Robotics & Sorting Technology

DRILLTEQ V-310

FEEDBOT D-310 & DRILLTEQ V-310

The CNC processing center with robot support forms one of the smallest possible cells of the furniture production. In this combination, the FEEDBOT D-310 increases your overall productivity. It does not have to take a break, can work around the clock on the shop floor and ensures consistently high quality. Small and medium-sized companies save a lot of time by using the robot integration FEEDBOT D-310 and reduce the workload for their staff. The resulting flexible manpower organization allows your workforce to be used more for value-added activities and production processes.

AUTOMATECH ROBOTIK

• Fast 4-axis robot with multipick capabilities to pick up to 4 parts at the same time

• Direct interfacing with the CNC outfeed conveyor from HOMAG

• Vision system to detect part shapes following the machine’s push sequence

• Dowelling directly in the robotic cell on a DRILLTEQ

• Automated outfeed of parts to the edgebander operator

• Automatic management of off-cuts and scraps

• Automatic data feeding and processing from CAD/CAM casegood solution software Unveil your untapped manufacturing potential with Automatech Robotik solutions. Armony robotic cell with ORRA tooling and intelligence. Unload of a HOMAG nesting router & load/unload of a HOMAG dowel inserter.

DRILLTEQ V-310

FEEDBOT D-310 AUTOMATECH ROBOTIK CELL

COMMUNICATION DRIVES EFFICIENCY

HELLO INDUSTRY PARTNERS,

In this issue, we explore how craftsmanship, innovation, and adaptability are shaping North America’s wood manufacturing industry. Through diverse profiles and analyses, we gain insights into how businesses are tackling modern challenges while honoring tradition and embracing technology.

Our feature on BDM Furniture highlights the Quebec-based company’s commitment to merging traditional quality with selective technological upgrades. BDM balances craftsmanship with tools like laser cutters and a 3D visual configurator to enhance customer experience and product customization, reinforcing the unique value of Quebec’s high-end, custom furniture sector.

Turning to cabinetry, we profile Current Millwork & Cabinetry, where General Manager Jason Howlett has guided the company’s sustainable growth through lean operations and ERP software. By refining processes and strengthening client relationships, Current Millwork’s journey from a seven-person team to a 40-strong workforce demonstrates the rewards of planning and efficiency.

In a thought-provoking analysis, Larry Coté, Managing Director of Lean Advisors Inc., explains the complementary roles of Value Stream Mapping and Process Mapping. Coté shows how these tools drive operational efficiency by aligning processes with customer needs and minimizing waste—providing manufacturers with clear frameworks for boosting both system-wide and departmental productivity.

The issue also covers the rising trend of offsite and modular construction. Jayden Campbell, Product Manager at Akhurst Machinery, discusses how prefabrication and hybrid methods are addressing North America’s housing crisis, offering sustainable and cost-effective alternatives to traditional building. Modular construction, while established in Europe, is now gaining traction across Canada and the U.S., presenting a transformative shift in affordable housing solutions.

Finally, Sandra Wood, Executive Director of the CKCA, shares the story of Cripps & Sons, a family cabinetry business in Nova Scotia. Led by two Red Seal Cabinetmakers, the Cripps brothers combine artisanal expertise with innovations like automation and European design aesthetics. Their journey reflects a commitment to quality and community, emphasizing resilience and adaptability in today’s competitive custom cabinetry market.

These stories reflect the resourcefulness across our industry, where a balanced approach to craftsmanship, technology, and sustainability provides new pathways to success. Together, they highlight the enduring strength of tradition and innovation working in harmony.

Until next time, keep innovating,

ART DIRECTOR

PUBLISHER

Mike Neeb miken@mediaedge.ca

EDITOR

Tyler Holt tylerh@mediaedge.ca

PRESIDENT Kevin Brown kevinb@mediaedge.ca

PRODUCTION MANAGER

Ines Louis Inesl@mediaedge.ca

Annette Carlucci annettec@mediaedge.ca

GRAPHIC DESIGNER

Thuy Huynh-Guinane roxyh@mediaedge.ca

CIRCULATION circulation@mediaedge.ca

Wood Industry is published four times an nually, Spring, Summer, Fall, Winter, for the secondary wood products manufacturing and marketing industries in Canada. Subscriptions are free to qualified participants in Canada’s secondary wood processing industry. Subscribe at www.woodindustry.ca. Paid subscriptions rates: $40 to Cana dian addresses, $60 U.S. and foreign, $20 student rate. Please mail payment to Wood Industry, 2001 Sheppard Avenue East, Suite 500, Toronto, Ontario M2J 4Z8 For subscription inquiries, e-mail circulation@mediaedge.ca

© 2024 by MediaEdge Communications All rights reserved. MediaEdge Communications and Wood Industry disclaim any warranty as to the accuracy, completeness or currency of the contents of this publication and disclaims all liability in respect to the results of any action taken or not taken in reliance upon information in this publication. The opinions of the columnists and writers are their own and are in no way influenced by or representative of the opinions of Wood Industry or MediaEdge Communications Published by

Tyler Holt

The all new AVENTOS top family

Masterfully Staged

Introducing the all new AVENTOS top lift systems by Blum. Sleek, redesigned, and user-friendly. Featuring fewer lift mechanism types, easy front adjustment, and integrated BLUMOTION for smooth, quiet closing.

Scan the QR code below to learn more.

Wood Design Show 2024 Doubles Woodworker Attendance in Montréal

The Wood Design Show 2024 took place on October 9-10 at Montréal’s Palais des congrès, attracting double the number of woodworkers compared to last year. Featuring keynote speakers like Manon Leblanc and Pierre Mierski, the event delivered dynamic presentations from top architects and designers. Attendees explored innovative design solutions from exhibitors and connected during a VIP networking cocktail event. The show highlighted cutting-edge trends, making it a must-attend for industry professionals, with its engaging mix of talks, product launches, and valuable networking opportunities.

Norea Capital Acquires 40% Stake in Beaubois to Boost U.S. Growth

Norea Capital acquired a 40% stake in Beaubois, a Quebec-based architectural woodworking firm, to support its U.S. expansion and manufacturing automation. Beaubois, already generating 70% of its revenue from U.S. clients, plans to use the investment to expand capacity and grow its market presence. With a $175 million backlog, Beaubois aims to enhance its production through automation, contributing to sustainable, highend projects like LEED® certified buildings. Norea Capital’s investment aligns with Beaubois’ strategic goals, reinforcing its leadership in the North American woodworking sector.

WIA Scholarship Program Now Open, Deadline Set for January 31, 2025

The Wood Industry Association (WIA) has opened applications for its annual scholarship program, with a deadline of January 31, 2025. This scholarship supports students studying woodworking, wood technology, and related fields. Since its launch, WIA has awarded over $551,000 to 298 students. Eligible candidates must be enrolled in accredited North American programs, with preference given to those pursuing careers in wood technology. Applicants must submit transcripts and letters of recommendation. This scholarship offers a valuable opportunity for aspiring woodworkers to advance their education and careers.

2025 FORM Student Innovation Competition Now Open for Entries

Formica Corporation’s 2025 FORM Student Innovation Competition invites architecture and design students to submit their creative furniture designs by March 7, 2025. Participants must incorporate at least three Formica® Laminate or FENIX™ products into their pieces, aimed at enhancing wellbeing in residential or commercial settings. The grand prize winner will receive $2,000 USD, with the design showcased at NeoCon 2025 in Chicago. Second and third-place winners will also receive

cash prizes and NeoCon invitations. This competition provides a valuable platform for students to gain industry recognition and network with design professionals.

Durham Furniture Marks 125 Years with Thanksgiving Celebration

Durham Furniture celebrated its 125th anniversary with a Thanksgiving luncheon for its staff, honoring its legacy of craftsmanship since 1899. The Ontario-based company, known for producing high-quality, solid wood furniture, operates from its historic red-brick factory and employs over 150 craftspeople, many from multi-generational families. Durham’s commitment to sustainability and craftsmanship has made it a trusted name across North America. The luncheon reflected on the company’s rich history while celebrating the team that has helped maintain its reputation for excellence over the past century and a quarter.

Tiago dos Santos

Appointed

AWMAC BC

National Board Director

The Architectural Woodwork Manufacturers Association of Canada (AWMAC) BC has announced Tiago dos Santos as its new National Board Director. With over 23 years of experience in the wood manufacturing industry, including a long tenure at Windsor Plywood, Tiago now serves as Sales Manager at SwiftSure Milling. His extensive background and expertise in sales and manufacturing position him as a key player in guiding AWMAC BC’s future growth and industry impact. Tiago’s appointment is expected to bring fresh ideas and energy to the

MAXIMUM RELIABILITY AT AN EVERYDAY PRICE

Introducing Progressa, the newest family of concealed undermount slides by Salice

Meet and exceed ANSI Grade 1 specifications ensuring unmatched durability, and unwavering performance.

Utilize true progressive action and synchronization to smoothly operate under dynamic loads of 45 kg (Progressa) to 70 kg (Progressa+).

The fully integrated fluid-dampening device ensures an enhanced smooth glide and exceptional deceleration during closing.

Made for 13 mm (1/2”) and 16 mm (5/8”) drawer side material thicknesses

organization as it continues to support the architectural woodworking sector in British Columbia.

Patrick Meyer Named Executive Director of AWMAC BC

Patrick Meyer has been appointed as the new Executive Director of AWMAC BC, bringing over a decade of experience in the non-profit sector. Known for his expertise in leadership, strategic planning, and operational management, Patrick will succeed Glenda Harskamp, who is set to retire in December. AWMAC BC praised Glenda’s significant contributions and looks forward to Patrick’s leadership as the organization continues to grow within the woodworking industry. With his strong background in organizational management, Patrick is expected to drive AWMAC BC forward, ensuring it navigates future challenges and opportunities in the sector effectively.

IKEA Canada Lowers Kitchen Prices by 25%

IKEA Canada has reduced prices across its kitchen range by up to 25%, marking a key milestone in the company’s $80M investment to lower prices on over 1,500 products throughout 2024. This includes SEKTION kitchen systems, UTRUSTA fittings, and MAXIMERA drawers. Additionally, from October 3 to November 6, 2024, customers can enjoy an extra 15% off purchases over $1,500, along with 0% APR financing on purchases over $4,000 through a partnership with RBC. IKEA aims to make kitchen

renovations more affordable for Canadians, reflecting their commitment to accessible home design.

Interfor Exits Quebec with $30M Sale, Closes Montreal Office

Interfor Corp. has announced the

sale of its Quebec operations, including three manufacturing facilities, to Chantiers Chibougamau Ltée (CCL) for $30 million. The deal includes sawmills in Val-d’Or and Matagami, as well as the Sullivan remanufacturing plant. Interfor is also closing its Montreal corporate office as it shifts focus to its Ontario and New Brunswick sawmills. CEO Ian Fillinger cited limited fiber availability, partly due to 2023’s record forest fires, as a key factor. About 300 employees will join CCL, which will review operations post-sale to address ongoing wood supply challenges.

Quebec Coroner Calls for Stricter Murphy Bed Safety Regulations

A Quebec coroner has recommended that all Murphy beds lacking proper safeguards be removed from the Canadian market, following the tragic death of a five-year-old boy in January. The coroner, Donald Nicole, outlined 11 recommendations in his report, including that only Murphy beds compliant with ISO 10131 safety standards be sold in Canada. The boy was killed when a faulty Murphy bed at a resort unexpectedly opened and collapsed on him. The incident has prompted renewed calls for

mandatory safety standards, with the coroner urging immediate regulatory changes to prevent further accidents.

Canfor

Names

Stephen Mackie as New President and CEO

Canfor has appointed Stephen Mackie as its new president and CEO, effective November 1, 2024. With nearly 20 years at Canfor and 30 years in the forest products industry, Mackie brings extensive operational expertise to his new role. John Baird, chairman of Canfor Pulp’s board, highlighted Mackie’s deep knowledge of British Columbia’s fiber dynamics as key to his leadership. Mackie will also continue in his role as Executive Vice President of North American operations at Canfor Corporation, further strengthening his influence within the company’s strategic direction.

B.C. Manufacturing Faces Collapse Without Urgent Action, Report Warns

British Columbia’s manufacturing sector is at risk of collapse without immediate intervention, according to a new report by the Canadian Manufacturers & Exporters (CME). The sector’s share of B.C.’s GDP has fallen to 5.7% in 2023, down from 9.5% in the late 1990s, while employment has dropped to a decade-low of 171,800 jobs. High costs, complex regulations, and low investment are driving the decline. The CME report urges streamlined regulations, reduced taxes, and improved access to skilled labor to prevent further losses and restore the sector’s competitiveness. Immediate action is crucial to avoid further economic damage.

Our K 945S panel saw offers modern design, innovative

The precisely milled, cast iron machine table with a 700 x 840 mm (27 x 33 in) extension on three sides offers more support for large dimensioned workpieces. With the easy to mount circle cutting and sanding units, the new Felder bandsaw is a versatile investment for perfection in woodworking.

The AD 941 planer thicknesser inspires and amazes woodworkers all over the world. Perfectly planed surfaces, maximum reliability and userfriendliness that is in a class of its own and top operating safety.

Our new changeable gluepots increase flexibility giving you the productivity of larger edgebanders. The quick and easy change to other adhesive colours and the use of PUR glue guarantee productive procedures and excellent edges for all areas of application.

NAVIGATING GROWTH

Jason Howlett’s Blueprint for

Success

By Joy Doonan, Wood Industry Writer

at Current Millwork & Cabinetry

CURRENT MILLWORK’S APPROACH TO GROWTH

When Jason Howlett first joined Current Millwork & Cabinetry in Parksville, British Columbia as General Manager in 2013, the company was in its early stages of growth, and was the 7th employee at that time.

Jason quickly became involved in ownership, and now, in 2024, he shares some insights on how it has grown to over 40 employees.

One key to success for Current Millwork has been to embody the adage “work smarter, not harder.” Leanness and efficiency permeate every aspect of the business, from project selection to shop floor logistics. But it wasn’t just about growth. With a strong focus on culture, planning and foresight, Current Millwork & Cabinetry has fostered a sustainable business model that has allowed the company to occupy a market niche and build consistently strong relationships with stakeholders.

TRANSITIONING TO RESIDENTIAL PROJECTS: A SHIFT IN STRATEGY

Jason’s journey with Current Millwork began when he was seeking a lifestyle change to better suit his growing family. He came from a construction project management role in the Lower Mainland, which was exceptionally demanding of his time. He wanted to embrace the “Vancouver Island lifestyle” that would afford him the ability to select the projects and partners for which would best suit his vision and personality. This desire ultimately led him to join Current Millwork,

where he could help shape the company’s direction.

Of course, embracing the Vancouver Island lifestyle has come with a trade-off. “We don’t get a lot of overtime out here,” Jason explains, “so we knew we had to schedule 40 hours a week, and we knew we had to be really strong in scheduling and culture to attract staff. And so that’s really been the driving strategy for all these years.”

The addition of residential projects to Current Millwork’s commercially focused company was initially daunting. “It’s a different strategy, a different angle, it’s arguably a different division of our organization entirely,” he says. His past experience in the business-to-business (B2B) world meant that adapting to a more personal, residential client base required a shift in approach. Nevertheless, by understanding their strengths—specifically in architectural casework and panel processing—Jason and his team have been able to fine-tune their operations to deliver high-quality results. “I’ve done everything from project manage-

ment to driving the delivery truck,” Jason notes, emphasizing the hands-on approach that has helped him stay in touch with every aspect of the business over the years.

MAXIMIZING EFFICIENCY IN THE SHOP

Current Millwork & Cabinetry operates out of a 9,000-square-foot facility equipped with a beam saw, a nested router, an edge bander, and two finishing booths. “We pack a lot of equipment and material onto our shop floor and make sure we’re utilizing every square foot very consistently,” Jason explains, “A lot of our traditional wood machinery is on wheels and flexible to make use of the space”. Investing meticulous care in the structure and organization of the operation early on was critical in setting the foundation for maintaining the same efficiency as the company grew.

Their commitment to efficiency has led to continual improvements in workflow. In the company’s early days, it was important to develop a sensible production process by thoroughly taking stock

of heuristics. Staff initially used a paperbased, value-stream-mapping-like system to identify potential bottlenecks in the production flow. Nowadays, the company has invested in ERP software that streamlines its current operations, but these early logistical foundations were an example of the foresight that has always driven Current Millwork & Cabinetry’s business practices.

One of the ways Current Millwork maximizes value in its operations is by starting each project with transparency. “If you’re telling the truth, it’s really easy to back up the truth,” Jason says. “We can be intentional in our actions and ensure we’re delivering a product that meets our customer’s expectations.” Whether it’s architectural casework or custom cabinetry, Jason believes that clear communication from the outset is critical to meeting, and often exceeding expectations. He adds, “It’s about getting the stakeholders in the room to identify potential issues and solve and agree upon solutions to those issues early on.”

Over the years, the team has refined its ability to foresee potential pain points

Credit: Current Millwork

in projects “It’s a matter of equipping our team and our people to be able to do something about it once those areas have been identified,” says Jason. This focus on proactive problem-solving is supported by significant investment in staff training and development, allowing the company to maintain a high level of communication and quality assurance with clients. Over time, this meticulous focus on planning for efficiency has helped the company identify and refine its own market niche, transitioning from more traditional millwork to more heavily casework-based expertise.

LEVERAGING INDUSTRY STANDARDS THROUGH AWMAC

Jason also talked to Wood Industry about his experience as President of the B.C. chapter of the Architectural Woodwork Manufacturers Association of Canada (AWMAC). One of the aspects he most appreciates about the association is that it provides comprehensive industry standards that help his company further streamline and communicate its processes when working with stakeholders.

“It’s the set of standards to refer to for the manufacturing and installation of architectural woodwork”, Jason comments. Current Millwork & Cabinetry places high importance on these standards, with all of its project managers and department managers taking the Manufacturers’ Standards Exam, as provided through AWMAC.

This commitment to quality is not just a talking point—it is ingrained in how the business approaches potential projects and partnerships. “We spend time at the beginning of the process looking for projects and partners that are going to appreciate that level of quality and that level of standard and care,” Jason notes. The value of these connections extends beyond business, as Jason emphasizes the importance of building relationships with others in the industry. “You can have some really great conversations just over a burger and a beer after a board meeting,” he reflects. “Sometimes it’s just talking to someone peer-to-peer who gets what you’re saying. I appreciate talking to other entrepreneurs who understand what we go through.”

BUILDING A SUSTAINABLE FUTURE THROUGH QUALITY AND COLLABORATION

Combining traditional millwork expertise with a focus on architectural casework, and leveraging innovative technology and an efficient production process, Current Millwork has carved out a unique market niche, offering custom, high-quality solutions for commercial, multi-family, and residential clients.

Jason has done this by embracing a proactive, transparent approach, steering the company toward sustainable growth while staying true to the relaxed, qualitydriven ethos of Vancouver Island. As the business continues to evolve, its focus remains on delivering exceptional products, adhering to high industry standards, and maintaining strong partnerships.

In an industry where time is money, Jason’s ability to foresee challenges and invest in both people and processes sets Current Millwork apart.

Joy Doonan is a writer from Ottawa. She has a degree in Sociology and a certificate in Technical Writing, and she takes a special interest in small business sustainability.

Credit: Current Millwork

CANADA’S HOUSING STARTS

New Facilities, New Beginnings, a Renewed Commitment to the Industry

By Tyler Holt, Editor of Wood Industry Magazine

Housing starts in Canada provide critical insights into economic health, construction activity, and real estate demand. With housing shortages and affordability challenges persisting, especially in urban centers, tracking shifts in housing starts offers valuable information for developers, policymakers, and analysts alike. This article delves into Q3 2024 housing starts data and compares it to the same period in 2023, examining monthly trends across single-detached and multi-unit housing types, and providing a detailed provincial and regional breakdown to reveal the complexities shaping Canada’s housing market.

Q3 2024 OVERVIEW:

COMPARING YEAR-ON-YEAR TRENDS

In Q3 2024, Canada experienced a 7.6% decline in total housing starts compared to Q3 2023. This overall decline masks distinct shifts within housing types: Single-detached housing starts: Rose by 5.3% to 44,147 units, highlighting consistent demand in suburban and rural areas.

Multi-unit housing starts: Declined sharply by 10.3% to 177,551 units, indicating a slowdown in urban high-density housing projects.

These diverging trends reflect Canada’s evolving housing landscape, where affordability concerns, economic pressures, and market conditions are impacting single-detached and multi-unit segments differently.

MONTHLY BREAKDOWN:

Q3 2024 VS. Q3 2023

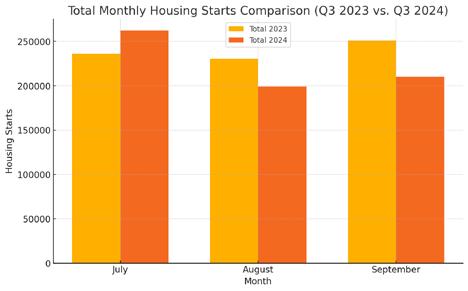

A closer look at each month within Q3 2024 uncovers more granular trends in Canada’s housing starts.

July 2024: Total housing starts rose by 11% to 262,245 units, with singledetached starts up 5.5% and multi-unit starts climbing by 12.2%. This increase suggests strong demand and an active start to the quarter, driven by ongoing population growth and a need for highdensity housing in urban areas.

August 2024: While single-detached starts increased by 6.1%, multi-unit starts fell by 18%, leading to an overall decline of 13.6%. This shift points to cooling activity in multi-unit housing, potentially driven by economic uncertainties, financing challenges, and construction delays.

September 2024: Single-detached starts continued to rise by 7.5%, but multiunit starts dropped by 21.3%, resulting in a total decline of 16.3%. This trend likely indicates market adjustments, affordability pressures, and delayed multi-unit projects due to regulatory or financial hurdles.

These month-by-month figures suggest that while demand for suburban and sin-

gle-detached homes remains steady, the multi-unit sector faces hurdles that could impact urban housing availability.

ANALYSIS BY HOUSING TYPE: SINGLE-DETACHED VS. MULTI-UNIT

Single-Detached Housing

The consistent growth in single-detached housing starts reflects Canada’s shifting demand towards suburban living:

Demand Shift: Since the COVID-19 pandemic, there has been a marked preference for larger, single-detached homes, particularly in suburban areas where land is available and prices are more affordable. This trend is seen in

provinces like Alberta, Saskatchewan, and parts of Ontario, where suburban single-detached homes are increasingly popular.

Affordability Pressures: The high cost of urban real estate has driven many Canadians to seek homes in suburban and rural areas, where single-detached housing remains more attainable. This trend is contributing to strong growth in the single-detached sector.

Multi-Unit Housing

In contrast, multi-unit housing starts declined sharply in Q3 2024, especially in August and September, due to several factors:

Financing and Regulatory Challenges: Developers are contending with higher interest rates and financing conditions, which make large-scale projects less viable. Additionally, regulatory challenges, such as zoning laws and construction approvals, can delay multi-unit housing starts, especially in major cities where demand is highest.

Natural Market Corrections: The decline may represent a correction following previous record years for multi-unit construction, as seen in 2023. While demand for urban rentals remains high, increased construction costs and ongoing supply chain issues have dampened developers’ enthusiasm for new projects.

This decrease in multi-unit starts raises concerns for urban centers where high-density housing is essential for accommodating growing populations, particularly among renters and lowerincome families.

PROVINCIAL TRENDS AND REGIONAL ANALYSIS

A detailed look at provincial data reveals

regional disparities, reflecting localized economic conditions, policy influences, and housing demands.

Newfoundland and Labrador (N.L.)

Newfoundland and Labrador saw a 73% increase in multi-unit projects in September 2024, reflecting strong growth in high-density housing. Year-to-date data shows a 152% increase in total starts, suggesting a response to demand in cities like St. John’s, where population growth and affordability have spurred construction.

Prince Edward Island (P.E.I.)

P.E.I. experienced a decline in monthly housing starts in September, particularly in multi-unit projects. However, YTD data reflects an 81% rise in housing starts, signaling robust growth in urban living options to meet housing needs in Charlottetown and Summerside.

Nova Scotia (N.S.)

Nova Scotia posted moderate growth in September, led by multi-unit construc-

tion in Halifax. The province saw a 51% increase in YTD housing starts, driven by Halifax’s expanding population, increased job opportunities, and high demand for rentals.

New Brunswick (N.B.)

New Brunswick recorded a 24% increase in monthly housing starts in September, largely in multi-unit projects. With a 40% increase in YTD starts, cities like Moncton and Fredericton continue to address local demand for multi-family units, highlighting the province’s steady housing market expansion.

Quebec

Quebec’s housing starts are predominantly multi-unit, especially in cities like Montreal and Quebec City. The demand for high-density housing remains strong in urban centers, though YTD growth has slowed slightly due to construction and financing challenges.

Ontario

Ontario has experienced a decline in total housing starts, with single-detached starts falling sharply in Toronto and Ottawa. Developers are focusing on multiunit construction to meet affordability needs in urban areas, but financing and regulatory constraints have dampened new starts.

Manitoba

Manitoba’s housing starts are stable, led by multi-unit projects in Winnipeg. YTD growth remains moderate, though demand for urban rentals supports steady multi-unit development.

Saskatchewan

Saskatchewan posted consistent growth, with strong demand in both single-de -

tached and multi-unit segments in cities like Saskatoon and Regina. The province’s economic resilience and affordable housing market support steady new construction.

Alberta

Alberta leads in housing starts among Western provinces, with high demand for multi-unit projects in Calgary and Edmonton. Driven by interprovincial migration and economic recovery, Alberta saw a significant rise in new starts, especially in affordable, high-density projects.

British Columbia (B.C.)

B.C.’s housing starts cooled in 2024 after record highs in 2023, especially in Vancouver. Multi-unit construction remains strong due to land scarcity and high urban demand, though affordability constraints and rising costs are slowing new developments.

REGIONAL IMPLICATIONS FOR HOUSING AFFORDABILITY

The decline in multi-unit starts in major urban centers like Toronto and Vancouver poses potential challenges for housing affordability:

Impact on Rental Prices: With fewer new multi-unit projects, rental availability may decrease, exacerbating rental price increases, especially in urban centers that rely on high-density housing to accommodate growing populations.

Policy Considerations: Municipal governments may need to revisit policies that impact housing affordability, such as zoning flexibility, financing incentives, and construction support programs to encourage high-density developments.

Urban centers dependent on high-density housing face significant risks if multiunit starts remain low. Without sufficient multi-unit development, the strain on urban rental markets could intensify, affecting low-income and middle-income households most acutely.

KEY ECONOMIC AND POLICY CONSIDERATIONS FOR Q4 2024 AND BEYOND

To address these diverging trends and

stabilize Canada’s housing market, several policy and economic interventions are necessary:

1Financing and Interest Rate Support: Addressing the financing challenges faced by developers, especially for multi-unit projects, will be essential. Policy solutions, such as subsidized interest rates for affordable housing projects, could incentivize developers to commit to multi-unit projects in high-demand urban areas.

2Zoning and Regulatory Adjustments: Revisiting zoning laws, particularly in high-density urban areas, can alleviate some of the regulatory hurdles that delay or obstruct multi-unit construction.

3Expansion of Affordable Housing Initiatives: To address affordability concerns, federal and provincial governments may need to expand affordable housing programs, focusing on subsidized multi-unit developments in key urban centers.

HOLZ-HER EPICON 1735

4

Long-Term Urban Planning: Developing comprehensive urban plan ning strategies that address housing, transportation, and infrastructure needs is essential to support long-term housing stability in urban centers.

Q3 2024 underscores a complex housing market in Canada, with single-detached starts growing steadily while multi-unit starts decline. The diverging trends reflect economic, regional, and policy influences that shape Canada’s housing landscape. As the country enters Q4, policymakers, developers, and stakeholders must address these challenges, particularly for urban housing. If multi-unit construction remains subdued, rental costs and housing shortages in major urban centers could worsen, exacerbating affordability issues for Canadian families.

This analysis is based on data from the Canada Mortgage and Housing Corporation (CMHC), which provides housing start statistics on a monthly and quarterly basis.

• Machining Y Direction: Up to 1500 mm

• User-Friendly 18” Display

• Radar-Powered Safe Detect System Available

• 10 Year Guarentee On All Linear Guides

• Highly Flexible Table Concepts

BDM FURNITURE

Craftsmanship and Customization at the Forefront of Quebec’s Furniture Industry

By Tyler Holt, Editor of Wood Industry Magazine

FURNITURE

The world of furniture manufacturing has seen dramatic shifts over the last few decades, as globalization and mass production have upended traditional business models. Despite these challenges, some companies remain steadfast in their commitment to quality, craftsmanship, and customization. One such company is BDM Furniture, a Quebec-based firm that has carved a niche in the upper-middle and highend custom furniture markets. With a rich history, a focus on quality materials, and a deliberate blend of traditional craftsmanship and selective technological integration, BDM has positioned itself as a leader in the industry. This article takes a deeper dive into the company’s evolution, its role in Quebec’s furniture industry, and how it’s navigating the complexities of the modern furniture market.

A LEGACY OF LEADERSHIP AND TRANSITION

BDM Furniture was founded by Richard Darveau, a visionary in the Quebec furniture industry, whose passing in recent years marked a significant transition for the company. Today, BDM is managed by Darveau’s children, who inherited the company. Philippe Darveau, Richard’s son, with his 17 years experience in the furniture industry remains Chairman of the Board and continues to play an active role in decision-making, ensuring that the company remains true to its roots.

The new leadership structure, comprising Martin Desaulniers as President and Marie T. Cossette as CFO, has guided BDM through this transition. Robert Kelly, Vice President of Sales, has been with the company for over a decade, bringing his extensive experience from other notable furniture manufacturers such as Canadel and Heritage Home Group. Under this leadership, BDM has continued to evolve, balancing its historical foundation with modern demands, while ensuring that the company’s core values remain intact.

BDM Furniture specializes in crafting high-quality, customizable furniture using North American birch, known for its beauty and sturdiness.

Philippe Darveau

QUEBEC’S ROLE IN FURNITURE MANUFACTURING

Quebec’s reputation as a hub for highquality, custom-made furniture is well known, and BDM has become a key player within this industry. As Kelly notes, “Quebec was on the forefront of custom higher-end dining furniture like nowhere else in the world.” The region’s strength lies not only in its abundance of high-quality hardwoods, but also in its deep tradition of craftsmanship. This combination has made Quebec a prime location for manufacturers dedicated to producing solid wood furniture that prioritizes quality and durability over mass production. Kelly compares the Quebec furniture industry to that of Amish country in the United States, where craftsmanship and custom, small-batch production reign supreme. Just as Amish furniture makers are known for their woodworking expertise, Quebec’s manufacturers have a similar tradition of excellence. Small village towns across Quebec have a rich his-

tory of skilled woodworkers, creating an environment where companies like BDM can thrive by tapping into both the skilled labor pool and the high-quality raw materials that the region provides.

BDM capitalizes on this heritage by crafting custom furniture that stands out for its quality. As Kelly highlights, the abundance of solid hardwoods in North America, makes the region ideal for solid wood furniture manufacturing. “We’ve chosen to use yellow birch because of its rigidity, its ability to expand and contract, and its versatility in accepting multiple colors,” Kelly explains. The choice of yellow birch isn’t just aesthetic, but practical, as it holds up well in different climates, including the fluctuating humidity levels found in regions like the northeastern United States.

CUSTOMIZATION AS A KEY DIFFERENTIATOR

In a industry where furniture options are increasingly driven by mass produc-

tion, BDM has taken a different approach, focusing on providing personalized, highquality furniture for its customers. The company’s dedication to customization is a major differentiator in the market, allowing it to stand out against lower-priced, mass-produced alternatives, particularly those made in Asia.

Kelly explains, “We specialize in personalizing furniture to the best of our abilities, with over 220 different chairs available in all the different finishes and fabrics.” BDM offers its customers the ability to tweak designs, select from a wide range of finishes, and make choices that reflect their personal tastes. This level of customization not only ensures that the furniture fits perfectly into a customer’s home but also adds a unique value proposition that mass-produced furniture simply cannot match.

Customization at BDM goes beyond simply offering a few variations on a product. Customers can choose from different chair styles, table shapes, and wood fin-

With over 220 chair designs and a wide range of finishes and fabrics, BDM Furniture offers extensive customization options to meet diverse customer preferences.

Combining traditional craftsmanship with selective technological integration, BDM Furniture ensures each piece is meticulously constructed and finished to high standards.

ishes, tailoring their furniture to their exact specifications. This personalized approach means that each piece of furniture is crafted with the customer’s preferences in mind, from the initial design stages to the final finishing touches. As Kelly puts it, “It’s not just ‘Here’s our dining room set, here’s the price.’ We explain what we do, what our roots are, and the type of construction you can expect from us.”

BALANCING TRADITION WITH TECHNOLOGY

While BDM prides itself on its craftsmanship, the company also recognizes the importance of integrating modern technology where it enhances the production process without compromising quality. This approach has allowed BDM to stay competitive in an industry where efficiency and cost management are crucial.

One of the key technological innovations at BDM is the introduction of a laser cutter for fabrics, which has helped

streamline the upholstery process. Additionally, the company has invested in a tabletop sander, which allows for more consistent finishes on their wood products. “We’ve integrated technology like a laser cutter and a tabletop sanding machine to maximize efficiency, but we haven’t sacrificed the artisanal quality of our finishing, which is still hand-done,” Kelly explains. This blend of technology and traditional handcrafting ensures that BDM maintains its high standards while also improving efficiency.

The company’s upcoming launch of a 3D visual configurator is another example of how BDM is using technology to enhance the customer experience. The configurator will allow customers and sales associates to visualize furniture pieces in real-time, ensuring that the right combinations of finishes, materials, and styles are selected before an order is placed. This not only improves accuracy

in custom orders but also helps customers better understand the options available to them.

Kelly acknowledges that the integration of technology is a delicate balance, particularly for a company that places such a high value on craftsmanship. “If we don’t have that hands-on approach, we just become one of those other manufacturers building on volume,” he notes. By carefully choosing which processes to automate and which to maintain by hand, BDM ensures that its products remain unique and of the highest quality.

QUEBEC’S DESIGN INFLUENCE: BLENDING TRADITION AND INNOVATION

Quebec has long been recognized as a trendsetter in North America, particularly when it comes to design. Whether in fashion, food, or furniture, the region has been at the forefront of innovation, often blending contemporary styles with tra-

“IF WE DON’T HAVE THAT HANDS-ON APPROACH, WE JUST BECOME ONE OF THOSE OTHER MANUFACTURERS BUILDING ON VOLUME.”

ditional elements. BDM is no exception, as the company continually pushes the boundaries of design while staying true to its roots.

Kelly reflects on Quebec’s influence in the furniture industry: “Quebec has always been a trendsetter, whether in furniture, fashion, or food. I saw these contemporary, transitional trends coming from Quebec in the 90s, and it’s still leading the way in terms of unique designs.” The ability to blend the old with the new is a hallmark of Quebec’s furniture industry, and BDM’s designs reflect this philosophy.

For instance, while the company remains committed to traditional woodworking techniques, it has recently introduced new collections that feature modern materials and designs. The company’s use of oak and walnut in recent product launches is a testament to its ability to innovate within the framework of classic craftsmanship. By offering new finishes and fabrics that appeal to contemporary tastes, BDM ensures that it stays relevant in a rapidly evolving market.

One of the key design trends that BDM is embracing is the mid-century modern aesthetic, which has seen a resurgence in popularity in recent years. The company’s upcoming oak collection features softer, more rounded lines than previous offerings, giving a nod to midcentury modern design while maintaining the quality and craftsmanship that BDM is known for. “We’re going to do a little more mid-century modern softening of those lines, of those edges,” Kelly says, referring to the upcoming collection. The new line will also feature a more natural, ecological finish, allowing the characteristics of the wood to shine through.

EDUCATING CONSUMERS ON THE VALUE OF QUALITY

One of the biggest challenges BDM faces, according to Kelly, is educating consumers on the value of high-quality, custom furniture. In an age of fast fashion and disposable goods, many consumers are unaware of what goes into crafting a piece of solid wood furniture or why it might cost more than a mass-produced alternative.

“The challenge is to make sure we translate the value proposition to the end

consumer. Many people don’t know what a quality chair or bed should cost, but if they understand what they’re purchasing, they can make an informed decision about the furniture they want in their homes,” Kelly explains. By providing customers with information about the materials, construction techniques, and labor involved in making a piece of furniture, BDM aims to create an informed customer base that appreciates the craftsmanship behind their products.

This educational approach is particularly important as BDM competes in a global market where cheaper alternatives are readily available. However, Kelly remains confident that once consumers understand the difference between massproduced furniture and the high-quality, customizable pieces BDM offers, they will see the value in investing in a product that will last for generations.

LOOKING TO THE FUTURE: INNOVATION AND GROWTH

As BDM looks to the future, the company remains focused on maintaining its high standards of craftsmanship while continuing to innovate. The introduction of new materials, such as oak, and the company’s ongoing commitment to customization ensure that BDM remains competitive in the ever-evolving furniture industry.

Additionally, BDM is exploring new ways to integrate functionality into its designs. For example, the company is working on new expandable table designs that allow customers to maximize their dining space without compromising on style or quality. These functional innovations, coupled with the company’s dedication to staying on-trend with new finishes and fabrics, position BDM for continued success in the high-end custom furniture market.

While the challenges of competing with mass-produced furniture from abroad remain, BDM’s commitment to quality, customization, and innovation ensures that it will continue to thrive. By staying true to its roots while embracing the future, BDM represents the best of what Quebec’s furniture industry has to offer.

CKCA membership helped us to legitimize our new business and it provided us access to a wealth of knowledge and resources that help us stay ahead in the ever-changing world of kitchen design and manufacturing.

By joining CKCA, you gain knowledge, access from advocacy -- and you make new friends along the way!

CRIPPS & SONS

Skill, Commitment, Family

By Sandra Wood, Executive Director of the CKCA

Cripps and Sons is a family run business with roots from farming in Devon, England. The family immigrated in 2003 to Tatamagouche, Nova Scotia and the business was started in 2009.

During the early years, the direction of the business was led towards fine woodworking involving furniture building, stairs and custom cabinetry. Custom cabinetry became a bit of a forte and blew up from there.

RED SEAL

Jim took the opportunity to challenge his Red Seal Cabinetmaker exam, passing and becoming a valuable member in the production of the national Red Seal examination. For a short while, Sam left to become a sales rep for Richelieu Hardware specializing in board, doors and countertop. After that, both collaborated, purchasing the equipment needed to start their own cabinetmaking shop, Cripps & Sons Woodworking Inc. Sam has also challenged and passed his Red Seal exam, making Jim and Sam the youngest Red Seal Cabinetmakers in the province and perhaps the only Red Seal qualified brothers working together. Something they take great pride in.

PRODUCTION AND EXPANSION

The company has remained small, with 5 employees plus 2 installers.

In 2022 they built their current shop that is 6400 sq ft. and will start construction on an addition that will focus on automation and will integrate a finishing line to help keep up with demand, as well as a small sanding robot to help remove some monotony from that task. The company is focused on improving efficiency. The expansion will provide more storage and future expansions will focus on automation including an automated production line.

EQUIPMENT

Technology is something Jim and Sam love. Some of their current machinery includes a 5x12 Selexx Chief CNC machine, the last

orange one to be ordered in Canada deeming it a limited edition model; a Felder edgebander with the patented GluBox technology for PUR glues; a ProEdge Elev8 dowel inserter which is still currently the only one in the world.

100 BOXES A WEEK

On average Cripps & Sons produces 100 custom cabinet boxes a week. Generally, especially lately, their projects have been fullhouse jobs, seldom just a kitchen. They are looking to increase their output with their expansion projects.

The company sells both to retail customers and direct to dealers. They have put a lot of effort into creating a unique and interesting showroom inspired by European and Scandinavian trends while showcasing some of the newest hardware available on the market. Their plan is expand their

network of dealers in the near future and to offer a fully customizable cabinet solution to more clients with a focus on modern styles and trends with a lasting high quality product.

CLIENTS

The company has a variety of clients from individual homeowners and local general contractors to commercial companies and the local high-end golf resort. They have built great ongoing relationships with many of their clients for several years, and are constantly building new working relationships with other companies on a regular basis and expanding their client base.

OUTSIDE SCOPE? BRING IT ON!

Cripps & Sons take pride in all of their projects and every project has something unique about it. One notable project they

Jim Cripps (Left) and Sam Cripps (Right).

are working on now has some steam bent white oak parts and custom reeded white oak panels. The company pushes themselves hard to be different. Their showroom has three kitchens based off the French or English kitchen, the Scandinavian flat slab style and then a more Italian industrial look. They are always looking for ways to be trendy and stay on top of new hardware and accessories boasting multiple servo-drive units and an accessory packed showroom. They never shy away from projects that may seem crazy, they work harder to make

sure the outcome of the project is bang on to what the designer or architect has drawn. Sometimes they get pulled into larger parts of projects outside the scope of cabinetry because they enjoy the challenge. They like to do fun and interesting projects and to keep the energy in their shop and workplace lighter and enthusiastic.

ASSETS

Cripps & Sons believe that one of their greatest assets is that they are young, innovative

and always looking for ways to improve. They do their absolute best to provide designers and architects with finished product that matches their drawings and inspirations regardless of what’s needed, whether it be going above and beyond to source material or using a whole different fastening method to create the final product.

As Red Seal Cabinetmakers, the youngest in Nova Scotia, they like to look at the whole process of the project from start to finish. They work with contractors, plumbers and electricians to help bring the customer ultimate vision to life. They strive for top quality and currently use the PEANUT fastening system for all their cabinets which they believe provides a much faster construction method than the typical screws. Because of the ease of this system, they can provide cabinetry flat pack to some of their local contractors who have projects where the cabinets must be built on site.

The company is also a member of the Nova Scotia Interior Decorators Association which connects them to their community, but also helps them stay up to date with new trends or fashions that direct the styles and finishes of cabinets. This is also why they joined the Canadian Kitchen Cabinet Association in 2024. Being able to collaborate with likeminded shops nationwide means they can get as much information as possible to stay current in matters affecting people in the industry. They also want to help elevate the industry nationwide.

Credit: Cripps and Sons

COMPETITIVE ADVANTAGE

Cripps & Sons has a loyal customer base and they believe this is because of the quality of their work and their knowledge. They enjoy a smooth process for all the leads and a great final product. Because they are in a rural location they try to offer as much as possible to make sure their customers aren’t having to travel hours in either direction to obtain other items. They provide the cabinetry, but also the lighting, high end appliances, countertops, sink, faucets and cabinet inserts. In their opinion designers enjoy being in their showroom where they can create a project from start to finish in one location and if there are any technical cabinetry construction questions, they can be easily answered. A number of their customers come through word of mouth or recommended by contractors and previous customers.

CHALLENGES AND SOLUTIONS

As with many cabinet shops, Cripps & Sons are in need of skilled labour. They have learned you can teach skills, but you can’t fix an attitude to want to learn. Also, being located in a rural area creates long travel times to jobsites. Because they are a custom shop they rarely use the same materials from one job to another, so their materials costs are high as are their shipping costs which drives up their project prices. They find it can sometimes be overwhelming with the number of moving parts in a project, but it also allows the company to control all these moving parts so there is no surprises when they proceed to the final stages. Behind the company is a strong family that is supportive. Being Red Seal Cabinetmakers with 3 of their employees in the Red Seal appren-

ticeship program means they not only can create consistency they are creating a generation of skilled labour. Their passion for what they do has led them to approach Apprenticeship NS to help develop the cabinetmaker Red Seal apprenticeship program.

FUTURE

This highly skilled shop has a bright future. While they produce European-style kitchens, they are excited by Scandinavian design and see this gaining in popularity. They are a highly skilled, custom shop, but they are also embracing technology and expect most shops will integrate robotic within the next 10 years.

We’re so glad Cripps & Sons joined CKCA. We look forward to watching this company grow!

Sandra Wood is the Secretary and Executive Director for the CKCA. She enjoys “connecting the dots” and facilitating strong networking opportunities to engage members. She believes associations are about fostering strong business relationships fueled by an empathic and sound business approach.

VALUE STREAM MAPPING VS PROCESS MAPPING

By Larry Coté, Managing Director, Lean Advisors Inc.

Value Stream Mapping (VSM) is a powerful tool that can help businesses and organizations transform their operations and become more competitive. By mapping out the flow of value from the customer’s perspective, VSM can help identify areas of waste and inefficiency and provide a roadmap for improvement. This tool is especially useful in complex production environments where each step, from raw material to finished product, must align with customer demands and quality standards.

A key benefit of VSM is that it helps businesses deliver higher-quality products and services to their clients. By identifying and eliminating waste across the entire value stream—covering activities like material handling, machining, assembly, and finishing—businesses can reduce defects and ensure that each stage adds value, leading to significant gains in quality and customer satisfaction. For example, a VSM exercise might reveal delays in the finishing process due to inefficiencies in sanding or coating. By addressing these steps as part of an end-to-end approach, manufacturers can reduce lead times and achieve smoother, more efficient operations.

OPERATIONAL COMPETITIVENESS

VSM can also significantly enhance competitiveness by streamlining operations and reducing waste. For manufacturers facing tight margins and varying customer specifications, VSM allows them to lower costs and quickly adapt production processes. This agility is crucial for companies dealing with custom orders or seasonal demand fluctuations. By focusing on cross-functional collaboration, VSM engages staff in the problem-solving process, leading to a more cohesive, motivated team and enabling continuous improvement throughout the organization.

In summary, Value Stream Mapping is an indispensable tool that helps businesses transform operations, improve quality, and become more competitive while fostering an engaged and empowered team. By adopting VSM methodology, companies can elevate service delivery and achieve greater success. The approach promotes alignment with

PSA-80 PRO Panel Sanding Assistant.

The fastest sanding machine on the market, now with DUAL SANDING UNITS engineered to elevate your productivity like never before.

The Omnirobotic PSA-80 PRO Panel Sanding Assistant offers autonomous sanding quality and performance in its simplest form. Specially designed for kitchen cabinet manufacturers, this advanced sanding machine will help you overcome the skilled labor shortage and boost your productivity. Powered by AutonomyOS™, an AI platform for robots, it autonomously performs every sanding task with a quality that is second to none.

Building Trust. Creating Together.

broader corporate goals, such as reducing cycle times, cutting costs, and maintaining quality standards that resonate with end customers.

Process Mapping is another essential tool, especially valuable for understanding an organization’s structure and main workflows. It visually lays out the flow between departments or individuals, highlighting key decision points and clarifying where handoffs occur. In manufacturing, process maps help teams understand how each production stage interconnects—from cutting and assembly to finishing and packaging—ensuring that everyone grasps the company’s operational framework.

Most companies should have a process map for their operations; if not, creating one is essential. Process Mapping provides an overview of the organization, helping firms understand how various departments collaborate to move products through the production line. This is particularly helpful in environments where multiple departments or teams

handle various production stages. A process map might reveal, for example, that delays in assembling a cabinet arise from inefficiencies in the preceding cutting process, highlighting the need for better coordination and workflow optimization.

PITFALLS OF PROCESS MAPPING

A caution with process maps is that some managers misuse them to locate “bottlenecks or problem areas” without understanding the systemic causes. In manufacturing, where production often involves multiple steps, focusing on isolated bottlenecks, such as in the sanding department, without addressing upstream or downstream impacts can limit true improvements. This approach risks creating a blame culture and impeding business planning by triggering uncoordinated changes. Such actions can harm morale, reinforce siloed thinking, and, ultimately, slow progress. Process maps are best utilized as guides for understanding departmental roles rather than as tools for pinpointing individual accountability.

In conclusion, understanding the difference between Value Stream Mapping and Process Mapping is essential for organizations to use each tool effectively. Leveraging the strengths of both tools allows companies to drive success confidently, using VSM for broad, system-wide improvements and Process Mapping for clarifying departmental responsibilities.

KEY ELEMENTS OF EACH

In the context of production environments, Value Stream Mapping’s endto-end focus is especially beneficial for eliminating waste across production stages, ensuring each process step— from material handling to final finishing—adds customer value. By supporting cross-functional Key Performance Indicators (KPIs) related to quality, speed, and cost-efficiency, VSM allows organizations to tackle challenges holistically. Meanwhile, Process Mapping’s departmental view can clarify the roles of specific teams and help pinpoint areas for training or workflow improvement within departments like assembly or finishing.

While Process Mapping lacks the broad transformative potential of VSM, it’s valuable for maintaining a clear understanding of how each team or department contributes to the product lifecycle. For instance, process maps can help a manufacturer visualize the flow of orders and understand where delays might occur, making it a useful tool for onboarding new staff and ensuring a smooth handoff between teams.

CONCLUSION

For manufacturing companies, Value Stream Mapping and Process Mapping

are complementary tools that, when used effectively, can provide a roadmap to higher efficiency and improved service delivery. VSM is essential for developing a cohesive, end-to-end view of

production, identifying root causes of inefficiency, and fostering an engaged team aligned with corporate objectives. Conversely, Process Mapping is invaluable for visualizing workflows within departments, offering a snapshot of specific production processes that can help identify areas for improvement in each stage.

Using these tools in tandem allows manufacturers to address both broad and localized challenges, from identifying system-wide waste to clarifying departmental roles and responsibilities. Fully leveraging VSM and Process Mapping empowers businesses to elevate productivity, foster collaboration, and confidently pursue excellence in a competitive market.

Larry D. Coté, Managing Director and founder of Lean Advisors Inc. in 1999, has pioneered Lean methodologies across various sectors, including healthcare, education, and government. Now leading the newly merged Lean Advisors and Lean Practice Group, Larry brings unparalleled expertise in Lean consulting worldwide.

STRENGTH IN NUMBERS

Our cluster thrives on the collaborative model of sharing best practices, gathering new ideas, and working together.

Join us and become part of a dynamic and supportive community dedicated to helping each other succeed.

TO LEARN MORE VISIT www.wmco.ca

PEANUT® 3 IS THE ULTIMATE GAME CHANGER

Save assembly time and eliminate the hassle of glue with PEANUT® 3, our single-component, invisible connector that’s an optimal insertion solution for large-scale manufacturers. This 100% hidden hardware allows cabinets to be assembled in seconds without the use of a clamping machine, optimizing production efficiency and decreasing costs.

PEANUT® 3

A Developing Trend OFFSITE CONSTRUCTION IN NORTH AMERICA

By Jayden Campbell, Product Manager, Akhurst Machinery

North America is currently facing a significant housing affordability crisis, particularly in its urban centers, where the cost of living has surged. Families struggle to find affordable housing, and cities are confronted with the increasing houseless population. The construction industry is turning to innovative solutions, including modular housing and hybrid construction methods, to address these challenges. These approaches provide solutions that emphasize affordability, speed, and sustainability, offering a path forward for urban areas struggling to meet housing demand.

MODULAR HOUSING: A FAST AND COSTEFFECTIVE SOLUTION

Modular construction is emerging as a promising strategy to deliver affordable housing quickly. This method involves manufacturing building components, or “modules,” offsite in controlled environments. The prefabricated modules are then transported to the building site and assembled like building blocks, forming a complete structure. The advantages of modular construction lie in its ability to drastically reduce construction timelines, improve cost control, and scale effectively to meet large housing demands.

One of the primary benefits of modular construction is the ability to reduce construction timelines significantly. Traditional construction projects can take years, often delayed by weather, labour shortages, and supply chain disruptions. Modular construction bypasses many of these challenges by manufacturing components indoors, in factory settings, where production can continue year-round, unaffected by external conditions. This rapid build process is crucial to meet severe housing shortages in fast-growing urban areas such as Toronto and Vancouver and U.S. states like Texas and Florida.

In addition to the speed of delivery, modular housing offers cost savings. Manufacturers can reduce material waste and labour costs by standardizing designs and producing modules in bulk. The controlled factory environment enables efficiency, reducing errors and rework. Additionally, the offsite production of modules requires less skilled labour at the construction site, reducing expenses. These advantages make modular housing a particularly attractive solution for low-income hous -

traditional on-site construction. This combination leverages the strengths of both approaches, offering improved efficiency, flexibility, and sustainability. In offsite construction, components like walls, floors, and roofs are manu-

factured in factories and then transported to the construction site for assembly. This reduces the amount of work needed onsite, which can significantly shorten construction timelines. On the other hand, onsite construction allows

TOP: Figure 1: Heijmans Article 1” – Photo: Heijmans, NL – Modular Building Automation Floor Cassette Lines BOTTOM: Figure 2: Heijmans Article 1-3” – Photo: Heijmans, NL – Modular Building Automation X-Fill Insulation filling bridge equipped with X-Floc blowing system

ing projects, where budget constraints are often tight.

Canadian and US cities are beginning to embrace modular housing to solve their housing crises. For example, Vancouver’s Rapid Housing Initiative uses modular construction to provide affordable homes for vulnerable populations, including low-income families and seniors. These homes not only meet high energy-efficiency standards but

also contribute to long-term cost savings through reduced utility expenses.

OFFSITE VS. ONSITE HYBRID CONSTRUCTION: BLENDING THE BEST OF BOTH WORLDS

While modular construction presents significant advantages, the construction industry is also exploring the benefits of hybrid construction—a method that blends offsite prefabrication with

for customization and adaptation to the unique conditions of each project site.

Hybrid construction takes the best elements of both methods in its ability to balance speed with customization, enabling developers to maximize efficiency and maintain the flexibility to meet the specific demands of each project. For instance, offsite manufacturing can occur simultaneously with onsite activities like site preparation and foundation work. This parallel processing can dramatically speed up overall project timelines, a significant advantage in parts of North America where climates can be unpredictable, and weatherrelated delays can add months to traditional construction projects.

Canadian industry news, feature articles, product profiles, design and technology updates delivered to your inbox every week.

www.woodindustry.ca www.lemondedubois.com

Hybrid construction also promotes sustainability, a growing priority in North America’s construction industry. By optimizing material use and reducing waste in offsite facilities, hybrid construction methods contribute to greener building practices. Additionally, energyefficient designs can be more easily integrated into prefabricated components, helping to meet Canada’s ambitious climate goals.

LEARNING FROM THE NETHERLANDS: A MODULAR CONSTRUCTION LEADER

In the realm of modular construction, countries like the Netherlands, Sweden, and Japan are leading the way with innovative solutions and rapid build times. Industry leaders such as BAM and Heijmans in the Netherlands have made remarkable strides in modular construction. They are known for their use of cutting-edge Modular Building Automation (MBA) equipment to construct sustainable, affordable housing at a faster pace than traditional methods. These companies have embraced offsite construction and factory-built components to streamline processes and reduce construction times dramatically by focusing on sustainability, speed, and efficiency.

BAM, for example, places a strong emphasis on modular and sustainable construction, producing energy-efficient homes in controlled environments that can be rapidly assembled on-site. Similarly, Heijmans, another leading Dutch

construction company, has embraced modular technology focusing on sustainability and alternative, decentralized energy generation. Both companies’ approaches enable the construction of net-zero homes—houses that generate as much energy as they consume—with the primary goal of increasing housing production.

Both companies utilize MBA’s machinery to produce timber and steel frame components, optimizing the use of offsite construction. This approach not only addresses the housing demand in the Netherlands but also supports their climate objectives.

In contrast, the North American construction industry is just beginning to adopt similar rapid modular construction methods. While American and Canadian companies are increasingly interested in the benefits of offsite construction, traditional construction processes still dominate, which we see often results in longer build times.

Comparatively, modular homes can be completed in the Netherlands in a few days or months. In contrast, traditional North American construction projects often take much longer, up to a year or more. The West is starting to see the potential of these technologies. Still, the adoption rate and infrastructure investment will need to increase significantly for the industry to match the efficiency seen in the Netherlands.

By embracing more modular and hybrid construction methods like those used by BAM and Heijmans, North American construction companies could

significantly enhance the speed and sustainability of their projects.

MEETING NORTH AMERICA’S HOUSING AND SUSTAINABILITY NEEDS

As North America continues to face housing challenges, these innovative construction techniques—whether through modular housing or hybrid construction—are poised to play a central role in shaping the future of affordable, efficient, and sustainable housing. While Europe, especially the Netherlands,

embodies modular construction, North America is beginning to catch up. Partnerships, like those between Akhurst Machinery and MBA, are advancing this transformation, promising a more efficient, cost-effective, and sustainable construction landscape. By utilizing these practices, companies across the country can support cities in meeting the housing demands of their populations while also contributing to longterm environmental and economic sustainability.

Jayden Campbell is a dedicated Product Manager at Akhurst Machinery, where he leverages his industry expertise to drive product innovation and streamline operations. With a passion for machinery and technology, he is committed to delivering solutions that empower clients and support Akhurst Machinery’s growth in the industry.

Offsite construction means that homes can be completed in a matter of days or months.

FINDING UNCONTESTED MARKETS

Applying Blue Ocean Strategy in the Cabinet, Furniture, and Millwork Industries

By Tyler Holt, Editor of Wood Industry

Price competition is a persistent challenge for cabinet manufacturers, furniture producers, and millwork companies in both the residential and commercial markets. As businesses compete for market share, the focus often shifts toward lowering prices or offering marginally better quality. This competition, while necessary, frequently results in shrinking margins and increasingly crowded markets. Is there a way for businesses in the secondary wood manufacturing industry to find new growth opportunities without getting caught in the constant struggle of competing on price alone?

Blue Ocean Strategy by W. Chan Kim and Renée Mauborgne provides a framework that encourages companies to step outside conventional competition by creating blue oceans—new, uncontested markets where competition becomes irrelevant. For businesses in the cabinet, furniture, and millwork sectors, applying these principles could provide a path toward sustainable growth by identifying opportunities beyond price wars and saturated markets.

OVERVIEW AND REVIEW OF BLUE OCEAN STRATEGY

Red Oceans vs. Blue Oceans:

Shifting the Competitive Landscape

At its core, Blue Ocean Strategy makes a distinction between red oceans, where companies compete in well-defined market spaces, and blue oceans, where businesses create new demand in untapped markets. Red oceans are characterized by crowded competition, commoditization, and price pressure, which is a familiar situation for many in the secondary wood manufacturing industry.

Kim and Mauborgne argue, “The only way to beat the competition is to stop trying to beat the competition.” In blue oceans, companies don’t have to fight over existing market share. Instead, they create value in new ways, offering something that isn’t already available. This shift in focus opens up growth opportunities that wouldn’t exist in a red ocean.

Value Innovation: Balancing Differentiation and Cost

A key concept in Blue Ocean Strategy is value innovation—the idea that companies can achieve both differentiation and cost efficiency simultaneously. This runs counter to the typical assumption that businesses must either offer higher quality at a premium price or lower costs to compete on price alone.

Kim and Mauborgne describe value innovation as “the cornerstone of blue ocean strategy.” For businesses in cabinet and furniture manufacturing, the challenge is to find ways to deliver new, compelling products or services while keep-

ing costs manageable. This might involve rethinking traditional approaches, such as developing modular furniture systems that offer customization without the complexity or cost of fully bespoke solutions.

Reaching Non-Customers: Expanding Market Potential

Many companies focus exclusively on serving their existing customer base. Blue Ocean Strategy challenges this approach by highlighting the importance of reaching non-customers—those who aren’t currently buying your products but could be persuaded to do so with the right offering.

Kim and Mauborgne outline three tiers of non-customers. First-tier noncustomers are those on the edge of the market who may purchase occasionally but aren’t fully engaged. Second-tier noncustomers avoid the industry’s offerings entirely, while third-tier non-customers may be unaware of the products altogether. For cabinet and furniture makers, this might mean exploring segments like DIY homeowners who see custom cabinetry as too complex or contractors who typically avoid custom millwork due to cost or lead time. Addressing their specific needs could open up new revenue streams.

Strategic Sequence for Execution

Identifying a blue ocean opportunity is only part of the equation. Companies must ensure their strategy is not just creative but also commercially viable. Kim and Mauborgne provide a strategic sequence that ensures a smooth transition from idea to execution:

1. Create exceptional buyer utility, 2. Set a strategic price, 3. Manage costs, and 4. Overcome adoption hurdles.

The sequence emphasizes the importance of delivering clear value to customers while maintaining profitability and managing the potential challenges of introducing a new approach. For businesses in the secondary wood manufacturing industry, this might involve carefully balancing innovative product offerings with

efficient production methods to ensure new ideas remain cost-effective.

Sustainability and Renewal of Blue Ocean Strategy

Blue Ocean Strategy also addresses the question of long-term sustainability. Competitors will eventually attempt to imitate successful innovations, which can push a once-blue ocean toward saturation. To maintain a competitive edge, businesses need to continuously innovate. As Kim and Mauborgne note, “The key to sustaining blue ocean strategy is to value innovate again and again before the competition catches up.”

This insight is particularly relevant to the cabinet and furniture industries, where trends and customer preferences can shift over time. Staying ahead requires an ongoing commitment to exploring new technologies, design approaches, and customer segments.

APPLYING BLUE OCEAN STRATEGY TO THE CABINET, FURNITURE, AND MILLWORK INDUSTRIES

Escaping Price Competition in Cabinet and Furniture Manufacturing

For cabinet makers and furniture manufacturers, the battle over price is a familiar one. Companies often compete by offering the lowest prices or by emphasizing craftsmanship to justify a higher price. However, these approaches limit the potential for significant growth and can erode margins.

By adopting value innovation, companies in this industry can find new ways to differentiate their products while keeping costs manageable. One example might be offering semi-custom cabinetry—products that provide flexibility in design without the cost and complexity of fully bespoke solutions. This approach allows businesses to capture both budget-conscious buyers and those seeking higher levels of customization.

By combining streamlined production processes with innovative product designs, manufacturers can create a unique value proposition that doesn’t rely on di-

rect competition with mass-produced or fully custom solutions.

Reaching New Markets and Non-Customers

Most cabinet and furniture companies focus on a familiar customer base—homeowners, builders, and businesses looking for high-quality or custom products. However, by targeting non-customers, companies can significantly expand their market reach.

For example, first-tier non-customers could include builders or contractors who typically avoid custom cabinetry because of long lead times or high costs. By offering quicker turnaround options or preconfigured designs that allow for some customization, manufacturers could attract this group.