.

BEST ACCOMMODATION INVESTMENT

®

ISSUE N O

110 AUSTRALIA’S

SHOWCASE

SPECIALISING IN FURNITURE FOR HOTELS, MOTELS, SERVICED

SPECIALISING IN FURNITURE FOR HOTELS, MOTELS, SERVICED APARTMENTS, RESORTS AND REFURBISHMENTS.

Furniture FF&E design concepts 3D Rendering & Furniture Overlays Custom furniture and joinery manufacture Turnkey packages Project Management Inhouse quality control

IN HOTEL FIT OUTS OUR SERVICES

NUMBER ONE

Mayor Gordon Bradbery on how his council turned Wollongong

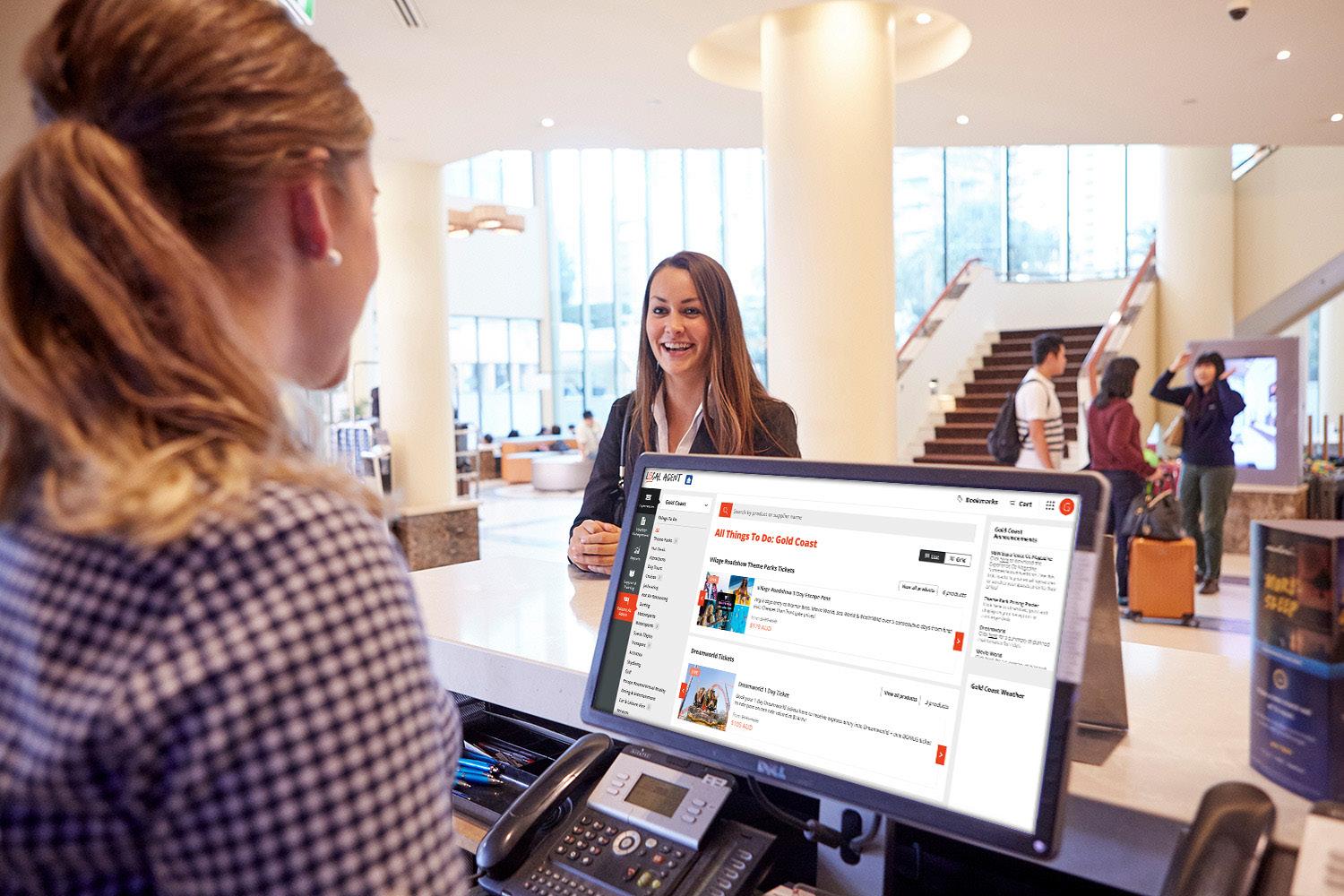

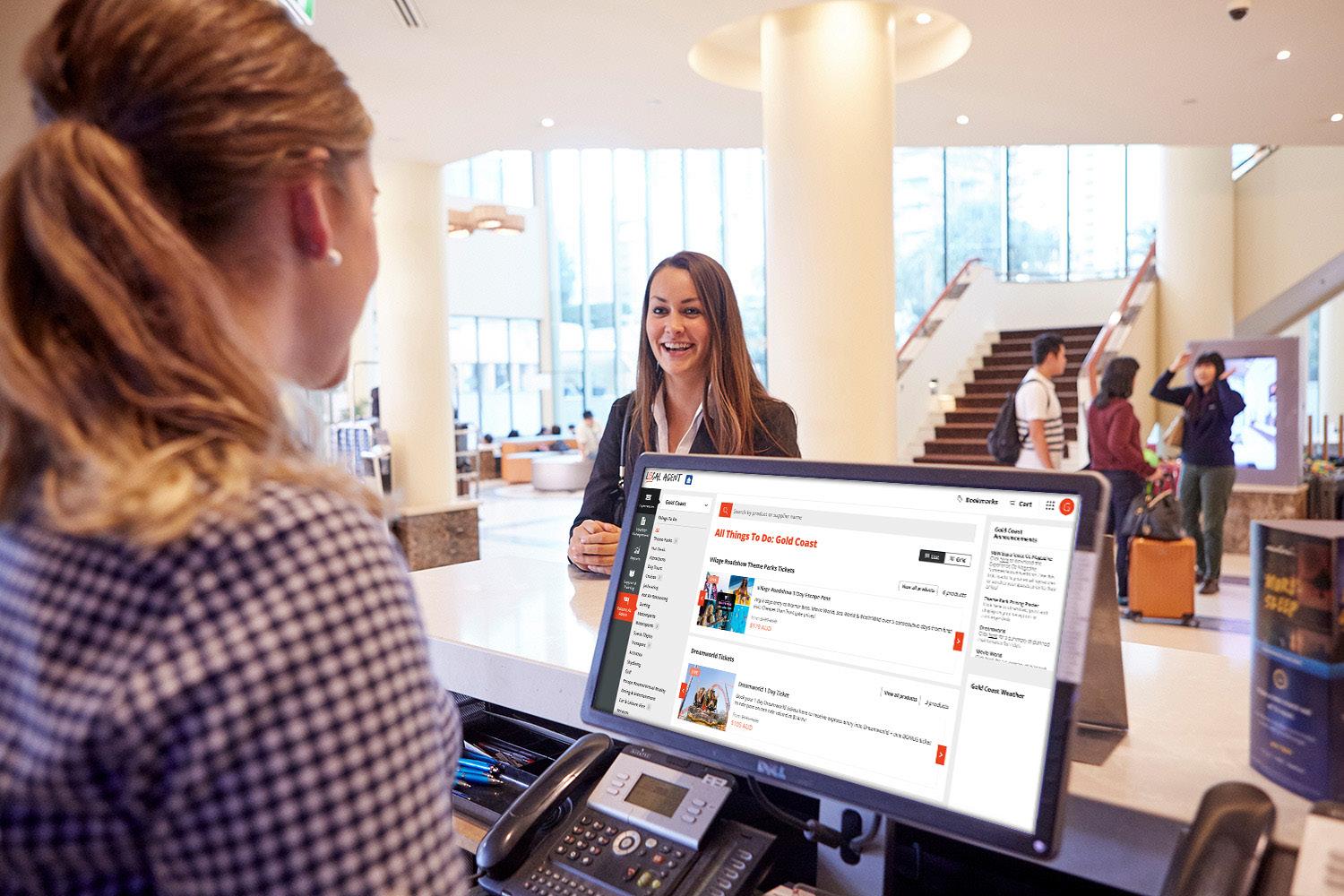

What’s Inside ISSUE N O . 110 Contents FACES OF THE INDUSTRY 24 Mandala Asset Solutions’ John Zeckendorf on his blueprint for success. GO, GO GADGET 16 Hi-tech whiz-bangery to help streamline your operations. ON THE MARKET 6 Managing Director Trudy

discusses where the market is at. BROKER PROFILE 62 Meet the Gold Coast’s

broker,

EMBRACE THE ALGORITHM REGIONAL SNAPSHOT: WOLLONGONG 10 38 If you’re not already using dynamic pricing, you’re missing out.

Regular Features Meet out two new Victorian brokers. 60 NEW APPOINTMENTS If you need a break, you’ll need a manager. Find one here. 80 RELIEF MANAGERS ResortBrokers’ national directory #weareeverywhere. 82 MEET OUR TEAM The importance of motel lease top-ups. 66 BROKER INSIGHT FANTASTIC PLASTIC! 58 Check out ResortBrokers’ Barbie-themed Christmas party. WHAT'S COOL 78 Director

checks out the best tech hotels.

Crooks

lifesaver

Syd Douglas.

around.

Tim Crooks

Pilot Partners

We’re pleased to announce that Informer will now be distributed in select airports around the country.

Our great thanks to Brisbane Airport and Ballina Byron Gateway Airport, our first two partners to sign up for this exciting new initiative. More airports will come online soon, so watch this space.

4 Preface

If we’re to believe sci-fi movies, we know the evolution of artificial intelligence doesn’t end well for the human race. But concerns about AI’s potential dangers aren’t limited to the spinners of stories. An early forewarner was the late Stephen Hawking who knew a thing or two about science.

Big Tech leaders Tim Cook (Apple), Mark Zuckerberg (Meta), Bill Gates (Microsoft), Eric Schmidt (formerly Google) and Jack Ma (Alibaba) have also expressed concerns about the detrimental consequences of unrestrained AI, while still pushing ahead with harnessing its power for the benefit of their businesses.

It’s clear AI is here to stay and that it’s we humans who are having to adapt to it rather than it to us. (I became “self-aware” I was in a brave new world the first time a website questioned my humanity by asking me to confirm “I am not a robot.”)

One area where AI is changing our industry, and for the better, is dynamic pricing. An AI algorithm can adjust an accommodation business’s rates several times a day without the operator even touching it. Quite remarkable really.

I know some of you already have dynamic pricing in place, but many

We’re off to a flying start in our first Informer of calendar year 2024 with our main feature on dynamic pricing fitting into our “tech” theme.

of you don’t, especially smaller motel and caravan park operators. So, we’ve approached the topic at the most fundamental level by asking:

What is dynamic pricing? And how can it improve my business?

If you read our main feature, you’ll find out.

Thanks to those who provided their expert insights on this subject: Andrew Bullock, CEO, 1834 Hotels; Anthony Stanley, Director Performance & Revenue Management, Choice Hotels AsiaPac; Chris de Closey, Director, Switch Hotel Solutions; Wayne Chang, General Manager – Commercial Strategy, Discovery Parks Group; and Melissa Kalan, CEO, Australian Revenue Management Association.

Our Faces of the Industry this issue is Mandala Asset Solutions’ John Zeckendorf. At ResortBrokers, we’ve long said, “Coast for show, inland for dough.” It’s a time-tested principle meaning that investors get better investment returns when they’re prepared to consider regions that city slickers in Melbourne, Sydney and Brisbane might sniff at.

John is like-minded on this issue. Mandala specialises in regional assets and John shares his views on why other investors baulk at

them (and how they’re missing out by so doing). In our feature, you can read about Mandala’s remarkable growth from one hotel to a $200 million nationwide portfolio of 35 under John’s stewardship, as well as John’s incredible, and often colourful, career and mountaineering achievements.

Our Broker Insight this issue comes by way of Sunshine Coast and Fraser Coast broker David Faiers who stresses the importance of keeping your motel lease toppedup. If you’re not already doing this, David’s article is a cautionary tale!

Meanwhile, on the other coast, our Central Gold Coast broker Syd Douglas shares his community service experience as a surf lifesaver and the life lessons he has gained from it (and, yes, even applied in the management rights field).

Finally, we’re delighted to introduce two new brokers for Victoria. Former Colliers Western Region Victoria general manager Hugh Thomas will cover the state’s west. Chris Boschetti, previously Victorian Sales Operations manager at Australian Liquor Marketers, will look after the east. Welcome aboard, gents. END

5

Words_Ian Crooks, Chairman

Maintain the Gauge

In this column, I always like to give you our take on where the market is sitting.

ResortBrokers doesn’t set the market — supply and demand does, as ever — but we understand it as professionals who are active in this space on a day-to-day basis meeting buyers and sellers on the ground. We like to keep you abreast of where the market is at, so you can best position yourselves for sale or your next purchase.

So, what’s the market doing?

We’re seeing huge demand for new hotels, motels and caravan parks across the country. As our wise founder Ian Crooks (aka dad) says, hatches, matches and dispatches will always drive the accommodation market.

Four of the Best Across

Add to births, weddings and funerals the following: a population explosion, domestic migration, an itinerant workforce, international tourism and Australians’ great love for holidays!

The macro-economic outlook for our industry remains positive out to the horizon. The enormous demand we’re seeing for new accommodation businesses comes as no surprise given our insatiable need for them. In the last decade alone, the number of hotels alone has risen a staggering 40% across Australia.

But there’s also significant barriers to entry these days: spiralling construction costs, ongoing supply chain challenges, rising borrowing expenses, as well as motels being converted to social housing by government in response to our ongoing housing crisis.

Australia

What’s more, building companies are spoiled for work. There’s so much infrastructure either under construction or in the pipeline that Class 3 buildings like hotels are finding it harder to get out of the ground.

That puts existing stock at a premium. We’re seeing a lot of that stock come onto the market now.

ResortBrokers has traditionally sold around 200 accommodation properties and businesses a year. In the privately owned, small business space, we were accustomed to properties turning over every five to seven years.

Obviously, Covid was the almightiest of spanners thrown in the works. Because of that, we’re now seeing the release of built-up compression of owners and operators who were ready to sell prior to Covid, had no choice but to hold through Covid, then came out the other side into one of the most profitable trading periods we’ve ever seen historically for accommodation businesses.

While these businesses have much more room to grow, these sellers are understandably ready to move on. With more supply coming onto the market, vendors need to meet the market on its terms. Don’t get me wrong, there’s no shortage of highly qualified buyers. But no one is paying overs. Accommodation businesses that are priced fairly will sell, in many cases very quickly. We have sold and settled some deals inside four days (yes, you read that right).

Hotels

271 apartments

five

We

the entire franchise off-market to Choice Hotels Asia-Pac, which doubles its Melbourne portfolio

this single acquisition. To the best of our knowledge, no other agency has brokered an entire brand sale. This was the second such sale for us; the first being the celebrated Art Series that includes five Melbourne hotels and one each in Brisbane and Adelaide. We sold that brand, also off-market, for Deague Group to Mantra for $45 million in 2017.

City Edge Apartment Hotels franchise_Melbourne VIC ResortBrokers has delivered another whole brand sale —

one I was delighted to handle personally. City Edge Apartment

comprises

across

Melbourne hotels.

sold

with

Our Sydney brokers Jacqueline

and Tim Mayoh made history with the largest ever sale of a Quest franchise. The sale of the 88-apartment Quest Liverpool broke Jac and Tim’s own record, set in November 2023, with the 59-apartment Quest Cronulla Beach. The sale of 4.5-star Quest Liverpool, located approximately 30 minutes’ drive from the CBD in Greater Western Sydney, followed a successful campaign that attracted strong interest resulting in an offer and acceptance within days of going to market. ResortBrokers has been Quest’s preferred agent nationwide for over a decade.

Quest Liverpool_Sydney NSW

Featherby

SOLD & SETTLED

& SETTLED In this market, you need a broker who understands price — and will defend yours.

SOLD

On The Market 6

Accommodation businesses that are overpriced are getting little, if any, attention. Some vendors are expecting to achieve the same yields as when interest rates were 3% lower. That’s just not going to happen in this market.

Unfortunately, we’re having to turn down vendors with unrealistic price expectations.

We pride ourselves on being honest with our clients in delivering a service. In this market, we’re levelling with vendors by saying we don’t think they should

lose three months or more holding out for an unrealistic sale price that simply won’t be achieved. That said, if we take your sale on, we’ll defend your price to the hilt.

In many cases we’ll exceed your price expectations because we know how to create competition for quality assets and businesses.

ResortBrokers’ inhouse research department spends a lot of time analysing the accommodation market’s performance across the country.

We also analyse our own performance. Having analysed over 500 sales across the last three years, we found that compared to our competitors, ResortBrokers is:

2.4 times more likely to achieve a result at list price

4.6 times more likely to achieve a result above list price

There’s nothing that pleases us more than pleasing our clients. Your success is our success, as we say. We’re in a market with many moving parts. It’s more important than ever to engage a broker who understands market prices, will defend yours and even exceed it. END

Gladstone Downtown Central_Gladstone QLD Another sale that demonstrates one of our signature skills: the ability to find buyers for assets right around the country, no matter where they’re located. Our Central Queensland broker Nathan Benjamin sold this passive freehold comprising 37 strata titled lots to a Victorian buyer for a yield of 8.02%. The purchaser is a very wellestablished caravan park owning family out of Geelong. This is the third asset they have bought through ResortBrokers across the country, highlighting our scale.

Gladstone Downtown Central_Gladstone QLD Another sale that demonstrates one of our signature skills: the ability to find buyers for assets right around the country, no matter where they’re located. Our Central Queensland broker Nathan Benjamin sold this passive freehold comprising 37 strata titled lots to a Victorian buyer for a yield of 8.02%. The purchaser is a very wellestablished caravan park owning family out of Geelong. This is the third asset they have bought through ResortBrokers across the country, highlighting our scale.

SOLD & SETTLED

Gabba Central Apartments_Brisbane QLD Our dynamic director duo of Tim Crooks and Alex Cook settled one of Brisbane’s largest ever transactions with this off-market deal that saw the management rights of the 317-key Gabba Central Apartments change hands from seller Collective Hotel Management to a private syndicate for more than $10 million. Again, this transaction underscores ResortBrokers’ strength in having sophisticated buyers’ networks and knowing our buyers’ individual investment profiles so we can match up businesses that interest them.

SOLD & SETTLED

7 Sold at list price Sold above list price 0% 5% 10% 15% 20% 25% 30% 35% Competitors ResortBrokers 2.4x 4.6x

Words_Trudy Crooks, Managing Director

SETTLED

QTR 3

Our Top Recent Sales & Listings

We’ve been experiencing exceptionally high demand across all accommodation asset classes. Here’s a selection of some of our biggest and best sales and listings.

PARK REGIS CONCIERGE APARTMENTS

SYDNEY, NSW

This rare Sydney business, a 65-apartment complex in blueribbon Cremorne, was bought by an experienced Queensland operator.

Tim Mayoh M: 0419 038 882

SETTLED

GOLD COAST AIRPORT MOTEL

BILINGA, QLD

This nifty 13-room hotel, only 300m from the airport and 80m from Kirra Beach, has sold.

Miguel Bozina M: 0419 848 444

SETTLED

CLUBB COOLUM BEACH

COOLUM BEACH, QLD

This iconic Sunshine Coast holiday resort has been sold by ResortBrokers for the second time in its history. The first time was 16 years ago!

Chenoa Daniel M: 0403 143 151

Glenn Millar M: 0412 277 804

SETTLED MITCHELL CARAVAN PARK BOURKE,

NSW

Prime regional assets like this 40-site caravan park in Bourke are in huge demand.

Chris Kelly M: 0431 055 221

SETTLED

WINTERSUN GARDENS MOTEL

BICHENO, TAS

This easy-to-run 14-room motel on Tasmania’s east coast has sold.

Marissa von Stieglitz M: 0437 198 164

UNDER CONTRACT

CASINO MOTOR INN CASINO, NSW

This profitable, 30-room motel near Casino’s CBD is now under contract.

Miguel Bozina M: 0419 848 444

Sales Activity resortbrokers.com.au

8

LISTING

EDEN HOTEL APARTMENTS

SHEPPARTON, VIC

Set for completion in September quarter 2025, this off-the-plan 4.5-star 67-key hotel is set to raise the bar in Shepparton’s high-end accommodation market. Tim Crooks

UNDER CONTRACT

NOOSA HEADS MOTEL NOOSA HEADS, QLD

The leasehold for this 23-key, 4-star rated motel in Noosa’s highly competitive accommodation market is now under contract.

UNDER OFFER

QUEST MACQUARIE PARK SYDNEY, NSW

The franchise to this 111-key apartment hotel in one of Sydney’s most prominent business park districts is now under offer.

Jacqueline Featherby M:

Mayoh M: 0419 038 882

LISTING

SPRING HILL TERRACES MOTEL & APARTMENTS BRISBANE, QLD

This 28-room budget motel on a prime 1,672 sqm inner-city lot is on sale for $8.9 million.

LISTING

ROOM MOTELS GATTON, QLD

Recently listed, the freehold going concern of the 39-key Room Motels is the Lockyer Valley’s latest four-star accommodation for corporate and leisure travellers.

SETTLED

MIRAMBEENA MOTEL WHYALLA, SA

We received huge enquiry and multiple offers for this 46-room motel, showing a 7.5% return with a long-term lease, located in South Australia’s second largest regional centre.

9 resortbrokers.com.au

0422 208 450 Alex

M: 0467 600 610

M:

Cook

David Faiers M: 0432 766 788 Chenoa Daniel M: 0403 143 151

Trudy Crooks M: 0477 882 210 Alex Cook M: 0467 600 610

Kelli Crouch M: 0410 441 750

0424 497 056 Tim

Jason Vogler M: 0427 431 213 David Faiers M: 0432 766 788

Embrace the Algorithm

Advances in software and AI have made dynamic pricing accessible to even the smallest accommodation businesses. If you don’t already use it, you’re missing out.

Words_John Miller

Whether you operate a hotel, motel or caravan park, no matter the size, you face the same issue: a fixed number of rooms. Sure, you can always build more, but you’ll need development approval and have to make a capital expense, which in the current building crisis isn’t an appealing option. Even if you build, your room count will only go so high until you max out on space. There’s no getting away from it; fixed supply remains accommodation business operators’ constant problem when it comes to increasing revenue.

HOW TO SOLVE IT?

The silver bullet is dynamic pricing. Dynamic pricing uses software to raise or lower an accommodation business' rates several times a day, typically three or four.

Rates are adjusted after accounting for a wide range of factors including competitors’ rates and current and forward supply and demand.

Dynamic pricing is an element of revenue management, though the terms are often used interchangeably.

“Dynamic pricing is a process whereby you’re looking to maximise the supply and demand curves for any accommodation asset in whatever location it may be in,” says Andrew Bullock, CEO, 1834 Hotels.

“If you work on a static rate philosophy, the fixed supply arrangement of hotels means you’re always going to have a certain number of rooms you can sell on any given night.”

“But if you use dynamic pricing, you can increase revenue by driving your rates up in times of high demand. You can also drive occupancy in lower demand periods, by offering discounts, for example, to improve your overall RevPAR.”

1834 Hotels applies dynamic pricing as part of its comprehensive hotel management package. Founded in Adelaide in the 1980s, the white label management company serves a nationwide clientele of hotels, motels, resorts and serviced apartments. Over the more than two decades Bullock has been with 1834 Hotels, the last 15 years as CEO, he has seen the democratisation of dynamic pricing technology make it both accessible and affordable to most operators, regardless of size.

“Once upon a time you needed a team of revenue managers to be able to dynamically price your hotel,” says Bullock. “It was predominantly used by large CBD hotels who had teams of people working manually off spreadsheets to determine rate changes and positioning. That’s just not the case anymore.”

// Main program loop while (true) { // Get user input String input = getUserInput(); // Check for exit condition if (input == "quit") { break;}

Feature 10

Andrew Bullock, CEO, 1834 Hotels.

“Dynamic pricing technology has come a long way to where it was even five years ago. With the tools available in today’s market, you can do it with even the smallest accommodation assets.”

1834 Hotels uses dynamic pricing software Duetto and its own proprietary reporting software to adjust rates for the hotels it manages. These programs web scrape rate and other data from a hotel’s competitor set, which can be set as wide as a client likes. After importing the data, the system then makes projections of the hotel’s best rate position by room type.

“What are you leaving on the table by not moving your rate position around?”

“Today’s technology uses AI algorithms that will price point your hotel three or four times a day, putting all your competitor set data in, looking at forward demand curves, historical data, etcetera, and then drive your rate and occupancy position without you even touching it almost,” says Bullock. “Obviously, you need companies like ours to manage that process, but these platforms are far more acceptable and easier to use than they once were.”

Bullock says operators who don’t use dynamic pricing don’t realise the substantial returns they’re missing out on.

“It’s often a case of operators not knowing what they don’t know,” he says. “Your hotel may be doing well with good occupancy. But what are you leaving on the table by not being able to move your rate position around? Doing so can deliver enormous revenue uplift. Twentyfive per cent plus in revenue uplift is not out of the question for a hotel moving from a static price model to a dynamically priced model.”

OCCUPANCY AND RATES: TWO SIDES OF THE SAME COIN

Anthony Stanley, Director of Performance and Revenue Management, Choice Hotels Asia-Pac agrees some operators still don’t appreciate the benefits of dynamic pricing.

“We still hear it today, this obsession with occupancy while overlooking rates,” he says. “It’s been an education piece for us to get our franchisees to think about both sides of the equation: occupancy and rates.”

“If you can drive average daily rates higher when compared to occupancy then, ultimately, you’re making the business more profitable because your revenue increases while your operational expenses remain the same.”

Choice Hotels Asia-Pac introduced revenue management as an opt-in program for its franchisees about six years ago. Today, approximately 75 per cent of its franchisees in Australia and New Zealand take advantage of the service.

In an industry first, Choice Hotels International developed its own automated revenue management system, ChoiceMAX, which integrates with its proprietary property management system, ChoiceADVANTAGE.

In Choice’s US homebase, ChoiceMAX is now in its third year of operation. In Asia Pacific, ChoiceMAX is coming into its second year.

While the number of keys will impact how far ChoiceMAX can increase revenue, returns can be significant.

“We’ve proven an average return on investment of five-to-one over the course of a 12-month period,” says Stanley. “So, for every dollar you invest you’re getting five back in terms of revenue uplift.”

Despite the undeniable upside, Stanley says some Choice franchisees are still hesitant to embrace dynamic pricing.

“Some operators get side-tracked by the implementation cost,” he says. “Others believe their revenue potential has peaked. Others can be concerned with a perceived loss of control.”

“For every dollar you invest you’re getting five back in terms of revenue uplift.”

“But the process can be as hands-off or as collaborative as the operator likes. We have some franchisees our revenue management team never hears from. They’re happy to delegate that responsibility so they can concentrate on the operational aspects of the business. Then we’ve got others proactively working with their revenue manager multiple times a week. How they manage that section of their business is completely in their control.”

11

Anthony Stanley, Director of Performance and Revenue Management, Choice Hotels Asia-Pac.

DYNAMIC PRICING IN MANAGEMENT RIGHTS

Switch Hotel Solutions, a full-service agency specialising in the management rights sector, uses a combination of software Lighthouse (formerly OTA Insight) and RoomPriceGenie, and benchmarking data STR, alongside its own proprietary system.

“Lighthouse provides market level data for the regions,” says Chris de Closey, Director, Switch Hotel Solutions.

“Say, for example, you have a short-term letting business on the Gold Coast. The first 22 days of December are looking very soft. That means we’re having to adjust our revenue strategy accordingly to meet the demands of the market.”

“Software like RoomPriceGenie assists you to monitor market movements and pricing. So, if the market moves a specific percentage, it will make your property move in the same direction. That way you’re not missing out on any market movements.”

“We use benchmarking data like STR to tell us whether what a particular client is experiencing — higher occupancy, say — is true for the wider market as well. For example, our client might be at 20 per cent whereas the market might be at 10 per cent.”

Chris de Closey, Director, Switch Hotel Solutions

Chris de Closey, Director, Switch Hotel Solutions

Feature 12

SWITCH HOTEL SOLUTIONS TEAM

“Or they might be at 80 per cent and the market might be at 100 per cent. It gives us different levels of data about how the market is performing, how we’re performing against the market and then we make the revenue decisions from there.”

De Closey founded Switch in 2019 and now has over 60 clients around the country, predominantly short-term holiday letting businesses in the 20- to 50-room range.

“Dynamic pricing in a management rights model is a little different because you’re potentially dealing with individual unit owners,” he says. “While we want to optimise prices as much as we can, we still need to get the occupancy as well to ensure we’re getting unit owners returns on their properties.”

“It’s really about educating operators on the advantages of dynamic pricing.”

Returns after implementing dynamic pricing can vary wildly, says de Closey. “We’ve had some clients see returns of over 50 to 60 per cent year-on-year growth, while others have reported 10 to 20 per cent.”

“It really depends on the business as there are so many different pieces to factor in.”

As with regular hotels, the conversation around dynamic pricing is still one to be had with many operators, says de Closey.

“In the management rights space, some experienced operators can be a bit set in their ways,” he says. “They’ve been doing it for 15 or 20 years and don’t have the understanding or knowledge to increase what they need to do in terms of revenue management.”

“It’s also the case that in the regional markets, dynamic pricing is not as prevalent as the metro markets. It’s really a matter of education and explaining to operators the advantages of dynamic pricing.”

13

DYNAMIC PRICING TAKEUP INCREASING

Melissa Kalan, CEO, Australian Revenue Management Association (ARMA), says the adoption of revenue management and dynamic pricing in the accommodation sector has significantly improved in the last decade.

“Larger hotel chains and upscale accommodations were early adopters, starting in the late ‘80s and early ‘90s,” she says. “Over the last 10 years, and particularly from around 2016, we’ve seen a much greater uptake from holiday parks, resorts, apartmentstyle properties, franchisee networks and many more independent operators.”

"In the last five years, the barriers for small operators to adopt dynamic pricing have drastically diminished."

ARMA was founded in 2011 to improve the understanding of the practice of revenue management and dynamic pricing within the accommodation sector.

“Operators such as Choice Hotels Asia-Pac and Best Western Hotels & Resorts began offering a revenue management opt-in service for their franchisees with great success,” says Kalan.

“There was a lag in tech operators serving the broader mid-market that could accommodate a broad range of budgets and the nuances that small-medium operators have over large chains. This has changed drastically in the last five years, breaking down barriers to entry for many operators. With an abundance of data, including the AI capabilities of today, many of the larger chains are incorporating data for dynamic personalised pricing and lifetime customer pricing strategies.” END

Dynamic Uplift

Switch Hotel Solutions was engaged in July 2021 by the owner of a 31-room motel in Outback Queensland to implement revenue management. Switch applied dynamic pricing using a combination of its own proprietary software together with Lighthouse (formerly OTA Insight) and RoomPriceGenie, as well as benchmarking data STR.

Within a year of using dynamic pricing, the motel’s monthly revenue of $70,000 increased to over $100,000 in July 2022 and then to over $129,000 in July 2023. Occupancy of 45% in July 2021 almost doubled, reaching 85% and 86% in July 2022 and July 2023 respectively. The graph on the right shows the revenue uplift month-on-month.

Parks & Tech

In the holiday and caravan park space, Australia’s largest owner-operator Discovery Parks has led the way on dynamic pricing. Discovery first trialled dynamic pricing in 2018 and now has 50 of its 87 parks around Australia using AI software Ideas (styled IDeaS).

Pricing is controlled by Adelaide support office, which decides whether a park should go on Ideas, but with the active engagement of park managers. Discovery Parks’ competitor sets include other parks in the area, as well as motels offering facilities similar to caravans such as kitchenettes, and even apartments offering full-size kitchens which are akin to park cabins.

“Generally speaking, we aim to not under-price ourselves against a competitor motel or overprice ourselves against a luxury apartment,” explains Wayne Chang, General Manager – Commercial Strategy, Discovery Parks.

In adjusting prices, Ideas will consider a host of factors, including OTA ratings of competitor parks. If a competitor park offers similar facilities but has a lower rating on Booking.com due to, say, poor guest

Melissa Kalan, CEO, Australian Revenue Management Association (ARMA).

14 Feature

“Airlines have done a great job educating consumers on dynamic pricing.”

service, Ideas can adjust the rate of the Discovery Park accordingly.

Says Chang, “Consumers will go online and say, ‘Well, Discovery has a 9.2 rating on Booking.com, but this other one has only 8.1.’ It helps consumers decide, ‘Well, for another $20 a night I’d be happier staying at a place with a higher rating.”

Chang says dynamic pricing benefits park guests as much as park operators.

“With dynamic pricing, we can achieve strong margins when demand is at its highest and offer lower tariffs through off-peak periods,” he says. “This means we’re able to provide a price point that suits a certain segment in the market who can’t afford to travel in peak periods but who now can because we’ve provided affordable rates in times of low demand. That's a win for consumers and allows us to achieve additional occupancy during times we may otherwise be much quieter."

While the introduction of Ideas and dynamically changing rates has been an education process within business, Chang says today’s consumers are savvy and expect prices to move around.

“Airlines have done a great job educating consumers in this space,” he says. “The pressure is not really on the accommodation industry. Consumers realise if they book late, they could miss out or have to pay more. They understand that, depending on the time of year, if they leave it too late to book, they probably may not get the room type they want and that rates will most probably go up.”

Ideas updates prices three times a day but getting the timing of those updates right is crucial, says Chang.

“Our research shows consumers have a habit of looking for destinations during their work lunch break as well as when they get home from work,” he says. “So, we make sure we update our pricing before the majority of consumer activity happens during the day.”

END Yearly Comparison (by Month)

15

2021 2022 2023

Go, Go Gadget

Remote Control

Contactless motel management is a growing trend — and smart locks are making it increasingly viable

No contact. No keys. No drama. Hi-Way Motel Grafton is a 31-room budget motel whose manager is onsite about once a month. The rest of the time, he’s managing the motel remotely from his Brisbane home, over three hours’ drive away.

“We were looking at going contactless pre-Covid, but Covid really put it into focus for us,” says Hi-Way’s manager Cameron Mackay.

“Guests would just walk off with keys or not respond when we asked for them back. With inflation, costs have gone out of control. It’s now about $200 to replace a traditional lock. So, we needed a solution.”

Enter Salto KS , a cloud-based smart lock system that gives motel managers control over room access from anywhere at any time. The Spanish-based company’s locks are now used by over 20 million guests in 90 countries.

Mackay was introduced to Salto at a NoVacancy Expo in 2022. By January 2023, Hi-Way Motel Grafton had Salto installed. At $60,000, including internet upgrades, the cost was steep, but worth every bit of the owner’s investment, says Mackay.

Salto locks are activated by a six-digit access code the guest will receive by text and email about 10 minutes before check-in commences. The guest simply enters the code into the lock’s keypad to get room access. Mackay has set up a profile for each room within the Salto KS system that will generate a fresh code for each new reservation. Housekeepers and supervisors are issued their own separate codes.

“The efficiencies are terrific,” says Mackay. “It really does the job perfectly for what we need. For guests, it gives them a lot more reassurance and safety. We don’t generate the access codes. They’re all auto generated by Salto.”

Feature 16

From smart locks to smart apps and destination EV charging, tech is revolutionising accommodation businesses

“Another benefit is that it has helped reduced bad debts. We don’t send the room access code without payment first."

“Also, if a guest breaks house rules, we can lock them out of their room straight away. Fortunately, we’ve only had to do that once. If need be, we can give emergency services a unique access code as well.”

Mackay says most younger guests love contactless management, but there is a generational divide.

“Smart locks give both guests and managers a lot more reassurance.”

“Some people love the fact they don’t see anyone, that they can walk straight into their room. Older guests aren’t that sold on it. Most in that demographic want a manager physically there. I’d say if you’re considering implementing a smart lock system, it’s worth thinking about whether it’s suitable for your guest profile.”

Hi-Way’s owner is now looking to install Salto at two of his other properties, a backpackers’ hostel in Ayr and a nine-room motel in Mackay (North Queensland), which is also managed remotely by (Cameron) Mackay using traditional lock boxes and physical keys.

“Personally, managing multiple properties, it’s better for my own mental health,” says Mackay. “I can carve out a reasonable life for myself. When you’re always onsite you kind of get caught up in your own world, and it’s 24/7 stressful. Contactless is much better. I went up to Mackay last week and was still operating Grafton in transit very easily. All I needed was my phone and laptop.” END

17

Go, Go Gadget

Plugand Play

ChargeBoss brings EV charging to accommodation businesses

Destination electric vehicle (EV) charging is becoming increasingly important in the accommodation space. Rising demand is driving hotels, motels and resorts to consider installing EV charging for guests.

“Destination EV charging is fast becoming a pivotal point of difference in the choice of accommodation for the growing number of EV drivers, which tripled in 2023,” says Emma Allen founder and director of ChargeBoss.

“We’re going to get to a point in the next 10 years where EVs make up 50 to 80 per cent of new car sales."

“From an accommodation perspective, EV drivers will use EV charging station maps like PlugShare which enables us to see exactly where chargers are and how to map our trip."

“Say a hotel has EV charging and another doesn’t. As an EV driver, my preference would be the hotel with EV charging. It can literally put you on the map.”

“EV charging is fast becoming a pivotal point of difference.”

Allen launched ChargeBoss in May 2023 to provide accommodation businesses, clubs and entertainment venues with fully automated 24/7 EV charging stations. ChargeBoss stations require no handling by hotel/motel staff. There are no apps, subscriptions or calls. Guests interact directly with the charger. They simply scan, pay and plug their car into the charger.

“Guests can then sit by the pool, have lunch or leave it overnight,” says Allen.

ChargeBoss’ system generates direct revenue for the hotel, allowing operators to set their own charge rates (for example, 29 cents per kilowatt) and run tailored marketing campaigns.

Feature 18

“A hotel can offer free charging if, say, a guest spends $50 at the bar,” says Allen. “Or, they could have a free charging weekend for dads on Father’s Day.”

Based in St Leonard’s, Sydney, ChargeBoss has a growing list of accommodation clients from smaller boutique hotels to the over 50-rooms range in New South Wales, Victoria and Western Australia, with plans to expand into other states. The business has just been designated as preferred EV charging provider by a large hotel chain, to provide a consistent solution across its operators nationwide.

Chargers range from Level 2 AC medium-to-long dwell time chargers to Level 3 DC fast chargers. The fastest DC chargers can fully juice EVs in as little as 15 minutes.

Allen says implementation costs will vary depending on the age of hotel and how much wiring is needed. Charging units can cost as little as $2,000 to $2,500 and are OCPP (open charge point protocol) compliant, making it eligible for various grants. Installation varies from $3,000 to $30,000 or more depending on the requirements of the site.

Allen says she was inspired to start ChargeBoss to fill a gap in the hospitality market.

“If a hotel wanted to do it themselves it would be hard for them to research,” she says. “Who do I know who does this? What chargers are commercially viable? What software do I integrate with it? What ChargeBoss has done is build an eco-system that integrates the charger with the payment software and electrical infrastructure. It’s an all-in-one solution.” END

19

Go, Go Gadget

A Touch of Paradiso

Paradiso Place’s smart phone app give its residents control of everything in a single app (yes, just one)

Feature 20

The three glittering towers that will comprise Paradiso Place in Surfers Paradise are still under construction, but SPG Land’s flagship Australian development has already collected a swag of industry awards.

The $1 billion luxury development swept last year’s 5th Annual PropertyGuru Asia Property Awards (Australia) with seven wins from seven nominations, including the coveted Best Apartment Development (Queensland) award.

Among the prizes Paradiso Place took home was Best Smart Building Development. This was due in large part to the development’s integrated smart phone app that gives residents everything they need to control in a single app, activated by a finger click or voice command.

“Most developers think of smart home technologies as an afterthought,” says Lester Lim, SPG Land’s Senior Regional Marketing Director. “What we’ve done is work at the planning stage of Paradiso Place to develop the Paradiso Place app.”

“Paradiso Place’s app is integrated which means the same app allows you to control all the devices in the home.”

Paradiso Place’s app controls everything, including air conditioning, lighting, curtains and intercoms and connects with building management services to allow residents to book amenities and concierge services.

“With other developers, if they give you a smart lock from Yale, for example, you have to use the Yale app to open the door,” says Lim. “If you get aircon from, say, Mitsubishi they’ll give you the Mitsubishi app that comes with it, which means you need to open a second app to control your air conditioning.”

“Because we’ve planned this from the ground up, Paradiso Place’s app is integrated which means the same app allows you to control all the devices in the home.”

Each of Paradiso Place’s 258 apartments are fitted with a smart hub that integrates all appliances. Residents can ‘set the mood’ of their apartment before they arrive home or grant access to their guests remotely.

“Because we did the planning from the start, we also installed smart solutions in the common areas,” says Lim. “What this means is that our app allows you to send an invitation. I can, say, invite you to my apartment in Paradiso Place through the app. You will be sent a QR code, which you accept. When you arrive at Paradiso Place you can scan the QR code at the door for access. Or, say you have a function on Level 26 of the building. The QR code will allow you access to Level 26. The resident doesn’t need to come down to get their guest. They don’t need to buzz them in or make a rearrangement or whatever. Of course, for security purposes, the QR code is one-time use only.”

Paradiso Place Tower 1 opens in 2026. END

21

SPRING HILL TERRACES

SPRING HILL, QLD

REF

Rare, inner-city Brisbane freehold motel, one of the last remaining

A scarcity of accommodation so close to central Brisbane makes the freehold going concern of Spring Hill Terraces Motel & Apartments an extremely rare offering, one of the few that has not already been snapped up by investors.

The 28-room Spring Hill Terraces occupies a prime inner-city site along Water, Warry and Kennigo streets, only 1.5 km from the CBD and a few hundred metres from Fortitude Valley. The large lot size of 1,672 sqm is extremely rare for inner Brisbane, adding to this freehold asset’s incredible development potential.

Currently operating as a budget motel, this versatile asset’s wide variety of room configurations range from fully self-contained two-level townhouse and studio apartments to standard rooms, twin rooms and singles.

Inner Brisbane is a major beneficiary of Brisbane’s ongoing population boom which will continue to drive demand for existing accommodation, especially in the current market where there are significant barriers to entry for new supply. For the new owner, this incredibly versatile asset invites repositioning, redevelopment or to simply continue as is.

• Rare, inner-city Brisbane freehold accommodation in a tightly held market

• 28-room motel occupying a prime inner-city Spring Hill location, only 1.5 km from the CBD

• Large 1,672 sqm lot, incredibly rare for inner Brisbane

• Huge guest demand for Brisbane city-fringe accommodation in a squeezed supply environment

• Recent refurbishments by the owner of approximately half the motel’s rooms

• Ideal for repositioning or redevelopment to upscale or luxury accommodation to capitalise on Spring Hill’s unique character and location

• Untapped potential to attract corporate, public sector and hospital guests

• Dynamic pricing and savvy digital marketing will unlock revenue and increase occupancy

• Huge upside to increase the motel’s easily achieved annual net profit of $825,000

• Wide variety of room configurations, including 7 fully self-contained two-storey townhouse apartments

VICTORIA PARK QUEEN’S WHARF SPRING HILL TERRACES MOTEL & APARTMENTS CROSS RIVER RAIL BRISBANE ARENA ROMA ST PARKLANDS BRISBANE BOTANIC GARDENS ST ANDREW’S WAR MEMORIAL HOSPITAL ROYAL BRISBANE & WOMEN’S HOSPITAL HERSTON NEW FARM FORTITUDE VALLEY SUNCORP STADIUM BRISBANE CBD MILTON BRISBANE SHOWGROUNDS

// FH008163

FREEHOLD MOTEL 28 ROOMS

NET PROFIT $825,000 TURNOVER $1,288,267 PRICE $8,900,000 TRUDY CROOKS Managing Director 0477 882 210 trudy@resortbrokers.com.au ALEX COOK Director 0467 600 610 alex@resortbrokers.com.au

1,672

SQM BLOCK INNER CITY LOCATION

Boost your business without the extra hours. Collaborate with Choice Hotels™ and take your business to the next level, leaving more time to spend on the things you love. Visit JoinChoiceHotels.com.au or call 03 9243 2500 Invest in you.

24

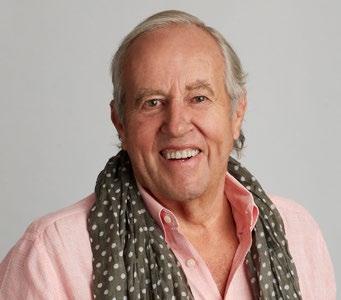

Faces of the Industry

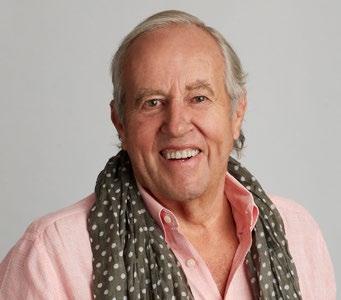

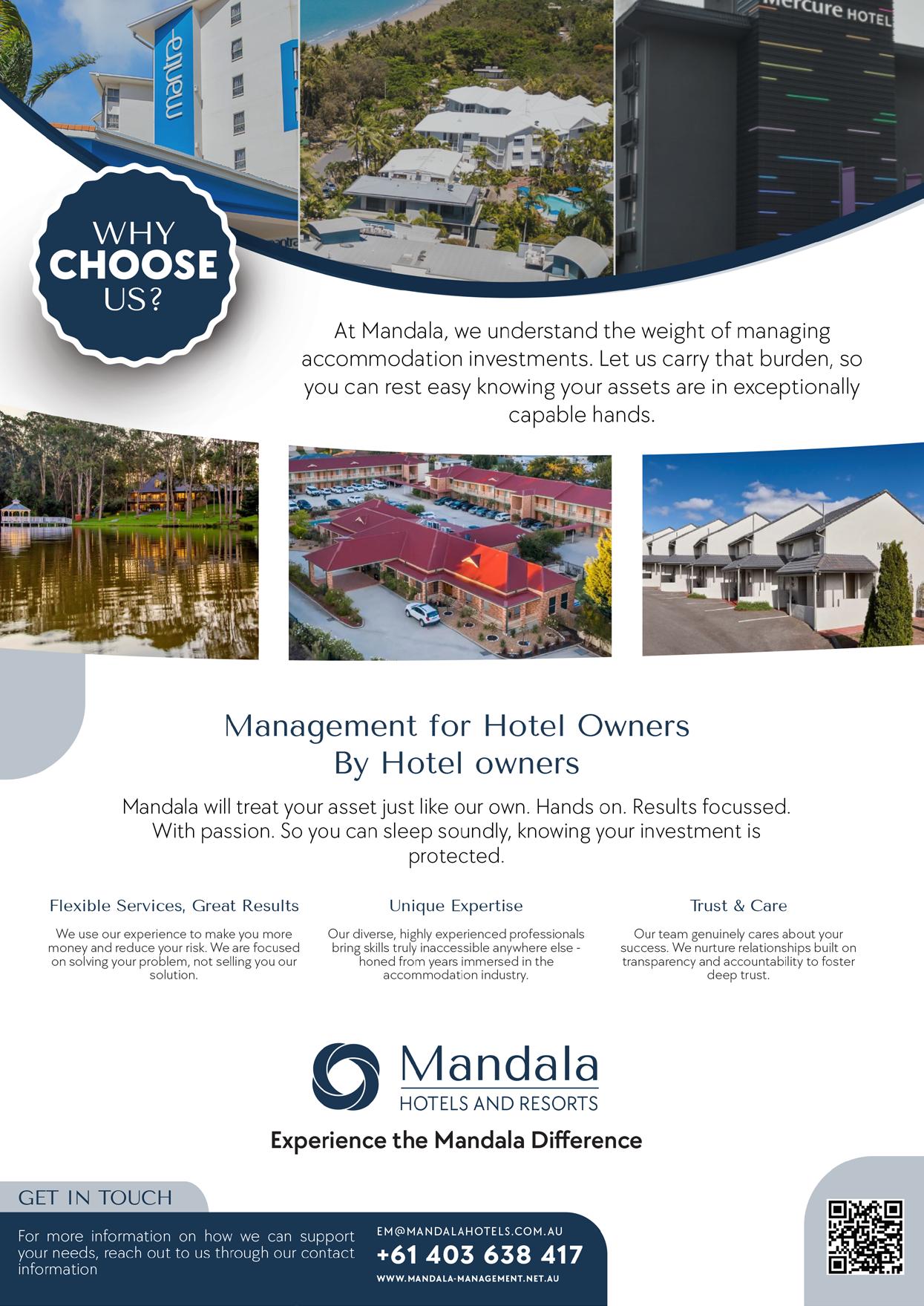

Mandala Asset Solutions’ John Zeckendorf discusses his company’s steep ascent, whether money can buy happiness, and breaking down mountain-size problems into manageable molehills.

Words_John Miller

When John Zeckendorf was preparing to climb Denali on his quest to conquer the Seven Summits, he would take a dice along on his regular training sessions. If at the end of any session he rolled a six, he committed to repeating the session in full. Zeckendorf’s idea was to introduce a chance factor, something he couldn’t control. Hence the dice.

“Denali’s weather is completely unpredictable,” says Zeckendorf. “You can turn up at a campsite to find it too dangerous to stay in or that it’s blown away entirely. So, you have to push on to the next camp or climb back down to the last one. It’s like running a marathon only to realise you have to run it again once you get to the finish line. So, I introduced a random element, something outside my control in order to adjust my mindset, if necessary. If I rolled a six, I had to do the whole thing again regardless of what it was I’d just done. In one case, it was an eight-hour run. I had to call my wife to tell her I’d be a bit late.”

The method in this madness worked. Zeckendorf went on to summit Denali, his third of the seven following his earlier climbs of Kilimanjaro and Elbrus. After Denali, it was Vinson, then Aconcagua, which he managed on his second attempt in 2016. The following year, he became the first Tasmanian to summit Everest, thereby completing his conquest of the Seven Summits, the highest mountains in each of the seven continents.

Broad Peak, opposite K2, is a likely contender were Zeckendorf to attempt another summit above 8,000 metres. “But don’t tell my wife,” he jokes. As to why he climbs the world’s tallest mountains, he gives a Malloryesque response: “I climb them because they’re mountains I want to climb,” he says.

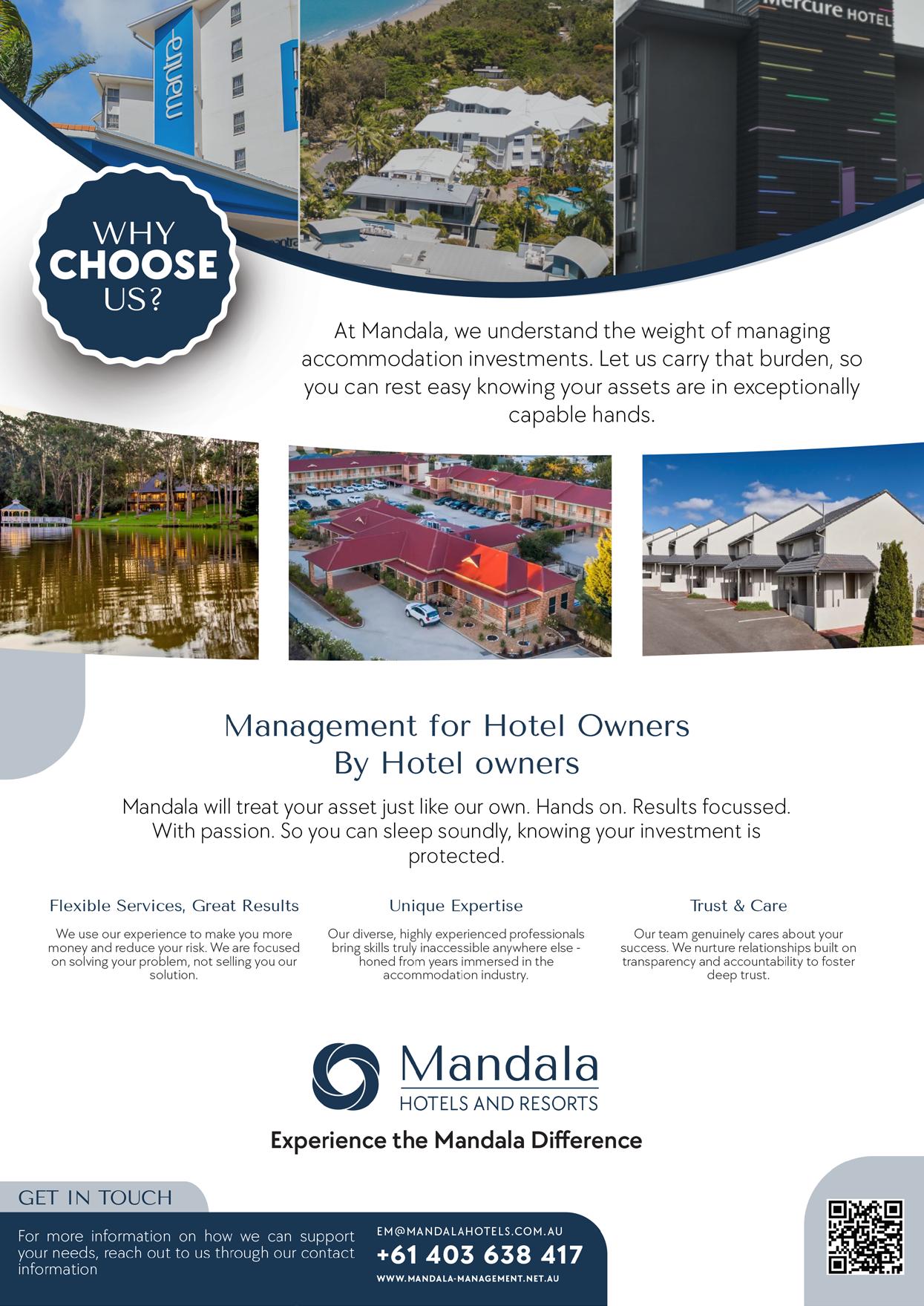

Throughout this mountaineering at high altitudes, Zeckendorf has also managed to steer Mandala Asset Solutions, one of Australia’s largest regional accommodation funds, which he founded in 2002 with business partner Ryan Shaw.

The pair met working at PricewaterhouseCoopers in the 1990s where they specialised in insolvency. When Southeast Asia melted down in the 1997 Financial Crisis, they relocated there to take on a number of floundering assets. The skills Zeckendorf acquired came in handy when, in 2000, he left PwC to reconcile the profligate spending of Prince Jefri Bolkiah, the notorious playboy and younger brother of the Sultan of Brunei, who chalked up $40 billion worth of debt. More on this later.

Mountaineering has helped Zeckendorf navigate the commercial challenges his work has thrown him, but business has also informed his mountaineering. The trick, he says, is to break down the mountain, be it figurative or actual, into smaller manageable targets.

“You end up in this position where it doesn’t really matter what’s thrown at you, you can find a way through it,” says the 53-year-old, who is based in Kingston Beach, just outside Hobart.

25

“People get overwhelmed by the enormity of what’s before them. Most people look at a big problem and focus on the wrong question. They think, gosh, how can I do that? But they need to ask, what do I need to be able to do to break that down into something I can do? You do that quite a lot with climbing mountains. You don’t think of the enormity of the mountain in front of you. You think, OK, what do I have to do next?

I’ve just got to make it up to here. I’ve just got to go there. I know I’ve got to get through this tricky bit, so I need to practice and prepare for it. When you get around to actually doing it, it’s just a matter of putting it all together.”

Mandala’s success has come from assembling those constituent parts. From a single hotel acquisition in 2002, it has grown its portfolio to 35 properties in 22 cities across Australia, representing some $200 million in accommodation assets under management. Mandala is also expanding its external management offering to owners of regional and city accommodation properties that want to benefit from Mandala’s highly successful operating model.

“The word mandala means segment,” says Zeckendorf. “It’s when you put the segments together that you end up with the whole. It’s about the

harmony of the elements working together. Take any one segment away and it doesn’t work. It’s a principle most people have heard of, the idea of taking things that aren’t the same and putting them together, with the whole being greater than the sum of its parts. That’s what Mandala has always done. We’ve always collaborated with people in long-term partnerships. We tend not to do one-night stands, we’re much better at being married."

“It works in a business sense. It’s not that we’ll only work with certain people, it’s that when you find a formula that works you want to keep it going to some extent. That’s what’s really worked well with ResortBrokers.”

“When you find a formula that works you want to keep it going to some extent. That’s what’s really worked well with ResortBrokers.”

Mandala’s primary focus is the acquisition and management of accommodation properties in regional locations, where Zeckendorf says you will always find better

returns than major metropolitan areas. The company is attracted to accommodation businesses in regional economic centres that are export driven, especially by mining or agriculture, or have strong government-based services or domestic tourism.

“The returns can be fabulous,” he says. “But often these accommodation businesses and regions are often overlooked by investors.”

“There’s probably a number of reasons why. For one, these buildings often aren’t shiny or glamourous. They may be in towns people haven’t heard of, or if they’ve heard of them, it may not have been for the right reasons. It’s also quite an ordeal just getting to some of these towns because of the vast distance. Then there’s the issue of management. If you want to run something in the middle of nowhere, you’re probably not going to attract a firstclass manager. We’re lucky. Most of our managers are fabulous and we can track them because we’re bigger.”

Besides mountaineering and commerce, Zeckendorf has been on another journey, one which guides his life, personal relationships and business ethics. No profile of him would be complete without

26 Faces of the Industry

mentioning it, though accepted wisdom tells us the subject should not be discussed in polite company.

Raised Jewish, and with a grandfather who perished in Auschwitz, Zeckendorf converted to Christianity when he met his wife in his 20s and remains a committed Christian today. He is comfortably open about his Christian faith, neither pushy nor reserved.

“Everyone in Mandala knows my faith position but it doesn’t mean I broadcast it,” he says. “A Russian friend of mine says, ‘You Australians don’t talk about religion or politics, but we Russians realise there’s nothing else worth talking about.’”

“I realise I’m not just accountable to my investors but to a higher authority. I know I could make more money if I cut corners, but I want to do the right thing. The good news is that when Fair Work does an audit on any of our employees, we never have a problem as we don’t underpay them!”

Between 2000 and 2002, Zeckendorf opened one of the most unique chapters in his storied life when he worked to reconcile the debt of Prince Jefri Bolkiah who served as Brunei’s Minister of Finance and Economy before being undone by the 1997 Asian financial crisis.

Zeckendorf was recruited by his predecessor, a friend from his PwC days who had burnt out working to square the debt, whose parting advice was to stay well clear of court politics.

“It was the best tip he gave me,” says Zeckendorf. “And he was absolutely right. That wasn’t my job. My job was to clean up the mess.”

“Basically, they threw me the keys to 70 assets around the world, including luxury hotels, jewellery, palaces, you name it, and a whole bunch of toys. We had about $5 billion worth of assets. But we also had $40 billion worth of

liabilities. So, we had a mismatch between the prince’s means and his responsibilities. My job was to resolve both sides of that equation. After three years I had basically done that.”

“It was the perfect role for me. It was a huge amount of autonomy and responsibility but solving these sorts of problems are fascinating to me. I’m a troubleshooter who likes a good crisis.”

Zeckendorf saw the trappings of extreme wealth as well as the traps it laid for the prince. It recalled, he says, the lament of King Solomon, the wise sage of the Old Testament, whose pursuit of his own pleasure did not result in lasting fulfillment, only spiritual emptiness. “Come now, I will test you with pleasure and gratification; so, enjoy yourself and have a good time. But behold, this too was vanity,” says Ecclesiastes, a book of the bible attributed to Solomon.

“His immense wealth left him wanting,” says Zeckendorf.

“Prince Jefri had many, many girlfriends, many mistresses and

a whole bunch of wives. Around mega wealthy people there’s also an abundance of what I shall politely call parasites.”

“That’s where all the loose women and cocaine and that sort of stuff was going on.”

“One of the last wives that came along, they actually really loved each other. He didn’t have money in those days, and she didn’t want money. She actually loved him. From what I saw at a distance that was probably the relationship that made him happier than everything else. It was just that one woman that he had fallen in love with, and she with him.”

As for Mandala, Zeckendorf says the plan is to develop the business for the foreseeable future. If the company were to reach $1 billion of accommodation assets under management, he says it would be highly attractive to a sovereign wealth or super fund for a roll up.

“For the next five, ten years we’ll grow it, but at some point in that journey someone will make us an offer and our investors may say, ‘OK, that sounds like enough.’” END

Mandala & ResortBrokers

SCALING THE HEIGHTS

Mantra Mackay (formerly Mackay Marina Motel)

Rydges Armidale (formerly Powerhouse Hotel Armidale)

Quality Inn Carriage House East Wagga Wagga, NSW

Mantra Bathurst (formerly Quality Hotel Bathurst)

Peninsula Boutique Hotel

Port Douglas, QLD

Thunderbird Motel Yass, NSW

Knotts Crossing Resort

Katherine, NT

Lincoln Downs Resort & Spa

Batemans Bay, NSW Cullen Bay Resorts Darwin, NT

27

Mt Barney Lodge Scenic Rim, QLD

Stunning Scenic Rim eco-friendly acreage accommodation

ResortBrokers in conjunction with Andreas Realty presents the amazing eco-friendly Mt Barney Lodge.

Mt Barney Lodge is the perfect destination for conferences, seminars, team-building retreats and camps. With its unique location bordering the World Heritage-listed Mt Barney National Park, and around a 2-hour drive from the Brisbane and Gold Coast airports, the lodge provides the perfect backdrop for corporate or educational events.

Tightly held by the same family for many years they have developed a solid school groups, families and corporate bookings, year round. Adventure activities, catering, F&B and conferences create a diversified income stream away from the more traditional accommodation services provided.

The unique atmosphere of getting back to nature by day and then relaxing in various levels of comfort by night, provides an edge over other properties on the market. A must inspect for anyone looking for a quality eco-friendly accommodation business.

• 3 renovated Queenslanders

• 2 rustic family cabins

• 2 deluxe hybrid caravans

• 2 Mountainview camper trailers

• Campground capped at 100 pax for comfort

• Amenities Block

• Site Office

• Adventure activity packages

REF // FH008199

SPECIAL PROJECT

On qualification Net Profit $ Offers around $4.5M Price $ On qualification Turnover Jason Vogler Broker, SE & SW QLD jason@resortbrokers.com.au +61 427 431 213 Andrea Sommerville Andreas Realty andrea@andreasrealty.com.au +61 439 413 555

Agnes Water Beach Club

Regional Australia’s best buy — by far!

Situated in the heart of Agnes Waters, the Agnes Water Beach Club showcases 36 two-bedroom self-contained apartments, strategically positioned near shops, cafes, and Australia’s northernmost surf beach.

The manager’s residence includes a fully air-conditioned, ground-level apartment featuring two bedrooms, two bathrooms, and an outdoor deck.

Boasting a net income nearing half a million dollars, along with a robust body corporate salary and a low buy-in multiplier, this property stands out as one of Queensland’s premier investment opportunities.

Agnes Water has earned recognition from Lonely Planet as one of Queensland’s top 10 holiday destinations. Acting as a gateway to the Great Barrier Reef, the town is enveloped by national parks, offering secluded beaches, breathtaking coastal landscapes, and excellent fishing opportunities.

• Accommodation module agreement

• Fully staffed if you don’t want to operate it yourself

• Prime location in the heart of Agnes Water

• Two-bedroom manager’s residence

• 31 units in letting pool

• Solid body corporate remuneration

REF // MR008151

Agnes Water, QLD 36 APARTMENTS 31 LETTING 17 YEARS OWNER’S RESIDENCE 2 BED 2 BATH MANAGEMENT RIGHTS $480,000 Net Profit $ $490,000 Real Estate Price $ $1,950,000 Total Price $ $1,460,000 Business Price

Chenoa Daniel Broker, Sunshine Coast chenoa@resortbrokers.com.au +61 403 143 151 Glenn Millar Broker, Sunshine Coast glenn@resortbrokers.com.au +61 412 277 804

REFLECTIONS

Coolangatta Beach

With a net operating profit (NOP) of $1,977,775 for FY23, this is a genuine ‘super rights’ offering, one of the largest ever to come to market on the Gold Coast.

This premium management rights business would suit an experienced operator looking to expand their portfolio with a top-tier complex.

Situated in the heart of Coolangatta directly across from Greenmount Beach, Reflections Coolangatta Beach’s two landmark towers, Reflections on the Sea and Reflections Tower 2, each rising 21 storeys, have made it one of Coolangatta’s

Landmark Coolangatta resort in prime beachfront location

NOP $1.97M backed by $608K BC salary across two schemes

202 total apartments over 2 towers

84 apartments in letting pool 25-year caretaking and letting agreements

most recognisable and sought-after holiday destinations.

Comprising 202 luxury apartments and resort-style facilities, Reflections Coolangatta Beach’s exceptional visitor appeal is reflected in its extraordinary occupancy rate of over 92 per cent, which is some 25 per cent higher than the Gold Coast average of 67 per cent (as per STR data for the calendar year to July 2023).

On Booking.com, Reflections on the Sea and Reflections Tower 2 enjoy a “Fabulous” 8.7 rating and a “Very good” 8.2 rating respectively.

Consistently high performing holiday business with repeat clientele

Fantastic occupancy rate 92%+

Highly experienced on-site management/staff

Multi award-winning property

$1,977,775

Expressions

Net Profit of Interest

C O O L A N G A T TA B E CA H Premium

Super

Landmark

REF // MR008090 202 APARTMENTS 84 LETTING 25 YEARS 2 TOWERS MANAGEMENT RIGHTS

Coolangatta

Rights.

Property.

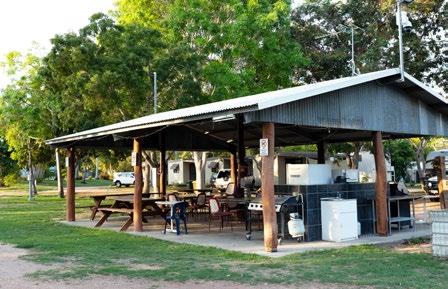

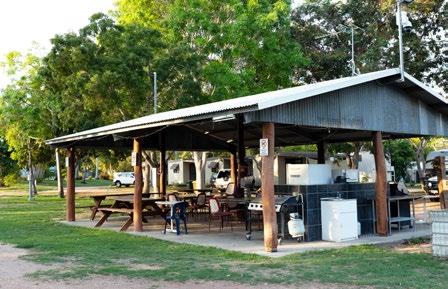

Charters Towers Tourist Park Charters Towers, QLD

Charters Towers Tourist Park offers an exceptional opportunity and a proven track record

Charters Towers Tourist Park has been meticulously owned and operated for seven years, demonstrating a proven track record of revenue growth and operational excellence.

The park offers a diverse range of accommodation options, from comfortable ensuite cabins to powered sites, catering to a broad range of guests. Recent improvements include an upgraded camp kitchen, painted amenities and new air conditioners in several cabins.

In addition, the park is equipped with 16 security cameras, ensuring a safe and secure environment for guests, as well as Wi-Fi throughout the premises, giving guests uninterrupted connectivity during their stay.

Charters Towers Tourist Park is situated in a town buzzing with development activity with a strong presence of boarding schools as well as promising a steady influx of local visitors and tourists to spur potential further growth.

This is a unique opportunity to invest in a thriving tourist park with multiple accommodation streams, a strong growth trajectory and a prime location in a bustling town.

The Charters Towers Tourist Park is more than just a business; it’s a lifestyle and a chance to be part of the Charters Towers tourism industry.

• Steadfast ownership and operation spanning 7 years

• Positioned as a top-tier tourist destination

• Offers a diverse array of accommodation options

• Consistent track record of revenue growth

• Located in a dynamic town with significant regional development

• Park-wide Wi-Fi for guest convenience

• Features a comfortable and well-equipped manager’s residence

REF // FH008081

$665,115 Net Profit $ Price $4,750,000 $ Turnover $1,107,134 Des Fagg Broker, Townsville & Surrounds des@resortbrokers.com.au +61 427 849 119 CARAVAN PARK OWNER’S RESIDENCE 4 BED 1 BATH 30 CABINS 62 CARAVAN SITES 2 HECTARES

Mulga Creek Hotel Byrock, NSW

This FHGC has it all! Hotel/motel, caravan park

and lucrative mail-sorting business

The Mulga Creek Hotel is more than just a place to stay; it’s a destination in itself that attracts visitors from far and wide, eager to experience the charm and hospitality of this iconic establishment.

The hotel is the town. It serves as a central meeting place and postal delivery hub, further cementing its importance within the local community.

The property boasts a commercial kitchen, enabling the provision of quality food services to guests and locals alike. The hotel also includes three motel rooms attached directly to the main building, providing convenient and comfortable guest accommodation.

The caravan park and cabins offer additional accommodation options, ensuring the property caters to a wide range of visitors.

One of the standout features of this opportunity is the annual mail sorting contract, which generates an additional income of $50,000. This not only provides a steady revenue stream but also further integrates the hotel into the fabric of the local community.

• Multifaceted property offering hotel, motel, caravan park, cabins and camping facilities

• Additional annual income of $50,000 from onsite mail sorting service

• Three motel rooms conveniently attached to the main hotel building

• Additional accommodation options are provided by cabins

• The property serves as the central hub of the town

• Equipped with a commercial kitchen for quality food service

• Inspections are by appointment only

REF // FH008008 $175,323

Profit

Net

10.6 HECTARES OWNER’S RESIDENCE 2 BED 1 BATH FREEHOLD HOTEL

$ $1,100,000 Price $ $554,805 Turnover Chris Kelly Broker, Central West NSW chris@resortbrokers.com.au +61 431 055 221

Quest Yelverton Kalgoorlie Kalgoorlie, WA

Quest regional powerhouse with net profit over $1M located in WA’s Golden Outback

The immensely profitable Quest Yelverton Kalgoorlie is on the market for the first time in 18 years. Situated in the mineral-rich Goldfields region of Western Australia, Quest Yelverton Kalgoorlie comprises an extensively refurbished 50-key complex situated in the heart of Kalgoorlie. The business has consistently high occupancy rates (3-year average of 83%) and a corporate client ratio above 75% making it the go-to Kalgoorlie destination for corporate travellers from around Australia.

Quest Yelverton Kalgoorlie has solid leases in place with multiple option renewals available out to 2046, which gives an incoming owner security of tenure and the opportunity to grow and develop the business over time. The apartments have been consistently upgraded with the staggered refurbishment of three accommodation blocks completed from 2017 to 2019.

Kalgoorlie is the gateway to the Goldfields region and has thriving mining and tourism industries which attract visitors from around Australia.

The business is backed by the successful Quest franchise model. This business would suit a first-time operator and/or an experienced business owner looking to join the prestigious Quest brand.

• High revenue and profit performance

• Operated under the Quest brand

• Long-standing relationship with key corporate clients

• Predominantly refurbished facilities

• Excellent lease tenure with comparatively affordable rent

• Central Kalgoorlie location

• Extensively refurbished 50-key strata complex

• 23 years remaining on lease terms including options

REF // LH007991

Blair Macdonald Broker, Western Australia blair@resortbrokers.com.au +61 433 149 144 $1,167,767 Net Profit $ Price $3,790,000 23 YEARS ON LEASE 50 KEYS HOTEL LEASEHOLD OWNER’S RESIDENCE 1 BED 1 BATH

Dragon Phoenix Resort & Restaurant

353 & 361-363 Frome Street & 332-338 Balo Street, Moree NSW

ResortBrokers has been appointed by Receivers and Managers to market, by way of an expressions of interest campaign, the following assets which are offered to the market separately and in one line:

• the freehold going concern and business operations of the Original Dragon & Phoenix Motel at 361-363 Frome Street, Moree NSW 2400 (situated at Lot 21, 22 and 23 on DP1154009);

• the freehold going concern and business operations of the (former) Billabong Motel at 353 Frome Street, Moree NSW 2400 (situated at Lot 100 on DP1080846); and

• Lot 20 (DP1154009) at 332-338 Balo Street, Moree NSW 2400.

Original Dragon & Phoenix Motel occupies a 4,406 sqm* lot and comprises 39 rooms including a two-bedroom manager’s residence, a restaurant and commercial kitchen, function room, and two outdoor artesian thermal baths.

The (former) Billabong Motel occupies a 2,113 sqm* lot and comprises 24 rooms, including a three-bedroom manager’s residence.

Lot 20 (DP1154009) occupies a 2,984 sqm* lot. The building on the lot comprises 34 partially complete apartments in respect of which no final occupation certificate has been issued.**

The property includes two tradable water licences (Water Access License No. WAL20980 and WAL15676) which relate to an artesian bore located on Lot 22 on DP1154009.

An Information Memorandum is available in addition to further information in the Data Room.

• Motel comprising a total of 63 rooms in central Moree location

• Motel benefits from Moree’s locational advantages as a regional hub of northern NSW

• Potential upside through proposed Moree Special Activation Precinct

• Restaurant and function area offer a potential for additional income streams independent of letting business

• Includes two managers’ residences, one in each motel complex

• Array of solar panelling

• Surrounded by chrome moly fences which act as a security measure

REF // FH008183

* approximate ** Fire safety concerns, among other structural defects, have been identified in the construction ADDITIONAL LOT EXPRESSIONS OF INTEREST FREEHOLD GOING CONCERN MOTEL

For sale by expressions of interest closing Friday, 26 April 2024 at 5pm AEST. Boundary lines are indicative only Alex Cook Director alex@resortbrokers.com.au +61 467 600 610 Jason Vogler Broker, SE & SW QLD jason@resortbrokers.com.au +61 427 431 213 David Faiers Broker, Sunshine & Fraser Coast david@resortbrokers.com.au +61 432 766 788

L’Amor Holiday Apartments Yeppoon, QLD

Relaxed coastal lifestyle with a growing business

Discover the unique investment opportunity of L’Amor Holiday Apartments, nestled on the Lammermoor Beach and a stone’s throw from Yeppoon.

This exclusive management rights offers more than just a coastal lifestyle; it presents a thriving business venture with a robust repeat clientele base, including corporate guests and valued partnerships with Blue Care and the local hospital.

With 20 years remaining on long-term agreements and growing net profit, L’Amor is a beacon of security and profitability in the picturesque coastal market.

• Experience the perfect blend of business and coastal living

• Enjoy a strong partnership with Blue Care and the local hospital

• Benefit from a strong, repeat customer base, including extended-stay corporate guests

• Relish the security of long-term agreements, with two decades remaining

• Take advantage of low operational costs

• Delight in the property’s prime location, just minutes from Yeppoon’s city centre and directly opposite Lammermoor Beach

• Appreciate the ease of maintaining the property grounds

• Offers guests unique, individually styled, air-conditioned apartments with stunning island views

REF // MR008121

17 UNITS 13 LETTING 20 YEARS OWNER’S RESIDENCE 3 BED 1 BATH MANAGEMENT RIGHTS

Nathan Benjamin Broker, Central Queensland nathanb@resortbrokers.com.au +61 459 955 649 $208,800 Net Profit $ $700,000 Real Estate Price $ $1,400,000 Total Price $ $700,000 Business Price

Gunnedah Tourist Caravan Park Gunnedah, NSW

Enjoy a country lifestyle and solid income with this easy-to-run caravan park

This easily manageable caravan park is perfect for newcomers to the industry, tree changers or someone seeking a semi-retired lifestyle. Gunnedah Tourist Caravan Park offers a range of cabin, caravan and site accommodation set among 3.75 acres of spectacular land.

Located in a strong regional town, this well-established business has been consistently growing year on year. Along with the continued economic development in the area, undoubtedly it will bring more visitors to the region increasing the demand for accommodation and services provided by the caravan park

You may choose to operate with the current tourist focus, however, you may wish to capitalise on the initial development income along with an ongoing permanent stream of income. Gunnedah Tourist Park has a licence to operate 20 permanent dwellings providing an opportunity to add relocatable homes.

Gunnedah Tourist Caravan Park is a solid investment opportunity with a proven track record, strong growth prospects and a peaceful rural lifestyle. This is an opportunity not to be missed.

• Located in the bustling regional town of Gunnedah

• Untapped growth opportunity with no current OTA listings

• Spacious property spread across 1.6 ha of land

• Expansion potential with the ability to add relocatable homes

• Consistent business growth year on year

• Semi-retirement lifestyle opportunity in a thriving caravan park

• Key future growth planned for local region

Russell Rogers Senior Executive Broker russell@resortbrokers.com.au +61 416 166 909 Jason Vogler Broker, SE & SW QLD jasonv@resortbrokers.com.au +61 427 431 213 REF // FH008154 $346,651 Net Profit

15 CABINS 36 POWERED SITES MANAGER’S RESIDENCE 3 BED 2 BATH FREEHOLD CARAVAN PARK

$ $1,950,000 Firm Price $ $578,261 Turnover

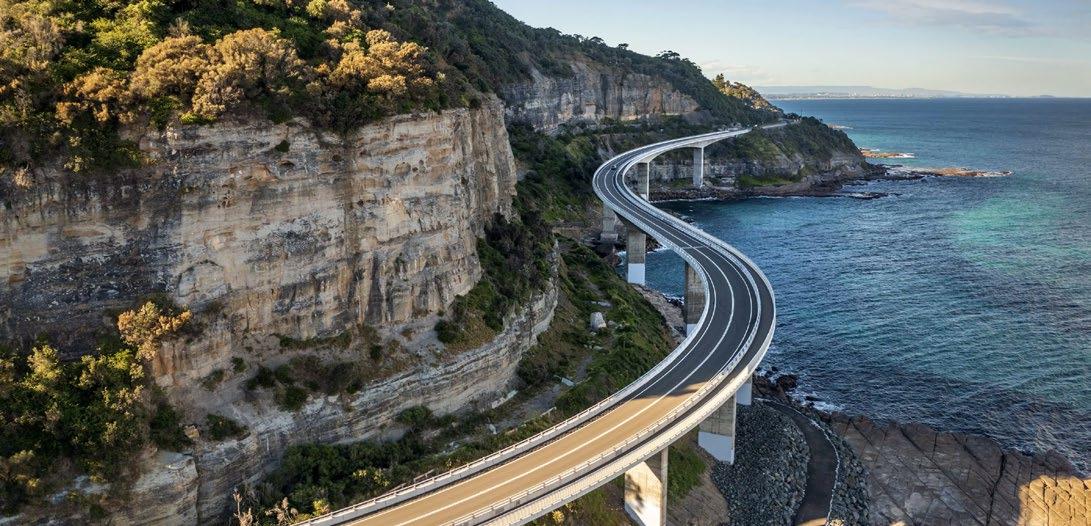

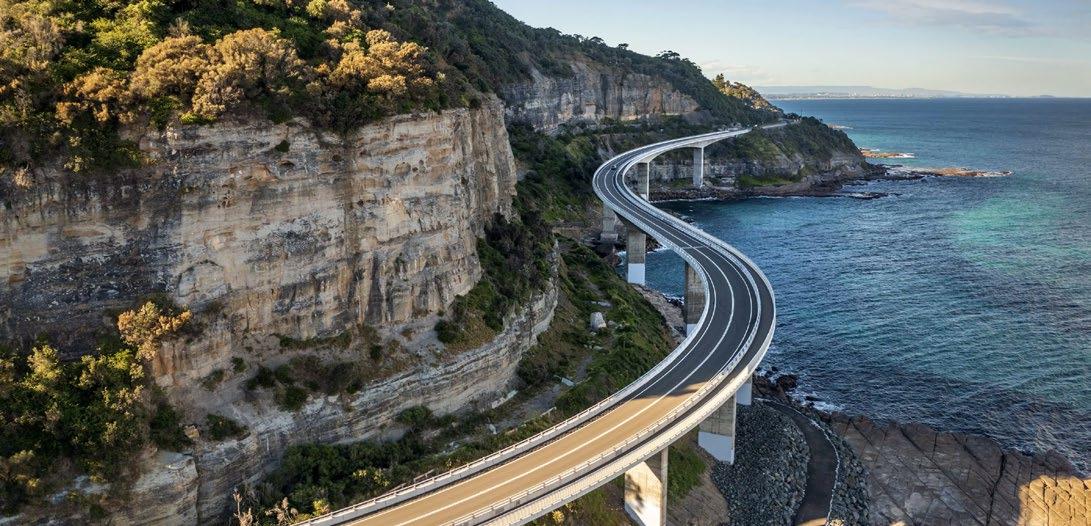

The reinvention of New South Wales’ third largest city is one of the great urban renewal stories of the last decade. Lord Mayor Gordon Bradbery spoke to Informer about how his council managed it.

Words_John Miller

The Gong is having a moment. In its official marketing, Wollongong spruiks itself as a “city of innovation”. Slick sloganeering, surely. But money doesn’t lie. Billions of investment dollars are pouring into Wollongong at a rate of knots. Cranes dot the skyline, new hotels are popping up, and bars and restaurants are abuzz into the wee small hours. Last year, the NSW Top Tourism Town Awards recognised Wollongong’s leisure appeal with a top three place.

“We’ve been in Sydney’s shadow for so long, people are discovering something quite incredible has happened right under their nose,” says Lord Mayor Gordon Bradbery.

Regional Spotlight 38

Bradbery, 72, has overseen Wollongong’s renaissance as mayor for the last 12 years. Wollongong City Council under his leadership has been vigorously pro-business and forward thinking, working to a 10-year masterplan,

“ Sydneysiders are discovering something quite incredible has happened right under their nose.”

Economic Development Strategy 2019–2029. Invest Wollongong, a collaboration between council, the state government and University of Wollongong, has attracted unprecedented levels of investment.

“We’ve got ourselves into a position where we can pick and choose our investment opportunities,” says Bradbery. “Whereas we were once more vulnerable to just accepting any offers that came our way that looked like investment opportunities, we can now be a bit more selective in the way we apply the attention and kudos we’ve developed out of our economic development strategy.”

39

Wollongong’s CBD alone has attracted $1.9 billion worth of projects over the last decade. During that time, the number of bars and cafes has doubled to almost 200. The CBD has recently seen a 75 per cent uplift in A-grade office space as Wollongong positions itself as a cheaper alternative to Sydney, which has long cast its shadow some 90 kilometres south.

The positioning is working. The city’s population is now almost 220,000 including over 10,000 Sydneysiders who, since the last census, have left the state capital for Wollongong’s coastal charm, lower cost of living and better traffic. On the worklife balance front, Wollongong has a happy labour force with staff turnover at half the national average. The city has also become a darling for start-ups, particularly tech companies, so much so that it has earned the cute moniker “Siligong Valley.”

Wollongong’s reinvention has been 12 years in the making and is still a work in progress says Bradbery. The city was in a funk when he was voted mayor in September 2011 in the first elections since council was put into administration by the NSW Government in 2008 following an ICAC enquiry that found widespread corruption.

“The city had a reputation, and not one to be proud of,” says Bradbery. “It was pretty down in terms of the council it had up until 2008 when it was dismissed. It reinforced the sense that we’d been in the malaise.”

Wollongong’s decline has its roots in the collapse of its coal mining and steelmaking industries decades earlier. Between them, these two industries had been the city’s mainstays for the better part of the 20th century before a massive downturn in the mid-1980s. The bust precipitated two lost decades for the city. When Newcastle’s steelworks closed in the late 1990s, there was talk Wollongong’s Port Kembla would go the same way.

“Wollongong went into sort of a hibernation,” says Bradbery. “The city was really just marking time.”

Today, Port Kembla is on the rebound. Construction on Port Kembla Energy Terminal is 70 per cent complete. When it comes online in 2026, the terminal will meet more than 75 per cent of New South Wales’ gas needs, as well as attract gas-intensive advanced manufacturing to Wollongong.

Another huge energy project is Hydrogen Headstart. In delivering the 2023-24 Federal Budget, Treasurer Jim Chalmers singled out Wollongong as central to this initiative that will see the Commonwealth invest $2 billion to support large-scale renewable hydrogen production such as BOC Gas in Wollongong’s southern suburb of Cringila.

Energy is just part of Wollongong’s new economic mix. Under Bradbery’s stewardship, council is determined to widen Wollongong’s economy across a diverse range of industries including health, tech, education, sport, culture, aged care, retail, tourism and hospitality.

“Being so dependent on coal and steel meant we were extremely vulnerable to cyclical fluctuations. That’s why there was such a positive attitude in council back then towards reinvention, looking at ways we could diversify our economy to future proof it against cyclical downturns,” says Bradbery, who was elected as an independent, unaligned — and unimpeded — by party affiliation.

“Wollongong’s reinvention has been 12 years in the making.”

Regional Spotlight 40

“We’ve given people plenty of reasons to come here now.”

In setting Wollongong’s direction, Bradbery says council didn’t look to other cities, neither here or abroad, for a template of urban reinvention.

“That’s not to say we’re not open to learnings from other locations, but at the same time the city had spent so much time comparing ourselves to others that it was almost paralysed with comparisons,” he says. “That was the problem in as much as everyone was telling us what everyone else was doing and how successful they were and that we weren’t up to the benchmarks that had been set by other cities.”

“So, we more or less just decided, let’s utilise the talents and visions within, and just stick to our own sense of self-worth and direction, instead of trying to be all things to all people. Let’s do what we can well. We just asked, What are our unique features? What are our skill sets? Then a basic SWOT analysis and we just got on with it.”

Bradbery says pulling everyone together on the same page was the initial challenge, bringing onboard business organisations like Illawarra First, Business Illawarra, Regional Development Australia and i3net.

“What we created were critical masses of common interests that then plugged into implementing our economic, social and environmental vision for the city,” he says.

Another successful council initiative was the Wollongong CBD Night Time Economy Policy, in force since 2020. The policy has turned Wollongong into a genuine night-time destination by extending operating hours to 2am for bars and other businesses. Over 35 approvals for new and expanding businesses in the CBD have been granted, including restaurants, bars, theatres and gyms.

Most of all, Bradbery says unlocking Wollongong’s natural features by way of infrastructure that allows locals and visitors to enjoy them has played a significant part in the coastal city’s revival.