TO ALL FARMERS, FOR ALL FARMERS

797 www.ruralnews.co.nz

797 www.ruralnews.co.nz

ers rejected a proposal to increase the director fees pool by $73,500 to $475,000/annum.

FRUSTRATED RED meat farmers soundly rejected a move by the Beef + Lamb New Zealand board to increase its director fees.

At B+LNZ’s annual meeting in Nelson last week, 66% of voting farm-

Under the proposal, chair Kate Acland’s fee would gone to $90,000 from $76,220. Each director would have received $45,000 from this year (currently $38,110).

The pool available for additional

director duties was to increase to $25,000 from $20,000.

Federated Farmers meat and wool chair Toby Williams, a sheep farmer from Gisborne, isn’t surprised with the voting results.

Williams told Rural News that farmers are frustrated and not making any money now.

“I’m not surprised because the conversations I’m having with farmers and the sentiment is that we are not making any money,” he says.

“Farmers are finding it tough, and they believe everyone else should be tightening their belts too”.

Williams also questioned the timing of B+LNZ’s proposal and noted that

Alliance Group chair Murray Taggart is looking forward to spending more time on farm as he steps down after a total of about 18 years on the meat co-operative’s board – including the last 10 years as chairman. It is perhaps a bittersweet end to his time at the top, coming during a downturn in the market, especially for lamb, which saw Alliance post a loss before tax of $97.9 million in its 75th anniversary year. “I don’t think you ever get the fairy tale ending in any of these things”. – Photo by Nigel Malthus. (Rural News will run the full profile on Taggart’s time at Alliance in our April 9 issue.)

only 12% of farmers had cast their votes.

For the vote on lifting director fees, 1540 farmers cast their votes: 976 against the proposal, 510 voted for it and 54 abstained. A second resolution put forward by the B+LNZ board on the appointment of the auditor gained 96% support from farmers. Acland says since farmer support was required for the director fee increase to proceed, the fees will not be increased this year.

“We respect this result. We recognise it’s extremely tough on farm now and believe this has been reflected in the voting outcome,” Acland said.

“However, the fact remains that B+LNZ’s director fees are well below industry benchmarks… so we’ll pick this up again when the time is right.”

The meeting also passed three farmer-sponsored resolutions.

A motion by Waikato farmer Jason Barrier calling for “a unified emissions position, for the sheep and beef sector, before entering into further emissions discussions and negotiations with the government” was passed with 60% support.

Barrier says sheep and beef farmers cannot afford a repeat of the deeply compromised position they faced with He Waka Eke Noa.

Farmer Neil Henderson’s remit calling for B+LNZ to acknowledge NZ ruminants are not causing significant global warming got 65% farmer support.

Helen Mandero’s remit for B+LNZ to resist genetically engineered practices was narrowly passed with 50.65% supporting it.

DAIRY PRICES are easing but cost inflation is down across the board, providing some relief to farmers.

Last week’s Global Dairy Trade (GDT) auction saw prices drop 2.8% and the key whole milk powder (WMP) prices fell 4.2%. Most products posted price falls – the exception being anhydrous milk fat which rose 2.5%. The auction was notably weaker than pre-auction expectations and futures market trends.

Westpac chief economist Kelly Eckhold notes that support from the three main regions that usually pick up the bulk of product in the auctions was weaker this time.

“Chinese buyers pulled back further as did Middle Eastern buyers a touch. In contrast to the weaker auctions last year, this time we saw regions that don’t usually feature in the top three purchasers have to pick up the slack in

the auction – which presumably contributed to the weak result.”

However, he says Chinese demand remains around the 10-year average.

Overall, dairy prices remain around long-term averages, but on-farm costs have increased significantly over this time.

But Eckhold says latest data shows cost increases on-farm normalised in

2023 and came in close to their forecasts at an average of 2.4% over 2023.

He points out that cost inflation fell almost across the board. The only main area where costs inflation increased in 2023 compared to 2022 was with respect to central government and local authority rates and fees.

“These high and sticky cost increases have also been felt outside

the farming sector. Significant declines in costs were seen in fertiliser, feed and fuel which was in large part due to the easing in supply-chain pressures seen globally now that Covid and the impact of the Russian war in Ukraine are a bit further behind us.”

However, debt servicing costs remain elevated and are expected to remain high over 2024 as the RBNZ brings inflation under control.

Eckhold believes a saving grace is that interest rates currently look to have peaked. Wages costs are expected to moderate from the very high levels seen in recent years as the labour market continues to ease.

“The outlook for on-farm costs is relatively flat from here. As most cost categories have now normalised, we now see on-farm inflation trending close to aggregate economy inflation rates in the coming couple of years. That means on-farm cost inflation at around 3% in 2024 and 1.9% in 2025,” he says.

For six months ending January 31, Fonterra’s profit after tax rose to $674 million – up $128m on the same period last year. Earnings before income and tax (EBIT) reached nearly $1b, up 14% from last year.

The co-operative has declared an interim dividend of 15c, 5c more than last year and remains on track for a full-year dividend guidance of 50-65c/ share.

With less than two months left in the 2023-24 season, Fonterra has narrowed its forecast farmgate milk price range to $7.50 - $8.10 per kgMS, with the mid-point remaining at $7.80/ kgMS.

Chief executive Miles Hurrell says earnings have been driven by higher margins and sales volumes in foodservice and consumer channels. He says this has helped to offset lower returns in the ingredients channel following historically high price relativities last year.

Sales volumes are up 22kilo metric tonne (kMT) or 1.3% to 1,721kMT and gross margins are up from 16.6% to 18.4%.

“At the same time, our balance sheet position remains resilient, with our strong underlying performance and low debt position helping to further lower our financing costs this year.

“Operating expenses for continuing operations are up $52 million on last year after removing the impact of FY23 impairments, due to increased

labour costs, professional fees and investment in IT infrastructure.”

Consumer and foodservice earnings are also up year-on-year, due to improved pricing and higher sales volumes. Meanwhile, ingredients channel earnings are down year-on-year off the back of historically high price relativities in FY23 and lower margins in Australia Ingredients during FY24. Global Markets’ reported profit after tax is up $230 million to $380 million, due to lower input costs in Southeast Asia, Sri Lanka and Fonterra Brands New Zealand. Fonterra Australia’s performance has been impacted by the higher Australian milk price.

In February, Fonterra announced plans to merge its Australia and Fonterra Brands New Zealand businesses from 1 May.

Greater China reported profit after tax is up $94 million to $232 million, primarily due to strong performance in the foodservice channel.

Hurrell says the outlook for dairy trade is positive.

He says a gradual re-balance of China domestic milk production and import demand has improved but remains volatile with a soft economy. At the same time there’s increasing demand from key import regions, particularly Southeast Asia, and Middle East and Africa.

On the supply side, EU and US production remains stifled due to high on-farm costs, while New Zealand and Australia production has lifted mainly due to better weather conditions.

– Sudesh Kissun

ONE OF the country’s former experts in animal welfare is taking the new Government to task over its plans to allow the export of live cattle.

John Hellstrom, ex chief veterinarian of MAF and chair of the National Animal Welfare Advisory Committee (NWAC) –whose role was to advise government on animal welfare standards, says the move is disgraceful. He has now organised a petition to try and get the government to stop going ahead with its plans.

In a previous life, Hellstrom’s role as chair of NWAC was to advise government on animal wel-

fare standards and in that capacity he made no secret of his opposition to live exports.

He claims a move to reinstate live exports could put at risk NZ’s reputation as a primary

exporter of quality sustainable products. He says both the Europeans and British will not be

FMG MEMBERS

Like many Kiwi farmers and growers, FMG’s legacy goes back a long way. We’ve been around for over a century through rural New Zealand’s highs and lows, and we’re in it for the long haul.

If you’re an FMG Member then you have an opportunity to play a closer part in this legacy— and are entitled to stand for election to FMG’s Board of Directors*.

Our Directors play a critical role in supporting FMG’s continued growth, as well as its core purpose of helping to build strong and prosperous rural communities. If you’re interested, read on and head to www.fmg.co.nz/news to see if you meet the criteria needed.

CRITERIA

FMG’s Constitution and Director Member Election & Special Director Appointment Policy (the Policy) require that a third of all Member Directors retire by rotation at each year’s AGM.

This year Geoff Copstick and Debbie Hewitt are due to retire by rotation. Geoff will be seeking re-election. Debbie has opted not to stand for

re-election. Consequently, there are two Director vacancies, with one being contested by a current Director.

The FMG Board would like to sincerely thank Debbie for her contribution to the Mutual and we wish her well.

MORE INFORMATION

If you would like to stand for FMG’s Board of Directors, please head to FMG’s website. Here you’ll find all the information you need, including The Policy, which sets out the criteria for the evaluation of Member Director candidates, including current Directors.

Applications to stand for election close on Wednesday, 9 April 2024.

FMG’s 2024 Annual General Meeting will be held on Friday, 23 August 2024 in the Wairarapa. FMG Members will receive further details on this closer to the time, along with Member Election voting packs.

*More detail can be found on www.fmg.co.nz/news or by contacting FMG’s General Counsel Lisa Murray at lisa.murray@fmg.co.nz

We’re here for the good of the country.

“There is no doubt that cows suffer on these voyages despite the best intentions.”

rupted, they are subjected to rough sea voyages, often they can’t lie down or get thrown around and sometimes they have to lie down in their own faeces.”

happy, because they are moving away from such practices.

Hellstrom told Rural News resuming the trade could lead to a reduction in welfare standards for the cows being sent overseas. He says while the ship journeys ships today are not as bad as the standards of the past, they are still bad.

“There is no doubt that cows suffer on these voyages despite the best intentions,” he claims. “Even if they put weight on they are still have their social hierarchy dis-

Hellstrom says today it is still a two or three week voyage where up to 80 cows will be crammed into a container, and when they reach their final destination they will not enjoy the protection of the animal welfare rules in NZ. Hellstrom believes instead most of the animals will end up in feed lots and never see grass again.

“They will live short and brutish lives.”

Hellstrom claims even the best feedlot operation in the world is nowhere near as good as pastoral farming in NZ. He says if NZ was exporting to countries which had

LIVE EXPORT NZ (LENZ), the industry group behind reinstating live exports, says that in 2020 New Zealand exported $255.89 million of live cattle to the rest of the world.

“Live exports have made up roughly 0.2% of all agriculture revenue since 2015. In the past 10 years, around 5000 farmers across New Zealand have supplied breeding cattle for export, with an average of over 40 animals per farm.”

LENZ claims that additional to the livestock value farmers receive directly, a shipment of around 3000 animals can return roughly $1.5 million to New Zealand based service providers – including domestic livestock transporters, veterinarians, feed supply companies, quarantine facilities and regional accommodation providers.

“It’s the rural areas and rural service centres that see most of the economic benefits from the trade as this additional income circulates creating an economic multiplier effect.”

It adds that livestock for export usually attract a premium.

“This can be 50-85% of an animal’s value above the domestic market. Selling

equivalent animal welfare legislation and protected farming practices he wouldn’t be that concerned about it.

He says he can’t emphasise how little concern is taken for these animals at the other end, wherever they go.

Hellstrom claims the move to reinstate live exports appears to have come from a small minority of farmers. He says many other farmers are against live exports because they can see the potential reputational risk to NZ.

Hellstrom also questions just how much the trade would be worth to the NZ economy, saying the numbers he’s seen are ‘all over the place’.

The petition has only been going a few weeks and already Hellstrom says there has been a strong response to it. The aim he says is to keep it open until June before handing it into Parliament.

However, he adds that if the present Government acts quickly on the legislation, he will close the petition off earlier to make sure it can be presented to Parliament.

livestock for export is a useful income generator for rural communities.”

Under a reinstate live export programme LENZ is pushing for a ‘Gold Standard’ for the export of livestock from New Zealand.

“The Gold Standard system takes export welfare to a level unmatched internationally and contributes to New Zealand’s position as a premium producer of sustainable and ethically produced agriculture.”

LENZ adds that shipping under the Gold Standard will mean:

The lowest regulated stocking densities in the world during transit

No exports of pregnant cattle, which was phased out in June 2022

A responsible vessel owner program that mandates management practices that are designed to avoid ‘catastrophic failure’ Minimum standards of vessel quality, that will result in the discontinued use of any ship that poses an inherent or high animal welfare risk

A transparent reporting system that measures and reports on animal welfare during the voyage.

DESPITE SOME earlier confusion around the exact timing, the new Government is moving to reform the way local bodies implement Significant Natural Areas (SNA) rules on farmland.

Federated Farmers has welcomed the suspension of SNA rules as a positive step forward for both farmers and New Zealand’s biodiversity.

Biodiversity spokesperson Mark Hooper says the unworkable rules were universally despised by farmers, and Feds are pleased to see the back of them.

His comments follow the announcement by Associate Environment Minister Andrew Hoggard saying that the coalition Government has agreed to suspend the requirement for councils to comply with the

SNA provisions of the National Policy Statement for Indigenous Biodiversity for three years. This will cover the time it will take the new Government to replace the existing Resource Management Act (RMA).

Hoggard says as it stands, SNAs identified on private property limit new activities and development that can take place on that property.

“In their current form they represent a confiscation of property rights and undermine conservation efforts by the people who care most about the environment: the people who make a living from it.”

Hoggard says the Government is proposing to make the changes as quickly as possible to ensure councils and communities do not waste resources and effort implementing national direction requirements

that may change following a review, which he says is being scoped now.

Mark Hooper says the SNA rules infringe farmers’ private property rights and added endless layers of unnecessary complexity, compliance and cost – for very little environmental gain.

“They risked driving perverse outcomes where farmers actively choose to plant exotic species instead of natives because the Government have just made everything too hard.”

Hooper says farmers are NZ’s leading conservationists and can’t think of any group of people who are doing more to protect and enhance our country’s biodiversity.

“Farmers need to be empowered and supported to make further improvements on their properties, instead of tying them up in needless red tape.”

MARLBOROUGH FEDERATED

Farmers has got some real concern about the mental wellbeing of farmers and their families in the region because of the drought and there’s a lot of pressure starting to build.

These comments come as the Government classified the top of the South Island as medium-scale adverse drought event, which has been welcomed by local farmers.

Earlier this month, Agriculture Minister Todd McClay classified the drought conditions in the Marlbor-

ough, Tasman and Nelson districts as a medium-scale adverse event. He says this formally acknowledges the challenging conditions facing farmers and growers in the district.

McClay says these districts are in the grip of an intense dry spell and knows this has made day-to-day conditions on the ground extremely tough for farmers and growers.

“I know farmers and growers in other parts of the country are also experiencing dry conditions and we’re keeping a close eye on the sit-

uation in those regions.”

Meanwhile, Rural Communities Minister Mark Patterson has been in the region to see firsthand the problems facing farmers and growers.

“This decision to declare a drought will unlock further support for farmers and growers, including tax support,” Patterson explains. “This is on top of funding of up to $20,000 made available to the Top of the South Rural Support Trust last month to provide extra support.”

Local Federated Farmers provin-

cial president Evan White says it’s a huge relief for local farmers that the Government has recognised the severity of the drought. He says even just having recognition of how extreme things have been will go some way to boosting morale – particularly in areas where they’ve been hit the hardest, like south of Blenheim.

“Creeks that have never dried up before have stopped flowing, everything has browned off, and 50-yearold native plantings are starting to die. Stock water is under real pres-

sure as wells dry up. Summer crops are failing, and farmers are having to chew into livestock feed set aside for winter,” he says.

White adds that even if there was rain now, it’s debatable how much good it will do this late in the season. He says it’s been a challenging season already with low stock prices, especially for lamb. Inflation and rising interest rates are also hitting the sector hard. – Peter Burke @rural_news

facebook.com/ruralnews

•

•

STUBBORNLY HIGH

farm input costs, a slow Chinese recovery and a flood of Australian lamb onto the global market are the main factors contributing to the tough times being faced by NZ’s sheep farmers.

This is borne out in the latest Beef + Lamb New Zealand’s (B+LNZ) Mid-Season Update, which confirms that farmers will have to continue to dig deep to stem what look like widespread cash losses in the sheep and beef sector for the 23/24 financial year.

It says the outlook for the season has worsened significantly since their forecasts in October, because of Chinese and Australian factors, with the latter’s exports of red meat bigger than originally forecast.

The report says an excellent lamb crop last spring has meant there are more lambs to sell, but this cannot compensate for lower per head

prices and unavoidably high costs. Farm profits it says are forecast to be down 54% to an average of $62,600 per farm – a 67% fall in farm profit

from the 2021-22 year. This is the lowest profit level since the 1980s and the Global Financial Crisis.

Sam McIvor, B+LNZchief executive, says farmers are feeling it with many having already worked hard on cutting costs. He adds that all the indications are

THE LATEST ASB quarterly report suggests a more positive outlook for the primary sector compared with previous quarters.

It notes that prices for key commodities have rebounded and forecasts have been nudged upwards.

ASB economist Nathaniel Keall says the more bullish growth outlook has a lot to do with changing expectations around what monetary policy will do. He adds that markets have

become more bullish that rates won’t need to move as high, and the global economy might manage the fabled ‘soft landing’.

The report notes that dairy prices have managed to rebound by about 22% since their lowest point earlier in the season, but are still around 30% below the peaks enjoyed the previous year.

Keall says the main feature of recent auctions has been the endur-

ing absence of Chinese purchases.

Over the past three months, the world’s largest dairy importer has purchased less than 40% of the whole milk powder (WMP) on offer at each auction, versus a historical average of 55-60%. “We’ve twice revised our 2023/24 milk price forecast since our last report. The recent uptick has also pushed our forecast for the 2025 season higher, to a fairly robust $8.30 per kgMS,” he says.

they’re leaving no stone unturned to find additional savings – especially farmers with relatively high debt levels.

“Certain farm classes,

But while there are some sweeteners for the dairy sector, the report describes meat prices as looking “pretty crook” and notes that overall protein prices have been hit the hardest. Keall says this is driven by cost of living pressures with consumers reducing their meat consumption. He says this is likely to continue for a while yet.

“But pessimism around the global economy is no longer acute as it once

such as high country, hard hill country, and South Island hill country, are hardest hit with profitability due to their heavier reliance on sheep revenue. The East Coast region, still recovering from Cyclone Gabrielle and ongoing wet weather setbacks in 2023, is projected to have the lowest regional profitability.”

But the report notes that it’s not all bad with beef holding up much better, driven by significant demand out of the US as it rebuilds its herd, post-drought. All beef is forecast to average $5.15 per kgCW for the season, which is 2.9% down on last year, but 2% higher than the five-year average.

Demand for lamb in Europe and the US has also been strong and this is expected to continue for the rest of the season.

was, so we are hopeful that meat prices will rise modestly as the season draws to a close.”

Two key factors remain a problem for the NZ lamb industry: The whopping 13% rise in Australian lamb production, which has led to an oversupply and a generally weak lamb market; and China, where growth still remains sluggish as the country tries to sort out its domestic economic problems. – Peter Burke

ZESPRI’S FIRST charter shipment of the 2024 New Zealand kiwifruit season is on its way to Shanghai.

The vessel Kowhai carrying 700,000 trays – or around 2500 tonnes of Zespri SunGold Kiwifruit – as well as 15 containers of Zespri RubyRed for customers in China.

Both the Kowhai and the season’s second charter the Solent Star are expected to reach Shanghai by the end of March.

This is the first of 63 charter vessels Zespri expects to use this season to ship around half of the expected 193 million trays – or almost 695,000 tonnes – of Green, SunGold and RubyRed Kiwifruit to more than 50 countries.

That’s up from the 51

charter vessels used last season. The benefits of charter ships is they carry more fruit and provide more certainty by sailing straight to market without calling on other ports en route. This season’s charter programme using refrig-

erated reefer vessels with fruit stored in holds in the body of the ship will include three services to Northern Europe, 14 to the Mediterranean, four to North America’s West Coast and 42 to Asia. The remaining volume will be shipped using con-

tainer services. Zespri chief operating officer Jason Te Brake says, after a positive growing season, the sight of the first ship setting sail for 2024 is always an exciting moment for the industry.

“Every season we look forward to our ship-

ping programme getting underway and delivering our Zespri kiwifruit to our markets around the world and that’s especially true with such a big crop expected this year,” he told Rural News “We’ve put a lot of focus on our season plan-

“Every season we look forward to our shipping programme getting underway and delivering our Zespri kiwifruit to our markets around the world and that’s especially true with such a big crop expected this year.”

ning and how we manage this season’s increase in crop volume that will allow the industry to deliver consistently good quality fruit to our customers and consumers throughout the season.”

Te Brake says a key part of this is starting the season strongly and getting a good source of fruit to customers, so Zespri can capitalise on early sales opportunities and the strong consumer demand for its fruit.

He says Zespri is look-

ing forward to seeing both charter and container ships continue to set sail from the Port of Tauranga to more than 50 markets – including Europe, China, Japan and others over the coming weeks and months.

Te Brake says Zespri is continuing to monitor the global shipping environment and remains confident of its ability to deliver this season’s crop, through its charter and container services programme.

The grass is greener.

by CSIRO in Australia.”

FORMER ACT MP and Federated Farmers president Owen Jennings believes he’s come across a new fertilising method in Australia that yields “outstanding results”.

“In my travels I have always looked out for new farming methods for New Zealand, but this is the most spectacular and promising option I have encountered,” Jennings says.

“It takes using natural, organics to a whole new level with results that gobsmacked me. Frankly, I doubted the numbers until I found they were measured and verified, independently,

He told Rural News that cattle on this fertilised pasture that were consistently achieving 1.2kg daily weight gains are now achieving 2.95kg.

“What is equally notable is that parasite loading was substantially reduced,” Jennings adds

“Wheat yield increases have been equally dramatic with the new fertiliser producing 5228kg a hectare compared to a control area of 3200 kg and another block using a standard NPKS mix at 4132kg.”

He says this result was achieved at a lower cost than the typical fertiliser mix and also included a massive drop

in striped rust. Jennings says on a 1 to 10 scale, the new fertiliser came in at 1 while the standard mix could only attain a 6 mark.

“This new method involves a blend of ground down minerals – up to 90 separate minerals including some I had not even heard of – applied to a compost which is then spread at low rates once a year,” he explains.

“The thinking is based on feeding the soil biota rather than the plant. The scientist behind the product, who has spent many years researching the option, says feeding the soil adequately in a balanced manner means the plants will be healthy and will optimise yields.”

Jennings says one of the big advantages for him is how the fertiliser sequesters significant amounts of carbon in the soil. “On a Queensland vegetable growing property organic matter in the soil has gone from 0.58% to now sitting at 2.61% after 2 years of farming, which equates to 90 metric tonnes of carbon per hectare

or 330 metric tonnes of carbon dioxide per hectare,” he explains. “Soil health is radically improved and plant life is improved – so animals and humans using grass and crops all benefit.”

Jennings adds other examples show a tomato crop improved from 130 tonnes per hectare to 290 tonnes, sugar cane from 130 tonnes to 290 tonnes, onions from 30 to 75 tonnes, ginger from 22 tonnes to 57 tonnes.

“These results are unbelievable without the CSIRO verification”

Jennings says he’s very keen to get this fertiliser system into New Zealand.

A

DairySmart, winner of the 2023 Technology

title at the

Primary Industries Awards, says it is on a mission to transform mastitis management in New Zealand. In the process, it claims its testing system can make life happier and less stressful for farmers and their staff, improve cow well-being, reduce antibiotic use and tackle antibiotic resis-

tance – all while reducing costs.

The company’s leading edge diagnostic system centres on a novel system of whole herd milk culture-based pathogen screening and the Jupiter machine. This is said to be world first AI and machine learning software technology for sample analysis, from which DairySmart feeds results back to farmers and their vets within 48 hours of taking a milk sample.

The technology identifies infected cows and which pathogen, giving a clear picture of cows with

ON MIKE Prattley’s 2200 cow North Canterbury farm, antibiotic usage is down 90% after two years of using DairySmart diagnostics.

Meanwhile, mastitis is down 55% and SCC are down 33%, according to DairySmart.

Chief executive Ben Davidson puts the potential impact for DairySmart in perspective.

“When you think of the NZ autumn, we have got about five million cows that are dried off in a two-month window,” he explains.

“Some of them need certain antibiotics, but many of them don’t and up until now, there hasn’t been a fast, accurate way to mass sample and culture these cows for identifying individual mastitis

pathogens, or to mass process the results.”

Davidson says DairySmart can process thousands of cow’s milk samples a day, and any result that its Jupiter machine is not 100% sure about is referred to SVS Labs for their microbiologists to analyse. The results are then fed back into the software, constantly improving the machine’s ability to diagnose milk cultures.

“The way the whole antibiotic resistance issue is shaping up for our veterinary industry,” he adds. “Vet practices are becoming a really important part of supporting responsible, strategic use of antibiotics and DairySmart is what they’ve been missing.”

www.dairysmart.co.nz

harmful bacteria lurking in their milk.

The company adds that its validated in-flow sample tool fitted to each milking line is different from existing techniques and has applied for a patent for the design. It means no hand sampling and allows its techs to on-farm test 160-200 cows per hour.

Human error is removed from the process via a specially designed wand, which reads each cow’s ear tag and logs it directly to RFID embedded sample pottles.

There is no need

for handwriting in this system.

The company claims farmers who have implemented DairySmart say it has been a game-changer, empowering them and their teams with hard data, enabling better decision making, and easing the frustration, stress and cost of repeatedly dealing with mastitis cows.

Over 50,000 cows have now been sampled across NZ and farmers have apparently seen up to a 45% reduction in drycow antibiotic use compared to other strategies.

explains.

NEW RESEARCH has found that rural New Zealanders are less likely to be admitted to a hospital.

The University of Otago-led study, published last month in the New Zealand Medical Journal, revealed significant differences between hospitalisations for rural and urban New Zealanders.

The study used hospitalisation, the use of allied health services, emergency department and specialist outpatient data from 2014 to 2018, along with Census information, to calculate hospital use rates for residents in two urban and three rural categories.

The research found that, overall, regional centres had the highest hospitalisation rates and rural areas the lowest.

The study says that, on average, there were 1,079,000 all-cause hospitalisations per year between 2015 and 2019. Of those hospitalisations, 61% were for residents of major cities, 20% were other urban residents, and another 18% were rural New Zealanders.

Lead author Professor Garry Nixon, head of rural section at the University of Otago’s Department of General Practice and Rural Health, says he is surprised by the results because rural New Zealanders have poorer health outcomes, including higher preventable mortality rates.

“The problem is even greater for our most remote communities,” Nixon says.

“Despite the poorest health outcomes, highest levels of socioeconomic deprivation and the highest proportion of Māori residents. These areas have the lowest hospital admission rates and lowest utilisation of other hospital services such as emergency departments, specialist clinics and allied health services,” he

According to the research, out of 6.3 million specialist appointments, only 21% were for rural New Zealanders. Out of 705,000 emergency department attendances each year, 21% were for rural residents.

Nixon says the findings also go against the pattern seen in similar countries.

In Australia and Canada, for example, poorer health status and lack of access to primary care services result in higher rates of hospital isation for residents in rural areas.

“It’s unclear why this is not also the case in New Zealand, raising the possibility of poorer access to hospital services for rural communities,” Nixon explains.

Relative to their urban peers, rural people had lower all-cause, cardiovascular, mental health, and ambulatory sensitive hospitalization (ASH) rates.

Nixon believes there needs to be better moni toring of healthcare util isation to help reduce these inequities.

“This is not only between regions as has been the case in the past – like the post code lot tery – but also between neighbouring rural and urban areas,” he says.

“Accurate data is needed to provide evidence for policy and health service planning.”

He also believes the important role rural hos pitals have in reducing these disparities also needs to be acknowledged.

“In recent decades they have received little attention by the larger health service and are in need of specific strat egy and funding models that ensure their sustain ability.”

In addition to utilisa tion of hospital services, the researchers believe primary care access and utilisation are an impor-

tant part of the ruralurban equity puzzle.

“Since New Zealand currently lacks a nation-

ally consistent primary care dataset, the researchers plan to explore this when data is available.”

Beauty, brains and brawn – The award-winning Valtra T Series is a winner on all fronts, combining the power of smart technology

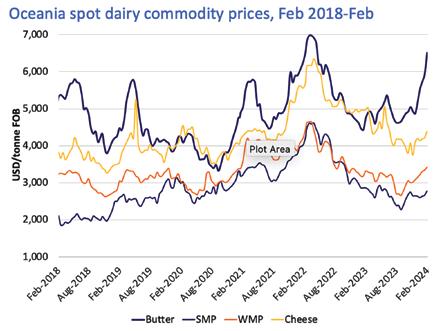

Dairy DAIRY COMMODITY

markets have largely continued their positive trend over the month of February 2024.

Butter prices have continued to soar, lifting 12% over February 2024

and are 20% higher than at the beginning of the calendar year. SMP continues to recover, lifting 8% over February 2024, while gains for WMP slowed to 1% and cheddar prices stalled.

Milk supply growth

from the global dairy exporting crowd continues to struggle. A return to meaningful production expansion from these regions will take some time.

Higher dairy commodity prices will trans-

late into firmer farmgate milk prices in all regions; a welcome relief for farmers who struggled to achieve profitability in 2023.

At this stage, it’s likely that it will take until the second half of this calendar year for volumes from the dairy exporting heavyweights to move back into positive territory.

Despite the struggling milk pool growth, sluggish demand remains the key influence on commodity prices, and therefore, farmgate forecast prices.

Beef FARMGATE BEEF prices are tracking into 2024 in a pretty positive light.

A combination of good on-farm conditions reducing pressure to quit stock alongside steady

demand means prices have held.

As summer met its mid-point through late December and into January, warm weather accompanied by rain in many regions kept pastures and crops in good shape longer than anticipated. Recent weeks have seen a shift to drier con-

ditions in some pockets, notably in the Upper SI and parts of the lower North. This said, the summer dry anticipated didn’t eventuate in many regions and late February rain is kicking things along again in some spots.

Due to the overall good growing conditions to date, on-farm pressure

to send cattle and also cull cows off farm has been less than the same time in 2023.

It is expected cull cows will be heading off farm over coming weeks, which may slightly reduce pricing for at least this cohort, as per normal seasonal trends.

In terms of NZ key beef export markets by

value, the US was up 12% for January this year vs. last, and China down 19% by value for the same period.

Overall, New Zealand beef markets are looking positive to start 2024 and look to remain this way throughout the year with pricing at or above the 5-year average.

PRICING FOR SI lamb has held around the 600 cents/kg cwt to begin 2024 as we continue the subdued waiting game for an improvement in pricing.

Drivers continue to be the same; competing good Australian supply and slow Chinese demand.

A small silver lining throughout Quarter 1 of 2024 has been on-farm feed supplies, in terms of crop and pasture, in most sheepmeat producing regions.

The most notable move here is Southland, with an excellent, kind summer in terms of pasture growth.

With lamb prices lower than anyone would

like, the need to quit stock has at least also been more subdued as producers opt to put extra weight on lambs to make up for a lower per kilogram price.

Looking at Australian sheep meat supply to start 2024, the elevated supply continues.

Weekly slaughter volumes increased 20% YoY and showed an 8% lift on January totals. Heading into February this was still 6% up YoY but March is expected to even out to March 2023 numbers.

China’s continuing soft demand due to a sluggish economy and reduced consumption saw the total value of exports drop from 41% to 31% YoY for the month.

Positively, we see an uptick towards both the US and UK however, a 9% lower value (1% higher volume) was realised in terms of total New Zealand exports for the month of January (compared to Janu-

ary 2023).

Meat processors are reporting optimism in terms of pricing lifts to global markets especially, UK, EU, and North America. The waiting game continues.

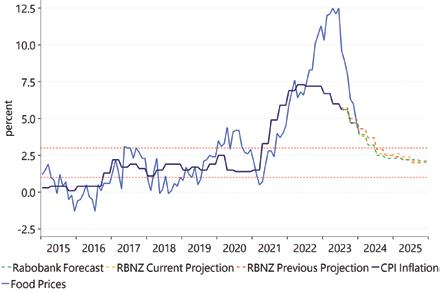

THE RBNZ left the OCR unchanged in February and indicated that they are happy with the progress on controlling price growth.

In subsequent media interviews, Governor Adrian Orr indicated that it wasn’t a difficult decision to leave rates unchanged.

Our own house view is for inflationary pressures to continue easing as the economy operates well below capacity and restrictive interest rates pressure the unemployment rate higher.

As a result, we do

expect that the RBNZ will be cutting rates this year to set the economy on a glide path towards 2% inflation next year without a deep and painful economic contraction.

The rate hikes already delivered have not fully flowed through to the economy because many borrowers are still enjoying comparatively-low fixed rates on their debt. As we move through the year, more of those borrowers will reset to higher rates, increasing the pressure on the economy, and the pressure on the RBNZ to cut rates pre-emptively to soften the blow.

Although we expect the RBNZ to begin cutting rates in the second half of the year, we also expect that the USA will be cutting earlier and faster. As a consequence, our forecast on the NZ$/ US$ exchange rate is for appreciation over the back half of the year up to 0.6400 on a 12-month view.

EVEN BEFORE the National-led coalition came into power, India was very much at the fore of its trade agenda.

India, with its teeming billions, is seen as a country which offers an attractive new market for some but not all of our primary produce.

Right now, the main NZ primary exports to India are forestry and wool and few apples. In the latest statistics from MPI, India hardly features. The new Government clearly wants this to change and we’ve already seen Trade Minister Todd McClay head to India just before Christmas and Foreign Affairs Minister, Winston Peters just a week or so ago. Prime Minister Chris Luxon has also said he’ll go there.

So, the courtship of one of the most powerful economies in the world is now in overdrive and for good reason.

Australia got the jump on us when it signed an FTA with India in 2022, which has seen tariffs cut on Australian exports including lamb and wool, wine, avocados and infant formula to name a few.

So where the bloody hell has sleepy old Kiwiland been?

When Sir Edmund Hillary became our High Commissioner to India in 1985 there was clearly a massive opportunity to get the drop on the Aussies and others. Hillary – supported by the PM at the time, David Lange – had a great relationship with India but since then it seems the lights have gone out and nothing much has happened. The Hillary factor was huge; just like Rewi Alley played a significant role in opening up the Chinese market for NZ.

Australia apparently used cricket in their courtship of India and one hopes there was no match fixing in the process

Does NZ do the same? We have some excellent sports people playing in that country at the moment.

One trade insider claims that NZ has not ‘courted’ the Indians properly and in the way they might expect. They believe the process of obtaining any Indian trade deal is slow and showing respect and heaping praise on them is part of the deal. Whatever has happened in the past is now history and it seems that the coalition Government is making a deal with India a top priority.

The problem is that any deal is likely to exclude dairy products given that India has a large domestic industry and is highly protective of it. So, any deal NZ ever gets with India will not be as ‘comprehensive’ as the FTAs with the UK and the EU but a deal of any sort is better than no deal. Watch this space!

“He’s promised to get her an audition!”

Your old mate would like to pay special tribute to former Countrywide editor Terry Brosnahan who passed way earlier this month. Terry was an old-school journo and a strong supporter of NZ farming. He will be greatly missed, not only by his family, but the wider rural community. Terry had battled health issues in the past few years, but this did little to stop him turning out great articles and stories that benefitted rural NZ. Unfortunately, with the change of ownership of Countrywide late last year, Terry and a number of his long-time colleagues were dumped by the new publishers, leaving NZ rural journalism the poorer for it. Terry’s attitude to his craft was best summed up by his Twitter (X) profile: “A journalist gathers the facts without fear or favour to bring the reader closer to the truth.” RIP Terry.

The Hound reckons the powers at Landcorp (or as they/them like to call themselves, Pāmu) are coming under the microscope with the new government in place.

The first signs have already come from State Owned Enterprises Minister Paul Goldsmith who has said that he is “not happy” with its performance. Goldsmith’s comments follow the state farmer’s measly half year result in 2023 of $3 million – down from $15 million for the 2022 half year. The minister says he expects SOEs to operate as efficiently and profitably as similar businesses not owned by the Crown. “I am not yet satisfied that Pāmu is achieving this and I expect it to take steps to improve.” Goldsmith could start by clearing out all the woke political appointments made to Landcorp’s board by the previous administration and put in place some hard-nosed business types who demand results and not feelgood claptrap from the SOE!

Your canine crusader understands that MPI were recently in front of the Parliamentary Primary Sector Select Committee for an 8-hour marathon hearing. Let’s hope members of the select committee were going through MPI’s budget with a fine tooth comb. There seems to plenty of fat in MPI’s budget to cut that would help with the Government’s goal to trim back excessive public sector body spending. A couple of suggestions for the chop would be everything to do with the totally useless and expensive Fit for a Better World programme, which seems to deliver a fancy report each year but has achieved SFA. Another area your old mate would aim to drop is the pointless money waster that is MPI’s investment in promoting regen ag and its huge handouts to Māori farming organisations. Surely if regen ag and the Māori farming sector are viable options they don’t need MPI (i.e. taxpayers) subsidising them.

AUCKLAND SALES CONTACT:

A mate of yours truly wants to know why the beef schedule differential is now more than 45-50 cents a kilo between North and South Island producers – if you look at February 2024 (p2) steer prices. As they told your old mate:

“This equates to one in 12 steers going to the meat co-operative or company courtesy of the southern producers.” They also suggest that the meat companies need to be far more transparent about why there is such a huge differential.

“Is it to help inefficient marketing and processing to compete with the northern companies,” they ask? “It has got to stop. We have heard all the old pathetic excuses over the years and remember they also make good money out of by-products, pharmaceuticals and hides etc – which are not disclosed.” These are all fair questions and the meat companies need to answer them pronto!

HEAD OFFICE POSTAL ADDRESS:

PO Box 331100, Takapuna, Auckland 0740

Phone 09-307 0399

PUBLISHER:

Brian Hight Ph 09 307 0399

GENERAL MANAGER:

Adam Fricker Ph 021-842 226

CONSULTING EDITOR:

David Anderson Ph 09 307 0399 davida@ruralnews.co.nz

PRODUCTION

Becky Williams

REPORTERS

Sudesh Kissun

Peter Burke

peterb@ruralnews.co.nz

MACHINERY

Mark Daniel

markd@ruralnews.co.nz

Stephen Pollard Ph 021 963 166 stephenp@ruralnews.co.nz

WAIKATO & WELLINGTON SALES

CONTACT:

PRINTED

DISTRIBUTED BY REACHMEDIA

As the National Rural Health Conference 2024 approaches, Fiona Bolden, chair of Hauora Taiwhenua, and Grant Davidson, chief executive of Hauora Taiwhenua, talk about the conference’s significance in addressing rural healthcare challenges.

FIONA BOLDEN, a longterm advocate for rural health, shared her perspective on the conference’s mission and impact, highlighting its role in fostering collaboration and support among rural health professionals.

“As chair of Hauora Taiwhenua Rural Health Network, it’s absolutely crucial for the National Rural Health Conference to thrive,” she stressed. “It’s the one platform where all rural health stakeholders can come together, sharing stories, extending support, and shining a light on the significance of rural healthcare.”

Bolden explained that the conference offers hardworking health providers a much-needed break from their daily grind, providing them with opportunities to learn, connect with their rural community, and foster a sense of camaraderie and empowerment.

Davidson shared the significance of this being the first conference following the full transformation of the countrywide rural health sector groups into one organisation, Hauora Taiwhenua. He noted that

“We deeply care about our communities and the provision of healthcare to them. It’s crucial for politicians to be aware of the inequities in rural health outcomes, the lack of adequate funding, and the ongoing under training of future rural health workers. Face-to-face interaction with politicians demonstrates basic respect for our communities and healthcare professionals, offering hope for the future amidst great change.”

at this year’s conference there is a greater diversity of attendees, reflective of the organisation’s unified voice, and the broad spectrum of abstracts received, representing various rural communities, midwifery, and students.

He sees this conference as a platform for the new era of rural health, embracing diversity and unity.

Reflecting on the conference’s value, Bolden highlighted its role in facilitating conversations with policymakers, advo-

cating for adequate funding and resources for rural health services. She emphasised the need for policymakers to acknowledge the unique challenges faced by rural communities and work towards sustainable solutions.

“As rural health professionals, we can often feel invisible to urbanbased politicians who dictate our funding and the survival of our rural services,” she explains.

“We deeply care about our communities and the provision of healthcare to them. It’s crucial for politicians to be aware of the inequities in rural health outcomes, the lack of adequate funding, and the ongoing under training of future rural health workers. Face-to-face interaction with politi-

cians demonstrates basic respect for our communities and healthcare professionals, offering hope for the future amidst great change.”

Looking ahead, Bolden emphasised the importance of building resilience in rural communities, particularly in the face of climate-related disasters and other challenges. She highlighted the role of Hauora Taiwhenua in facilitating these efforts and empowering rural healthcare providers and communities.

Being based in the Coromandel, Bolden felt the effects of Cyclone Gabriel and she noted that a year on, the community is definitely recovering better.

“With these vital transport routes recon-

necting us and enabling the tourist influx which the Coromandel economy is so dependent upon to return over this summer.”

The conference’s approach to addressing disasters impacting rural communities, such as Cyclone Gabrielle, was further highlighted by Davidson. He says this year’s panel discussion is a dedicated session focused on extracting lessons from past disasters like Gabrielle and the pandemic, with a particular emphasis on preparedness and response strategies for climate emergencies.

Throughout the conference personal, organisational, national, and international lessons will be shared with each conversation playing its part in encouraging preparedness.

Anticipating buzz conversations at the conference, Davidson highlighted three major themes.

Firstly, discussions surrounding climate change and proactive responses are expected. Secondly, conversations about the evolving health system and strategies to ensure rural health emerges stronger amidst changes are anticipated. Lastly, the importance of collective strength and connectivity within the organisation, councils, and chapters, aiming to maximise their impact in the coming year.

When asked to describe this year’s conference in three words, Davidson replied: “Support, Learning, and Excitement.”

WE HAVE good friends from way back who had lived in one of our major cities for many years.

They decided to dial things back somewhat, to slow down their fastpaced lives and schedules.

So, they quit their house and now travel around in a mobile home, camp-

ing up wherever suits them, for as long as they choose. Last I spoke with him, he’s loving every minute of the change.

He is the friend that first told me we have an epidemic of “hurry sickness” loose in our culture! He would readily quote supporting

research and gave many examples to back-up his thinking.

I remember the supermarket one: Just take a look at those lining up at the check-outs, he reckoned. Which one has the shortest queue with the least number of items on board their trolley? Some

people really do those calcs! I notice it more than ever now.

Of course, we now have self-service-checkouts to hurry us up even more. I have at times stood back and allowed some of the hurry sickness folks to get in ahead of me. Their reactions

usually prove the point!

Riding a motorcycle is another way of meeting some hurry sickness sufferers. You easily notice people seeing you in their rear vision mirrors as you come up behind. A few drivers courteously move to the left to let you ride on through. We usually thank them with a toot and a wave.

However, more than a few purposely move to the right to block you. I have experienced exactly that in the ‘one vehicle per green light’ queues on motorway on-ramps. Somehow, getting ahead of them seems to utterly wreck their day!

I’m sure that like me, you can figure out that continuously living life in a hurry and enjoying good health while doing it just won’t last the distance. They don’t mix well!

I first came across the following little piece a bunch of years ago. I thought it was timely then, and much more today.

Titled “Time of the Mad Atom” by Virginia Brasier, it reads: This is the age of the halfread page.

And the quick hash and the mad dash.

The bright night with the nerves tight.

The plane hop and the brief stop.

The lamp tan in a short span.

The Big Shot in a good spot.

And the brain strain and the heart pain.

And the cat naps till the spring snaps.

And the fun’s done!

Hmmmmm!

I find it quite amazing that despite having so many time-saving devices and suggestions today, we have so little time. Time still rushes on by.

There are time management books and tips galore. Experts abound! There’s a whole heap of stuff available to us that previous generations, like our grandparents for example, simply knew nothing of. They lived a rhythm of life, or tempo of life, that seems to escape us today.

As a farming family, I well recall we were never too busy to help out neighbours. Yep, we always had time.

Despite all the “extras” we have at our fingertips, life has not slowed down. The well-known and quoted “rat race” has not left us. For many, their calendars remain maxed out.

For me, personally, slowing down the momentum inside of me has been huge. I have found – and observed –that turmoil on the inside so often leads to turmoil on the outside.

If I am at rest inside, it slows stuff down on the outside. Yes, having an active faith in Someone, has truly settled so much for me.

Take care and God Bless. farmerschaplain@ruralnews.co.nz

DAIRY SHEEP and goat farmers are being told to reduce milk supply as processors face a slump in global demand for their products.

This month Maui Milk abruptly ended its milking season one month earlier, forcing 15 Waikato-based farmer suppliers to dry off their flocks.

Hamilton-based Dairy Goat Co-operative (DGC) is asking farmer suppliers to reduce milk supply for the next season, possibly by one-third.

DGC chief executive David Hemara told Rural News that the reduction is necessary to better balance incoming milk against forecast product sales for 2024-25.

“This is a continu-

ation of a cap that we have applied for several seasons and reflects changing demand levels in some markets since Covid.

“While the final amount of milk per shareholder is yet to be finalised, we have advised shareholders that we expect that they will be asked to reduce supply to around two-thirds of normal level.”

According to Hemara, the global supply/demand situation for goat milk has been impacted by several factors including declining birth rates internationally and the collapse of the Daigou informal sales channel to China during Covid.

He says there has also been a structural change in the China consumer market where over the last four years China

consumers have moved strongly to support Chinese domestic brands.

“This same impact has occurred in the infant formula segment,” Hemara says.

The drop in demand for goat milk infant formula is mirrored in the sheep milk sector.

Maui Milk chief executive Greg Hamill says Maui Milk is one of many companies being impacted by the imbalance between supply and demand for New Zealand sheep dairy products.

“I’m in constant communication with our sup-

pliers as we work through the end of this season’s production and options for next season,” he told Rural News.

Dairy sheep farmers are paid between $15 to $17.50/kgMS for milk. There’s also a taxpayer link to the sheep milk sector. Spring Sheep

Milk is 50% owned by state farmer Landcorp, which trades under the brand name Pāmu. Rural News understands Spring Sheep has finished products sitting in warehouses as global demand stagnates.

Spring Sheep chief executive Nick Hammond told Rural News that the primary segment of the industry where there has been a slowdown is in the China ingredients market, mainly due to recent declines in the birth rates.

“This has resulted in excess inventory as the market has adjusted. We do see this stabilising over time which is further supported by the removal of the tariff on milk powder imports from New Zealand into China from the start of this year,” he says.

remotest New Zealand as we set sail on an authentic adventure. Experience nature on an unfathomable scale as we explore Fiordlands’ world famous remote ice-carved mountains and winding waterways; discover the time-forgot rawness of wildlife-rich Stewart Island and Ulva Island; and experience the tranquil waterways, wildlife and rich history of Marlborough Sounds and Abel Tasman. Discover these treasured natural wonderlands, their unique wildlife, conservation and early New Zealand history as we expedition cruise remote shores, coves, inlets and waterways accessible only by sea aboard our luxurious, purpose-built 18-guest expedition yacht Heritage Explorer.

Hammond points out that Spring Sheep has been aware of these dynamics for some time and as such have proactively focussed on the diversification of both our products and the markets they serve.

“We have also actively calibrated our milk production growth over time to align with the current demand from our customers and our processing capabilities. This balance is crucial for maintaining balance and sustainability of future growth.”

Hammond remains optimistic about the sheep milk sector.

“Looking ahead, we are excited to share some promising new opportunities that will bolster our industry and create significant growth platforms.”

THE OPPORTUNITY

to spend more time on farm while providing a dedicated service for shareholders attracted new environmental manager Ben Howden to work for Waimakariri Irrigation Limited (WIL).

Howden is the first full-time internal environmental manager to work for the cooperative and says this demonstrates the importance WIL places on assisting shareholders to meet their environmental requirements while also responding to current and future environmental challenges.

“Spending more time out on farm with

shareholders while also considering what the future holds really appeals to me. I am keen to get to know our shareholders and find out how I can help them to achieve their environmental goals.”

Growing up on his family’s farm near Ashburton, Howden understands what it takes to operate a successful farm on a practical level. After high school, he attended Canterbury University where he gained a master’s degree in environmental science before starting his career as an environmental analyst with Rangitata Dairies in South Canterbury.

While working for Rangitata Dairies, he focused on providing on-farm and consent support for the company’s farming operations.

Howden then moved to Irricon where he spent five years working as an environmental consultant with a focus on consents and auditing during the time when Farm Environment Plans (FEPs) became a requirement for farmers.

“A year after I started at Irricon, Environment Canterbury launched their FEP (Farm Environment Plan) auditing programme,” he explains. “I provided practical advice to farmers and carried out audits. There was a lot to learn during this period

for both consultants and farmers.”

In 2021, Howden took up a principal consultant

role with Ravensdown where he led a team of consultants based in midCanterbury to support farmers in meeting their regulatory requirements and environmental goals.

“I enjoyed leading a team and had the opportunity to work in a large organisation where I could gain a lot of experience and learn new skills,” he says.

“After a few years, I wanted to spend more time out on farm again and being able to work closely with farmers is what attracted me to the role with WIL.”

Howden sees challenges and opportunities ahead for WIL’s shareholders and is looking forward to

helping them navigate options for a sustainable farming future.

“Obviously we have challenges in terms of regulation and climate change, but we also have plenty of opportunities including technology and efficiency gains,” he adds.

“The irrigation scheme also has an opportunity as a cooperative to secure a more sustainable and reliable water supply.”

Along with building strong relationships with WIL’s shareholders and familiarising himself with the irrigation scheme, he will be supporting the preparation of WIL’s discharge consent renewal during the first few months of his new role.

SHIPPING DISRUPTION caused by Houthi rebels in the Red Sea has so far not impacted fertiliser prices or supply on farm.

While both major fertiliser co-operatives, Ballance Agri Nutrients and Ravensdown have enough fertiliser on hand to meet demand, an escalation of the conflict through Middle East may however change things.

The first ship to be sunk by the rebels since the conflict started is the MV Rubymar, which was carrying 21,000 tonnes of ammonium phosphate sulphate fertiliser.

Ballance head of customer Jason Minkhorst told Rural News that while the sinking of MV Rubymar didn’t directly impact its supply chain, it’s indeed a tragic event.

“The only products that Ballance sources to be impacted by these attacks is NPK (nitrogen, phosphorous and potassium), which we source from Europe and can come through the impacted shipping lanes.

“These shipments will take a longer route to avoid the area resulting in a freight increase, but these costs have not been passed on to our customers.”

Minkhorst says the current geopolitical environment and extreme weather events continues to cause instability in fertiliser prices – including the conflict in the Ukraine, tensions in the South China Sea and other parts of the Middle East that are vital to fertiliser production.

“At Ballance, we have a diversified supply chain that allows us to mitigate these disruptions when it occurs. Having local manufacture of nitro-

gen and phosphate also helps provide supply security.

“Lower incomes, higher interest rates and increased operating costs are driving demand on-farm. However, we are currently seeing fertiliser prices below what they have been at recent peaks, which is good news for farmers,” he says.

Ravensdown, which doesn’t use the Red Sea and Suez Cana route to bring in fertiliser, says the ongoing dispute has impacted vessel rates.

However, so far, there has been little impact on fertiliser supply and availability, according to chief operating officer Mike Whitty.

“The Red Sea situation remains a risk and, like other importers, we are monitoring the situation carefully,” Whitty told Rural News

He points out that fertiliser prices have largely been unaffected, as the market is influenced by seasonal demand and supply factors.

“From a bulk shipping perspective, we do not use the Suez Canal and Red Sea route.

“However, recent missile attacks combined with the drought in the Panama Canal have contributed to longer shipping routes, decreased capacity and increased demand globally, which means more shipping days are required.

“This has contributed to a firming of vessel rates.”

Whitty warns that any escalation will continue to put pressure on the timing and availability of shipping, with containers particularly likely to be impacted.

– Sudesh KissunTechion New Zealand shows the cost of undetected drench resistance in sheep has exploded to an estimated $98 million a year.

A key contributor to the dramatic failure is that commonly used triple drenches are shown to be non-effective on 27% of New Zealand sheep farms. This mirrors other industry reports and highlights the increasing productivity and sustainability threat to the sheep farming sector.

In 2020, Techion –the business that developed the FECPAKG2 parasite testing platform – reported the cost of undetected drench resistance was $48 million a year. However, during the past three years, the company has seen triple drench failure increase from 15% of properties to 27% in 2023.

In 2017, a study by Techion alongside UK retailer Sainsbury’s showed undetected drench resistance reduced carcass value by 14%. Using 2023 Ministry for Primary Industries statistics this showed that nearly 18 million lambs went to the works in the 2022-2023 financial year with undetected drench resistance that could be costing the New Zealand sheep sector $98 million in 2023.

At an individual farm

level, for a property producing 4000 lambs annually, undetected drench resistance may reduce income by an estimated $81,200 per year.

“Farmers using untested, partially effective drenches will not see visual signs until things start to become serious,” says Wormwise programme manager, Ginny Dodunski. “While in the intervening years, farms can be quickly breeding high numbers of drench resistant worms.”

She adds that if a drench is only 70% effective, each time that drench is given it’s effectively leaving 30% of the worms behind.

“These then have three weeks to continue

MIRAMS CLAIMS that Techion’s FECPAKG2 is a costeffective and intuitive diagnostic tool.

“It is designed to empower farmers, veterinarians and animal health advisors to ensure treatment is appropriately targeted, timed correctly and that drug use is effective.”

He adds that by using the system regularly, farmers gain an insight into when and how parasites are impacting their animals. It also lets farmer know what triggers a parasite outbreak and what drugs work effectively on their property, allowing treatments to be based on facts.

to breed and lay eggs, if you’re drenching every 28 days, so it’s obvious how quickly resistance can build up.”

Techion founder Greg Mirams says the days of farmers simply assuming a triple drench will work are now gone.

“With limited effective quarantine protection in place, farmers are often unwittingly importing triple drench resistance onto their properties,” he

explains. “Many farmers have not tested whether their drenches are effective and as a result, are suffering production losses they are usually not aware of.”

He adds that farmers generally only become aware there is a problem when they experience poor lamb performance in late autumn, or a large tail end in hoggets or ewes through the winter.

“Unfortunately, when farmers observe these production losses, the drench has likely been failing for years.”

Meanwhile, other drench options fared no better in the latest analysis, with BZ/Lev combinations failing on 50% of properties, while Lev/Aba

It is estimated that the cost of undetected drench resistance in sheep has exploded to $98 million a year.

combinations were failing

on 32% of properties.

Mirams says the key to the success of a farm system approach is to understand worm burden via easy access to FEC data, which allows timely decisions and enables monitoring of the results of management changes.

“In two cases this year, the change in drench efficacy on the property was so significant that we went back and tested again, as we didn’t believe the changes could be so dramatic over three years,” he adds.

“We’re seeing the reduction in drench effectiveness increasing significantly. This can have a devastating impact on the farmer, their mental health, their property value and the wellbeing and performance of their stock.”

Under the hood, new engines will deliver more fuel efficiency, utilising either the JD14 13.6L engine, or the JD9 9L engine, Tier 3 configuration.

The new S7 Series family includes the S7 600, with 333hp rated/367hp max power, the S7 700 with 402hp rated/460hp max power,

the S7 800 with 473hp rated/ 540hp max power and the flagship S7 900 with 543hp rated/617hp

max power.

“Input costs, including fuel, are one of the most challenging elements of agricultural production, so we know the 10% fuel savings offered will be welcomed by farming and contracting enterprises,” Kelly adds.

The S7 Series also offers a new residue management system featuring straight knives, a mechanical tailboard drive and the available Premium PowerCast tailboard. This allows the machines to deliver more consistently sized and spread fine – or extra-fine cut residue –up to 13.7m (45 ft), while drawing up to 15 fewer horsepower.

A new, adjustable unloading spout ensures grain is going into the bin and not on the ground. This is complemented by a new cross-auger shutoff feature that completely empties the unloading system after the grain

tank is emptied. This reduces weight in the unloading auger and wear on the associated drive belts.

The new harvesters also feature an improved grain loss monitoring system in base equipment. This is said to be up to three times more accurate than the previous system, detecting losses at the rear of the cleaning shoes and the separator.

The new S7 Series has also been designed to be among the most comfortable combine harvesters ever produced. They come with a new operator station offering more storage space for food and drink, a more comfortable seat and more glass for better visibility. This is all designed to help the operator remain alert and focused through even the longest days of harvest.

Along with the oper-

ator comfort upgrades, the base S7 Series will be equipped with the G5PLUS CommandCenterTM, the Integrated StarFireTM 7500 receiver, JDLink modem and new corner post display, paving the way for new automation features and functionality into the future.

The Model-Year 2025 S7 Series and X9 Series combines have three technology packages operators can choose from, including Select, Premium and Ultimate.

At the top end, the Ultimate package includes Ground Speed Automation to manage the combine’s speed based on operator inputs for grain loss, engine load and rotor pressure to maintain consistent throughput.

The Harvest Settings Automation feature automatically adjusts rotor speed, fan speed, and

concave, chaffer and sieve clearances.

This is all based upon acceptable limits for grain loss, foreign material, and broken grain, to deliver a more consistent and higher quality harvest, irrespective of operator skill level.

Predictive Ground Speed Automation uses ground speed plus two forward-looking cameras, to visually assess changing crop conditions and a pre-harvest satellite image to generate a predictive field map, merging the two inputs to proactively manage ground speed and maximise combine throughput.

“These automation packages will help maintain peak performance throughput all day long regardless of variations in crop yield, down crop, or even with less experienced operators, maximising productivity at harvest,” Kelly claims.

AFTER 12 years of representing the Landini and McCormick brands in New Zealand, Bay of Plenty-based AGTEK and the brands’ manufacturer have mutually decided to wind up their long-standing agreement.

Managing director Gayne Carroll told Rural News that it’s been a long journey spanning nearly 30 years.

“From when I led the introduction of the Landini brand to NZ at Motor Holdings, then established the brand countrywide at Power Farming, before finally going it alone, by creating

and building AGTEK into a nationwide distributor, based at Te Puke.”

He says during the last 12 years, AGTEK and its dealers have worked hard to make the Landini name the “go to” brand in the horticultural sector, where it held an enviable reputation for no nonsense operation and productivity.

“Unfortunately, since Covid-19, the two Argo brands have battled to remain price competitive for New Zealand farmers, given rising global inflation and shipping costs, leading to the difficult decision to end the agreement.”

their parts needs going forward.”

Carroll adds that he’d also like to thank the independent, locally owned dealers who have supported the company over the years.

“Genuinely believing that these family-owned and local dealerships bring more to New Zealand’s rural communities than their corporate counterparts.”

He says the goal is to further strengthen and complement the portfolio of brands such as Goldoni, TYM and Orizzonti the company currently represent. www.agtek.co.nz

Carroll says he understands that a new distrib-

utor has recently been appointed, who will initially focus on the Landini brand, with the

McCormick product “shelved” at this stage.

“We wish to thank our loyal Landini and McCor-

mick customers for their support over the years and can assure them we will continue to look after

Looking forward, as one journey ends for AGTEK another is about to begin, with Carroll and his team currently working on some behind-thescenes developments that will emerge over the coming weeks and months.