LEGISLATIVE PRIORITIES

The rental housing industry has undergone drastic changes since 2020. A slew of new landlord-tenant laws has made the rental housing industry much more difficult to navigate than in years past. Furthermore, both prospective and current tenant habits have drastically changed after more than two years of lockdown. While some changes in tenant behavior have been harmful to housing providers, some of it leaves room for opportunity, particularly with changes in the way renters look for housing.

quick look at a prospective tenant’s Facebook profile could help a housing provider better understand how serious the prospective tenant is about their property. They also have an auto-response feature for prospective tenants to ask if a rental is still available, and all communication between buyers and sellers happens in-app. Listings are also easy to create on the facebook marketplace as you can take photos in-app with your phone.

office, highlight it! The same goes for nearby parks, backyards, or fenced-off front yards. Being within walking distance of supermarkets and local restaurants is also a great selling point.

The first place to start when building an effective property listing is to maximize your reach. This means making

A final option to consider is Zumper. Zumper listings also puts you in front of Facebook Marketplace, PadMapper, and Walkcore users, giving you a large

ZUMPER IS ALSO GOOD FOR THOSE OPERATING A SMALLER NUMBER OF

FOR MOST OF THEIR RENTAL BUSINESS NEEDS.

sure your listing finds as many prospective tenants as possible. Nowadays, there are more options than ever to choose from, including: Zillow, Facebook Marketplace, and Zumper.

Zillow, the most popular of the bunch, is one of the most common and trusted sites for listing the rental property. Zillow allows you to list properties for free, but offers a premium package that can help you get more exposure by placing your listing at the top of search results for your area.

Facebook Marketplace is a great option for those who want to greatly increase their listing’s reach but don’t want to spend money. Your listing will tap into their user base of around 2.9 billion users, all of whom are linked with their Facebook accounts. A

reach. Zumper is also good for those operating a smaller number of units who are looking for an easy one-stop shop for most of their rental business needs. Housing providers can collect rent for free, with a paid option for rent protection if you’d like. The service is also free to use for up to 10 listings.

Once you’ve chosen the right listing service(s) for your rentals, you then have to decide how to best market your property. This means highlighting the best features of your rental, taking good pictures, and making sure the unit is clean and ready to show. This is where you use changing tenant habits to your advantage. Even as COVID restrictions have lifted, many tenants still work from home and thus spend much more time there than ever before. If your property has room for a home

Tenants have also been checking out fewer homes before making a decision. Thus, it is more important than ever to provide high quality and well thought out pictures for your listing. Most prospective tenants would prefer the space to be empty; it will be the easiest for them to imagine themselves in the space. However, staging can work to your advantage if done right. Using generic furniture, maximizing open space, and keeping everything clean can help prospective tenants picture themselves in the unit.

Even with an excellent listing, timing the market well will minimize your chances of an extended vacancy. It is no secret that the rental housing market is busiest during the summer. Parents don’t have to break up their kids’ school schedules, college graduates are looking for rentals where their jobs land them, and convenient weather all factors into this. Not only is the rental market hottest during the summer months, but the increased demand also will allow you to maximize the rent that you charge, as rents typically go up during these months. If you are trying to rent in the winter and struggle with vacancy, considering a one time 6 or 18 month lease could help in the long term.

articles featured in Current must be around 650 words, include a byline of the author, and a final paragraph with contact information. Deadline is 15 days before the print date (print date is approximately the 13th of the month proceeding the publication.) Submit to publications@RHAwa.org.

Advertise

For advertising information (rates, production specifications, and deadlines), visit RHAwa.org/advertise

Education + Resources Denise Myers: (206) 905-0614

Event Coordinator Chloe Moser: (206) 905-0600 | cmoser@RHAwa.org

Grassroots Organizer

Daniel Bannon: (206) 905-0609

Member Services Specialist (Resource Desk) Sue Lewis: RHAwa.org/supportcenter

Member Services Specialist (Screening) Val Kushi: (206) 283-0816 | screening@RHAwa.org

RHAWA Current is published every month by the Rental Housing Association of Washington. Copyright ©2023 RHAWA Current with all rights reserved. Reproduction or use without permission of editorial or graphic content in any manner is prohibited. All copyrights, trademarks, and servicemarks are property of their respective owners. P.O. Box 31103 Seattle, Washington, 98103.

RHAWA provides screening services for members. We encourage rental housing providers to screen all prospective adult tenants.

Far more than a simple score, the RHAWA full credit report provides specific and complete details on an applicant's financial history. It allows you to determine their debt-to-income ratio and provides insight into their current level of financial responsibility, as well as past hardships.

When screening a prospective tenant, requiring them to fill out an application for tenancy is one of the most important steps. Not only will you rely on this for checking credit and background information, but you will also need to have this on file if you decide to rent to them. Make sure that the information they provide is both legible and complete.

The Fair Credit Reporting Act requires the applicant’s written acknowledgement to request a consumer report, which determines a consumer’s credit worthiness, credit standing, or credit capacity. Credit information and rental and employment verification information all fall under the definition of a consumer report.

When you run tenant screening on

prospective tenants, you are looking for lots of different information from a variety of sources. The criminal records* are pulled from a criminal records database; eviction records come from a statewide eviction records database. The applicant’s credit report and credit information come from the credit bureaus. When you order your tenant screening report from RHAWA, we wrap it all in one complete, easy-toread report for you.

RHAWA screening uses TransUnion to pull the credit information. The credit information for the prospective tenant is a hard pull from TransUnion. It is an actual report to ensure that the housing provider receives all the pertinent details. This is especially important, considering all the changes that have taken place throughout Washington State.

A credit report can help you determine a person’s financial responsibility. You might not feel a need to require flawless credit, but you may want to make

sure that they are conscientious when it comes to repaying their debt. An actual report can tell you how much debt an individual has and what their monthly financial obligation is for repaying that debt. For example: loans and credit cards. The report can also tell you if they have fallen behind on payments and when. This information is necessary to determine the debt-to-income ratio and make sure that a prospective tenant can afford to pay the rent.

Many screening companies offer credit reports without requiring a certification. They do not require a certification because they provide the housing provider with a “summary” report. The summary report does not include the in-depth information you will find in a full credit report. For example, they may show the applicant’s list of closed creditor accounts, but not provide the reason for why they have closed. This can be valuable information to determine if the applicant wasn’t paying on the accounts and perhaps the creditor

had to close it out as a charge-off, or it went to collection, or perhaps it was a lost or stolen card. A summary report does not provide information about the credit accounts being in arrears and whether they were 30, 60, or 90 days past due. Whereas a full credit report gives full detail of late dates and when the account becomes current in payments. These are just a couple of examples regarding key information missing from summary reports.

Several cities throughout Washington and the State itself have put forth many new ordinances and laws related to screening. The RHAWA screening department ensures that housing providers are getting the details they need to make unbiased and informed decisions, while complying with local laws that restrict certain details such as rent nonpayment during the COVID emergency and criminal history.

RHAWA also offers a class on how to interpret the screening report. You can access it through ONDEMAND education on the RHAWA website.

Don’t let the federally required Certification process deter you from having access to this important information. The RHAWA screening department

Continued on page 26

Denise Myers | Education + Resources Director | dmyers@RHAwa.org | (206) 905-0614

ALL CLASS SESSIONS ARE PRESENTED ONLINE ONLY UNLESS OTHERWISE SPECIFIED.

PM SERIES-04: UNDERSTANDING YOUR MARKET

When: Thursday, March 2 | 12-1pm

Cost: $30 Members | $60 Freemium Subscribers | $90 Guests

In this session, you will learn best practices for developing a successful and satisfying career in the housing industry. We will explore:

• Various career opportunities in the industry and how to develop a career as a real estate professional.

• Education and licensing requirements in Washington State.

• Standards for professional appearance, behaviors, and communication.

Instructor: Enrique Jevons, Property Management Professional.

PM SERIES-05: ADVERTISING AND SALES

When: Thursday, March 9 | 12-1pm

Cost: $30 Members | $60 Freemium Subscribers | $90 Guests

In this session, you will learn best practices for advertising and following up with prospective tenants. We will explore:

• Where to advertise for the best results.

• Tips and best practices when using various platforms.

• Writing appropriate and effective ad copy and effective marketing photography.

• How to build a relationship-based sales process.

Instructor: Cory Brewer, Property Management Professional.

LINK MEETINGS

Casual member meetings with topical discussions. No fee, simply order and pay for food at restaurant venues.

Claim Jumper, Tukwila | Fair Housing

When: Tuesday, March 14, 6:30-8pm

Harbor Lights, Tacoma | Fair Housing

When: Thursday, March 16, 6-7:30pm

Bob’s Burgers, Everett | Fair Housing

When: Thursday, March 16, 6:30-8pm

Duke’s Seafood, Bellevue | Fair Housing

When: Tuesday, March 21, 6:30-8pm

*Meeting time and subject may change. Please check calendar at RHAwa.org/events.

When: Thursday, March 16 | 12-1pm

Cost: $30 Members | $60 Freemium Subscribers | $90 Guests In this session, you will learn best practices for working with prospective tenants close sales quickly with qualified tenants while following all fair housing laws. We will explore:

• Responding to inquiries, explaining rental terms and screening criteria.

• Effective and safe techniques for showing the property.

• Evaluating applications and properly following up with all applicants.

Instructor: Cory Brewer, Property Management Professional.

When: Wednesday, March 22 | 12-1pm

Cost: $30 - Open to All

In this course, experienced real estate attorney, broker and investor, Devin Easterlin, will guide you through the basic principles and skillsets required for successful real estate investing, including:

1. Why real estate investing is the best path to create longterm wealth.

2. How to set your investment goals and then develop a strategy to meet them.

3. How to assemble a winning team.

4. How to run the numbers and find your first (or next) real estate deal.

5. And lastly, how to manage your property effectively and successfully.

Attendees interested in joining RHAWA for the first time will receive a discount on their first annual dues payment.

When: Thursday, March 23 | 12-1pm

Cost: $30 Members | $60 Freemium Subscribers | $90 Guests In this session, you will learn best practices for starting a new tenancy. We will explore:

• Setting lease terms to comply with all local laws

• Reviewing expectations and properly executing the lease

• Welcoming new tenants and move-in logistics

Instructor: Cory Brewer, Property Management Professional.

When: Thursday, March 30 | 12-1pm

Cost: $30 Members | $60 Freemium Subscribers | $90 Guests In this session, you will learn best practices for managing good working relationships with your residents. We will explore:

• Building relationships and creating a sense of community.

• Responding and following up to issues and maintenance requests.

• Managing incident reporting, including documentation and taking corrective action.

Instructor: Alberto Stein Rios, Property Management Professional.

Denise Myers | Education + Resources Director | dmyers@RHAwa.org | (206) 905-0614

About 90% of RHAWA members own less than five rental units. This means they are not often having to fill vacancies, sometimes going years with the same tenants. RHAWA provides tools and resources for owners to self-manage, but it is nearly impossible to remember all the steps when they are not filling vacancies on a routine basis. This checklist can help you make sure important steps are not missed.

• Watch the free ONDEMAND workshop at RHAwa.org/education-ondemand Washington Housing Provider Workshop and/or Seattle Housing Provider Workshop. (Contact dmyers@RHAwa.org or (206) 905-0614 for technical assistance.)

• Google the city where your property is located (or if unincorporated, the county) + rental property registration to see if your city has registration requirements.

• Prepare your rental unit and take photos.

• Set rental rates based on comparable rental units in the area.

• Create Application and Screening Criteria Notice following guidelines from RHAwa.org/rental-forms-leases-notices.

a. Application Criteria Guidelines

b. Application Criteria Guidelines (Seattle)

• If not yet certified, or certification has lapsed, apply for Landlord Screening Certification at RHAwa.org/get-started. This is a Fair Credit Reporting Act (FCRA) requirement for accessing confidential screening reports.

• Place the ad at Zillow.com, Apartments.com, Facebook Marketplace, or similar rental websites, listing your email (recommend separate dedicated email for rental operations) as a contact for inquiries. We recommend turning off the open application feature and requiring a home tour before application. In Seattle, an Application and Screening Criteria Notice must be included in the advertisement. Beware of pervasive fraud issues on Craigslist.com. Best practices are covered in free ONDEMAND classes.

• Create a standard email response that includes your Application and Screening Criteria Notice, a summary of key terms such as monthly rent, utility info, available date, pet/smoking policy, required ID and other documentation, and an invitation to view the home.

• Schedule and conduct a showing of the home. Conduct virtual showings as needed.

• In compliance with fair housing laws, invite all prospects who have seen the home to apply.

• Send an email invite to apply from QuickApp.

• Monitor the QuickApp dashboard for incoming applications (alerts should show in your email).

• Review applications in the order received to confirm the application is complete and required documentation has been submitted.

a. If Yes, submit an application for a screening report.

b. If No, reply to the applicant via email requesting additional information, and move on to the next applicant.

• Evaluate screening report(s).

a. If the applicant meets your screening criteria, offer tenancy.

b. If they do not, deny tenancy in QuickApp, completing the Adverse Action Notice. Then, evaluate the next applicant in order of completed application received.

• Send an email offering tenancy to the first qualified tenant that can accept your offered terms (move in date, rent rate, etc.). It is OK to give preference to an applicant willing to accept more favorable terms, like an earlier move-in date or higher rent.

• If there is a delay before the move-in date, ask the tenant to put down a deposit to secure a tenancy Deposit to Secure Occupancy & Receipt. Or, if the unit is currently vacant, you can have them sign the lease and pay the first month’s rent.

• Select the lease form and fill in all terms.

a. Use a single-family version when renting the entire property to a tenant.

b. Use a multi-family version when tenants share common areas.

c. Use a Rental Agreement when you are comfortable with “for cause termination” laws and having an “evergreen” rental agreement.

d. Use the Term Lease when you need to maintain the right to end a tenancy without having to give a “good cause” (local laws vary).

e. Attach all required addenda.

• Complete the Property Condition Checklist before move-in day including detailed notes and photos documenting pre-move-in condition.

• Schedule a meeting for move-in day.

• Meet the new tenants on move-day at the home:

a. Walkthrough and review property condition. Allow the tenant to make corrections as needed, and then have them sign the checklist. (Note: In compliance with State Law, do not collect the security deposit until the tenant signs this document). Let the tenant know that if they find something wrong in the first week or two of tenancy you will repair it.

b. Explain/show how to care for the property including, water shut-off valves, cleaning products/procedures for flooring, care of landscaping if applicable, and any other special rules or features of the property.

c. Provide courtesy products such as drain zips, non-damaging picture hangers, toilet paper, or other items to make their move-in easier.

d. Collect all outstanding move-in costs, including the security deposit, and first/last month’s rent. Non-refundable fees are not recommended as a best practice with the exception of an HOA move-in fee (not permitted in Seattle).

e. If a tenant requests it, you must allow them to pay move-in costs on an installment plan.

i. Use the form Deposit Payment Schedule (Extended) for properties in Burien, Kenmore, Kirkland, Redmond, and Seattle.

ii. Use the form Deposit Payment Schedule (WA State) in all other areas in WA State.

f. Review the lease in detail, making sure they understand all terms and rules. Sign if not already digitally signed.

g. Introduce to neighboring tenants and community amenities if applicable.

h. Provide contact information and explain when to call for repairs, and what they should do themselves (e.g., change detector batteries, change light bulbs, unclog drains/toilets, etc.)

i. Only after all the above steps, the tenant the keys, garage opener, etc.

• Start tenant file and ledger. File leasing documents and account for all payments.

• If you have questions about rental operations, laws, and best practices, go to RHAwa.org/support-center to find relevant articles and/or ask a question for our Support Center staff. Questions are generally answered within one business day.

All written, presented and recorded content provided by RHAWA for this course are for the use of the participants enrolled in the course. Copyrighted course content may not be further disseminated. Formal legal advice and review is recommended prior to selection and use of this information. RHAWA does not represent your selection or execution of this information as appropriate for your specific circumstance. The material contained and represented herein, although obtained from reliable sources, is not considered legal advice or to be used as a substitution for legal counsel. Event Cancellation and other policies RHAwa.org/cancellation-policy.

Bowlin, CPA

Paying taxes on the sale of an investment property can be expensive, especially if you live in a high-tax state. Not only are you responsible for Federal Capital Gains Tax (15% – 20%) and Depreciation Recapture Tax (25%), but you may also have to pay State Capital Gains Tax (0-13.3%), and Net Investment Income Tax (3.8%).

As a Washington property owner, you can pay up to 28.8% in taxes when selling your investment property. If you have plans to sell in 2023, a 1031 Exchange can be an excellent strategy to avoid paying a substantial tax bill.

What is a 1031 Exchange?

A 1031 Exchange, also known as a "like-kind" Exchange, gets its name from Section 1031 of the U.S. Internal Revenue Code. By performing a 1031 Exchange, you can sell investment real estate without paying tax if you reinvest the sales proceeds into like-kind investment property of equal or greater value and adhere to IRC 1031 rules and timing requirements. And, because the IRS defines "like-kind" as any real estate of the same nature or class (not

of the same quality or property type), you can exchange any real estate held for business or investment purposes for other real estate held for business or investment purposes, regardless of the property type.

Calculate Your 1031 Exchange Tax Savings: 5 Easy Steps

The tax liability on the sale of investment real estate is not just about federal capital gains tax – it is the total aggregate amount of tax owed when selling an investment property.

As a 1031 Exchange advisory firm, one of the first things we do when working with clients is to help them understand their tax liability and discuss tax-deferral options.

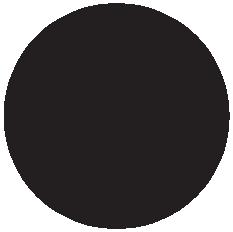

Federal and state tax authorities calculate the amount you owe based on the taxable gain (capital gain i.e. appreciation and depreciation recapture), not the gross proceeds from the sale of the property. To estimate the total tax liability from the sale of an asset, follow these five steps:

Step 1: Estimate the Net Sales Proceeds

Start by determining the fair market value of the investment property or the list price if you brought the property to market. There are several ways to calculate the sales price, but the most popular are the income method and the comparable sale method. With the income method, divide the current or estimated net operating income (“NOI”) by the target capitalization rate (“cap rate”). With the comparable sales method, an investor determines a value based on recent sales of similar local properties, both in terms of size and quality. Smaller properties and single-family rentals typically rely on the comparable sales method, while larger properties rely on net operating income to determine value. Most investors work with an experienced broker to set a supportable sales price. For example, let’s assume a comparison of similar local properties indicates a property may sell for $3,500,000 with $250,000 in deductible selling costs such as brokerage costs, title, escrow, and excise tax (if applicable). In this scenario, the net sales proceeds would be $3,250,000.

Importantly, the net sales proceeds do not consider any loan balances paid off at closing.

The remaining tax basis, also known as the remaining basis, is the total capital an owner has invested and capitalized in the asset, including the purchase price, closing costs, and capitalized improvements less the accumulated depreciation taken over the ownership period. For example, if you purchased the property for $850,000, invested $200,000 in capital improvements, and have $750,000 in depreciation, your remaining basis is $300,000. There are some limitations to the items you can include in a tax basis. Mortgage insurance premiums and routine maintenance costs are examples of items that are not included. A tax advisor can help to determine your property's current remaining basis, which can be adjusted based on capital improvements and tax deductions.

• Increasing the Tax Basis: Property owners will increase their tax basis anytime they invest money into the

property with capitalized improvements—such as a new kitchen, roof, or even an addition, as well as financing expenses. Expenses paid to operate the property, like legal fees, management expenses, and minor repairs, are not capitalized and instead treated as operating expenses which are deductible in the year they are expended. Capitalized improvements increase your investment in the property and are deducted from the net sales proceeds at the time of the sale to arrive at the property's capital gain.

• While some of these costs are intrinsic to real estate investment, like escrow fees, others are flexible. For example, a new roof, an upgrade to the kitchen, or adding a pool are capital improvements that have a wide range of costs, giving the owner some flexibility in the amount they can increase the tax basis of the asset versus deducting in the current year as operating expenses.

• Decreasing the Tax Basis: Owners of investment real estate that include a building or structure must also lower the property’s tax basis,

ultimately increasing the figure used to calculate the second form of gain referred to as “depreciation recapture.” The most common way to decrease the tax basis is through an annual depreciation deduction. The deduction is subtracted from the original tax basis on an annual basis and treated as a tax expense, offsetting income which is then “recaptured” at the time of sale. While it might seem unexpected to decrease your tax basis and eventually increase your tax costs, the depreciation deduction reduces an investor's annual taxable income and, thus, income tax due during the years of ownership. Note that depreciation recapture is not optional. Investors will be charged for depreciation recapture on the aggregate amount of available depreciation throughout the period of ownership regardless of whether they recorded depreciation expense. In addition, easements, some insurance reimbursements, and other tax deductions, like personal property deductions, can also decrease your tax basis.

The taxable gain is the realized return or profit from the sale of an asset, or, in other words, it is the net sales proceeds less the original tax basis, pre-depreciation. Tax authorities like the IRS use the taxable gain figure to determine the capital gains tax. To calculate the taxable gain, subtract the original tax basis from the net sale proceeds. Using the earlier example, if your original tax basis is $1,050,000 and the net proceeds from the sale of the property are $3,250,000, your taxable gain is $2,200,000. The second part of the tax liability is calculated based on the amount of depreciation available to take over the period of ownership – referred to as accumulated depreciation. Based on the details above, this amount is $750,000.

Your income, tax filing status, the state where you pay income taxes, and the property's location will determine your capital gains tax rate. The IRS, most state governments, and some local municipalities collect a tax on both the

capital gain and depreciation recapture from the sale of investment property, increasing the total tax rate due and thus increasing your tax bill.

At the federal level, the capital gains tax rate is 0% for investors with an annual income (including gains resulting from asset sales) less than $44,625 (single) / $89,250 (married filing jointly); 15% for investors with an annual income from $44,626 - $492,300 (single) / $89,251 to $553,850 (married filing jointly); and 20% for investors with an annual income above $492,301 (single) / $553,851 (married filing jointly). Most state tax authorities collect income tax rates on capital gains as well. The state tax rate ranges from 0% to 13.3%. California is at the top of the list with a 13.3% tax rate, while some states, like Texas, Washington, and Florida, do not collect state income taxes.

Our Annual Spring Workshop + Tradeshow will be held at the enchanting urban oasis: Cedarbrook Lodge , conveniently located near SeaTac. This is your best opportunity to gather the latest insights from across the industry in one day for your rental business.

Saturday, May 13

9 am – 3 pm

• Discover numerous skilled service providers at the tradeshow.

• Select from 12 expert-led educational breakout sessions with attorneys and industry professionals.

• Indulge in gourmet lunch and happy hour. Parking included. Register@RHAwa.org/swts

Tickets go onsale March 3!

For more information, contact Chloe Moser: cmoser@RHAwa.org

Brian Platt, Michael Urquhart and Ben Douglas | Paragon Real Estate Advisors | Vendor Member

As active multifamily brokers in the Puget Sound area, we have seen and been involved in more and more seller-financed transactions. Deals requiring a buyer to get a market-rate loan are falling short of sellers pricing expectations due to the increase in interest rates, the uncertainty of where they will go next, and the high down payment requirement from lenders. Seller financing has bridged the financing gap and carved a path for both the buyer and seller to meet their financial goals.

Seller financing is a viable alternative to traditional financing if you, the owner, own the building free and clear or have a very small loan amount left. This form of financing allows a buyer to purchase the property with a higher amount of leverage and a lower interest rate, allowing them to pay an otherwise above-market price.

In this current market with interest rates 2.75% higher than they were 12 months ago, seller financing allows for you to provide the buyer with the opportunity for a smaller down payment and a lower interest rate. What we see most often is an interest-only loan which requires 20-30% down and an interest rate of 0.5%-1.5% below current rates. The loan duration tends to be 3-10 years and has a balloon payment that is due at the end of the loan term. The great aspect of seller financing is you can create a loan with terms that work best for you based on your investment horizon and goals. Here are some of the pros and cons of seller financing:

PROS:

Aggressive Pricing: Since the buyer can get more favorable loan pricing and terms you would be able to price your property more aggressively. It would allow your property to trade at a price higher than the otherwise current market value.

No Management Cash Flow: You would be able to continue receiving cash flow from the property without the hassle of having to manage the building yourself or with a property manager. The buyer would make their monthly interest payments to you through a third-party facilitator that is set up with escrow at closing. We see owners receive equal or greater monthly cash flow without having to answer any more running toilet calls.

Tax Benefits: An owner would only have to pay capital gains tax on the initial down payment and could defer the tax burden of the balloon payment. Since the monthly payments are interest-only, they are treated as ordinary income and are taxed at a lower rate.

Continued Involvement: As opposed to cashing out with the sale of the property and moving on to your next endeavor, you would still be loosely tied to the property. If the buyer stopped performing on their loan payments, then you would regain the rights to the property and go through the sales process again. If handled correctly during the original sale, this should never happen as it is important to properly vet the buyer’s financials and real estate track record.

To give a real-world example of how this plays out, here is a case study of one of our recent sales:

• Sale price: $3,200,000

• Financing terms: 5 years interest-only with interest rates of 4%, 4.25%, and 4.5% for years 1, 2, and 3 through 5 respectively

• 75% Loan-to-Value

SELLERS POSITION BEFORE SALE:

• Current Net Operating Income from the property was $102,000.

• Exhausted from management responsibilities.

• Had a big capital gains tax liability.

• Relied on the passive income from the property.

• Owned the property free and clear.

• Moving towards retirement.

SELLER’S POSITION AFTER SALE:

• Received $800,000 at closing.

• Interest payments for years 1, 2, and 3-5: $96,000

- $102,000 - $108,000 respectively

• $2,400,000 balloon payment at the end of year 5.

• Zero headaches from management responsibilities.

• Freedom to pursue hobbies, travel, etc.

• Sold at an above-market price (3.8% CAP rate).

• Deferred Capital gains for 5 years.

• Received a personal guaranty on the loan from the Buyer.

Call us if you are curious about how seller financing would affect your property’s pricing. We would be happy to give you an updated market valuation and provide you with an array of exit strategies to help you make the best decision. Brian Platt at Brian@ParagonREA.com (206)251-8483, Michael Urquhart at Michael@ParagonREA. com (425)999-6650, or Ben Douglas at Ben@ParagonREA.com (206) 658-7247.

Denise Myers | Education + Resources Director | dmyers@RHAwa.org | (206) 905-0614

Check out the latest in our Support Center where we have completed law summary articles for Redmond, Burien, Kenmore, and Kirkland as well as a few articles on specific areas of Seattle law. In addition, we’ve created a separate article called Local Government Rental Law Codes which simply lists all of the local government rental regulations we are aware of, including links to either the code or ordinance if it is not yet codified. This list of local law references includes eleven cities (+ one county) with extensive rental regulations, and an additional ten cities that have rental registration/inspection programs, but

no other rental regulations. Our goal is to provide members with law summary articles for all of these and more as new laws appear.

As we work to write summaries of all city laws, remember, we already have instructions with our forms that reflect all local laws. RHAWA members can access these instructions within various tenant notice forms, and in the Lease Signing section, there is a separate instruction document, Leasing Requirements by Local Jurisdiction

City of Kirkland Law Summary

These policies are found in the following code: Kirkland Tenant Protections KMC 7.75 and apply to tenancies governed by RCW Chapter 59.18 (RLTA) and RCW Chapter 59.20 (Manufactured/Mobile Home Landlord-Tenant Act)

The total of all move-in fees and deposits charged by the landlord must not exceed one month's rent, except in subsidized housing where the monthly rent is based on the tenant’s income. A landlord and tenant can agree to higher deposit and/or fees if an agreement to waive provisions in the law is in writing, is not part of the standard lease agreement, and an attorney for the tenant has approved the waiver agreement.

• Tenants entering rental agreements with terms lasting six or more months may choose to pay their move-in fees and security deposits in six equal monthly installments over the first six months of occupying the dwelling unit.

• Tenants entering rental agreements with terms lasting fewer than six

months or month-to-month rental agreements, may choose to pay move-in fees and security deposits in two equal monthly installments over the first two months of occupying the dwelling unit.

• When raising rent at the beginning of a rental period or term lease renewal, landlords must give:

• 120 days' written notice for rent increases greater than three percent (3%); or

• 180 days' written notice for rent increases greater than ten percent (10%).

• As required under WA State law, 60 days written notice for any rent increases of 3% or less.

All written, presented and recorded content provided by RHAWA for this course are for the use of the participants enrolled in the course. Copyrighted course content may not be further disseminated. Formal legal advice and review is recommended prior to selection and use of this information. RHAWA does not represent your selection or execution of this information as appropriate for your specific circumstance. The material contained and represented herein, although obtained from reliable sources, is not considered legal advice or to be used as a substitution for legal counsel. Event Cancellation and other policies RHAwa.org/cancellation-policy.

Capital gains taxes are applied to the taxable gain based on the tax rate determined by your income and filing status, and the bill can be significant. There are four property tax categories: federal capital gains taxes, state and local tax, depreciation recapture, and net investment tax – which can overlap one another.

The federal capital gain tax and state taxes are calculated at the investor's tax rate on the taxable capital gain (i.e. appreciation). In our example above, a California property owner with a taxable gain of $2,200,000 would owe 20% in federal capital gains tax and 13.3% in state capital gains tax, amounting to $732,600 in tax. Individuals with significant investment and rental income may also have an additional 3.8% net investment tax—included as part of the Affordable Care Act—added on top of the capital gains rate. This brings the total capital gains bill in California to 37.1% or $816,200 in the example above. This example is unique to properties and taxpayers located in California, which has the country's highest tax rate paid on capital gains.

In addition to capital gains taxes, investors will also pay depreciation recapture. Investors take a depreciation deduction on their annual taxes to offset rental income. The depreciation deduction not only decreases the investor's annual tax liability but also decreases the remaining tax basis for the property. Once you sell the asset for a profit, you must pay back those deductions. This is depreciation recapture. The tax rate on depreciation recapture is a flat rate of 25% at the Federal level, can also include up to 13.3% state income tax, and also be subject to net investment income tax for an additional 3.8%. While capital gains tax is based on the taxable gain, depreciation recapture is calculated based on the accumulated depreciation during the investor's ownership. Based on $750,000 of accumulated depreciation, the depreciation recapture tax in this scenario could be as high as $315,750 or 42.1%.

A 1031 Exchange can be an excellent tool to defer capital gains, depreciation recapture, and net investment income taxes otherwise due from the sale of investment real estate, but they can also be complicated transactions. While 1031 Exchanges are flexible in the number of strategies that can be implemented, the rules put forward by the IRS are not flexible. Failure to adhere to IRS rules can result in either a failed Exchange, in which the entire tax liability is due or a Partial Exchange, in which a portion of the tax liability is due (generally the most expensive portion). Prior to the sale of investment property, investors considering an exchange should become familiar with how 1031 Exchanges work and the following primary rules:

• The Exchange must be set up before a sale occurs

• The Exchange must be for like-kind property

• The Exchange replacement property must be of equal or greater value

• The property owner must pay capital gains and/or depreciation recapture tax on "boot"

• The taxpayer that sold and acquired the Exchange property must be the same

• The Exchanger has 45 days following the sale to identify replacement properties

• The Exchanger has 180 days following the sale to complete the Exchange

A 1031 Exchange can improve the potential for cash flow and appreciation by allowing all of the proceeds to be reinvested. In our example, the investor's total tax liability would be $1,131,950. If the post-tax proceeds of $2,118,050 were reinvested and earned a 5% return, this would generate $105,903 in annual income. However, by performing a 1031 Exchange, the investor would have $3,250,000 to reinvest. At the same return of 5%, the exchange proceeds would generate an annual cash flow of $162,500. The difference in cash flow potential of over $56,500 represents one of the primary benefits of 1031 Exchanges – the ability to keep all your equity working for you to generate income and appreciation.

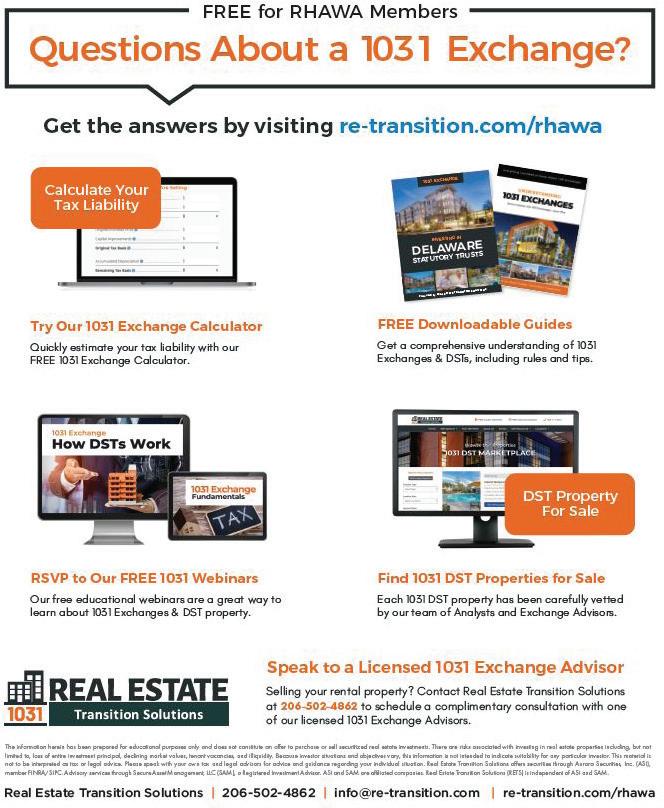

If you plan to sell your investment property and want to understand your tax deferral options, contact Real Estate Transition Solutions to speak with a licensed 1031 Exchange Advisor. We offer complimentary consultations that can be done over the phone, via video conference, or in person at one of our offices. To schedule your consultation, call 206-502-4862 or visit us at www. re-transition.com/rhawa.

Chief Exchange Strategist, Austin Bowlin, CPA, leads Real Estate Transition Solutions' (RETS) team of licensed 1031 Exchange advisors & analysts and provides consultation on tax liability, deferral strategies, legal entity structuring, co-ownership arrangements, 1031 replacement property options, and Delaware Statutory Trust investments. RETS is a consulting firm specializing in tax-deferred 1031

Exchange strategies and Delaware Statutory Trust investment property. For over 26 years, RETS has helped investment property owners perform successful 1031 Exchanges by developing and implementing well-planned, tax-efficient transition plans carefully designed to meet their objectives. Our team of licensed 1031 Exchange Advisors will guide you through the entire process, including help selecting and acquiring passive management replacement properties best suited to meet your objectives. To learn more about Real Estate Transition Solutions, call (206) 502-4862 or visit us at re-transition.com/rhawa.

The information herein has been prepared for educational purposes only and does not constitute an offer to purchase or sell securitized real estate investments. Such offers are only made through the sponsor's Private Placement Memorandum (PPM), which is solely available to accredited investors and accredited entities. Case studies and examples are for illustrative purposes and are not representative of future results. There are risks associated with investing in real estate properties, including, but not limited to, loss of entire investment principal, declining market values, tenant vacancies, and illiquidity. Because investor situations and objectives vary, this information is not intended to indicate suitability for any particular investor. This material is not to be interpreted as tax or legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your situation. DST 1031 properties are only available to accredited investors (generally described as having a net worth of over $1 million exclusive of primary residence) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity, please verify with your CPA and Attorney. Securities are offered through Aurora Securities, Inc. (ASI), member FINRA/SIPC. Advisory services are offered through Secure Asset Management, LLC (SAM), a registered investment advisor. ASI and SAM are affiliated companies. Real Estate Transition Solutions (RETS) is independent of ASI and SAM.

* Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated. Source: IRS.gov

Chester Baldwin | RHAWA Lobbyist

THANK

As the Legislative session in Olympia nears the policy committee cutoff on February 17 the priorities for both caucuses start to become clearer, and we have a better idea of what we are facing. With six rent control bills already introduced in Olympia (HB 1388, HB 1389/SB 5435, HB 1625/SB 5615, & SB 5697), the Rental Housing Association of Washington has been working double-time to educate lawmakers about the dangers of rent control. WA state is short nearly 800,000 housing units already and will be short more than a million units by 2044 according to the Department of Commerce. This is why the Rental Housing Association of Washington and our partners are supporting a host of bills that will lead to more housing creation.

Thank you for Coming to Olympia – Your Amazing Turnout Is Making the Difference

Thank you to everyone who has come to Olympia this legislative session, you have made a huge difference with your presence and your hard work educating lawmakers about our issues. This past week we had the RHAC Legislative Olympia Day and many of our wonderful members journeyed to Olympia to have their voices heard and we made a difference with lawmakers.

We are also very grateful to our many housing providers that came to the Rent Control hearings in Olympia on Tuesday, January 24 to fight the two rent control bills, House Bills 1388 and 1389. Your presence enabled us to have an incredible hearing and connect with lawmakers Opposing Rent Control. We had an amazing hearing, and it is YOUR time and participation that is making the critical difference for us in this year's battle against rent control!

We had well over 125 people join us on January 24 and we filled the hearing room and needed two additional overflow rooms for our housing providers! The tenant advocates were visibly surprised and not pleased! It was also great to see and hear the number of other industry association representatives, who came to speak against rent control, such as Commercial Real Estate Development (NAIOP), Community Bankers of WA, the WA Realtors, WA Business Properties Association, and Assoc of WA Businesses. That of course was in addition to all of our Rental Housing Association Coalition members including RHAWA, WLA, MHCW, WMFHA, and NARPM, the YLA brought members from Eastern WA!

The only problem with having so many wonderful housing providers join us in Olympia was that there wasn’t enough time for everyone’s voice to be heard in the hearing, but that is okay because the Chair and Committee could not ignore the number of us in attendance and in Opposition. Great job coming to Olympia and changing the narrative.

Included in our group photo are our Lawmakers from the House Housing Committee who also oppose rent control including newly elected Rep. Spencer Hutchins (District 26, Gig Harbor, and peninsula); Rep. Andrew Barkis (District 2, Pierce County and Yelm), Rep April Connors (District 8, Tri-Cities area), and Ranking member Mark Klicker (Distict16, Southeast WA) was the icing on Tuesday’s victory cake!

HB 1388 – Rent Control

HB 1388 applies to both residential housing and manufactured home communities, the bill prohibits a landlord from increasing rent more than the rate of inflation (CPI-U) or 3%, whichever is greater, up to a maximum or 7% above existing rent if the rent increase: (1) Is not justified by costs necessary to maintain the dwelling unit; (2) Is substantially likely to lead to the displacement of the tenant; or (3) Is used to avoid other tenant protections. The bill’s rent increase provisions do not apply to: (1) Dwelling units that are less than 10 years old; or (2) Tenancies for which the landlord is required to reduce rent to 30% or less of the tenant's income because of a federal, state, or

local program or subsidy. The bill requires Commerce to calculate and publish the maximum annual rent increase percentage on September 30, 2023, and on each following September 30th.

The bill creates a private cause of action for a tenant to recover actual damages, punitive damages equal to 3 months' rent and fees, and reasonable attorneys' fees and costs and provides that a violation of the RLTA or MHLTA is a violation of the Consumer Protection Act. The bill also prohibits charging a higher rent or including terms of payment or other material conditions in a rental agreement that are more burdensome to a tenant for a month-to-month rental agreement than for a longer-term rental agreement.

Additionally, the bill authorizes the Attorney General (AG) to investigate practices that violate this section. The AG may issue a cease-and-desist letter to prevent predatory practices that violate this section. If the recipient does not comply within five calendar days, the AG may file an action in court with a civil penalty up to $10,000 per occurrence and may imposes a civil penalty of no more than $25,000 per violation. When investigating, the AG may consider, in addition to any other relevant information: (1) The condition of the

dwelling unit, including outstanding repair issues, maintenance costs other than for upgrades, property taxes, etc.; (2) Whether a rent increase was issued to evade protections afforded to tenants; and (3) Whether a rent increase will result in the displacement of the tenant or household.

HB 1389/SB 5435 – Rent Control

HB 1389, like HB 1388, applies to both residential housing and manufactured home communities. The bill prohibits a landlord from increasing the rent more than the CPI-U or 3%, whichever is greater, up to a maximum or 7%. Commerce is required to calculate and publish the maximum annual rent increase percentage. Further, the bill prohibits a landlord from increasing the rent in the first 12 months of a tenancy and defines "Rent increase" to include any new charges added to a rental agreement that were not identified in the initial rental agreement. For example, new parking, utility, or other charges. The bill requires a landlord that increases rent above the limit to include facts supporting the exemption in the written notice of the rent increase. The bill also contains a VERY complicated "banking" process to carry forward the ability to give an increase later if not given in that year. Finally, the bill creates a private cause

of action for a tenant to recover actual damages, punitive damages equal to 3 months' rent, and reasonable attorneys' fees and costs.

HB 1625/SB 5615 – Local Rent Control

HB 1625 removes the State Preemption on Rent Control (RCW 35.21.830) allowing local governments to enact local rent control. The bill would allow every Local Government to create a different local rent control policy; that could mean more than 400 different local rent control policies across WA State. There is no floor in the bill to what a city could impose under local rent control including denying any increase whatsoever to housing providers. Allowing local jurisdictions to enact their own local version of rent control would be disastrous for many housing providers. The desperate need for “Middle Housing” solutions shows that cities have not found solutions for housing, why should we trust them with local rent control?

SB 5697 – Mobile Home Park Rent Control

SB 5697 only applies to Manufactured Housing, and it has added the UTC as the governing "rent control board" instead of the "Department of Commerce." The bill purports to authorize the utilities and transportation com-

mission (UTC) to regulate the rates and services of all persons engaging in the business of acting as a landlord for a manufactured home community/ mobile home park. The bill caps annual rent increases as follows: No increase during first 12 months of tenancy; At any time after the first year, increase may not exceed an amount greater than the rate of inflation as measured by the consumer price index.

Additionally, the bill contains vacancy control in limited situations where the tenancy is terminated by the landlord [landlord terminating a tenancy may not set rent for the next tenancy in an amount greater than the consumer price index]. The legislation expressly removes current law that describes leases having a term of 2 years or more; the intent must be to impair all such existing leases and prohibit new ones that do not conform to this bill.

This bill is essentially HB 1389, except WORSE. It applies only to Manufactured Housing Communities (MHC) and it has added the UTC as the governing "rent control board" instead of the "department of commerce." HB 1389 also contains the banked capacity

Chloe Moser | Event Coordinator | cmoser@RHAwa.org | (206) 905-0600

The absolute best way to send your message out to our members is by event sponsorship! RHAWA has over 5,000 members and supporters will be invited to the events yearround. We are seeking sponsorships for the 2023 events and are counting on your support to help make them a success. We have 5 in-person events

a year and have three to four different sponsorship packages available per event. One of the most popular items we offer is promotional email messages that are sent to our member base, giving sponsors over 50,000+ impressions for the campaign. All of the events will also be marketed in our CURRENT newspaper (with a distribution of over 7,000 readers) and bi-weekly Connections email for an additional 15,00020,000 impressions. There are a ton of different offerings we have available –there is always an opportunity to sponsor, no matter what your budget is.

Usually reserved for our higher tiered sponsorship levels, our highest value offer is a black and white ad for your company in our newspaper, CURRENT; that is over $600 value! We also offer tickets to events at every level as well as other online marketing tools.

This year for the first time ever, we are offering a Premier Level, Annual Sponsor. This is a one-time contribution for the entire year, and you will be recognized at every event. One lucky company will have the honor of a vendor profile article written about them

in the CURRENT, an ad on our events page that will remain there year-round, signage at the event, exhibitor booths when appropriate, podium time prior to the keynote speaker, and much more.

The live events for 2023 are: the Spring Workshop Tradeshow, the Live Legal Event, the Membership Appreciation Day, the Annual Business Meeting, and the Holiday Gala.

To learn more about sponsor benefits or to secure yours today, contact Luke Brown at lbrown@RHAwa.org.

We encourage you to consider the vendors found within these listings for your rental business needs. When seeking competitive bids, be sure to mention your RHAWA membership as many offer member discounts. RHAWA does not specifically endorse any business listed herein. References are always recommended. If you would like to submit a customer testimonial for our records, please submit to publications@RHAwa.org. Please note that changes made to a vendor member profile will not be reflected in the CURRENT Vendor Listings unless the change is also sent to publications@RHAwa.org.

Brink & Sadler (253) 582-4700 | brinkandsadler.com

Hutchinson & Walter, PLLC (425) 455-1620 | hutchcpa.com

Pacific Publishing Co. | Print + Internet (206) 461-1322 pacificpublishingcompany.com

Seattle Rental Group | Property Management (206)315-4628 | www.seattlerentalgroup.com

(360) 529-7567 |

Donald B. Kronenberg (206) 877-3191

Greenwood

(206) 783-2900 |

Brink Property Management

Dean Foggitt (425) 458-4848 | brinkpm.com

Access Evictions

Travis Eller (425) 641-8010 | accessevictions.com

Christopher T. Benis, Attorney at Law First Avenue Law Group, PLLC

Vendor of the Year 2006 (206) 447-1900 | firstavenuelaw.com

Demco Law Firm, P.S. (206) 203-6000 | demcolaw.com

Dimension Law Group PLLC

Synthia Melton (206) 973-3500 | dimensionlaw.com

Flynn and Associates, PLLC

Sean Flynn (206) 330-0608 | theflynnfirm.com

Glasson Legal (206) 627-0528 | glassonlegal.com

Gourley Law Group / The Exchange Connection (360) 568-5065 | gourleylawgroup.com

Holmquist & Gardiner, PLLC (206) 438-9083 | lawhg.net

Jeffery Bennett (503) 255-8795

Law Office Of Shaun Watchie Perry (206)729-7442 | swp-law.com

Ledger Square Law

(253) 327-1701 | ledgersquarelaw.com

Ling & Liang PLLC

(206)462-2884 | ling-liang.com

LT Services (206) 241-1550 | ltservices.net

Loeffler Law Group, PLLC (206) 443-8678 | loefflerlawgroup.com

Maxwell Glasson (206) 627-0528 | loefflerlawgroup.com

Micheal D Mclaughlin, Attorney at Law (253) 686-9786

Reed Longyear Malnati & Ahrens, PLLC (206)624-6271 | www.reedlongyearlaw.com

Seattle Real Estate Law Group (206) 623-4846 | seattlerealestatelawgroup.com

Eastside Funding (425) 230-0000 | eastsidefunding.com

First Federal Savings and Loan (206) 586-1701 | ourfirstfed.com

First Financial Northwest Bank

Tom Jarzynka (425) 264-2757 | ffnwb.com

Homebridge Financial (206) 915-3742 | homebridge.com

Luther Burbank Savings Bank

Tiana Jackson: (425) 739-0023 lutherburbanksavings.com

Pacific Crest Savings Bank

Scott Gibson (425) 670-9600 | (800) 335-4126 paccrest.com

Umpqua Bank | Multifamily Lending

Matt Couch (425) 602-1250 | umpquacrelending.com

Washington Federal Vendor of the Year | 2015

Tim Marymee: (206) 777-8213 | (800) 324-9375 washingtonfederal.com BATHTUB + SHOWER RENOVATION

Fischer Restoration (888) 345-2532 | fischerrestore.com

Flippers Warehouse (206) 656-3222 | flipperswarehouse.com

Tub Cove Inc. New Tubs, Surrounds and Bathroom Plumbing (206) 522-1711 | tubcove.com

NWK9 Bed Bug Detectives (206) 801-3522 | nwk9bedbugdetectives.com

Ultrasonic Mini-Blind Cleaning + Repair (425) 771-7799 | shineablind.net

+1 Construction (206) 313-6587 | plusoneconstruction.com

Bellan Group, LLC

Susan Bellan (206) 383-0102 | bellan.com

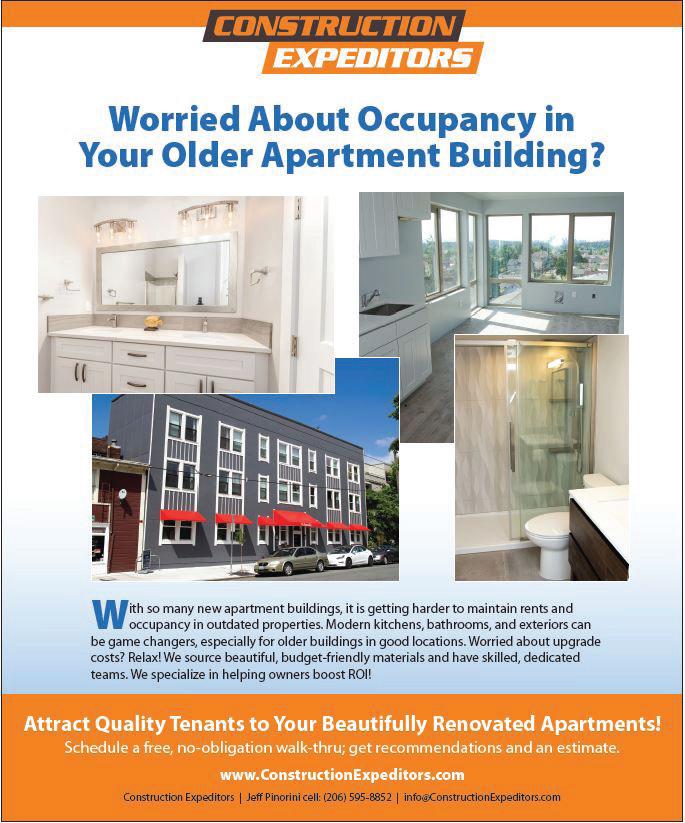

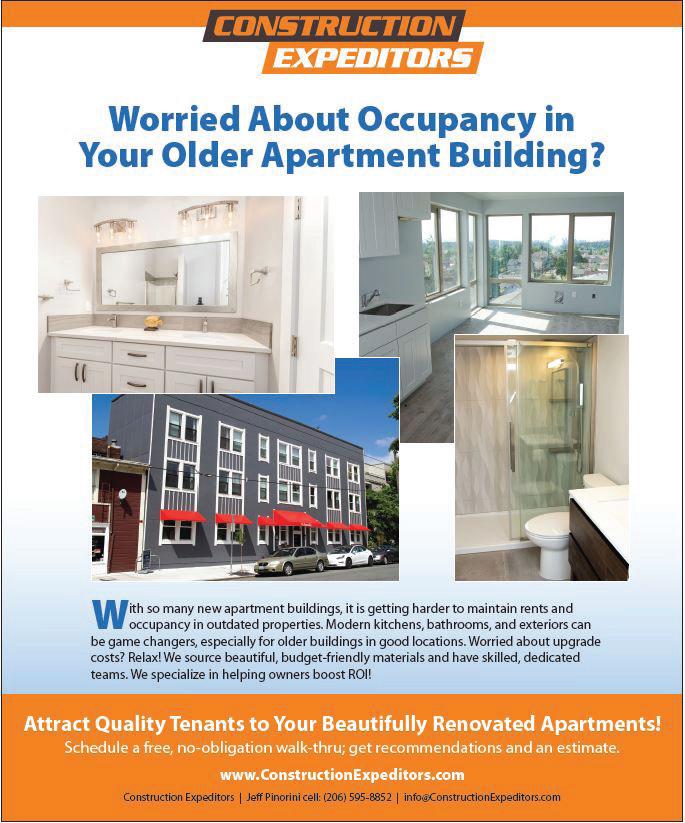

Construction Expeditors, LLC (206) 595-8852 | (877) 644-1700 constructionexpeditors.com

Fischer Restoration (888) 345-2532 | fischerrestore.com

Flippers Warehouse (206) 656-3222 | flipperswarehouse.com

Haynes Contracting LLC (253) 335-7905 | haynescontractingllc.com

Interland Design

Jake Cervilla (425) 290-9639 | interlanddesign.com

Kanso Homes, Inc. (206) 278-3403 | kansohomes.com

Maintco (425) 822-5505 | maintcogc.com

Masonry Restoration Consulting (425) 344-3893 masonryrestorationconsulting.com

Next Level Property Maintenance (206) 922-8119 | nxtlevelpm.com

Pro Realty Options, Inc. (425) 745-2400 | prorealtyoptions.com

Rife Masonry

Chad Rife: (206) 696-6998 | rifemasonry.com

T.E. Kelly Company, LLC

Tim Kelly: (206) 240-1950

The Wall Doctor, Inc.

Gary Borracchini (425) 822-8121 | thewalldoctor.com

Top-Rung Construction LLC

Gary Gilmer (253) 893-1101 | fieldsroofservice.com

Envirotest | Mold & Air Quality Analysis Donald B. Kronenberg (206) 877-3191 | seattlemoldandairquality.com

Reinhart Electric & Service (425) 251-5201 reinhartelectric.net

T.E. Kelly Company LLC Tim Kelly: (206) 240-1950 CRIMINAL BACKGROUND CHECKS

Rental Housing Association of Washington Chartrice Young (206) 283-0816 | RHAwa.org

Dunn Lumber | Doors, Windows & Lumber (206) 632-2129 | dunnlum.com

Affinity Real Estate Management (206) 812-9155 affinityrem.com Pacific Crest Real Estate (206) 812-9155 pacificcrestre.com

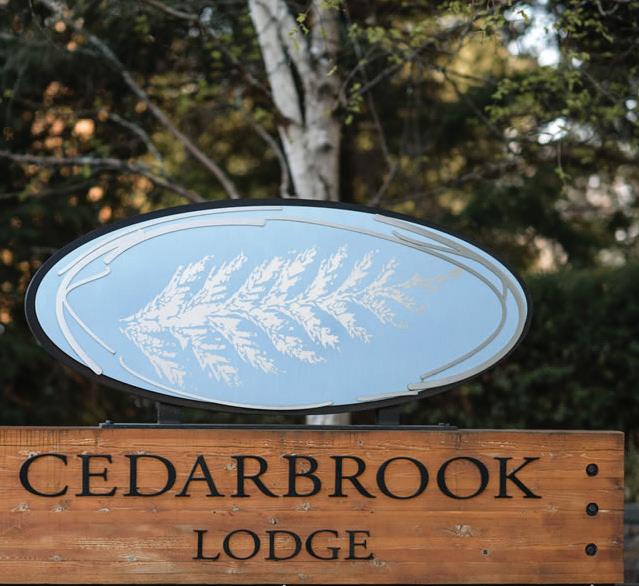

SRC Windows (253) 565-2488 | srcwindows.com

Best Plumbing Group (206) 633-1700 | (425) 771-1114 bestplumbing.com Day & Nite Plumbing & Heating Inc.

Vendor of the Year | 2020 (425) 775-6464 (800) 972-7000

dayandnite.net

Fischer Plumbing, Inc. (206) 783-4129 | fischerplumbing.com

The Pipe Guys (253) 537-2830 | pipeguys.com

DRYER VENT + DUCT CLEANING

The Chimney Specialists, Inc. | Dryer Vent Only Seattle: (206) 782-0151 | (888) 979-3377

So. King Co.: (253) 833-0144 | (888) 979-3377

Pierce Co.: (253) 475-0399 | (888) 979-3377

thechimneyspecialists.com

VentMasters (206) 362-5190 | ventmasters.net DRYWALL

313-6587 | plusoneconstruction.com

A&A Electric (206) 212-1888 | anaelectric.com

ABC Towing, Inc. Seattle: (206) 682-2869

Tukwila: (206) 767-4024

abc4atow.com

Bellan Group, LLC

Susan Bellan (206) 383-0102 | bellan.com

Bravo Roofing, Inc.

GoldStar Vendor + Vendor of the Year | 2014

John Paust, Estimator: (206) 948-5280 (253) 335-4825 | (360) 886-2193

john@bravoroofs.com

bravoroofs.com

Construction Expeditors, LLC (206) 595-8852 | constructionexpeditors.com

Diamond Roofers, LLP

Flat & Low Slope (206) 202-7770 | diamondroofers.com

ER Flooring (360) 402-9566 | erflooring.com

First Choice Remodeling, Inc. (253) 846-9000 | firstchoiceremodelinginc.com

Global Paving LLC (253) 286-7943 | globalpavingllc.com

Masonry Restoration Consulting (425) 344-3893

masonryrestorationconsulting.com

Maintco (425) 822-5505 | maintcogc.com

Pioneer Masonry Restoration Co. (206) 782-4331 | pioneermasonry.com

Dimension Law Group PLLC

Synthia Melton (206) 973-3500 | dimensionlaw.com

Flynn and Associates, PLLC

Sean Flynn (206) 330-0608 | theflynnfirm.com

Olympic Estate Group, LLC

G.A. “Jeri” Schuhmann (206) 799-0544 | OlympicWealthStrategies.com

Access Evictions

Travis Eller, Attorney at Law (425) 641-8010 | accessevictions.com

Demco Law Firm, P.S. (206) 203-6000 | demcolaw.com

Glasson Legal (206) 627-0528 | glassonlegal.com

LT Services, Inc. (206) 241-1550 | ltservices.net

Loeffler Law Group, PLLC (206) 443-8678 | loefflerlawgroup.com

Maxwell Glasson (206) 627-0528 | loefflerlawgroup.com

Axis

The Wall Doctor, Inc.

Gary Borracchini (425) 822-8121 | thewalldoctor.com

Rental Housing Association of Washington Denise Myers (206) 283-0816 | RHAwa.org ELECTRICAL MAINTENANCE + REPAIR

A&A Electric (206) 212-1888 | anaelectric.com Alpine Ductless, LLC (360) 529-7567 | alpineductless.com Capstone Solar (206) 580-3448 | capstonesolar.com

Electric & Service

Colliers International

GoldStar Vendor + Vendor of the Year | 2018

Tim McKay: (206) 223-5586

CPX LLC

(866) 405-1435 | cpxone.com

Dan Chhan: (206) 223-1265

Joe Levin: (206) 223-5583

Sam Wayne: (206) 515-4498

Brittany Rondello: (206) 515-4495

colliers.com

Flynn Family Lending

Matt Flynn (425) 221-8660 | flynnfamilylending.com

Havium. Inc (888) 642-8486 | havium.com

Kidder Mathews

Dylan Simon: (206) 414-8575

Jerrid Anderson: (206) 499-8191

DylanSimon.com

Luther Burbank Savings Bank

Tiana Jackson: (425) 739-0023 lutherburbanksavings.com

McTaggart Real Estate (206) 322-9495 | darcoapts.com

Paragon Real Estate Advisors, Inc.

Vendor of the Year | 2016 (206) 623-8880 | (800) 643-9871

paragonrea.com

Peak Mortgage Partners

Dave Eden (206) 660-3014 | peakmp.com

Sound Reatly Group

Charles Burnett, CCIM (206) 931-6036 | soundmultifamily.com

Umpqua Bank | Multifamily Lending

Matt Couch (425) 602-1250 umpquacrelending.com

Wilson Property Management, Inc. Gary Wilson, CPM (425) 453-0089 | wilsonmanagementinc.com

Homebridge Financial (206) 915-3742 | homebridge.com

MASONRY SERVICES

Pioneer Masonry Restoration Co. (206) 782-4331 | pioneermasonry.com

Matt Flynn (425) 221-8660 | flynnfamilylending.com

Kidder Matthews Simon and Anderson Team (206) 747-4725 | dylansimon.com

Luther Burbank Savings Bank

Tiana Jackson: (425) 739-0023 lutherburbanksavings.com

Jackson

Pacific Crest Savings Bank

Todd M. Hull | Scott Gibson (425) 670-9624 | (800) 335-4126 pacificcrestbank.com

Peak Mortgage Partners

Dave Eden (206) 660-3014 | peakmp.com

Sound Community Bank (206) 448-0884 x202 | soundcb.com

Umpqua Bank | Multifamily Lending

Matt Couch (425) 602-1250 | umpquacrelending.com

Washington Federal Vendor of the Year | 2015

Tim Marymee (206) 777-8213 | (800) 324-9375

washingtonfederal.com

Tacoma Public Utilities Power: (253) 502-8600

Water: (253) 502-8723

TacomaPowerRebates.com/multifamily

Pacific Northwest Locksmith (206) 531-0411 | pnwlocksmith.com

Dunn Lumber (206) 632-2129 | (800) 248-3866 dunnlum.com

First Choice Remodeling, Inc. (253) 846-9000 | firstchoiceremodelinginc.com

Multifamily Elites (425) 698-1631 | multifamilyelites.com

Pro Realty Options, Inc. (425) 745-2400 | prorealtyoptions.com

Real Property Management Today (253) 426-1730 | rpmtoday.com

RentalRiff (541) 600-3200 | rentalriff.com

MASONRY SERVICES

Rife Masonry Chad Rife: (206) 696-6998 | rifemasonry.com

Masonry Restoration Consulting (425) 344-3893 masonryrestorationconsulting.com

METER + BILLING SERVICES

Guardian Water & Power

Chris Apostolos (206) 271-6913 | (877) 291-3141 x139 guardianwp.com

Submeter Solutions, Inc.

Jeff Lowry: (425) 228-6831 (888) 64-METER (63837) | submetersolutions.com

MOLD | MOLD INSPECTIONS

Envirotest | Mold, Air Quality Analysis, Inspections

Donald B. Kronenberg (206) 877-3191 | seattlemoldandairquality.com

ON-SITE LAUNDRY SERVICES

Hainsworth Laundry Jason Hainsworth (509) 534-8942 | hainsworth.biz

PAINTING | PAINT

Extreme Steam Carpet Cleaning (425) 330-9328 | extremesteamcc.com

Interland Design

Jake Cervilla (425) 290-9639 | interlanddesign.com

Ohlsen's Property Renewal (206) 228-2123 | propertyrenewals.com

PEST INSPECTIONS

NWK9 Bed Bug Detectives (206) 801-3522 | nwk9bedbugdetectives.com

Straight Street Building / Home Inspection

John Leon Gonzalez (206) 999-1234 | hi@homeinspect.ws

PIPE RESTORATION

Best Plumbing Group (206) 633-1700 | (425) 771-1114

Fischer Plumbing, Inc. (206) 783-4129 | fischerplumbing.com

The Pipe Guys (253) 537-2830 | pipeguys.com

Tub Cove Inc. One-piece one-of-a-kind bath walls (206) 522-1711 | tubcove.com

PLUMBING

Best Plumbing Group (206) 633-1700 | (425) 771-1114 bestplumbing.com

Day & Nite Plumbing & Heating Inc.

Vendor of the Year | 2020 (425) 775-6464 | (800) 972-7000 dayandnite.net

Fischer Plumbing, Inc. (206) 783-4129 | fischerplumbing.com POOL LEAK DETECTION

American

Brink Property Management

Dean Foggitt (425) 458-4848 | brinkpm.com

Cadence Real Estate (206)258-4871 | www.cadencere.com

Capstone Commercial Real Estate Advisors

John Downing (206) 324-9427 | capstonerea.com

Champions Real Estate Services (425) 744-5550 | nwchampions.com

Cornell & Associates Inc (206)329-0085 | www.cornellandassociates.com

Dave Poletti & Associates (206) 286-1100 | davepoletti.com

Dobler Management Company Inc. (253) 475-2405 | doblermanagement.com

Elita Living Real Estate LLC

Erica Vincent (206) 323-0771 | elitaliving.com

Emerald Heights Property Management

Ryan Dosch (206) 457-2475 emeraldheightspm.com

First Comercial Properties NW. (206) 985-7275 | fcpnw.com

Foundation Group, LLC (206) 324-7622 | foundationgroupre.com

Icon Real Estate Services Inc.

Jeremiah Roberson (425) 633-3330 | www.iconre.org

Jean Vel Dyke Properties, LLC (206) 725-3103 veldyke.com

Jevons Property Management

Enrique Jevons (206) 880-7935 | jevonsproperties.com

Krishna Realty (425) 209-0055 | krishna-realty.com

Lexington Asset Management (310) 650-3343

Longley Property Management Inc.

Venita Longley (206) 937-3522 | longleypm.com

Madeson Management LLC

Melissa Melia (206) 673-4282 | madesonmanagement.com

Madrona Real Estate Services, LLC

Bradford Augustine (206) 538-2950 | MadronaRealEstate.com

Maple Leaf Management LLC

Michelle Bannister (206) 850-8095 | mapleleafmgt.com

Marathon Properties

Jeff O’Hare (425) 745-9107 | marathonpropmgmt.com

Multifamily Elites (425) 698-1631 | multifamilyelites.com

Nathaly Burnett Property Management (253) 732-9535 | beyondseattle.com

Next Brick Property Management (425) 372-7582

Niche Realty Associates LLC (206) 851-4694 | nichrealtyassoc.com

Northfield Properties Inc. (425) 304-1250 | (425) 304-1250

North Pacific Property Management

Joshua Fant (206) 781-0186 | (800) 332-1032

northpacificpropertymanagement.com

Pacific Crest Real Estate (206) 812-9155 | pacificcrestre.com

Park 52 Property Management

Paul Jakeman (253) 473-5200 | park52.com

People’s Real Estate, Inc.

Lisa Brannon (425) 442-9941 | peoplespm.com

Phillips Real Estate, LLC (206)22-8600 | philipsre.com

Pilot Ventures LLC | Property Management (206) 566-6600 | pilotnw.com

Rental Housing Association of Washington (206) 283-0816 | RHAwa.org/RMAP

Windermere Property Management / WPM South, LLC

Ed Verdi (253) 638-9811 | wpmsouth.com

WPI Real Estate Services, Inc. (206) 522-8172 | wpirealestate.com

Yardi

Kelly Krier (805) 699-2040 | yardi.com

RECYCLING + GARBAGE

Prospector Property Management (206) 508-6366

prospectorpropertymanagement.com

Real Estate Gladiators (425)260-3121 | www.realestategladiators.com

Real Estate Investment Services (REIS)

Lakewood: (253) 207-5871

Seattle: (206) 319-5981

REISinvest.com

Real Property Management Today (253) 426-1730 | rpmtoday.com

Redside Partners, LLC

Craig Swanson (206) 323-1771 | redsidepartners.com

Rentals Northwest

Richard Wilber (253) 581-8616

Renters Marketplace

Larry Cutting (425) 277-1500 | rentersmarketplace.com

Seattle's Property Management (206) 856-6000 | seattlespropertymanagement.com

Seattle Rental Group Property Management (206)315-4628 | www.seattlerentalgroup.com

SJA Property Management (425) 658-1920 | sjapropertymanagement.com

SJC Management Group

Jason Clifford (253) 863-8117 | sjcmanagement.com

Spartan Agency, LLC (253) 863-6122 spartanagency.com

SUHRCO Residential Properties (425) 455-0900 | (206) 243-5507

suhrco.com

The Paris Group NW (206) 466-4937 | theparisgroupnw.com

TQ Handyman LLC

Trevor Rose: (206) 222-5129

trevor@tqhandyman.com

T-Square Properties | Real Estate Brokers (425) 485-1800 | www.tsquaremanagement.com

Weber & Associates Property Management (425) 745-5838

Westlake Associates (206) 505-9400 | westlakeassociates.com

Wilson Property Management, Inc.

Gary Wilson CPM (425) 453-0089

wilsonmanagementinc.com

Windermere Property Management

/ Lori Gill & Associates (425) 455-5515 | wpmnorthwest.com

Windermere Property Management

/ JMW Group (206) 621-2037 | windermere-pm.com

Junk Busters-Big Haul (360) 390-2014 | junkbustersllc.com

BricksFolios Real Estate Solutions

Jyotsna (Jo) Dixit (425) 503-1225 | brickfolios.com

Capstone Commercial Real Estate Advisors

John Downing (206) 324-9427 | capstonerea.com

Champions Real Estate Services (425) 744-5550 | nwchampions.com

Colliers International (206) 223-1428 | colliers.com/seattle

Cornell & Associates Inc (206)329-0085 | www.cornellandassociates.com

Dave Poletti & Associates (206) 286-1100 | davepoletti.com

DVF Legacy Investments (206) 650-6113 | pugetsoundinvesting.com

Elita Living Real Estate LLC

Erica Vincent (206) 323-0771 | elitaliving.com

Foundation Group, LLC (206) 324-7622 | foundationgroupre.com

Havium. Inc (888) 642-8486 | havium.com

HFO Investment Real Estate (971) 717-6337 | hfore.com

Jean Vel Dyke Properties, LLC (206) 725-3103 | veldyke.com

Kay Properties & Investments

Dwight Kay (855) 899-4597 | kpi1031.com

Kidder Mathews

Dylan Simon: (206) 414-8575

Jerrid Anderson: (206) 499-8191

DylanSimon.com

Krishna Realty (425) 209-0055 | krishna-realty.com

Leading Edge Property Management (425) 405-2358 | edgehomerentals.com

Lee & Associates

Multifamily Team

Candice Chevaillier (206) 284-1000 | lee-nw.com

Madrona Real Estate

Bradford Augustine (206) 538-2950 MadronaRealEstate.com

McTaggart Real Estate (206) 322-9495 | darcoapts.com

Next Brick Property Management (425) 372-7582

Niche Realty Associates LLC (206) 851-4694 | nichrealtyassoc.com

North Pacific Property Management (206) 781-0186 | (800) 332-1032 northpacificpropertymanagement.com

Paragon Real Estate Advisors, Inc.

Vendor of the Year | 2016 (206) 623-8880 | (800) 643-9871 paragonrea.com

Park 52 Property Management

Paul Jakeman (253) 473-5200 | park52.com

People’s Real Estate, Inc. (425) 442-9941 | peoplespm.com

Phillips Real Estate, LLC (206) 622-8600 | phillipsre.com

Prime Metropolis Properties, Inc. (425) 688-3003 | pmp1988.com

Real Estate Gladiators (425)260-3121 | www.realestategladiators.com

Real Estate Investment Services (REIS) Lakewood: (253) 207-5871

Seattle: (206) 319-5981

REISinvest.com

Seattle Land Broker Inc. (206) 973-3022 | seattlelandbroker.com

SJA Property Management (425) 658-1920 | sjapropertymanagement.com

Sound Reatly Group

Charles Burnett, CCIM (206) 931-6036 | soundmultifamily.com

SUHRCO Residential Properties (425) 455-0900 | (206) 243-5507 suhrco.com

Tecton Corporation (206) 448-4100 | tecton.com

The Chang Group (425) 678-2288 | changgroup.com

The Paris Group NW (206) 466-4937 | theparisgroupnw.com

T-Square Properties | Real Estate Brokers (425) 485-1800 www.tsquaremanagement.com

Westlake Associates (206) 505-9400 | westlakeassociates.com

Windermere Property Management / Lori Gill & Associates (425) 455-5515 | wpmnorthwest.com

Windermere Real Estate Commercial

Therasa Alston (206) 650-4777

Windermere Real Estate / East

Buck Hoffman (206) 660-3764 | buckhoffman.com

WPI Real Estate Services, Inc. (206) 522-8172 x105 | wpirealestate.com

HOUSING

Ideal Inspection Services LLC RRIO Certified + Licensed Inspector (206) 930-0264 | idealinspectionservice.com Optimized Inspection Services, LLC Bryan Mize (206) 349-0733 |

Guardian Water & Power

Chris Apostolos (206) 271-6913 | (877) 291-3141 x139 guardianwp.com

Submeter Solutions, Inc. Jeff Lowry: (425) 228-6831 (888) 64-METER (63837) | submetersolutions.com

ABC Towing, Inc. Seattle: (206) 682-2869 Tukwila: (206) 767-4024 abc4atow.com

Bio Clean, Inc. (425) 754-9369 | biocleanwa.com

SERVICES

Conservice (435) 419-4960 conservice.com

Tacoma Public Utilities Power: (253) 502-8600 Water: (253) 502-8723 TacomaPowerRebates.com/multifamily

Pacific Publishing Co. | Print & Internet (206) 461-1322 | pacificpublishingcompany.com

Renters Marketplace Larry Cutting (425) 277-1500 | rentersmarketplace.com

Seattle Public Utilities | Saving Water Partnership (206) 615-1282 | savingwater.org

WATER | FIRE DAMAGE RESTORATION

Fischer Restoration (888) 345-2532 | fischerrestore.com WATER HEATER SALES & SERVICE

Best Plumbing Group (206) 633-1700 | (425) 771-1114 bestplumbing.com

Day & Nite Plumbing & Heating Inc. Vendor of the Year | 2020 (425) 775-6464 | (800) 972-7000 dayandnite.net

Fischer Plumbing, Inc. (206) 783-4129 | fischerplumbing.com

Greenwood True Value Hardware (206) 783-2900 | greenwoodhardware.com

Masonry Restoration Consulting (425) 344-3893 masonryrestorationconsulting.com

Shine a Blind | Blinds On-Site Ultrasonic Mini-Blind Cleaning + Repair (425) 771-7799 | shineablind.net

SRC Windows (253) 565-2488 | (800) 870-2488 srcwindows.com

Tacoma Public Utilities Power: (253) 502-8600 Water: (253) 502-8723

TacomaPowerRebates.com/multifamily

Echo Yard Maintenance (206) 909-6873

idea and full control on sites where an eviction has occurred. HB 1389 actually required the department to calculate the annual increase percentage. The utilities and transportation commission (UTC) does not appear to have that function under SB 5697. Further, HB 1389 provided some illusory rights to recoup capital invested in the property over the preceding 12-month period, but SB 5697 does not allow any such recovery (or pretend to allow it as in HB 1389). We are strongly opposing this bill.

HB 1817/ SB TBD – Housing Gap Vouchers

We have been working on Housing Gap Vouchers for most of this legislative session and just this week we introduced that bill in the House and Senate (Senate version awaiting bill number now). The House bill HB 1817 is scheduled for a hearing in the House Housing Committee on February 14 at 4pm and we will be out in force and need YOU to show our support for this important bill.

Our Housing Gap Vouchers would create rental assistance vouchers in

partnership with the public housing authorities for residents to bridge the gap between their income and their rent, especially helping with rent increases. The bill makes available rental assistance for seniors, low-income families, and members of marginalized communities living in manufactured housing or rental housing in Washington. These vouchers are targeted to 80% AMI and below, adjusted by family size and area and the voucher is good for up to 12 months and allows residents in need to reapply. The voucher amounts are enough to bridge the gap but not paying all of the resident’s monthly rent.

This is a critical priority for us as we need to help lawmakers understand that rents have increased because of many factors and that rent control is not the answer; the answer is providing targeted assistance to those low-income families and seniors who need the assistance.

HB 1628 – Highest State REET Tax in America on Properties Over $5 Million