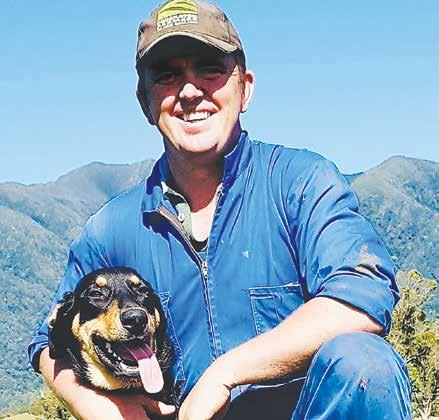

NEW OPEN Country Dairy chief executive Mark de Lautour isn’t fazed by growing competition for milk in dairy heartland, Waikato.

De Lautour, who took the role three months ago, says the Talley’sowned business welcomes competition.

“We welcome it because we back ourselves as being the best,” he told Dairy News

“We have a history of producing good results for our suppliers, so all we are saying is, bring it on.”

Waikato, where Fonterra remains the dominant player, is a crowded field. Open Country operates alongside Fonterra, Tatua, Synlait, Yashili and the newest arrival, Singaporebased food giant and one-time Open Country stakeholder Olam.

According to DairyNZ, the Waikato region is home to nearly 29% of the nation’s dairy herds, and 22% of the dairy cows.

One sign of the fierce competition is that Open Country no longer has a waiting list of suppliers in Waikato.

But de Lautour points out that even with Olam arriving on the scene, Open Country has boosted milk supply for the new season.

The company pays its suppliers in full four times a year. For the first period of the new season, June to September, the company is forecasting a payout midpoint of $8.10/

OPEN COUNTRY Dairy chief executive Mark de Lautour believes all eyes are on China as the new season progresses.

“Many buyers globally are watching China with interest, looking to see if/when Beijing is going to stimulate its internal consumer activity.”

He thinks it’s possible Chinese buyers will remain subdued,

kgMS. Farmers will be paid in full in November. The payout midpoint is forecast to increase during the season.

De Lautour says farmers like their policy of paying faster and creating value at the same time.

“In a dwindling milk pool with new players coming in, you have to

and utilise domestic inventories until early 2024, after which milk powder imports from New Zealand become tariff-free.

He says there are two reasons for this: state-owned dairy companies don’t want to end the financial year with high-priced inventories, and they expect to benefit from the final tariff removal from January 1 next year.

be a very good operator to maintain and attract suppliers. I think with on-farm costs increasing along with interest rates, our payment model creates real value”

Open Country is forecasting an average payout of around $8.25/ kgMS for the new season. However, de Lautour points out that it’s

early days and things could change either way.

Open Country Dairy produces milk powders for export to China and other markets. It’s also a major cheese producer, setting a production record last season and forecast to do even better this season.

De Lautour says it has invested in its Waharoa cheese factory to boost capacity. Sustainability changes at the plant – like wood pellets and not burning coal – attracted more global cheese customers.

“So, this gives us lot of options: We can run our cheese plant harder when there’s demand and produce milk powders as well.

“We are looking at how this can be replicated in other regions.”

De Lautour joined Open Country from another Talley’s subsidiary, Affco, where he was the head of sales and marketing.

He sees a similar culture in both the companies. Neither of them are co-operatives, so their success depends on the ability to pay farmer suppliers a competitive farmgate price and provide high-level service.

“We aren’t a co-operative, so farmers have the choice. They know they can hand in their notices and that makes the whole relationship one based on trust and performance,” he says.

De Lautour says Open Country prides itself on being in regular contact with farmers through its milk supply team, but without dictating how they should run their own businesses.

DAIRYNZ’S NEW chief executive Campbell Parker will take up his new role in October.

He was announced as the new chief executive last week to replace Tim Mackle who leaves the industry-good organisation this week after 15 years in the role.

Parker joins DairyNZ from GEA Farm Technologies NZ, where he has been CEO since 2020.

With over 25 years experience in agriculture, Parker held previous roles with PGG Wrightson, Bank of New Zealand (BNZ) and Ballance Agri-Nutrients.

He holds a Bachelor of Agriculture, majoring in rural valuation from Massey University and grew up on a sheep, beef and dairy grazing farm.

Parker is excited by the opportunity to contribute to dairy farming in a new and challenging role.

“I am genuinely hum-

bled and excited to be joining DairyNZ as the next chief executive.

“I am passionate about the role the dairy sector plays in creating jobs, building communities, and contributing to the success of the New Zealand economy,” said Parker.

“It is important to build on the good work

Tim and the team have done over the past decade, and to keep that moving, working collaboratively to ensure long-term sustainability

and profitability of the sector.”

DairyNZ chair Jim van der Poel is pleased with the expertise Parker brings to the chief execu-

tive role, including extensive experience in the rural and corporate sectors.

“Recruiting a new chief executive who is

passionate about dairy farming and its future has been hugely important to us – alongside leadership skills to continue DairyNZ’s positive direc-

tion, as an organisation here first and foremost to represent our dairy farmers,” says van der Poel.

“Campbell brings significant leadership and sector experience that will be invaluable to both DairyNZ’s senior team and in supporting and representing our farmer levy payers, in a wide range of forums.

“Campbell is passionate about agriculture and supporting New Zealand dairy to continue as a world-leading sector. We are pleased to welcome Campbell to the team.”

Van der Poel also thanked Mackle for his significant service to DairyNZ and its farmers.

“Tim has been a true advocate for our dairy farmers and a steadying force at DairyNZ, during a period of significant change and challenge for the dairy sector.”

Peter Scott will act as chief executive until Parker takes over.

FONTERRA FARMER shareholders always look to their co-operative to pay them the highest sustainable milk price, and understandably they ask questions when they see global differences in milk price, says Co-operative Council chair John Stevenson. He was commenting on Fonterra having to pay its Australian farmer suppliers $1.50/kgMS more than its New Zealand suppliers.

Last month, Fonterra Australia announced an opening weighted average milk price for the 2023/24

season of A$8.65/kgMS. That’s NZ$9.50/kgMS. For NZ suppliers, the co-op last month opened with a margin of $7.25 to $8.25, and a midpoint of $8/kgMS.

Stevenson told Dairy News that it is important to note that the NZ and Australian milk prices are calculated in very different ways, reflecting the different markets, product mixes and competitive environment.

“Fonterra’s NZ farmers have received comparatively higher milk prices than their Australian members

in some previous seasons. Fonterra management are best to comment on the detail of these reasons.

“Council is interested in Fonterra’s strategic choice to focus on NZ milk, differentiating it in the global market and earning a premium.

“For some time, we have been asking how this ‘premium’ will be evidenced and measured.

“We have yet to see this value identified in reporting from management, so will continue to ask this on behalf of our farmers.

“As well as comparing the NZ milk price to Australia’s, Council is also keenly interested in the NZ milk price compared to EU and US milk prices. We include reporting on that in our annual report each year, which is released prior to the Fonterra annual general meeting.”

A shrinking milk pool in Australia is forcing major processors, including Fonterra, to outbid each other and secure farmer suppliers.

Federated Farmers dairy section chair Richard McIntyre says NZ

dairy farmers would love to have a higher milk price, but they are aware that milk price is affected by a processor’s product mix and the market the product is sold into.

“We see this between NZ processors, but the distinction is particularly evident between NZ and Australian processors,” he told Dairy News “Australia’s milk production is largely consumed internally, whereas the vast majority of New Zealand’s milk is exported.” – Sudesh Kissun

“I am passionate about the role the dairy sector plays in creating jobs, building communities, and contributing to the success of the New Zealand economy.”

THE ABSENCE of Chinese demand from the global market is keeping dairy prices subdued.

Last week’s Global Dairy Trade (GDT) auction posted a rare flat result, with both the price index and whole milk powder (WMP) price unchanged from the previous auction.

ASB economist

Nat Keall says digging deeper into the auction data shows that Chinese demand is still largely absent from the market. The North Asia region bought just 23% of the WMP on offer – a lower proportion than it was generally purchasing around this time last year during the midst of rolling zero-Covid lockdowns.

Keall says looking purely in terms of outright volumes, the 2474 MT of WMP purchased by China at this auction looks to be the second lowest of the last seven years.

“It is possible that buyers are keeping their powder dry until offer volumes increase over the coming auctions, but for now, it’s a bearish sign,” he says.

For the time being, resilient demand from Southeast Asia is helping keep prices from falling further. The occasional short-term boost from a handful of Middle Eastern buyers seeking a particular product stream is helping too.

But with growth set to slow in Southeast Asia over the course of

2023/2024 and purchase volumes already at a historically high baseline at this point last season, Keall sees a limit to how far this region can support prices.

“For a farmgate milk price in the upper end of Fonterra’s forecast range, we’ll need China to return to the party,” he says.

“Given weaker economic data and comparatively strong Chinese dairy production, that’s doesn’t look imminent in our view.”

ASB is retaining

FAST-FOOD GIANT McDonalds spent a record $598 million last year on New Zealand milk, cheese, and other primary industry ingredients.

Its annual shopping list, released this month, shows the fast-food chain used $214m worth of NZ products in its local restaurants. A whopping $384 million of produce was exported to other McDonald’s markets. The total spend was $52 million more than in 2021.

Nearly 7 million litres of fresh milk was sourced from dairy farmers – the equivalent of 246 Fonterra milk tankers and enough to fill Kelly Talton’s Stingray Bay aquarium tank 19 times, the company says.

Nearly 2 million kilograms of cheese and other dairy products were used locally, along with 11.6 million kg of cheese exported – the equivalent weight of 6500 empty shipping containers.

The company also used 900,000kg of lettuces and 12 million kg of potatoes in its local restaurants.

McDonalds sources its cheeses from Fonterra’s Eltham site in Taranaki. It

its forecast milk price of $7.25/kgMS for the 2023/24 dairy season.

Keall adds that both the NZ dollar spot rate and the all-in NZD forward rate have underper-

formed their forecasts slightly and that’s added a bit of upside to the forecast since they launched it as $7/kgMS six months ago.

Another factor that could impact dairy prices is NZ milk production.

Keall believes both global and local dairy production are past their recent lows.

“Still, the softer outlook for global demand is the key thing and as we’ve noted all along, we think farmers should prepare for the risk that the season’s milk price is lower than the last couple,” he says.

Westpac’s senior agri economist Nathan Penny says last week’s flat results do little in

terms of setting direction for prices over coming months.

For now, soft global dairy demand and soft global dairy production are effectively in a stalemate, he says.

Penny also talks about two possible circuit breakers: one is the longawaited rebound in Chinese dairy demand; and the other is spring New Zealand dairy production.

“Our view is that Chinese dairy demand still comes through and lifts global dairy prices,” he says.

“Though admittedly, the risks are that the expected demand rebound is pushed out even further. “Meanwhile, spring produc-

tion can shift the global dairy price dial in either direction. We anticipate a modest 1% production lift over the 2023/24 season compared to 2022/23.

“However, there is a wide range of possibilities. One possibility is a stronger production rebound on an improved spring relative to the weak production over spring 2022/23.

“Alternatively, tight cashflows could see lower fertiliser use and other cost-saving measures in say animal health resulting in lower production.”

Westpac is maintaining its forecast milk price of $8.90/kgMS for the new season.

@dairy_news

facebook.com/dairynews

says New Zealand farmers are also strategically important suppliers to McDonald’s worldwide. Kiwi produce is exported to McDonald’s markets including Australia, the Pacific Islands, Asia and the United States.

“McDonald’s has long recognised New Zealand as one of its top global suppliers of quality beef and dairy. It’s great to be able to supply a local menu where around 90% of the ingredients are sourced from across Aotearoa, and to share this quality produce with McDonald’s markets around the world,” says managing director NZ and Pacific Islands, Kylie Freeland.

“While we’re a small market in terms of our number of restaurants in the McDonald’s world, New Zealand is amongst the top 10 countries that supply beef to McDonald’s. Globally, we have several commitments around sustainable beef production, and the climate, which means we’re working closely with our local suppliers and industries to help encourage continuous improvement and making a positive impact on the planet.”

heads down to focus on our core mission to support herd improvement in New Zealand.”

FARMER CO-OPERATIVE LIC says changes to the current animal evaluation model proposed by DairyNZ isn’t the way forward.

In a submission to DairyNZ last week, LIC says it welcomes increased competition around herd improvement.

“We understand some farmers might want a simpler animal evaluation system with a single index and we will continue to work with DairyNZ to find a solution for that – but their proposal is not the way forward.

“We strongly believe that the co-operative is in a strong position to deliver for you under the current model, and we will continue to put our

In a letter to farmer shareholders, LIC chief executive David Chin says the co-op, representing over 9000 dairy farmers, has invested heavily in genomics on their behalf.

China says this is delivering significant value to LIC farmers.

“Genomic bulls are widely available for AB and the majority of our 9000+ farmers are utilising them,” says Chin.

DairyNZ - through subsidiary New Zealand Animal Evaluation Ltd (NZAEL) - believes that creating one animal evaluation index would ensure breeding decisions are made consistently.

It proposes that a single evaluation will be co-ordinated by NZAEL, as an industry good, credible source of data avail-

able to everyone to use.

The sector is currently using three Breeding Worth animal evaluation indexes – owned respectively by LIC, CRV and NZAEL. DairyNZ chair Jim van der Poel says this creates confusion in the sector – and sub-optimal outcomes.

However, in his letter,

Chin says it’s not clear who the proposal really benefits.

“While the proposal aims to facilitate more competition in the AB market, we note that competition in the AB market exists today in New Zealand, with opportunities already available for new players to enter

the market. This is to the benefit of New Zealand farmers, and the existing competition helps to drive investment in R&D.

“The proposal would risk disincentivising investment in R&D without clear benefits for increasing the choice of AB providers for farmers.”

Chin claims the proposal will increase costs to farmers and the industry.

“While the proposal is intended to make genomics more widely available for New Zealand farmers, most farmers in New Zealand have ample access through LIC and are receiving value on farm. DairyNZ is proposing to use farmer-levy money to re-create a genotype database which already exists.

“The proposal also contains an unclear and confusing fee model, with

a lack of clarity on how exactly the model would be funded. For example, there is reference to straw levies and levies for cow enrolment via herd record providers as optional charges depending on what other fees are included.

“Although it is unclear how DairyNZ intends to enforce collection of these levies, ultimately all costs are borne by the industry one way or another.”

Chin also questions how the proposed single breeding index would operate without the participation of LIC and other existing AB companies.

The proposal requires all parties to be involved, including LIC.

But Chin says the current model does not encourage participation by current industry participants.

“The proposal fails to address how the model would operate and how it would be funded should existing companies, including LIC, choose not to participate.”

LIC also claims the ‘size of the prize’ is based off flawed assumptions and is not accurate.

It is not clear what the problem is that DairyNZ is trying to solve, says Chin.

“The proposal claims that there is an opportunity of $1.36 billion return on farm over the next 10 years by increasing BW year-on-year through genomics. There is no independent modelling or evidence to support this opportunity. In fact, the modelling associated with the proposal is retrospective and only looks at data up to 2020.”

Submissions on DairyNZ’s proposal close this week.

slow on-farm adoption of genomics, fragmented datasets and multiple versions of BW presented to farmers.

will be able to breed better animals every year.

KIWI DAIRY farmers continuously strive to be world-leaders in pasturebased production, emissions efficiency and animal care. Our sector’s success in global trade relies on these factors.

Maximising genetic gain is important if New Zealand is to continue being world leading. Genetic gain expressed in Breeding Worth (BW) results in cows that are more efficient producers, meaning they need less feed for each kilogram of milk they produce. Right now we are missing out on genetic gain due to

That’s why New Zealand Animal Evaluation Ltd (NZAEL), a DairyNZ subsidiary, is proposing a single, independent BW index that will include all useful genomic information and make NZAEL’s BW more reliable and the sector standard.

Having more reliable information allows farmers to make better decisions, which will help ensure genetic gain is the best it can be for Kiwi dairy farmers. This will help New Zealand keep up with the rest of the world when it comes to rates of genetic gain – meaning our farmers

We want to help all dairy farmers in New Zealand unlock additional potential profit – for their benefit and that of New Zealand as a whole. The work we have done shows us this change is the right thing to do. However, we need an operating model that is fair to all participants – a model that encourages all sector participants to get involved will see everyone working together and give us the greatest chance of success. We have developed a proposal and are now consulting with farmers and sector participants to get feedback to improve our thinking.

To be clear: NZAEL is not seeking to own genomics data. Commercial breeding companies will retain ownership of the genomic data they have invested in collecting.

However, as an industry good organisation we are requesting access to it so the whole sector can benefit. This is the same approach taken to the current phenotypic data – such as herd testing data – that flows into the Dairy Industry Good Animal Database.

This is a significant change for the sector and brings plenty of challenges, but we believe we would be remiss in our duty to farmers not to work towards this change. This is

about dairy farmers and us all working together to get the best outcomes.

We believe the development of one BW with genomics by NZAEL as an industry good body, on behalf of the sector, is a positive use of farmer levies.

NZAEL works closely with worldrenowned experts – agricultural geneticist Dorian Garrick and AbacusBio managing director and agricultural scientist Peter Amer – who have made it clear New Zealand’s rate of genetic gain has not improved to the level we should expect in the past 10 years.

• Jim van der Poel is DairyNZ chairman

SCION SCIENTISTS have embarked on important new research to find out how much methane is being consumed by microorganisms in New Zealand’s planted forest soils.

Forest soils are good habitats for bacteria that absorb and release methane (CH4) as a source of carbon and energy. By quantifying how much methane is consumed by the bacteria, known as methanotrophs, at field sites, the project will reveal just how important planted forest soils are to New Zealand as part of broader efforts that seek to better understand the country’s total net emissions and ways to mitigate climate change.

Once complete, the research will provide valuable insights for policy makers examining greenhouse gas emissions as it can be used to paint a more accurate picture of the country’s total net carbon budget.

Due to agricultural activity, methane produc-

tion in New Zealand is disproportionately high on a per capita basisabout six times the global average. Understanding the potential for other land uses, such as forestry, to mitigate these agricultural emissions is critical, says Scion senior scientist Dr Steve A. Wakelin.

“We know that forests are great for storing carbon from carbon dioxide, but this research is helping us learn about forestry’s capability to offset methane emissions as well. We believe it is a first step in a future programme of work that will demonstrate how different land uses in New Zealand are all interconnected, and how to manage these holistically for win-win outcomes.”

He says New Zealand’s economy is reliant on the livestock sector for jobs, food and income. Scion’s research aims to show how forestry can support the agricultural sector to tackle one of its biggest challenges.

CLIMATE COMMISSION chair Dr

Rod Carr recently shared the commission’s views – and some personal ones – with the Waikato Regional Council Climate Action Committee.

Climate Action Committee chair Jennifer Nickel says councillors welcomed the opportunity to pick Carr’s brains to navigate the complex topic that is responding to climate change.

Councillors asked questions about agriculture, soil, riparian planting, forestry, shipping, aviation, energy, biosecurity, the role of local government and supporting capacity of iwi Māori,

“Scientists are working on breeding lower methane-emitting livestock, using methane ‘vaccines’ and inhibitors, and investigating farming system change such as feed and additives.

“However, even combined these are unlikely to ‘nudge the needle’ enough to meet our emissions reduction targets.

“As Aotearoa works towards a low-carbon future, this issue is one

among other things.

“What really stood out for me was the reiteration of how there are so many positive opportunities for our communities to be had from a rapid transitioning to a low emissions economy, in particular around health and avoiding future costs,” says Nickel.

“I’m really enthusiastic about future potential for ecosystems services payments for landowners who protect our natural habitats.”

Carr attended the committee to share the commission’s draft recommendations to the Government for

for us to tackle together.”

The Ministry for Primary Industries is funding the research, with support from Lincoln University. It follows international studies proving that forest soils create optimal conditions for the methane-absorbing microbes.

As methane in the air passes over and diffuses within forest soil, methanotrophs consume the methane.

“We find methanotrophs are abundant in our DNA-based surveys of planted forest soils,” Wakelin says.

“Indeed, based on overseas systems, it turns out that planted forest soils are pretty good habitats for methanotrophs; we just haven’t looked at this in New Zealand before.”

Scion’s Microbial Ecology - Soil Systems team is now collecting New Zea-

the development of its second emissions reduction plan, and which the council will submit on.

The Government must deliver the second emissions reduction plan for New Zealand next year. The commission’s advice focuses on identifying critical gaps in action, and where existing actions need to be urgently strengthened and accelerated to meet the second emissions budget (20262030) on New Zealand’s path of netzero greenhouse gas emissions and reductions in methane of 24-475 by 2050.

land’s first field-based measurements of methane flux - how fast the soil microbes are consuming methane.

Researchers have installed methane flux chambers at two field sites near Christchurch: Orton Bradley Park and McLeans Island. At both sites Scion already collects environmental DNA and measures environmental properties; this information will now be integrated with the methane flux data. Chambers have also been installed in Kaingaroa Forest in the central North Island - New Zealand’s largest commercial pine plantation.

Sampling of these field chambers will reveal how much methane the forest soil microbiome is consuming over an entire year.

“If rates of consumption are high, we need to know as this data will be important for our national carbon budget,” says Wakelin.

“Given the importance

Nickel says councillors were particularly interested in the commission’s views on agriculture, soils and forestry as they are identified in the council’s Climate Action Roadmap as pathways to reduce emissions and adapt to climate change.

Agriculture is a key economic sector for the Waikato, yet it is also this region’s greatest source of emissions. The next biggest sources are the transport and energy sectors.

Carr told the councillors it was important to get on board with new innovations to “reduce the emissions

of methane as a greenhouse gas for agriculture, it could just be a case of forests to the rescue.”

Lincoln University’s Prof. Tim Clough says the collaborative research with Scion will reveal important data.

“With Scion’s expertise in forestry aligned with Lincoln University’s facilities for tracegas sampling and analysis provided through the New Zealand Greenhouse Gas Centre, we have a great partnership in place to assess the big opportunity of forest methane consumption.”

Methane is responsible for about 25% of global warming. What’s more, each molecule of methane has about 28 to 35 times greater warming potential than carbon dioxide (CO2). This means that concentrations of methane in the atmosphere have considerably more potential to alter climate change compared to the same volume of carbon dioxide.

from agriculture”.

“The world is already on that pathway through breeding, feeding and feed supplements,” says Carr. “We’re already seeing in Europe and parts of North America significant reductions and biogenic methane associated with protein production – and we need to get on board, or we will be left behind.”

The councillors also heard from Carr about the commission’s views on forestry, given the region’s large exotic and native forestry contribution.

FARM COSTS have risen 33% over the past years to top on average $9.17/ kgMS last season, according to DairyNZ.

Data also shows that on average farm costs increased by around 13% between the past two seasons (2021/22 and 2022/23).

However, costs are forecast to reduce from around $9.17/kgMS last season to around $8.96/ kgMS for the news season that started June 1.

DairyNZ chief executive Tim Mackle says it is good to be seeing a slight reduction in farm expenses, particularly for urea and supplementary feed, but costs are still high.

“We are hearing from farmers that on-farm inflation is one of the biggest concerns impacting their profitability, as they have experienced significant price increases in the past year,” says Mackle.

DairyNZ has launched an online tool - DairyNZ Econ - to help farmers better understand the current economic environment.

Mackle says farmers are focused on managing rising costs at the start of the new dairy season.

“Every farm is different but, given the scale of cost increases in the past few seasons, many farms will be feeling the current profit squeeze.

“They will likely be starting the season with inflation, farm costs and milk prices front of mind,

and considering how to approach the year ahead.

“That’s why we are focused on supporting

our farmers through current market conditions. We are excited to launch our new DairyNZ Econ Tracker to farmers, which provides some of the latest information on the New Zealand dairy sector, including farm economics.

“This is a central platform where farmers can gain information to help understand their operating environment, track sector trends, and then apply the information to their individual farm businesses.”

The DairyNZ Econ Tracker builds on the available information from the DairyNZ Economic Survey and Dairy Statistics and provides a

snapshot of the dairy sector’s economic situation.

Information will include forecasts applying regional and national average data, providing useful trends to observe for farmers to consider the application to their individual farms.

“Farmers can use this data to help look for trends and understand the current economic environment, including what is happening now and what may happen in the near future, to support their budgeting and farm business planning.”

Context and information provided from the Econ Tracker will help farmers prepare for different scenarios in the

seasons ahead. DairyNZ has also been working with farmers to understand what they are doing to farm through the current economic environment.

Farmers’ top tips include surrounding yourself with people who understand farming and its outlook, having a strong support team and ensuring young stock have the best possible start.

These tips and more are available on DairyNZ’s website.

The new DairyNZ Econ Tracker is available online at dairynz.co.nz/ econtracker.

@dairy_news

facebook.com/dairynews

How can you reduce your reliance on imported feed?

With the air of uncertainty around imported feeds in both the short and long term, now is a good time to explore alternatives. And you don’t have to look far. Planting an extra paddock in maize at home, or ordering more maize silage in, may be all that’s needed.

Maize silage is the ideal supplement to pasture. The cows love the stuff, it helps you maintain high production and milk quality when your feed levels dip (and will keep for years if they don’t). To find out about adding more maize to your farm system, contact your local Pioneer representative, call 0800 PIONEER or visit pioneer.co.nz/maize-silage

It’s reported that just over 100,000 people attended this year’s four day National Fieldays at Mystery Creek near Hamilton. As expected, the number of people attending the event and exhibitors was well down on pre-Covid numbers and, according to reporter PETER BURKE who first attended the event in 1981, this year was quite different.

sense. But with the primary sector in something approaching the doldrums, it would be interesting to know who sold what, and whether the ‘suit’ events were suitable for all concerned.

ters such as Jo Luxton, the associate Minister of Ag, and Rachel Brooking, the Minister for Food Safety.

so sure. There are ‘hubs’ sustainability and health

Of course, it’s election year and no one should have been surprised to see a posse of politicians out on the prowl, seeking support. Labour was represented for three days by Prime Minister Chris Hipkins who popped up at various stands and seminars to promote his party’s good news. Ag Minister Damien O’Conner seemed to be everywhere and at every event, joined by other relevant Minis-

Christopher Luxon arrived on the Wednesday accompanied by his ag spokesperson Todd McClay, and in their distinctive blue jackets they traipsed around the venue talking to people and meeting with VIP’s. Dairy News caught up with them, but other media said they never saw him.

For whatever reason, Luxon took Thursday off and went to Wanaka to meet more party faithful, and that decision puzzled many people, especially given the fact that

Thursday is a day when largest numbers of farmers traditionally attend the event. His absence that day allowed ACT to take centre stage and chase the farmer votes. Their stand was a buzz of activity, which tended to support the anecdotal evidence that ACT will take a lot of rural votes. As for the Greens and NZ First, the word was they were there, but we didn’t see or hear from them. Who knows what impact, positive or negative, the efforts of the various politicians at Fieldays will have come October and whether the same politicians will be back next year or in three years’ time.

BUT FOR the muchmaligned dairy industry, NZ’s primary export returns for 2023 would be looking grim.

That’s the conclusion one can draw from the Ministry for Primary Industries’ latest Situation and Outlook for Primary Industries (SOPI) report, released before a group of industry leaders at the Fieldays. The report shows that earnings from the dairy sector were $25.1 billion – double that of the meat and wool sector and more than three times that of horticulture.

The total revenue from the primary sector for 2023 was a record $56.2 billion – nearly $3 billion more than last year. The very good news

is that dairy exports are predicted to reach $28.2 billion by 2027, while export growth for meat and wool will remain static for the next four years and is unlikely to reach the $12.3 billion it

was in 2022.

The section in the SOPI report on dairying notes that China is easily NZ’s single biggest market for dairy products, taking 34% of our exports. Indonesia at 6%

is the next biggest market with Australia third at just 5%. China is the biggest market for all our dairy products except for casein and products which is snared by the US.

According to the SOPI report, the performance by the dairy sector is excellent, especially considering the challenges and uncertainties it has faced due to Covid19 in China. But there are also warning signs in the report with commentary on the fact that global dairy prices are in decline, although they remain above average. It notes that demand for dairy has weakened due to a slowdown in global economic growth, rising inflation and high food prices.

It also points to better supply coming onto the world market from the EU and the US in the past season, but goes on to suggest that milk production in these coun-

Agriculture Minister Damien O’Connor along with Prime Minister Chris Hipkins launched the SOPI report at Fieldays. O’Connor, forever the optimist, described the SOPI report as impressive given the tough times the primary sector has endured in the past 12 months. He says it’s shown resilience and resourcefulness to get where it has. He says there will be headwinds, but NZ will handle these based on the solid foundations that already exist.

“We have always undershot with our forecasts, and I believe because farmers are innovative and adapt I think we will continue to grow our exports,” he says.

A feature of the report says O’Connor is a focus on what is described as ‘hyper traceability’: identifying more precisely what’s happening in the marketplace. He says this shows that there are expectations both from the supermarkets and the consumers who are now using a QR code to find out exactly where their products are coming from. He says all those in the primary sector need to be aware of the implications of this.

At the launch, PM Hipkins acknowledged the difficult couple of years the primary sector has been through, saying the objective of his government is to get rural communities back on their feet. He says there is reason for optimism and he spent much time talking up the benefits of the FTA with the UK.

“For the first time since the early 1970’s our meat and dairy sectors have meaningful access to the UK market. The FTA also opens the door for increased collaboration in the agritech space in which NZ is a world leader. In a changing world, agritech has never been so important because it offers possibilities to improve farm efficiency, increase sustainability and reduce the carbon footprint of agriculture.”

tries has now slowed and will likely prevent any crash in dairy prices.

There is recognition in the SOPI report of high farm input costs affecting on farm profitability in NZ, but it says that the staff shortages in the sector are easing and, as most of us have seen, pasture growth in the past few months has been excellent.

Overall, the SOPI report paints a picture of a good 2023 year, but that growth in the coming few years will be incremental rather than spectacular. Horticulture will go through something of a rebuilding phase to get volumes of kiwifruit and apples up, while meat and wool remains a challenge.

@dairy_news

facebook.com/dairynews

METHVEN FARMER and former Nuffield scholar Hamish Marr is New Zealand’s new Special Agricultural Trade Envoy.

Marr is an arable farmer based in Methven producing high quality seeds for global export and he was awarded New Zealand Seed Grower of the Year in 2022 in recognition of his work.

Until recently, he was also vicechair of the New Zealand Seeds authority which oversees seed certification on behalf of the Ministry for Primary Industries.

He will replace Mel Poulton in the trade envoy role from July 1.

The role involves working alongside government to support key objectives and advocate for our farmers and growers offshore.

Minister of Agriculture and Minister

for Trade and Export Growth Damien O’Connor says Marr comes from a strong farming background and has first-hand experience exporting products to market – making him wellsuited to advocate for NZ farmers and growers offshore.

“Since 2017, this Government has secured seven new or upgraded Free Trade Agreements, including the goldstandard United Kingdom Free Trade Agreement which is now in force.

“As [trade envoy] Hamish will play an important role supporting New Zealand exporters to seize these new opportunities in market, as well as working with our trading partners to tell the story of our move towards a sustainable and climateresilient agriculture sector,” says O’Connor.

WESTPAC HEAD of agribusiness Tim Henshaw says their new sustainable farm loan will help farmers on their journey to become more resilient food producers.

The new loan is the first in the country to accelerate sustainability across all aspects of farming and importantly covers all term debt associated with the farm.

A soft launch of the new loan was held at National Fieldays this month and Henshaw says the response from farmers has been “super positive”.

“Every farmer we spoke to has been very positive and what resonates with them is the whole of farm approach,” he told Dairy News

“Under our loan, the whole farm will be considered a sustainable asset, not just one thing on the farm. That’s a point of difference with other similar offerings in the market.”

Once farmers sign up to the loan, they have two years to meet the sustainability standards. They get a discount in lending from day one with a 0.2% discount off the existing loan interest margin across all term debt asso-

ciated with the farm. After meeting those standards within two years, their farm is considered sustainable.

Importantly, farmers can use existing compliance work already done on the farm to meet the standards and Henshaw says farmers love that provision.

Westpac, which already has sustainability offerings for institutional banking and residential customers, says agriculture is the next big cab off the rank.

“We believe agriculture is very important for New Zealand,” Henshaw says.

Currently, the farming sector is facing challenges, dealing with climate change on farm and an avalanche of regu-

lations coming their way.

“We believe our new sustainable loan will help farmers on their journey to reach sustainability goals,” says Henshaw.

He says sustainability is becoming incredibly important with global consumers and supply chains requiring stronger sustainability credentials from food producers.

“We think the bar will continue to go higher,” he says.

The loan is structured

STRESS FREE MATING

Bulls weighing your feed supply down? Across New Zealand, dairy farmers are switching to 100% AB, removing bulls from farm. With the benefits of CowManager, a slightly longer AB season becomes a breeze, and you can confidently say goodbye to retaining bulls on farm.

to meet four key standards: plans and maps, environment and sustainability, animal welfare and people. Farms will be audited by AsureQuality.

Westpac NZ chief executive Catherine McGrath says the new sustainable farm loan is the first in the country to accelerate sustainability across all aspects of farming and importantly covers all term debt associated with the farm.

“With our newly

launched Westpac Sustainable Farm Standard we are encouraging farmers and growers to improve sustainability practices and build more resilient farms.

“Our loan focuses on supporting our farming customers to assess and reduce on-farm vulnerability and risks that climate change and extreme weather events may have on the land, farming systems and infrastructure.

“We’re also keen

WESTPAC HAS also launched a new sustainable business loan to support corporate and agribusiness customers to make progress on their sustainability initiatives, whether they are working to improve the environment or achieve positive social outcomes, or both.

Westpac NZ chief executive Catherine McGrath says its customers are telling them that they are seeing strong sentiment for change from their customers, suppliers and shareholders.

“We know that being a sustainable business makes good business sense. It can help to build great teams, connect with consumers, reduce operating costs and support the community.

“So, we have designed a loan to provide tangible support for customers who are wanting to invest in sustainability initiatives.

“This sustainable business loan will help our corporate and agribusiness customers invest in projects that improve the environment, help adapt to climate change, or deliver positive social outcomes for communities or groups.

“It complements the Sustainable Farm Loan but has a more targeted focus on specific assets and projects.”

to encourage increased focus on farm management, waterway biodiversity and nutrient improvements on the farm, and understanding and managing agricultural emissions.”

McGrath says Westpac has worked with AsureQuality to ensure that the Westpac Sustainable Farm Standard is robust and equivalent to all applicable aspects of the industry-agreed Sustainable Agriculture Finance Initiative guidance.

“We’ve also designed our Westpac Sustainable

Farm Standard to complement farm assurance programmes that many of our customers are already using on-farm, to reduce duplication and reporting commitments for our customers.

“Our standard defines requirements that farmers need to meet, with a view to improving sustainability outcomes in areas like water management, application of fertiliser, waste management, climate change mitigation, adapting to climate change and better outcomes for biodiversity and soil health.”

“Under our loan, the whole farm will be considered a sustainable asset, not just one thing on the farm. That’s a point of difference with other similar offerings in the market.”Westpac head of agribusiness Tim Henshaw says their new sustainable farm loan will help farmers on their journey to become more resilient food producers.

PRIME MINISTER Chris Hipkins says New Zealand has important sustainability credentials to uphold and says these hold the country in good stead when it talks trade with overseas countries.

He says NZ needs to keep giving customers around the world reasons for continuing to buy our primary products.

His comments came at the announcement at Fieldays of a new $17.5 million project to build a greenhouse gas testing and research facility in Palmerston North to monitor and measure emissions from

cattle. This was just one of a suite of measures announced by Hipkins and Agriculture Minister Damien O’Connor at a function at the Fonterra stand.

Funding for the new emissions testing station will come from government - $11.7m, the Centre for Climate Action on Agricultural Emissions - $4m and AgResearch - $2m. Massey University will provide the land, cattle, services, and utilities for the project. The centre is expected to be built in just over a years’ time.

Hipkins says climate change is one of the biggest challenges facing the world and NZ wants to lead the charge in reduc-

Stay in sunny Nelson & Blenheim. Enjoy a Queen Charlotte Sound cruise, lunch & wine taste at Seifried winery, a Greenshell Mussel Cruise. Visit Motueka, Kaiteriteri, Abel Tasman National Park and Pupu Springs. Train to Omaka Aviation Centre.

Forgotten Highway & Taranaki

Nov 7, 2023 + Feb 13, 2024 6 Days

ing agricultural emissions.

He says the new facility will provide permanent methane measuring equipment which in turn will accelerate and help the wide scale testing of new tools and technologies many people have been asking for.

“Our goal is to partner with farmers to ensure New Zealand retains its brand as a low emission, environment friendly source of food and fibre.

Farmers can’t do it all on their own and agriculture is too important for the Government not to be investing in better envi-

DAMIEN O’CONNOR says the Government is also backing two new pasture projects with $4.3 million co-invested with industry through its Sustainable Food and Fibre Futures fund looking at soil and grass to help farmers reduce costs, maintain good pastures, and remain a world-leading sustainable producer of high value food.

One of the projects will see whether extended periods of deferred grazing will encourage pasture roots to grow larger and deeper which in theory would increase water and nutrient use efficiency, reduce nutrient losses and increase pasture resilience to recover from extreme weather events such as

ronmental outcomes. We want the best price for the best products, pro-

Visit Hobbiton, travel 40km by Rail Cart into the Forgotten World - 10 hand dug tunnels and over 25 bridges. New Plymouth sightseeing tour, cruise aboard Paddle Steamer Waimarie, then Northern Explorer train back to Auckland.

floods and droughts.

“The other project, Ensuring a Sustainable Future Pasture Presence in NZ, will look at increasing the productivity of pasture grass. The new ryegrass pastures under development are expected to increase productivity by around 20 percent, and provide farmers with options to reduce nitrate leaching, increase carbon sequestration and improve water use efficiency,” says Damien O’Connor.

He says lifting NZ’s sustainability credentials and lowering our emissions profile will be key to future-proofing the industry and cementing a path towards continued export growth.

duced by the best farmers in the word,” he says.

Hipkins says NZ farm-

ers are already well placed to meet the latest consumer demand trends

and says this latest package is about the Government being at the table to help them do even better.

Agriculture Minister Damien O’Connor described the establishment of the new facility as a smart investment. It will include 12 respiration chambers which allow researchers to measure and monitor changes to methane emissions in individual cows.

“We are leading the world in some of that investment technology, and this will allow us to do with cattle what we have doing that with sheep,” he says.

FARMERS’ SATISFACTION with their bank relationship continues to slip and more perceive they are under undue pressure, the latest Federated Farmers Banking Survey shows.

Although a majority of the 1017 respondents to the May survey remain satisfied with their banks, with 56% very satisfied or satisfied, this was down three points from the previous survey in November 2022 and is the lowest since the biannual surveys began in May 2015.

“Interest rate and cost increases are making it tough for many New Zealanders and businesses and the rural sector isn’t immune,” Federated Farmers president Wayne Langford says.

But the survey results indicate the banking sector has work to do lifting the standard of their liaison and service to the agricultural sector.

Many respondents were complimentary about their banking rela-

tionships, but others highlighted the size and speed of interest rate increases on top of continued concern about banks’ tough lending policies for rural purposes.

“Also mentioned was less frequent communication, bank branch closures and consolidation of rural staff into larger centres more remote from rural areas, high turnover of bank staff and staff having less understanding of farming,” Langford says.

Arable farmers were the most satisfied of industry groups, while sharemilkers were the least satisfied, with barely half saying they were very satisfied or satisfied.

About 24% of farmers perceived they had come under undue pressure from their banks over the past six months, up six points from November 2022. All industry groups had higher proportions compared to six months ago and all were over 20%. Dairy farmers felt the most under pressure

and meat and wool farmers felt the least pressure.

Some 44% of farmers felt their mental wellbeing had been affected by their debt levels, interest rates, changing condition, or other forms of pressure, up three points from six months earlier.

“With banks making

healthy profits, we don’t want them to be forgetting our rural communities and suggest reinvestment in extra customer service at this time,” Langford says.

“When times are tough, good communication is even more important, but our May survey

shows farmer satisfaction on that front has slipped a bit more, continuing the decline of the last five years.”

Other key results from the Federated Farmers survey:

■ 79% of farmers said they had a mortgage, up two points from

NEW DAIRYNZ chief financial officer Robyn Marsh started last week, an appointment DairyNZ says will provide strong financial direction, vision, and profitable management.

DairyNZ chief executive Dr Tim Mackle says Marsh – who takes on the title of chief financial officer and general manager of corporate services – is an experienced sector finance leader.

“We are privileged to recruit an individual with such depth of knowledge and expertise, along with solid understanding and appreciation of our sector.

Robyn grew up on a South Taranaki

dairy farm and being part of a rural agricultural community is an anchoring motivator in her career and way of life.”

As a chartered accountant, Marsh started her career with Deloitte Touche Tohmatsu before moving to Fonterra in 2002. There she held several financial leadership roles, such as general manager of global accounting services and mergers and acqui-

November 2022. Over the past six months, the average farm mortgage value has increased from $4.19 million to $4.31 million while the median increased from $2.50 million to $2.80 million.

■ The average mortgage interest rate increased from 6.29% to 7.84%, up 155 basis points since November 2022 (and up 405 basis points since its lowest point in May 2021). Sharemilkers had the highest average of 8.41%.

■ Overall, 2.1% of farmers were paying a mortgage interest rate of less than 5%, down from 10.1% in November 2022 (and from a peak of 91.5% in May 2021). Meanwhile, 1.8% were paying a rate higher than 10%, compared to 0.3% in November 2022.

■ 74% of farmers had an overdraft facility, a little higher than November 2022.

sitions. Her initial focus will be the execution of the strategic plan for the coming year, to help align priorities and overall strategy. She says she is excited to be taking her career in agricultural finance to the next level and having the opportunity to be part of positive progress for the dairy industry.

“There are significant challenges and opportunities facing the dairy

■ The average overdraft interest rate increased from 8.59% to 10.07, up 148 basis points since November 2022 (and up 379 points since its lowest point in November 2021). Dairy had the highest average of 10.49%.

■ Only 0.3% of farmers were paying an overdraft interest rate less than 5%, almost the same as in November 2022 (and down from a peak of 20% in November 2021). Meanwhile, 35% were paying more than 10%, up from 14% in November 2022.

■ More farmers had budgets compared to six months ago. This reflects tougher times financially from falling incomes and rising costs. 68% farmers had an up-to-date budget for the 2022/23 season and 41% had an up-to-date budget for the upcoming 2023/24 season. Both are record highs since the survey began in 2015.

sector today and into the future,” she says.

“Collaborating with our farmers and sector partners on innovative solutions is an effective way to drive a positive future for dairying. Working at DairyNZ provides a great opportunity to be a part of this journey, and I look forward to progressing my work in the sector to date with this new role.”

TROUBLED CANTERBURY milk processor Synlait continues to undergo changes.

The listed company recently decided to offload two cheese companies it had only purchased two years ago.

Now, the biggest shareholder – Bright Dairy of China – is ringing changes to its board representatives. It’s replacing two of its four board members. Bright Dairy owns 39% of Synlait and the company’s financial woes in recent years would be concerning to the Chinese conglomerate.

The company’s two new board members will be chief financial officer Liu ‘Ryan’ Ruibing and vice president Zhu ‘Julia’ Yi. It has four seats on the Synlait board.

Another dairy company in strife is Happy Valley Nutrition. This is the company that has spent millions preparing a greenfield site near Otorohanga to build a new milk plant but is still looking for capital to construct the plant.

The company’s loan facility is due to expire at end of this week and a decision on whether the project is still a goer could be made soon.

Fonterra collect most of the milk from around Otorohanga and the co-operative’s farmer shareholders are privately opposed to the project. They claim there is no need for more stainless steel capacity and that the NZ milk pool is not growing.

A Waikato dairy farm is getting behind a new initiative to help cafes and the dairy sector cut down on the use of single-use milk bottles by the thousands each year.

The Udder Way is a twoyear-old Australian company selling 18-litre milk kegs for baristas to reduce their plastic milk bottle use by up to an estimated 10,000 per cafe each year.

The Tasmania-based business claims it has eliminated 1.6 million milk bottles from waste by connecting its kegs up to milk dispensers or taps at Australian hospitality outlets.

In its first New Zealand play, The Udder Way kegs are now being filled with organic and non-organic milk by boutique dairy company Green Valley Dairies from its Mangatāwhiri factory in North Waikato.

A big win for the dairy industry, hospitality sector and the environment.

BOUTIQUE MILK company Lewis Road Creamery’s latest offering to mark Matariki is unfairly facing heat from certain quarters of Māoridom, who are opposed to any commercialisation of all things Māori.

Lewis Road Creamery - for the second year - has produced a spicy flavoured milk to commemorate Matariki, and says the not-for-profit product costs it money to produce.

The product highlights Matariki and is a collaboration with Māori dairy farmers, facts that seem to elude the critics.

The milk, from Pouarua Farms, uses native horopito that’s been wild-harvested from the Horopito region near Ruapehu, combined with ginger root, sweet notes of caramel, spices and earthy black pepper.

Pouarua Farms is jointly owned by Ngāti Maru, Ngāti Paoa, Ngāti Tamaterā, Ngāti Tara Tokanui and Te Patukirikiri. They have supplied PKE-free milk to Lewis Road Creamery for several years.

SOBERING IS perhaps the best word to describe the latest Situation and Outlook report on Primary Industries (SOPI) produced by the Ministry for Primary Industries (MPI).

The quarterly report is a snapshot of the performance of our primary sector that also forecasts the outlook for the coming four years, based on data from a variety of sources.

First up the good news, much touted by the Government, is the performance of the overall sector in the past to the end of June: The sector has earned the country a whopping $56.2 billion – an increase of 6% on 2022 and according to Agriculture Minister, Damien O’Connor, $1.2 billion more than MPI had earlier predicted.

This great outcome is largely the result of the performance of the dairy industry which earned $25.1 billion – double that of the meat and wool sector. Further good news is that, all things being equal, the dairy industry will keep up the good work over the next four years and by 2027, export revenue from the sector will hit $28.2 billion.

But in a world where things change rapidly, where the words volatility and uncertainty are commonly used, there is no guarantee things will go as MPI suggests.

They themselves note that a lot depends on the production of other dairy producers and what the demand is from consumers – especially China which remains by far NZ’s biggest market for dairy products. In essence there are ‘ifs and buts’ and fingers crossed.

On the home front, dairy farmers face a tidal wave of challenges with high interest costs, inflation, on-farm costs, a messy situation with regulations which has now become politicised and then there a still something of a problem with accessing labour.

So, it’s far from a perfect world.

Head Office: Lower Ground Floor, 29 Northcroft St, Takapuna, Auckland 0622 Phone 09-307 0399.

Publisher: Brian Hight Ph 09-307 0399

General Manager: Adam Fricker Ph 021-842 226

Editor: Sudesh Kissun Ph 021-963 177

Machinery Editor: Mark Daniel Ph 021-906 723 markd@ruralnews.co.nz

Reporters: Peter Burke Ph 021-224 2184 peterb@ruralnews.co.nz

Subscriptions: Julie Beech Ph 021-190 3144

Production: Dave Ferguson Ph 027-272 5372

Becky Williams Ph 021-100 4831

Digital Strategist: Jessica Marshall Ph 021 0232 6446

AUCKLAND SALES REPRESENTATIVE: Stephen Pollard Ph 021-963 166 stephenp@ruralnews.co.nz

WAIKATO SALES REPRESENTATIVE: Lisa Wise Ph 027-369 9218 lisaw@ruralnews.co.nz

WELLINGTON SALES REPRESENTATIVE: Ron Mackay Ph 021-453 914 ronm@ruralnews.co.nz

SOUTH ISLAND SALES REPRESENTATIVE: Kaye Sutherland Ph 021-221 1994 kayes@ruralnews.co.nz

AS A co-operative, Ravensdown has a responsibility to monitor market and industry trends for farmers and growers.

Today, it’s no secret that the predominant trend in the fertiliser industry currently is one of low levels of purchasing by farmers.

Looking at the previous spring and autumn periods, we’ve seen total fertiliser volumes across New Zealand decrease by around 20-30%, but farmers are spending about the same. When interest rates, fuel and labour are generally uncontrollable costs, fertiliser management can be one of the first levers farmers can pull to manage price pain on farm.

Looking more broadly, we’re all aware of an even more dominant trend affecting the wider agriindustry. And that’s the trend of softening farmgate profitability –especially in the dairy, and sheep and beef sectors. So, we have been thinking about where these trends might take the country.

It’s becoming clear that an impact on overall productivity (and, by definition, country-wide economic return) looms as a potential threat, if these trends were to continue over the next two to three years.

Ravensdown has collated information from a wide variety of studies to assess the immediate and medium-term impact of withholding fertiliser applications on New Zealand farms.

The studies all show that withholding fertiliser applications for a year will often have little impact on hill country and dairy farms. But when we move beyond that, there will be losses in pasture production and quality. If fertiliser application is withheld for extended periods, a cost management exercise has the potential to quickly impact farm profitability as productivity declines.

If withholding Superphosphate (i.e.,

withholding both P and S) continues after one year, then the average loss of pasture production and quality for low to medium fertility farms will be 5-10% by the second year and become progressively worse thereafter.

Unless there are farm management changes such as providing alternative feed or lowering overall feed demand, animal production will follow this decline in pasture supply and quality.

When you’re looking at a potential productivity loss of 20-30% for three-four years of deferred fertiliser applications the potential consequences are significant.

To put things into perspective, on an average dairy farm with average Olsen P, 7% less pasture growth equates to a loss of around one tonne of dry matter per hectare, representing a loss of around 70 kgMS/ha.

On an average sheep and beef farm with medium fertility and Olsen P, a 15% loss in pasture production means you could be looking at around two fewer stock units per hectare.

More than a cost issue

Today it’s well understood that cost isn’t the only reason farmers might be holding back on fertiliser applications. The ramifications for fertiliser use are far broader than cost. Regulations, societal expectations, and global consumer and customer demand mean farmers are increasingly using fertiliser more accurately to improve the efficiency of nutrient use.

We appreciate the absolute requirement to meet expectations and stay within emissions boundaries, but it’s up to farmers to decide on their level of productivity risk.

Role of Ravensdown

Ravensdown has an important role to play in providing fertiliser to our shareholder customers at the best available price.

But we have a strategy that goes beyond that.

Smarter farming for a better New Zealand means we want to help farmers with just that –smarter, more precise, and more productive farming.

Soil testing, precision

spreading, environmental planning, agronomy advice and nutrient budgeting all have a significant impact on farm cost and productivity. Ravensdown has a team of dedicated farming experts, soil scientists and the environmental capability to help with all these

things.

When thinking about long-term productivity, we believe this is the right time for farmers to be thinking about what the soil fertility on their farm is looking like.

OVER THE past two years, Fernside farmer Julie Bradshaw has refined her dairy herd size using genomics while maintaining the same level of milk production.

Julie has been participating in a Next Generation Farming project designed to help farmers meet tough nitrate caps while maintaining their viability. As part of this project, farmers like Julie are using innovation to demonstrate productivity and environmental benefits to their neighbours in the region and beyond.

Waimakariri Landcare Trust (WLT) and Waimakariri Irrigation Limited (WIL) have partnered with the Ministry for Primary Industries (MPI) for the project, with support from MPI’s Sus-

tainable Food and Fibre Futures fund along with Environment Canterbury, Ballance, and DairyNZ.

The biggest change Julie has made on her farm over the last two years is closely examining her herd selection process using genomic data.

Julie has already reduced her herd size by 15 cows and is planning to remove 10 of last year’s calves based on genomic data she has received from LIC. She credits the reliability of the information with helping her to make these

science-based decisions.

“The advances in the data we are getting now, and the reliability of that data means that we can be certain about which animals to keep.

“There is no point paying for grazing for animals for three or four

years that that don’t end up being productive dairy cows.

“With the reductions I have made I have still retained the same level of milk production, so I know I have made the right decision.”

In the past, Julie

would have retained cows with low BW (Breeding Worth) but with the possibility of reductions in the numbers of cows on farms in the future, she wants to ensure that her herd is performing at its best.

“When you look at what is happening overseas you can see that farmers have already reduced their herd numbers and it is only a matter of time before it happens here.

“It is challenging but you need to look at your entire farming operation and see what you can do to farm more efficiently. With all the science and data that we can access now it makes sense to use all the tools you have in your toolbox.”

Julie says she believes genomics and scientific innovation will play an increasingly signifi-

cant role in New Zealand farming in the future.

“When I look at the data, I am getting now compared to a few years ago it is amazing. I think the data will continue to improve as more herds get involved and this will be a huge benefit to everyone involved in the farming industry.”

Julie has shared what she learned from the innovation project with local farmers and she says most of them are keen to know more about her journey and can see the benefits of using science to improve their farms.

“Farmers are supportive and willing to share what they have learned. If you are a farmer who is open to innovation and new ideas, I believe you will be able to continue to farm into the future and have a successful farming business.”

COMMERCIAL FARMERS ARE HIGH VALUE READERS AND BIG USERS OF RURAL PRINT

I STARTED my career in agriculture in Northland in 1982 as a consultant for the Ministry of Agriculture and Fisheries.

I worked in the same region as Hugh Kirton, a legend in dairy consulting. Wanting to be the kind of consultant Hugh had become, I asked him what I needed to do. He told me there were only two things: (1) learn from your best farmers and (2) learn from the best scientists. I have taken Hugh’s advice. Farmers and scientists have been my teachers.

During the 40 or so years of my career, I have seen farming go through good times and tough times. There is no doubt this last season has been tough for many farmers.

Rising interest rates have made tight margins even tighter and they hit in a season which was heavily impacted by extreme weather events. It looks like the coming season could be another tough one. One thing I have learnt over the past four decades is that the top farmers who get through tough times best are the ones who only make minor system changes. In other words, they stick with their knit-

ting. These farmers stay the course and keep doing what they know works.

Data from DairyNZ’s Economic Farm Survey shows this quite clearly.

Figure 1 shows the return on assets (ROA) from dif-

ferent farm systems. The average ROA of the low, medium, and high feeding systems ranges from 5.3% to 6.9%. However,

the ROA of the medium (System 3) ranges from below zero to more than 25%. In other words, the difference between sys-

tems is far less than the difference between farms running the same system. When things are tight, rather than chang-

ing systems, look at what improvements you can make within the system you are currently running to reduce the impact of forces largely outside of your control.

If you are running a system which feeds maize silage, consider fine tuning your management to:

• Keep feed losses to a minimum.

• All systems have some feed losses. These are inevitable. However, in my experience, losses can be as low as 8% or as high as 40%. I have written extensively around minimising losses.

The key points can be summarised as follows:

■ Use an inoculant that works. There is plenty of data to show a proven product can reduce drymatter and energy losses.

■ Keep the stack face tight and clean. The longer maize is exposed to air the greater the losses.

■ Feed out on a dry, hard surface - a feed pad is preferable. If you don’t have one, make sure the ground is dry and the paddock isn’t pugged.

Feed maize silage when you will get the best response rate.

The more milk produced per kilogram of dry matter fed, the higher the return. I have also written extensively on this, and the summary is: Fill short term feed gaps to keep cows milking. When supplements are used well, it is reasonable to expect response rates of 80-130gmsMS.

Increasing BCS from a 4 to 5 results in an extra 15kgMS and earlier calving the following season. Keep maize silage costs to a minimum.

The cost of feed has a big impact on the profit received. Some ways farmers can reduce feed costs are:

Consider growing maize silage on your effluent paddocks. Research has shown maize grown on effluent paddocks needs little or no fertiliser. This could save around $1,600/ha. Think carefully how you source your maize silage.

Home-grown maize silage is usually cheaper however remember that difference in price between home grown and bought in maize is the price you are willing to pay for risk.

I have just covered ways farmers can maximise their return from feeding maize silage. However, there are many factors within a farm system that impact profitability.

If you are concerned about your system, it is worth getting either a farm consultant or a top farmer who is running a system similar to yours to have a look at how you can improve physical and/ or financial performance. Alternatively, you can contact Wade Bell, Matt Dalley, or me through the Pioneer website (pioneer. co.nz).

• Ian Williams is a Pioneer forage specialist. Contact iwilliams@genetic.co.nz

AS THE new dairy season gets underway and farmers tackle ongoing financial challenges, they are being urged not to make hasty decisions about selling cows and cutting back on supplementary feed.

GrainCorp Feeds NZ general manager Daniel Calcinai claims that there is conflicting advice out there.

“While some dairy industry commentators are advocating for farmers to reduce costs by selling cows and not buying in supplementary feed, I believe this is a short-sighted approach,” says Calcinai.

“Reducing your herd size and cutting out supplementary feed may not be the best option and could affect the profitability of some farm businesses over the next few years, not just this

season.

He says farmers need to take a long-term approach to their decision-making, to minimise risk and give themselves the best chance of success.

“While prioritising the use of homegrown feed, the best thing farmers can do is review inputs, including their herd’s total diet, and create a base feed plan, including costs and income. This will help them see what margins might be achievable in various scenarios.”

Tracking production in real time can help them make more informed feed and herd management decisions, he says. “Based on our calculations, in most cases, feeding the right feed at the right time will continue to pay off financially.”

He says farmers can elect to have their milk

data sent to his company from their milk companies daily, which they upload into Tracker.

“We can then use that information to help them monitor outcomes of decisions made, plan, budget and evaluate different scenarios.

“We then combine real time information with other data to mea-

sure things like feed conversion efficiency, milk urea nitrogen, milk quality and composition, Fat Evaluation Indexes (FEIs) and margin. This can help farmers make better, fact-based, proactive decisions.

“It’s about maximising the utilisation of homegrown feeds and then adding the right supple-

ment to complement the seasonal pasture conditions and the cow’s diet. Our goal is to improve rumen function and feed conversion efficiency in a cost-effective way.”

Making sure cows are efficiently turning feed into milk will be crucial as farmers start exploring ways to reduce their onfarm emissions.

Dairy companies are rallying to support farmers to reduce on farm emissions and protect the industry’s global competitive advantage. Fonterra recently released information to help its suppliers reduce emissions and their farm’s carbon footprint by recommending specific actions they can take.

Three key areas in which Fonterra encourages farmers to act are through improved animal efficiency, better nutrition and understanding the implications of supplementary feed.

“While on-farm emissions targets don’t come into effect until 2025, our team is equipped to help farmers get ready and get some runs on the board now. It’s a busy and challenging time for dairy farmers. We have a responsibility to step up

and do what we can to help ease the load,” says Calcinai.

“For example, we can help measure, monitor and alter milk urea nitrogen levels excreted by improving a herd’s nutrition, optimising rumen function and feed utilisation.

“Not only can this help reduce the levels of nitrogen excreted on pasture and reduce the risk of waterway leaching, if managed and implemented correctly, but it can also improve productivity and margins. It’s all about efficiently turning feed into milk, minimising waste, and maximising milk output.”

Calcinai says farmers are being told to reduce their her size but this shouldn’t come at the expense of production.

@dairy_news

THE USE of collars and monitoring technology use on farm is expected to keep climbing, says MSD New Zealand livestock business unit lead Pauline Calvert.

She says around 15% of New Zealand’s national milking herd, which numbers about 5 million across 11,000 dairy farms, are fitted with a monitoring device.

Of that number, more than 750 farms are using SenseHub with Allflex collars – making MSD New Zealand the market leader in this area, she says.

“These figures will only continue to grow, as more farmers realise the benefits of having another set of eyes and hands on the farm,” says Calvert.

She says that in tough economic times significant investments on farms, such as monitoring technology, might not be a priority but it is during challenging times that an investment like this pays off well into the future.

“The return on investment on collars, and we know this from our customers, well and truly stacks up.

“The costs being saved by front-footing health

issues, for example, saves time and money in the long run and those costs can far outweigh the initial cost of investing in monitoring tech.”

She says detecting heat and monitoring cow health are two of the ways farmers are using collars to their advantage, but that’s just the start of what they are capable of.

“Ultimately, collars and monitoring technology equip us with knowledge, and on-farm, knowledge very much is power.

“By having real-time information to hand

AT THE National Fieldays this month, three farmers spoke about the impact of cow collars on their businesses.

Kane Brisco contract milks 305 Friesian cows on a 142ha property in Inglewood, Taranaki.

Brisco is also known as the founder and director of Farm Fit Ltd, an initiative that inspires farmers to develop both their physical and mental health.

Brisco recently helped his farm owners make the switch to Allflex collars.

His SenseHub Dairy hardware with Allflex collars was operational from November 2022, about 14 days into 2022 mating. His shed became a one-man operation overnight since the collars were fitted and SenseHub began collecting data.

His empty rate lowered, his in-calf rate went up, and crucially, for the first time in 14 years of dairy farming, he could take time off to recharge during mating.

Farm owner Rhys Dary who milks 1100 cows on two properties in Huntly, Waikato has been using collars for three years.

A third-generation farmer, Darby is

we’re able to keep across the health of our cows, such as seeing up-to-date rumination data or other health indicators, and then use that information to act on health issues before they become bigger problems and start affecting outputs.

“We also know that healthy, well-managed livestock are better not just from an animal welfare context, but a sustainability point of view as well.

“Collars and monitoring allow us to make the best use of our resources to have the most efficient

now into his second mating season on his 450-cow herd, and his third mating on the 650 cow herd.

He was happy with his previous in-calf and empty rates but was looking to gain more data on the performance of his herds and tighten up on farm efficiencies. With collars, he was able to maintain his production while using rumination data to enhance diet and eliminate waste and gain more time and freedom to explore other business avenues.