the cost of fossil fuels, changes to energy policy and electricity sources and pricing.

A more detailed discussion of the risks that could impact our business and financial condition are discussed in our SEC filings, including our most recently filed Annual Report on Form 10-K

Final score development: impact and likelihood were assessed, informing the final score and ranking for identified risks and opportunities.

2 4 6

Risks and opportunities development.

At this time, outside of our 2020 TCFD analysis accessible through our 2021 TCFD Report, we have not identified a material climate-related risk to our business. In addition, the geographic diversification of the properties in Regency’s portfolio means individual natural events such as a severe storm, which potentially impact one or a small number of properties, should not have a significant financial impact on the business in the aggregate. However, we continue to monitor the impacts of climate risk on our business and aim to use the ongoing property-level analyses and projections developed by our consultant to assess our business’ climate vulnerabilities and perform resiliency planning. Furthermore, we intend to leverage the data and models to determine the relevance of disclosure related to the quantifiable financial impacts on our Company, if any.

In 2022, we revisited our climate-related goals and disclosures and, in line with best practice, developed a net-zero Scope 1 and 2 GHG emissions goal and an interim Science-based GHG emissions reduction goal, together with a strategy to achieve both.

Vulnerability scores workshop: key internal stakeholders reviewed and discussed the relative rankings of the risks and opportunities.

All of these actions to identify and manage climate risk at the property and portfolio level are monitored and coordinated by our Real Estate and Management Committees, with oversight from our Board. This ensures that a holistic strategy guides the approaches in our business lines.

We have for many years disclosed our energy use, water consumption, waste diversion, and GHG emissions in our annual Corporate Responsibility Report. Details related to our strategy and progress against our targets are provided throughout this 2022 Report.

We are committed to measuring, reducing, and reporting our GHG emissions. Regency's Scope 1 and 2 GHG emissions consist primarily of electricity consumed in common areas and vacant tenant spaces within our operational boundary/control. Scope 3, on the other hand, represents the most significant portion of our reported emissions and comes from sources such as tenant activities, business travel, and employee commuting.

Early 2022 marked Regency’s transition to targets for reducing Scope 1 and 2 GHG emissions on an absolute basis. Aligned with the Paris Agreement, we’re committed to reducing our absolute Scope 1 and 2 GHG emissions by 28% by 2030 — a target endorsed by the SBTi — and to achieve net-zero Scope 1 and 2 GHG emissions across all operations by 2050. Through this pledge, we continue to reduce our Scope 1 and 2 GHG emissions and measure, report, and collaborate with our tenants to reduce their operational emissions.

Our overall Scope 1 and 2 GHG emissions reduction of 12% compared to our 2019 baseline is driven by several factors, including the improvement of common area energy efficiency, the deployment of renewable energy solutions, and the purchase of renewable energy.

To help reduce the environmental impact at our centers and meet our 2030 goal, we have identified the following two primary reduction strategies:

Energy efficiency focused on LED conversion and lighting controls in our common areas, and

Renewable energy through the growth of on-site solar generation projects at our centers

Details on our GHG emissions reduction strategy and energy initiatives are provided on the following pages.

We have developed an interim GHG emissions reduction strategy aligned with limiting global warming to well below 2°C compared to the pre-industrial level, positioning Regency to contribute as the world transitions to a netzero future. Through this process, we aim to focus on LED conversion and lighting controls, and growing our renewable energy footprint. As of year-end 2022, we had nine properties that generated on-site renewable energy and, in total, have an installed capacity of 2.5 MW-DC. The on-site production of clean energy generated was 3,479 MWh.

For our reporting in 2022, Regency will take credit for reducing its Scope 2 GHG market-based emissions by incorporating renewable energy certificates (RECs). These RECs total approximately 3,478 MWh, equivalent to our on-site renewable energy generated in 2022, and when applied to our Scope 2 market-based GHG emissions, is equivalent to the reduction of 1,083 MtCO2e.

We continue to expand and explore additional renewable energy and efficiency projects, and plan to introduce more initiatives at our properties to benefit the environment. We will continue to share near- and long-term progress regarding our de-carbonization strategy.

RECs/Greener Grid/Innovation

Energy E ciency (LED Conversions)

Actuals + Business-As-Usual (Scope 1&2)

Renewable Energy Consumption (On-site Solar)

Baseline Year 2019 (Scope 1 & 2)

Goal Scenario - Scope 1 & 2 SBTi (well below 2°C)

Improving energy efficiency across our operational control is critical to achieving our Science-based targets. Exterior common area lighting represents Regency’s total energy consumption and is our largest source of GHG emissions, while stationary combustion follows, accounting for approximately 12%. In 2012, we started to replace our existing lighting systems with energy-efficient LED lighting. Over the years, we have continued to make progress on this strategic priority and, to date, have converted more than 275 of our shopping centers to highly efficient DarkSky™ compliant LED fixtures. In 2022 alone, we converted more than 20 shopping centers, which produced savings of 591,687 kWh = $106,119.

Additionally, throughout 2022, we continued to take advantage of opportunities to use cool-roofing technology, improve glazing and insulation at our properties, and maintain and replace HVAC units.

We’re proud of the progress made over the years; however, we recognize that the opportunity to reduce our total energy consumption remains as we position Regency to meet our 2030 GHG emissions and energy efficiency goals.

ENERGY

6% Like-for-Like Energy Consumption Reduced From 2019 (1)

Regency continues to focus on expanding the use of renewable energy technologies at our shopping centers and sharing the benefits of affordable, clean power with our tenants and local communities. This initiative has been incorporated into our business strategy since 2011. While we continue to deploy opportunities to provide our tenants with affordable and clean renewable energy, in the future, we plan to procure strategically in order to reduce Regency’s own GHG emissions footprint. Given our vast geographic distribution, solar is currently the most effective and readily available renewable option, but we continue to review other potential renewable options for future deployment.

As of year-end 2022, we had nine properties with solar energy arrays at our centers with a total installed capacity of 2.5 MW-DC. The on-site production generated approximately 3,500 megawatt hours of clean energy all of which was provided to our tenants.

Regency’s most significant use of water within our operational control is landscape irrigation, which is primarily impacted by weather patterns and water restrictions. We recognize the need to conserve this natural resource to keep it available for future generations while also preserving the environment and minimizing effects such as drought and water shortages. At Regency, we strive to implement best practices in water management at our properties by focusing on strategies that balance the use more efficiently, while also providing shade and pedestrianoriented landscape areas for the community to enjoy.

We do this through high-efficiency irrigation systems, including “smart” controllers that adjust schedules based on local weather conditions to optimize irrigation run times. We also, where possible, use reclaimed water from our local utility providers and plant native, drought-tolerant plants. Other measures like stormwater management systems that protect stream channels

from excessive erosion, permeable paving systems, and rainwater retention cisterns are just a few other measures to conserve water usage on our properties.

The water we use is sourced from municipal, public, and private water utility providers, and we comply with public policy and local requirements for water use and monitor consumption regularly. We strive to reduce our water use without compromising the environments at our centers and encourage our tenants and other stakeholders to undertake water conservation measures, including through our Tenant Sustainability Guide, which provides guidance on tools and practices our tenants can use to reduce water use.

5%

From 2019 (1)

In partnership with our tenants and network of local recyclers, composters, and waste haulers, we work to promote responsible waste management practices across our shopping center portfolio. While recycling programs vary significantly based on local recycling infrastructure, we continuously strive to provide our tenants and center visitors with the means to recycle and compost their waste. Collaboration with our tenants to reduce waste management is key to our success. While it presents a challenge, we advise our tenants on how recycling can be maximized and its benefits to the environment and their businesses through our Tenant Sustainability Guide.

Not only do we focus on waste diversion and resource conservation at our properties, but we also seek effective waste management programs at our corporate and regional offices. Together with tenant engagement, waste management remains a strategic priority.

29%

Regency was an early adopter nearly ten years ago and has since been a leader in supporting the development of a national network of electric vehicle (EV) charging stations. EV stations positively impact our communities and provide visitors to our centers with a modern amenity that enables them to reduce their carbon footprint directly.

In 2022, we continued to advance our electric vehicle program by installing 107 stations across our properties. This was a 2% increase from 2021 when we had 690 active stations across 405 Regency properties.

We respect and strive to protect biodiversity and natural habitats at, and around, our neighborhood shopping centers, and during development projects.

Evaluating and mitigating potential environmental impacts during new development begins during the site planning phase, which includes an environmental assessment tailored to local regulations and engagement with local communities. For example, based on the planning phase, modifications are made to the site construction plans as necessary, which could include relocating protected or endangered species. Additionally, we seek to minimize the impact on the local environment from our ongoing operations at or around our neighborhood shopping centers.

We require our vendors and contractors to assist us in our efforts. To minimize any potential impact on biodiversity and habitats, we implement the following measures where appropriate:

Scope 3 GHG emissions represent the most significant portion of our reported emissions, although measuring emissions in the supply chain is currently challenging and not as accurate as we would like due to the need for more available and reliable data. We recognize that our engagement efforts related to the accessibility of data are key to our long-term success. Furthermore, accurate data enables us to better understand the environmental impacts and risks across our supply chain.

In 2022, we enhanced our data collection process to ensure more frequent engagement with our suppliers and better controls in our data collection process.

This process change not only fosters collaboration with our tenants and supply chain vendors, but also allows for greater visibility in our Scope 1 and 2 GHG emissions data to help effectively drive change within our operational control. We believe the regular cadence of our reporting combined with granular data results in more effective conversations about driving progress. Furthermore, our Leasing and Legal teams continue to support the Company in advocating for more robust green lease provisions with our tenants. While this change demonstrates our commitment to measuring, reporting, and collaborating with our tenants and supply chain vendors, there is still much more room for us to adapt, refine, and raise the bar.

(1) Represents average number of personnel in 2022.

(2) Named Executive Officers as of 12/31/2022.

(3) Includes individuals with VP, SVP, EVP or President titles.

(4) Includes individuals who identify as American Indian or Alaska Native, Native Hawaiian or Other Pacific Islander, two or more races, or declined to provide.

(5) Employed after 12 months from taking parental leave.

(6) US Department of Agriculture

(7) US Environmental Protection Agency

(8) Board metrics are based on director nominee for 2023 election year.

(9) Regency references the following emissions factor sources to calculate GHG emissions: DEFRA 2022 UK Government GHG Conversion Factors for Company Reporting

2022 Green-e Residual Mix Emissions Rates

U.S. Environmental Protection Agency (EPA): Emissions Factors eGRID for Greenhouse Gas Inventories

Intergovernmental Panel on Climate Change (IPCC) Fourth Assessment Report: Climate Change 2007 (AR4) Optional Emissions from Commuting, Business Travel and Product Transport (EPA430-R-08-006) May 2008

The Greenhouse Gas Protocol Initiative: World Resources Institute (2017). Emission Factors from Cross-Sector

Tools March 2017

The Greenhouse Gas Protocol Initiative: World Resources Institute (2015). GHG Protocol tool for mobile combustion. Version 2.6.

The Greenhouse Gas Protocol Initiative: World Resources Institute (2013). GHG Protocol tool for mobile combustion. Version 2.5

(10) Absolute consumption figures correspond to all assets owned for any portion of the reporting period and include subsidiaries and joint ventures. Figures are based on actuals, unless otherwise noted, and calculated using the methodology included in the GHG Protocol. We continue to make efforts to improve GHG emission data collection.

(11) GHG emissions data for 2019, 2020, and 2021 have been restated to correct an error in the boundary of Corporate Office operational control that was identified after the publication of our 2021 Corporate Responsibility Report.

(12) Scope 1 emissions are related to stationary combustion, mobile combustion, and fugitive emissions within Regency's operational boundary. Fugitive emission figures are based on estimates provided by a third-party, and as such data availability will vary from year over year. We continue to make efforts to increase data completeness.

(13) Scope 2 emissions are related to purchased grid electricity consumed by Regency and primarily relate to parking lot lighting, common areas, maintaining inside vacant tenant spaces, and corporate offices, and exclude electricity that our tenants consume. Tenant consumption is reported in our Scope 3, category 13 downstream leased assets in accordance with the GHG Protocol. Regency calculates both location-based and market-based Scope 2 emissions per the GHG Protocol.

(14) Market-based GHG emissions were calculated by applying the value of any Green-e eligible Renewable Energy Certificate (RECs) purchased or retired in the reporting period from our Scope 2 location-based emissions.