CONFIRMING ITS “immense faith” in the dairy industry, the country’s second largest milk processor is embarking on a significant investment programme.

Open Country is building its first butter plant at its Waharoa site in Waikato. The new plant will be commissioned around August next year.

The Waharoa plant, which celebrates its 20th anniversary this year, is also getting an upgrade to one of its dryers and whey processing capability. At Open Country’s biggest site, Awarua in Southland, a new cheese plant is being built.

The investments give Open Country more optionality, says chief executive Mark de Lautour.

He says the new butter plant at Waharoa will be an excellent protein and fat balance for its milk.

“Depending on where the market is, we will decide where to put our fat – butter or AMF or even whole milk powder,” he told Dairy News

“If protein prices are up, we will produce more cheese, so it gives us that optimum mix.”

The base butter plant will produce 20 to 25kg blocks of butter, with the option of doing smaller packs for the food service sector.

However, de Lautour says Open Country has no plans to enter the branded or retail butter market.

“It will be a bulk butter plant and we’re going to have equipment to do small packs, however we’re not

calling it retail and not going into branded products,” he says.

“Also, the butter plant will give us the opportunity to look at all parts of the value chain, which is relevant considering the strategic changes that are being announced currently in the NZ dairy sector.

“While we are simply not consumer brand players, it is always prudent to have the capability in our company should the likes of Wool-

worths or PAK’n SAVE come to us with an opportunity.”

Open Country’s upgrade comes at a time when the national milk supply pool remains static and adding more stainless steel isn’t seen by many as the right strategy.

De Lautour points out that Open Country is making improvements to its existing plants.

While the new butter plant at Waharoa won’t create the need for

more milk, the dryer and whey capability upgrade mean it could indeed process more milk.

De Lautour says they are recruiting more milk suppliers and farmers are showing “strong interest”.

He adds that the investments reflect the company’s “immense faith” in the dairy industry.

“I know that the New Zealand dairy industry is the best in the world and that will prove out over time.

“When you talk about carbon efficiency, emissions and productivity, there are always things we can do better. But since being in this role, I’ve spent a lot of time with our farmers, and I know that they are doing a fantastic job.

“They are probably the most entrepreneurial and commercial in the country because every one of them made a conscious decision to join us. We have to repay that faith and make sure we are also committing to them and their region with world class facilities.”

Open Country’s board signed off the new cheese plant project at Awarua eight months ago, with global dairy prices under pressure.

De Lautour says the company believes in investing when times are tough.

“We are very lucky, as a company, because we can invest now. It’s a massive commitment.”

Open Country, part of the Talley’s Group, has four sites – in Waharoa and Horotiu in the Waikato, Whanganui and Awarua in Southland.

AFTER FIVE consecutive rises, whole milk powder prices dipped in the latest Global Dairy Trade (GDT) auction.

However, Westpac chief economist Kelly Eckhold believes there’s still some upside risk to the bank’s $8.40/kgMS forecast milk price for this season.

Last week’s auction saw the GDT price index drop 0.5%. WMP prices dipped 2.5% to US$3,394/ metric tonne. Eckhold noted that the GDT auction was more mixed than others recently.

He says futures markets had suggested a modestly weaker outcome which did eventuate. While WMP prices were relatively weak, butter prices jumped 6.2%. Skim milk powder prices also rose slightly –0.2% to US$2,766/MT.

“Chinese buyers

pulled back this time, but Southeast Asian and Middle Eastern buyers took up the slack,” says Eckhold.

“Overall prices remain around 10% or so above their long-term averages. Some upside risk to

our milk price forecast of $8.40/kgMS for the 2024/25 season remains but its early days yet.”

Fonterra has opened the season with a forecast range of $7.25-$8.75/ kgMS, with a midpoint of $8/kgMS.

The co-operative says milk supply and demand dynamics remain finely balanced and China import volumes have not yet recovered to historic levels.

Listed milk processor Synlait has also

announced a $8/kgMS opening forecast for the 2024-25 season.

The company says it has taken a conservative approach to its forecasts given the exposure to future global dairy commodity prices, which are

volatile in nature, at the beginning of the season.

Synlait farmer suppliers have received, on average, $0.28/kgMS above the base milk price for the last two seasons. The company is forecasting to pay similar incen-

tives for the 2023-24 and 2024-25 seasons.

Synlait says it will continue to monitor movements and keep farmer suppliers updated as required.

Meanwhile, Taupobased milk processor Miraka has announced a 2024-25 season milk price of $8.42/kgMS.

Miraka chief executive Karl Gradon says the company is committed to doing its part to pay the best milk price, to the best people and farms. Miraka will pay its suppliers a base price which has been set at $8.25/kgMS. Farmers can also earn an additional premium under Te Ara Miraka, the company’s farming excellence programme. Since its establishment in 2010, Miraka has paid more than $21 million in premiums to farmer suppliers.

FARMERS ARE now more pessimistic about prospects for the broader agri economy.

This is despite improved confidence in their own farming operations, according to the latest Rabobank Rural Confidence Survey.

The survey, completed earlier this month, found that after rising strongly in the last two quarters, farmer confidence in the broader agri economy has reversed course, falling

to -25% from -16%.

The survey also found that farmers’ expectations for their own farm business operations were up across all parts of the sector, with the dairy industry rising from +5% to +10%.

Rabobank chief executive Todd Charteris says that while it’s disappointing to see headline confidence fall, there were still some positives.

“We generally do see the reading for farmers’ confidence in their own

businesses sitting a little higher than for the broader agri economy, but the two measures do almost always move in the same direction, so it is a bit unusual to see them taking diverging paths this quarter,” Charteris says.

He says one possible reason for this is that farmer concerns about the overall economy are feeding into pessimism about the prospects for the agri economy.

Additionally, Charteris says that

dairy farmers saw healthy price rises on the Global Dairy Trade (GDT) auction platform during May and June which will likely have lifted sentiment. Also marginally improved was sentiment around farm viability.

“Last quarter, we saw 9% of farmers self-assessing their operations as ‘unviable’ with this now dropping to 7%,” Charteris says.

Additionally, at the top end, the survey also saw a small lift in the

proportion of farmers assessing their businesses as ‘easily viable’ with this up 2% to 16%, he says.

Regardless, Charteris says what is clear is that farmer sentiment remains subdued. “Given the importance of the sector to the wider economy, it really is essential that everyone involved with the industry bands together to support the country’s food producers and to get things moving in the right direction.”

• High Flow

• Compact/Robust

• New Pilot Flow Filter

• Side/Bottom Mount

• Detach to Clean

• For Water Storage Tanks

• Adjustable levels from 50mm-2.5m

• Minimises pump operation

•Available in 20/25/32/50mm

• Stainless steel bracket and Shaft

• Fits plastic and concrete tanks

• Rugged and long lasting

SYNLAIT FARMERS can

do nothing but watch from the sidelines as the company battles its financial woes, says supplier Willy Leferink.

The former Federated Farmers dairy chair says farmers are waiting to see what happens to the listed milk processor.

Leferink is one of many Synlait suppliers who have handed a twoyear cessation notice to the troubled processor. He’s unhappy with the company’s performance and payout. Synlait has about 300 suppliers, sending milk to its two plants – at Dunsandel and Pokeno. It has revealed that more than half of its supplier base wants to leave.

“Let me make it clear, we have no problem with Synlait’s staff, they are excellent,” Leferink told Dairy News

“What we are disappointed with is Synlait’s performance and payout. They are also $1 lower in the advance compared to Fonterra which creates quite a bit of cashflow stress,” says Leferink.

In April, Synlait reported a $96 million half-year loss. Last month, it signalled fullyear earnings will be at the lower end of its $45m-$60m range, before expected one-off charges.

Leferink believes Synlait directors should have

“rattled the cage earlier”.

He noted that it’s a company problem, not an industry one. Synlait overstretched itself when it built a plant in the North Island a couple years ago and made some other regrettable decisions, according to Leferink.

He also believes a float of Synlait could be on the cards.

Leferink says farmer suppliers feel they can’t do anything but “wait and see what happens next”.

He says suppliers have had hard conversations with both management and the board, where the suppliers’ position has been made clear.

“If they want to get their suppliers back, they need to do better than what they do now.”

Leferink says Synlait burned through a lot of trust and goodwill in its supplier base over the past season due to its payout not matching Fonterra’s and the financial struggles that resulted from that.

Synlait chief executive Grant Watson believes the company still presents an excellent value proposition to farmers, “with our best-in-class Lead with Pride programme and attractive specialty milk premiums [being] stand out features”.

“We are pleased to confirm a competitive advance rate profile for the 2024/25 season, with an opening advance rate

of $6/kgMS,” he says.

“The new profile accelerates the proportion of the full season milk price paid throughout the season.”

Synlait’s latest market update piled more bad

news on shareholders and sending its share price to a new low of 30c last week. The company is now forecasting that it’s unlikely to meet three of its current banking covenants as at 31 July 2024.

A FORMER New Zea-

land Dairy Board marketing executive believes Fonterra should retain its consumer business but change the way it’s running the business.

Dr Poh Seng Ong, a former chief executive officer Asia region of NZDB, says he’s sad to read that Fonterra is deliberating to sell its consumer business.

Ong believes Fonterra’s consumer business will continue to perform strongly is there’s support from the top, who are usually non-consumer professionals.

He also believes Fonterra must recruit suitable people to run its consumer business.

“I use the word ‘suitable’ instead of ‘top marketing’ because different phases of marketing consumer growth require different marketing people.”

Speaking to Dairy News from Singapore, where the 79-year-old lives in retirement, Ong noted that during the era of the NZDB, the consumer business was a steady business with nonvolatile pricing/revenue.

He says the returns were much better than the commodity business.

DR POH Seng Ong says that during time, New Zealand Dairy Board had several strengths – top R&D and support for the consumer business from the board and management.

“During my time, the scientists at the Dairy Research Institute at Palmerston North were top class. We had one-week meetings, twice a year. At each meeting, we were pushing the other to get things going forward.

“On my marketing side, I pushed the R&D to develop products that I believed the market needed, while the R&D kept pushing me to market-research their new ideas/development. Those meetings

“The consumer business helped the farmers in two ways: consistently higher returns buffered the low payout to farmers when commodity prices were down. Remember that commodity busi-

were very productive.”

Ong says back then the consumer business had the full support of the NZDB board including then chair Sir Dryden Spring and senior management.

“Farmer directors from NZ Dairy Group, Kiwi Dairy Co-op and Northland Dairy Co-op visited the Asian markets and were very supportive.

“All these farmers were inspiring, interfacing with us in the marketplace. We in the marketplace appreciated that dairy farmers worked all day long, every day, seven days a week, except for the one or two winter months. We were a team together. Morale was high.”

ness competes on price,” he says.

“Secondly, with more milk going into our own

consumer business, it meant there was less milk to sell as commodity. This resulted in less pressure on the commodity prices.”

Last month, Fonterra announced a step-change in its strategic direction, setting out on becoming a world-leading provider of high-value, innovative dairy ingredients.

As part of this, the co-op said it was exploring full or partial divestment options for some or all its global Consumer business, as well as its integrated businesses Fonterra Oceania and Fonterra Sri Lanka. Fonterra’s global Consumer business includes a portfolio of market leading brands such as Anchor, Mainland, Kāpiti, Anlene, Anmum, Fernleaf, Western Star, Perfect Italiano and others.

Ong recalls that in the 1980s, NZDB bosses decided to extract more value out of milk by going into the consumer business. Commodity prices were depressing, he adds.

“In 1986, I was recruited in Singapore to turn the Malaysia company around. The Malaysian company was mainly in the consumer business. It was losing money for several years. None of the consumer brands were market leader or close to market leadership. The two brands of milk powder, Anchor and Fernleaf, were the lowest-priced milk powder in the market, and each had market share, at no more than 1% or 2%,” he says.

In 1988, Fernleaf full cream milk powder was ‘re-launched’. The Anchor brand was discontinued.

Ong says, within three years, the Fernleaf full cream milk powder became either No. 1 in market share, with a market share of around 23%, or a close No. 2 to Nespray, a Nestle brand, which was the unchallenged market leader in Malaysia for years, until then.

“The company became highly profitable and all the initial invest-

ments in the launch were recouped.

“In 1991, I created the brand Anlene for the skim milk powder category. In a record time of less than six months, I pushed the R&D to formulate the product I wanted in Anlene.”

Anlene skim milk powder was launched in Malaysia in 1991. It was the most expensive skim milk powder in Malaysia and the gross profit margin was over 45%. Ong says it was a resounding success.

“Within one year, Anlene was market leader with market share at over 60%. By then the Malaysian company was the biggest consumer milk powder company in Malaysia, giving higher returns to dairy farmers than the commodity milk powder business.

“I then got the R&D to develop a milk powder for pregnant and breastfeeding women. I called this brand Anmum. Again, it immediately became No 1, outselling Sustagen, a brand owned by American company Mead Johnson. The gross profit margin of Anmum was even higher than Anlene: it was 60%.”

Ong says the success was repeated in Singapore and Taiwan.

All these three markets – Malaysia, Singapore and Taiwan – were highly profitable, giving higher returns to dairy farmers than the commodity milk powder.

TAUPO-BASED MILK

processor Miraka has landed a deal to supply premium low-carbon A2 milk products into China.

The deal with Chinese dairy company Theland was signed in Auckland during the recent visit of Chinese Premier, Li Qiang. Miraka chief executive, Karl Gradon, and Tony Nie, managing director of Milk New Zealand, on behalf of Theland, signed the deal in the presence of Trade Minister Todd McClay.

“Premier Li Qiang’s visit was hugely significant for New Zealand. It was a privilege for Miraka, New Zealand’s second largest, Māoriowned global export business, to play a part in supporting the trade rela-

tionship between China and Aotearoa New Zealand,” says Gradon.

“Theland is a cornerstone customer of Miraka. We have entered into a new supply and research agreement with Theland to produce a new range of premium low-carbon, A2 milk products.

“Theland strives to be a sustainably focused

business that produces goods with minimal impact upon the taiao / environment. This approach aligns closely with our kaitiakitanga values.”

The Miraka dairy plant is the world’s first to use geothermal energy. It has one of the lowest manufacturing carbon emissions footprints that there is globally, emit-

ting 92% less carbon than traditional coal-fired factories.

Meanwhile, Miraka has announced a 202425 season milk price of $8.42/kgMS for its farmer suppliers.

Gradon says that following a tough season on-farm they’re pleased to get in behind farmers for the season ahead by providing a strong milk

A RECORD 13 dairy farms supplying Miraka have taken out the 2023/24 season top spots under Te Ara Miraka, the company’s farming excellence programme, and received an extra premium of 20c/kgMS on top of the company’s milk price, totalling a forecast $8/kgMS, including the premium.

Miraka chief executive Karl Gradon joined more than 350 guests at the company’s annual suppliers’ awards dinner held in Taupo recently to celebrate the milestone.

“We’re proud of our top 13 farms – a new record for Miraka – who share first place equally having each achieved the maximum 100 points under our farming excellence programme, Te Ara Miraka.”

price for 2024/25.

“We’re committed to doing our part to pay the best milk price, to the best people and farms.”

Miraka will pay its suppliers a base price, set at $8.25/kgMS. Farmers can also earn an additional premium up to 20c/kgMS under Te Ara Miraka, the company’s farming excellence programme.

“We reward our farmers for achieving high standards of sustainability, people development, animal welfare and milk quality,” says Gradon.

“Under Te Ara Miraka, our suppliers can earn an additional premium of up to $0.20/kgMS on top of our milk price. Since our establishment in 2010, Miraka has paid more than $21 million in premi-

ums to our loyal farmer suppliers.”

Chad Hoggard, Miraka general manager of onfarm excellence, said the company’s 2024-25 milk price will be well received by their dairy farmers and that he was also proud of farmer performance which has consistently improved over the last three seasons under Te Ara Miraka.

“Our farmers work hard to achieve high standards and it’s also pleasing when we can deliver a stronger milk price for the new season. Our farmers are more than just business relationships to Miraka – they’re people who become part of our whānau and their kaitiakitanga values align with ours. We have worked closely together to refine Te Ara Miraka to ensure we’re continuously improving.”

EARLIER SIGNALLING

by the dairy industry of how many hectares of maize silage is required each season would assist maize growers to better plan their planting programmes, says the Foundation for Arable Research’s Ivan Lawrie.

This follows an unprecedented rollercoaster ride for prices and demand in the last two years, with the market disruption caused by the war in Ukraine in early 2022 spiking prices of grains internationally.

In New Zealand, the market highs quickly turned downwards as maize growers sought to catch the tail-end of high prices, just as the dairy market reduced demand for silage and international prices plummeted.

As whatever maize is not bought by dairy

“While the local dairy pay-out prices correlate more closely to all grain prices in New Zealand due to demand, if there is an availability of cheap imported grain this drives price down.”

farmers for silage is taken through by growers for grain, this led to an oversupply of maize grain in the North Island, which was exacerbated by a shortage of storage facilities.

According to data from the Arable Industry Marketing Initiative

(AIMI), a survey of grower intentions, sowings, harvest tonnages and sales, the area planted in maize has remained quite stable since 2019 at around 55,000 to 58,000ha intended for silage and 15,000 to 17,000ha for grain.

“These are survey figures of course, and the final use of the crop can vary according to the season, but on the whole that proportion did not vary too much until the 2024 season,” Lawrie says.

Tonnage figures show that production of maize silage is less variable on an annual basis than grain production, with grain yields more vulnerable to seasonal conditions.

The 2023 harvest in particular saw tonnage of both crops drop

significantly due to the extreme weather conditions, notably

Gabrielle. AIMI figures show that most of the maize

grain (around 90%) is sold under contract with prices fixed well ahead of harvest.

“New Zealand local grain prices do not necessarily follow the international trend due to our isolation, but this only happens to a point. While the local dairy pay-out prices correlate more closely to all grain prices in New Zealand due to demand, if there is an availability of cheap imported grain this drives price down, especially for maize grain where the poultry industry has quite a concentrated power over the market,” says Lawrie.

In a situation where demand for silage has decreased, the North Island is not well furnished with storage and drying capacity for grain, meaning that growers have little ability

to “hold grain” until price opportunities improve.

“Investing in infrastructure development would help the ability to smooth out peaks and troughs in the local market at least,” Ivan Lawrie says.

The feed market is dairy focused, with 60 to 80% of New Zealand’s maize grain crop sold into dairy channels. New Zealand has a deficit of 3.5 million tonnes in animal feed products, which is met by imports. Dairy accounts for about 68% of total imported feed, which is dominated by palm kernel expeller (PKE).

Poultry accounts for about 12% of total imports, but 48% of grain imports. Milling accounts for 7% of imports, but 33% of grain imports.

@dairy_news

facebook.com/dairynews

FONTERRA IS opening a sixth application centre in China to boost its growing foodservice business.

The new application centre in Wuhan is under construction. It will add to those in Beijing, Chengdu, Guangzhou, Shanghai and Shenzhen.

The centres play an important role in the coop’s Foodservice business by enabling Fonterra to partner with local customers and develop product applications designed to meet local consumer tastes and trends.

Fonterra opened its first-ever application centre in Shanghai in 2014. The same year it opened Waitoa UHT manufacturing site in the Waikato, which specialises in producing highvalue cream products sought after by Fonterra’s Foodservice customers.

Fonterra chief executive Miles Hurrell says its Greater China foodservice business is a key part of the co-op’s value-add strategy, with the cream products produced at Waitoa UHT contributing strongly to this success.

“The formula for our foodservice Whipping Cream was developed by our expert team at Fonterra’s Research and Development Centre in Palmerston North and

is an excellent example of how we use innovation to add value to farmers’ milk.

“This product alone is used in approximately 400 million beverages and 260 million cakes in Chinese bakery stores each year and we’ve seen a continued increase in demand since 2014.

“Our application centres play a pivotal role in driving innovation and tailoring Fonterra’s Foodservice offerings to the tastes, culture and trends of the area in which they’re located.

“They include different spaces and equipment to enable technical experts and experienced chefs to test and develop new products, often in collaboration with customers.

“The addition of a

AS PART of an official visit to New Zealand this month, Chinese Premier Li Qiang visited the Fonterra Centre in Auckland. He was accompanied by New Zealand Prime Minister, Christopher Luxon and other officials. Speaking at the event, Fonterra’s chief executive Miles Hurrell says Fonterra has built a strong relationship with its partners in China over the years.

“China’s economic growth has gone hand in hand with increasing demand for our high-quality dairy ingredients and growth of our Foodservice business in China,” says Hurrell.

“Underpinning Fonterra and our customers’ shared successes is the strong relationship between our two countries.”

During the event, Fonterra showcased the co-op’s business in China with a range of its Foodservice and Ingredients products on display.

Hurrell says Fonterra continues to invest in innovation in China’s dairy sector.

new application centre in China signals the continued growth we expect to see from our Greater China Foodservice business and this will likely lead to further growth in demand for our foodservice cream products,

which we are well set up to cater for,” says Hurrell.

In FY23, Fonterra’s Greater China foodservice business reported $2.2 billion in revenue with gross margins of 17.9%.

Fonterra’s Greater

China chief executive Teh-han Chow says the high-quality product coupled with the local expertise the application centres provide gives Fonterra a competitive edge in China.

“While we already

have a strong Foodservice business in China, we’re looking to continue to grow. By working closely with customers to create product applications that help their businesses to thrive, we can all benefit from the opportunities

the China market presents.”

Fonterra’s Foodservice business is also growing in Southeast Asia, particularly in the bakery channel, with the emergence of specialty bakery and lifestyle cafes across the region. Like China, in-market chefs assist the team in developing new local applications based on consumer needs.

It sells to businesses that cater for out of home consumption –bakeries, cafes and global quick service restaurant chains.

Fonterra partners with Foodservice customers to test and develop products for their kitchens, using its network of Fonterra Application Centres (FACs) and professional chefs.

ers, growers, biosecurity and conservation personnel,” Shackleton says.

MAKERS AND retail-

ers of animal health and crop thriving products are backing the Government’s plan to step up approval processes for new offerings.

Animal and Plant Health New Zealand chief executive Liz Shackleton says that the association’s members have innovative products waiting for approval that will address some of agriculture’s greatest challenges: responding to a changing climate, biosecurity incursions, resistance issues and export trade requirements.

“These innovations don’t belong in a queue, they belong in the hands of our pioneering farm-

“We applaud efforts to streamline and modernise the approval process. Our regulators have an important role as gatekeepers of these products, and we support efforts to help them in this role.

“This review gives us the opportunity to pave future pathways. We look forward to working with our regulators and government to speed up approving innovative products so that our country can go forth, grow, protect, adapt and prosper,” says Shackleton.

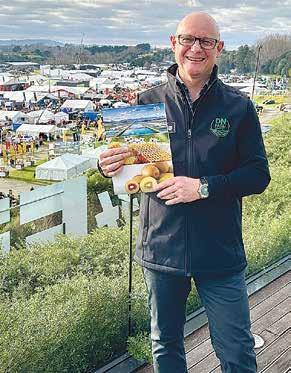

At the Fieldays, the Government announced a regulatory sector review on the approval process for new agricultural and horticultural products.

Regulation Minis-

ter David Seymour says red tape stops farmers and growers from getting access to products that have been approved by other OECD countries.

“It can take nine years and wrangling government agencies to get approval here,” says Seymour.

“Farmers overseas are using innovative technologies that we don’t have access to that make animals emit less methane, make fruit and vegetable plants grow faster, and control pests and diseases with less environmental harm.

“If we don’t remove these barriers to productivity, we will fall behind our global competitors when we need to grow the economy through trade.”

The review will be

welcomed by companies like Royal DSM, which produces Bovaer, a feed additive that enables farmers to achieve a significant and immediate reduction of the environmental footprint of meat, milk, and dairy products. DSM claims that on average it reduces enteric methane emissions by

30% from dairy cows and 45% from beef cattle.

The company expects that by the end of this calendar year, 17 out of the top 20 global dairy companies will have the ability to use Bovaer in their home markets if they choose to do so. Unfortunately, Fonterra is likely not one of those

17, it says.

DSM applied for approval of 3-NOP (the active ingredient in Bovaer) in February 2021, to the Environmental Protection Authority. In August 2023, the EPA approved DSM’s application to import and manufacture 3-NOP. MPI is responsible for the next step — assessing the substance before it can be used on farms. They have yet to receive an application from DSM.

According to the EPA, Bovaer is a trade name product with a specific composition that it has not assessed for on farm use.

The concentrations of 3-NOP approved by the EPA are restricted for use in manufacturing facilities only, they are not end-use products (for use

on farm or by farmers) as that wasn’t part of DSM’s application.

It says MPI is responsible for assessing efficacy, animal welfare, the potential for residues in food and risks to trade in primary produce.

“The EPA is working closely with MPI on the regulation of methane (and nitrogen) inhibitors, with the aim of streamlining the EPA’s application and assessment process for these substances.”

Federated Farmers arable section chair David Birkett says Bovaer is approved as safe for animals, farmers and consumers in more than 55 countries, including the EU, Australia, Canada and Switzerland.

“But our farmers can’t use it.”

FARM PLASTIC recycler, Agrecovery’s Green-farms Product Stewardship Scheme (GPSS) has been officially accredited under the Waste Minimisation Act (2008).

The GPSS is designed to tackle the challenge of farm plastic waste head-on, with a focus on four primary farm plastics waste streams in the first 3 years of the scheme being in effect: agrichemical containers, bale wrap and silage sheets, small seed and feed bags, and large 1T and 500kg fertiliser sacks. The GPSS has also been accredited to incorporate

Animal Health and Household Pest and Weed plastic packaging.

Agrecovery board chair Anders Crofoot says receiving the accreditation is a testament to the hard work and commitment of its team, stakeholders, and the agricultural community.

“Together, we are setting a new standard for environmental responsibility, ensuring that our actions today pave the way for a more sustainable tomorrow.”

David Burger, DairyNZ’s general manager farm solutions and policy,

reinforced the scheme’s importance to the dairy sector.

“New Zealand dairy farmers are committed to reducing their environmental footprint, including minimising plastic waste. The GPSS offers a solution to enable our farmers to progress further along this journey,” says Burger.

Agrecovery has designed the scheme to include a phased approach to encompassing a broader range of materials over time with plans to significantly broaden the range of recyclable plastics covered by the GPSS in

the next 2-7 years. This expansion is a response to the feedback from the farming community and an acknowledgment of the evolving needs of the agricultural sector.

Agrecovery chief executive Tony Wilson says that this is a landmark achievement not only for Agrecovery but for the entire New Zealand primary industry.

“Our accredited GPSS underscores our dedication to stewardship and sustainable practices, driven by the demands and cooperation of New Zealand’s farmers and growers.

We’re looking forward to expanding our schemes and fostering innovation and collaboration to ensure a sustainable future for all.”

The GPSS will operate as a voluntary scheme until regulations are in place to ensure all producers of the targeted products participate. Regulations proposed by the industry-led scheme co-design process to support the GPSS would require those selling the targeted products paying levies to enable a free nationwide collection network for farmers and growers.

“All my dairy farms have a pump on hand as part of their spring survival kit. I believe every cow that needs to be calved at the shed will benefit from a sachet alongside any AB’s and NSAID’s if needed.”

Martin, MaVet MB, The Farm Vet

THE FORTUNES of the dairy industry are expected to bounce back in about a year’s time, according to the Director General of the Ministry for Primary Industries (MPI), Ray Smith.

Speaking to Dairy News from the Fieldays where MPI unveiled its latest Situation and Outlook for the Primary Industries (SOPI) report, Smith noted that while volatility may continue to be the order of the day, a return to the days of better prices are coming.

The SOPI report predicts that in the year from 1 July 2024 to 30 June 2025, export returns for dairy will drop from last year’s high of $26 billion to $24.1 billion

– a drop of 7%. Cheese, infant formula and casein are three product lines which according to the SOPI report will take several years to get back 2023 levels; SMP will be a bit better and WMP will quickly bounce back.

Butter and AMF are the category that seems is the least affected. Overall, it will be 2026 before dairy export earnings are back to 2023 levels, but in saying that, it is valid to point out that 2023 was an exceptionally good year for the dairy sector.

One of the challenges for dairy is its dependence on the Chinese market which takes 34% or $8.158 billion of our dairy products – the next biggest at just 5% are the US and Australia. Ray Smith says China had dropped to a 3.5% growth rate but says it’s now up to 5.5%.

“But I don’t think it will get back to those historical highs we have seen. While consumer confidence is still weak, I think it’s coming back

DAIRY PROCESSORS are happy with the Government’s move to reduce redtape for exporters.

The Dairy Companies Association of New Zealand (DCANZ) says the proposals to remove the requirement for individual exemptions will remove a long-standing and self-inflicted barrier to trade.

The need for exemptions has been a handbrake on dairy exporters pursuing new value-added markets and product opportunities, says DCANZ chairman Matt Bolger.

Dairy exporters currently need to apply for an exemption where the composition of the product being exported differs from the relevant New Zealand standard. Compositional requirements for products often differ between New Zealand and export markets with each country’s food regulators determining the appropriate standards for product to be sold in their domestic market.

For example, the levels of vitamin D differs between the New Zealand and China infant formula standards, due to the differing levels that infants in each country receive from other sources.

DCANZ has advocated that the New Zealand requirement for exporters to apply for exemptions unnecessarily second guesses the regulatory competence of other countries. New Zealand now has over 400 market and parameter specific exemptions for dairy exports with the potential for each of these to require updating when either New Zealand or third country standards change.

Exemptions requirements over-

look the fact that New Zealand dairy exporters operate under independently verified risk management programmes. The Animal Products Act 1999 requires that dairy exporter risk management programmes document the measures taken, in compliance with New Zealand processing requirements, to produce safe and suitable products which meet the relevant country of sale requirements.

“Our dairy exporters invest a lot in building close customer relationships, research and science, and understanding customer and consumer needs to drive product innovation. Sometimes the exemptions process takes months which has meant the companies can’t respond quickly to customer needs, for reasons that aren’t necessary. Addressing this will help increase export value, create great products for customers, and grow returns to NZ,” says Bolger.

New Zealand is unique in the exemption requirements that it currently imposes upon its dairy exporters.

“We are pleased the Government has listened to dairy exporters concerns. Addressing them will ensure New Zealand has a regulatory framework that better facilitates the export of high-quality, safe and suitable dairy products so dairy companies can con tinue growing their contribution to the economy.”

Dairy exports account for one in every four dollars New Zealand earns from all goods and services trade.

DCANZ will be assessing and provid ing feedback on the options put forward in the consultation document.

THE DAIRY industry remains NZ’s single largest primary export earner, accounting for 50% of our export dollars, double that of meat and wool with horticulture coming a reasonably close third, having displaced forestry.

MPI produces the SOPI report – a quarterly snapshot of the market outlook for the primary sector. The June report released at Fieldays forecasts that overall export returns for the next year will be down by 5% to $54.5 billion on last year’s record $57.4 billion. But MPI expects things to get better in a year or more and return to the highs of 2023.

It says farm input costs will remain elevated in 2024/25 putting a squeeze on farm profitability and farmers will need to keep controlling costs in the coming season. But it adds that some help for farmers has come with the 7% drop in fertiliser prices.

demand for our protein there,” he says.

and that demand will be there in the next year or two. It’s such a big market with more people coming into the middle classes that you have just got to believe there is

The other factor to emerge in the SOPI report regarding China is that milk production there rose by 6.6%, driven by what amounts to government subsidies, which has fuelled expansion of

dairy cattle herds and raw milk production in recent years.

Perhaps worth noting is the fact that milk production in Asia now sits at around 446.9 million tonnes – up 2.7%. It is this overall rise in milk production that led to

the decline in global dairy prices in 2023, notes SOPI.

The report says that the slower pace of imports into China is also driven by a drop in demand from hotels restaurant and institutions.

But the China story is not all bad news, with predictions by MPI that demand for NZ dairy products there is likely to remain strong in the short to medium term as economic growth picks up. However, there is still a sense that volatility will remain the norm for a while, and this is borne out by the ups and downs in the farmgate milk price predictions. Smith says despite this volatility, MPI is predicting an $8.50/kgMS payout for 2024 which will no doubt be welcomed by dairy farmers.

ONE OF the world’s largest animal health and nutrition companies, DSM, now known as dsm-firmenich, has developed a feed additive Bovaer to lower methane emissions from cows.

Over the years, Bovaer has undergone tests in various countries. Today, it is authorised and available for sale in around 60 countries, including the US, the EU, Australia and the UK.

The company says that by the end of this calendar year 17 out of the top 20 global dairy companies will have the ability to use Bovaer in their home markets if they choose to do so. Unfortunately, NZ and Fonterra are likely not one of those 17.

Chippy’s regret

LABOUR LEADER Chris Hipkins’ current tagline must have been pinched from Sinatra’s song ‘My Way’ as he trudges around the provinces lamenting, ‘Regrets, I’ve had a few’. At the recent Fieldays he continued his mea culpa mission, trying to convince farmers he and his party are very, very sorry and that they can change. Milking It reckons Hipkins is pushing it uphill at the moment. After the previous six years of feeling under attack, it will be a while before cockies will trust the left side of the house again. Meanwhile, the new mob have made concrete changes that should assist farmers – ETS exemption, bank inquiry, agrichem access, winter grazing rules, etc. Chippy has his work cut out for him getting back in the good books!

MYSTERY CREEK Fieldays was a more positive affair than many expected, given the headwinds facing farmers lately. The tents and flags went up, the punters came in – 106,000 according to Fieldays – looking for a bargain and, according to many exhibitors Dairy News spoke to, the general vibe was pretty good. Big, welltimed announcements from Wellington helped, such as the removal of agriculture from the ETS, and the bank inquiry announcement. But it’s likely that, while happier on the surface, farmers were still only buying smaller items, such as hotdogs and socks, because the farmgate prices for meat, milk and wool still don’t match the more upbeat mood at Fieldays.

INDUSTRY-GOOD bodies have had a torrid time recently, with some facing backlash from farmers particularly over their stance on emissions pricing and He Waka Eke Noa.

The DairyNZ director elections last year attracted only 18.3% of all levy-paying dairy farmers and 28% on a milk solids basis.

With some key industrygood bodies facing a change of leadership, one farmer is suggesting that the time may be right for a peak pastoral sector levy body for all sectors.

Deer Industry NZ is looking for a new chair and chief executive, Beef+Lamb NZ is looking for a new CEO and DairyNZ has a new CEO and a change in chairmanship may also be on the cards. The suggestion may go down well with many farmers.

SYNLAIT’S WOES continue to drag the company down. The listed milk processor’s share price dropped to an all-time low of 30c last week, valuing the company at around only $65 million, a huge slump from its peak value. Over the past year alone, the share price has lost 82% of its value, leaving the troubled company with a market capitalisation of only $65m.

There are only two options for Synlait. Either it has to sell assets or it has to raise more share capital. But no one wants to buy its $400m under-utilised Pokeno plant and not too many shareholders are keen for a capital raise either. Something has to give.

Bovaer is a classic example of an innovative technology not available to NZ farmers because of red tape.

Announcing a regulatory sector review on the approval process for new agricultural and horticultural products recently, Regulations Minister David Seymour noted that red tape stops farmers and growers from getting access to products that have been approved by other OECD countries. It can take nine years and wrangling government agencies to get the same approval in NZ. New products need approval from the Environmental Protection Authority and New Zealand Food Safety.

The review will look at the process and the overlap between regulators. In Bovaer’s case, it applied for EPA approval of 3-NOP (the active ingredient in Bovaer) in February 2021. In August 2023, the EPA approved DSM’s application to import and manufacture 3-NOP. MPI is responsible for the next step — assessing the substance before it can be used on farms.

This process has taken too long and our farmers are missing out. Animal and Plant Health NZ chief executive Liz Shackleton rightly points out that innovations don’t belong in a queue, they belong in the hands of our pioneering farmers and growers.

Head Office: Lower Ground Floor, 29 Northcroft St, Takapuna, Auckland 0622

Phone 09-307 0399.

Postal Address: PO Box 331100, Takapuna, Auckland 0740

by: Rural News Group

by: Inkwise NZ Ltd Contacts: Editorial: sudeshk@ruralnews.co.nz

material: davef@ruralnews.co.nz Rural News on-line: www.ruralnews.co.nz

Subscriptions: subsrndn@ruralnews.co.nz

Publisher: Brian Hight Ph 09-307 0399

General Manager: Adam Fricker Ph 021-842 226

Editor: Sudesh Kissun Ph 021-963 177

Machinery Editor: Mark Daniel Ph 021-906 723

markd@ruralnews.co.nz

Reporters: Peter Burke Ph 021-224 2184 peterb@ruralnews.co.nz

Subscriptions: Julie Beech Ph 021-190 3144

Production: Dave Ferguson Ph 027-272 5372

Becky Williams Ph 021-100 4831

Digital Strategist: Jessica Marshall Ph 021 0232 6446

AUCKLAND SALES CONTACT: Stephen Pollard Ph 021-963 166 stephenp@ruralnews.co.nz

WAIKATO & WELLINGTON SALES CONTACT: Lisa Wise Ph 027-369 9218 lisaw@ruralnews.co.nz

SOUTH ISLAND SALES REPRESENTATIVE: Kaye Sutherland Ph 021-221 1994 kayes@ruralnews.co.nz

FONTERRA PUT a wide, but realistic, range on its opening 2024-25 milk price forecast. The $8/ kgMS midpoint came along with a range of $7.25 to $8.75 attached.

The new season midpoint forecast is higher than the current $7.80 forecast for the 2023/24 season. But it is lower than some might have expected. The SGX-NZX futures pricing for the 2024-25 season has been hovering around the $8.50 mark recently. That said, the latter is market pricing for the actual outcome not a forecast of Fonterra’s forecast.

Fonterra’s new season milk price forecast seems consistent (on our calculations) with softer-thancurrent GDT prices on average over the season ahead. An $8 milk price would be close to, but a touch under, average on an inflation-adjusted basis.

Fonterra’s forecast looks cautious. In fact, it says so itself. The co-op noted that ‘given the early point in the season, the uncertainty in the outlook and ongoing risk of volatility in global markets, we are starting the season with a cautious approach’.

That seems a fair view. Indeed, our own 2024-25 milk price forecast, that has remained unchanged for months at $8.20, could be seen as a bit conservative too given it also factors in lower GDT prices on average over the season ahead compared to current levels.

Labels like cautious or conservative might give some a feeling that upward adjustment is more likely through the season than downward adjustment. That might turn out to be the case, all going well. We will happily revise up our own forecast if developments suggest this is appropriate. But the opposite is also possible. That is the very nature of uncertainty and risk. We have certainly seen plenty of

forecast adjustments in previous seasons and this one is mostly likely to be no different.

This begs the question whether milk price forecasts at the beginning of the season are so cautious that they tend to underestimate the actual outcome? Or, more generally, how does the actual milk price outcome compare to Fonterra’s first forecast for the season?

To get a feel for this we have had a quick look over the past 10 seasons and compared the final milk price result with Fonterra’s first forecast. The following chart shows the difference between those two figures. We have assumed the 2023-24 milk price finalises at $7.80. Some observations are:

• The average milk price forecast error over the past 10 years has been close to zero.

• The number of overshoots has equalled the number of undershoots (at 5 apiece).

• There have been some very large misses.

Milk price forecasts are not always accurate –a fact that should surprise no one and demonstrated by some very large surprises on occasion. For example, in 2016-17 when the final milk price came in at $6.12, a full $1.87 higher than Fonterra’s first forecast of $4.25. Or in 2014/15 when the milk price finished at $4.40, which was a whopping $2.60 below the initial forecast of $7 forecast. Other milk price forecasters have no doubt seen similarly large surprises over time too.

If nothing else this highlights the inherent difficulty in forecasting – more than 12 months ahead – something that depends on many, and highly volatile, components like commodity prices, currency fluctuations, weather conditions, and costs.

Despite some very large misses, the fore-

cast errors average close to zero. This is consistent with no forecast bias over time. The unders and overs have tended to balance out over time.

Does this give any

guidance for the season ahead? To be frank, it is difficult to know whether the 2024-25 milk price will end up higher or lower than $8.00 (or our $8.20 forecast for that matter). In the end, what matters most is what happens, not what is forecast. So, it is back to watching the regular GDT auctions, and fluctuations in the NZD.

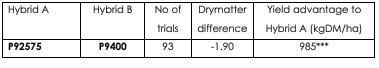

THIS TIME of the season is a great time to sit down with your Pioneer area manager and merchant representative to discuss maize hybrids. Choosing the right maize silage hybrid to plant for your environment can make a big difference to yield and profit.

Crop management and breeding more defensive and high yielding hybrids have resulted in an annual gain in maize silage yields of 250 kgDM per hectare per year (Figure 1). As a result, a newly introduced Pioneer hybrid will usually have a considerable yield advantage over older hybrids. So how should you go about selecting the right maize silage hybrid?

Step 1: Choose a hybrid that has the right maturity.

Maize hybrids require different amounts of radi-

ation to reach harvest maturity. Short maturity hybrids have lower comparative relative maturities (CRMs) and require less radiation than longer maturity hybrids (higher CRMs). The Pioneer® Brand maize silage catalogue for 2024-25 provides an approximate number of days from planting to harvest, by district, for all Pioneer® brand maize hybrids. This guide is particularly

useful when you are targeting a specific date to have the next crop or permanent pasture established in autumn.

Step 2: Choose a hybrid that has the right agronomic traits for your environment.

Selecting hybrids which have high ratings for the agronomic traits that are important in your environment will help ensure stable yields over a number of years.

For example, if you are planting maize in a warm, humid environment with a history of Northern Leaf Blight (NLB), chose a hybrid with a good NLB tolerance rating. Whilst this does not guarantee resistance against NLB, it provides another tool to reduce the risk and potential loss of yield.

Step 3: Select hybrids that will give high drymatter yields. Yield is key. From those hybrids that meet your maturity and agronomic requirements,

select 2-3 hybrids that will give you the highest total drymatter yield. Hybrid selection decisions should be based upon maize silage yield summary data.

Usually a number of side-by-side comparisons conducted over two or more seasons are required to generate the statistical significance necessary to demonstrate that hybrid yield are due to hybrid genetics and not environmental causes, maturity differences or sampling errors. Table 1 shows an exam-

We connect your water meter data with climate, soil moisture to give a real basis to irrigate or use water with: • The right amount • At the right time

use

• Good Value... cost effective data

• Easy setup and easy to use

Table 1: Maize silage trial yield results

ple of the relative yield performance of a popular Pioneer® brand maize silage hybrid.

Step 4: Purchase high quality maize seed. Maize hybrids vary genetically in their ability to germinate and grow rapidly under stressful conditions. This is known as seed vigour. However, differences in seed vigour are not only due to genetics. Seed harvesting method, handling, drying, shipping and storage can all influence the emergence and growth potential of the maize hybrid that you plant. For best results purchase high quality New Zealand produced seed from a company that has ISO certified quality control

systems in place. Ordering maize seed You may be wondering why I have written about choosing and ordering your Pioneer maize hybrid this early in the season. The main reason is that it’s easier to remember what has worked and what hasn’t with last season’s maize crop. Before calving is a great time to have a conversation with your pioneer area manager and merchant representative to discuss what hybrid is best suited for the 2024/25 season.

• Wade Bell is Genetic Technologies farm systems manager. Contact him at wbell@genetic.co.nz.

@dairy_news facebook.com/dairynews

• Uncomplicated presentation giving simple farm management decisions

• Nationwide service and backup

• We are well established being the leading provider of water measuring systems

• Equipment is reliable land well proven to perform

• We support you in your audit and environmental reporting

WE ALL recognise the symptoms of a classic down cow: dull eyes, sleepy, head down, poor responsiveness.

However, we’re seeing more down cows that are bright in the eye, highly responsive and trying to get on their feet but unable to do so. While these cows go down at similar times to calciumdeficient milk fever cases, they can also occur at other times of the season.

Cows can go down at peak lactation, months after calving, or towards the end of the season, just before dry off. These are ‘crawler’ cows, as they often crawl along the ground, clawing with their front feet in an attempt to get on their feet.

The issue

Crawler cows are usually an indication of a much larger problem which will be affecting the entire herd and is caused by an underlying phosphorus (P) deficiency. This will be a diet-based deficiency, but not necessarily driven solely by phosphorus deficiency in the diet.

Diagnosis – tricky

Phosphorus deficiency can be hard to diagnose through blood analysis. Maintaining adequate phosphorus in the blood-

stream is so critical to survival that the body will readily mobilise bone phosphorus stores in order to keep blood phosphorus levels within a tight range.

Blood testing can be useful in diagnosing phosphorus deficiency, however, in my experience, the problem cannot be excluded on the results of a single blood test. We’ve seen many herds respond rapidly to supplemental phosphorus, when only 1-2 cows have shown blood deficiency out of 10-15 samples taken.

I’ve found this issue is better diagnosed by looking at the feed ratios in the diet and calculating the amount of total phosphorus being supplied.

P and high energy diets

Consider the phosphorus energy equation when

soluble sugar levels and this can also drive higher demand. While these sources of energy drive good levels of production, it also sets up a much higher dietary requirement for phosphorus.

Availability over quantity

Availability is often more important than quantity when considering phosphorus requirement.

Different phosphorus sources can vary dramatically in availability. Typi-

calculating phosphorus into any ration. Phosphorus drives energy synthesis within the body, high soluble sugars and starches drive additional demand for phosphorus.

We’ve found high soluble sugar in the diets particularly drives much

higher requirements for phosphorus. Crops, such as fodder beet, are known to have a high phosphorus requirement due to a combination of low levels in the plant as well as high soluble sugar content. Modern grass cultivars also have very high

cally, the more soluble the phosphorus source, the less will be needed to meet demand. Phosphorus sources with lower solubility will increase excretion levels. Apart from the cost factor, feeding large amounts of product delivering poor

availability is not just a waste of money, it can also impact the environment by increasing the excretion levels.

Reluctance with P supplements

Phosphorus supplementation causes a general nervousness among some vets and farmers. This is largely driven by European research that shows excess levels of phosphorus can potentially increase risks around milk fever. However, this is an issue of balance and is relevant to most elements in the feed.

There are also justifiable concerns around excessive levels of excreted phosphorus finding its way into the environment. Looking at the context of the studies, many northern hemisphere farmers have fed levels far in excess of requirement. However, Kiwi dairy farms commonly supplement at levels that are very low by northern hemisphere standards.

European farmers have, in the past, used dicalcium phosphate, which has a lower availability than other forms of phosphorus. Recent research is concentrating on the use of more efficient phosphorus salts with better availability, with a focus on lower levels of excretion into

the environment.

Nutrient management programmes have also focused on what is considered over-application onto New Zealand pasture land. Twenty years ago, grass phosphorus levels were commonly in excess of 0.5%, but are now more commonly around 0.35% or less. Other performance issues

Science has identified phosphorus as a key component in over 400 metabolic processes. Given its importance, a deficiency can affect performance across both production and animal health. While the majority of phosphorus deficiency is subclinical, even subclinical deficiency can restrict milk production, impact immunity, conception, as well as foetal growth and development. Clinically, phosphorus deficiency can lead to nervous system issues or even a spontaneous breakdown of the red blood cells (haemolytic anaemia), though these two issues are usually not concurrent.

With adequate supplementation, you can ensure you never experience a crawler cow, or the other subtler issues caused by phosphorus deficiency.

• Chris Balemi is Agvance Nutrition founder and managing director.

WITH FARMERS facing challenging financial times, a move to deferred grazing is one of many cost-effective systems available to them.

That’s the view of AgResearch scientist Dr Katherine Tozer who was at Fieldays this month talking to farmers about this option. The concept is not new and some of the early research dates to the 1950s and 1960s by one of the early ag scientists, Eddie Suckling. In 1951 he presented a paper at the Grasslands conference showing the success of over-sowing pastures in autumn as opposed to spring.

In recent years there has been a revival of this concept, coming with the support from the likes of

DairyNZ and Beef+Lamb NZ. To that end, Tozer and others have done further research to fill in gaps from early investigations into this pasture management tool.

Put simply, deferred grazing is about resting or locking up a limited amount of the grazing platform for a period between mid to late spring and late summer. Tozer says in the case of dairy, this could be up to10% of the pasture and maybe slightly longer for sheep and beef farmers, depending on their individual feed and water availability. The overall aim of the system is to improve pasture quality and at Fieldays there was significant interest in this option.

As well as effectively giving pasture a rest and allowing it to re-seed itself and develop better

roots, Tozer says they are doing more research on the issue over-sowing during the ‘deferred period’.

She says this involves the farmer assessing what grass species – such as plantain or other mixtures – will be best, and then over-sowing these on the ‘deferred paddocks’.

“When the stock are brought in to eat the deferred pasture, they will trample in the seed and ensure that it has good soil contact and will establish easily. It also means that as the grass is eaten down, the seeds will have light – necessary for growth, but also some protection from the remaining grass,” she

says. The advantage of this, says Tozer, is that the longer grass in the paddock will retain soil moisture which is good for germinating the seed. She says the longer grass will also prevent the paddock from drying out too quickly.

@dairy_news facebook.com/dairynews

THE AIM of the research by Katherine Tozer and others is to get some hard data on the benefits of deferred grazing. She says for example they are interested in seeing how the system improves root depth, pasture resilience and if it has any impact on carbon sequestration.

“So, we have got two sites [with] rhizotrons installed. These are clear plastic tubes inserted at an angle into the ground, and with the aid of a camera we can measure of root growth over time to see how it’s changing, in terms of seasonal growth, and how deferred grazing is having an impact as opposed to not using deferred grazing,” she says.

Tozer says one issue of concern raised about deferred grazing is the risk of facial eczema due to dead grass in paddocks where spores are commonly found. She says their research shows that when spore counts occurred in deferred grazing pasture, these were much lower than in conventional pasture.

For Tozer and advocates of deferred grazing, the message at Fieldays to farmers was ‘give it a go’. Start small and trial the idea to see how it works. She says it may not be for everyone, but is a good option – with one proviso. Tozer says deferred grazing will likely not work in a paddock where browntop or weeds are very dominant. She says browntop is very difficult to work with and paddocks that are already good will benefit most from deferred grazing and will likely improve profitability.

Have a feed pad or barn design in mind but don’t know where to go next with it?

NumatAGRI Construction can help design it and build it too. Check out what one of our recent customers had to say about NumatAGRI Construction’s design and build service:

“I’veworkedwithalotofbuildingagencieswithlotsofthings happeningonfarmconstantly.WithNumatAGRIConstruction,the processwasjustverysmooth.We’reveryhappywiththeresults” Michelle Borrie, North Otago

KIWI AGRI-TECH start-up Bovonic, behind the mastitis detection technology QuadSense, has secured a $940,000 capital investment to help get it to dairy farmers sooner.

QuadSense is an inline, automated detection technology that the company says enables dairy farmers to quickly and accurately detect mastitis, one of the most expensive diseases affecting the global dairy industry.

“The interest and response from New Zealand dairy farmers for QuadSense has far exceeded our expectations,” says Bovonic founder Liam Kampshof. “The market is demanding a user-friendly, affordable solution to mastitis detection that’s easy to install and use and Quad-

Sense is fulfilling these on-farm requirements.

“Since we first showcased our innovation in 2021, more than 450 farmers from all over the world have registered their interest in our product with 400 units already pre-ordered by New Zealand farmers,” says Kampshof.

“With the level of demand we’ve received, we made the decision to commercially launch the technology at this year’s National Fieldays rather than later in 2024.”

While other solutions are effective, for many farmers they are costprohibitive, according to Bovonic. It says DairyNZ, estimates other automatic mastitis detectors can cost as much as $3,000 per bail.

“Mastitis is a signif icant problem and can be a source of stress for farmers and their ani mals so there’s a lot to gain from detecting mas titis early. We’ve designed QuadSense to be accu rate, fast, and easy to use, but at $500 per Quad Sense unit, per bail, importantly it delivers an economically viable

“I’M NOT what you would consider a Formula One farmer, but I must be doing something right,” says Fonterra farmer Francis Smits, who is quick to point out that he and his wife Regina have a simple set up on their Reporoa farm.

Yet this hasn’t stopped them achieving the top level of The Co-operative Difference since it was first introduced in the 2019-20 season. They are among around 70 farmers to do this.

Francis has been a dairy farmer for the best part of half a century and says that simplicity has always been a key focus. “One of the big things for me is to keep what I do quite simple. I don’t have a flash set up, but it works,” says Francis.

With 130 Friesen cows on their 68ha property, caring for the land is also an important part of what they do.

“We have a stream from a spring that borders the farm. That’s where we get water from so we are very careful to make sure it stays in a good condition.”

Michael Hide, Fonterra’s on-farm excellence director, says The Co-operative Difference framework was introduced to ensure on-farm practices support the delivery of the co-op’s strategy.

“We’re always looking to protect and grow the value of our farmers’ milk,” says Hide.

“The Co-operative Difference helps us stay at the forefront of key issues such as safety and animal wellbeing while also recognising farmers like the Smits who consistently provide the highest quality milk. Ultimately, it

means our milk is backed by the quality and sustainability credentials our cus tomers and communities expect.”

Te Tihi level, which translates to “The Summit”, means achieving milk quality excellence for at least 90% of the season on top of meeting the base criteria across five performance areas within the Co-operative Difference framework – Environment, Animals, People & Community, Co-op & Pros perity and Milk.

The Smits have always supplied Fon terra, or its legacy companies, and Fran cis says there are clear reasons for that.

“I like the co-operative model and Fonterra’s stability has always made us feel secure, which is important. The management seems to be more levelheaded compared to what we had before, and I have confidence that they are doing their best for farmers.”

Kampshof. “It will also allow us to start building connections overseas so we can trial QuadSense in other markets.

“The venture investment in Bovonic reflects the real need for innovative technology solutions that can improve dairy farmers’ productivity and profitability. It also shows

with rotary milking systems. The funds will also be used to strengthen Bovonic’s market presence by installing QuadSense on more farms and showcasing its value to the wider industry. While Bovonic remains focused on its current goals, the company acknowledges the

Francis’ passion for farming started at a young age. When he was just 11, he worked as a relief milker for the farmer down the road.

“Then I left school in 1975 and worked as a farm boy for 8 years,” he says.

Using the skills he learnt during that time, Francis started a 50/50 sharemilking role milking 135 cows. He did that for five years before another five-year stint sharemilking on another property milking 360 cows.

In 1993 Francis and Regina bought the farm they are currently on and haven’t looked back. He says there’s a lot to enjoy about the farming lifestyle.

“I’ve never minded the early starts and I like working outside.”

“By

“Cycling

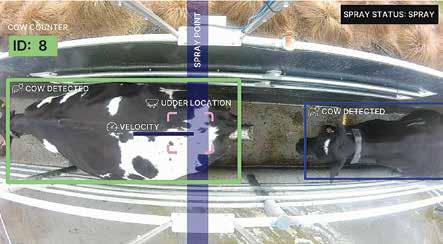

OGY specialists GEA, in partnership with agricultural AI start-up AgriAI, have announced the launch of their walkover teat sprayer, designed to reduce mastitis cases and labour requirements, while optimising animal welfare.

According to DairyNZ, mastitis in the New Zealand dairy industry, brings with it an average cost of $180 per cow, per year, meaning a typical herd of 300 mixed-age cows are likely to see an accumulative loss of $54,500/ annum. Teat spraying post- milking has been proven to reduce the incidence of new mastitis infections by 50%,

but manual teat spraying requires additional labour, but if applied inadequately can lead to inconsistent results.

Back in 2022, GEA introduced the iSPRAY4 on-platform teat sprayer for rotaries, featuring four nozzles and utilising crossfire spray action to cover both the teat barrel and teat end. Recognising that 70% of cowsheds in New Zealand are a herringbone layout, GEA saw an opportunity to build on the success of the onplatform teat sprayer and develop an effective walkover teat sprayer suitable for both rotary and herringbone cowsheds.

Said to be a gamechanger for boosting

udder health, the new walkover teat sprayer is equipped with advanced

AI-driven camera technology that offers realtime udder tracking and

timed sequential spraying, instead of the more typical break-beam sen-

Tailor-made for the 60 plus traveller

Great Britain & Ireland Jul 14, 2024, 30 Days

Join our timeless adventure across Great Britain and Ireland.

sors. This delivers a thorough coverage of the front and back of the teats as the cow walks over the unit, regardless of her speed or how close the following cow is. These features are said to set it apart from other products on the market, ensuring superior teat spray coverage as cows exit the cowshed.

The sprayer also includes sensor technology to detect when nozzles need cleaning and automatically sprays

water to ensure they remain unobstructed. Built entirely of stainless steel for durability and strength, it also features four nozzles and a crossfire spray like the on-platform teat sprayer.

The product is collaborative effort of GEA’s New Zealand-based Product and Technology & Innovation Teams, and AgriAI, looking to address the challenge of maximising milk quality and yield without compromising animal welfare.

WAIKATO MILKING Systems has unveiled the final production version of its ErgoPOD, a state-ofthe-art semi-robotic technology designed to increase milking speed, productivity, and efficiency in the parlour.

ErgoPOD will be available for installation on farms next year. After years of development, the prototype was introduced a year ago and at this year’s Fieldays, visitors saw the final production version.

WMS executive chairman Jamie Mikkelson says that to unlock the significant productivity gains that ErgoPOD now provides, the company embarked on a mission several years ago to

understand the barriers and challenges that limit milking efficiency.

By studying the work routines of milking operators, they identi-

fied the activities that increased effort for the operator and posed musculoskeletal challenges leading to fatigue and health impacts.

“We also meticulously anal-

ysed every aspect of the milking routine to identify opportunities for automation that would reduce labour and make milking easier,” says Mikkelson.

The culmination of their research and development efforts, guided by a milking science-based approach, resulted in a groundbreaking milking management system. This system significantly reduces the effort required in milking, breaks productivity barriers, and creates a healthier, safer milking environment.

The company says after years of development, ErgoPOD promises to revolutionise milking for dairy farmers worldwide.

Rolls up to 15m wide, therefore fewer joins which means less risk, faster installation and shorter good weather window required.

Design assistance and

A tapestry of incredible destinations and breathtaking experiences. From London's Royal pageantry and a dazzling West End show, to the historic streets of Oxford and the enigma that is Stonehenge. Journey through the Cornish Peninsula, Cardiff and Waterford and embrace the legend of the Blarney Stone in Killarney. The incredible Ring of Kerry, the dramatic Cliffs of Moher, the rich history of Belfast, the Giant's Causeway. Explore ancient Chester and experience Liverpool. Cruise Lake Windermere, tour Glasgow and visit the

company - Firestone

FARMERS ARE getting more and more data but often struggle to decipher it into strategies, says Watermetrics.

The company, which began as a water data collector, says it has a solid history of performing in this area.

“In recognising the data overload situation, we have developed not only easy-to-read presentations, but also a backup team to help you understand and better use the information we provide,” it says.

“We are happy to share information, which is a big step forward ahead of competition.

“We can set up targeted presentations for individual situations. We have onboard agronomy and soil knowledge and can give accurate, easy to interpret information that aids management

decisions.”

Watermetrics says its can accurately report data to authorities and maintain a relationship with those authorities on the client’s behalf.

“Any audit or verification work is undertaken with qualified staff and we can do verification work nationally.

“Our team interpret soil status to interpret best irrigation. This can combine satellite and advanced weather forecasting as well as water supply concerns, and crop agronomy requirements.

“We have been developing stock water systems where we can set up tank or pond level readings with alerts.

“This saves farm staff time. With our new Axioma meters for smaller diameter pipes we can measure what

water has gone into a system and see if the right amount has arrived where it should. This is extremely helpful for leak detection work and has

literally saved farmers time and money but also ensured stock are looked after.”

The company also says many water users

now need to supply clean water to their houses, apartments or rural stock water schemes. They can measure and monitor tanks and flows plus

set up and control clean water systems.

“This clean water aspect is growing in demand and requires the right kit for the spe-

cific situation. The setup of sensors and cleaning equipment needs professionalism and correct equipment, or you get little return on your investment.

“Our data displays are simple to understand and we can send alerts from this data for critical points to your cell phone. This saves time and provides peace of mind for the operator.”

Watermetrics has consolidated its range of equipment largely in the South Island. But it’s expanding its sales and service team. Watermetrics Hamilton team is available for work in most Northern locations.

Watermetrics says it’s extending its Lora network into Otago and Southland which will give a large number of farms access to the network.

www.watermetrics.co.nz