Clondrohid, Co. Cork and Dunboyne, Co. Meath Call: +353 2641311 or +353 1 8252059 Email: sales @ midcorkpallets.com Website: www.midcorkpallets.com Take a closer look at Ireland’s leading manufacturer of pallets, supplier of packaging and storage solutions. and print directory 2024

IRISH PACKAGING

The answer has been in our hands the whole time. From planning to design to implementation, our sustainable packaging delivers end-to-end solutions today for the challenges of tomorrow. Visit smur�tkappa.com #BetterPlanetPackaging

2 Sector Overview

David Little, Chair of The Irish Packaging Society and Managing Director of Leonard Little & Associates Ltd, advises on what real sustainability looks like when it comes to packaging, and reveals details of a brand new booklet which aims to introduce key aspects of the evolving field of Sustainable Packaging and Packaging Waste Management.

6 Cartonboard

The outcome of the Packaging and Packaging Waste Regulation discussions will hopefully put in place a reliable legal framework as a base for long-term investments across the European cartonboard industry, writes Winfried Mühling, Director of Marketing and Communications, Pro Carton.

10 Krones

Krones has unveiled the next evolutionary step in filling beer and CSDs into glass bottles with its Modulfull HES.

12 Irish Paper Packaging Circularity Alliance

The Irish Paper Packaging Circularity Alliance is setting out to promote the benefits of fibre packaging and to change consumer behaviour and improve packaging practices throughout the country.

14 Mid Cork Pallets & Packaging

Continuous improvement and development have been key to year-on-year growth at Mid Cork Pallets & Packaging.

18 Plastics

Urgent action is required to increase availability of circular feedstocks if Europe is to meet its ambition of using 25% of plastics from circular sources in new products by 2030, according to a new report from Plastics Europe.

21 Smurfit Kappa

It was another eventful year for Smurfit Kappa, as their committed and dedicated people continue to provide innovative and sustainable packaging solutions for their customers.

24 Repak

Zoë Kavanagh, CEO, Repak, examines the potential challenges of meeting our new EU plastic recycling targets, but explains that it is also a massive opportunity for Irish business to increase its recycling rates.

26 PPWR Agreement

March 2024 saw the EU Council presidency and the European Parliament’s representatives reaching a provisional political agreement on a proposal to make packaging more sustainable and reduce packaging waste in the EU.

Aluminium Foil

2023 saw a challenging market for European aluminium foil across all segments, according to the latest figures from the European Aluminium Foil Association.

Flexible Packaging

Prices of flexible packaging materials in Europe steadied on high levels at the end of 2023, although most are below the peaks from mid-2022.

Packaging Design

Shayne Tilley, General Manager of Logo and Brand at VistaPrint, on the packaging design trends that are offering brand owners the opportunity to tell their story in innovative,

PUBLISHED BY Tara

PUBLISHER

Patrick Aylward

EDITORIAL & MARKETING DIRECTOR

Kathleen Belton kathleenbelton@tarapublications.ie

EDITOR

John Walshe johnwalshe@tarapublications.ie

SALES

Brian Clark brian@tarapublications.ie

Aaron Stewart aaron@tarapublications.ie

DESIGN

Niall McHugh niall@oceanpublishing.ie

PRODUCTION MANAGER

Milly Burke Cunningham

PRINTED BY W&G Baird Ltd.

Every effort has been made to ensure the accuracy of the information contained in this publication, but the publisher cannot accept responsibility for errors or omissions.

IRISH PACKAGING & PRINT

42 Listings Product & Service Index…….42 Alphabetical Listings of Packaging, Processing & Logistics Companies…53 CONTENTS 14

6 2

353

Publishing, 14 Upper Fitzwilliam St., Dublin 2 Tel: 00

(0) 1 678 5165

Clondrohid, Co. Cork and Dunboyne, Co. Meath Call: +353 2641311 or +353 1 8252059 Email: sales@midcorkpallets.com Website: www.midcorkpallets.com Take a closer look at Ireland’s leading manufacturer of pallets, supplier of packaging and storage solutions. and print directory 2024

and print directory 2024 32 21 IRISH PACKAGING & PRINT

IRISH PACKAGING

IRISHPACKAGING

WHAT REAL PACKAGING SUSTAINABILITY LOOKS LIKE…

David Little, Chair of The Irish Packaging Society and Managing Director of Leonard Little & Associates Ltd, advises on what real sustainability looks like when it comes to packaging, and reveals details of a brand new booklet which aims to introduce key aspects of the evolving field of Sustainable Packaging and Packaging Waste Management.

For all businesses, CSR (corporate social responsibility) and driving sustainability are of increasing importance, which is highlighted by the ever-increasing amounts of legislation and regulations. This increase in regulation adds complexity and a requirement for technical understanding that is not easily fulfilled by one’s existing complement of staff. As a result, we are seeing a real increase in demand for Sustainability Officers and technical support on legislation, sustainable production and sustainable packaging.

All products have a carbon footprint. From raw material extraction (Scope 1) to product manufacture and use (Scope 2) towards final end of life (Scopes 2 & 3) when the product is discarded or recycled. For product

IRISH PACKAGING & PRINT 2 ı SECTOR OVERVIEW

carbon footprint analysis, the formula consists of Scope 1, 2 and 3 elements along its life cycle. Packaging typically falls into Scope 3.

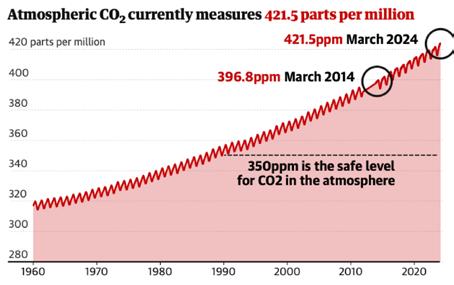

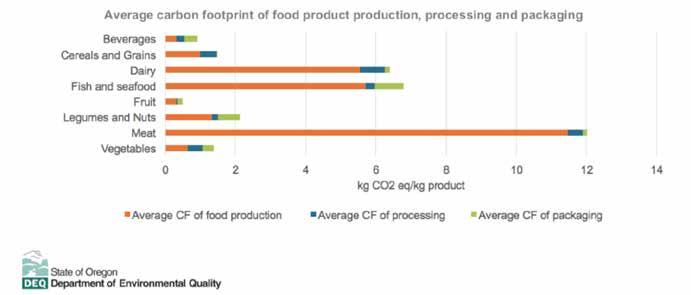

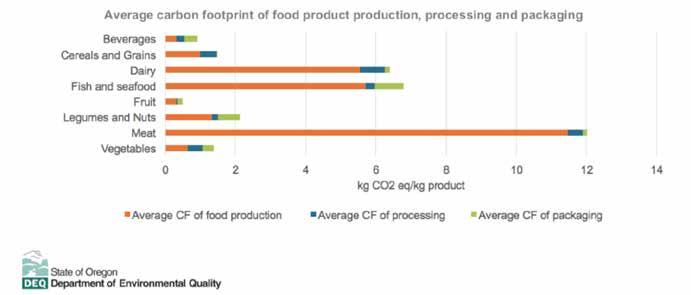

Packaging has its part to play, but packaging is by no means the biggest proportion of CO2e (carbon footprint equivalent) per food type. The biggest allocation of the CO2e of a finished product comes from the growing /farming or maturing phase of the product. There is a small carbon footprint impact in processing and a little bit on packaging at the end, depending on the food type. While accepting packaging has its part to play, as you can see from the green flashes on the graph below, depending on the food type, packaging has quite a limited impact in general. I think packaging suffers from being so visible in retail situations and in our homes’ recycle bins. As you can see from Graph 1, choosing different food types to buy and consume can have a much greater impact on reducing the carbon footprint, than tweaking the packaging. Rightly, we all need to play our part and reduce our carbon impact in our

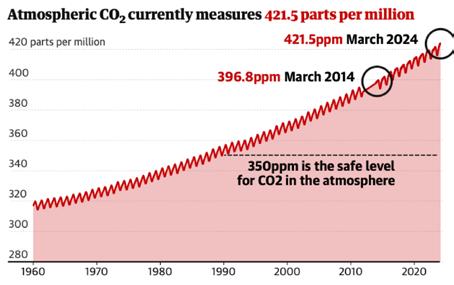

life, in our business and in our industry. Similarly, the top economies need to take the lead and show and promote best practice to the rest of the world. Taking a selfish approach as individuals or countries will be a race to the bottom and we will have unstoppable global warming, with God knows what consequences! Graph 2 above shows the urgency…

EMBRACING THE SUSTAINABILITY CHALLENGE

Trying to increase sustainable packaging, retailers and brand owners are correctly driving for more recycled content, reduced plastic content

with mono-materials and better recyclability. The industry is embracing this challenge and where possible, is removing unnecessary packaging, offering more recycled content, simplified laminate structures, and light-weighted packaging. However, there is still more to be done; we need to consider, and put more emphasis on, Removing, Reusing / Refilling and Rewarding.

There are some products, like dry powder sachets, that will never be easily recycled, as maintaining product integrity in that format needs good barrier properties, which mostly leads us to using paper/plastic/foil

IRISH PACKAGING & PRINT SECTOR OVERVIEW ı 3

Graph 1: Average carbon footprint of food production, processing and packaging (Source: Packaging and Wasted Food Report 2017)

Graph 2: Atmospheric CO2 has been rising since 1960 (Source: Guardian).

film laminates. It will take time for the packaging industry to develop more sustainable solutions for some products. Removing is not just about removing unnecessary packaging; it’s also about potentially removing a viable product from the market, but a product that is unsustainable, a product that for the size, the price point etc. is using too much packaging, is too hard to recycle or is not in the optimum format. Retailers needs to take the lead here. This is a difficult thing to do, because you already have a customer base for that product and those customers like it and use the product. I think we are going to eventually get down to being told to take these formats off the shelf and replace in a different packaging format or take them off the market. Therefore, wouldn’t it be better if we started as a food & drink sector to consider in advance if every pack is presented in its optimum format, designed for circularity, and not just for the customer, who more and more is looking for convenience over and above everything else. We need to educate the end-customer and start to make tough decisions. We should really be on a war footing with Climate Change; it’s that serious. Action is needed now and one part of it is following the Sustainable Packaging Principals below.

These are fairly self-explanatory; however, Respect, I think, needs a bit more clarity. Respect to me includes respect for the environment, for the production process, a drive towards circularity and reducing waste throughout the process, but it is also

about responsible supplier selection. This is another area of contention. We have been guilty of sourcing at the lowest cost, which often, if we checked, may well have the highest carbon footprint. For instance, importing packaging or widgets from China, with a large carbon footprint, when we could have got them in Europe. I believe the carbon footprint needs to be taken into the buying decision and should be considered as important as the monetary considerations. We are where we are due to greed, short termism and only chasing shareholder value. With Corporate Social Responsibility, companies will need to make decisions on a broader base, e.g. “Here are the monetary metrics, and here are the environmental impact metrics, and the social impact metrics; now, let’s make a decision knowing all the facts”. Don’t forget buying more local will be better for the local / regional employment and economic figures and consume less carbon in shipping etc.

Packaging design for circularity focuses on Reduce, Remove, Refill, and under format choice, Reuse. In other words, you might change the type of substrate (glass / paper / metal / plastic), moving from a flexible film wrap of biscuits to a tin for Reuse or a stand-up pouch of olives back to a glass jar for instance. Under the material choice, the focus is on Recycle, so here you are looking at the same substrate type but altering or changing the material spec. to aid recyclability, or use a higher recycled

content, or maybe by removing or reducing a complex laminate structure, if possible.

SUSTAINABILITY & FOOD WASTE

It’s all well and good to want to make your packaging more sustainable; however, what you don’t want is to increase food wastage. As you can see from the graph on the next page, food waste is hugely impactful on carbon footprint and potentially choosing a lesser, but more sustainable spec., could reduce the shelf-life or increase packaging waste. Testing and knowing the impact of the new spec. is crucial in understanding the barrier properties - moisture vapor transmission rates (MVTR) and oxygen transmission rate (OTR) - and assessing the equivalence or difference to your existing packaging.

Changing specifications can also impact on the pack seals, requiring changes in pressure, temperature, dwell time and probably impacting on runability. Bad seals will add to pack failure and reduced shelf life. Therefore, in making pack changes, two things are really important: (1) you have a baseline, a ‘control’ based on a specification that is currently working, and (2), you need to carry out extensive product/pack testing of the new more sustainable material, because in our eagerness to make our product more sustainable, we cannot inadvertently increase food waste. World food wastage per year is about 1.3 billion tons, with Ireland accounting for about one million tons.

Good packaging helps to prevents food waste.

If food waste was a country, it would be number three in the world in CO2e emissions after China and USA.

RIGOROUS TESTING OF NEW MATERIALS

Testing new materials is essential and can be done with a combination of internal tests and external laboratory tests to ensure things like seal strength and barrier properties are up to the required standard etc. Regarding having a good baseline, what you need in this case as a packer/filler, is a detailed current specification with performance tolerances from your existing packaging supplier for all your layers of packaging,

IRISH PACKAGING & PRINT 4 ı SECTOR OVERVIEW

Graph 3: Sustainable Packaging Principles

be it primary, secondary or tertiary packaging. If you have that detail, this then becomes the ‘control’ where you know for instance the BCT (box crush test) or the recycled content, or the barrier properties, the seal strength, the burst strength etc. of your packaging. With this detail, you now can now make comparative decisions based on the expected performance and help to speed up the NPD process and improve the outcome.

These specs are also useful to control internally, as your customers/ retailers will continue to require more advanced specifications in order to meet their own obligations. The days of relying on supplier specifications are gone, in my opinion. Packers/ fillers should work with their suppliers, manage their own specs and request the relevant information to meet their needs. This does require a technical understanding but puts you in control of your packaging performance and will make things easier in the end.

THE BENEFITS OF TECHNOLOGY

Technology can help. Imagine if we all used a similar format and standard, presenting all material data in the same form, wouldn’t that make sense? There is a growing community of industry stakeholders adopting the groundbreaking Open 3P standard (Streamline data capture, enhance compliance). The Open 3P Data Standard could transform the

way you manage packaging data. The standard is a free to use, open standard, developed and maintained by Open Data Manchester. Its goal is to standardise the reporting format of the material ingredients, content, composition etc. Data is added at each stage of the supply chain (as much as companies wish), so each level has access to the previous level’s detail, from, for instance, plastic pellet to the finished printed retail flow wrap. With large scale acceptance, this will create specification information accessibility in a standardised format.

The benefit of the material specification access will bring transparency in composition, recycled content etc., and bring efficiencies for converters, packers/ fillers, retailers and waste recovery operations. Wouldn’t it be handy if all retailers used the same specification / reporting format? I think it makes sense, and hopefully the food & drink industry buy into it. Check it out at www.open3p.org

NEW RESOURCES ON SUSTAINABLE PACKAGING

As mentioned at the beginning of the article, having internal packaging expertise and knowledge will help drive these projects and processes. To help, The Irish Packaging Society offers a range of training courses and has created a booklet which aims to introduce key aspects of the evolving field of Sustainable Packaging and

Packaging Waste Management. The booklet is a collaborative effort between The Irish Packaging Society, connecting and educating professionals in various packaging domains, Dar Ltd, a specialist micro-consultancy with extensive experience in packaging producer responsibility and sustainable environmental management, and Leonard Little & Associates Ltd.(Est. 1976), a packaging consultancy and packaging training company.

The booklet will be published in April 2024 and will be available to download by members of The Irish Packaging Society and available to view by all, on our website (www.irishpackagingsociety.ie).

The plan is that the booklet will be updated in-line with legislation every six months or so.

Major changes will be required by the packaging and packaging waste industry to deliver best practice, as we take on board a number of challenges to align with international and European Union policy and law requirements to manage climate change and the transition to a circular economy etc.

The booklet is intended to be a helpful guide to navigate the terminology and complexities for packaging design and purpose, in line with policy and legislation requirements. Look out for it on our website: www.irishpackagingsociety.ie

ABOUT THE AUTHOR:

DAVID LITTLE is Chair of The Irish Packaging Society and Managing Director of Leonard Little & Associates Ltd (Est. 1976), a packaging consultancy and training company. David has over 35 years’ experience in the packaging industry.

David is a Print / Packaging Technologist, Consultant and Lecturer in Packaging in the UK, EU and Ireland. He is a member of the Leadership Team of The Packaging Society (UK), and a Fellow of the Institute of Materials, Minerals and Mining (IOM3).

IRISH PACKAGING & PRINT SECTOR OVERVIEW ı 5

Graph 4: Why we need food packaging (Source: Windmuller & Hulscher, via FAO of United Nations).

PACKAGING INDUSTRY: Back to normal?

The outcome of the Packaging and Packaging Waste Regulation discussions will hopefully put in place a reliable legal framework as a base for long-term investments across the European cartonboard industry, writes Winfried Mühling, Director of Marketing and Communications, Pro Carton.

The packaging industry – be it cartonboard, plastics, metal, glass, or any other substrates –took with relief that the trilogy discussions ended with a decision on a new regulation for packaging and packaging waste.

It is too early to discuss the exact outcome, however; more details need to be confirmed before the regulation will be finally approved by the Council and the European Parliament. A committed legal framework will end the given uncertainty and create a sound base for future-oriented investments.

ECONOMIC ENVIRONMENT EASES BURDENS

The strict actions of central banks played a crucial role in controlling and reducing the double-digit inflation that stifled the European economy. The implementation of stricter monetary policies, primarily through interest rates, brought back a sense of control. Forecasts for 2024 indicate a significant decline in inflation,

Winfried Mühling, Director of Marketing and Communications, Pro Carton.

expected to fall well below 3% across Europe. This estimated decrease, with two or three further interest rate cuts, gradually moves towards the return to the central banks’ target range of 2%, deemed essential for long-term economic stability and financed investments.

This period of high inflation marked a first-time challenge,

IRISH PACKAGING & PRINT 6 ı CARTONBOARD

particularly for younger generations. Gen Z consumers, having never witnessed such levels of inflation, found themselves confronting a phenomenon previously only read about in textbooks. Soaring shelf prices for essential goods reduced purchasing power, forcing them to tighten budgets, leading to consumer reticence. Consumer behaviour shifted noticeably, with a growing preference for private label alternatives and a general pause on expensive purchases. This careful approach by consumers reflected a desire to prioritise meeting basic needs and ensuring financial security to be prepared for even more challenging times.

2023: ANOTHER CHALLENGING YEAR

Across Europe, consumer purchasing power weakened, leading to a subsequent decline in sales across different consumer segments. Early 2023 further strained the market as businesses continued to adjust inventory levels following the pandemic’s disruptions. Substantial

stock levels of packaging material had built up during the pandemic as a consequence of overstocking. The subsequent unstocking impacted the entire value chain, affecting all types of packaging substrate demand.

2023 was subsequently classified as another challenging year for the entire packaging industry. Pro Carton members’ mills used the times of forced standstill to advance necessary maintenance activities and invest in upgrades of the installed equipment to further improve output and to secure further reduction in CO2 emissions.

Some of Pro Carton’s member mills located in Scandinavia can already boast a net zero manufacturing process for cartonboard production. Pro Carton strongly believes investing in a sustainable future will create a timely financial return, as inflation decreases and consumers have more spendable income. This will require substantial investments in new technologies. These are investments the industry is ready to take, based on a reliable and steady legal framework.

To highlight the successful path that the cartonboard industry is on, the results of Pro Carton’s 2023 study on the carbon footprint of cartonboard acknowledge this progression and highlight the collaboration across the industry. Between 2018 and 2021, we revealed a staggering 24% reduction of CO2 equivalent emissions from cradle to grave. The investments in further reducing usage of fossil energy sources are paying dividends. Also, a strong focus on reducing waste at all production stages added to these substantial improvements.

Here we need to mention the combined efforts of the entire value chain, starting with pulp producers, via cartonboard manufacturers to folding carton producers. More than 60 production sites reported their emissions as a base for this report, which was a substantial contribution.

2024: THE “NEW

NORMAL”

Cartonboard will play a major role in Europe’s transition to a circular economy. Fibre based packaging has

IRISH PACKAGING & PRINT CARTONBOARD ı 7

The European cartonboard packaging industry is poised for a period of sustainable growth, driven by consumer preference, and supported by the upcoming implementation of PPWR legislation. (Image from Metsä Group).

Spain-based Alzamora Group’s luxurious three-dimensional spherical packaging solution for beauty brand GERnétic was crowned Carton of the Year at the 2023 European Carton Excellence Awards (ECEA).

been a leader in terms of the circular economy for decades and we have continued to improve and invest in these over recent years.

All Pro Carton’s members actively provide their best resources to contribute to cross industry alliances, such as 4evergreen. The challenges that lie ahead are too complex to be solved by one company alone, and we are very fortunate that our industry understands this. Our industry is based on an efficient collection and recycling system for fibre-based products. The industry has already committed to raise the bar even further for fibre-based packaging recycling rates, to levels of 90% by 2030. In fact, we are already leading the industry, with an 82% recycling rate across Europe (Eurostat). Harmonised and separate collection systems of fibre-based packaging material will help to boost recycling rates and the quality of recovered materials.

The choice between recyclable packaging and alternatives hinges on various factors, including consumption habits, transportation,

storage, and consumer preferences. Building a successful circular packaging ecosystem relies on consumer engagement. Neglecting their preferences in a top-down approach only lengthens the journey, potentially to the detriment of consumer trust. By collaborating with consumers, we can accelerate adoption and create a future that resonates with their values and needs. Informed decision-making is vital for businesses to withstand environmental scrutiny.

Business owners must be empowered to choose the best packaging options aligned with their requirements and consumer preferences, within a framework defined by clear, same time flexible legislation. In a circular economy, diverse packaging solutions are imperative to cater to product demands, with recycled and reusable systems coexisting, guided by scientific research to determine the most environmentally optimal solutions. The path forward should embrace both options rather than adopting an either/or approach.

CONSUMERS SUPPORT CARTONBOARD Consumer preferences for sustainable packaging materials became obvious in our latest Pro Carton Consumer Packaging Perceptions Survey 2024 (available at www.procarton.com/ wp-content/uploads/2024/03/EUSummary-Slides-Final.pdf). We asked more than 5,000 consumers across Germany, Italy, Spain, France and the United Kingdom about their packaging choices.

The recent findings revealed a strong preference for cartonboard packaging over plastic, with 87% of respondents expressing this sentiment - this represents a 1% increase compared to the findings from the previous study conducted in 2022. It clearly demonstrates the preference of consumers for recyclable fibre-based materials from renewable resources.

Climate change remained the biggest concern for consumers in Europe, despite high inflation and the war in Ukraine. Pro Carton found that 68% of consumers mentioned climate change, well ahead of inflation (56%) and warfare (56%). Additionally, the survey findings concluded that

IRISH PACKAGING & PRINT 8 ı CARTONBOARD

consumers believe they have a clear idea on how to improve the negative impact of climate change. When asked what are the most suitable actions to tackle the negative impact of climate change, consumers were clear to mention increasing recycling efforts and planting new trees. The link between healthy forests and improved global climate becomes increasingly clear in consumer minds.

82% of consumers in Europe feel confident to decide which packaging materials can be recycled. This is another 5% increase compared to our 2022 study. A vast majority (88%) of European consumers reported the significant trust they have in the efficient collection and recycling infrastructure of paper and cartonboard packaging. This level of trust sits well ahead of other materials, such as glass, metal and plastic packaging.

2024 AND BEYOND FOR CARTONBOARD

The European cartonboard packaging

industry is poised for a period of sustainable growth, driven by consumer preference, and supported by the upcoming implementation of solid legislation. This regulation signifies a commitment to a more sustainable future and is expected to provide a firm legal foundation for additional investments in new technologies and innovations. We are likely to see an investment-friendly environment of decreasing interest rates and low inflation. This gives hope that increasing purchasing power will lead to increased demand for packaged products.

The proven environmental benefits of fibre-based packaging are undeniable. Cartonboard truly promotes all aspects of a circular economy, promoting zero waste practices in production and recycling packaging material all over again in an open loop.

Consumer preferences also play a crucial role. We are seeing a continuous increase in favour of recyclable and

sustainable packaging materials, like cartonboard. This presents exciting growth opportunities for the fibrebased packaging industry, not only in established applications, but also in the development and adoption of innovative solutions for entirely new product categories.

In a fragile macroeconomic environment, any forecast can be caught up in reality in a matter of days. We are still looking forward with confidence to sustained growth for fibre-based packaging. Our industry will play a major role in Europe’s transition to a circular economy.

It’s crucial to acknowledge the importance of a sustained, diligent effort. Continued focus on research and development, working in tandem to maintain end-user and consumer trust, and co-operating across industry borders, will all be instrumental in securing these new growth areas and solidifying the growth position of fibrebased packaging in the years to come.

EUROPEAN CARTON EXCELLENCE AWARDS CELEBRATE PACKAGING EXCELLENCE

The European Carton Excellence Awards (ECEA) celebrate the crème de la crème of sustainable packaging.

Hosted by Pro Carton and the European Carton Makers Association (ECMA), the coveted awards saw Spain’s Alzamora Group’s luxurious three-dimensional

spherical packaging solution for beauty brand GERnétic crowned Carton of the Year in 2023, whilst Graphic Packaging International’s innovative Boardio fibre-based pack for Perfetti Van Melle Mentos gum won consumers over in the Public Award, as well as taking home the Sustainability Award.

Other awards celebrated innovation, including a premium beauty product that demonstrates tamper evidence using only Sappi virgin fibre cartonboard, eliminating the need for film wrapping, while another folding carton for laundry detergent, formed from MM board and paper recycled cartonboard, successfully tackles the challenge of replacing a plastic tub with a sustainable alternative.

“The European Carton Excellence Award continues to recognise excellence in packaging design, innovation, and sustainability,” noted Winfried Mühling, Head of Marketing & Communications at Pro Carton, who described the Awards as “the most relevant carton packaging competition in Europe”.

For more information about the 2023 winners or to enter the 2024 awards, please visit www.procarton.com

IRISH PACKAGING & PRINT CARTONBOARD ı 9

The Boardio fibre-based pack for Perfetti Van Melle is the first time a major global confectioner has created a paperboard bottle in the chewing gum category.

KRONES REVEALS NEXT GENERATION in Liquid Filling

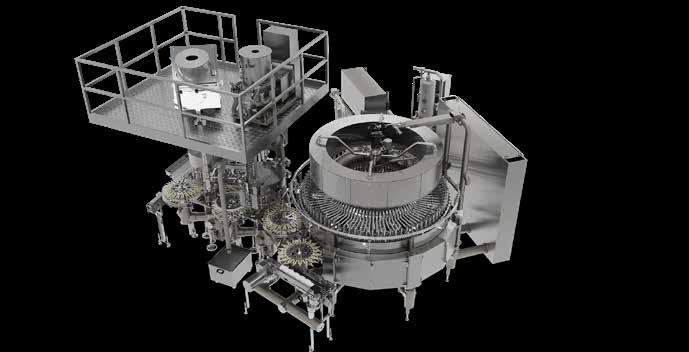

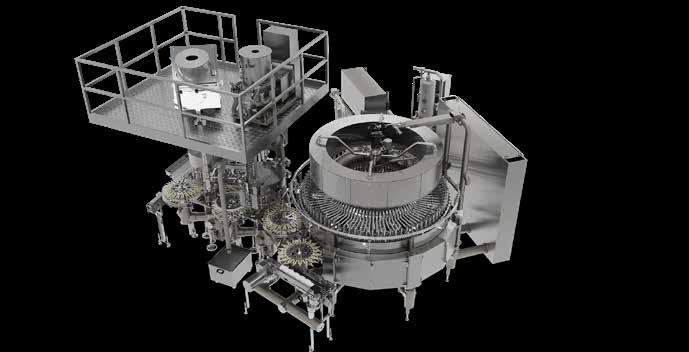

Krones has unveiled the next evolutionary step in filling beer and CSDs into glass bottles with its Modulfull HES.

Krones works continuously to make its products and solutions more and more sustainable. And now the Krones team has succeeded in taking the Modulfill HES beer filler to the next level with respect to flexibility, sustainability and machine output.

The results are outstanding on both oxygen pickup and CO2 consumption.

SETTING NEW STANDARDS

For the first time, Krones is combining the redesigned HES filling valve with a dry-running vacuum pump to synergise the advantages of both systems. For example, a revamped arrangement of the individual functions within the filling valve results in optimised flow conditions. That, combined with “lower” vacuum levels in the filling

process, enables the Modulfill HES to set entirely new standards for oxygen pickup and CO2 consumption in conventional beer filling.

Yet another plus in terms of product quality is the intelligent process-gas control system. A sensor measures the residual oxygen in the headspace of the filler bowl and thus makes it possible to monitor and dynamically regulate oxygen pickup to the desired level.

SHORTENED MACHINE DOWNTIMES

Digital features reduce the need for manual interventions.

Krones has added automation to the probe adjustment and to the CIP cups, which make it possible to achieve the same performance on a more compact machine using the automated CIP

cups. During cleaning, the necessary interventions are reduced to an absolute minimum, which in turn significantly shortens scheduled machine downtimes and increases overall equipment effectiveness (OEE). Machine changeover times are likewise shortened due to the use of the latest generation of the MultiGuide Base multi-functional clamping starwheel.

A further digital feature is the automatic filling-pressure control system. Inline measurement of the product temperature inside the filler bowl and information on the CO2 content (based on the product at hand) can be combined to calculate the real saturation pressure and thus regulate the filling pressure. This reduces the need for operator interventions when restarting the machine, for instance in order to prevent foam-over.

The Krones Modulfull HES offers:

• Increased flexibility in production as a result of optimised and automated operator interventions;

• Sustainable filling and capping owing to new media-saving options;

• More compact machine delivers the same performance due to new automatic CIP cups.

IRISH PACKAGING & PRINT 10 ı KRONES

Krones’ Modulfill HES sets new standards for oxygen pickup and CO2 consumption in conventional beer filling.

Shaping the future together

It’s important to look beyond the short term, which is why Krones is working on “Solutions beyond tomorrow”. Beverage filling lines, digital services and plastics recycling: Krones’ innovative solutions combine superior performance with sustainability.

krones.com

IPPCA: PROMOTING CIRCULAR SOLUTIONS

The Irish Paper Packaging Circularity Alliance is setting out to promote the benefits of fibre packaging and to change consumer behaviour and improve packaging practices throughout the country.

The Irish Paper Packaging Circularity Alliance (IPPCA) was formed to promote the benefits of fibre packaging, circularity and plastic reduction initiatives within the packaging industry. With a diverse membership of manufacturers, QSR’s, coffee retailers, industry member associations, including well known national and international brands, IPPCA aims to positively change consumer behaviour and improve packaging practices by advocating for legislative balance and sustainable solutions.

The Government’s ambitious recycling targets for 2025 and 2030 highlight the pressing need for improved recycling infrastructure. IPPCA acknowledges the challenges posed by inadequate facilities and aims to address these through collaborative efforts and most importantly, innovative solutions. Paper recycling in Ireland surpasses current EU targets, making it the optimal choice for scaling infrastructure towards fibre material circularity.

OUR NATIONAL IMPACT

Paper cups have become an integral part of modern life worldwide, offering a convenient means to enjoy beverages on the move. Being made of up to 95% virgin fibre coming from sustainably managed forests, their recyclability

potential remains largely untapped. Unfortunately, due to the lack of onthe-go recycling infrastructure, cups can end up in general waste, limiting future recycling prospects of this highvalue, in-demand material.

The Cup Collective (TCC), launched across Dublin in October 2023, presents a solution by streamlining paper cup recycling on an industrial scale throughout Europe. TCC allows for easy segmentation-at-source by consumers as they separate lids, liquids and cups at the specially designed collection bins, so that waste processing is simplified. With the potential to recycle over 63 million paper cups annually on a national scale, the initiative aims to simplify participation for both consumers and businesses. Central to this effort is a live database used by the scheme to track recycling progress in real time. Cups are collected by Panda Recycling and prepared for shipment to James Cropper, a speciality paper mill with a cup recycling facility in the UK.

Since the launch of The Cup Collective, 72,800 paper cups have been collected in Dublin, with the potential for 219,500 paper cups annually across participating sites. The Cup Collective is now operational in 16 sites in Dublin such as Applegreen,

Bewley’s Tea & Coffee, Butlers Chocolate Cafés, Insomnia Coffee Company and McDonald’s, with many others set to join the scheme.

THE EUROPEAN PERSPECTIVE

The Packaging and Packaging Waste Regulation (PPWR) sets out the EU’s rules for the management of packaging and packaging waste. It states that EU countries must adopt measures to minimise the amount of packaging waste and its environmental impacts. IPPCA welcomes a harmonised approach on the recyclability of packaging.

However, navigating the complexities of the PPWR in Europe poses challenges. The biggest disagreement among negotiators centred around restrictions on singleuse packaging and reuse targets. Initially, the Commission proposed broader restrictions encompassing single-use packaging of all materials. However, the finalised PPWR will only restrict the use of single-use plastic packaging in specific end-uses. IPPCA acknowledges the need to balance compliance with sustainability, advocating tailored approaches for industry-specific concerns.

The Joint Research Center (JRC) released its latest findings, comparing the environmental performance of alternative food packaging to paper packaging in the HORECA (Hotel, Restaurant, Café) sector. Key findings of the report show that single-use packaging, particularly cartonboard,

IRISH PACKAGING & PRINT 12 ı IRISH PAPER PACKAGING CIRCULARITY ALLIANCE

• Balance of reuse and recycling: Promote equitable treatment for both reuse and recycling initiatives, avoiding approaches that may exacerbate plastic waste and negative environmental outcomes.

• Recycling targets: Proactively work towards meeting EU recycling targets, leveraging initiatives like The Cup Collective to enhance paper packaging recycling levels.

• Certified standards: Ensure adherence to EU certification levels for paper cups and other paper packaging, addressing false environmental claims and promoting transparency.

outperforms reusable packaging in various environmental impact categories (e.g. climate impact and water consumption), supporting the removal of mandatory reusable packaging targets for takeaway food and beverage packaging.

In Ireland, it is crucial to follow these findings within the framework of existing or future packaging and waste policies. Overlooking these findings, for example with the proposed latté levy, will result in behaviours and outcomes contrary to the legislation’s environmental goals.

ADVANCING CIRCULAR ECONOMY PRINCIPLES

In many economies, the traditional production model follows a linear trajectory: extracting materials, manufacturing products, and ultimately discarding them as waste - a make, use and dispose conveyor belt. The circular economy model prioritises sustainability by promoting sharing, reusing, repairing, and recycling materials within the supply chain.

Two prominent recycling methods - closed-loop and open-loop - play crucial roles in realising the circular economy’s objectives. Closed-loop recycling involves reintegrating manufactured goods back into the same or similar products, such as glass bottles being recycled into new glass bottles. Conversely, open-loop recycling

transforms secondary raw materials into entirely new products. For instance, used paper cups can be repurposed into magazine paper or cup carriers.

To meet stringent safety standards for food and beverage packaging, open-loop recycling is often employed for items like paper cups. This approach aids efficient collection, sorting and recycling processes, maximising the value of secondary raw materials within the circular economy framework.

IPPCA’S KEY POSITIONS:

• Recycling parity: Advocate for policy parity in packaging recycling schemes, prioritising renewable and highly recyclable materials.

E.g. Ensure paper cups are added to the recycling list.

• Collaboration in solutions & policy: Champion collaborative approaches between industry and policymakers, emphasising evidence-based policies and operational efficiency.

CONCLUSION

IPPCA’s initiatives are in line with the Circular Economy Action Plan, supporting the objective of achieving recyclable packaging by 2030.

IPPCA is committed to fostering sustainability within the packaging sector. Through collaboration, innovation, and advocacy for balanced policies, IPPCA strives for a future where packaging practices promote environmental stewardship and adhere to circular economy principles.

We are actively building an inclusive Alliance. For those interested in joining, please reach out to info @ ippca.ie

IRISH PACKAGING & PRINT IRISH PAPER PACKAGING CIRCULARITY ALLIANCE ı 13

Pictured at the launch of The Cup Collective are (l-r): Rob Tilsley, Fibre Operations Leader, James Cropper PLC; Dara O’Flynn, Chief Operating Officer, Insomnia Coffee Company; Julie Murray, Head of Coffee Culture, Bewley’s Coffee Ltd; Vasilii Stepa, Area Manager, Butlers Chocolate Cafés; Maria Cassidy, Head of Coffee and Innovation, Applegreen PLC; Derek McNicholas, Corporate Accounts Manager, Panda Ireland; and Helen McFarlane, Sustainability Manager at McDonald’s.

Paper cups have become an integral part of modern life worldwide, offering a convenient means to enjoy beverages on the move, and being made of up to 95% virgin fibre coming from sustainably managed forests, their recyclability potential remains largely untapped.

NEVER STANDING STILL

Continuous improvement and development have been key to year-on-year growth at Mid Cork Pallets & Packaging (MCP).

MCP’s forward-thinking and courageous mindset has led the company to the forefront of its respective industries through pioneering innovative manufacturing techniques, investing in high tech. machinery and setting new standards for quality and sustainability.

Headquartered in Clondrohid, Co. Cork, MCP comprises over 700,000 square feet (and expanding) of pallet manufacturing, storage and packaging distribution, as well as generating electricity and, more recently, offering fulfilment services to its customers.

Founded in 1978 by Johnny Lehane, a former teacher in the Gaeltacht, the company has always been famed for its entrepreneurial spirit and passion.

MCP are renowned for producing the highest quality pallets, manufactured with industry-leading precision in Ireland (both north and

south) across a wide range of sizes, designs etc., ranging from wooden pallets to EPAL pallets and from customised pallets and crates to second-hand pallets. To continue to ensure their quality of product, MCP are currently introducing their third automated pallet manufacturing machine to offer customers greater choice of pallet and timber crates. This new machine will enable MCP to surpass their current manufacturing capabilities of producing approximately 9,000 pallets daily or 2.5 million pallets per annum.

CONTINUOUS IMPROVEMENT PROJECTS

Another key factor in MCP’s growth in recent years has been the number of successful continuous improvement projects the company has integrated into its operations. “We have never been shy in investing in our processes, products, people or locations,” explains Aidan Harty, Managing Director of MCP. “As a result, we are currently commissioning our third pallet manufacturing machine; we pioneered one of the first Combined Heat & Power Plants (CHP) and constructed multiple new warehouses

at both our sites in Cork and Meath to offer our customers the largest range of pallet, packaging and storage solutions, to name but a few.”

SUSTAINABILITY AS A WAY OF LIFE

In 2019, MCP commissioned one of Ireland’s first Combined Heat and Power (CHP) plants. The CHP plant is powered by biomass, which is a biproduct from its pallet manufacturing operations, helping MCP use 13,000 tonnes less carbon per year and generating 1.3 megawatts of green electricity per hour. This electricity is supplied directly to the national grid and can power the needs of up to 1,300 homes. The heat that this plant generates is also utilised by MCP to heat-treat and kiln-dry pallets to ISPM15 standards and power their 10 onsite kilns.

“We feel that we are fortunate in that we have never taken a shortsighted view of the environment or our sustainability obligations or commitments,” stresses Aidan. In fact, MCP boosted their green electricity credentials in the last two years with the installation of a 598KWp solar generation facility on 3,359 square metres (3,000 solar panels) of unused

IRISH PACKAGING & PRINT 14 ı MID CORK PALLETS & PACKAGING

MCP’s headquarters at Clondrohid, Co. Cork.

MCP are currently introducing their third automated pallet manufacturing machine to offer customers greater choice of pallet and timber crates.

rooftop space, as well as intelligent LED lighting systems, which reduce the company’s CO2 emissions by 265 tonnes a year.

“These efforts help us to use our own solar power energy to run our operations and help us in our quest to move off the grid,” smiles Aidan. “We realise that many companies have only recently added the environment as an agenda item and when we look at how far our company has come down this road already, we are relieved that we were one of the early adopters. However, like everything, we are not going to sit on our laurels and be content with our current operations; we are going to continue to look at ways to improve our service, reduce costs and enable our transition to a carbon neutral operation.”

LEADING CORRUGATED PACKAGING PROVIDER

MCP have also seen significant growth, particularly in recent years, across their packaging division and the company is Ireland’s leading single source corrugated packaging partner for many SME businesses across the food and drinks, e-commerce and medical sectors. MCP like to stand out from the competition and offer a unique service to their packaging customers, from a full design and prototyping service available in-house, through to management of production and

MCP offer customers a third-party warehousing option, including the storage and distribution of food grade and non-food grade packaging and third-party warehousing of ambient food, packaging and consumer products.

MCP are renowned for producing the highest quality pallets, manufactured with industry-leading precision in Ireland (both north and south) across a wide range of sizes, designs etc.

storage and warehousing, including manufacturing, storage, distribution and more recently, fulfilment.

MCP’s dedicated team work with their customers to create packaging that improves product protection, while also increasing efficiencies, reducing costs and enhancing customer experiences.

“At MCP, we always go the extra mile to deliver unrivalled service that consistently surpasses expectations and therefore, we are able to provide innovative and scalable solutions that support the success and growth of our customers’ business,” Aidan reveals.

DISTRIBUTION, STOCK MANAGEMENT & WAREHOUSING

As a complementary service, MCP also provide their customers with an unrivalled nationwide distribution and stock management service for subsequent re-ordering. In 2022, MCP developed their operations even further, offering some of their existing customers a third-party warehousing option, a side of the business that has expanded ten-fold. As a result, the company expanded its BRCGS certification to include the Storage and Distribution of Food Grade and Non-Food Grade Packaging and third-party warehousing of ambient food, packaging and consumer products. This is

IRISH PACKAGING & PRINT MID CORK PALLETS & PACKAGING ı 15

something that is certainly not offered by many packaging suppliers.

Although some of the continuous improvement projects have included large investments, they have also embarked on several projects at ground level, including implementation of a new management information system, warehouse management system and maintenance and spare parts ordering system and the adoption of several lean manufacturing features, which have allowed the company to better analyse

its production processes, Overall Equipment Effectiveness (OEE) etc.

“In fact, these improvements have ignited a catalogue of other continuous improvement projects,” Aidan notes. “We have empowered our staff and it has been like a building block for the company and has allowed us to fine-tune our operations across each department.”

At the core of MCP’s business is their dedication to outstanding customer service, with a singular

focus to help their customers protect what matters most – whether that’s protecting their products, safeguarding their supply chain, optimising costs or promoting sustainability, MCP are committed to supporting the success and growth of their customers’ business. “Our unique business model reflects our commitment to excellence and outstanding customer service,” concludes Aidan. “We provide expertise and solutions, while keeping things simple, clear and concise.”

16 ı MID CORK PALLETS & PACKAGING

IRISH PACKAGING & PRINT

MCP have become a leading single source corrugated packaging partner for many SME businesses across the food and drinks, e-commerce and medical sectors.

MCP comprises over 700,000 square feet of pallet manufacturing, storage and packaging distribution, as well as generating electricity and, more recently, offering fulfilment services to their customers.

Clondrohid, Co. Cork and Dunboyne, Co. Meath Call: +353 2641311 or +353 1 8252059 Email: sales @ midcorkpallets.com Website: www.midcorkpallets.com SPECIALISTS IN END TO END PALLET, PACKAGING AND STORAGE SOLUTIONS

NEW REPORT IDENTIFIES CHALLENGES IN CIRCULAR ECONOMY FOR PLASTICS

Urgent action is required to increase availability of circular feedstocks if Europe is to meet its ambition of using 25% of plastics from circular sources in new products by 2030, according to a new report from Plastics Europe.

Plastics Europe published its biennial ‘The Circular Economy for Plastics: A European Analysis’ report on March 19, 2024. Its data provides an overview of European plastics production, conversion, consumption and waste management, and includes an analysis of plastics production from non-fossil sources, and recycling technologies.

The study’s central finding is that circular plastics now account for 13.5% in new plastic products manufactured in Europe. This means that the European plastics system is halfway towards the interim ambition, which was established in the ‘Plastics Transition’ roadmap, to use 25% of plastics from circular sources in new products by 2030.

However, the report’s data also highlights several major challenges that will undermine the plastics system’s progress towards circularity; including growing rates of incineration with energy recovery (+15% since 2018) of plastics waste needed as circular feedstock/that could have been recycled.

“Our latest ‘Circular Economy for Plastics’ report provides essential insights into the transition of the plastics system,” noted Virginia Janssens, Managing Director of Plastics Europe. “This edition is also broader in scope and contains more in-depth data than ever before. Whilst the data confirms the shift to circularity is firmly established and picking up pace, it is frustrating that we still incinerate so much plastics waste when this potential feedstock is desperately needed by our industry to accelerate the transition. Without urgent action to increase the availability of all circular feedstocks for plastics, we cannot maintain the current rate of progress

and realise the ambitions of our ‘Plastics Transition’ roadmap and the EU Green Deal.”

In total, 26.9% of European plastics waste is now recycled, meaning that for the first time, more plastics waste is recycled than is put into landfill; an important milestone in Europe’s plastics circularity journey. However, to meet the growing demand for plastics manufactured from circular feedstocks, we need to massively upscale the collection and sorting of post-consumer plastics waste, and increase the availability of biomass and captured carbon.

Circular plastics content in new products was

13.5%1 in 2022 (7.3 Mt).

When it comes to plastic packaging

IRISH PACKAGING & PRINT

MARCH 2024 A European Analysis Executive summary 18 ı PLASTICS

The Circular Economy for Plastics

The Circular Economy for Plastics: A European Analysis, from Plastics Europe, was published on March 19, 2024.

Executive summary Key report figures

Virginia Janssens, Managing Director of Plastics Europe.

Europe’s plastics 26.9

Plastics waste incineration Almost the use

recycled plastics increased by +70% reaching 6.8 Mt. Since 2018,

Plastics rate reached

of post-consumer

Circular plastics content in new products was

13.5%1 in 2022 (7.3 Mt).

waste, the recycling rate reached 37.8% in 2022. This rate needs to improve further if we are to achieve the 2018 Packaging and Packaging Waste Directive targets of 50% by 2025, and stay on track for 55% by 2030.

Circular plastics content in new products was

13.5%1 in 2022 (7.3 Mt).

Plastics

packaging, building & construction, and agriculture sectors. However, others, including automotive and electricals and electronics, are falling behind.

Europe’s share of global plastics production

Plastics waste incineration with energy recovery increased by

The report found that in 2022, circular plastics were produced from several sources: the largest source (13.2% of all plastics produced) was mechanically recycled, while only 1% came from bio-based feedstock, and 0.1% was chemically recycled. (2022). If this continues, Europe will become increasingly dependent on imports and its ability to invest in circularity and support the transitions of the many downstream sectors and value chain partners that rely on plastics, will be undermined.

26.9%2

Plastics recycling rate reached Almost 25% of plastics waste is still sent to landfill.

DRIVING ADVANCES IN CIRCULARITY

To maximise recycling rates, we need to significantly increase investment in sorting and recycling capacities, including in chemical recycling. Extended Producer Responsibility (EPR) schemes to increase separate waste collection and other mandatory measures to incentivise mixed waste sorting will be very important, the report notes. Fostering market demand for circular plastics resins can also play a vital role in encouraging the necessary investment. Chemical recycling, as a complement to mechanical recycling, is essential to maximising the resource potential of plastics waste currently being sent to landfill and incineration. The transition to a plastics circular economy cannot be achieved without a continent-wide roll-out of chemical recycling technology.

The data also highlights that the uptake of circular plastics is not uniform but varies by industry sector. The strongest demand comes from the

“The continent-wide rollout of chemical recycling, as a complementary solution to mechanical recycling, is essential to meet ambitious mandatory recycled content targets for applications and industries that require high-quality plastics,” stressed Virginia Janssens. “To incentivise the necessary investments and ramp up the deployment of chemical recycling in Europe, we urgently need a green light and clarity from EU policy makers. We need legislative acceptance of chemical recycling and the adoption of a Mass Balance attribution method based on a fuel-use exempt model.”

Europe’s share of global plastics production dropped from 22% in 2006 to 14% in 2022.

The report stresses how Plastics Europe’s members are already driving major advances in the circularity of their operations, including investing in cutting-edge recycling technologies, renewable energy and producing more plastics from biomass and CO2. They are also working closely with their value chain partners to deliver new systems thinking, higher performing products, eco-design innovation and new infrastructure.

plastics content ambitions by 2030 sorting centres. The measurement is now done when the recycling actually takes place, according to the Packaging and Packaging Waste Directive (PPWD) (EU) 2018/852. The substances have been removed from the sorted materials.

The report also shows that Europe’s share of global plastics production decreased from 22% (2006) to 14%

The roadmap prioritises what the industry, as plastics producers, can do to further accelerate this transition, but also provides recommendations to policy-makers as to how they can support the transition through the creation of an enabling policy and regulatory framework:

• Incentivising circular plastics production and conversion: increasing the availability of circular feedstock for plastics production and setting minimum mandatory circular content targets in new plastics products is essential for incentivising investment and innovation, and key in sectors such as automotive and electrical and electronics.

Circular plastics economy (Source: Plastics Europe, The Circular Economy for Plastics: A European Analysis).

• Chemical recycling: to unlock investments and stimulate innovation, policy-makers need to give a green light to this essential technology. To do so they should, for example, adopt a Mass Balance attribution method (as already

IRISH PACKAGING & PRINT PLASTICS ı 19

Executive summary Energy Recovery Landfill Conversion to plastic products & parts by companies Mechanical Recycling Recycling by dissolution Chemical Recycling Export/Import Fossil-based feedstock Products in use (<1 to >50 years) Pre-consumer plastics waste Reuse, repair & refurbished Waste collection & sorting Polymerisation Bio-based feedstock Carbon-captured feedstock Export/Import Plastics production &/or compounding Overall plastics production Consumption of plastic products & parts by end-users Recycling

economy 1. Pre-consumer plastics waste is mainly originating from the plastics conversion activities, and production to a lesser extent. 2. Including recycling of EU27+3 plastics waste abroad. 3. Several steps are needed between the input of plastics waste into chemical recycling and the input into polymerisation, also depending on the chemical recycling technology. 11 PLASTICS EUROPE THE CIRCULAR ECONOMY FOR PLASTICS - A EUROPEAN ANALYSIS | 2024 Executive summary

Circular plastics

2018,

Mt. 1. This number excludes pre-consumer recycled plastics content (pre-consumer recycled ‘circular plastics’ as an overarching term including post-consumer recycled plastics, and 2050 set in the roadmap, pre-consumer is excluded. 2. Recycled quantities were previously measured upon leaving the sorting centres. The measurement calculation point therefore lies after impurities and unsuitable substances have been 3. The vast majority of plastic waste incineration in the EU27+3 is with energy recovery.

use of post-consumer recycled plastics

6.8 Mt. Since 2018, THE CIRCULAR ECONOMY FOR PLASTICS - A EUROPEAN ANALYSIS | 2024 figures

+15%3 since

reaching 16

the

increased by +70% reaching

dropped from 22% in 2006 to 14% in 2022.

2

26.9%

reached recovery Almost 25%

plastics waste

landfill. plastics content (pre-consumer recycled plastics means recycled plastics from waste arising from the plastics production and converting processes). The “Plastics Transition“ roadmap defines post-consumer recycled plastics, plastics from bio-based feedstock, and from carbon-capture. To measure progress towards the 25% and 65% circular plastics content ambitions by 2030 excluded. leaving the sorting centres. The measurement is now done when the recycling actually takes place, according to the Packaging and Packaging Waste Directive (PPWD) (EU) 2018/852. The unsuitable substances have been removed from the sorted materials. EU27+3 is with energy recovery. post-consumer

PLASTICS EUROPE EUROPEAN ANALYSIS | 2024 figures

recycling rate

of

is still sent to

12

(pre-consumer recycled plastics means recycled plastics from waste arising from the plastics production and converting processes). The “Plastics Transition“ roadmap defines umer recycled plastics, plastics from bio-based feedstock, and from carbon-capture. To measure progress towards the 25% and 65% circular

with energy

post-consumer

PLASTICS

ANALYSIS | 2024

recovery.

12

EUROPE

Circular plastics content in new products was

1 in 2022 (7.3 Mt).

Plastics recycling rate reached

26.9%2

Plastics waste sorting and recycling

used in sectors like renewable energy and wood, and for fair trade cocoa and chocolate) for calculating chemically recycled content in new plastic products, and introducing more ambitious recycled content targets for sensitive applications.

Plastics waste incineration with energy recovery increased by +15%

estimated that 32.3 Mt of post-consumer plastics waste1 was collected in 2022. shows that, for the first time, the share of post-consumer plastics waste collected separately is higher compared to mixed collection streams, reaching 50.7% (16.4 Mt). This is a positive development recycling rates for separately collected plastics are 13 times higher than those collected via mixed the case of plastics packaging, post-consumer waste is currently almost only recycled if collected

Plastics waste sorting and recycling

streams containing plastics, and mandatory measures to incentivise mixed waste sorting should be implemented. Municipal waste incineration should also be included in the revised EU ETS system, the potential of chemical recycling as an alternative to landfilling and incineration should be properly recognised and carbon capture should be obligatory for remaining waste incinerators after 2040.

For the first time, more post-consumer plastics waste is being recycled than sent to landfill, accounting for 26.9%2 (8.7 Mt) of waste treated in 2022.

Europe’s share of global plastics production dropped from 22% in 2006 to 14% in 2022.

Plastics recycling rate reached

26.9%

It is estimated that 32.3 Mt of post-consumer plastics waste1 was collected in 2022. The report shows that, for the first time, the share of post-consumer plastics waste collected separately is slightly higher compared to mixed collection streams, reaching 50.7% (16.4 Mt). This is a positive development since recycling rates for separately collected plastics are 13 times higher than those collected via mixed streams. In the case of plastics packaging, post-consumer waste is currently almost only recycled if collected separately.

The report shows that, for the first time, the share of post-consumer plastics waste collected separately is slightly higher compared to mixed collection streams, reaching 50.7%.

• Phase-out of landfill and incineration: to accelerate this process, whilst avoiding the shifting of plastics waste from landfill to incineration, existing EU legislation, including the Landfill Directive, needs to be properly implemented and enforced. Minimum and steadily increasing landfill and incineration taxes should be introduced on all waste

• European competitiveness: a level playing field needs to be urgently created to restore the plastics sector’s competitiveness through, for example, the development of a comprehensive EU equivalent to the US Inflation Reduction Act, and the creation of a harmonised and consistent regulatory framework across the EU Single Market.

should urgently initiate a Clean Transition Dialogue with the plastics industry, which looks at the enablers, investments, roadblocks and solutions for reaching a circular, net zero and sustainable plastics system in Europe.

For the first time, more post-consumer plastics waste is being recycled than sent to landfill, accounting for 26.9%2 (8.7 Mt) of waste treated in 2022.

“Separate collection“ means separation of waste by end-users into different collection containers to facilitate recycling.

Plastics recycling rate reached

26.9%

cut-offs of insulation, flooring or wall-covering boards). quantities were previously measured upon leaving the sorting centres. The measurement is now done when the recycling actually takes place, according to the Packaging and Packaging Waste Directive (PPWD) (EU) 2018/852. The point therefore lies after impurities and unsuitable substances have been removed from the sorted materials.

• Public procurement: considering its economic importance, it can play a crucial role in promoting circularity by, for instance, prioritising circular plastics content in public tenders.

• Waste management and recycling: incentivising the massive additional investments in separate collection, sorting and recycling infrastructure and technologies that are required is vital. More specifically, separate plastics waste collection needs to be significantly increased through, for example, Extended Producer Responsibility schemes, and mandatory measures to incentivise mixed waste sorting as a complementary solution to separate collection of plastics waste.

COLLABORATION IS KEY Collaboration between all actors within the European plastics system, and with policy-makers and regulators, needs to be intensified. To support this objective, the

Commission

“Separate collection“ means separation of waste by end-users into different collection containers to facilitate recycling.

For the first time, more post-consumer plastics waste is being recycled than sent to landfill, accounting for 26.9% (8.7 Mt) of waste treated in 2022.

“The European plastics system is too big, complex, and interconnected for any part of it to successfully deliver a competitive, circular and net zero system alone,” said Virginia Janssens. “We need to find better ways of listening, talking and deepening our collaboration. To boost this essential collaboration, we call on the European Commission to urgently establish a Clean Transition Dialogue to look at the roadblocks and solutions for creating a competitive circular plastics system in Europe together.”

The report is available to download at: https://plasticseurope.org/knowledgehub/the-circular-economy-for-plasticsa-european-analysis-2024/

IRISH PACKAGING & PRINT 20 ı PLASTICS

European

Post-consumer plastics waste: waste generated by households or by commercial, industrial, and institutional facilities in their role as end-users of the product which can no longer be used for its intended purpose.

returns of the distribution chain or the installation of plastic products (e.g.

This includes

11.0% 49.4% 3.8% Post-consumer plastics waste collection and treatment 32.3 Mt via MIXED waste collection 15.9 Mt Recycling Energy recovery 59.7% Landfill 36.5% via SEPARATE waste collection 16.4 Mt Recycling Energy recovery 39.6% Landfill

18 PLASTICS EUROPE ECONOMY FOR PLASTICS - A EUROPEAN ANALYSIS | 2024 Executive summary China Europe 1 North America 2014 2022 2006 24% 19% 26% 17% 32% 22% 21% 20% 14% 0 5 10 15 20 25 30 35 % backdrop of rest of the decreased from tracking global North America respectively. dependent on standards, circularity, plastics, will be European competitiveness: a threat to the transition Europe in the global production 21 THE CIRCULAR ECONOMY FOR PLASTICS - A EUROPEAN ANALYSIS | 2024 Weakening European competitiveness is seen as a threat to the transition, according to Plastics Europe. Executive summary Key report figures 13.5%1 in 2022 (7.3 Mt). Circular plastics content in new products was Europe’s plastics dropped 22 14 26.9 Plastics rate Plastics waste incineration with energy recovery increased by +15%3 since 2018, reaching 16 Mt. Almost 25% of plastics waste is still sent to landfill. 1. This number excludes pre-consumer recycled plastics content (pre-consumer recycled plastics means recycled plastics from waste arising from the plastics production and converting ‘circular plastics’ as an overarching term including post-consumer recycled plastics, plastics from bio-based feedstock, and from carbon-capture. To measure progress towards the and 2050 set in the roadmap, pre-consumer is excluded. 2. Recycled quantities were previously measured upon leaving the sorting centres. The measurement is now done when the recycling actually takes place, according to the Packaging calculation point therefore lies after impurities and unsuitable substances have been removed from the sorted materials. 3. The vast majority of plastic waste incineration in the EU27+3 s with energy recovery. the use of post-consumer recycled plastics increased by +70% reaching 6.8 Mt. Since 2018, 12 THE CIRCULAR ECONOMY FOR PLASTICS - A EUROPEAN ANALYSIS | 2024

Executive summary Key report figures 13.5%

3 since 2018, reaching 16 Mt. Almost 25% of plastics waste is still sent to landfill. 1. This number excludes pre-consumer recycled plastics content (pre-consumer recycled plastics means recycled plastics from waste arising from the plastics production and converting processes). The “Plastics Transition“ roadmap defines ‘circular plastics’ as an overarching term including post-consumer recycled plastics, plastics from bio-based feedstock, and from carbon-capture. To measure progress towards the 25% and 65% circular plastics content ambitions by 2030 and 2050 set in the roadmap, pre-consumer is excluded. 2. Recycled quantities were previously measured upon leaving the sorting centres. The measurement is now done when the recycling actually takes place, according to the Packaging and Packaging Waste Directive (PPWD) (EU) 2018/852. The calculation point therefore lies after impurities and unsuitable substances have been removed from the sorted materials.

The vast majority of plastic waste incineration in the EU27+3 is with energy recovery.

use of post-consumer recycled plastics

by +70% reaching 6.8 Mt. Since 2018, 12 PLASTICS EUROPE THE CIRCULAR ECONOMY FOR PLASTICS - A EUROPEAN ANALYSIS | 2024

3.

the

increased

summary

Executive

1. Post-consumer plastics waste: waste generated by households or by commercial, industrial, and institutional facilities in their role as end-users of the product which can no longer be used for its intended purpose. This includes returns of material from the distribution chain or the installation of plastic products (e.g. cut-offs of insulation, flooring or wall-covering boards).

quantities were previously measured upon leaving the sorting centres. The measurement is now done when the recycling actually takes place, according to the Packaging

Packaging Waste Directive

been removed from

sorted materials.

2. Recycled

and

(PPWD) (EU) 2018/852. The calculation point therefore lies after impurities and unsuitable substances have

the

11.0% 49.4% 3.8% Post-consumer plastics waste collection and treatment 32.3 Mt via MIXED waste collection 15.9 Mt Recycling Energy recovery 59.7% Landfill 36.5% via SEPARATE waste collection 16.4 Mt Recycling Energy recovery 39.6% Landfill

18

THE CIRCULAR ECONOMY FOR PLASTICS - A EUROPEAN ANALYSIS | 2024

PLASTICS EUROPE

SMURFIT KAPPA: Creating the Future Together

It was another eventful year for Smurfit Kappa, as their committed and dedicated people continue to provide innovative and sustainable packaging solutions for their customers.

Amid a difficult environment for the industry in 2023, mainly due to de-stocking and a lack of economic activity in certain sectors, Smurfit Kappa saw progressive improvements because of its performance-led culture.

“Our people continue to live values of loyalty, integrity, respect and safety at work, with a relentless focus on delivery and quality for customers, ensuring that Smurfit Kappa will have an unrivalled advantage across our 36 countries,” revealed Smurfit Kappa Group CEO, Tony Smurfit.

The company, headquartered in Dublin with European headquarters in Amsterdam, is a leading provider in sustainable packaging, offering a range of products including paper, board, packaging, bag-in-box solutions, displays and containerboard. This past year has been the second-best year in the company’s 90-year history, reaping the benefits from their decades of experience in innovation and dedication when it comes to sustainable solutions for customers. Tony Smurfit praised the efforts of their skilled team, which has delivered the company into a position where “we’ve never been in better shape financially, strategically or operationally”.

SIMON COMMUNITY

Although one of the world’s leading packaging suppliers, when it comes to Smurfit Kappa, responsibility starts in the community. To reflect this, Smurfit Kappa Ireland recently launched their charity partnership for 2024 with the Simon Community. Across the country,

each Smurfit Kappa plant was involved with various fundraisers and activities for the charity, which included a collective Christmas jumper day and awareness sessions with a member from a local Simon Community branch. This commitment to their charity partners and communities coincides with the group’s sustainability target of spending €24 million on social investments over the next five years. The company is dedicated to many other sustainability targets, including a 30% reduction in waste sent to landfill by 2025, net zero emissions by 2050 (55% intensity reduction in fossil CO2 emissions in their global paper and board mill system by 2030) and 1% reduction of their water usage annually.

Conor Timmons, Regional General Manager – Corrugated, Ireland, stressed that “each of our seven companies in

Smurfit Kappa Ireland contributes to supporting social, environmental and community initiatives”.

At the Cork plant, 2023 was a busy year for community involvement, including support for STEAM (Science, Technology, Engineering, Arts, and Maths) education in local schools, renovating the local community centre and providing financial support for Cork Mental Health.

SUSTAINABILITY

The company continues to exhibit innovation when exploring new paper-based solutions to replace plastic box packaging. Recently, Smurfit Kappa created a sustainable packaging solution to transport bees for Biobest, a world leader in biological crop protection and pollination. When Biobest approached the packaging

IRISH PACKAGING & PRINT SMURFIT KAPPA ı 21

Pictured as Smurfit Kappa Ireland donate a cheque to the Simon Community are (l-r): Anthony Carroll, Conor Timmons, Catherine Kenny, Jason Cannon, and Muirgheas Griffin.

giant, the emphasis was on an insulated, weather-resistant box to transport live bees. The boxes were to be robust and able to withstand long periods outdoors to be used for outdoor pollination. The collaboration was a huge success, with Peter Van Leent, Sustainability Manager at Biobest, acknowledging Smurfit Kappa’s “same deep commitment to sustainability”.

Smurfit Kappa, along with Two Sides, the print and paper advocacy association, will continue to advocate for EU Packaging and Packaging Waste Regulation (PPWR) as part of Europe’s Green Deal objective. In November, the EU parliament voted in favour of the PPWR, which encompassed multiple measures to reduce packaging waste. In December, the EU council reached an agreement on a proposal for a regulation on packaging and packaging waste. Both institutions will begin to start negotiating the final legislation under the current Belgian presidency. The adopted positions

of both institutions is positive for Smurfit Kappa, a company that places sustainability at the centre of its operating model.

“We don’t have to reinvent the wheel,” explained Saverio Mayer, CEO, Smurfit Kappa Europe. “Sustainable packaging, 100 percent renewable, recyclable and biodegradable already exists.”

Once again, Smurfit Kappa has recently been recognised as a leading ESG performer by Morningstar Sustainalytics for the third year running. The company has been placed first against its paper packaging peers, with a ‘Low Risk’ score of 10.7. Morningstar Sustainalytics is one of the leading ESG rating companies in the world, with over 14,000 companies assessed across 42 industries. Garrett Quinn, Company CSO at Smurfit Kappa, commented that the strong ESG ratings “reflects our ongoing dedication to delivering best-in-class ESG performance for all our stakeholders”.

INVESTMENTS

Smurfit Kappa continue to invest in new machinery to enhance the customer experience. 2023 was a significant year for Smurfit Kappa Cork customers, with the introduction of three new machines to manufacture solid board divisions. Smurfit Kappa Cork is now one of three Smurfit Kappa plants that manufacture solid board, along with sister sites in Scotland and Germany.

There was also continued expansion outside of Ireland, as part of the company’s strategic goal to provide the most innovative and sustainable packaging solutions to their customers. Their investment into their Mold plant in North Wales increased capability, flexibility and speed, making it the largest box factory in the UK. The investment included state-of-the-art equipment that reduced CO2 per tonne emissions by 15%, as well as an extra 10,000 trees, shrubs and bushes and a three-acre nature trail for staff and the local community.

IRISH PACKAGING & PRINT 22 ı SMURFIT KAPPA

Smurfit Kappa calls for EU Council to support Europe’s circular economy.

The Biobest sustainable new bee packaging creates a buzz.

In South Europe, the company announced an investment to double the Spanish Bag-in-Box plant capacity, the investment will introduce even more enhanced energy waste management systems and lead to significant savings in energy consumption. These developments will further strengthen the sustainability of the plant’s operations and its product portfolio.

The company is also continuing its expansion in Northeast Europe with the acquisition of Asterias, one of the largest printing houses in southern Poland. Asterias offers a comprehensive portfolio of innovative packaging solutions, including graphic design, prototyping, printing and laminating, to deliver a final product.

WELLBEING MAP LAP

Smurfit Kappa’s UK & Ireland employees participated in a virtual walk across the world in a bid to support healthy lifestyle choices and behaviours. In the most recent edition, teams raced across a virtual map of Ireland and the UK. Upon passing a town or large city, images and information concentrating on history and culture were available for each team. It was a great success, with 656 participants completing 242 million steps over a four-week period. Each week, a winning team was chosen to donate to the charity of their choice.

BEST WELLBEING IN THE WORKPLACE STRATEGY