THE

Visit www.eCommerceCanada.com/CDAP to learn more

Application

As trusted advisors of the program we will work with you to draft your application program and ensure you are properly identifying your needs for digital transformation.

Digital Needs Assessment

We work in this everyday and can easily identify your gaps in technology and ensure the information provided to the CDAP program is accurate.

By working with you through the application process we can become familiar with your needs and reduce the timeline to generate the Digital Roadmap and apply for the grant.

Lets Work Together to Map Your Digital Strategy Into the Future

Advisor

It is my pleasure to present the second issue of Retail Insider the magazine – Canada’s only national retail publication. Editor-in-Chief Sean Tarry and the entire team have been working hard to put this issue together which includes an exceptional roster of content showcasing the Canadian retail industry.

Within this issue, we explore the reinvention of the shopping centre, the current state of the lux ury retail sector in Canada, the performance of the Canadian grocery industry, and more. And, as always, we feature a number of interviews with retail experts and innovators, as well as guest-au thored pieces, including an interview about the future of physical and digital retail with Jean Pierre Lacroix of Shikatani Lacroix and a great contribution from Liza Amlani regarding the reasons that explain why retailers are ‘seeing their shadow’ amid change.

Industry associations Retail Council of Canada and the Canadian Federation of Independent Business have also included highly informative columns, as has eCommerce Canada Founder and digital pioneer, David Nagy. As a result, Re tail Insider Media Ltd., which includes the Retail Insider website, this digital publication, as well as other activities, has become the definitive news and information source for retail in Canada.

I myself have written a feature story for this issue concerning luxury retail in Canada and the trends that are helping to shape the sector, including a shift of brands and stores to the sub

urbs and the exodus from multi-brand retailers by brands that want to stand on their own. Clear ly, there’s money in Canada, and consumers are spending it as we see luxury retailers performing better now than prior to the pandemic.

Congratulations to the whole team responsible for putting this excellent sophomore issue of Re tail Insider the magazine together. We look for ward to showcasing our next issue as we prepare to head into the Holiday Season in December. And, look out for some new initiatives by Retail Insider in 2023.

Sincerely, Craig Patterson Publisher craig@retail-insider.com

Craig Patterson Publisher craig@retail-insider.com

14 // Retail Development Reinventing the shop ping centre experience

QuadReal Property Group is thrusting the industry into the future with an entire portfolio of exciting projects that spans the country.

22 // The State of Grocery Grading Canada's grocery industry

From product sourcing to the consumer experience, the current state of grocery innovation in Canada is explored.

28 // Food Innovation Creating a network of innovation and inspiration

Through a collaborative approach, a unique platform has been established to enable the continued growth of Canada’s food ecosystem.

32 // Product Creation When will retailers stop seeing their shadow?

Rethinking outdated buying, sourcing and product assortment practices to reduce excess and increase profitability.

36 // Sector Analysis The state of luxury retail in Canada

Unmoved by the pandemic, luxury retail sales in Canada continue to rise. But what are the trends impacting current and future opportunities within the sector?

40 // The Future of Retail Focus on ESG initia tives critical to future growth of retail brands

Purpose-driven brands that stand for the things they believe in are setting themselves apart from competitors in the eyes of values-seeking consumers.

46 // The Integrated Experience Connecting the online and in-store experiences to spark growth

Retail expert, Jean Pierre Lacroix, shares his views on the future of retail and the ways merchants can enhance the experience they offer.

Brand

and secure

Patterson

PUBLISHER

Fuhs

Tarry

Design

Liza Amlani, Diane J. Brisebois, Shelby

Laura Jones, David Nagy, Craig Patterson, Mario Toneguzzi

Julott

EDITORIAL OFFICE

Bloor Street West, Toronto, ON, M5S 3L3

Retail Insider the magazine is published

times each year by Retail Insider Media Ltd.

24

the strategic use of technology, the Canadian grocery experience may never be the same

innovation and creativity,

A Canadian Survey of Consumer Expectations conducted by Bank of Canada underscores the challenges that inflation is creating for Canadians, as well as the products whose rising prices are causing the greatest concern. Grocery, far and away, tops the list for all income brackets, ahead of gasoline, housing, rent, mortgage costs, and automotive, with lower income earners feeling significantly more challenged than those earning higher incomes.

Percentage of Canadians, by income bracket, who rate inflated grocery prices as their top concern:

$40,000/year

Recent Statistics Canada data shows that the labour shortage that’s been blighting the efforts of merchants to rebound in a post-pandemic environment is set to continue into the final quarter of the year and the approach toward the busiest shopping period on the retail calendar.

The number of people working in wholesale and retail trade in Canada fell by 27,000 in July, the second consecutive monthly decline that the industry’s experienced. Ontario was hit the hardest, losing 14,000 workers (-1.3%), followed by Quebec which lost 12,000 workers (-1.8%).

above $100,000/year

PwC Canada’s Consumer Insights June 2022 pulse survey reveals a strong connection between a retailers’ protection of consumer data and the level of trust consumers place in brands.

of survey respondents are open to sharing their information if it’s not disclosed to other companies or third-party providers.

say that the protection of their personal information greatly influences their trust in a brand.

Data revealed within Accenture’s The human paradox: From customer centricity to life centricity report suggests that there’s a disconnect between consumers’ needs and their favourite brands’ ability to meet them in a timely manner.

of Canadian consumers wish companies would respond faster to meet their changing needs.

of executives think their customers are changing faster than their business can keep up.

According to a recent Trendex North America report, Canadian luxury apparel sales are expected to undergo significant growth over the next five years.

$3.2 Billion 15.2%

The projected sales that the sector will achieve by 2026.

The expected increase in luxury apparel sales in 2022, up from $2.4 billion in 2021 to an impressive $2.8 billion.

The anticipated average annual increase in luxury apparel sales from 2023-2026.

Retail, like many other industries around the world, has undergone an accelerated digitization since the onset of the COVID-19 global pandemic. And, although a recent report released by Adyen reveals that 67 per cent of Canadian consumers prefer to shop in-store, opportunities that result from a unified offering are immense.

of consumers believe that retailers effectively used technology to make products accessible during the pandemic.

believe physical stores should focus on the experience beyond the product, given that the same products are easily found online

Small businesses becoming creative with messaging is a sign of the times

// By Laura Jones, Chief Strategic Officer and Executive Vice President, Canadian Federation of Independent Business

It seems like a lifetime ago that handwritten signs were posted in small businesses across Canada alerting customers to “temporary” closures to help flatten the curve and keep employees and customers safe. The doors were shut but the signs explained why, exuding warmth and a hope that things would be back to normal soon. They con nected communities.

Throughout the pandemic, small businesses’ signs continued to connect us as we tried to navigate the new normal. Some signs were basic: telling us how many customers could come in, others were humorous or encouraging kindness and patience.

While business owners exuded goodwill towards customers and community, they were themselves dealing with unprecedented stress. Paying bills, dealing with health concerns, and navigating the latest government support program announce ments. All took a toll.

As we head into the last quarter of the year, things look a lot more normal. Retailers know they aren’t. CFIB research shows that almost twothirds (61%) of businesses in the retail sector are carrying pandemic debt and 59 per cent of small retail businesses are still making less than normal revenues. Supply chain challenges, rising prices and labour shortages are now top worries.

And while the challenges keep coming, custom ers, especially the loyal ones, remain a bright spot. So how do retailers make the most of this season?

Reminding people to feel good about shopping local

As we head into the busiest retail season, there are new signs to put up - ones to remind people to feel good about shopping local.

Why is this important? Small businesses have always had a special place in the hearts of their customers, and the pandemic underscored how bleak things are when they are shuttered. But even the most loyal customers can use a remind er that they are very important to you and their choice to shop local matters.

According to a recent Maru Public Opinion poll, 86 per cent of consumers say supporting small business is important to them and 83 per cent say they feel a sense of pride when shopping at a local business. Tapping into these sentiments is an obvious win-win for business owners and their customers. And it doesn’t have to be hard or time-consuming.

The “BRA-VO” for shopping local at my local lin gerie store always puts a smile on my face as do the signs written on chalkboards with messages as simple as “thank you for shopping local.” The greater number of small businesses that express these sentiments, the stronger the movement becomes as the messaging gets reinforced.

Signs aren’t only for windows these days. If you are active on social media #SmallBusinessEvery Day, #shoplocal and #SmallBusinessSaturday are used to promote local shopping.

Small Business Saturday™ and #SmallBusinessEv eryDay

If creating your own signs sounds like a lot of work, there are free resources available. Small Business Saturday™ - the Saturday between Black Friday and Cyber Monday - is a great oppor tunity to bring attention to the importance of supporting independent businesses. This year, it will take place on November 26. Free posters and other promotional tools, including ones to promote a sales event, will be available at Small BusinessEveryDay.ca in the coming weeks.

Complementing Small Business Saturday, CFIB has a #SmallBusinessEveryDay campaign that runs all year round with a special contest in the summer. Posters and social images are available here: cfib.ca/promoteyourbusiness.

And if you need more information, our Business Resource line is 1-833-568-2342.

We know retailers continue to face significant challenges. But you don’t have to face them alone. Remind your customers that shopping local creates community. And know your signs matter more than anyone ever tells you.

Laura Jones is the Executive Vice-President and Chief Strategic Officer of the Canadian Federa tion of Independent Business (CFIB), the largest non-profit organization representing over 95,000 businesses across Canada.

Small Business Saturday™ is brought to you by CFIB and American Express and supported by Canada Post.

Lamenting the dramatic downturn of digital retail while identi fying opportunities for the future

// By David Nagy, Founder, eCommerce Canada

By most accounts, 2022 has brought upon us the much overdue “death of ecommerce”. The much-maligned channel that enjoyed exponen tial growth through the better part of two pan demic-heated years has taken a steep tumble for the first two quarters of this year. And, the pros pects aren’t rosy for the near-term as a further fallout is expected even during the Q4 shopping season. Bricks-and-mortar is picking up steam as shoppers regain confidence in being back in pub lic and visiting physical stores for the first time since the Trump Administration left the White House. And, there are a multitude of trends that act as signals to this new reality.

The most obvious example is investor confi dence in the company that had typified the rise of eCommerce since 2017, Shopify. To be clear, this juggernaut of Canadian ecommerce isn’t any worse of a company than it was one year ago, but the fickle hand of consumer confidence tells a different story. An over 80 per cent drop in share price, accompanied by a host of strategic initia tives that haven’t done much to build trust, have helped erase $170B in market cap in less than a year. A turnaround of such enormous magnitude leads many to have to read the charts to really believe it.

However, Shopify isn’t alone. Even the vastly more diversified Amazon took its lumps this year

with a drop of nearly 40 per cent by mid-June. Almost all research into consumer trends over the first half of 2022 shows a distinctive pull back from online shopping with YoY declines over 20 per cent in some sectors throughout the early part of this year. Much of the popularity gained since the early part of the pandemic has now been given back as the cooling effect of ecom merce has taken hold.

Perhaps it’s no surprise that the tech sector in general has, at some level, followed this decline. What happens next is anyone’s guess. But it’s worth taking a look at some of the systemic issues that have created some of the current challenges that complicate the performance of ecommerce brands:

The COVID-19 pandemic simply created too many online stores. Estimates vary, but we know that tens of thousands of new online retailers entered the market in 2020 and 2021, but in an economy that supports just $100B CAD in online sales. An addition of that many new entities in a market that has stagnated is a recipe for disaster (or negligible profitability).

On the topic of profit margin, stress has never been higher. Increased competition is certainly

one area of concern, but when you start to list the constraints, there is a lot working against online retailers that are going to hold growth at bay for some time to come. The most prominent of those is shipping costs, which continue to skyrocket as the cost of labour and fuel drive up rate cards without the ability to increase prices in a con sumer market that has the luxury of choice.

Not to be forgotten is the drastic increase in customer acquisition cost (CAC). The combined forces of increased digital advertising costs, more demand for advertising inventory, increasing consumer disinterest and diminishing loyalty to online retail is inflating CAC while customer lifetime value (LTV) is trending in the opposite direction. The result? Lower net margins that newer companies without sizable customer bases and resilient operations simply can’t survive.

The talent gap continues to grow as a still tragi cally undermanned and under-skilled workforce tries to keep up with domestic demand for ser vices in a no-win game. Running an eCommerce business sometimes feels more like you’re paying for people to learn, but they don’t stick around long enough to develop in-house expertise. One can only hope that initiatives like the Canada Digital Adoption Program (CDAP) will help with youth skills development leading to our future workforce leaders. In a globally competitive mar ket, this is exactly what Canada needs.

It can’t go without mentioning the economic uncertainty surrounding the global economy and the fact that supply chain channels are still critically broken even on this side of the pan demic. These “larger than ecomm” issues impact every facet of consumerism and present a greater challenge for retail as a whole.

By all accounts, these seem like dark days for on line retailers. But I’d like to share a bold predic tion - there has never been a better opportunity in ecommerce than there is right now.

The glut of competition means that only the strongest companies will survive. And those companies will be able to acquire assets from weaker companies that would have been horribly overvalued one year ago for just pennies on the dollar.

The unaffordable talent in the industry will settle in as demand shrinks and makes it possible for companies to grow expertise in-house. As a re sult, loyalty may become a thing again.

Every gold rush comes to an end and with it, many dreams die, too. On the other side of every boom, there’s a bust - but that’s simply the way ecosystems adjust for change. In the midst of this bust, we will develop the strongest online retail ecosystem this country has ever seen and the sur vivors will be the beneficiaries of market adjust ment that stabilizes the industry for a time.

-------

To learn more about eCommerce Canada and the ways it can help your company grow and suc ceed, visit ecommercecanada.com

The talent gap continues to grow as a still tragically undermanned and under-skilled workforce tries to keep up with domestic demand for services in a no-win game.

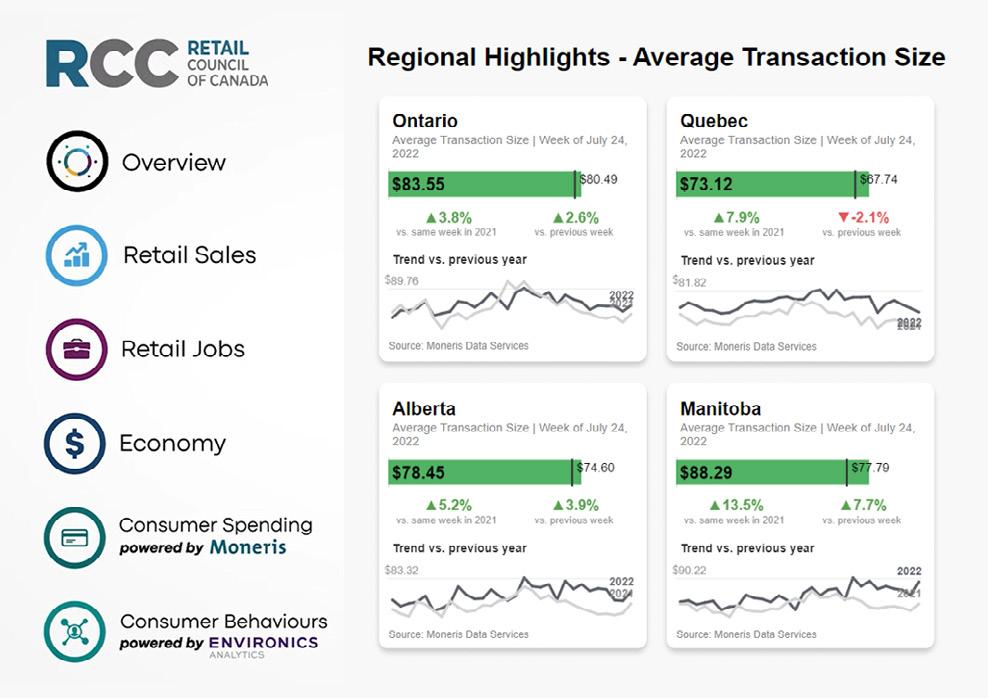

Meaningful data to help Canadian merchants navigate the challenges of a changing retail landscape

// By Diane J. Brisebois, President & CEO of Retail Council of Canada (RCC)

If we have learned one thing from these past two years, it’s that things can change in the blink of an eye - changes retailers thought they had years to prepare for, and behaviours they assumed consumers would stick to forever, are long gone. As we have all learned throughout the pandemic, and as we begin to settle into a post-pandemic world, we are realizing that consumers are still changing the way they shop.

Consumers are currently visiting brick-andmortar stores with less frequency than they did prior to the pandemic, and close to 40 per cent shop more often online for products they would have previously bought in stores. One of the most significant effects of COVID-19 is the realiza tion that, for many of us, geographical location has become less relevant - so long as there’s an internet connection. This flexibility allows more consumers to move away from urban centres supported by data. In fact, recent statistics show that close to 25 per cent of consumers plan to live in less densely populated areas. And it’s a trend that continues.

The unpredictable and ever-changing consumer has made successful retailers quickly understand that they need to rebuild their vision, strategy, and priorities for the future. That means reshap ing to account for the move online, allowing for

surprise trends such as the move back to ‘lo cal’ shopping, and re-inventing the function of ‘brand’ stores with many now becoming more of a multi-purpose experience destination, integrat ed into a digital and online offering with rapid, local fulfilment.

As waves of infection and associated restrictions come and go, demand curves may also ebb and flow at short notice and may inevitably drive a change in buying patterns. Understanding this shifting consumer behaviour and building a brand strategy that responds to it, while account ing for a new risk environment, could be key to longer-term retail success.

As a result, many retailers and businesses are realizing more than ever before that good data helps retailers, big and small, make better, more informed decisions, deploy more robust strate gic initiatives, pivot quickly and effectively, and improve relationships with both customers and business partners.

Conversely, research has shown that low-quality data adversely impacts many areas of business performance. It can translate into incomplete customer or prospect data, wasted marketing and

communications efforts, increased spending and, overall, worse decision-making. Thus, it is of no surprise that Retail Council of Canada's (RCC) recent member survey showed retailers believe that quickly accessing relevant data, and im proving the quality of that data, should be a top priority for their business.

Data is one of the most valuable assets a busi ness can have and poses tremendous potential in supporting long-term success. That’s why it’s vital to utilize the right tools and technologies to fully leverage all available data and make it as accurate as possible.

RCC understands that the more you know about your audience, the more easily you can make profitable decisions. By paying attention to your core demographic and the metrics that provide a deeper knowledge of changing consumer be haviour and shopping preferences, retailers are presented with a treasure trove of insights to im prove the shopping experience and increase sales.

With that in mind, RCC has been working in collaboration with KPMG for the past year to de velop a new tool for retailers in Canada, provid ing them with access to relevant data and metrics in a one-stop dashboard. It was built to serve as retailers’ first-stop temperature-check on Cana da’s retail sector.

The RCC Retail Pulse Dashboard saves you time and, as a member feature, allows you to cus tomize the dashboard for specific data relevant to your business, providing the opportunity to find many other key metrics to help you navigate sales, hiring, the economy, consumer spending and pandemic-related metrics.

With current data from Statistics Canada, Goo gle, Environics Analytics (coming soon!), Mo

The awe-inspiring development of Oakridge Park in Vancouver setting a standard for the industry.

neris Data Services and other partners, the Retail Pulse Dashboard provides insights on changing Canadian demographics, mobility and shopping trends, labour, types of products sold and average purchases – and the list goes on.

Access to the dashboard is available to all em ployees of RCC Members. To view the full version of the dashboard, you will need to sign in with an RCC account. Doing so is quick and simple, and you can create an account by clicking here. To become a member and access exclusive member-only Retail Pulse Dashboard content, click here.

Amid worldwide economic disruption brought on by the COVID-19 pandemic, RCC realized retailers needed an updated roadmap - one that takes into consideration new shopping habits formed by customers during the “new normal” of lockdowns and reopenings, and the emerging technologies that are changing our landscape.

We encourage you to visit the Retail Pulse Dash board and provide feedback so we can continue to build a one-stop shop dashboard that helps you and your teams develop and deploy the suc cessful strategies required to meet the changing needs of the new consumer.

Questions? Please contact us at membership@ retailcouncil.org

Seamlessly addressing evolving consumer behaviours and attitudes, and an outdated shopping centre model, QuadReal Property Group is thrusting the industry into the future with an entire portfolio of exciting projects that spans the country

By Sean Tarry >The awe-inspiring development of Oakridge Park in Vancouver setting a standard for the industry.

The Canadian retail industry is in the midst of an evolutionary period unlike anything its many players throughout its long and storied his tory have ever seen before. Driven largely by the need to modernize their businesses in the throes of an accelerated digitization of the world around us, merchants of all sizes and formats across the country are investing in the development and im plementation of new technologies in order to in crease efficiencies and enhance their operations. However, within the digital revolution that’s currently taking place, retailers cannot lose sight of their customer, the tactile experiences that they continue to seek and their ever-heighten ing expectations concerning the retail shopping journey. For shopping centres across the country, particularly in light of shifting consumer prefer ences and behaviours, the need to modernize the experience offered is perhaps more significant. In fact, according to Andy Clydesdale, Executive Vice President, Retail, QuadReal Property Group, the shelf-life of the traditional shopping centre has expired.

“The typical ‘mixed medley’ old school shopping centre that everyone has come to know through the years is dead,” he asserts. “Customers just aren’t going to go out of their way to get some thing they can get everywhere. So, the exact same shopping mall with exact same tenant mix, located in a different place, simply isn’t compel ling enough in this day and age. The future, as I see it, is about having a really unique point-ofview, staying true to it, and offering a dynamic and engaging experience that people will literally want to write home about. It’s also about creat

>> Development of a highly sustainable, mixed-use, transit-oriented neighbourhood and cultural hub

$6.5 billion redevelopment project

900,000 sq.ft. of best-in-class luxury retail and culinary experiences

800,000 sq.ft. of some of the best-connected, well designed and highly sought-after new workspaces in the city

2.6 million sq.ft. residential GLA

3,000 residential units housing 6,000 residents

Approximately 100,000 sq.ft. of community amenity space

>> Interior renovation to coincide with lifestyle expansion, mixeduse redevelopment, integrating indoor and outdoor lifestyle retail, presenting a unique customer and resident experience opportunity, reinforcing the mall as a community gathering place.

Transit connection to project

1,000 premium rental and condominium units

110,000 sq.ft. of net new retail (70,000 sq.ft. North Retail / 40,000 sq.ft. South Retail)

Addition of three levels of underground parking

Integration of public parkland

ing amazing places for people to congregate, and integrated communities for people to live, work and play. In other words, total reinvention is afoot. And it’s about time.”

The reinvention of the Canadian shopping centre that Clydesdale suggests as a remedy to the mal aise that envelops most mall experiences is being spearheaded by he and his team at QuadReal who have an entire portfolio of properties that they are helping to thrust into the future.

From the breathtaking redevelopment of Oakridge Park in Vancouver to the inspiring reinvention of Bayview Village Shopping Centre, and all projects in between, QuadReal are ap proaching each with a similar mixed-use vision of the future that’s best described as an idyllic and seamless amalgam of everything a person

or family might need in order to live, work, play and shop, all in one centralized and optimized location.

It’s a vision that Clydesdale says he and his team fully believe in, adding that they also recognize the importance of the work required in order to see it through to fruition.

“Given the sheer magnitude of what we have going on in our portfolio, we are extremely cog nizant and conscious of our role in both creating communities and shaping the next generation of shopping centres,” he says proudly. “We rec ognize that every leasing decision, every design decision, everything we do at our shopping ven ues from a service and programming perspective, matters immensely as it contributes to the overall big picture. At the end of the day, regardless of whether retail is the amenity or the driver, it is always the connective tissue, the centerpiece, the

>> Mixed-use redevelopment, developing existing site into a vibrant, sustainable and innovative urban community.

Replacing existing retail centre in its entirety with 125,000 sq.ft. of retail

5,000 residential units

8 acres of parkland and green space

Over 20,000 sq.ft. of community amenities

5,100 below grade parking spaces

heart, and the actual soul of the property. Obvi ously, to that end, we want to get it right.”

Fortunately for Clydesdale, it seems that ‘getting it right’ is something that seems to come with the territory at QuadReal. It’s a track record that’s recognized by the retail and property develop ment industry veteran. However, he’s quick to point out that it’s only possible to continue the company’s fine legacy into the future through constant learning and an ever-enhancing under standing of the customer and the experiences they seek within the shopping journey. And, he adds, the execution of the vision that he and his team are seeing out has got to be driven by genuine and thoughtful strategy and a focus on the things that people are looking for, raising the bar concerning the shopping centre experience of today, as well as tomorrow.

>> The former “Interchange” site will be redeveloped as a vibrant master-planned, mixed-use community for residents to live, work and play, serving as a destination for the rest of the VMC and Vaughan

14M to 15M sq.ft. total GFA 400,000 to 800,000 sq.ft. office GLA 250,000 to 600,000 sq.ft. retail GLA 12,000 to 13,000 residential units

Over 5 hectares of park, privately owned public and green spaces

Upwards of 25,000 residents expected by 2038

“At the end of the day, regardless of whether retail is the amenity or the driver, it is always the connective tissue, the centrepiece, the heart, and the actual soul of the property."

- Andy Clydesdale

>> Revitalization of a heritage landmark - the historic Canada Post building - including preservation of the building’s architectural fea tures through sustainable and adaptive re-use.

1,130,000 sq.ft. office GLA (two towers 21 and 22 storeys)

185,000 sq.ft. retail GLA

2 levels of parking with 240 spots on each level

Programmable indoor and outdoor gathering spaces

10,000 knowledge workers will occupy the building on a daily basis

>> The proposed large-scale transformational mixed-use development project envisions:

125,000 sq.ft. office GLA

300,000 sq.ft. retail GLA

10 high-rise residential towers

2,800 condos and 850 rental units housing 8,000 residents

A 153-room boutique hotel

1.65 acres of green space including parks, gardens and paths

“If I were to assign a particular theme to what we’re doing across the country when it comes to reimagining our shopping centres, it’s authentici ty,” he says. “It would be easy to fill vacant spaces with just any tenant. But we are very consciously and carefully curating our mix so that it is true to the brand and communities we serve. Similarly, it would be much easier to add a residential com ponent to any project in a vacuum. However, we prefer designing the future in close collaboration with the community. For instance, over 15,500 people have shared their feedback on what the future of Cloverdale Mall looks like. We could simply pull a template from an old event out of the drawer. But we just don’t operate like that. In short, we aren’t at all haphazard within our ap proach to anything we do. At the end of the day, we are really committed to creating the best live, work, play experience possible and doing so in the most considerate and authentic way.”

“To see these projects, which have been called ground-breaking, gamechanging, catalysts, ambitious, and even audacious, unfold in realtime, with a front row seat, is a career highlight, to be sure." - Andy Clydesdale

>> Positioning the large and successful regional shopping centre for transformation from a retail-only destination to a holistic mixed-use development, including a significant residential component, with the goal of ultimately serving as the new town centre for the city and township.

Reactivation of the north end of the Centre through the creation of The Courtyard: 27,500 sq.ft. of additional indoor and outdoor space including a number of elevated urban food offerings; entertainment spaces; lounge and event areas for social gatherings.

Population of Willow Way, a 5,000 square foot dedicated rotating incubator space for up-and-coming local vendors and artisans offering handcrafted and one-of-a-kind items.

>> Goal is to collaborate with the residents of the area as well as the municipality on the creation of a dynamic, sus tainable and holistic mixed-use community for the future.

Clydesdale goes on to explain that, although he feels that the traditional shopping centre concept and model is outdated, he also believes that the roles they play in the communities they’re locat ed in are drastically underestimated.

He explains that shopping centres need to be viewed as far more than simply places of trans action. Going forward, he suggests that Canada’s shopping centres be designed and developed as experiential and congregational hubs where peo ple can meet, engage, shop and enjoy life.

In fact, if executed properly, says Clydesdale, a shopping centre can serve to inspire, educate, entertain and spark a level of joy in their visitors. It’s representative of the work that QuadReal has built its reputation on – a constant reinvention

that Clydesdale says he’s extremely pleased to be a part of.

“To say that it is an honour to be part of these development projects at QuadReal is an under statement,” he says. “Oakridge Park, for example, is one of the most monumental redevelopments currently underway in North America, given its sheer scale, ground-breaking design and overall ambition. The Post in Vancouver is easily regard ed as one of the most ambitious heritage rede velopment projects in Canada’s history. Over at Assembly Park, we’re building what will ultimate ly become Vaughan’s new downtown. And, of course, the 32-acre Cloverdale Mall site is being completely reimagined to create a vibrant, sus tainable, and innovative mixed-use urban com munity. These are prestigious shopping venues that have been long-standing fixtures within the communities they’re located in. To see these proj

Reactivation of the northeast wing to include expanded food and bev erage, fashion, lifestyle, entertainment and experiential options.

>> Continued focus on adding to Marché Central’s strong service and value tenant mix alongside development of the shopping venue’s Phase 6.

An additional aggregate density of 600,000 sq.ft. including:

Walmart – 140,000 sq.ft. Lufa Farms (rooftop greenhouse) – 125,000 sq.ft. Decathlon – 35,000 sq.ft.

ects, which have been called ground-breaking, game-changing, catalysts, ambitious and even audacious, unfold in real-time, with a front row seat, is a career highlight, to be sure.”

Although the undertakings that Clydesdale refers to are but a few in the multi-development portfo lio currently active under the company’s purview, they’re examples that do well to illustrate the emergence of the incredible microcities, new town centres, downtown cores, retail epicentres and cultural hubs that the property development leader is working on erecting. And, if you ask the retail and property development veteran, it’s work that’s laying a foundation for the future of the shopping experience.

“Retail has changed so much over the course of the past few years. But it’s also an industry that’s

Goal is to collaborate with the residents of the area, as well as the municipality, on the creation of a dynamic, sustainable and holistic mixed-use community that complements the existing retail offering.

always changing, perhaps more often and quick er than any other. The pandemic precipitated some of the changes that are currently impacting the way we do things. And it accelerated other shifts and trends that had already begun prior to COVID. However, as we begin to truly enter the post-pandemic period in Canada, retailers and property developers have got to be cognizant of the evolving needs of a savvy consumer. Cana dian shoppers are discerning, and they’re only going to become more discerning going forward, which means that the industry has got to be on top of its game in order to consistently deliver the always-fresh offering and experience that keeps them coming back for more. At QuadRe al, we understand that you can’t fix tomorrow’s problems with yesterday’s solutions. And, we’re confident that by virtue of our strategies, which are grounded in research and inspired by innova tion, that we’ll be able to help the Canadian retail industry meet the future head on.”

Retail is one of the most dynamic, constantly changing industries and the need to keep informed and trained to take advantage of new opportunities has never been more important. Retail Council of Canada’s (RCC) wide breadth of events and programs, developed in close collaboration with retailers, is the quickest way to empower retail teams, re-invigorate, and refresh valuable contacts with others in the industry. RCC members enjoy significant savings on all registrations.

Retail Conditions Webinar Fall Edition

Exclusively for RCC members

September 21, 2022

In Conversation with Clint Mahlman of London Drugs

September 22, 2022

Toronto Congress Centre - South Building

Retail Matters Webinar: Economic Impact of Inflation and War

September 27, 2022

Retail Holiday Shopping Forum

October 13, 2022

Toronto Congress Centre - South Building

In Conversation with TJ Flood of Canadian Tire

October 20, 2022

Toronto Congress Centre - South Building Retail West

October 27, 2022

The Westin Bayshore, Vancouver

In Conversation with Paul Wood of Giant Tiger

November 4, 2022

Toronto Congress Centre - South Building

Retail Conditions Webinar Holiday Edition

Exclusively for RCC members

December 14, 2022

Check out the line up of great RCC Events and register to kick-off your Fall learning!

In addition, there are the many specialized online certification and retail education programs that can assist retailers in training entry-level and experienced staff alike. For details, please visit RetailCouncil.org/Resources/Education Sponsorship opportunities are available. Please contact Nikita Patel at npatel@retailcouncil.org for details.

Considering everything from warehousing and transportation to the consumer shopping experience, and all points in between, Retail Insider the magazine’s Editor-in-Chief sits down with the Food Professor to determine the current state of grocery innovation in Canada //

By Sean Tarry

By Sean Tarry

The past two-and-a-half years or so have prov en to be an extremely difficult time for mer chants operating in any vertical or sector within the retail industry. Labour shortages and supply chain disruptions have often dominated conver sations concerning the top-of-mind issues that are keeping executives up at night, plaguing just about every type of retailer. The need to invest in technological improvements and enhancements in order to remain relevant in the age of digitiza tion has also presented far-reaching ramifications for players industry-wide to address. And, of course, the scourge of inflation has put a dent in nearly every operation and enterprise from coastto-coast, resulting in a slew of cost-reduction exercises in an attempt to maintain profit levels.

When it comes to rising prices, few sectors have experienced such significant and sustained in creases as food. In fact, food inflation has been hovering between 8 and 9 per cent for the better part of the past 12 months, threatening to surpass 10 per cent, squeezing the budget of the average Canadian and creating undue tension related to their weekly grocery shopping trip. As a result, a great deal of pressure is being placed on grocers that are operating with razor-thin margins and suffocating constraints to manage expectations. So, with little wiggle room around pricing or the ability to significantly reduce operating costs, most grocers across the country are leaning on innovation to help improve the customer experi ence and find efficiencies from sourcing to shelf.

With this need to innovate in mind, Retail Insider the magazine and the Food Professor, Sylvain Charlebois, analyze the current state of grocery innovation in Canada. Taking a close look at everything from product sourcing and development to the in-store and mobile customer experience, we grade the collective performance of the industry, identifying where positive strides are being made and the areas of the operation that require improvements in order to satisfy the evolving needs of the Canadian consumer and increase the profitability of their organizations.

A grocery retailer is nothing if it’s not for the product on its shelves. Afterall, it’s what brings the consumer through the front doors in the first place. However, bringing consumers back to the store, and engendering their loyalty, is becoming increasingly dependent on more than simply making product available. Today, consumers want choice and a wider variety of selection within their grocery shopping experience. And, they’re beginning to look more toward the gro cers themselves to provide them with inspiration via product innovation.

According to a 2021 NielsenIQ report titled Pri vate Label Trends During the Pandemic, a com prehensive 100 per cent of Canadian households regularly purchase private label products from the grocers they shop at, representing an average annual spend of $1,319. Further, the report found that the stature of private label products in the minds of Canadian consumers is also elevating,

“First, you have to appreciate the fact that the margin of error when it comes to product crreation within the grocery sector is very slim. Taking this into consideration, the industry has done extremely well to develop some really innovative products in recent years.”

- Sylvain Charlebois

revealing that 45 per cent believe that they offer superior quality to that of national brands. It’s success that’s recognized by Charlebois who says that it’s the direct result of the dedication and commitment that Canadian grocers have paid toward the development of their in-house prod ucts.

“First, you have to appreciate the fact that the margin of error when it comes to product cre ation within the grocery sector is very slim,” he asserts. “Taking this into consideration, the industry has done extremely well to develop some really innovative products in recent years. But, one thing that those operating within the Canadian industry are trying to do is incorporate more of the innovation that’s happening outside of the country in order to diversify some of the categories that may have recently gone stale.”

Charlebois goes on to explain that there is a great deal of headway to be made with respect to product packaging and the related issues around sustainability. He says that it’s a “work in progress that isn’t an easy fix,” and that partnership align ment and a shift in approach is required in order to begin remedying those ailments within the operation.

However, when it comes to the customer ex perience that’s centred around the product, the veteran retail expert believes that grocers have yet to properly determine how to best service them, yielding one of the biggest opportunities to enhance their offering.

“When talking about ready-to-serve meal kits, how much time should grocers be dedicating toward their clientele?” he asks. “Providing these types of products is one way by which grocers can help save their customers time, enhancing the convenience of their experience. However, everyone within the industry has got to figure out how much time and effort they want to commit toward helping their customers feel empowered to cook at home.”

With such razor-thin margins, most grocers within the country are starting to pay more thought and attention to the ways in which au tomation could be leveraged within their opera tions to reduce costs and increase efficiencies. In fact, McKinsey & Company research generated prior to the pandemic suggested that at least half of all work activities within North American retail are technically automatable through the use of robotic technologies. Further, its data implied that 6 in 10 (60%) occupations are comprised of tasks that are more than 30 per cent automatable.

Fast-forward nearly five years and a global lockdown later, and the general sentiment with respect to automation and the benefits it can present are becoming even more pervasive. And, when examining the Canadian grocery oper ation, it seems that perhaps the area offering the greatest opportunities with respect to the introduction and use of autonomous technolo gies is that of warehousing. Robotics present the potential for significant enhancements through the facilitation of the steady and efficient flow of product. However, according to Charlebois, there is much work required in order to begin realizing even a portion of its true capabilities.

“There have been some strides made around the use of warehouse technologies to not only save human capital, but to improve the accuracy and efficiency of orders,” he says. “However, generally speaking, when you compare the food industry with other sectors, there is a definite lag. The pandemic provided a bit of a wakeup call for those within the industry. But, to change any leg acy systems or ways of doing things within gro cery is difficult. You’re dealing with family busi nesses and tradition, so positive evolution most often happens relatively slowly and is tough to come by. In addition, it takes time to implement the tools required to build a technologically-driv en operation – something that Canadian grocers have generally not done enough of to date.”

Transporting product along the grocery supply, from its source of origin all the way to grocery store shelves, requires efforts of gargantuan proportions. And, given the volatility of today’s global supply chain – one that’s been tainted and tarnished by geopolitical unrest, record-breaking inflation and rising costs, and general congestion at ports around the world – it’s no wonder that grocery CEOs and their teams are concerned about the viability of their supply.

According to a report conducted by New Yorkbased advisory firm, Mazars, supply chain issues are at the top of the list of business challenges that have got to be addressed in order to main tain and increase profitability. The Annual Food & Beverage Industry Outlook for the United

States revealed that 54 per cent of leaders with in the sector consider issues around the supply chain the greatest threat to their near-term success.

In order to mitigate and manage risks within the supply more effectively, most leaders (41%) believe that strategic investments made toward diversifying their supply chains pose the most meaningful improvements. And, as part of this diversification, nearly a third (30%) plan to source more product domestically, increasing the use of near-shoring and local sourcing. It’s a trend that is recognized by Charlebois who be lieves that these shifts may in the end change the entire grocery supply, for the good.

“There are a lot of changes happening, both around the world as well as here at home, when

it comes to supply chain innovation and strate gic thinking,” he says. “And, a lot of it is centred around the near-shoring of product. Everyone is becoming more compelled to take a close look at the just-in-time model, determining how it needs to evolve in order to operate more efficiently. In fact, we’re likely to see a just-in-time 2.0 model very soon, making operations much more lean, nimble and protected against black swan events, which is so critical when dealing with such nar row margins. It will involve an increased reliance on local producers, forcing greater innovation and the development and design of new supply chains.”

There is no doubting that perhaps the biggest im pact sustained by the Canadian grocery industry as a result of the COVID-19 global pandemic was the incredible spike in online orders that occurred. According to Statistics Canada data, only 19 per cent of Canadians had ordered their groceries online at least once prior to lockdowns. That number increased to an estimated 30 per

cent just a month into the pandemic, and to an astounding 49 per cent following 12 full months. And, as recent data generated by industry re search firm, Caddle, indicates, the promise of positive online experiences is becoming a prom inent factor when it comes to customer loyalty, with 52 per cent of Canadian grocery shoppers stating to be somewhat willing to switch brands for better ecommerce service. It’s a digital trend that Charlebois says has been critical in the re cent success of grocers as customer expectations around the online grocery offering continue to rise.

“The industry did a great job pivoting during the pandemic to make curbside pickup available for their customers,” he says. “It alleviated consumer concerns over health and safety and ensured that Canadians across the country were still able to complete their weekly grocery purchases. Home delivery services were also enhanced to meet the changing needs of the consumer. Today, howev er, there is increased competition as new players enter the market promising delivery within half an hour in some regions. As a result, expectations concerning the entire digital grocery experience are heightening, and grocers are well aware of that. They need to adjust and continue to pivot as much as possible to service a virtual market that’s growing every day. There’s still an unbelievable amount of work to be done in order for the in dustry in general to get to where they’d like to be digitally. However, the improvements that have been made over the course of the past few years have been dramatic.”

Despite the obvious and significant gains that have been made in grocery ecommerce sales since the onset of the COVID-19 global pan demic, much of the experience for most Cana dians continues to reside within the traditional brick-and-mortar grocery store. There is still very much a sensorial happening that remains for many shoppers – one that takes place inside

“There's still an unbelievable amount of work to be done in order for the industry in general to get to where they'd like to be digitally. However, the improvements that have been made over the course of the past few years have been dramatic."

- Sylvain Charlebois

a tactile shopping journey. It’s all part of what continues to drive a significant portion of the in-store grocery experience and its allure. How ever, according to Caddle data, it’s an experience that’s set to change dramatically over the coming months and years, with technology at the cen tre of much of the innovation. And, it seems as though consumers are starting to demand its use as well.

Results of the firm’s research suggests that a whole range of technological enhancements to the in-store grocery experience are being sought by today’s consumer, from the inclusion of dig ital signage, price tags and kiosks that display product information, to tap-to-pay capabilities at checkout. Research also reveals that current use of in-store technology is on the rise, with 75 per cent of Canadians having used self-checkout during a grocery trip at some point during the last 6 months. Further, 85 per cent of those who have used self-checkout kiosks have reported to have been satisfied with the experience.

It’s a digitization of the Canadian grocery experi ence that Charlebois says is paying dividends for those within the industry that have embraced the change. However, he says that although technol ogy is helping to increase interactivity for the shopper, the value of meaningful human interac tion within the experience cannot be overlooked.

“The ways in which technology can be used to improve the grocery shopping experience and

increase engagement with shoppers is incred ible,” he says. “Over the next several months, I anticipate the introduction of even more digital screens and signage located throughout stores, informing consumers and providing them with content that will ultimately inform their purchas es. However, at the moment, it’s the human ele ment of the grocery experience and the ways in which consumers are being serviced in real-time that’s presenting the biggest challenges. There’s been huge investments made by the industry into technologies as a means to enhance the experi ence offered to customers. But we’re entering into a new era in which people are realizing just how difficult it is to recruit top talent and entice them to work for their companies. It’s the labour part that grocers have got to get right. And, if they do, marrying expert service with technological advancements, grocery within the country will never be the same.”

Servicing a market as diverse as the one that exists in Canada while pivoting and adjusting an offering that has to be reliable, efficient and convenient in order to satisfy the needs of an evolving omnichannel consumer, is no small task. And, given the turmoil and uncertainty that the industry’s been faced with over the course of the past two-and-a-half years, it’s a task that has taken on greater meaning, becoming that much more difficult to conquer.

However, as Charlebois points out, although he’s not one to freely dole out A+ marks, believing that there is still quite a bit of work to be done and progress to be made, he’s confident in the dedication of grocers across the country and the effort that they’re putting toward elevating the Canadian grocery experience for their consum ers. And, he says that, considering the pace at which grocery moves, combined with shifting consumer behaviour, he’s not expecting innova tion within the sector to slow any time soon.

Through a collaborative approach, the Canadian Food Innovation Network is providing a platform to help enable the continued growth and success of Canada’s food ecosystem // By Sean Tarry

When it comes to the need for innovation and the development of strategies and ways by which to continue satisfying the needs of today’s consumer, few sectors can attest to facing as much pressure as that of food and grocery. Fulfilling the needs of Canadians each and every day while consistently increasing convenience around the experience, creating greater efficien cies, enhancing digital capabilities and making it all tick along seamlessly, is daunting enough.

However, when considering the fragmented nature of the Canadian food ecosystem, the notion of actually executing on this vision can often seem impossible. In order to address this issue, and others, the Canadian Food Innovation Network (CFIN) was recently founded. And, ac cording to Dana McCauley, the Network’s Chief Experience Officer, its already helped to start filling a critical need within the industry, consoli dating its many players to facilitate growth.

“The food industry is an incredibly important contributor to the Canadian economy,” she ex plains. “However, it’s also a very fragmented one that’s segmented by regions. Unlike other sectors and industries, it’s next to impossible to get all stakeholders into the same room to discuss the big issues impacting the industry. CFIN was born of the impetus to highlight the importance of the food industry to the overall health of the country and to help facilitate connections and partner ships between retailers, manufacturers, ingredi ent purveyors, technology providers and others that are often operating in siloes. Essentially, we’re a platform and a network that helps bring all of these players together, encouraging innova tion and collaboration in order to help the entire industry grow. A win for CFIN is when a project is initiated in the Atlantic with service providers located out West and a consumer in Ontario. It’s collaboration and connections that the industry has traditionally found it difficult to achieve.”

Increasing innovation capacity

McCauley goes on to explain that the benefits that result from the facilitation of these partner ships is most obvious in the bottlenecks that are avoided within the innovation stream. She says that most of the food industry’s innovation ca pacity is consumed by attempts to problem solve and find partners, resulting in extended timelines and increased friction within the process. CFIN has been created to help remove that friction and free up the time and resources of those operating within the Canadian food industry that can be applied to innovation and development.

Founded in 2021, CFIN is a pan-national orga nization that operates virtually without a head office. It allows for a nimble and flexible approach to servicing its members. And, unlike most other networks and super-clusters that are funded by the government, membership to join CFIN’s growing community is free. And, perhaps more interesting is the way in which CFIN and its ser vices are structured, enabling the organization to

approach funding in a significantly different way when compared to other agencies, differentiating its offering.

“We don’t follow the same linear flow that others follow, which involves receiving funding, put ting out a funding call, attracting applicants, and then funding those that align with the challenges being addressed, before doing it over again,” she explains. “Instead, we’re taking more of a com munity-building approach that’s anchored to the launch of our YODL platform – a place where members can come to share ideas, truth test, seek information, put out a call for help and assistance or to offer theirs. It’s an incredibly powerful tool that, built on the premise of thought-leadership, content should lead to conversations, the identi fication of partnerships within the community, and newer and better ideas. CFIN monitors and analyzes all of the conversation that’s taking place and tailoring our funding calls to reflect the real problems and challenges. It results in really good applications and the opportunity for us to fund really great projects. And it also allows us to pro vide thought leadership to government who are creating policies.”

Although CFIN does not lobby government or advocate on the behalf of those working in the food industry, they do condense the insights gen erated through its community conversations and engagement between members to identify trends and sentiment. They share these insights in their reports, some of which are shared with their government funders who are keen to learn more about industry’s needs. It’s an incredibly inventive way to harness a very grassroots approach via digital means, helping to accelerate meaningful connections. And, it seems to be an approach that’s working wonders thus far. In barely more than a year, CFIN has reviewed hundreds of applications, put somewhere in the region of $4 million into Canadian business and attracted in excess of 1,700 members. And, it’s also been

involved in some meaningful projects that are set to improve and enhance the grocery experience for Canadians.

“We’ve been working with a number of innova tions that are going to change the way some

aspects of grocery retail work, helping the in dustry become more efficient and profitable,” she asserts. “On the operational side, we’re working with a company called Gastronomous which is ostensibly helping to solve a foodservice and meal kit problem through robotic automation that integrates into current operations. It’s es sentially a tool that portions fresh ingredients, removing manual labour that would normally be required, completing the task much more effi ciently and safely, extending shelf-life. We’re also working with companies that are focusing on the convergence of health, nutrition, wellness and eating. For instance, Canadian Pacifico Seaweeds works with indigenous communities in efforts to get more value-added seaweed products into the ingredient supply chain in order to aid in the development of new functional foods.”

In addition to these fascinating projects and in novations, CFIN is also working with a member partner on ground-breaking developments that

“We truly believe that Canada can compete on a global stage when it comes to being first to market with technologies and innovations that are complex."

- Dana McCauleyCFIN is working with a number of companies across the country, like Nutrimeals (pictured) to advance innovation Photo courtesy of Nutrimeals

could revolutionize the traditional supply chain and the way retailers and foodservice providers look at product sourcing. Innovations from On tario Genomics concerning cellular agriculture has resulted in a potentially revolutionary discov ery. The not-for-profit organization responsible for the management of genomics research proj ects has learned that it not only has the ability to produce protein using precision fermentation and cell-multiplier technologies, it can also produce an array of flavours and ingredients like vanilla, chocolate or coffee bean. The impacts of such an innovation could lend to the creation of a much more local supply chain, resulting in a complete supply chain rethink. And, according to McCauley, these examples are just the start of the innovations that CFIN are going to help bring to market.

“We’re constantly engaging in conversations with members and other stakeholders within the

industry, looking for the next big thing, with an eye on the ways the local sector would be im pacted as well as potential international impacts. We truly believe that Canada can compete on a global stage when it comes to being first to market with technologies and innovations that are complex. And, in the work that we’re doing, we’re learning a lot about where there are gaps in knowledge and ways those gaps can be prop erly filled through the introduction of dynamic services, learning opportunities and partner ships. This learning and experience will allow us to build more capacity, provide more innova tors with the chance to see their developments through to fruition and help the food and gro cery industry in Canada continue to thrive.”

For more information about the Canadian Food Innovation Network, visit cfin-rcia.ca/homeRethinking outdated buying, sourcing and product assortment practices to reduce excess and increase profitability // By Liza Amlani, Principal and Founder, Retail Strategy Group

Groundhog Day. The annual tradition on February 2nd is when the semi-mythical groundhog, Punxsutawney Phil, emerges from his burrow. Early spring is on its way if he does not see his shadow. Winter is extended by anoth er six weeks if he does. Or, so the story goes.

Retailers and brands, knowingly or not, cast their own shadows. Unlike Phil, where there is a chance that he won't see his shadow, retailers see theirs every season.

The shadow for the retailer is outdated practic es for buying, sourcing and assorting products. With that comes excess inventory and the even tual cadence of markdowns to salvage profit. In turn, full-price sales decrease, and there is a severe hit to gross margins.

We speak to brands often, and they tell us that re tailers are rapidly scaling back today. In response, vendors are dropping prices as they sit on can celed orders. Customers are starting to tighten their belts and are spending less in stores. Supply chain disorder, raw material costs and availabil ity, and increases in lead times are forcing price increases. As a result, inventory sales ratios are growing while spending plateaus. However, even these conditions won’t force a change in retail’s reactive behaviour.

Much like Bill Murray in the classic movie also entitled Groundhog Day, he couldn't escape to February 3rd, so he did whatever he felt. Eventu ally, this wore on him. And, to wake up to a new day, he needed to change his behavior. This begs the question - what leads to retailers casting a shadow to begin with?

Brands and retailers continue to overbuy.

Excess piles up because brands and retailers buy too much. Finance teams project sales plans by adding an increase to the previous year's results, essentially looking to the past to predict the fu ture. Product teams need to buy into the forecast,

literally. And organizations as a whole need to pay more consideration to feedback provided by frontline employees.

Plus, there is a need to meet the minimum fac tory order quantities while guessing how many units will sell next year.

It takes too long to get to market

Retailers and brands plan product assortments too far ahead of the selling season with 52 weeks being the norm for apparel, 90 weeks or so for footwear, and 3 years or more for the most inno vative products. When we are so far away from the season, it's difficult to know if the product will hit the mark once in the market. It's also im possible to respond when the customer changes behaviour. Markdowns are almost assured, and that translates to a hit in profitability.

Product creation calendars are inefficient

Product creation calendars are outdated and full of redundant process steps. Teams do not work efficiently, and the calendar is padded with extra time to ensure everyone hits their deadlines, add ing barriers to an already slow process.

For example, a brand we spoke to has product, planning, merchandising and insights teams working in isolation from each other. Internally, they say that insights are being "held hostage." In other words, insights from customers are not making their way back to all teams. Although those holding the insights intend to share, they do not know the best way or moment to do it.

As a bonus, retailers have moved into triage mode due to the current economic downturn. We have heard that many will be taking a "wait and see" approach and are planning to ride things out. Others are sitting on excess goods and are looking to survey customers to determine how

much they would be willing to pay for those items. However, these responses will reinforce outdated ways of working and the retailer will continue to see its shadow.

We propose that retailers should "act and see." The current downturn is the opportunity need ed to improve the product assortment process well before an economic recovery. Here's how to banish the shadow - we have broken it into shortterm and long-term plays.

First, the short-term plays: we suggest actions that are implemented rapidly with minimal dis ruption.

Renegotiate with partners - Consider working closely with vendor and factor partners to pack and hold core/seasonless materials and styles.

Calendar optimization - Get functional teams in a room to eliminate redundant processes and clarify ownership of milestones.

Integration - Formalize innovation and insights into the product creation calendar.

Here's an example of a short-term play: we facil itated an audit of calendar moments for a large outdoor brand in recent work we completed. Within 90 days, we could survey all cross-func tional teams and understand the specific chal lenges of each. Redundancies were identified, ownership of tasks was clearly defined, and accountabilities were ready to be assigned to spe cific teams. After bringing all teams in one room to meet, they left knowing exactly what to work on, when to execute, and when to converge.

Second, the long-term plays: actions that need more time to bear fruit. It's good fruit, though.

Develop a multi-track calendar - Capture mate rial and product innovation, R&D and long lead time developments. The multi-track calendar sits in parallel with the seasonal product creation calendar and ranges from 3 to 10 years.

Invest in insights technology - Help drive inno vative product and assortment decisions.

Vendor optimization - reduce the number of vendors to the most valuable ones. Redefine the relationship with vendors from a service provid er to a true partner. Then, enable digital trans formation within the partnership to increase real-time decision-making across production, testing and fit.

How about an example of a long-term play: A major brand investing the time to establish a physical/digital materials library. The library would host pre-approved materials from which product creation teams could pull, leading to increased material adoption rates. Moreover, this ensures that teams are working on high-value tasks versus creating something already existing. This is valuable long-term work because of the gains in efficiency. Since overdevelopment is re duced, there is also a benefit from a sustainability perspective.

Sure enough, in February 2022, Phil the ground hog emerged from his hole and saw his shadow. The folklore tells us this meant six more weeks of winter.

Coincidentally, retailers have been releasing their quarterly reports and making headlines with hits in profit, slashing guidance, and scrambling not to leave more money on the table. Every report pushes us closer to the cusp of (if we are not already in) a recession, and the shadow grows a bit taller.

However, it doesn’t need to be that way. Retail ers can take the necessary action immediately to diminish the shadow and reap the benefits of being closer to their customers and getting faster to market. Doing things in this way, the excess is reduced, and profitability is preserved. In groundhog-speak, that means an early spring for retailers.

Unmoved by the pandemic, luxury retail sales in Canada continue to rise. But what are the trends impacting current and future opportunities within the sector?

By Craig PattersonLuxury retail continues to be a strong sector in Canada despite pandemic challenges, indicat ing a wealthy consumer base in the country that is willing to spend. As a result, new luxury brands are targeting the country as luxury retail in Canada shifts to suburban nodes.

Following pandemic lockdowns, many luxury brands are saying that sales are higher now than they were prior to the pandemic. Remarkably, some luxury brands even say that sales were higher during lockdowns as sales associates targeted con sumers directly by selling goods via digital chan nels. Now there’s a race to build physical stores as consumers seek out experiences, something luxury brands tend to excel at.

It’s clear that Canada has become an important tar get for luxury brands. In decades past, the market was considered to be “too small” for some. Today, however, brands such as Ferragamo are choos ing Toronto to open first-in-the-world concept stores. And while new brands continue to enter the market, other brands such as Cartier have been updating operations by renovating, expanding and relocating storefronts in Toronto and Vancouver.

For decades, luxury retail has been focused in the downtown cores of Canadian cities. That appears to be changing, however, as suburban malls target luxury brands while new centres are built in Van couver and Montreal.

In terms of the suburbanization of luxury, the trend took off in 2009 when Tiffany & Co. opened at Toronto’s Yorkdale Shopping Centre Oxford Properties has since added more than two dozen of the world’s top luxury brands to the mall, creating the densest clustering of luxury brands anywhere in Canada. As a result, Toronto’s downtown BloorYorkville area is now a competitor and Yorkdale has many brand stores not located downtown.

It’s an interesting trend that will be replicated in Vancouver with the overhaul of two subur ban shopping centres. QuadReal is redeveloping Oakridge Centre, which will become a mixed-use site that will include a luxury retail component that is expected to attract some of the world’s biggest names. Not to be outdone, landlord SHAPE is redeveloping the Brentwood Town Centre in Burnaby to create The Amazing Brentwood, a newly branded centre boasting investment by L Catterton. That investment is significant given its relationship to LVMH, and the landlord is also tar geting top luxury brands for The Amazing Brent wood project.

L Catterton also invested in Royalmount in Mon treal, which is also targeting many of the world’s top luxury brands to open in the centre technically located in the Town of Mount Royal. Royalmount will compete with the downtown Montreal luxury node which, after years of contraction, is primarily centred around Holt Renfrew Ogilvy on Ste-Cath erine Street. Holt Renfrew Ogilvy itself functions both as a department store and a luxury mall with its roster of luxury brand concessions contained within.

Holt Renfrew Ogilvy itself functions both as a department store and a luxury mall with its roster of luxury brand concessions contained within.

It’s not just Canada’s biggest three cities seeing a shift of luxury retailers to the suburbs. The same has happened in Alberta’s two largest cities. In Edmonton, West Edmonton Mall has become a luxury node which in effect killed all luxury retail in downtown Edmonton. After Louis Vuitton made the decision to vacate Holt Renfrew in the city in early 2020, Holt Renfrew itself made the de cision to exit entirely. Today, West Edmonton Mall is home to Louis Vuitton, Gucci, Saint Laurent, Rolex, Canada Goose and soon, Balenciaga.

Calgary also saw Holt Renfrew exit downtown, though Holts remains open. Louis Vuitton moved to the suburban CF Chinook Centre which is also home to Tiffany & Co. and Burberry, with more on the way.

The suburbanization of luxury retail in Canada puts Canadian cities more in line with what’s seen in the United States, where for decades luxury brands have operated in suburban malls. It’s part of a phenomenon around the death of the American downtown core and the rise of suburbanization that picked up speed following World War II with car ownership exploding and the construction of new single-family residential communities on the edge of rapidly expanding cities amid new wealth.

Many department stores in the United States also once housed luxury brands, though the depart ment model itself has almost died in the United States. In Canada, department stores were typically less luxury-heavy than they are now. Today, lux ury can primarily be found in three large-format retailers - Holt Renfrew, Saks Fifth Avenue and Nordstrom.

The big three US-based Saks Fifth Avenue and Nordstrom both entered Canada within the last decade. Seat

tle-based Nordstrom, which operates six fullpriced standalone stores in Canada, opened first in Calgary in 2014. Luxury brands are part of the mix, though only the downtown Vancouver Nord strom store has shown success in terms of selling high-end goods or retaining luxury brands for that matter. In Toronto where Nordstrom introduced luxury brands to its CF Toronto Eaton Centre and Yorkdale stores, many brands have since vacated, leaving empty boutique spaces.

New York City-based Saks Fifth Avenue, as well, has seen brands exit stores in Canada. Saks oper ates primarily on a wholesale model in which the retailer stocks boutiques within, at a time when many brands are wanting either concession spac es or standalone boutiques. Saks has struggled in Canada - the downtown Toronto flagship lost Louis Vuitton, Dior and Saint Laurent among other brands, leading to a store renovation to fill the empty boutique spaces. The CF Sherway Gardens store in Toronto was downsized with a menswear floor being moved upstairs, and the CF Chinook Centre Saks store in Calgary was never luxu ry-heavy to begin with when it opened in 2018.

Holt Renfrew, which has operated for over 185 years in Canada, has been able to maintain its prominence and brand selection in the country partly because of its concession strategy. Many of the boutiques found within Holt Renfrew oper ate as leased concession spaces, something many brands have demanded in recent years. Now Holt Renfrew is home to an impressive roster of luxury brands, many operating concessions, creating a far more compelling luxury retail experience overall when compared to Nordstrom or Saks Fifth Ave nue in Canada.

Things could change for Holt Renfrew in the future, however, as luxury brands begin opening standalone stores. Some brands have seen remark able success operating concessions within Holt Renfrew, with some considering opening their own stores either on streets or in malls. In Toron to, landlord Oxford Properties could scoop some

brands operating boutiques within Holt Renfrew at Yorkdale - Gucci, Dior, Prada and Chanel already operate boutique spaces at Holts with doors direct ly into the mall, which in effect means that Holts is competing with its own mall landlord. It will be interesting to watch what happens as brands such as Fendi open standalone stores at Yorkdale - one of Fendi’s reasons for the opening of its new store is the fact that Holts no longer allows fur to be sold within its walls, which is said to have angered some brands.

The future of luxury retail in Canada remains bright while the dynamics around geographic lo cations experience a shift. In the coming years, we are more likely to see more luxury brands opening standalone stores in major Canadian cities as we see a polarization of luxury nodes in some centres.

At the same time, Canada is still a market smaller in population and wealth than the state of Califor nia. Given the relatively small population of Cana da, some more obscure and up-and-coming brands are likely to remain as wholesale accounts within multi-brand retailers, at least for the time being.

And at the same time, we’ll be seeing more luxu ry brand stores opening in Canadian cities in the years to come, including in new suburban nodes that are part of the continued shift in high-end re tail. The growth in luxury retail sales in the country is a strong indication that there is spending power in Canada. And, the opening of new stores also signals the importance of brick-and-mortar retail at a time when we’ve seen rapid growth in digital channels, particularly since the pandemic. As a result, it will be fascinating to see what happens going forward and how these trends might further impact the state of luxury retail in Canada.

Purpose-driven brands that stand for the things they believe in are setting themselves apart from competitors in the eyes of valuesseeking

Sean TarryDevelopment of authentic ESG strategies are allowing brands to build deeper relationships with consumers.