The 2023/24 financial year marked the first year of Ray White’s commercial business rebranding to RWC, and what a year it’s been.

RWC made more than $5 billion in settled transactions in the 23/24 financial year, across more than 4500 sales, with results remaining fairly steady when compared to the same period last year.

The real estate market is currently operating through a period of cautious optimism, despite broader economic instability. Several factors contribute to this sentiment and provide a strong basis for a progressive recovery from the contracted trading volumes the industry has seen over the last few months.

Experienced private capital sits at the forefront of this optimistic recovery and, as a result, we’re seeing RWC businesses that tend to play in the private space posting some amazing numbers, with milestone results for those businesses. The more time I spend in these businesses the more I’m seeing well capitalised private investors with good knowledge re-entering the market and wanting to capitalise on this cycle of the market.

It was a successful year for auctions across the RWC network. Auctions are the lifeblood of Ray White, with more than 120 years of being competition creators. RWC scheduled 456 auctions in the 2023/24 financial year, up 21.9 per cent year-on-year. Clearance rate and bidder numbers held steady when compared to last year, with RWC recording a preliminary clearance rate of 60 per cent and an average of 5.2 registered bidders per auction. Auctions continue to provide the best results for our sellers, with properties which sold under the hammer in the last 12 months receiving premiums an average of 26.7 per cent higher

than the highest offer received prior to auction. RWC’s first June Auction Showcase was a resounding success with more than 60 auctions scheduled for the month, up 103 per cent yearon-year. The June Auction Showcase recorded a clearance rate of 73.5 per cent, with an average of 5.1 registered bidders.

The RWC network continues to grow, as the group welcomed RWC Adelaide, RWC Medical, RWC Retail, RWC Gateway, RWC Ballarat and RWC Central Coast all joining the group in the last 12 months.

While interest rates aren’t expected to be cut in Australia until 2025, interest rate cuts have begun globally with Switzerland and Sweden cutting their interest rates in recent months. This trend is set to see a renewed sense of confidence return to the market, and I expect the 2024/25 financial year will see transaction volumes increase across the commercial market.

I want to thank all of our clients for their support throughout the last 12 months, and we look forward to working together in 2024/25 and continuing to provide you with the best possible service for all your commercial property needs.

James Linacre Head of Commercial

RWC Australia and New Zealand

Hundreds of people tuned in to listen to July’s edition of RWC’s Between the Lines webinar, where our panel of experts discussed Western Australia’s commercial investment market.

Ray White head of research Vanessa Rader hosted the webinar, and was joined by RWC WA joint managing director Stephen Harrison, and RWC WA director of capital markets Brett Wilkins.

“Western Australia has been one of the markets for a number of years now which has outperformed through GSP and the economy when it comes to Australia,” Ms Rader said.

Ms Rader said Perth’s office market had been outperforming other capitals around the nation, with the vacancy currently sitting at 14.9 per cent. She asked Mr Wilkins what he was seeing in the office market in Perth.

“There’s a lot of people wanting to

hop into the market, but you’ve got a disconnect between a lot of vendors and purchasers,” Mr Wilkins said.

“There’s only been two large office sales in the last 12 months. I think that’s going to start to change, you’re seeing some of the owners start to revalue their books.

“There’s plenty of demand out of Singapore and local demand for offices, but it’s just taking a reassessment of values.”

Mr Wilkins said Perth had bucked the work-from-home trend which has been taken on globally.

“The mess that’s happening in Sydney and Melbourne and the US is not happening in Perth,” he said.

“The work-from-home factor is not that strong here, with occupancy still sitting at 85-90 per cent.

“But I do think the office market overall has been tainted by what’s happening in Sydney and Melbourne.”

Mr Harrison said Perth’s office market had already started attracting interest from offshore investors.

“One of the large office transactions Brett mentioned was bought by a Japanese company, whereas we hadn’t seen much interest out of Japan before,” Mr Harrison said. “There is always interest coming out of Singapore.

“Where our problem lies is having assets of which are at a scale that interests them.

“Most of these offshore investors can’t be bothered unless it’s an asset worth more than $60-70 million, and we just don’t have a huge amount of that stock listed over here.”

Mr Wilkins said the Singapore and Malaysia enquiry into Perth was the strongest it’s been since the start of Covid.

“There’s always been strong Singapore interest into Perth, but Covid stopped that for a number of years,” he said.

“The Singapore market is as hot as you can get, but there’s now a lot of private interest back into Perth.

“I think it’s very opportunistic, it’s seen as a good time to buy. There’s always some money that will flow in here because it’s a safe haven.”

Mr Wilkins said there was strong retail interest from offshore buyers as well.

“I sold two large retail properties in Murray Street Mall earlier this year for around $80 million, and while they were both bought locally, a number of the under bidders were out of Singapore and Indonesia.

“They’re also looking at industrial investments, it’s right across the spectrum.”

Mr Harrison said retail centres, particularly neighbourhood centres, had seen strong demand from family investors, syndicates, and interstate investors.

“There have been a number of centres which have sold off-market, and the yields on those centres are still relatively tight,” Mr Harrison said.

“They are seen as a safe haven investment, especially if they are centred around non-discretionary spending with a supermarket anchor, maybe a hairdresser or a liquor store.

“If they are based around non-discretionary spending we are still seeing yields around the 6 per cent range and on the odd occasion even a touch below.”

Ms Rader asked the experts what the outlook for new construction looked like in Western Australia, with construction costs, planning issues, and labour shortages being problems in the past.

“There have been some improvements in planning with the local government completely bypassed now, you just go straight to the state government.

“So planning’s not the big issue now, it’s just construction costs and the lack of tier one builders.

“Construction costs seem to be stabilising, but there’s still the issue of a lot of major builders failing, so if you want to develop a property, who do you actually go and talk to?”

Mr Harrison said it was a bit of a chicken and the egg situation where they need the population to fill the labour shortage, but we need to build the apartments for people to live in.

“We need workers, we need population to build buildings, but unfortunately in a lot of areas high density apartment developments aren’t feasible. It’s only really in areas with high networth demographics that this projects are even feasible.

“So we’ve got ourselves in a situation where we need workers to build buildings, but we don’t have the buildings for them to live in.

“As it stands we have 1500 to 2000 people a week moving into WA, and we don’t have enough room for them as it is. So I’m not really sure where that supply will come from in the future.”

VANESSA RADER Ray White Head of Research

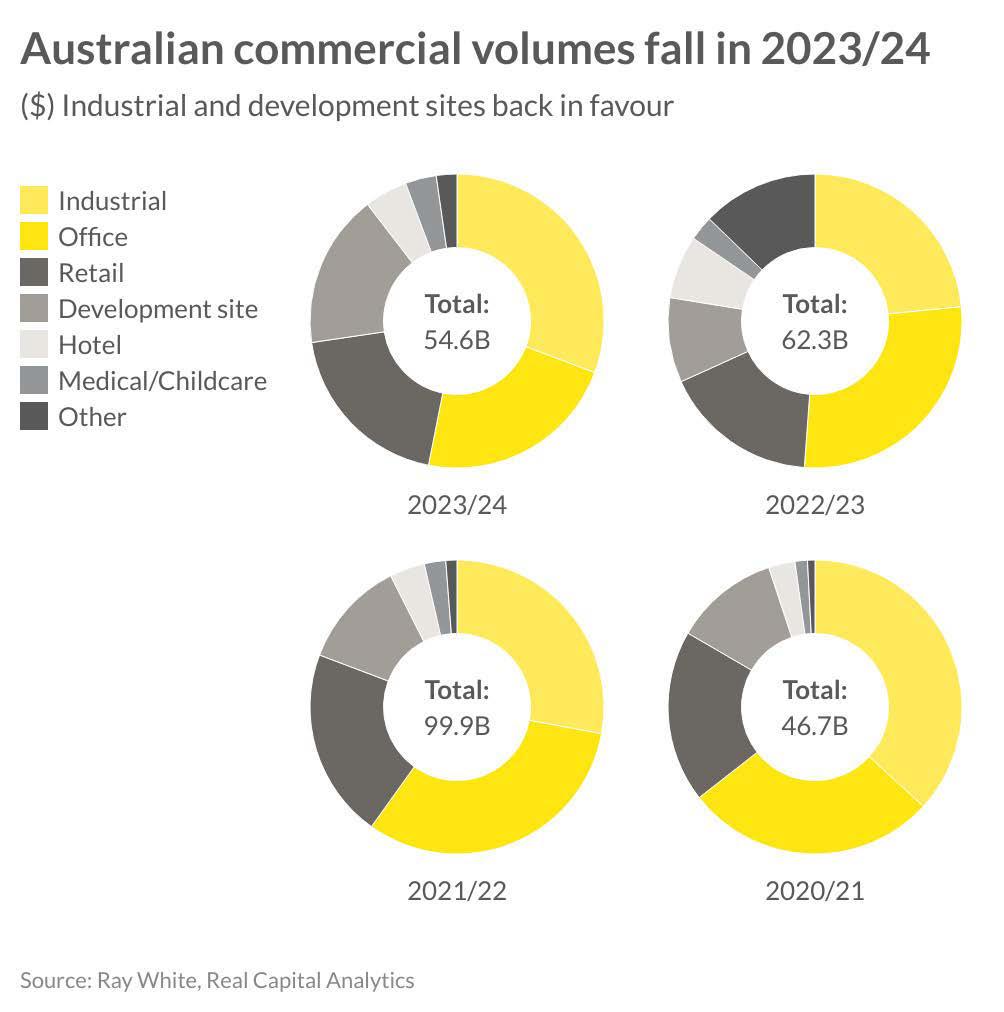

The Australian commercial property market has experienced another difficult year, with total volumes declining by 12.3 per cent to $54.6 billion in the latest financial year. This lacklustre performance comes despite expectations of renewed confidence stemming from interest rate stability and anticipation of potential rate reductions. While yield corrections across most sectors attracted private investor groups seeking improved returns, the persistent gap between vendor and purchaser expectations continued to limit market turnover.

The market’s trajectory over the past few years paints a picture of declining activity. Commercial sales peaked in 2021/22, with nearly $100 billion changing hands. However, this figure dropped sharply by 37.6 per cent to $62.3 billion in 2022/23, coinciding with interest rate increases, before declining further this year. Despite this overall downward trend, certain asset classes have shown growth, indicating shifting confidence levels across various property types.

Industrial property has emerged as the standout performer over the four-year period, particularly during the pandemic. Although the volume of large assets coming to market decreased in subsequent years, the sector has seen significant growth recently. Industrial sales amounted to $14.6 billion (23.5 per cent of total turnover) in 2022/23, increasing to $16.8 billion (30.7 per cent of total sales) in the past 12 months. This growth has been driven by larger institutional sales and an uptick in private buyers, particularly those investing up to $20 million. These investors, both local and interstate, have been attracted by quality yields in a market where new supply remains constrained. Low vacancy rates and promising long-term growth prospects have kept yields competitive in this sector.

Development site activity has also seen a resurgence after years of limited action. The persistent lack of supply, notably in residential and industrial markets, has spurred this revival, with activity growing to $9.3 billion. Increased confidence surrounding construction costs has contributed to this upturn, with strong growth in capital values making many projects more financially viable compared to prior years. This trend is likely to fuel another round of construction activity in some markets, subject to labour constraints.

The retail sector has enjoyed an uptick in activity, particularly during the first half of 2024. A shortage of new supply coupled with continued population growth has sparked a renaissance in this asset class, maintaining high occupancy rates and improving future prospects. Retail sales reached $10.7 billion in 2023/24, slightly up from the previous year, with its share of total turnover growing from 17.1 per cent to 19.5 per cent over the fiscal year.

In contrast, the childcare and medical sectors have experienced change in market activity. After strong interest in recent years, buyers have become more discerning, particularly in the childcare segment. However, welllocated assets with strong covenants remain attractive to private buyers seeking stable returns at competitive yields.

Geographically, the distribution of investment activity has remained relatively steady. NSW continues to lead, accounting for $22.9 billion or 41.3 per cent of total turnover, a slight increase from 38.8 per cent the previous year. Victoria ranks second, representing 26.5 per cent of the market, followed by Queensland, which has consistently accounted for approximately 20 per cent over the past four years. Smaller markets with historically volatile performance continue to show mixed results, with some investors retreating from Tasmania, Northern Territory, and the Australian Capital Territory after strong showings in 2021/22.

While the Australian commercial property market has faced challenges over the past year, the varied performance across different sectors and regions suggests a complex landscape. The industrial and development site sectors have shown resilience and growth, while retail has seen a modest resurgence. However, the overall market continues to grapple with the effects of interest rate uncertainty after higher than expected inflation results, putting a dampener on decision making for many investors as we enter into the 2024/25 financial year.

LETEICHA WILSON

Property Management Performance Specialist

In the world of commercial property investment, the structure of a lease is not just a formality—it’s a critical component that can significantly impact the management and value of the asset. When leases aren’t structured correctly, they can create ambiguity and conflict, leading to unfavourable outcomes for both landlords and tenants. It is imperative for landlords to engage skilled professionals who can provide expert advice on lease structuring to ensure the protection and optimal performance of their investments.

One of the most common areas of conflict in leases arises from unclear clauses regarding repairs and maintenance. When the responsibilities of landlords and tenants aren’t explicitly defined, it can lead to disputes and confusion. For instance, if a lease doesn’t clearly outline who is responsible for maintaining HVAC systems, structural repairs, or common area upkeep, both parties may find themselves at odds when issues arise. This ambiguity can result in costly legal disputes and deterioration of the property.

Another critical aspect of lease structuring is the makegood obligation, which usually requires tenants to return the property to its original condition upon vacating. If these obligations are not clearly defined and condition reports are not conducted at the commencement of the lease, it can exacerbate conflicts at the end of the tenancy. Without a clear benchmark of the property’s initial condition, landlords may struggle to enforce make-good clauses, leading to disputes and potential financial loss.

Engaging qualified leasing agents and property managers is essential to navigate the complexities of lease structuring. These professionals bring a wealth of knowledge and experience to the table, ensuring that leases are crafted with precision and clarity.

Skilled leasing agents understand the importance of detail and clarity in lease clauses. They ensure that all aspects of the lease, from repairs and maintenance to outgoing recovery, are explicitly outlined. This precision helps prevent grey areas that can lead to conflict, providing both landlords and tenants with a clear understanding of their rights and responsibilities.

Leasing agents and property managers provide tailored advice to landlords, helping them structure leases that align with their specific needs and goals. Whether it’s advising on market rents, negotiating favourable terms, or ensuring compliance with relevant legislation, these professionals work to protect the landlord’s asset and maximise its value.

For commercial property investors, the importance of properly structuring leases can’t be overstated. Poorly crafted leases can lead to ambiguity, conflict, and financial loss. By engaging skilled leasing agents and property managers, landlords can ensure that their leases are detailed, clear, and aligned with best practices.

The expertise of these professionals helps to prevent disputes, protect the property’s condition, and safeguard the landlord’s investment. In a competitive market, the peace of mind and operational efficiency gained from expertly structured leases are invaluable. As a commercial property investor, making the decision to work with qualified professionals is a critical step towards securing the longterm success and profitability of your assets.

RWC manages properties across all asset classes right across Australia. Take a look at some of our top managements from across the nation. RWC will have a management specialist located right near your property, so enquire with us today.

UNDERWOOD, QLD

3,040sqm* clear span facility on a 4,926sqm* site with a long term tenant in place. The location offers prime connectivity across SEQ via immediate access to the M1 Pacific Motorway.

TOOWOOMBA, QLD

Multi-tenanted industrial complex set on 1Ha* and features a large warehouse, office, storage and amenities. The site is fully fenced and boasts dual driveways and easy access to major highway routes.

2,443sqm* modern two-storey commercial building strategically located in one of SEQ’s premier business hubs with easy access to M1 Motorway and Brisbane’s inner city, tenanted by a Queensland Government Department.

WARNER, QLD

This exceptional 2,128sqm* freehold property, boasting 750sqm of lettable space, serves as a bustling health clinic with two established tenants occupying the space for over a decade. A testament to stability and community trust, this asset stands as a cornerstone in a high-demand location.

66 Broad Street, Labrador, 4215

•Sub-divide, build townhouses, a unit block or your dream executive home (STCA)

•Existing solid 4 bedroom, 2 bathroom house, live in or easily rent with substantial holding income

•Includes pool, extra living areas, parking for 4 cars or boat caravan, recently painted, modern kitchen, solar panels

•Zoned - Medium Density Residential

•So many options, walk to Broadwater, shopping, schools, close to Gold Coast Hospital / University & Harbour Town

3090, 3094 & 3098 Gold Coast Highway,

return - high density development / investment opportunity

Land area 1,281m2*

Current building area 1,105m2*

Current net income 315K* per annum + GST

Multi-level hotel / highrise development (STCA)

Existing approval for 310m2* over 2 levels on vacant lot

Centre zoning - Surfers Paradise

Portfolio sale - three separate titles in-line

Drift Bar located at 30 Esplanade Bulcock Beach, Caloundra, 4551

Drift Bar, situated on the waterfront at Bulcock Beach, is the heart and soul of Caloundra's bar and nightlife scene.

With consistent trading income across the last six years of current ownership, this well established locally owned business is prime for you to continue to deliver fantastic results in the ever expanding Caloundra market.

•Strong consistent income

•Prime location

•Long term lease

•Fully staffed

•Equipment and stock included

4/4 Kingfisher Drive, Peregian Beach, 4573

Located in a ten unit, two level property within Peregian Beach's vibrant village square, this bite sized investment is leased by one of the area's favourite restaurants.

•50m2* property with food/retail approval

•Inner courtyard location - covered alfresco dining area

•Currently leased to Pitchfork Restaurant which operates in both Shops 4 and 5

•Full height sliding doors to the front

•Rear access

•Current net rental $38,749.96pa + outgoings + GST

•Current 5 year lease term expires 28 February 2028

Two versatile commercial suites for medical, office, and retail tenants

B9 suite (ground floor): 224 sqm at $400/m2 net (outgoings $95/m2)

B5 (level 1): 234 sqm at $400/m2 net (outgoings $95/m2)

George Street features prominent medical and retail establishments

Urraween,

Grant Turner 0457 766 812 grant.turner@raywhite.com

Julie Ryan 0447 445 453 julie.ryan@raywhite.com

4/10-12 India Street, Capalaba, 4157

146m2*(+ 110m2 mezz) warehouse and office unit

Wednesday 28 August, 4pm.

Mezzanine level - 35m2* office and 75m2* storage

Easy access via the container-height front roller door

2 reserved car parks with bollards

Occupied by monthly tenant at $31,879.20 PA + GST

Self-contained amenities Ground floor - 78m2* warehouse and 60m2* office

2 of NLA with potential to add additional NLA

2 of Land Medium Impact Zoning

up renovation complete 2023/2024

up garages for 5 vehicles or additional storage

electrical switchboard & double-glazed windows

as vacant possession with income from cell tower

80 Goondoon Street, Gladstone Central, 4680

•5 Year lease to 31 January 2029 with further options to 2035

•Gladstone Region's sole Westpac Bank on primary CBD corner

•Westpac top 5 ASX listed company with market capitalization $81b*

•Large 1,304m2* site on rare and substantial dual street frontage

•Building NLA 755m2* with 24 valuable on site car parking spaces

•Net income $159,100 pa + GST, outgoings 46.9% paid by Westpac

•Level 1 occupied by Westpac, level 2 vacant contains modest fit-out

30B Warwick Street, Harristown, 4350

Land area: 964 square metres* Building/floor area: 4000sqm*

•Tenanted investment opportunity: long-term lease in place providing stable returns

•Land area: 964sqm*

•Building area: 400sqm*

•On site car parking: ample parking space for staff and clients

•Proximity to CBD: conveniently located near the central business district

•Professional offices: suitable for a variety of professional services

•Fully air-conditioned: ensures a comfortable working environment

•Staff amenities: equipped with high-quality facilities for staff convenience

15A Aplin Street, Cairns City, 4870

For only the second time in 38 years a rare opportunity to purchase a fully tenanted CBD mixed use property.

•Cairns CBD commercial/residential

•3 storey freehold building

•Tightly held position showing excellent return

•Land size 97sqm | net lettable 206sqm

•Level G: retail, the renowned Cairns Burger Café

•Level 1: residential, 2 bedroom apartment

•Level 2: residential, 1 bedroom apartment

An inspection is a must and will confirm the long-term viability of this site. Please contact Helen or Susan for further information. Inspections are strictly by appointment only.

Sale

$765,000

Tenanted investment

ROI 7.4%

RWC Cairns

raywhitecommercial.com

Helen Crossley 0412 772 882 helen.crossley@raywhite.com

Susan Doubleday 0408 038 380 susan.doubleday@raywhite.com

9 Hargreaves Street, South Cairns Business Park, Edmonton, 4869

RWC Cairns is proud to be the exclusive agent to market this property for sale. Vacant possession.

This property is ideal for any business that requires high visibility, security, and hardstand. It is located in the South Cairns Business Park in Edmonton and provides excellent visibility as it backs onto the A1 Bruce Highway.

Land size: 1,147sqm

Industry zoning: medium impact

GLA: 928*sqm

Showroom: 266*sqm

Office: 12*sqm

Kitchen/lunchroom: 12*sqm

Warehouse floor area: 335*sqm

Mezzanine floor area: 298*sqm

Sale

$1,400,000

Vacant possession

Grant Timmins 0422 534 044 grant.timmins@raywhite.com

828

Josh Jones 0499 773 788 josh.jones@raywhite.com Marc Zietsman 0412 047 026 marc.zietsman@raywhite.com

Ben Sands 0432 547 164 ben.sands@raywhite.com 0488 113 270 teamsands@raywhite.com

Franz Stapelberg 0430 655 676 franz.stapelberg@raywhite.com Nicolas Milner 0416 433 217 nicolas.milner@raywhite.com

10/47

2

Emily Pendleton 0402 435 446 emily.pendleton@raywhite.com

Christine Freney 0417 757 645 christine.freney@raywhite.com

277 Brisbane Road, Monkland, 4570

Cory Hoy 0421 004 484 cory.hoy@raywhite.com

Fraser Martin 0423 273 438 fraser.martin@raywhite.com

• Air-conditioned

•

• Join neighbouring tenants such as Petbarn, Officeworks, BCF, QML Pathology & Greencross Vet Clinic

Level 1, 441 Kent Street, Sydney, 2000

The Carla Zampatti Building is a truly unique warehouse office building located in the western corridor of Sydney. There is basement parking, bike racks and showers. Tenancies feature polished timber floors and brick walls.

•Warehouse offices with creative fit out

•Stylish front of house, consists of 56 desks

•Exposed timber ceilings, ironbark columns

•Large timber windows facing east over Kent Street

Suite 1801/25 Bligh Street, Sydney, 2000

Bligh Chambers offers modern premium office space with hotel-style end-of-trip facilities in the heart of Sydney’s financial district. Tenants can also enjoy exclusive use of the building’s squash court, gym and end of trip facilities. 3.5-star NABERS energy rating.

•Take advantage of this beautiful high quality fitout

•Presents as new with no expense spared

•Sublease or new direct longer lease from 3 years

•Prime position on Level 18 with direct lift exposure

•Front of house w/ 10-12p boardroom, 10 workstations

•5-6p meeting room, 6 glass offices, full kitchen

•Timber floors, exposed ceilings and premium finishes

Suite 102, 66 Clarence Street, Sydney, 2000

66 Clarence Street is an 11 level office tower on the corner of Erskine Street and Clarence Street. The building features end of trip facilities and parking in the basement. 4.0 star NABERS. The top 2 floors provide coworking spaces.

•Walk into this fresh, bright new spec fitout

•Large reception, 4p meeting room, 6-8p boardroom

•Collab desk for 8 staff, 2 focus rooms, 26 workstations

•Large kitchen with breakout area and cafe seating

•Features exposed ceilings and polished concrete floors

Townhouse CC lodged

Zoning: R2 Low Density Residential

Height limit - 9m

3.7km* to Schofields Town Centre

375 Gardeners Road, Rosebery, 2018

Auction Tuesday, 20 August 2024 at 10:30am (AEST)

AuctionWORKS, Mezzanine level, 50 Margaret Street, Sydney

Land size: 152sqm*

Internal area: 120sqm*

Current rental return: $34,137 (excl GST) per annum*

Open plan showroom leased to a flooring company

Potential for long-term investment or owner-occupancy

Excellent access to bus and rail networks

Close to shops, cafes and restaurants on Gardeners Road

Samuel Hadgelias 0480 010 341 shadgelias@raywhite.com

Steve Pappas 0438 355 555 steve@firmstonepappas.com.au

RWC SC

raywhitecommercial.com

104 & 104A Swanson

Mortgagee in possession

Land size: 202sqm*

Internal Area: 240sqm*

2 x commercial premises with excellent street frontage and foot traffic

2 x 2-bedroom residential apartments with separate rear/side access

Blank canvas with potential for repositioning or redevelopment^

350m* to Erskineville Station and 1km* to Newtown Station

Auction

Wednesday 7 August at 11:00am (AEST)

Ray White Corporate, Level 7, 44 Martin Place, Sydney

RWC SC

raywhitecommercial.com

Samuel Hadgelias 0480 010 341 shadgelias@raywhite.com

Baxter van Heyst 0447 113 025 baxter.vanheyst@raywhite.com

*Approx ^Subject to Council Approval

45 Thomson Street, Kiama, 2533

CDC approved for architecturally crafted 4-bedroom duplex homes

Designed by renowned architects ARQUERO

Site area - 847sqm*

FSR - 0.7 : 1

100m* to newly built Kiama Shopping Centre R3 development siteapproved for

100m* to Kiama Public School

800m* to Kiama Train Station

Auction Monday 19 August at 6pm (AEST)

Uniting Church, 48 Manning Street, Kiama

RWC SC

Leslie (Yifu) Li 0403 261 752 leslie.li@raywhite.com

Jayden Bennett 0435 715 829 jayden.bennett@raywhite.com

260 Edmondson Avenue, Austral, 2179

Key property features:

•Significant 2,555sqm* land parcel

•Zoned B1 Local Centre

•Unique development approval, innovative mix use design by ARKI-vis

•Mixture of 25 x two bedrooms and 18 x one bedrooms/studio

•862sqm* of retail/commercial space

•30m* frontage to Edmondson Avenue, prime investment opportunity

•Directly across from Coles Property Group's latest acquisition for future development

•Significant service oriented development projects such as childcare, medical centre, and shopping precinct under construction in close proximity

95 Burwood Road, Burwood, 2134

Key property highlights:

•Established and diverse income stream from 3 longstanding tenants, generating annual net passing income $308,695+GST*

•Freehold investment zoned MUI Mixed use

•Huge development opportunity - 60 metre height limit4.5:1 FSR ^

•Distinguished corner position in highly sought-after Burwood retail strip, nestled between Burwood Westfield and Burwood Train Station

•Open hard stand car park for three cars at the rear of the premises

115 Queen Street, Berry, 2535

Expressions Of Interest

Closing Thursday 29 August at 4pm

RWC Greater Sydney South along with Ray White Berry proudly presents 115 Queen Street, Berry NSW 2535 for sale via Expression of Interest. An exceptional opportunity is available for the first time in over 60 years to purchase this freehold property located in the centre of Berry's bustling town centre.

Additional highlights of the asset include:

•373.1m2* parcel of land

•Current net income of $204,676.02*

•Freehold opportunity - 5 specialty shops

•High exposure to Queen Street

•Located in the heart of the Berry Town Centre

Brad Lord 0439 594 121 blord@raywhite.com

Shane Hilaire 0401 691 790 shane.hilaire@raywhite.com

RWC Greater Sydney South

raywhitecommercial.com

16 Chapman Street, Werrington, 2747

•Serviced and benched lots ranging between 2,160sqm to 9,146sqm*

•All lots provided with DA approval for warehousing & offices

•E4 General Industrial zoning providing for a range of users

•Maximum building height: 12.5m*

•Excellent connectivity via Great Western Highway, M4 Western Motorway & A9 The Northern Road

•Moments from Werrington Train Station, Western Sydney University, Nepean Hospital, St Marys Town Centre & Penrith CBD

•Ideal for developers, occupiers & investors

•Excellent long-term investment & capital growth prospects

1/34 Geelong Street, Fyshwick, 2609

1960's two-storey, double-brick building

Two-level unit; 270sqm* ground + 270sqm* first floor

400sqm* hard-stand

Renovated interiors throughout

Restored hardwood flooring

High clearance ceilings

Zoning: IZ2: Industrial Mixed Use Sale $2,275,000 excl. GST

Frank Giorgi 0403 839 822 frank.giorgi@raywhite.com

Piette Roberts 0484 947 693 piette.roberts@raywhite.com

888 Nicholson Road,

Of Interest Closing 13 August at 2pm AWST

6,584m2* large format retail centre on a 1.42ha* site

Excellent exposure at a busy intersection

Fully leased net income $1,436,390pa

Woodley-Page 0438 939 869

Wilkins 0478 611 168

Long term leases to Dan Murphy's and Revo Fitness

Diagonally opposite Livingston Marketplace WALE of 4.66 years by income

Of Interest Closing Thursday 29 August 2024 at 2pm AWST

A regular shaped site of 7.98ha*

750m* from North West Coastal Highway

2.5km* to coast and Glenfield/Drummond Cove

9.5km* to Geraldton Town Centre

Zoned Rural Residential

The site is unimproved, level and cleared

Elevated position - stunning river views

Convenient to central CBD - free public transport

Michael Milne 0403 466 603 michael.milne@raywhite.com

Stephen Harrison 0421 622 777 stephen.harrison@raywhite.com High-grade exclusive amenities

178

•Total land area | 244m2*

•Total building area | 148m2*

•One (1) car space at rear

•Rear access via R.O.W

•Allocated visitor parking in front

•Irreplaceable position at the intersection of Warrigal Road and North Road

•All major arterials and conveniences at your doorstep

•Located 2km* from Chadstone Shopping Centre & 14km* from Melbourne's CBD

•Commercial 1 Zone (C1Z)

RWC Oakleigh

raywhitecommercial.com

George Kelepouris 0425 798 677 george.kelepouris@raywhite.com

Anthony Anastopoulos 0488 095 057 anthony.anastopoulos@raywhite.com

Bayside investment | sideby-side commercial premises on Nepean Hwy

•Two properties on one title

•Potential Income (fully tenanted) | $85,500 p/a net*

•Total land area | 458m2*

•Combined building area | 247m2*

•Double frontage | 11m*

•Rear access with 7 car spaces

•Commercial 1 Zone (C1Z)

394-395 Nepean Highway, Chelsea, 3196 Sale Private Sale

Ryan Amler 0401 971 622 ryan.amler@raywhite.com

33 & 39 Mckinney Road, Warkworth, 0981

33 & 39 McKinney Road, Warkworth, is offered for sale via tender closing at 4 pm, 28th August 2024 (unless sold prior). The purchase price will be plus GST (if any).

Key Features

•3.85 ha (more or less) in two fee simple freehold titles.

•Approx 232m of road frontage

•AUP - mixed housing suburban zone

•Live zoned and development ready

•Subdivision supplementary information available