ISSUE N O . 107

AUSTRALIA’S BEST ACCOMMODATION INVESTMENT SHOWCASE

®

NUMBER ONE IN HOTEL FIT OUTS

SPECIALISING IN FURNITURE FOR HOTELS, MOTELS, SERVICED

SPECIALISING IN FURNITURE FOR HOTELS, MOTELS, SERVICED APARTMENTS, RESORTS AND REFURBISHMENTS.

OUR SERVICES

Furniture FF&E design concepts

3D Rendering & Furniture Overlays

Custom furniture and joinery

manufacture

Turnkey packages

Project Management

Inhouse quality control

What’s Inside Informer

Old

Our Director of New Developments and Hotels Tim Crooks checks out the hottest hotel launches.

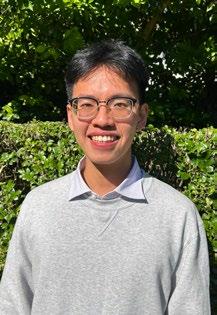

Property Economist feature. Our inhouse number-cruncher Josh Mangleson explains how ResortBrokers’ intern program is helping the next generation of industry professionals. New Kids on the Block. Meet our newest team members, Syd Douglas on the Gold Coast and Twee Nguyen in Victoria.

80 Relief Managers. If you need a break, you’ll need a manager. Find one here.

82 Meet our Team. Resortbrokers’ national directory #weareeverywhere

3

resortbrokers.com.au Contents Cover image:

of the National Archives of Australia 6 8

On the Market. Managing Director Trudy Crooks on the accommodation industry’s new players looking to reposition old assets.

Courtesy

42

Q4 Sales Activity. our biggest deals from around the country for Q4.

26

On the Road. Northern Interests CEO Ben Seekamp on what makes a good roadhouse and on giving back to the outback.

Regional Snapshot: Sunshine Coast. Our dynamic duo Glenn Millar and Chenoa Daniel say there’s ample room for growth in the Sunny Coast’s accommodation market.

PAGE10 22

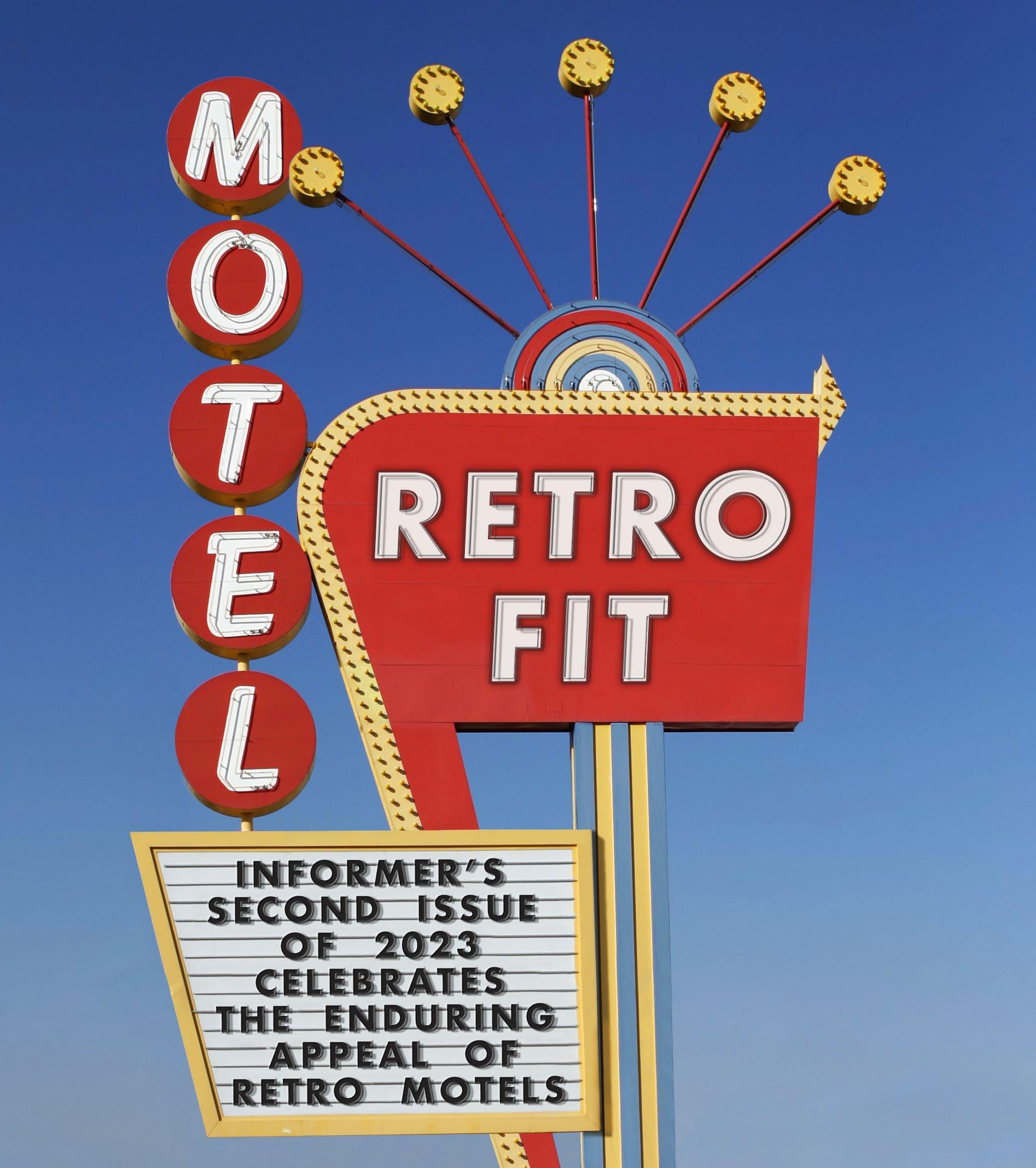

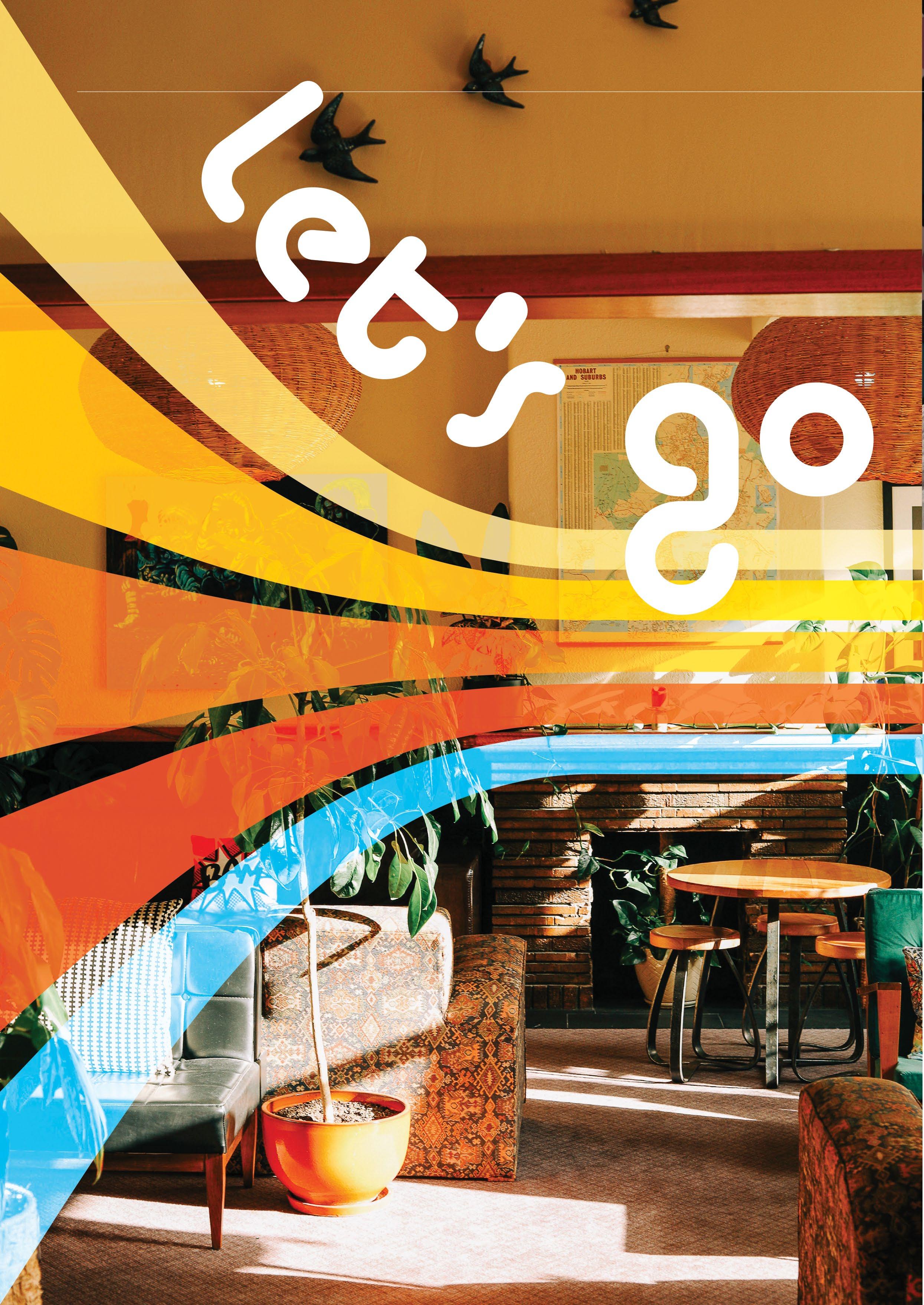

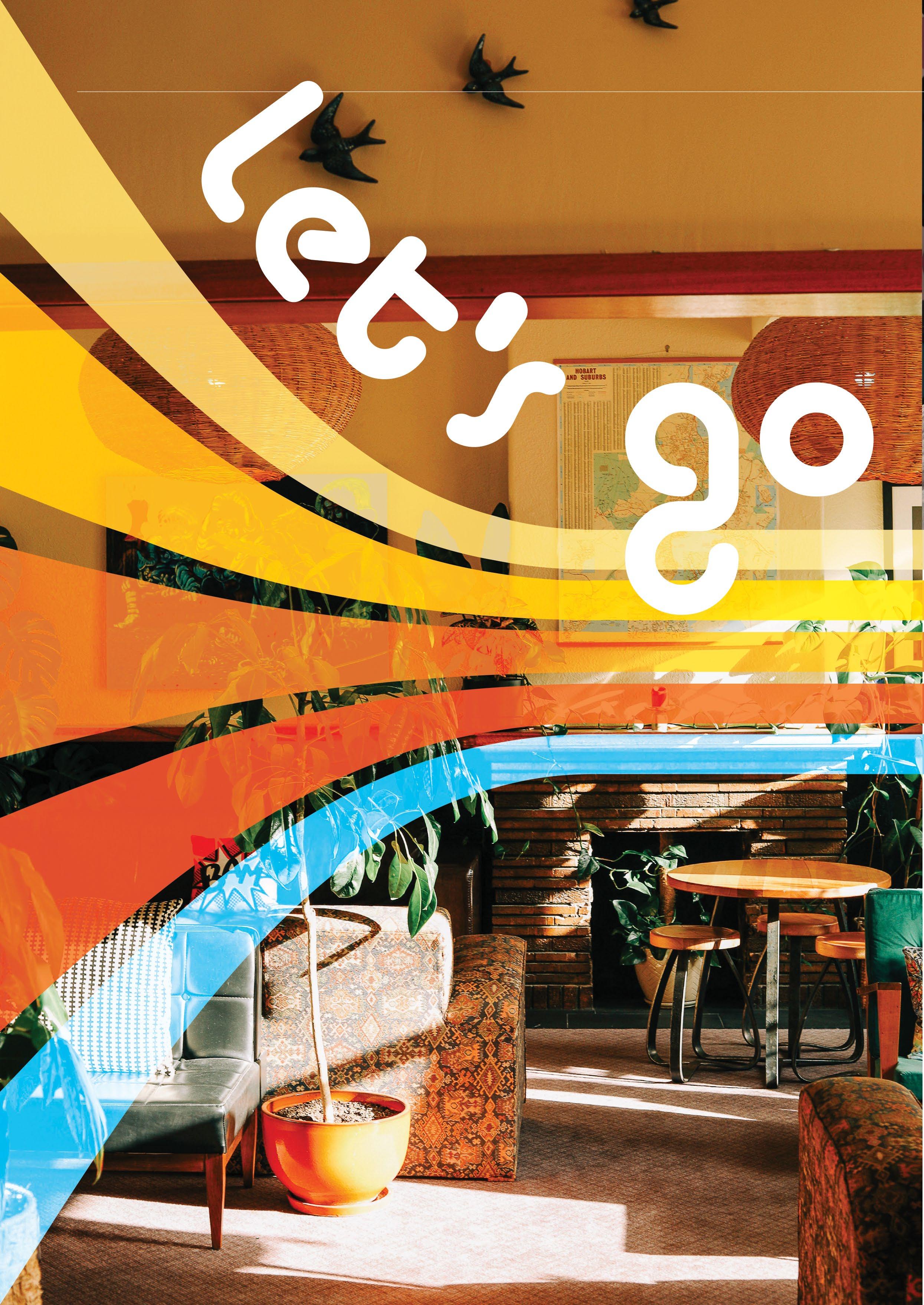

School Cool. Our cover story celebrates Australia’s retro motels and our abiding affection for them across the decades.

Faces of the Industry. Managing Director of Radisson Hotels Australasia, Lachlan Hoswell, talks to us about the group’s ambitious plans for the region.

58

Property Profile. How a Hong Kong financier turned a Charters Towers mental hospital into a boutique accommodation property.

R E S O R T B R O K E R S

107

Words_Ian Crooks, Chairman

EL DORADO Surfers Paradise, QLD

THE PINK HOTEL Coolangatta, QLD

EL DORADO Surfers Paradise, QLD

THE PINK HOTEL Coolangatta, QLD

RESORTBROKERS’

THE SAILS MOTEL & POOL CLUB Brunswick Heads, NSW

Retro R droce

Preface 4

They say if you hold onto something long enough it will eventually come back into fashion. That’s certainly true of some clothes I own (good taste never dates), and it’s also true of retro motels, which is our theme for this issue of Informer.

There’s no doubt about it, there’s a great demand for retro motels. Back in the day, I sold one of them, El Dorado in Surfers Paradise. It was a cracker of a motel, ultra-modern for its time and, if memory serves me correctly, the first motel in Surfers Paradise where guests could park directly outside their room. It’s gone now, but I imagine if it were around today it would be all the rage.

Australian holidaymakers seem very taken by retro motels. And they can be very profitable for owners. If they do a good job retro-fying (is that a word?) the motel they can achieve great tariffs. I know of one such motel on the northern NSW coast that was very rundown. The family who bought it completely gutted it and refurbished it in the retro style. This didn’t cost them anywhere near the cost of buying a new motel, and now they’re charging around $600 per night while enjoying strong occupancy. I imagine the revival

of the roadside motel, especially of the retro kind, will continue for some time. Covid has made us fall in love with Australia as a tourist destination again and the great Australian road trip is back in vogue.

We’re on the road ourselves this issue. We shine our headlights on the Sunshine Coast, which, as our dynamic duo of Glenn and Chenoa write, still has a long way to go to fully realise its potential. The Sunshine Coast’s star is rising and is set to rise even further. This Easter, the Sunshine Coast was the third most popular tourist destination in the country after Melbourne and Sydney, as revealed in a recent Tourism and Transport Forum report. We also visit roadhouses in South Australia and the Northern Territory, owned by Adelaide-based Northern Interests who have steadily grown their portfolio of six properties since the late 1990s. We also speak with an operator of a unique accommodation property in Charters Tower that was once a mental hospital. We also talk with Lachlan Hoswell, who ResortBrokers knows very well from his long career in the industry, who’s now spearheading Radisson Hotel Group’s expansion in Australasia.

We’re delighted to introduce our two new brokers, Syd Douglas on the Gold Coast and Twee Nguyen in Victoria. Syd joins us after seven successful years as a property manager, including the last four years at Boardwalk Burleigh Beach. Twee has operated two successful management rights businesses in Melbourne for the last seven years. We first met Twee when she attended a ResortBrokers’ seminar on the Gold Coast in 2014, which encouraged her to get into the management rights business. Now, she’s joined us. I wish both Syd and Twee well, and I’m sure they’ll do well. You’ll also notice in this issue we have offshore properties listed for sale: four in Vanuatu and eight beautiful villas in Bali. Finally, I’m delighted by ResortBrokers’ outstanding Q3 results and want to congratulate all vendors and buyers who’ve transacted through us this quarter. These results indicate the strength and resilience of the accommodation property sector nationally coming off some tough years due to Covid. My entire career, I’ve held the view there’s no better business than running an accommodation property, and I’ve no reason to doubt it now.

Enjoy the issue. END

MOTEL MOLLY Mollymook, NSW

THE CUBANA RESORT Nambucca Heads, NSW

BLUE WATER MOTEL Kingscliff, NSW

BLACK DOLPHIN MOTEL Merimbula, NSW

(Formerly Surfbeach Motel) 5

Image courtesy of the National Archives of Australia.

Are you

positioned for a reposition?

Everywhere we look these days we’re being encouraged to recycle — and that’s no bad thing. In our industry, a recycling of sorts is also taking place. Up and down the country, we’re seeing a recycling of accommodation property assets. Except we don’t call it recycling, we call it “repositioning.” Old motels are being converted into retirement villages. Retirement villages are being turned into affordable housing. And on and on it goes. This is nothing new. Different purposes have been found for buildings as long as buildings have existed. But what’s interesting is the new money that has entered this space and the opportunities this creates for the owners of accommodation property assets.

Last year, ResortBrokers sold Port Denison Motor Inn, located in Bowen in Queensland’s Whitsunday Region. The buyer was ASX-listed Eureka Group Holdings which is in the business of providing quality, affordable accommodation for seniors. This property had a very interesting history. It was originally built in 2001 as a 46-unit retirement village, then it was repositioned as a short-term holiday let, and now Eureka plans to reposition it once again as a retirement village to the tune of $105 million. And the vendor was very happy to let it go for a figure just over $5 million, which was a phenomenal return on their investment.

retirement homes — a 30-unit property in Windsor, Brisbane, and a 50-unit property in Toowoomba — for conversion into social housing.

These purchases are part of a $3.9 billion investment by the state government in social housing, consisting of new builds as well as repurposed assets, such as the ones sold by Aveo.

What’s clear is that there are new buyers with considerable capital entering the repurposing space, both government and corporate.

Private sector buyers will always look at past trade, but these new buyers are now looking much closer at the underlying real estate with an eye to repositioning it. Traditionally, sales have transacted largely on what the asset has been earning.

Now, we’re seeing a new kind of buyer looking at properties in great locations and building their own cashflows based on what they think the asset can generate if repositioned. This, in turn, has led to record sales and some very happy vendors.

I see no end to this trend. Australian towns and cities are continuing to grow apace and are pushing the limits of their own boundaries, especially in our regions. Traditionally, motels and caravan parks were built on the outskirts of a town. But as those towns have grown, those assets are now sitting on great pieces of land. What was once the outskirts of a town is now virtually in the heart of town!

It’s a trend we’re seeing right across Australia — assets changing hands for changing purposes. At present, we’re in talks with the NSW government for the sale of an asset listed with us on the Central Coast. If it comes off, the property may be repositioned towards social housing, which would be great to see.

In Queensland, the state government has been buying up former aged care facilities to be repurposed as social housing. In January, it purchased a 30-unit former aged care facility in Clayfield from Aveo Group for $9.4 million. In March, it purchased two more Aveo

The domestic tourism boom has highlighted the need for better accommodation throughout regional and coastal Australia. Cashed-up funds and operators are responding to that need. They’re looking at these assets differently, not just on what they’ve earned in the past but on what they think they can earn in the future if repositioned.

What does all this mean for you? Well, if you’re a landlord of one of these assets and there’s big money splashing about, perhaps it’s worth seizing the moment. Opportunity, like land, is a non-renewable resource. And, as the saying goes, opportunity waits for no one.

On The Market

“Opportunity, like land, is a non-renewable resource.”

6

Big funds are looking at old assets with new eyes to reposition them, which is creating enormous opportunities for owners.

Yields for freehold going concerns are very tight at present. If your passive investment is underperforming in the current market, then perhaps it’s worth having a conversation with your broker about selling. If your lessee is selling up, perhaps it’s time to reunite the freehold with the leasehold and selling the whole kit and caboodle. The demand is certainly there from this new generation of funds looking to reposition underperforming assets.

The freehold passive of this 4.5-star motel came to market for the first time since it opened in 2008 and sold for a 6.7 per cent return on investment. The 52-key hotel is one of Toowoomba’s premium assets and enjoys high occupancy supported by corporate and leisure trade. Toowoomba continues to enjoy high investor appeal as the epicentre of Queensland’s Darling Downs. Sold by Ian Crooks and Jason Vogler

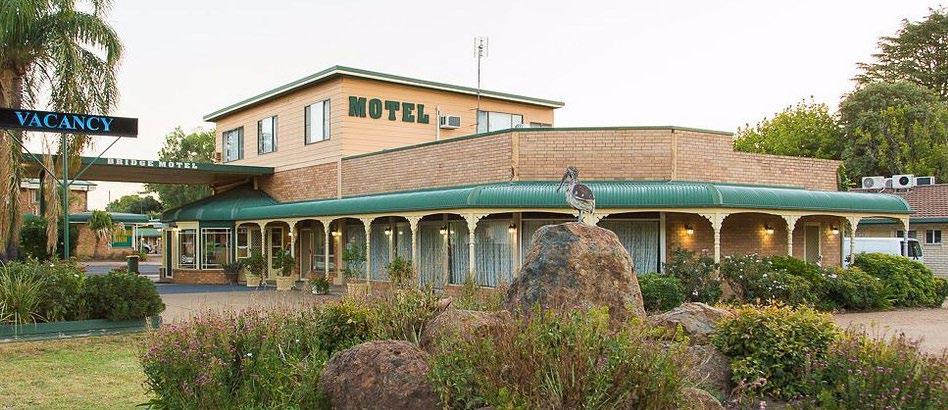

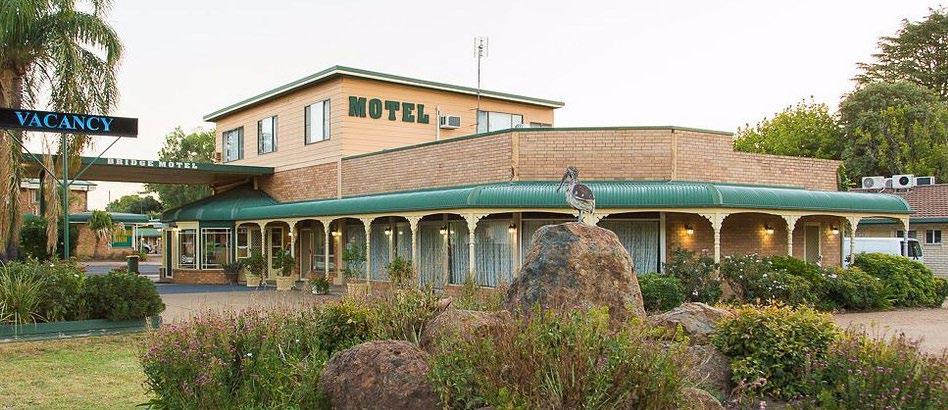

Bridge Motel Wellington_Wellington NSW

The freehold going concern of the largest motel in Wellington was sold by Chris Kelly for a 17.3 per cent yield. This 35-key motel has a mainly corporate clientele with a solid 75 per cent occupancy. The buyer had been looking for a freehold going concern to place under management rather than a passive investment. Freehold going concerns continue to be in short supply in the Central West, but there’s plenty of buyers helped by favourable yields and cap rates.

A lot of landlords will naturally question why they should sell. They will say, this has been a great passive investment for me, and passives are hard to come by, so I’d better hang on to it. It’s true, passives are in short supply.

But it’s also true that demand is sky high from large funds on the hunt for prized real estate. If your asset is presently underrented, there’s enormous upside in reuniting the leasehold with the freehold and selling the whole shebang.

Finally, ResortBrokers’ outstanding Q3 results indicate the strength of the accommodation property sector nationally. Across the country, we settled 123 properties totalling $246 million last quarter, with another 82 new deals worth $169 million heading towards settlement before the end of the financial year.

Most encouragingly, our number of enquires for the quarter was 8,802, which surpassed pre-Covid levels. In April we also saw our strongest month on record for the number of enquiries for freehold going concerns. Interest in this asset class has surged by 75 per cent compared to this time last year.

Ultimately, the accommodation property business is about people. We love setting people up in a great business, and we love helping people sell their business to set them up for their next step or a well-deserved retirement. So, hearty congratulations to all vendors and buyers who transacted through us this quarter. We’re glad we could help make it happen for you. END

Travelway Motel_Port Pirie SA

The vendor had owned and operated this property for 41 years! SA continues to see very strong buyer enquires, with enormous interest for quality stock, especially in the regions. The freehold going concern of the 29-key Travelway made a highly attractive offering with a strong repeat clientele made up of mostly workers and corporates. Sold to an experienced buyer in an off-market sale brokered by our top-selling agent this FY, Kelli Crouch

Grange MR portfolio_Brisbane QLD

Alex Cook and Jessie Shi sold this trio of business-only management rights in one line: the 169-unit Linton Apartments in Woolloongabba, and the 64-unit Mahogany and 55-unit Tranquillity Gardens, both in Mt Gravatt. The vendor was a Sydney-based group, and the buyer was an established management rights operator on the Gold Coast looking to enter the Brisbane market, which they did with this purchase, which went for a 6x multiplier.

Four of the Best Across Australia

Platinum International_Toowoomba QLD

“It’s a trend we’re seeing right across Australia — assets changing hands for changing purposes.”

Words_Trudy Crooks, Managing Director

Our Top Recent Sales & Listings QTR 4

We’ve been experiencing exceptionally high demand across all accommodation asset classes. Here’s a selection of some of our biggest and best sales and listings.

LISTING

GRANTHAM FARMWORKERS

LODGE FREEHOLD, GRANTHAM, QLD

High income housing asset with 272 beds running at 100% occupancy.

Nathan Eades

M: 0448 339 920

Jason Vogler

M: 0427 431 213

SOLD

OCEAN SHORES MOTEL LEASEHOLD, OCEAN SHORES, NSW

30-year lease on nifty 12-room motel, only minutes to Brunswick Heads and Byron Bay.

Miguel Bozina M: 0419 848 444

UNDER OFFER

LE BEACH HOLIDAY APARTMENTS

MANAGEMENT RIGHTS, BURLEIGH HEADS, QLD

The management rights to this Burleigh Heads beachfront beauty is business-only and boasts a solid $530K net.

Todd Warner M: 0438 170 763

SOLD

GOLDEN REEF MOTOR INN INVESTMENT, STRATHDALE, VIC

Handy 26-key freehold passive investment in the heart of Bendigo.

Debbie Cooper M: 0427 559 545

Trudy Crooks M: 0477 882 210

UNDER OFFER

ATHERTON HINTERLAND MOTEL LEASEHOLD, ATHERTON, QLD Brand new 30-year lease offering an exceptional 48% ROI.

Shane Croghan M: 0418 451 006

UNDER OFFER

QUEST CRONULLA BEACH LEASEHOLD, CRONULLA BEACH, NSW

Prime Cronulla Beach opportunity to join the highly successful Quest brand.

Jacqueline Featherby

M: 0424 497 056

Tim Mayoh

M: 0419 038 882

Sales Activity resortbrokers.com.au

8

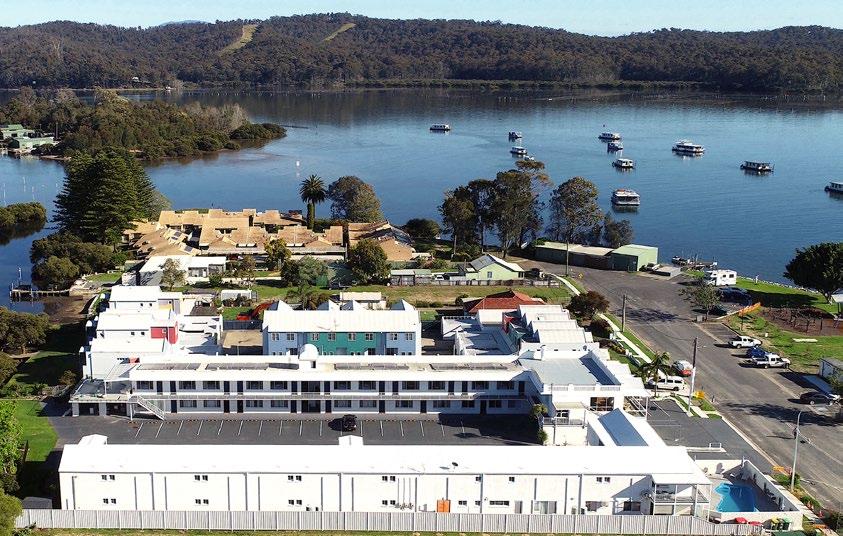

LISTING

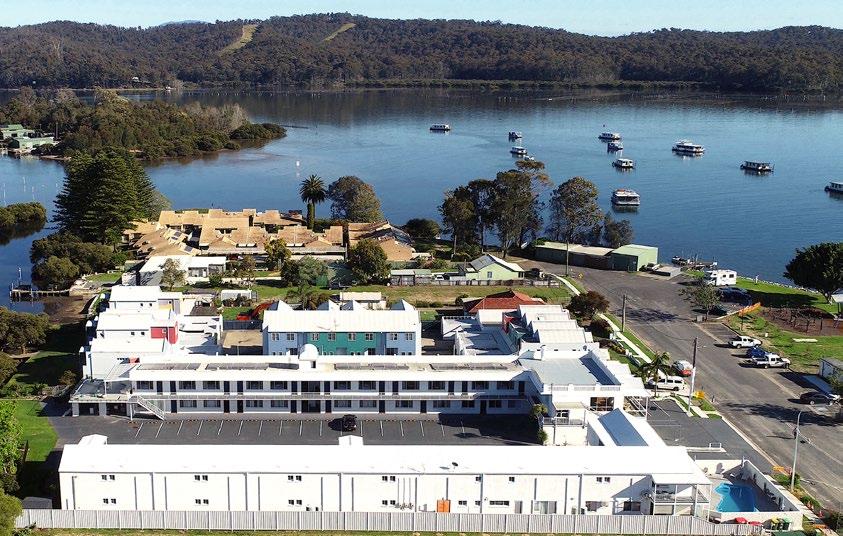

BATEMANS BAY LODGE FREEHOLD

BATEMANS BAY, NSW

Turnkey business opportunity for 43-room prime waterfront property.

Russell Rogers M: 0416 166 909

Sarah Hutchins M: 0407 020 443

LISTING

ATRIO APARTMENTS & THE MIRO MANAGEMENT RIGHTS, FORTITUDE VALLEY, QLD

Absolutely prime short-stay MR in Brisbane CBD fringe netting $1.35M.

Alex Cook M: 0467 600 610

Frank Matus M: 0435 742 698

SOLD VICTORIA COVE

MANAGEMENT RIGHTS, VICTORIA POINT, QLD

Beautiful 150-townhouse bayside complex netting $480K.

Jeff Keast M: 0414 669 007

Alex Cook M: 0467 600 610

SOLD QUEST JOONDALUP LEASEHOLD, JOONDALUP, WA

90-key Quest apartment hotel in Perth’s northern growth corridor netting over $540K.

Blair Macdonald M: 0433 149 144

LISTING

KIN KORA VILLAGE CARAVAN PARK FREEHOLD, GLADSTONE, QLD

11-acre mixed-use caravan park and manufactured housing estate.

Nathan Benjamin M: 0459 955 649

UNDER OFFER

TWO RIVERS MOTEL FREEHOLD, WENTWORTH, NSW

Easy-to-run 25-room motel offering incredible value at $40K per key.

Russell Rogers M: 0416 166 909

Kelli Crouch M: 0410 441 750

SOLD

SCAMANDER SANCTUARY HOLIDAY PARK LEASEHOLD, SCAMANDER, VIC

New 30-year lease of a glamping and caravan park on Tassie’s east coast.

Marissa von Stieglitz M: 0437 198 164

9 resortbrokers.com.au

10

11

New South Wales

01. Motel Molly, Mollymook Motel Molly’s owners call their refurb “Moroccan inspired,” but the hotel’s impeccable pastel palette makes it retro enough. motelmolly.com.au

02. The Black Dolphin Motel, Merimbula

Designed by famed Australian architect Robin Boyd, this 1960 roadside icon was recently sold by ResortBrokers’ Russell Rogers to ASX-listed Aspen Group and is now part of Tween Waters Merimbula. aspenholidayparks.com.au/ tween-waters-merimbula

03. The Blue Water Motel, Kingscliff This Tweed region retro revival has a soothing pastel palette and a cool coastal vibe. thebluewatermotel.com.au

The 18-key The Isla opened its burntorange doors in 2022 after a makeover featuring a sunset-inspired colour palette and a nod to the ‘70s. theisla.com.au

Built in the ‘60s as The Casablanca Motel, the 22-key motel was given a makeover in 2015. The hacienda archways leading from the carpark to the rooms are a nice twist on the classic roadside motel. thesailsmotel.com.au

Opened in 1962 during the heyday of the roadside motel, the 45-key Astor Motel reopened in 2021 after a refurb which restored its retro roots by bathing it in vibrant pink, orange and teal, beautifully contrasted by white. The revamp reestablished the Astor as an Albury landmark and is now enjoying the “Fine Times!” promised by its neon sign. astorhotelalbury.com.au

01 06 11 07 08 02 03

04. The Isla, Batemans Bay

05. The Sails Motel & Pool Club, Brunswick Heads

06. The Astor Hotel Motel, Albury

10

This 13-key Shoalhaven sanctuary has been newly renovated with bright orange doors beautifully offset by white. theberryview.com.au

The 10-key Blueys Motel is relaxed, coastal chic with an appealing palette of teal, blue and white. blueysmotel.com.au

The 12-key Chalet Motel is a classic ‘60s motel with a tropical vibe and one of the few dog friendly retro offerings around. chaletmotel.com.au

This 20-key Wollongong wonder is textbook retro: two-storey red brick, a curled-iron banister and gorgeous green, pink, blue and yellow doors. thirroulbeachmotel.com.au

Turning heads at Nambucca Heads is the 37-key The Cubana with its bright colour scheme and setting on 5 acres of tropical gardens. thecubananambucca.com.au

The Sunseeker is a 12-key ‘80s brick motel given a retro reboot a few years ago. thesunseeker.com.au

Formerly a surfing motel called The Hideaway, the 22-key Halcyon House re-opened in 2015 after extensive renovations that saw it reborn into a boutique offering that evokes memories of carefree summers past. halcyonhouse.com.au

13 12 09 04 05

07. The Berry View, Berry

08. Blueys Motel, Blueys Beach

09. Chalet Motel, Brunswick Heads

10. Thirroul Beach Motel, Wollongong

11. The Sunseeker, Byron Bay

12. The Cubana, Nambucca Heads

13. Halcyon House, Cabarita

Victoria

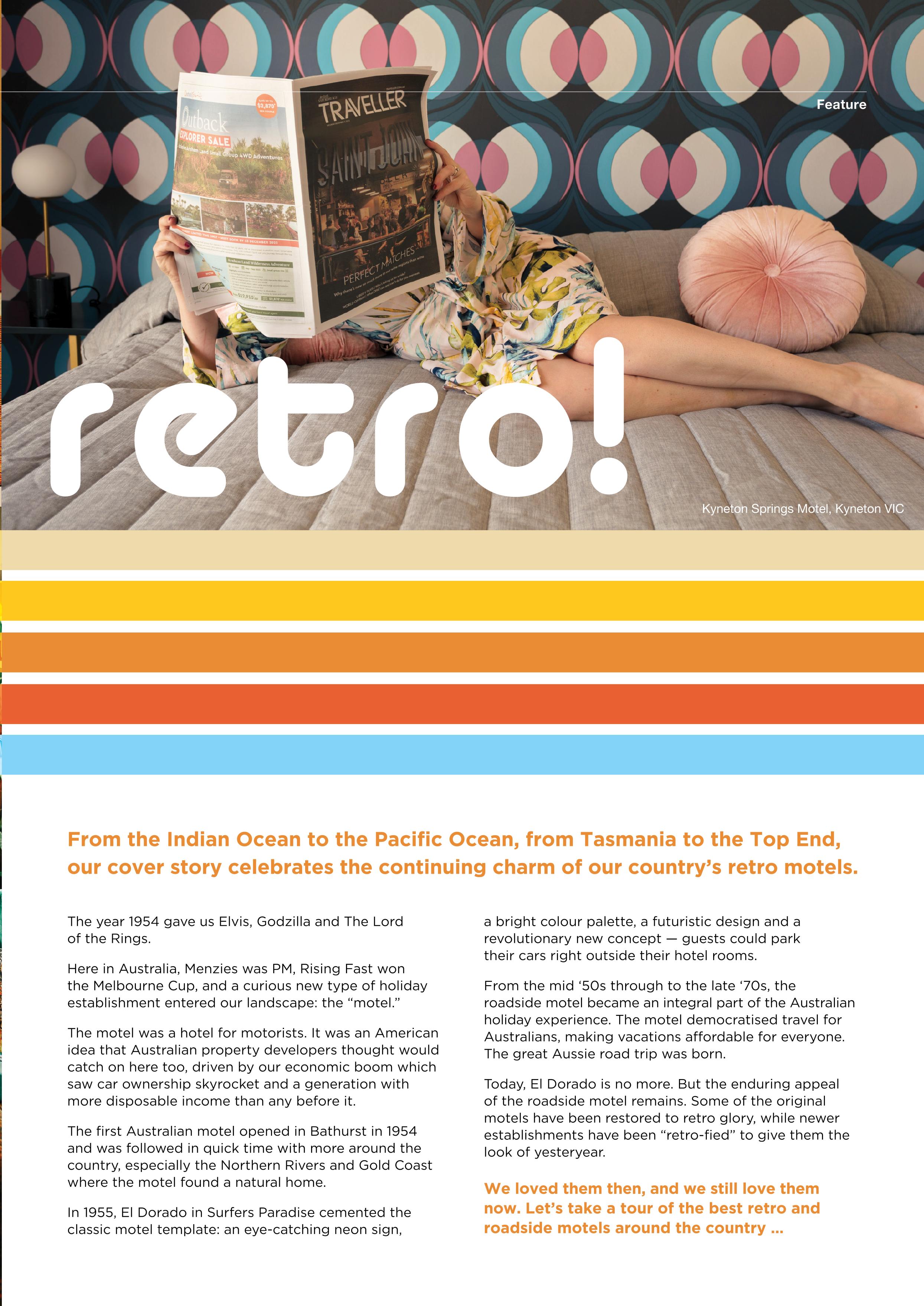

14. Kyneton Springs Motel, Kyneton

Recently reopened after a retro refurb, the 20-key Kyneton Springs Motel, about an hour’s drive from Melbourne, has serious street presence with its eye-catching three-part neon sign. The retro renaissance continues inside with kitschy cool rooms adorned with pop art featuring ‘50s icon Jayne Mansfield. kynetonspringsmotel.com

15. Sunnymead, Aireys Inlet

Previously Lightkeepers Inn Motel, this 20-key boutique hotel on the Great Ocean Road re-opened in February after a retro revival boasting whitewashed walls, palm trees and orangepainted doors. sunnymeadhotel.com.au

16. River Drive Motel, Tarwin Lower

This cosy 5-key hotel was lovingly refurbished with a nod to nostalgia. riverdrivemotel.com.au

South Australia

17. Seaview Motel, Kingscote

The first ever motel built on Kangaroo Island in the 1920s, the heritage-listed 17-key Seaview has enough pastels to warrant inclusion in the retro camp. seaview.net.au

18. Retro Paradise, Adelaide

This one-bedroom workers’ cottage was built in the 1880s. Today, it’s a magnificent melange of vintage Hawaiian, retro atomic and pop art styles. retroparadiso.com.au

14 15 17 18 14

19. The Retro Shack, Aldinga Beach

Built in 1955 and renovated a la retro a few years ago, The Retro Shack is adorned with vintage wares such as Tretchikoff prints and plastic flamingos. theretroshack.com

20. 1965 Lobethal, Lobethal

This Adelaide Hills hotel is tiny but has ‘60s in spades. Vintage lamps, Danish furniture, a vinyl record player and Onkaparinga blankets that first put Lobethal on the map, way back when. 1965lobethalbnb.com.au

21. Marion Hotel, Adelaide

This 62-key hotel’s reception has serious late ‘60s cred and was reopened in 2018 after a $20 million refurb. marionhotel.com.au

Tasmania

22.

Riverfront Motel & Villas, Rosetta

Built in 1960, this hotel’s signature feature is a gigantic Googie-style double catenary arch, originally created to celebrate the 1954 Royal Visit. riverfronthobart.com

23.

Alabama Hotel, Hobart

Opened as a hotel in 1867, “The Bam” as it is affectionately known had a midcentury makeover about a decade ago. ago and is now a 17-key masterpiece. alabamahobart.com.au

16 19 20 21 22 23 Feature 15

Queensland

24.

Built in the 1950s, this 10-key weatherboard wonder was restored to retro glory about 15 years ago. The self-described “beach shack” is painted mint green and adorns its front garden with ‘50s nostalgic: rainbow-coloured beach umbrellas, red-and-white striped sling chairs and a white picket fence. Oh, and plastic pink flamingos. lacostamotel.com.au

the

aesthetic. Opened in the 1953 as The Ocean View Motel, this 17-key hotel was given a retro reboot in 2018. Undoubtedly, this is Australia’s most iconic retro hotel and consequently one of its most Instagrammed. A Muriel’s Wedding cameo adds to its star power. thepinkhotelcoolangatta.com

Palm Beach Pastel perfection, the 7-key Mysa Motel occupies the site of former Gold Coast institution, the Palm Trees Motel. Mysa pays homage to its bygone occupant by way of two intertwined palm trees in its flashy pink neon marquee. themysamotel.com

A rare retro(ish) offering on the Sunshine Coast. The 10-key Loea opposite the Maroochy River has a vintage coffee van and an understated beach vibe. loea.com.au

La Costa Motel, Bilinga

25. The Pink Hotel, Coolangatta Awash with pink, this mid-century masterpiece ticks every box of

retro

26. The Mysa Motel, Palm Beach

27. Loea Boutique Hotel, Maroochydore

La Costa Motel, Bilinga

25. The Pink Hotel, Coolangatta Awash with pink, this mid-century masterpiece ticks every box of

retro

26. The Mysa Motel, Palm Beach

27. Loea Boutique Hotel, Maroochydore

24 25 26 28

28. Ventura Beach Motel, Mermaid Beach

This classic ‘70s Mermaid walk-up shows its retro credentials with a coat of powder blue and candy pink paint.

venturabeachmotel.com.au

29. Blue Heron Motel, Mermaid Beach

Calling itself a “classic seventies motel,” this 14-key Mermaid motel has retro-fied its reception, and the kidney-shaped pool out back is mid-century magnificence. blueheronmotel.com.au

Western Australia

30. Indian Ocean Hotel, Scarborough

Built in 1968, the then White Sands Motel was modelled after the famous Sands Hotel in Las Vegas. During the ‘70s, this 59-key beachside hotel was the place to stay for bands touring Perth, including Led Zeppelin and The Rolling Stones. Today, the Indian Ocean Hotel keeps the beat going as a live music venue and with inspired installation art in the shape of a giant amplifier. indianoceanhotel.com.au

Northern Territory

31. K – Town Hotel, Katherine

This 20-key Katherine hotel is a classic roadside inn… and stupendously pink. ktownhotel.com.au

27 29 30 31

Quay & Isle Residences

NEWSTEAD, QLD

‘Quay’ and ‘Isle’, two architecturally stunning river-side high-rises, are the latest exciting instalments of Mirvac’s landmark Waterfront Newstead Precinct.

Comprising c. 127 apartments in each tower and offering a range of resort-style facilities, Quay is scheduled for completion in mid-2024, with Isle to follow in 2025. Both rising 25 levels to enjoy magnificent river and park views from their prime Newstead locations, these two exceptional buildings are destined to set a new benchmark for refined urban living.

‘Quay’ and ‘Isle’ represent an opportunity to secure large-scale, off-the-plan Management Rights in Brisbane. Combined with the exceptional quality and prime location, makes for a highly desirable offering.

For the astute, experienced operator, this is a rare opportunity to acquire highly sought after business in its infancy. The successful purchaser will benefit from a considerable BC salary, 25-year accommodation module agreement and secure operational areas. ResortBrokers will shortly be inviting Expressions of Interest for these truly exceptional marquee assets. Interested parties will be required to sign confidentiality agreements and inspections are by appointment only. Dataroom and EOI closing date information will be provided.

Coming soon to market QUAY RESIDENCES

Before acting on any information in this publication, purchasers should fully consider the appropriateness of the information, having regard to their objectives, and financial and tax situation and needs, and seek their own advice from appropriately qualified advisers.

All images are artist’s impression. Architecture, services and finishes are indicative only and subject to change. Image shows upgraded finishes and fittings options. Furnishings are not included in this apartment. Views depicted are indicative only. Views and view corridors may be affected by other developments and planning issues outside of the control of Mirvac. The location, extent, height and design of the upstand balustrades is subject to change.

Alex Cook Director alex@resortbrokers.com.au +61 467 600 610 Tim Crooks Director of New Developments tim@resortbrokers.com.au +61 417 544 562 ®

ISLE RESIDENCES

ISLE RESIDENCES QUAY RESIDENCES

What’s Cool In The Industry

Director of New Developments and Hotels Tim Crooks checks in to check out the hottest hotel experiences.

Tim Crooks

m: 0417 544 562

e: tim@resortbrokers.com.au

Dive Bar

In 2010, divers exploring the Åland Islands off the coast of Finland discovered a shipwreck with 46 perfectly preserved bottles of Veuve Clicquot champagne, untouched for 170 years. Inspired by how well this bounty of bubbly aged over time in deep water, Veuve Clicquot decided to do it all over again. In 2014, the Champagne house submerged 300 bottles and 50 magnums of its champagne at the same location.

To showcase the results of this eccentric experiment, Veuve Clicquot is offering its three-day “ v” experience in June. This includes a comparative tasting of the submerged champagne alongside Veuve Clicquot’s regular variety. Certified divers will be able to descend into the depths to see the Åland Vault, where the aging bottles are submerged. veuveclicquot.com/en-int/cellar-in-the-sea-experience

Rolling In It

Melbourne keeps bringing it on the hotel front. March saw two 5-star openings: The Ritz-Carlton Melbourne on Lonsdale St, which has bragging rights of being Australia’s tallest hotel (the lobby is on the 80th floor), and Le Méridien Melbourne on Bourke St, which was originally a hotel, then a theatre, then a cinema, then a nightclub … and back to a hotel again. But my pick of Melbourne openings is The Royce Hotel which rolled out the carpet in February. This Art Deco darling on St Kilda Rd in South Yarra was built in 1928 as a dealership for luxury cars, including Rolls Royce, hence the name. Now, it’s reopened as a 94-suite boutique hotel after a two-year reno. roycehotel.com.au

OWO wow

Singapore’s celebrated Raffles chain, part of Accor since 2015, has reimagined London’s Old War Office (OWO) as a swanky hotel. The Edwardian-era OWO, where Churchill once orchestrated Allied forces in WWII, boasts luxury guest rooms and suites. Raffles London at The OWO is the chain’s first UK opening. If these interiors seem familiar, it’s because you’ve seen them before. They’ve featured in every Daniel Craig Bond film from Casino Royale to No Time to Die. Raffles London at The OWO opened May 8 to coincide with the coronation of King Charles. theowo.london

What’s Cool

20

fast simple Meet resly, The preferred trust accounting Property Management System. resly Learn more at www.resly.com.au homegrown

A Radisson

Individual

Marquee brand Radisson Hotel Group has a mammoth global presence but only a small footprint in this part of the world. Lachlan Hoswell is looking to change that.

A little more than six months into his new role as Managing Director Australasia of Radisson Hotel Group, Lachlan Hoswell has ambitious plans to drive the group’s growth here.

While the 114-year hotel giant has an international presence of more than 1,700 hotels in operation or development, including an operating portfolio of over 100 properties in India and 76 in China, its presence in Australasia is limited to four hotels with one each in Melbourne, Sydney, Fiji and Papua New Guinea.

In Australia, the group’s two flagship properties are Radisson on Flagstaff Gardens Melbourne and Radisson Blu Plaza Hotel Sydney. Since joining Radisson in October 2022 after an 11-year stint as general counsel and commercial officer for Minor Hotels, Hoswell has been tasked with driving the group’s expansion in a huge expanse of territory that includes Australia, New Zealand, Fiji, New Caledonia, Papua New Guinea, Vanuatu, Solomon Islands and other islands in the Pacific.

“We’re looking to aggressively grow our portfolio in this region,” says 50-year-old Hoswell. “Obviously, you always want more hotels in Sydney and Melbourne. But we’re also keen to get ourselves into

markets like Brisbane, Canberra, Adelaide, Gold Coast, Auckland and Wellington.

“And when you go to the islands themselves, Fiji, Vanuatu, New Caledonia, they’re all places we think the group can do well in.”

So far, Hoswell has signed two new hotels to be constructed in Queenstown, the 171-key Radisson Blu Hotel, Queenstown Remarkables Park and 257-key Radisson Queenstown Remarkables Park, which are next door to each other and within walking distance of the Queenstown Events Centre and close to the Remarkables ski fields.

Radisson Hotel Group also has a pipeline of new openings for Lake Tekapo, located halfway between Queenstown and Christchurch, Eden, and Radisson Collection hotels in the Blue Mountains and Queenstown.

“We’ve also had letters of intent signed this year, and we are close to finalising a number of these,” he says. “Radisson Hotel Group has a portfolio of well-known global brands, and we have an extremely strong presence in leading international source markets for Australasia like China, India and Europe.

“We’ve been focused on innovation and our strategic priorities are constantly evolving so that we not only deliver strong revenue but do so efficiently to better serve our owners and partners.”

Hoswell says the group’s agility enables it to put forward better commercial terms than other big majors.

“We do different deal types,” he says. “We lease as well. We’ll underwrite our management agreements. We’ve got a new franchising package we’re putting forward this year that we’re looking to include services like revenue management and reservations. So, we know when our brand is on the door we’re going to make a difference to owners.

“It’s not just about distribution. It’s about what services we can add that are going to make life better for a franchisee. Our revenue management services allows owners to have access to their own specialist dedicated revenue manager who has the latest revenue management systems to maximise their performance at cost better than having a revenue manager onsite. Even things like our essential reservations’ hours. If an operator wants to operate only between 9 am and 5 pm, but they want to redirect calls of a nighttime, they can redirect calls to us.”

22

Faces of the Industry

23

Faces of the Industry

Another useful string to the group’s acquisitions bow is Radisson Individuals, its affiliation brand. This allows an existing hotel to join the Radisson family but retain its own individuality. The offering sets the group apart from other major hotel brands. In 2022, the group made its first foray into Papua New Guinea this way by opening the 156-key Grand Papua Hotel in central Port Moresby.

“When you’re talking top tier hotel groups, our Radisson Individuals brand is unique,” says Hoswell. “The smaller hotel groups have what’s called a ‘white label’ presence, which means they operate the hotel, but you don’t know they do. The majors don’t do that.

“Radisson Individuals will be a very compelling regional brand because it allows an existing hotel to plug into Radisson Hotel Group’s global distribution, but they can keep their own brand.

“Their property is what it is but is referred to as a Radisson Individuals property.

“It means it’s a low transition cost to an owner as well. So rather than us sitting there and saying, look it must be a Radisson Hotel, these are the brand standards, you need to change all your showers, change your furniture, change this, change that, provided you sit in that upscale market segment you really don’t have to do too much to jump onboard.

“A lot of individual owners like to hold onto their individuality, so I think there’s some strong merit behind our Radisson Individuals brand.”

Hoswell thinks the Radisson Individuals brand would be perfect for established upscale hotels on the Gold Coast, Brisbane and Sunshine Coast.

“For us, a good management rights offering, whether it’s Gold Coast,

Brisbane or Sunshine Coast, Radisson Individuals could be a perfect fit,” he says. “I know there are a few conventional competitors in that space, but they’re not going to give you the global presence of Radisson Hotel Group.

“For us to be able to introduce some additional services like revenue management, reservations and other key things we can support them with, I think that could be a good fit for properties who want to broaden their client base.”

Hoswell is a 20-year hospitality industry veteran. He began his hospitality career as legal counsel for Wyndham in 2002 in their development team, then with Accor where in addition to his in-house legal role he rose to the executive team.

After four years with Accor, he joined the up-and-coming Thaiheadquartered Minor Hotels where his legal and commercial roles synergised. Hoswell says the fusing of his roles helped his transition to his new role with Radisson.

“When I was at Minor my role evolved, so pretty much the last five years at Minor I was leading development,” says Hoswell. “I was overseeing the legal team, but I wasn’t tools-on anymore.

“I oversaw the property team, the contract team, sat on the executive committee, and I was a director of the organisation.

“I had already started moving in a different direction within Minor. So, I had a lot of knowledge to take with me into Radisson Hotel Group. Obviously, Radisson Hotel Group is very different to Minor.

“But with the network of people I have, and the brand Radisson Hotel Group is, this allowed me

24

Radisson Blu Resort_Fiji Radisson on Flagstaff Gardens_Melbourne VIC

to make the transition relatively smoothly. So far, so good.”

Hoswell says one of the biggest changes he’s seen in his two-decade career has been the rise of the Chinese and Indian tourist markets.

“Australasia is seen as a very desirable location to holiday for these markets,” says Hoswell.

“We provide natural beauty with a well developed tourism industry, and a safe environment to travel.”

Since 2018, Radisson Hotel Group has been a subsidiary of Jin Jiang International, which is one of the leading hotel operators with a global portfolio of over 11,000 hotels.

“Jin Jiang’s loyalty program alone has 180 million members,” says Hoswell. “The size of the Chinese market, we just can’t comprehend that volume as a membership base.”

As for the group’s plans in Australia, Hoswell sees regional areas getting stronger with international visitors on top of the already wellestablished tourist destinations.

“It’s going to open up more regional tourism to international travellers, which I think will be a positive trend in the future,” he says.

Based in Radisson Hotel Group’s Sydney business unit, Hoswell resides in Buddina on the Sunshine Coast, where he finds himself

on weekends when he’s not travelling.

“I’ve been fortunate to work for some of the best hotel groups in the world but still live in one of the best places in the world,” he says. “I’m very blessed to live where I do and have the job that I do.”

While hard pushed to name a favourite Radisson hotel, Hoswell says the group’s Fiji property is something special.

“I love Fiji and the Radisson Blu there,” he says. “It’s on Denarau Island, which is a great spot to be. That’s the one I love to escape to.”

25

END

Radisson Blu Resort_Fiji

Radisson Blu Resort_Fiji

Radisson on Flagstaff Gardens_Melbourne VIC

Radisson Blu Plaza_Sydney NSW

Sunshine Coast Regional Spotlight

Words_Glenn Millar & Chenoa Daniel

The Sunshine Coast’s accommodation market is already highly sophisticated but there’s ample opportunity for growth, writes ResortBrokers’ Sunshine Coast team.

We’re biased of course, but there’s so much to love about the Sunshine Coast.

Gorgeous beaches, a lush hinterland, award-winning restaurants, chic bars and a thriving cafe scene. Our ‘rival’, the Gold Coast, has all this too, of course. But our key point of difference (other than our better beaches) is that we have mostly low-rise resorts. Holidaymakers who prefer the Sunshine Coast over the Gold Coast like coming back because they don’t feel they’re having a break from the city by coming to... another city.

The other point of difference is that the Sunshine Coast still has so much untapped potential. We both feel the Sunshine Coast is where the Gold Coast was 30 years ago. Don’t get us wrong, the Sunshine Coast is already a very mature accommodation market but there’s enormous potential for growth.

Take Mooloolaba, for instance. Mooloolaba and Noosa are as close as we get to matching Surfers Paradise in terms of nightlife. While Noosa is highly sophisticated, Mooloolaba is still very basic. That’s all set to change, and we feel Mooloolaba is nicely poised to be “the next Noosa.”

Come 2025, Minor Hotels will roll out the carpet on its 180-key Avani Mooloolaba Beach Hotel. It will the group’s first Australian property under its Avani Hotels brand (there are several Avani Residences dotted around the country but no Avani Hotels). Its location on the corner of Brisbane Road and First Avenue, right across from the Mooloolaba beach foreshore, couldn’t be better. Calile Malouf Investments, the group behind The Calile Brisbane, has announced plans for a luxury resort on the Sunshine Coast. Currently awaiting council approval, the resort will occupy a 2.4 ha site at

3-7 Serenity Close in Noosa Heads, which will feature 178 rooms, 12 suites and 15 villas.

Both projects are a major show of confidence in the development potential of the Sunshine Coast.

As far as management rights goes, it’s worth noting that management rights businesses on the Sunshine Coast provide approximately 90 per cent of short-term letting options. Unlike the Gold Coast, the Sunshine Coast has only a handful of full-service freehold hotels. On that front, we’ve got the likes of Prestige Residential, operators such as Ross Lynch at Noosa Pacific Resort (see sidebox), and Seabreeze Resorts investing in the Sunshine Coast.

These are smart and sophisticated management rights operators, which should reassure smaller players about the strength of our management rights market. That’s not all to say it’s all plain sailing. Real estate prices have skyrocketed on the Sunshine Coast. No more so than Sunshine Beach, which is now the second

Regional Spotlight

26

most expensive suburb in Australia. While this is great news for people who own apartments on the Sunshine Coast, it’s proving a bit of a challenge in management rights because it’s driven up the prices of managers’ units which are routinely part of the management rights package.

Most people who’ve been in the management rights market long enough understand that when you buy a manager’s unit you usually pay a 10 per cent premium, precisely because it is a manager’s unit.

Management Rights Operator Profile

Ross Lynch Noosa Pacific Resort

After working as a field service engineer for a decade, Ross Lynch was contemplating a major lifestyle change. Like many other Melburnians, the Lynchs were regular Noosa holidaymakers and were taken by its laid-back lifestyle.

ResortBrokers’ Sunshine Coast Sales Record

$350m worth of sales

200 management rights businesses sold

1+ settlement every month

Now, it’s the reverse.

To purchase a management rights business, the usual ratio for the sale price is around 60 per cent for the business and 40 per cent for the manager’s unit. But now we’re dealing with sometimes 70 to 80 per cent of the purchase price being the unit.

Something’s got to give. We’re having a bit of a battle at the moment convincing vendors that although their unit may be worth, say, $1m if it wasn’t attached to the management rights, it will now attract a lesser value precisely because it’s tied to the management rights.

This isn’t so much of a problem where the management rights

Having previously lived in Maroochydore in the 1990s and having developed a love for the Sunshine Coast, the Lynchs decided to take a chance on management rights.

“We thought we’d give it a go,” says the 55-year-old. “Noosa is a wonderful natural beauty, with great beaches, a fantastic national park and stunning river.

It has something for everyone, from relaxing to thrilling, with great restaurants and cafes.”

Starting with the 20-key La Mer in Sunshine Beach, which they managed with great success for four years, the Lynchs eventually made the decision to upgrade to the 51-key

$108m worth of sales

59 management rights businesses sold $14.8m currently under contract

agreement doesn’t require the manager to live on-site.

In those cases, the business and the apartment can be decoupled, and the manager can monetise their apartment by letting it out just like any other apartment in the holiday pool.

All that said, the Sunshine Coast is still the best place to buy a management rights business. Good assets will sell at the right price. We’re still turning over properties, particularly high-end properties, with very healthy multipliers and at a volume and rate of any market in the country, except perhaps the Gold Coast.

But we’re hot on its heels. END

Noosa Pacific Resort located on a stunning inlet of the Noosa River.

Since taking on the management rights in August last year, the Lynchs have focused on transforming Noosa Pacific Resort into a premier destination.

One of their key initiatives is the introduction of a luxurious pontoon boat available for guests to rent.

Unlike other pontoons in Noosa, the Lynchs’ pontoon is the first of the luxury kind and doesn’t require a boat license, allowing any adult to drive it during daylight hours.

www.noosapacific.com.au

27

GLENN MILLAR

CHENOA DANIEL

While studying my Bachelor of Property Economics at Queensland University of Technology (QUT), I was required to undertake an internship as part of my studies. My time spent as an intern acted as a springboard to my first property career opportunities and was vital in shaping my early professional experience.

There is nothing more valuable to a student than hands-on experience, particularly in the property industry. While theoretical knowledge is vital, learning how to apply it in a realworld context is indispensable.

On-the-job training is something we are now excited to offer today’s students through ResortBrokers’ internship program. The students of today are the valuers, brokers, developers and analysts of tomorrow. Their learning is vital to the ongoing success of the property industry today and into the future.

For Semester 1 2023, we’ve selected three promising students from a competitive group of QUT Property Economics candidates to participate in the internship program. ResortBrokers’ interns work for our research arm and/or our new buyer enquiry follow-up system called ResortBrokers Concierge.

Our first intake of interns, Hesmatt Amini, Grace Taplin and Jet Lim explain more in our Q&A.

Introducing ResortBrokers’

Internship Program

Our in-house property economist Josh Mangleson introduces our brand-new initiative to help train the next generation of accommodation property professionals.

What have you enjoyed about the experience so far?

Hesmatt: The opportunity to be able to interact with real buyers and build my communication skills while learning from the experienced individuals working here at ResortBrokers.

Grace: I’ve enjoyed building my confidence over the phone. Gaining real world experience chatting with buyers has developed my understanding of the accommodation property sales industry.

Jet: Everyone is friendly and really experienced in what they’re doing. It’s nice to hear about their experience and ask them questions with the idea of applying what I learn in the future.

What made you want to join ResortBrokers’ internship program?

Hesmatt: My long-term career aspiration is to become a successful real estate broker upon graduation. I thought there’s no better way to do this than by completing my internship at Australia’s longest established and most experienced specialist agency in the accommodation property sector.

Grace: I was really intrigued about the accommodation industry. It was something I knew nearly nothing about, so I was keen to learn more. I think specialised knowledge is really valuable and is definitely something that can set you apart from the crowd. ResortBrokers specialises in the sale of accommodation assets, produces in-house reports and has brokers all around Australia, so it ticked all the boxes for me.

Jet: I’ve always been a fan of Selling Sunset (a Netflix reality TV series) and researching. Upon learning ResortBrokers deal with some exquisite properties I knew it was the right fit for me.

What are some tasks you are involved with day-to-day?

Hesmatt: My main task involves acting as the concierge servicing new listing enquiries by initiating first contact with clients and potential buyers. After collecting and logging the necessary information into the system I then liaise with our brokers by appropriately allocating those enquiries.

Grace: I spend most of my day on the phone following up recent listing enquiries. I really enjoy chatting with potential buyers and learning a bit more about what they’re looking for. This helps us ensure buyers are alerted when a suitable listing comes to market and helps our brokers know who to contact.

Jet: Preparing data for Information Memorandums for regions/LGAs and data clean-up and improvements to property records.

What’s something you’ve learned about the accommodation industry?

Hesmatt: Before working with ResortBrokers I never gave much thought about the different sale types in the accommodation property sector such as freehold going concerns, passive investments, leaseholds and management rights. I learnt the particulars in the different sale types and how they work, but I was also surprised to learn how some businesses are priced differently using a multiplier rather than a yield.

Grace: I’ve learnt so much in my short time at ResortBrokers. My key takeaway so far is learning how a multiplier is achieved to value management rights.

Jet: I’ve learned more about management rights and that there are different sale types in the accommodation sector that cater to the needs of different investors that want a piece of the accommodation property market.

28 Property Economist Feature

Words_Josh Mangleson, Property Economist

Collie Hotel Collie, NSW

institution the Collie Hotel in NSW’s Central West

The very well known Collie Hotel is centrally located being on the Oxley Highway 80 km northwest of Dubbo, 50 km east of Warren and just 36 km up the road from Gilgandra. The property also has a separate home for the new owners which has three well-sized rooms and large open living areas. The local tennis courts are located directly next door to the hotel. The hotel’s location makes the business the central meeting point for all locals but also a huge tourist attraction being located on a major thoroughfare.

The hotel has shown year-on-year growth and traded well through Covid. The turnover for this current financial year is well in front of last year’s turnover of $1,475,406 and an adjusted net profit of $334,020. The hotel’s location adds to year-round consistent trading with seasonal workers from pickers to shearers and solar-farm workers constantly working in the district for extended periods. This constant trade creates a solid business case for making more rooms for motel guests with new owners. Properties like this do not come to market often so if you have been looking in this area, don’t let this one pass you by.

• Strong local as well as strong tourist clientele

• Year-on-year growth in turnover and net profit

• Located on Oxley Highway in large stock grazing, cotton & grain growing region

• Four rooms of various configuration as well as five caravan sites

• Projected turnover of $1.8 million this year and adjusted net profit of $334,020 last year

• Separate three-bedroom home for owners/managers

• Staff to continue on in accommodation, bar and kitchen

• Huge social media presence to stay for new owners

$334,020 Net Profit $ $1,475,406 Turnover $ $2,200,000 Price

4 ROOMS OWNER’S RESIDENCE 3 BED 1 BATH FREEHOLD HOTEL

REF // FH007741

+61 431 055 221

Chris Kelly Broker, Central Coast NSW chris@resortbrokers.com.au

SummerHill Motor Inn

Merimbula, NSW

Fantastic growth opportunity, renovated, sustainable energy cost savings

Voted as the #1 motel by Tripadvisor in the area for 8 consecutive years, SummerHill continues to rank as a top performing motel each year. Boasting 20 well-maintained rooms; a spacious, double-storey 2-bed owners’ residence with an adjoining 1-bedroom self-contained unit (which could be converted into additional motel letting); swimming pool; BBQ area; landscaped gardens; and on-site laundry.

Recent renovations geared towards sustainable energy and cost savings include solar systems and 2 EV charging stations. The property has already seen a 32% increase in ADR, 33% increase annual turnover and significant reductions in electricity (approx. 45%) and gas (approx. 85%) expenses. Installing solar batteries to the system has the potential to reduce utilities costs even further.

The SummerHill Motor Inn is currently marketed as an adults-only property, popular with repeat corporate travellers. By welcoming families and coach / tour groups, the new owners could easily increase revenue and occupancy rates.

With a fantastic lifestyle, great location, established reputation and ample opportunities ahead, there is every reason for buyers to seriously consider this property as a solid next investment.

• Ranked #1 motel in Merimbula on Tripadvisor for eight consecutive years

• Newly invested facilities for energy reduction

• Opportunity to renovate into high-end motel

• Opportunity to convert one-bedroom self-contained unit into motel letting

• Enjoys repeat corporate clientele

• Operates an efficient contactless booking system

• Run as adult accommodation with opportunity to open up to families

• Well-maintained motel

REF // FH007646

OWNER’S RESIDENCE 2 BED 1 BATH 20 ROOMS FREEHOLD MOTEL On application Net Profit On application Turnover $ Russell Rogers Senior Executive Broker, South Coast NSW russell@resortbrokers.com.au +61 416 166 909 Sarah Hutchins Sales Manager to Russell Rogers sarah@resortbrokers.com.au +61 407 020 443 $ Expressions of Interest

Prestigious Newstead Management Rights Opportunity

Premium management rights — High $303K net, one body corp and no requirement to live on-site

ResortBrokers exclusively presents this outstanding Management Rights opportunity, located minutes from Brisbane’s CBD in the city’s most desirable riverfront suburb.

With an extremely strong net profit of $303K (including apartment rental income), significant return on investment and no requirement to live on-site (the luxury unit can be rented), this business boasts premium accommodation in a complex that is exceptionally well-maintained with processes easily transferred to the incoming manager.

With a strong salary, topped-up 24-year agreements, high-yield letting appointments and only one body corporate, contact Frank for a confidential discussion and inspection as this business will sell quickly.

• No office hours or requirement to live on-site

• High net profit ($303k) with very manageable duties

• Only one body corporate with great relationships

• Long, topped up agreements in place (24 of 25 years)

• Over 13.8% ROI including apartment rental income

• Premium location with excellent tenancy rates

• Convenient on-site office to run your business

• Extremely well run with transferable processes

• Inspections are by appointment only

$303,000 Net Profit $ $2,200,000 Price

REF // MR007704

+61 435 742 698

Frank Matus Broker, Brisbane frank@resortbrokers.com.au

ONLY

24 YEARS OWNER’S RESIDENCE 3 BED 2 BATH MANAGEMENT RIGHTS

STRONG NET PROFIT $303K

ONE BODY CORPORATE

94 LETTING 25 YEARS 238 UNITS OFF THE PLAN

Estilo on Kittyhawk & Estilo on the Park Chemside, QLD

Attention — Incredible off-the-plan business-only management rights — $517K net!

On the market for the first time is the management and letting rights to Estilo on Kittyhawk and Estilo on the Park. This is a unqiue opportunity that offers the best of both worlds: a proven income from a fully established complex as well as upside from the off-the-plan complex currently under construction next door.

This well-known developer has intentionally retained the management rights of the first complex until such time that the commencement of the second development is opportune for acquisition. The combination offers economies of scale to attract an exceptional operator who can bring their expertise in both established and off-the-plan management rights to the table.

Estilo on Kittyhawk and Estilo on the Park offer:

• 25-year Accommodation module agreements

• Verified P&L showing $517,120 net profit

• Total of 238 apartments with 94 in the combined letting pool

• No set office hours and manageable duties

Estilo on Kittyhawk Established

• 116 apartments over two buildings with 48 in current letting pool

• Good size office of 16 sqm on ground level of Building 1 (east)

• 3 sqm storage on basement level 1 and 2

• Optional 2 bed / 2 bath unit for sale priced at $899K

Estilo on the Park Off The Plan

• Under construction and due for completion in Q3 of 2024

• Comprises 122 residential lots

• Projected letting pool of 46 apartments

$ $343,594 Combined BC Salary REF // OTP007737

$ $2,999,296 Business Price

$ $899,000 Optional Real Estate

Tim Crooks Director of New Developments

$517,120 Net Profit

tim@resortbrokers.com.au +61 417 544 562

Broker,

jeff@resortbrokers.com.au +61 414 669 007

• Designed to be run from Estilo on Kittyhawk. On-site 9 sqm office on mezzanine level under O.A.

Jeff Keast

Brisbane

Arena Hotel Chullora, NSW

Arena Hotel in Greater Western Sydney is a box seat opportunity

Arena Hotel is a well-established 88-key budget hotel on the Hume Highway in the Greater Western Sydney suburb of Chullora.

On offer is the freehold to a hotel held by a family for 17 years, ready to hand over the reigns and see the asset propelled to the next level.

The hotel’s prime position on the Hume Highway is in a rapidly growing Sydney location, only 15 minutes’ drive from Sydney Olympic Park, providing easy access to venues such as Accor Stadium, Qudos Bank Arena and Sydney Showground. The new owner will reap the benefit of a quality hotel build, options to revitalise the asset including the surrounding land, generous parking availability and a simple accommodation concept. This property is ready to flourish.

Hotel freeholds such as Arena are tightly held, making this a rare opportunity to buy into the rapidly developing Greater Western Sydney market.

• Rare 88-key Sydney freehold going concern

• Incredible opportunity to revitalise, rebrand or reposition an outstanding asset

• Ground-level cafe can be leased out or used for guest breakfasts

• 2-bedroom ground-floor manager’s unit

• Large parking area, guest laundry and barbecue facilities

• Spacious 4,238 sqm lot

• Inspections by appointment only

$ Expressions of Interest On application Turnover $

88 KEYS 4,238m 2 LOT SIZE OWNER’S RESIDENCE 2 BED 1 BATH FREEHOLD HOTEL

REF // FH007727

+61 419 038 882

Tim Mayoh Broker, Greater Sydney tim.m@resortbrokers.com.au

Russell Rogers

+61 416 166 909 On application Net Profit

Senior Executive Broker, South Coast NSW russell@resortbrokers.com.au

Feature 34

Photo credit: Derek Swalwell

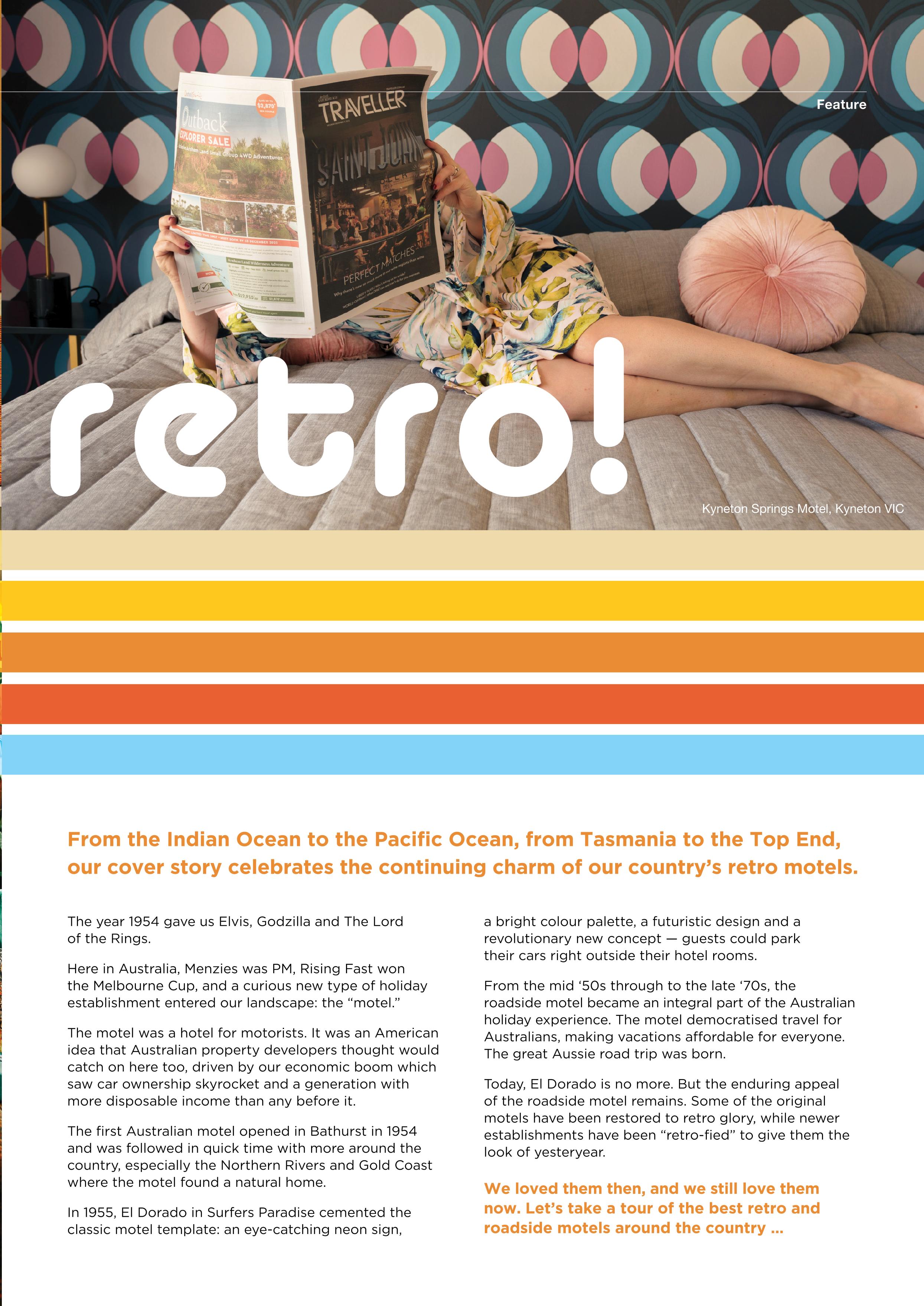

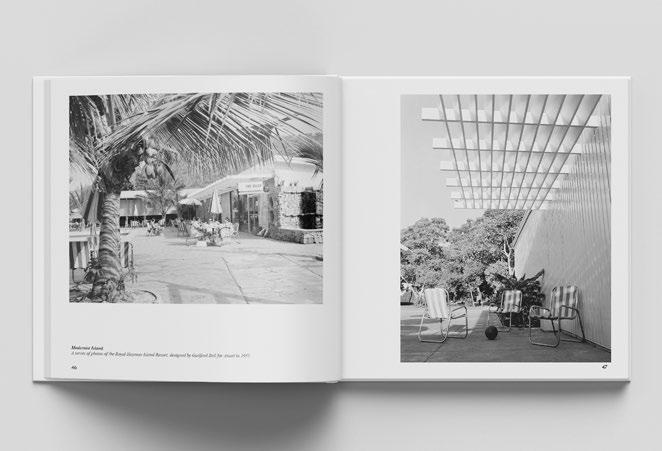

ABC TV presenter and architecture aficionado Tim Ross channels our national romance with retro motels

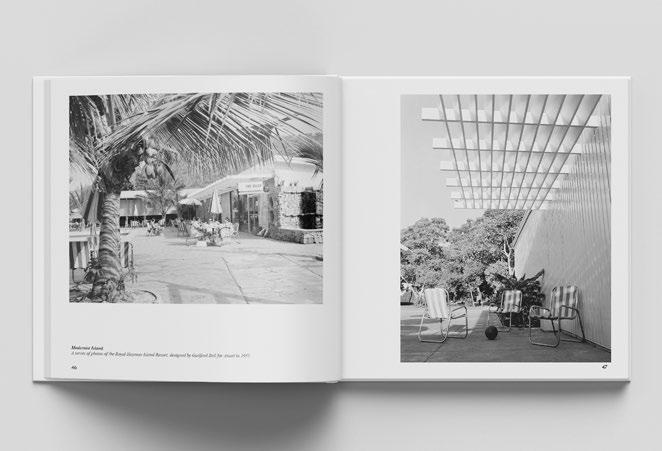

For the past several years, Tim Ross has had a love affair with Australia’s roadside motels. That affair was consummated in his resplendent 2019 book Motel. Images of Australia on holiday, which is populated with a collection of around 80 photos from the National Archives of Australia lovingly curated by Ross. Fittingly for a book about roadside motels, Ross has taken his show on the road, which will run until 13 August at various locations across the nation.

An American import, roadside motels became an integral part of the Australian holiday experience from their heyday in the ‘50s and ‘60s through to their decline in the ‘70s and ‘80s. Roadside motels were stylish and sophisticated, with novelties such as breakfast hatches and carparks right outside hotel rooms which revolutionised the Australian road trip for holidaymakers.

“It’s important to remember that before the advent of the motel most people stayed in guest houses or with friends or you stayed in a pub with a shared room,” says Ross. “Roadside motels were a revolution. You could go to a motel and have your own bedroom and bathroom. They were so modern. For most Australians, it was their first taste of staying in a modern building.”

35

Australia hit peak retro between 1955 and 1960 when the number of motels doubled every year. Particularly in vogue was Googie-style architecture. Named after Googie’s coffee shop in West Hollywood, the style was characterised by bold and futuristic designs that incorporated elements such as geometric shapes, vibrant colours, and steel and glass construction.

Googie-style found its natural habitat on Queensland’s Gold Coast. One of the best exemplars of Googie was El Dorado Motel, which opened in Surfers Paradise in 1955. One of Australia’s first motels, El Dorado’s design featured abstract murals in bold primary colours combined with areas of black. (Incidentally, El Dorado was once sold by ResortBrokers’ Chairman Ian Crooks.)

“With a lot of these hotels, particularly the ones on the Gold Coast, they were built by people who had gone overseas and just taken some photos,” says Ross. “So, the proportions are all out of whack because it’s just an interpretation of something they’d seen overseas. Pioneers like Bernie Elsey on the Gold Coast came back from Florida with a bunch of photos taken with a Box Brownie and said to his builders, ‘Make this.’ So, they did.”

Celebrated Australian architect Robin Boyd derided our adoption of American design as “Austerica.” Boyd added his own spin to the roadside motel by placing the bathroom at the front of the unit thereby muffling the sound and lights of parking cars for other guests. One of Boyd’s roadside creations, the Black Dolphin Motel in

Feature

“Today’s appeal of cuts across generations.”

retro motels

Images on pages 18 & 19 are courtesy of the National Archives of Australia. 36

Tim Ross

Ross’ roadshow Reception this way: motels – a sentimental journey with Tim Ross is touring nationally for the next two years.

Ross’ live show MOTEL plays at the Mitchelton Winery in Nagambie, Victoria, on 26 August.

Merimbula on NSW’s Sapphire Coast, was recently sold by ResortBrokers’ Russell Rogers to ASX-listed Aspen Group.

“Robin was a bit of a snob,” says Ross. “But he was right to consider that it was important for us to have buildings that reflect our landscape and who we are.”

Ross says today’s appeal of retro hotels cuts across generations. “You can be seduced by the romance of something without it being of your time,” he says. “It can be of your parents’ or your grandparents’ time and still have an appeal. I’m interested in images from the ‘50s and ‘60s, and it wasn’t my time.”

For those with personal memories of staying in these hotels, they hold a special appeal.

“People just love them,” says Ross. “It’s this wonderful walk down memory lane. Our memories of our trips, our family holidays are so evocative, so formative, so burnt into our minds, that we can’t get enough of these memories of holidays of the past.

“They took us away from the everyday. And there was the magic of those small moments, whether it’s the breakfast magically appearing through a little hatch or being able to watch TV in bed.

“There was a luxury to them but also a simplicity to the way we lived back then. There was an austerity to the way we lived in the past, so these motels represented moments of glamour. Even the shitty ones had a touch of glamour.” END

37

Motel. Images of Australia on holidays is published by Modernister.

On The Beach Bribie Island, QLD

High-netting management rights on absolute beachfront

ResortBrokers is proud to present this absolute beachside resort situated on tranquil Bribie Island with bridge access to the mainland and less than one hour’s drive from Brisbane and Sunshine Coast airports.

The complex comprises two uniquely designed buildings. A five-level mid-rise hosts 21 apartments and offers residents easy access with a direct lift service to the various one- and two-bedroom apartments and six luxury penthouses. On the beachfront, the villa complex comprises 10 apartments in total with a mix of three-bedroom ground-floor units with beachfront views and another six penthouses with a tri-level design. The three-bedroom beachfront apartments are very popular with families as each has a private, gated courtyard and is literally seconds from the beach.

Incoming operators will enjoy the only four-bedroom apartment in the complex which is set over two levels and has been fully renovated.

Offering a net profit of $505,093 and a return on investment of 15 per cent, this is a smart asset acquisition for a savvy buyer looking for an idyllic island lifestyle.

• Long tenure of 24 years on agreements

• Upside to grow the letting pool

• Supportive body corporate committee

• Strong consistent net profit with growth potential

• Large fully renovated private four-bedroom, two-bathroom manager’s residence

• Strong return on investment of 15%

• Genuine beachfront location with top amenities in the vicinity

• No set office hours (rare for a short-term resort of this calibre)

• Premier short-term asset with limited quality room stock in the vicinity for competition

$505,093 Net Profit $ $3,395,000

Price

REF // MR007529

37 APARTMENTS, 22 LETTING 24 YEARS OWNER’S RESIDENCE 4 BED 2 BATH MANAGEMENT RIGHTS Chenoa

Broker, Sunshine Coast chenoa@resortbrokers.com.au +61 403 143 151 Glenn

Senior Executive Broker glenn@resortbrokers.com.au +61 412 277 804

Daniel

Millar

Grantham Farmworkers Lodge Grantham, QLD

Large scale & secure cash cow run completely under management

Grantham Farmworkers Lodge is an excellent investment opportunity to acquire a freehold interest in a near new workers’ accommodation facility. The facility is presently operating with 272 beds, which include single and twin share rooms as well as dormitory-style accommodations. There is a range of high-quality amenities, including two swimming pools, a volleyball court, a commercial hotel and food business licenses, a bar, two communal kitchens, common areas, and two laundries.

Currently, Grantham Farmworkers Lodge is 100% occupied and holds two accommodation service agreements, which guarantee minimum rentals and provide a secure, passive income. Grantham Farmworkers Lodge has a current Development Approval (DA) for a total of 548 bed worker accommodation facilities and a 54 site Residential Land Lease Community (RLLC) development over surplus land to meet the rising housing demand in the region.

Due to the high demand for worker accommodation in the area and the lack of availability, a new accommodation service agreement has been signed with Stanbroke for their exclusive use of the facility.

• Circa $1.15M net profit for FY23

• DA approved for large expansion

• Currently 272 bed with approval for 548 beds with considerable demand

• Fully occupied on a contract with Stanbroke

• Fully staffed with management and 12 casual staff

• Infrastructure already onsite to begin expansion

• 36.52ha landholding - flexible urban zoning

Approx $1.4m FY24 Proj. Net Profit

Turnover $ $ Expressions of Interest

Approx $1.75m

272 BEDS 36.52Ha LANDHOLDING MANAGERS RESIDENCE ONSITE SPECIAL PROJECT

REF // FH007760

+61 427 431 213

Jason Vogler Broker, South East & South West QLD jasonv@resortbrokers.com.au

+61 448 339 920

Nathan Eades Broker, Brisbane nathan@resortbrokers.com.au

Sussex Palms Holiday Park

Sussex Inlet, NSW

Boutique-style freehold cabin park on NSW’s South Coast

Nestled on a large 6,728 sqm block of low maintenance landscaped grounds and consisting of a range of accommodation options, from a three-bedroom cabin with 2 bathrooms ideal for a family getaway through to the one-bedroom Bungalow cabin for cosy couples retreats. Also on site are 28 privately owned vans that provide the owners with a steady income.

This friendly and well-maintained park has so much to offer, including an outdoor swimming pool (the only one in town), a large undercover BBQ area, a clean and modern amenities block with coin operated washing machines and a dryer for guests to use.

The owner’s residence is a modern spacious two-storey 4-bedroom, 2-bathroom home on a separate 917 sqm block.

Currently run by a husband-and-wife team, this easy-to-run caravan park prides itself on its high standards and is one of the tidiest caravan parks in the area. With annuals providing a steady income, this is a fantastic opportunity for someone looking for a lifestyle change.

• Easy-to-run park perfect for first time entrants

• Outstanding location with close proximity to Sydney and Canberra

• Steady income from annuals

• Large manicured 6,728 sqm block

• Large modern owner’s residence on separate 917 sqm block

• Consistent trading results $ $3,000,000

REF // FH007707

Price 28 PRIVATE VANS OWNER’S RESIDENCE 4 BED 2 BATH 7,645m 2 LAND SIZE CARAVAN PARK

russell@resortbrokers.com.au +61 416 166 909

sarah@resortbrokers.com.au +61 407 020 443 On application Net Profit On application Turnover $

Russell Rogers Senior Executive Broker, South Coast NSW

Sarah Hutchins Sales Manager to Russell Rogers

Eton Lighthouse Resort Vanuatu

Own a piece of paradise in Vanuatu

Located on the island of Efate in the Pacific nation of Vanuatu, Eton Lighthouse Resort is a golden opportunity to own a boutique property in one of the world’s most sublime tropical settings. There are no restrictions on foreigners buying property in Vanuatu, which means you can own outright a piece of this beautiful country whose name means “Our land forever.”

While other Pacific nations such as Hawaii, Fiji or Tahiti are now highly commercialised, Vanuatu retains its idyllic island charm. Eton Lighthouse Resort comprises 7 premium villas, all with spectacular ocean views, which have been immaculately built to the highest standard.

The resort is being sold in one line, allowing the purchaser to operate the property as they see fit going forward. The resort could be easily positioned either as a boutique resort or as a private holiday residence for a family or corporate business.

Efate is the third largest island in Vanuatu, and its capital, Port Vila, is the seat of government. The city is an important tourism hub attracting more than 82,000 visitors a year in an industry that generates around AU$100 million annually. There is simply no other development like this in Vanuatu.

• Sublime island setting

• Uninterrupted ocean views from all villas

• 60 metre exclusive water frontage, legal access to 2.5 kilometres of water frontage

• Secluded, quiet and peaceful location away from the city

• Only 30 minutes’ drive to Port Vila

• Close to local attractions: Blue Lagoon, Eton Beach and Eton Village

• Beautifully landscaped grounds complete with the largest private pool on the island

• Eco-friendly resort fully powered by on-premises solar system $ $3,500,000 Price

SUBLIME ISLAND SETTING SPECIAL PROJECT

7 VILLAS 2.5KM OCEAN FRONTAGE

REF

FH007716

ian@resortbrokers.com.au +61 411 171 648

alex@resortbrokers.com.au +61 467 600 610

//

Ian Crooks Chairman

Alex Cook Director

ControlRemote

place of Burke and Wills, is 1,050 km northeast of Adelaide; Marla

Travellers’ Rest is 1,100 km northwest of Adelaide; and The Elliott Store is halfway between Alice Springs and Darwin in the Territory. A Northern Interests side company also owns and operates the Puma Port Augusta Truckstop about 320 km north of Adelaide.

For most companies “remote work” means their staff work from home when the office is an easy commute away. But for Northern Interests, “remote work” takes on a whole new meaning. The company’s 130 employees work in some of the most remote parts of the country, several hundreds of kilometres away from a capital city.

Roadhouses are the Adelaidebased company’s stock in trade, and Northern Interests has become an expert at running them for the last 25 years. In 1998, Northern Interests acquired its first property, Spud’s Roadhouse, in Pimba about 480 kilometres north of the state

capital. Pimba is as small and remote as it gets. It has a resident population of about 15 and lies at the junction of the Stuart Highway to Alice Springs. For truckers and tourists travelling through, Spud’s is Pimba. The roadhouse is the settlement’s one defining feature.

“If you’re travelling through the outback, you can’t do without roadhouses,” says Northern Interests CEO Ben Seekamp.

Today, Northern Interests has seven roadhouses spread across remote towns in SA and NT. Glendambo Ampol Roadhouse is 592 km north of Adelaide; Innamincka Trading Post, the famous resting

In February 2023, Northern Interests purchased Timber Creek Hotel through Resort Brokers’ Kelli Crouch, which lies 285 km west of Katherine in the Territory and approximately 193 km east of the NT/WA state border. Timber Creek is Northern Interests’ second largest site by geographical size and has motel rooms, cabins, and caravan sites, as well as a restaurant and bar. Marla is the company’s largest roadhouse with 48 motel rooms, a caravan park, a supermarket, as well as a restaurant, bar and pool.

Northern Interests’ motto is “servicing the outback,” a guiding philosophy Seekamp says the company lives by.

“We are there to service people,” says the 48-year-old. “You need somewhere to stop to get fuel, get a bite to eat or just take a break from the long drive. If you’ve broken down, you need help. We get frustrated with the unmanned fuel facilities that get placed in the vicinity instead of a full-service business. They’re good at providing fuel but if you get a flat tyre, an unmanned fuel bowser can’t help you.

Roadhouse Industry Insight 42

Northern Interests CEO Ben Seekamp discusses how vital the humble roadhouse is to the bush, and on giving back to the outback.

“We can sell you a tyre or repair your tyre to get you going again. Unmanned fuel tanks are very one dimensional. If that’s all that existed, people would struggle to travel in the outback.”

Seekamp says roadhouses not only provide vital services but also down-to-earth country hospitality that gives travellers reassurance and adds to their outback experience.

“If you’re 60 years old and have just bought a caravan and are about to do your first road trip, it can be pretty daunting,” he says. “On your first trip, you want somewhere that’s safe to park, somewhere to plug in your caravan, and somewhere you can enjoy a nice meal and get fuel.

“We’re also a reliable source of information for tourists, who have questions such as ‘Are the roads OK?’

‘Is it going to rain?’ ‘How fast should I go?’ It can be overwhelming doing a thousand-kilometre trip with a new car and caravan on a road you’ve never been on. And then there’s a few movies about the outback that put some fear into the equation!”

Seekamp has worked for Northern Interests since 2005. A chartered accountant by training, he worked for a commercial property firm before transitioning into managing roadhouses. In 2012, he bought in as a partner.

So, what makes a good roadhouse?

Seekamp says Northern Interests has several criteria when looking to acquire one.

“There are many key aspects to consider,” he says. “Being in a good structural condition is important as getting construction or maintenance work done in the outback is very difficult. It’s difficult in capital cities but throw in five hundred kilometres to the job and see who wants to do it! We’ve passed on opportunities because of the maintenance needed upfront. A lot of outback places can be in poor shape.

“Good staff accommodation is vital, reliable power supply, quality of water, waste systems are all important and not often a concern when buying city-based businesses.

43

“We like to see upside potential and we think our size and experience is likely to help with finding better ways to do things. Timber Creek, for instance, was run very well by its previous owners, however fresh eyes and knowing what has worked elsewhere has opened up opportunities to further improve the site.

“We also look for remote locations that are safe, having police in the town or at the very least mobile phone coverage is important to us.

“Location and distance from other businesses is also another critical factor. You don’t want to be too close to a major city because travellers will just push on to get

there. In terms of competition, we look to see who’s nearby. You really want to be at least 100 km away from your competition if the business case is to stack up.

“Having a local community nearby is also advantageous. You can’t only rely on tourists because that trade will peak and trough. Having a community or residents nearby is a definite bonus, like Timber Creek does. The locals give you a good base for business.”

Seekamp says staff accommodation is critical, particularly for backpackers. Northern Interests recently sold its Ord River Roadhouse in Kununurra in the Kimberley region of Western

Australia due to, in part, its lack of staff accommodation which made finding employees difficult.

“Backpackers are there to save money,” says Seekamp. “They want basic cheap accommodation. Accommodation is expensive in Kununurra and to pay $400 a week in rent doesn’t stack up for them.”

Seekamp says Northern Interests employees are typically people who like living in quiet, remote towns away from the hustle and bustle of big cities.

“We employ a diverse range of people, some who love the outback way, some looking for a change and a lot of travellers and backpackers,” says Seekamp. “You need to be

Roadhouse Industry Insight 44