No Steam Required.Curing

Accelerate TTBLS Crystal Growth with Less Time and Energy Use

Improve your product AND your bottom line. Treated SureCure is a fundamentally better way to create TTBLS crystals, with more uniformity and more efficiency in, both, time and energy use, compared to steam curing and other methods. Battery manufacturing and performance will benefit from tested and proven enhancements like stronger plates, more-consistent curing, increased cycle life, and improved charge acceptance — all while providing verifiable savings.

INDUSTRY NEWS Hammond Bolsters Asian Production Capacity With New Treated SureCure® Manufacturing Line

With full-scale operations of its North American Treated SureCure® manufacturing line underway, Hammond Group announced increased production capacity at its Malaysian plant. The facility in Kuala Lumpur is capable of making just over 4.1 million pounds of Treated SureCure® per year. Demand for one of its most effective additives had risen to such a degree that the company doubled capacity by bringing

production online in the US in early 2023. In addition to SureCure® products, Hammond Malaysia produces Advanced Negative Expanders tailored to assist with SLI, Deep-Cycle, PSoC and

Energy Storage needs. The plant is ISO:9001 Certified and allows for quick turnaround on orders to customers throughout Asia. Read more at HammondGlobal.com/news.

OBITUARY: 'A LIFE WELL LIVED'

COVER STORY: ALL ARE WINNERS

JOHN BANNISTER GOODENOUGH

The father of the lithium ion cell, and one of the three figures that created today’s huge lithium battery business, died on June 25 a month short of his 101st birthday

A QUESTION OF BALANCE

For the last 15 years, the lead and lithium battery industries has been engaged in a war of words about their relative merits. But each has its virtues and places in the ESS spectrum

NEXT STOP SCOTLAND!

Flow batteries continue to make inroads into the energy storage landscape of the future. The recent IFBF discussions bodes well for next year's excursion in the Highlands

The last great myth of the 21st century: climate change is containable and even reversible

IN THIS ISSUE

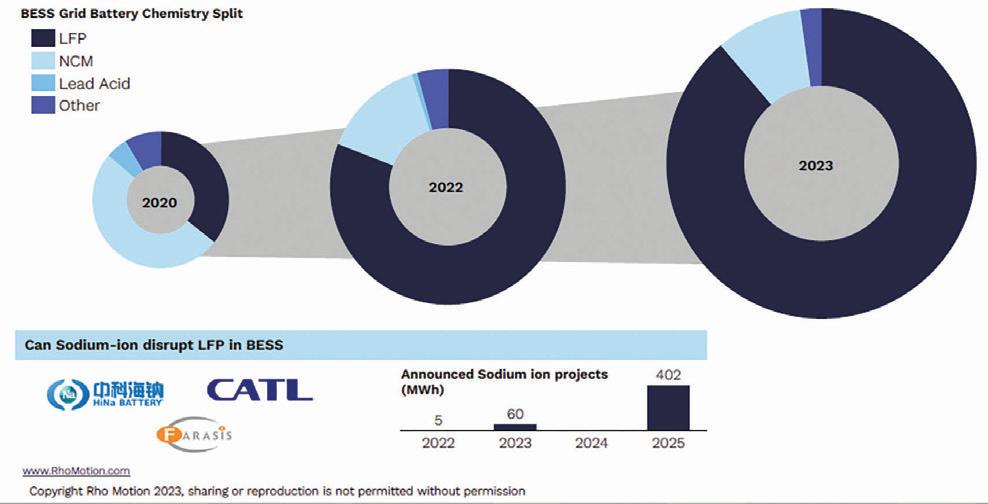

Lithium ion phosphate — the now acknowledged standard for energy storage at scale

EDITORIAL: The developed world vs the rest of the planet | 10 PEOPLE NEWS The battery industry gets ready to give back to Cambodia | Farewell to John Bannister Goodenough, the father of the lithium ion cell | Meylemans takes over as EUROBAT GM

NEWS | 25 RECYCLING NEWS | 28 COVER STORY: A QUESTION OF BALANCE In defence of lead … and lithium

THE ESS PERSPECTIVE | 35 THE SUNLIGHT PERSPECTIVE | 39 THE AMARA RAJA VIEW

EVENT REVIEWS: EUROBAT General Assembly; International Flow Battery Forum; Advanced Technology and INNOVATION SHOWS

UPCOMING EVENTS: ESJ details the conferences and shows ahead

Editor: Michael Halls | email:mike@energystoragejournal.com | tel: +44 7977 016918

Digital editor: John Shepherd | email: john@energystoragejournal.com | tel: +44 7470 046 601

Advertising manager: Jade Beevor | email: jade@energystoragejournal.com | tel: +44 1 243 792 467

Finance: Juanita Anderson | email: juanita@batteriesinternational.com | tel: +44 7775 710 290

Energy

Publisher: Karen Hampton karen@energystoragejournal.com

+44 7792 852 337

Editor-in-chief: Michael Halls mike@energystoragejournal.com

+44 7977 016 918

Subscriptions and admin: admin@energystoragejournal.com | tel: +44 1 243 782 275

Design: Antony Parselle | email: aparselledesign@me.com

The contents of this publication are protected by copyright. No unauthorized translation or reproduction is permitted. Every effort has been made to ensure that all the information in this publication is correct, the publisher will accept no responsibility for any errors, or opinion expressed, or omissions, for any loss or damage, cosequential or otherwise, suffered as a result of any material published.

Any warranty to the correctness and actuality of this publication cannot be assumed. © 2023 HHA Limited. UK company no: 09123491

The developed world vs the rest of the planet

It’s the latest and possibly the last great myth of the 21st century: climate change is containable and even reversible through concerted human action.

And the frantic drive into renewables and its corollary energy storage — for this read the battery business — will save the planet.

From simple manufacturers of an essential component in modern and industrial life, we, collectively, have become visionaries for the future and saviours of mankind. That pesky carbon dioxide and that tricky global warming will be solved by our engineers, our entrepreneurs and not-forgetting our everresourceful innovators.

But one question doesn’t seem to be attracting much attention. And that’s whether the huge sums of money being committed to reducing emissions are worth the effort?

Certainly, it sounds the case when listening to the soundbites of politicians, that salvation is at hand. US president Joe Biden last year called the signing of the Inflation Reduction Act committing the country to huge tax breaks as the “biggest step forward on climate change ever.” The Brookings Institution, a think-tank, reckons the final cost of the package will top $1 trillion and almost three times larger than the US government estimate of $369 billion. The IRA, said Brookings, “has the potential to lower energy costs, contribute to lower inflation, increase productivity, and raise economic output over time”.

It might be nice to think this is the case. The fact is that though the developed world — essentially North America, Japan and Europe —

is making huge strides in reducing its emissions of CO2 levels, it is still a far-cry from carbon neutrality.

And meanwhile any shortfall created is being picked up elsewhere. Given what’s happening in other parts of the world, this is going to be just a drop removed from an ever-growing ocean of greenhouse gases.

Energy Storage Journal is not a climatechange denier, nor do we believe our drive into renewables and energy storage is a waste of money, time or effort.

However, on a planet of almost 8 billion people our efforts are not, so far, enough — failure of a sort will become inevitable.

The emerging world will not hesitate to put climate change lower down a list of priorities that contains elements such as better health care, education and a better standard of living, A quick look at their growing needs is reflected on their targets for climate neutrality — China aims for its CO2 emissions to peak by 2030 (and which already emits roughly a third of all climate change gases) and to be carbon neutral by 2060.

China provides more than half of the world’s steel and cement, but the CO2 emissions from just those two sectors in China are higher than the European Union’s total CO2 emissions.

India, with a similar population of around 1.4 billion souls, is aiming for climate neutrality by 2070. Already in 2022 India’s emissions are higher than that of Europe in its entirety.

The move into electric vehicles across the developed world is unlikely to make much of

China provides more than half of the world’s steel and cement, but the CO2 emissions from just those two sectors are higher than Europe’s total CO2 emissions.

a dent into the emissions from those two countries — auto manufacturers may boast that some 500 EV types will be launched in the next five years but China’s own cement and steel manufacturing already accounts for more than the whole of the emissions from Europe.

There’s also no need to simplify the world into the good guys and the bad ones — the developed North versus this pair of the environmentally irresponsible two. The fact is the rest of the developing world is on the same trajectory as China and India. We tut, tut — hypocritically — at our peril about emerging nations’ irresponsibility in wanting a standard of living closer to ours at the expense of the environment.

Robert Bryce, the commentator, points to the issue of energy inequality in his brilliant and highly recommended blog, https://robertbryce.substack. com.

“The average American consumes 20 times more energy per year than the average resident of Africa, … there are 1.4 billion Africans, who, on average, consume about 600kWh of electricity per head, per year. The average American consumes that every three weeks.”

He writes: “The average American consumes 20 times more energy per year than the average resident of Africa, and four times more than the average of Asia. There are 1.4 billion Africans, who, on average, consume about 600kWh of electricity per head, per year. The average American consumes that much electricity every three weeks.

“The reductions in the US and Western Europe are being swamped by increases in the rest of the world, and in particular, in India and China. Thus, the big challenge facing the world is not how many Teslas are being sold in Marin County, but how many coal plants are going to be built in Bangladesh, Cambodia, and other desperately poor countries.”

He points out that nearly 19 gigawatts of new

coal-fired capacity was brought online last year, with the biggest new additions happening in India, Japan, and Pakistan. Between 2000 and 2022, global CO2 emissions increased by 10,700 million tonnes. Of that increase, about 10,300 million tonnes occurred in the AsiaPacific region.

So where does this all leave the battery industry? First the good times will continue for lead manufacturers and, if the world supply of the huge quantities of metals required holds up, the lithium battery manufacturers will do excellently too.

But we shouldn’t deceive ourselves as being visionaries of the future or saviours of the planet. Or not yet anyway.

Mike Halls, EditorIn testing times, the battery industry needs a reliable partner

As the lead battery sector steps up the industry’s presence in a range of applications, from automotive to energy storage, telecoms and critical power, the subject of expanding R&D has re-emerged as an important topic of discussion at conferences.

At Battery Council International’s annual conference in 2022 panellists and delegates alike called for more investment in R&D and greater efforts to engage government agencies, national laboratories and the next generation of battery scientists and professionals to focus on advanced lead batteries.

R&D was again a topic of debate at BCI’s 2023 annual conference –and is also a constant on the agenda of other global industry bodies

including the International Lead Association and the Consortium for Battery Innovation.

R&D focus

Mark Hulse, vice president of sales and marketing for Maccor, acknowledges that the lead battery industry has increased its focus on R&D as lithium and other battery chemistry contenders push further into battery markets —and he welcomes that.

Maccor has strong connections with businesses in lithium ion, lithium metal air and solid state and Hulse is now encouraging the lead battery industry to let Maccor help them as they strive to make the next technological advances in their products.

Hulse has been with Maccor for nearly 30 years and says it is great to see a resurgence of R&D for lead acid. However, he also sees a need to focus on additives and related materials to further improve lead products. And it’s especially important for Maccor to be forging new partnerships with lead battery makers too, “because we cut our teeth on R&D and supporting advances in technologies”, Hulse says.

Maccor has strong connections with businesses in lithium ion, lithium metal air and solid state and Hulse is now encouraging the lead battery industry to let Maccor help them as they strive to make the next technological advances in their products.

The company does work with systems for some lead acid firms but usually more in areas where those

players are also developing products using other battery chemistries.

As lead acid is a mature technology, R&D waned for some years, but with lead acid now firmly on the R&D track, Hulse says “they would greatly benefit from our speed, accuracy, performance and reliability”.

“We have the most accurate systems and one of the fastest systems in terms of control measuring and that is what you need in terms of R&D.

“You need to be able to measure the smallest of changes in equipment and materials and for that the most important thing to have is accuracy.”

Chemistry agnostic

Maccor has sold more test channels than all of its competitors combined and Hulse points out that Maccor’s expertise can supply channels that run down to nanoamp scale.

And while Hulse is keen to expand work with lead acid, Maccor’s testing tech is chemistry agnostic. Of particular importance is that program tests can be tailored to whatever the chemistry or product is.

It does not have to be a battery it could be another kind of energy storage device such as a super or ultra capacitor.

“We’ve been around a long time and that’s what we’ve been about from day one — giving our customers the most accurate and fastest channels.”

Maccor’s ‘Watchdog’ system can also check on internet and PC connections during testing and if a problem occurs, such as a cable being unplugged, can automatically suspend the test and retain results up to that point.

“All of our channels have what we call isolation relays. The isolation relay opens up to isolate the device under test if a test is suspended for any reason. Also, if a customer is having an issue we have the best customer service department in the industry.”

Applications

Existing clients cover a wide range of applications including materials, medical, home & garden, cell manufacturing, pack manufacturing, e-mobility, automotive and aerospace. Maccor is also involved working with US national labs in research for the Department of Energy and federal government.

In terms of cost, Hulse acknowledges that in tough economic times budgeting for the best can be a difficult call for finance chiefs (even if advised to do so by technical managers) but then it is important to think about the cost of not investing in the best testing technology out there.

“If money was no object I know most everybody would come to us because they know we’re the best in the business for everything from testing to performance and reliability and customer service.”

Ownership cost

Hulse said the importance of understanding cost of ownership has grown over the past 20 years or so as cheaper testing systems have emerged. But the comparisons are stark. Maccor has many customer’s with systems that are more than 15 years old and still running reliably with the company’s support.

Compare that to one client that had to be ‘rescued’ by Maccor after they bought a cheaper system that

barely lasted a few months before problems with reliability began to emerge, costing the firm time and money. They eventually bought a system from Maccor and the original purchase sits there unused.

Maccor sold its first Windowsbased system nearly 26 years ago now (earlier systems were DOS based) yet they can run even the latest version of Maccor’s software without hardware upgrades.

When a company buys a tester Maccor never charges for software updates as long as they purchased the system from Maccor, which is unique in the business and there is also constant customer support with Maccor’s expert service team via phone and email.

However, Maccor has a strong presence in Asia too, where the vast majority of its customers are involved in batteries but there are also those who need to test fuel cells and rely on Maccor’s precision technology and support.

Looking ahead to how the business will develop in the coming years, Hulse says Maccor is focusing on a new processor coming on line that’s going to allow customers to run even faster speeds – in the range of sub-one millisecond.

Environmental susbtainability

Maccor is also responding to increasing demand for sustainability and climate-friendly services. The company’s new 8500 series is a return to grid system for higher voltage type applications, so it can handle anything ranging from approximately 50v to 1200V.

The 8500 requires less energy to run, therefore making it a powerful but green tech option.

The domestic US market currently represents around 60-65% of Maccor’s market and Hulse says Europe is probably in the lead as far as international markets go, with the UK and Germany being the biggest.

As global demand for sustainable supplies of energy continues to escalate, battery makers will be among those who are best suited to step up and help countries make the most use of renewables.

But battery manufacturers will need a reliable, accurate and trustworthy technology partner to convince power companies to buy their products – and Maccor stands ready to rise to the challenge.

“We’ve been around a long time and that’s what we’ve been about from day one — giving our customers the most accurate and fastest channels.”

Mark Hulse, vice president of sales and marketing for Maccor

Adding a helping hand

ABC making a difference to children in Siem Reap

The ABC conference committee and Sorfin Yoshimura have once again set up an initiative — the ONE Minute Giveback — to support a local children’s charity hospital in Siem Reap. The initiative is set to run throughout the entire 20ABC.

After the very successful 18ABC in Bali in 2019, the ONE Minute Giveback will continue in Siem Reap! In partnership with Sorfin Yoshimura Conference Works, the organizer of ABC will be working towards a HUGE CSR effort to raise funds for Angkor Hospital for Children so they can continue to improve the health and lives of those most in need. In a difficult world post Covid now more than ever our giveback activity has a real chance of helping the lives of those less fortunate than us!

• One in five Cambodians survive on less than US$2.70 a day. (Cambodian Ministry of Planning, 2020)

• A child born in Cambodia is five times more likely to die before their fifth birthday than a child born in a wealthy country.(World Health Organisation, 2015)

Cambodia is one of the poorest countries in the Asia and Pacific region and is still emerging from decades of conflict.

This year the ONE Minute Giveback will be supporting Angkor Hospital for Children with all proceeds directly improving the lives and health of local children in Siem Reap and help ensure families living in poverty have access to healthcare for their children via the free medical services the hospital provides.

FIVE GREAT WAYS YOU CAN GIVEBACK

2. DONATE ONE MINUTE

4.

DONATE ONLINE

If you are able to make a donation to support Angkor Hospital for Children through the ONE Minute Giveback we would love to hear from you. To deliver our aims of the Giveback we are looking to partner with organisations that will help make a difference in Siem Reap!

Contact:

Mark Richardson, mark@conferenceworks.com.au, +61 412 160 133

Scott Fink, sfink@sorfin.com, +1 917 773-3675

Donate ONE Minute of your time onsite during 20ABC and drop by the giveback area in the foyer of the main exhibition hall. We will be sorting, packing and stacking goods and items that the hospital has identified as critically needed.

3. DONATE ONE DOLLAR

Delegates' partners will be out taking onsite donations with the help of our event team. Any cash donation from the value of ONE United States Dollar is greatly appreciated and will be gifted to the Hospital onsite during the event.

Information about Angkor Hospital for Children is available on AHC’s charity page www.angkorhospital.org.

Delegates are able to donate to AHC directly via their websites

5. ONSITE

We will be accepting donated items onsite. We will share a ‘Wishlist’ of items our charities have requested. Should you wish to donate larger amounts of items please contact the team to discuss.

to those less fortunate

THE ANGKOR HOSPITAL FOR CHILDREN

Every child — rich or poor — deserves to be healthy.

Angkor Hospital for Children is a leading children’s healthcare organization based in Siem Reap, Cambodia. We’re a teaching centre of excellence inspiring a new generation of health workers. We’re working in some of Cambodia’s poorest communities to empower caregivers with vital health information.

Our community is made up of hospital staff, board members, volunteers, partners and supporters, united under a common mission: improving healthcare for every child in Cambodia.

Why we’re here

Over the last 20 years healthcare in Cambodia has improved significantly. However, children still die from preventable causes. Access to quality healthcare within Cambodia is not universal. There is a lack of care available for children with long-term, rare or acute conditions — particularly for those in the poorest and most remote villages.

Last year in numbers

• 97,978 Total treatments were provided from outpatient care to specialty services.

• 1,447 Children received life-saving emergency treatment in our specialist PICU.

• 40 Government health facilities received our support to set up systems to improve patient care, install life-saving equipment and provide training and mentorship to health professionals.

• 2 Doctors completed their three-year sub-specialty training programme to become a paediatric specialty doctor, to address the gap in specialty care in Cambodia.

• 63,919 Virtual and in-person attendances were recorded in AHC’s educational sessions for external healthcare professionals, nursing and medical students, and AHC staff.

• 142,446 Attendances were recorded in AHC’s prevention and health education activities in villages, schools and communes.

John Bannister Goodenough, 1922-2023: 'A life well lived'

We are sad to report that John Goodenough, father of the lithium ion cell, and one of the three figures that created today’s huge lithium battery industry, died on June 25 a month short of his 101st birthday.

John, who was interviewed several times for Energy Storage Journal, was awarded the joint Nobel Prize for Chemistry in October 2019 with the two other pioneers of the lithium battery, Stanley Whittingham and Akira Yoshino.

In our subsequent interviews with Whittingham and Yoshino each acknowledged the huge debt the world owes to Goodenough who discovered the cathode material of choice and so made the lithium ion battery truly portable and rechargeable.

“John was an unassuming, modest and gentle man whose work has touched everyone’s life,” said Bob Galyen, the former CTO of CATL and a friend. “It was a life well lived and John had an intellect of astonishing proportions and his contributions to science extend well beyond the lithium cell.”

Oddly enough for someone whose research has ended up in the household or pocket of most of the planet, he was regarded as a backward child. It was only much later that it was found that he was dyslexic and he later described how he dealt with this problem by studying abstract mathematical thought and Greek and Latin.

Aged 18 he left school as top of his class and received a scholarship to Yale. After the bombing of Pearl Harbor, he volunteered for service, but was not called up until January 1943. This gave him time to complete his undergraduate degree in mathematics. He had entered Yale as a freshman with a background in Latin and Greek and little idea of what he would do after the war was over.

He graduated while working as a meteorologist in the US Air Force. A crisis of faith around this time led him to dedicate himself to a life of service starting with studying physics at the University of Chicago or Northwestern University.

“When I arrived at Chicago the registration officer, professor Simpson, said to me, “I don’t understand you

veterans. Don’t you know that anyone who has ever done anything interesting in physics had already done it by the time he was your age; and you? You want to begin?”

Undeterred, he earned a master’s degree in 1951 and a doctorate the following year.

For the next six decades his astonishing academic career and research led him from his early work at MIT on computer memory to the University of Oxford in his 50s where most of his ground-breaking work on lithium cells was pioneered. The last three decades of his life were at the University of Texas, where he held the Virginia H Cockrell centennial chair in engineering.

He was still working until his late 90s and in the last years of his life was pioneering a solid state battery.

As recently as 2017 he announced patents for new battery cells using a solid glass electrolyte instead of a liquid one, using an alkali metal anode. The glass electrolytes allow for the substitution of low-cost sodium for lithium. This had the possibility of being a second world-changer to the energy storage industry.

Caring little for money, John signed away most of his rights. He shared patents with colleagues and donated stipends that came with his awards to research and scholarships.

He was married to Irene Wiseman for 65 years. She died in 2016. In the latter part of her life he would work at

the university in the morning and visit her care home in the afternoons, she suffered from dementia.

In addition to being a Nobel laureate John was feted internationally being a member of the US National Academy of Engineering a member of the National Academy of Sciences, French Academy of Sciences, the Spanish Royal Academy of Sciences, and the National Academy of Sciences.

He wrote more than 800 articles for scientific journals, 85 chapters and eight books. He was a co-recipient of the 2009 Enrico Fermi Award and elected a Foreign Member of the Royal Society and was presented with the National Medal of Science by US president Barack Obama.

Among his many publications is a very personal one: “Witness to Grace”, in which he describes how his intellectual journey had also included “a religious quest for meaning in what or whom I would choose to serve with my life.” He was born into an agnostic family but during the war years he developed a faith and was a devout Christian to the end of his life.

Career development

To return to his spectacular career: the crucial point in Goodenough’s researches and associated lithium battery’s development was when he was offered a position of professor and head of the Inorganic Chemistry Laboratory at Oxford University.

Up till then. Goodenough had been working as a research scientist at MIT’s Lincoln Laboratory where he had been part of an interdisciplinary team that developed the first randomaccess memory (RAM) for the digital computer.

His fundamental research had focused on magnetism and on the metal–insulator transition behaviour in transition-metal oxides. He also developed a set of semi-empirical rules to predict magnetism in these materials in the 1950s and 1960s, now called the Goodenough–Kanamori rules which is a core property for high-temperature superconductivity.

Goodenough’s contribution was to the development of the ferrimagnetic, ceramic memory element, a contribution that put him in charge of a ceramics laboratory and that gave him a decade in which to explore the magnetic, transport, and structural properties of transition-metal compounds.

In 1952, he joined the group at MIT Lincoln Laboratory charged with the development of a ferrimagnetic ceramic to enable the first RAM for the digital computer.

“The air defence of this country depended on having a large digital computer, and the computer had no memory!” Goodenough later said.

“The rolled alloy tapes first tried did not switch fast enough. Although the Europeans who had developed ferrimagnetic spinels were convinced that it would be impossible to obtain the required squarish B-H hysteresis loop in a polycrystalline ceramic, the magnetic-core RAM was delivered within three years of my arrival with a read/ rewrite cycle time of less than the required six microseconds.”

In the course of this work, Goodenough showed how cooperative orbital ordering gives rise to crystal distortions, and he used this ordering to articulate the rules for the sign of the spin-spin magnetic interactions in solids.

These rules have subsequently provided a true guide to the design as well as the interpretation of the magnetic properties of solids; they are known as the Goodenough-Kanamori rules, and they inspired the title of Goodenough’s first book, Magnetism and the Chemical Bond

Although these were astounding advances in both physics and chemistry. It was his appointment to Oxford University in 1976 that so much came together.

Once there, Goodenough recognized

that the layered sulfides would not give the voltage needed to compete with batteries using a conventional aqueous electrolyte, but that an oxide would provide a significantly higher voltage.

From previous work, he knew that layered oxides analogous to the layered sulfides would not be stable, but that discharged LiMO2 oxides could have the same structural architecture as discharged LiTiS2

Goodenough assigned a visiting physicist from Japan, Koichi Mizushima, the task of working with Goodenough’s postdoc, Philip Wiseman, and a student, Philip Jones, to explore how much Li could be extracted reversibly from layered LiMO2 cathodes, and with M = Co and Ni he found he could extract electrochemically over 50% of the Li at a voltage of around 4.0V versus a lithium anode, nearly double that for the sulfides, before the oxides began to evolve oxygen.

Their groundbreaking findings with Li1-xCoO2 were published in the Materials Research Bulletin 15, 783-789, (1980).

The report concluded with the statement, “Further characteristics of the intrinsic and extrinsic properties of this new system are being made.”

However, when Goodenough went to patent his cathodes, no battery company in the UK, Europe, or the US was interested in assembling a battery with a discharged cathode, so he gave the patent to the AERE Harwell Laboratory.

Nevertheless, with his postdoc Peter Bruce, now a professor in St Andrews, Scotland, and a new student, MGSK Thomas, Goodenough continued in Oxford to demonstrate that the Li+-ion mobility in Li1-xCoO2 is even higher than that in the sulfide cathode LiTiS2.

This finding meant that a Li1-xCoO2 cathode would provide the needed voltages and rates that would usher in what was later termed the “wireless revolution”.

Meanwhile, Rachid Yazami in Switzerland, exploring Li insertion into graphite, reported that a discharged graphite anode did not have a problem with dendrites if the carbon/LiCoO2 cells were not charged too rapidly, and Akira Yoshino in Japan then assembled the discharged cell Carbon/LiCoO2 to demonstrate the Li-ion battery that was licensed to the SONY Corporation, which marketed with it the first cell telephone.

Today, almost everyone from five

years upwards has an application of this battery in his or her pockets.

Michael Thackeray was working on the Zebra battery (see Energy Storage Journal passim), a modification of the sodium-sulfur battery, in South Africa when he read the article in the Materials Research Bulletin. He immediately applied for a sabbatical to work with Goodenough in Oxford.

He came to the city with the announcement that he was inserting Li reversibly into magnetite, the ferrimagnetic spinel Fe3O4 used by Greek sailors in an early version of the compass. He wished to replace cobalt, which is expensive and toxic, with iron, which is abundant and benign. The spinels A[B2]O4 contain a three-dimensional framework of BO6/3 octahedra sharing edges; in the layered LiMO2 oxides they form 2-dimensional layers.

The A atoms of a spinel occupy interstitial tetrahedral sites that are bridged by empty, face-sharing octahedra, and Goodenough realized from his earlier work on spinel memory elements that the Li inserted into Fe[Fe2]O4 was entering and displacing that interstitial A-site Fe into the bridging interstitial octahedral sites to create a rock-salt structure with the [Fe2]O4 framework remaining intact.

Bill David, at the Rutherford Laboratory, had just joined Goodenough’s group from the Clarendon with a PhD involving structural analysis, so he and Thackeray demonstrated that Goodenough’s hypothesis was correct.

Meanwhile, Goodenough told Thackeray to investigate the electrochemical reversible insertion of Li into the spinel Li[Mn2]O4; it gave a voltage of 3.0V versus lithium. Manganese is also abundant and benign. On his return to South Africa, Thackeray showed his students that extraction of Li from Li[Mn2]O4 gives a voltage of 4.0 V versus lithium. A modification of the Li1-x[Mn2]O4 spinel cathode was later used by Nissan to power their Leaf electric car.

By then the next stage in the development of the lithium battery was complete. Akira Yoshino in 1985 fabricated the first prototype of the LIB and received the basic patent. This configuration was commercialized by Sony in 1991 and by A&T Battery in 1992.

“It’s rare that we’ll see a figure like John Goodenough again in our lifetimes,” said one commentator. “He had a life of modest and quiet achievement — a well lived life and with a legacy that the whole planet can thank him for.”

EUROBAT’s Westgeest steps down, Meylemans takes over as GM

Alfons Westgeest, general manager of EUROBAT, announced on June 5 he was stepping down and Gert Meylemans, previously director of communications, would take over.

Westgeest, who tried to retire four years ago but came back, has been a central figure in EUROBAT since his involvement in 2002 and arguably the key creator of the present trade organization.

Westgeest, a well-known and well-liked figure in all sections of the European energy storage industry, said he had enjoyed his time with EUROBAT.

“It’s not just been fun to build up and strengthen the organization but we have achieved real success in helping influence the direc-

tion of battery regulation across the EU.”

Marc Zoellner, president of EUROBAT and CEO of Hoppecke Batteries, in a touching speech at the conference dinner, paid tribute to Westgeest’s relentless commitment to building up EUROBAT and its members.

“I will truly miss him and thank him for the wonderful work he has done,” he said.

Meylemans, who joined EUROBAT in August 2018, said he had a very tough act to follow but “hoped to continue to build on the great work Alfons has done”.

EUROBAT — the association for European automotive and industrial battery manufacturers and

Skyllas-Kazacos joins Tivan advisory group

Vanadium redox flow battery pioneer Maria SkyllasKazacos has joined a new technical advisory group set up by minerals processing tech company Tivan.

Tivan said on May 31

Skyllas-Kazacos’s technical knowledge and experience would be keenly sought in developing and standardizing the global value chain in VRFB.

Other initial appointments to the group included Stéphane Leblanc and Simon Flowers.

Leblanc is a former MD of Rio Tinto Iron & Titanium. Flowers is the director and principal of Sustainergy Consulting and a former international team leader with US energy firm ConocoPhillips.

The group will provide independent technical advice to support development of two projects, including Tivan’s Mount Peake in Australia’s Northern Territory — which the company says has one of the largest flat-lying, shallow vanadium-titanium deposits in the country.

The other is the Speewah vanadium-titanium-iron project in Western Australia, of which Tivan acquired 100% ownership in April.

supply chain in EMEA — was formed in 1957 and was originally based in Switzerland.

But it was only when it moved to Brussels at the turn of the century that it became the lobbying and trade body that it is today.

EUROBAT is a non-profit association under Belgian law and is staffed by association management company Kellen. Westgeest became Kellen Europe’s board member for global develop-

ment in 2022.

Before EUROBAT, Westgeest was the founder and managing partner of Ernst & Young’s association management practice in 1988 in Brussels. He joined EY in 1981 and left the firm in 2004.

This year’s EUROBAT general assembly and convention was held on June 6-7 in Madrid.

See our event review towards the end of the magazine.

Roden joins ENTEK International as North America account manager

James Roden has joined ENTEK International’s lead acid separator sales team as North America account manager, the company announced on May 31.

Roden, who has more than 10 years of sales experience in the automotive industry, will be based at ENTEK’s headquarters in Oregon.

ENTEK announced last year that it was to expand its manufacturing of AGM battery separators to India and the US, in response to expanding demand for energy storage solutions for inverters, industrial applications and electric vehicles.

In March, the company said it was also investing

$1.5 billion to build a lithium ion battery separator production facility in the US state of Indiana. The Terre Haute plant, on a 340-acre greenfield site, will be the biggest investment to date by the US-based producer of wet-process lithium-ion battery separator materials, in support of the growing EV industry in Indiana and across the country.

Taylor succeeds Longney as TBS group MD, Davis retires

ship as TBS starts a new phase of its development program.

However, Longney will remain a director of TBS and support Taylor in his new role.

Taylor has been with the company since 2019 when he joined as group operations director, responsible for all UK manufacturing operations, supply chain and facilities management at the Gloucestershire HQ.

announcement on July 3, TBS announced that the much-respected Paul Davis was retiring from the firm after 39 years.

Frank Macchiarola joined the American Clean Power Association as chief policy officer on June 20, the trade organization announced.

Davis joined TBS in February 1984 as a service technician, moving to sales several years later.

UK-based TBS Engineering has announced the appointment of Richard Taylor as its new group MD following the announcement that David Longney will be stepping down.

TBS said on July 3 that Longney, who has worked with the company for nearly 40 years, had decided to make way for new leader-

In 2022, Taylor accepted a new role as group aftermarket director.

Longney said: “It was a difficult decision to step down, however, I believe in my time as MD we have moved the business forward in many ways, placing TBS in a strong competitive position for the future.

"In a separate LinkedIn

Straw named director of new ENTEK Manufacturing unit

turer and supplier of replacement wear parts in the industry.”

Straw will have profit and loss responsibility for the division and reports to Linda Campbell, VP of extrusion sales.

Macchiarola, former senior VP of policy, economics and regulatory affairs at the American Petroleum Institute, is leading a team working on regulatory and legislative proposals to boost development of advanced clean energy technologies.

Jason Grumet, ACP’s chief executive officer,

said: “The clean energy sector is at a pivotal moment, and growing our team to embrace the opportunities before us will ensure this industry has the bench strength in place to match the moment.”

Doe Run promotes Mangogna to VP operations and COO

Tammy Straw has been named as director of ENTEK Manufacturing’s new wear parts division, which will make and sell replacements for all brands of twin-screw extruders.

The June 9 announcement followed the February opening of ENTEK’s 98,000 ft2 manufacturing and engineering facility in Henderson in the US state of Nevada.

ENTEK Manufacturing president Kim Medford said the new division was key to the group becoming the number one manufac-

Straw has worked with ENTEK for 24 years and has been the company’s marketing and business development manager since 2016, also leading ENTEK’s inside sales team.

She is also the vice chair of the NPE sales and marketing committee for the US Plastics Industry Association.

Also joining the new Wear Parts Division is Kelsey Dennis, who will be responsible for wear parts sales. She has been with ENTEK since 2010, and most recently worked in customer support and inside sales.

The Doe Run Company, the mining group and natural resources firm, announced on June 28 it had promoted Brian Mangogna VP for mining and milling to be chief operating officer and VP for operations.

Mangogna has spent almost 25 years with Doe Run, starting as a metallurgist, advancing over the years as mill superintendent, mill manager and general manager for the company’s Southeast Missouri (SEMO) Mining and Milling Division. In 2021 he joined the executive team and was promoted to VP of mining and milling.

In his new job he will oversee day-to-day opera-

tions for the company’s mining and metals operations, its battery recycling plant as well as its mines and mills.

Mangogna said: “Doe Run has a long history of being a global provider of lead, copper and zinc — three base metals that enable modern society — but can also recover cobalt, nickel, tin and antimony from resources within our control, whether ore bodies or metals by-products."

Metair moves interim CEO, CFO appointments to permanent positions

Interim CEO of battery and auto components group Metair Investments, Sjoerd Douwenga (pictured), has been appointed to the role permanently, the company said on May 31.

Interim CFO Anesh Jogia has also been appointed permanently. He will also work as executive director

ABTC appoints Deutsch as CFO

and a member of the firm’s investment committee.

The interim appointments of Douwenga and Jogia were announced in March, following the resignation of then CEO Riaz Haffejee.

Metair said the permanent appointments “will allow for a seamless leadership transition”.

The group’s energy storage division includes Turkey’s Mutlu Akü lead battery business, Romanian lead and lithium company Rombat and South Africa’s First National Battery.

In March, Metair reiterated that plans to sell off the energy storage business remain suspended as a result of the geopolitical climate in Europe and global financial instability.

ECS award for Argonne Lab scientist Meng

Senior Argonne National Laboratory scientist Shirley Meng has been honoured by The Electrochemical Society for her work on battery tech innovations.

Argonne said on July 10 Meng will be presented with the ECS 2023 battery division research award in October, in recognition of her work on interfacial science, which has led to improved battery technologies.

Meng is chief scientist at the Argonne Collaborative Center for Energy Storage Science and is a professor at the Pritzker School of Molecular Engineering at The University of Chicago.

Her research focuses primarily on energy storage materials and systems, specifically rechargeable bat-

teries for EVs and trucks, power sources for the internet of things and gridscale storage integration with renewables.

ECS highlighted two papers published last year by Meng in the Journal of The Electrochemical Society, one exploring the use of external mechanical pressure to regulate the growth of dendrites that form at the interfaces in batteries and lead to an electrical short.

The second paper looked at the process of lithium plating and stripping in rechargeable lithium batteries.

The battery division research award was established in 1958 to encourage excellence in battery and fuel cell research.

American Battery Technology Company said on May 22 it had appointed Jesse Deutsch as CFO.

Deutsch has more than 25 years of financial leadership experience including as a former CFO of global brands such as Kraft Foods.

He now oversees all financial operations of the company including those supporting an acceleration of battery recycling and battery metals manufacturing.

Deutsch, who has an MBA from New York Uni-

versity and a Bachelor of Science in economics from The Wharton School of the University of Pennsylvania, will also have responsibility for corporate functions including financial planning and analysis, accounting and controls, risk management, financial performance and revenue growth, investor relations, and reporting and compliance.

ABTC’s CEO Ryan Melsert said: “As we ramp up our commercial scale manufacturing operations over the coming months, we are excited to have such an experienced leader as Jesse join ABTC.

“We have an immense number of financial and strategic opportunities in front of us, and with this enhanced leadership team we are looking forward to driving them to execution.”

Deutsch’s appointment followed ABTC’s announcement in January that it had expanded its team toward commissioning of the firm’s lithium battery recycling plant.

Oliver Gross appointed senior fellow at Stellantis

Oliver Gross has been promoted to a new post as a senior fellow for energy storage and electrification at auto giant Stellantis.

Gross confirmed the appointment to Energy Storage Journal on May 12.

Gross is an expert in lithium ion and NiMH chemistries with a focus on motive applications.

His career to date has included being responsible for operations of analytical labs, electrical, environmental and abuse test labs, pilot lines and

supporting services.

Gross has also designed, developed and brought to manufacturing cells and modules for consumer electronics, military, aerospace, and automotive industries.

Ecobat looks for new CCO as Soule departs

Ecobat chief commercial officer Thea Soule has left the company, Energy Stor-

age Journal has learned. Soule, who joined Ecobat in 2020, said on August 15

that she had recently left her post — but she did not give details.

Asked whether she would remain in the battery-related world, Soule said there would be “more news to come on my next endeavour”.

An Ecobat spokesperson told Energy Storage Journal: “We can confirm Thea’s departure and express our gratitude for her contributions. The search for a chief commercial officer successor is underway, and updates on the CCO appointment will follow.”

Former Microsoft exec Steen named Freyr CEO

Former Microsoft executive Birger Steen has been appointed CEO of Freyr Battery, as part of a leadership shake-up announced by the company on August 10.

Steen, is a former worldwide VP of distribution and small-medium business at Microsoft in Seattle, VP and GM at Microsoft Russia and GM at Microsoft Norge.

He chairs the boards of Nordic Semiconductor and Pagero and succeeds Freyr

co-founder Tom Einar Jensen — who has been appointed executive chair of the Norway-based battery developer’s board.

Both appointments, effective August 21, follow the retirement on August 9 of founder and executive chair Torstein Dale Sjøtveit.

Sjøtveit said Freyr would “continue to push the frontiers of innovation and apply new technologies to next-generation battery manufacturing”.

Freyr plans to develop up to 43GWh of battery cell production capacity by 2025, with an ambition of up to 83GWh in total capacity by 2028.

Last month, Freyr said it had been awarded €100 million ($112 million) from the European Union to support its Giga Arctic project in Norway.

Last November, Freyr announced it had bought a site in the US state of Georgia to build its planned Giga America battery cells manufacturing plant.

Soule was a key speaker at June’s Pb2023 International Lead Conference in Athens, where she told delegates that, after spending much of her career in Brazil’s agricultural industry, she had spent the last three

years learning and integrating outside-industry experience into the world of battery recycling.

Separately, Stefanie Scruggs has been promoted to chief sustainability and HSE officer. “Since joining Ecobat last summer, she has expertly elevated the critical work we do to help the world meet its essential energy storage needs by promoting a circular energy economy,” the firm said.

“From improving blood lead levels to releasing the Ecobat Sustainability Report, Stefanie’s leadership has pushed our organization to the forefront of sustainability and safety standards. Under her guidance, Ecobat has adopted improved HSE initiatives and increased accountability for meeting safety goals.”

Zodl to join Clarios as CFO

Clarios said on August 21 it had appointed Helmut Zodl as its new CFO effective September 1.

Zodl joins Clarios from GE Healthcare where he was also CFO and led the spin-off of the company from its parent, listing GE Healthcare on the NASDAQ.

A native Austrian, Zodl is also a former group CFO for air condition-

ing, white goods and industrial automation firm Midea in China.

Clarios president and CEO Mark Wallace said Zodl’s international expertise in the automotive industry made him an outstanding choice for his new post.

Zodl succeeds John DiBert, who left Clarios in April to become CFO at Air Canada in his hometown of Montreal

Leoch to cooperate on solid-state batteries with Chinese university

Lead and lithium battery giant Leoch signed a framework agreement on June 8 to cooperate on solid-state tech R&D with China’s Fuzhou University.

Singapore-headquartered Leoch said the move is in line with development of its new energy batteries business — and can nurture training and scientific research on both sides.

Leoch owner and chairman Dong Li (pictured) said process control, scientific research technol-

ogy and collaboration are key to advances in battery technologies.

He said he looked forward to Leoch working with the university’s materials science and engineering college.

In March, Leoch announced plans to build a manufacturing plant in Mexico to ramp up its market presence in the Americas.

Dong Li said then that the location had been chosen because of its unique geographical location and

export policy advantages for the region — such as the USMCA free trade

Banner posts battery sales record despite ‘burdensome EU red tape’

Lead battery manufacturer Banner reported record full-year sales of €307 million ($333 million) on June 6 — but warned increasing European red tape and rising energy prices were major burdens.

The Austria-based firm said auto batteries were the key driver of its sales for the year ended March 31, which it said were up by more than 7% over the previous year.

Banner said it sold more than four million starter batteries over the period.

Meanwhile, a new licensing partnership with Leoch International for the Banner brand in China and an extension of the company’s licensing deal with Duracell should boost future sales in Asia and Europe.

Banner said the past financial year was characterized by far-reaching, global changes throughout the entire automotive industry, rising energy, raw material and labour costs and increasingly problematic supply chain issues.

Group commercial CEO

Andreas Bawart said the rise in sales was despite “massive cost increases in every area from raw materials to labour and naturally the meteoric upturn in energy prices.

“A short-term improvement is not in sight and un-

fortunately the EU and Austria are contributing to these difficulties.

“A vast number of regulations have been introduced, the implementation of which has led to a huge increase in the administrative burden upon small and medium-

sized enterprises like ours.” Bawart said it was inexplicable that political leaders were presiding over a situation where European battery makers “are suffering enormous competitive disadvantages” while trying to challenge Asian competitors.

Brill Power unveils ‘chemistry-agnostic’ battery booster for performance, safety

Brill Power unveiled chemistry agnostic tech on June 14 that it claimed could significantly improve battery performance and safety.

Brill, a spin-out from Oxford University, said its power battery intelligence platform boosts battery performance explicitly for larger battery systems in industrial, commercial and utility-scale applications.

The company’s BrillCore hardware and proprietary BrillOS operating system

are at the heart of the technology — providing “intelligent active loading of battery cells or modules” to overcome inherent performance limitation of the weakest cell in the pack that limits existing BMS solutions.

Active loading allows all of the potential from battery cells to be utilized, extending battery lifetime by up to 60%, Brill claims.

According to Brill, BrillOS is chemistry-agnostic and can be updated

wirelessly to be compatible with future battery technology.

Brill CEO Christoph Birkl said the system addressed “all of the pain points” that can be encountered by battery pack and systems developers. “Industrial and gridscale battery systems are necessarily large and expensive investments, so any frailty in the technology can have profound implications for the success and viability of the solution.”

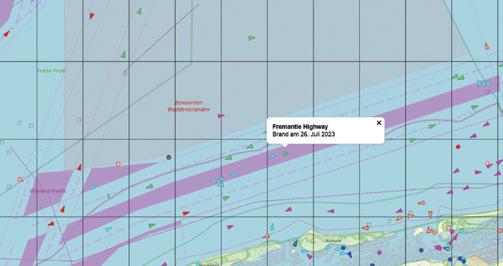

Fire-damaged EV cargo ship towed to Dutch port with batteries blamed for blaze on board

Stricken car carrier the Fremantle Highway was being towed into a Dutch port, as Energy Storage Journal went to press, after a fatal onboard blaze, with initial reports suggesting an EV battery was to blame.

According to Lloyds List, nearly 500 EVs were among the 3,784 cars on board the vessel when fire broke out on July 25, while en route from Germany to Singapore via Egypt.

Dutch broadcaster RTL has released a recording of an initial emergency re-

sponder reporting that the fire “started in the battery of an electric car”.

But the Netherlands Coastguard has distanced itself from the recording, saying it is too early to say what triggered the blaze that led to the death of one of the 23 crew members and injured many others.

Rijkswaterstaat, part of the Dutch Ministry of Infrastructure and Water Management, said yesterday there were no indications that the fire was continuing.

A towing operation began this morning to take the Fremantle Highway into the port of Eemshaven, with experts from a number of agencies on board the vessel.

Rijkswaterstaat said the cargo could be safely unloaded at the port allowing investigators to establish the cause of the blaze.

Only two of the rescued crew members remained in hospital as of July 30, according to vessel charter company Kawasaki Kisen Kaisha.

The Fremantle Highway was built in 2013 and has the capacity to carry 6,000 vehicles.

An industry observer told

NY governor launches ESS fire safety taskforce

A new multi-agency fire safety taskforce has been ordered to spearhead inspections of ESS sites across New York State.

State governor Kathy Hochul said on July 28 the Inter-Agency Fire Safety Working Group would ensure the safety and security of ESS sites following fires at facilities in Jefferson, Orange, and Suffolk Counties this summer.

Despite such fires being “exceedingly rare” Hochul said state agencies would begin immediate inspections of energy storage sites

through the working group.

She said this would help prevent fires and ensure emergency responders have the necessary training and information to prepare and deploy resources in the event of a fire.

Hochul said the working group will review ESS operations and operators — as they examine the condition of their batteries to verify operation within design parameters, correct any deficiencies, check on-site fire suppression measures and confirm fire suppression plans with

local fire departments.

Findings from probes into the incidents will include a list of recommendations for stationary energy storage equipment and installations.

The findings and recommendations will be shared with organizations including the New York City Fire Department, National Fire Protection Association, International Code Council, the New York State Fire Prevention and Building Code Council and Underwriters Laboratories.

The governor did not sin-

Energy Storage Journal: “As terrible as the incident has been, one can only imagine how much worse thing might have been if the ship had been filled to capacity.”

In a separate report published on July 27, Allianz Commercial said fires on vessels like the Fremantle Highway remain one of the biggest safety issues for the shipping industry.

The report said lithium ion fire risks will likely ease over time as manufacturers, carriers, and regulators address the current challenges.

“In the meantime, attention must be focused on pre-emptive measures to help mitigate the peril.”

gle out sites involved in recent fires, but one is known to be Convergent Energy’s BESS facility in Warwick.

The utility reported on June 29 that investigations were underway following a fire involving one of its Powin Centipede systems.

In June 2022, Hochul unveiled plans for 22 largescale solar and battery storage projects for some 2,408MW in New York State.

Last May, New York City fire commissioner Laura Kavanagh said she would consider supporting further measures aimed at stamping out lithium ion battery fires following a number of incidents, some fatal, involving e-scooters and ebikes.

“As terrible as the incident has been, one can only imagine how much worse thing might have been if the ship had been filled to capacity.”

Pexapark backs solar-BESS agreement ‘first’ for UK

Software and advisory firm Pexapark said on July 5 it is supporting a milestone hybrid power purchase agreement (PPA) and optimization agreement that will boost the solar-storage market in the UK.

The deal, announced by equity fund DIF Capital Partners, covers a 55MW solar farm with a 40MW/80MWh battery storage system in Leighton Buzzard and is the UK’s first bankable and unsubsidized co-located hybrid PPA, according to Pexapark.

The move will provide

secured revenue across the solar-BESS system over a 10-year term.

In the UK, 45% of all planning applications for solar projects submitted in the past two years have been for hybrid systems that include battery storage, Pexapark said.

And the company said its own analysis indicates that 64% of renewable energy businesses in the wider European market are now seeking to introduce or increase the proportion of energy storage in their portfolios.

However, Pexapark said PPAs for co-located proj-

ects have remained difficult to agree on because of their complex operational usage profiles and contracting structures, which has limited options available for financing solarhybrid schemes.

Brian Knowles, director of storage and flexibility at Pexapark, said the innovative nature of the UK agreement “reflects our commitment to finding new PPA solutions for unsubsidized renewable energy developers and offtakers, with contracted revenue that offers attractive returns and low risk profiles for investors”.

California close to 6GW online BESS milestone

California now has nearly 6GW of battery storage capacity online, the California Independent System Operator (CAISO) revealed on July 11.

CAISO president and CEO Elliot Mainzer said total BESS capacity on the grid increased to 5.6GW as of July 1.

“Just three years ago, we had about 500MW on the grid and this rapid growth of energy storage in Cali-

fornia has significantly improved our ability to manage through challenging grid conditions,” Mainzer said.

He said it was essential for the state to continue to invest in innovative technologies such as energy story in the face of more frequent climate extremes including record heatwaves and droughts.

CAISO says 1MW of electricity provides roughly enough power to meet the

demand of 750 homes, while 5,000MW can provide enough electricity to power around 3.8 million homes for up to four hours before the batteries need to be recharged.

The battery systems are increasingly being paired with new or existing solar resources at the same location because such facilities can provide greater operational efficiency and flexibility, the operator says.

SVOLT breaks ground for Thai battery plant

SVOLT said on July 10 it had broken ground for construction of a battery modules and packs factory in Thailand.

The Chinese battery maker said the Chon Buri province facility, expected to be completed by the end of this year, will strengthen its presence in the thriving Thai EV market.

The facility is designed to have an annual production capacity of around 60,000 modules.

One line will be dedicated to the production of modules for hybrid electric vehicles, while the second line is designed to produce modules and packs for plug-in hybrid electric vehicles and battery electric vehicles.

Both production lines will use independently developed pouch cells and prismatic cells, with advanced automated welding processes and monitoring equipment

ensuring efficient, highquality production.

Chairman and CEO Hongxin Yang said SVOLT’s advanced lithium battery tech would form the basis of a local battery chain supply network that would contribute to China’s new energy market expansion.

SVOLT’s Thai operations are through its wholly owned subsidiary SVOLT Energy Technology (Thailand).

Canada agrees battery incentives deal for Stellantis, LGES plant

Stellantis and LG Energy Solution (LGES) are resuming construction of their NextStar Energy EV battery plant in Canada under a deal worth up to C$15 billion ($11.4 billion) in tax breaks for the project, Ontario’s provincial government confirmed on July 6.

The battery partners had been pressing provincial and federal government leaders to scale up support for NextStar in line with that available in the US under the Inflation Reduction Act.

Now Ontario is to provide C$5 billion in tax breaks for the project with a further C$10 billion coming from the federal government.

Production at the plant is planned to start in 2024 with an eventual annual production capacity in excess of 45GWh.

A statement issued by Ontario premier Doug Ford and other ministers said the incentives were a direct response to those offered by the US government — but warned they could be reduced or cancelled if the US should drop its support for battery makers.

Ford said the deal also extends to a project by Volkswagen and its subsidiary PowerCo SE to establish the auto giant’s first overseas EV battery cell manufacturing plant in Ontario. Volkswagen could receive up to C$13 billion in performance incentives.

However, incentives are linked to the amount of batteries that Stellantis produces and sells, in line with the conditions in the agreement for the Volkswagen battery cell manufacturing plant.

NextStar Energy is one of eight battery plants that LGES has secured in North America in response to its growing EV market.

European Court of Auditors warns on EU battery ambitions

The EU risks falling behind in its bid to become a global battery powerhouse, according to a report published on June 19 by the European Court of Auditors.

Access to raw materials remains a major roadblock, along with rising costs and fierce global competition. The EU’s efforts to grow its battery production capacity might therefore not be enough to meet the increasing demand, meaning it may fall short of its 2035 zero-emission goal, the auditors warn.

“Nearly one in every five new cars registered in the EU in 2021 had an electrical plug, and the sale of new petrol and diesel cars is to be banned by 2035. This has made batteries a strategic imperative for the EU,” says the report.

“But Europe’s battery industry is lagging behind its global competitors, particularly China, which accounts for 76% of global produc-

tion capacity.”

Annemie Turtelboom, the ECA member who led the audit, said: “The EU must not end up in the same dependent position with batteries as it did with natural gas — its economic sovereignty is at stake.”

Between 2014 and 2020, the battery industry received just €1.7 billion ($1.9 billion) in EU grants and loan guarantees, on top of state aid of up to €6 billion authorized between 2019 and 2021, mainly in Germany, France and Italy, says the report.

The EU’s battery production capacity is developing rapidly, with the potential to grow from 44GWh in 2020 to 1,200GWh by 2030 claims the report. However, this projection is not guaranteed and could be jeopardized by geopolitical and economic factors.

“First,” says Turtelboom, “battery manufacturers may abandon the EU in favour of other regions, not

least the US, which offers them massive incentives. Unlike the EU, the US directly subsidizes the production of minerals and batteries, as well as the purchase of electric vehicles made in the US using American components.

“Second, the EU depends heavily on imports of raw materials, mainly from a few countries with which it lacks trade agreements: 87% of its raw lithium imports come from Australia, 80% of manganese imports from South Africa and Gabon, 68% of raw cobalt imports from the Democratic Republic of Congo, and 40% of raw natural graphite imports from China.

“Although Europe has several mining reserves, it takes at least 12-16 years from their discovery until production, making it impossible to respond quickly to increases in demand.”

“Third, the competitiveness of EU battery production may be jeopardized

Basquevolt opens solid state center

Basquevolt, the solid state lithium battery developer and manufacturer, inaugurated its innovation center in mid-June in an official ceremony presided over by the president of the Basque government, Iñigo Urkullu and the company’s investment partners.

The company claims that its technology will revolutionize the lithium battery market as the greater efficiencies and safety of solid state batteries replaces existing lithium chemistries.

The company CEO, Francisco Carranza, said he expects to start producing its 20Ah cells by the end of the year. A spokesperson said solid state lithium technology

can “reach a high energy density — 1,000Wh/l and 450Wh/kg) — while reducing overall battery pack costs.

“Basquevolt battery cells can be produced through a more efficient,

less complex process, creating a 30% reduction in the capital investment needed per GWh in a gigafactory and 30% less energy used per kWh produced, compared to lithium-ion batteries.”

by rising raw material and energy prices. At the end of 2020, the cost of a battery pack (€200 per kWh) was more than double the amount anticipated. In the last two years alone, nickel has risen in price by over 70% and lithium by 870%.”

The auditors also criticise the lack of quantified, time-bound targets. Some 30 million zero-emission vehicles are expected on European roads by 2030 and, potentially, nearly all new vehicles registered from 2035 onwards will be battery-powered. However, the EU’s current strategy does not assess the capacity of its battery industry to meet this demand.

The auditors warned of two potential worst-case scenarios should the EU battery production capacity fail to grow as projected.

The first is that the EU could be forced to delay its ban on vehicles with combustion engines beyond 2035, thus failing to meet its carbon-neutrality objectives.

The second is that it could be forced to rely heavily on non-EU batteries and electric vehicles, to the detriment of the European automotive industry and workforce, to achieve a zero-emission fleet by 2035.

GS Yuasa announced the start of operations on June 15 of a 240MW/720 MWh BESS to support a wind power facility in Japan.

Yuasa said the lithiumion BESS delivered to the North Hokkaido Wind Energy Transmission Corporation started operations last March, following a

16-month installation period that ended in November 2021.

The system, equipped with about 210,000 modules and 3.3 million cells, will be maintained by Yuasa for 20 years.

Yuasa manufactured the batteries, which use the firm’s proprietary Starelink

battery maintenance service and associated remote monitoring technology to constantly monitor the voltage of all cells.

The BESS will help to suppress output fluctuations caused by weather changes and aid grid stabilization, the company said.

EU batteries chief on guard over battery subsidies from China, US

European Commission VP and batteries czar Maroš Sefcovic has said the bloc is monitoring “massive” Chinese and US battery industry subsidies — but signalled a conciliatory approach to protecting European manufacturers.

Sefcovic said while attending the opening of BASF’s joint center for battery material production and battery recycling in Germany on June 29: “We are looking carefully at China’s massive subsidies to its industry, in particular clean-tech innovation and manufacturing, and ways to protect our own.”

The EU is also in contact

with its “US friends” regarding the Inflation Reduction Act, which he said could lead to unfair competition, close

markets, and fragment critical supply chains.

Such incentives in several countries are affecting the EU’s capacity to succeed in the green and digital transition.

Sefcovic said the EU still needed to work and trade with China but should “focus on de-risking rather than decoupling”.

However, where trade is not fair, he said Europe must respond more robustly.

According to BASF, its new plant in Schwarzheide is Germany’s first production site for high-performance cathode materials and also the first fully automatic

Report reveals €13bn cost of Europe battery materials plan

The EU needs to invest more than €13 billion ($14 billion) by 2040 to guarantee just a quarter of key battery materials from European sources to power its green energy agenda, says analysis released on May 9.

The study by European electrochemical and thermal energy storage research center, CIC energiGUNE, assessed the impact of the Critical Raw Materials Act published by the European

Commission in March.

Study author and CIC sustainability expert, Andrea Casas, says analysis of the European Commission’s own estimates show the bloc will need to invest €7 billion by 2030 and €13.2 billion by 2040 to guarantee European sources of 25% of the region’s demand for lithium, cobalt, nickel, manganese and natural graphite.

EU member states could expect to contribute up to

€5 billion in public funding by 2040 towards the overall total, if the bloc wants to follow the lead of the US in supporting its battery sector under the Inflation Reduction Act.

However, the study does not comment on whether the bulk of the investment will come from European Commission coffers or private investors.

large-scale production plant for cathode materials in Europe.

The plant is sold out for the next few years and will supply products tailored to the specific requirements of cell manufacturers and automobile manufacturers in Europe.

Meanwhile, Sefcovic, who has championed the European Battery Alliance that was set up in 2017, said it has attracted more than €180 billion ($196 billion) of investments to date.

“There are now more than 160 industrial projects being developed along the entire value chain, with around 30 announced lithium-ion gigafactories and around 70GWh installed capacity by 2022.

batteries for mobility and energy storage is expected to increase 89-fold by 2050, Casas says.

Meanwhile, the demand for rare earths used to manufacture permanent magnets used in wind turbines or electric vehicles should increase six to seven times by 2050.

Casas says it is indisputable that critical raw materials are essential to EU plans for a network of battery gigafactories to support the clean energy transition.

The COO of Volkswagen’s PowerCo battery cells subsidiary, Sebastian Wolf is among the latest keynote speaker to be announced for this year’s Batteries Event, which will open in Lyon, France, on October 10.

Conference organizer Avicenne Energy has also published the first detailed preliminary program for the event, where more than 150 speakers

are set to address more than 1,000 delegates.

The Batteries Event will be held at the Centre de Congrès until October 13 and cover a range of topical issues impacting the industry ranging from trends and best practices to battery production and recycling.

Program and registration details are online. See also the events section of this magazine.

According to Casas, other strategic raw materials are also likely to require large investments such as copper for electrifying infrastructure, silicon for solar panels or platinum group metals for hydrogen electrolysis.

To date, the EU is almost exclusively dependent on imports for many critical raw materials, Casas says.

“In addition, the suppliers of these imports are often highly concentrated in a small number of third countries, both at the extraction and processing stages.”

All this becomes even more relevant when taking into account global demand for lithium to manufacture

However, she says it is also necessary “to be clear that deploying this plan will require significant investments to ensure the effectiveness of the measures taken”.

The European Commission’s Critical Raw Materials Act defined this year, for the first time, a list of strategic raw materials vital to powering the bloc’s green tech agenda, including domestic battery manufacturing for EVs and energy storage systems.

The Commission has said that by 2030, Europe should not be dependent on any single third country for more than 65% of its supply of any strategic raw material, unprocessed and at any stage of processing.

Morrow loan deal boost for for giga plans in

Morrow Batteries said on July 5 it had achieved an 86% yield of battery cells production at its customer qualification in South Korea just four months after opening.

CEO Lars Christian Bacher praised the results, saying industry standards put the initial average yield of new production lines at 70%.

Morrow started test production at Chungju-si in

February and has produced more than 600 prismatic cells with NMC battery chemistry.

The Norway-based battery maker said its industrial scale-up is now on track.

Morrow said it will produce a few hundred LFP batteries at B-sample stage during the summer.

The customer qualification plant will have a capacity of 2,000 battery cells per month.

Australia critical minerals blueprint launched

Australia unveiled a new critical minerals strategy on June 20, including a pledge to pump A$500 million ($332 million) of fresh investment into sectors including battery materials supply.

Resources and Northern Australia minister Madeleine King said the country aimed to become a “globally significant producer of raw and processed critical minerals”.

Independent modelling has found increasing exports of critical minerals and energy-transition minerals could create more than 115,000 new jobs and add

A$71.2 billion to GDP by 2040, King said.

But jobs could more than double that figure and GDP increase to A$133.5 billion by 2040 if Australia builds downstream refining and processing capability and secures a greater share of trade and investment.

Australia is the world’s largest producer of lithium — accounting for some 47% of world supply in 2020.

King said it is the third largest producer of cobalt and fourth largest producer of rare earths and produces significant amounts of metals such as aluminium, nickel and copper.

€500m R&D financial support awaits EU battery projects

Battery developers are being urged to make bids for millions of euros in financial support still up for grabs in Europe.

Wouter Ijzermans, executive director at the Battery European Partnership (BEPA), gave details of around €500 million ($547 million) in potential aid still available from the EU’s Horizon Europe R&D program during the International Flow Battery Forum in Prague on June 27 (see our events section).

BEPA works in tandem

Norway

On May 12, Morrow said it had agreed a loan deal of NOK567 million ($53 million) to support development of its battery cells projects at Arendal in Norway, where production is to

begin in 2024.

An investment decision to start on the next facility — the Eyde 1 14GWh per annum batteries production plant — will be taken in the first half of 2024.

Fitch upgrades China’s CATL to A- rating

Fitch Ratings, the international credit rating agency, announced on June 26, it had upgraded CATL, the China-based battery producer to a senior unsecured rating to A- from BBB+.

To put this into context this says the likelihood of defaulting on its debt is equivalent to that of Spain or Poland not paying their international obligations. Both countries are also rated A-.

Fitch says it expects the firm to have a compound annual growth rate of 18% over the next three years and its EBITDA (earnings before interest tax deductions and amortization) of around 15%.

Fitch says: “The company’s performance in 2022 and the first quarter this year demonstrates solidification of its dominant market share, technological capability and capacity leadership. These are commensurate with or stronger than peers’ in the respective industries.

“The ratings are con-

strained by the current nature of the volatile, evolving EV battery sector, which sees rapid changes in its competitive environment and technology. Regulatory risks in specific markets could also constrain CATL’s overseas growth, but Fitch believes the risks are manageable.”

Fitch believes CATL will continue to maintain its leading global market position and has a strong order book that supports future growth with adequate leverage headroom.