Better days ahead for Synlait farmers? PAGE 3

Final breeder sale

Page 6

Better days ahead for Synlait farmers? PAGE 3

Final breeder sale

Page 6

The JCB Series lll has taken telehandling to a new level. Redesigned and re-engineered from the ground up, the JCB Series lll has raised the bar — literally.

Designed to be productive, without compromising safety or comfort

You’ll wonder how you farmed without it! jcbagriculture.co.nz

SUDESH KISSUN

sudeshk@ruralnews co nz

SYNLAIT FARMER suppliers are relieved to see the troubled milk processor on the road to recovery.

Supplier and former Federated Farmers dairy chair Willy Leferink says a forecast milk price 10c higher than Fonterra’s mid-point and market-based advance rate have given farmers new hope.

Synlait is also talking about a new loyalty programme and Leferink says farmers are looking forward to the details. But Leferink says farmers are waiting for a good business plan from Synlait once the special meeting to recapitalise the business is held later this week.

“We will be keeping a close eye, and I may even be attending the meeting,” he told Dairy News.

Leferink isn’t surprised by the recapitalisation plan, which will see the company’s two biggest shareholders Bright Dairy and a2 Milk inject cash into the debt-laden dairy and infant formula maker.

The plan will go before a special meeting scheduled for September 18. Under the plan, a2 Milk will end up retaining its current shareholding (19.8%), while Bright Dairy’s ownership will increase from 39% to 65.25%.

The two companies will control around 85% of Synlait’s voting capital, with retail shareholders’ share declining from around 41% to 15%. This has angered some smaller

shareholders, including founder John Penno.

However, Leferink says he’s more relieved now than he was a few months ago.

“There was strong indication that Bright Dairy was not going to let the business collapse,” he says. “I know not everyone is happy.”

Leferink says farmers were worried a2 Milk “had a desire to play poker” when it came to Synlait’s future.

“We wanted them to sit around the table and sort it out and they did.”

This month Synlait lifted its 2024-25 forecast milk price by 60c to $8.60/kgMS and committed to a competitive advance rate profile for farmers.

Synlait director on-farm excellence, Charles Fergusson, told Dairy News the advance rate is 75% of the forecast price and rises to 85% early next year.

Fergusson says Synlait is aware of the challenges its farmers have been facing as the company has been “off the pace when it came to advance rates”.

“Farmers have been very clear to us; they wanted us to step up. So we are happy to do that.”

Fergusson says this week’s vote, if successful, should help repair the company’s balance sheet and further help in delivering a competitive milk price and advance rate.

Synlait says despite the lift in the forecast price, it continues to take a conservative approach to its 2024-25

forecast, given the exposure to volatile future global dairy commodity prices at the beginning of the season. Retention of Synlait’s milk supply remains a critical priority for the company.

Fergusson says Synlait is committed to delivering a competitive milk price and advanced rate profile to ensure the company’s onfarm offering remains attractive to farmer suppliers.

“Synlait will continue to monitor future forecast movements and update farmer suppliers as needed.”

The final milk price for the 202324 season will be confirmed when the company’s full-year result is released on 30 September.

@dairy_news

facebook com/dairynews

DAIRYNZ CHAIR elect

Tracy Brown says working together to create and implement sensible, affordable and enduring policy has never been more important.

The Matamata farmer, who next month becomes chair of the industrygood organisation, says there’s finally effort going into non-partisan agreements to support farmers as environmental stewards of the land.

Brown made the comment at a breakfast event in Parliament last week organised by the Dairy Companies Association of New Zealand (DCANZ) and DairyNZ. About 150 people attended, including politicians, industry leaders and farmers.

Brown says many of New Zealand’s export markets are sharpening their focus on the country’s strong environmen-

tal credentials.

“The Government aims to double export value, and emerging technologies are keeping us all on our toes to test, trial and take forward.

“That’s why DairyNZ’s new strategy takes aim at the long-term success of the dairy sector, including smart partnerships, so we know exactly where we focus, where we can work with others, and how we make the best collective investments with our partners, to make those big shifts in international competitiveness.

“We are a science-led organisation with farmsystems expertise, and we are driven to serve every dairy farmer of New Zealand.

“We chart a path forward from three strategic pillars: accelerating onfarm productivity, powering more adaptable

and resilient farms, and enabling sustainable and competitive dairying.

“Sustainability and profitability must go hand in hand and so our new DairyNZ vision is to make the levy the best investment of every dairy farmer.”

Brown noted that DairyNZ was proud to be the industry good organisation for dairy farmers, working hard to ensure close alignment with farmers, research partners, processors, and the Government, to maintain a solid understanding of

marketplace challenges and opportunities now and into the future.

“Thankfully, I get the feeling that for the first time in a long time, genuine effort is going into non-partisan agreements to support us as environmental stewards of

the land, who deliver on one of the oldest and most noble pursuits there surely ever was - food production.”

Brown called for sensible, practical, affordable, enduring policy.

She urged the gathering, when seeking to support the country’s wellbeing, look to dairy first.

“When needing to source sciencebased solutions, look to DairyNZ first.

“When looking for an example of what New Zealand is best at – look to New Zealand dairy farmers first. Because when dairy does well, New Zealand does well.”

Brown highlighted dairy’s contribution to the country. It is NZ’s largest goods exporter, delivering around one in every four export dollars.

Milksolid produc-

tion remains strong and steady, tracking up per cow and per hectare for the last 24 years.

The sector generates almost 55,000 jobs – 38,000 on farm, 16,000 in processing – and is a significant contributor to regional GDP.

The biggest advantage the sector has over others around the world is being pasture-based.

“Pasture first; our unique selling point that keeps us at the top of the international game, with our girls taking 82% of their meals al fresco (open air) in the paddock,” she says.

Brown milks 680 cows on 240 hectares in Matamata and has been a DairyNZ director since 2019. She takes over as chair from Jim van der Poel at DairyNZ’s annual meeting in Christchurch next month.

LIC IS embarking on a ground-breaking project aimed at breeding heat tolerant and disease resistant dairy cows for Sub-Saharan Africa, in collaboration with the global leader in precision breeding, Acceligen, and the Bill & Melinda Gates Foundation.

The initiative seeks to address food insecurity in the region by providing high-performing dairy animals to help grow sustainable dairy markets, contributing to improving human and animal welfare.

It will combine LIC’s expertise in breeding efficient dairy cows for pas-

ture-based systems with Acceligen’s cutting-edge gene editing capabilities to produce animals that can produce more milk than native species.

LIC chief executive David Chin emphasises the benefit of this global collaboration.

“This is a big one for LIC and we are proud to be involved. Collaborating with Acceligen allows us to work with the very best in the world, whilst showcasing our advanced breeding capability to global markets.

“The initiative supports us to stay at the forefront of the latest technolo-

gies and is an opportunity to leverage international expertise with positive benefits for the dairy sector.

“As a leader in pasture-based dairy genetics and a farmer-owned co-operative, LIC supports dairy farmers to navigate their unique challenges and provide them with the right tools to breed the most sustainable and profitable herds.

“Gene editing technologies could help give farmers even more tools to improve their productivity and efficiency – and that’s something we have to explore,” says Chin.

Embryos bred from LIC’s worldclass pasture based genetics will be sent to the US, where Acceligen will perform gene edits on the stem cells. The embryos will then be transferred into dams that will give birth to gene edited sires. The bull calves will be transported to Brazil for rearing. The semen will be collected from these sires and sold into Sub-Saharan African markets through a developed distributor network.

The New Zealand Government has committed to legislative change to enable the greater use of gene tech-

nologies, ending the effective ban on gene editing by the end of 2025. Chin says LIC is actively looking at the science and viability of adopting such tools for New Zealand farmers.

“We continue to explore gene editing as a breeding technology to ensure the co-operative stays current with this area of science so we can understand how the sector may adopt it in the future.

“LIC is supportive of tools that can enhance the productivity of the dairy sector and we are ready to adopt new technologies.”

SUDESH KISSUN

CHLOE JONES wears three hats and it’s this trifecta that makes her tick.

Her day job is managing operations at Fonterra-owned farms in the upper North Island. With husband Cory, they own Jones Agri Fencing. And she chairs New Zealand Young Farmers, a 1700-strong organisation for those aged between 15-31 in the food and fibre sector.

“This trifecta makes me who I am: all three roles involve thinking strategically about the future,” she told Dairy News.

“At Young Farmers, sitting in the boardroom, I’m thinking strategically about the future of our organisation. On the farms, it’s about looking at operations and keeping things going in the right direction. The fencing business, it’s always about how we can keep improving things for our clients.”

Chloe is Fonterra’s regional farm operations manager for upper North Island, overseeing farms located near milk plants factories at Whangarei, Hamilton and Cambridge. Milking is done on two farms while some are dry stock farms. The farms exist for the purpose of taking by-product from the factories.

She works closely with

farm managers and staff on how to optimise farm operations and get the most out them, whilst understanding their purpose, for farmer shareholders. Chloe has been with Fonterra for six years after entering the Farm Source graduate programme. After a stint in Otago as an area manager, she moved to Tokoroa and took up this role one year ago.

The fencing business, a team of three, is run day-to-day by Cory, “because he understands quality workmanship, doing the practical operations, and organising and running jobs. Because he knows about fencing and I don’t”.

“My strength is looking after the books, numbers, compliance and

administration,” Chloe says.

Chloe’s introduction to Young Farmers came while working on a farm nine years ago, a local farmer “dragged” her along to meet some people. The Piarere Young Farmers Club, near Tirau, was her first club. Chloe then went to Massey University and later Otago and kept her membership at local clubs and a regional committee level.

She admits that her opinion may be biased but points out that young farmers clubs are critically important for the food and fibre sector.

“You can go and join rugby and netball clubs but not everyone is into sport and also the club isn’t only about those

“A rural teacher, a rural accountant who have moved into the middle of nowhere, are all in the same boat. Our clubs offer a chance to meet others in the community, get along with them and a reason to stay in the community.

“At the end of the day, our clubs make communities stronger and our food and fibres sector stronger.”

Chloe reveals that she wanted to be an engineer when she grew up.

“Then I realised I was relief milking every weekend from the age of 13, enjoyed getting up under the stars, wasn’t directly from a dairy farm, and that our agricultural industry was my passion.

BALLANCE AGRI-NUTRIENTS has launched SimplyFert, an ex-hub and therefore lower-cost offering said to give its shareholders choice and flexibility for purchasing nutrients.

The co-op says this is its second new service innovation this quarter, following the announcement of its Fixed Price Nitrogen pilot last month.

Ballance says SimplyFert gives its shareholders access to quality fertiliser without the extra cost associated with Ballance’s wider distribution network, nutrient specialist support and advice, or digital support and services through MyBallance, its online digital platform.

“We know that most of our

shareholders value the full service that Ballance provides through our nutrient specialists, our digital solutions, world class supply chain and products developed for the NZ industry. There are some though, who, in some instances, don’t require the support and convenience of our full distribution network, or who may not want access to our full suite of services,” says Jason Minkhorst, general manager customer at Ballance.

“SimplyFert demonstrates our deep understanding of our shareholders’ evolving needs, whether that be on farm solutions or more recently, ways to provide more cost-effective nutrients on farm.”

SimplyFert will offer Ballance’s core products with a minimum

3

order of 12 tonnes. Further, shareholders who purchase SimplyFert forgo the additional services Ballance offers, including the convenience of accessing fertiliser from the local service centre as they must pick up their fertiliser directly from Ballance’s hubs located at Mount Operations, Maru Street, Timaru and Awarua.

“We are really pleased that we’ve been able to offer our shareholders two new service offerings in the past few weeks. While we acknowledge that they may not work for all shareholders, these innovations will benefit the cooperative as a whole,” says Minkhorst.

THE YOUNG Farmers’ board has undertaken a strategy refresh While the aim remains to connect and nurture people in the food and fibre sector, it’s less about being everything to everyone

“We are going to be really clear about what our value proposition is

The NZ Young Farmers annual membership remains at $70 Membership was steady for a few years before a small decline this year

Chloe puts this down to people going overseas post-Covid She says NZYF continues to look long term and raise awareness of farming among the young population, with its FMG Young Farmer of the Year, Junior Young Farmers of the Year, and Junior Young Farmer of the Year and AgriKids NZ contests

She points out that parents get as competitive as the kids

“Our vision for the contest is to elevate the food and fibre sector by enabling and promoting excellence Having competitors that come along from these age groups to gain an understanding of what the sector is about – helps us move towards this and develops them along the way”

“We have Young Farmers clubs across NZ in rural and urban areas – including in Auckland and at Massey, Lincoln and Otago universities. They’re connected by like-minded people associated with our food and fibres sector.

“Not everyone’s journey starts with knowing where they are going, but if we can get our young people in NZ to

Chloe has another year left to run as chair of NZYF As for the future, her passion is farming and governance roles and she’s not rushing into anything

“Life’s pretty hectic with the trifecta; for me right now it’s about consolidating where I’m at I’m and where I want to go

“I’m interested in farming governance roles but I’m not rushing into anything Right now, it’s awesome to be young and in the governance space ”

realise where they can add value in our food and fibre sector, and be passionate about it, and get

connected into a local community – we’ve got a lot better chance of keeping them long term.”

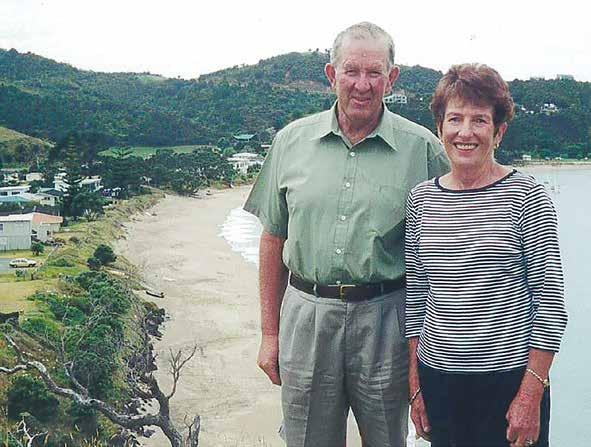

THE 63RD National Holstein Friesian Bull sale this week (September 18) will mark 54 consecutive years that retiring Kerepehi breeder Michael Lynch has entered and sold his bulls at the event.

Lynch, of Lyncrest Holstein Friesians, has been associated with sales conducted by PGG Wrightson and its predecessor company Wright Stephenson and Company Limited.

At the 1971 sale, Lyncrest Isar Rubin, a yearling bull of full Ariki breeding, sold as lot 44. However, research reveals that the first Lyncrest bull was sold at the Waikato Combined Breeders 53rd annual sale in 1968. The sale was run over three days and included four breeds of dairy cattle and conducted by four companies apart from Wright Stephenson. Lot 268, Lyncrest Governor Buster, sired by a Turepo bull from a daughter from one of Michael’s foundation

At this week’s 2024 National Bull sale, to be held at the Te Awamutu saleyards, Michael will sell his last draft of nine Lyncrest bulls.

cows, Seacrest OE Betsy VHC.

Michael joined the NZ Friesian Association back in 1959. His father, impressed by his enthusiasm for registered pedigrees, purchased some pedigree calves from the Arataki Stud at Ohaupo, and eight yearlings at a dispersal sale at Thames back in 1955. So began the Lyncrest Friesian stud.

From the beginning, AI was used by the NZ Dairy Board proven bull team. It was four years until the first bull registered carrying the Lyncrest connection was born in 1963 – Lyncrest

Ideal, sired by Ruaview Ideal from a daughter of one of the Arataki cows. He was sold to the NZ Dairy Board and became a Premier Sire. He was the first of many bulls that Michael entered for AI at both LIC and CRV Ambreed. At least 11 of the bulls have graduated to wide-

spread usage in the national herd.

The first three were sons of LIC bulls and there were sons of imported North American semen. Only ones with high production ratings were used to blend with NZ bloodlines. A highlight for Michael was when Lyncrest Cascade

Bob was selected with a group of NZ bulls to take part in the ‘Canz’ trial in Canada to compare the performance of bulls from the two countries. Along with his success of selling bulls, he also held 27 annual sales on the farm, selling mainly in-calf heifers along with some cows, which met

with strong demand from new and past buyers of Lyncrest cattle.

Michael served at different roles in NZ Holstein Friesian Association (NZHFA) – at club, branch and national levels. He was on the council for 16 years, served as president from 1995 to 1997 and was

WORKSAFE IS recommending the dairy industry reassess its use of slide pulsators, following a recent death in a Waikato milking shed.

treasurer for three years. He was a senior judge for 49 years and a classifier for 25 years. He was part of a 1982 trade delegation to China, South Korea and Indonesia looking at export opportunities. He was a delegate to the World Holstein Conference in Japan in 1996. He’s also an honorary life member of NZHFA.

Returning to the sale, originally held at Claudelands Show Grounds, there was a show prior to the sale. Lyncrest bulls on numerous occasions won Champion Bull or Reserve along with receiving the highest price of the sale.

At this week’s 2024 National Bull sale, to be held at the Te Awamutu saleyards, Michael will sell his last draft of nine Lyncrest bulls.

Following Michael’s retirement, the Lyncrest prefix will not be lost to the industry as his grandson Dylan and his partner Natasha have established Lyncrest Dairies Ltd with 70 of Michael’s cows. They are sharemilking in Southland.

Jeff Bolstad died on 27 July in Morrinsville when his clothing become entangled in the rotating bar of a slide pulsator. There is no indication the 69-year-old intentionally reached into any part of the machinery.

WorkSafe is in the early stages of investigating the circumstances, but already has enough information to urge caution. “We are extremely concerned about the risk posed by exposed moving parts on slide pul-

for Cattle Troughs

Flow

sators and urge farmers to check their set-up is safe or bring a specialist in for advice,” says WorkSafe’s investigation manager, Paul West.

Under the Health and Safety at Work Act 2015, there is an obligation for businesses to manage their health and safety risks.

For farmers, this means to either ensure slide pulsators are safe, substitute them for an electronic pulsator, install safeguarding to prevent access to any moving parts, or remove them. PVC tubing used on some farms is unlikely to provide enough protection to eliminate the risk and meet the required guarding standards.

“The risk of clothing entanglement is real, and steps need to be taken to manage that risk. Any rotating shafts that can catch clothing or body parts need as much protective guarding as possible, or to be replaced,” says West.

Mount

OVER THE past 12 months, Fonterra Oceania has launched a range of new dairy products in Australia and New Zealand.

The new products –like chilli and garlic brie, Anchor ghee and cheese snacking range – meet an increasing demand for products that offer both convenience and fuller flavours, reflecting broader lifestyle and taste trends.

Leveraging consumer insights, shopper behaviour, and quickto-market capability, Fonterra Oceania says it’s using innovation to add a little bit of luxury to the supermarket dairy shelf.

Fonterra Oceania director of marketing and innovation Renée Milkop-Kerr says it was important to constantly look for ways to innovate and improve products that help meet the changing needs and preferences of today’s savvy consumers.

“Alongside convenience, there is a growing preference for fuller, richer flavours in dairy products. As palates evolve, people are looking for more indulgent taste experiences, whether through higher fat content in dairy or through more complex, bold flavour profiles,” Milkop-Kerr says.

Fonterra’s new Mainland Special Reserve Chilli and Garlic Brie was launched in New Zealand addressing emerging flavour trends, especially during celebratory moments. Also in New Zealand, Anchor Double Cream was launched in time for the festive season and provides a richer, creamier, and more indulgent cream –tapping into the insight that people are looking for extra luxury when cooking and entertaining.

Fonterra Oceania says Australians and New Zealanders have demonstrated they love butter, but they frequently see it as the

carrier of flavour rather than the flavour itself.

“Turning this belief around is the new Mainland Sweet Cinnamon Spreadable, available in Australia, which has shown that butter itself can be the flavour hero.”

In New Zealand, Anchor Ghee was launched, bringing high quality dairy to global cuisines – particularly for those who cook Indian and Sri Lankan dishes and love the high smoke point and slightly caramelised flavour compared to butter.

“Alongside convenience, there is a growing preference for fuller, richer flavours in dairy products.

“As palates evolve, people are looking for more indulgent taste experiences, whether through higher fat content in dairy or through more complex, bold flavour profiles,”

Fonterra Oceania says.

A new snacking range in Australia has been introduced under the Bega brand, leveraging ‘Australia’s most loved cheese’ offering. This provides a healthier snacking option for many families and is perfect for the lunch box.

Two new Mainland natural cheese slice options were introduced in New Zealand, American Style Cheddar and Gouda, reflecting shopper preferences for convenience alongside flavour and quality.

Fonterra Oceania also launched Kapiti yoghurt singles in New Zealand, extending the range from the larger tub sizes to a snackable format, which introduced Kapiti to new shoppers.

Flavours include Succulent Summer Plum, Lush Lemon, Sweet Rhubarb and Vanilla, and the latest addition to the range, Fig and Manuka Honey, launched in April this year.

SUDESH KISSUN

THE AUSTRALIAN dairy industry is heading for more consolidation as milk supply shrinks, according to dairy analyst Steve Spencer.

He told Dairy News that as that consolidation occurs, assets and processing capacity will go with it.

He was commenting on the decision by major Australian milk processor Saputo to close its King Island Dairy plant and retire the iconic brand by mid-2025, impacting 58 employees. King Island Dairy, which began in the 1900s, is renowned for its speciality cheeses. Canadian dairy giant Saputo bought the business in 2019.

Melbourne-based Spencer is managing director, global insights for Ever.Ag Insights, a global market intelligence and advisory provider for the ag sector.

He says, like other parts of Australia, milk supply on King Island, part of Tasmania, is also dwindling.

“There is dwindling milk production on the

island, to keep provenance with that name, and it is an expensive place to get milk and product to and from. It is not attractive for someone to take on, even those in the speciality category,” he adds.

Saputo says that over the past 10 months, it has sought to maximise value for the business by conducting an intensive review of all commercial and financial alternatives for King Island Dairy, including a potential sale to a third party.

The company says its immediate focus will be to work with its valued King Island employees, dairy farmers and the broader King Island community to support them through the transition period.

Leanne Cutts, president and chief operating officer (International and Europe) Saputo Inc, says the decision had not been taken lightly.

“After thoroughly reviewing every possible option, closure of the facility was determined as the most viable way to strengthen SDA’s competitiveness based on changing industry and market conditions.

King Island Dairy’s historic roots are deeply embedded in the region, it was hoped the strategic review would identify a potential buyer for the facility. It is a unique brand, with a plant that is nearly 100 years old and designed to produce hand-made specialty cheeses.”

The news has shocked the 1600 residents of the island but they are still hoping for someone to buy the business. King Island Dairy is one of the biggest employers on the island.

that said the news was “sad and concerning”, and his heart went out the company’s 58 employees.

“However, the secondlast chapter of the book isn’t the end; there is the potential for someone out there who has admired King Island Dairy from afar to possibly come in and rescue the brand yet,” he said.

Blackie said domestic and international cheesemakers had long admired the King Island Dairy

Milk production in Australia in the 2023/24 season, which ended in June, was 3.1% higher on the previous year at 8.4 billion litres which was an increase of 249 million litres. However, this season, milk production is forecast to grow at 1.5%.

Australia produced 8.129 billion litres of milk in 2022/23, marking not only the third consecutive year of decline in milk production but also Australia’s lowest available supply of milk for manufacturing – products including cheese and milk powder – since the 1990s.

brand, and hoped they’d snap up the business.

“Now is their chance to swoop in and rescue a legendary brand that doesn’t deserve to be retired, so I encourage them to move now quickly before it’s too late.”

Since the most recent production high in 2020/21, more than 700 million litres have been lost from the supply chain, resulting in a chronic shortage of milk for manufacturing, according to Rabobank.

Spencer says there’s intense competition in

retail between brands and private label milk and dairy products.

However, he notes that the competition at farmgate is not as intense this year, as production conditions have been okay, and companies were cautious about over-paying for milk – as happened in the 2023-24 season with the slippage in commodity prices last spring.

“If the rising global market prices flow into this market, which will be delayed for various reasons, and production slows after spring, then there may be greatest contest for milk postpeak.

“But most milk is locked into contracts and limited volumes can freely move between processors. The greatest issue is whether we’ll see greater pressure on farm exits as the season rolls on.”

EUROPEAN DAIRY co-operative Arla Foods is forecasting a total revenue of nearly $25 billion this year.

The farmer-owned milk processor says that while geopolitical tensions continue, the positive trend on consumer purchasing power from the first half of 2024 should prolong into the second half, especially in Europe as inflationary pressure continues to subside and wages increase.

“This is anticipated to translate into a continued upturn in the demand for dairy, although it is uncertain how consumers will react to the expected higher retail price levels following the commodity price increases,” Arla says.

“The uncertainty is also underlined by a lesser volume of available milk on a global level.”

Arla Foods is owned by more than 8400 farmers from Denmark, Sweden, the UK, Germany, Belgium, Luxembourg and the Netherlands. The co-op is one of the leading players in the international dairy arena with wellknown brands like Arla, Lurpak, Puck and Castello.

For half-year ending June 30, 2024 Arla Foods reported total revenues of almost $12 billion and achieved a net profit of $300m. For the six months, Arla collected 7 billion kg of milk.

Peder Tuborgh, Arla Foods chief executive say it has delivered a robust half-year performance in 2024 where the positive trajectory from the later part of 2023 has continued.

The performance allowed Arla to increase the milk price by nearly 10c/kg of milk, compared to the second half of 2023 and pay a half-year supplementary payment to farmer owners of 3.5c/kg of milk, based on the half-year volumes.

“We are satisfied that the momentum created by our farmer owners and employees in 2023 has continued into 2024, and today Arla is able to announce a robust half year result with a competitive milk price that paves the way for enhanced sustainability efforts going forward,” says Tuborgh.

He notes that the rising milk price and the half-year supplementary payments are mainly driven by rising commodity prices, Arla’s Fund Our Future transformation & efficiency programme and a return to branded volume growth.

Arla’s strategic brands had a volume driven revenue growth of 4.1% in the first half of 2024 compared to a decrease of 6.0% the first half of 2023.

The growth was spearheaded by the Lurpak, Puck and Arla brands which respectively grew volumes by 7.9%, 4.4% and 3.8% in the first half of 2024.

“We are very pleased to deliver a competitive milk price.

“At the same time, the return to branded growth happened with a higher magnitude than expected due to the strength of our brands and successful efforts to regain growth, so we are on a positive trajectory.” – Sudesh Kissun

MARK DANIEL markd@ruralnews

A 2022 Nuffield scholar, Lucie Douma, was brought up on a Southland dairy farm and as a hobby likes the risky business of trail running and ultra marathons. It should be no surprise then that she works in the “risk” industry as head of client strategy and advice at insurer FMG.

At the recent Tractor and Machinery Association (TAMA) conference held in Wellington, Douma delivered an interesting presentation titled ‘Global Trends Impact on the New Zea-

land Agricultural Sector’.

Noting that much of our export might is driven into China, Douma suggested it was probably wise to cast the net a little wider, with other parts of Asia in the ascendancy and worth a closer look. This might be sage advice given that recent reports suggest that large-scale dairy farms in China, with over 1000 cows, make up 25% of producers and is predicted to rise to 40% by the 2025-26 season.

Looking further afield, she suggested that Europe, not unlike New Zealand, is currently focusing on the two main challenges of a changing political landscape and

the lack of availability of a reliable labour force.

With regards to the former, after many years of a largely left leaning or Green political landscape, there are currently moves to the centre or far right administrations, a move that should be beneficial to farmers. Indeed, in Germany, recent regional elections in the eastern stage of Thuringia and Saxony, The Alternative for Germany (AfD) Party won over 30% of the vote, while the Green Party won less than 5%.

This is likely to give the European Union some sleepless nights, as it is the first time a far-right party has won an election since World War 2.

FIRST UP to the podium at the recent Tractor and Machinery Association (TAMA) Conference in Wellington, Minster for Agriculture, Todd McClay, reflected on a difficult 12 months, but hinted at signs that things were turning the corner, saying “when ag does well, New Zealand does well”.

With 80% of the goods being exported traceable to rural NZ, McClay accepted that “things have been challenging”, not least with a myriad of rules and regulations handed out to rural folk during the six-year tenure of the previous government, which in many cases did not focus on outcomes.

consumers were increasingly demanding better quality, traceability and a genuine commitment to environmental obligations.

“However, those solutions do not need to be the most expensive, but they do need to be effective,” says McClay. “Of course, there will be farmers in some areas that might need a little attention and some friendly advice, but I would suggest that more of the carrot and a little less stick will get to the required result a lot quicker.”

On the European labour front, recruitment to agriculture is becoming an increasingly difficult problem, as is the general commitment of those that do venture

into the industry. This has seen the industry continuing to adopt a greater focus on agri-tech and automation. On the ground this means more robotic milk-

ing sheds, autonomous vehicles and even a move away from traditional farm shops to automated vending machines for farm products. Douma suggested these are probably areas that NZ Ag should look at.

Currently one of the greatest impacts in dealing with Europe is ongoing issues with the Suez Canal route. With shipping companies choosing to take the “safer” route around South Africa and the North Atlantic, journeys are being extended by around 20 days, increasing costs and eating into product shelf life. Up until recently, the situation has not been helped by reduced ship-

ping levels through the Panama Canal because of low water levels, although in the last few months this has improved. In North America, a different problem is emerging, primarily affecting corn and soya bean growers in the Mid-West. While climate change is continually on the radar, GPS guidance systems are currently under discussion. With farmers in much of the US relying heavily on GPS for planting, fertiliser and pesticide applications, their government is suggesting there is a national security risk if current systems encounter disruption from aggressive parties.

He said that in a sector that employed in excess of 350,000 people, poorly thought-out rules and regulations drove up costs. But he was pleased to convey that his Government’s primary sector focus was to ask to simple questions: “Is it necessary, yes or no, and is it cost effective, yes or no?”

Since taking office, the new coalition has repealed or amended twenty rules and regulations, the largest being He Waka Eke Noa and the removal of agriculture from the Emissions Trading Scheme.

While spending time listening to agricultural leaders and farmers, the Minister suggested that NZ agriculture still needs to keep a close eye on environmental matters, because overseas

Coming away from Fieldays in June – his first as Minister for Agriculture – McClay noted an increase in optimism and a collective relief that the unending avalanche of red tape had stopped appearing in the mailbox.

McClay mentioned the “doubling up” of Farm Plans by local government: “There can be absolutely no need for consultants and huge council fees to achieve worthwhile farm plans. Why indeed does local government even need to be involved, when the likes of Fonterra and other farming companies are working with their shareholders to bring a plan together, usually with a far greater understanding of the industry”.

In closing, he accepted times are tough but noted that there are signs of light at the end of the tunnel with inter-

– Mark Daniel

H is the 1!

GOOD ON Miraka for eschewing electric power for its future tankers, opting for the much more practical heavy-vehicle ‘green’ choice, hydrogen, putting NZ’s first H-powered tanker on the road It’s no accident that in the tractor and farm machinery industry, momentum is growing for a future switch from diesel to hydrogen fuel Kubota, Deutz and JCB, for example, are well down the road with hydrogen engines Not only does it require less re-tooling for manufacturers, and the fuel network, hydrogen is better suited to sustained heavy work And unlike battery power, it doesn’t require hours of downtime to recharge In contrast to Miraka, Fonterra has an electric tanker on trial, which they only operate on flat land, for short trips, and takes three hours to recharge

THIS MONTH, the government announced a pause to the rollout of the national farm plan system

However, Environment Southland’s message to farmers is: start pulling together the information for farm plans now So, what should farmers do? Stop work on their respective farm plans or carry on as urged by ES?

This confusion isn’t helping the farming sector

The Government must move quickly with changes to the Resource Management Act that will put a stop to councils like ES working on freshwater farm plans, already a requirement in the Southland Water and Land Plan

Everyone agrees that we need a farm plan system that is practical and cost-effective and based on specific farm conditions So, why the confusion?

IT’S THAT time of the year again when milk processors announce their annual results and final milk payout for the previous season

It’s also the time when Fonterra farmer shareholders and those who supply independent processors watch the small Waikato processor Tatua show them a clean pair of heels in the payout race

Just to refresh your memory, Tatua paid its 101 shareholder farms a whopping $12 30/kgMS for milk supplied last season, leaving Fonterra and other processors in the dust The small co-op’s earnings for the 2022-23 season equated to $15 20/kgMS before retention They retained $2 90/kgMS or $43 million for reinvestment in the business

Fonterra, Synlait and Tatua are expected to announce their results towards the end of this month

NORMALLY FARMER good organisations are happy to use the media to get their message across to politicians and the consumers

However, across the ditch a leaked email from the Australian peak farmer body, National Farmers Federation (NFF), is directing its members to stay silent on a story linking the common farm chemical paraquat to Parkinson’s disease

In a leaked email seen by the ABC, the NFF head office encourages its members to “avoid prolonging the story”

The widely used herbicide has been under safety review by the chemical regulator since 1997 Last month, proposed regulatory changes were announced, which are open for public consultation until the end of October However, not all farmers are abiding from the NFF directive The leader of the Victorian state branch has ignored it, saying she believes a debate needs to be had about the safe use of the chemical and the health of farmers

WHILE DAIRY farmers were busy milking cows last Wednesday morning, 150 leaders and stakeholders of the industry gathered at Parliament over breakfast to celebrate their achievements.

Apart from featuring some delicious dairy products, the gathering heard that the sector is New Zealand’s largest goods exporter, delivering around one in every four export dollars.

The stats are impressive: strong and steady milksolid production – tracking up per cow and per hectare for the last 24 years; and provider of almost 55,000 jobs –38,000 on farm, 16,000 in processing and a significant contributor to regional gross domestic product (GDP).

Speaking at the event, Ohaupo dairy farmer and outgoing DairyNZ chair Jim van der Poel acknowledged a special group who were not in the room – farmers and rural communities.

Without them none of this would be possible, noted van der Poel.

The primary sector contributes 81% of NZ exports and dairy accounts for 45% of that number. But as van der Poel pointed out, with size comes responsibility.

As the biggest exporter of goods in the country, the sector must look outwards to markets, but day-to-day it must remain grounded in communities.

The breakfast was attended by politicians from different parties. It gave industry leaders another opportunity to further strengthen relationships across the political spectrum, critical to the sector’s future success.

Let’s hope last week’s breakfast has strengthened the appetite for politicians to work with dairy farmers and develop policies that will promote farming, not hinder growth.

Head Office: Lower Ground Floor, 29 Northcroft St, Takapuna, Auckland 0622

Phone 09-307 0399.

Postal Address: PO Box 331100, Takapuna, Auckland 0740

Published by: Rural News Group

Printed by: Inkwise NZ Ltd

Contacts: Editorial: sudeshk@ruralnews.co.nz

Advertising material: davef@ruralnews.co.nz

Rural News on-line: www.ruralnews.co.nz

Subscriptions: subsrndn@ruralnews.co.nz

Publisher: Brian Hight Ph 09-307 0399

General Manager: Adam Fricker Ph 021-842 226

Editor: Sudesh Kissun Ph 021-963 177

Machinery

Editor: Mark Daniel Ph 021-906 723 markd@ruralnews.co.nz

Reporters: Peter Burke Ph 021-224 2184 peterb@ruralnews.co.nz

Subscriptions: Julie Beech Ph 021-190 3144

Production: Dave Ferguson Ph 027-272 5372

Becky Williams Ph 021-100 4831

Digital Strategist: Jessica Marshall Ph 021 0232 6446

AUCKLAND SALES CONTACT: Stephen Pollard Ph 021-963 166 stephenp@ruralnews.co.nz

WAIKATO & WELLINGTON SALES CONTACT: Lisa Wise Ph 027-369 9218 lisaw@ruralnews.co.nz

SOUTH ISLAND SALES REPRESENTATIVE: Kaye Sutherland Ph 021-221 1994 kayes@ruralnews.co.nz

BRUCE THORROLD

DAIRYNZ BELIEVES that it’s time to join the latest agricultural revolution.

The history of agriculture is a story of innovation and revolution. Since our Neolithic ancestors shifted from hunting and gathering to shepherding and cropping 12,000 years ago farmers all over the world have harnessed new ideas to transform food production.

We can see fascinating examples from the Islamic Empire in medieval times, Britain in the 17th-19th centuries, the Pacific and into Aotearoa during Polynesian settlement and the Green Revolution of the 20th Century. Each revolution has had flow-on effects to population growth and society.

Right now we are in another agricultural revolution with two themes.

The first is social – a drive for food security, with a broad concept of sustainable food production. The second is technological where science is generating new opportunities from gene technology, automation and AI and the microbiome.

In New Zealand these two themes are coming together in innovations that aim to deliver food production with a lower environmental footprint and higher productivity.

Modern gene technology is a central part of this revolution. By 2040, Australia’s national science agency CSIRO projects a $19.2 billion benefit and 31,200 new jobs from gene technology in the food and agriculture sectors. Right now, AgResearch have new plants in glasshouses that should decrease methane emissions, reduce N loss to waterways and improve animal health. These plants are gene edited or genetically modified and have been developed over 20 years of research. They have been tested overseas and now need to see the light of day in New Zealand to test their true merits.

This is no longer a theo-

The science of gene technologies has moved on, and we support the Government’s recent moves to update the rules.

retical discussion; we now face a real choice.

My view is it is time for change. Dairy farmers are looking for solutions to the challenges that the public and our customers have laid down. We want to explore all promising avenues that could help us deliver better farming.

The science of gene technologies has moved on, and we support the Government’s recent moves to update the rules. But there are three important considerations as we see it.

We believe a regulated approach is needed that considers the wide range of views, opportunities and risks. Decision making needs to recognise mātauranga Māori to provide enduring settings. We’re committed to working to inform the policy within the dairy farming context.

We must consider carefully the views of our customers around new gene technology.

And if we proceed there must be a way for all farmers to choose. We have been talking with dairy farmers over the past few months, and respecting individuals’ choice is a clear theme that emerged. How do we have a GM plant such as pine tree or a grass in the landscape in a way that also allows for other growers and producers of agricultural products to maintain the status quo?

How do two farm systems thrive as neighbours if these changes are made? We have the opportunity here to learn from the world. In Australia and the US, organic farmers and GM croppers work in the same communities.

Gene technology has applications beyond agriculture including medicine and pest control – helping our native birds enjoy a predator free lifestyle, reducing the risk of wilding pines in tussock

grasslands and helping solve the wasp problem in Abel Tasman National Park.

This revolution doesn’t belong to agriculture, but it’s an agricultural revolution nonetheless. We need to begin now to deliver the tools to meet the challenges that will determine our future.

• Bruce Thorrold is DairyNZ chief science advisor

next few years.

NEW ZEALAND’S dairy exports have been the backbone of the country’s economy for several decades, and exports remain buoyant despite pandemic-era disruptions and impending downturns in East Asia in the

Yes, duty-free access to China has helped and will continue to, but with impending demographic challenges in that market, and worsening conditions in Japan and elsewhere, what does that mean for the country’s future exports?

But still, with this

battle out of the way for the moment and producers breathing a sigh of relief, farms and dairy producers across New Zealand have several more hurdles potentially on the horizon. Namely, new trade deals as global shipping routes continue to bounce back from the Covid-19 era.

Still, potential new free trade agreements (FTAs) with other emerging markets remain on the horizon. Earlier in August, Overseas Trade Minister Todd McClay said the current Government is “pulling out all the stops” to get a trade deal with India done. This bodes well for NZ

Inc. in general but particularly the dairy industry as growing Western eating habits continue to develop in that market, increasing the need for dairy products.

Following the NZ-Chinese FTA more than 15 years ago, understandably New Zealand has placed considerable focus on boosting its relationship with New Delhi. It makes sense, with a population of 1.4 billion, although maturing, the sheer size of the Indian market could potentially sweep up Chinese and other East Asian exports in the next decade which are expected to decline if current demographic trends remain on track.

“But while there, I made the case again that whenever NZ does a trade deal, we are often much smaller than our partner,” McClay said. He said the development to boost trade relations with the large Asian market is backed up by previous agreements developed by both countries dating back to 2011.

getting over the issue of a semi-protectionist Indian market is the average high tariffs. Whole milk powder has an average 15% import duty levied on it, while finished cheese products have a basic customs duty of 40%; overall, the average duty levied on imports currently is around 33%, adding a layer of complexity to already tense negotiations between Wellington and New Delhi.

Hardjo is the #1 Lepto serovar infecting people in NZ. Get 12 months proven protection with Ultravac® 7in1. NZ’s only combination clostridial and Lepto vaccine for cattle and sheep.

Former Prime Minister John Key said at the time (MFAT) that, “This is the first of what will be many NZ Inc. country and regional strategies that will set ambitious medium-term goals and provide a clear direction for the whole of government effort over a fiveyear period,” adding, “Our relationship with India has always been friendly and warm, and we have seen good growth over the past few years. Two-way trade is worth more than $1.2 billion per year, and India has become our thirdlargest source of international students and our 10th largest source of visitors”.

As the agreement from the 2011-era document states, the core aim of that move was a free trade agreement (FTA) in the coming years. That has not panned out as successive governments would or could have hoped for, simply that as the target of trade of $1 billion a year has been missed successively each year, to even seeing trade dip, respectively over time.

Another key hurdle of

India, which has a comparable domestic dairy industry complex, may see little point in the development of dairy ties with NZ but, long term, as McClay points out, the relationship between the two countries can help strengthen the Indian industry with the latest technologies available and developed by New Zealand agri-tech entrepreneurs—this, in effect, would create efficiencies and help develop further goodwill between both countries. The current state of New ZealandIndia relations suggests that three years is an overly optimistic timeframe for concluding a comprehensive trade deal. Moreover, recent rulings by the Intellectual Property Office of New Zealand (IPONZ) on the copyright of Basmati rice may dent further hopes to win over New Delhi.

The Indian Government’s fierce protection of its domestic dairy industry, as evidenced by its exclusion from the early-stage deal with Australia, presents a formidable challenge. McClay’s reluctance to discuss potential concessions publicly is understandable, but it also hints at the difficult compromises that may lie ahead.

While the Government’s enthusiasm for engaging with India is laudable, it must temper its optimism with a dose of realism. Negotiating a comprehensive trade deal with India in just three years is a Herculean task, especially given the history of stalled talks and the complex economic interests at play.

• Daniel Rad is a rural and geopolitical studies expert based in the UK.

A FORMER dairy farmer with a passion for breeding good cows has switched gears after farming in her own right.

Jan-Maree Pyle has combined 21 years of dairy farming with eight years’ working in the artificial breeding space and put it all together in her new role as a breeding consultant for STgenetics New Zealand (STg). She is available from Dunedin south.

Jan-Maree and her husband Karl worked their way up through the sharemilking system through to leasehold farms in Southland milking between 250 to 850 head during their career.

The daughter of a harness racing trainer has always had an eye for

stock, and when JanMaree turned her attention to breeding decisions – including some registered Holsteins – she was hooked.

Her drive since has been to breed mediumsized cows with capacity, good udders, and good legs and feet.

When she was exposed to dairy tours in Europe, she took another step to appreciating how genetics can impact on performance when it is teamed with great management. It changed her perspective on breeding for their own farm, and she is now using her knowledge and international exposure to help others.

She says there are great gains to be achieved

through the right genetics.

“I think in the past Kiwi farmers have thought that by putting global genetics into their herd they were going to have these huge, big cows that need lots of feed and that’s no longer what it’s about,” Jan-Maree said.

“We farmed on a lowcost system, and we could get cows to 510kg milksolids with the correct breeding. I’m now seeing animals that have been crossed with our global sires, and their calves are medium-sized, and they look exciting.”

She says being on farm is her happy place.

“In all honesty, I love sitting at the kitchen table or being down at the cowshed talking farm-

ing with clients.

“It’s the ultimate compliment when my clients

tell me that they feel like I’m part of their business. It’s not just about

FOR THOSE rural women who feel menopause might be getting the best of them, a series of events is heading to the Waikato that could help.

According to the Australasian Menopause Society, the onset of menopause can cause a whirlwind of symptoms, including night sweats, sleep issues, joint pain, anxiety and fatigue.

While many women go through this phase of life with minimal discomfort, others find it a challenging journey.

According to the Menodoctor Survey, 58% of respondents reported severe or very severe symptoms and 64% of women were unaware that the symptoms they were experiencing were caused by menopause.

An event series, named ‘Mocktails & Menopause’ is taking place in Hamilton, Matamata, and Waitomo.

In 2023, a similar event was hosted in Te Awamutu as a one-off. This year will see four events take place.

Held across September and October, the events will see a panel of specialists share insights, advice and practical tips.

the genetics. It’s also about that connection with farming, and to the people within it.

“Then it’s also about seeing the results of the breeding decisions I’ve helped make. That is the proof of the pudding. I’m born and bred down here, and I’m not going anywhere.”

She says STg also appealed to her because of its global lead in sexsorting technology and research.

From a global standing start in 2004, STg now own nine of the top 25 Total Performance Index (TPI) bulls in the April 2024 sire summaries (including the No.1 TPI sire in the world –Captain).

Captain was the No.1

Attendees will have the opportunity to ask questions to each one, and connect with other women going through similar experiences.

The speaker line-up includes workplace transition coach Rae MacDonald, Buteyko breathing practitioner Felicity Campbell, leadership and growth coach Rae Gunn, GP Dr Ala Farah, radiographer and health coach

Genomic Total Performance Index (GTPI) sire in 2019, and he has held No.1 proven TPI sire for six successive proof runs. He is also No.1 in Canada and the UK, and he joins other household STg sire names, Delta-Lambda, Rubicon, Delta, Chief, Johnboy, and Charl. STg also runs a large heifer-breeding programme in Ohio. That is where it initiated EcoFeed – a finalist for Innovation in Climate Action for the 2024 International Dairy Federation (IDF) Dairy Innovation Awards.

EcoFeed focuses on identifying animals that have superior feed conversion efficiency and reduced methane production.

Lesley Egglestone, mindset coach and therapist Claudia Laschet, and medical herbalist Wendy Eyre.

Tickets are limited and include a mocktail and dinner platter and cost $80 per person.

To book tickets, head to https:// humanitix.com/nz/ and search ‘Menopause & Mocktails’.

– Jessica Marshall

THE HEALTH and productivity of dairy cows means the difference between a successful or struggling dairy operation, and these can be significantly influenced by proper mineral supplementation. While the necessity of minerals is widely accepted among dairy farmers, farmers do not put enough importance on the form of the mineral being supplemented and the important role this can play in achieving uptake and functionality. Understanding the differences between various mineral forms will give farmers an edge when choosing correct mineral supplements to drive animal performance. Different forms of

•

•

•

Minerals can be purchased in a number of forms, each with varying levels of absorption and utilisation. The two main categories are inorganic and organic (chelated). Inorganic minerals

This category is the most commonly used and includes forms like, sulphates, oxides, chlorides, and carbonates. While cost-effective, their bioavailability is typically lower, meaning cows might not absorb them efficiently. For example, copper sulphate is widely used but not as readily absorbed or targeted as the chelated forms. This reduced absorption can mean higher doses are required to meet the cow’s nutritional needs, potentially leading to negative interaction with rumen micro-

flora, negative interaction with other minerals, and poor translocation within the body, all leading to increased excretion (wastage).

Inorganic minerals are more susceptible to antagonistic interactions within the digestive system. For instance, the presence of high levels of iron or sulphur in the diet can interfere with the absorption of copper, reducing its efficacy even further. Therefore, while inorganic minerals are a cost-effective choice, their lower bioavailability and potential for nutrient interaction must be carefully managed.

Organic minerals

Organic minerals are bound to organic molecules, such as amino acids. This binding increases their stability and absorption compared to inorganic forms. Zinc glycinate is an example where zinc is attached to the amino acid glycine, making it more bioavailable and beneficial for cow health, reproduction, and milk production. Research indicates that organic minerals can significantly improve immune function, hoof health, and overall productivity.

The superior bioavailability and body storage of organic minerals means cows can achieve optimal health ben-

BIOAVAILABILITY REFERS to the proportion of a nutrient that is absorbed and utilised by the body Mineral supplements with high bioavailability mean cows receive the full benefit of the nutrients, leading to several advantages:

1 Effective utilisation: Highly bioavailable minerals are better absorbed, reducing the need for high dosages and minimising waste This efficiency is important in ensuring cows get the necessary nutrients without overloading their systems or causing imbalances

2 Cost-effectiveness: Although minerals with high bioavailability might have a higher initial cost, their higher efficiency often results in overall cost savings Farmers can reduce feed costs and improve herd health, leading to better productivity and profitability

3 Health benefits: Better absorption of minerals supports essential bodily functions For example, adequate copper levels for enzyme function and immune response, and zinc for skin health and reproductive performance

efits with lower dosages, reducing the risk of nutrient imbalances and minimising environmental impact. Organic minerals are more efficiently translocated and stored throughout the body. They tend to store in every cell of the body rather than just specific organs, and they also tend to be more palatable to cows, encouraging consistent intake and improving the overall efficiency of the diet.

Chelated minerals Chelated miner-

Higher bioavailability means these minerals contribute effectively to the cow’s overall health

4 Environmental impact: Efficient mineral absorption means fewer excess minerals are excreted into the environment This reduction in waste contributes to more sustainable farming practices

5 Predictable performance: Minerals with high bioavailability provide more consistent results, leading to better management of herd health and productivity Farmers can rely on these supplements to deliver the expected benefits, supporting their ability to maintain a healthy and productive herd

By choosing the right forms of minerals, farmers can significantly improve the health and productivity of their dairy herds

Agvance Nutrition commonly uses highly bioavailable mineral supplements to ensure Kiwi dairy cows are receiving the best nutrition for optimal performance

als are bound to chelating agents, often amino acids or peptide. These form a stable structure that improves absorption. These forms, like zinc chelate or copper chelate, are highly bioavailable, ensuring cows can utilise them effectively, even at lower doses. Chelated minerals offer better protection against potential antagonisation from other minerals in the diet, making them particularly useful in complex feed formulations. Studies have shown

chelated minerals can improve reproductive performance, enhance growth rates, and boost immune response. Their stability in the digestive tract allows for more predictable absorption and utilisation, leading to more consistent health outcomes. While chelated minerals can be more expensive, lower rates can be used to achieve higher efficiency and effectiveness.

• Chris Balemi is Agvance Nutrition founder and managing director.

OVER THE last two decades, the days of combi machines for spreading and raking grass have disappeared, with manufacturers and end users realising that dedicated machines lead to far better results.

Claas was one of the first to offer a harvesting system where mowers were matched with tedders, that in turn were followed by recommended swathers, to present the best possible row to the harvesting elements.

Produced at its Bad Saulgau facility, the latest Claas tedder range has been “topped off” with the Volto 1300 and 1500 models, each unit offered with the choice of nonsteered or steered axles.

In the case of the 1500 model, which is equipped with fourteen rotors, each 1.5 metres diameter, the stresses placed on the machine chassis and sub-frames, in both sizes, have resulted in a completely re-engineered solution, alongside a new

driveline.

The result is said to provide increased strength and durability, but also allows the machines to cope with the changing ground contours that are likely to be simultaneously encountered, both longitudinally and laterally, across the fully working width.

Clever geometry ensures the centre of gravity of the re-engineered frame remains close to the transport axle, ensuring maximum stability, particularly when lifting at the headlands. The steering axle option also comes into play on the headlands, allowing the rotors

to stay in work and make the operation smoother.

Looking at the machine in more detail,

the tedder rotors remain the company’s well known Max Spread units with arms angled at a

very precise 29.3°. The overall machine rake angle is adjusted by a single crank handle sit-

uated at the front of the main chassis, with the inclusion a large position indicator for easy

adjustment. The angle of engagement can be adjusted between 12-16˚. The rotor houses are now oil filled to increase longevity and reduce service intervals.

Looking at the driveline, the shaft speed has been increased by 50% to reduce the torque loadings, while the finger drives, connecting each part of the frame, have also been reinforced to allow 180° folding, even at full power.

Moving the tedder from work to transport is achieved using a single-acting lift ram, with a double-acting spool valve controlling the folding of the two arms and lowering into the carrying cradles. Overall transport width is kept below 3m with a folded height of 3.29m.

In the case of the 13m version, the machine is configured with 12 rotors, although the driveline remains the same as its larger brother, as does the choice between either 15/70-18 or 500/55-20 tyres for softer conditions.

@dairy_news facebook com/dairynews

•

• Bio Power Gold has been used successfuly on farm by John & Susan Hayward, Judge Valley Dairies Ltd, Te Awamutu

• Ask your contractor to use Bio Power by PPP Probiotics and control your costs without compromise

• If you don’t use a silage inoculant try Bio Power and see what you are missing

RECENTLY LAUNCHED

to complement the existing DM 8612 TL and DM 9614 TL machines,

Massey Ferguson has added the heavy-duty 9614 TL and 10114 TL butterfly mowers to its DM range, with working widths of 9.6m and 10.1m respectively.

Equipped with the

latest spur gear cutter-bar and a conditioner as standard, the latter is offered with the choice of the tined KC version or the RC roller option, which features drive to both rollers and a more aggres-

sive steel-on-steel option for heavier crops such as lucerne.

Pro models offer ISOBUS control, allowing users to automate functions or adjust conditioning intensity to match the

Feeds all products where you need it, over fences, into troughs or direct to the paddock accurately! NEW!

crop and produce a uniform dry matter content.

Pro models can also connect the front and rear mowing units, offering manual or automatic side shift for the front mower, helping to reduce missed areas on hills or sidling land.

In operation, the system automatically adjusts ground pres-

sure, via MF’s TurboLift, in relation to the rear mower. GPS section control lifts the mower on the headland to avoid previously worked areas, while the rear mower automatically raises and centres when reversing.

All Pro models are also be optioned with a belt grouper that transfers crop to the centre.

GRASSLAND SPECIALIST

Kuhn’s Gyrorake GA 8731+ and GA 9531+ models are described as “large width” semi-mounted rakes with central delivery.

Simple and practical to use, the machines offer working widths from 7.7 to 9.3 metres, making them suitable for contractors or medium and large farms wishing to increase throughput of round or large square balers and forage harvesters.

Offering the ability to deliver adjustable swath widths from 1.4 to 2.3m, the GA 9531+ model uses 15 tine arms on its 4m diameter rotors, offering the ability to group two windrows of grass, or the straw from behind combine harvesters equipped with cutting widths of up to 7.5m.

Utilising well-proven features from the extensive Gyrorake range, the rotor drive features a double reduction via the Master Drive GIII gearbox, which has proven record of robustness in all conditions.

The GA 9531+ model features six wheels per rotor, incorporating a tandem axle) for superior ground following on all types of terrain, working in conjunction with 3-D articulation, alongside increased stability at higher speeds.

Designed to offer simple adjustment of the working or windrow width and the raking height (the latter can be done hydraulically) the Stabilift system locks the rotors in the windrow clearance phase, maximising ground clearance during headland turns. It also helps maintain a low centre of gravity and increased stability, particularly on slopes, while also locking the rotors during transport for increased safety. www.kuhn.co.nz

RECENTLY LAUNCHED and likely to be an indent-only machine for New Zealand, Kverneland’s new 15.6 metre tedder is aimed at increased productivity and timeliness.

Spreading grass, whether for hay or silage, might appear a simple task, and traditionally it was, but as crops have got heavier and tractors more powerful, there has had to come a new approach to the design of the machines to do so.

At close to 16m wide, the Kverneland 85156 C has been designed and manufactured to deal with increasingly heavier crops and higher horsepower tractors, with special attention to the forces created by leverage from the outer extremities of the tedder back into the main frame.

With strength and durability comes bigger section steel and more weight, so the decision was made to use a trailed format, which in turn makes a wide machine easier to fold tightly behind the tractor for transport between jobs.

At more than 50 feet wide, the design brief also had to incorporate adaptability over undulating ground, in both fore-and-aft and side-to-side situations.

The result is what Kverneland calls the TerraFlow linkage, which connects the main boom to the frame’s axle using two short linkages that impart tractive effort to the boom, as well as a hinge point for adjusting rotor angles. The latter is achieved using a single hydraulic ram, while also lifting the rotors out of work at the headland.

The TerraFlow design works across the whole machine, effectively creating a flexible boom that allows each of the 14 rotors to follow ground undulations.

The rotors are smaller in diameter, which Kverneland suggests helps

promote a more efficient pick up and even distribution of the crop, as well as helping to separate the stalks as they are “hit” by a greater number of tines as the tedder moves across the paddock, which is also said to reduce “leaf shatter” in fragile crops.

In the field, the crop is left in a consistent blanket across the full working width, although those operators looking to leave material slightly ridged – perhaps to reduce dew penetration or to allow wind to pass through rather than over the tedded material – are also catered for by reducing the rotor speed.

The layout sees the main ram altering the rotor angle and lifting them out of work, while secondary rams activated by sequential valves fold the rotor boom and lower it onto a cradle for transport.

Kverneland suggests a tractor of around 150hp to handle the machine, allowing speeds of up to 12km/h, to deliver a work rate of 8-10ha an hour.

In other news, the company has also added two butterfly mower conditioners to its range, with the introduction of the 5387MT and 5395MT models, initially for European markets. Fitting between the 5087MT and 53100MT Vario to offer a wider choice, both models can be fitted with BX swath groupers.

The 5387MT uses a pair of 3.2m eight-disc beds, the 5395MT uses 3.6m nine-disc beds, and both feature round cutting discs carrying twin ProFit quick-change blades.

Based on the 3300-series mower platform, the machines offer fixed cutting widths of 8.75m and 9.5m respectively.

Incorporating Kverneland’s own QuattroLink bed suspension system, a multi-link mechanism allows up to 700mm of vertical and 30 degrees of transverse movement. Kverneland claims that by using a pulltype suspension, each bed can react to demanding ground conditions –even at high forward speeds – while a non-stop safety break-back mechanism across the full working width helps avoid impact damage.

For the conditioning units, steel, semi-swing type tines combine with an adjustable conditioning plate to alter the conditioning intensity across a wide range of crops.

Machine control is achieved via in-cab switchboxes, said to be easy to set up and allow a wide range of adjustments to be made on the move.

The addition of the optional BX belt-type swath grouper to either machine allows the full cutting width to be placed into a large single swath.

WITH MASTITIS being a drain on production, resources and animal health any tools that help dairy farmers to quickly detect the problem, particularly that of subclinical cases, will help dairy farmers maintain a healthy bottom line.

Mastatest is a patentprotected solution that is said to provide dairy farmers and vets with easy, accurate, and rapid bovine mastitis diagnoses, produced by Mastaplex, a company founded on the back of initial research carried out at the University of Otago.

Said to simplify the decision on how to treat a mastitis cases, to improve the health of a herd, the system offers automated diagnostics, with results by e-mail within 24 hours, removing the need

for the plating of milk samples or the need to interpret culture results.

The system can be used daily for cows with clinical or subclinical mastitis, to provide data informing users of the presence, or absence of bacteria, the type of bacterial species and also helping to identify cows that don’t need antibiotic treatment, so avoiding a milk withholding period.

On the farm, milk from suspect animals is placed in the testing cartridge, before being placed in the Lapbox.

The science behind the Mastatest system captures colour change phenomena with an electronic eye. Resultant data is transmitted to the cloud, via the Lapbox, where analytical algorithms take over to interpret the results.

Those results are said to

help users select of the right antibiotic for each cow, helping to improve

cure rates and reduce their time out of the herd.

During the development and testing phase, seven spring

calving pastoral dairy herds from the Canterbury and Otago regions of New Zealand were selected from farms serviced by Vetlife New Zealand Ltd. All farms were chosen based on the fact that they had expressed interest in on-farm diagnosis for mastitis, were prepared to follow the study protocol and contributed towards the funding of the project as part of their annual veterinary fee.

Across the seven farms, out of the 6467 cows calving, 608 cows and 648 quarters were

diagnosed with clinical mastitis by farm staff. Overall, complete data records were available for 259 quarters in the NS group and 276 quarters in the selective group. These quarters were from 471 cows with a single quarter affected, 29 cows with two quarters affected and two cows with three quarters affected.

A summary of the resultant data found the use of an on-farm diagnostic system to inform therapeutic choice for mild to moderate clinical mastitis reduced the use of antimicrobials by 24% with no evidence detected for a difference in bacteriological cure at 21 days, clinical recurrence within 60 days, ISCC measured 30–35 days before dryoff or days milk withheld from sale.

This report looks at the many factors that are drawing farmers to new Farm Technology, from labour shortages to a drive for more profit. The list of tech solutions is huge: Satellite and GPS technology, sensors, smart irrigation, drones and automation, mobile apps, farm management software are just a few areas where tech is helping farmers improve their productivity.

MARK DANIEL markd@ruralnews co nz

BACK IN 2022, Claas announced the sale of its Cargos self-loading wagons to Bavarian company, Fliegl, suggesting that the market for such wagons was static, with too many players vying for the limited business and a pressing need for more room at its Bad Saulgau factory.

Not wishing to appear that it might be leaving its customers in the lurch, there needed to be an established need for parts and service into

the future, so Fliegl was an ideal buyer, given that it already produced tipping and push-off trailers, alongside manure spreaders and slurry tankers.

During an agreed transitional period, Fliegl received the rights to use the Cargos name and Claas livery, with Claas committed to continue to help Fliegl build and develop the product line.

Now that Fliegl is selling the machines, there appears to be a change of emphasis in their use.

During its tenure under Claas, the Cargos series was marketed under the company’s grass-

land range, perhaps with some additional transport work. Fliegl sees the machines as multi-taskers that can obviously be a forage wagon, or with the pick-up and chopper

mechanism removed, as a general-purpose trailer, with a moving floor, for haulage tasks.

To this end, Fliegl suggests that the trailers might even be at home in

AFTER DIVESTING its Kongskilde plough business to German investment company FairCap in April, signalling the return of the Överum plough name, CNH Industrial has reportedly sold the remainder of the Kongskilde business to Italian company Seko Industries.

While there has been no official notification from the CNHI camp, multiple sources are reporting that the deal was completed in early August and that

CNH no longer sell Kongskilde products.

Furthermore, in a communication to his dealer network, Carlo Alberto Sisto, president of CNH Industrial in the Europe, Middle East and Africa zone, advised, “In line with the strategic decisions of the CNH Group, we confirm that as of August 7, 2024, CNH will cease the production and distribution of cultivators, hoes, mixer wagons, trailed forage harvesters and stone pick-

ers, as well as the distribution of disc cultivators and ploughs. The products will no longer be part of CNH’s product catalogue and will no longer be orderable. All current and previous orders for products will be fulfilled during the transition period necessary to transfer production to Seko’s factories”.

Subject to confirmation, the sale of Kongskilde would seem to signal a reversal by CNH to position the New Holland brand as a

the timber industry or on farms, where they might cart grass from alongside a forage harvester or grain away from a combine harvester.

This flexibility could