STUDENT MANAGED INVESTMENT FUND REPORT

With the generous resources provided by donors of the Student Managed Investment Fund and the Cabot Wealth Management Laboratory, Bertolon School of Business students have the resources to manage real financial dollars in their investment portfolio. Students are able to expand their education beyond the classroom into the real world through this practical hands-on learning experience.

On behalf of the program’s participants—past, present and future—we want to express our appreciation to the following donors and companies for making this valuable opportunity possible:

Rob and Rachel ’98 Lutts

Mario Gabelli and Regina Pitaro

Rob and Rachel ’98 Lutts

Mario Gabelli and Regina Pitaro

Update from Associate Professor Sanjay Kudrimoti 3

Update from Associate Professor Sanjay Kudrimoti 3

The Student Managed Investment Fund at Salem State University gives finance students experiential learning opportunities in portfolio management and the investment management process. It is made up of two endowed funds: the Rob and Rachel Lutts Student Investment Fund and the Mario J. Gabelli Student Investment Fund.

Founding donors, Rob and Rachel ’98 Lutts believe in the power of providing finance students with experiential learning opportunities in portfolio management and the investment management process. They created the first fund to be managed by students at Salem State providing annual scholarships for Bertolon School of Business students. We are thrilled that the first student investment fund scholarship has been awarded for Academic Year 2022-2023.

Joining that same vision, Mario Gabelli and his wife, Regina Pitaro grew the endowment substantially in 2021 when they created the Mario J. Gabelli Student Investment Fund with their generous $250,000 gift. Their support will make it possible for more students to get practical hands-on experience in investing and increase the number of student scholarships awarded each year in perpetuity.

In their investment courses, offered through the AACSB-accredited Bertolon School of Business, students enrolled in the Advanced Financial Analysis course are given the responsibility of managing the Student Managed Investment Fund. They take on the roles of portfolio manager, chief analyst, student trustee, and analyst, analyzing and investing designated funds into a variety of securities. Students are trained in the use of Bloomberg Terminals to analyze financial and non-financial information and make recommendations for investment of the fund. Students write analyst reports and present their research and recommendations to an audience of community members. This experiential learning not only helps deepen student understanding of business and financial concepts but also sharpens their critical thinking, analytical, technical, and written and oral communication skills.

Since the endowment’s creation in 2019, student participation has evolved from a directed study course to a course required of all finance concentration students. Professor Sanjay Kudrimoti teaches students the concepts related to financial decision making and value creation and engages them in the use of Bloomberg terminals for information extraction and data analysis. Advanced Financial Analysis (Finance 468) has students use the Student Managed Investment Fund in real practice, helping to implement the process for investing the funds, guiding research and investment activities and enriching the student experience through active hands-on learning.

The idea for the course came from Bertolon School of Business alumnus, Joel Surette ’19, and his classmates in the university’s Finance Club, who took the lead on developing the framework for the fund.

The pilot innovation fund course, Individual Projects in Business Administration (Business 498), launched in the spring semester of 2019 with 10 business students enrolled and Salem State Accounting and Finance Professor Sanjay Kudrimoti leading the class. While the course was initially designed for students to discuss concepts and research business for investments, the goal of the new course is for students to create returns on the fund, therefore growing the assets to have more to invest and ultimately creating scholarships for students. Since it launched in 2019, more than 50 students have taken the course and have gone through the experience of managing a portfolio.

While the intent is to invest with a growth mindset, students also make sure that there is always some cash for the next set of students to invest.

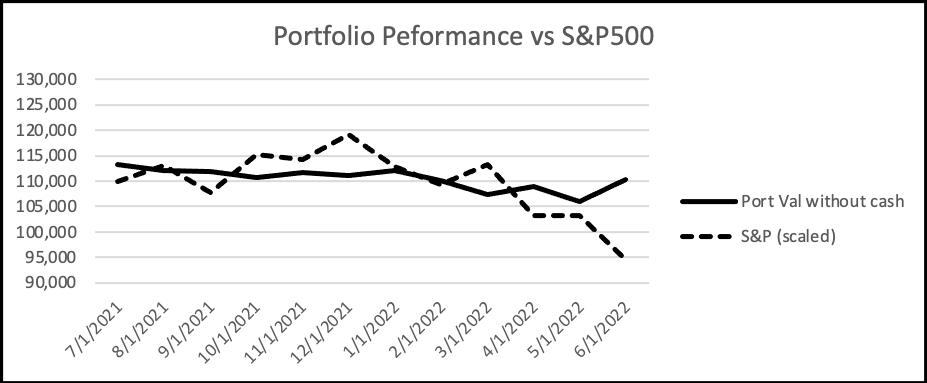

On September 1, 2021, at the start of the 2021-22 academic year, Dow Jones Industrial Average (DJIA) closed at 35,312.53 (S&P 500 was 4,524.09). DJIA set an all-time high record on January 4, 2022, at 36,799.65 (on January 5, 2022, its intraday high was 36,952.65) (S&P 500 4,818.62). As of June 30, 2022DJIA is 30,781.00 (June 17, 2022 DJIA closed at 29,806 its most recent low) (S&P 500 3,789.50). Based on the numbers above DJIA is down 12.83 percent (S&P 500 is down 16.24 percent) over the span of the academic year and the indices are down 16.70 percent and 21.36 percent respectively from their corresponding highs. A bear market is defined as an index like the DJIA or S&P 500 falling 20 percent or more from a recent high for a sustained period. Since 1928, the S&P 500 has experienced 26 bear markets.

Discounting for the bear market that occurred at the start of the pandemic (February 19, 2020 – March 23, 2020) when the markets had dropped 33 percent from their respective highs, the previous bear market was observed in early 2009. Between January 6, 2009 and March 9, 2009 the market lost 27.62 percent of its value. The students of the class of 2021-22 were most likely in elementary school (with their ages being between 8–10 years). So, for all practical purposes, this group of students was experiencing market breakdowns for the first time.

It was commendable that students with their readings and research had a good handle on the markets and were extremely cautious with their recommendations when it came to buying new stocks. Student Managed Investment Fund (SMIF) grew, thanks to the generous donations from the school’s supporters. As of June 30, 2022, the portfolio value stood at $389,469.12 of which 76.9 percent of the value was in cash. 23.1 percent of the portfolio ($89,915.52) was invested in 27 securities (25 stocks, one equity ETF and one bond ETF). The investment amounts ranged from $550 (Activision Blizzard Stock) to $7,177 (Intuit, Inc). The investments spanned multiple industries belonging to a wide spectrum of sectors. The range of sectors included – Communication Services, Consumer Discretionary, Consumer Cyclical, Manufacturing, Healthcare, Industrial, Financials, and Information Technology.

As always, the goal of SMIF is capital preservation along with capital appreciation, so while the students primarily focused on asset allocation strategy thus creating a welldiversified portfolio, because of the current extraneous circumstances they also were focused on market timing. The beta values for the existing portfolio ranged between a minimum of 0.24 to a maximum value of 1.86 and the portfolio beta is 1.02.

Calculations made as of June 30, 2022, indicated that the SMIF portfolio had a -7.93 percent return on its invested amounts while the fund is cash rich with 77 percent of its total holdings in cash. Given the bear market conditions, SMIF is in a relatively healthy position.

Going forward, students will also be advised to scrutinize the portfolio and think as a sell-side analyst and to recommend if any stocks should be sold to capture the profit or to rebalance the portfolio.

Students of the Finance Seminar class (Finance 469) researched extensively on Mutual Funds and ETFs and have made a joint recommendation for one Mutual Fund and one ETF. A small portion of the SMIF will be used to execute trades on their recommendations in the near term.

Sanjay Kudrimoti Associate Professor, Accounting and Finance Advisor to Student Managed Investment Fund

Fredy was born in Colombia, Ibague and migrated to the US in 2003. His interest in business and finance began when he was given the opportunity to manage a social enterprise for a nonprofit in 2019. He is currently the Social Enterprise Manager for the Haven Project Inc., located in downtown Lynn. He oversees a cafe that is run for profit and a job training program that hires homeless young adults ages 17-24. The position has introduced him to real-life management of business finances, employees and grants. With his current work experience and knowledge gained from SSU he hopes to continue working in the non-profit sector and apply entrepreneurial/financial ideas to improve services.

Bruno currently works for Bank of America as a Financial Center Manager, a position he’s held since 2018 earning him multiple awards, including the prestigious Pinnacle Summit Award in 2019. While performance-driven, Bruno’s management style focuses on individual strengths and human behaviors to achieve the best results. Fluent in Portuguese and Spanish, Bruno hopes to make a greater impact in the Latino community through financial literacy support.

Riley first started her undergraduate degree in 2012 at George Washington University. While taking a few years away from academia, she worked as a Realtor with Keller Williams Realty. She returned to Salem State to finish her undergraduate degree in 2019. She was surprised with how much she loved her introductory level finance courses and decided the corporate finance and accounting concentration would be an excellent base to start her career. She hopes to combine her knowledge in the business field with a law degree and enter the corporate legal field. Riley is currently attending Suffolk Law School.

Taylor started her career at a notable law firm in Boston, where she managed a broad range of administrative and client servicerelated responsibilities. She went on to work as an associate at a successful investment firm, where she provided operational and administrative support. Taylor decided to pursue a degree in finance because of the notable disparity of resources for women and individuals with low incomes attempting to navigate the world of finance. She plans to use her knowledge of personal finance to further educate the low-income and female population on opportunities that will serve their future. Taylor is also a member of Tomorrow’s Women Today which is a non-profit organization for women in Boston. Taylor is working as a Digital Operations Analyst at National Grid.

During the 2022 Spring semester, there was an additional cash infusion which will be invested in Fall 2022. For a cleaner comparison with S&P500, the portfolio value above is shown without the inclusion of this additional cash. Despite the overall downturn in the stock market as evidenced by S&P500, the portfolio performed much better.

Activision Blizzard

Communication Services

ATVI $77.86 $55.01 10 41.34%

Verizon Communication Inc Communication Services VZ $50.75 $57.18 25 -10.42%

T Mobile US, Inc Communication Services TMUS $134.54 $119.24 15 14.84%

Visteon Corporation Consumer Discretionary VC $103.58 $101.41 40 12.54%

Alibaba Consumer Discretionary

BABA $113.68 $201.70 6 -50.85%

Darden Restaurants Consumer Discretionary DRI $113.12 $148.27 35 -15.32%

Ford Motor Company Consumer Discretionary F $11.13 $20.33 250 -42.39%

General Motors Consumer Discretionary GM $31.76 $35.22 125 7.31%

Generac Holdings Industrial GNRC $210.58 $215.19 25 33.17%

CVS Healthcare CVS $92.66 $74.77 32 27.55%

Johnson & Johnson Healthcare JNJ $177.51 $168.73 30 5.12%

Pfizer Inc Consumer Discretionary PFE $52.43 $34.02 50 56.97%

Regeneron Pharmaceuticals Consumer Discretionary REGN $591.13 $625.73 10 -2.95%

American Airlines Group Inc Industrial AAL $12.68 $18.28 250 -10.83%

Jacobs Engr Group Inc Industrial J $127.13 $137.39 35 -0.41%

Intel Corp Information Technology INTC $37.41 $41.72 50 4.27%

Dell Technologies Information Technology DELL $46.21 $55.96 90 -10.26%

Advanced Micro Devices, Inc Information Technology AMD $76.47 $91.58 30 15.89%

Mastec Inc Information Technology MTZ $71.66 $62.28 38 36.01%

Tencent Holdings LTD Information Technology

TCEHY $45.16 $49.46 30 -5.62%

Spotify Technology S.A Information Technology SPOT $93.83 $146.38 8 -24.00%

Intuit Information Technology INTU $385.44 $358.92 20 14.19%

Union Pacific Industrial UNP $213.28 $216.18 25 3.84%

Prologis

Financials PLD $117.65 $118.61 40 7.70%

PG & E Utilities PCG $9.98 $12.10 400 0.91%

I Shares Global Clean Energy ETF Equity Fund ICLN $19.05 $26.20 50 -20.99%

PIMCO Active Bond ETF Fixed Income Funds BOND $95.25 $108.15 50 -10.70%