OPEC is Trying to Outlast the Shale Boom

FINAL EV TAX CREDIT RULES IMPACT ON U.S. MARKET

U.S. Tech Companies Pumping Billions into New Data Centers

Will Iranian Sanctions Tamper Oil Price Volatility?

SEVERE WEATHER EVENTS TO HIT U.S. ENERGY HARD

OPEC is Trying to Outlast the Shale Boom

FINAL EV TAX CREDIT RULES IMPACT ON U.S. MARKET

U.S. Tech Companies Pumping Billions into New Data Centers

Will Iranian Sanctions Tamper Oil Price Volatility?

SEVERE WEATHER EVENTS TO HIT U.S. ENERGY HARD

We have moved to a new bigger station in San Antonio!

Sundays 2pm-3pm 930AM San Antonio

THE ONLY OIL AND GAS SYNDICATED NATIONAL RADIO SHOW

MOST listened to show on Sunday nights! Thank you HOUSTON!

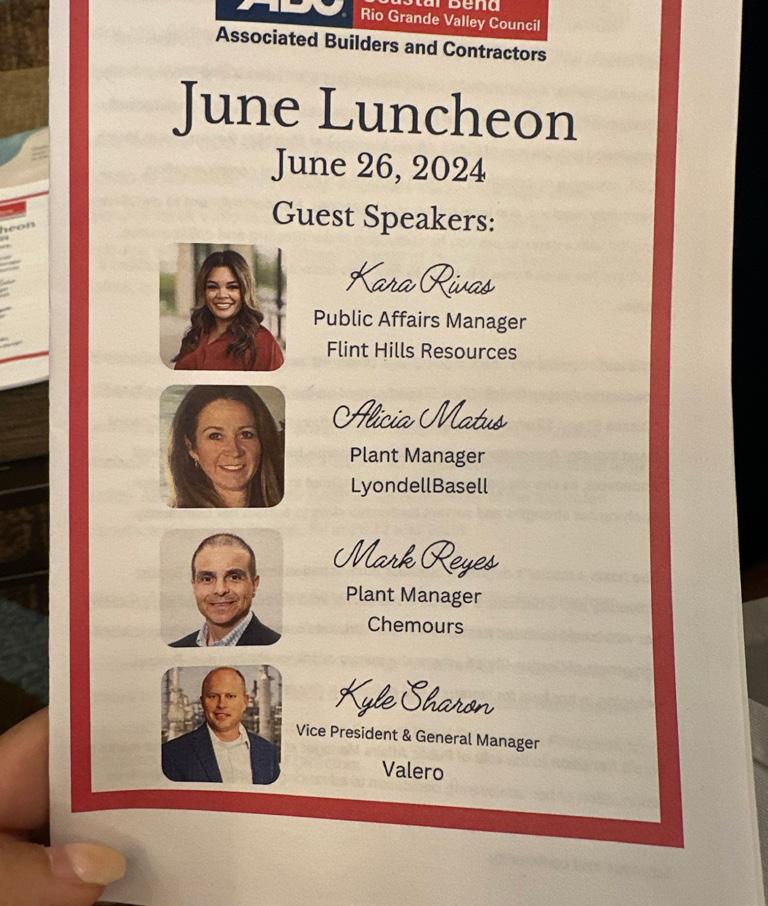

Saturdays 7am KEYS 1440AM / 98.7FM Corpus Christi

Sundays 8pm-9pm KFXR 1190AM / simulcast on the iHeartRadio app Dallas / Fort Worth Worldwide

Saturdays 1pm-2pm KWEL 1070AM / 107.1FM Midland Odessa Permian Basin

Sundays 2pm-3pm The Answer 930AM San Antonio / New Braunfels / San Marcos / Austin

Sundays 8pm-9pm KTRH 740AM / Simulcast on the iHeartRadio app Houston / Worldwide

Saturdays 6am-7am, 11am-12 noon

Sundays 6am-7am, 5pm-6pm AM 1440

To listen to the show: Visit shalemag.com or download iHeart mobile app to listen live!

energy for

Finding and producing the oil and natural gas the world needs is what we do. And our commitment to our SPIRIT Values—Safety, People, Integrity, Responsibility, Innovation and Teamwork— is how we do it. That includes caring about the environment and the communities where we live and work – now and into the future.

EDITOR-IN-CHIEF

Robert Rapier

CHIEF FINANCIAL OFFICER Suzel Diego

PUBLICATION EDITOR Tyler Reed

ASSOCIATE EDITOR David Porter

VIDEO CONTENT EDITOR Barry Basse

STAFF WRITERS

Felicity Bradstock, Tyler Reed

DESIGN DIRECTOR

Elisa Giordano

VICE PRESIDENT OF SALES & MARKETING James Moreno / james@shalemag.com

ACCOUNT EXECUTIVES

John Collins, Ashley Grimes, Doug Humphreys, Matt Reed

SOCIAL MEDIA DIRECTOR

Courtney Boedeker

SOCIAL MEDIA MANAGER

Gargi Bhowal

DIGITAL COMMUNICATIONS MANAGER Amanda Villarreal

CONTRIBUTING WRITERS

Felicity Bradstock, Alex Charfen, Jess Henley, Kenneth M. Horwitz, Matt Jaye, David Porter, Robert Rapier, Tyler Reed

CONTRIBUTING PHOTOGRAPHER

Fonzie Munoz

STAFF PHOTOGRAPHER

Malcolm Perez

EDITORIAL INTERN

LeAnna Castro

The Port of Corpus Christi’s Foreign Trade Zone 122 program helps increase global competitiveness of U.S.-based companies. Foreign Trade Zone 122 can defer or reduce duty payments, streamline supply chain costs and help companies thrive in competitive domestic and foreign markets.

LATELY, I HAVE BEEN BUSY PERUSING THE RECENTLY RELEASED 2024 STATISTICAL REVIEW OF WORLD ENERGY. FOR 70 YEARS THIS WAS THE BP STATISTICAL REVIEW OF WORLD ENERGY, BUT LAST YEAR BP HANDED OVER THE PUBLICATION TO THE ENERGY INSTITUTE (EI).

The Statistical Review is the bible of energy statistics. It provides comprehensive data on global oil, gas, and coal production and consumption, as well as on carbon dioxide emissions and renewable energy statistics.

Global energy demand continues to grow. Primary energy consumption increased by 2% from 2022, surpassing pre-COVID levels by over 5%. Fossil fuels contributed 63.6% of the increase while renewables contributed the remainder. Global energy demand continues to grow faster than the ability of renewables to keep pace, much less displace fossil fuels.

Still, renewable energy grew at six times the rate of total primary energy, making up 14.6% of total consumption. However, renewables like wind and solar contribute only 8.2% of the world’s energy consumption, with hydropower contributing another 6.4%.

The real heavy lifting is done by fossil fuels, which accounted for 81.5% of the world’s 2023 energy consumption. Oil production leads all categories, responsible for 32% of global energy consumption.

Last year marked a record for U.S. oil production, with an average daily production of 12.9 million barrels per day (BPD), an 8.5% increase over 2022. The U.S. enjoys a lead over Saudi Arabia and Russia of more than 2.4 million BPD, but that lead is far greater when natural gas liquids (NGLs) are considered.

With NGLs included U.S. production in 2023 was 19.4 million BPD. That’s 8.0 million BPD ahead of Saudi Arabia and 8.3 million BPD ahead of Russia’s numbers in that category. Those are massive leads driven by the increase in U.S. natural gas production over the past two decades, which substantially boosted U.S. NGL production.

Carbon emissions in the U.S. declined by 2.7% from 2022, and emissions in the European Union fell by 6.6%. But, across Asia Pacific, emissions jumped 4.9%, an increase equivalent to triple the combined decline in the U.S. and EU. Any progress Western countries make in reducing carbon emissions is being negated by massive increases in Asian countries.

In other news, the International Energy Agency (IEA) recently released its Oil 2024 report, in which they projected that by 2030 oil production will reach “a staggering 8 million barrels per day above projected global demand.”

The report cites the proliferation of electric vehicles, the growing utilization of renewable energy, and China's declining oil consumption growth as key contributors to this projected trend. The IEA still expects oil demand to grow, but it projects that oil production growth will vastly outstrip demand growth. Consider me skeptical. Bloomberg made a similar prediction in 2016, that there would be a massive excess of oil by 2023. In fact, oil demand grew by 5 million BPD during that period, so consider me skeptical of the IEA projection.

Finally, we have an election rapidly approaching. In this issue, we look at the energy policies of the two major candidates for president. It is a unique situation because often all we must rely on are campaign promises. This time, both men have a track record we can examine. We do that in this month’s cover story.

Thank you for reading Shale Magazine. Until next time.

ROBERT RAPIER Editor-in-Chief

THE PUBLIC IS RIGHTFULLY CYNICAL ABOUT CLAIMS MADE BY POLITICIANS. I HAVE OFTEN NOTED THAT WE TEND TO ELECT THOSE WHO MAKE THE MOST BELIEVABLE CAMPAIGN PROMISES. BUT AFTER THEY ARE IN OFFICE, MANY POLITICIANS FAIL TO DELIVER ON THEIR CAMPAIGN PROMISES. THEY TELL PEOPLE WHAT THEY NEED TO IN ORDER TO GET ELECTED.

But the 2024 presidential election offers something unique for voters. Instead of evaluating campaign promises, we can see the track records of two men who have already been president. Past behavior often serves as a reliable predictor of future actions because it reflects established patterns and habits. This concept, rooted in behavioral psychology, suggests that individuals are likely to repeat behaviors that have been reinforced over time, creating a consistent trajectory for future behavior.

With that in mind, we could evaluate the proposed energy policies of Joe Biden and Donald Trump. But since we already have track records for each man serving as president, it is perhaps more informative to look at those respective track records.

From a big-picture viewpoint, Donald Trump has been pro-fossil fuels but provided less support for green energy. Joe Biden has been the opposite, creating a more hostile environment for fossil fuel production, and a more conducive environment for green energy. But as they say, "The road to hell is paved with good intentions." Thus, let's look at each candidate's energy policies and the results of those policies.

Note that the purpose of this article isn't to promote one candidate over the other, but rather to give a factual account of each president's energy policies while in office.

During Donald Trump's presidency, policies heavily favored the coal, oil, and natural gas industries. This included opening federal lands and offshore areas to fossil fuel exploration and extraction, such as the Arctic National Wildlife Refuge (ANWR).

The Trump administration fast-tracked the approval process for key infrastructure projects, including the Keystone XL and Dakota Access pipelines. These projects were aimed at boosting the transport of oil and natural gas across North America. The Trump administration supported investments in innovative energy technologies, such as carbon capture and storage (CCS) and small modular reactors (SMRs) for nuclear power.

But Trump came under criticism from environmentalists for several policies. The administration's withdrawal from the Paris Agreement underscored its focus on national energy interests over global climate commitments, reflecting a broader strategy of prioritizing economic growth over

environmental considerations.

Trump's administration rolled back regulations aimed at reducing carbon emissions and protecting the environment. For example, the Clean Power Plan, which sought to reduce carbon pollution from power plants, was replaced with the Affordable Clean Energy (ACE) rule, which provided states more flexibility in setting emissions standards. The administration also rolled back regulations on methane emissions from oil and gas operations, arguing that it would boost energy production and economic growth.

The administration also repealed the Clean Water Rule, which had expanded the scope of protected waterways, potentially reducing restrictions on mining and drilling operations.

While the Trump Administration's focus was predominantly on fossil fuels, there was some support for renewable energy initiatives. The Department of Energy under Trump announced several funding opportunities for advanced energy technologies and grid modernization. The administration also imposed tariffs on imported solar panels, which some critics argued could hinder the growth of the solar industry in the U.S. The counterargument to this was these tariffs should encourage more domestic production of solar panels.

Overall, Trump’s administration placed a strong emphasis on promoting fossil fuel production and reducing regulatory burdens on the energy sector. These actions were intended to bolster U.S. energy independence, create jobs, and position the country as a dominant player in the global energy market. However, these policies were often criticized for their potential long-term environmental impacts and for downplaying the importance of renewable energy sources and climate change.

Joe Biden's presidency has marked a significant shift in U.S. energy policy, emphasizing a transition towards clean energy and addressing climate change.

While Biden has not completely turned away from fossil fuels, on his first day in office he canceled a key permit for the Keystone XL pipeline project that would have allowed the project to cross into the U.S., citing concerns that it would worsen climate change. This effectively killed the project.

Another of Biden’s first actions as president was to reenter

the Paris Agreement, signaling to the world a renewed commitment to global climate leadership. This move underscored the administration's focus on reducing greenhouse gas emissions and combating climate change.

The Biden Administration has imposed stricter regulations on new fossil fuel projects. This includes pausing new oil and gas leasing on federal lands and waters as part of a review of federal leasing policies. More recently, the administration paused new permits to export liquefied natural gas (LNG) until the Department of Energy finishes a new review of climate impacts.

The administration set a goal of achieving a 50-52% reduction in greenhouse gas emissions by 2030, relative to 2005 levels, and aimed for net-zero emissions by 2050. These targets are part of the broader agenda to address climate change and accelerate the transition to renewable energy.

Biden reversed many of the environmental rollbacks from the previous administration, including reinstating stricter emissions standards for vehicles and industries. This also involved reestablishing regulations for waterways and public lands. The administration has focused on tightening methane regulations, aiming to significantly reduce methane emissions from the oil and gas industry.

The Biden Administration passed the bipartisan Infrastructure Investment and Jobs Act, which allocated $1.2 trillion for various infrastructure projects, including $65 billion for power grid improvements and $21 billion for environmental remediation. It also included significant investments in clean energy technologies and electric vehicle (EV) infrastructure. The Inflation Reduction Act also earmarked billions of dollars toward energy security and addressing climate change.

The Biden administration has prioritized the growth of the EV market by setting a goal for electric vehicles to make up 50% of all new car sales by 2030. This includes substantial funding for building a nationwide network of EV charging stations. The administration’s policies include incentives for consumers to purchase electric vehicles and for manufacturers to invest in EV production.

In summary, Joe Biden’s presidency has been characterized by a strong push towards renewable energy and significant climate action, after promising to transition the U.S. economy towards a more sustainable future. These efforts represent a marked departure from the previous administration’s policies and reflect a broader vision of environmental stewardship and economic transformation.

Although the energy policies of the candidates are in stark contrast, the effect each had on the energy sector may seem at first counterintuitive. It is often hard to directly correlate a president’s policies to their impacts on the energy sector, because much of what happens in the energy sector plays out over a long period, or is more impacted by macro factors well beyond a president’s control.

For example, I have often noted a seeming contradiction between the George W. Bush and Barack Obama Adminis-

trations regarding oil production. While Bush had strong ties to the oil industry, and was a pro-energy president, U.S. oil production declined all eight years he was in office.

However, the Bush Administration passed several laws aimed at accelerating the development of fracking. Many of those laws helped spur the subsequent enormous increase in U.S. oil and gas production.

The irony is that President Obama presided over most of this production surge. However, the regulations and developments in the industry that enabled the shale boom took place during the Bush Administration. Those impacts are still felt today all over the world. But if you were only looking at oil production, you might mistakenly credit Obama’s policies for this huge surge.

The point is that these situations are often more complex than they seem on the surface. It is also somewhat hard to make direct comparisons between Trump and Biden due to the impact of the COVID-19 pandemic. But let’s attempt to make a comparison.

President Trump took office in January 2017. The average price of gasoline had fallen for two years. Oil production had risen in five of the six previous years, but had dipped in 2016 in response to a price war from OPEC.

During President Trump’s first three years in office, oil production resumed growth at about the same rate as from 2010 to 2015. New oil production records were set in 2018 and 2019. Natural gas production records were set in 2017, 2018, and 2019.

The national average price of gasoline rose during Trump’s first two years in office, before pulling back some in his third year. Trump is often associated with low gasoline prices, but the average price during Trump’s first three years in office was higher than during Obama’s last two years in office. Again, one shouldn’t read too much into this, as there were macro factors – like strong global demand – putting upward pressure on prices.

Then the COVID-19 pandemic hit in 2020, and that upended the oil markets. By April 2020, stay-at-home orders caused oil demand to crash. Production, in turn, dropped by 3 million barrels per day in May 2020. Oil futures briefly went negative. The stock market was crashing, and the national average gasoline price briefly dropped below $2.00 a gallon. Some fondly recall $2.00 a gallon of gasoline, but they forget that it’s because there was little demand for gasoline since most people were staying at home.

By the end of 2020, gasoline prices and oil production had recovered somewhat, but the repercussions of the pandemic would continue. Biden’s energy policies didn’t help, but supply chain disruptions made the biggest impact on gasoline prices during Biden’s presidency.

From Obama’s last year in office through Trump’s last year in office, oil production increased by 2.5 million BPD. However, production in 2020 was 1 million BPD lower than in 2019 due to the pandemic. The 2019 production record would stand until President Biden’s 3rd year in office.

Renewable energy would continue to grow during Trump’s presidency. Between 2016 and 2020, renewable energy consumption in the U.S. rose by 21.5%. The growth in solar power consumption was especially strong under Trump, rising 138% during his term.

However, the bottom line for energy companies wasn’t as good under Trump. The primary reason was that the energy

sector had a horrible year in 2020 due to Covid. But let’s take a closer look at the financials of ExxonMobil, the largest publicly traded supermajor.

During Donald Trump’s first three years in office, ExxonMobil earned a total of $54.9 billion in net income. The pandemic hit during the 4th year, and ExxonMobil posted a loss of $22.4 billion. So, for Trump’s full term, ExxonMobil earned $32.5 billion. For comparison – and for reasons I will explain below – during Joe Biden’s first three years in office, ExxonMobil earned $114.8 billion in net income. (As a reference point, ExxonMobil earned $89.1 billion in net income during Obama’s second term).

Thus, even if we omit the impacts of the pandemic, ExxonMobil earned more than twice as much during Biden’s first three years than it did under Trump’s first three years. This may seem counterintuitive given the respective administration’s attitudes toward the oil industry, but I will elaborate in the next section.

When Joe Biden entered office, the U.S. was still in the thick of the COVID-19 pandemic. Oil production had bounced back from the deep dive it took in the spring of 2020, but some of that production loss had been shut in permanently. Thus, as demand recovered, supply was slow to catch up. This began a surge in oil and gasoline prices that began in the summer of 2020, but that would persist throughout the first half of Biden’s term.

When Biden was inaugurated, the national average price of gasoline was $2.48 per gallon. The price would steadily rise throughout his first year in office. For comparison, the average price during Biden’s first year in office was $3.10/ gallon, versus $2.53/gallon during Donald Trump’s first year in office. This was great for oil companies, but not so great for consumers.

Early during Biden’s second year in office, Russia invaded Ukraine. In response to this, President Biden announced that the U.S. would stop importing Russian oil. Here we can draw a contrast between Trump’s presidency because he probably wouldn’t have made the same decision. For that matter, Trump has asserted that Russia would have never invaded Ukraine if he had been in office.

The decision to stop Russian imports disrupted operations in many U.S. refineries. In response, the price of oil surged to above $100/bbl, and the national average price of gasoline briefly topped $5.00/gallon. The average price of gasoline during Biden’s second year in office was $4.06/gallon, the highest annual average on record.

Biden responded with the largest-ever release of oil from the nation’s Strategic Petroleum Reserve (SPR). This is another decision President Trump might not have made. However, this release is generally cited as a factor in helping bring energy prices back down in 2023.

Many of Biden’s critics have focused on high prices and his overall hostility toward the oil and gas industry. But the results are mixed. As previously noted, oil companies made a lot more money under Biden. That’s because high prices

are good for oil companies – but bad for consumers. However, U.S. oil production also resumed its growth under Biden. From the 2020 plunge, oil production grew in 2022, and then surged to a new all-time high in 2023. It is on track to set another production record this year. Natural gas production has set production records during all three years Biden has been in office and is on track to set a new production record this year.

Renewable energy grew by 11% during Biden’s first three years, with solar power surging by another 82%. This growth rate is consistent with, but a little less than growth during Trump’s first three years in office.

Energy policy achievements are often difficult to decipher. The single biggest factor that has impacted the oil and gas industry in the U.S. over the past 20 years is the shale boom. Even though President Obama wasn’t pro-oil, he presided over the largest expansion of U.S. oil production in our history. Macro factors were more important than his policy decisions.

Thus, even though Biden has been hostile toward oil and gas, the industry continues to set records. Donald Trump was quick to take credit for production records set during his term. Biden has largely been silent on the issue, largely because of promises he made to move the U.S. away from oil and gas.

The reality is that these production records are not a result of Trump’s or Biden’s policies. They may have had a marginal impact, and there may be a longer-term impact, but it is hard to correlate the results of a president’s energy policies with results in real-time.

Had Biden served during Trump’s term, and Trump during Biden’s, the results wouldn’t have been substantially different when it comes to oil production. There may have been an impact on prices depending on actions taken concerning Ukraine. But, natural gas and oil production records would likely have still been set in the years they were set.

The real bottom line is this. If you favor pro-fossil fuel policies that could come at the expense of environmental regulations and support for renewables, then Trump is your man. If you favor a more hostile environment for fossil fuels and more money funneled into renewables, then Biden is your man. Just be sure to maintain realistic expectations around the short-term impacts of either president’s policies.

About the author: Robert Rapier is a chemical engineer in the energy industry, and Editorin-Chief of Shale Magazine. Robert has 25 years of international engineering experience in the chemicals, oil and gas, and renewable energy industries, and holds several patents related to his work. He has worked in the areas of oil refining, oil production, synthetic fuels, biomass to energy, and alcohol production. He is author of multiple newsletters for Investing Daily, and of the book Power Plays. Robert has appeared on 60 Minutes, The History Channel, CNBC, Business News Network, CBC, and PBS. His energy-themed articles have appeared in numerous media outlets, including the Wall Street Journal, Washington Post, Christian Science Monitor, and The Economist.

By: Tyler Reed

Six months after Hamas brutally attacked Israel, Israeli forces announced they would remove the majority of the troops in southern Gaza, sparking a slight drop in oil prices. Only one brigade will remain in the area, leaving a minimal Israeli presence as the conflict continues.

Brent fell below $90 per barrel while crude slipped to less than $86 following Israel’s announcement, potentially indicating a much-needed reprieve from the soaring prices at the pump for most Americans. While some experts remain skeptical of a turnaround, the hope of a reprieve from exorbitant gas prices would be much welcomed.

The Israeli government made the extraordinary announcement that it would be removing a significant amount of troops from its operation in southern Gaza. Six months after the brutal attack of October 7th, which triggered the Israeli-Hamas conflict, the world remains shocked by the devastation the conflict has brought. As Israeli troops depart Southern Gaza, many are seeing this as a sign of hope that a peaceful end is possible between the two Middle Eastern forces.

The announcement comes mere days after President Biden told Israeli Prime Minister Benjamin Netanyahu that the US policy would hinge on Israel’s immediate action to address civilian and humanitarian suffering. At the same time, it may seem like a glimmer of hope for a resolution, but rising tension with Iran may shed some different light on Israel’s decision to diminish troops in southern Gaza.

While some are viewing Israel’s move as a potentially hopeful indication, tensions continue to rise between Israel and Iran. A high-ranking Iranian military authority warned Israel that Israeli embassies could be targeted. Iranian officials claim an attack would be in retaliation for the missile strike against the Iranian Consulate in Damascus.

Naturally, Israel retorted that their military would be ready to respond to any action Iran takes against their embassies. Tensions between the two Middle Eastern nations skyrocketed within the past few months alone.

Following Israel’s withdrawal, Brent futures slid below $90 a barrel at the end

of the first week of April. Meanwhile, West Texas Intermediate dropped under $86 per barrel, a slight dip compared to the rally of the past several months. While a slight drop in oil prices could provide a much-needed reprieve for gas prices in general, experts question whether the slight downturn is indicative of a trend or a minor divot in an overall bullish market.

While the oil rally took a hiatus for a brief period of time, the geopolitical tensions in the Middle East and the ongoing Russian-Ukrainian conflict, many are skeptical of a dip in crude costs as an indicator of a turnaround.

With a threat of conflict looming between Israel and Iran, the potential for drastic crude and Brent gains is on the horizon. Following Israel’s withdrawal, US crude and Brent gained more than 4% as tensions increased in the Middle East. An additional regional conflict in the area could potentially disrupt crude supplies, threatening an already fragile supply line.

Other factors, including OPEC’s strict export limitations and globally tight supply, seem to indicate a continued surge in oil futures. The United States, in particular, is potentially on the up as we enter peak oil season when many Americans take to the road for summer vacations and road trips.

Throughout his presidency, Joe Biden has made his disapproval of oil and fossil fuel usage abundantly clear. Even with controversial decisions, such as the recent liquid natural gas restrictions, President Biden continues to make oil prospects difficult, contributing to increased pressure on prices at the pump.

Until the Biden Administration alters its direction and gives Americans a break at the pump, the cost of a summer adventure may prove too much for American citizens. As the president seeks re-election, ultra-high gas prices could prove to be a political headache, claims Will Kennedy of Bloomberg News.

As the geopolitical conflicts continue, crude supply could remain tight, driving up the cost for Americans. This light reprieve following Israel’s withdrawal from Southern Gaza could only be a minor calm before a major storm.

Until the Biden Administration alters its direction and gives Americans a break at the pump, the cost of a summer adventure may prove too much for American citizens.

About the author: Tyler Reed began his career in the world of finance managing a portfolio of municipal bonds at the Bank of New York Mellon. Four years later, he led the Marketing and Business Development team at a high-profile civil engineering firm. He had a focus on energy development in federal, state, and local pursuits. He picked up an Executive MBA from the University of Florida along the way. Following an entrepreneurial spirit, he founded a content writing agency. There, they service marketing agencies, PR firms, and enterprise accounts on a global scale. A sought-after television personality and featured writer in too many leading publications to list, his penchant for research delivers crisp and intelligent prose his audience continually craves.

By: Robert Rapier

Since 2008, the shale boom has grown U.S. oil production by about 9 million barrels per day. In the early days of the shale boom, when it wasn’t clear whether this development would have a significant impact, it was largely ignored by OPEC. By late 2014, as U.S. oil production growth was approaching 5 million BPD, OPEC decided they could no longer ignore it.

At its November 2014 meeting, OPEC announced it would defend market share that was being lost due to the rise of non-OPEC production, especially from the United States. It was a shift in strategy that I called OPEC’s Trillion-Dollar Miscalculation at that time.

The stated belief from some OPEC members at that time was that this would cause a dip in oil prices, and that would put a lot of the marginal shale oil producers out of business. Instead, oil prices plummeted, some shale oil producers went out of business, but the strategy indeed cost OPEC at least a trillion dollars of lost revenue as most shale producers held on.

In late 2016 the cartel waved the white flag, abandoning this strategy and returning to making production cuts to boost

prices. That strategy persists to this day. Since 2016, U.S. production has grown by another 4 million BPD, forcing OPEC to remain in production-cutting mode in order to defend prices. At its most recent meeting, OPEC extended production cuts into next year, but announced plans to start easing the cuts beginning in October 2024.

Whether they follow through will clearly depend on the supply and demand dynamics at that time. However, there may finally be reason for optimism within the group.

OPEC’s current strategy seems to be to keep production at a level that can support oil prices in a range of $80-$100/bbl. This becomes challenging if U.S. production continues to grow, which has been the case for the past 15 years. But, if they can hold out until U.S. shale oil production peaks and begins to decline, OPEC’s strategy may finally pay off.

U.S. production is 700,000 BPD higher than it was a year ago this month. However, production has been essentially at a plateau since late last summer. In August 2023, the U.S. produced 13.0 million BPD of crude oil. That gradually rose to 13.3 million BPD by the end of 2023 but has

since declined back to 13.1 million BPD.

Unless there is a surge of production over the next couple of months, by August the U.S. will have essentially flat year-over-year growth in oil production. That has only happened twice in the past 15 years. The first time was during OPEC’s 2015-2016 price war, and the second was during the COVID-19 pandemic in 2020. If U.S. production is flattening, this would mark the first time since the shale boom began that it wasn’t caused by extraordinary external factors.

OPEC is certainly watching these developments. If U.S. production continues to flatten or even decline, OPEC’s strategy may start to pay off. Global oil demand continues to grow. OPEC might be able to start relaxing its production quotas while keeping prices high.

It’s important to note that OPEC countries possess 70% of the world’s proved oil reserves. Russia has another 6%, while the U.S. only has 4%. So, the U.S. and the rest of the world stand to lose economically in the long run if non-OPEC production declines and OPEC regains market dominance.

We have seen this situation previously. Leading up to the shale boom, U.S. crude oil imports were growing every year, and the U.S. was sending enormous amounts of cash to oil-producing countries. If that’s not what we want as a country — and I don’t think it is — we need to start making serious plans on how to avoid it.

About the author: Robert Rapier is a chemical engineer in the energy industry, and Editor-in-Chief of Shale Magazine. Robert has 25 years of international engineering experience in the chemicals, oil and gas, and renewable energy industries, and holds several patents related to his work. He has worked in the areas of oil refining, oil production, synthetic fuels, biomass to energy, and alcohol production. He is author of multiple newsletters for Investing Daily, and of the book Power Plays. Robert has appeared on 60 Minutes, The History Channel, CNBC, Business News Network, CBC, and PBS. His energy-themed articles have appeared in numerous media outlets, including the Wall Street Journal, Washington Post, Christian Science Monitor, and The Economist.

By: Felicity Bradstock

U.S. energy infrastructure has been widely critiqued over the years for being outdated and prone to failure. This has become particularly evident in the face of severe weather events and natural disasters, such as winter storms and summer wildfires.

Scientists are now worried that these events could occur more often, and the energy infrastructure is not prepared to take this hit. So, how can the U.S. rapidly weatherproof its infrastructure to ensure Americans don’t lose power?

In May, Houston suffered the effects of a devastating storm that destroyed windows, blew down trees and flooded large portions of the city. Winds were recorded at speeds of up to 100 miles per hour, which is similar to those registered during Hurricane Ike, demonstrating the intensity of the storm. This left 630,000 people in Houston and a further 55,000 in Louisiana without power. After the event, Houston’s mayor, John Whitmire, said that some customers may be left without power for several weeks, at a time when temperatures were set to rise into the 90s. Lingering power outages after severe weather events are common across the U.S., as utilities battle to get their aging energy infrastructure back up and running.

Scientists are worried that as the world heats up it could increase the instances of severe weather events. Warmer air holds more moisture, which can result in more frequent, heavy rainfall and stronger storms. In the case of tornadoes, they have not been more frequent or intense but recent studies show that they have been taking place in more concentrated bursts. However, it is still extremely difficult to predict weather trends and if global warming is having an impact on these trends, scientists cannot yet accurately anticipate the result.

This means that the U.S. must prepare its energy infrastructure regardless of what’s coming to ensure that people across the country are not unnecessarily left without power for extended periods.

While it is well known that U.S. grid systems are vulnerable to severe weather events, recently, some unexpected damage has been seen with newer equipment, showing the need for greater preparedness. In May, a tornado passed through Iowa, leaving destruction in its wake. The path went through a wind farm and, unexpectedly, it bent a giant, metal wind turbine in two, causing it to go up in flames. This was particularly surprising as modern wind turbines are built to withstand extreme conditions. Energy companies have invested billions in turbine technology over several decades, advancing the machinery to adapt to its surroundings by changing angles or locking the blades. It's not just the grid and renewable energy projects that are being negatively affected by severe weather but also oil and gas operations. The forecast of a strong hurricane season in the Atlantic between June and November is expected to knock several offshore projects offline. Meteorologists believe as many

as 20 to 30 named storms could hit this year, up from 20 in 2023. Last year, the storms had little impact on U.S. oil and gas production and only one made landfall. However, if the hurricanes this year follow a different path it could be extremely detrimental to oil production, as well as hit towns and cities across the country hard.

With crude production in the Gulf of Mexico contributing around 14% of U.S. oil production, and the Texas and Louisiana Gulf Coast accounting for almost half of U.S. refining capacity, if any of these areas are hit by a strong storm it could result in a major disruption to output.

What’s Next?

Governments are trying to mitigate the effects of climate change by investing in a green transition. Another way to mitigate risk is by investing in greater infrastructure preparedness across this country. This means building stronger, more durable energy infrastructure and equipment that is less prone to damage in the case of a severe weather event.

In September 2023, the Federal Energy Regulatory Commission (FERC) recommended a revision of the standards for power grid and natural gas infrastructure to ensure energy equipment is resilient to storms, winds and extreme heat. This recommendation was based on the findings of a report on winter storm Elliott in 2022, which focuses on the mitigation of energy infrastructure destruction and unnecessary power outages.

The report emphasizes the importance of completing reliability standard revisions from Winter Storm Uri in 2021, which led to the largest controlled power outage in the history of the U.S. FERC Chairman Willie Phillips stated, “Some

recommendations from the 2021 Uri report are still not implemented... It shouldn’t take five winter storms in 11 years to show us the gravity of the situation we find ourselves in.” The FERC also highlighted the need to establish state-level reliability rules for natural gas infrastructure. Only by following these types of expert recommendations can the U.S. gradually prepare its energy infrastructure for the future and ensure consumers do not unnecessarily suffer.

About the author: Felicity Bradstock is a freelance writer specializing in Energy and Industry. She has a Master’s in International Development from the University of Birmingham, UK, and is now based in Mexico City.

By: Jess Henley and Tyler Reed

19 REPUBLICAN STATES have appealed to the U.S. Supreme Court to intervene against Democratic-led lawsuits filed against big oil and gas companies. The lawsuits allege that big oil and gas companies lied to the public about the potential climate harm of fossil fuels. However, Republican states are pushing back, claiming California and other states do not have the authority to dictate the climate policy for the nation.

Optimism prevails as Republican states challenge climate lawsuits. Although some experts say the challenge is unlikely to succeed, states including Alabama, Florida, and West Virginia are optimistic about their chances. The complaint alleges that five predominantly Democratic states, California, New Jersey, Connecticut, Minnesota, and Rhode Island, are attempting to dictate global emissions and the U.S. energy system.

Five Democrat-Led States File Against BP, ConocoPhillips, and Exxon Mobil Corp and Other Super Majors

California led the charge in filing the suit, with other Democratic-led states quickly following behind. The civil lawsuit filed in the state supreme court in San Francisco alleges that supermajors such as Shell, Chevron, ExxonMobil BP, and ConocoPhillips should be held responsible for environmental impacts caused by fossil fuels.

California Governor Gavin Newsom made this statement regarding the climate lawsuits:

“For more than 50 years, Big Oil has been lying to us — covering up the fact that they’ve long known how dangerous the fossil fuels they produce are for our planet. California taxpayers shouldn’t have to foot the bill for billions of dollars in damages — wildfires wiping out entire communities, toxic smoke clogging our air, deadly heat waves, record-breaking droughts parching our wells.”

The 135-page complaint claims that the supermajors have known and hidden the potential climate impacts of burning fossil fuels since the middle of the previous century yet downplayed this impact for their own gain. The suit alleges company scientists knew the extent to which fossil fuels could contribute to issues such as forest fires, severe weather events, and global climate.

The claim goes on to blame oil and gas companies for a surplus of misinformation throughout the 1970s to discredit climate change scientists and conceal climate concerns from the American people.

Additionally, the lawsuit seeks to establish a fund that would supposedly be designated to help relieve those impacted by environmental issues, such as natural disasters, severe weather conditions, floods, fires, and other alleged complications brought about by fossil fuels.

Alabama Attorney General Steve Marshall was quick to respond, announcing the 19-state lawsuit. In a recent statement, Marshall said, “If the Supreme Court lets them continue, California and its allies will imperil access to affordable energy for every American.”

Alongside Alabama, Republican states joining the complaint to the Supreme Court include: Alaska, Florida, Georgia, Idaho, Iowa, Kansas, Mississippi, Missouri, Montana, Nebraska, New Hampshire, North Dakota, Oklahoma, South Carolina, South Dakota, Utah, West Virginia, and Wyoming.

The complaint would prevent states like California and others from pursuing this lawsuit in the Supreme Court, which Republican states claim would harm the American and global energy systems.

Although energy companies did not immediately respond, they have argued the lawsuit seeks to overstep authority into the commerce and energy sectors, which remain reserved for the federal government's jurisdiction.

Despite the 19-state Collective challenge against the Democratic-led lawsuits, some experts are skeptical of the challengers’ viability. As early as last year, the Supreme Court denied similar arguments from ExxonMobil and Chevron. However, the complaint may carry more weight since it stems directly from the state’s Attorney General offices.

Doug Kysar of Yale University Law School said, “the arguments are almost entirely variations on those that were raised by the fossil fuel industry in their unsuccessful attempts to argue that these suits belong in federal court.”

Other legal experts say the Supreme Court is unlikely to take the challengers’ case, given the court has denied similar requests previously, having already seen the arguments.

Still, Republican states remain hopeful as the Supreme Court weighs the decision.

About the author: Tyler Reed began his career in the world of finance managing a portfolio of municipal bonds at the Bank of New York Mellon. Four years later, he led the Marketing and Business Development team at a high-profile civil engineering firm. He had a focus on energy development in federal, state, and local pursuits. He picked up an Executive MBA from the University of Florida along the way. Following an entrepreneurial spirit, he founded a content writing agency. There, they service marketing agencies, PR firms, and enterprise accounts on a global scale. A sought-after television personality and featured writer in too many leading publications to list, his penchant for research delivers crisp and intelligent prose his audience continually craves.

About the author: Jess Henley began his career in client relations for a large manufacturer in Huntsville, Alabama. With several years of leadership under his belt, Jess made the leap to brand communications with Bizwrite, LLC. As a senior copywriter, Jess crafts compelling marketing and PR content with a particular emphasis on global energy markets and professional services

By: Felicity Bradstock

IN RECENT MONTHS, there has been a major shift in the oil and gas industry due to the merger of a multitude of U.S. fossil fuel companies to establish bigger, more powerful players. As several oil majors acquire smaller firms, the absorption of their portfolios is putting resource power in the hands of just a few companies. The era of the megamerger is providing an alternative outlook for oil and gas, with companies joining forces to establish a strong foothold in the U.S. fossil fuels industry for years to come.

Over the last year, a wide range of oil and gas firms have undergone mergers. Oil majors, such as Chevron, Exxon and Occiden-

tal, have acquired smaller fossil fuel companies to increase their production capacity both at home and abroad.

Last October, Chevron acquired Hess for $53 billion in stock, giving Chevron a 30% stake in Guyana’s Stabroek Block and a stake in its Bakken shale operations in North Dakota, as well as boosting oil production by around 386,000 bpd. This merger will allow Chevron to diversify its operations beyond the U.S. and give the company a place in the new era of “lower-carbon” oil production in the Caribbean.

Shortly after, Exxon Mobil announced that it had bought out Pioneer Natural Resources for $59.5 billion in an all-stock deal, marking the oil major’s biggest merger since its acquisition of

Mobil. This move helped Exxon to expand its U.S. oil production, adding 711,000 bpd to its portfolio and doubling its crude output in the Permian Basin.

In December, Occidental Petroleum agreed to purchase the U.S. shale oil producer CrownRock in a $12 billion cash-and-stock deal, including debt, to expand its domestic operations. The CEO of Occidental, Vicki Hollub, stated, “We found CrownRock to be a strategic fit… Where we are looking at oil prices being long term, that it would help us in (oil) downturns.” The acquisition is expected to be completed by August this year.

In May this year, Houston-based ConocoPhillips announced plans to purchase its Texas rival, Marathon Oil Corp, in a $22.5 billion all-stock deal, which includes $5.4 billion in debt. This move will increase ConocoPhillips’s domestic, onshore oil output, adding operations in the Bakken and Eagle Ford shales and Permian Basin, as well as Montney Shale in Western Canada and the Anadarko Basin of Oklahoma.

In total, $250 billion worth of consolidation deals took place in 2023, with more expected to be seen this year. The total value of deals in January and February alone was $55 billion, which equates to around double the amount in the same period in 2023. Mergers involving U.S. shale companies accounted for 80% of the value.

However, it seems that not every company has been successful in taking a piece of the megamerger pie. The U.S. oil and gas producer Devon Energy lost bids to acquire at least three fossil fuel companies in the last year as its shares were reportedly not accepted as acquisi-

tion currency. Devon had its eyes on Marathon, CrownRock and Enerplus but failed to close any of the deals. Higher drilling costs and production challenges have made Devon stock less attractive to companies looking to undergo a merger. It is uncertain whether Devon will look to other companies, such as Permian Resources, Matador Resources, and privately-owned Mewbourne Oil, to expand its Delaware basin portfolio or if the oil major will focus on its current operations.

Bryce Erickson, the leader of valuation consultancy Mercer Capital's oil and gas group, predicted that Devon would make an acquisition sooner or later, given the current sentiment in the industry. Erickson stated, “Real or imagined, from my chair, there is a sort of feeding frenzy – it’s acquire or be acquired.”

Meanwhile, Matthew Bey, senior global analyst at the geopolitical intelligence firm Rane, explained, “Now we are starting to see a lot of larger players trying to gain as many assets as they can, in order to take advantage of economies of scale.” Bey added, “I think that all of them are trying to grow bigger in order to at least increase their own market share, increase their own size, increase their own revenue. But I'm not sure how much of it is solely about the idea of trying to outman one another.”

As the major deals of 2023 are expected to be completed this year, it is uncertain whether more will follow. However, given the current investment sentiment in the oil and gas industry, it is likely that more mergers will take place this year and next as companies race to expand their domestic and foreign assets and establish a strong position in the U.S. fossil fuel industry.

By: Felicity Bradstock

Two years after the launch of the Inflation Reduction Act (IRA), the U.S. government has finalized its final electric vehicle (EV) tax credit rules, which could change the face of the U.S. EV market for years to come. While the Biden Administration is adamant that the new rules support a “made in America” approach to manufacturing and critical minerals production, some Democrats and Republicans oppose the rules, suggesting they are far too reliant on Chinese supply chains.

The IRA provides a maximum tax credit of $7,500 per new EV, with $3,750 offered if the vehicle meets certain critical mineral criteria and another $3,750 provided if the EV meets specific battery component requirements. To be eligible for the tax credit, the vehicle must also meet a manufacturer’s suggested retail price (MSRP) limitation, and the taxpayer claiming the credit must meet certain requirements, such as income limitations. These rules will come into effect on July 5, 2024, and will cover 22 EV models of 100 currently available.

The new rules have changed little since the draft rules were established last year. They outline regulations on what percentage of foreign battery components and critical minerals are permitted in eligible vehicles, how dealers can offer the incentive at the point of sale, and which foreign suppliers are banned from accessing the credit.

The U.S. Department of the Treasury and Internal Revenue Service (IRS), which released the rules, says that the final rules lower costs for consumers, spur a boom in U.S. manufacturing, and strengthen energy security by building resilient supply chains with allies and partners. The

Treasury believes the rules strengthen and secure supply chains and provide certainty for manufacturers and taxpayers. The organization emphasized that since Biden took office, the U.S. has attracted $173 billion in private-sector investment in EVs and the battery supply chain.

Secretary of the Treasury Janet L. Yellen stated, “President Biden’s Inflation Reduction Act has unleashed an investment and manufacturing boom in the United States. I’ve seen firsthand in Tennessee, North Carolina, and Kentucky how ecosystems have developed in communities nationwide to onshore the entire clean vehicle supply chain so the United States can lead in the field of green energy.” Yellen added, “The Inflation Reduction Act’s clean vehicle credits save consumers up to $7,500 on a new vehicle, and hundreds of dollars per year on gas, while creating good-paying jobs and strengthening our energy security.”

Meanwhile, Assistant to the President and National Climate Advisor Ali Zaidi said, “EV sales have quadrupled. New factories are opening up, including 15 gigafactories commissioned to bring back jobs manufacturing batteries invented here in America. Driven by the President’s vision and leadership, the sector is experiencing a manufacturing boom – and it’s reaching every corner of the country. These credits for clean vehicles are the latest action by the Biden-Harris Administration to save consumers thousands of dollars and ensure the future of the auto industry is made in America by American workers.”

Despite the enthusiasm over the rules within the Treasury, some politicians are not so optimistic about what the new rules mean for the U.S. EV industry. Senator Joe Manchin (D-WV), who wrote much of

the IRA, believes there are clear loopholes in the commercial vehicle credit, and their EPA tailpipe rules that mean “the Administration is effectively endorsing ‘Made in China.’”

Manchin stated, “The Administration has made clear from Day 1 of implementing the consumer electric vehicle tax credit in the Inflation Reduction Act that they will break the law in pursuit of their goal to flood the market with electric vehicles as quickly as possible. For example, the law sets clear thresholds for sourcing the critical minerals and components necessary for EV batteries domestically and from our free trade partners which the Treasury has cut in half until 2027. It also prohibits vehicles containing materials sourced from foreign adversaries including China, Russia, Iran or North Korea from being eligible for the tax credit after 2024, but now Treasury has provided a long-term pathway for these countries to remain in our supply chains. It’s outrageous and illegal.”

Manchin added, the “Administration is so desperate for Chinese EV components that they are blatantly breaking the law by implementing a bill that they did not pass and ignoring what Congress agreed upon.”

In the lead-up to the passing of the new rules, Senator Manchin took several steps to encourage changes to the rules, close the loopholes and boost the position of the U.S. automaking and battery manufacturing industries. In December, Manchin sent a letter to the U.S. Government Accountability Office (GAO) requesting a legal opinion on whether the proposed guidance issued by the U.S. Department of the Treasury for implementing section 30D — the Clean Vehicle Tax Credit — of the Inflation Reduction Act, is subject to review under the Congressional Review Act. In January, he held a hearing where he discussed his concerns with the Administration breaking the law by issuing proposed rules not in line with the electric vehicle tax credit provisions in the IRA.

Several Republican politicians have also been vocal about their opposition to the new rules, introducing a bill in the Senate in early May that could eliminate it entirely.

It does seem that the new rules allow for greater flexibility initially, aimed at driving down the cost of EVs for consumers to

encourage greater uptake. However, the Treasury, as well as several automakers and energy industry experts, believe it is necessary to extend tax credits to cars using foreign components in the short term until the U.S. can adequately develop its manufacturing and critical minerals industries.

Under the rules, automakers are given a two-year grace period to source graphite from non-Chinese entities of concern, so long as they submit a report showing how they will change their supply chains after 2026. The rules also offer credits for cars using critical minerals from 20 free trade partners, as well as countries that have signed a narrower critical minerals free trade agreement, such as Japan.

While the rules introduce stricter tests for measuring whether 50% of the vehicle’s critical minerals are provided by U.S. producers or a free trade agreement partner, vehicles are also eligible if half the value added by either the extraction or processing of its critical minerals took place in the U.S. or a trade partner. Although some believe this rule is too broad. Even with looser rules, only around 20% of EV models currently on the market are eligible for tax credits. The government believes that stricter rules would have a severely detrimental effect on EV uptake and a knock-on effect on the green transition. Several automakers have praised the new rules for providing greater eligibility than would otherwise be possible, giving them time to establish diverse supply chains and domestic manufacturing operations.

John Bozzella, CEO of the Alliance for Automotive Innovation explained, the updated rules make “good sense for investment, job creation and consumer EV adoption.” Bozzella added, “The EV transition requires nothing short of a complete transformation of the U.S. industrial base,” he said in a statement. “That’s a monumental task that won’t – and can’t – happen overnight.”

About the author: Felicity Bradstock is a freelance writer specializing in Energy and Industry. She has a Master’s in International Development from the University of Birmingham, UK, and is now based in Mexico City.

By: Jess Henley

US Treasury Secretary Janet Yellen recently concluded a four-day summit with Chinese officials sternly warning that Washington will not allow Chinese imports to threaten US jobs in new industries. Yellen ended the visit by urging Beijing to temper excess industrial capacity.

Although the talks’ focus centered on new industries, such as solar panel production, renewable energy technology, and sustainable industrial production, the treasury secretary also expressed concerns over China’s support of Russia in their war against Ukraine. While no new sanctions were officially mandated against Chinese imports, the serious warning was expressed loud and clear.

“I Won’t Let “Artificially Cheap” Chinese Imports Threaten US Jobs”

As the US and other nations push towards the energy transition, clean energy jobs in new industries have skyrocketed in the last decade. In 2022, the DOE reported that clean energy jobs grew by more than 300,000 in the US alone. Naturally, these new industry jobs represent a massive portion of the US workforce, potential boons to the economy,

and alternative energy capabilities for the United States. However, Treasury Secretary Yellen said President Biden views Chinese imports of new industry-related material as threatening US and other foreign firms.

Although imports may seem like an affordable solution to increasing demand for renewable energy technology, the cost goes beyond the price tag. Yellen dubbed these imports “artificially cheap” because of their greater impact and threat to American industrial jobs and production.

A significant portion of the talks was devoted to the production of electric vehicles, batteries, and solar equipment, an area the Biden Administration heavily emphasizes for domestic production. The Chinese government

subsidizes the production of such materials, driving a dramatic increase in Chinese companies’ production facilities.

The Chinese policy of subsidized clean energy production created a boom in clean energy production facilities. Yellen claims this policy led to overinvestment, threatening the global fair market. Meanwhile, the overabundance of Chinese production facilities produces far more than the domestic demand, leading to an influx of Chinese imports.

Although Secretary Yellen did not threaten any new tariffs or sanctions against Chinese imports, she did warn them that President Biden would not allow “artificially cheap” Chinese imports to overflood the market and potentially threaten American jobs.

Yellen urged the Chinese government to alter its policy, allowing the United States and other nations to produce energy transition technology domestically. At the same time, she recognizes that the People’s Republic of China will need time to discuss the excess capacity issue and reach a solution.

She went on to say, “We’ve seen this story before. Over a decade ago, massive PRC (People’s Republic of China) government support led to below-cost Chinese steel that flooded the global market and decimated industries across the world and in the United States.”

President Biden and Treasury Secretary Yellen aim to avoid a repeat of the “China Shock” of the early 2000s, in which the surge of Chinese exports flooded the market, decimating the economies and production of other World Trade member nations.

During her second trip in nine months, Yellen claimed the talks prioritized advancing American interests and that other nations, such as European allies, Japan, Mexico, and the Philippines, shared US concerns.

In addition to the capacity issue discussions, Yellen mentioned difficult talks over the Chinese support of Russia during the Russian-Ukrainian conflict. After the United States spearheaded multiple sanctions and price caps against Russian oil and other exports, China helped Putin subvert sanctions by becoming a major purchaser of Russian oil.

While the majority of the talks did not center on Chinese involvement with Russian interests, Yellen made a point of mentioning that it has been discussed.

As the US and other nations push towards the energy transition, clean energy jobs in new industries have skyrocketed in the last decade.

At the end of her visit, Yellen noted that she and President Biden have no desire to untie the mutually beneficial trade between the United States and the Chinese government. However, she expressed a severe warning against overcapacity production. Yellen wants a “healthy economic relationship with China” moving forward.

Chinese officials pushed back, expressing “grave concerns” over the president’s restrictions on trade and investment. Chinese President Xi Jinping claimed that the Chinese production rate was in line with Chinese goals and concluded that he did not feel pressure to “bend to outside will.”

While the talks concluded peacefully, it remains to be seen how effective Yellen’s warnings against Chinese production will be.

About the author: Jess began his career in client relations for a large manufacturer in Huntsville, Alabama. With several years of leadership under his belt, Jess made the leap to brand communications with Bizwrite, LLC. As a senior copywriter, Jess crafts compelling marketing and PR content with a particular emphasis on global energy markets and professional services.

By: Jess Henley and Tyler Reed

The Environmental Protection Agency (EPA) and Department of Energy (DOE) have announced a massive incentive for small oil and gas producers. This $850 million grant program, open for competitive bidding until August 26th, has the potential to significantly reduce methane emissions. It offers optimism in combating greenhouse gas emissions as it aligns with the Biden Administration’s plan.

As the Biden Administration pushes radical green reform, these grants follow a long series of environmental policies from the White House. Naturally, the primary target for these grants is oil and gas companies, which are said to be responsible for 1/3 of the global methane emissions.

The funding is made available through the Inflation Reduction Act, one of the Biden Administration’s primary climate legisla-

tions. While the grants are mainly geared toward small oil and gas producers, the major funding program is open to all sectors. This inclusive project ensures that industry, academia, NGOs, Native American tribes, and state and local governments are all considered in the fight against methane emissions. The DOE and EPA are responsible for distributing the funds and allocating which organizations receive grant money.

The Inflation Reduction Act represents an expenditure estimated to cost well over $1 trillion. This law will enter its third year in August, and the cost is expected to escalate further. As of its first anniversary, economists estimated Biden’s climate agenda could reach triple its initial estimated cost.

This enormous funding program’s primary goals are to detect, measure, quantify, and reduce methane emissions. This investment emphasizes small oil and gas companies and encourages them

to locate leaks and address potentially avoidable emissions.

Identifying and quantifying methane emissions is a primary goal for the grant program, as many sectors and organizations lack the technology to detect and calculate their emissions accurately. Because of this, portions of the grant funding will be allocated to installing methane detection technology within these organizations.

Additionally, grant money can be spent to install machinery and technology to help significantly capture and reduce methane emissions. Adopting clean energy tech

and machinery will be essential to lessen methane emissions released from industry complexes.

“These investments from President Biden’s investing in America agenda will drive the deployment of available and advanced technologies to understand better where methane emissions are coming from. That will help us more effectively reduce harmful pollution, tackle the climate crisis, and create good-paying jobs,” EPA Administrator Michael Regan told Reuters.

In addition to the expenditures

Identifying and quantifying methane emissions is a primary goal for the grant program, as many sectors and organizations lack the technology to detect and calculate their emissions accurately.

of the Biden administration, the European Union is also taking on methane emissions. In March, the EU adopted the first legislation to reduce methane emissions from the hydrocarbons sector.

To map methane emissions globally, the Environmental Defense Fund (EDF) developed a satellite to detect and locate methane emissions on the Earth’s surface. Lead scientists from the EDF claim the satellites are designed to help produce high-quality data, creating a detailed map of where major methane emissions originate. MethaneSAT launched in March via a SpaceX rocket and cost $88 million to develop.

Reducing methane emissions could be a viable option in the near future with the combination of the private sector’s efforts, government legislation, and international cooperation. However, the cost-effectiveness of this allocation of funds is still uncertain.

About the author: Jess Henley began his career in client relations for a large manufacturer in Huntsville, Alabama.

With several years of leadership under his belt, Jess made the leap to brand communications with Bizwrite, LLC.

As a senior copywriter, Jess crafts compelling marketing and PR content with a particular emphasis on global energy markets and professional services.

About the author: Tyler Reed began his career in the world of finance managing a portfolio of municipal bonds at the Bank of New York Mellon. Four years later, he led the Marketing and Business Development team at a high-profile civil engineering firm. He had a focus on energy development in federal, state, and local pursuits. He picked up an Executive MBA from the University of Florida along the way. Following an entrepreneurial spirit, he founded a content writing agency. There, they service marketing agencies, PR firms, and enterprise accounts on a global scale. A sought-after television personality and featured writer in too many leading publications to list, his penchant for research delivers crisp and intelligent prose his audience continually craves.

By: Jess Henley

With Israel and Iran exchanging tit-for-tat strikes in an increasingly escalated fashion, the question remains large as to what will happen to the global supply of crude should the Middle Eastern conflict persist. With President Biden’s recent signing of a US Security Package aimed to increase pressure on Iran, Russia, and China, whom Biden referred to as “Putin’s Friends” in a statement, time will tell as to the effectiveness of a new round of U.S. sanctions on easing global uncertainty for crude.

Oil prices briefly surged on April 19 when Israel struck back at Iran in response to Tehran launching over 100 missiles and drones against them, which was itself in response to Israel striking an Iranian embassy in Syria. On April 19, international benchmark, Brent Crude, shot up nearly 2% to just under $88 per barrel. However, after Iranian officials downplayed Israel’s retaliatory strike and talks of an IsraeliHamas ceasefire percolate, Brent Crude futures have dropped to around $87.28 as of the publication of this article. International conflict, especially in the Middle East, is never good for price volatility. As we enter the heavy summer driving months, Americans are more anxious than ever as to where prices at the pump will go from here.

On April 24, President Biden signed into law the National Security Package that was passed in the Senate earlier this month. The recently

passed a US Security Package, which includes new Iran sanctions measures, has raised questions about its potential impact on the oil trade and whether it can be used to pressure China to reduce its exposure to Iranian oil.

Experts suggest that while the new US sanctions legislation may not immediately disrupt the oil trade, it could serve as a tool to influence China. The Biden administration might leverage these measures to encourage Chinese buyers to decrease their reliance on Iranian oil. This is particularly significant as China is the largest purchaser of Iranian crude, accounting for approximately 90% of Iran’s crude exports. However, it remains to be seen how effective the new measures will be in subduing Iranianorigin crude flows to top customers such as China and Russia. Iranian crude is often sold to independent refiners in China at steep discounts, and buyers frequently trade goods instead of paying cash. According to market sources, almost all Iranian cargo is paid in Chinese yuan instead of dollars.

The new legislation expands sanctions on the Iranian oil trade since it includes secondary sanctions on financial institutions facilitating that trade. According to international sanctions attorney and partner at Bass, Berry & Sims Thad McBride, “Access to the U.S. financial system, including through the use of dollar-denominated transactions, continues to be important to most major banks and other financial institutions, even in China. The threat to Chinese actors of being blocked from that access may be potent. We have seen at least

anecdotally that Chinese banks are reluctant to engage in transactions with Russia even when those transactions may be legally permissible under U.S. law given the threat of U.S. sanctions. There could be a similar impact with respect to transactions involving Iranian oil.”

The legislation also requires the executive branch to report on the implementation of the measures after 180 days. However, there are still questions about how the measures will be implemented, mainly since the legislation includes a waiver if entities have ceased their trade or are taking steps to reduce their involvement.

“Many non-U.S. financial institutions are so wary of U.S. sanctions that they will refuse to engage in transactions with Russia (or Iran) even when the transaction is permissible under U.S. sanctions,” McBride noted. “The waiver provision is broad. It gives the president

discretion to assess how and when sanctions measures should be imposed. It does not mean that the president will not decide to impose sanctions. It simply provides flexibility to apply sanctions or not based on the totality of circumstances as opposed to under a specific black-or-white trigger.”

Because the trade is illegal, it poses obvious challenges for the US in curbing it. Some experts believe that significant measures to restrict Iran’s oil production and exports are more likely to be implemented after the US presidential elections in November. These measures could potentially involve empowering Israel to target some of Iran’s critical energy infrastructure.

The new legislation doesn’t add new sanctions powers but focuses on some nodes in the supply chain. According to a report in S&P Global Commodity Insights, Rachel Ziemba, a

senior adviser at political risk consultancy Horizon Engage, adds more public scrutiny around this trade because the administration must report on its policies.

For now, sanctions are likely to stay targeted and may prompt a modest decline in trade. The Biden administration has not enforced existing US sanctions on Iran, so an expanded sanctions effort may simply be moot.

About the author: Jess Henley began his career in client relations for a large manufacturer in Huntsville, Alabama. With several years of leadership under his belt, Jess made the leap to brand communications with Bizwrite, LLC. As a senior copywriter, Jess crafts compelling marketing and PR content with a particular emphasis on global energy markets and professional services.

Experts suggest that while the new US sanctions legislation may not immediately disrupt the oil trade, it could serve as a tool to influence China.

By: Matt Jaye

Today’s companies recognize the importance of conducting employment background checks. Background checks are an important component of most hiring practices. According to a national survey of HR professionals, 96% of employers conduct at least one type of background screening.

Whether organizations seek to verify previous employment and educational credentials, check references, or identify criminal history, performing a complete background check helps bring transparency to the hiring process and reduces risk for the company, its employees, and customers. Background checks come in a variety of shapes and sizes depending on the industry and type of position. However, conducting a thorough background check takes more than simply selecting an off-the-shelf background screening solution.

HR professionals need to be aware of the pitfalls of an incomplete background check, both for the integrity of the hiring process and to reduce risk to the company in the long and short term. Here are some of the common pitfalls of incomplete background checks and how to avoid them:

Background checks aren’t simply for identifying individuals who have committed a federal crime or who have been terminated for company misconduct. There are many other aspects of

an employee’s history that require verification and investigation.

One staffing industry survey noted that about 46% of employees said they knew someone who lied on their résumé. A thorough background check can identify individuals who have misrepresented their education or professional credentials, those who have provided false references, and those with post-employment criminal convictions.

Downplaying the risks associated with poor or incomplete background checks can open organizations up to negligence claims, reputational risk, and dangerous activities in the workplace. Companies can successfully manage these risks by choosing a comprehensive screening program provider that not only identifies troubling past behavior but also thoroughly verifies the background information candidates and employees provide.

Just as the recruiting process may vary for different types of positions in different functions, the background check process can vary depending on position or industry.

For example, employees in positions requiring interaction with children or the elderly or those involving direct patient care within the healthcare field will require exclusion and debarment checks as required by the U.S. Department of Health and Human Services and other bodies. Employees in

Downplaying the risks associated with poor or incomplete background checks can open organizations up to negligence claims, reputational risk, and dangerous activities in the workplace.

financial services may require a credit check as part of a comprehensive background screening. Given all the variations between types of positions and the possible categories to check, companies must do more than simply enter an employee’s address and Social Security number in an online portal and wait for a feedback report. Instead, take the time to determine the individual

background check needed for each segment of the employee population. This ensures the right aspects of individual backgrounds are checked thoroughly and in accordance with applicable laws and regulations.

Not all background checks are created equal, and many do not

go far enough. To ensure background checks uncover employee misrepresentations or omissions, it’s important to select a background check provider that helps overcome the following mistakes:

• Not covering all of the bases: Background checks don’t need to be limited to educational, criminal, and employment history. Key elements of a pre-employment screening should also include professional licenses and certifications, consumer credit reports, motor vehicle records, and a Social Security fraud check.

• Insufficient check attempts: It’s important to be cautious of background check providers that follow a “three and out rule” specific to employment and education verification attempts, making only three verification attempts before closing a background check as incomplete. Limited checks will result in a higher number of incomplete background screenings—checks for which the company is still billed.

• Unverified sources: Employment information should be verified with the appropriate primary source (for example, a company’s HR department) and not solely with the name and number candidates provide on their employment application or résumé.

• Incomplete education verification: Educational background checks should verify that an applicant’s listed school is real, not a diploma mill, and that the institution’s legitimacy is confirmed by an acceptable accreditation body.

• Limited diversity of criminal background checks: There are many different types of criminal record searches at the county, state, and federal levels, and it’s necessary to understand which searches will most effectively meet the needs of your organization.

Incomplete background checks can be costly, negatively impacting a company’s bottom line and opening it to regulatory or reputational risk. To avoid the common pitfalls of incomplete background checks, it’s important to choose a background check provider that understands where and how to get the most accurate and verifiable employee background information possible. Your background check provider should also work with you to recommend the most appropriate background check solutions based on your industry and type of employee positions. Background checks are too important to leave to a provider that doesn’t provide thorough and comprehensive information.

About the author: Matt Jaye is Vice President of Sales for Corporate Screening, a Cleveland, Ohio-based provider of global background screening and Human Resources outsourcing (HRO)-related solutions that was established in 1987. Jaye, a member of the Professional Background Screening Association (PBSA) and the Society of Human Resource Management (SHRM), has been with Corporate Screening for more than 20 years.

By: Felicity Bradstock