TO ALL FARMERS, FOR ALL FARMERS

“Complacency now will put at risk the huge eradication effort we’ve all contributed to so far.”

NEW ZEALAND’S world-first Mycoplasma bovis eradication programme is making great strides but this isn’t the time for complacency, says Ospri.

Bulk tank milk (BTM) screening results this spring – 34,853 samples tested from July 1 to September 27 –found 88 ‘detects’ so far. After on-farm sampling and investigation, there have been no new confirmed cases.

Ospri told Rural News that all the indicators – from BTM screening to beef herd surveillance – gives it confidence that its 10-year programme is working.

“While there are no confirmed M. bovis cases today, we can’t assume we’ve found all infection yet.

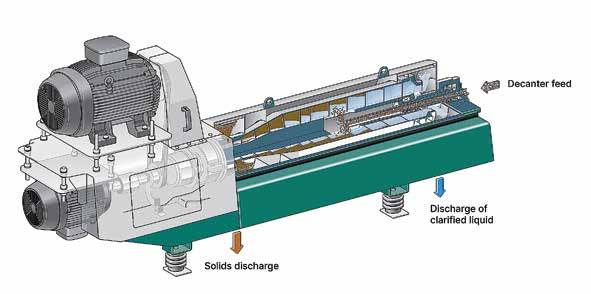

New Zealand’s beef sector and scientists are joining forces to create environmentally efficient beef. The cutting-edge trial at Te Mania Angus stud near Parnassus, North Canterbury has already sparked interest from scientists and farmers in Australia who recently visited the farm. The feed intake is measured by feeding silage in a bin that sits on load bar scales. Story P 11

To confidently claim eradication, Ospri needs a large volume of samples over multiple years to achieve this. The programme is currently in the ‘delimiting’ phase.

“This means we continue to check for infection and gather data. Our national surveillance, through livestock and BTM testing, remains an important tool.”

The M. bovis eradication programme started in 2018 and is expected

to take 10-years. To date, 282 confirmed properties have been destocked. Almost 190,000 cattle have been culled and nearly 3000 claims have been processed. Farmers have been compensated to the tune of $290m for financial losses incurred because of programme activities. The programme has cost over $700m to date.

Ospri points out that the eradication was estimated to cost $870 million in 2018.

By comparison, it was estimated the cost of letting M. bovis spread would have been $1.3 billion in lost productiv-

ity in the first 10 years alone.

It says the programme will need ongoing funding. DairyNZ, Beef + Lamb NZ and the Government, through the Ministry for Primary Industries, provide funding.

“New Zealand’s world first M. bovis eradication programme has made great strides towards being able to declare the country free from the disease,” Ospri says.

“However, with a few years of work remaining, the programme will need ongoing funding - including farmer levies. Earlier this year, pro-

gramme partners decreased levies significantly, and levies will continue to adjust in relation to the needs of the programme.”

BMT screening will continue to play a key role in the programme. In spring, detect results rise.

“We know that our screening test has increased sensitivity during early lactation, therefore, we have an increased chance of detecting possible infection in spring,” Ospri says.

“The start of the milking season is our best time to capture infection risk from milking herds returning from winter grazing and heifers entering the milking platform for the first time. Most of the confirmed properties found by BTM surveillance have been identified during the spring period

“To confidently claim eradication, Ospri points out that it will need a large volume of samples over multiple years to achieve this,” it says.

“The programme is currently in the ‘delimiting’ phase. This means we continue to check for infection and gather data. Our national surveillance, through livestock and BTM testing, remains an important tool.”

Ospri acknowledges the impact BTM screening has on farmers and their operations.

“In the years to come, we’re confident that the impact to farmers will reduce. But right now, it’s too soon to say specifically what work or restrictions will decrease. We need to carefully balance the potential disruption of our work, against the risk of missing any underlying disease in the national herd.”

NEWS 1-16

AGRIBUSINESS 18-19

HOUND, EDNA 20 CONTACTS 20 OPINION 20-22 MANAGEMENT 23,25 ANIMAL HEALTH 26-27 MACHINERY AND

28-30 RURAL TRADER 30-31

HEAD OFFICE

Lower Ground Floor, 29 Northcroft Street, Takapuna, Auckland 0622

Phone: 09-307 0399

Fax: 09-307 0122

POSTAL ADDRESS

PO Box 331100, Takapuna, Auckland 0740

Published by: Rural News Group

Printed by: Inkwise NZ Ltd

CONTACTS

Editorial: editor@ruralnews.co.nz

Advertising material: davef@ruralnews.co.nz

Rural News online: www.ruralnews.co.nz

Subscriptions: subsrndn@ruralnews.co.nz

SUDESH KISSUN sudeshk@ruralnews.co.nz

FONTERRA FARMERS have a message for their co-operative – they need to see consistently strong performance in both payout and returns from share ownership.

Fonterra Co-operative Council chair John Stevenson says that rising costs have had a real impact on farmers’ bottom lines.

“We can see that with the latest DairyNZ breakeven milk price being above $8/kgMS,” Stevenson told Rural News.

“Many farmers have reported to us that they have felt significant financial pressure over the last 24 months. Fonterra needs to execute on their revised strategy to ensure that our returns are well above our costs.

“Council will be keeping a keen eye on how Fonterra delivers on its six strategic choices.”

Last week, Fonterra released a revised strategy, promising to deepen its focus on its high-performing Ingredients and Foodservice businesses to grow value for farmer shareholders and unit holders.

Revised targets are increasing average return on capital to 10-12%, up

from 9-10%, a new dividend policy of 60-80% of earnings, up from 40-60%, while remaining committed to maintaining the maximum sustainable Farmgate Milk Price.

Chairman Peter McBride says the revised strategy creates a pathway to greater value creation, allowing the co-op to announce enhanced financial targets and policy settings.

“The co-op exists to provide stability and manage risk on farmers’ behalf, while maximising the returns to farmers from their milk and the capital they have invested in Fonterra.

“Through implementation of our strategy, we can grow returns to our owners while continuing to invest in the co-op, maintaining the financial discipline and strong balance sheet

DAIRY company

Miraka has lifted its forecast milk price for the season to $9.17/kgMS.

Miraka chief executive Karl

Gradon says he expects the company’s milk suppliers will be pleased with the strong 2024-25 season price update.

“Our farmers have experienced a difficult and challenging period, with

lower commodities over time and higher operating expenses and interest rates.

“We’re supporting them with a strong 2024/25 season forecast milk price.”

Miraka’s milk price is 17c above Fonterra’s mid-point for the season.

Miraka’s 2023-24 final milk payout is $8/kgMS. Fonterra’s final Farmgate

Milk Price for the 2023-24 season finished at $7.83/kgMS. This, combined with the 55 cents per share dividend, provides a total cash payout to a fully shared-up farmer of $8.38/kgMS. The dividend includes a special 15c return to farmers.

Fonterra Co-operative Council chair John Stevenson says the special dividend of 15 cents per share,

we’ve worked hard to build over recent years.”

Stevenson says early feedback from farmers indicates that they view the new targets positively.

He notes that delivery of these targets will see strong returns to Fonterra farmers alongside significant investment into growing the co-operative.

“Council views performance as the key to delivery of this strategy, and we will be monitoring and reporting on our view of how Fonterra executes against these targets.”

Stevenson says a competitive milk price is critical for Fonterra to deliver on strategy, as there is strong competition for milk from all processors.

“A strong sustainable milk price is the most important number to our farmers, but business performance is very important as well.

“It is pleasing to see a focus in the strategy on Fonterra delivering the strongest farmer offering, including a stronger payout and improving on farm cash flow.”

Fonterra is also going ahead with plans to divest its consumer businesses in New Zealand, Australia and Sri Lanka.

The co-op says the process is ongoing and progressing well.

on top of interim and final dividends totalling 40 cents per share, demonstrates the strength of Fonterra’s balance sheet.

“In addition, the special dividend is a welcome acknowledgement of the tough times faced by shareholders in the relatively recent past when the returns from ownership were not adequate.”

WHEN KELVIN Wickham stepped into the chief executive’s role at Ballance Agri-Nutrients one year ago, it was more challenging that he had expected.

Like any other business, the fertiliser cooperative was also reeling from the impact of higher shipping and labour costs and soaring interest rates. Inventory and debt levels also needed controlling.

One year on, Ballance delivered its financial results for the year ending May 31, 2024with a closing inventory of 281kt (kilotonne), 37% lower than prior year, a lower working capital and $69 million reduction in debt.

Wickham, who joined Ballance after a lengthy career with Fonterra, where he was part of the management team, says the first year has been “lots of learning”.

● Revenue down to $929 million reflecting lower

●

●

●

● Continued reinvestment into co-operative assets with $69 million of capital expenditure.

“A new industry, new people and there were more challenges that I expected,” he told Rural News

“It just meant a higher focus on efficiency, managing inventory through the supply chain and looking after the balance sheet for the first year than perhaps I was thinking.

“My initial focus has been on performance of our core functions: maintaining a focus on safer operations, offering meaningful support to our customers, building our capability to ensure a

strong team to move us forward.”

A major decision during the year was selling ruminant feed manufacturer SealesWinslow to Farmlands.

Wickham explains that SealesWinslow was a loss-making business for Ballance.

It was offloaded to Farmlands which has other brands in its feed portfolio and has a better opportunity to run the business. The sale also contributed $28m towards reducing Ballance’s debt.

The rest of the debt

payment came from selling down inventory.

“We had a significant drive through the year to sell down inventory because it was too high and higher priced. By selling that inventory down and freeing that working capital, and by selling Seales Winslow, we retired some debt which

is always nice to do,” he says.

Overall, Wickham is happy with the co-op’s balance sheet and the debt-to-equity ratio.

While he’ll be happier to see the debt levels down further, recent drops in the interest rates will be helpful.

“But this year we will

see a further improvement in the balance sheet.”

Wickham says Ballance has no plans to close any plants but is looking at what future products the plants could manufacture. Competitor Ravensdown is closing its Dunedin superphosphate plant and will continue

THE CHINESE Government has unveiled a major stimulus package to revive flagging economic growth, so will this help New Zealand food and fibre exports to the lucrative market?

Rabobank dairy analyst Emma Higgins believes it’s still early days.

“We will need to see fundamen-

operations as a port store and distribution centre. Both co-ops will be left with one plant each in the North and South Islands.

Wickham says logistically it makes good sense because of costs associated with distributing bulk products.

“Our focus is on safety, reliability and efficiency and we will continue driving that.”

Wickham says Ballance is looking into whether the products they manufacture today will be products required by farmers in the future.

“We’re looking at different types of products, more denser products, so if you have more nutrients per tonne product you can reduce your distribution costs and storage needs and still deliver benefits for farmer growers.

“So, changing the nature of how we use the assets is potentially on the cards.”

tal positive change to income for consumers and also increase confidence within China before we can get excited about this stimulus package having a significant impact on our food and fibre exports,” she told Rural News.

“These announcements are a step in the right direction for these fundamentals to change, however, it’s early days.”

reducing the level of reserves banks must set aside before making loans.

says future prices could be linked to the Chinese stimulus package.

Adopting a suite of measures to reduce borrowing costs, the People’s Bank of China cut interest rates on existing mortgages by 0.5 percentage points and supported new lending by

Last week’s Global Dairy Trade (GDT) auction saw whole milk powder prices rise 3% to US$3559/ tonne, its highest average price on the platform for the past 24 months.

NZ dairy analyst Rosalind Crickett

“Looking ahead, there are a variety of factors at play to keep an eye on, particularly with the economic stimulus efforts by the Chinese government and the implications it will have on its domestic production and imports.”

MARSHALL

“DISAPPOINTING”

–

that’s how Synlait chief executive Grant Watson describes the company’s full-year financial results.

In the 2024 financial year, Synlait experienced a profit loss of 61%, down to $56 million, and its operating cashflow was down 221% to $47.2 million.

The results, announced last week, follow a difficult year for the milk processor, one which saw many farmers issue cessation notices.

Watson says the result was largely down to impairments, a challenging trading performance, and high financing costs.

“What I do feel pretty good about is we’ve actually done a lot of work during the year to strengthen the foundations under the business but clearly they don’t show in the results,”

Watson told Rural News

Last month, Synlait took on a recapitalisation process which led to Bright Dairy of China owning 65% of the company. Under the new recapitalisation plan, which took effect 1 October, a2 Milk Company maintains its 19.8% stake in the company. Minority investors have seen their overall stake reduce to 14.9%.

“We are really well-

set for the year ahead,” Watson says.

He says there are numerous things the company has undertaken that he believes mean the company is set to succeed in 2025, including an end to its disputes with a2 Milk over exclusive manufacturing rights.

In August, after the end of the financial year covered in the results, Synlait and a2 Milk ended a year-long arbitration with a deal which meant Synlait’s exclusivity for a2 Platinum and other nutritional products under the Nutritional Powders Manufacturing and Supply Agreement (NPSMA) would cease to apply from 1 January 2025.

The company has also completed a strategic review of its North Island business.

Watson adds that there has also been “really good” underlying demand across the core business.

“So, yeah, tough year, it’s behind us,” he says. “We’re off to a good start. We’ve certainly got plenty to do in front of us, don’t get me wrong.”

He says that going forward, the company will have a stronger balance sheet following the recapitalisation, but it needs to focus on deleveraging.

“These are businesses that have a lot of operations. What we don’t

need is any additional leverage on the balance sheet,” Watson says.

He says that additionally, the company needs to focus on restoring profitability.

of delivering against rea sonably strong demand signals and continuing to work hard on our cost base and, again, really good momentum in both of those areas.”

the company needs to ensure that any cessation notices issued in 2024 are withdrawn.

the company has intro duced a one-off payment of 20c/ kgMS for its South Island farmers and a 0.05c/kgMS payment for its North Island farmers.

in place on 31 May 2025, must be supplying to Synlait for the 2025/26 season; and must remain un-ceased until 31 August 2025.

MILK PROCESSOR Synlait is offering a one-off payment of 20c/kgMS to retain South Island suppliers, many of whom issued cessation notices to the company this year. The company hopes the extra payment will entice farmer suppliers to stay. The extra payment comes with conditions: to be eligible farmer suppliers must not have a cessation notice in place on 31 May 2025, are supplying milk to Synlait in the 2025 / 2026 season and remain un-ceased until 31 August 2025.

The listed company, majority-owned by Bright Dairy of China from October 1, is fighting to keep suppliers on board. Under Synlait’s milk supply agreement, farmers must issue a two-year cessation notice before withdrawing their supply. Therefore, farmer suppliers would have to issue another cessation notice before May 31 this year for supply to be withdrawn by the end of 2025-26 season. The one-off payment will be based on milksolids supplied in the 2024-25 season and will also be made available to new suppliers.

Synlait chief executive Grant Watson says the company began FY24 with too much production capacity, unsustainably high levels of debt, significantly higher interest rates, and sharply declining demand for infant formula at a macro level.

“Although those challenges are evident in the year’s result, we begin FY25 with new momentum and a stronger financial foundation.

“Our future success depends on a strong, stable and competitive farmer base. Providing farmer suppliers with compelling reasons to remove cessation notices is a top priority, ensuring we have the secure milk supply to underpin our business recovery.

“We have announced additional payments for our farmer suppliers to recognise how critical their milk supply is to Synlait’s future. We hope these combined actions will accelerate cease notice withdrawals.”

Synlait chief executive Grant Watson

Watson says he believes that payment will be “extremely wellreceived”.

The payment will be based off milk solids supplied in the 2024/25 season and will be made available to new suppliers.

The conditions of the payment mean those applicable must not have a cessation notice

We deliberately challenge our Romneys by farming them on unfertilised native hill country in order to provide the maximum selection pressure and expose ‘soft’ sheep.

RATE & SURVIVAL

Over the last 20 years ewes (including 2ths) have scanned between 185% and 210% despite droughts. Over the same period weaning weights (adj. 100 days) have exceeded 36kg from a lambing % consistently above 150%.

• All sheep DNA and SIL recorded.

• Ram hoggets have been eye muscle scanned since 1996. IMF scanned since 2023.

• Ewe hoggets have been mated (to Romney sires) for over 20 years.

• Breeding programme puts an emphasis on worm resilience - lambs drenched only once prior to autumn. FE tolerance introduced more recently.

• Scored for dags and feet shape. Sires DNA rated for footrot and cold tolerance.

• We are ‘hands on’ breeders with a focus on detail and quality.

• We take an uncompromising approach - sheep must constantly measure up.

MEAT COMPANY Alliance says declining stock numbers in New Zealand were the primary driver behind the closure of its Smithfield plant in Timaru.

Alliance chair Mark Wynne says a final decision on the closure will be made later this month but “the economics are pretty compelling”. Federated Farmers is backing Alliance’s decision to mothball the Smithfield plant but says it feels for the employees and other supporting businesses that will be impacted.

The 139-year-old Smithfield plant is the company’s oldest site and requires significant investment in repairs and maintenance to keep it operational. Sited on potentially valuable land beside Caroline Bay just

north of the city, it is also facing encroachment from retail development.

Wynne told Rural News that Smithfield is the area where the declining stock has had a significant impact.

“If you go back 20-30 years, New Zealand was famous for 60 million sheep. Now, we have roughly 23 million so it’s a structural change and land use change has been a key part of that,”

Wynne told Rural News.

“In the early 2000s you saw significant sheep and beef conversion into dairy farms and more recently, we’ve seen reasonable volumes of whole of farm - not just a few hectares out the back kind of thing - but the whole farm being sold off into carbon farming.”

Although sheep are ‘a dual purpose’ animal, wool had been in the doldrums for a very long

time, and the red meat commodity cycle, particularly lamb, had been on a downward swing for the last couple of years.

Wynne says the board reviews Alliance’s processing networks on a regular basis.

“When the economics finally don’t work anymore, then you must decide.

“Unfortunately, Smithfield is the area where the declining stock has had a

significant impact.”

Asked if the closure was not already a “done deal” despite the consultation, Wynne says they will listen to the feedback from staff during the consultation period.

“The economics are compelling for the closure. But you know we go through these processes in good faith, and we will listen to their feedback.

“That feedback will close on Friday the 11th

of October. And we will make our final decision by Friday the 18th, a week later.”

Wynne said the site would “undoubtedly” be sold eventually but nothing has yet been done towards that.

“We haven’t even had official valuation of the site, etc.

“Our priority has been really working through the process, working with our employees and trying

THE COUNTRY may have to import maize grain next season unless the issue of having enough gas to dry the local product is resolved.

This is the view of Federated Farmers Arable group chair David Birkett, who says such an option would not be good for farmers or the country.

The issue revolves around the fact that maize grain grown in the North Island and used mainly in the dairy industry must be dried to a moisture

level of 14%. All the North Island grain is dried at large special facilities off farm and to do this they use gas which is now in short supply. This is unlike the South Island where growers have their own drying facilities and diesel is used in the drying process.

With uncertainty around the availability of gas and if there is gas its cost, companies who ultimately buy the grain are unwilling to give contracts to farmers to grow the crop

because the price is a virtual unknown at this stage.

Birkett says growers are still trying to get contracts, but this is proving difficult.

“North Island growers are particularly apprehensive because last season the grain price collapsed and a lot of growers lost money, so they are nervous about going into a season without a signed contract in front of them. We are not seeing those contracts coming through because of the

to get the best outcome.”

About 600 staff would be affected and significant redundancies are expected, although staff would be offered the opportunity to apply for re-deployment at the company’s other processing plants where possible.

Federated Farmers

South Canterbury president Greg Anderson called the announcement a tragedy for Timaru and the region.

“I just feel for the families and all the tradesmen that work out there. That’s the worst part about it.”

It’s not just fathers, but sons and brothers and daughters who work at the plant and may now all be redundant, he said.

However, he highlighted dairy rather than forestry as the key factor in South Canterbury.

“The unfortunate thing is that sheep farm-

gas situation so there is a lot of apprehension out there,” he says.

Maize grain is used as a supplement in the dairy industry and concerns have been raised that if this is not available what would be the alternatives and at what cost? The issue is seen as big in the dairy industry, but could be a problem for pig and poultry farmers

Birkett says Federated Farmers has taken a leading role on the issue and has been talking to gas suppliers and

ing is just not profitable enough and there’s too much land use change. In my area, probably a couple hundred thousand sheep have disappeared to dairy farming.”

Forestry conversion had taken place in areas such as the Hakataramea and North Otago, but it didn’t have the same impact in the province as it did in the North Island.

Anderson himself farms sheep and beef on hill country in the Fairlie Basin but says the flat land of the basin used to have 35,000 sheep and now has none at all.

“The biggest land use change down here has been dairy farming.”

An Alliance shareholder for 35 years, Anderson says he hopes the company is now on the right track and has picked the right works to mothball.

grain companies to resolve the issue as quickly as possible. He says they have also been talking to government ministers to make them aware of the serious implications of the situation and there is a suggestion that the government may import gas.

“There is a small window to get the seed in the ground and time is running out. If the problem can’t be resolved it has serious implications for the farmers and country,” he says.

– Peter Burke

• High Flow

• Compact/Robust

• New Pilot Flow Filter

• Side/Bottom Mount

• Detach to Clean

• For Water Storage Tanks

• Adjustable levels from 50mm-2.5m

• Minimises pump operation

•Available in 20/25/32/50mm

• Stainless steel bracket and Shaft

• Fits plastic and concrete tanks

• Rugged and long lasting

FORMER DRYLAND now irrigated under the Central Plains Water Ltd (CPWL) irrigation system is producing 475 million litres of milk a year, but would produce only 34 million litres in a dry year without irrigation, according to new figures released by the company.

The figures say the land also produces 2 million kg of beef and 12 million loaves of bread, compared with only 0.86 million kg of beef and 9.4 million loaves without irrigation.

The numbers come from a study by The AgriBusiness Group Ltd and commissioned by CPWL for the company’s 2024 annual report, which has recently been distributed to shareholders.

The report says

CPWL’s water supply has transformed central Canterbury’s agricultural landscape.

“The 23,564 hectares that was dryland and dependent on rain, is now irrigated via the CPWL scheme. Production from this now irrigated land is significant and contributes to meeting the needs of a growing population and boosting the region’s economy.”

CPWL CEO Susan Goodfellow said it was time that there was greater awareness and acknowledgement of the positive economic impact that irrigation has on the region and some balance to what has tended to be negative public sentiment towards irrigation.

“We quietly work away and add value but, but we often face criticism by those that do not fully

understand what we do and the contribution we make,” she said.

The benefits were evident across a variety of farm systems.

“Obviously we grow more than just milk, wheat for bread and beef. However, we selected these measures for the study because they can be related to by a wide range of households.”

The study was based on last year’s production figures, and assessed

what production would have been without irrigation.

It considered only the 23,564ha of land in the CPWL area that was previously dryland, not the 21,436ha now on the company system which was previously irrigated but relied on pumping groundwater from the aquifers.

The company says converting that land to CPWL surface water has reduced the impact on

aquifers and improved energy efficiency while maintaining crop yields.

The scheme had brought about a 50-70% reduction in abstraction of groundwater, and a 29% reduction in nitrogen discharged below the root zone on CPWL shareholders’ farms. 100% of shareholders’ farms have Farm Environment Plans and 99.3% have achieved grades of A or B in independent audits.

CENTRAL PLAINS Water Limited has upgraded its water intake on the Rakaia River with a $1.7 million new “labyrinth weir” to increase the scheme’s resilience to river floods.

Previously the intake had a straight concrete channel weir which in times of flood allowed excess water to overflow its top edge and return to the river, while in more extreme floods a “fuse plug” - a sacrificial gravel bank - would blow out when river flows reached about 1200 cumecs. That would allow all the water to escape the weir, to protect the scheme’s intake gates and other infrastructure. However, resuming operations required a few days for the flood to recede and the plug to be reinstated, which has historically led to some extended disruptions to water delivery.

“We were quite vulnerable because every year we would usually get 1000-1200 cumecs three or four times a season, and we’d be anxiously watching the water lapping at the fuse plug and expecting it to go any minute. Sometimes it would, and other times we would be lucky enough and it would hold,” said CEO Susan Goodfellow.

The new weir consists of a concrete labyrinth structure in a zig zag profile for a much greater effective length of about 250m. There is still a fuse plug but it is not expected to blow until a flood reaches around 3000 cumecs.

THERE’S BEEN widespread praise from the primary and business sectors for the Government’s speedy negotiation of a trade deal with the United Arab Emirates.

The NZ International Business Forum (NZIBF) describes the deal as a welcome bright spot which will help build further trade in the Middle East while Beef+Lamb NZ says it’s a boost for hardhit farmers.

According to Trade Minister Todd McClay, the deal - called a Comprehensive Economic Partnership Agreement (CEPA) - will unlock economic opportunities for Kiwi exporters and create stronger supply chains with one of our most important trading partners in the Gulf region.

The agreement took just over four months to negotiate and is one of the fastest agreements NZ has ever negotiated. It will see the UAE immediately eliminate duties on 98.5% of NZ exports when the deal takes effect and this will rise to 99% within three years.

“This will create new opportunities for New Zealand businesses in the dynamic UAE market, contributing to our ambitious target of doubling exports by value

MEAT INDUSTRY Association chair Nathan Guys says his organisation welcomes the move, noting that the UAE is the second largest market for the red meat sector in the Gulf Cooperation Council after Saudi Arabia.

Guy says with a population where over 75% are Muslim, the UAE is a key halal market that is increasingly looking for reliable sources of high-quality red meat that meets their strict halal expectations.

“Halal-certified exports made up 37 percent of total red meat exports and were worth approximately $3 billion in 2023/24, so NZ is well placed to meet the UAE’s red meat needs,” he says.

Beef + Lamb New Zealand chair Kate Acland says food security is a priority for the UAE with international trade identified as a key enabler, and beef in particular cited in their strategy as a key item to secure supply in.

The dairy industry is a major beneficiary of the deal and according to Kimberly Crewther, the executive director of DCANZ – the organisation that represents dairy companies – says that eliminating tariffs on all dairy products provides important certainty to continue growing this trade.

in ten years,” McClay says

This agreement was concluded in just over four months following the launch of negotiations on 7 May this year, making this New Zealand’s fastest-ever trade agreement negotiation, and the most trade liberalising of any of the UAE’s CEPAs to date.

McClay says the deal shows the Government’s commitment to opening doors and reducing costs and barriers for Kiwi exporters.

“The UAE is a key export destination and hub in the Gulf region.

In the year to June 2024, two-way trade was valued at NZ$1.3 billion. The UAE is one of our largest markets in the Middle East, and a top 20 export market overall,” he says.

Currently NZ dairy exports to the UAE amount to $718 million, red meat $46 million and horticulture $44 million.

In addition, NZ exports $237 million in industrial products and tourism accounts for $31 million NZ imports around $152 million of products and services from the UAE including plastics, carpets, travel

services and glass.

Stephen Jacobi, the executive director NZIBF, says while the deal is called a ‘Closer Economic Partnership Agreement’ CEPA, it is for all intents and purposes a Free Trade Agreement.

“It’s just a linguistic issue because it is a preferential trade agreement.

“It has all the elements of previous FTAs including market access and a reduction in tariffs, trade rules; all the ones we would associate with things like rules of origin, customs procedures, trade facilitation and digital economy competition,” he says.

Although he hasn’t seen the final text, he believes that it has chapters relating to the environment and labour. He says the issue of investment is a side agreement which is simply how the UAE prefers it to be.

Jacobi says the days of the big transformational FTAs, such as those with the EU and the UK, are over but this is the type of deal we’ll see more of in the future, which is still great news for NZ.

Jacobi says while such an agreement may be a basis for future deals, he says in the case of India, a deal with that country is likely to be less comprehensive than that with the UAE.

it is much needed by the sector.

BEE AWARENESS month

– September – ended on a high for the struggling apiculture sector.

The signing of the Comprehensive Economic Partnership Agreement (CEPA) with United Arab Emirates (UAE) is a good outcome for NZ honey exporters, according to the chief executive of ApicultureNZ, Karin Kos.

The organisation represents and advocates for a significant number of individuals and organisations in the apiculture sector.

Kos says the removal of the 5% tariff on NZ’s $3.5 million honey exports to the UAE is good news for the sector. She says this will make doing business easier for exporters at a time when

“We are hopeful that more deals like this will come through in the future. While the 5% tariff is not huge, every dollar counts during this difficult time for our industry. It is great to know of the Government’s commitment to get out and secure more deals,” she told Rural News

Kos says the sector is constantly looking for new opportunities because manuka honey is a small, young industry globally. She says manuka is regarded as a premium product so it’s about opening and growing those markets.

“UAE demand for NZ honey has risen notably in the past five years and has presented new opportunities for exporters looking to reach consumers interested in high quality food products,” she says.

sector came right at the end of

Improve the overall performance of your knockdown herbicide including the speed of burndown with Hammer ® Force.

annual promotion of the bee industry.

During the month of the September, local bee clubs, whose members consist of hobby apiarists, have been getting out to the community and schools and raising the awareness and importance of bees, not only to the wider primary sector but especially to city and towns folk.

Kos says many people are simply not aware of how important bees are to the NZ economy –especially their role in pollinating all manner of fruits, vegetables and flowers.

“We have about 60-plus bee clubs across the country and their members who are all volunteers and are very knowledgeable. They run a series of events in their respective communities as part of the aware-

ness campaign. We also have support from larger companies who also get involved in this monthlong programme,” she says.

Kos says some townsfolk see bees as a nuisance but seem to forget that bees make for great gardens. She says one of the pleasing things that’s happened in recent years is that schools, helped by local bee clubs, have got hives on their school grounds – but in a safe place.

“There is one school in central Wellington that has its own hives, which is really special,” she says. Kos says she’s very pleased with this year’s awareness month and says the good news about the UAE trade deal has made it a good month for the sector.

• Fast acting: Faster burndown than glyphosate applied alone

• Enhanced control: Helps improve overall control on tough broadleaf weeds such as Mallow

• Non Residual: Nil grazing or drilling withholding period, no additional restrictions to the use of glyphosate

FARMERS AND scientists are using the latest technology to measure how efficiently New Zealand beef cattle convert feed into liveweight and their greenhouse gas emissions in a cutting-edge trial on a North Canterbury farm.

Cattle of all breeds eat variable amounts each day, some more, some less than their counterparts, while gaining the same weight.

Now research teams are hoping to use the information from the trial to develop genetic tools that farmers can use to produce animals that feed more efficiently and emit less methane, without reducing the animal’s productivity.

The trial at Te Mania

“The feed efficiency of an animal is important to farmers because they’re facing rising costs behind the farm gate.”

Angus stud near Parnassus has already sparked interest from scientists and farmers in Australia who recently visited the farm.

Geneticists from Beef + Lamb New Zealand’s Informing New Zealand Beef programme, scientists from AgResearch and Te Mania Angus stud

are working together on the project.

Head of genetics at B+LNZ Dr Jason Archer says the goal of the trial is to develop new traits specifically for the New Zealand beef industry so farmers can produce efficient cattle with a light environmental footprint and run productive and profitable farms.

“The feed efficiency of an animal is important to farmers because they’re facing rising costs behind the farm gate. An animal that can grow or produce more for the same amount of feed eaten is a real advantage for the farmer. At the same time, we are keen to find animals that produce less methane.

“We aim to create two breeding values - the measure of an animal’s genetic potential to pass on specific traits to its offspring - one for feed efficiency and another for methane emissions per kilo of feed.

“In sheep, we have shown that we can breed for animals that produce less methane for

every mouthful of feed.

The goal in this trial is to try and identify those cattle that can do both – produce less methane per kilogram of feed and grow faster per kilogram of feed. That way we can get a double shot of lower methane and better animal performance.”

Director at Te Mania

Angus Will Wilding says feed intake is measured by feeding silage in a bin that sits on load bar scales.

“Basically the Vytelle Sense system is a big tub of silage sitting on scales. Only one animal can feed at any one time. While the animal eats, the system reads its NAIT identification tag, records which specific animal is eating, and weighs feed

before, during and after feeding.

“The system feeds data back to Vytelle in Canada and they collate the data to tell you exactly how much each animal has eaten.

“When the animals have a drink, they are weighed on scales, providing data for their daily weight gain.”

AgResearch then use Portable Accumulation Chambers to measure methane emissions during the trial, he says.

“Farmers will benefit from the trial because they will be able to extract more value from inputs by having a more accurate feed efficiency

Estimated Breeding Value (EBV) as a tool in their toolbox.”

400cc

HERD IMPROVEMENT

company LIC says it’s well-positioned for the challenges ahead and remains focused on its core purpose – delivering value for farmer shareholders.

LIC chairman Corrigan Sowman made the comment at the co-op’s annual meeting in Hamil-

ton last month.

Sowman, a dairy farmer from Golden Bay, acknowledged the headwinds the sector may face but expressed confidence in LIC’s resilience and future potential.

“Our cooperative is well-positioned for the challenges ahead. We remain focused on our

core purpose: delivering value for our farmer shareholders. This goes beyond short-term gains. Our decisions today shape the future of New Zealand’s national herd.”

Looking forward, LIC says it will continue to innovate and invest in the health and productivity of herds, using cutting-edge

genetic improvements and data-driven solutions to support farmers.

“LIC is here to safeguard the future of farming in New Zealand. Our teams are working hard every day to improve herd performance, which in turn supports the strength of our communities and the broader dairy

sector,” says Sowman.

Reflecting on the cooperative’s financial performance, Sowman emphasised LIC’s ability to deliver a sustainable profit and a solid return for its shareholders despite a challenging economic environment.

“We are proud to have closed the year with a

respectable profit of $7.7 million and a total dividend of 18.84 cents per share, thanks to prudent management and a strong balance sheet with no debt.”

The cooperative forecasts underlying earnings of $16-22 million for 2024/25, barring any significant external factors.

Sowman notes that with a strong financial

foundation and no debt, LIC is positioned to continue delivering long-term value to its farmer shareholders.

At the AGM, LIC welcomed two new directors - Mike O’Connor, North Island region, and Tony Coltman, South Island region, and a new member of the Shareholder Reference Group (SRG).

SPECIALIST HORTICULTURE and viticulture weather forecasters Metris are reporting near ideal spring start conditions for fruit growers this season. Metris forecaster and chief executive Dr Mark Bart says good winter chilling has been followed by a mix of mild weather, followed by occasional rain-bearing fronts, which has been positive for key fruit and grape growing regions around the country.

“The mild start to spring for the country has come in waves as Australia’s record heat for this time of year has been pushed onto New Zealand from Westerlies that are squeezing between the competing low pressure systems to the south of us and high pressure to the north.

“This pattern is bringing frequent westerly winds, followed by periods of short, sharp southerlies and frosts of the kind we experienced through September.”

He says growers across Hawke’s Bay, Gisborne, Bay of Plenty and the Wairarapa in the north and in Blenheim are reporting good growth and flowering and are expecting solid fruit-set.

“It is shaping up to be a positive season for fruit growers. We experienced good chilling with cold nights which likely knocked back disease and importantly bodes well for fruit development.

“Plant growth has been between 10-12 days ahead of usual due to the mix of winter chilling and mild conditions from the predominantly westerly weather pattern. We are seeing this in the Growing Degree Days we are tracking for clients where we have weather stations – apples are up considerably on last season.

He says the cold southerly fronts have brought on harder frosts than seen in the previous two to three seasons.

“While there is extra frost pressure and the frosts have been harder than last season, that comes with periods of clear, warm days which have been a good thing to help get into orchards and vineyards to clear and keep disease pressure under control - a key risk to manage for the season ahead.

AFTER THREE years of record performance, mānuka honey exporter and retailer Comvita has reported an annual net loss of $77 million.

The listed company says its balance sheet has been hit by several factors: low consumer demand in China, loss of a major customer in North America, cancellation of major shopping festivals in China and aggressive competition.

For the year ending June 30, 2024, Comvita revenues declined $30m to $204m.

Weaker sales were reported in China, North America, Australia and New Zealand (ANZ) and Europe, Middle East and Africa (EMEA), offset somewhat by revenue growth in Southeast Asia in its HoneyWorld retail outlets.

While percentage gross profit remained

robust at 55%, one off and non-recurring costs of $7.6m after tax meant that the company recorded a net profit after tax of $16.9m before impairment, and an underlying NPAT loss of $9.3m after impairment.

This weaker performance led to a material gap between the company’s net total assets (tangible and intangible) and its market capitalisation, indicating potential impairment, Comvita says. An independent impairment review was initiated by the board, resulting in a non-cash impairment of $64.2m (before tax). Including this impairment Comvita’s reported NPAT loss is $77.4m.

Sales in Greater China were $89.8m, down $19.2m or 17.6%.

Sales were impacted by the cancellation of the 12:12 shopping festival in December 2023 and 6:18 shopping festival in June 2024, as well as gener-

ally lower honey sales due to macro-economic challenges. The sales miss shaved off $15.3m from the gross profit.

North American sales also took a hit – down 26% to $26m for the full year. The company blamed this on the loss of some distribution with one major customer.

Excluding that customer loss, offline revenue was up 19%. Online revenue was 49% of total sales for the year, up 7%

on the previous year.

Sales in the Rest of Asia segment were up 17% to $37m, however, sales in NZ and Australia were down 10% primarily due to weak cross border sales to China market.

Comvita chief executive David Banfield says he was extremely disappointed with the results, particularly after three

THE SUPPLY and demand dynamics also impacted the company’s balance sheet.

It says the mānuka honey industry experienced significant growth between 2008 and 2020, with hive numbers trebling, to peak at around one million hives in 2019.

This created significant oversupply to the market, which coupled with declining exports and Comvita’s growing market share meant that many beekeepers exited the category, with production down 56% between 2020 and 2023.

Comvita notes that the current economics of an apiary operation are unsustainable in the long run.

It’s currently estimated that there are around 500,000 hives in New Zealand - half the 2019 number.

“This contraction in supply will see a return to supply and demand equilibrium with associated economics in the near term. Comvita is well placed for long-term supply through its forest programme that is already productive,” it says.

consecutive years of record performance.

“Throughout FY24 we faced difficult trading conditions in our key markets along with aggressive price activity

from competitors caused by industry overstocks.

“Our revenue and gross profit declined along with significant non-recurring costs and a non-cash impairment.

“We already have action underway to target value consumers whilst continuing our brand premiumisation in key Asian markets. Our $10-15M cost out programme is on target and is designed to streamline and simplify the business and ensure agility through different economic cycles. In addition, we have a clear focus on inventory reduction, enabling us to reduce net debt to targeted levels.”

Comvita says it faced aggressive and potentially unsustainable price competition in all markets, primarily aimed at its entry point product range.

“This activity caused by a glut in supply meant that market share was directly impacted in its Greater China and Rest of Asia segments,” the company says.

The Hansen Ball Valve’s unsurpassed frosty friendly reputation is equalled only by its full flow capacity to deliver high volumes of water quickly. With a host of practical features, it’s the only NZ made Ball Valve with a 100% replacement warranty.

Male/Female or Female Thread Options

Smooth

Open/Close & Removable Handles

RICHARD BURKE, a leading CEO in the primary sector, has departed from a company he’s played a huge part in developing into one of the best in country.

Burke started off as a tractor driver 30 years ago at Gisbornebased LeaderBrand and rose through the ranks to become CEO of the company for the past 10 years. Now the sons of Murray McPhail, who set up the company, have decided they will run the family business themselves

Burke did quite well at accountancy at school in Gisborne so decided he’d give office work a go. But soon he realised that he wanted to work outside and almost immediately

headed off overseas to try his luck in the UK. Luck he struck in meeting a UK girl who later became his wife and through a set of circumstances they stayed in NZ and had a family.

“My initial plan was to go back to the UK but to do this I needed a job and a mate suggested

that I might get one at LeaderBrand, which I did – driving a tractor – and in the end, I just stayed with the company and moved up through the ranks. About 14 years ago, owner Murray McPhail decided to step away from the business for a while to do other things and he offered me the

“I DON’T have a lot of plans right at the moment,” says Richard Burke, as the 53-year-old ponders his next career move.

He still has ties in Gisborne where his elderly parents still live, but both his children are overseas. Son Fergus is playing professional rugby for the English club Saracens. He says leaving Gisborne could be an option and adds that in the course of his time at LeaderBrand he’s spent a lot of time travelling anyway.

He says he knew that at some stage he would have to leave LeaderBrand and a succession plan to build capability in the company is in place. He says

CEO role,” he told Rural News.

The transition from being one of the team to the boss and leader was a steep learning curve for Burke. He says he had to learn a few hard truths about the changes he needed to make him-

in the last six or so years he’s enjoyed watching staff grow and develop and says helping others to do that in future in another capacity may be an option. Burke says change is a bit daunting and scary but many people have come to him with options.

“I do love the industry and think it’s very interesting, diverse and changing and I think there is almost a revolution coming in the form of new technology and other things to make it competitive and that still really excites me. But I am really interested in leadership positions, and I’ll look at options and just wait for the right role to come up,” he says.

self in the new role, but once that occurred, he says they made some cool progress and do some great things. This included building a new greenhouse, buying out competitors and setting up a salad factory.

“It was really excit-

ing,” he says.

But while all the material things may look exciting, Burke says for him the times he remembers most were the hard times. Times, he says, when there were floods, disasters, product recalls or whatever.

“Times when my back was up against the wall and people were looking to me for leadership to deal with a crisis and then to put them at ease,” he says.

Developing his own leadership skills and building relationships both within and outside the business was another highlight of his tenure as CEO, says Burke. He says a lot of his time was spent corralling people to work in the same direction, whether they agreed with it or not, was a big part of the job.

His interest in leadership came to the fore when he attended an advanced executive leadership and management course at the prestigious University of Oxford in England – a three-week course for some of the world’s top executives.

SUDESH KISSUN

CHANGES, future proofing the industry and

ensuring fair returns are some of the challenges facing potato growers, according to Potatoes New Zealand chief executive Kate Trufitt.

She points out that while farmers love growing potatoes, those involved in the billiondollar industry also need to see a fair return for

their efforts.

Trufitt says this is currently being eroded by cost of compliance and limitations being set by local governments.

“Potatoes are not grown in isolation and tend to form part of a growing system, rotated with other crops or animal farming. This is

not always recognised when rules are put in place,” Trufitt told Rural News

Trufitt, who completed one year in the role in August, says it has been an incredible journey championing the interests of potato growers.

“I’m honoured to lead such a dynamic industry and work alongside a team that shares my commitment to growth and excellence.

“The potato industry is crucial to New Zealand’s economy, and I’m excited to continue advancing initiatives that support our growers, enhance our research and promote our potatoes, both locally and internationally.”

Key highlights include a successful levy vote.

PNZ secured an impressive 94.74% approval for the proposed commodity levy from the eligible voting growers, reflecting broad support.

Trufitt also played a key role in the development of Strategy 2028. She says the forwardlooking strategy, shaped by extensive grower consultation and industry feedback, aims to guide the sector’s growth and resilience over the coming years.

Despite various challenges, Trufitt believes the outlook for the New Zealand potato industry remains positive.

Her strategic vision is set to enhance key relationships, expand market opportunities, and strengthen the industry by directly visiting grow-

ers and stakeholders.

Trufitt is also enthusiastic about expanding Potatoes New Zealand’s international presence and further advancing practices that will benefit the industry for generations to come.

“There’s so much more we can achieve. I’m excited about the future and the possibilities it holds for our industry.

“Together, we can ensure that New Zealand potatoes remain a staple on tables across the country and beyond.”

The top three potato producing regions in New Zealand are Canterbury/ Westland, Auckland and Manawatu. The domestic value of the New Zealand table potato sector comprises 36% of the total domestic potato sector value. In 2021-22, over $1 billion worth of potatoes were produced by NZ growers. However, this dropped to $931m in 2022-23.

Domestically consumed processed (crisps) and frozen/fries potatoes make up 62.5% of the total domestic industry value in 2023.

The export market accounts for 12.5% of total potato industry value for 2023, which is an increase from 8.3% in 2022.

Planted area has dropped 18.6% between 2018 and 2023, a loss of 1920 ha.

Total annual potato production has reduced by 107,990 tonnes between 2018 and 2023, a decrease of 20.5%.

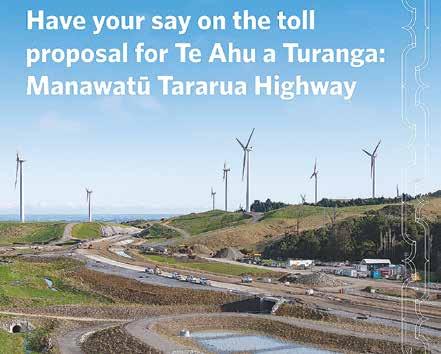

FARMERS IN the Tararua District are meeting to decide whether to throw their weight behind a move to oppose the tolling of the new highway linking the Manawatu and their district.

The road through the Manawatu Gorge was closed in 2017 after successive slips made the route impassable and now a new road is due to open in 2025. The Transport Agency claims the new 11km long, $620 million road will take nearly 15 minutes off the present alternatives – Pahiatua Track to the south of the gorge and the Saddle

Road to the north – both slow, hilly roads which wind over the ranges and are hardly roads of choice.

Up until just a matter of weeks ago there was no hint that the new road would be tolled and it was assumed that it would just replace the old Manawatu Gorge Road. So not surprisingly there has been an angry outcry when out of the blue NZTA announced that they had assessed the new road as meeting its assessment criteria for introducing tolls. This would see a light vehicle pay $4.30 per trip and a truck $8.60.

Tararua Federated Farmers president Thomas Read – a dairy

farmer from Dannevirke –says that he’s in the process of getting feedback from his members to see

if Feds as an entity will oppose the proposed tolling of the new road. Read says while his

milk goes to the Fonterra plant at Pahiatua, much of the goods for farms such as his on the eastern

side of the ranges come from the Manawatu. He acknowledges that if trucks used the toll road, costs would go up. There is also concern about stock coming across from the Tararua district to the Fielding saleyards –yet another cost.

“I’m just in the process of making sure our people are aware of the implications of toll proposal and will support any action we take,” says Thomas Read.

It’s not just farmers who are affected. Many rural professionals travel regularly to the Manawatu as do students to Massey University and the main hospital for Tararua is in Palmerston North.

BEEF + LAMB New Zealand (B+LNZ) has appointed Alan Thomson as its new chief executive officer.

He’s currently working for Hitachi Australia as director of agribusiness. Originally from New Zealand, Thompson has had a lifelong career in, and affinity with, the agricul tural sector and in his last role was involved in agritech.

He replaces Sam McIvor who is now working for OSPRI.

B+LNZ board chair Kate Acland says she’s delighted with the appointment and says the board was intent on taking the time to get the right person. She says they are confident that’s Alan Thomson.

“He has a strong commercial background and will be focused on delivering great outcomes for farmers. He wants to see our farmers thrive and our sector realise its potential. I know he’s excited about bringing B+LNZ’s refreshed strategy to life for farmers and making a real difference,” she says.

Acland says Thomson’s recent work in agritech has included projects such as supporting farmers in the Great Barrier Reef catchment area to capture data to enable operational decisions in order to mitigate environmental impacts. He’s on the board of DataFarming, an Australian agritech business, and prior to Hitachi, he was at Ravensdown for a number of years in a variety of roles in New Zea land and Australia.

Thomson will relocate to Wellington and will start on November 4. He says he’s excited to join B+LNZ and make a difference for farmers. He says he’s deeply committed to agriculture and sees huge potential for sheep and beef farming.

“I’m proud of work I’ve done on the ground with farmers in New Zealand and Australia, working to understand what they need. That really drives me. On a personal level, I’m also looking forward to return ing to New Zealand to be closer to family,” he says.

The ‘out of the blue’ announcement on tolling the new road has drawn an angry response from the Tararua district, led by Mayor Tracey Collis. The council has launched a ‘stop the toll campaign’ and held a public meeting where residents vented their anger at NZTA and the Government for allowing the toll proposal. Collis is quoted as saying she is very unimpressed with the short consultation period. Submissions close on October 7.

The final decision on whether to toll the road will be Cabinet’s, but if the tolling goes ahead, National MPs in the surrounding regions may find their popularity drops just a bit.

FARMERS AND growers can now easily manage their seed requirements thanks to a pioneering FarmlandPRO feature launched by Farmlands.

Farmers and growers can easily and quickly visit FarmlandsPRO to purchase straights, premixed or customseed mixes in whatever quantity is required,

right rural supplies delivered where and when they need them.”

The development of the feature was a collaborative effort between Farmlands’ digital team and the farming community. By working closely with farmers and growers, Farmlands says it ensured that the new seed ordering functionality meets

“Selecting the right seed mix and ensuring it’s planted in the right conditions can significantly impact crop yield and farm profitability.”

all directly in the app. Orders can be placed paddock-by-paddock, with the ability to select the size of the paddock (in hectares), the name of the paddock and the date of delivery. As with all purchases in FarmlandsPRO, delivery direct to farm for orders greater than $500 is free.

This new feature has been released three months after the initial launch of FarmlandsPRO.

FarmlandsPRO is “quickly becoming the convenient, always on, channel of choice for NZ farmer and growers” the rural retailer says.

It is seeing an increasing trend of customers self-serving through FarmlandsPRO as they discover how useful the tool is to order on the go and have products easily delivered.

Farmlands chief executive Tanya Houghton says that FarmlandsPRO is a convenient and streamlined way to order seed and that it’s a channel that benefits both customers and the co-op.

“Precision and convenience are crucial in modern farming. Our new seed ordering feature in FarmlandsPRO is a great example of us designing solutions to give farmers and growers greater control and flexibility,” says Houghton.

“The new seed feature is timed to meet the seasonal buying needs of our farmers and growers ensuring they get the

customers through FarmlandsPRO, ensuing they can easily see and access exclusive FarmlandsPRO deals and information.

In September, Farmlands also launched its first FarmlandsPRO

the practical needs of those on the ground.

Users can also be confident that they’re getting the best price from Farmlands on every order, eliminating the need for quoting, the company says. Farmlands says the new feature is part of an ongoing commitment to support farmers and growers with leadingedge digital solutions that enhance their productivity and streamline their operations, as well as the co-op’s.

“Selecting the right seed mix and ensuring it’s planted in the right conditions can significantly impact crop yield and farm profitability. Giving customers the ability to specify paddock-level details through FarmlandsPRO is a major advance” says Houghton.

Customers can easily access the new seed ordering feature by updating their FarmlandsPRO app, available on both the Apple App Store and Google Play Store.

Beyond the new seed ordering feature, FarmlandsPRO is said to have numerous benefits. It lets farmers and growers order, track and manage their rural supplies anywhere, anytime, and frees up Farmlands technical experts to spend more time supporting customers with on-farm or orchard challenges and less time processing orders. Farmlands has also enhanced how it communicates with its

exclusive product deals, with a second set of deals to be launched on 1 October. It says customers can easily access the products that they need, through a channel that is designed for them.

Taking care of their local environment is something many New Zealanders feel passionate about. On any given day throughout the country, you’re likely to find teams of volunteers engaged in clearing weeds, planting trees or cleaning up waterways.

The Westpac Water Care Project was established to give those passionate volunteers an extra helping hand, as part of the partnership between Westpac NZ and NZ Landcare Trust. The programme which began in 2022, sees Westpac provide six catchment groups each year with a $10k grant to support a local conservation project.

“Supporting our rural communities is an incredibly important part of what we do at Westpac,” says Westpac NZ Head of Agribusiness Tim Henshaw. “We went into this partnership with NZ Landcare Trust to try and make a difference at a grassroots level – helping groups across the country to protect and enhance their local environment.”

All Westpac employees receive two volunteer days each year to lend a hand to a cause of their choice and Mr Henshaw says many teams opt to use theirs to help grant recipients with their projects.

“I know lots of our teams have really enjoyed getting their boots dirty and helping to make a difference in their communities.”

To date, 18 groups have received Westpac Water Care Project grants.

Recipients of the Canterbury Westpac Water Care Project grant, Summit Road Society, owns much of the Avoca Valley catchment.

The Society is focused on restoring the environment throughout the valley –restoring native bush as well as creating habitats for native wildlife, enhancing freshwater quality and reducing erosion and sediment run-off.

They applied for a grant to help it to purchase trees, which it then organised volunteers to plant. More than 1,600 trees were planted in the Avoca Valley through four community planting days in May and June 2024.

Summit Road Society General Manager

Bill Martin says it’s been great to have support from the Westpac Water Care

Project grant.

“We’re really proud of what we’ve achieved in the valley so far and are grateful to everyone who’s played a part. Over the past three years, we’ve planted more than 53,000 natives throughout the valley. Ultimately, we’re aiming to plant a further 35,000-40,000 to complete the restoration of Avoca Valley stream.”

If you’re interested in supporting the Summit Road Society and restoration of the Avoca Valley catchment, visit facebook.com/summitroadsociety Applications for the 2025 Westpac Water Care grants will open in 2025. For more information, visit https://landcare.org.nz/ project/westpac-water-care-project/

RURAL NEW Zealand has been taking some very big hits of late. The latest of these, the closure of Alliance’s Smithfield plant at Timaru, is yet another blow for the heartland – the engine room of the economy.

Farmers are struggling with the effects of adverse weather, terrible prices for lamb and having to sell their products in an unstable global market.

For the workers at Smithfield it is a bitter blow. They are highly skilled people who have played a huge part in the local and national economy. There are also the other people who have support roles around the processing plant who will now have the unenviable task of finding work and maybe having to leave the district.

While many may see the closure of the 139-year-old Smithfield plant as a surprise, the fact is that this has been a storm coming and the fact that it’s taken so long to happen is itself a surprise. Alliance rightly points to the age of the plant and need for investment to upgrade it. Another major factor is declining stock numbers, so the economics of an upgrade don’t cut the mustard. Unfortunately, Smithfield is the area where the declining stock has had a significant impact, says Alliance.

But there are other things in play as well.

Land use change – for the worse – has seen pine trees planted on good sheep country, with the result that the national ewe flock continues to drop. That is not the fault of Alliance, rather questionable economic policies which encourage the planting thousands of hectares of land in pines. For what good reason, many ask. Carbon farming, they say.

The other factor at play with Smithfield is urban encroachment and there are rumours in Timaru that a developer is interested in the site for retail or other business options.

There is talk that the coolstores at the site may be kept as they are believed to be in reasonable condition. Little is for certain now.

What is certain is that there could be more closures like Smithfield if stock numbers continue to decline and newer plants with greater capacity and are better designed to better meet the needs of overseas consumers take over from the older plants.

HEAD OFFICE POSTAL ADDRESS:

PO Box 331100, Takapuna, Auckland 0740

Phone 09-307 0399

PUBLISHER: Brian Hight Ph 09 307 0399

GENERAL MANAGER: Adam Fricker Ph 021-842 226

EDITOR: Sudesh Kissun Ph 021-963 177 sudeshk@ruralnews.co.nz

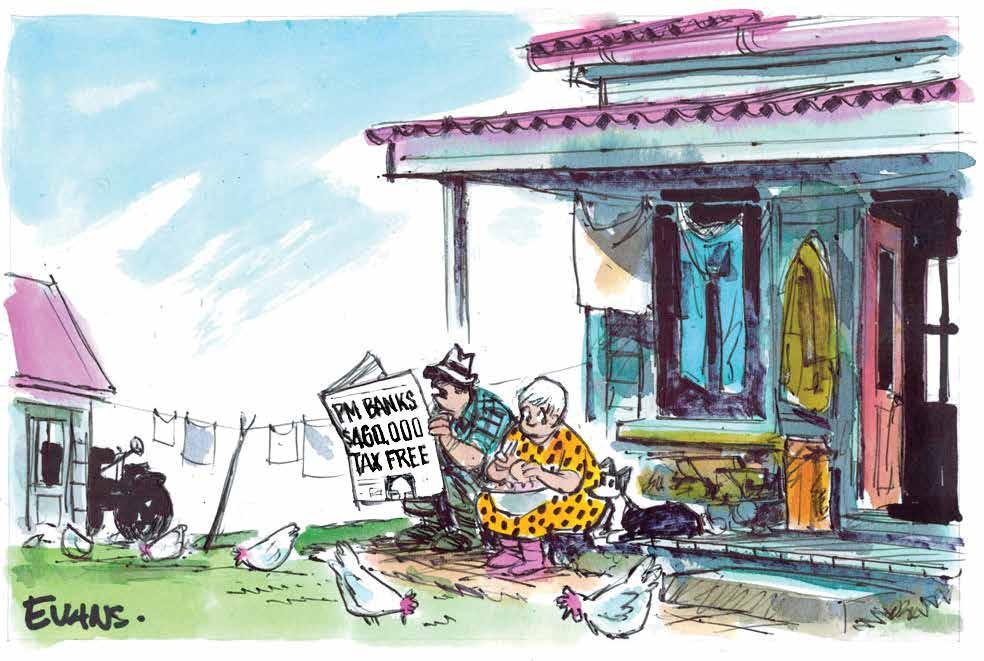

“What’s a capital gain?”

ACC HAS released its injury statistics for 2023 work-related claims. While the total of injury claims was up 1200 to 226,600 the incidence rates for claims in agriculture, forestry and fishing continued the decline that began in 2020 and is now down to 149 claims per full-time employee – behind manufacturing, which now has the highest rate. So, still high, but making good progress.

A mate of yours truly suggested ACC’s stats are missing a new, significant category – the thousands of entitled public servants ‘mortally wounded’ by the Government’s edict that these overpaid, underworked wonks must come back to the office and do… whatever it is they do. After the recent layoffs in the public sector, if they refuse to replace their slippers with work shoes, there’s no doubt a long queue of unemployed workers who will!

BEEF+LAMB NZ has run a roadshow to sell its new strategy. Thirty meetings, which a total of just 400 farmers attended – barely a baker’s dozen per meeting. Given that there are some 23,400 sheep & beef farms in NZ (BLNZ Farm Facts 2021) the low turnout suggests a huge wave of apathy afflicting B+LNZ’s funders. The roadshow followed the 2024 AGM which featured a poorly-timed attempt to hike directors’ fees and one of the worst-ever voter turnouts at just 12%. At the time, chair Kate Acland blamed farmers’ busy schedules, ‘divisive’ social media and climate change remits for the low turnout. What’s the excuse this time? On top of the cost of the roadshow, B+LNZ spent a fortune promoting it. The Hound humbly suggests the ‘no show’ suggests they’d already lost the room.

PRODUCTION: David Ferguson Ph 027 272 5372 davef@ruralnews.co.nz

Becky Williams Ph 021 100 4381 beckyw@ruralnews.co.nz

REPORTERS: Peter Burke Ph 021 224 2184 peterb@ruralnews.co.nz

Nigel Malthus Ph 021-164 4258

MACHINERY EDITOR: Mark Daniel Ph 021 906 723 markd@ruralnews.co.nz

THE LATEST travel receipts for MPs are in (April – June 2024).

Running the cutter, we have National on a total of $697,315 - an average of $13,946 for its 50 MPs. Act spent a modest $103,536 for an average of $9,412 for 11 MPs.

NZ First spent a total of $70,566 or $8,820 for eight MPs. Labour averaged $21,156 for 35 MPs - a total of $740,481. The Greens are usually big carbon emitters, and this year is no exception. They spent no less than $284,780 for an average of $17,798 for 16 MPs.

Te Pāti Māori spent $188,887 - the highest average of $31,481 for its six MPs. Co-leader Debbie Ngarewa-Packer easily burned the most jet fuel, spending $60,990 – a lot for an MP who is in Opposition and hates oil and gas exploration.

AUCKLAND SALES CONTACT: Stephen Pollard Ph 021 963 166 stephenp@ruralnews.co.nz

WAIKATO & WELLINGTON SALES

CONTACT: Lisa Wise Ph 027 369 9218 lisaw@ruralnews.co.nz

FORMER POLITICIANS seem incapable of staying away from the limelight after they retire. Richard ‘Mad Dog’ Prebble opines weekly in the media, Helen Clark has an opinion on everything, and not a week goes by without Sir John Key making the headlines. Last week his reckons included the view Trump will, and ‘should’, win the 2024 US election circus. Key said Trump’s “better for the economy”, but he also raised the ‘T’ word –tariffs. Exporters are rightly wary of the implications for trade into the US if the Orange One wins and whacks hefty tariffs on imports. The NZ wine industry, for example, fear they could face 20% tariffs, which would kill returns from their biggest export market. The US circus is beyond our control, but we can’t pretend the result won’t impact us.

SOUTH ISLAND SALES CONTACT: Kaye Sutherland Ph 021 221 1994 kayes@ruralnews.co.nz

DIGITAL STRATEGIST: Jessica Marshall Ph 021 0232 6446

EVOLUTION IS important. So is feeding people properly.

Most people know this intuitively, but it doesn’t stop them trying to alter evolution’s course. In agriculture, the selection of plants and animals from their wild state has been hugely beneficial in terms of food production. Adding enablers (founded on engineering, science and then technology) has created extra yields upon which we are now dependent. Without those increased yields, which have been achieved mostly on existing farmland rather than expansion, starvation and more war would have occurred.

Since 1961, US wheat yield has doubled from 1.5 tonnes per hectare to over 3. In the same timeframe, UK wheat yields increased from over 3 tonnes per hectare to approximately 8 tonnes.

New Zealand’s wheat yields are now over 9 tonnes per hectare.

These increases have been achieved by overcoming genetic and environmental limitations, mostly to do with human capability (tractors achieve more than horses which achieve more than people), nutrients, water and control of pests and diseases.

Similarly, breeding animals to fit the environment, or altering the environment to fit the animal (such as barn systems for milk in the USA) has also been part of process.

DairyNZ’s statis-

tics released each year show productivity gains for the last 30 years per animal (from an average of approximately 280 kgMS per cow to just under 400) and per hectare (from approximately 700 kgMS per hectare to over 1100).

More people are being fed from less land and water per person because of productivity gains per hectare. Agriculturalists have been working with nature, investigating limitations, and identifying systems to overcome those limitations –enhancing productivity.

A rethink has occurred in this era of climate change awareness, and in our attempts to reduce the impacts of human progress, particularly in methane from animals, we might be overlooking the very aspects that could help us in the future.

American researchers from Stanford University and the Carnegie Institute have calculated the net effect of the improvements that have been achieved. Between 1961 and 2005 (the research was published in 2010) they found that although

emissions from factors such as fertiliser production and application had increased, the net effect of higher yields had avoided emissions of approximately 13.1 GtCO2e per year. A gigatonne has nine zeros before the decimal point and one GtCO2e is apparently equivalent to the mass of all land mammals in the world not counting humans. A lot.

The researchers estimated that each dollar invested in agricultural yields had resulted in 68 fewer kgC (249 kgCO2e) emissions relative to 1961 technology ($14.74/tC, or approximately $4/tCO2e). They concluded that “further yield improvements should be prominent among efforts to reduce future GHG emissions”.

Despite this, the research on agricultural methane has been focused on inhibiting it.

Methane is important

for the ruminant animal. By removing hydrogen ions in a safe and belchable form, the likelihood of rumen acidosis is reduced.

Dr Graeme Coles, nutrition scientist, explains the science: “Under normal conditions, the New Zealand dairy cow loses about 45% of the energy she derives from her feed by making methane,” he says.

“However, that does mean that she is able to clear 55% of the energy (in the form of short chain fatty acids (SFCA)) to the circulation. Even a small improvement in the amount of SCFA that can be cleared from the rumen will significantly reduce the pressure to make methane.”

Despite this, much of the research and commercial investment to date has been in pursuit of products that

inhibit the methanogenic microbes, either chemically or by vaccinating against them. “This causes expression of the symptoms of rumen acidosis – reduced rumen pH, reduced rate of feed utilisation, reduced animal productivity and in extreme cases, rumen wall tissue damage,” he says.

Dr Coles has been developing a rumen prebiotic that enhances clearance of fermentation products from the rumen

to the circulation. Farmers are reporting an 8% improvement in energy recovery from a given diet. Over a decade of on-farm investigation, Dr Coles calculates that 60kg of MS per cow per year has been achieved.

Improved feed conversion means less methane.

The American researchers concluded that future agricultural productivity is critical, as it will shape emissions from conversion of native landscapes to food and

biofuel crops. Conversion is a major threat to biodiversity.

Investment in agricultural research is an important mitigation strategy, and focussing on enhancing rather than blocking would fit with the next stage of evolution.

Ruminants and their microflora have evolved over millennia. Changing the relationship must be done with care.

Charles Darwin pointed out that “It is not the strongest of the species that survives, not the most intelligent that survives. It is the one that is the most adaptable to change.”

Enhancing gives flexibility; blocking does not. We forget Darwin at our peril.

• Dr Jacqueline Rowarth, Adjunct Professor Lincoln University, is a director of DairyNZ, Ravensdown and Deer Industry NZ. She is a colleague of Dr Coles and their latest paper on ‘An agroecological approach to preparation and use of a milk protein production baseline’ was published at the end of September.

NEW ZEALANDERS

have a love affair with property investment.

After securing a family

home, buying a rental property is traditionally seen as a safe way to build wealth over the long term. However, the increas-

ing regulatory complexities of being a landlord, recent high interest rates, and softening house prices have encouraged investors with a passion

for property to consider an alternative: a Listed Property Vehicle (LPV) – also known overseas as a Real Estate Investment Trust.