- 2024 www.rooftopgroup.org

AnnualPlan 2023

Contents 2 Summary Who we are Our vision and values Responding to customer feedback Annual objectives Reliable landlord services Good quality homes Support and advice Our business Annual objectives Value for money Key performance indicators Growth Risk management 3 4 5 6 7 7 8 9 9 10 11 12 13 13

The year ahead will be challenging for both Rooftop and its customers with the current cost of living crisis and ongoing high inflation. The 7% rent cap will help support customers but does mean that we have had to make hard choices about how we allocate our more limited resources to cover a £1 million gap between our costs and rental income.

In response, we have adapted our business to be more efficient with a new ‘Operating Model’ which places an even greater focus on the things which customers tell us matter most – the quality of existing homes, reliable repairs and landlord services, and support for those who need it.

We have allocated an additional £250,000 to tackle damp, mould and condensation in customers’ homes this year, as well as £3.4 million over the next three years to upgrade the energy efficiency of around 157 of the lowest energy-rated properties. This year we will also replace 250 kitchens, 160 bathrooms and 200 heating systems. We also have a budget of £36,000 to support those most in need through our Emergency Assistance Fund and will provide money advice to more than 700 households.

Having completed the backlog of around 2,900 repairs which developed during the lockdowns of 2020 and 2021, we will focus on improving the speed and quality of repairs, as well as continuing to improve communication and how we resolve and respond to complaints.

Our focus reflects the aims and aspirations of the Social Housing White Paper, The Better Social Housing Review and ‘Together with Tenants’ charter, and proposals for the introduction of consumer regulation in 2024. We began collecting data on the new Tenant Satisfaction Measures in January 2023, and will publish those results regularly, alongside summaries of complaints.

As a not-for-profit business, we have continued to streamline our support functions and invest in customer-facing services to deliver Value for Money, including reducing our staffing budget by about £400,000 in real terms. As ever, we will formally monitor progress of delivery of this plan on a quarterly basis with the Board and provide customers with a half-year update in the autumn.

Summary 3

Whoweare

Rooftop is a local housing association which exists to meet housing need in the communities of South Worcestershire and North Gloucestershire. We are driven by our Values and are close to our customers.

We manage around 7,000 homes and provide a range of accommodation and support services for older people and people escaping domestic violence.

Rooftop is also a specialist in providing culturally appropriate homes for the Gypsy and Traveller community at three sites, in partnership with Solihull and Bromsgrove Councils. This year will see a new Gypsy and Traveller site being developed in partnership with Coventry City Council.

We deliver approximately 100 new homes a year, the majority of which are low-carbon and built to the highest energy efficiency rating of ‘A’ to address fuel poverty and climate change.

Partnership is critical to our success, and we work particularly closely with the district councils of Wychavon, Malvern, Tewkesbury, and Gloucester City. We are delighted to be a strategic partner with Homes England, through the Matrix Housing Partnership.

4

Our vision and values

In late 2022 we consulted customers, colleagues, and stakeholders about our plans to focus what we do and set that out in a new simple Vision.

Our corporate priorities around Good Quality Homes, Reliable Landlord Services, and Support and Advice directly incorporate that customer feedback. This is our new Vision:

5

Respondingto customer feedback

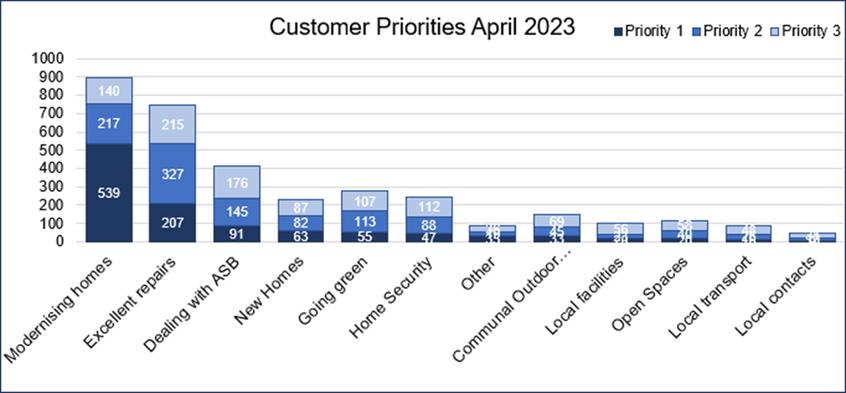

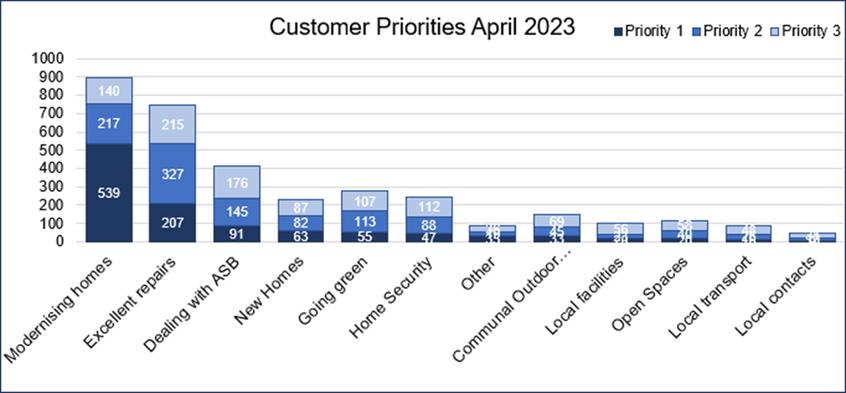

Customers have been consistent in telling us what matters most; investment in existing homes, a reliable repairs service, energy efficiency, and tacking anti-social behaviour issues. Customers also want us to manage neighbourhoods and communal areas well. A summary of the 1,135 responses from April 2023 is below:

6

Annualobjectives

Our plans for the year ahead are summarised below, with specific Annual Objectives set out in the table on page 10. Key Performance Indicators for 2023-24 are set out on page 12.

Reliablelandlord services

Customer satisfaction in housing and most other areas of life has declined since the pandemic. Our target is to achieve at least 82% satisfaction for landlord services and 85% satisfaction for repairs this year. Ongoing improvements to the repairs service, better complaint handling, and a focus on improving day-to-day customer communication will be key.

We know from customer feedback that Shared Owners and Leaseholders want a more responsive service, and we will develop a clear offer for those customers this year.

We will also continue our work in developing ‘promises plus offers’ that are neighbourhood focused by responding to local feedback and priorities.

7

GoodQuality Homes

This year we plan to spend £6.2 million on new kitchens, bathrooms, heating systems, and other planned works. We also expect to spend around £5 million on an anticipated 18,000 repairs.

We will introduce an enhanced standard for empty properties to ensure that our homes are of a good quality standard when new tenants move in. We will also work hard to tackle issues with damp, mould and condensation.

We have already completed 3,000 surveys of homes in the past year and will continue this programme to enable us to develop a revised long-term investment plan for existing homes this year.

This year we will submit a planning application to deliver up to 300 new homes on a brownfield site next to Gloucester City centre, with around 200 of those homes for rent and Shared Ownership. Our aspiration is to deliver this as a Net Zero Carbon housing development. Alongside this, we will continue to develop affordable homes for local people in the areas where we work with a target to complete 128 homes this year.

8

Supportandadvice

We will aim to support at least 700 customers in the year with money advice and helping them to maintain their tenancy, ensuring they maximise their benefits and claim any grants they are eligible for.

This year we will also develop plans for all retirement living schemes’ alarms to be switched to digital by 2025 and upgraded to ensure residents have a modern and robust system fit for the future.

In response to customer feedback, we have a dedicated Anti-Social Behaviour team in place. It will continue to offer support and advice for customers on this important issue and ensure that we take enforcement action where it is needed.

Ourbusiness

With Rooftop’s overall costs rising higher than inflation in areas such as repairs and maintenance, we will this year continue to drive the digitisation of systems to make our organisation more efficient and effective.

We will also focus on improving and expanding the data that we hold on our customers and homes, and implementing key actions on Equality, Diversity and Inclusion for customers and colleagues.

9

Annualobjectives

10

Valueformoney

Each year, Rooftop’s annual accounts include a self-assessment of how we are achieving Value for Money in delivering our annual and long-term Corporate Plan objectives and complying with the regulatory Value for Money Standard. Our assessment is based on the ‘Sector Scorecard’ metrics, which include key performance indicators covering customer satisfaction, financial security and our effectiveness as a business.

This year, our focus is on reducing void losses, most notably in our housing with care homes, and ensuring that the review of our repairs service, including contract negotiations, delivers long-term efficiencies, savings and productivity gains. We will continue to automate and digitise internal and customer services wherever we can and where it is appropriate to do so.

11

KeyPerformance Indicators2023-24

12

Rooftop is committed to continuing to deliver as many new homes as it can, whilst ensuring we continue to improve the quality of our existing homes. The table below sets out the number of homes we aim to deliver over the next five years. Our delivery programme is linked to our funding from Homes England, these homes will be delivered across South Worcestershire and North Gloucestershire.

Growth

Wealsorecognisethatweneedtobeopentocarefullyandproperly consideringotherformsofpotentialpartnershipasawaytodeliverour charitablearticles.WehaveadoptedtheNationalHousingFederation VoluntaryCodeforMergers,GroupStructuresandPartnerships,andour approachissetoutinmoredetailonourwebsite.

Riskmanagement

Risks are assessed, prioritised, and control measures are implemented with assurance across three lines of defence reported through our Executive Team to the Audit and Risk Committee and the Group Board. The risk process is dynamic with risks being reviewed quarterly. On pages 14-15, we have summarised the top seven risks within our framework, plus a cross cutting risk which could impact on delivery of the annual objectives within this plan.

Planning Year 2023/24 2024/25 2025/26 2026/27 2027/28 Total Social Rents 83 50 123 25 78 359 Shared Ownership 45 20 81 35 39 210 Total 128 70 204 50 117 569

Development Programme 2023 to 2028

13

1 Healthand Safety

LandlordHealthand Safetycompliance declines.

Occupationalhealth andsafety disregarded. CausesofDamp, Mouldand Condensation(DMC) arenoteffectively tackled.

Increasingfailuresto meetstatutory requirementsand regulatorystandards: Colleaguesafety compromised.

Gas/Fire/Electrical/ Lift/Water/Asbestos. Increasecomplaints aboutDMC. Increaseriskof injury/fatality.

MonthlyCompliance Report.

2 Stock Investment Requirements

Multipleinvestment requirements crystalisingatonce:

Damp,Mouldand Condensation. BandCtargets (2030). SmokeandCO detectors. NewFire Regulations2022. BuildingSafety Act2022. DecentHomes/ stockinvestment.

Challengetomake therightdecisions abouttradeoffs betweenpriorities.

3 Financial Viability

Inflation/Costof LivingCrisis.

7%RentCap.

Poorperformanceon incomecollection.

Poorperformanceon voids/allocations.

Investmentwillhaveto bealignedtoprioritiesthiswillcreatea timescalewhichmay notmeetwith expectations: Meetingstatutory deadlinesmaybecome challenging. Someinvestmentmay bedeferred.

Regulator. Customers. Stakeholders.

LossofIncome–rent arrears.

Expenditureincreases beyondincome collection.

Rentarrearsincrease. Voidslossesincrease. Compoundsother strategicrisks(1/3/4).

Regulatory/Statutory intervention: StaffTurnover. G2downgrade.

MonthlyCompliance Panel.

RSH HSE.

Breachofregulatory requirements–potentialself-referral.

Customersatisfaction declines.

Complaintsincrease.

HOinvestigations increase.

Disrepairlegalcases increase.

Knockoneffecton timesensitive investment–for exampleDampMould andCondensation remedialactionis delayed.

QuarterlyHealthand SafetyCommittee.

Quarterlyriskupdate report.

AnnualInternal Audits.

MonthlyCompliance Report.

MonthlyCompliance Panel.

Bi-monthly Investmentoverview report.

AnnualInvestment Strategyactionplan. AnnualObjectives. DampMouldand CondensationProject Group. BandC (Decarbonisation) ProjectGroup. InternalAudit.

QuarterlyRisk. Updatereport.

Financialviability concerns. Breachofloan covenants. Reductionin Development Programme. Unabletomaintain existingstockto decenthomes standard.

G2/V3downgrades.

KeyPerformance Indicators.

Management Accounts.

Quarterlyriskupdate report.

AnnualInternaland ExternalAudit.

Risk Cause Impact Consequence

Monitoring

14

Poordatainhibits decisionmakingcustomerdata/asset data.

Lackofcybersecurity awareness/cultureof unconsciousrisk takingwith data/securityofdata.

Sub-optimaldecision makinginrelationto customerservices/ equalitydiversityand inclusion/investment. Mistakesmadebecause ofpoordata. Delaysinresponding duetopoordata. Potentialformajor cybersecuritybreach increases. Cybersecuritybreach.

Systemicdataissues aretreatedasafailure ofGovernanceand wouldriskaG2 downgrade.

Cybersecurityfailures/ victimofaseriouscyber securitybreachcan costasignificant amountoftimeand money(insuranceisin placetomitigatethe cost).

Valueformoney. Servicedeliveryimpactslowbusinessrecovery.

5

Repairservice/Cost

Cross-cuttingriskwhich canincreasethe likelihoodofother strategicrisks materialisingmorerapidly assystemsofinternal controlareweakened Servicedeliverydeclines

Servicedelivery/ performancedeclines. Higherexpenditureon repairsservice. Wedonotmeetconsumer standardexpectations

Customersatisfaction declines.

Complaintsincrease. Budgetoverspends.

KeyPerformance Indicators.

MonthlyCompliance Report.

Quarterlyriskupdate report.

AnnualCyber SecurityStrategy plan.

AnnualInternal Audits.

KeyPerformance Indicators.

StaffSurveys.

Quarterlyriskupdate report.

AnnualInternal Audit.

PoorPlatform

PropertyCare

Increasedcostofrepair service. Increaseinvoidtimes.

Customersatisfaction declines.

Complaints/HO investigationsincrease. G2downgrade. Budgetoverspends.

KeyPerformance Indicators.

Quarterlyriskupdate report.

AnnualRepairs Strategyactionplan. AnnualObjectives. CustomerSurveys.

Seriousreputational damagecanhave multiplenegative consequences: Quarterlyriskupdate report.

7

Cuttingacrossall

Crystalisationofany

Increasednegative publicityregarding seriousfailures.

Reducedconfidencein Rooftopbystakeholders andlenders. Regulatoryengagement.

Reductionin confidenceof lendersmaking refinancingornew lendingmore expensiveandor moredifficultto attract. Lossof opportunitiesto workwithpartners andstakeholders. Riskofregulatory intervention.

Bi-monthlyGCE overviewreport.

Annual Communication Strategyplan.

AnnualSectorRisk Profileanalysis reporttoAuditand RiskCommittee.

4 Data/Cyber Security

Service delivery

Colleagueslack capacitytodeliver increasedworkloads.

6 Repairs Service

SharingVehicleisnot fitforpurpose. Contract renegotiationsare unsuccessful.

Contract Management.

Reputational Risks

strategicrisks.

oftheaboverisks couldresultinsevere/ catastrophic reputationaldamage.

15