P O R T F O L I O

As we continue to embark on our journey through the second half of 2023, a year full of trials and triumphs, we’re proud to present the August edition of Portfolio magazine.

This month’s Portfolio presents a variety of topics, from a deep dive into the markets for some of our alternative assets, to getting to know one of RWC’s leading agents.

Ray White Head of Research Vanessa Rader takes a look at one of the most sought after commercial assets in the current market - self storage. She takes a look at how the rental crisis is affecting the demand for self storage, and what the opportunities are for investors.

She also focuses on the seniors and aged care living, and how the supply of these assets isn’t keeping up with Australia’s aging population or the current housing crisis.

We also meet RWC’s top performing female agent Emily Pendleton, as we hear how her career has developed so far, and how she has grown to become one of the top six per cent of agents at RWC.

RWC’s monthly Between the Lines Live webinar was held in Perth last month, where host Vanessa Rader spoke to RWC WA Director of Capital Markets Brett Wilkins, the man behind Western Australia’s biggest commercial dealthe $1.3 billion sale of Jandakot Airport. The pair chatted about the state of the Western Australian commercial market, which assets were performing well, and who was investing.

Andrew Freeman Head of Agency Operations

With Australia’s population increasing by close to 500,000 in 2022, housing supply has been a burning issue across the country given price rises and rental vacancies plummeting. The mismatch between the supply of homes and the increasing demand as the population grows has put pressure on all segments of the housing market. The rapid rise in construction costs and labour shortages has been a major stumbling block for developers adding stock across the country, be it houses, units, infill development as well as options for seniors and aged care or the student market.

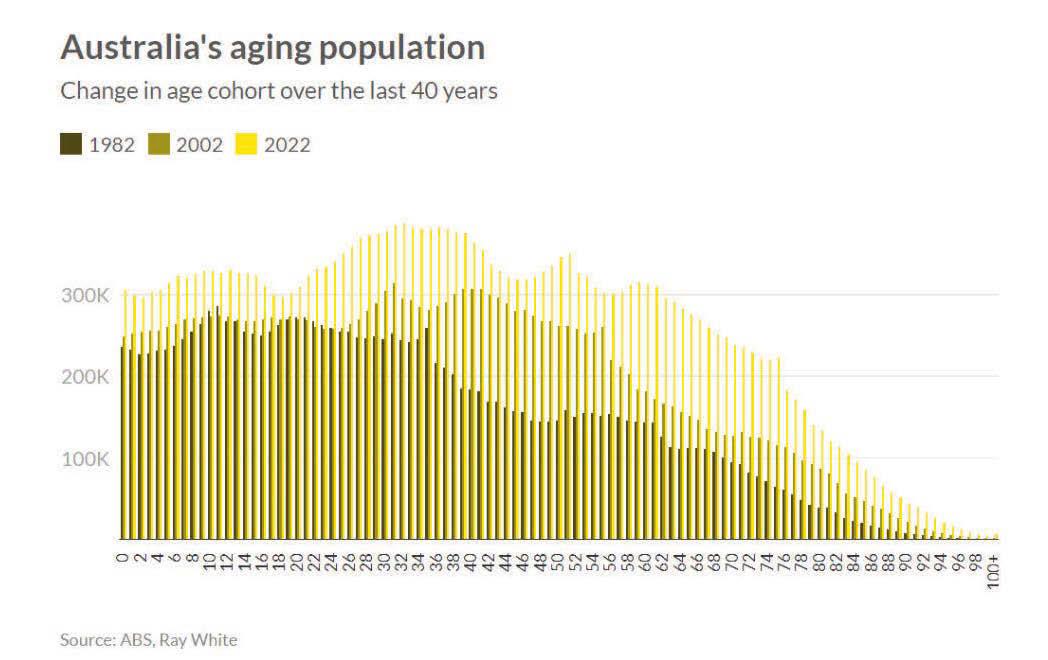

There is no doubt that Australia has an aging population, over the last 20 years we have seen a ballooning age cohort emerge in the over 60s group now representing approximately six million, up from 3.3 million in 2002. With approximately 130,000 people each year being added to this age group over the last 20 years, housing options have not kept pace with this growing demand. In this younger 60+ age group, seniors housing and retirement living are the most sought after providing greater experiences, services with low care, freeing up traditional housing stock across communities.

Australia’s over 80+ population is currently represented by more than 1.1 million, this has increased 80.5 per cent over the last 20 years. A combination of the aging baby boomer generation, together with Australia’s lifestyle and improved medical practices, has resulted in average life expectancy becoming the fifth highest in the world (2021) at 83.2 years old. For this older age cohort or those requiring additional care, aged care facilities offer a variety of levels of care and benefits from the Federal Government subsidies for operators. Given this government backed income historically there has been high interest in aged care facilities as an investment class. Institutional and listed funds are increasing their exposure to these assets particularly given their high occupancy, limited supply and ongoing growing prospective pool of residents.

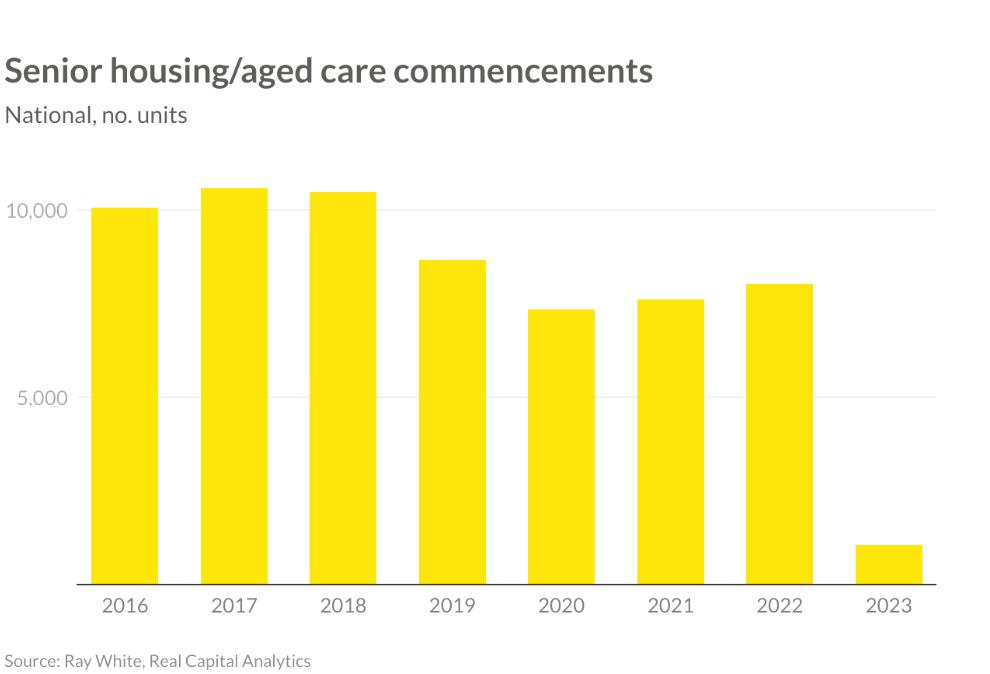

Looking at the supply of these facilities across the country, during 2016-2018 we saw approximately 10,000 aged care and senior living units commenced each year, during 2019 we did see this decline and, as we entered the COVID period, further decreases were felt. As a result in 2022 only 5,730 dwelling units were completed across Australia, a significant mismatch compared to the rapid increase in population over this same period which saw the over 60s age group increase by 149,500 people.

By the end of this year, a further 8,200 units are expected to be completed, however, this does not meet the existing demand particularly for the expanding over 80s age group requiring care facilities. While we are currently in an undersupply situation, this is expected to worsen given the construction slow down and population pressures, particularly over the coming years where these age groups will further grow.

On the investment front, we continue to see buyers seeking out care facilities backed by government subsidies. This sector continues to be attractive to the institutional and offshore buyer groups, resulting in more than $1.7 billion in sales during 2022/2023. Seniors’ housing and their strong income profile - given high occupancy, rising rents, and home values - has also not gone unnoticed by investors. Although, this has come back in recent years due to the tightly held nature of these assets, which has ensured yields remain competitive in the 5-7 per cent range.

Emily Pendleton’s interest in commercial real estate began when she was a little girl. Coming from a family of real estate investors, she has strong memories of looking at listings online with her father.

Despite its reputation for being a male dominated industry, Emily jumped at the chance to start her career in commercial real estate, joining the team RWC Northern Corridor Group shortly after finishing school. Fourteen years later she is not only RWC’s top female agent, but one of the highest performing agents in the network overall.

Just six months into her first role in commercial real estate, a hybrid associate and admin position, RWC Northern Corridor Group director Michael Shadforth asked Emily to step up and become her own agent.

“I got stuck straight into it, and here I am now,” Emily said.

Emily has consistently been in the top six per cent of agents for the past few years, and claims leases, a good support team, hard work, and having thick skin are the secrets to her success.

“I have worked in commercial for 14 years but I have only recently built a team to allow me to work on larger asset sales and projects that allow me to think outside the box,” she said.

“I have had an average of 50-70 leases on the go at any one time since I went out on my own, so I brought an associate on to help me with leases.

“I was very close minded about having a team, but when I let that go and gave it a shot everything changed, and I wouldn’t have it any other way.”

Emily said she would love to see more young women considering a career in commercial property.

“I think commercial is a bit intimidating for many young women,” she said.

“When I first started and then stepped out on my own I had a lot of nasty comments and a lot of men telling me I won’t succeed, or people trying to take business from me.

“But once you show your position and show you’re not going anywhere, things start to get easier. You do have to have a tough facade.

“I had a lot of support from my team and my directors.” She said there was a huge opportunity for women in the commercial property sector.

“Commercial property allows you to do both sales and leasing, while residential property managers look after leasing,” she said.

“There’s opportunities to help women business owners who are looking to lease property, think of beauty salons and hairdressers. There are so many businesses like that which are looking to expand after Covid.

“Once you’ve done a few deals you get to put your sold signs up and people start to see you as a real agent in the market.”

Another edge which Emily used to cement herself as an agent was using the latest tools and technology.

“A lot of older agents aren’t using all of the technology and tools that we have access to,” she said.

“Being able to be innovative and use the tools Ray White has given us has allowed me to show that I am better and quicker than these other people.

“Use the tools available and you don’t need to fight other agents, do your work humbly and you’ll prove yourself over time.”

But at the end of the day, Emily said success came down to one simple thing - hard work.

“You have to put in the work. When you’re your own agent in control of your own time you can go get your hair done at 2pm if you want to, but you’ve got to have discipline and monitor your time and implement a daily schedule,” she said.

“You have to be willing to put in the work and the hours, you have to be willing to pick up the phone and make calls.

“But once you’ve done that hard work, and you’ve got a good team, you can step back and start working on the business instead of in the business.”

VANESSA RADER Ray White Head of Research

VANESSA RADER Ray White Head of Research

Activity in the self storage market has always tracked well. Historically, larger offshore funds have purchased large portfolios of assets across the country, however, in more recent years the private sector has increased its appetite for these assets. Industrial assets have been the most desired commercial investment class since the start of the pandemic and these assets were not forgotten, selling at yields in the sub five per cent range.

Over the last 12 months, there has been $132 million in sales recorded achieving mixed results. Quality assets have maintained low yields, however, assets have recorded capitalisation rates as high as eight per cent in some regional markets. Enquiry levels have been elevated across the country from the private sector including syndicates and high net worth individuals looking for the security of these assets and their stable income streams. There has been an increase in buyers venturing interstate to secure these assets with high population growth zones across the country the key focus for these buyers.

Like other industrial assets, rents have increased considerably and the end consumer has been hit hard by these increases thanks to higher insurances, increased land costs and taxes, and the overall high demand keeping vacancies low. The major users of self storage facilities are individuals who need to store their personal belongings rather than business use, and with the current housing shortage felt across the country, difficulty in securing a rental property has added to the need to store goods for a prolonged period, keeping occupancy high. This is most apparent in highly populated areas or those which have seen strong migration growth such as south east Queensland, Perth, and western Sydney, while there has been some move away from regional markets as post COVID-19 some population flows have come back to major cities.

There are currently 50 self storage developments in the 300,000sqm of industrial storage space to the marketplace. with south east Queensland expected to enjoy the greatest the occupancy of self storage, which is currently high. New technology around security increasing as demand increases for industrial assets in the current environment.

More than 200 people tuned in to RWC’s July Between the Lines webinar which focussed on Australia’s west coast commercial property market.

Host, Ray White head of research Vanessa Rader, was joined by RWC WA director of capital markets Brett Wilkins to shed light on how each commercial asset class is performing in Western Australia.

Mr Wilkins is behind Western Australia’s largest commercial real estate deal, being the sale of Jandakot Airport for $1.3 billion in 2021.

Mr Wilkins said industrial was still the hottest asset class post-Covid.

“Vacancy is more or less zero, and there is still good, solid demand,” he said.

“There is lots of demand off the back of mining and general economic activity.

“Yields have been blown out but that has been more than overcome by increased rents.

“There’s strong demand from both owner occupiers and investors. Industrial is holding up really well.”

Ms Rader said there were not too many large industrial transactions occurring in Western Australia, and asked Mr Wilkins how that end of the market was performing.

“The majority of Perth industrial is held by families, and a lot of institutions want to spend the money here, and if they could get something of size then they would spend,” Mr Wilkins said.

While there is some new industrial supply being added to the market, Mr Wilkins said there was a shortage of industrial land.

“You have to go a long way out of Perth now to get to some of the industrial subdivisions,” he said.

“There is construction activity happening because the rents and the demand just overcome the obstacles on the construction side of things.”

When it came to Perth’s office market, Ms Rader said Perth had behaved quite differently when it came to the work-fromhome trend which had kept occupancy higher.

Mr Wilkins said there was still reasonable demand for office investments.

“The demand is there, but it’s harder to work out where the values are at today,” he said.

“We have very high incentives and they haven’t shifted, they’re still averaging 50 per cent.

“Yields have shifted due to the cost of debt, but there just haven't been many transactions.”

“West Perth is strong with smaller investors and owner occupiers.

“There has definitely been a flight to quality, and some of the West Perth offices have been keenly sought after.

“Anything to do with small cap mining, traditionally centred at West Perth, is strong.”

Mr Wilkins said the retail market was performing well with low vacancy rates.

“Most of the retail strips where there are vacancies, it's mostly because landlords don't want to meet the market for rents,” he said.

“Retail strips are very keenly sought after from tenants and definitely from investors.

“Yields are sitting between 5-7 per cent, but some retail strips like Napoleon Street in Cottesloe or Bayview Terrace in Claremont where demand from investors looks beyond the current interest rate cycle that we’re in at the moment.

“Larger retail went through a change when Covid came along, regional centres and subregional centres were on the nose at the time, neighbourhood and convenience retail hit the peak.

“I’m getting 3-4 inquiries a week about convenience centres. They’re super popular.

“Regional shopping centres are now back in demand, but they have become more entertainment centres.”

Mr Wilkins said the demand for healthcare assets was huge.

“Healthcare is up there with industrial as the hottest asset class out,” he said.

“I have sold approximately $150 million in healthcare properties in the past two years, buyers were mostly funds from the east coast and Singaporean private investors.

“The assets included medical centres and a couple of private hospitals.

“Activity has slowed down over the last six months but there’s still a strong demand and that won’t dissipate.”

Ms Rader asked Mr Wilkins if he had seen an increased demand for commercial property from eastern states investors.

“At all levels of the market, there has been increased demand from the eastern states in the last year, from small private investors to larger institutions,” Mr Wilkins said.

“People are attracted to the value for money, yield differential and the indication that the WA economy is very strong and they should invest here.”

Mr Wilkins said foreign buyers were still looking to invest in Perth across all asset classes.

“Traditionally Perth is home to Sinaporean, Indonesian, and Malaysian money, there’s not as much investment from Hong Kong, China, or elsewhere.

“Covid stopped that for a few years, but Singaporean investors are starting to look at Perth again, but transaction activity overall has obviously started to slow down.

“Singaporean buyers tend to love Perth hotels, but they will purchase shopping centres, industrial, vineyards, all sorts of assets.”

RWC manages properties across all asset classes right across Australia. Take a look at some of our top managements from across the nation. RWC will have a management specialist located right near your property, so enquire with us today.

Located on a major arterial intersection, this 2,179m2 building on a 4,501m2 allotment is leased to Total Tools on a long-term basis

Fully leased neighbourhood shopping centre

An “A” grade commercial/medical asset with 38 tenancies totalling 7,290m2 net lettable area underpinned by GenesisCare and Appleberry childcare centre

Fully leased, IGA anchored neighbourhood shopping centre with nine specialties

PYRMONT,

50m2 and 79m2 offices featuring private amenities conveniently located near public transport and surrounded by vibrant cafes and shops

RINGWOOD, VIC

657m2 high capacity restaurant with full commercial kitchen and five zoned dining areas

36-44 Daintree Drive, Redland Bay, 4165

New development of nine high quality, strata titled units

Sizes range from 300sqm* to 379sqm*

Ground floor reception/office and first floor mezzanine

Located in the highly successful Redlands Business Park

Close to M1 Motorway on- and off-ramps

Prices start from $1,050,000 + GST

Nathan Moore 0413 879 428

nathan.moore@raywhite.com

Hugh Fletcher 0429 583 765

hugh.fletcher@raywhite.com

RWC Bayside

raywhitecommercial.com

60 Jardine Drive, Redland Bay, 4165

777sqm* warehouse

104sqm* mezzanine

3-phase power

3 container-height roller doors

Kitchenette and disability-compliant amenities

19 on-site car parks

Located close to the M1 and Gateway Motorways

89 Tingal Road, Wynnum, 4178

933m2 disability-compliant office

Large open-plan reception/waiting area

8 private offices, training room & staff amenities

30 secure basement car spaces

250m* to rail and bus connections

Located 14km* east of Brisbane CBD

Development potential up to 28m/8 storeys STCA^

Expressions Of Interest

Closing Thur 31st August, 4pm

Offered for sale with vacant possession

Benn Woods 0408 689 651

benn.woods@raywhite.com

Nathan Moore 0413 879 428

nathan.moore@raywhite.com

RWC Bayside

raywhitecommercial.com

Lot

Maudsland, 4210

Conveniently located in the northern Gold Coast Growth Corridor, just off Gaven Arterial Road, this prime real estate is only 16km from the iconic Surfers Paradise Beach.

Available Lots:

•Lot 2 - 516m2*

•Lot 3 - 559m2*

•Lot 4 - 560m2*

•Lot 5 - 614m2*

RWC Gold Coast

47 High Street, Southport, 4215

427m2* of prime land & 458m2* of total building area

Net rent income of $208,808.36.pa + GST + outs

High exposure with 50,000* cars passing daily

8 x car spaces (5 x externally & 3 x garaged) + mancave

Zoned 'Priority Development Area' with unlimited height

6 private bathrooms, a shower and change room

Overseas owner must liquidate - call now

Auction Thursday 17 August at 11am

Gold Coast Turf Club, Bundall

Jackson Rameau 0438 451 112

j.rameau@rwsp.net

RWC Gold Coast

raywhitecommercial.com

49599 Bruce Highway, Benaraby, 4680

1,419* Hectares (3,506* acres) across seven titles

22km* south of Gladstone

Expressions Of Interest

Closing Wed 6 Sept 2023 4pm

Tony Williams 0411 822 544 tony.williams@raywhite.com

Andrew Allen 0408 799 585 andrew.allen@raywhite.com

Only 11mins* to Tannum Sands & waterfront

One of the largest private land holdings in the region

3.8km* frontage to the Bruce Highway raywhitecommercial.com

RW Special Projects Queensland

•Free standing cottage previously leased to construction business and tattoo studio.

•Site area of 604m2*

•140m2* internal area.

•Ideal for accountant, lawyer, estate agent, health, beauty, tattoo, etc^

•Off-street and on-street parking.

•Inner city CBD location. Zoned 'Principal Centre'

•Surrounding neighbours include Oaks Hotel, Commonwealth Bank and Westpac.

•Great potential for outdoor signage and business exposure.

Andrew Allen 0408 799 585 andrew.allen@raywhite.com

Atlas Corrin 0434 314 283 atlas.corrin@raywhite.com

RWC Gladstone

raywhitecommercial.com

14/368 Earnshaw Road, Banyo, 4014

1,000sqm of high-grade commercial office and

Corporate appeal with an A-grade fit-out

500sqm warehouse with access via two container height

500sqm office over two levels

Solar system producing 39 kWh from 128 solar panels

12 exclusive car parking bays

Close to public transport

Lease $240,000 + outs + GST

Maclay Kenman 0490 196 600 maclay.kenman@raywhite.com

Stephen Ferguson 0412 803 244 stephen.ferguson@raywhite.com

RWC Milton

raywhitecommercial.com

Caboolture QLD, 4510

4,748m2* warehouse and office over three buildings

8,204m2* total land

Holding income with scope for owner occupancy

In-room Fri 1 Sept, 10am

Lvl 26, 111 Eagle Street Brisbane QLD 4000

Suitable for owner occupier and savvy investors

Chris Massie 0412 490 840 chris.massie@raywhite.com

p

son Sim Grant 0433 427 503

grant@thecommercialguys.com.au

RWC Northern Corridor Group -

raywhitecommercial.com

This warehouse boasts a high-profile presence on busy Scott Street, only minutes from Cairns CBD. The warehouse has high clearance, a full bathroom and a kitchenette. From its location to its attention to detail there's nothing missing in this contemporary complex.

Details of property:

Warehouse: 225 sqm*

Office: 35 sqm*

Secured concrete hardstand: 180 sqm*

Great location positioned centrally to all the Cairns Greater Region. Right in the heart of the Cairns industrial and commercial precinct, the area is well known for its accessibility and access to major arterials. High-end properties of this calibre are worthy of inspection.

Lease

Helen Crossley 0412 772 882 helen.crossley@raywhite.com

Grant Timmins 0422 534 044 grant.timmins@raywhite.com

raywhitecommercial.com

GF / 207 Lake Street, Cairns City, 4870

Welcome to GF/207 Lake Street, Cairns City. Offering a unique opportunity for those in the medical or consulting industry. With its prime location in the medical precinct on Lake Street, you'll benefit from high visibility, ensuring maximum exposure for your business.

•Ground Floor 218.7 sqm*

•Reception and foyer

•4 separate consulting rooms

•Theatre room

•Separate administration area

•Staff room & kitchen

•Staff amenities

•Separate PWD facilities

•Onsite parking for 14 vehicles (shared with L1)

•Ambulance bay

Lease

Susan Doubleday 0408 038 380 susan.doubleday@raywhite.com

Grant Timmins 0422 534 044 grant.timmins@raywhite.com

RWC Cairns

raywhitecommercial.com

85-97 Bardon Road, Berrinba, 4117

Service Station on Prime Corner Position with Co-Located Drive-Thru

210m2 service station shop/showroom - with the option to expand

Over 500m2 Medical with additional 200m2 Pharmacy

Abundance of parking to account for the expected traffic

Multiple entrance and exit points, along with internal roads

Car Wash with 5 bays

Over 15,000 vehicles per day on Bardon Road

Lease

Mukhtaar Hashim 0433364786 mukhtaar.h@raywhite.com

Julie Ryan 0447 445 543 julie.ryan@raywhite.com

RWC CSR

raywhitecommercial.com

351 Tor Street, Wilsonton, 4350

964m2 freehold corner offers high visibility on two streets

Tenanted to a national dental brand with 105+ locations

Gross rent $51,570.60 per year Inc GST

Attractive prospect of occupying the premises or investing

Fully fitted, maintained and functional premises

Council approved for medical/paramedical space

Expressions Of Interest

Closing 31.08.2023

Sid Arora 0469 831 089 sid.arora@raywhite.com

Clearspan warehouse / excellent internal clearance

Corporate office accommodation

Leased to Bruder Manufacturing Pty Ltd

Retuning: $298,620 Net + GST PA

Brand new 3 + 2 year lease

Offers To Purchase

Harry Egan 0409 494 248 harry.egan@raywhite.com

RWC Southwest

raywhitecommercial.com

143 Evans Road, Salisbury, 4107

Functional office, awning and storage area

Commanding and elevated frontage to busy Evans Rd

Development upside (STCA)

5,059sqm of industrial land

778sqm of office area

Expressions Of Interest

Matt Wray 0408 730 943 matt.wray@raywhite.com

Greenslopes Medical Precinct is an innovative and dynamic health and medical facility that aims to transform the healthcare industry. The facility is a state-of-the-art health facility that provides an integrated healthcare system. This ensures that the community has access to the most advanced multidisciplinary collaborative and preventative healthcare services available.

•Flexible leasing options start from 70sqm*

•Construction completion date set for Q4 2024

•Directly across the road from Greenslopes Private Hospital

•Opportunity to collaborate on the design/customisation of fit-out with commitment at an early stage

•Secured staff and visitor car parking

•Large hospital-grade lifts

•Ambulance bays provided

Sale/Lease

Franz Stapelberg 0430 655 676 franz.stapelberg@raywhite.com

Chris Meyer 0422 585 357 chris.meyer@raywhite.com

raywhitecommercial.com

1305 Lytton Road, Hemmant, 4174

The architecturally designed units are situated on a high exposure corner site with proximity to Hemmant Station, Gateway Motorway, Brisbane Airport and the CBD. The project at the corner of Lytton Road and Violet Street, Hemmant presents an exciting opportunity for owner occupiers, tenants and investors alike looking for a strategically located industrial facility to lease or buy.

•Units ranging from 180sqm* - 380sqm*

•Concrete mezzanines at 3.7m* above ground floor providing fantastic clearance underneath

•Minimum of 2 allocated car spaces per unit

•Electric roller doors in each unit

•3 phase power, bathroom & kitchenette

Sale/Lease

Jared Doyle 0408 160 570 jared.doyle@raywhite.com

Jack Gwyn 0424 807 166 jack.gwyn@raywhite.com

Offering investors a refurbished, multi-tenanted asset located in a highly sought-after city fringe precinct. This freehold building presents a diverse income stream from exceptional retail and residential tenants with long-term leases in place. With a total lettable area of 309m2* and a land area of 192m2*, this freehold property represents a unique opportunity to own a premium asset in a thriving city fringe location.

•Refurbished freehold in thriving City Fringe locale

•Fully leased with excellent tenancy profile

•Income $290,000 net approx.

•Exciting new retail concept by established local retailers

•Retail lease term 5+5+5

•Spacious 4 bedroom apartment with separate access

Zorick Toltsan 0411 227 784

RWC Eastern Suburbs

raywhitecommercial.com

665 Old South Head Road, Rose Bay, 2029

•Located in the heart of Rose Bay Shopping Village, less than 10kms from Sydney CBD

•First time offered in 70 years, a generational opportunity

•Incredible opportunity to develop a 4 level mixed use residential apartment & retail complex (STCA)

•Comprises of 2 x retail shops, 2 x offices + separate 3 bedroom residence with dual access

•Estimated fully leased income of $160k per annum + GST with scope for rental uplift

•Offers rear lane access with lockup garage + additional onsite parking for 2 cars

•Land Area 430m2, Existing Floor Area 352m2 + 140m2 of external / outdoor areas (approx).

Auction 11.00am, September 9th 2023 On Site

Zorick Toltsan 0411 227 784 ztoltsan@raywhite.com

Daniel Ungar 0400 112 202 dungar@raywhite.com

RWC Eastern Suburbs

raywhitecommercial.com

1-3 Tweed Coast Road, Hastings Point, 2489

Ripples Licensed Cafe

Seascape Leisure Centre

Neptunes's Castle Kid's Club

BP Franchisee tenanted fuel station

12* various styles of tourist accommodation

Marine Discovery Centre - State-of-the-art technology

9.96 hectares of prestigious positioned land

Expressions Of Interest

Closing 31 August 2023

If not sold prior

100% Interest in the Business & Freehold

Ryan Langham 0420 581 164

ryan.langham@raywhite.com

Nathan Huxham 0403 583 306

nathan.huxham@raywhite.com

RWC Burleigh Group

raywhitecommercial.com

19-27 Rodgers Street, Kingswood, 2747

Site area - 3,835 sqm*

FSR 3.5: 1 / Height Limit 18m

Zoning - MU1 Mixed Use

Activated DA approval for 132 units

Alternative development schemes available^

180m* to Nepean Hospital

400m* to Kingswood Train Station

Expressions Of Interest

Closing Wednesday 16 August at 3pm

Samuel Hadgelias 0403 254 675

Leslie (Yifu) Li 0403 261 752

Peter Vines 0449 857 100

RWC SC

raywhitecommercial.com

168 Morgan Street, Broken Hill, 2880

High demand location for childcare

DA approved for 100 childcare spaces

Potential upside to include aftercare facilities^

Prime position, close to multiple primary schools

250m* to Broken Hill Hospital

Expressions Of Interest

Closing Thursday 17 August at 3pm

RWC SC

raywhitecommercial.com

Baxter van Heyst 0447 113 025 baxter.vanheyst@raywhite.com

161, 164-166 Little Bloomfield Street and 178 Bloomfield Street, Gunnedah, 2380

Total land size - 6,351 sqm*

Street frontage - 20m*

Zoned R3: Medium Density Residential & RU1: Primary Production

Concept plans are available

Multi dwelling and childcare centre opportunity^

Flexible settlement terms offered

1.4 km* to Gunnedah town centre

Auction Tuesday 29 August at 10:30am

Leslie (Yifu) Li 0403 261 752 leslie.li@raywhite.com

Baxter van Heyst 0447 113 025 baxter.vanheyst@raywhite.com

10/18-28 Sir Joseph Banks Drive, Kurnell, 2231

RWC Greater Sydney South is pleased to present 10/1828 Sir Joseph Banks Drive, Kurnell for sale via Expression of Interest. This incredible factory sits proudly at the end of this modern complex with its 1,162m2* internal floor area which is complimented by its large sun bathed first floor office with north facing windows wrapping around the office.

•Total Building Area of 1,162sqm*

•Modern complex with B-double access

•Quality high clearance warehouse with light filled office

•13 marked car spaces on site

Expressions Of Interest

Closing Thursday 26th August at 4pm

Brad Lord 0439 594 121 blord@raywhite.com

Dean Munk 0451 100 654 dean.munk@raywhite.com

RWC Greater Sydney South

raywhitecommercial.com

Lot 153/15 Gadigal Avenue, Zetland, 2017

Shop plus parking space in carpark

Tenanted until April 2025 with option to renew

Collect $49,535.76 (approx) rent per annum

Low strata fees (tenant paying all outgoings)

Previously approved for a café (lapsed DA)

Retro interiors, full glass frontage, cool vibes

Quick access to Eastern Distributor & airport

Alex Santelli

0403 104 146

a.santelli@rwcss.com

RWC South Sydney

raywhitecommercial.com

14 Schofields Road, Schofields, 2762

DA Approval for 1381 units across 17 buildings

Approved GFA of 118,797 sqm

Total Site Area of 120,020 sqm

Site zoned R3 and SP2

Substantial site infrastructure works already completed

Ability to stage construction and or sell down super lots

Located moments from Schofields station

Expressions Of Interest

Closing Wednesday 23 August 2023 at 3:00pm

Peter Vines 0449 857 100 peter.vines@raywhite.com

Victor Sheu 0412 301 582

victor.sheu@raywhite.com

RWC Western Sydney

raywhitecommercial.com

2,017m2* Rectangular shaped block

Single carriage-way for heavy vehicle access

866m2* High-clearance warehouse

124m2* Attached office/showroom

Covered loading area

3-Phase Power

Break-room, kitchenette, 2x toilets & shower

Sale

$2,500,000 ex GST

Frank Giorgi 0403 839 822 frank.giorgi@raywhite.com

Piette Roberts 0484 947 693 piette.roberts@raywhite.com

RWC Canberra

raywhitecommercial.com *Approx

Level 6, Unit 27/28 University Avenue, City ACT, 2601

311m2 fitted-out office

Easy access to public transport, public parking, restaurants & cafes

Located in heart of Canberra's CBD.

Impressive reception area

Large board room and meeting room

Two offices and a spacious open plan work area

Kitchenette / staff break out area

Sale

$1,400,000 ex GST

Andrew Green 0417 133 071 andrew.green@raywhite.com

3/29 Jersey Road, Bayswater, 3153

Auction 24th of August at 11:00am

Onsite

Building Area 330 sqm*

Four (4) Car Spots

Industrial 1 Zone (IN1Z)

4.9m Roller Door Clearance

5.5m Roof Height

Office & Showroom Space

Mitch Rosam 0402 355 805

mitch.rosam@raywhite.com

Nitish Taneja 0416 890 577

nitish.taneja@raywhite.com

RWC Ferntree Gully

raywhitecommercial.com

174S & 174D Weatherall Road, Cheltenham, 3192

Tenant - Bottlemart

3 + 3 Years commencing April 2023

Paul Waterhouse 0417 660 153 paul.waterhouse@raywhite.com

Nitish Taneja 0416 890 577 nitish.taneja@raywhite.com

Shop Area 60sqm*

The home - Potential Rent: $700-$750p/w.

Completely freestanding and separately accessed

RWC Ferntree Gully

Rent $28,880.00* + GST and Outgoings with Annual 3% raywhitecommercial.com

220-222 Old Dandenong Road, Heatherton, 3202

23,180sqm* of vacant land moments from Dingley bypass & Major

Auction Wednesday 9th August at 11am

Zoned Green Wedge under the city of Kingston

Paul Waterhouse 0417 660 153

paul.waterhouse@raywhite.com

Nitish Taneja 0416 890 577

Close proximity and access to the Dingley Bypass RWC Ferntree Gully

nitish.taneja@raywhite.com

raywhitecommercial.com

9/229 Colchester Road, Kilsyth, 3137

Building Area: 175 sqm* LED Warehouse Lighting

Auction Auction Tuesday 22nd August at 11am

Nitish Taneja 0416 890 577

nitish.taneja@raywhite.com

Three (3) Car Parking

Self contained amenities

Land Area: 250 sqm* Industrial 1 Zone

Automatic Roller Door

80 amps of 3 Phase

Paul Waterhouse 0417 660 153

paul.waterhouse@raywhite.com

Good Natural Light

raywhitecommercial.com

RWC Ferntree Gully1265 North Road, Oakleigh, 3166

Total land area | 265m2*

Ryan Amler 0401 971 622 ryan.amler@raywhite.com

Simon Liang 0451 954 318 simon.liang@raywhite.com

Plus separated two-bedroom

Total building area | 130m2* RWC Oakleigh

Comprising shop front | 50m2* raywhitecommercial.com

Total rental income | $39,370 per annum

G01/9 Balcombe Road, Mentone, 3194

New 5-year lease to January 2028 plus option to 2033

Net Income: $60,000 pa* plus GST

Annual fixed 4% increases

Immaculate presented 150sqm retail premises

Two onsite car spaces and storage cage on the title

Sale

Ryan Trickey 0400 380 438 ryan.trickey@raywhite.com

Will Jonas 0422883011 will.jonas@raywhite.com

RWC Glen Waverley

raywhitecommercial.com

213-215 Blackburn Road, Mount Waverley, 3149

Land - 1,015m2*

Zoning - Commercial 1

Building - 480m2*

Two Food preparation areas at either end

Level one office and back of house area

Onsite car parking

Sale

Price on application

Ryan Trickey 0400 380 438 ryan.trickey@raywhite.com

Will Jonas 0422883011 will.jonas@raywhite.com

RWC Glen Waverley

raywhitecommercial.com

123 Watkins Street, White Gum Valley, 6162

Located just 3km* from the Fremantle Town Centre

Three-storey walk-up apartment complex

12 strata units - all fully leased

Land Area: 2,630m2

12 car bays

"Residential R20/R25"

Gross Projected income: $218,634*pa (Sept 2023)

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

Stephen Harrison 0421 622 777

stephen.harrison@raywhite.com

RWC WA

raywhitecommercial.com

107 Abernethy Road, Belmont, 6104

Freestanding two-storey office building on 911m2* parcel of land

604m2* NLA

Split into 3 separate tenancies

Excellent exposure along Abernethy Road

19 parking bays

Ability to occupy and/or secure leased investment

Buy 1, 2 or all 3 units

Expressions Of Interest

Chris Matthews 0413 359 315 chris.matthews@raywhite.com

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

RWC WA

raywhitecommercial.com

23 Tribute Street West, Shelley, 6148

Located at the entry to the Shelley Primary School

Rare opportunity for medical & allied health professionals

995m2 of land | 190m2 NLA

Reception | 3 consulting rooms | Pathology room

Staff and patient amenities

Kitchen & staff room

Expressions Of Interest

Stephen Harrison 0421 622 777 stephen.harrison@raywhite.com

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

Prominent CBD location

2 storey, heritage listed hotel building

Huge beer garden and entertainment area

Substantial nightclub building and fit out

Securely leased - established tenant

Sale

Phil Zoiti 0419 993 656 phil.zoiti@raywhite.com

RWC WA

raywhitecommercial.com

23 & 26 Sharpe Avenue, Karratha, 6714

The best Thai restaurant in Karratha

Lease: 5 yrs exp Dec 2027

Karratha central location

123m2* restaurant + 27m2* alfresco

$840,000 (Going Concern)

Sale

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

27-29 King Street, Norwood, 5067

Approx 499m2

Flexible floorplan to suit a variety of uses (S.T.C.C).

Ample on site parking

Ian Lambert 0413 155 665

ian.lambert@raywhite.com

Lauren Herman 08 7228 5600

rwcadmin@raywhite.com

RWC Adelaide Asset Management

raywhitecommercial.com

Near new 2 storey post-quake office/showroom building. Well located on an outstanding high profile corner site. Ideally situated to service Shirley, the Central City and the surrounding northern and eastern suburbs. This 728m2* standalone building is split into four separate fully self-contained office areas of 182m 2* each. Unit 1 is leased returning $38,134pa + GST net. Unit 2 (182m2*) and Units 3 & 4 (364m2*) are vacant (total vacancy 546m2*) providing an opportunity for an investor to lease out or an owner occupier to buy and occupy all or part of the vacant area and collect a rental from the leased area(s). Advantaged by good natural light and having a total of 10 onsite car parks. Excellent signage opportunities (subject to any consent). Ideal for tenants, an owner occupier or an investor.