FROM THE CHAIRMAN

Dear Owner

It has been a pleasure serving our Community for the year 2021, and an even greater pleasure to present the 2021 Annual Report.

Once again, The Sandyport Community made it through another difficult year with great success. We continued to experience the ups and downs of the pandemic; however, we managed to stay united and focused on the further development of our Community. We are grateful to all residents and owners who continue to be understanding and supportive during these challenging times.

In 2021, we worked feverishly on major projects to enhance our Community and we are pleased with the completion of several of these, including the refurbished tennis courts at the main entrance and the two new dog parks with special socialization areas for owners and other residents. Additionally, our Sandyport Drive and Roberts Isle recreational parks were both given a facelift and new additions, and the beloved Phase 5 Gazebo was upgraded with new decking and a fresh coat of stain. Also, in an effort to keep the Community as green and lush as possible, several locations throughout were treated to new trees and vegetation.

As our projects are ongoing, many will continue into 2022, namely the sewer plant expansion, the road paving of the entire Community, and the walk-path construction. In keeping with the standard of the Community and the restrictive covenants, we have successfully removed all commercial vehicles and vessels from the Sandyport Community. We continue to strengthen our security measures for the protection and well-being of our owners and residents. With no reports of security breaches for the year 2021, our security system and best practices continue to prove that we have the right systems in place to ensure a safe and secure Community.

ROGER SEIVRIGHT Chairman since 2019 Sandyport Homeowners Association Ltd.2021 also saw a tremendous increase in our Community development with the sale of a number of lots. As a result, we welcomed the addition of five beautiful new homes. This kind of investment in the Community, particularly during a pandemic, is both exciting and encouraging for property value.

Unfortunately, due to the pandemic restrictions, we were not able to host our annual Community social event. We hope that 2022 represents a return to normal and that we may go back to hosting these types of events.

In closing, I would like to thank you for your continuous support of and love for our Community. There is an unmeasurable amount of evidence that boasts the work we have completed over the years. I extend my appreciation to my fellow directors for their support and for continuing to give their knowledge and expertise to serve the needs of the Community.

The future is looking bright!

2 FROM THE CHAIRMAN

4 OUR BOARD OF DIRECTORS

5 MANAGEMENT TEAM

6 OPERATIONS SUMMARY 1

OUR BOARD OF DIRECTORS

CHOSEN BY YOU TO SERVE OUR COMMUNITY

Our Articles of Association requires that a Board of 7 volunteer Directors each serve a term of 2 years. Every year at least 3 Directors’ tenure comes to an end and we vote at our Annual General Meeting to elect their replacements. Former Directors may be re-elected.

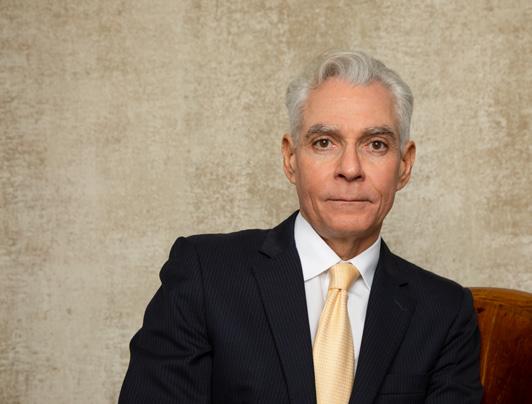

Chairman

Re-elected 2021

Treasurer

Elected 2020

Elected 2020

Director

Re-elected 2021

Re-elected 2021

Secretary

Re-elected 2020

roger seivright

Antionette Turnquest

Costantinos Berdanis

MICHELE MOODIE

craig lines

roger seivright

Antionette Turnquest

Costantinos Berdanis

MICHELE MOODIE

craig lines

OPERATIONS SUMMARY SECURITY

Sandyport Community thrives to be a safe and well-secured community, as we did not experience any security breaches for the year 2021. We have continued to use the dog patrol within sensitive areas, heightened security at all entry points, and added additional wall spikes at Jacaranda Close boundary wall. Also, we enhanced our perimeter lighting and upgraded existing security systems to continue our vigilance throughout the Community.

COMMUNITY PROJECTS

The continued projects that began in 2021: The renovation of the two main entrance tennis courts, the enhancement of the recreational parks, the creation of the two new dog parks, and the marina and board walk refurbishment, are all completed.

The Community projects to begin in 2022 are the road paving of the entire Community, the main entrance walk path, the expansion of the sewer plant (done by Water Mark and Plummer Engineering Ltd out of Sun City, Florida) Due to a significant increase in sewerage usage, the sewerage tanks have reached their maximum capacity, thus the reason for this much needed improvement. To bring these projects into fruition, should the Association require a special assessment, management will notify the homeowners in advance of the associated cost. The importance of completing these projects cannot be ignored. We must continue to keep our Community functioning properly.

maintenance division

The Community continues to be well kept, along with ample street lighting, clean roads, with physically enhanced parks and buildings kept in pristine condition. We continue to witness our Community looking beautiful, but who keeps it all together? The answer is our maintenance team. Sandyport Community's longest serving employees are: Mr. Orpheus Ingraham and Mr. Daron Taylor of the maintenance department, have been serving the Community for over 25 years. These men, filled with vast knowledge of this Community, are proud of how the Community has grown. Over the years, their passion have led to the implementation of new features and enhancements for the Community.

Daron, who joined the Sandyport maintenance team as a young professional, is a walking encyclopedia of Sandyport's history, and he is a valuable asset to the community. He understands the mechanisms of how everything should operate. He has vast knowledge and skills with electrical, plumbing and the water and sewerage operations of the community.

Daron has become an ambassador to the residents, as his knowledge and experience assists residents' understanding of the Community's physical landscape, and operational rules and procedures.

Orpheus, the maintenance team's manager, is one of the most kind and thoughtful employees of the Community. When conversing, he listens intently and gives excellent feedback regarding various contributions to the management of the Community.

"Keeping our Community looking beautiful is what we do!"

painters | "PASSION FOR PAINTING"

When you want passionate and professional service, Louis Joseph Painters are very reliable and efficient. Louis Joseph Painters has provided the Community with their exceptional service since 2001. Owned and operated by Mr. Louis Joseph, affectionately called "Louis", Louis has the humblest personalities in the Community. The care and dedication that Louis Joseph Painters put into their service is outstanding. The painters go the extra mile to ensure the Community's owners and residents are pleased with their service.

waste treatment plant

A TIME TO EXPAND

The waste treatment plant in its current state is functioning and providing the Community with good results. However, due to the recent and ongoing addition of new buildings and homes within the Community, the waste treatment plant needs to expand. Currently, the waste treatment plant's capacity utilization rate is 100%. To operate efficiently and effectively for our Community, the plant's usage must be reduced and maintained at 75% or lower.

Management has been working feverishly since November 2021 with Water Mark Engineering Group and Plummer out of South Florida to craft a plan for the waste plant to meet the Community's current and future needs. A full assessment of the plant was completed and a draft was received with several analysis reports to support the expansion project. We have had several meetings and discussions with relative parties concerned on the expansion of the plant. We can say with confidence that this project is fully supported by all parties concerned.

The waste treatment plant expansion project has been deferred to 2022. However, the management team is continuously working by maintaining the proper operation of the existing tanks, lift stations, and pumps until the commencement of the expansion. The sewer systems are maintained by only two gentlemen: Mr. Charles Cooper and Mr. Kentraniqueo McIntosh, who are excellent at performing their duties.

The present condition and functioning of this system are due to Charles' and Kentraniqueo's efforts and combined 14 years of experience. Their professionalism is beyond exceptional, especially when troubleshooting all challenges that arise with the sewer systems. We salute Charles and Kentraniqueo for their outstanding service in the Community.

Landscape REPORT

We have contracted the services of Caribbean Landscape for the past six years. The Sandyport Community is pleased with their performance and continues to work closely with them to strengthen their relationship with the needs of our residents. What we see in the Community is a result of Caribbean Landscape strength and agility when it comes to reorganizing their team and the expertise that they bring as a company.

In 2021 we saw a change in their management which welcomed Rashad Strachan. Rashad is full of youth, experience and innovation. Having an extensive career in horticulture, Rashad was brought here to now manage the Sandyport landscaping team. He has a rather shy character but one thing for sure, he gets the job done. I see a great future for Rashad here. Let’s continue to welcome him to the team.

We still have our beloved Oliver here with us. Oliver name reigns throughout the Sandyport Community. Almost all the residents ask for Oliver. Oliver knows every property, every resident, their specific requests, and their dislikes when it comes to their landscaping. This makes our residents feel special and that is what we are looking for in this Community. We want our residents to have confidence that the Caribbean Landscape team here in Sandyport can do the job.

We salute this fine team of who passionate and agile in their skills fine grounds men Thank

TREASURER’S REPORT

This year we see a ray of hope. The pandemic is still present but its effect is diminishing. Because many projects were completed in 2021, we have had no surplus this year.

In comparison to 2020’s revenues of $3.56M, 2021’s revenues increased by 1.51% to $3.62M. Other services revenue, which is comprised of new construction fees, new carport fees, decals, etc. increased from 2020’s amount of $97.67K to 2021’s amount of $113.1K, an increase of 15.79%. In addition, 5 new homes were constructed. The table below shows the change in homes, lots and those under construction compared to the previous year.

With an increase of 1.22% in Water and Meter revenue, Management was able to reduce Waste Water Management cost by 7.5% and the Waste Water System Cost from 2020’s expenditure of $110.2K to 2021’s expenditure of $47.1K, a reduction of 57.24%. Also, the Association’s security expenses decreased by 12.55% from 2020’s expenditure of $1.08M to 2021’s expenditure of $951K.

For the year 2021, improvement costs increased by 21.15% to 302K. The Association focused on refurbishing of the entrance tennis courts, the recreational parks, creating two new dog parks, and the marina and board walk. Our bad debt provision in 2020 showed a balance of $91K and a balance of $79K in 2021, which is a decrease of $12K.

YEAR ON YEAR CHANGE

*SQ. FT. amounts were Quick Books amounts

2021 BOARD MEETINGS

2022 FINANCIAL Budget

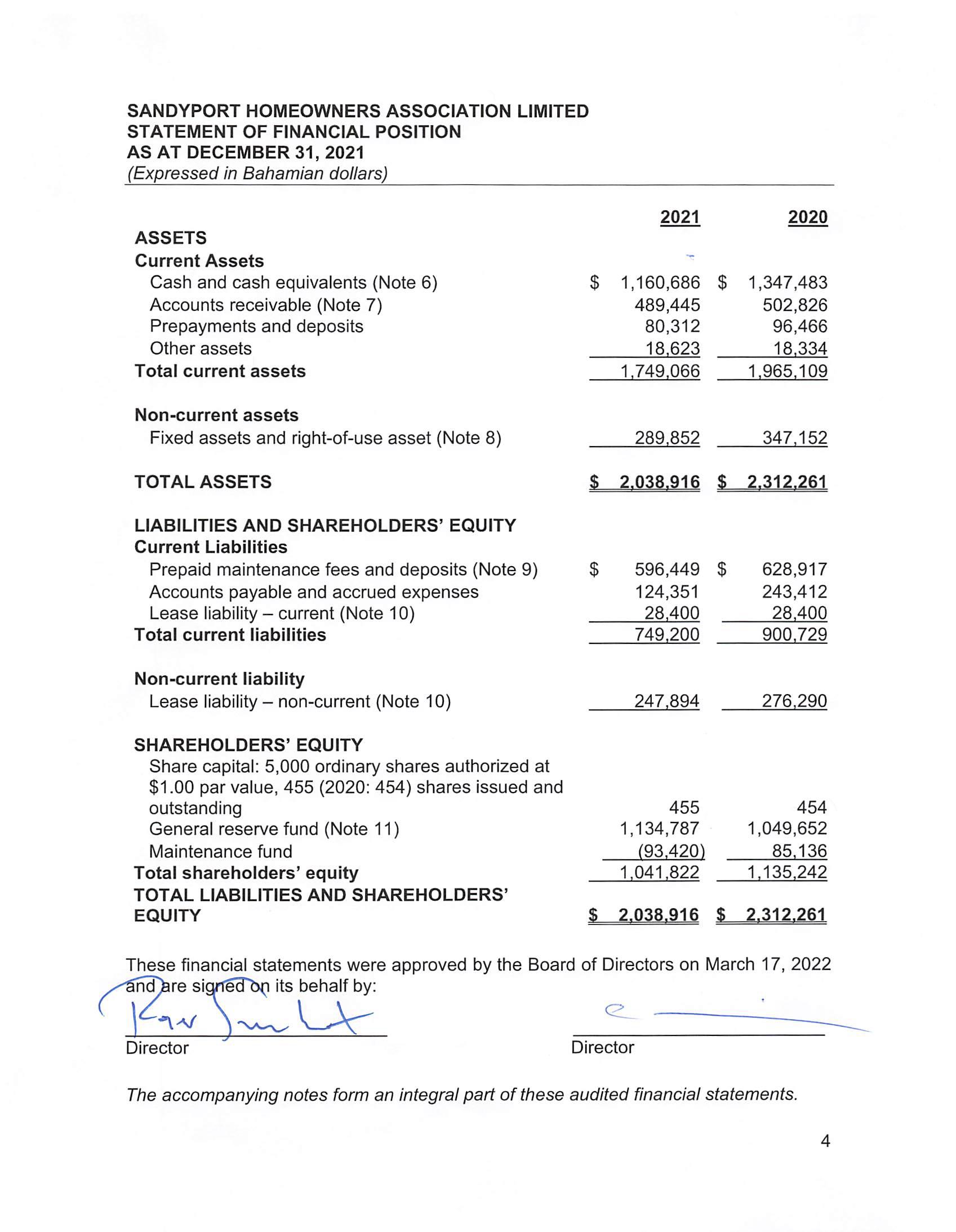

FINANCIAL STATEMENTS

AUDITED FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 AND INDEPENDENT AUDITORS’ REPORT OPINION

We have audited the accompanying financial statements of Sandyport Homeowners Association Limited (the “Homeowners Association”) which is comprised of the statement of financial position as at December 31, 2021 and the related statements of maintenance fund, changes in equity and cash flows for the year then ended and a summary of significant accounting policies and other explanatory information.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Homeowners Association as at December 31, 2021, and its financial performance and its cash flows for the year then ended in accordance with International Financial Reporting Standards (“IFRSs”).

BASIS FOR OPINION

We conducted our audit in accordance with International Standards on Auditing (“ISAs”). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the audit of the financial statements section of our report. We are independent of the Homeowners Association in accordance with the ethical requirements that are relevant to our audit of the financial statements in the Commonwealth of The Bahamas, and we

have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

RESPONSIBILITIES OF MANAGEMENT AND THOSE CHARGED WITH GOVERNANCE FOR THE FINANCIAL STATEMENTS

Management is responsible for the preparation and fair presentation of the financial statements in accordance with IFRSs, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the Homeowners Association’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Homeowners Association or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing the Homeowners Association’s financial reporting process.

AUDITORS’ RESPONSIBILITIES FOR THE AUDIT OF THE FINANCIAL STATEMENTS

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with ISAs, we exercise professional judgement and maintain professional skepticism throughout the audit. We also:

• Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omission, misrepresentation or the override of internal control;

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Homeowners Association’s internal control;

• Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management;

• Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Homeowners Association’s ability to continue as a going concern. If we conclude that a material uncertainty exists, then we are required to draw attention in our auditors’ report to the related disclosure in the financial statements or, if such disclosure is inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditors’ report. However, future events or conditions may cause the Homeowners Association to cease to continue as a going concern; and

• Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

We communicated with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

HLB Galanis & Co.March 17, 2022

Nassau, Bahamas

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED STATEMENT OF MAINTENANCE FUND

FOR THE YEAR ENDED DECEMBER 31, 2021

The accompanying notes form an integral part of these audited financial statements

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED

DECEMBER 31, 2021

(Expressed in Bahamian dollars)

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31, 2021

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021

(Expressed in Bahamian dollars)

1.GENERAL INFORMATION

Sandyport Management Association Limited was incorporated under the laws of the Commonwealth of The Bahamas on May 25, 1990 as a wholly-owned subsidiary of Sandyport Development Association Limited (“Devco”). On September 14, 1998, the name of the Association was changed to Sandyport Homeowners Association Limited (the “Homeowners Association”).

On May 21, 2008, ownership of the common areas and common infrastructure of the Sandyport residential community was transferred from Devco to the Homeowners Association.

The principal activity of the Homeowners Association is to manage the Sandyport residential community in accordance with the terms of the authority granted to Devco by licenses issued to each property owner defining their rights and obligations in regard to the common areas. Devco assigned the said authority under these licenses to the Homeowners Association on November 3, 2009.

On January 2, 2010, Devco transferred the ownership of the Homeowners Association to the property owners of the Sandyport residential community.

As at December 31, 2021 the Homeowners Association had 27 employees (2020: 26).

2. STATEMENT OF COMPLIANCE WITH INTERNATIONAL FINANCIAL REPORTING STANDARDS

The Association’s audited financial statements are prepared in accordance with International Financial Reporting Standards (“IFRSs”) for Small and Medium-sized Entities, as issued by the International Accounting Standards Board (“IASB”) and are presented in Bahamian dollars, the Association’s functional currency.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 (CONTINUED)

(Expressed in Bahamian dollars)

3.BASIS OF PREPARATION

a. Presentation of financial statements - The financial statements are presented in accordance with IAS 1, Presentation of Financial Statements (Revised 2007).

b. Management’s use of judgments and estimates - The Association uses accounting estimates and assumptions in the preparation of the financial statements. Although these estimates are based on management’s best knowledge of current events and transactions, actual results may ultimately differ from those estimates. The effect of any changes in estimates will be recorded in the Association’s financial statements when determinable. Estimates and judgments are continually evaluated and are based on historical experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances.

4.NEW OR REVISED STANDARDS OR INTERPRETATIONS

Overall considerations

The Association has not applied the following new and revised IFRSs that have been issued but are not yet effective.

•Amendments to IAS 16, Property, plant and equipment - Proceed before intended use*

•Amendments to IAS 37, Onerous Contracts - Costs of Fulfilling Contract*

•Amendments to IFRS 3, Business Combinations - Reference to Conceptual Framework*

•Annual Improvements to IFRS Standards 2018-2020, IFRS 9 and IFRS 16*

•Amendments to IAS 1, Classification of Liabilities**

•Amendments to IAS 1 and Practice Statement 2, Disclosure of Accounting Policies**

•Amendments to IAS 8, Definition of Accounting Estimates**

•Amendments to IAS 12, Deferred Tax related to Assets and Liabilities arising from a single transaction**

*Effective for annual periods beginning on or after January 1, 2022.

**Effective for annual periods beginning on or after January 1, 2023

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 (CONTINUED)

(Expressed in Bahamian dollars)

4. NEW OR REVISED STANDARDS OR INTERPRETATIONS (continued)

IAS 16 – Proceeds before intended use

In May 2020, IASB amended IAS 16, which prohibits an entity from deducting from the cost of property, plant and equipment amounts received from selling items produced while the company is preparing the asset for its intended use. Instead, an entity will recognize such sales proceeds and related cost in profit or loss. The Homeowners Association does not expect the amendments to have any impact in its recognition of its property, plant and equipment in its financial statements.

IAS 37 – Onerous Contracts - Costs of Fulfilling a Contract

In May 2020, IASB issued Onerous Contracts - Cost of Fulfilling a Contract, which specifies that the ‘cost of fulfilling a contract comprises the ‘costs that relate directly to the contract’. Costs that relate directly to a contract can either be incremental costs of fulfilling that contract (examples would be direct labour, materials) or an allocation of other costs that relate directly to fulfilling contracts. The amendment is essentially a clarification and the Homeowners Association does not expect the amendment to have any significant impact on its financial statements.

IFRS 3 – Reference to Conceptual Framework

In May 2020, IASB published Reference to Conceptual Framework that update IFRS3 so that it refers to the 2018 Conceptual Framework instead of the 1989 Framework; add to IFRS 3 a requirement that for transactions and other events within the scope of IAS 37 or IFRIC 21, an acquirer applies IAS 37 or IFRIC 21 (instead of the Conceptual Framework) to identify the liabilities it has assumed in a business combination; and add to IFRS 3 an explicit statement that an acquirer does not recognize contingent assets acquired in a business combination. These changes do not significantly change the requirements of IFRS 3. The Homeowners Association does not expect the amendment to have any significant impact on its financial statements.

IFRS 9 – Annual Improvements to IFRS Standards - 2018-2020

In May 2020, IASB amended IFRS 9 as part of its Annual Improvements to IFRS Standards 2018-2020. The amendment clarifies which fees an entity includes when it applies the ‘10 percent’ test in paragraph B3.3.6 of IFRS 9 in assessing whether to derecognize a financial liability. The Homeowners Association does not expect the amendment to have any significant impact on its financial statements.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 (CONTINUED)

(Expressed in Bahamian dollars)

4. NEW OR REVISED STANDARDS OR INTERPRETATIONS (continued)

IFRS 16 – Annual Improvements to IFRS Standards - 2018-2020

In May 2020, IASB issued an amendment to Illustrative Example 13 accompanying IFRS 16, as part of its Annual Improvements to IFRS Standards - 2018-2020, which removes from the example the illustration of the reimbursement of leasehold improvements by the lessor in order to resolve any potential confusion regarding the treatment of lease incentives that might arise because of how to lease incentives are illustrated in that example. The amendment is only as regards the illustrated example, therefore, no effective date is stated. The Homeowners Association does not expect the amendment to have any significant impact on its financial statements.

IAS 1 – Classification of Liabilities

In January 2020, IASB issued the final amendments in Classification of Liabilities as Current or Non-Current, which affect only the presentation of liabilities in the statement of financial position. They clarify that the classification of liabilities as current or non-current should be based on rights that are in existence at the end of the reporting period and align the wording in all affected paragraphs to refer to the ""right"" to defer settlement by at least twelve months. The classification is unaffected by expectations about whether an entity will exercise its right to defer settlement of liability. They make clear that settlement refers to the transfer to the counter party of cash, equity instruments, other assets or services. The Homeowners Association does not expect the amendments to have any significant impact on its presentation of liabilities in its statement of financial position.

IAS 1 – Disclosure of Accounting Policies

In February 2021, IASB issued 'Disclosure of Accounting Policies (Amendments to IAS 1 and IFRS Practice Statement 2)' which is intended to help entities in deciding which accounting policies to disclose in their financial statements. The amendments to IAS 1 require entities to disclose their material accounting policies rather than their significant accounting policies. The amendments to IFRS Practice Statement 2 provide guidance on how to apply the concept of materiality to accounting policy disclosures. The Homeowners Association does not expect this amendment to have any significant impact on its financial statements.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED NOTES TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 (CONTINUED)

(Expressed in Bahamian dollars)

4. NEW OR REVISED STANDARDS OR INTERPRETATIONS (continued)

IAS8 Definition of Accounting Estimates

In February 2021, IASB issued 'Definition of Accounting Estimates (Amendments to IAS 8)' to help entities to distinguish between accounting policies and accounting estimates. The definition of a change in accounting estimates has been replaced with a definition of accounting estimates. Under the new definition, accounting estimates are “monetary amounts in financial statements that are subject to measurement uncertainty”. Entities develop accounting estimates if accounting policies require items in financial statements to be measured in a way that involves measurement uncertainty. The Homeowners Association does not expect this amendment to have any significant impact on its financial statements."

5. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a. Foreign currency - Translations in foreign currencies have been converted into Bahamian dollars at the rate of exchange prevailing at the date of each transaction. At the balance sheet date, foreign currency assets and liabilities are translated into Bahamian dollars using year-end rates of exchange; differences arising are included in the statement of maintenance fund for the year.

b. Revenue recognition - Revenue is measured at the fair value of the consideration received or receivable and represents the monthly maintenance fee charged to the homeowners. This fee is based on square footage of the house on each property and owners of empty lots are charged a flat fee.

c. Cash and cash equivalents - Cash and cash equivalents include cash on hand and at bank and short-term deposits which have a maturity period of less than three months.

d. Trade and other receivables - Accounts receivable is stated at cost less provision for doubtful accounts and any impairment losses. Management records provisions when in their opinion, amounts are irrecoverable based on historical performance and solvency of the customer. The provision for doubtful accounts policy is based on accounts that are 360 days old and remains unpaid.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED NOTES TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 (CONTINUED)

(Expressed in Bahamian dollars)

5.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

e. Fixed assets and right-of-use asset - Fixed assets and right-of-use asset are stated at cost less accumulated depreciation and any impairment losses. Historical cost includes expenditures that is directly attributable to the acquisition of the items. Right-of-use asset is stated at present value of lease payments and is presented with fixed assets in the statement of financial position. Depreciation is calculated on the straight-line basis to write-off assets over their estimated useful lives as follows:

3 - 5 years

3 years

3 years

3 years

Waste water systemMaintenance equipmentComputer and office equipmentSecurity equipmentRight-of-use asset - 10 years

f. Income and expense recognition - Income and expenses are recorded on an accrual basis of accounting.

g. Improvements - These are various projects that are undertaken for the improvement of common areas. These projects are additions and modifications to existing infrastructure within the community. The costs associated with these projects are expensed in the period incurred but is accounted for on the accrual basis for projects not completed within the fiscal year. Improvements are itemized separately and by project for clarity.

h. Impairment of assets - An assessment is made at each financial position date to determine whether there is any indication of impairment of any assets, or whether there is any indication that an impairment loss previously recognized on an asset in prior years may no longer exist; the asset’s recoverable amount is estimated. An asset’s recoverable amount is computed as the higher of the asset’s value in use or its net selling price.

An impairment loss is recognized only if the carrying amount of an asset exceeds its recoverable amount. An impairment loss is charged to operations in the period in which it arises unless the asset is carried at a revalued amount in which case the impairment is charged to revaluation.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED NOTES TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 (CONTINUED)

(Expressed in Bahamian dollars)

5.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

h. Impairment of assets (Continued) - A previously recognized impairment is reversed only if there has been a change in the estimates used to determine the recoverable amount of the asset, however, not to an amount higher than the carrying amount that would have been determined (net of any depreciation), had no impairment loss been recognized for the asset in prior years.

i. Related party transactions - Related parties include members of the Board who are also homeowners.

j. Leases – IFRS 16 was adopted as from January 1, 2020. The operating lease contract was recognized on the statement of financial position by recognizing right-of-use assets and corresponding lease liabilities at the transition date. The Association applied the modified retrospective transition method, and consequently comparative information is not restated.

At the adoption date, lease liabilities were recognized for leases previously classified as operating leases applying IAS 17. These lease liabilities were measured at the present value of the remaining lease payments and discounted using the Association’s incremental borrowing rates at January 1, 2020.

In general, a corresponding right-of-use asset was recognized for an amount equal to each lease liability, adjusted by the amount of any prepaid or accrued lease payments relating to the lease contract.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED NOTES TO FINANCIAL STATEMENTS FOR THE

YEAR ENDED DECEMBER 31, 2021 (CONTINUED)

(Expressed in Bahamian dollars)

6.cash and cash equivalents

The Association does not earn interest on cash at bank at the prevailing market interest rates. The current accounts earned no interest during the years ended December 31, 2021 and December 31, 2020. The Association’s current account is non-interest bearing.

7.accounts receivable

Accounts receivable is comprised of the following balances:

Cash and cash equivalents are comprised of the following: The movement in the provision for doubtful accounts is as follows:

The aging of receivables are comprised of the following balances:

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES

TO FINANCIAL STATEMENTS

FOR THE YEAR ENDED DECEMBER 31, 2021 (CONTINUED)

(Expressed in Bahamian dollars)

8.FIXED ASSETS and right-of-use asset

The movement of fixed assets during the year is as follows:

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED NOTES TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 (CONTINUED)

(Expressed in Bahamian dollars)

8.FIXED ASSETS and right-of-use asset (CONTINUED)

Depreciation expense by functional categories is comprised of the following balances:

9.PREPAID MAINTENANCE FEES AND DEPOSITS

Prepaid maintenance fees and deposits are comprised of the following balances:

10. lease liability

Set out below is the carrying amount of the lease liability and the movement during the period.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 (CONTINUED)

(Expressed in Bahamian dollars)

10. lease liability (continued)

The following are the amounts recognized in the statement of maintenance fund:

11. general reserve fund

This amount represents a reserve established to provide for future contingencies.

12. security expenses

Security expenses are comprised of the following balances:

13.GARDENING EXPENSES

Gardening expenses are comprised of the following balances:

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 (CONTINUED)

(Expressed in Bahamian dollars)

14.IMPROVEMENTS

During the fiscal year, the key projects undertaken were the improvement of the Association’s waste water system and fencing of the premises. Otherwise, the Association focused on the completion of the prior year projects which included the CCTV Network installation and seawall and canal improvements. Overall improvement expenses are comprised of following balances:

15.WATER & METERS

Water and meters expenses are comprised of the following balances:

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 (CONTINUED)

(Expressed in Bahamian dollars)

16.MAINTENANCE OF COMMON AREAS

The expenses associated with the maintenance of common areas are comprised of the following balances:

17.WASTE WATER MANAGEMENT

Waste water management expenses are comprised of the following balances:

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED NOTES TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 (CONTINUED)

(Expressed in Bahamian dollars)

18.PAINTING EXPENSES

Painting expenses are comprised of the following balances:

19.RENT and utilities

The Homeowners Association rents office space from Artech Bahamas Ltd. at $40,800 per annum, inclusive of electricity and water. The lease will expire on August 31, 2022. Based on the change in the standard for leases please see Note 10 for the presentation in accordance with IFRS 16 – Leases.

20.CONTINGENT LIABILITIES

Waste water - Waste water - Following an evaluation of the waste water treatment system in 2012, Harris Civil Engineers recommended a series of improvements and repairs. Certain of the work was completed by the end of 2014 and it is estimated that completion of the remaining work will require an expenditure of $430,000. Allen’s Environment Construction LLC, Water Treatment Specialists, commenced improvement and repair work with an estimated expenditure of $148,000 in January 2020. The Board believes that the recommended work can be completed out of budgeted income streams but will consider the need for a special assessment should this become necessary.

In addition, the waste water system is almost at its operational capacity: the preliminary budget to expand the capacity to meet anticipated future requirements is $1 million. Under the terms of an Agreement dated November 3, 2009, the cost of such expansion will be borne by the developer, Sandyport Development Association Limited (Devco). The Board continues to explore alternative cost effective and productive solutions to this issue.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 (CONTINUED)

(Expressed in Bahamian dollars)

20.CONTINGENT LIABILITIES (CONTINUED)

Seawall - With the exception of a few unstable and incomplete sections of wall noted in an engineer’s report commissioned by the Association, the seawall is in fair condition with primarily corrosion damage to the coping beam. Engineers have advised that the durability and appearance of the wall can be improved significantly by completing the noted repairs and coating the concrete surface. The overall cost of the repairs has not been fully quantified.

21.FINANCIAL RISK MANAGEMENT

The Homeowners Association is exposed to a variety of risks including liquidity risk, credit risk, interest rate risk and capital risk management arising in the normal course of the Homeowners Association’s business activities. The Homeowners Association does not have any written risk management policies and guidelines. Management monitors the financial risks of the Homeowners Association and takes such measures as considered necessary from time to time to minimize such financial risks.

Liquidity risk - Liquidity risk is the risk that an enterprise will encounter difficulty in raising funds to meet commitments associated with financial instruments. Liquidity risk may result from an inability to sell a financial asset quickly, at close to its fair value.

Prudent liquidity risk management implies maintaining sufficient cash. The Homeowners Association monitors and maintains a level of bank balances deemed adequate to finance its operations. The Homeowners Association deposits cash with financial institutions of good standing.

Credit risk – Credit risk arises from the possibility that customers may not be able to settle obligations within the normal terms of transactions. The Homeowners Association performs ongoing credit evaluation of the debtors’ financial condition and maintains an account for allowance for doubtful trade and other accounts receivable based upon the expected collectibles of all trade and other accounts receivable.

SANDYPORT HOMEOWNERS ASSOCIATION LIMITED

NOTES TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2021 (CONCLUDED)

(Expressed in Bahamian dollars)

21. FINANCIAL RISK MANAGEMENT (CONTINUED)

The Homeowners Association has no significant concentration of credit risks with any single counterparty or group counterparties.

Interest rate risk – Cash flow interest rate risk is the risk that future cash flows of a financial instrument will fluctuate because of changes in market interest rates. Fair value interest rate risk is the risk that the fair value of a financial instrument will fluctuate due to changes in market interest rate.

Demand deposits and term deposits are the only significant interest-bearing assets and liabilities. Accordingly, the Homeowners Association’s income and operating cash flow are substantially independent of changes in market interest rates.

Capital risk management – The Homeowners Association manages its capital to ensure that it will be able to continue as a going concern while maximizing the return to homeowners through the optimization of the debt and equity balance. The Homeowners Association’s overall strategy remains unchanged from 2010.

The capital structure of the Homeowners Association consists of debt, cash and equity attributable to equity holders comprising of share capital, general reserve fund and maintenance fund.

21. subsequent events

There were no material subsequent events from the end of the reporting period to the date of the Auditors’ Report, which should be reported in these financial statements.

PROFESSIONAL ADVISORS

Auditors:

HLB Galanis & Co.

Building 12, Office 1

Caves Village

P. O. Box N-3205

Nassau, The Bahamas

Tel: (242) 327-0689

Fax: (242) 327-0696

Web: www.hlbgalanis.com

Legal Advisors:

Kahlil D. Parker

Cedric L. Parker & Co.

Chambers

No.9 Rusty Bethel Drive

P.O. Box N-1953

Nassau, The Bahamas

Tel: (242) 322-4954/5

Fax: (242) 328-3706

Email: kdp@parkerslaw.net

Consulting Architects:

Alberto G. Suighi

Artech Bahamas Ltd.

Lagoon Court

Nassau, The Bahamas

Tel: (242) 327-2335

Fax: (242) 327-2337

Web: www.artechbahamas.com

Bankers:

CIBC First Caribbean

Sandyport Branch

P.O. Box N-8350 / N-7125

Nassau, The Bahamas

Tel: (242) 327-8364 / 327-4957

Fax: (242) 327-4955

Account: 200-167527

Web: www.cibcfcib.com

Scotiabank

Cable Beach

P.O Box N-7518

Nassau, The Bahamas

Tel: (242) 702-8100

Fax: (242) 327-5728

Account: 70045-72613

Web: www.bahamas.scotiabank.com

Insurance Agents:

Tavares & Higgs

Blake Road

P. O. Box SP-64003

Nassau, The Bahamas

Tel: (242) 327-8606

Fax: (242) 327-8607

Email: stavares@tavareshiggs.com