FINANCIAL EDUCATION IS IMPORTANT, BUT...

The Realities of Student Loans

The Benefits of Contactless Payments

Girl Math

Have You Heard of It?

Are You A Fan?

SPRING 2024

Anderson

1720 North Main Street Anderson, SC 29621

1434 Pearman Dairy Road

Anderson, SC 29625

100 Hanna Crossing

Anderson, SC 29621

Columbia

1025 Pulaski Street

Columbia, SC 29201

Corporate Office & Support Center

420 E. Park Avenue, Ste. 100

Greenville, SC 29601

Easley

118 Brushy Creek Road

Easley, SC 29642

Five Forks

117 Batesville Road, Ste. 200

Simpsonville, SC 29681

Member Solutions Center

Greenville: 864.232.5553

Nationwide: 800.922.0446

Mills Avenue

300 Mills Avenue

Greenville, SC 29605

Spartanburg

130 North Town Drive

Spartanburg, SC 29303

Taylors

3237 Wade Hampton Boulevard

Taylors, SC 29687

Verdae

601 Verdae Boulevard

Greenville, SC 29607

24/7/365 SERVICE

MONEYLINKSM Online

at www.spero.financial

MONEYLINKSM Audio Response

Greenville: 864.232.3645

Nationwide: 800.633.4364

To locate an ATM near you, visit www.spero.financial

LOCATIONS

FIND US ONLINE /MySperoFi @MySperoFi @MySperoFi www.spero.financial CONTACT

Insured by NCUA Copyright ©2024 by Spero Financial and The Brand Leader. All foreign and U.S. rights reserved. Contents of this publication, including images, may not be reproduced without written consent from the publisher. Published for Spero Financial by The Brand Leader. 3 Letter from the President 5 Community & Events

Member Spotlight: BRIAN GRAYBILL, MEMBER SINCE 2008 8 Feature: FINANCIAL EDUCATION IS IMPORTANT, BUT … 11 Credit Corner: THE REALITIES OF STUDENT LOANS 14 Money Matters: THE BENEFITS OF CONTACTLESS PAYMENTS 16 What's Trending: GIRL MATH – HAVE YOU HEARD OF IT? ARE YOU A FAN? In This Issue 1

6

THE BIG REVEAL FALL 2024

YOU

Reimagined just for

Letter from the President

Brian McKay PRESIDENT

Dear Members,

It's hard to believe that it's already spring. With the newness of the season comes some exciting new things we have in store for you in 2024 — all designed to take your member experience to the next level.

For instance, this June, if you have a Spero debit card, you’ll be receiving a new one in the mail that enables you to enjoy tap-to-pay convenience. Be on the lookout for more information coming soon. In the meantime, turn to page 14 to learn how you will benefit from this new contactless payment technology.

To learn more about all that is on the horizon in 2024, I invite you to join us on Tuesday, April 16, for our Annual Members Meeting, where we will share several other solutions currently in the works for our members. I promise you, you don’t want to miss it. I hope to see you there! Visit our website for more details.

Everything we do has always been and will continue to be centered on our members. At Spero, our why starts with you. Every day, we strive to serve you better than the day before. Your financial success is our success, and we want to walk with you every step of the way.

Whatever your financial goals are for this year, we want to help you achieve them. The first step is gaining insight into what powers our financial decisions. Did you know that our thought patterns, habits, and behaviors all shape how we handle money? I encourage you to turn to page 8 to learn more. Also, take a few moments to browse the other articles in this edition for a closer look at topics ranging from the realities of student loans on page 11 to new social trends that your wallet may not be a fan of on page 16.

This year is off to a great start, and we have so much to look forward to in the coming months.

I appreciate you!

3

Kasasa Checking Giveaway

We’re making Kasasa Checking even more rewarding by giving away $1,000 to five (5) winners! To be eligible, open a Kasasa Checking account between now and June 14 and complete the following items by the second full monthly qualification cycle:

Make 12 debit card purchases of $5 or greater

Sign up for eStatements

Receive one direct deposit or perform an ACH transaction

That’s all there is to it. Complete those steps, and you’re in the running to win!

5,000$ Kasasa Checking Insured by NCUA. Membership required. “Kasasa” is a trademark of Kasasa Ltd., registered in the U.S.A. Visit www.spero.financial/kasasa-sweepstakes for full contest details. No purchase necessary. Void where prohibited. Promotion begins on April 8, 2024 and ends June 14, 2024. At the time of the drawing, you must be 18 years of age or older, a U.S. Citizen or U.S. Lawful Permanent Resident, all accounts and loans with Spero Financial must be in good standing. All employees and volunteers of Spero Financial and their immediate family members residing in a single household are not eligible. The Monthly Qualification Cycle begins at 12:01am on the last day of the month and ends at midnight on the second to last day of the following month.

KASASA ® CHECKING GIVEAWAY

Community & Events

Financial Workshop Calendar

Join us each month for our Financial Workshop Webinar series. From 12 p.m. to 1 p.m., you can hear from money experts on a range of topics that impact your financial health. RSVP at spero.financial/workshop.

Thursday, May 21

STUDENT LOANS | During this workshop, GreenPath will provide insights on student loan repayment planning in the wake of the pandemic and the uncertainty that followed.

Tuesday, April 23

ASSET ALLOCATIONS | During this workshop, Pinnacle Wealth will share best practices for balancing risk and reward as you work toward your financial goals.

Thursday, June 27

AIM FOR YOUR BEST FINANCIAL LIFE

IN YOUR 20S & 30S | During this workshop, Pinnacle Wealth will help those new to investing understand the importance of financial planning and the steps they should take today to ensure future success.

Congratulations to our 2023 FiCEP graduates!

This February, 36 Spero team members received their official certification. These team members completed a rigorous multi-week course and passed a final exam to become America's Credit Unions Certified Financial Counselors.

Holiday Closures May 27 MEMORIAL DAY June 19 JUNETEENTH

5

Brian Graybill

MEMBER SINCE 2008

Member Spotlight

6

Brian Graybill is a Spero member (and a former Spero employee), but he’s better known as a husband, father, and commercial property agent. When he joined the Spero team in 2008, Brian didn’t know what that relationship would mean to him and his family today.

When he worked in our Member Solutions Center, Brian says he “quickly realized the value of a credit union and its focus on serving and improving members’ financial lives.” While he wasn’t familiar with credit unions before joining the Spero team, Brian jumped right in. It didn’t take long for him to discover that our core values aligned with his own.

One of Brian’s favorite (and funniest) Spero memories happened during a promotional event where the Director of Marketing at that time would dress up in a mullet and throw a dinner to celebrate the success of each branch. We gladly admit that our team mantra of “work hard and play hard” still rings true today!

Since then, Brian and his family have soared with Spero in more ways than one — through checking accounts, a mortgage, minor savings accounts for their children, and even a business account for his wife’s luxury travel business.

This financial security also paved the way for him to launch his post-Spero career as a commercial property agent.

Brian says he “quickly realized the value of a credit union and its focus on serving and improving members’ financial lives.”

Sharing the same focus on community impact as Spero, Brian’s top priorities in his real estate career are serving the local community and having the flexibility to be with his family — especially at his sons’ soccer games. Brian notes that being a commercial property agent has allowed him to reach his personal goals and the goals he set for his family, both of which he is thankful for.

After joining the team, Brian opened his personal membership with the credit union. Fortunately, he and his wife graduated college without student debt; however, with no borrowing history or credit score, they faced obstacles when applying for their first credit card. “Unfortunately, when I attempted to get a credit card, I had no credit history, and I was denied by every credit card company,” Brian recounted.

He wasn’t sure what steps to take until Spero approved him and his wife for a small credit card. Brian says this was what it took to “get our credit score started and eventually strong enough to purchase a house and set us on a successful financial journey.”

“I am blessed to be able to help business owners purchase and lease buildings in the upstate of SC, and these businesses, in turn, help build and strengthen our local community. From helping my church, Fellowship Greenville, find a building and tract of land for a new campus in Simpsonville to helping a physical therapist find a building to treat patients to helping a baseball coach find a center for sports training to helping a local business owner find a storefront for his retail business, every encounter gives me the opportunity to be a part of the Greenville community. And for that, I am incredibly grateful!”

At Spero, our purpose is to inspire and nurture financial hope one member at a time. Our journey with Brian started with his first credit card and eventually led to him enjoying financial peace of mind. Stories like his are the reason we do what we do. Our why starts with you!

7

MEMBER SPOTLIGHT

Financial Education Is Important, But …

It’s often said that money rules the world. While this isn’t entirely true, money definitely plays an important role in our lives. It impacts everything from basic necessities to our greatest aspirations. The irony is that while we acknowledge the significance of money in our lives, we often don’t prioritize it as such. Many of our financial decisions, from everyday spending to savings, are often subconsciously rooted in the habits, thought patterns, and behaviors that have shaped our lives.

As a credit union, we’re on a mission to change that. We want our members to have complete control over their money, not the other way around. One avenue through which we do this is financial education — offering free online courses, resources, and financial workshops for our community. We firmly believe that financial education is the key to unlocking financial freedom.

We also know financial education is pointless if it’s not paired with self-awareness and intentionality. Simply put, financial education isn’t truly effective until we apply it to our lives. It's not just knowing about personal finance; it’s about practicing it.

In this article, we’ll dive into how our habits, thought patterns, and behaviors shape our finances. We’ll also offer ways to become more aware of those impacts and be intentional about our financial decisions.

Our Behavior’s Role in Our Finances

For many, financial health is closely tied to behavior and habits. They affect every decision we make with our money, and the hard part is sometimes we don’t even realize it. According to the American Psychological Association, 43% of daily actions are habitual and happen while thinking about or doing something else. Our financial practices are no different. While we may make some purposeful decisions with our money, most things we do with our money are repeated behaviors that have turned into habits.

FEATURE

Our behavior impacts our finances in several ways:

1 | EMOTIONAL

Fear, anxiety, sadness, happiness, and all the emotions in between can influence our financial behaviors. Being aware of and regulating behaviors caused by emotions is important for success in our financial journeys. For example, impulse shopping is often triggered by emotions such as stress, excitement, or boredom.

2 | SOCIAL

You’ve probably heard the phrase, “keeping up with the Joneses.” This saying references the way our money habits are often shaped by comparison and a desire to keep up socially and economically with those around us. Whether we realize it or not, our family, friends, and other influential figures impact the thought patterns, habits, and behaviors we form about our finances. Recognize the ways that those around you have spoken into your life. Consider whether they’re a positive or negative influence on your finances.

3 | SITUATIONAL

Our experiences affect our thought patterns and behaviors regarding our money. If we’ve experienced a significant loss of money in the past, we’ll probably do whatever it takes to avoid that experience again. If we’ve done something to positively impact our finances, we will likely repeat that behavior. Our life is a collection of

experiences, so it’s no surprise that the things that happen to us — good or bad — greatly impact the formation of the thought patterns, habits, and behaviors that guide our decisions. The same holds true for our financial life.

What Does This All Mean?

Self-awareness is a critical part of financial education. When we’re aware of our personal strengths and challenges, the tactics, topics, and tips we learn through courses, resources, and workshops will be more effective. Try to become more in tune with the root of your thoughts that drive your financial decisions. Practicing self-awareness will set you up to grow in awareness and intentionality within your financial journey. A few ways you can do this are:

1 | TAKE A MONEY PERSONALITY ASSESSMENT.

Understanding your money personality is essential to capturing the “why behind the buy” and the psychological influences that play a role in how you make your money decisions. By doing so, you can make better, more intentional financial decisions that will shape your financial future.

2 | TRACK YOUR FINANCES.

Tracking your finances will give you a clear picture of where your money is going and reveal your decisions regarding your money — intentional or not. Once you start tracking your income and spending, you’ll be more aware of where your money is going — and better able to control where it goes in the future.

3 | TAKE INVENTORY OF THE INFLUENCES AROUND YOU.

While the role others have on our habits, thoughts, and behaviors can be hard to pinpoint, there are likely some influences that can be easily identified. If you begin noticing patterns that others have on your financial behaviors, you can come up with a game plan to combat negative tendencies or set boundaries that help you make decisions based on your own needs, values, and goals, not those of anyone around you.

While this may feel like a lot of work, remember it’s a process. Simply take small, intentional actions to practice self-awareness and pursue financial literacy. Your financial journey doesn’t have a deadline; ultimately, it’s up to you what path you take. If you need a helping hand, we’re here to support you. You can always find free financial education resources on our website and reach out to schedule a free financial coaching session with one of our certified financial counselors.

9

Personal Loan

The perfect loan for .

Whether you want to consolidate debt, cover an unexpected expense, or make a big purchase, a Spero Personal Loan has you covered. Apply online to get competitive rates and same-day funding.* With a Spero Personal Loan, your possibilities are endless.

Open yours today!

spero.financial/personal-loan

PERSONAL LOAN

R. Member Since 2021 Membership required. Subject to credit approval. *Same-day funding available on loans if: (1) the application is received by 2:00 p.m. on any day the credit union is open; (2) your application is approved using our standard underwriting guidelines; (3) you've provided all relevant information requested and we've had an opportunity to verify the information provided, and (4) you've reviewed and signed your loan agreements and disclosures. 10

Giovannie

The Realities of Student Loans

Let’s be real for a moment. Student loans are serious financial commitments that come with real responsibilities. According to Forbes, more than half of students leave college with student loan debt. Across the U.S., student loan debt totals over $1.75 trillion. While this number is substantial, it’s not surprising considering the rising price tag of higher education. From 1980 to 2020, there has been a 180% increase in the cost to attend a four-year college full-time.

With this staggering mountain of debt, it’s no surprise that student loans have been a hot topic in the media over the past few years. The issue became even more prominent when the Federal Government paused student debt interest accrual and repayments in response to the COVID-19 pandemic in March 2020. Since then, relief measures have been extended nine times. New loan forgiveness programs have also been announced for certain borrowers, leaving others wondering if their federal student loans will be forgiven as well.

CREDIT CORNER

11

According to the U.S. Department of Education, when federal student loan repayment resumed in October 2023, 40% of borrowers missed their first payment.

With this uncertainty, borrowers understandably feel a range of emotions regarding their student loans. Some feel fear and anxiety surrounding the added pressure of a high monthly payment. Others feel under-prepared to take on payments after experiencing relief for an extended period. Still others wonder if they even need to make student loan repayment a priority. Of course, there are also those who feel fully prepared to pay down their student debt and become debt-free.

Whatever category you’re in, we see you and understand just how big of a role a student loan can play — not just in your finances but in all areas of your life. In this article, we’ll explore the importance of fulfilling student loan obligations and offer a few helpful strategies for navigating your student loan journey.

The Importance of Making Student Loan Payments

If you find yourself wondering, “What will happen if I don’t pay my student loans?” consider these impacts:

01

Credit Score

Student loans are just like any other loan or type of credit — failing to make timely payments can negatively affect your credit score, as your loan servicer will report late payments to the credit bureaus. Late payments could have significant ramifications for your future financial goals and aspirations. Your credit score not only influences your ability to buy a house, purchase a car, or get another type of loan, but it can also affect your ability to get a job and be approved for leases — among other things. On the flip side, making your student loan payments on time can positively affect your credit score.

02

Wage Garnishment

Wage garnishment is a court order that directs an employer to withhold an employee’s earnings to pay a debt. This can have a significant impact on your income. If you fail to pay your student loans, lenders can garnish or withhold up to 25% of your wages, depending on whether it is a private or federal student loan. If you have federal student loans, the government may collect outstanding payments via tax refunds or other government payments.

03

Additional Fees

Unpaid student loans may incur late fees or past-due fees. These vary between federal and private loan servicers, with private loan servicers having more flexibility to set their fees, whether flat or percentage-based. Either way, late fees only increase the total amount you will have to pay back.

12

Strategies To Consider for Repayment

While it can feel overwhelming, we recommend evaluating your options and developing a game plan for your student loans. This process looks different for everyone, and there are many routes to follow. Start by assessing your current financial situation, then consider how the strategies below might fit into your repayment game plan.

1 | INCOME-DRIVEN REPAYMENT PLANS

If you’ve assessed your finances and found that the minimum payments for your federal student loans exceed your budget, you can apply for an income-driven repayment plan. While few private loan servicers offer alternative repayment plans, federal loans provide many different plans (each with unique eligibility requirements) for borrowers to explore.

These modified plans limit your monthly payment to a certain percentage of your income. And while they may slow the time it takes to pay off your loan and cause you to pay more interest over time, they may be a good option to help balance your budget in your current situation.

2 | DEFERMENT OR FORBEARANCE

If you assessed your finances and found that you cannot make any payment toward your student loans, explore deferment or forbearance. These options often require proof of a qualifying event of hardship. While these options won’t allow you to pay off your debt faster, they do provide relief from the negative credit impact that not paying your payment would typically have.

3 | REFINANCING OR CONSOLIDATION

Refinancing or consolidating your student debt could be a strategy to help you pay your debt down quickly. Refinancing could help you get a lower interest rate on your loans, resulting in significant savings over the life of your loan. While this isn’t the right choice for everyone, it might be worth considering, especially if you have multiple loans or a variable interest rate.

4 | PAYING MORE TO THE PRINCIPAL

If your budget has a surplus that you could pay toward your student loans, it may be a good idea to make additional payments towards your loan each month. Paying more toward the principal will help chip away at your debt faster and reduce the total amount you’ll pay in interest over time.

The

climate surrounding student loans

can be

confusing and overwhelming. Taking an honest assessment of your finances and developing a game plan to tackle your student loans can help you feel empowered in your financial journey. Always remember, we’re here to help! Schedule an appointment with a Certified Financial Counselor or visit one of our branch locations today.

CREDIT CORNER 13

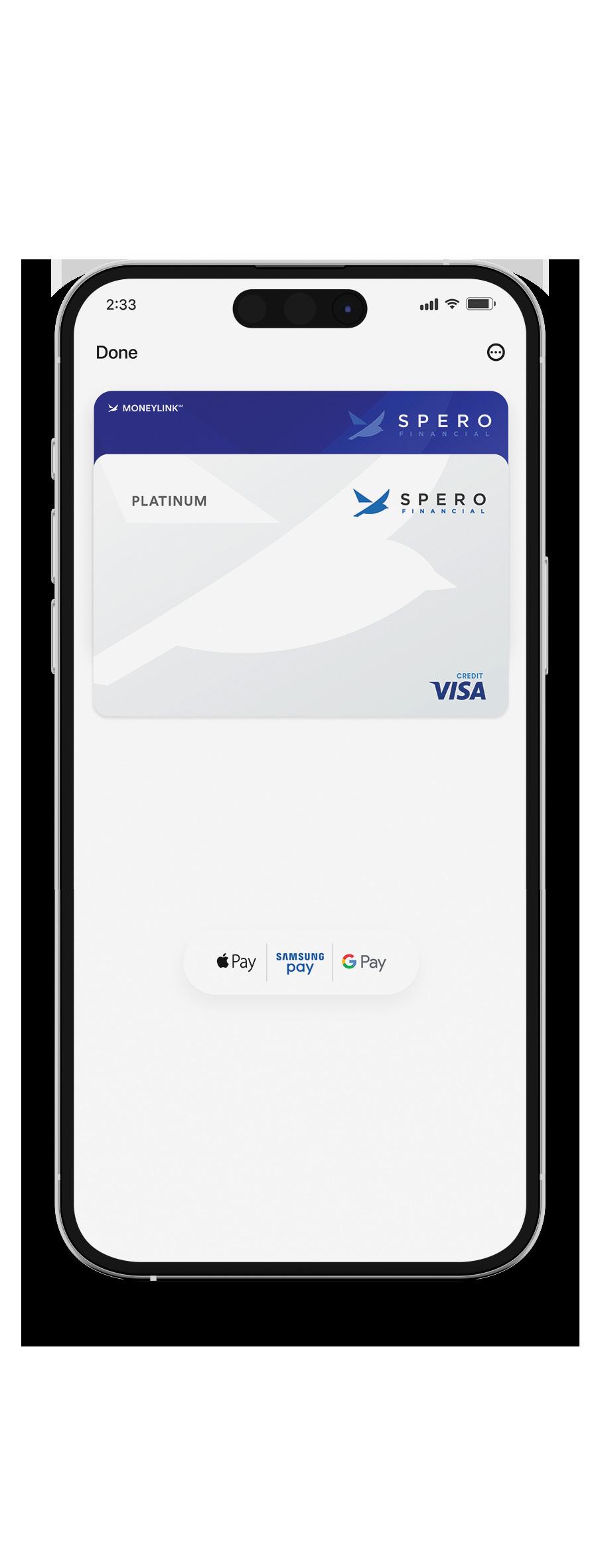

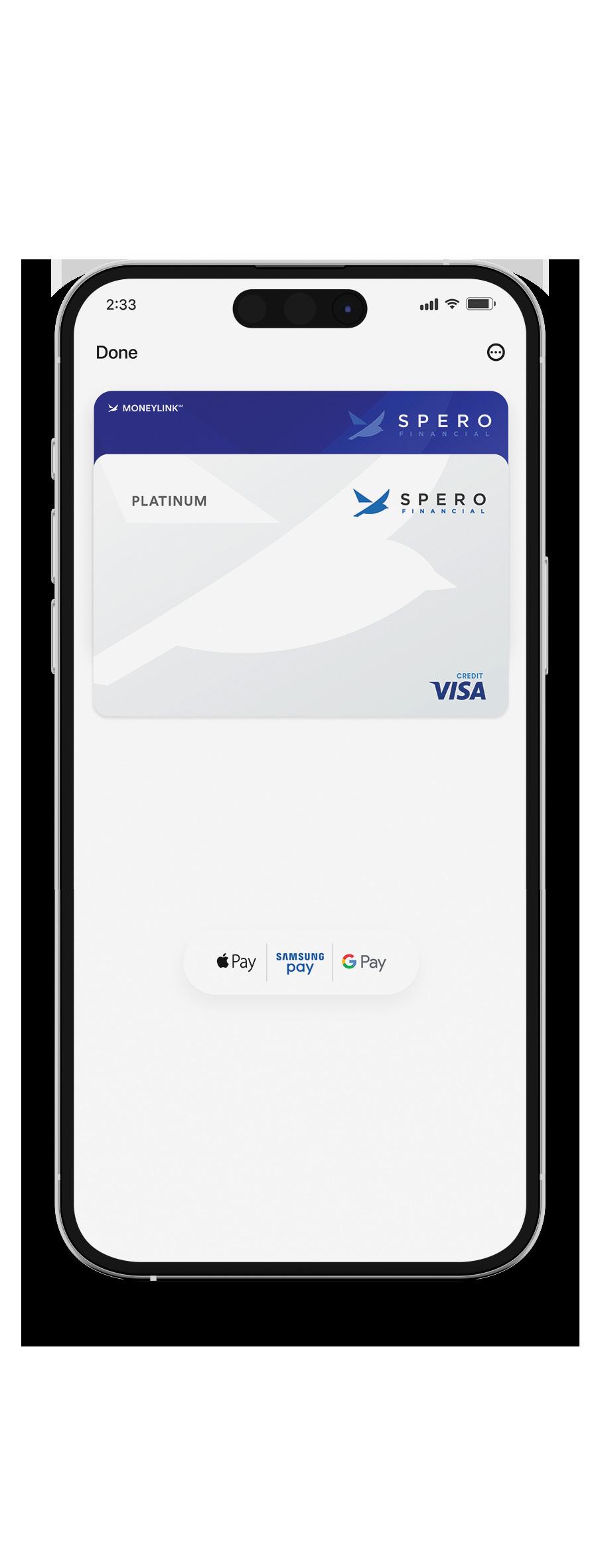

The Benefits of Contactless Payments

How we make purchases has changed drastically over the past few decades. We went from primarily using cash to relying on debit and credit cards. In keeping with the trend, even the cards have transformed — from raised numbers to magnetic stripes to EMV chips to the latest innovation: contactless technology.

If you have questions about how contactless payments work or wonder whether it’s a secure way to pay, we’re here to shed some light on how these cards work and why you might enjoy having one. Fun fact: Spero debit cards and credit cards are contactless. So, as a Spero member, you can enjoy all the benefits we share below.

What Is Contactless Payment?

Contactless payment, also known as notouch or tap-to-pay, is a feature of some credit and debit cards, digital wallets, and point-of-sale systems with adequate technology. Using radio frequency identification (RFID) and near-field communication (NFC), the point-of-sale system captures and processes short-range electromagnetic signals that transmit your card information. Transactions are completed within seconds, with an electronic tone or green light signaling that the payment has been accepted.

If you have a contactless card, you should see an icon that looks like the Wi-Fi symbol on the front of your card. Compatible card readers will also display this icon. When you go to pay, simply tap your card or hover it above the card reader.

14

Contactless Payment Security

Believe it or not, contactless payments are safer than magnetic stripe technology. Your contactless card or device produces a one-time code for each transaction, keeping your card information secure. NFC only works within a short physical distance, making it even more unlikely for interruptions to occur during your transaction.

One caveat to this is that contactless cards don’t require a PIN. While no PIN makes for a quicker transaction, if someone manages to get a hold of your physical card, they may be able to make purchases more easily than with a chip or magnetic stripe card. As such, in the event your debit or credit card goes missing, always contact us immediately to put a lock on the card.

Why Go Contactless?

Contactless payment methods are more than just secure — they offer other practical benefits, too.

01

Efficient Transactions

As mentioned, speed may be the most prominent benefit of contactless payments. The advanced contactless chip technology is faster than traditional methods, making transactions more convenient for consumers and merchants.

02

Reduced Contact with Public Surfaces

Paper money can hold more germs than a toilet (eww!), and chip and magnetic stripe cards require direct contact with card readers that countless individuals have touched. But with contactless cards and devices, you can make a purchase without touching the card reader even once.

03

Less Wear and Tear

Because contactless cards have fewer physical interactions, they last much longer. They don’t experience the same wear and tear as other cards that must be handled by cashiers, slid through old card readers, or inserted into point-of-sale systems.

04

Better for Travel

U.S. public transportation is starting to accept contactless payments, making getting from one place to another easier than ever. Contactless cards are quickly gaining worldwide acceptance, enabling seamless international travel.

05

Fraud Prevention

Contactless payment methods use advanced technology like tokenization and encryption to protect your information. Your money should stay safe as long as your card is in your hands.

The embrace of contactless payments represents a pivotal shift toward a more convenient, efficient, and secure way of making purchases. They are slowly becoming the new norm, so the more we learn and the better we understand them, the sooner we can enjoy their convenience and benefits. Give it a try today with your Spero debit and credit cards!

15

MONEY MATTERS 15

Girl Math: What Is It? Are You a Fan?

If you’ve been on social media or around anyone who’s scrolled their social feeds over the last six months, you’re probably familiar with the term “girl math.” Whether you love seeing videos of people explaining girl math, can’t understand it, or have never heard of the term, we’re here to offer a different perspective and even address some of the dangers associated with the fun trend.

For the record, we didn’t come up with the term “girl math.” TikTok users created it, and as often happens, the term stuck. (A “boy math” trend is brewing ... but more on that in another article.) The original intent of girl math was all in good fun, designed to elicit a laugh. But while some took offense to the gender stereotype, others treated it as sound financial advice.

By the end of this article, we hope you’ll have laughed at the humor associated with the topic, understood the idea behind girl math, and maybe even learned a few reasons not to take it too seriously.

First Things First, What Is Girl Math?

Forbes explains girl math as “an invested set of ‘rules’ that women supposedly keep to when justifying impulse spending.” A TikTok user coined these rules when she shared a video of a shopping trip and jokingly justified her purchases.

Examples include:

An item priced at $3.95 only costs $3.

Anything under $5 feels free.

Returning a $50 item and then spending $100 really only counts as spending $50.

Cash is not real money.

Buying on sale really means you’re saving money.

Not spending today means you double your spending budget for tomorrow. While the jokes are intended to be funny, and some might make sense in the right context, the idea often encourages unnecessary purchases and bad spending habits. Let's start by looking at how these thought patterns can damage our finances. Then, we can take a moment to appreciate the humor while choosing to be more intentional with our money.

16

Why Our Wallets May Not Be a Fan

We enjoy the joke just as much as the next person and even find ourselves doing a bit of girl math from time to time. But if we’re not careful, the idea can be taken too far and truly impact our financial health.

BEFORE HITTING BUY ... TAKE A PAUSE!

If we take this funny trend too seriously, we may overspend and make unnecessary purchases. While girl math could make sense in some cases, like qualifying for free shipping, in other cases, it might not make sense at all — for example, if regular shipping costs $5, but you have to spend another $50 to qualify for free shipping. Girl math can also help justify purchases we weren’t planning to make in the first place, especially if it’s a sale that “we just can’t pass up.”

To challenge overspending, consider delaying the purchase you are planning to make. Our environment has primed us for instant gratification. While not always bad when shopping, this norm often fuels overconsumption (aka impulse shopping). This especially rings true if FOMO (fear of missing out) creeps in. There’s a reason why companies promote “limited-time offers.” The false urgency feeds FOMO, and often, without considering whether we really need — or even want — the product, we click the buy button.

Our advice is to give yourself time to think. Do you need it? Can you live without it? How will this purchase impact my future goals? If you’re still thinking about it a week later, then it might be a purchase worth making.

AVOID IMPULSE SHOPPING ON A CREDIT CARD.

If it’s taken too seriously, girl math can go beyond budgets and impact credit. To keep up with the desire to spend, some have allowed overspending to trickle onto their credit cards. This can become a slippery slope if we don’t have a full understanding of the long-term impacts of accumulating credit and the impacts on our future goals. Contrary to what some TikTok users believe, credit cards are not free money.

If you find yourself using your credit card for unnecessary or impulse purchases and cannot pay off the balance each month, we encourage you to look at your spending habits and restructure them to become more sustainable.

So,

Let’s Recap.

Girl math was intended to be a joke — nothing more! While we don’t want to blow a joke out of proportion, there are some real ways people use the concept to justify unhealthy financial habits. So, laugh at the relatable humor, but be aware of the ways the fun could have a very real impact on your life. Doing so will help you avoid the financial pitfalls and unhealthy patterns that may accompany it.

17

WHAT'S TRENDING?

PO

www.spero.financial

Box 10708

Greenville, SC 29603