AMPLIFY YOUR VOICE

With

With

Chloe Moser | Event Coordinator | cmoser@RHAwa.org | (206) 905-0600

Are you all ready for a new year full of new and fun events?

I was so thrilled to see all your shining faces and fabulous formal wear at the Annual Gala last December, what an incredible turnout –why I would say it was the very cat’s pajamas!

2023 is here and I can’t wait to show you the lineup of amazing events we will have for you:

First off, in May 2023 we will be having the Spring Workshop and Tradeshow again. This year the event will be at Cedarbrook Lodge in SeaTac, WA. The Cedarbrook Lodge team is thrilled to host us and share with us their gorgeous venue surrounded by stunning nature views. This is your best opportunity to get information to help your rental business from across the indus-

try in a single day! Hear from housing providers, property managers, attorneys, financial experts, and more to build your knowledge base and run your rental properties with confidence. Whether you want to make sure you're complying with all of the laws in your area, find out more about investment opportunities, or make some valuable connections with RHAWA vendors to bolster your rental network, we've got you covered!

Next up, Legal Forum! If you think you’re excited about the virtual Legal Forum, get ready for our first live in-person Legal Forum since 2019. This year the event will be on June 28, with the location TBD. We can’t wait to get you in front of some incredible attorneys who can tackle those hard to answer questions.

Followed by, Membership Appreciation Day! This day is for you – our members! On a sunny weekend in late August gather your family members and join us for a fun day out. Location is still top secret…but let me tell you –it’s going to be a fun one! There will be food, games, and so much more for us to celebrate our number one priority: YOU!

Later in October, we’ll be having our Annual Business Meeting (ABM) live and in person. The ABM will be held on October 25 for all our members to gain a deeper understanding of our amazing organization. Join us in Kirkland at 11 Capital for an evening of education and discovery.

Finally, what you’ve all been waiting for…RHAWA’s Annual Gala! Saturday, December 2 we’ll be dressed to the nines Under the Big Top at Emerald City Trapeze Arts. This year’s theme is Winter Circus Under the Big Top and we can’t wait to show you what we’ve been planning. While there won’t be any lions or tigers, you will be amazed at the visual delights their trapeze artists and acrobats have in store for us.

If you are interested in sponsoring any of these events, please contact Daniel Bannon at dbannon@RHAwa.org. Be sure to watch your emails and check out our events calendar at RHAwa. org/events for more information about 2023 events. Thank you again for being the amazing members you are –we’ll see you soon!

In rental housing, landlords often deal with sensitive information. Keeping that information secure is important because identity theft is so common. Any breach of information could affect someone’s financial history, credit report, and even result in the theft of money or other assets. It’s important that we all do our part to make sure that information stays secure.

When you are taking applications for a new unit, it is important to remember

that you are responsible for keeping that information secure. A prospective tenant is entrusting you with their personal identifying information; social security number, driver’s license, and bank account information. If sensitive information like this falls into the wrong hands it can put someone at risk for identity theft.

Make sure that you keep all tenant applications stored in a secure area such as a document safe or locked filing cabinet. When you are ready to dispose

of the information make sure to do so properly, use a paper shredder or other secure disposal system.

Remember that the information you receive in a credit report is meant solely for you as the certified Rental Property Owner/Manager. It is meant for you to view in order to make an informed decision as to whether or not the applicant qualifies to rent your unit. This report is not to be given to or shown to the applicant as FCRA rules state (15 U.S.C. 1681b).

You should keep a copy of the rental application along with proof of ordering a tenant screening report, such as a paid receipt for your order or the summary sheet (this comes with all RHA reports), on file for five years. Remember to destroy your copy of the applicants’ credit report after you have made your decision as to whether or not they are qualified to rent from you.

Following these simple precautionary measures can help protect the safety of your applicants’ identity. Wouldn’t you want every precaution taken to protect your identity if you were in their shoes? It is important that you are aware of RHAWA’s responsibilities in providing you with consumer reports as well as your own obligations now that you have access to this information for tenant screening. This is governed by the Furnishers of Information Obligations under the Fair Credit Reporting Act (FCRA).

If you have any questions about these obligations or any other regulations put forth by the FCRA, fair housing, or RHAWA, please email the staff in our Tenant Screening department. We’re happy to help you understand the rules and how to best comply with them.

Formal legal advice and review is recommended prior to selection and use of this information. RHAWA does not represent your selection or execution of this information as appropriate for your specific circumstance. The material contained and represented herein, although obtained from reliable sources, is not considered legal advice or to be used as a substitution for legal counsel

Denise Myers | Education + Resources Director | dmyers@RHAwa.org

When: Thursday, February 2 | 3-4 pm

Cost: $30 Members | $60 Freemium Subscribers

$90 Guests

Location: ONLINE Only

Many cities in Washington require periodic inspections, usually on a lottery basis. Each of these local inspection programs is different and has unique checklists and criteria. Professional home inspector, Lisa Lotus of Taurus Home Inspections frequently completes these required rental inspections for housing providers in the cities of Seattle, Tukwila, and Burien. In this class, she will review how these programs work, the criteria for passing the inspections, common failures, and how to correct them. Information on registration and inspection programs statewide will be included in the class materials.

When: Wednesday, February 8 | 2-4:30 pm

Cost: $50 Members | $200 Freemium Subscribers

Location: ONLINE Only

Over the last few years, conflicting state and local laws have changed everything from lease renewals to rent payment enforcement. Contradictory and unclear language make it difficult to predict how case law will unfold over the coming years. Hear three attorneys – Chris Benis, Christopher Cutting, and Kaitlyn Jackson – discuss your most difficult questions. Experienced property management professional and housing provider rights advocate, Cory Brewer will moderate questions and lead the discussion. Register now and submit your questions in advance!

When: Thursday, February 9 | 12-1 pm

Cost: $30 Members | $60 Freemium Subscribers

$90 Guests

We are kicking off our 12-part series designed for Property Managers in Washington State. In this session, you will learn best practices for developing a successful and satisfying career in the housing industry. We will explore:

• Various career opportunities in the industry and how to develop as a real estate professional in Washington State.

• Education and licensing requirements in our state.

• Standards for professional appearance, behaviors, and communication.

Instructor: Lawton Coursey, Property Manager

RHAWA MEMBERSHIP PREVIEW AND ORIENTATION

When: Tuesday, February 14 | 1-2 pm

Cost: Free

Please join Grassroots Organizer, Daniel Bannon for an overview of Member Benefits and Services offered by RHAWA. Participants will receive a tour of the RHAWA website and tools and are encouraged to ask questions relating to member benefits throughout the meeting. Register for this meeting which is designed for New Members and those considering membership with RHAWA. Specific Property Man-

(206) 905-0614

agement and Legal questions cannot be addressed during this meeting. Seats are limited to 25 participants.

RENTAL PROPERTY

When: Thursday, February 9 | 12-1 pm

Cost: $30 Members | $60 Freemium Subscribers

$90 Guests

Richard D. Gann, JD, Managing Partner with 1031 Capital Solutions, will review and compare the five most important strategies for deferring capital-gains taxes upon the sale of appreciated rental property:

1. 1031 exchange

2. 721 transfer into REIT

3. Qualified opportunity zone (“QOZ”) fund

4. Charitable remainder trust (“CRT”)

5. Installment note trust (aka “Deferred Sales Trust” TM)

Additional topics will include debt replacement considerations, depreciation tracking, procedural requirements, and general tax implications. This webinar is designed for rental housing owners contemplating a sale and seeking to minimize the tax consequences of their transactions.

PM

When: Thursday, February 16 | 12-1 pm

Cost: $30 Members | $60 Freemium Subscribers

$90 Guests

In this second session of our Property Manager Series, you will learn best practices for creating and participating in a safe, fair, and ethical workplace. We will explore:

• Prevention of sexual and other types of harassment.

• Promoting diversity, equity, and inclusion in workplaces.

• Reporting unethical behaviors.

Instructor: Susan Stahlfeld, Attorney

When: Multiple dates and times, visit RHAwa.org/events to check the schedule.

Cost: Free

Discussing various subjects related to the housing industry.

* Meeting time and subject vary by location. Check the online calendar for details at rhawa.org/events.

When: Thursday, February 23 | 12-1 pm

Cost: $30 Members | $60 Freemium Subscribers

$90 Guests

In this third session of our Property Manager Series, you will learn best practices for providing fair and equal housing opportunities to prospects and tenants. We will explore:

• Protected classes in various jurisdictions, including the source of income and criminal history.

• How to process accommodation requests, including the use of service animals.

• How to respond to retaliation and harassment claims involving tenants and/or staff members.

Instructor: Maxwell Glasson, Attorney

Chester Baldwin | RHAWA Lobbyist

ON MONDAY, JANUARY 9, THE WASHINGTON

LEGISLATURE

FOR THE 2023 SESSION. THE REGULAR SESSION WILL LAST 105 DAYS AND ENDING ON SUNDAY, APRIL 23, 2023.

This legislative session marks the first session in over two years that will be convened back in person, although virtual testimony and meeting options for the public will remain available. We will keep you updated about the Legislature’s plans and logistics for remote activity. This still remains in flux and will likely become clearer as we go through the session. Systems and procedures are still being worked on by legislative staff.

With little change in the legislature’s partisan makeup, there will similarly be little change to the ongoing priorities of the legislative leadership, although with an interesting dynamic between the Democrats in the House and Senate, and differing priorities. The major issues of the previous session will carry forward, especially with a large class of freshman legislators, as well as many legislators that are coming to the capitol campus for the first time since

being elected in the 2020 elections.

The House is controlled by the majority of Democrats with a 58-40 margin, and Democrats control the Senate 29-20. Andy Billig (Spokane), Senate Majority Leader remains in his post, and Laurie Jinkins (Tacoma) remains the Speaker of the House. The biggest change to the leadership is Rep. Joe Fitzgibbon (West Seattle) who was elected House Majority Leader, succeeding retiring Democrat Pat Sullivan.

House Housing Committee Representatives

• Strom Peterson, Chair (D-21)

• Emily Alvarado, Vice Chair (D-34)

• Mari Leavitt, Vice Chair (D-28)

• Mark Klicker, Ranking Minority (R-16)

• April Connors, Asst Ranking Minority (R-8)

• Andrew Barkis (R-2)

• Jessica Bateman (D-22)

• Frank Chopp (D-43)

• Debra Entenman (D-47)

• Spencer Hutchins (R-26)

• Sam Low (R-39)

• Julia Reed (D-36)

• Jamila Taylor (D-30)

Senate Housing Committee

• Patty Kuderer, Chair (D-48)

• Noel Frame, Vice Chair (D-36)

• Phil Fortunato, Ranking Minority (R-31)

• John Braun (R-20)

• Annette Cleveland (D-49)

• Chris Gildon (R-25)

• Ann Rivers (R-18)

• Rebecca Saldaña (D-37)

• Sharon Shewmake (D-42)

• Yasmin Trudeau (D-27)

• Jeff Wilson (R-19)

In committee leadership news, there are several new committee chairs in the House and Senate. Please see below for the new 2023 committee chairs (in parenthesis below):

New House Committee Chairs Environment (Rep. Doglio); Consumer Protection and Business (Rep. Walen); Finance (Rep. Berg); Healthcare & Wellness (Rep. Riccelli); Local Government (Rep. Duerr); and State Government (Rep. Ramos).

New Senate Committees Chairs Business, Financial Services, Gaming & Trade (Sen. Stanford); Environment, Energy & Technology (Sen. Nguyen); Local Government, Land Use & Tribal Affairs (Sen. Lovelett); Way & Means, Capital Budget Chair (Sen. Mullet).

Nearly 400 bills have been pre-filed in the House and Senate, covering topics from education credit access and

curriculum reform, updating the business corporation act, voting rights, retail theft, and online marketplace reform, judicial rights, and traffic safety.

Governor Jay Inslee (D), in mid-December, released his proposed budgets, which proposes large spending into affordable housing and includes issuing $4 billion in housing bonds, which would require approval from the legislature and voters, to finance parts of the budget. There remains a tough dynamic in terms of housing and zoning issues between many local elected officials and the state which will play out further over the session.

Several statewide officials are also releasing proposals for the upcoming legislative session. Attorney General Bob Ferguson, in partnership with Representative Mari Leavitt, is proposing HB 1051, also known as the “Scam Protection Act”, to address illegal robocalls and robocall harassment. Additionally, he and the Governor are proposing legislation to outlaw assault weapons.

Revenue updates from the last quarter of the year have not shown a major decrease in revenue projections. Budget writers have remained cautiously optimistic about future projections but have stated that they are not anticipating strong growth in revenue.

Budget writers have also said they are not planning on cutting the current budget or making major changes to the budget, rather are looking to assess program effectiveness with current funding levels and examine the performance of programs that the Legislature has adopted in the past several years. The budget picture will continue to be shaped throughout the session and as the state revenue forecasts are issued in the spring of 2023, reflecting a possibly changing economic picture. Much remains to be seen.

In general, we are not yet hearing significant support for major legislative proposals for broad-based tax or fee increases in the 2023 session…but we will keep you in the loop as legislation is introduced.

Luke Brown | Business Development Specialist |

Hello members, my name is Luke Brown and I’m the new business development specialist here at RHAWA. I grew up in San Diego, California, and received a brief introduction to the rental housing industry when I worked at Hanken Cono Assad, a San Diego based workforce housing provider. There, I shadowed and assisted property managers at various properties around the San Diego State University college area, helping coordinate vendor repairs during unit turnover and working to better market the properties.

During my time at the University of Washington, I worked as both a sales associate and manager at Sunglass Hut and gained valuable customer service experience. Since graduating from UW with a degree in Economics, I have taken on my new role here with RHAWA. As the business development specialist, I will be working closely with our Executive Director and Deputy Director on developing both membership growth strategies and ways we can better serve our current members. Future articles will discuss specific business development strategies in depth, but

in this article, I will be focusing on the importance of accurate information on your RHAWA profile for both yourself and the association.

Reporting an accurate legislative district is very important, as the location of district lines determines which representative you will be voting for. On February 8, 2022, Washington state underwent redistricting, which changed the boundaries of every district in the state. For many of you, your legislative district changed on this date. This changes the voting pool in each district and can change the political priorities of the district as a whole. This is particularly relevant because, as many of you know, the 2023 legislative session is currently underway. Updating your legislative district will allow us to connect you with both local and state legislators, giving you opportunities to connect with the lawmakers who are representing your area. Making these connections will directly bolster your ability to improve your legislative district, as lawmakers hearing personal stories from citizens from their legislative district has a profound

impact on how they move forward with legislation.

In tandem with your legislative district, recording accurate unit counts and addresses is crucial. If your property makeup has changed, whether that be adding properties, selling, or both, recording the new unit counts and associated addresses will greatly help our advocacy efforts. The more information we have about our members, the more effective we will be in advocating on their behalf. Being able to accurately describe how many units RHAWA supports, how many units our members own and operate, and the locations of these units will greatly enhance how well we can describe our members to lawmakers. This will help us build a more accurate and genuine story to advocate on your behalf.

Furthermore, feedback whenever possible is extremely beneficial to us. Feedback can be received in a number of ways, most importantly through our Connect Forum. The Connect Forum gives you direct communication with other members, where you can share

your own unique experiences to guide each other with everything from repairs to tenant relations. In addition to being able to bounce around ideas with other members, you will also be able to interact with RHAWA staff. Our staff regularly checks the Forum to add clarification or answer any questions you may have. We strongly encourage all our members to check out the Forum, as the more engagement we have, the more all of us benefit.

In addition to the Connect Forum, you can also ask our staff directly about RHAWA related questions. Daniel Bannon, our Grassroots Organizer, is more than equipped to answer most of your questions. You can also reach out to Daniel to share your experience as a small housing provider. RHAWA is always looking to gather member stories and share these stories with other members, media outlets, and lawmakers.

Lastly, I’d like to thank you all for reading. I’m truly looking forward to my future with RHAWA.

Brian Platt, Michael Urquhart and Ben Douglas | Paragon Real Estate Advisors | Vendor Member

The beginning of the year is a time when many owners in the real estate industry take time to reflect and review the performance of their buildings. As active multifamily real estate brokers in the Puget Sound Region, we are exposed to the building operations of some of the most sophisticated and successful apartment operators. We have resources pertaining to all facets of building operations including lenders, insurance agents, rental data, rental strategies, effective advertising platforms, management companies, attorneys, and additional maintenance/remodel contacts.

Our expertise can assist in identifying where your building operations could be improved upon. Please reach out for a free property analysis and/or valuation to see how you could maximize your return on investment. Below are detailed the various sectors in which you may be able to improve to maximize your return and resulting property value.

Property tax assessments – Are your taxes too high? Do you need to appeal the assessed value? We can provide a valuation on your property to compare it to your assessed value and refer you to an expert to appeal your assessed value.

Lenders – Do you need to refinance soon due to an upcoming maturity date? Looking for an update on the current interest rate environment? Are you looking for the perfect combination of rates, amortization, and term? We have relationships with the most active lenders in the marketplace and can assist with the ideal time in this interest rate environment.

Insurance costs – Have you shopped your policy recently? We can let you know if you are paying too much for minimal coverage. We have a relationship with the highest quality insurance agents that are sure to cut back your insurance expenses while maintaining or even improving the quality of your insurance.

Rents – Are you keeping up with the market? We can provide rent comps within your neighborhood so you can see how your rents compare to your other neighbors’ buildings.

Utility Bill Backs – Are you charging back for utilities? We can provide the numerous strategies and utility reimbursement structures owners are using and discuss the best structure suitable for your building.

Additional Income Streams – Are you charging for parking, pet rent, storage income, and month-to-month fees?

Advertising – Are you reaching all renters? We have suggestions for new ways to reach out to potential tenants.

Management – Do you have the right team in place? Do you want to interview a new management company to take over operations? We do not do management ourselves and can provide unbiased recommendations.

LLC formations – Protect your investments with LLCs. We work with local real estate attorneys that can help.

Vendors lists – Trusted referrals for rehabs, roofs, unit turns, full remodels, etc.

Tenant issues – We have resources that can help.

Landlord Maintenance – Recommended every 12 months

1. Do a full walk through of the property. Allows you to monitor your condition and identify areas for preventative maintenance.

2. Put together a preventative maintenance checklist for all appliances, fixtures, carpets, paint, caulking, air filters, etc.

3. Put together a Capital Improvements List that includes the date of any new systems as well as warranty expirations – roof, appliances, hot water tanks, replaced siding, furnace, etc.

4. Put together a list of your annual expenses – taxes, insurance, water/sewer/garbage, common electrical, maintenance, and professional management. Compare your YTD totals with past Profit/Loss statements to make sure nothing is out of the norm.

5. Review current interest rates and loan programs. If you have a loan in place it’s likely variable, 3-57-10 year money. Staying up to date with interest rates and planning ahead is key in this rapidly changing interest rate environment.

6. Hire professional cleaners upon tenant move out. Yes, there is an expense associated ($200 roughly) but steaming carpets, painting walls, and dusting will help prolong the life of your units and capture a higher rent.

7. Respond to tenants’ needs as quickly as possible. Any repairs such as a broken toilet, refrigerator, or range should be fixed within 24 hours, but preferably within 12 hours. This will go a long way to a healthy tenant/landlord relationship and less tenant turnover.

8. Reach out to your tenants every 6-12 months with a handwritten note or email asking them to let you know if there is anything you can do to improve their tenancy.

If you have any questions about the current real estate market, interest rates, DST’s, cost segregation or loan options for acquisition, disposition, or refinance purposes, please contact Brian Platt at Brian@ParagonREA.com, Michael Urquhart at Michael@ParagonREA.com, or Ben Douglas at Ben@ParagonREA.com for more information.

Cory Brewer, General Manager | Windermere Property Management / Lori Gill & Associates | RHAWA Board of Director and Vendor Member

2022 was another whirlwind year in the world of residential leasing through the Greater Seattle Area, with record-breaking pricing and one of the fastest spring markets we have ever seen. To keep things interesting, a number of new landlord/tenant laws were enacted throughout the region at the city and county levels; not to mention at the state level.

When running a statistical analysis of the single-family rental market, I don’t often do too much comparison with the sales market; however, this year in particular (2022), it feels like there was a strong correlation between the two. Some of the patterns were to be expect-

ed, others came as more of a surprise. The data referenced in this piece, unless otherwise noted, was gathered via the Northwest Multiple Listing Service (NWMLS).

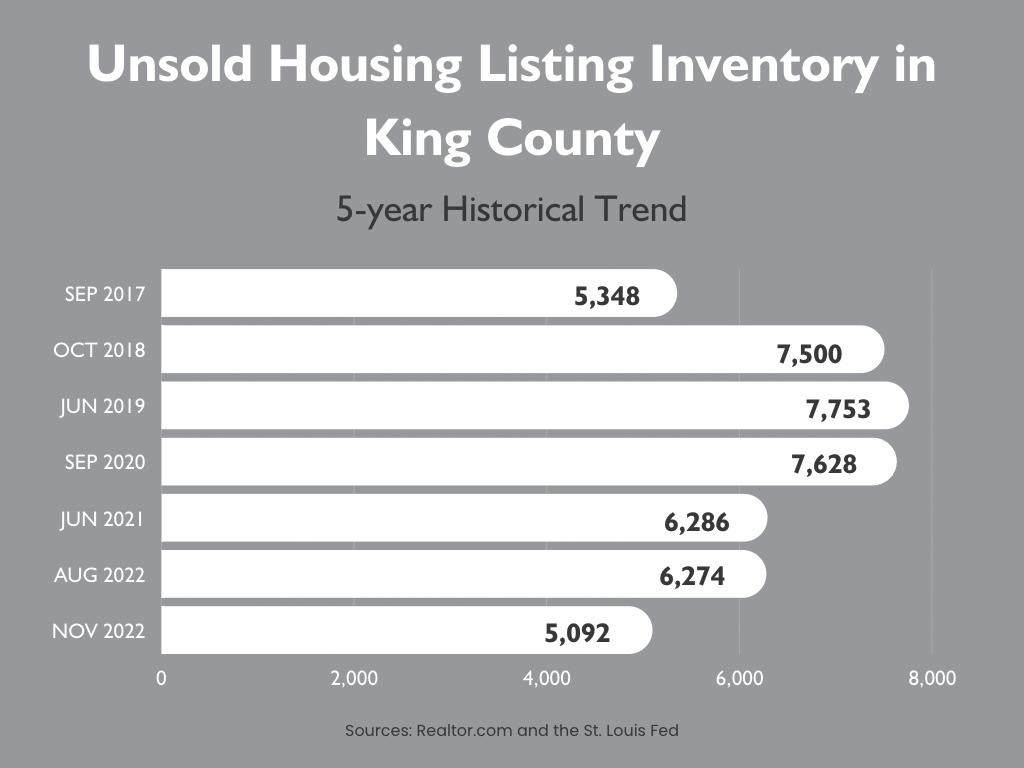

The year started off with a bang due to a combination of factors such as low inventory, COVID-19 related pent up demand, hiring sprees by local tech companies, and very low interest rates. The average home in King & Snohomish Counties during the months of April and May sold in less than 10 days! Limited inventory of homes for sale pushed many people to the leasing market, which also peaked in May at $2.46 per square foot in King County

(the highest single month $/sqft average that I have ever observed).

The second half of 2022 produced quite the opposite effect on the sales market as interest rates began to steadily rise. Pricing in both counties fell by more than 15% from the Spring peaks, and DOM (Days On Market) extended significantly. King county slowed by over 60% while Snohomish slowed by 160%; some truly remarkable numbers. The leasing market, however, maintained a much more stable trendline with pricing in King County remaining flat for the year (January compared to December), and in Snohomish County pricing was up by over 7%. The mar-

ket in King County slowed by about 17% while the Snohomish leasing market actually sped up by over 22%.

So how do we make sense of all this? From my perspective, the primary factor is the rise in interest rates and the subsequent reduction in buying power. Would-be sellers could not get as much for their home as their neighbor had a couple of months earlier, and buyers were looking at significantly higher monthly payments for the same sale price. Rental pricing remained relatively flat by the end of the year as would-be buyers turned back to the leasing market.

One of the most interesting developments that we encountered at our brokerage was the number of those aforementioned would-be sellers who contacted us in late summer / early fall after trying to sell their homes but were unsuccessful. Early on in the COVID-19 pandemic, this became quite common for condo units in the city core, but we knew something was changing when we started getting those calls on 4-bedroom suburban houses in late spring. Homeowners who made the decision to flip to the rental market before the end of Summer made out very well, especially in terms of market time. Rental inventory began to grow during a time when a seasonal market slowdown is typical, but even with more inventory rental pricing remained quite stable, especially compared to home sale prices which fell steadily during the back half of the year and ended (December) below where they began (January).

Switching gears: As has become a consistent theme over the past several years, 2022 was no stranger to evolving landlord/tenant law ordinances. Most notably, the ARCH organization (A Regional Coalition for Housing), comprised of cities throughout the Greater Eastside, encouraged its members to pass a series of new rules intended to benefit renters amidst the rising cost of housing. Some of the proposals did pass in some cities, such as Kenmore, Kirkland, and Redmond, while in other cities they either did not pass or were not formally considered. The proposals focused largely on a few primary themes; security deposit limits, late fee limits, and extended notice for rent increases.

Certainly, a balanced approach is beneficial for a healthy housing market. The acute challenge presented by the ARCH effort is that slightly different versions of the proposals were passed from one city to the next, and in most cases enacted on very short notice. Where nearly all cities in King County (aside from Seattle) had long held consistent leasing rules, we are now dealing with a version of landlord/tenant law in Kirkland that is slightly differ-

AT THE FEDERAL LEVEL, A RECENT DECISION STEMMING FROM THE CARES ACT HAS REQUIRED THAT THE MOST COMMON LEASE VIOLATION NOTICES BE EXTENDED FROM 10 DAYS TO 30 DAYS FOR COMPLIANCE, AND FROM 14 DAYS TO 30 DAYS FOR UNPAID RENT.

ent from Redmond, which is slightly different from Kenmore, which is slightly different from Issaquah, which is slightly different from Bellevue, etc.

Speaking of Seattle; there have been updates to the RRIO program as well as a revised version of the Renter’s Handbook (which must accompany every lease in the city), just to name a couple. An additional number of cities throughout South King County, such as Burien, Auburn, and Federal Way have passed their own new ordinances which speak to many of the previously mentioned topics and beyond.

Snohomish County now requires a 14-day issuance of a payment plan prior to a Pay-Or-Vacate Notice. It’s a lot to keep up with, especially if you own or manage properties in multiple jurisdictions.

At the federal level, a recent decision stemming from the CARES Act has required that the most common lease violation notices be extended from 10 days to 30 days for compliance, and from 14 days to 30 days for unpaid rent (with limited exceptions). We are

anticipating that in its 2022 session, the Washington state legislature will hear bill proposals on everything from a statewide rental property registration to security deposit overhaul to funding for rental assistance to some form of rent control (Washington remains the only state on the West Coast without it).

Are these legal policies working? The jury is most definitely out. The city of Seattle has lost well over 2,500 rental houses going back to 2020. It’s too early to see what the effects have been on other nearby cities adopting similar policies, but it is quite simple math to understand what happens to the cost of rental housing when there are fewer rental houses available. Our advocacy efforts as an industry, in partnership with organizations such as NARPM (National Association of Residential Property Managers), have been to encourage housing policy that will encourage the development and growth of more housing supply, not the depletion. If you are reading this and you feel similarly, reaching out to your representatives is worth the effort.

In summary, 2022 was a remarkable

year with frenzied sales market activity driven by factors such as limited supply and low interest rates. Rental housing providers by and large experienced stability and, depending on the timing, realized price appreciation, particularly on new leases. Those looking for housing, depending on the timing, may have found that there wasn’t much to choose from. The evolving landlord/tenant law environment drove some providers out of the market, while others turned to property management professionals for help whether they were new to the market or had long managed their own rentals but felt it was time to hire out some help. As an industry, we’ll continue to discuss responsible solutions to housing affordability, and it all starts with supply & demand.

Cory Brewer is the General Manager at Windermere Property Management / Lori Gill & Associates. His firm oversees management of approximately 1,500 residential rental homes throughout the Greater Seattle Area, as well as commercial & multi-family properties. He may be contacted via wpme@windermere.com. Visit their website wpmnorthwest.com.

Denise Myers | Education + Resources Director | dmyers@RHAwa.org | (206) 905-0614

The majority of cities and counties in Washington do not currently monitor residential rental properties other than responding to tenant complaints about housing code violations. Only a select group has programs that require rental registration, and even fewer require routine periodic inspections on all rental properties under their jurisdiction. This growing number of cities requir-

ing rental housing registration usually charge a registration fee for each unit or property, and require renewal on an annual or less frequent basis. Some cities simply require housing providers to obtain a standard business license. Each local government is unique. RHAWA makes an effort to learn about and share information on these types of programs, but it is challenging for us

to manage an exhaustive list. All rental housing providers should carefully review the city website where each property is located and look for any regulations related to rental housing. If the property is not within any city limits, check the county website. The table below includes a summary of programs currently known to RHAWA. If you are aware of additional city registration

and inspection programs, please let us know by emailing Denise Myers at dmyers@RHAwa.org.

For more information on inspections, attend a class session with Lisa Lotus from Taurus Home Inspections – Rental Inspections: City Requirements on February 2 from 3-4:00 PM. Register at RHAwa.org/events.

Registration + annual renewal for all residential rental housing units, single-family homes to large multi-family communities.

Fees: $25 + $1/additional unit

Annual Housing Business License is required for each residential rental property.

Fees: $30 - $500 for each property based on the number of units.

Annual Registration is required for each residential rental housing unit.

Fees: $8-$10 per unit

All registered rental properties must be inspected at least once every 3 years.

The owner must hire a qualified rental housing inspector or City inspector to do the inspections.

Inspections are only required for communal housing and state-licensed facilities.

Property inspections are required every 3-3.5 years.

The owner can hire City Inspector for $100 or use a private inspector and pay a $45 fee to City.

Annual Housing Business License is required for each residential rental property.

Fees: $263.75 - $791.25 for each property based on the number of units.

Business License required.

Fees: $50 to open; $5 annual renewal.

All properties subject to inspection must be registered.

Fees: No registration fee; $15 for online submission of the inspection report.

Business License required.

Fees: $50 to register; $5 annual renewal.

Rental properties must be registered annually. (Rental Housing Safety Program website is currently offline)

Licensing + annual renewal for all residential rental housing properties.

Fees: $40 + $1.50/additional unit

Licensing + annual renewal for all residential rental housing properties.

Fees: $50 + $10/additional unit

Business License required.

Fees: $10 to register; $5 annual renewal.

Every three years, at least 20 percent of a property’s rental units are required to be inspected. The owner must hire a qualified rental housing inspector from a list provided by the City.

No inspection requirement.

Property inspections are required every 3 years. Single-Family Homes are not subject to inspection.

The owner must hire a qualified rental housing inspector.

No inspection requirement.

Property inspections are required every 5 years.

All registered rental properties must be inspected at least once every 3 years.

City or county inspectors conduct all inspections at no charge to the owner.

All registered rental properties must be inspected at least once every 2 years.

City inspectors conduct inspections at no charge to the owner, or the owner may hire a qualified private housing inspector.

Property inspections are required every 5 years. Inspection is done by the city for a fee or qualified private inspector paid by the owner.

Annual rental registration for each property.

Fees: None

All rental properties must be registered and renewed every two years.

Fees: $70 per property including one unit; $15 for each additional unit

All rental properties must be registered.

Fees: $100 per property, waived with completion of “Crime Free” education.

Rental Business License is required and must be renewed annually.

Fees: $25 - $1500 based on anticipated gross income.

Rental Business License is required and must be renewed annually.

Fees: $40 per property including one unit; $15 for each additional unit

Rental Business License is required and must be renewed annually.

Fees: $80 - $324 per property based on number of units.

Inspections are required on a complaint basis.

Inspection is required once in the first 5 years, based on lottery selection.

Inspection is done by the city for a fee or qualified private inspector paid by the owner.

No inspection requirement.

The landlord must self-certify that properties meet minimum inspection criteria.

No inspection requirement.

Each unit must be inspected before renting and then once every four years.

Inspection done by city for a fee or qualified private inspector paid by the owner.

Formal legal advice and review is recommended prior to selection and use of this information. RHAWA does not represent your selection or execution of this information as appropriate for your specific circumstance. The material contained and represented herein, although obtained from reliable sources, is not considered legal advice or to be used as a substitution for legal counsel.

Daniel Bannon | Grassroots Organizer |

As many of you know, my name is Daniel Bannon and I am the Grassroots organizer for the Rental Housing Association of Washington. I started working for RHAWA just over a year ago in December of 2021 and I thought it would be fun and informative to reflect on what I have learned in this last year as well as provide some thoughts on what I would like to learn going forward. I hope this article will provide some insight into the inner workings of RHAWA while also providing the opportunity for our members to get to know me.

When I started working for RHAWA I had much to learn and I was eager to do so. I had worked in property management previous to working for RHAWA so I had a baseline of knowledge regarding the operation of a rental property, however, there is always more to learn. My first task working for RHAWA was to learn about how the organization works and understand what kind of work needs to be done in order to provide the highest level of service to our members. This education came in a format that is likely familiar to many

of our members: The Rental Housing AcademyTM. The Rental Housing AcademyTM provides incredible education for our members but it is also utilized to educate new employees at the association. Stemming from this, you can rest assured that when our staff members discuss the value of our education services, they are speaking with first hand knowledge of how to use our education system and as well as the quality of our classes. In my education, I learned best practices for running a rental property from Denise Myers as well as a breakdown of our legislative issues from our Government Affairs team. This education was crucial to my foundation of knowledge with RHAWA because it gave me a perspective on the intersections between legislative issues and how these issues impact the day-to-day operations of a rental property owner.

Following my introduction and education with RHAWA, I attended my first event where I would be speaking to individuals on behalf of RHAWA. Despite the immense amount of information I had just learned through our

education services, I was still quite nervous to speak on behalf of the association. Luckily, the rest of the government affairs team was there to guide me through this new experience. I observed how our team would speak to members as well as non-members about the association. When we would meet non-members, I learned how to communicate the value of RHAWA while keeping it short and sweet. Most of our staff could ramble about the benefits of membership for hours, so it was fascinating to learn what key benefits we mention in a brief conversation. Reflecting on this experience highlights some of the most noticeable changes I experienced in the last year while working with the association. When I have attended events recently, I am now confident and experienced in speaking about the benefits of our association as well as communicating our goals as an association. Instead of observing the conversations our government affairs staff are having with seemingly random individuals, I am now recognizing our members who regularly attend events and introducing them to our new staff members. This

transition happened much faster than I was expecting, and I am enjoying passing along the lessons I have learned to our new staff members.

Another aspect of my experience I would like to highlight is regarding my contributions to our CURRENT Newspaper. When I first started writing articles for our newspaper, I was still figuring out how to write in an informative and personal way. During my education at the University of Washington, I would typically write in an analytical, professional manner but I wanted my articles in CURRENT to provide some insight regarding my personality as well as my knowledge. It took a few attempts, but coming into the summer months I think found that balance that I was looking for. I’m sure if you compared some of my earliest articles to my recent articles you will notice a slight difference in tone, but a consistency in the quality of information I provide. I imagine myself speaking directly to our membership when I write articles for our newspaper and I

Daniel Bannon | Grassroots Organizer | dbannon@RHAwa.org | (206) 905-0609

If there is one thing we know about our members, it is that we are an outspoken group of small housing providers who are passionate about the rental housing industry. As such, RHAWA would like to foster connections between our members and give our members the ability to amplify their voices to a larger audience if they so desire. With Legislative Session underway, the topic of amplifying your voice is as relevant as ever. In this article, I will detail some of the ways RHAWA can help your outreach efforts as well as describe the importance of communicating with RHAWA as a member.

The first method that comes to mind when thinking about amplifying our member’s voices to a larger audience is our advocacy efforts. During Legislative Session we have, at a minimum, a weekly meeting that will provide you with updates regarding upcoming legislation as well as providing guidance as to how to provide testimony. We look forward to these meetings becoming a place where members and staff can bounce ideas off of each other regarding the most effective way to communicate with lawmakers as well as fostering deeper connections between staff and all the members who participate in our advocacy efforts.

Advocacy doesn’t end with the legislative session, there are local cities that are passing new laws regarding rental housing even after state lawmaking is over. This means that it is crucial to be involved year-round and part of being involved is reaching out to RHAWA when you need help or have questions. RHAWA is here to help you as a small housing provider and we cannot overstate how important it is that we learn from the experiences of our members in order to provide the highest level of service possible. We do our best to provide you with everything you may need to provide public testimony or communicate with your local lawmakers, but we know that these processes can be confusing and we may need to provide additional instruction in some cases. Whatever the situation, do not hesitate to reach out to me or the rest of the RHAWA team if you need answers. It is important to briefly note that RHAWA Staff cannot provide legal advice and there are some instances where an RHAWA staff member will advise the use of a legal professional for certain situations.

Additionally, we want all members who are interested in assisting and bolstering RHAWA’s outreach efforts to reach out and share their experience via a short interview with an RHAWA staff member. Every housing provider’s experience is different and the experiences of one member can inform the experience of another. RHAWA will never use the information gathered from member testimonials without express consent from the given member and it cannot be overstated how important these stories can be to not only our advocacy efforts but our outreach efforts generally. Learning about the personal experiences of our members can be effective in communicating the needs of small housing providers to the general population as well as lawmakers. We say this all the time, lawmakers and the general population are much more sympathetic when hearing directly from our members. Many individuals outside of our organization do not understand the struggles our members face and it is up to all of us to change that.

RHAWA values all kinds of feedback that our members can provide. For example, we received significant feedback regarding our 2022 Annual Gala letting us know how much our members appreciate the organization and accommodations of our biggest party of the year. This kind of positive feedback lets us know when we really knock something out of the park and helps us tailor future events to align with what our members value most. Alternatively, constructive criticism also helps us improve our services in order to serve your needs better. Sometimes we need to change things in response to member feedback, and we are happy to do so when it improves our members’ customer experience.

Recently, we received feedback from our membership that the Connect Forum is too convoluted which is discouraging higher levels of participation in the Forum. The Connect Forum was refined from 6 categories to three earlier this year and we saw a jump in engagement following this change. Taking simplification to its next logical step, we have determined that splitting the forum into categories makes the Forum needlessly difficult to navigate and the system would work better with simply one board where our members can interact. We are also running a poll in the Forum which is gathering feedback regarding recent changes and inquiring about future changes. The Connect Forum is one of the most valuable resources on our website, where you can meet fellow members from across the state and learn about their experiences and receive recommendations on best practices. The changes that are taking place on the Connect Forum are a direct result of member communication with RHAWA. We need your feedback in order to improve our services and we encourage members to speak up on the forum or via email if they have feedback on RHAWA’s services.

SPEAK UP

I hope you found this article informative and motivational. I want to motivate our members to speak up when they have something to contribute. Regarding both our advocacy efforts and the general operations of RHAWA, your feedback is crucial to making RHAWA the best it can be. Feel free to give us a call, email, or stop by a LINK Meeting if you want to help RHAWA continue to provide the highest level of service in the rental housing industry. Your feedback is the pathway to making changes in your favor and we will always encourage you to use your voice to make a difference. Thanks for speaking up!

TURN KEY MAKE READY, VENDOR

Apartment Painting Prices Walls Only*

One Coat Labor Only. Customer to Supply Paint.

Studio Apt...................................................From $395

One Bedroom Apt.....................................From $495

Two Bedroom Apt......................................From $495

Three Bedroom Apt...................................From $695

Houses............................................................Bid Only

*Ceilings, Doors, Jambs, Kitchen Cabinets, Millowrk, Base Trim, Wall Repair Additional Charges

Apartment Cleaning Prices*

Studio Apt...................................................From $195

One Bedroom Apt.....................................From $225

Two Bedroom Apt......................................From $250

Three Bedroom Apt...................................From $275 Houses............................................................Bid Only

*Heavily Soiled Additional Charges

Apartment Carpet Cleaning Prices*

Studio Apt.......................................................From $95

One Bedroom Apt.......................................From $125

Two Bedroom Apt........................................From $150

Three Bedroom Apt.....................................From $175

Houses..............................................................Bid Only

*Heavily Soiled Additional Charges, Town Houses Add $45

ADDITIONAL SERVICES WE OFFER (Bid Only):

• Vinyl Plank Floor Cleaning

• Water Extractions 24/7 - 365 days a year

• Odor Treatments

• Hallway Cleaning

• Pressure Washing EPA Compliant

• Junk removal after evictions

JON: (425) 330-9328 WENDY: (425) 870-2295

EMAIL: extremesteamcc@comcast.net

hope you have enjoyed learning about me over the past year.

I would be remised to forget to mention the most important aspect of our association. If you didn’t already guess, it is all of you: our members. RHAWA wouldn’t exist without the support of all of our members, and it has been an absolute pleasure meeting many of you over this last year. One of my first experiences meeting our members was at the East King County LINK Meeting and I immediately felt welcomed by the members I met that night. Since then I have built relationships with many of our LINK attendees and I look forward to continuing to meet attendees in the future. The value of interactions between staff and our members cannot be overstated and it is one of the key reasons we have changed the LINK Meeting schedule in order to allow more interaction between staff and membership. I have learned so much about the industry from our members and I appreciate everything you all have taught me over this last year. There is always more to learn and I am excited to see my knowledge base expand even more as I continue to meet members with unique experiences.

Thank you for taking the time to read my reflection on my last year with RHAWA. It has truly been a fascinating and informative experience and I look forward to using the skills and knowledge I have gained to continue assisting members in the future. I try to mention this as much as possible, but I encourage our members to reach out to me to ask questions about the association, especially if you have questions about our advocacy efforts or would like to share your experience as a housing provider. Answering questions about the association allows me to take note of my knowledge base and discover aspects of the association I may need to learn more about. On behalf of the association and all our staff, thank you for your membership. We look forward to providing the highest level of service for housing providers in 2023 and beyond.

Submissions are compiled and printed, depending on space available. RHAWA does not guarantee submissions will be included.

Interested in Submitting Your Annoucement?

We welcome information about industry job postings, new employee and location information, and more. If you have questions, or would like to submit an item for consideration, email publications@RHAwa.org.

We encourage you to consider the vendors found within these listings for your rental business needs. When seeking competitive bids, be sure to mention your RHAWA membership as many offer member discounts. RHAWA does not specifically endorse any business listed herein. References are always recommended. If you would like to submit a customer testimonial for our records, please submit to publications@RHAwa.org. Please note that changes made to a vendor member profile will not be reflected in the CURRENT Vendor Listings unless the change is also sent to publications@RHAwa.org.

Brink & Sadler (253) 582-4700 | brinkandsadler.com

Hutchinson & Walter, PLLC (425) 455-1620 | hutchcpa.com

Pacific Publishing Co. | Print + Internet (206) 461-1322 pacificpublishingcompany.com

Seattle Rental Group | Property Management (206)315-4628 | www.seattlerentalgroup.com

(360) 529-7567 |

Donald B. Kronenberg (206) 877-3191

Greenwood

(206) 783-2900 |

Brink Property Management

Dean Foggitt (425) 458-4848 | brinkpm.com

Access Evictions

Travis Eller (425) 641-8010 | accessevictions.com

Christopher T. Benis, Attorney at Law First Avenue Law Group, PLLC

Vendor of the Year 2006 (206) 447-1900 | firstavenuelaw.com

Demco Law Firm, P.S. (206) 203-6000 | demcolaw.com

Dimension Law Group PLLC

Synthia Melton (206) 973-3500 | dimensionlaw.com

Flynn and Associates, PLLC

Sean Flynn (206) 330-0608 | theflynnfirm.com

Glasson Legal (206) 627-0528 | glassonlegal.com

Gourley Law Group / The Exchange Connection (360) 568-5065 | gourleylawgroup.com

Holmquist & Gardiner, PLLC (206) 438-9083 | lawhg.net

Jeffery Bennett (503) 255-8795

Law Office Of Shaun Watchie Perry (206)729-7442 | swp-law.com

Ledger Square Law

(253) 327-1701 | ledgersquarelaw.com

Ling & Liang PLLC

(206)462-2884 | ling-liang.com

LT Services

(206) 241-1550 | ltservices.net

Loeffler Law Group, PLLC (206) 443-8678 | loefflerlawgroup.com

Maxwell Glasson (206) 627-0528 | loefflerlawgroup.com

Micheal D Mclaughlin, Attorney at Law (253) 686-9786

Reed Longyear Malnati & Ahrens, PLLC (206)624-6271 | www.reedlongyearlaw.com

Seattle Real Estate Law Group (206) 623-4846 | seattlerealestatelawgroup.com

Eastside Funding (425) 230-0000 | eastsidefunding.com

First Federal Savings and Loan (206) 586-1701 | ourfirstfed.com

First Financial Northwest Bank

Tom Jarzynka (425) 264-2757 | ffnwb.com

Homebridge Financial (206) 915-3742 | homebridge.com

Luther Burbank Savings Bank

Tiana Jackson: (425) 739-0023 lutherburbanksavings.com

Pacific Crest Savings Bank

Scott Gibson (425) 670-9600 | (800) 335-4126 paccrest.com

Umpqua Bank | Multifamily Lending

Matt Couch (425) 602-1250 | umpquacrelending.com

Washington Federal Vendor of the Year | 2015

Tim Marymee: (206) 777-8213 | (800) 324-9375 washingtonfederal.com

+ SHOWER RENOVATION

Fischer Restoration (888) 345-2532 | fischerrestore.com

Flippers Warehouse (206) 656-3222 | flipperswarehouse.com

Tub Cove Inc. New Tubs, Surrounds and Bathroom Plumbing (206) 522-1711 | tubcove.com

NWK9 Bed Bug

(206) 801-3522 | nwk9bedbugdetectives.com

Ultrasonic Mini-Blind Cleaning + Repair (425) 771-7799 | shineablind.net

+1 Construction (206) 313-6587 | plusoneconstruction.com

Bellan Group, LLC

Susan Bellan (206) 383-0102 | bellan.com

Construction Expeditors, LLC (206) 595-8852 | (877) 644-1700 constructionexpeditors.com

Fischer Restoration (888) 345-2532 | fischerrestore.com

Flippers Warehouse (206) 656-3222 | flipperswarehouse.com

Haynes Contracting LLC (253) 335-7905 | haynescontractingllc.com

Interland Design

Jake Cervilla (425) 290-9639 | interlanddesign.com

Kanso Homes, Inc. (206) 278-3403 | kansohomes.com

Maintco (425) 822-5505 | maintcogc.com

Masonry Restoration Consulting (425) 344-3893 masonryrestorationconsulting.com

Next Level Property Maintenance (206) 922-8119 | nxtlevelpm.com

Pro Realty Options, Inc. (425) 745-2400 | prorealtyoptions.com

Rife Masonry

Chad Rife: (206) 696-6998 rifemasonry.com

T.E. Kelly Company, LLC

Tim Kelly: (206) 240-1950

The Wall Doctor, Inc.

Gary Borracchini (425) 822-8121 | thewalldoctor.com

Top-Rung Construction LLC

Gary Gilmer (253) 893-1101 | fieldsroofservice.com

+

Envirotest | Mold & Air Quality Analysis

Donald B. Kronenberg (206) 877-3191 | seattlemoldandairquality.com

Greenwood True Value Hardware | Detectors (206) 783-2900 | greenwoodhardware.com

Pacific Northwest Locksmith | Detectors (206) 531-0411 | pnwlocksmith.com

Maintco (425) 822-5505 | maintcogc.com

Pioneer Masonry Restoration Co. (206) 782-4331 pioneermasonry.com

Reinhart Electric & Service (425) 251-5201 reinhartelectric.net

T.E. Kelly Company LLC Tim Kelly: (206) 240-1950

Rental Housing Association of Washington Chartrice Young (206) 283-0816 | RHAwa.org

Lumber |

& Lumber (206) 632-2129 | dunnlum.com

(206) 812-9155

(206) 812-9155

Therasa Alston (206) 650-4777

|

- 1031 Real Estate (206) 502-4862 | www.re-transition.com/rhawa

Partners, LLC

(206) 323-1771 | redsidepartners.com

+1 Construction (206) 313-6587 | plusoneconstruction.com A&A Electric (206) 212-1888 | anaelectric.com

ABC Towing, Inc.

Seattle: (206) 682-2869

Tukwila: (206) 767-4024

abc4atow.com

Bellan Group, LLC

Susan Bellan (206) 383-0102 | bellan.com

Bravo Roofing, Inc.

GoldStar Vendor + Vendor of the Year | 2014

John Paust, Estimator: (206) 948-5280 (253) 335-4825 | (360) 886-2193

john@bravoroofs.com | bravoroofs.com

Construction Expeditors, LLC (206) 595-8852 | constructionexpeditors.com

Diamond Roofers, LLP | Flat & Low Slope (206) 202-7770 | diamondroofers.com

ER Flooring (360) 402-9566 | erflooring.com

First Choice Remodeling, Inc. (253) 846-9000 | firstchoiceremodelinginc.com

Global Paving LLC (253) 286-7943 | globalpavingllc.com

Masonry Restoration Consulting (425) 344-3893

masonryrestorationconsulting.com

of the Year | 2020 (425) 775-6464 (800) 972-7000

dayandnite.net

Fischer Plumbing, Inc. (206) 783-4129 | fischerplumbing.com

The Pipe Guys (253) 537-2830 | pipeguys.com

DRYER VENT + DUCT CLEANING

The Chimney Specialists, Inc. | Dryer Vent Only Seattle: (206) 782-0151 | (888) 979-3377

So. King Co.: (253) 833-0144 | (888) 979-3377

Pierce Co.: (253) 475-0399 | (888) 979-3377 thechimneyspecialists.com

VentMasters (206) 362-5190 | ventmasters.net

DRYWALL

The Wall Doctor, Inc. Gary Borracchini (425) 822-8121 | thewalldoctor.com

EDUCATION – REAL ESTATE

Rental Housing Association of Washington Denise Myers (206) 283-0816 | RHAwa.org

ELECTRICAL MAINTENANCE + REPAIR

A&A Electric (206) 212-1888 | anaelectric.com

Alpine Ductless, LLC (360) 529-7567 | alpineductless.com

Capstone Solar (206) 580-3448 | capstonesolar.com

Reinhart Electric & Service (425) 251-5201 reinhartelectric.net

ENERGY CONSERVATION + WEATHERIZATION

Rental Housing Association of Washington (206) 283-0816 | RHAwa.org FLOOR

Capstone Solar (206) 580-3448 | capstonesolar.com

Energy Benchmarking Services

Michael Jones (206) 245-8737 | EnergyBenchmarkingServices.com

SRC Windows (253) 565-2488 | srcwindows.com

ESTATE PLANNING

Dimension Law Group PLLC

Synthia Melton (206) 973-3500 | dimensionlaw.com

Flynn and Associates, PLLC

Sean Flynn (206) 330-0608 | theflynnfirm.com

Olympic Estate Group, LLC

G.A. “Jeri” Schuhmann (206) 799-0544 | OlympicWealthStrategies.com

Access Evictions

Travis Eller, Attorney at Law (425) 641-8010 | accessevictions.com

Demco Law Firm, P.S. (206) 203-6000 | demcolaw.com

Glasson Legal (206) 627-0528 | glassonlegal.com

LT Services, Inc. (206) 241-1550 | ltservices.net

Loeffler Law Group, PLLC (206) 443-8678 | loefflerlawgroup.com

Maxwell Glasson (206) 627-0528 | loefflerlawgroup.com EXCHANGE —

1031 Capital Solutions (800) 445-5908 | 1031capitalsolutions.com

Gourley Law Group / The Exchange Connection (360) 568-5065 | gourleylawgroup.com

Investment Property Exchange Services, Inc. (425)582-3487 | www.ipx1031.com

Kay Properties & Investments

Dwight Kay (855) 899-4597 | kpi1031.com

- 1031 Real Estate (206) 502-4862 | www.re-transition.com/rhawa

AFB Floors (425)255-3893 | afbfloors.com

Alliance Flooring Services (253) 850-1288 | allianceflooring.com

ER Flooring (360) 402-9566 | erflooring.com

Rental Housing Association of Washington (206) 283-0816 | RHAwa.org

Seattle Public Utilities | Resource

(253) 281-7674 | tacomahousing.net

Optimized

Services, LLC Bryan Mize (206)

| seattlerentalinspector.com Seattle Rental Inspection Services (RRIO) (206) 854-0390 seattlerentalinspectionservices.com

Street Building / Home Inspection

Gonzalez (206) 999-1234 | hi@homeinspect.ws

Brent Ward State Farm Insurance (425) 488-9100 | (888) 532-1875

brentwardagency.com

Diamond Cut Insurance Group, Inc.

Larry Janowicz (425) 879-5198 | larry@dcigi.com

State Farm Insurance (206)322-3910 | myseattleinsurance.com

Colliers International

GoldStar Vendor + Vendor of the Year | 2018

Tim McKay: (206) 223-5586

INVESTMENT + FINANCIAL SERVICES

CPX LLC

(866) 405-1435 | cpxone.com

Dan Chhan: (206) 223-1265

Joe Levin: (206) 223-5583

Sam Wayne: (206) 515-4498

Brittany Rondello: (206) 515-4495

colliers.com

Flynn Family Lending

Matt Flynn (425) 221-8660 | flynnfamilylending.com

Havium. Inc (888) 642-8486 | havium.com

Kidder Mathews

Dylan Simon: (206) 414-8575

Jerrid Anderson: (206) 499-8191

DylanSimon.com

Luther Burbank Savings Bank Tiana Jackson: (425) 739-0023 lutherburbanksavings.com

McTaggart Real Estate (206) 322-9495 | darcoapts.com

Paragon Real Estate Advisors, Inc.

Vendor of the Year | 2016 (206) 623-8880 | (800) 643-9871 paragonrea.com

Peak Mortgage Partners

Dave Eden (206) 660-3014 | peakmp.com

Sound Reatly Group

Charles Burnett, CCIM (206) 931-6036 | soundmultifamily.com

Umpqua Bank | Multifamily Lending

Matt Couch (425) 602-1250 umpquacrelending.com

Wilson Property Management, Inc.

Gary Wilson, CPM (425) 453-0089 | wilsonmanagementinc.com

CrossCountry Mortgage LLC (206) 650-4041 | keaneloans.com

Eastside Funding (425) 230-0000 | eastsidefunding.com

First Federal Savings and Loan (206) 586-1701 | ourfirstfed.com

First Financial Northwest Bank

Tom Jarzynka (425) 264-2757 | ffnwb.com

Flynn Family Lending

Matt Flynn (425) 221-8660 | flynnfamilylending.com

Homebridge Financial (206) 915-3742 | homebridge.com

Kidder Matthews Simon and Anderson Team (206) 747-4725 | dylansimon.com

Luther Burbank Savings Bank

Tiana Jackson: (425) 739-0023 lutherburbanksavings.com

Pacific Crest Savings Bank

Todd M. Hull | Scott Gibson (425) 670-9624 | (800) 335-4126 pacificcrestbank.com

Peak Mortgage Partners

Dave Eden (206) 660-3014 | peakmp.com

Sound Community Bank (206) 448-0884 x202 | soundcb.com

Umpqua Bank | Multifamily Lending

Matt Couch (425) 602-1250 | umpquacrelending.com

Washington Federal Vendor of the Year | 2015

Tim Marymee (206) 777-8213 | (800) 324-9375 washingtonfederal.com

Tacoma Public Utilities Power: (253) 502-8600 Water: (253) 502-8723 TacomaPowerRebates.com/multifamily

Pacific Northwest Locksmith (206) 531-0411 | pnwlocksmith.com

Dunn Lumber (206) 632-2129 | (800) 248-3866 dunnlum.com

First Choice Remodeling, Inc. (253) 846-9000 | firstchoiceremodelinginc.com

Multifamily Elites (425) 698-1631 | multifamilyelites.com

Pro Realty Options, Inc. (425) 745-2400 | prorealtyoptions.com

Real Property Management Today (253) 426-1730 | rpmtoday.com

RentalRiff (541) 600-3200 | rentalriff.com

Rife Masonry Chad Rife: (206) 696-6998 rifemasonry.com

Masonry Restoration Consulting (425) 344-3893 masonryrestorationconsulting.com

Pioneer Masonry Restoration Co. (206) 782-4331 | pioneermasonry.com

Guardian Water & Power

Chris Apostolos (206) 271-6913 | (877) 291-3141 x139 guardianwp.com

Submeter Solutions, Inc.

Jeff Lowry: (425) 228-6831 (888) 64-METER (63837) | submetersolutions.com

| MOLD INSPECTIONS

Envirotest | Mold, Air Quality Analysis, Inspections

Donald B. Kronenberg (206) 877-3191 | seattlemoldandairquality.com

Hainsworth Laundry

Jason Hainsworth (509) 534-8942 | hainsworth.biz PAINTING | PAINT

Extreme Steam Carpet Cleaning (425) 330-9328 | extremesteamcc.com

Interland Design

Jake Cervilla (425) 290-9639 | interlanddesign.com

Ohlsen's Property Renewal (206) 228-2123 | propertyrenewals.com

PEST INSPECTIONS

NWK9 Bed Bug Detectives (206) 801-3522 | nwk9bedbugdetectives.com

Straight Street Building / Home Inspection

John Leon Gonzalez (206) 999-1234 | hi@homeinspect.ws

PIPE RESTORATION

Best Plumbing Group (206) 633-1700 | (425) 771-1114

Fischer Plumbing, Inc. (206) 783-4129 | fischerplumbing.com The Pipe Guys (253) 537-2830 | pipeguys.com

Tub Cove Inc. One-piece one-of-a-kind bath walls (206) 522-1711 | tubcove.com

Best Plumbing Group (206) 633-1700 | (425) 771-1114 bestplumbing.com

Affinity Real Estate Management (206) 812-9155 | affinityrem.com

All County Evergreen Property Management (253) 238-9590 | allcountyevergreen.com

Allen Property Management

Mike Larson (253) 582-6111 | (800) 995-6111 haroldallen.com

Bell-Anderson & Assoc., LLC, AMO (253)852-8195 | bell-anderson.net

Brink Property Management

Dean Foggitt (425) 458-4848 | brinkpm.com

Cadence Real Estate (206)258-4871 | www.cadencere.com

Capstone Commercial Real Estate Advisors

John Downing (206) 324-9427 | capstonerea.com

Champions Real Estate Services (425) 744-5550 | nwchampions.com

Cornell & Associates Inc (206)329-0085 | www.cornellandassociates.com

Dave Poletti & Associates (206) 286-1100 | davepoletti.com

Dobler Management Company Inc. (253) 475-2405 | doblermanagement.com

Elita Living Real Estate LLC

Erica Vincent (206) 323-0771 | elitaliving.com

Emerald Heights Property Management

Ryan Dosch (206) 457-2475 emeraldheightspm.com

First Comercial Properties NW. (206) 985-7275 | fcpnw.com

Foundation Group, LLC (206) 324-7622 | foundationgroupre.com

Icon Real Estate Services Inc.

Jeremiah Roberson (425) 633-3330 | www.iconre.org

Jean Vel Dyke Properties, LLC (206) 725-3103 veldyke.com

Jevons Property Management

Enrique Jevons (206) 880-7935 | jevonsproperties.com

Krishna Realty (425) 209-0055 | krishna-realty.com

Lexington Asset Management (310) 650-3343

Longley Property Management Inc.

Venita Longley (206) 937-3522 | longleypm.com

Madeson Management LLC

Melissa Melia (206) 673-4282 | madesonmanagement.com

Madrona Real Estate Services, LLC

Bradford Augustine (206) 538-2950 | MadronaRealEstate.com

Maple Leaf Management LLC

Michelle Bannister (206) 850-8095 | mapleleafmgt.com

Marathon Properties

Jeff O’Hare (425) 745-9107 | marathonpropmgmt.com

Multifamily Elites (425) 698-1631 | multifamilyelites.com

Nathaly Burnett Property Management (253) 732-9535 | beyondseattle.com

Next Brick Property Management (425) 372-7582

Niche Realty Associates LLC (206) 851-4694 | nichrealtyassoc.com

Northfield Properties Inc. (425) 304-1250 | (425) 304-1250

North Pacific Property Management

Joshua Fant (206) 781-0186 | (800) 332-1032

northpacificpropertymanagement.com

Pacific Crest Real Estate (206) 812-9155 | pacificcrestre.com

Park 52 Property Management

Paul Jakeman (253) 473-5200 | park52.com

People’s Real Estate, Inc.

Lisa Brannon (425) 442-9941 | peoplespm.com

Phillips Real Estate, LLC (206)22-8600 | philipsre.com

Pilot Ventures LLC | Property Management (206) 566-6600 | pilotnw.com

Rental Housing Association of Washington (206) 283-0816 | RHAwa.org/RMAP

Windermere Property Management / WPM South, LLC

Ed Verdi (253) 638-9811 | wpmsouth.com

WPI Real Estate Services, Inc. (206) 522-8172 | wpirealestate.com

Yardi

Kelly Krier (805) 699-2040 | yardi.com

RECYCLING + GARBAGE

Junk Busters-Big Haul (360) 390-2014 | junkbustersllc.com

BricksFolios Real Estate Solutions

Prospector Property Management (206) 508-6366

prospectorpropertymanagement.com

Real Estate Gladiators (425)260-3121 | www.realestategladiators.com

Real Estate Investment Services (REIS) Lakewood: (253) 207-5871 Seattle: (206) 319-5981

REISinvest.com

Real Property Management Today (253) 426-1730 | rpmtoday.com

Redside Partners, LLC

Craig Swanson (206) 323-1771 | redsidepartners.com

Rentals Northwest

Richard Wilber (253) 581-8616

Renters Marketplace

Larry Cutting (425) 277-1500 | rentersmarketplace.com

Seattle's Property Management (206) 856-6000 | seattlespropertymanagement.com

Seattle Rental Group Property Management (206)315-4628 | www.seattlerentalgroup.com

SJA Property Management (425) 658-1920 | sjapropertymanagement.com

SJC Management Group

Jason Clifford (253) 863-8117 | sjcmanagement.com

Spartan Agency, LLC (253) 863-6122 spartanagency.com

SUHRCO Residential Properties (425) 455-0900 | (206) 243-5507

suhrco.com

The Paris Group NW (206) 466-4937 | theparisgroupnw.com

TQ Handyman LLC

Trevor Rose: (206) 222-5129

trevor@tqhandyman.com

T-Square Properties | Real Estate Brokers (425) 485-1800 | www.tsquaremanagement.com

Weber & Associates Property Management (425) 745-5838

Westlake Associates (206) 505-9400 | westlakeassociates.com

Wilson Property Management, Inc.

Gary Wilson CPM (425) 453-0089

wilsonmanagementinc.com

Windermere Property Management

/ Lori Gill & Associates (425) 455-5515 | wpmnorthwest.com

Windermere Property Management

/ JMW Group (206) 621-2037 | windermere-pm.com

Jyotsna (Jo) Dixit (425) 503-1225 | brickfolios.com

Capstone Commercial Real Estate Advisors

John Downing (206) 324-9427 | capstonerea.com

Champions Real Estate Services (425) 744-5550 | nwchampions.com

Colliers International (206) 223-1428 | colliers.com/seattle

Cornell & Associates Inc (206)329-0085 | www.cornellandassociates.com

Dave Poletti & Associates (206) 286-1100 | davepoletti.com

DVF Legacy Investments (206) 650-6113 | pugetsoundinvesting.com

Elita Living Real Estate LLC

Erica Vincent (206) 323-0771 | elitaliving.com

Foundation Group, LLC (206) 324-7622 | foundationgroupre.com

Havium. Inc (888) 642-8486 | havium.com

HFO Investment Real Estate (971) 717-6337 | hfore.com

Jean Vel Dyke Properties, LLC (206) 725-3103 | veldyke.com

Kay Properties & Investments

Dwight Kay (855) 899-4597 | kpi1031.com

Kidder Mathews

Dylan Simon: (206) 414-8575

Jerrid Anderson: (206) 499-8191

DylanSimon.com

Krishna Realty (425) 209-0055 | krishna-realty.com

Leading Edge Property Management (425) 405-2358 | edgehomerentals.com

Lee & Associates

Multifamily Team

Candice Chevaillier (206) 284-1000 | lee-nw.com

Madrona Real Estate

Bradford Augustine (206) 538-2950 MadronaRealEstate.com

McTaggart Real Estate (206) 322-9495 | darcoapts.com

Next Brick Property Management (425) 372-7582

Niche Realty Associates LLC (206) 851-4694 | nichrealtyassoc.com

North Pacific Property Management (206) 781-0186 | (800) 332-1032 northpacificpropertymanagement.com

Paragon Real Estate Advisors, Inc.

Vendor of the Year | 2016 (206) 623-8880 | (800) 643-9871 paragonrea.com

Park 52 Property Management

Paul Jakeman (253) 473-5200 | park52.com

People’s Real Estate, Inc. (425) 442-9941 | peoplespm.com

Phillips Real Estate, LLC (206) 622-8600 | phillipsre.com

Prime Metropolis Properties, Inc. (425) 688-3003 | pmp1988.com

Real Estate Gladiators (425)260-3121 | www.realestategladiators.com

Real Estate Investment Services (REIS) Lakewood: (253) 207-5871

Seattle: (206) 319-5981

REISinvest.com

Seattle Land Broker Inc. (206) 973-3022 | seattlelandbroker.com

SJA Property Management (425) 658-1920 | sjapropertymanagement.com

Sound Reatly Group

Charles Burnett, CCIM (206) 931-6036 | soundmultifamily.com

SUHRCO Residential Properties (425) 455-0900 | (206) 243-5507 suhrco.com

Tecton Corporation (206) 448-4100 | tecton.com

The Chang Group (425) 678-2288 | changgroup.com

The Paris Group NW (206) 466-4937 | theparisgroupnw.com

T-Square Properties | Real Estate Brokers (425) 485-1800 www.tsquaremanagement.com

Westlake Associates (206) 505-9400 | westlakeassociates.com

Windermere Property Management / Lori Gill & Associates (425) 455-5515 | wpmnorthwest.com

Windermere Real Estate Commercial

Therasa Alston (206) 650-4777

Windermere Real Estate / East

Buck Hoffman (206) 660-3764 | buckhoffman.com

WPI Real Estate Services, Inc. (206) 522-8172 x105 | wpirealestate.com

Ideal Inspection Services LLC RRIO Certified + Licensed Inspector (206) 930-0264 | idealinspectionservice.com

Optimized Inspection Services, LLC

Bryan Mize (206) 349-0733

Submeter

Guardian Water & Power

Apostolos (206) 271-6913 | (877) 291-3141 x139 guardianwp.com

Submeter Solutions, Inc. Jeff Lowry: (425) 228-6831 (888) 64-METER (63837) | submetersolutions.com

ABC Towing, Inc. Seattle: (206) 682-2869 Tukwila: (206) 767-4024 abc4atow.com

Bio Clean, Inc. (425) 754-9369 | biocleanwa.com

Conservice (435) 419-4960 conservice.com

Tacoma Public Utilities Power: (253) 502-8600 Water: (253) 502-8723 TacomaPowerRebates.com/multifamily

Pacific Publishing Co. | Print & Internet (206) 461-1322 | pacificpublishingcompany.com

Renters Marketplace Larry Cutting (425) 277-1500 | rentersmarketplace.com

Join

Seattle Public Utilities | Saving Water Partnership (206) 615-1282 | savingwater.org

WATER | FIRE DAMAGE RESTORATION

Fischer Restoration (888) 345-2532 | fischerrestore.com WATER HEATER SALES & SERVICE

Best Plumbing Group (206) 633-1700 | (425) 771-1114 bestplumbing.com

Day & Nite Plumbing & Heating Inc. Vendor of the Year | 2020 (425) 775-6464 | (800) 972-7000 dayandnite.net

Fischer Plumbing, Inc. (206) 783-4129 | fischerplumbing.com

Greenwood True Value Hardware (206) 783-2900 | greenwoodhardware.com WATERPROOFING

Masonry Restoration Consulting (425) 344-3893 masonryrestorationconsulting.com

Shine a Blind | Blinds On-Site Ultrasonic Mini-Blind Cleaning + Repair (425) 771-7799 | shineablind.net

(253) 565-2488 | (800) 870-2488

Public Utilities Power: (253) 502-8600 Water: (253) 502-8723

MAINTENANCE Echo Yard Maintenance (206) 909-6873

Denise Myers | Education + Resources Director | dmyers@RHAwa.org | (206) 905-0614

This article provides a summary of the following Kenmore policies related to rental housing:

• Use of SSN in Screening

• Move-in Cost Caps

• Move-in Cost Payment Plan

• Notice to Increase Rent

• Late Rent Fee Cap

• Notice to Terminate Tenancy

• Rent Due Date Accommodation

These policies are found in the following:

• The Kenmore Tenant Protections KMC 8.55 applies to tenancies governed by RCW Chapter 59.18 (RLTA) and RCW Chapter 59.20 (Manufactured/Mobile Home Landlord-Tenant Act)

Use of SSN in Screening

A housing provider shall not require a social security number for the purposes of screening a prospective tenant, as allowed under RCW 59.18.257.

Housing providers are required to accept “alternative proof of financial eligibility."

Move-in Cost Caps

The total of all move-in fees and deposits charged by landlord must not exceed one month's rent, except in subsidized housing where the monthly rent is based on the tenants income.

Move-in Cost Payment Plan

• Tenants entering rental agreements with terms lasting six or more months may choose to pay their move in fees and security deposits in six equal monthly installments over the first six months occupying the dwelling unit.

• Tenants entering rental agreements with terms lasting fewer than six months or month-to-month rental agreements, may choose to pay move in fees and security deposits in two equal monthly installments over the first two months occupying the dwelling unit.

• Notice to Increase Rent

• When raising rent at the beginning of a rental period or term lease renewal, landlords must give:

• 120 days' written notice for rent increases greater than three percent (3%); or

• 180 days' written notice for rent increases greater than ten percent (10%).

• As required under WA State law, 60 days' written notice for any rent increases 3% or less.