3 minute read

Family Wealth Transfer

By Thomas J. Bayles, JD, MBA

Advertisement

The American Dream is a common and widely known concept among those in our community. It is a belief that through hard work and dedication, anyone can accumulate knowledge and wealth. What happens after the American Dream is achieved? Most families fail to preserve the wealth they have gained. By the end of the second generation, as much as 70 percent of a family’s wealth has not been preserved, and this statistic rises to 90 percent by the end of the third generation. You may think the cause of this damage to family wealth is poor tax planning or bad investment management, but it is more commonly due to the lack of trust and communication around group decision making. Family relationships have the strongest bonds, whether they be full of kind or harsh feelings. While family culture is hard to change, a family can establish a shared connection and identity while building resilience, if done right.

Families must have family meetings to choose interdependence, build trust, create a family mission statement, and practice group decision making. These meetings will create an atmosphere for families to share experiences, participate in activities, learn of common values, goals, and hopes, and practice traditions that will create a place of belonging and reinforce commitment to fortify relationships. Family education through family meetings are the key to preserving the wealth of those who have achieved the American Dream.

If your family derived its wealth from a family business, there are important steps to consider if your goal is to keep the business in the family. Merely leaving ownership of the business to family upon death without discussion or training is a recipe for disaster. Careful evaluation of a business succession plan should be formulated well in advance of retirement in order to ensure the successful generational transfer of a business. Initial considerations should include solutions if a key family member passes away. There are numerous additional considerations including voting rights, lifetime transfer of stock, inheritance, estate taxes, the role of life insurance, and cash liquidity, among other items. Significant effort should also be put into discussing and transferring business decision-making while key family members are still working in the business. A trusted family advisor, such as an experienced estate planning attorney, can be helpful in the succession planning process.

In the world we live in now, children hunger for a sense of belonging but have a difficult time finding a connection outside of the home. It is important that your home is a safe place for your family to feel comfortable enough to share their successes as well as their struggles. A strong family bond will help each member feel included. Once that bond is established, tough discussions will be easier to resolve, and the American Dream will live on for multiple generations. About the Author Thomas J. Bayles is an attorney at ProvenLaw, PLLC. The company name is new to the St. George market, but Mr. Bayles has been an attorney in St. George, practicing in estate planning and business succession planning for over twenty years. ProvenLaw is a legal group providing trust, estate, tax planning and litigation, probate, trust administration, and business succession planning in the state of Utah. ProvenLaw exceeds our clients’ expectations by offering unmatched expertise, client service, and quality work. With more than ninety years of collective experience, ProvenLaw promises consistency, knowledge, clarity, constant communication, resolution, and peace to our clients. If you would like to visit with us about your planning, please visit our website at provenlaw.com, or give us a call at 435-688-9231.

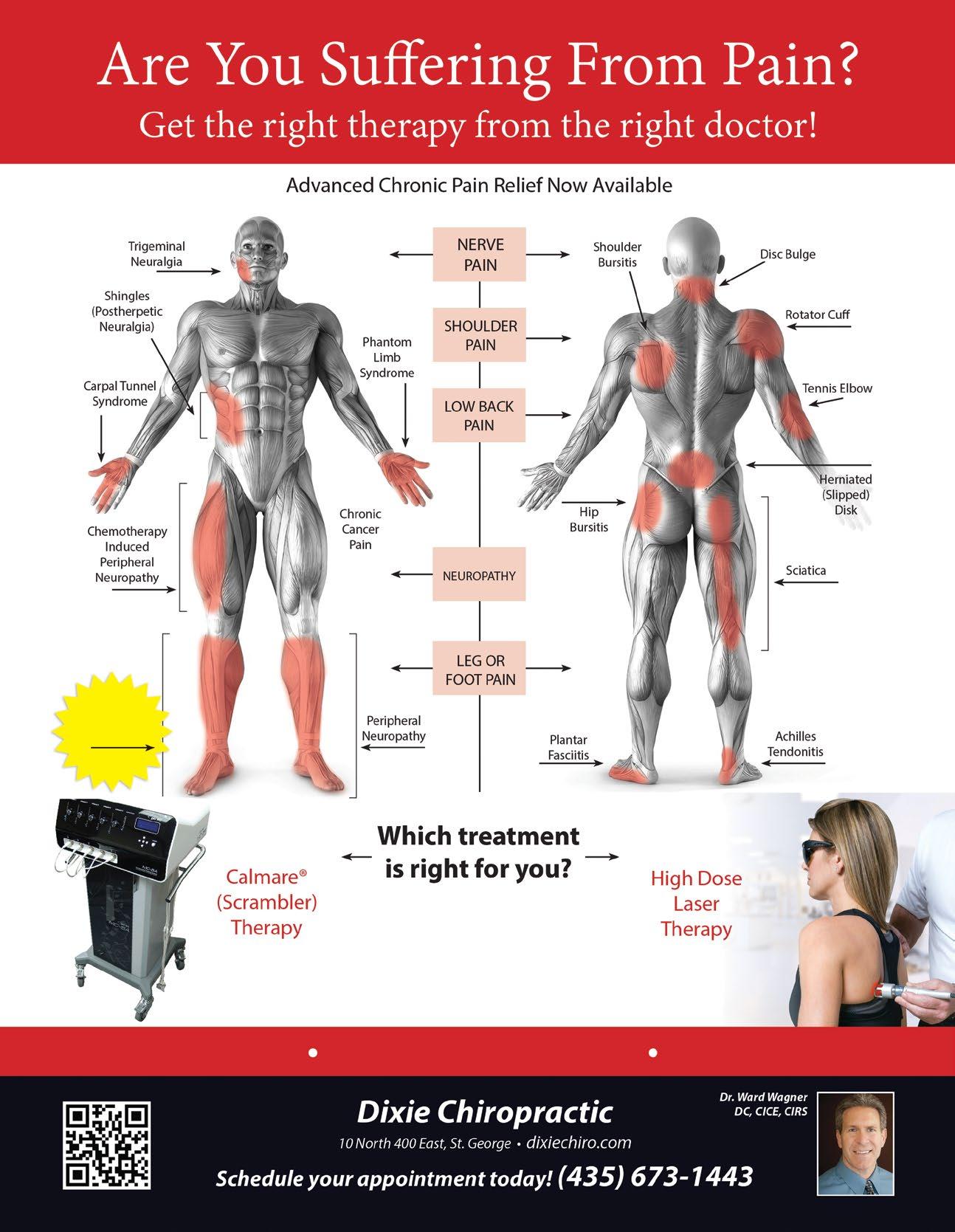

Drug Free, Pain Free Therapy

$99 Introductory Visit