ESS

ESS

Cell phone towers around the world have lead battery back up systems. Here, battery life really matters. Longer battery life is one of the reasons we engineered Gravity Guard.TM Hammond’s patent-pending innovation minimizes acid stratification for advanced battery applications.

One unlikely challenger to the market dominance of lithium batteries is starting to flex its muscles. In an exclusive interview with ABC's Ed Shaffer, he discusses the role bipolar batteries will play in BESS of all sizes.

I don't care what the weatherman says ....blind thinking on our EV/grid future

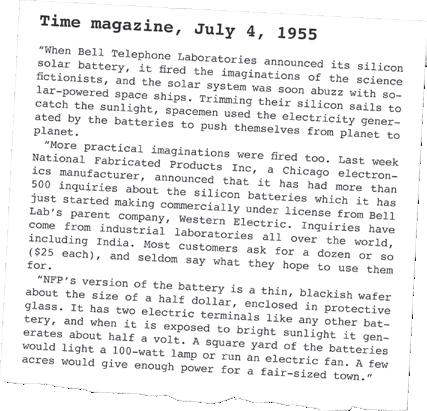

Three scientists, three different backgrounds, one accidental discovery. A lightbulb moment for the world as they discovered how to turn light from the sun into electricity and so change our planet's future.

The drive into renewables and its corollary energy storage is largely unstoppable. But in a continent that is still largely strapped for money, this is how the battery markets across Africa are developing.

Leclanché's Sritastava its well known, popular CEO quits, Blanc and Broad to manage the firm

Australia's Volt Resources forms new unit in bid to tap into US lithium and lead markets

Tales of darkness as we lift the lid on mischievous deeds in conferences around the world

Close your eyes, take your hands off the wheel and let your car drive you home. Or to work. Or to your holiday destination. That’s the dream of fully autonomous driving.

And it’s in our shops already! Didn’t you know it?

According to a survey of the general public in the US almost three-quarters of them believe that, if you have the money, you can buy a self-driving car.

And not just a car that will nudge you if you drift into a nearby lane on the freeway, but a fully and totally autonomous machine.

The question was posed to 2,000 drivers by Thatcham Research in the US this March where 72% believed that such a car could be bought now. A similar number of respondents in the UK gave a figure of 52%.

Given that this is the audience that battery manufacturers of all chemistries are pinning their hopes on, it shows a disappointing level of EV awareness.

Drilling down to the basics of the future reminds one of the joke about the First Law of Economists. It’s a simple one. For every economist’s opinion, there exists an equal and opposite one. (The Second Law then posits that they’re both valid and both wrong.)

The babble of informed and ill-informed opinion is now pointing in two directions.

First, there are the so-called ‘exuberants’. Expert opinion is mostly divided about how exuberant one should be. They say, probably rightly, that the energy transition is ploughing ahead full-steam and is unstoppable. But the timeline is vague.

At the extreme part of this camp are optimists such as the European Commission confidently predicting that European energy self-sufficiency if

Put aside talk of recession and economic doom and gloom — there’s a world of business opening up in developing nations that will keep batteries of all types thriving in the decades to come

not already there, is just around the corner.

Frans Timmermans, European Commission vice-president in charge of the Green Deal — and better known by Energy Storage Journal readers for wanting to get rare earths out of batteries and being technologically agnostic on all battery chemistries [except lead] — said this in October: “The era of cheap fossil fuel is over. For good. It will not come back.

“And while the era of cheap renewable energy is real and coming fast, it’s not coming fast enough to solve the problems this year or perhaps next year.”

Perhaps next year?!

Mr Timmermans may have wanted, like Alice in Wonderland, to believe six impossible things before breakfast but as a candid opinion on how Europe’s energy future is shaping up, he is about 10 years too optimistic.

That said Timmermans has captured the business flavour of what’s going on in Europe in particular and across the planet more generally.

Politicians, in general, have still yet to grasp that there’s a 100% link between renewables and energy storage in any brave new energy world of the future. What they do understand is that solar panels and wind turbines are the basic blocks of renewable energy.

Thankfully, the business world has filled in the gaps and dived into financing energy storage as well. The huge sums of investment here are focused almost exclusively on developments in lithium ion batteries. Despite the bleating at the time and subsequently, the Covid pandemic caused only minor delays in some of the planning for the megaprojects and gigafactories.

And in the other corner far from the exuberants are the sackcloth and hair-shirt brigade. They’re predicting that this is not just a recession around the corner but a global crisis too.

The four horsemen of the apocalypse are about to get over-shadowed by stockmarket collapses, rampant inflation, an over-strong dollar and uncle

Tom Cobbley and all.

The term ‘permacrisis’ — a newly minted word for 2022 and defined as an extended period of instability and insecurity — has entered the language.

The fact is, however, predictions of the doomsayers are starting to unravel. If just a little bit. Everything from nonfarm payrolls in the US and similar employment levels across the EU are better than expected. Inflation is falling more rapidly than predicted.

Europe, North America and vast swathes of Asia are going to move into overdrive with a flood of new lithium BESS projects. The economic logic behind them is compelling even in a time of an economic slowdown.

On top of this, a new wave of battery chemistries is emerging that look set to outpace even these lithium projects.

Sodium ion, flow batteries using iron (as well as the more traditional vanadium) and mechanical means using compressed air, high pressure water and gravity are going to be contenders, perhaps even leading contenders, for storage projects in the decade to come.

Even the prime incumbent technology, the lead acid battery, will continue to enjoy a future of sorts though its role in stationery markets will clearly be curtailed.

Forgetting the newly emerging markets in grid storage, the automotive sector for the lead battery isn’t going to go away any time soon.

Last year, according to Wood Mackenzie research, some 80 million new vehicles were produced. Each of which had a lead battery inside them. And not forgetting around 8 million of these were EVs which have a back-up lead battery for safety systems and to power in-car entertainment systems.

Lead-acid batteries need replacing every few years. Given an average vehicle life of 13-14 years, last year’s 80 million vehicles will still be requiring replacement batteries in the early part of the next decade.

Lead’s usage profile is one of unexciting but steady growth, driven by the need to meet demand for replacement batteries in an ever-growing global passenger fleet.

Given this ill-informed audience that battery manufacturers of all chemistries are pinning their futures on, their disappointing level of EV awareness is frightening

And away from the exuberants and the hair and sackcloth brigage in yet another corner are the steady-state analysts. These argue that the higher charges for commodities will simply mean that the price of batteries goes up. But not by that much either. They argue, with some reason, that the cost of batteries had reached impossibly cheap levels and that the low cost of so much involved with — which has now been incorporated to some extent in all the traditional carriers — needed to be modified.

So recommendations for the future?

Yes, the economic downturn will inevitably bite. Some projects will be delayed but only for a while. Car sales will struggle again for a while. But our marketing spend should be up, not frozen. There's a whole world of business opening up elsewhere. Our feature in this issue on Africa shows a whole continent waiting to do buiness.

Mike Halls, Editor-in-Chief

Ecobat said on October 3 Carole Chichester had been appointed chief accounting officer — one of a series of recent appointments announced by the lead battery recycling group.

Chichester was most recently executive global controller for oil field services with the Baker Hughes company in Texas, where she over saw the financials of the $10 billion revenue business and its nine global product lines.

Chichester reports to new chief financial officer Lloyd McGuire, whose appointment was announced on September 19.

McGuire, who was most recently a corporate finance and restructuring partner at FTI Consulting, interned with The Blackstone Group’s GSO Capital Partners after serving on ac

tive duty in the US Marine Corps as a judge advocate.

In the military, he focused on litigation and was deployed to Afghanistan with an infantry bat talion, acting as legal adviser to the commanding officer on matters including fiscal law, investigations, detainee operations, and the law of war.

Other appointments include that of Erich Esser as MD of Ecobat Re sources Germany/Austria, who has been in the post on an interim basis since June. His official appointment was announced on September 16 and he will continue as MD of the company’s polypropylene division.

Esser joined Ecobat in December 2021 as MD of plastics resources, having spent more than 25 years

Antony Parulian, former VP of sales and marketing at Arbin Instruments, has joined Californiaheadquartered Keysight Technologies as Americas e-mobility and energy storage business development manager and sales specialist.

Parulian announced the move in a LinkedIn post in August and praised

former co-workers at Arbin for their support during his time at the battery testing equipment specialist.

Parulian said his new job at the electronics testing, measurement equipment and software company was “an excellent opportunity for me to broaden my horizons and grow in my profession”.

in the automotive and chemical industries.

Meanwhile, Julie Gillespie has been appointed finance director for North America, the company said on September 14.

Gillespie joined Ecobat in August 2017 as director of group financial accounting and external reporting before being promoted to group controller in 2019.

gies, including renewable energy, to help meet green house gas emissions targets in territories National Grid serves.

The president of National Grid’s New York business, Rudolph Wynter, has been appointed a class I direc tor of the board of lead and lithium batteries firm EnerSys, the company an nounced on August 1.

Wynter leads National Grid’s regulated energy de livery portfolio, providing electricity and natural gas services across New York State.

In his more than 30-year tenure at National Grid and its legacy companies, Wynt er has worked in senior and operational roles including COO of its wholesale net works and capital delivery business.

His experience includes focusing on grid resilience and clean energy technolo

EnerSys president and CEO David Shaffer said: “The breadth and depth of Rudy’s experience in the utility industry, particularly with clean energy and elec tric grid resilience will pro vide immeasurable value to the EnerSys leadership team.”

Arthur Katsaros, the in dependent non-executive chair of the EnerSys board, said Wynter’s appointment “enhances the strength of the board and furthers our refreshment and succession planning initiatives at the board level”.

Wynter is a member of the American Society of Mechanical Engineers, the American Gas Association and the Edison Electric In stitute, and also works on the boards of GridWise Alliance, the Partnership for New York City and the American Gas Associa tion.

Swiss energy storage group Leclanché said on October 31 that Anil Srivastava had stepped down as CEO.

Srivastava decided to leave following the ap pointment of a new board on 30 September and a subsequent management restructure, with which he had been involved, the company said.

Leclanché is now man aged by Pierre Blanc as group CEO and chief tech nology and industrial offi cer of Leclanché e-Mobili ty, with Phil Broad as CEO of Leclanché E-Mobility and chief sales and devel opment officer of Leclan ché.

Srivastava said: “It's time for a change. When I de cided to accept this posi tion eight years ago, it was because of the reputation and the exceptional poten tial of Leclanché.

“I am proud of the work I have done together with all employees. I wish the com pany all the success as it at tains profitable growth.”

Board chairman Alexan der Rhea said Srivastava, together with other senior executives, had “greatly expanded” the firm’s cus tomer base.

Rhea said: “Now it is time for Leclanché to un leash all its stored value. We are certain that this new management struc ture will impulse a new dynamic to the company.”

Blanc and Broad are now members of the group’s executive committee, along with CFO Pasquale Foglia.

Blanc joined Leclanché in March 2000 as a chemi cal engineer in its alkaline battery division, where he was responsible for the development and manu

facturing of battery cells for major brands includ ing Varta, Energizer and Panasonic.

Blanc was appointed CTO in 2006, where he oversaw R&D and indus trialization of the compa ny’s lithium-ion business. Leclanché said he led the introduction of novel and unique production pro cesses, particularly for wa ter-based manufacturing for lithium-ion batteries.

Broad joined Leclanché in 2018 and was appoint ed executive vice president of e-Mobility Solutions in March 2019. His previ ous position at Leclanché was vice president of the commercial vehicles unit, leading application engi neering, programme man agement and sales.

Leclanché announced on August 9 that it had ap pointed Pasquale Foglia as

acting CFO — the firm’s third interim CFO in re cent months.

That announcement came after the company revealed on June 6 that it had negotiated conditions with “different stakehold ers” to secure Sfr15 mil lion ($15.5 million) fund ing for near-term liquidity requirements and could remain a going concern until June 2023.

Leclanché had warned on February 24 that li quidity remained tight ahead of a merger of its e-mobility business with a US-listed special pur pose acquisition company (SPAC).

Leclanché said then it had secured a Sfr20.4 mil lion bridging loan from the SPAC’s largest share holder, SEFAM, to run its operations ahead of the merger.

American Manganese announced the death on September 21 of its founder, president and CEO Larry Reaugh.

Reaugh was an accomplished and well-known figure in the mining industry, having successfully devel oped several mineral properties.

He was also instrumental in turning the company’s proprietary hydrometallurgical process from a manganese recovery technique to an innovative battery recyclingupcycling solution, known as the RecycLiCo patented process.

CTO Zarko Meseldzija was appointed as interim CEO by the American Manganese board as of September 21, with Paul Hilde brand becoming interim chairman and CFO Shaheem Ali appointed as a director.

Meseldzija said Reaugh had been “a great leader and mentor to many of us.

“Under his direction, we have grown as a pioneer in the lithium ion battery recycling industry and our team stands ready to ensure that his vision is carried out, and that the interests of the company’s shareholders are looked after.

“Larry will be sincerely missed, and we extend our deepest con dolences to the entire Reaugh family.”

On October 3, Meseldzija said the company had formally changed its name to RecycLiCo Battery Materials, following ap proval by Canada’s TSX Venture Exchange.

Meseldzija said: “In light of the immense global applications for our patented technology, it was evident that these applications were much broader than mining manganese, as our previous name suggested.

“As a battery materials compa ny, we focus on recycling lithium-

ion battery waste and upcycling it into battery-ready materials … our mission is to provide a circular solution that bridges the gaps in today’s segmented battery supply chain.”

RecycLiCo and R&D partner Kemetco Research had already announced that the leach sec tion of its technology defining demonstration plant project had achieved over 99% extraction of lithium, nickel, cobalt, and man ganese from lithium ion battery production scrap.

A detailed cost analysis of the economics of such processes is still needed. The crucial issue is still whether the cost of the recycling provides profits from the sale of the raw materials — as in lead battery recycling — or that the process is inherently uneco nomical and processing requires tolls and charges to be levied.

All-solid-state batter ies developer Solid Power said on November 29 that CEO, board member and co-founder, Douglas Camp bell, had decided to retire effective immediately.

David Jansen (pictured), the company’s chair and president, has been ap pointed as interim CEO while the firm looks for a permanent replacement.

Solid Power independent director John Stephens said: “Since co-founding

Solid Power in 2011, Doug has served as a passionate entrepreneur, beginning with the company’s earliest stages as a spin-off from the University of Colorado.”

Stephens said Campbell and the board had decided new leadership was needed “as we enter the next phase in our evolution and build on our momentum as a newly public company”.

Campbell said he planned to spend more time with his family and pursuing other interests while “continuing as a significant shareholder of the company for years to come and watching the growth and progress that I know the talented team at

Fluence Energy, the en ergy storage products and services firm, revealed in early September that

Manavendra Sial — bet ter known as Manu — would succeed Dennis Fehr as CFO, effective by the middle of the month. Fehr will work in the in terim as a non-executive employee until he left Flu ence on October 15.

Over the past four years, Sial has been EVP and chief financial officer for SunPower Corporation where he headed up Sun Power’s treasury, project finance, investor relations,

financial planning, and ac counting organizations.

From 2015 to 2018, Sial worked as EVP and CFO of Vectra, a portfolio company of funds man aged by affiliates of Apol lo Global Management.

Before this Sial held var ious global finance and operations senior posi tions with SunEdison from 2011 to 2015. Be fore that, Sial spent 11 years with General Elec tric.

Solid Power will continue to make”.

Solid Power announced the delivery of its first solidstate lithium metal cells in October 2020.

The pouch cells, which had a solid sulfide electro lyte, were manufactured using the company’s rollto-roll pilot line and were destined for the EV sector.

Solid Power has partner ships with both BMW and Ford to jointly develop allsolid-state batteries.

Highview Power has appointed Sandra Redding as general counsel, the company announced on November 23.

CEO Rupert Pearce said Redding’s experience would be a huge asset in expanding and transforming the company “from a category disruptor to global market leader”.

Redding has more than 20 years of international experience across a number of corporates in the energy sector, and in a wide range of cultural and

political environments. She most recently served as general counsel for Seadrill and prior to that as general counsel of the Dubai government-owned Dragon Oil.

She has also held several in-house legal roles within the RWE, Gaz de France and National Grid groups.

In May 2021, Highview announced it was developing up to 2GWh of long duration, liquid air energy storage projects across Spain for an estimated investment of around $1 billion.

10.

The company said Dennis succeeded Matthew Taylor, who has retired.

Dennis, whose career to date spans the industrial sector including manufac turing, engineering and waste management, is a non-executive director at Recyclus.

He was most recently MD at Pyrenergy — a UK-based energy-from-waste and re cycling business that recov ers energy and materials from hydrocarbon waste that would otherwise be destined for landfill, incin eration or export.

Jo Dennis appointed as MD of Recyclus groupManavendra Sial

Plans by ENTEK to ramp up its production of electric vehicle battery separators have been given a boost af ter the company revealed it had secured a tranche of un disclosed US federal fund ing to support the country’s domestic battery materials supply chain.

An ENTEK spokesperson told Energy Storage Journal that the group was among the first to be selected for project funding under the Bipartisan Infrastructure

Law.

The funding, announced by the Department of En ergy on October 19, is the first phase of more than $7 billion in total provided by the infrastructure law, EN TEK said.

It will support the compa ny’s investment in projects including plans unveiled on April 26 to build two “gigascale” EV battery separator plants in the US.

Kimberly Medford, presi dent of ENTEK Manufac

turing, said: “This support for our domestic supply chain and investment in our US manufacturing in frastructure ensures that we are prepared to supply criti cal US produced compo nents to US lithium battery manufactures.”

Medford took part in a White House event on No vember 2 in support of the Talent Pipeline Challenge — a US government-backed initiative encouraging in vestment in domestic infra

India’s Exide Industries for mally launched construc tion of its lithium ion cell gigafactory in Bengaluru on September 27 — but has pledged to maintain its pro duction and development of lead batteries.

The greenfield project was announced by Exide in March, when it said it had agreed a long-term techni cal collaboration deal with China’s SVOLT Energy Technology.

Managing director and CEO Subir Chakraborty told dignitaries at a cer emony marking the start of work on the new plant:

“While we continue to maintain our leading posi tion in the lead acid battery market of the past 75 years, we have simultaneously taken significant steps to strengthen our position in the emerging li-ion mar ket.”

The first phase of the fa cility is to be operational by the end of 2024.

Chakraborty said the project would not have been possible without the strong support of the Kar nataka state government.

Karnataka’s chief minis ter Basavaraj Bommai and skills development minis

ter Ashwath Narayan were among those attending the ceremony.

The new plant will span more than 80 acres of land and manufacturing batter ies for electric vehicles and other industrial uses.

SVOLT, in addition to providing the technology for the plant, is provid ing unspecified support for construction on a turnkey basis.

Exide is also setting up a research and development laboratory and pilot manu facturing line to support new product development for the Indian market.

Indian lead major Amara Raja Batteries announced on August 30 the comple tion of its $5 million invest ment in the Bangalore-based start-up known as Log 9 Materials.

Amara Raja had said in August 2021 that its deci sion to invest in Log 9 — in which it now has a stake of just over 15% — would be “pivotal” for the develop ment of EV two-wheelers and EV three-wheelers.

Log 9 CEO Akshay Sing

hal told Energy Storage Journal in October 2017 that the firm had made a technological breakthrough using graphene to improve the capacity of lead batter ies.

The company is also de veloping advanced battery and fuel technologies for electric vehicles and rapid charging battery packs.

Amara Raja has made a series of announcements in recent months to reaffirm the firm’s intention to grow

beyond its lead-acid roots to other areas of India’s EV and energy storage sectors.

On May 20, the company pledged to fast track its de velopment of a customer qualification plant for lithi um cells.

Chairman and MD Jay adev Galla said last July that the company was also look ing into the possibility of expanding its lead batteries business through greenfield investments or acquisitions in the Indian-Ocean rim.

structure jobs.

ENTEK said the event was an opportunity for the US-headquartered battery separators group to show case the firm’s commitment to supporting federal plans to expand its electric vehicle and energy storage battery supply chain.

Medford joined employ ers, training providers and state and local government leaders for the event.

Clarios International, which pulled out of a planned initial public of fering last July, is “con tinuing to assess” market conditions for the move, Energy Storage Journal was told.

A spokesperson for the world’s largest manufac turer of automotive bat teries said on September 27: “Our focus remains on advancing our strategic priorities and delivering on our financial commitments to continue to improve our market leading business.

“We have the luxury of being a high-quality com pany with strong support from our sponsors and a great long-term future ahead. This affords us flex ibility for when the market conditions are right.”

Clarios and its Brook field/CDPQ owners is committed to keeping the market informed, the spokesperson said.

The lead battery giant’s long-awaited IPO, which had been predicted in the market to raise some $1.7 billion, was pulled on July 29, 2021 in a move the company said was prompted by market volatility.

The cancellation coincided with a fall in momentum of the year’s record spree to that date of IPOs in the US.

Australia-based Volt Re sources has formed a new business unit through which it is supplying graphite prod ucts for lead acid and lithium battery markets in the US, the company announced on October 4.

The new unit, Volt En ergy Materials, will provide products including coated spheronised purified graph ite (CSPG) for lithium ion batteries and graphite ex pander additives for negative electrodes for lead batteries, the company said in an Aus tralian Securities Exchange announcement.

Volt Resources MD Trevor Matthews said the move

would boost the company’s partnerships with key in dustry players in the US in cluding batteries developer Apollo Energy Systems and Energy Supply Developers (ESD) — which was estab lished in March 2021 to help secure a battery materials supply chain for Li-ion bat teries.

In February, Volt was se lected as the CSPG supplier for ESD’s planned 50GWh lithium battery production facility, which is to start op erations in the US Midwest by 2025.

Tests by Apollo Energy have shown that lead bat tery cells containing Volt’s

graphite have “consistently delivered higher capacity” than those whose expander formulation was based on traditional carbon materials, Volt claimed.

The company said its ultrahigh purity graphite product used for lead acid battery expanders is a by-product of a larger downstream process for manufacturing spherical graphite or BAM for lithium ion battery anodes.

Meanwhile, Volt said the development of non-spheri cal graphite products for the alkaline and lead acid bat tery markets will improve the economics of its planned CSPG manufacturing fa

cilities in the US and Europe — using flake graphite pro duction capability from the Zavalievsky graphite mine in Ukraine, together with future production from the Bunyu Graphite Project in Tanzania.

Volt said in June it had re ceived commitments to raise $2 million in a share place ment to help restart graphite production in Ukraine.

On September 6, Volt said graphite produced at Zava lievsky during 14 days of Au gust was at an average daily production rate of 60.5 tonnes. Despite disruptions during recommissioning, production at Zavalievsky, 280km south of Kyiv, is on track to meet its fiscal 2023 forecast of 8,000-9,000 tonnes, the company said.

Lead batteries continue to dominate India’s electric ve hicles sector, but lithium is gradually increasing its mar ket share, the India Energy Storage Alliance (IESA) said on August 23.

Lead acid batteries account ed for 81% of the market in 2021, according to the IESA’s India Electric Vehicle and Component Market Over view Report 2021-2030.

The IESA said the lead bat teries share was the result of continuing high demand for electric rickshaws.

However, lithium is eating into market and in 2021, for the first time, demand for these batteries exceeded the 1GWh threshold, the report said.

Among lithium ion chemis tries, lithium iron phosphate is the preferred option for electric three- and four-wheel ers, while nickel manganese cobalt is the preferred option for electric two-wheeled ve hicles and e-buses.

The national EV market is set to expand at a compound annual growth rate of 49% between 2021 and 2030, according to the report’s business as usual scenario — reaching annual sales of

17 million units by that time, with nearly 15 million of those projected to be electric two-wheelers.

Meanwhile, annual de mand for batteries up to 2030 is anticipated to in crease at a CAGR of 41%, reaching 142GWh.

In April, ENTEK said it was investing to expand its

manufacturing of AGM bat tery separators to India and the US, in response to ex panding demand for energy storage solutions for invert ers, industrial applications and EVs.

In July, the boss of Indiabased Amara Raja Batteries said his company was look ing into the possibility of ex

pansion through greenfield investments or acquisitions for its lead battery business in the Indian-Ocean rim.

Chairman and MD Jay adev Galla said there would always be a place for lead battery technology — and warned that the rising cost of lithium batteries for EVs pre sented new challenges.

The Sovema Group has been acquired by Ger man metal-forming group Schuler for an undisclosed sum, the companies an nounced on August 23.

A Schuler spokesper son told Energy Storage Journal the deal was not subject to any relevant regulatory decisions and was closed at the end of September.

The acquisition included both the lithium ion and the lead acid battery parts of Italy-based Sovema’s business — which will “both be continued”, the spokesperson said.

“We consider it a great strategic fit as both companies’ technological

capabilities are fully com plimentary and gigafacto ries are about to come into play soon.”

The acquisition covered all Sovema entities includ ing Solith, which provides equipment for lithium ion cell and module produc tion, Sovel — high-perfor mance formation systems for lead and lithium storage technologies — and USbased battery testing equip ment company Bitrode.

Sovema general manager Massimiliano Ianniello said the deal would ensure the group could “play a major role in the gigafactory chal lenge”.

“So far, our size allowed us to serve our custom

ers with high quality and customization. Now, as part of Schuler, we will finally be able to reach the volumes required by the massive demand for battery manufacturing equipment in Europe and beyond.”

Bitrode president and CEO Cyril Narishkin said the takeover would help the firm “accelerate new product offerings and help Bitrode reach its techno logical potential”.

Sovema changed its name to Sovema Group in June 2017, in line with the lead battery equipment manu facturer’s expansion into making machinery for the lithium ion battery industry.

(TM)

(TM)

(TM)

(TM)

Floods that swept through Florida in the wake of Hurricane Ian created a “ticking timebomb” of fire-prone lithium EV bat teries, a top state official warned on October 10.

Florida has been reeling from devastation wrought by the category four hur ricane, which first made landfall on September 28.

State chief financial offi cer and fire marshal, Jim my Patronis urged federal transport safety chiefs to urgently assess fire risks associated with saltwater on EVs, saying firefighters need more support to deal with an inevitable increase in fires associated with

electric-powered vehicles.

Patronis said in a letter to the National Highway Traffic Safety Administra tion (NHTSA): “I joined North Collier Fire Rescue to assess response activi ties related to Hurricane Ian and saw with my own eyes an EV continuously ignite, and reignite, as fire teams doused the vehicle with tens of thousands of gallons of water.

“Subsequently, I was in formed by the fire depart ment that the vehicle once again reignited when it was loaded onto the tow truck. Based on my conversations with area firefighters, this is not an isolated incident.

I am concerned that we may have a ticking time bomb on our hands.”

Patronis said much of the existing federal guid ance on disaster response involving submerged ve hicles does not account for the risks associated with the exposure of lithium car batteries to saltwater.

He wants the NHTSA to require EV manufactur ers of the dangers related to vehicles impacted by storm surge, and said his office would distribute that information in Florida as soon as it became avail able.

The phenomenon of EVs catching fire after expo

sure to tropical storms was first noticed in Novem ber 2012 when 16 Fisker Karma vehicles caught fire and burned to the ground after being submerged by saltwater from Hurricane Sandy’s storm surge. Each parked car in Port New ark, New Jersey was worth around $100,000 each and provoked one of the earli est debates on the electrical safety of EVs.

Patronis has also asked for guidance on whether personal protective equip ment used by emergency rescue teams effectively protects first responders from poisonous gases asso ciated with EV fires.

A rulebook that aims to shed light on the true levels of greenhouse gas emissions involved in the battery materials supply chain for electric vehicles — and improve confidence in the environmental credentials of transport systems — has been made public by the Global Bat tery Alliance.

The move comes as governments scramble to tackle shortages in sup plies of key EV battery materials — amid warn ings by analysts that more carbon-intensive mining is needed to supply lithium ion battery manufacturers because recycling alone cannot meet demand.

The GBA acknowledges that the battery value

chain is “still relatively opaque and associated with issues such as high CO2 emissions and envi ronmental degradation”.

However, the GBA says the release of the first public version of its Greenhouse Gas Rule book, compiled with risk management consultancy Sphera, aims to improve the calculation and track ing of the greenhouse gas footprint of lithiumion batteries in electric vehicles.

GBA co-chair and CEO of Germany-based chemi cals group BASF, Martin Brudermüller, said the rulebook was needed to foster greater transparency and give industry players the means to “decisively

drive down the environ mental impact of their processes” globally.

GBA board member Julia Poliscanova, who is also senior director for vehicles and e-mobility at the EU’s clean transport campaign organization, Transport & Environment, said: “Sus tainably produced batter ies are essential to wean the world off fossil fuels. But regulators and society at large expect to know where the materials come from, how the batteries were made and how many carbon emissions they have released.

“The rulebook will en sure that data is gathered consistently so we can have confidence in the claims made by global manufac

turers.”

The GBA, which has its roots as an initiative launched in 2017 by the World Economic Forum, comprises 110 internation al organizations represent ing industry, academia and governments dedicated to the sustainable devel opment of battery tech nologies through respon sible trade and supporting global anti-corruption practices.

East Penn Manufacturing president and CEO Chris Pruitt laid bare many of the myths that surround the debate over lead and lithium batteries at the European Lead Battery Conference in France last month (see elsewhere in this issue).

China’s Contemporary Amperex Technology has held a ground-breaking ceremony for a RMB14 billion ($1.9 billion) battery manufacturing complex in the country’s Henan province, the company announced on September 28.

CATL did not disclose the expected manufactur ing capacity of the plant, to be built in the indus trial city of Luoyang, but said it would enhance its market coverage in China’s central and west ern regions.

The project has the support of Luoyang’s municipal authorities, with which CATL is working to promote “the ecological construction of the new energy indus try”, including battery production, the company said.

The announcement was the latest move by CATL to ramp up its domi nance of battery manu facturing for the EV and energy storage systems

markets.

On August 12, the company confirmed plans to invest more than €7bn ($7.1 billion) in building a 100GWh lithium ion battery production plant on a greenfield site in Hun gary — its second such facility in Europe.

CATL said that, subject to shareholder approval, initial construction of the Debrecen plant would start later this year.

Last month, CATL an nounced that cobalt and lithium used in a battery cells supply deal with Germany’s BMW would be sourced from “certi fied mines”.

The move to head-off potential criticism over sustainability and human rights issues came on the same day the companies announced a multi-year agreement on the supply of next-generation cylindrical battery cells to power BMW’s ‘Neue Klasse’ electric vehicles starting from 2025.

Electrovaya is to build its first US lithium ion bat tery gigafactory at an esti mated cost of $75 million in the state of New York, the company announced on October 3.

The 137,000 ft2 facility near Jamestown will add to the firm’s existing Cana dian facilities and produce batteries for a range of products including electric trucks and buses.

The Empire State Devel opment agency is provid ing up to $4 million of tax credits to support the proj ect at the site of a former electronics manufacturing plant. Electrovaya said the facility is also set to benefit

from additional federal and state funding.

CEO Raj Das Gupta said the gigafactory would open in phases, starting late 2023 and eventually produce more than 1GWh of batter ies annually using “100% renewable energy”.

The plant will help Elec trovaya to increase manu facturing capacity, improve supply chain security and overall gross margins, Das Gupta said.

State governor Kathy Ho chul said the project would create up to 250 jobs and support New York’s plans to establish a national hub for battery innovation and manufacturing.

Indonesia is considering imposing an export tax on nickel — a move that could further ratchet up costs of a key material for electric ve hicle batteries, the country’s president confirmed on Au gust 18.

Joko Widodo told Bloom berg News the levy was under consideration by the government.

Widodo had said in a speech on August 16 that Indonesia should capital ize on its position as a “key producer in the global lithi um battery supply chain” to boost domestic investments in battery production and clean energy technologies.

According to the Inter national Energy Agency’s (IEA) Southeast Asia En ergy Outlook 2022, pub lished in May, Indonesia and the Philippines are the two largest nickel produc ers in the world.

“Nickel supply chains are likely to be significantly af fected by policy develop

ments and other events in Indonesia,” the IEA said.

Meanwhile, Indonesia and the Philippines’ share of global production has risen considerably since 2010, from 25% to around 50% in 2021. The IEA said this share is set to expand further in the coming years, as they are expected to be responsible for around 70% of global production growth over the period to 2025.

Energy Storage Journal reported in February that Taiwan-based Foxconn, also known as the Hon Hai Technology Group, was in vesting in producing elec tric vehicle batteries and energy storage systems in Indonesia, under a memo randum of understanding signed with Indonesia’s Ministry of Investment, state investment agency BKPM, energy firm Indika Energy and battery-swap ping technology company, Gogoro.

Japan’s government un veiled targets on August 31 to expand the annual domestic production of electric vehicle and en ergy storage batteries to 150GWh by 2030.

Ministers also want to see 30,000 workers trained up to support the country’s fu ture battery manufacturing industry and supply chains.

The government said it need new educational pro grams introduced at tech nical institutions to help attract a new generation of workers to the batteries sector.

Japan’s Ministry of Econ omy, Trade and Industry (Meti) said a panel of ex perts would have the task of formulating a national battery strategy, as the country launches a fresh push to counter strong

competition from bat tery manufacturing rivals across Asia.

Meti said the goal in cluded achieving “fullscale commercialization of all-solid-state batteries by around 2030”.

The panel will work with battery industry leaders in Japan to agree on a specific plan by the end of March 2023.

The ministry said the gov ernment would step up sup port for Japanese companies that can secure battery ma terials supply chains such as forging alliances and part nerships with mineral-rich countries worldwide.

But Meti said it would be up to private Japanese com panies to also raise capital on the markets to take part in large-scale investments in battery projects overseas.

Strategic Power Projects said on October 3 it had received planning permission for a 200MW battery storage sys tem in Ireland, amid fears of looming electricity black outs.

The application for the €140 million ($136 million) Dunnstown project, ap proved by national planning authority An Bord Pleanála, is the country’s single largest battery planning application to date, Strategic Power said.

Managing director Paul Carson said: “Security of supply and electricity black outs have sadly become pre dictable headlines in Irish news titles, north and south.

“Battery-based energy storage is part of the solu tion. It can be quickly de veloped, is very cost effec tive and is the backbone of modern, resilient, and decar

bonised energy systems.”

Carson said the new fa cility “won’t solve Ireland’s storage problems on its own, but if the positive decision is a sign of things to come, then that is very positive news for the people of Ireland”.

Energy Storage Ireland head Bobby Smith, whose organization represents Ire land and Northern Ireland’s energy storage industry, said: “The invasion of Ukraine and our dependency on im ported fossil-fuels means electricity consumers have seen dizzying increases in their bills and the worst may yet be to come. Energy stor age allows us to fully har ness our renewable energy resources and replace expen sive, polluting, fossil fuels.”

Last October, UK battery storage operator Gresham House announced a partner

ship with Strategic Power to develop a solar and battery storage pipeline across Ire land with a combined capac

Liberty Energy said on September 6 it had made an undisclosed investment in sodium ion battery tech developer Natron Energy.

Natron plans to use the funds to speed up production of its Prussian blue sodium ion electrodes chemistry, towards launching what it described as mass production of sodium ion batteries.

ity of more than 1GW.

Strategic Power said its BESS projects all utilize lithi um ion battery technology.

On May 4, Natron said it was teaming up with lead batteries giant Clarios to manufacture what they said would be the world’s first mass-produced sodium ion batteries.

Freyr Battery said on August 30 it had signed a binding agreement to supply 38GWh of LFP battery cells to Japan’s Nidec Corporation between 2025 and 2030.

Norwegian prime minister Jonas Gahr Støre has laid the cornerstone of Morrow Battery’s battery cells gi gafactory on the country’s south coast in a ceremony on September 26.

Støre said Battery Fac tory 1, under construction in Arendal, was essential to government efforts to make Norway an “attractive host country for sustainable and profitable activity along the entire battery value chain”.

Morrow has teamed up with Siva — the Industrial Development Corporation of Norway — in establish ing a joint company to build the 30,000m² plant in four phases with construction company Veidekke, at a cost of NOK400 million ($38 million).

The factory will have an annual production capac ity of 1GWh of battery cells when it starts up, with total capacity planned to reach 43GWh on completion of all four construction phases. The complete gigafactory

is expected to be ready by 2028.

Morrow’s batteries will use LNMO cathode mate rial, which it said eliminates the need for cobalt, reduces the use of nickel and lithium and maximizes use of “read ily available and manga nese”.

Morrow said on Septem ber 15 that Swiss tech group ABB had been chosen as a non-exclusive preferred supplier of technology for its gigafactory.

The firms signed two memorandum of under standing agreements, paving the way for ABB’s Energy Industries unit to use Mor row’s lithium batteries in energy systems for a range of applications and indus tries, including e-mobility, hydrogen, offshore wind, oil and gas and utilities.

ABB’s scope of supply may include electrical equip ment, automation, robotics, cyber security, security sys tems, and digitalization, Morrow said.

The two companies will also collaborate on projects to deploy sodium ion batteries in energy storage systems to provide backup power for Liberty’s electric pumping systems used by companies working in the oil and natural gas exploration and production sectors.

Liberty president Ron Gusek said: “The careful evaluation of sources of energy storage for our power-dense operations led our team to determine that Natron’s sodium ion batteries are a safe, costeffective solution that is already being utilized in industrial applications.”

Natron co-founder and CEO Colin Wessells said: “Our partnership with Liberty dramatically accelerates Natron’s expansion into oil and gas markets with the introduction of battery storage in the completion services industry.”

Natron claims its battery technology is ideally suited to support pressure pumping applications with highly variable power load requirements.

The sales deal is worth in excess of an estimated of $3 billion to Freyr from 2025 to 2030, based on projected raw material prices.

The cells will be produced at Freyr’s planned ‘Giga Arctic’ plant in Mo i Rana, Norway and the deal includes an option to “upsize” to 50GWh of cells during the period and to potentially expand supplies further beyond 2030.

The agreement builds on an earlier, conditional offtake agreement between the companies, for 31GWh of cells.

Freyr and Nidec have also entered into a joint venture agreement to develop, manufacture and sell energy storage systems using modules and packs produced by Freyr.

The partners said battery modules production is expected to be integrated into Freyr’s activities at the Giga Arctic plant.

Nidec is a leading manufacturer of highefficiency electric motors that is expanding its reach into the ESS market.

PM lays gigafactory cornerstone for Norway’s ‘battery future’

Published by India, Asia’s next regional superpower, is about to challenge China’s supremacy in economic growth, future investment and cutting edge energy storage technology and manufacture. Read more about, and be featured in, Batteries International’s special publication in our Battery World Series starting this January.

Batteries International is exploring how India is set to become the new world battery superpower.

Scan this qr code to contact Jade

To submit features, advertorials and artwork contact Jade: jade@batteriesinternational.com

Bringing the industry together www.batteriesinternational.com

An investigation has been launched into the cause of a Tesla Megapack bat tery fire at PG&E’s Moss Landing battery storage facility in California, the utility told Energy Storage Journal on September 28.

Tesla and PG&E is joint ly conducting the probe into the Elkhorn lithium ion battery plant fire, of which the utility said it became aware at the BESS at 1.30 am local time on September 20.

A spokesperson said safety systems worked as

designed when the fire was detected and automati cally disconnected the bat tery storage facility from the electrical grid.

A preliminary report filed with the California Public Utilities Commis sion said there were no in juries to onsite personnel and property damage to the battery was “expected to exceed $50,000”.

Elkhorn has multiple safety systems and proto cols in place for fire pre vention and mitigation including an incident com

China is preparing to un veil a raft of new measures to tighten regulations for electric vehicle battery recycling in the country, state media reported on September 16.

The government wants to “strengthen national and industrial standards” and promote “technologi cal breakthroughs in the dismantling and efficient recycling” of used batter ies, according to Ministry

of Industry and Informa tion Technology official, Huang Libin, as report ed by the Xinhua News Agency.

Huang said environmen tal protection and greater efficiency in the use of bat tery materials was key to “ensuring the sustainable development” of what China terms the new en ergy vehicles industry.

According to Huang, more than 190 businesses

mand centre at a “safe dis tance from the batteries”, the spokesperson said.

Tesla and PG&E broke ground for the 182.5MW/730MWh BESS plant on July 29, 2020. At that time, the partners said the Moss Landing facility would be the larg est utility-owned storage system of its kind in the world.

The development agree ment allowed Tesla to in crease the size even fur ther, to a total of 1GWh in total.

Finnish technology group Wärtsilä said on Septem ber 26 it had been select ed to supply two lithium iron phosphate BESS units for the Cayman Islands by the Caribbean Utilities Company (CUC) — the utility’s first energy storage facilities.

have established in excess of 10,000 EV battery re cycling collection points nationwide as of the end of last month.

Data released by the ministry on August 3 said China’s production of new energy vehicles increased by 120% in the first half of this year compared to the same period last year.

The data estimated that the country’s combined production of lithium ion batteries for the first half of the year exceeded 280GWh — a year-onyear increase of 150%.

Spain’s CEMA Baterías an nounced on September 19 that it had acquired an un disclosed “large stake” in solar-storage specialist AlgeBat.

A CEMA spokesperson told Energy Storage Jour nal the deal would expand the lead and lithium battery distribution firm’s market presence, in particular with opportunities to support projects combining solar power generation with bat tery storage.

Cádiz-based Alge-Bat spe cializes in the distribution and assembly of industrial solar installations through out western Andalusia.

CEMA founder and CEO Rafa Fernández said: “Our teams share the same vision and values and we can con tinue to learn a lot from each other, exchange knowledge and expand our frontiers.”

CEMA imports, exports and distributes battery brands from firms such as Monbat, Varta, Trojan and

US Battery.

In March, CEMA an nounced it had invested more than €1.5 million ($1.7 million) to build one of the biggest battery distribution centers in the Iberian region in Seville.

On completion, the center will cover an area of more than 6,000m2, with the capacity to house a total of between 225,000-500,000 lithium ion and lead batter ies arriving from Asia, Eu rope and the US.

Wärtsilä will deliver the 10MW/10MWh GridSolv Quantum systems under an engineering, procure ment, and construction contract, which it said would help CUC almost double its renewable energy capacity on Grand Cayman, the largest of the three Cayman Islands.

The energy storage systems should become operational in mid-2023.

Until now, the network connected electricity gen eration sources on Grand Cayman comprised 161MW of imported, diesel-fuelled genera tion and about 14MW of solar photovoltaic generation.

The island’s first com mercial solar project was commissioned in 2017.

CUC is a privatelyowned electricity gen eration, transmission and distribution utility that owns an installed generat ing capacity of 161MW. It is the only electric utility on Grand Cayman, which has a population of around 65,000.

CUC’s customer ser vices and technology VP Sacha Tibbetts said the BESS installation would be “a crucial step for CUC to integrate more renewable energy into the grid.

“Once this project is completed, we anticipate savings on fuel costs and improved reliability of services for our custom ers on Grand Cayman.”

LiNa Energy announced plans on September 28 to expand development of its solid-state sodium battery tech in India, including establishing a presence in the country in partnership with innovation support agency Social Alpha.

UK-based LiNa said it will work through Social Alpha’s ‘Clean Energy In ternational Incubation Center’, which is a joint

initiative of India’s govern ment and Tata Trusts and supported by organiza tions, companies and agen cies including India’s De partment of Biotechnology.

The battery tech devel oper plans to oversee bat tery cell testing and future pilot projects from India.

As part of the collabora tion, LiNa will establish a presence in India to opti mize its product develop

Italian energy tech compa ny Energy Dome is to con duct a feasibility study into the use of its ‘CO2 Battery’ at one or more renewable power project sites oper ated by Ørsted, the compa nies said on September 27.

The partners signed a memorandum of under standing that included an option to develop multiple 20MW/200MWh of Ener gy Dome’s energy storage units — potentially start ing construction of the first project at an undisclosed location in continental Eu rope in the second half of 2024.

The partnership follows Energy Dome’s June 8 an nouncement that it had completed its first commer cial demonstration facility at Sardinia, Italy, and was working on a new com mercial utility-scale facility in Sardinia, under a part nership with Italian energy company A2A.

Energy Dome says its technology “can be de ployed just about any where at less than half the cost of similar-sized lithium ion battery storage facilities and have superior round-trip efficiency, with no performance degrada tion over a 25-year life cycle”.

The company says its technology “does not in volve scarce and environ

mentally challenging raw materials like lithium.

Instead, it uses carbon di oxide and off-the-shelf components to charge and discharge power from four to 24 hours, enabling re newables to serve as fullydispatchable daily energy resources”.

CO2 is used in a closedloop charge/discharge cy cle as a storage agent, the firm says. Before charging, gaseous CO2 is kept in a large dome structure.

During charging, electric ity from the grid is used to compress the CO2 into liq uid form, creating stored heat in the process. Dur ing discharge, the liquid CO2 is evaporated using the stored heat, expanded back into its gaseous form, and used to drive a turbine to generate electricity.

Ørsted, majority owned by the Danish state, devel ops, builds and operates facilities including offshore and onshore wind farms, solar farms and energy storage plants.

Ørsted VP Europe On shore Kieran White said: “We consider the CO2 Battery solution to be a promising alternative for long-duration energy stor age. This technology could potentially help us decar bonize electrical grids by making renewable energy dispatchable.”

ment for the India market and oversee battery cell testing and future pilot projects.

LiNa started work on its battery technology in 2017 as a spin off from Lancaster University. The company says its batteries are ideally suited for the Indian market as they do not require liquid cooling or refrigeration systems that are typically needed for lithium ion systems in high temperatures.

The firm says the batter ies contain no “conven tional critical materials used for battery manufac

turing”, such as lithium, cobalt, manganese, or graphite.

Last December, UK sodi um-ion battery tech devel oper, Faradion, announced it was being acquired by a subsidiary of India’s Reli ance Industries, Reliance New Energy Solar, for £100 million ($135 mil lion).

Reliance said it would use Faradion’s tech at its proposed energy storage gigafactory in India — one of four such facilities in Jamnagar — for which the company announced plans in June 2021.

Materials technology and recycling group

Umicore announced the inauguration on Sep tember 21 of its cathode materials production plant in Poland.

Nysa will provide ad vanced cathode materi als for advanced lithium battery cell manufactur ers, with annual produc tion capacity set to reach 20GWh by the end of 2023 and 40GWh in 2024, with the poten tial to rise to more than 200GWh in the second half of the decade.

Meanwhile, Umicore reaffirmed plans to build a precursor and cathode active materials facility in Canada and to expand its existing ca pacity in Asia, to achieve a global production capacity of more than 400GWh by 2030.

Nysa is “fully pow ered” by renewable electricity generated by a nearby onshore wind farm, the company said.

Construction of the cathode materials plant began in 2019 and pro

duction started in July.

CEO Mathias Mie dreich said: “With this gigafactory, Umicore is leading the way in bat tery materials in Europe offering key ingredients for a responsible and sustainable value chain for electric transport.

“Its state-of-the-art product and process technologies comple ment our metals refining and cathode precursor production facility in Finland as well as our world-class R&D and pioneering battery recycling activities in Belgium.”

Umicore announced in June 2020 that a €125 million ($142 million) loan from the European Investment Bank would partly pay for its invest ment in the project.

On May 10 this year, Umicore formally opened a global R&D centre for cathode materials in South Korea — next to the company’s existing R&D and cathode materials production plants in Ch’onan.

UK legislators have been urged to back draft legis lative proposals that could see lithium ion battery storage sites designated as “hazardous” — and sub ject to tough new fire safe ty and planning controls.

If enacted, the propos als could influence future regulatory development in other areas of the world as investment in battery stor age projects gather pace, industry insiders have told Energy Storage Journal.

Former government minister Maria Miller told the House of Commons on September 7 that ex isting regulations did not require battery storage planning applications to be referred to the Environ ment Agency, the Health and Safety Executive or the fire service but, un der her proposals, these agencies would become statutory consultees in the planning process.

“We need lithium ion battery storage facilities,

but they must be seen cor rectly for what they are: highly complex, with the potential to create danger ous events and hazardous substances.”

Meanwhile, Miller urged the government to an nounce “an immediate review” of battery storage projects already grant ed planning permission, along with existing bat tery storage plants, “to en sure that they do not pose a threat to residents or the local environment”.

“We cannot allow lithi um ion battery storage fa cilities to continue as they are and become another legacy fire issue, with all the risks that that entails to the lives of the people we represent and the envi ronment we want to pro tect,” she said.

“Lithium ion batteries are “innocuous when they function normally, but if they fail and thermal run away occurs, there is a complex chemical reaction.

“The only way to stop a battery fire is to cool it down with a constant stream of water and wait for the fire to go out, which might take days, creating huge quantities of water containing high ly corrosive hydrofluoric acid and copper oxide — by-products of battery fires,” Miller said.

“These toxic chemicals cannot be allowed to seep into watercourses, because they would cause immense environmental damage.”

Miller said that while only a handful of battery storage facilities were al ready operating in the UK, more are scheduled to come on stream and 366 projects are under construction or awaiting planning permission.

She said the National Fire Chiefs Council was also calling for battery storage developers to en gage at the earliest oppor tunity with local fire and rescue services.

Iron-based flow battery company ESS is to deploy up to 200MW/2GWh of long duration energy storage in the US under a multi-year agreement announced on September 20 with the Sacramento Municipal Utility District (SMUD).

ESS said it will deliver a mix of its Energy Ware house and Energy Center systems to be integrated with SMUD’s grid, start ing in 2023.

ESS plans to set up fa cilities for battery system assembly, operations and maintenance support and project delivery in Sacramento, while also establishing a “center of

excellence” to train and expand the workforce for long duration energy storage technology in partnership with higher education institutions.

The facility will create “a state-wide skilled tal ent pool to help build and maintain California’s fastgrowing LDES resources”, ESS said.

An ESS spokesperson told Energy Storage Journal that exact details about the number of systems that will eventu ally be deployed will be announced later. However, the 2GWh figure takes into account the storage duration of the systems, which is four to 12 hours.

The addition of 2GWh of storage, when coupled with renewable energy sources, is equivalent to removing 284,000 tonnes of CO2 emissions per year and will provide enough energy to power 60,000 homes for 10 hours, ESS said.

SMUD’s CEO and general manager Paul Lau said: “Long-duration battery technologies move SMUD’s 2030 zero carbon plan forward by expand ing our dispatchable renewable energy resourc es and opening doors to innovation, job training and development oppor tunities in the green energy sectors.”

Miller also told MPs of international incidents involving lithium battery storage facilities, includ ing the April 2019 fire at Arizona Public Service’s 2MW/2MWh McMicken energy storage facility in Surprise, Arizona, where she said fire officers “suf fered life-changing injuries when the unit exploded”. That incident prompted concerns among regulators about the use of lithium batteries at utility scale.

In 2020, the state of New York amended building fire safety standards to in clude specific regulations relating to the design and installation of energy stor age systems. However, ac cording to the New York Solar Energy Industries As sociation, stringent fire de partment regulations still “prohibit the use of most energy storage systems”.

Miller said: “Thermal runaway events occur in almost every country in which battery storage is used. Even South Korea, a pioneer in the development of large-scale battery stor age, experienced 23 major battery fires between 2017 and 2019.”

Miller, the MP for Basing stoke, presented her pro posals under the 10-minute rule bill — which allows backbench MPs to make their case for new legisla tion.

She secured enough sup port among fellow MPs for the proposals to move ahead and to be given a sec ond reading in March 2023.

However, a spokesperson for Miller’s office told En ergy Storage Journal on September 22 that Miller was continuing to discuss draft legislation with col leagues, which could see the proposals raised in par liament again before the end of this year.

US Strategic Metals (USSM) said on Septem ber 15 it would break ground during the month on a pilot materials plant in Missouri as part of a bid to end US reliance on imports of critical supplies for electric vehicle batter ies.

USSM said the precursor cathode active material (PCAM) plant, combined with its existing hydro metallurgical processing (hydromet) facility at the site, would “close the loop on the production of criti cal minerals wholly within the US”.

When production starts at the site, US electric ve hicle manufacturers and battery companies “may no longer need to go out side the country — to

China or other countries — to get the critical mate rial needed to power their vehicles”, USSM said.

Jamil Jaffer, former se nior adviser to the Senate’s foreign relations commit tee and USSM advisory board member, said: “This new plant and its ability to provide cobalt, nickel, lithium, and other critical minerals.

"It has the potential to help break China’s stran glehold on the processing of these critical materials once and for all.”

The hydromet pilot plant has been in operation for more than two years, us ing what USSM said was proprietary American technology “to process a wide range of raw mate rials cleanly — including

material from used EV batteries, existing mine waste, and raw ore — to obtain new battery-grade metals and other strategic metals”.

A commercial-scale hy dromet plant is being built and should start up by the end of this year. USSM estimates that it could supply half of the total demand in the US for co balt and nickel sulfate by 2025, and “potentially the full US demand for cobalt sulfate” soon after.

Energy Storage Journal reported last March that the US Geological Survey had warned the country was still heavily depen dent on imports for key battery materials includ ing cobalt, lithium, man ganese and nickel.

Lithium battery systems manufacturer BMZ Group said on September 15 it in tended to acquire a stake in German plastics supplier Schütz Kunststofftechnik, in part to shore up its ma terials supply chain.

BMZ said it would act as a strategic investor in sup porting its supplier of bat tery cell holders.

The planned deal would give Schütz access to BMZ’s

network of clients, includ ing those in the energy stor age and e-mobility sectors.

Schütz is a longstanding supplier of cell holders and spacers installed in BMZ battery systems.

BMZ founder and CEO Sven Bauer said: “Procure ment bottlenecks, price de velopments and a shortage of skilled workers means we are in very challeng ing economic times. At the

same time, our market is a future-proof growth indus try.”

Strategic partnerships that enable BMZ to secure and expand its market pres ence “are only logical”, he said.

Schütz managing partner Michael Schütz said the in vestment deal was “a door opener for new sales mar kets, across industries and worldwide”

Japan-based NGK Insula tors said on September 12 it had received an order from Toho Gas for its so dium sulfur battery to pro vide grid electricity storage services.

The batteries have an out put of 11.4MW and a com bined capacity of 70MWh, which the ceramics group said is equivalent to one day of electrical power con sumption by about 6,000

average homes.

The batteries will be in stalled at Toho’s Tsu former liquefied natural gas plant. Construction is to start this October.

NGK did not disclose fi nancial details of the order, but said the batteries would be directly connected to an electrical power grid and intended to stabilize supply and demand.

The project aims to sup

port continued use of re newable power including solar and wind generation in the region, NGK said.

NAS batteries have been installed at more than 200 locations worldwide to date, NGK said.

In August, the company said it would deploy its batteries with solar at manufacturing sites in the country to reduce CO2 emissions.

Chinese battery giant CATL said on Septem ber 9 that cobalt and lithium used in a battery cells supply deal with Germany’s BMW will be sourced from “certified mines”.

The move to head-off potential criticism over sustainability and human rights issues came on the same day the companies announced a multi-year agreement on the sup ply of next-generation cylindrical battery cells to power BMW’s ‘Neue Klasse’ electric vehicles starting from 2025.

The partners said the agreement was based on their “shared com mitment to building a sustainable and in future circular battery value chain”.

CATL said it would “primarily use renewable energies and secondary materials for the produc tion of the high-perfor mance battery cells”.

According to the agreement, CATL will deliver the new cylindri cal battery cells, which come with a standard diameter of 46 millime tres and will be produced at two of CATL’s future battery plants in China and Europe, each with an annual capacity of up to 20GWh dedicated to BMW.

Joachim Post, BMW’s board of management member for purchasing and supplier network, said: “CATL is a strong, dedicated partner that values sustainable action just as much as we do. Our two companies will continue to lead the way in the future and are committed to sustainable, environmentally-respon sible practices.”

CATL, BMW gives ‘certified mines’ pledge

European lead battery ma jor Monbat is preparing to unveil a range of lead and lithium energy storage sys tems for the industrial and residential markets, the com pany said on November 24.

The commercial director of Monbat’s industrial batteries division, Bozhidar Nekeziev, said the company intended to promote a range of BESS systems for the residential and small business sectors, deploying “traditional, wellestablished lead-acid VRLA batteries” as well as lithium ion-based technologies.

Bulgaria-based Monbat says the move aims to sup

port “energy independence” and could encourage cus tomers to form their own power supply microgrids as Europe looks to ramp up renewable electricity genera tion.

Monbat said enabling homes and business to play an active role in the deploy ment of future energy sys tems would “change the philosophy” of electricity generation, distribution and consumption from a linear, ‘producer-distributor-con sumer’ relationship, “to an open system with complex and synergistic complemen tary roles and functions”.

Green Lithium, the chemi cal subsidiary of mining giant Trafigura, is to build the UK’s first large-scale lithium refinery at Teesside, in northern England.

At the same time Altilium Metals, a lithium recycling start-up, has also chosen Teesside for, it claims, the largest planned recycling facility for end-of-life EV batteries.

Green Lithium expects construction of its plant to take three years, create more than 1,000 jobs and to commission the plant in 2025. The refinery will provide 50,000 tonnes of low-carbon, battery-grade lithium chemicals annually.

Altilium has secured £3 million ($4.45 million) in government innovation awards and says the recy cling plant will process bat tery waste from 150,000 EVs a year — providing a sustainable supply of criti cal metals to support grow ing production of EVs.

Europe has an increasing appetite for ready sources of lithium. Some 89% of hard-rock lithium, for ex

ample, is processed in East Asia.

Green Lithium CEO Sean Sargent said: “Without a lo calized supply, Europe’s battery energy storage and automotive sectors will fail.

Green Lithium is seizing the opportunity presented by Europe’s future high de mand and potential future uncertainty in the Chinese market.”

Securing a “critical mass” of installed BESS capacity would support homes and businesses that use integrat ed systems in generating and consuming “more than half or almost all of their electric ity demand”, Monbat said.

The company did not say when it expected to launch its BESS products, but said it would offer options for out door or indoor modular sys

The BMW group said on November 25 it will build a high-voltage battery as sembly plant at its car manufacturing facility in Debrecen, Hungary, where it is investing more than €2 billion ($2 billion) by 2025.

Markus Fallböhmer, BMW’s senior VP of bat tery production said the ‘BMW iFactory’ would strengthen the “close link between battery assembly and vehicle production”.

In Debrecen, the nextgeneration round battery cells will be assembled into a battery housing, which is later integrated into the underbodies of vehicles,

tems, configured with lead acid or lithium batteries.

Last June, the senior man agement team of Monbat pledged to further develop operations after securing a 20.78% stake in the lead batteries group.

Also in June, Monbat and Advanced Battery Concepts announced plans to develop a commercial bipolar bat tery.

Fallböhmer said.

BMW said the official start of production for the sixth generation batteries will be in 2025 — in paral lel with the start of vehicle production.

All batteries for vehicles produced at Debrecen will be assembled on the plant site, which will span more than 140,000 m² in total.

In August Contemporary Amperex Technology (CATL), the Chinese lithium battery giant — and histori cally a key supplier to BMW — announced that it was planning to invest €7.34 bil lion ($7.5 billion) to build a 100 GWh EV battery plant in Debrecen.

CellCube said on Novem ber 23 it had agreed a deal with North Harbour Clean Energy to build a manufacturing and assem bly line for its vanadium redox flow batteries in Australia.

The first project under the manufacturing coop eration agreement will be to develop Australia’s biggest VRFB to date — a 4MW/16MWh based on the proprietary technol ogy of CellCube brand owner Enerox.

CellCube and North

Harbour will also con duct a feasibility study and work towards a final investment decision on a 50-50 joint venture to manufacture VRFBs in Australia.

The partners said North Harbour, which is backed by Australia superannua tion fund Aware Super, has already secured “a large project pipeline to include deployments of VRFBs”.

“We are excited to bring manufacturing of this Australian-invented and

critical energy storage technology to Australia with our strategic partner

CellCube”, said North Harbour MD and founder Tony Schultz.

Schultz said the partners will also “collectively review and select the best site to deliver initial annual production capacity of at least 40MW/160MWh, with a target of 1,000MW/8,000MWh per year and creating more than 200 new jobs in the short term.”

The US Department of En ergy said on November 16 it was allocating nearly $74 million in funding for 10 projects that are developing electric vehicle battery recy cling and reuse technologies.

The DoE said the allo cation would come from funds announced under the Bipartisan Infrastructure Law and would support projects leading to seconduse scale-up demonstrations that integrate end-of-life EV

batteries into secondary ap plications.

According to the US gov ernment, more than 1.2 mil lion EVs have been sold in the US since Joe Biden be came president in January 2021— more than tripling the number on the road be fore he took office.

With demand for criti cal battery minerals, such as lithium and graphite, projected to increase by as much as 4,000% in the

coming decades, this latest round of funding supports the recycling and reuse seg ment of the domestic bat tery supply chain, the DoE said.

In October ENTEK, lead and lithium battery separa tor manufacturer an nounced it planned to ramp up its production of EV bat tery separators were among the first to be selected for project funding under the infrastructure law.

US energy storage operator and developer Jupiter Pow er said on November 15 it had been acquired by a business unit of global fund manager BlackRock for an undisclosed sum.

Jupiter’s owners, private equity firm EnCap Invest ments, said the sale through the EnCap Energy Transi tion Fund I (EETF I) with co-investment partners Yor ktown Partners and Mercu ria Energy, should close be fore the end of 2022.

Jupiter, founded in 2017, owns a 655MWh BESS fleet in Texas, has another 340MWh of new projects in or “near” construction — including its first project in California — and a pipeline of more than 11,000MW of other projects it says are in active development.

Earlier this year, Jupiter closed a stand-alone stor age portfolio debt financing of its operating units and announced a collaboration to secure 2,400MWh of battery storage systems for projects slated for 20242025.

EnCap was an early in vestor in Jupiter. The sale to BlackRock’s Diversified In frastructure business, part of BlackRock Alternatives, is the second exit transac tion by EnCap’s $1.2 bil lion EETF I.

In addition to Jupiter,

EETF I has backed a range of renewable power and battery storage companies.

BlackRock’s acquisition follows its announcement on August 16 that it was in jecting A$1 billion ($700

million) in capital to sup port the roll-out of 1GW of battery storage projects across Australia, as part of its purchase of Melbournebased renewables developer Akaysha Energy.

Freyr Battery has bought a site in the US state of Georgia to build its planned ‘Giga America’ battery cells manufactur ing plant, the company said on November 11.

Norway-based Freyr said the initial projected capital cost of the first phase of the Bridgeport Industrial Park plant was $1.7 billion.

The first phase of the project will have an an nual production capacity of around 34GWh.