3 minute read

a good time for Estate Tax Planning

Now is the time, before the year end, to look over your big financial picture. For some, part of that picture is estate tax planning, which involves a review of your assets and to whom they will transferred at death so that estate tax is limited.

For wealthy taxpayers, taking advantage of unusually generous estate tax exclusions tops the agenda. For 2016, the first $5,450,000 of a taxable estate—including all taxable gifts made while alive—is exempt from estate taxes. This total effectively doubles to nearly $11 million for a married couple.

tax-deferred investments would be taxed as ordinary income before they could be donated to a charity during the life of the donor.

The money given to the charity counts toward the donor’s required minimum distribution, but doesn’t increase the donor’s adjusted gross income or generate a tax bill.

By Sheldon J. Donner

Sheldon J. Donner is a CPA and Principal of Taxation at AGH Business Advisors & Certified Public Accountants. He can be reached at shel.donner@ aghllc.com or 404.835.1878.

This information is very general in nature and should not be considered to be tax advice. The reader should discuss any and all matters contained herein with a tax professional for advice which fits his or her situation.

The annual exclusion for gifts is $14,000 per beneficiary, generally. In circumstances where the estate may be subject to the estate tax, gifts in excess of the annual exclusion may make for good estate tax planning. Gifting to children and grandchildren before year end should be considered. Assets with a high tax basis should be considered first, along with assets more likely to appreciate in value. Low tax basis assets should be left in the estate—all other matters being equal—so that they receive a tax basis “step-up” for income tax purposes.

Other than gifting, there are other estate tax planning ideas to be considered, including Qualified Personal Residence Trusts, a sale of assets to a “Defective Grantor Trust” (income tax neutral), making a charity an IRA beneficiary, making discounted gifts, charitable remainder trust gifting and others.

Another special tax benefit permits owners of retirement accounts who are over age 70½ years to donate up to $100,000 from these accounts to charities and escape taxation. Normally, the proceeds from the sale of such

Shows & Plays

Everyone’s favorite holiday stories are being told all around the Atlanta area this season.

Village Auditorium, 8534 Main St. Woodstock, 30188. 678-494-4251; elmstreetarts.org

A Christmas Tradition

From Dec. 9 to Dec. 18, Marietta’s Earl Smith Strand presents “A Christmas Tradition,” a song and dance review that spotlights Christmas and holiday classics. Tickets are $25 for adults and $20 for seniors, students and military. Earl Smith Strand Theatre, 117 North Park Square, Marietta, 30060. 770-293-0080; earlsmithstrand.org.

Rudolph the Red-Nosed Reindeer

The faithful recreation of the classic animated TV special returns to the Center for Puppetry Arts through the month of December, excluding holidays.

Ticket prices vary according to the date, but are generally $20 to $25. The Center for Puppetry Arts, 1404 Spring St. NW, Atlanta, 30309. 404-873-3391; visit puppet.org.

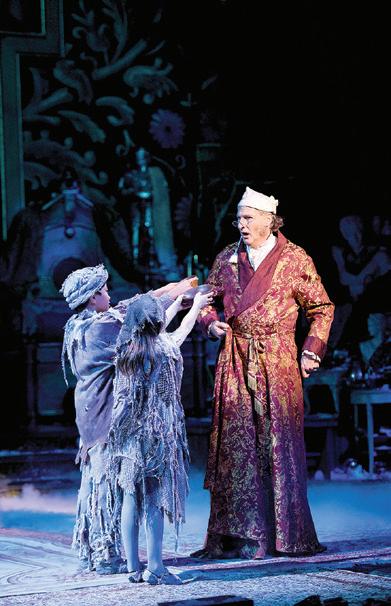

A Christmas Carol

Several area theaters are staging the classic tale by Charles Dickens. The Alliance Theatre stages it through Dec. 24. Tickets start at $20 for adults and $14 for children. Alliance Theatre, 1280 Peachtree St. NE, Atlanta, 30309. 404-733-5000; alliancetheatre.org

Elm Street Arts’ production of A Christmas Carol runs from Dec. 9 to Dec. 24. Tickets are $15 in advance and $18 at the door. Elm Street Cultural Arts

Miracle on 34th Street, the Musical

A Christmas classic, this time with music, is offered by Act 1 Theater on weekends through Dec. 18. Friday and Saturday shows at 8 p.m.; Sunday shows at 2 p.m. Tickets are $20 for adults, $17 for seniors and children. Special “Dinner & a Show” and “Lunch & a Show” tickets are available. Act 1 Theatre’s stage is at Alpharetta Presbyterian Church, 180 Academy Street, Alpharetta, 30004. 770-6638989; Act1theater.com.

A Charlie Brown Christmas

Lionheart Theatre’s “Live on Stage” version of the beloved Christmas special includes cookies and punch with the cast. The show runs Dec. 8 to Dec. 18, Thursday through Saturday at 7:30 p.m. and Sunday at 2 p.m. All seats are $10. Lionheart Theatre, 10 College St. NW, Norcross, 30071. Go to lionhearttheatre.org.