SHINE BRIGHT

Neon signs illuminate the past, present and future By

Kevin JohnsonCooperation among public and private entities is critical in solving housing woes. Plus, we present our fifth annual Referred Real Estate Agents list. By Claire Fortier

Neon signs illuminate the past, present and future By

Kevin JohnsonCooperation among public and private entities is critical in solving housing woes. Plus, we present our fifth annual Referred Real Estate Agents list. By Claire Fortier

Oh, the good old days! You know, back in 2019; when houses were plentiful and the median sales price for a home was $270,000, according to the Richmond Association of Realtors. Life was rosy back then. A house sat on the market for 33 days and required an income of $66,000 to buy. With a median household income for Richmond families of $69,509, homeownership was in reach, even if it meant getting a second job or a loan from your parents.

Now, a yearly income of $116,400 may get you in the market for a starter home, but you must act fast. Houses now sell in about 22 days, which means many buyers make purchases sight unseen or without inspections. The 2022 median income for Richmond households was $82,249.

of this year.

This “long hangover from the Fed money policy to get out of a recession,” Lafaye e says, has “created golden handcuffs.” Those golden handcuffs — mortgages with low interest rates — meant a critical market that served as starter or move-up housing evaporated. That meant staying put for baby boomers, who own 28% of all U.S. homes with three or more bedrooms, according to Redfin.

“Currently we have got the great lock-in effect going,” says Craig Toalson, chief executive officer of the Homebuilders Association of Virginia. “There are a lot of people in their 50s or 60s who say, ‘I don’t need this 2,500- or 3,000-squarefoot house. I would love to move, but the new one down the street, with half the square footage, costs more, and I have a low interest rate.’”

That’s a question we asked local real estate agents, builders, housing agencies and other stakeholders. While answers varied, most agreed that this is a multifaceted problem requiring public/private

Sources: Census Bureau and NAHB analysis

vision and cooperation.

One way of ge ing boomers to move, Toalson says, is to focus on constructing homes for what he calls “the active adult market,” or those 55 years and older. “It would be great if some folks got creative to reduce the barriers in cost of this product. If we could get the cost of that product down — maybe by ge ing some fees waived (by local and state agencies), maybe some grants from local government, maybe the local government puts in some infrastructure, maybe allow the developer more density ... that should free up inventory.”

Another solution is to build more housing in general. “We still have the same problem — lack of inventory. And each passing year it gets more acute,” Lafayette says. While many of those interviewed agreed with Lafaye e, they also agreed that “we can’t build our way out of this,” as she says.

It’s not just a local problem. According to a recent article in The Wall Street Journal, “A decade a er an epic construction binge, fewer homes are being built per household than at almost any time

in U.S. history.”

Locally, “we’ve been underbuilt for over a decade now,” Toalson says.

But building more homes faces several hurdles: Finding suitable tracts of land, ge ing all the necessary jurisdictional approvals, ge ing through the gauntlet of public hearings and finally finding the labor and supplies to build.

“A developer can’t bring anything out of the ground for under $350,000,” Lafaye e says.

The scarcity of building lots, says Vernon McClure, founder of Main Street Homes, is primarily driven by the lack of zoned lots available. Finding more tracts of land for building will require local jurisdictions to rethink zoning.

“There will be no substantive change without a seismic shi in some factors,” says Monique Johnson, chief of programs for Virginia Housing. “Less than 5% of the land in this area is zoned for multifamily housing. Affordable development is having a tough time in this environment because the operating costs are continuing to escalate.”

According to Market Graphics

Total e ect of building codes, land use, environmental and other rules

$93,870 (11% Gain 2016 to 2021)

$41,330 During Development

$52,540 During Construction

Research Group, a national new homes research company, the market demand for lots between 2024 and 2029 is 42,101. In Chesterfield County alone, 12,036 will be needed; in Henrico County, 6,070. The current Richmond-area inventory is 7,982 lots.

Even when the land is found, “If I start a zoning process now, it will take at least one year to approve, one year for a preliminary plan and one year for construction plans,” McClure says. “Add six to 12 months of construction and it will take at least four years to get a new lot on the ground. This assumes everything goes somewhat smoothly and the zoning is approved.”

But that doesn’t allow for o en-intense public hearings that can add months or years to the process.

“Every time there’s a new proposed development, large or small, we see a very small percentage of residents showing up to public hearings with outrage to oppose any new housing plan,” Toalson says. “This is dramatically hurting our community. We need courage and more

• Cost of applying for zoning approval

• Hard costs of compliance (fees, required studies, etc.)

• Land dedicated to the govt. or otherwise left unbuilt

• Standards (setbacks, etc.) that go beyond the ordinary

• $1,779: OSHA/other labor requirements during development

• $1,442: Pure cost of delay during development

• Fees paid by the builder after purchasing the lot

• Changes to building codes over the past 10 years

• Architectural design standards beyond the ordinary

• OSHA/other labor requirements during construction

• $941: Pure cost of delay during construction

Source: NAHB/Well Fargo Housing Market Idex (HMI)

citizens to support new housing construction. If we don’t, we’re essentially telling our friends, family, neighbors and service workers that they can’t afford to stay here and to move someplace else.”

Even with a suitable tract of land and no headwinds from the public, the cost of building must factor in regulatory costs. Since 2016, there has been an 11% increase in costs attributed to regulations, which include fees to government agencies, architectural design standards, land dedicated for green space or left unbuilt and costs like required studies. Those costs tack on an average of $93,870 to the price of a new home.

Reducing those fees or waiving them on more affordable housing is one way of reducing costs. Another is to change lot sizes requirements.

Greg Allen, who worked as a planner for Chesterfield County for 30 years and now serves as an advocate for quality neighborhoods, suggests several ways of easing the costs of building new homes. One is to reverse the current building trends of 1,600-square-foot houses or

condos with an a ached garage. “Most of our young adults today are living in 600- to 1,200-square-foot apartments without garages,” he says.

Another way is to reduce lot sizes for new single-family homes. Most lots in Chesterfield County, for example, are built on a 12,000-square-foot lot. According to Allen, “If you could increase your density, say two times what you could have go en with a 12,000-square-foot lot, your development footprint is going to be smaller. Allow the smallest lot possible. Let (developers) get their density. Let them put their half-a-million-dollar house on a 6,000-square-foot lot. Ultimately, the county is ge ing more tax revenue, more utility fees out of each 6,000-square-foot lot. That’s a win-win, and that’s the direction counties should be going.”

“If we want to create housing that is sustainable, it’s going to take cooperation from public, private, nonprofit and public support,” Lafaye e says.

“We have got to get creative,” Gonzales adds, “so everything is on the table.”

Alot of factors contribute to the cost of housing, but chief among them is that there just isn’t enough housing to go around. Demand is greater than supply, and it’s draining Virginians’ bank accounts.

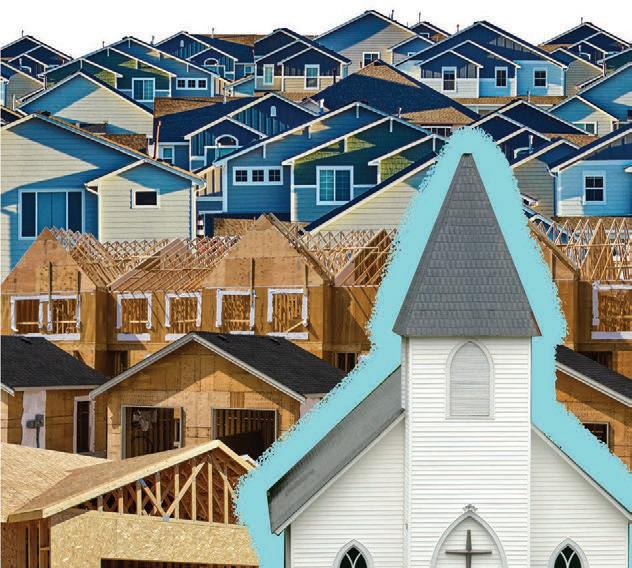

Faith organizations are trying to enter the market, offering to develop land they already own into affordable housing — homes and apartments where occupants pay no more than 30% of their income for their rent or mortgage. But zoning laws are ge ing in the way. State legislators are trying to help faith communities circumvent current zoning and special-use permit laws to put up housing more quickly.

In Virginia, counties and cities control their own zoning. In many cases, the properties owned by faith communities aren’t zoned for apartments, which are considered “high density” and are o en how affordable housing is built.

Churches, synagogues and mosques

that want to develop their land into affordable housing often need either approval to rezone the property or a special-use permit. Faith communities across the country have found it difficult to get their requests approved without the help of an expert, says Alex Horowitz, project director for the Housing Policy Initiative at The Pew Charitable Trusts. Experts can cost a lot — money that many religious organizations don’t have.

Plus, zoning approvals and red tape can add years to development plans. The time it takes to turn church land into affordable housing is “a painful topic,” says Nina Janopaul, president of the board of trustees at Virginia Diocesan Homes, a nonprofit affiliate of the Episcopal Diocese of Virginia that helps churches find ways to develop their land into community resources, like lowincome and senior housing. “I tell people never less than five years, maybe 10.”

In 2024, state Sen. Ghazala Hashmi,

D-Chesterfield, introduced Senate Bill 233, the Faith in Housing for the Commonwealth Act. The bill, which has been continued to the 2025 session, would allow faith communities to develop affordable housing on land they already own without being subject to some zoning laws.

The bill, if passed, would also require housing built on a faith group’s property to be run by a property manager with experience in affordable housing; the faith group would not be allowed to operate the development — unless, of course, they have that experience. It’s all subject to Virginia fair housing laws, meaning faith organizations can’t rent based on a tenant’s religious beliefs.

Supporters say the bill would alleviate friction that stretches projects into years or decades. Critics believe it sets a bad precedent, usurping local authorities’ sovereignty over their towns and applying unequal rights to property owners.

“When you have two properties side by side, and they both have the same zoning on them, but by virtue of one property having a different type of owner, they get more property rights — that’s problematic,” says Joe Lerch, director of local government policy at the Virginia Association of Counties.

The bill was reviewed in commi ee in January, when lawmakers expressed concerns that it weakens local government’s say in land use. For now, it’s being reviewed by the housing commission, which is chaired by Hashmi.

“In many states, bills are not passing the first time they’re introduced,” Horowitz points out. “And state lawmakers are ge ing comfortable with the concept of taking a more proactive role in ensuring that housing for their constituents is not blocked by local regulatory barriers.”

Hashmi’s goal is to reintroduce the bill next session following revisions by the housing commission, she says. “I want to get the legislation in a position by next year where we know that going into session, we have agreement.”

In March, we distributed our Referred Real Estate Agent survey to 3,889 subscribers and 5,636 Realtors from a list provided by the Richmond Association of Realtors. We invited both groups to share the names of three real estate agents they would recommend to a friend or family member for their market knowledge, negotiation skills, professionalism, customer service and integrity. e agents listed below earned the most votes.

Bentley Affendikis Joyner Fine Properties

804-938-3539 thea endikis group.com

Feras Almomani Shaheen, Ruth, Martin & Fonville Real Estate 804-274-9468 srmfre.com

Catena Armstrong Rashkind Saunders & Co. 804-839-3822 rashkind saunders.com

Marlene Austin

ICON Realty Group 804-437-1253 iconrealtyrva.com

Nikki Axman Venture Agency 804-582-7653 ventureagency rva.com

Amy Beem Samson Properties 540-681-1500 manorhouse rva.com

Susie Benson The Steele Group — Sotheby’s International Realty 804-334-3966 sothebysrealty.com

Shana Bloom

Bloom Real Estate 804-767-2627 bloomreal estate.com

Caleb Boyer Providence Hill Real Estate 804-955-8668 phrehomes.com

Joie Boykins East Coast Realty & Relocation, Powered by eXp Realty 804-248-0109 vabuyersand sellers.com

Maria Brent The Steele Group — Sotheby’s International Realty 804-310-1259 sothebysrealty.com

Chelsea Brown Keller Williams/ Richmond West 804-502-2689 kw.com

Joe Cafarella River Fox Realty 804-212-7507 joecafarella.com

Ernie Chamberlain

George: A Real Estate Group 804-921-4307 georgerva.com

Cabell Childress Long & Foster/ Cabell Childress Group 804-340-7000 cabellchildress.com

Mark Cipolle i Keller Williams 804-349-6463 kw.com

Angie Cooper River Fox Realty 804-986-2133 riverfoxrealty.com

Sean L. Cra Long & Foster 804-338-3800 longandfoster.com

John Daylor Jr. Joyner Fine Properties/ Daylor Stiles Team 804-347-1122 daylorstiles team.com

Cassie Dickerson Liz Moore & Associates 804-397-9258 lizmoore.com

Jennie Do s Long & Foster 804-370-6565 longandfoster.com

Jim Dunn Joyner Fine Properties 804-864-0323 Jimdunn homes.com

Ali Elk Friske Maison Real Estate Boutique 310-403-6889 maisonvirginia.com

Keia Evans Samson Properties 804-512-4494 keiatheagent.com

Ashley Fenske River City Real Estate Co. 804-475-0487 ilovelivinginva.com

Wes Fertig Joyner Fine Properties 804-339-7722 joynerfine properties.com

Susan Fisher Long & Foster 804-338-3378 longandfoster.com

Page George Maison Real Estate Boutique 804-402-4565 maisonvirginia.com

Debbie Gibbs

The Steele Group — Sotheby’s International Realty 804-402-2024 sothebysrealty.com

Aaron Gilbert Berkshire Hathaway HomeServices PenFed Realty 804-868-0080 bhhs.com

Mark Goad The Good Life RVA 804-358-3684 thegoodliferva.com

Melissa Grohowski Long & Foster 804-651-1595 longandfoster.com

Judy Flaig Graffum Judy Flaig Gra um 804-334-5307 judygra um.com

Meg Grymes The Steele Group — Sotheby's International Realty 804-282-3136 sothebysrealty.com

Elizabeth Hagen Joyner Fine Properties 804-241-6156 Joynerfine properties.com

Catherine Ham The Pace of Richmond/ Keller Williams 804-677-9118 thepaceofrich mond.com

Stephanie Harding Venture Agency 804-582-7653 ventureagency rva.com

Kathryn Harned Reynolds EmpowerHome Team/ Keller Williams 561-351-8690 rtrsells.com

Lauryn Haynie One South Realty Group 804-246-3037 lovetherivercity.com

Annemarie Hensley Compass 804-221-4365 compass.com

Michael Hippchen Nest Realty 804-683-1552 nestrealty.com

Neil Hodge Small & Associates, Inc. 804-456-6000 smallrealestate.com

Jessica Houser Nest Realty 540-849-8211 nestrealty.com

Sarah Huffman River City Real Estate 540-259-1195 ilovelivinginva.com

Sarah Jarvis One South Realty Group 804-356-4700 onesouthrealty.com

Jimme e Jones Joyner Fine Properties 804-270-9440 joynerfine properties.com

Teri Jones Samson Properties 804-886-1922 samson properties.net

JoanElaine Justice The Reynolds Empower Home Team/Keller Williams 804-539-9779 Empower home.com

John Kendig Long & Foster 804-405-0945 longandfoster.com

Tricia Kinder Fathom Realty fathomrealty.com 804-944-5770