BILLION EUROS WAS THE TOTAL INVESTMENT IN EUROPEAN ORIGINAL PRODUCTION RECORDED IN 2021.

BILLION EUROS WAS THE TOTAL INVESTMENT IN EUROPEAN ORIGINAL PRODUCTION RECORDED IN 2021.

STREAMERS’ SHARE OF INVESTMENT IN EUROPEAN CONTENT GREW RAPIDLY IN 2021.

NETFLIX HAS MORE THAN HALF OF STREAMERS’ EUROPEAN CONTENT.

The new streaming service

SkyShowtime has officially launched across Europe.

The platform now offers a premium offering across Denmark, Finland, Norway, and Sweden for the first time. SkyShowtime will also be available through the following distribution partners across its Nordic markets: Allente, RiksTV, Ruutu, Sappa, Strim, Telenor, Tele2, Telia, Telmore and YouSee from Nuuday, and TV 2 Play. Once launched across more than 20 countries, its apps and content will be available in 18 different languages.

Alon Shtruzman, CEO of Keshet International, is stepping down from the company by the end of the year after a decade in the role. Shtruzman has led the division since it was launched by Keshet Media Group in 2012. A replacement has not been named and Shtruzman’s next move is not yet known. Under Shtruzman leadership, Keshet International established a global distribution and production infrastructure.

Leonine Studios acquired

house

The National Association of Television Program Executives (NATPE) announced that it will file a court petition to restructure its business affairs with the Bankruptcy Court under Chapter 11 of the Bankruptcy Code. NATPE has been adversely impacted by the COVID pandemic, which prevented NATPE from holding events, which typically generate significant revenue. These cancellations forced NATPE to operate on its financial reserves, which now require it to reorganize the NATPE business structure. Due to the rise of different strains of COVID-19 NATPE was forced to cancel its flagship Conference and Marketplace events in 2021 and 2022.

With a record volume of productions forecast over the coming months and in order to manage the challenges of its fast expansion, both in France and worldwide, Federation Entertainment will be renamed Federation Studios. Headed by Pascal Breton and co-directed by Lionel Uzan, the company will strengthen its finance

TelevisaUnivision has appointed Guillermo Borensztein as Senior Vice President of International Content Licensing and CoProduction. Based in Miami and reporting jointly to Michael Schwimmer, President of Global Platform Strategy and Revenue, and Pierluigi Gazzolo, President and Chief Transformation Officer, Borensztein will lead content licensing efforts, as well as drive coproduction deals for linear and streaming original content. Borensztein joins TelevisaUnivision from ViacomCBS International Studios, where he led the content sales and co-production business and spearheaded the new film division.∙

team, as well as a strategic addition to its staff in the form of Julie Gualino Daly, who will be working as Group Chief Financial Officer. Gualino Daly will continue building the Group’s Finance function. She will work closely with Benoit Lacombe, the group’s COO, she will actively participate in its financing strategy.

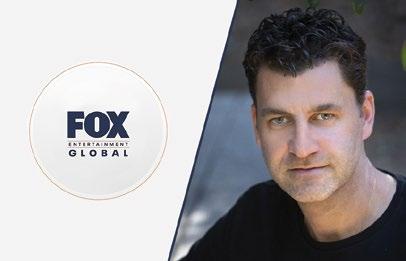

Fox Entertainment will launch Fox Entertainment Global, the company’s newly formed worldwide content sales division. The area will be responsible for further diversifying and monetizing Fox’s rapidly expanding portfolio of owned original programming. Fox Entertainment Global will be responsible for overseeing the international, multi-platform sales and distribution of intellectual property owned and produced by Fox Entertainment and its portfolio of in-house production studios and content acquired from outside producers. The division will be overseen by Fernando Szew, who has been named CEO of Fox Entertainment Global.

Instead of writing this column, I could be watching some new content like "The House of the Dragon" (yes, GOT is back!) or "Rings of Power," the first series story from the "Lord of the rings." Two super productions, one of them considered the most expensive show in history. Rings are expensive: almost 750 Million dollars for the first season.

That represents an excellent example of what the streaming wars brought to us: a content fight with big pockets. "GOT" is something special for people like me who were raised during the payTV expansion, where we all wanted to have an HBO premium package activated at home. Although now we can have it directly on B2C platforms, there is something in common with those pay-TV days; we need to wait a week for new episodes, and no more "bingewatching" for big titles.

I decided to keep writing and thought, "What's the hottest news in the last days? I can't take the answer from my head: Ads, ads, ads, and more ads. Advertising seems to be the new Messiah in the streaming landscape. It's a well-known tool for the media legacy companies, and perhaps it's the primary way of selling anything for the last 100 years.

The new Netflix ad-based tier (we already assume they broke a promise) is expected to generate a

quarter of their total revenue from advertising by 2027 in the United States. Online video advertising will generate three times more revenue than SVOD in 2027; no surprise that all major SVOD services want to participate in that growth. Nearly 60% of global Netflix subscribers will be on the ad-supported tier, and this change will happen through a combination of new subscriber acquisition and "downgrading" of existing subscribers to the ad-based tier.

I am happy for them; really, this is excellent news for our industry.

By Pablo Mancusowas the main difference from the only TV we knew, and that product and that promise were pretty fair; that's why we paid for it. But then, having the best content available wasn't enough. They had to put ads on those channels.

In the beginning, it was just a little, but pay-TV ended up having way too many ads. The original oath was broken, so we didn't want to pay for it anymore.

Wall Street is happier than me about the new Ad-era. What I am concerned about is the possibility of creating some kind of déjà vu process, one we can call pay-TV 2.0

Pay-TV business models have been tested for five decades and still generate a significant amount of money. When they started, it was a premium experience for users; it was the best TV with no ads. That

Probably I am wrong (in fact, I hope so), but there are too

many ingredients here that indicate we are going on a similar path: great weekly content, the need to create new revenues, the explosion of ad-based streaming models, and the simple fact that we are humans and we tend to replicate what did before. So yes, let's welcome pay-TV 2.0! I am sure the 3.0 version will be available soon.

NEW FINDINGS BY OMDIA INDICATE THAT THIS BUSINESS MODEL WILL ALMOST DOUBLE FROM $190 BILLION IN 2022 TO $362 BILLION IN 2027, WHERE ONLY NETFLIX IS EXPECTED TO GENERATE JUST UNDER A QUARTER OF ITS REVENUE FROM ADVERTISING.

In the next five years, online advertising revenues will almost double from $190 billion in 2022 to $362 billion in 2027, according to the latest research from Omdia. "Netflix is expected to generate just under a quarter of its revenue from advertising by 2027 in the US. With the growth in SVOD expected to increase from $86 billion in 2022 to $118 billion in 2027, it is no surprise that all the major SVOD services, including Netflix, want to participate in that growth," Omdia's Senior Research Director, Maria Rua Aguete, said.

Omdia estimates that by 2027 nearly 60% of global Netflix subscribers will be on the ad-supported tier, and this change will happen through a combination of new subscriber acquisition and "downgrading" of existing subscribers to the ad-tier option.

Ad load and ad formats are major tactical considerations in implementing hybrid models. Omdia expects Netflix to cap in-stream video ad loads and refrain from introducing ads in the user interface to maintain the premium consumer experience, particularly internationally, where hybrid models are not fully established. According to some reports, Netflix intends to keep the ad load below 4 mins per hour. That trend is on par with HBO Max ad load cap but below all other hybrid streamers in the US.

60% of global Netflix subscribers will be on the ad-supported tier

2027

global: Preliminary advertising revenue forecast, $bn

In the United States, Omdia expects Netflix to balance out ARPU on the hybrid model tier to be roughly equal to premium tier consumer price despite the ad load capping. That strategy will be much more challenging in far less mature international markets with lower CPMs and a smaller pool of premium CTV advertisers. Under this assumption, Omdia expects that Netflix will generate 23% of its US revenue from instream advertising in 2027. Globally, this figure will be significantly lower, around 14%. Although advertising will not displace subscriptions as the primary source of Netflix revenue, the impact of Netflix advertising move on a broader competitive landscape should not be underestimated. Under this revenue model, Netflix will become a formidable CTV ad market player in the United States, fully competitive with other prominent hybrid direct-to-consumer models, such as Hulu, Peacock, and Paramount+.

By Omdia

WITH CONSTANT EVOLUTION IN VIEWERSHIP AND SPENDING, A NEW STREAMING FORMAT HAS EMERGED THAT IS CATCHING THE EYEBALLS OF BOTH CONSUMERS AND ADVERTISERS: FREE AD-SUPPORTED STREAMING TV, ALSO KNOWN AS FAST.

Today's consumer has more places to watch their favorite TV content than ever before. One of the newest ways they watch is on free ad-supported streaming television, also known as FAST, a form of over-the-top (OTT). Companies like Amazon, Peacock, Xumo, Tubi, and Pluto are reaching consumers with news, entertainment, sports, and more in an environment that mimics linear TV and is often built right into a TV manufacturer's interface.

FAST providers are enjoying the most rapid expansion in their history. Pluto TV, launched in early 2014, took six years to reach 16 million monthly active users (MAUs) in the US. It has almost doubled that total in the last two years. Other FAST services have enjoyed similarly explosive growth, including Xumo and The Roku Channel. It is not surprising that such a dynamic market has attracted a host of other FAST services.

TV manufacturers now have built-in FAST services. Three of the top four US smart TV brands (TCL, Samsung, LG, and Vizio) have branded FAST services available from the home screen. Samsung and LG provide access to their FAST services TV Plus and Channels from the home menu bar. Vizio does the same for WatchFree but also dedicates a button on the TV remote. Connected TV (CTV) device manufacturers such as Roku, Amazon Fire TV, and TiVo 4K Stream also have native FAST apps. App providers such as Plex and DistroTV also provide access to vLinear channels.

As Verizon stated in a recent paper, conditions for the rapid expansion of free TV services have become much more favorable in the last several years. Most

homes that want broadband services now have it, and with 82% of US households using at least one SVOD service, virtually all are streaming. In other words, a massive audience is streaming and searching for things to watch online. However, the availability of an audience does not explain why so many are gravitating toward FAST services.

In today's multiscreen video world, more TV viewers rely on streaming services to discover and watch their favorite video content. For example, US consumers are expected to spend close to six hours per day in 2022 with TV and digital video, two with much of that time devoted to streaming video services, both adsupported and non-ad-supported.

Companies like Xumo, Pluto, Tubi, or Amazon Freevee offer streaming services that also feature linear-style channels, encouraging a lean-back experience that mimics traditional video or cable but in a streaming video format. For advertisers, FAST provides a unique opportunity to reach cord-cutters while they are "scrolling," "channel surfing," and discovering new content, a prospect not possible through ad-free services like Netflix or even from ad-supported ondemand services like Crackle.

As a result of this growth, more premium video publishers are seeing the advantage of creating FAST services to reach and engage with audiences. For example, ABC, Fox, NBC, and CBS now offer FAST news channels, and cable networks like Hallmark Movies, A&E, History, and BBC use FAST channels to reach their audiences. While consumers may land in the FAST sphere without even knowing it, recent Xumo data shows viewers will spend an average of over 100 minutes with FAST video content. Whether viewers are consuming their content on a TV screen, computer, or mobile device, FAST provides them with the convenience of varied content with the nostalgic feeling of surfing through a wide array of personalized channels. Consumers also appreciate that FAST providers typically do not crowd their content with too much advertising.

Moreover, research shows that media plans are most robust when TV is also combined with streaming, including FAST. In fact, in a recent case study analyzing 20,000 multiscreen campaigns, Comcast Advertising found that reach was highest when 20-30% of an advertiser's investment was allocated to streaming. Today, FAST is an increasingly important piece of that streaming allotment, playing an important but complementary role in media plans. To understand the dynamics behind FAST's growth, there are key market participants: streamers, hardware manufacturers, and content providers.

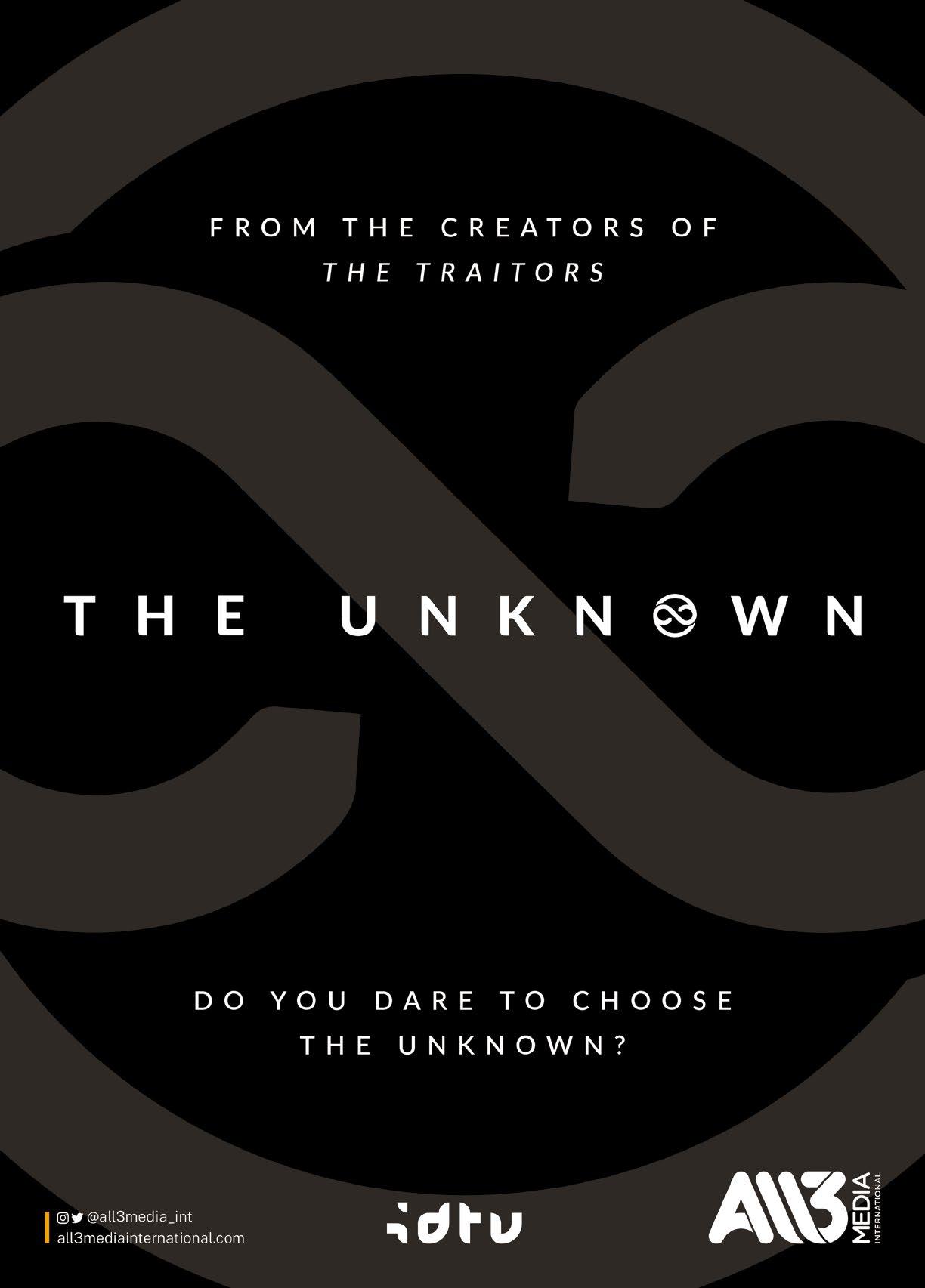

E

EVP St r ategic Development, All3media International

“

FAST is a marketplace that is coming to its own in the last three years. From a growth point of view, I think there continues to be a tremendous amount of room for FAST, both in terms of content, audience, territory, and platforms. While the United States has a head start on FAST, I see a tremendous opportunity in global markets. Many have already started to adopt FAST or launch their own FAST platforms. Some are local players, and some are global companies, like Pluto or Samsung. I also see a tremendous number of opportunities regarding monetization of FAST, as advertisers and marketers are beginning to really recognize the value and quality of those audiences."

"I would not describe FAST as 'added value.' I think it is a fast-growing new business opportunity that leverages the assets and infrastructure of existing television content companies. A+E sees FAST as the second coming of cable, or the third version of broadcast, just with greater flexibility, much greater targetability, greater data, and greater reach. On a streaming basis, your reach opportunities are phenomenal, almost unlimited."

"We started FAST three years ago. It was a single channel, and we did not know if that would take off or go anywhere. Today, we have 14 channels, and we will be growing that portfolio in 2023. We started in the United States, and it is our expectation in 2023 or 2024 to extend beyond those US boundaries into markets that have developed FAST and are ready for consumers, advertisers, and marketers. Our footprint will be growing over the next months, and I see many markets across the globe as very promising for FAST, particularly those with strong infrastructure, a strong broadband, and a high degree of viewership on connected TV, which will lead to monetization."

Online video advertising to generate USD 259 billion revenues

2025

“

We see a range of opportunities around FAST. There's the opportunity to launch our own channels around some of our key brands, around specific genres and key talent. We're immensely proud of our 'Midsomer Murders' channel, where we do a lot of work around the curation of that show, working with the team responsible for the Midsomer brand to make this an integral part of the Midsomer family. Other recent launches include 'Homes Under The Hammer' and 'Great British Menu.' We have a further three channels launching before the end of the year, one of which is focused on a key talent for us; and we continue to operate with Cinedigm our reality channel 'So…Real,' and our single brand channel for 'The Only Way Is Essex.' A channel like 'So…Real' is great for opening up opportunities for some great brands that do not have the volume for a single IP channel."

"I think the core work we do around our channels is the curation and turning these channels into experiences for fans, particularly around single IP or single talent. Digital media has been a component of All3Media International's strategy for many years. We've always been at the forefront, from some of the first coproductions between UK producers and the big SVOD players, having our own niche SVOD service, and now launching FAST services."

"I think what's different this time is the need for a new set of skills. As well as the traditional distribution skills of rights management, we are assuming editorial control, creating elements for our channel, and through working with a technology provider, having overall responsibility for our channel feed that plays out 24/7. That meant ensuring we have competency to produce on-air promotions and to work with platforms to build our audiences through bespoke promotion. In FAST, where we are running our own channels, elements that our traditional client base might be responsible for, we become responsible for."

Free video streaming services used by US adults in millons.

“

It's well documented that the US remains the biggest market in the FAST channel space, but other key territories to focus on include the UK and Germany. There's also growth of note in Latin America, where we recently launched our 'MasterChef' Brazil FAST channel, as well as emerging activity in Australia and New Zealand. We recognize that many more platforms are being launched worldwide, and, as a leading distributor, we want to work with those. But it will always be the content itself that will drive decision making, utilizing our strong, existing recognizable IP."

"In September, we launched our first ever-dedicated Banijay-branded general entertainment FAST channel, Horizons: Powered By Banijay, in a landmark move that further extends our reach on free ad-supported services worldwide. Horizons brings more than 200 hours of premium UK content to viewers on Samsung TV Plus UK, LG Channels, and Rakuten and features several series from our 130,000-plus hour catalog, including 'Location, Location, Location,' '8 Out of 10 Cats' and 'Pointless,' as well as drama series 'Gunpowder' and 'The Woman in

White.' This channel features new integrated 'Powered by Banijay' branding, which will now be added to Banijay Rights' entire suite of 15 live FAST channels and close to 50 live streams globally. Horizons builds on our success in the UK global FAST channel market, where earlier this year, we launched our channel brands 'McLeod's Daughters' and 'Deal or No Deal USA' on Samsung TV Plus UK, as well as 'Deal or No Deal,' 'Fear Factor' and 'The Biggest Loser' on LG. Meanwhile, we recently launched a German-dub aggregate channel in Germany, 'Spannung & Emotionen,' which features shows such as 'Peaky Blinders,' 'Broadchurch,' 'Dark Matter,' and 'The Bridge.'"

"We are a platform-agnostic business and will continue to be. FAST channels haven't changed our strategy per se but do add shelf life to our existing titles in our expansive catalog. This whole new world has helped us to bring in a new school of talent, including schedulers, analysts, and editors, something we are fully embracing."

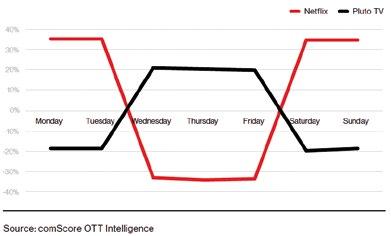

Changes in viewership for Pluto TV and Netflix throughout the week

BETH ANDERSON G M FAST, BBC Studios

BETH ANDERSON G M FAST, BBC Studios

“

The beauty of FAST is that it has a low barrier to entry with no paywalls, creating an inclusive environment for all audiences to come together and explore and find content. With this easy access comes increased audience attention and demand for content."

"With BBC's 100th anniversary this year, BBC Studios is uniquely positioned to build and curate FAST and AVOD channels that deliver highly engaged audiences. Major wins include unleashing fan-favorite British brands to a previously untapped audience through deals with Pluto, Amazon Freevee, The Roku Channel, Samsung TV Plus, and Xumo, among others. We launched the 'Top Gear' FAST channel on Samsung and Plex."

"In the past 12 months, we have doubled FAST and AVOD channel distribution from BBC Studios, more than doubled FAST, and AVOD audience reach for BBC content in the US year over year, and we are now looking at where we can iterate, refine, and selectively expand. We have multiple ecosystems allowing us to act globally and think locally, and our usage data allows us to listen to consumers in each region and deliver impactful content."

US connected TV ad spending, 2019 - 2024 billons, % change, and % of total media ad spending.

DAVID SMYTH CEO, Beyond Rights

DAVID SMYTH CEO, Beyond Rights

“

The television industry is always in flux and constantly evolving to take advantage of new technology and changing consumer behavior. FAST channels are doing both successfully and can provide new revenue streams for distributors, especially those with sizeable and cross-genre catalogs like Beyond Rights. As the FAST world grows and more consumers engage, perhaps recently put off by the rising subscriptions on SVODs and the cost-ofliving crisis in many territories, it is now becoming a meaningful revenue opportunity."

"We have recently announced a partnership with OTTera, which will see us launch several FAST channels globally, probably a mix of Beyond branded channels and IP-based channels around some of the long-running, volume franchises we have in our catalog. Earlier this year, we launched our collaboration with Insight TV to create Beyond branded blocks on its InWonder channel, and we have now extended this relationship to include a much wider selection of content. We have also recently signed a deal with Samsung to create IP-led FAST

channels and are currently exploring several other opportunities around the world that can readily work alongside our current FAST activities."

"For distributors, if we are to be successful, it's vital that our strategy reflects and evolves with the changing media landscape, ensuring we can effectively monetize new opportunities as they arise. Beyond has always looked to evolve in line with industry developments, so at one level, our work in the FAST space fits neatly with our existing strategy. However, this innovation in the consumer space is changing our ability to reach and respond to them directly. So, we are now aligning direct consumer behavior more closely with our content acquisition and subsequent distribution strategy than ever before."

“

FAST business means international growth. OTT streaming is in its nascent stages outside of the US. FAST, while growing quickly, is nowhere near critical mass. Penetration of markets where local broadcast stations have a strong presence will be the next frontier. Moreover, it is advertising innovation. There is a constant cycle of innovation in the CTV ad space. SSAI (server-side ad insertion) on FAST channels provides an opportunity for greater targeting capabilities than in most formats and especially linear TV. Further, there are opportunities to innovate ad formats, whether that's been experimenting with shorter ads, adding QR codes, or leveraging banners."

"The ability to provide free content to audiences in a new format is the greatest added value. While linear channels are not new by any means, the technical infrastructure of FAST allows us to provide a bettercurated experience, including programming stunts and marathons based on current events in the zeitgeist. Our single IP channels offer an opportunity for enthusiasts to binge their favorite content 24/7. We anticipate other innovations in the future. Put simply; the opportunity to serve our audience in a more curated and customized way without the cable TV costs drives engagement and therefore growth and value."

"FAST business changed FilmRise's global strategy in recognizing the high levels of engagement on FAST channels in the US. It's been especially important to FilmRise to include FAST channels as part of our go-to-market strategy in new territories. While local broadcasters are more entrenched globally and adsupported streaming is still in its nascent stages outside the US, FilmRise must provide a familiar viewing experience, the linear experience, as cordcutting proliferates globally."

DANIEL GAGLIARDI

VP Digital Distribution and Business Development, FilmRise

Fremantle International

Fremantle International

“It is undeniable that FAST is attracting users. There are many potential reasons: SVOD saturation, subscription fatigue, penetration of connected TVs, easy discoverability, reasonable ad-loads, and value proposition (free). One thing we know is that FAST is here to stay. It is a big market in the US and is growing stronger, with several platforms having already reached the $1bn revenue mark per year. We plan to have a dozen FAST channels up and running in the US by the end of 2022. In addition to the US, we believe that international growth will be a big opportunity for us. Thanks to our fully localized content, the editorial curation of our channels, and our marketing and promotion firepower, we can become a truly global player in the FAST industry."

We have been working hard on the creation of successful FAST channels. In addition to massive hits like 'Baywatch,' 'BUZZR,' 'The Price Is Right,' and 'Supermarket Sweep,' we have recently launched 'The Jamie Oliver Channel,' with over 300 hours of renowned chef Jamie Oliver's programming; 'Combining Chop' N Chat,' 'Travelogues' and seasonal specials. We expect to launch additional great channels in the next 12 months, both in the US and Internationally (UK, Germany, Australia, France, Italy, Spain, and others). Our channels are credible linear channels, with editorial curation, attention to detail, and a range of high-quality creativity."

"FAST is increasingly becoming a relevant revenue stream in Fremantle distribution's business, changing our strategy in several ways. On data: FAST allows us to access a large amount of structured data on content consumption. We then feed this information to different teams involved in the channel creation and other parts of the company. It creates an efficient cycle of communication and powerful crosscollaboration. Regarding advertising, we are keen to explore different business models (Inventory share, Revenue Share, Hybrid), and we are in the driver's seat to positively affect revenues by excelling at curation, marketing, and data analysis. Finally, are brands: in addition to single title channels, we are creating new FAST channel brands that we believe will be valuable both in the short and long term."

PATRICK RIVET EO, Thema“

The growing opportunity for Thema is to monetize our overflow content, not only entertainment but also sports, by crafting FAST channels that can live along with our pay-TV offer. Any media company of any size can monetize its content by licensing it to a FAST service provider. In contrast, some large media production and distribution companies, like Thema, have developed or acquired their own FAST video platforms to monetize media assets better."

"We recently launched three FAST channels. Vive Kanal D Drama offers Turkish drama series, a popular category much acclaimed by audiences, including a careful selection of hits from Kanal D Drama to the FAST digital market. It is now available on Roku Channel's 'Espacio Latino.' It is also available on Samsung TV Plus in Mexico and on Canela TV. The second channel is Vivaldi, curated by Mezzo and distributed by Thema, offering an extensive, carefully curated collection of the most exclusive programming. It is available on The Roku Channel, Plex, LG, and other CTV platforms. Finally, ITV Deportes is a FAST channel in Spanish dedicated to Mexico's most popular sports and includes exciting analysis and comments from experts in each sport. It is available on The Roku Channel and Canela TV in the US."

"In the post-pandemic world, high inflation rates are putting the squeeze on household budgets, causing a noticeable increase in cord-cutting. Consumers love the idea of having a TV-like viewing experience for free, except for maintaining an Internet connection. Moreover, FAST platforms offer a similar viewing experience with no monthly fees and can be accessed on any device. Another advantage is access to niche, branded, and original content. FAST service platforms seek to broaden their appeal for audiences by acquiring niche, branded content to stream on their platforms."

M anaging Director, GoQuest Media

M anaging Director, GoQuest Media

“

The foundation of the FAST channel business is to solve the 'Selection Dilemma' of users. There is so much content to consume through various platforms with competitive pricing that it becomes an endless search for what to watch next. We see an immense opportunity to monetize long tail or library content. Also, niche content categories can be monetized on FAST. While broadcast television is on a decline, the linear nature does provide stickiness for many content categories, and replicating that on FAST is where we see significant growth opportunities. I would say that FAST will accelerate cord cutting much faster than VOD did."

"For content owners, we think the added value of this business model is the ease of creating channels in any country. Earlier, if you wanted to launch a linear broadcast channel, it would take millions of dollars in capex, tech, and distribution. The investment to launch one FAST channel is less than $10k. There is no betteradded value when the cost of setting up is almost nothing. Launch and experiment because the cost of failure is not as high. For viewers, it's free, easy to access, handpicked and curated content, and puts zero cognitive load while deciding what to watch."

"The FAST business has significantly changed our global strategy. Our primary mission is to squeeze every bit of monetization from the content we represent. B2B licensing is constrained by the buyers' capital allocation, focus, and overall capacity. FAST allows us to break through this monetization ceiling. It also allows us to build our own audience thesis and test them. Advertisingsupported models such as FAST or YouTube are something we are betting on in the next eighteen months."

creating channel vehicles that will be a key component of our distribution business, offering us flexibility in how we get our content in front of consumers across different windows."

Initially, we see this as a business model to exploit our huge library of 90,000 hours of content and get this in front of consumers and super fans of shows such as 'Hell's Kitchen,' 'Come Dine With Me,' 'Murdoch Mysteries,' and more. It's clearly a growing sector, and we're thinking about this with a long-term view of

“

"We have recently launched a 'Come Dine With Me' channel with Samsung in the UK and have a couple more channel launches planned around that franchise. In general terms, we are looking at another four to six launches globally in 2022 and then have plans for further new channels in 2023, distributed across multiple territories and platforms. We have a clear strategy that falls into three buckets of single IP ('Hell's Kitchen' and 'Come Dine'), genre channels, for example, Storylands (Non-English Language Drama) or Our World (Natural History, Wildlife), and broader plays in the general entertainment (ITV Choice) and drama spaces."

especially when the content is free. FAST is currently the fastest-growing streaming tier, but there's also so much demand for it from audiences worldwide and much potential in businesses, content providers, and advertisers."

“

As more and more people are turning to digital TV platforms to consume content, FAST has quickly gained a foothold in the market. Various research shows that around 3/4 of viewers don't mind seeing relevant advertising during TV watching,

"We have two channels on many platforms, such as Samsung TV Plus, Freevee, Pluto TV, and Rakuten TV. We are also working with some platforms to create specially curated channels for their audience. Finally, we have four more FAST channels coming down the pipeline. Our highly sought-after channels are Filmstream and Fashionstream, which broadcast critically acclaimed classics, independent movies, and the latest from the fashion world plus lifestyle content."

By Diego AlfagemezEV P, G lobal Business Development & Digital Distribution, ITV Studios

CMO & CDO, SPI International

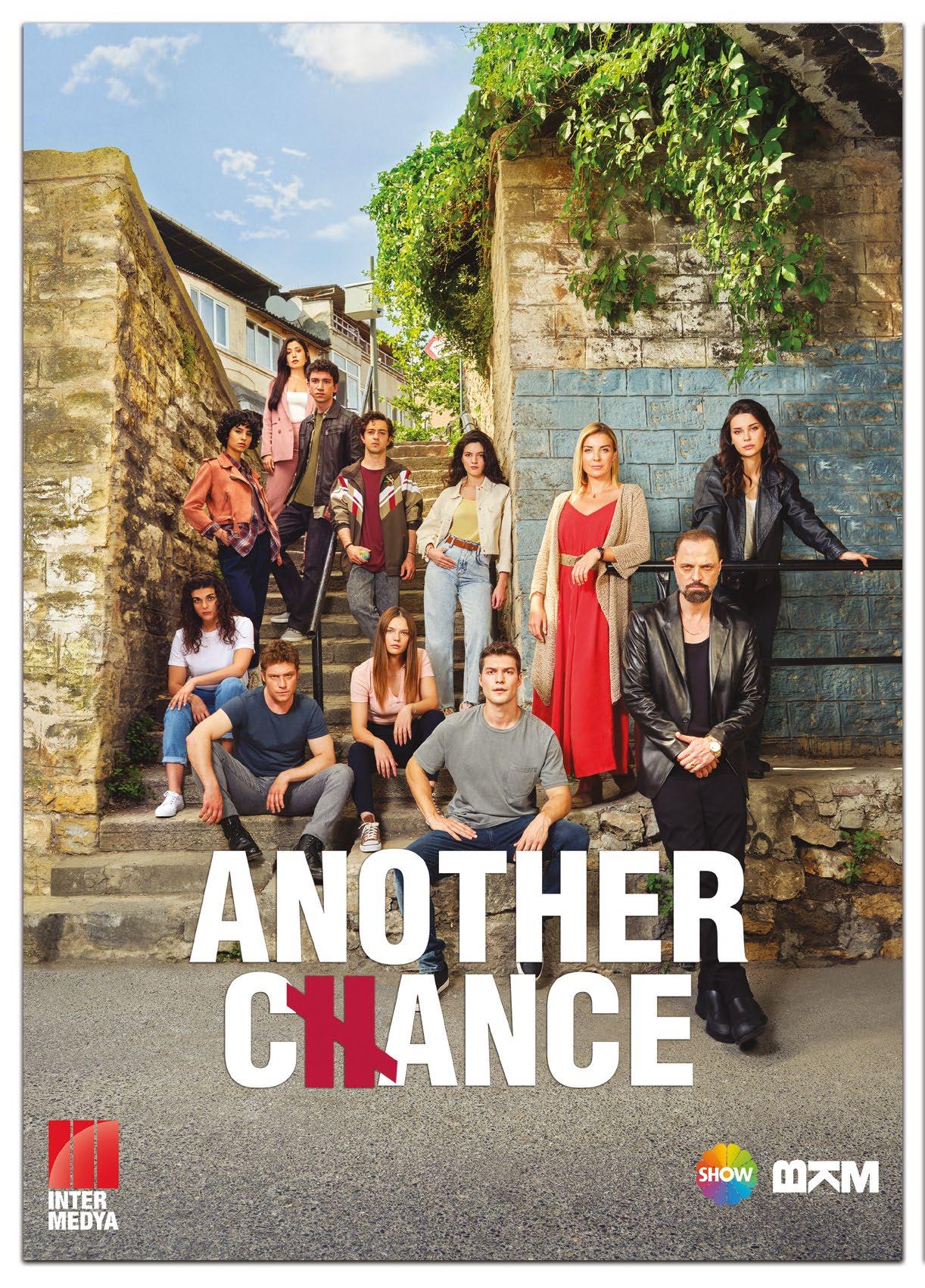

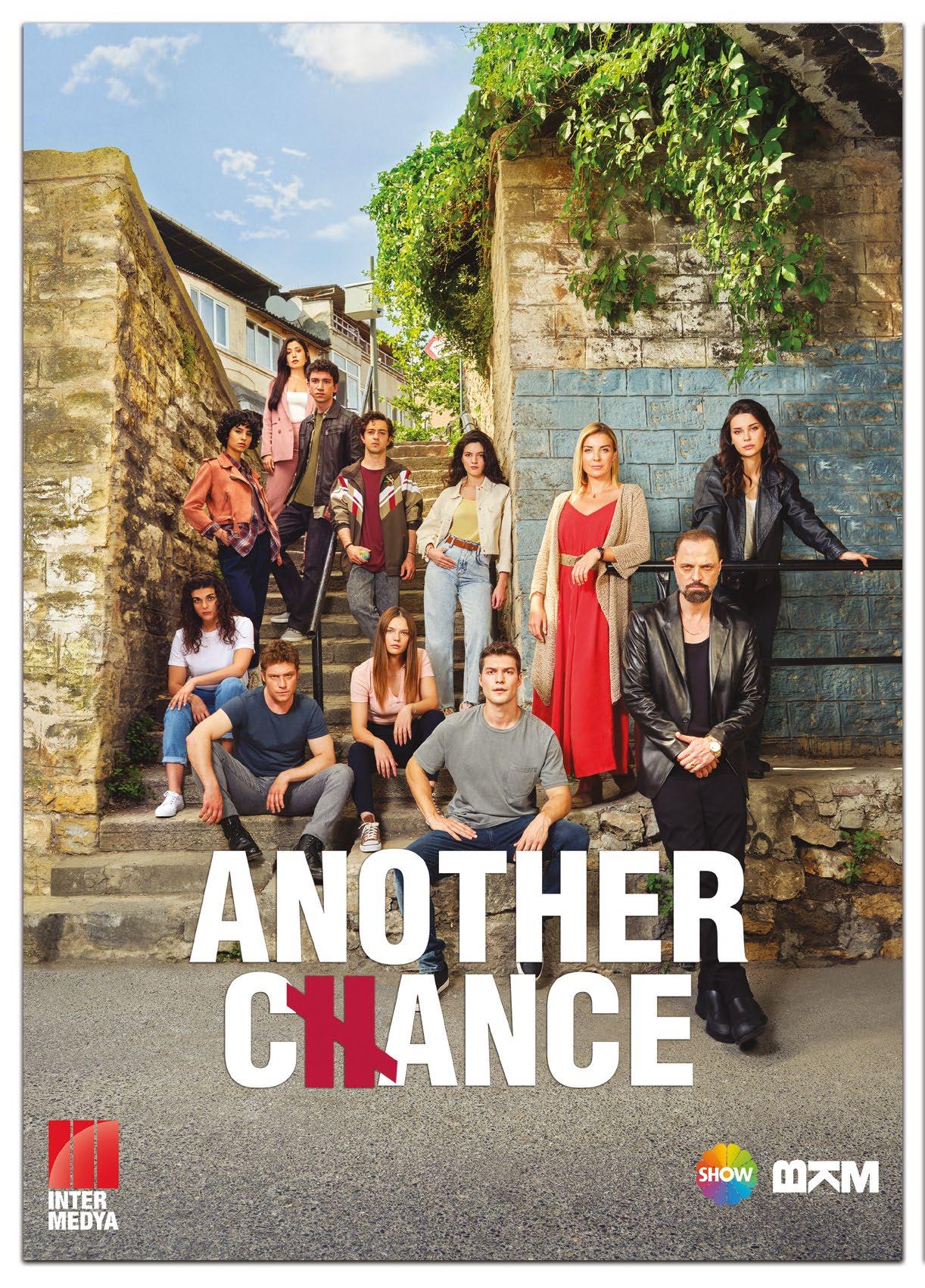

In 2022, Inter Medya celebrates a significant milestone: 30 years in the international content business. The company's achievements during these years are many: an established name in the distribution arena, more than 150 countries reached with its content, and the creation of its own production label. Can Okan, Founder and CEO; and Ahmet Ziyalar, President and COO, spoke with Señal News and recounted the company's history, challenges, and goals.

CO: "I am so proud! It makes me very happy to have reached this point in a business that I have worked so hard and devotedly. We are celebrating our 30th anniversary with a growing team that carries Turkish content to more than 150 countries."

AZ: "I think being a 30-year-old company is not easy! It is our greatest wish to have many more successful years with the pride and happiness of being a company that brings Turkish culture to the world."

CAN OKAN, FOUNDER AND CEO; AND AHMET ZIYALAR, PRESIDENT AND COO, RECOUNT THE UNIQUE PATH THE TURKISH COMPANY EXPERIENCED IN THE PAST 30 YEARS, CHARACTERIZED BY CONSTANT EVOLUTION AND DIVERSIFICATION.

CO: "When Inter Medya was first established, it was a company that brought content from abroad to Turkey. We handled all the work with a team of two people. Today, we are 35 people and still growing. Over time and in parallel with the worldwide success of Turkish content, the nature of our work has changed, and we started to bring Turkish content to the international market. Political and economic problems arise in different countries. Of course, that impacts countries' purchasing power, but despite all these difficult times, our content sales have not lost momentum. Likewise, during the pandemic, there was great uncertainty for everyone, and production became very difficult. Moreover, all exhibitions were canceled, and everything moved to digital. Those times were perhaps the most difficult we experienced. Despite that, we overcame these times even stronger, got used to the new order quickly, and internalized our business model. Our sales continued to increase and grow."

keep up with today's technology. They have different perspectives, which is a great inspiration for us. Together with them, we discover other worlds and keep ourselves up to date. We encourage them to convey their thoughts and ideas to us as much as possible. After all, two heads are better than one! Inter Medya is more than just a corporate company; it is a team that operates like a family. We take care of this culture in our internal management. We see it as a contribution to Inter Medya and our industry."

CO: "At Inter Medya's first years, its basic market structure remained more or less the same but soon found itself operating both inbound and outbound. Beginning in 2001, Inter Medya expanded its range to cover the Central and Eastern European markets, Russia and the CIS countries, Central Asia, and the Baltic. From 2007, the Middle East and North Africa started to show great interest in Turkish content. At the beginning of 2014, Inter Medya licensed Turkish Dramas to Spanish-speaking TV channels in the United States and 21 countries in Latin America. After that, the demand from those countries never decreased. In 2020, following the popularity of online streaming platforms, we launched the 'New Generation Turkish Series' and acquired the representation rights of several successful mini-series. In 2021, Inter Medya created Inter Yapım, an independent production company aiming to produce high-quality content for local and international digital platforms. These are the important milestones we can count in general."

AZ: "We have a young and very dynamic team with knowledge of different cultures and a global vision. They follow global trends from various sources and

CO: "In today's world, I think that content could be the fastest developing and growing business.

Especially with the

pandemic, the expected momentum was gained earlier, and our industry experienced a boom in production and consumption. The content industry has made great progress in quantity and quality."

CO: "Of course, our biggest goal is to continuously improve our content catalog and not to leave a country where we don't deliver Turkish content. In addition, we want to consolidate the production journey we started last year by signing big projects."

AZ: "As Can said, our biggest goal is to keep our catalog up to date and diverse and to maintain an offer that meets the demands of all our customers. In addition, our greatest wish and dream is to create productions that will stream on local and international platforms with our new initiative Inter Yapım."

By Diego Alfagemez

MARCO NOBILI, EVP, INTERNATIONAL GENERAL MANAGER OF PARAMOUNT+, AND OLIVIER JOLLET, EVP, INTERNATIONAL GENERAL MANAGER OF PLUTO TV, DESCRIBE THE COMPANY'S STRATEGY FOR BOTH SERVICES AND ITS GLOBAL EXPANSION PLANS.

In the midst of the streaming war, where the number of platforms is growing every day, and the content available to consumers is almost unlimited, offering a solid and attractive product is not easy. In the case of Paramount, the company found a recipe that worked out well and that many other players are now looking to emulate: offering a premium subscription-based platform (Paramount+) and another based on advertising (Pluto TV). To learn more about this approach and talk about the global expansion plans for both services, Señal News interviewed Marco Nobili, Executive Vice President, International General Manager of Paramount+, and Olivier Jollet, Executive Vice President, International General Manager of Pluto TV.

What role does streaming play in the company's overall strategy? Nobili: "Streaming is key to Paramount's global strategy. We have found success in accelerating this strategy by using a marketby-market approach, allowing us to expand into new markets quickly and economically. With 6.8 million net subscriber additions last quarter, Paramount+ has established itself as one of the

fastest-growing brands due in part to our global expansion efforts. We most recently saw successful launches in both the UK and Italy, and we look forward to continued growth as we enter 45 markets by year-end, including France, Germany, Switzerland, and Austria." Jollet: "Through this market-bymarket approach, we are not only accelerating our paid streaming presence but also our presence in the ad-supported market. Pluto TV continues to scale its market share and expand its content offering in global markets. We have grown Pluto TV's monthly active users to nearly 70 million and secured its lead as the number-one free adsupported streaming TV service, with more than 1.000 channels globally through more than 425 content partners."

How do you feel the company's SVOD and AVOD offerings complement each other?

Nobili: "Our mix of streaming options allows us to cater to various audiences based on their preferred viewing experience. On Paramount+, viewers are given the opportunity to choose from a vast content library of blockbuster movies, hit TV shows, and new originals that span Paramount's portfolio of iconic brands."

Jollet: "Pluto TV delivers a wide range of content spanning categories including movies and television, news & opinion, sports, comedy, reality, crime, classic TV, game shows, explore, gaming & anime, music, 'En Español,' kids, and more. While we do not have any original content, we do have original channels, a variety of which are dedicated solely to popular Paramount IP, allowing audiences to enjoy iconic titles from 'SpongeBob' to 'CSI' to 'Star Trek.'"

How do you stand out from the rest in a streaming market overcrowded with platforms?

Nobili: "We are at a different growth phase and have a fundamentally different approach than the legacy streamers. We have a diversified playbook with

Paramount+ as part of our strong portfolio of direct-to-consumer, broadcast video-on-demand, ad-based video-on-demand, free ad-supported streaming TV, pay channels, and free-toair networks, all of which have an established base of viewers. Our experience in successfully running all aspects of this vast portfolio gives us a huge advantage over our competitors. We also have found value in establishing distribution partnerships and growing the global accessibility of Paramount+, as illustrated in our recent multi-year distribution agreement with Sky in the UK, Ireland, Italy, Germany, and Austria. We make it easy for audiences around the world to access great entertainment. From fan-favorite films to new original series, we are committed to delivering an expansive selection of cannot-miss entertainment for fans of all ages."

Would Paramount consider implementing a model that somehow combines all the company’s streaming platforms?

Jollet: "Paramount is a handful of companies with a content pipeline that can lead in all segments of the global entertainment market. Our mix of free and paid streaming options has been at the heart of our strategy from the start, offering viewers the freedom to choose the plan that is right for them. We also have seen that consumers want

both a lean back and a lean forward experience, and through our powerful ecosystem, we are able to cater to both viewing experiences."

When it comes to producing or acquiring content, what is Paramount's strategy for shaping the programming offer of both Paramount+ and Pluto TV?

Nobili: "At Paramount, we expect to grow our global direct-toconsumer expense to over US$6 billion in 2024, allowing us to continue to produce quality content both globally and locally. We know audiences have big expectations, and we have something for everyone, from blockbusters to new star-studded originals to iconic shows with the stars we know and love. As our service expands globally, we will continue to invest in local content, allowing us to expand our pipeline of premium intentional originals and cater to an array of audiences. With 12 studios creating content locally around the world, we plan to greenlight 150 international originals by 2025 while continuing to draw viewers in with highly anticipated original series, movies, and sports. From global to local content, we truly provide a mountain of entertainment for all fans everywhere."

Jollet: "Pluto TV creates a unique and curated experience in each market, offering premium content packaged into channels

programmed by local teams. We combine our team's expertise in content genres and streaming data to make informed and intentional decisions when acquiring content and launching new channels."

What are your future plans regarding Paramount's streaming expansion?

Nobili: "We remain focused on expanding Paramount+ on a global scale, bringing international blockbuster hits such as 'Top Gun: Maverick,' and original series such as 'Tulsa King' and '1923' to audiences around the world. With the service launching in France, Germany, Switzerland, and Austria in December, Paramount+ will be available in more than 45 markets globally by the end of the year. Beyond 2022, we look forward to debuting the service in India next year while continuing to deliver incredible value to our subscribers."

Jollet: "Expanding Pluto TV internationally is critical to Paramount's overall streaming strategy. We plan on continuing to leverage our distribution partnerships to introduce Pluto TV in new markets, with our next launch set for December 1 in Canada, where the service will debut with its most robust content offering to date with more than 100 unique, curated channels and over 20.000 hours of content."

By Federico Marzullo

One of the biggest challenges that media brands face today is their diversity efforts. Many traditional and mainstream media companies have started to be more thoughtful about building cultural, racial, ethnic, and lifestyle diversity into their content. Building awareness and driving viewership of any new shows will require paying attention to inclusion and representation, both on and out of the screen.

Preside nt of Global Drama at Fremantle

“Inclusion and representation have become essential. The large American platforms have mandated it across projects, and we are finding more insistence upon it globally. Even without the mandates, it makes both creative and commercial sense. Talent, behind and in front of the camera, is what we all look for, and of course, inclusion is key in finding that talent.

“Latinx, LGBTQIA+, Gen Z, or Millennial audiences seek content that speaks to their culture and experiences in a relatable way. I think we all like to see something of ourselves reflected in the stories that are told, and for too long, those stories were rather narrowly prescribed, not necessarily intentionally, but still didn’t connect with everybody. Now the audience expects and deserves to see those.”

“I think there is a that reinforces the value of programming that helps to differentiate the broadcaster/ streamer and attract more niche audiences. It is always tough to predict what audiences want and what constitutes a niche. I’m not sure that they want just a niche; better to have shown that they transcend to a big audience and are distinct and specific. As an industry, we still need to get out of old habits (hiring the same writers, crew, cast, etc.) and broaden our point of view. But it is key to the future to do so.”

Seni or Vice President, International Programming, A+E Networks

do fully believe that consumers of content are looking for shows that will entertain them but also shows they can relate to who they are. Those of us that are in the global part of the entertainment business recognize that diversity means a broad set of identities. Diversity and inclusion are necessary to consider when you create content, and if you are a platform that plays content, then you have to make sure that is on your service or channel.”

“We have a corporate mission to ensure that diversity, equity, and inclusion is an aspect that runs around our entire business. When you look at some of our top shows that not only continue to do well on our linear networks but also have become popular on streaming platforms, you will find titles like ‘The Lincoln Lawyer,’ which came out of A+E Studios and completely represents a diverse cast. We also have several unscripted series like ‘The Secret of Skinwalker Ranch’ that also reflects diverse characters, which is authentic.”

“In response to the fact that global audiences seek these expanded narratives that represent the diversity of people from all over the world and their cultures, we are reflecting that in content that has risen in popularity and all different platforms. The

Inte rnational Sales, Keshet International

‘niche’ target audiences (‘Squid Games,’ ‘Stockholm,’ and ‘Narcos’), which have all gone on to be enjoyed by massive mainstream audiences around the world.”

eople want to see themselves on screen. That said, shows like ‘The A Word*,’ which was picked up by HBO Globosat in Latin America, and its spin-off ‘Ralph & Katie’ are not only successful because they feature a family dealing with autism or LGBTQi characters and actors with Downs’ Syndrome. They are loved because, at their heart, they are entertaining, relatable dramas that are joyfully uplifting to watch.”

“It is human nature to want to see ourselves on screen, and our lived experiences brought to life there too. As an industry, I believe we are responsible for representing all members of our society fairly and positively in both scripted and non-scripted shows. By doing this, we have the power to challenge preconceptions and change long-held stereotypes for the better. I’m excited about our upcoming period drama ‘Cuba Libre,’ the extraordinary biopic of Annie Silva Pais, a very progressive Portuguese woman who abandoned her family to follow her political beliefs and support the Cuban revolution, changing the course of many people’s lives along the way.”

“There are so many trends to support the value of diversity and inclusion. Whether it’s the proliferation of competitive reality shows focusing on particular skills or interests like make-up artists, glass-blowing, or dating formats featuring only LGBTQIAi contestants. However, plenty of shows have reached well beyond their original

“At Keshet International, we love distributing local language content from all over the world. Our current slate has dramas from Portugal, Iceland, Israel, Sweden, and Japan. From our experience, the story comes first because great content knows no boundaries. Our Norwegian comedy-drama ‘Pørni’ was picked up across Latin America by HBO and is a great example of this.”

Alberto Fernández Dig ital Content Director, RTVEbiggest challenge is bringing creators and their work into the ecosystem. In other words, to support, empower and hire talent behind the camera for those shows. We have to stop looking into the regular places where we want the content to come from and how we want it to be produced, and we need to celebrate and support content creators that they themselves are diverse. Without those authentic voices behind, you cannot create an authentic, diverse program, series, or movie.”

“A+E is working to improve in the area of overall diversity, and something that we are trying to support, echo, and voice within the industry. For example, we are very proud that we were among the founders of the Mipcom Cannes Diversify TV Awards, a long-time celebration of diverse content.”

he so-called ‘conquest of spaces’ has become one of the main demands for new audiences, and knowing how to deal with it properly is key for content generators and broadcasters. This process goes two ways: firstly, in having a faithful representation of the diversity in which young people live and coexist, who naturally accept realities that in another era would be conflictive. Secondly, in de-dramatizing these realities, looking at them face to face and connecting them with universal narratives that can make general public sympathize with.”

“The main revolution in content production in recent years is how these audiences have managed to subvert the semiotics of the stories we consume. To do this, you have to see the evolution of Disney, the great shaper of global values for children and adolescents. The way in which their shows deal with issues such as mental health, sexual orientation, ethnic origin, or even economic power relations has changed radically in the last ten years. Not only that, but diverse audiences also demand that they must be the protagonists of their stories, not a quota for minorities within a product that is aimed at all audiences.”

“The main challenge lies in the effect of the process I have described above: to prevent differentiation from ending in polarization. There is a risk that diverse content generates a dynamic of action-reaction between diverse and hegemonic audiences. In that sense, I believe that this process has a lot to do with the emergence of certain political discourses that take advantage of this environment to deepen division and confrontation. The production of diverse content should be a way to democratize our societies and improve dialogue and acceptance of others, which is why it is key that, while content is produced and developed from new points of view, the door is always left open to everyone.”

By Diego Alfagemez

SABRINA AYALA, SVP OF SALES, FRANCE, ITALY, IBERIA, AND LATIN AMERICA AT CINEFLIX RIGHTS, EXPLAINS THE COMPANY'S STRATEGY AND GOALS

AFTER CELEBRATING ITS 20TH ANNIVERSARY.

Cineflix Rights is celebrating its 20 th anniversary in 2022 as one of the UK's largest independent distributors. Sabrina Ayala, SVP of Sales, France, Italy, Iberia, and Latin America at the distributor, explains the company's strategy and goals after its first two decades.

What is Cineflix Rights’ strategy when it comes to shaping its catalog?

"We aim to ensure we have something for every audience sector and taste, so our catalog is packed with stand-out scripted content and big stars, alongside factual shows spanning multiple genres. We are constantly refreshing our slate with new content from some of the world's most creative producers to ensure there is always something new for our buyers, plus returning seasons of existing favorites."

What projects are you interested in getting involved in? What business model works best for Cineflix Rights?

"We work with producer partners in various ways and use a suite of innovative financing options: from acquiring a format for production in

the United States or Canada; prebuying distribution rights; or coming on board as a co-production partner at an early stage. Our objectives are always the same: to provide the finances and expertise to help our partners create high-quality shows which have the potential to become long-running brands for the international market, maximizing the return on their IP."

Do the demands of the clients vary greatly depending on the region?

"Some territories have restrictions on content, some are more partial to limited premium series, and others are looking for volume with multiple seasons of longer-length series, but in general, everyone wants a good story. And that is what our Mipcom slate delivers, whether that is our new drama 'Last King

How is the process of choosing the ideal partner for each project?

"Our position as the UK's largest truly independent producer means we have the scale and flexibility to deliver individually tailored distribution strategies for each show. We can source the best content from creatives worldwide and are not tied in with any particular platform when it comes to selling it so that we can provide the best options to our buyers. We can offer a wide range of content from premium dramas starring big Hollywood talent to platforms looking for noisy content to draw in viewers, through to long-running factual hits spanning multiple genres including true crime, property, and lifestyle, science, and history to buyers who are looking for volume shows that deliver audience recognition and loyalty."

How was Cineflix's performance in 2022, and what are the next goals?

of The Cross' or the new season of 'Irvine Welsh's Crime.' Our premium factual content is also strong on storytelling, with titles such as 'Patrick Aryee's Wild World.'"

"We have had a great year. We are building our catalog of high-profile hit dramas with big talent attached; and adding returning seasons of some of the world's biggest, longest-running factual brands. Moreover, this Fall, Cineflix Rights is celebrating its 20 th anniversary, which is an opportunity to accelerate growth and consolidate our unique position in the market. As we look forward, we will continue to increase our growth in scripted, build our slate of movies, and expand our digital activity."

By Federico Marzullo

MARTA EZPELETA, GM OF DISTRIBUTION, COPRODUCTIONS, ACQUISITIONS, AND INTERNATIONAL OFFICES AT THE MEDIAPRO STUDIO, HIGHLIGHT THE BUSINESS VALUE OF THE CORRECT EXPLOITATION OF CONTENT AND HOW THEY MANAGE THEIR WINDOWING STRATEGY.

The Mediapro Studio's international distribution strategy features a vast array of productions and partnerships worldwide. With new shows launching at Mipcom, the company will try to expand its global footprint. Marta Ezpeleta, GM of Distribution, Coproductions, Acquisitions, and International Offices at The Mediapro Studio, talked with Señal News about these plans.

What defines The Mediapro Studio's international content distribution strategy?

"The main criteria is the content itself, quality content. We always seek a wide variety of content in which all genres and targets are represented to respond to our client's needs worldwide. Our job is to constantly converse with all of them and stay updated on what they are looking for. For The Mediapro Studio Distribution, achieving optimal exploitation of all our content in each market and territory is essential, based on the best agreement and sales strategy. Therefore, it is equally vital that the content reaches the client that makes more sense. We like to attend to them in their success, go hand in hand and be a partner that follows up with all our support, from marketing and press, in the launches for their linear channels and platforms. We seek to consolidate longterm relationships. Content

internationalization is in our DNA. An excellent example of expressing our strategy can be summed up with 'The Head,' a series whose first season has been sold in more than 90 countries. The second season will begin its journey to the international market at Mipcom."

What value does The Mediapro Studio assign to its original productions' global expansion?

"For The Mediapro Studio, all productions are equally important and have very high-quality standards. Our goal is to achieve excellence in every one of them, whatever the genre, for all types of audiences and clients. That

"All productions are equally important and have very high-quality standards. Our goal is to achieve excellence in every one of them."

footprint is inherent in all the phases of our work. It begins with creation, development, and production and finishes with its distribution. That said, our main challenge is self-demand. It allows us to reach those quality standards and offer the best possible content. Another fundamental challenge involves the ability to adapt to an environment that we face daily and that changes at breakneck speed."

What feedback do you have from the market about Mediapro's original slate?

"It is very positive. We are constantly analyzing and reflecting on how we do things and how we can improve them. Clients continue to trust us and see us as a creator and provider of quality content. Proof of this is that the series that we released, perform everywhere. A recent example is the premiere of "Iosi, el Espía Arrepentido" on Amazon. It has been a massive success, led by the Mediapro team in Argentina. Another example is the recent premiere of "Hunting Ava Bravo," a film starring Kate del Castillo, produced by our office in the United States, and Wild Sheep Content, Erik Barmack's company. It was released on Roku in the United States and Amazon in Latin America."

"As part of the internationalization of the content we produce, strategic alliances are part of our essence. In fact, three of the most relevant announcements of 2021-2022 have come from these alliances. One is the agreement with TelevisaUnivision to produce content for VIX, from which the series "Las Pelotaris 1926" and "Cenizas de la Gloria" emerged. Other partnerships have been signed with the Turkish production company Medyapim for creating content in Spanish and with Penélope Cruz to launch the production company Moonlyon. That spirit of internationalizing everything we do is the same that has led the group to incorporate El Terrat production company and, recently, Erik Barmack's production company based in Los Angeles. Both have the mission of producing content for the whole world. We want to partner with the best talent."

"In line with what I mentioned about the vertiginous change that our industry is experiencing, platforms like TikTok and Snapchats are valuable because it is where people share content. It is a space that The Mediapro Studio not only takes into consideration and gives relevance.

We also have a training and talent recruitment program called The Mediapro Studio Labs. It is an initiative aimed at new creators to get to know them and give them the space to create that content. This year, we have already closed its second edition, receiving more than 1,300 projects in the analysis, review, and selection phase. That is the importance we give to these platforms, to the point of wanting to attract those that voices, listen to them, and if it makes sense, develop their projects within the studio."

What will be the new launches of Mediapro for Mipcom?

"Our catalog is extensive and varied, but 'Las Pelotaris 1926' will be one of the year's series. I would also highlight 'UPA Next,' a series produced by Globomedia for Atresplayer that will be available internationally, and the second season of 'The Head,' co-produced with Hulu Japan. Of course, it's not the only thing we'll have because we're back with the second season of 'Express,' a production we did for Starz in Spain and Latin America, starring Maggie Civantos. We will also have 'The Paradise 2,' a coproduction with Reelmedia, and new titles such as 'Las Bravas FC,' starring Mauricio Ochmann. We will give all these productions the place they deserve."

By Aldo Bianchi

By Aldo Bianchi

"As part of the internationalization of the content we produce, strategic alliances are part of our essence. In fact, three of the most relevant announcements of 2021-2022 have come from these alliances.""The

2022 will be a year to remember for Eccho Rights. First, investment and coproduction outfit Night Train Media has fully acquired the company, that is celebrating its tenth anniversary. To recap Eccho Rights’ history, Señal News spoke with Fredrik af Malmborg, its CEO.

What does it mean for the company to celebrate its first tenth anniversary?

"It has been great fun to challenge existing assumptions and to see the breakthrough of new series. It has allowed us to build an amazing team of 40 people in five offices worldwide. Personally, I clearly remember when we were about to launch 'Ezel' in Chile, and 'expert' friends called and expressed worries that it was almost irresponsible to launch this kind of content in Latin America. We had the same warnings when we launched 'The End' on SVT in Sweden. I believe we have contributed to challenge the old assumption that series from one country never will work in another. To be a part of this cultural globalization has been great fun."

What are the company's most significant milestones?

"The development of Eccho Rights in the last ten years has been amazing, a lot of fun and progress. In 2012, we launched our first breakthrough Turkish hit series, 'Ezel,' and soon after, we brought the first daily series from

Turkey, 'Elif,' which was a smash hit globally. Then we launched our slate of Nordic series, and just two years ago, we launched our UK office with six English language series launches this year. To build a company like this, going from just three people to the present team of 40, has been a great experience."

What role does Eccho Rights’ team have in the growth of the company?

in popular culture in the last teen years. A new hit can come from anywhere, and more and more media companies, not just Netflix, have built success on this. Even though we are now doing more and more series in English, the truth is that a well-produced drama in any language may be a global hit.”

What will be Eccho Rights’ goals for the next ten years?

"I believe the next big change is for producers to work with companies like us to build a profitable business by combining normal licensing with direct-to-consumer operations. That will allow producers to keep IP and to develop new and very interesting programming slates, also in high-budget shows. Our goal is to help producers to build such series and to launch them powerfully. If this can be combined with a strong creative development team, first-class distribution, financing operations, and marketing investments, we can build a really powerful model."

Golden Boy

“To recruit great people and to see them grow is very rewarding on a personal level. I believe we have taken team building rather seriously; combining fun and hard work is important. We trust people and see them grow. Then you get a lot of support back. It is also fun to mix people from different cultures and to make them understand that the future is not just a series from their home countries but a blend of influences from around the world. It is still very true that if you get inspiration and understanding of other cultures, you grow as a professional. Central in our development has been the belief that independent producers are the ideal form for TV productions, and they should not be packed into big corporate organizations but be given the tools they need to succeed, but with better terms."

How do you evaluate the evolution of the content business?

“The unexpected success of Turkish drama is a very interesting sign of globalization in the taste

Eccho Rights is now part of Night Train Media. How will this new structure open a new era for the company?

"Night Train Media is a perfect home for Eccho. We have a very skilled financing and development team and a sister company in factual distribution in the group. With some additional investments, we can build the dream company for the future."

By Diego AlfagemezECCHO RIGHTS IS CELEBRATING ITS TENTH ANNIVERSARY, AND FREDRIK AF MALMBORG, CEO, RECOUNTS THE COMPANY'S FIRST STEPS, AND HIGHLIGHTS ITS FUTURE BUSINESS OBJECTIVES.

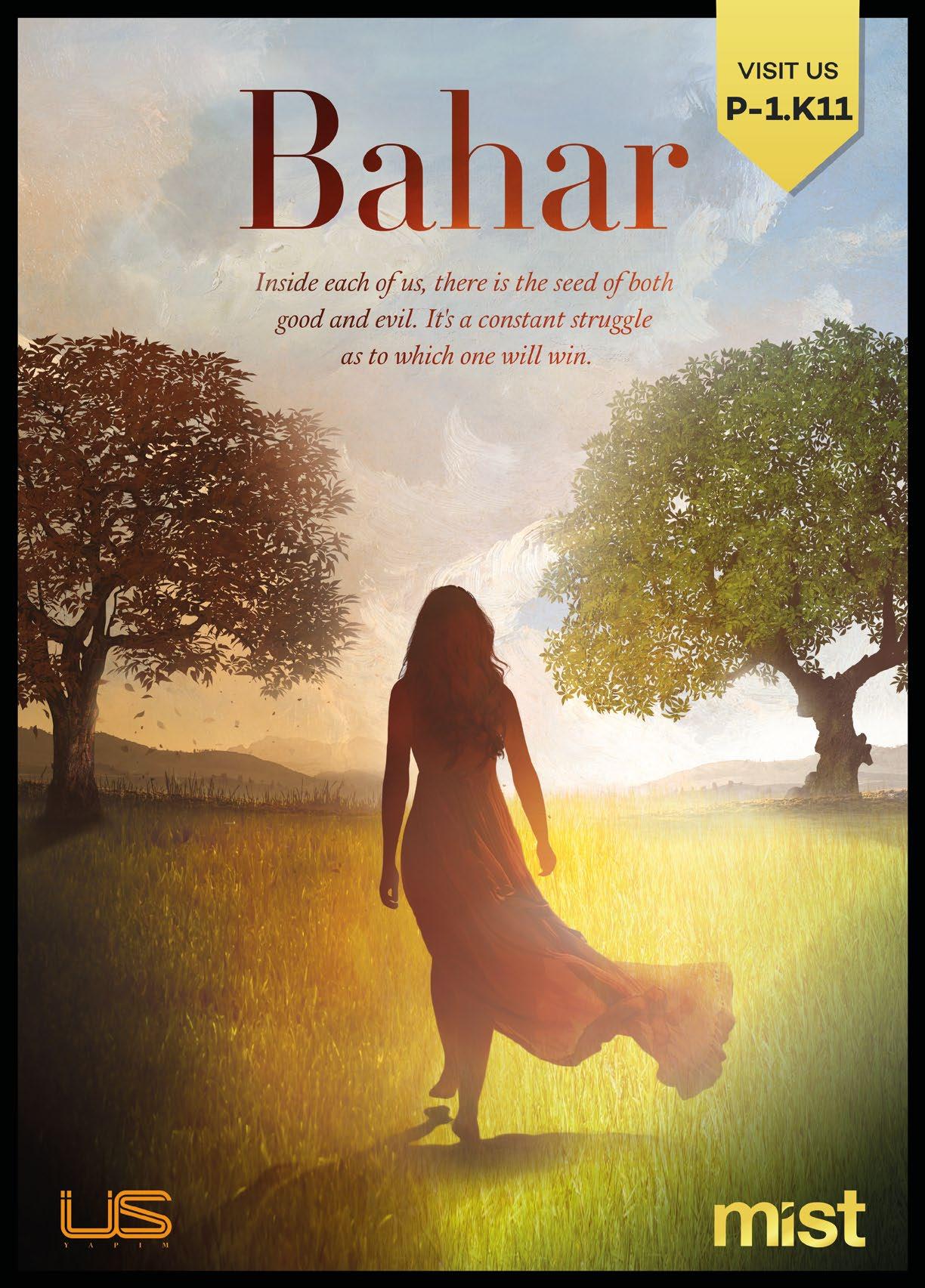

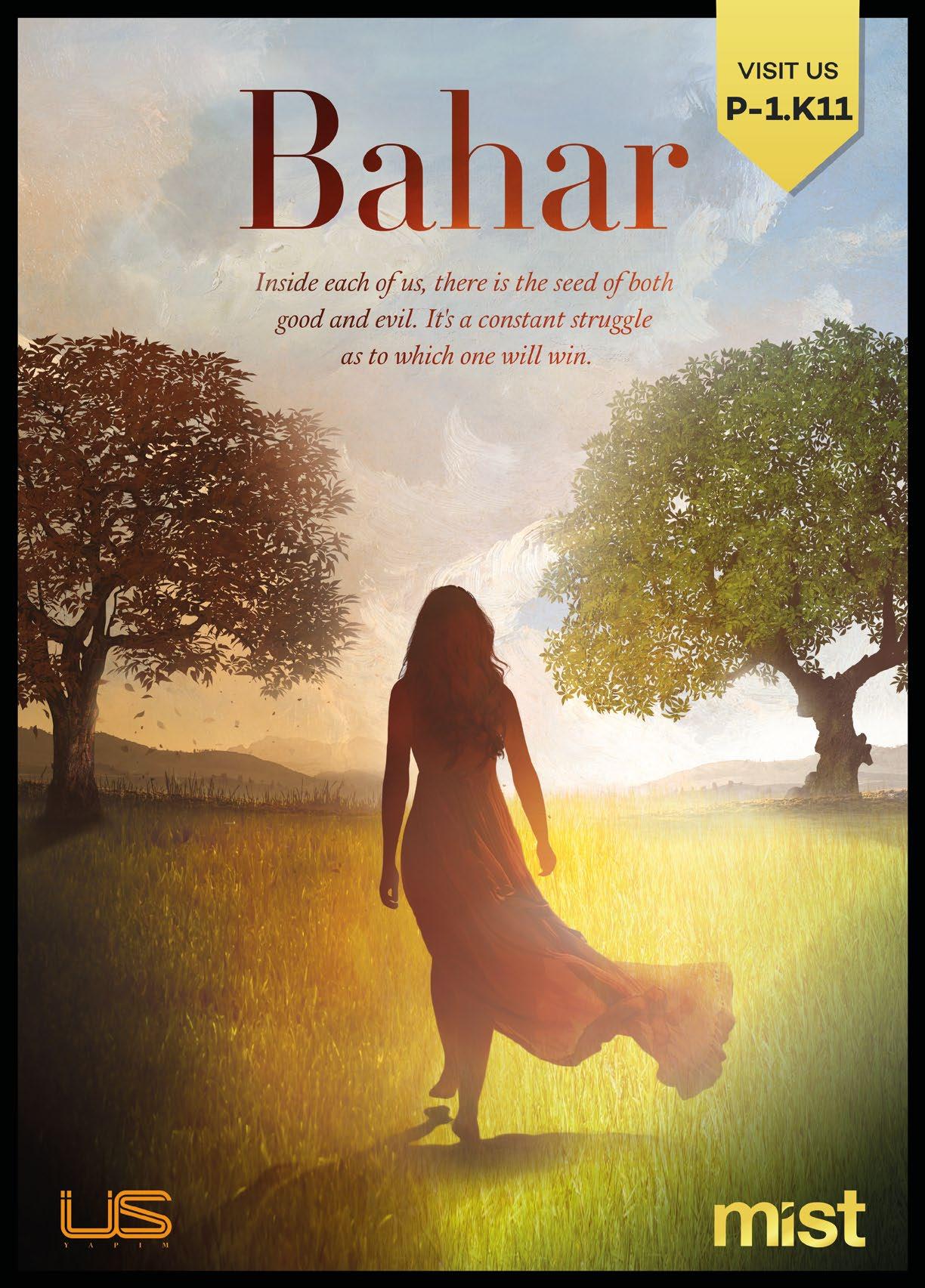

For several years, Mistco has been representing the TRT catalog globally, which will continue to do on an exclusive basis. At Mipcom, the Turkish company will have a huge launch: its own IP, "Bahar" ("Kader Oyunları"), along with the brand new TRT series "The Secret of An Angel ("Cennetin Çocukları"). In addition, Mistco will present another new brand new drama, "The Hunter."

"Until this year, our only focus was to distribute our catalog in the best way possible. In 2022 we have decided to move one step forward and started to work on our first coproduction with US Yapım, which is the creator of internationally successful dramas such as 'Hold My Hand,' 'Melek,' 'Blackboard,' and 'Between Us,'" Aysegul Tuzun, Managing Director at Mistco, stated.

As Tuzun stated, even though any genre from Turkey is well-accepted by international audiences, there is still a huge demand for traditional

Turkish dramas. The two new titles of the company are perfect matches with that trend. "Bahar" (100x45'), co-produced by Mıstco and Üs Yapım, is the story of a young girl who is struggling to keep the goodness inside despite all darkness around. After witnessing the murder of her father, she is trying to prove that Aysun (her stepmother) committed the murder. Furthermore, the love between Bahar and Demir, who met just days before the murder, grows daily but becomes even more impossible since Aysun (her stepmother) is obsessively attached to Demir and determined to win Demir at any cost.

Furthermore, “The Secret Of An Angel” stars Alp Navruz (Hold My Hand) and İrem Helvacıoğlu

(Lifeline). The series is about a family whose members see their lives changed abruptly by a tragedy. Cennet, who was exposed to domestic violence for years by her husband, Yılmaz, gets sick and is hospitalized. While being treated, she sees a lawyer's number (Zeynep) on the hospital window and calls her for help. She gives her a letter to be opened after she dies.

This letter will not only bring Zeynep and Halil, the eldest son of Cennet but also cause conflict between the siblings. "The Secret of An Angel" is about the struggle of all women who are victims of domestic violence worldwide and also offers romance through the love story between Zeynep and Halil.

Mistco will also showcase "The Shadow Team" at Mipcom, which now enters its third season, featuring Murat Yıldırım. The Turkish distributor will also highlight new seasons of "The Great Seljuks: Alparslan," a title that has been sold to over 40 countries, including a recent sale to Israel. Moreover, "An Anatolian Tale," the highest-rated drama of the last three years, will return to Cannes looking for more international expansion.

By Diego Alfagemez

ADAM LEWINSON, CHIEF CONTENT OFFICER OF TUBI, TALKS ABOUT THE PLATFORM'S EXPANSION IN LATIN AMERICA, WHERE IT RECENTLY LAUNCHED IN COSTA RICA, ECUADOR, EL SALVADOR, GUATEMALA, AND PANAMA.

In August, streaming service Tubi announced the expansion of its footprint in Latin America with launches in Costa Rica, Ecuador, El Salvador, Guatemala, and Panama. These five new territories joined Tubi's offering in Mexico, where the AVOD platform debuted in 2020. "Tubi is one of the dominant free streaming platforms across North America. In 2020 we launched in Mexico, and we already see stellar success. Over time we realized we wanted to expand deeper into Latin America, so that is why we decided to launch in these five new territories. We are bringing our playbook for free ad-supported streaming in each of these countries. We are here to supersize viewers with a massive library," Adam Lewinson, Chief Content Officer of Tubi, told Señal News.

Popular movies, including "The Green Hornet," "Hellboy," "American Psycho," "Gridiron Gang," "Snatch," "Machete," "Hook," "The Other Guys," "The House Bunny," "The Social Network," "Obsessed," and "La Bamba," as well as TV series including "L.A.'s Finest" and "Masters of Sex," are streaming for free on Tubi in all five new territories. Additionally, regionallyproduced TV series will soon be available, including Mexico's "Bienvenida Realidad," "Atrapada," and "El Sexo Débil," as well as local versions of popular series such as "The Nanny," "Bewitched," and "Married with Children."

Content localization is a crucial aspect of Tubi's global roll-out strategy. "In any country we launch, we are very focused on localizing the product and the content offering. If you look at Tubi in the United States, Canada, Mexico, or Guatemala, they are all different by design. Obviously, the app and its content are in Spanish in these five new Latin American countries. It is a mix of regionally produced titles with Hollywood and other foreign content dubbed in Spanish. The experience feels precise and localized," Lewinson assured.

According to the executive, also extremely important is to know the Latin American audience, which he defined as "highly engaged."

To achieve that, Tubi is using performance data that reveals, for example, that over the last year in Mexico, the streamer has seen total viewing time grow 60% year-overyear and Total Viewers increase 40% year-over-year.

Lewinson also analyzed the current general state of streaming, which he believes "offers the advantage to super-serve whatever people are looking to watch, democratizing content." However, he noted that consumers are starting to feel overwhelmed with all the available streaming platforms available to choose from, and, at the same time, they end up being a big budget for consumers.

"Tubi has been in the free adsupported business since day one. It actually started as an ad-tech platform. Nowadays, there is so much subscription fatigue with all these streaming services, which cost a lot of money. Eventually, people look at their credit cards and wonder if they are worth it, so they start cutting. That is why now all these services are adding advertising. Ultimately, we see a validation of what we were always confident about: free television is the right business model. The history of television has been on our side, as it has been predominantly free and adsupported. The perception has changed, as streaming is now seen as the paid tier. Viewers will, of course, pay for it if they get what they want. For most TV viewers, things are getting back to normal, and they are very comfortable with the business model of free streaming ad-supported," he concluded.

By Federico Marzullo“ IN ANY COUNTRY WE LAUNCH, WE ARE VERY FOCUSED ON LOCALIZING THE PRODUCT AND CONTENT WE OFFER."

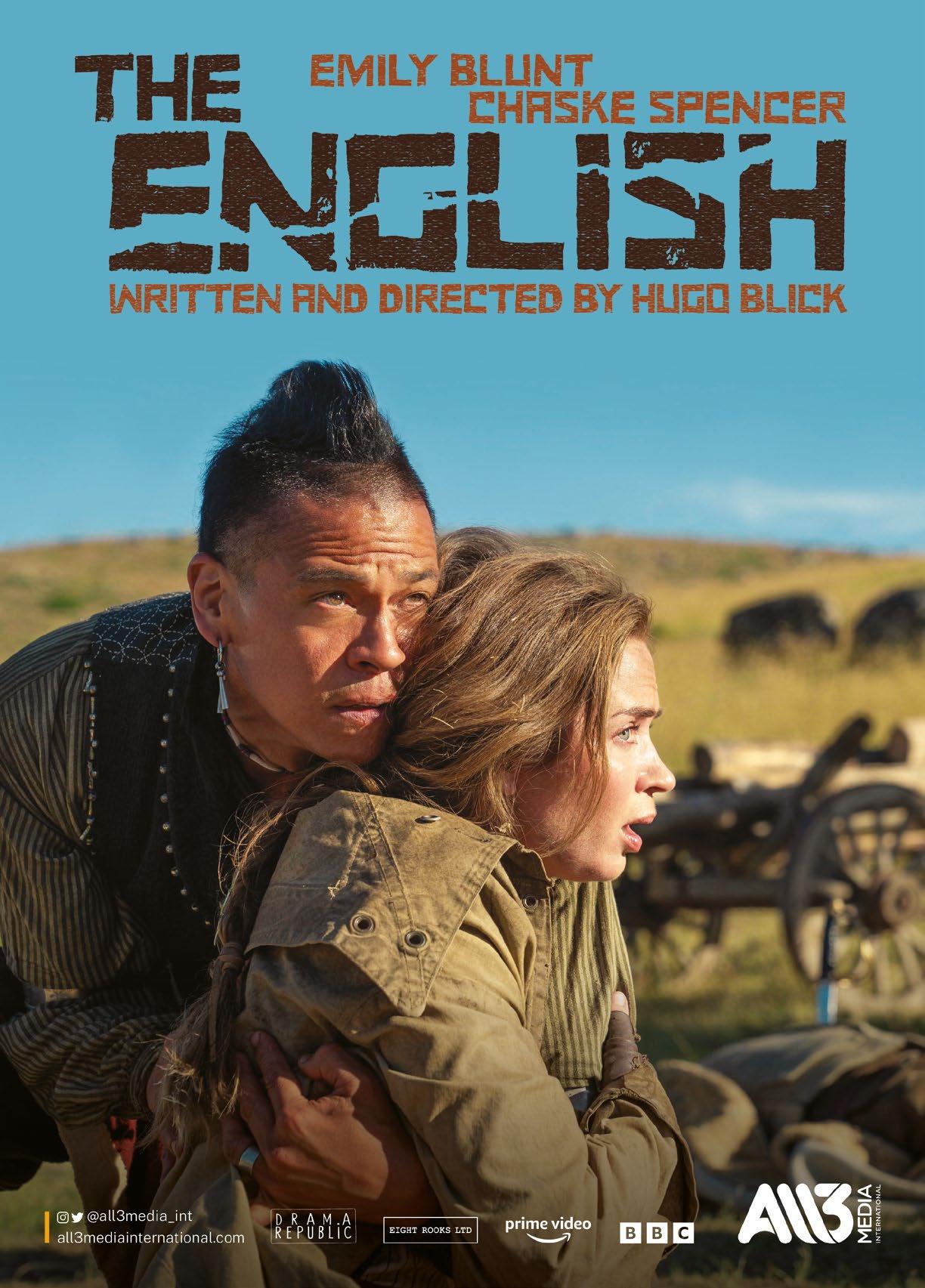

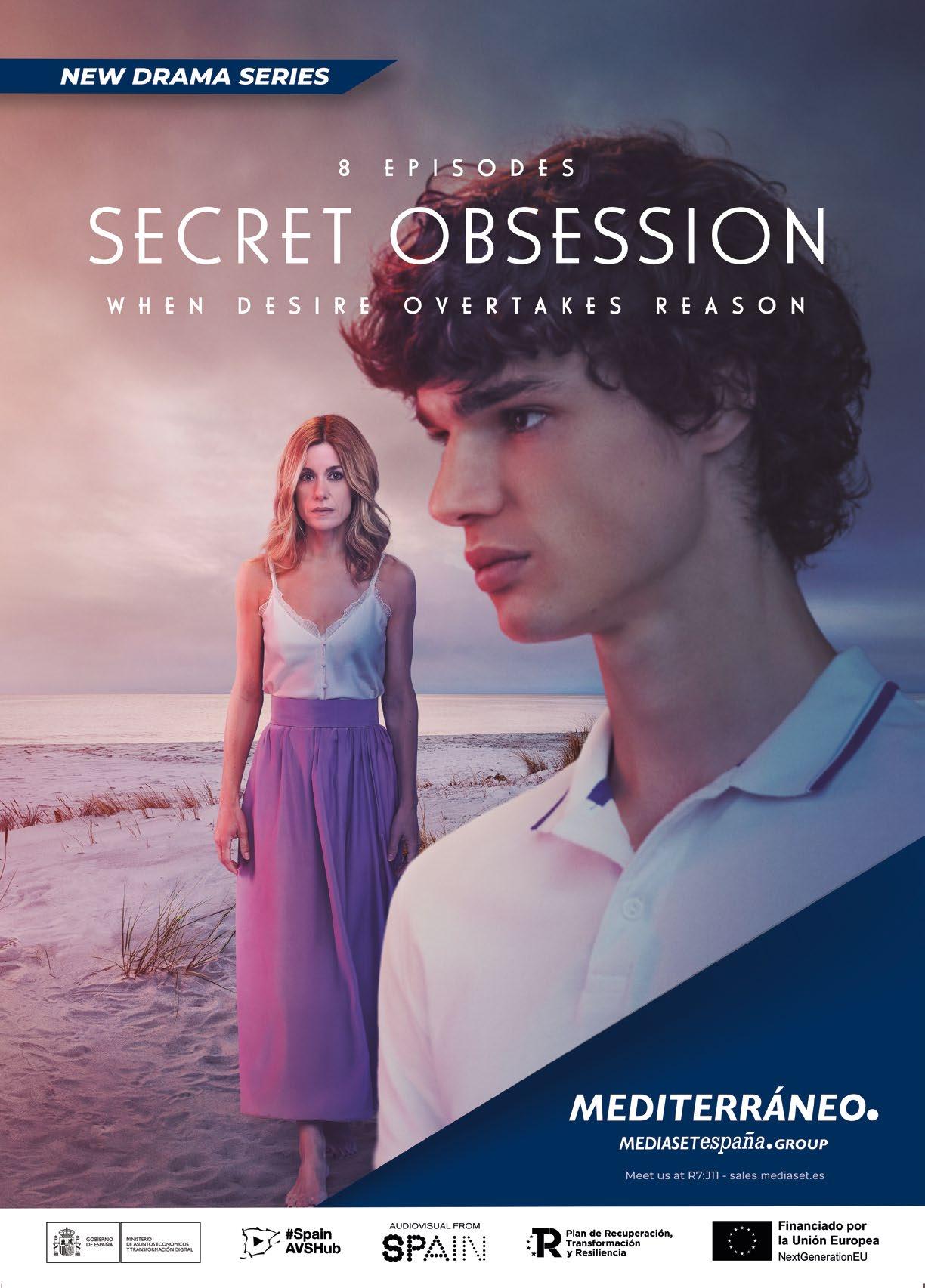

ANA BUSTAMANTE, GENERAL DIRECTOR OF MEDITERRÁNEO MEDIASET ESPAÑA GROUP, EXPLAINS THE DIVERSIFIED STRATEGY OF THE COMPANY, WHICH DOES NOT ESTABLISH A SINGLE DISTRIBUTION BUSINESS MODEL.

Mediterráneo Mediaset España Group operates in various business segments while analyzing new strategic alliances, both at the level of co-production and distribution with OTT platforms. Speaking to Señal News, Ana Bustamante, General Director of Mediterráneo Mediaset España Group, explained the critical factors of the company’s strategy.

What criteria define Mediterraneo's international distribution strategy?

“We have a diversified strategy, which does not establish a single distribution model. On the one hand, the content is the main differentiating element; since each title has characteristics that make it more suitable for a certain type of channel or platform, it does not have to work in a generalized way. On the other hand, the territories and their cultural factors define what type of product can be offered in each region. Hence, the importance of evaluating each title, each territory, and each client, to offer content that adjusts to individual needs. In this sense, our comedy brands are very successful in territories such as Greece, where we are celebrating the 10 th anniversary of the production of the local version of ‘Marriage Scenes’ on the Alpha TV channel. Other brands from our fiction catalog have been adapted and broadcast on Greek channels, such as ‘El Chiringuito de Pepe’ or ‘La Que Se Avecina.’ The latter, along with ‘El Pueblo,’ are two titles that have also been very successful in Bulgaria”.

“In the Americas, the demand is mostly focused on dramatic series. An example is ‘Mothers: Love and Life’ and ‘The Devil’s Watches,’ which have several closed windows in the region, such as Peacock in the USA, and Directv, and Claro Video for Latin America. We have an extensive catalog. Since the birth of our subsidiary, we do not only offer fiction produced by Mediaset España. We are also incorporating other genres such as ‘Sapo, SA Memorias de un ladrón,’ a true biographical crime premiered exclusively on Prime Video Spain that will also be broadcasted on our free-TV channels. We are also promoting the biographical sports docuseries ‘Ángel Nieto: Cuatro Vidas,’ a portrait in four episodes of one of the most important figures in world motorcycling. Moreover, ‘Nude Sweet’ is a documentary series released this year about a famous influencer in more than 65 countries. It is gratifying and enriching to incorporate all kinds of genres, honoring our goal of offering diversified content for all tastes. This model allows us to reach all types of windows.”

“At Mediaset España, the production of original content prevails. This year the successful fiction ‘Entrevías’ has stood out, while well-established brands are maintained, such as ‘La Que Se Avecina,’ ‘El Pueblo’ or ‘Madres: Amor y Vida,’ among others. Regarding the attributes, two factors are considered: on the one hand, that they are contents suitable for free-TV and, on the other, the profitability of the product. We value this profitability not only with the broadcast on our channels but also with the sale, both to platforms and traditional television channels, in Spain and abroad. For many years we have been committed to this model of coexistence that is giving us great results”.

“We evaluate all kinds of combinations. In recent years we have made co-production agreements, as is the case of the ‘Los Relojes del Diablo’ series, a Picomedia production in collaboration with RAI, or ‘Lejos de ti,’ a Cross Productions production in collaboration with RTI. Since the birth of Mediterráneo, we have strengthened our alliance with the main platforms on the national and international scene. Mediterráneo’s relationship with all platforms is very fluid, but Prime

Video is undoubtedly one of our main allies. Over the last few years, our collaboration has allowed us to jointly explore different business models with great success, highlighting among them the exclusive premieres of titles before the free-to-air broadcast on the Mediaset España group’s channels. Throughout this year, it has exclusively premiered the new seasons of ‘Madres’ and ‘Desaparecidos: la Serie,’ as well as several documentary genres titles such as ‘En la Corte del Principito,’ ‘Angel Nieto, Cuatro Vidas’ and ‘Sapo, SA Memorias de un ladrón,’ the most recent premiere of the platform. They will soon premiere the docuseries’ Dulceida al Desnudo’. All these productions are carried out by production companies Unicorn Content, Supersport, or Mandarina Producciones, among others. We also have an excellent relationship with Netflix, which we started a few years ago with the acquisition of the series ‘Vivir Sin Permiso’ worldwide. Recently, the success, both on Mediaset and Netflix, of the series ‘Entrevías’ stood out. This series managed to be the leader in its free-to-air broadcast on Telecinco with its two broadcast seasons and extrapolated its popularity to the digital environment. On Netflix, the premiere of the first season was positioned for three consecutive weeks as the most watched series among non-English speaking productions on this platform, adding a cumulative total of 138 million hours watched and ranking among the Top 10 series most viewed in 75 countries. This scenario confirms that the series produced for free-to-air television can also achieve great success on free-TV. Disney+ also opted for our series ‘Besos al Aire’ as the first Spanish fiction premiered exclusively on the platform, acquiring the rights for Europe, Africa, and Latin America. With HBO Max we developed titles like ‘Patria’ (Alea Media), ‘Dolores: la Verdad Sobre el Caso Wanninkhof” (Unicorn TV), or the recently released ‘Salvar Al Rey’ (Mandarina Productions). All three titles have had great success with critics and audiences. ‘Salvar Al Rey’ is the most viewed original content in Spanish on the platform, just behind ‘The House of the Dragon.’ The main objective lies in offering interesting stories and content for the different windows and being very agile and flexible when looking for the most convenient broadcast formula at each moment and project.”

By Aldo Bianchi

THE TRADITIONAL FICTION CO-PRODUCTION EVENT HAS ADDED THE ENTERTAINMENT BUSINESS TO ITS SIXTH EDITION, GATHERING 728 ACCREDITED PROFESSIONALS FROM 31 COUNTRIES IN AMERICA AND EUROPE.