the launch of the Industry Transformation Maps (ITMs), Singapore’s economic transformation efforts have achieved significant results. The ITMs were first launched in 2016 under the Future Economy Council (FEC) as roadmaps to drive transformation for 23 industries across six cluster subcommittees, namely Manufacturing, Built Environment, Trade and Connectivity, Essential Domestic Services, Modern Services, and Lifestyle.

The COVID-19 pandemic has accelerated structural shifts in the global economy, such as the digital revolution and enhancing the focus on sustainability and resilience. To prepare businesses for the post-COVID world, the Government announced last year that the ITMs will be refreshed over the next five years.

ITM 2025 is strengthened by three key thrusts: incorporating the recommendations of the Emerging Stronger Taskforce (EST); closer integration with research and innovation; and greater focus on jobs and skills. In this edition of Chinese Entrepreneur, two Trade Associations share their experiences and perspectives in spearheading the ITM-related initiatives.

The Singapore Furniture Industries Council (SFIC) is the official representative body of Singapore’s furniture and furnishings industry. As an aggregator and multiplier in the furniture eco-system, SFIC plays an active role to grow and transform companies and the industry.

In 2021, SFIC celebrated their 40th anniversary and launched the 2025 Furniture Industry Roadmap which aims to position Singapore’s furniture industry as the key driver of worklife integration for a more sustainable urban living environment. SFIC will revisit their industry roadmap every three years to ensure its relevance in shaping the industry.

The 2025 Furniture Industry Roadmap

incorporates three key pillars, namely market agility, urbanite-centricity, and enterprise adeptness. These three pillars guide SFIC members as they seize opportunities for growth.

Firstly, the agility of the industry and its members remains a core thrust. SFIC will help members harness sustainability as a competitive advantage to capture new business opportunities quickly.

Secondly, the urbanite-centricity theme focuses on helping members understand customer psyche and produce sustainability-driven furniture and could, ultimately, venture into new areas. They would gradually embrace innovative technologies to develop more urbanite-centric products and solutions.

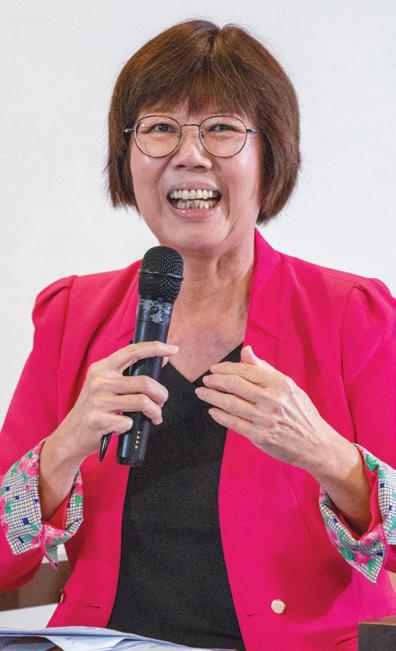

Shermaine Ong, Executive Director of the Singapore Furniture Industries Council (SFIC)Thirdly, the roadmap fosters enterprise adeptness where members will cultivate stronger business mindset to gain a foothold in their respective arenas. They would also tweak their business model or skillset to reach a comfortable level of business expansion. This also means taking a step at a time to scale up, and form collaborations with non-conventional partners such as those in the healthcare industry; urban planners; designers; and green solutions providers to drive all-round development.

In February 2022, SFIC introduced the Furniture Sustainability Programme which is a trait-centric programme that has its development strategy outlined for guiding business development in the furniture trade. This programme embraces the SFIC vision, “be the nexus of tomorrow’s work-life integration for sustainable urban living”. Group Executive Director of SFIC, Shermaine Ong shares that SFIC believes in the future of smart urban living where innovative solutions will improve the urban environment. They hope to scale to new heights in making urban living more sustainable.

SFIC has also assumed the Chairmanship of the ASEAN Furniture Industries Council (AFIC) with the aim of further strengthening intra-ASEAN trade. This eight-member organisation comprises fellow associations from Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. Collectively, they aim to adopt more green practices on the journey to pursue sustainable business development.

Together with the Singapore Business Federation and the Singapore Green Building Council, SFIC formed the Alliance for Action (AfA) to bring together stakeholders to create and enhance sustainable spaces. A key area of focus is to set and implement a benchmark to reduce the use of formaldehyde in furniture-making and building products.

With growing interest in sustainability, more enterprises are keen to adopt sustainabilitydriven solutions. SFIC hopes to accelerate the development of the industry to be at the forefront of sustainability. Many members are already placing greater emphasis on sustainability and things are moving much more quickly than anything people could have visualised in the furniture industry.

SFIC continues to implement its sustainability strategy through the following five complimentary strategies.

Firstly, to invest in education and capacity building with members by forming dedicated teams to champion and increase awareness to build up sustainability capabilities.

Secondly, SFIC takes ownership to engage stakeholders to join them on this journey to scale up products and services and contribute to the advancement of the industry.

Thirdly, to establish more strategic partnerships and foster stronger relationships locally and overseas. This will help their members find more ways to expand audience reach and venture into new markets.

Fourthly, to develop an industry-wide robust system for quality assurance and compliance with sustainability practices. Assessment tools, certification schemes and support are

provided for members. SFIC is helping its members to acquire the relevant knowledge and competencies.

Lastly, members can come up with solutions and pilot ideas for sustainability with one another and beyond.

SFIC has a membership of over 360 companies and is an advocate for Singapore’s furniture industry. They conduct focus group meetings for the five industry clusters of furniture manufacturers, interior fit-out specialists, retailers, designers, as well as materials or components providers. Challenges faced by the members are being discussed during these sessions. Topics such as geopolitical tensions, supply chain disruptions, increased business cost, manpower crunch and climate change

surfaced in many of their discussions.

The COVID-19 pandemic has changed the way people work and furniture players have felt the differences in the market. SFIC is stepping up efforts to meet the shift in consumer demands and adapt to the fast pace of innovation. They see an increase need for employers to learn how to respond to situations and take relevant approaches to manage their employees’ expectations and stress levels.

SFIC is like the backbone that always provides support for their members. They understand the membership base and members’ segmented needs. Besides connecting with the members, SFIC pays close attention to the emerging

trends to stay relevant in the rapidly changing environment. Shermaine believes that challenges and changes will make people more resilient. If people stay motivated and find new ways to solve problems and strengthen the work culture, they will be able to rebound from tough times.

In the pursuit to remain relevant, some SFIC members lack the required industry knowledge to push their projects forward. To help these members, SFIC is building up a culture of knowledge sharing and learning together. A private Telegram channel has been set up by SFIC for the purpose of sharing information and current events, as well as alerting the members with new opportunities.

The 2025 Furniture Industry Roadmap aims to position Singapore’s furniture industry as the key driver for work-life integration for a more sustainable urban living environment.

SFIC also identifies skill gaps so that they can set and implement the best practices to share with their members. Members can tap on these to come up with new ideas and initiatives, share opportunities with one another and do business matchings. When people of different backgrounds come together, they build social connections, engage in knowledge exchange and collaborative problem solving. Such group dynamics will let the members develop a sense of belonging.

The extensive members’ network is a valuable resource to SFIC. The stronger the connections among members, the easier it is for SFIC to gather ground feedback that is necessary to come up with future development plans.

The SFIC Institute, the talent development training arm of SFIC, conducts Masterclass series which equips participants with skills and tools that will enable them to navigate the evolving workplace.

Besides helping members to transform, SFIC also believes that business transformation starts with workforce development. In today’s digital age, SFIC hopes to stay nimble and make advancements through upskilling. It believes that investing time and resources in upskilling and educational activities are essential. It also provides opportunities for members to acquire human resource and talent development capabilities.

The SFIC has a talent calibration programme called the Young Leaders Chapter (YLC) which was formed since 1999. YLC provides the next generation of youth leaders a platform to start their journey and share their experiences with

one another. The goal is to reboot the industry by bringing in new creative blood to contribute to the industry with their expertise. A good balance of both the fresh and experienced leaders can reinvent the SFIC, and even steer its future growth.

YLC can also be seen as a mentoring model where the seniors take the lead and provide support to the youths. The youths are also given room to grow and develop themselves. Several YLC leaders who were groomed over the years have now taken up positions in the SFIC Executive Committee. Such a culture is cohesive and will ensure leadership continuity in the long run.

In this spirit, SFIC continues to identify competencies, address challenges, align goals,

In June 2022, SFIC embarked on a forest visit during the first industry-led Sustainability Business Model Transformation Mission to Denmark.

In June 2022, SFIC embarked on a forest visit during the first industry-led Sustainability Business Model Transformation Mission to Denmark.

and grow in the coming years with the guidance of the 2025 Furniture Industry Roadmap. SFIC remains committed to all stakeholders and to foster strong partnerships with the Government, fellow Trade Associations and Chambers (TACs), leaders of SFIC Executive Committee and Advisor Chew Mok Lee to scale new heights.

It is very encouraging that the global furniture industry is expected to grow at a compound annual rate of 6 per cent over five years to reach US$850 billion in 2025.

Shermaine hopes that SFIC members can tap into this global opportunity and be part of this future growth.

Working in collaboration with the Copenhagen School of Business Executive Foundation, SFIC joined an intensive week of executive programme with the professors and guest speakers.The precision engineering (PE) industry is a key contributor to Singapore’s economy. It plays a crucial role in improving manufacturing processes and providing critical support for a wide range of businesses such as the semiconductor, marine and offshore, aerospace and medical technology industries.

Led by the Economic Development Board (EDB), the PE ITM was the first industry-specific roadmap to be rolled out for the manufacturing sectors, aimed at helping the industry achieve $14 billion in added value and create 3,000 professional, manager, executive and technician (PMET) jobs by 2020. As of 2019, the number

of PMET jobs in the sector has already increased by about 4,000. In 2021, the value added by the PE industry was the highest, amounting to nearly $15 billion.

A key strategy of the ITM aims to shift the industry mix of PE towards higher value-added activities that would form the foundation for the next era of manufacturing. This will be done by growing complementary sectors such as robotics, additive manufacturing, sensors, advanced materials and lasers and optics. The ongoing ITM refresh seeks to enable the sector to capitalise on digital manufacturing and create good jobs in these growth areas.

Founded in 1982, the Singapore Precision Engineering and Technology Association (SPETA) is the leading trade association that serves and drives the PE community towards the adoption of advanced manufacturing technology and Industry 4.0. Currently, SPETA has close to 400 members comprising both SMEs and MNCs.

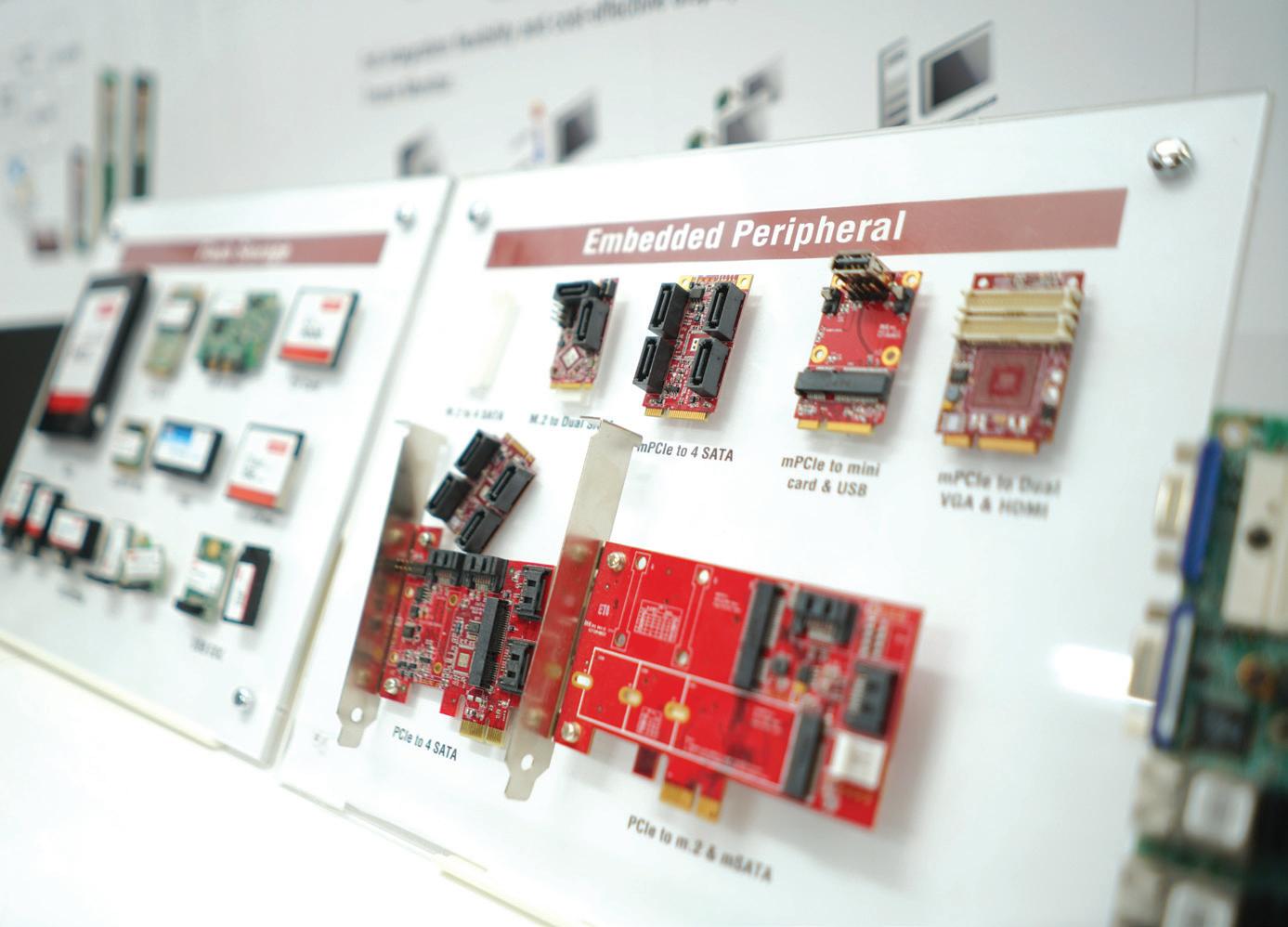

DASH (Digitalisation, Advanced Technologies, Smart Manufacturing and Industry 4.0) is one of the committees set up by SPETA. Through this initiative, the Association provides support for digitalisation, deepening of technical skills and innovation capabilities for members to maintain their competitive edge in the market.

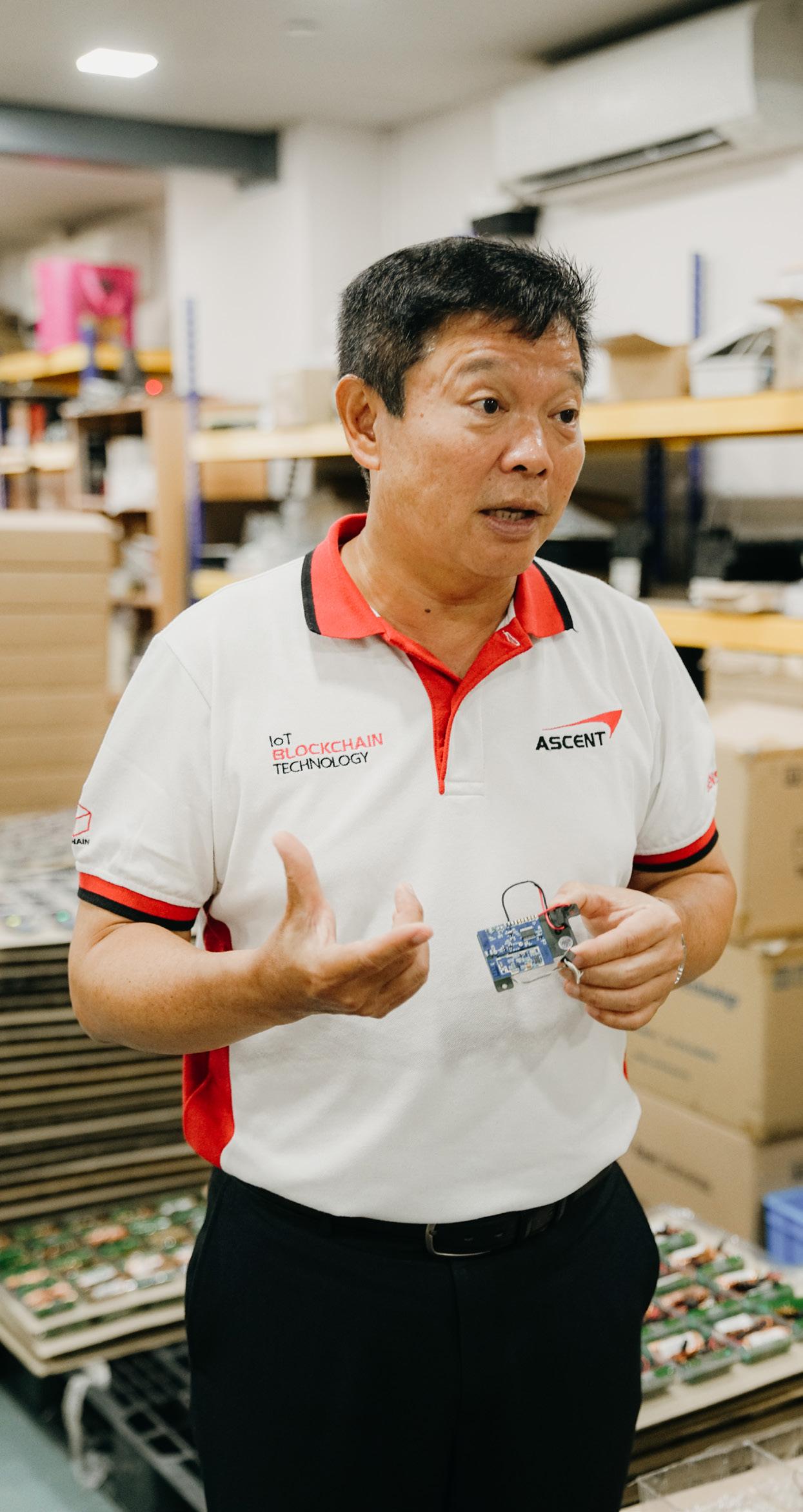

Embarking on digital transformation starts by using technology to improve business processes. Digitalisation streamlines business operations by automating processes with wireless and built-in devices. This helps to ensure quality control and increase productivity. Advanced technologies such as

Simon Lim, Executive Director of the Singapore Precision Engineering and Technology Association (SPETA)the Internet of Things (IoT), 5G and Artificial Intelligence (AI) present manufacturing companies with opportunities to overcome their limitations and venture into new territories.

Smart autonomous agents such as autonomous robots are designed to optimise operations and improve performance while collecting realtime data. The data collected from both sensors and software is used to evaluate and make improvements to achieve higher efficiency while being cost-effective at the same time.

Through DASH’s seven strategies: Deepen and diversify our international connections; acquire and utilise deep skills; strengthen enterprise capabilities to innovate and scale up; build strong digital capabilities, develop a vibrant and connected city of opportunity; develop and

implement ITM-related initiatives; and partner one another to enable growth and innovation, SPETA plays an important role in driving the PE ITM.

While the ITMs continue to exist as more targeted strategies for specific sub-sectors, a new 10-year plan to grow Singapore’s manufacturing sector by 50 per cent and maintain its share of about 20 per cent of Gross Domestic Product (GDP) was launched last year.

To achieve the goals set out in this Manufacturing 2030 plan, the sector will have to develop its competitiveness through its ability to innovate quickly and produce higher-value products. The Government has outlined a threepronged strategy.

At Schneider Electric’s Innovation Summit Singapore 2022, SPETA co-organised an Expert Learning Session on “Accelerating Sustainability Goals in Manufacturing 2030”.First, it will continue to attract the best global and local companies in niche areas that will help Singapore remain a critical node in global value chains. Second, Singapore will ramp up its efforts to grow the size and capabilities of local enterprises in advanced manufacturing to create better job opportunities for Singaporeans. Third, the Government will work with polytechnics and universities to make engineering and manufacturing attractive to students.

In March this year, Minister for Trade and Industry Gan Kim Yong unveiled the Singapore Economy 2030 plan, which aims to provide direction and coordinate actions across the key pillars of our economy for long-term, sustainable growth. The plan will be driven by separate strategies across the four key pillars of the economy, namely services,

manufacturing, trade and enterprises.

The Singapore Economy 2030 vision continues to build upon the Manufacturing 2030 plan launched last year. To ensure that Singaporeans can access good job opportunities in the manufacturing sector, the M2030 Careers Initiative will be launched.

Under this initiative, the Government will work with the industry and target graduates from polytechnics and the Institute of Technical Education (ITE), who have been trained with industry-relevant skills. Dialogues and engagement sessions facilitate communication between the Government, industry representatives and students. As the ITE’s industry partner, SPETA plays its role as one of the panellists. Through these sessions, students gain a better understanding of the career pathways and job opportunities in the industry. Companies can attract and develop talent while they are still students by offering them internships. Such opportunities allow the students to apply their knowledge and skills practically, companies can also retain talent and develop them as part of their career progression.

To level up the industry’s talent development capabilities, SPETA will work with industry partners such as the Singapore Semiconductor Industry Association and Institutes of Higher Learning to develop a Manufacturing Employer Handbook. The Handbook will provide a range of human capital best practices and resources, to support companies in developing structured career progression pathways for their employees. SPETA will identify and work with at least 20 companies to pilot the adoption of these practices and pathways.

Since 2019, the Yellow Ribbon Singapore (YRSG) has been collaborating with SPETA and Nanyang Polytechnic (NYP) to equip inmates with skills for a career in the PE industry under the TAP (Train And Place) and Grow initiative.

As a result of this collaboration, a training academy equipped with industry grade equipment was set up in the prison in September 2021. The academy runs a four-month course conducted by NYP, which will lead to a Workforce Skills

Qualification (WSQ) Advanced Certificate in PE. Graduates will continue to be supported after they complete the course. YRSG and SPETA are working together to provide job placement opportunities with over 400 SPETA member companies.

The inaugural batch of 17 inmates graduated from this PE course in April this year. All 17 of them who enrolled in the programme have graduated and will be employed, after their release, in roles such as quality assurance technicians or machinists by SPETA member companies.

One of the outreach events organised by SPETA on Building Digital Capabilities for Business Transformation. More than 30 people attended this session.To achieve the goals set out in this Manufacturing 2030 plan, the sector will have to develop its competitiveness through its ability to innovate quickly and produce higher-value products.

Besides serving its members, SPETA is also committed to create greater awareness and help other companies in the PE industry on the road to sustainability and internationalisation.

At Schneider Electric’s Innovation Summit Singapore 2022 which was held recently in July, SPETA co-organised an Expert Learning Session on “Accelerating Sustainability Goals in Manufacturing 2030”. The panel discussion on the implementation of innovative solutions to address challenges and successfully implement sustainability strategy was moderated by SPETA’s Executive Director Simon Lim, with Kia Jie Hui, Head of SPETA’s Sustainability Committee as one of the panellists.

In addition to various seminars and outreach events, SPETA also co-organised the Medical Manufacturing Asia 2022 with Messe Dusseldorf Asia, which is the region’s leading specialist trade fair for Asia’s medtech and medical manufacturing processes sectors. This is a great platform for companies to come together, get to know one another and explore new opportunities for collaboration.

In partnership with SPETA, Enterprise Singapore and the Infocomm Media Development Authority (IMDA) have developed the PE Industry Digital Plan (IDP) to introduce local SMEs to basic solutions that will help them kickstart their digital journey, enable them to do higher value work, build core digital capabilities and to enhance their operational productivity.

As part of the SMEs Go Digital Programme, the IDP consists of a three-stage Digital Roadmap that helps companies identify gaps in their capabilities as well as the digital solutions they

can adopt at different stages of their growth. To help employees level up together with their employer and ensure that they are able to adapt and use these technologies confidently, the corresponding digital training roadmap under the IDP helps companies tailor their training programmes to their employee needs and their relevant stage of business transformation. SPETA’s Executive Director Simon Lim encourages members and companies to tap on all these resources and venture into new markets as they prepare for the green economy.

SPETA was invited to be one of the panellists at ITE’s dialogue with Minister of State for Education and Manpower Gan Siow Huang (in pink).

Amid the difficulties in analysing and forecasting macroeconomic conditions, economist Chen Kang likens their changes to a unique game of tug of war between the bulls and the bears — in which economic reforms, policies and outcomes are interpreted differently among the players, and the current outcome encapsulates the people’s aggregate response. However, the big question is whether China will press on with economic reforms despite all the challenges.

Translated by Yuen Kum Cheong

Translated by Yuen Kum Cheong

The global macroeconomy has remained sluggish since Russia invaded Ukraine in February this year, which caused food shortages, increased oil prices and higher inflation. Germany, the engine of Europe’s economic growth, is in trouble because of its high dependence on Russian oil and gas, and its economy was stagnant in Q2 2022.

The US Federal Reserve has increased the benchmark Federal funds rate by 225 basis points in four successive rate hikes in order to control inflation. The tightened monetary policy and withdrawal of fiscal stimulus have dampened the US’s economic recovery from Covid-19, resulting in economic contraction in the first two quarters of this year.

China’s economy grew by just 0.4% year-on-year in the second quarter of the year, and the first two quarters this year contracted quarter-on-quarter. The recently announced July figure was also lower than expected. Apart from the unfavourable global conditions, China faces several domestic challenges. In late July, the IMF again lowered its annual economic growth forecast for China to 3.3%, which is a far cry from the Chinese government’s 5.5% target at the start of the year.

Macroeconomic conditions are very difficult to analyse and forecast; their changes can be likened to a unique game of tug of war between two teams — the bulls and the bears — in which the number of participants is not fixed. Neither the players nor the spectators could see the contest itself, and could only grasp the situation based on the data collected and published.

The tug of war has three features. First, each team has some members with firm beliefs, so they interpret the same information differently. For example, the People’s Bank of China (PBOC) trimmed the key rate (the medium-term lending facility rate) by ten basis points (bps) on 15 August, and a week later cut its five-year loan prime rate by 15 bps. Members of the bulls team would give a positive “bulls’ explanation” as they believe that these developments would improve credit, stimulate investments and encourage property purchases.

Macroeconomic conditions are very difficult to analyse and forecast...Workers work at a demolition site, following the Covid-19 outbreak, in Shanghai, China, 9 September 2022. (Aly Song/Reuters)

People at the Bund promenade along the Huangpu River in Shanghai, China, on 10 September 2022. (Hector Retamal/ AFP)

Members of the bears team, however, would offer “a bears’ conclusion” that the central bank’s rate cuts at a time of increased inflationary pressures are definitely not a good sign, indicating grim economic conditions, and that lowering the loan prime rate would not improve the troubled property market.

The second feature of the tug of war is its many non-neutral spectators watching from the sidelines and sitting on the fence for the time being. As permitted by the rules of the contest, they would enter the arena to join the tug of war when encouraged by others’ actions or when they feel that the outcome is clear.

Third, the rules of the contest also permit the participants to withdraw from the contest to become spectators or join the other team at any time. The different interpretations of the

information, the spectators’ actions or inaction, and the participants’ withdrawal or defection have an impact on the outcome of the tug of war.

As the current macroeconomic models do not have an effective way to aggregate individuals’ actions and interactions at the micro level to form a clear macro picture, their ability to analyse and forecast is greatly limited.

Nonetheless, we can still focus on key indicators to make some crude conclusions about the macroeconomic trends. Some published data are indicative of the short-term status of the tug of war, while others can be used to analyse the mid to long-term situation.

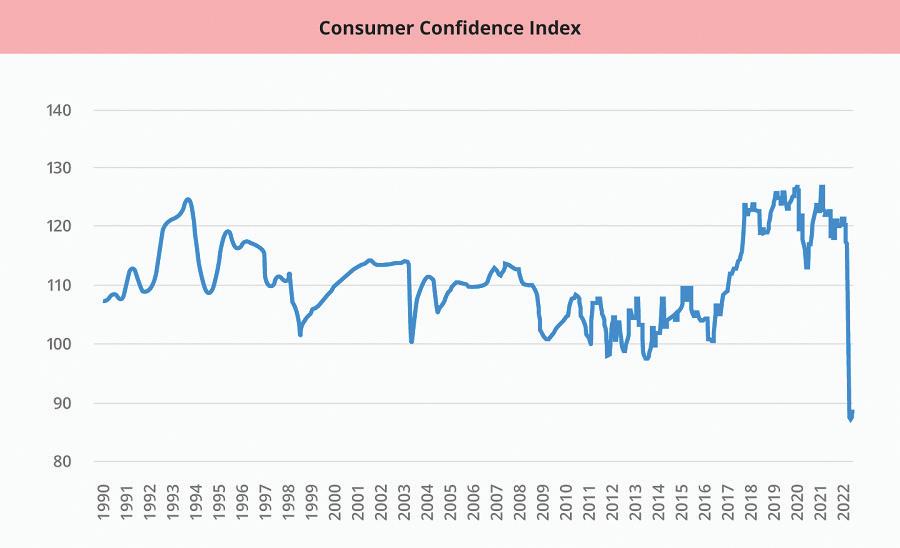

(Note: Data from January 1990 to June 2022.

Source: Chen Kang, China’s National Bureau of Statistics; Graphic: Jace Yip)

The Consumer Confidence Index (CCI) and the Business Climate Index (BCI) are two useful indicators for analysing short-term changes. China’s National Bureau of Statistics (NBS) has published the monthly CCI since 1990. Chart 1 shows that the CCI has clearly begun to decline in March this year, averaging 87.5 from April to June, which is 30.9 points below the average of 118.4 from January to March.

... the recent decline in consumer confidence is largely related to the strict dynamic zero-Covid policy.

This sharp decline is unprecedented in the past 30 years, which has seen the late 1990s SOE (state-owned enterprises) reforms to bring the larger enterprises under the government’s control while privatising or closing the smaller ones; the 2008-2009 global financial crisis; and the Covid-19 outbreak in 2020.

A detailed observation of the CCI would surmise that the recent decline in consumer confidence is largely related to the strict dynamic zero-Covid policy.

The CCI consists of three components: income, employment and consumption. The income of employees of enterprises that are unable to operate as usual due to “static management” (静态管理, i.e., putting normal life on pause) is greatly affected. If the enterprise shutters, the employees will lose their jobs and income. Even for those who are guaranteed a basic salary, their performance-based income and bonuses will be greatly reduced. Evidently, these people will join the bears team by being careful in consumer spending.

Unemployment or the increased likelihood of unemployment will affect consumption. Notably, the unemployment rate of 16 to 24-year-olds has steadily climbed this year, rising from 14.3% at the end of last year to 19.9% in July this year. Their struggle to secure employment could largely be due to the hiring freeze or reduction in new hires by enterprises. Consequently, consumer spending of these youths and their families is negatively affected.

Consumption willingness is directly affected by the repeated disruptions to business activities caused by Covid-19 and frequent PCR tests. Stories of people trapped in shopping malls, airports and on highways will also affect the willingness to travel. The foregoing discussions show that the battered consumer confidence can only be partially restored with the easing of Covid-19 measures as the pandemic wanes, but there will be some lasting impacts.

When confidence is lacking, consumers will tighten their purse strings. The total retail sales of consumer goods from January to July this year has decreased by 0.2% year-on-year, or even lower when taking inflation into account.

The BCI, which affects investor confidence, is another index used to analyse short-term changes. The NBS has published this index quarterly since 1999. Business confidence reached a low of 105.6 in Q1 2009 during the global financial crisis. The historical lowest, however, was 88.2 in Q1 2020 at the start of the Covid-19 outbreak.

The BCI has continued to decline since the middle of last year, from 125.2 in Q1 2021 to 112.7 in Q1 2022. The Covid-19 impact on the various industries is evident: hospitality and F&B are the hardest hit with the index falling by 42.8 in the same period. Meanwhile, the index for manufacturing has declined by 19.0 and that for wholesale and retail has fallen by 14.6.

The bears’ upper hand in the current investment climate can be explained by the increased ownership risks, the restrictions on informal financing channels and the sluggish property market.

In this file photo taken on 31 July 2022, a health worker takes a swab sample from a woman to be tested for Covid-19 at a swab collection site in Guangzhou, Guangdong province, China. (AFP)

As the BCI is a short-term indicator, it cannot be used to forecast mid- to long-term investments. We need other data to assess the investment strategy in the tug-of-war between the bulls and the bears.

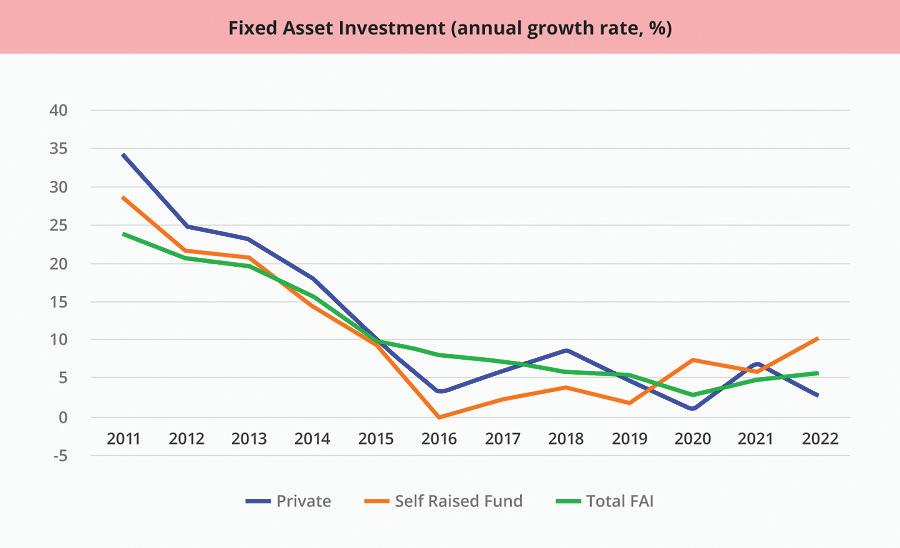

Chart 2 shows an interesting trend, whereby even prior to Covid-19 the growth of China’s fixed asset investment (FAI) decreased from 23.8% in 2011 to 8.1% in 2016 and 5.4% in 2019. The trend is unrelated to the Covid-19 control measures, and cannot be explained by external changes, such as the tense China-US relations and the overwhelming pushback against globalisation.

The bears’ upper hand in the current investment climate can be explained by the increased ownership risks, the restrictions on informal financing channels and the sluggish property market.

Chart 2. Fixed asset investment (Note: 2022 figures are for July, year-to-date; Graphic: Jace Yip)

First, it is evident from Chart 2 that the growth of private FAI, which accounts for 60% of the total FAI, is highly correlated to the growth of total FAI. In recent years, the ownership and regulatory risks to private FAI have significantly increased. Private enterprises are subject to tougher regulations and stricter treatment in terms of anti-corruption, environmental protection, financial deleveraging and anti-trust.

Although some Chinese government officials talked about adopting the principle of “competitive neutrality” to deal with enterprises of different ownership, and China’s leader tried to boost business confidence by stating that “private enterprises and entrepreneurs are family”, the environment for the survival of private enterprises has not significantly changed. On the contrary, they have borne the brunt of the recent regulatory measures to “prevent disorderly capital expansion”. The increase in ownership risks has significantly reduced the growth of private investments.

Second, the stagnation in China’s financial reform has resulted in severe financial disintermediation, while the strict regulation of informal financing channels has reduced investment and financing activities and stagnated financial innovation. Data from 2017 show that bank loans account for only 11.3% of FAI, with 65.3% from self-raised funds and 16.9% from other funding sources.

In the black boxes that are “self-raised funds” and “other funding sources”, much of the financing comes from informal financing activities, such as fund-raising from relatives and friends, enterprise self-financing, and borrowing from shadow banks or underground lenders. Private investments that are snubbed by banks and capital markets often rely on these informal financing channels, which have been strictly regulated in recent years, thus limiting the sources of self-raised funds.

In Chart 2, the growth of FAI through self-raised funds is highly correlated to the growth of total FAI and private investments. This illustrates that the slowdown in private investments is closely linked to the strict regulation of financing channels for private enterprises.

Third, residential fixed investments exceed 20% of the total FAI. Since the banks established the “three red lines” that set thresholds on borrowings last year, property developers are generally cash-strapped, resulting in a recent spate of problems such as “rotten-tail” (unfinished) properties and property buyers withholding mortgage repayments. However, the growth of residential investments has rapidly declined since 2012, from 30% in 2011 to 16.7% in 2013 and -0.2% in 2015, evidently caused by unaffordable property prices, an ageing population and high vacancy rates.

... the growth of residential investments has rapidly declined since 2012, from 30% in 2011 to 16.7% in 2013 and -0.2% in 2015, evidently caused by unaffordable property prices, an ageing population and high vacancy rates.

According to a PBOC survey of its urban customers in June 2018, 36.5% of the respondents expected property prices to rise. In June this year, the figure fell to 16.2%. In the first half of this year, property investments declined by 5.4%, property sales decreased by 28.9%, and the land sales area fell by 48.3%. These data indicate the status of the tug-ofwar between the bears and the bulls in the property market.

Currently, most people believe that property prices will not increase further, and property speculation has ceased. While property speculators have stopped purchasing properties, owner-occupiers now believe that properties are priced too high to purchase. This deadlock in the property market has affected local governments’ income from land sales, which in turn causes them to be conservative when pump-priming economic growth.

The above analysis shows a dilemma. China’s market reforms have borrowed from the Eastern European experience by starting with the market for products and services and being very cautious about developing the markets for productive factors (especially the capital market), thus taking a “one step forward and two steps back” approach.

Nevertheless, the broad direction of financial marketisation is quite clear. Capital market reforms have continued after the 2008 global financial crisis, including the successive liberalisation in businesses such as trusts,

insurance, bonds and private banking. Progress has also been made in RMB internationalisation and capital account convertibility.

However, the global financial crisis has also made some people lose confidence in the market economy and instead laud the “China model”. They have boosted the Chinese government’s confidence in its current economic system while gradually weakening its willingness to press on with financial marketisation.

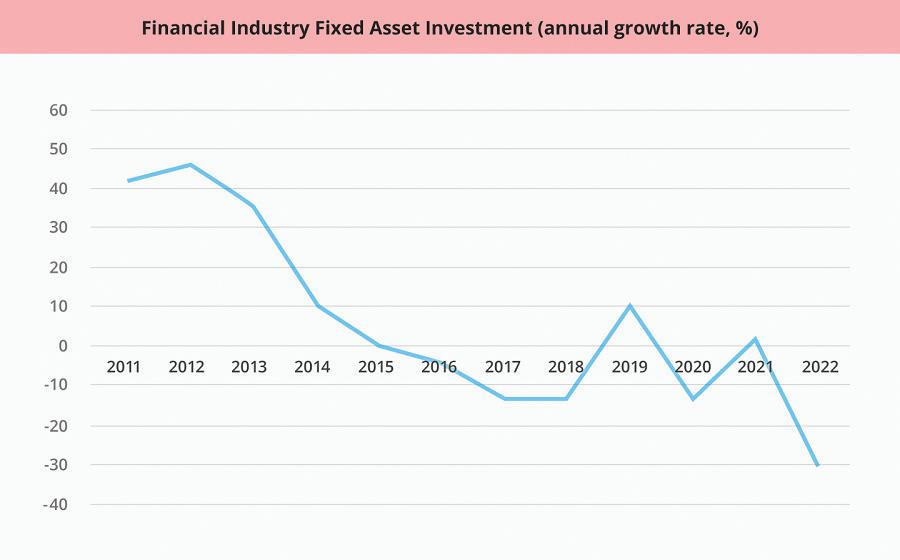

After China’s stock market crash in 2015, government interventions in financial activities have become increasingly frequent. How should financial market reforms continue, and which model should China use? There are yet no answers to these questions, and the financial industry seems to have lost direction amid high confidence in the “chosen path”.

Chart 3 shows that the growth of the financial industry FAI has decreased from 46.2% in 2012 to 0.3% in 2015, and it has been in negative territory since, with the exception of 2019. It has further declined by 30% in the first seven months of this year, which affirms the conclusion that the financial industry has lost its way.

How should financial market reforms continue, and which model should China use? There are yet no answers to these questions, and the financial industry seems to have lost direction amid high confidence in the “chosen path”.

In the 1980s, emerging out of China’s dual pricing system (the government control pricing and the free market pricing systems) were profiteering government officials (官倒爷) who used their authority to obtain sought-after products at the controlled prices to sell at the higher market prices. Many have still not forgotten the huge discontent among the people caused by these officials, whose existence indicates the lack of thoroughness of market reforms.

These profiteers vanished after the abolition of the dual pricing system and the liberalisation of the market for products and services.

Fortunately, China’s leader at the time did not waver in the debate on whether the market should be “surnamed socialism or capitalism” that determined the direction of the reforms, and resolutely chose the path of marketisation that ended China’s shortage economy inherited from the central planning.

However, due to the stagnation in reforms, the dual pricing system persisted for a long time in the transactions of capital, land and other factors of production. Profiteering by those in power continued, albeit in a less

... abandoning market reforms will only lead to common poverty instead, as maintaining the status quo will create more opportunities for corruption, increase income inequality, render the use of capital increasingly inefficient, and further reduce investments and innovation.

People wait to cross a street at the central business district in Beijing, China, on 8 July 2022. (Wang Zhao/AFP)

obvious manner. The huge profits attracted many rent-seeking activities, which became the main reason for corruption, power-for-money deals, and income inequality. Evidently, the corruption cases in recent years are mostly related to the financial industry, often involving huge sums of money.

Those who do not understand this process may be misled into thinking that these are the consequences of the market economy, and that the abolition of market reforms will reduce corruption and help China achieve the goal of common prosperity. However, the real reason is the stagnation of market reforms.

The profiteering opportunities will peter out with capital marketisation and the abolition of the dual pricing system. Meanwhile, abandoning market reforms will only lead to common poverty instead, as maintaining the status quo will create more opportunities for corruption, increase income inequality, render the use of capital increasingly inefficient, and further reduce investments and innovation.

Some believe that China’s currently sluggish economy will rapidly improve with the waning of Covid-19. However, it is not so simple, as the above analysis shows. The communique of the Third Plenary Session of the 18th Central Committee of the CPC in 2013 has articulated to “let the market play the decisive role in allocating resources and let the government play its functions better”.

The way in which this statement is understood and the manner in which it is implemented are essentially at the core of the tug-of-war between the bulls and the bears. The current outcome encapsulates the people’s aggregate response to the Chinese government’s preferences revealed during the past decade. Managing the people’s expectations and maintaining their confidence are of crucial importance to the nation’s economic stability.

www.thinkchina.sg

This article was first published in ThinkChina on 14 September 2022. ThinkChina is an English language e-magazine by Lianhe Zaobao. SCCCI collaborates with ThinkChina to cross-share content.

“Let the market play the decisive role in allocating resources and let the government play its functions better...” — The communique of the Third Plenary Session of the 18th Central Committee of the CPC in 2013

Interview with Terence Teo, President of Singapore Industrial Automation Association

Incorporated since 1982, the Singapore Industrial Automation Association (SIAA) is a trade association for companies and professionals in the Automation, Internet-of-Things (IoT) and Robotics (in short, AIR) sectors. SIAA plays a crucial role in galvanising the AIR business community through the line-up of programmes and initiatives to foster business collaborations and build capabilities. In this edition of Chinese Entrepreneur, SIAA President Terence Teo shares how SIAA serves their members and how to survive the data tsunami.

A: The fourth industrial revolution, also commonly called the Industry 4.0 (I4.0), focuses on automation, machine learning and data exchange. This reduces manual labour and improves productivity. There is an acceleration in the use of automation systems, the IoT and AI solutions. I4.0 is a new phase for companies to evaluate their usual growth approach and think about how to sustain growth.

The best approach is to learn from others that are doing well in the industry. Businesses can adjust their traditional processes according to their own needs, pick up new robotics advancements, and explore the relations between people and robots. It is just as important to consider things like the company’s platform, product size, production volume and capacity, human resource allocation, model optimisation technique and costeffective investment.

Minister of State for Trade and Industry Alvin Tan (fourth from the left) and SIAA President Terence Teo (fourth from the right) visited a smart farm which is a project by a member of SIAA. The advanced farming solution controls the entire smart farm enabled by IoT.

Minister of State for Trade and Industry Alvin Tan (fourth from the left) and SIAA President Terence Teo (fourth from the right) visited a smart farm which is a project by a member of SIAA. The advanced farming solution controls the entire smart farm enabled by IoT.

Q: What are the key developments in the automation industry in the recent years?

Automated machines and robots are doing some of the routine tasks that were done by workers. Some are even programmed to carry out complex tasks beyond what humans can do. Workers will need to be trained to operate these machines and robots and maintain the systems. Machines with poor health will hinder and affect the production capacity. It is advisable for companies to conduct checks and decide if they should scrap old machines and invest on new ones. Through data collection, companies will be able to monitor machine efficiency, production capacity and downtime.

but has been referred to by the Harvard Business Review as the sexiest job of the 21st century. High salaries, great career opportunities and flexible working hours are factors that make this field attractive.

Secondly, get ready for the future. Although there are self-driving cars, drones to lay bricks, and intelligent computers to diagnose illnesses and issue prescriptions, computers still struggle with creativity, problem-solving and forming emotional connections with people. Once we figure out the parts of a job that cannot be automated, we should try to focus and develop skills in those areas.

Thirdly, use data to find your perfect project or roles. Big data is not only changing our jobs but also how we find our jobs. Platforms such as LinkedIn and Glassdoor are getting smarter in

Q: The Singapore economy and many traditional economic sectors are undergoing transformation.

Q: How has the COVID-19 pandemic affected the pace of industrial automation?

A: Companies are embracing automation with the tightening of the labour market and higher customer expectations. We have seen an increase in the use of service robots during the pandemic. With travel restrictions, many

companies faced a shortage of operators in the shop floors and logistics warehouses, especially in material handling. With the implementation of the material handling robotics system, a closed loop is formed as the whole process requires little human intervention, reduces miscommunication and wrong data that is manually entered. Robots do not need to maintain safe distancing; this lowers the risk of infection. Productivity will not be affected by fatigue caused by repetitive work processes.

Collaborative robots and mobile robot transporters are used to do pick and place, highprecision visual inspection and autonomous transportation of items. Traditional processes are automated while material control processes are optimised. The production schedule will be more predictable and accurate as these will be handled by the I4.0 central management control systems.

The IoT and AI technologies help to fill the gaps in workplaces due to labour shortage, safe distancing control, contact tracing, remote management, and remote work arrangement.

A: SIAA serves our members and the AIR industry in four areas:

Knowledge: Besides identifying the trends and opportunities in the AIR sectors, we also organise activities for members to share their views and feedback.

Network: SIAA has both local and overseas networks with government agencies, trade offices, associations, institutes, and companies, which help our members explore opportunities for collaboration.

Marketplace: Since 2014, SIAA has been organising the IoT Asia+ which has a wide selection of conferences and exhibitions for members to gain exposure. Members can also join our Singapore Pavilions to venture into new markets in Southeast Asia. This year, we have completed our first two Pavilions in the Philippines and Penang.

Leadership: We are always looking out for new technology, with the latest in Agricultural Technology (Agritech) and Sustainability. Members can also learn more about 5G and the management of intangible assets.

SIAA launched AIRHUB (https://airhub.ai/) portal in May 2021 as a repository of products and solutions of our members. AIRHUB is the marketplace for solutions and collaboration opportunities both local and in the region in Manufacturing, Logistics and Warehousing, Smart Buildings and Facility Management and Urban Solutions. End users and business owners can browse through the implemented projects and solutions for idea generation and crafting of their business models. Members can also source for business partners online.

There are about 120 companies and 190 products and solutions in AIRHUB. In 2021, we facilitated 180 targeted connections consisting of 40% business collaborations, 44% demand and supply and 16% technology.

A: Firstly, rising costs. Collating common challenges and curating solutions help companies to reduce costs, as we work with trade associations and cluster groups to get to end-customers.

Secondly, internationalisation. Every year, SIAA organises around eight Singapore Pavilions in Southeast Asia. Through these trade shows, members can find partners and serve their customers directly. We also work with overseas trade associations to be a bridge for members to build international partnerships.

Thirdly, forming collaborations. Grouping our members into application clusters facilitates networking and capability development. For example, the companies in the Facility Management cluster (SIIX-AGT, Advantech and Anewtech) worked together on a security robot

application. In the Agritech cluster, Linkwise Technology worked with Delta Electronics and SPTel on smart urban farm projects.

Lastly, innovation. SIAA facilitates the networking of technology partners through the National Robotics Programme (NRP), Innovation Partner for Impact (IPI) and overseas trade offices. We identify members that are keen to embark on innovation and leverage on IPI’s services for technology scouting and landscape studies, as well as curate tech offers and provide advisory services.

SIAA works with the Association of Information Security Professionals (AiSP) to conduct workshops on Operational Technology (OT) Cybersecurity. We also organise member visits to Singapore Polytechnic 5G & AIoT (Artificial Intelligence of Things) Technology Hub to learn about the developments in these areas.

Q: What are the key challenges faced by your members? How does SIAA address these challenges?SIAA had a half-yearly discussion with SIAA Advisor, Minister of State for Trade and Industry Alvin Tan (sixth from the right) on the issues faced by the industry amid the changing landscape.

A: The Government has established the Future Economy Council (FEC) which comes up with the Industry Transformation Maps (ITMs) for 23 industries. Each ITM opens opportunities to adopt new technologies. It also provides information on career pathways and reskilling options for different sectors. Companies can build a strong network, attract talent and address skill gaps through training courses.

As a member of NRP’s Project Evaluation Panel (PEP), SIAA contributes knowledge and expertise in the field of robotics as well as identify areas for research and development to

help Singapore companies.

In 2019, SIAA worked with Enterprise Singapore’s Standards Division and Singapore Manufacturing Federation - Standards Development Organisation (SMF-SDO) to launch the Standards Roadmap for Industrial and Service Robots.

The Open Platform Communications Unified Architecture (OPC UA) serves as a data exchange standard for the integration of automation systems and machines. Data acquisition from machines, sensors and autonomous robotic handlers can be standardised and deployed quickly. This is at the heart of the I4.0 solutions for the industry.

Q: How has the Government been supporting the automation industry?A group photo was taken during the MoU signing ceremony among the National Robotics Programme (NRP), ROS-Industrial Consortium Asia Pacific, Senior Minister of State for Manpower Dr Koh Poh Koon (first row, second from the left) and SIAA President Terence Teo (first row, second from the right). Looking ahead, they will lead the industry on the adoption of the Robot Operating System (ROS).

A: Our near-term plan is to increase the stickiness of SIAA’s services to the members as we focus on their needs in innovation and technology. Our objective is to help companies with business collaborations and capabilities building.

The medium-term plan will be to first gather the problem statements of members via design thinking workshops. SIAA wants to increase members’ awareness in trending topics so that they can make informed decisions as they reinvent their products and solutions and find the right business partners.

Staying relevant and dynamic will continue to be a key success indicator for SIAA. We are transforming ourselves to serve the industry better and find new ways to sustain SIAA’s operations.

A: We need individuals with various skillsets in building the automation system, from developing the business strategy to monitoring equipment efficiency.

Firstly, we need mechanical design engineers to design and develop the automation system using the Computer-Aided Design and Manufacturing (CAD/CAM) software. Secondly, control engineers must be familiar with programming, dashboarding and communication protocols associated with the Internet. Their expertise in machine sensorisation, IoT gateways and edge computing are needed in data collection. Thirdly,

data science, data analytics and AI knowledge will enable engineers to design systems with predictive maintenance (PdM) capabilities. Lastly, having project-management skills can ensure the smooth implementation of automation projects. All these are essential for efficient and integrated manufacturing and control systems.

Q: What are the key skills that are essential to the industry?

Q: What are SIAA’s near- and medium-term plans? What is your definition of success for SIAA?

EVERCOMM SINGAPORE PTE LTD

HONG SHIN BUILDERS PTE LTD

GENSCRIPT BIOTECH (SINGAPORE) PTE LTD

HEALING HANDS CHIROPRACTIC PTE LTD

VENTURER GROUP CORPORATE SOLUTIONS PTE LTD

JCP LAW LLC

KNOVO PTE LTD

CHINA AIRLINES LTD

MESCALON PRIVATE LIMITED

GREAT SOURCE PTE LTD

JOINT STOCK COMMERICAL BANK FOR FOREIGN TRADE OF VIETNAM MCC LAND (SINGAPORE) PTE LTD

SINGAPORE RETAILERS ASSOCIATION

FOPPIANI SGP PTE LTD

OTSAW DIGITAL PTE LTD

WANG YIXUAN

ALIGN TECHNOLOGIES PTE LTD

ZOEY LIU

EVEREDGE PTE LTD

LIFE ORIGIN PTE LTD

UNICLA INTERNATIONAL PTE LTD

BIOPRO SOLUTIONS PTE LTD

ALPHA NETWORKS SOLUTION PTE LTD

NS SOLUTIONS ASIA PACIFIC PTE LTD

MOTHERS WORK PTE LTD

HASHSTACS PTE LTD

ONG YEOW CHONG

SMART MEDIA4U TECHNOLOGY PTE LTD

JODIA TAY LIM SHEN XIANG

HUI DA CONSTRUCTION PTE LTD

TRIDENT CONSULTANCY PTE LTD

GARICK KEA HQ GANO (SINGAPORE) PTE LTD NG TZE YONG

TRS FORENSICS PTE LTD

SINGAPORE MOBILITY CORPORATION PTE LTD

ZHT SMARTCARD PTE LTD

LEE PEI HUA RACHEL

ASTUTE ENGINEERING PTE LTD

DISTRIBUTED LEDGER TECHNOLOGIES (DLT) PTE LTD

HONYO INDUSTRIES

FIREROCK CAPITAL PTE LTD

QUANTUM STRATEGIC HOLDING PTE LTD

GREEN LINK DIGITAL BANK PTE LTD

MKJ HAPPY STATION PTE LTD BSI GROUP SINGAPORE PTE LTD

MR MS MR MS MR MR MS MR MR MDM MS MR MS MS MR MS MR MS MR MR MR MR MDM MR MDM MR MR MS MDM MR MR MS MR MR MR MR MR MR MS MR MR MR MR MR MS MR MS

CHEN CHIU-HAO

JONG ADELINE JOHNSON WANG

GINA LOW CALAUNAN DARREN KU ZHI YOU

JEREMY CHEONG YON-WEN TE KELLY KOH BOON WAY JASON YEO WANG YAN

HOANG MINH TRANG TAN ZHIYONG TONG ROSE TANG SISI LING TING MING WANG YIXUAN SEOW HOCK MENG ZOEY LIU RICHARD TEO HU MENG

EDDIE CHUA KEITH CHIA JEANNIE CHIA LIONEL FANG SHARON PHOONG-WONG BENJAMIN SOH

ONG YEOW CHONG LI SHANGJING JODIA TAY LIM SHEN XIANG

WANG LIANGPENG SEE XUE XIAN

GARICK KEA CHRISTOPHER YEO NG TZE YONG

TAN SWEE WAN THOMAS CHIA

HUANG ZHENQUAN RACHEL LEE HO SOO EE

PREM PIYUSH RICK TAN

ZHANG YAN CHUA THIAM HAO

LIM MONICA

ZHOU JIAMENG, KIMI ALICE NEO

CEO Director President of APAC Director/CEO CEO & Founder Director Co-Founder Sales Manager Corporate Trade Director Director

Chief Representative CEO Executive Director

General Manager South East Asia Founder and CEO Managing Director Director Account Manager Associate Director Director Director

Chief Executive Officer Chief Commercial Officer General Manager

Founder & Chief Executive Officer Managing Director Manager in Account Management and Operations Director of Public & Government Affairs Associate District Director Vice-President Director Sales and Marketing Manager

Vice-President, Consumer Insights Managing Director

4th-generation Owner and Apprentice Craftsman

Chief Executive Officer Managing Director Chief Executive Officer

Senior Associate Director

Head of Marketing Managing Partner Director Director

Head of Product Sales, Digital Trade and Supply Chain Director

Head of Sales

Others Construction Health & Social Services

Health & Social Services

Professional, Business & Technical Services

Professional, Business & Technical Services Education

Transport, Storage & Logistics

Others

Wholesale & Retail Trade Finance & Insurance Real Estate

Wholesale & Retail Trade Transport, Storage & Logistics

Others

Information & Communications Information & Communications

Others

Professional, Business & Technical Services Health & Social Services

Wholesale & Retail Trade Agriculture Information & Communications Information & Communications

Wholesale & Retail Trade Information & Communications

Professional, Business & Technical Services

Professional, Business & Technical Services Real Estate Finance & Insurance Construction Others Others Manufacturing Others Others

Professional, Business & Technical Services Wholesale & Retail Trade

Others

Others

Professional, Business & Technical Services Manufacturing Information & Communications Wholesale & Retail Trade Finance & Insurance

Food & Beverages Services

Professional, Business & Technical Services