The Stock Market +44 (0)20 7493 0876 rarebooks@shapero.com www.shapero.com 106 New Bond Street London W1S 1DN Shapero RARE BOOKS

1. [AMERICAN COMMISSION ON IRISH INDEPENDENCE].

Bond-Certificate Campaign. First Loan of the Elected Government of the Republic of Ireland. The Purpose of the Issue is to Finance the Elected Government of The Republic in Projects of National Reconstruction and for such other purposes as the Government may decide.

New York, [c.1919].

£750 [ref: 90000]

A rare political pamphlet promoting the first American bond-drive to finance the newly declared Irish Republic.

The bonds were issued as part of the external loan authorised by the Dáil Éireann in August 1919, the assembly formed of the Sinn Féin MPs elected to the UK’s Parliament in the general election of 1918, and headed by the future President of Ireland, Éamon de Valera (1882-1975). In total, the external loan raised over $5,000,000 in the USA to help keep the political and revolutionary movements alive in Ireland during the country’s struggle for independence.

With double-page map of Ireland showing the election result of 1918, in which 73 of 105 seats were won by the republican party Sinn Féin.

OCLC records only 4 copies in institutional collections, 3 in the USA (Boston Athenaeum, Boston College, and University of Michigan), the other in the National Library of Ireland. COPAC adds another copy at the University of Cambridge.

First edition; 8vo (21 x 13.5 cm); doublepage map of Ireland showing the result of the December 1918 general election; unbound, stapled, small tear to tile-page; [8]pp.

‘ God Irrevocably F I xed the b oundar I es o F I reland ’

Books by Babson. [Mail Order Booklet].

Babson Park, Babson’s Statistical Organization, Inc., [1938].

£75 [ref: 109945]

Scarce mail order booklet by the US economist & temperance campaigner.

A prolific writer, Babson (1875-1967) authored nearly fifty books during his lifetime on themes ranging from the dangers facing Protestantism to his The Future Method of Inventing Money (1914), a frank insider account of the investment world dedicated to the premise that knowing when to buy is more important than knowing what to buy.

Mail order booklet; (9 x 15.5 cm); 12ff. printed on recto only, each with perforated line for purchasing, loose brochure; original blue wrappers, stapled.

Our Campaign for the Presidency in 1940. America and the Churches.

Chicago, National Prohibitionist, 1941.

£450 [ref: 109857]

A reflection on electoral defeat by Roger Babson (1875-1967), an economist and temperance campaigner who stood unsuccessfully for the Prohibition Party in the US presidential election of 1940.

Inscribed by the author to the future chairman of the Prohibition Party Earl Dodge (1932-2007): ‘Dedication. See Page 147 which shows what church people could do for us if we had a ticket which they would value. To Mr Earl Dodge with great respect for his good works and patience. Roger H. Babson, Jan. 3rd. 1961’.

Unfortunately the votes never quite materialised, and Dodge was unsuccessful in all six of his bids (in 1984, 1988, 1992, 1996, 2000 and 2004) to become president of the USA.

First edition, inscribed by the author; 8vo; presentation inscription to front free endpaper; dustjacket, publisher’s cloth, jacket.

2. BABSON, Roger W.

3. BABSON, Roger W.

2. BABSON, Roger W.

3. BABSON, Roger W.

BASS, William Louis.

The Maelstrom. A Wall Street Primer.

Branchville, Published & distributed by William Louis Bass, 1931.

£375 [ref: 109832]

A curious post-crash guide urging novice investors to undertake a ‘course of practical instruction’ before entering the ‘man-made machine known in trade parlance as THE STREET, but which, throughout this treatise, will be denominated THE MAELSTROM’ (p.12).

OCLC records 8 copies in institutional collections, all located in the USA.

First edition; 8vo (21.5 x 15 cm); frontispiece illustration after James Montgomery Flagg; publisher’s tan cloth, lettered in black to upper cover; [2], 107, [1]pp.

5. BLACK, William Harman.

The Real Wall Street. An Understandable Description of a Purchase, a Sale, a “Short Sale”...

New York, The Corporations Organization, 1908.

£450 [ref: 91936]

The first edition of this helpful guide to stock trading aimed at the novice investor. William Harman Black (1868-1955) went on to have a successful career at the bar, retiring as a Justice of the Supreme Court of New York.

First edition; 8vo (18.5 x 13 cm); ownership inscription in pen to rear pastedown, old staple holes, tape to p.64 bottom margin, tear to p.65 bottom margin; publisher’s red cloth backed pictorial boards, some wear to extremities; [6], 69, [1]pp.

4.

4.

Pitfalls of Finance and Politics.

Baltimore, Square Deal Publishing Company, 1922.

£350 [ref: 109841]

The first edition of this fascinating exposé, naming and shaming prominent individuals and firms involved in the promotion of dubious and downright fraudulent investments.

First edition; 8vo (23 x 16 cm); in-text illustrations; publisher’s cloth, dollar sign device incorporating title in gilt to spine and upper cover, edges worn, old worm with loss to pastedowns, front and end few ff.; [8], 290pp.

A handbill advertising tickets and shares in the state lottery of 1780. In this instance 16,021 prizes were issued against 31,979 blank tickets for a total jackpot of £480,000.

7. BROOKSBANK & RUDDLE.

Licenced by Authority of Parliament. State Lottery 1780. [Geo. III. c.16].

London, [n.s.], [1780].

£650 [ref: 94422]

First introduced in 1569, by 1780 the government’s monopoly on hosting lotteries had become an important means of raising state finance. Leading stockbrokers like Brooksbank and Ruddle were invited by the Treasury to tender tickets which could then be sold on to the public for a premium. This method ensured the government would make a clear profit without risk, whilst the public, who seldom bought single shares, ‘most people taking a fourth, an eighth, or a sixteenth of a ticket’ (Ashton), would not feel the effect of the rise in price.

Handbill, 8vo (23 x 15 cm); single leaf.

6. BOYCE, Frank.

8. [CARLISLE INVESTMENT TRUST].

Safeguarding Your Investments. How to make Profits.

London, Carlisle Investment Trust, Limited, 1936.

£350 [ref: 109827]

A rare investor’s guide published by the Carlisle Investment Trust as promotional material, with a useful glossary of technical terms, tables of stamp duty and income tax, and relevant statutes to the rear.

Recorded on OCLC (accession no. 59037298), but currently showing no copies in institutional collections.

8vo (24 x 16 cm); loose compliments slip to front free endpapers, erratum tipped in after title verso, investment ledger to rear; publisher’s blue cloth lettered in gilt, spine and edges faded; 134, [40]pp.

9. COWEE, George A. Common Stocks and the Next Bull Market.

Boston, The Fort Hill Press, 1931.

£225 [ref: 109855]

The first edition of this post-crash investment guide, with a chapter speculating on the factors that will form the basis for the next bull market. Predictions include electrified railroads, the ‘autogiro’ aircraft that can take off and land vertically, and television, which was still then ‘only in its infancy’.

First edition; 12mo (18 x 13.5cm); ownership inscription in pen to front pastedown, illustrated with diagrams including folding chart tipped-in to p.17; publisher’s red cloth, upper cover stamped in gilt; 138pp.

The Theory of Stock Exchange Speculation.

London, Longmans, Green, and Co., 1875.

£375 [ref: 109760]

‘Our object in writing this book is to endeavour to show to persons who may contemplate trying their hand at Stock Exchange speculation, the improbability of their hopes being realized’ (introduction).

Republished in America twenty-seven years after it made its first appearance in England, Crump’s Theory of Stock Exchange Speculation was one of the earliest works to systematically define the art of speculation.

Fourth edition; 8vo; ad. to half-title verso, minor spotting; publisher’s cloth; [2], viii, 153, [1]pp. Dennistoun 101 (1903 ed.)

11. DOWLING, S.W.

The Exchanges of London.

London, Butterworth & Co. (Publishers) Ltd, 1929.

£150 [ref: 109821]

A handsome copy of this history of the origin and business methods of the London Exchanges by S.W. Dowling, formerly a lecturer for the Institute of Bankers.

First edition; 8vo (22 x 14.5 cm); illustrated with photogravure plates including frontispiece; blue calf ruled in gilt by Bickers & Son, gilt spine and dentelles, all edges gilt, spine faded, minor scuffing; vii, [5], 260pp.

10. CRUMP, Arthur.

10. CRUMP, Arthur.

12. DUGUID, Charles.

How to Read the Money Article.

London, Effingham Wilson, 1901.

£500 [ref: 109822]

The first edition of this fascinating work aimed at demystifying financial journalism for the ‘uninitiated’ investor. The author, Charles Duguid (1864-1923), was ‘City editor’ of the Morning Post, where he was responsible for coverage of business in the City of London and reporting on economics more generally.

First edition; 8vo (19 x 13 cm); dated ownership inscription in pencil to title page, front and endpaper pink ads., 31pp. numbered ads. to rear; publisher’s red cloth, spine and upper cover lettered in black, spine slightly faded, minor wear to extremities, pp.16-17 joint cracked but holding; vii, [1], 130, [2], 31pp. Dennistoun 148.

13. [ECONOMIC PANIC].

The Town and Country Magazine: or Universal Repository of Knowledge, Instruction, and Entertainment, 1796.

London, Printed for H.D. Symonds, August, 1796.

£225 [ref: 109828]

An issue published in the run-up to the Panic of 1796-1797, the last in a series of economic crises which shook the Anglophone world at the close of the 18th century. Illustrated with two engraved plates including ‘The Falling of the Stocks’.

The Panic was precipitated by a collapse in property prices in the USA, and worsened by the passing of the Bank Restriction Act 1797 in Great Britain the following year. This measure was designed to prevent a run on the Bank of England by account holders who feared an imminent French invasion.

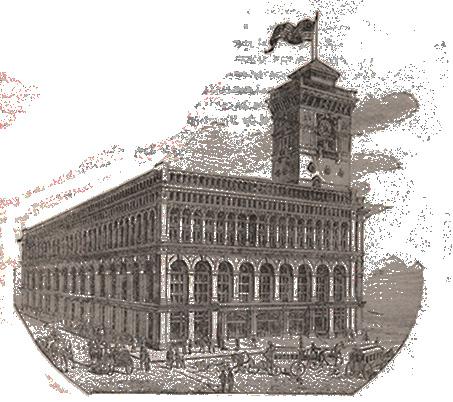

Origin, Growth, and Usefulness of the New York Produce Exchange.

New York, Historical Publishing Co., 1884.

£350 [ref: 109750]

First edition of Richard Edwards’ review of the New York Produce Exchange, a history of the commodities market from its foundation in 1861. OCLC records just seven copies.

First edition; 8vo (24.5 x 16 cm); library stamp to title, numerous in-text illustrations; without wrappers, stapled with first 12pp. loose, title browned; 378pp.

Common Stocks and Uncommon

New York, Harper & Brothers, 1958 [1959].

£700 [ref: 109804]

After thirty years in investment banking, Philip Fisher (1907-2004) presents the tenets by which he has brought success to the clients of his eponymous firm.

Critical of more technical forms of analysis based purely on numbers (‘a sizeable number of research projects, governed merely by the law of averages, are bound to produce nothing profitable at all’) Fisher proposed a more in-depth manner of evaluating stocks. With a focus on growth-potential and quality management, his Common Stocks and Uncommon Profits offers a list of do’s and don’ts to investors who hope to follow his profitable lead.

The first investment book to make the New York Times best-seller list, the work caught the attention of Warren Buffet, who says ‘I sought out Philip Fisher after reading his Common Stocks and Uncommon Profits. When I met him, I was as impressed by the man as by his ideas. A thorough understanding of the business, obtained by using Phil’s techniques enables one to make intelligent investment commitments’.

First edition, later issue (date code C-I); 8vo (22 x 14.5 cm); dust-jacket, cloth back grey boards gilt; xiii, [1], 146pp. Zelden p.21; Dennistoun 504.

14. EDWARDS, Richard (editor).

15. FISHER, Philip A.

Profits.

14. EDWARDS, Richard (editor).

15. FISHER, Philip A.

Profits.

London, Longman, Brown, Green, & Longmans, 1855.

£450 [ref: 109809]

An early history of the London Stock Exchange.

An early history of the London Stock Exchange. John Francis (1810-1886) entered the Bank of England in 1833 and became chief accountant in 1870. In Chronicles and Characters of the Stock Exchange he paints a broad canvas of its history, with anecdotes from the various bubbles and manias, frauds and forgeries, and tales of the leading families, including the Rothschilds. The appendix lists useful trading information for the time.

‘New Edition’ (i.e. third edition); 8vo (23 x 14.5 cm), appendix, 12pp. contemporary reviews to rear; later brown cloth, gilt spine, fore-edge uncut, water stain to head gutter margin pp.272-273, old partially erased annotations to head margins of preface and contents pages; xii, 360, xiipp. Dennistoun 67.

Boston, Houghton Mifflin, 1955.

£675 [ref: 109805]

The first edition of this much lauded account of the 1929 Wall Street crash by the Canadian-American economist John Kenneth Galbraith (1908-2006), one of the chief advocates of postwar liberalism, who served as the seventh American ambassador to India.

John Kenneth Galbraith provides a chronicle of that year with an in-depth review of the economic, political, and psychological events that contributed to the collapse of the stock market... The book succeeds in helping the reader understand the causes and the results of the boom and subsequent bust. (cf. Zerden).

First edition; 8vo (22 x 14.5 cm); frontispiece; dust-jacket, red cloth; ix, [3], 212pp. cf.Dennistoun 146 (2nd issue); Zerden p.67.

17. GALBRAITH, John Kenneth. The Great Crash 1929.

16. FRANCIS, John. Chronicles and Characters of the Stock Exchange.

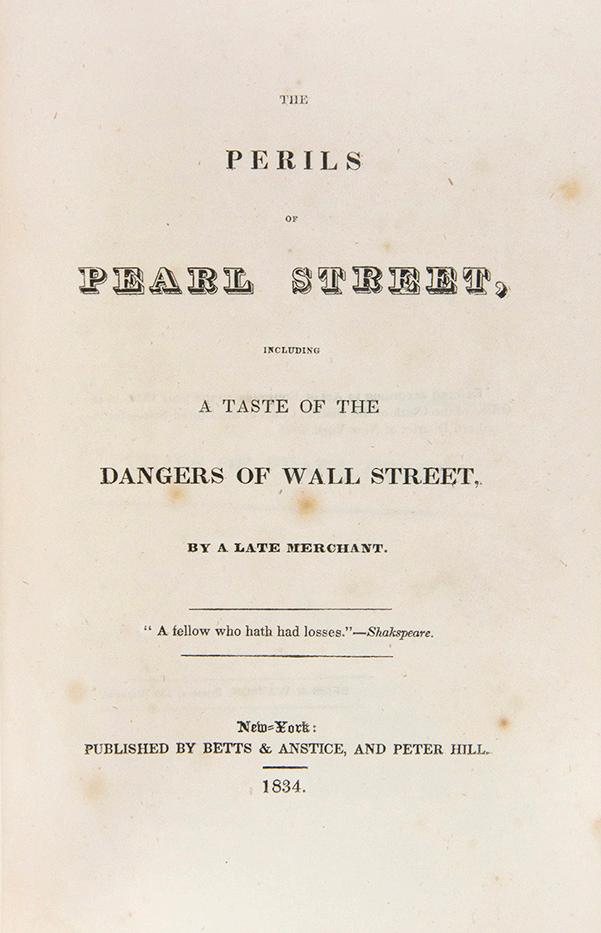

Rare first edition of an early Wall Street novella.

18. [GREENE, Asa].

The Perils of Pearl Street, including a Taste of the Dangers of Wall Street.

New York, Betts & Anstice, 1834.

£3,500 [ref: 104969]

The first edition of this early Wall Street novella in which an innocent upstate New York carpenter’s son, Billy Hazard, is ruined by a failed short-selling trade: ‘It is one of the most ingenious arts of modern speculation, that a man may sell what he has not, and grow rich upon the proceeds’ (p.224).

First edition, first printing; 8vo; publisher’s green cloth, burgundy leather title label to spine gilt, end leaves severely foxed as usual with initials to front free endpaper, with mild spotting to the associated terminal leaves, expertly rebacked preserving original spine, a really nice copy of a vulnerable little book. Sabin 28584.

Stock Exchange Securities and How to Select Them.

Edinburgh, William Blackwood and Sons, 1904.

£375 [ref: 109770]

‘The Institute of Bankers in Scotland, the Society of Accountants in Edinburgh, and the Institute of Accountants and Actuaries in Glasgow have arranged for several years past an annual course of lectures mainly for the instruction of the younger members on subjects connected with their practical everyday work. The subject chosen for 1904 was “Stock Exchange Securities”.’ (Preface)

Concentrating mainly on the gilt edge market.

First edition; 8vo (22 x 14.5 cm); ads. to rear endpapers, scattered spotting; publisher’s cloth, gilt spine, edges bumped, minor wear; [2], 84pp.

The Stock Market Barometer.

New York & London, Harper & Brothers, 1922 [i.e. October 1923].

£375 [ref: 109742]

William Peter Hamilton (1867-1929) was editor of the Wall Street Journal from 1908 to 1929 and a leading proponent of the Dow Theory, a trendfollowing trading strategy which called for ‘soulless barometers, prices indexes and averages to tell us where we are going and what we may expect’ (p.4).

First edition, later printing ‘K-X’; 8vo (20 x 14 cm); illustrated with charts and appendix of Dow Jones stock averages, 2 half-titles; publisher’s red cloth, title in gilt to upper panel, spine ends rubbed, minor staining. Denistoun 404; Larson 1947; Zerden, p.4; Hess Collection.

19. GUNN, Niel Ballingal.

20. HAMILTON, William Peter.

19. GUNN, Niel Ballingal.

20. HAMILTON, William Peter.

Mining Fraud by the son of Nathaniel Hawthorne.

21. HAWTHORNE, Julian.

Solomon Columbus Rhodes and Company.

1909.

£250 [ref: 109850]

The first edition of this pamphlet promoting investment in a fictitious mining company.

The author, Julian Hawthorne (1846-1934), was the son of the novelist Nathaniel Hawthorne, and a talented journalist and writer in his own right. He used his skill and family name to sell half a million shares of stock in non-existent mining companies in Canada before being discovered and convicted of mail fraud, spending a year in prison at the Atlanta Federal Penitentiary.

First edition; 12mo (17 x 12 cm); portrait frontispiece; original wrappers, stapled; [32]pp.

22. HEIZMANN, Hans.

Das Baumwoll-Termingeschäft und dessen Einfluss auf die BaumwollIndustrie...

Schaffhausen, Buchdruckerei Bolli & Böcherer, 1907.

£150 [ref: 109856]

A dissertation on cotton futures and their impact on the cotton industry by Hans Heizmann, submitted for the degree of Doctor juris publici et rerum cameralium in political sciences at the University of Zurich. The first of five works on the subject to be printed.

Provenance: Bibliothek des Edig. Statist. Bureau.

First edition; 8vo (23 x 15.5 cm); library stamp to upper wrapper and title-page; original grey printed wrappers, spine cracked with loss but holding, wrapper margins toned; [xv], [1], 129, [3]pp.

23. HEMMING, Henry G.

Hemming’s History of the New York Stock Exchange.

New York, Henry Glover & Co., 1905.

£2,000 [ref: 109923]

The first edition of Henry Hemming’s richly illustrated history of the New York Stock Exchange, with four engraved views of ‘Old New York’, and 353 steel-engraved portraits of members of the exchange.

Notable alumni depicted include Jack Pierpont Morgan (1867-1943), heir to the eponymous investment bank, Frederick H. Prince (1860-1950) known for his plan to consolidate the nation’s railroads, and Ransom H. Thomas (1852-1922), who as president steered the exchange through the ‘Knickerbocker’ Panic of 1907. A classic work on the Stock Exchange, from its informal origins in the coffee houses of the newly independent republic to its position at the centre of global commerce.

First edition; 4to (30 x 24.5 cm); engraved frontispiece, 4 views & 353 engraved portraits; later black morocco backed marbled boards, gilt spine, slight fraying to fore-margin of first few ff. else near fine; [4], 45, [1]pp. Larson 1606.

Investment Guide. Compiled by Henry Clews & Co., Bankers.

New York, 1899.

£250 [ref: 109749]

The third issue of this annual pocket guide to investment opportunities in the United States, with lists of railroad and industrial bonds, stock options, ephemeral data including population estimates, and bank clearances for the year 1899.

OCLC records just one copy of the 1899 issue, held by the New York Historical Society Library.

Investment annual, third issue; 12mo (13.5 x 10 cm); frontispiece, minor tear to fore-margin not affecting text from p.69 onwards; black wrappers, stamped in gilt to upper cover, stapled; [2], 109, [1]pp.

Private Telegraphic Code of Henry Clews & Co.

New York, [1908].

£450 [ref: 109758]

The private telegraphic cipher of the banking house of financier and Wall Street memoirist Henry Clews (1834-1923). Private codes such as these were designed to facilitate accurate trading via telegraph in the pre-internet age, providing a standardised list of key words to take the place of phrases and figures.

Fourth issue; 12mo (14 x 10 cm); front pastedown detached from endpapers, toned; purple morocco tooled in blind, upper panel gilt stamped, minor dampstaining to endpapers and prelims; 76, [2]pp.

24. [HENRY CLEWS & CO].

25. [HENRY CLEWS & CO.]

a

mer

HENRY, George Garr. How to Invest Money.

New York, Funk & Wagnalls Company, 1908.

£225 [ref: 109840]

The first edition of this insightful work on ‘the various classes of securities which are available as investments and their relative adaptability to different needs’ by the investment banker George Garr Henry (Preface). With provenance for the American diplomat Truxtun Beale (18561936), appointed minister resident in Persia in 1891, later serving as minister plenipotentiary for Greece, Serbia and Romania.

Provenance: Truxtun Beale, 28 Jackson Place, Washington D.C. (inscription).

First edition; 8vo (20 x 14 cm); ownership inscription in pen to front pastedown, initials in pen to p.6 with offsetting to p.7, printer’s device to title; publisher’s blue cloth, lettered in white to upper cover; 121, [1]pp. Dennistoun 464 (2nd ed.)

27. [JACKSON, Frederick].

A Week in Wall Street. By one who knows.

New York, for the Booksellers, 1841.

An

One of the earliest and most interesting Wall Street ‘novels’ for a unique portrait of The Street at its inception. This title is one of the very first books on the stock market in America.

‘While the author wrote to expose the evils of the stock market and of banking, the book if used critically has great value, as an early and rare picture’ (Larson).

First edition, 8vo (18 x 11 cm); contemporary paper-covered boards, marked with ink on upper cover, label, rubbed and partly worn away, spine partly split; overall a good copy, housed in modern black solander box, black morocco label, gilt lettered; x, (2), 152pp. Larson 1627; Kress C.5511; Wright I, 1466.

£6,500 [ref: 93946] I can d I plomat

’ s copy

26.

early Wall Street critique.

28. KARO, Max.

City Milestones & Memories. Sixty-five years in and about the City of London.

London, Wiedenfeld and Nicolson, 1962.

£150 [ref: 109823]

The first edition of Max Karo’s memoir City Milestones & Memories, a ‘scrapbook’ style history of Britain’s financial capital. This copy ‘From the apartment of HRH The Princess Margaret, Countess of Snowdon, 1930-2002’ (bookplate).

First edition; 8vo (22 x 14.5 cm); bookplate to front pastedown, 25 numbered half-tone plates; unclipped dustjacket by Eric Ayers, publisher’s grey cloth, gilt spine, small tears to dustjacket spine head and tail, minor wear; xii, 148pp.

29. KELLY, Fred C.; BURGESS, Sullivan. How Shrewd Speculators Win.

New York, Sears Publishing Company, 1932.

£550 [ref: 109753]

The scarce first edition of Fred Kelly and Sullivan Burgess’ foray into behavioural economics. ‘In their attempts to probe the mystery of the stock market’s movements, the authors investigate the psychological weaknesses that hamper the investor’s chances for success’ (Zerden). Virtually unknown to a new generation of investors, the work was republished in 1964.

OCLC lists thirteen copies worldwide, and only one outside of the USA at the International Institute of Social History (Netherlands).

First edition; 12mo (18.5 x 12 cm); publisher’s cloth, stamped in black to spine and upper panel, minor wear to extremities and light staining; [8], 178pp. Dennistoun 736; Zerden, p.41; Hess Collection.

p r I ncess m ar G aret ’ s copy

KENNEDY, John [Jonk].

As Others See Us! Being a Series of Caricatures of Members of the London Stock Exchange.

London, Garamond Press, 1932.

£125 [ref: 109849]

The first edition of John Kennedy’s As Others See Us! A series of predominantly kind caricatures of members of the London Stock Exchange in the 1930s, with an index naming the subjects.

First edition; 4to (25.5 x 19 cm); 70 numbered plates, errata slip tipped-in to title verso; publisher’s grey cloth backed boards, slightly soiled, title with minor spotting otherwise internally crisp and clean.

Dennistoun 765.

31. KENT, Henry Grey (Duke of).

Autograph letter signed to Charles Lockyer, Comptroller of the South Sea Company requesting payment of a dividend.

August 6th 1725.

£750 [ref: 84356]

The now notorious South Sea Company was established in 1711 in an attempt to replicate the success achieved by the East India. Unable to realise its monopoly on trade to South America due to Britain’s entanglement in the War of Spanish Succession (1701-1715), the Company soon fell victim to market speculation before imploding spectacularly in 1720.

Many members of Britain’s elite were ruined by the collapse. This letter from Henry Grey, Duke of Kent (d.1740) to the company’s Comptroller was an attempt, likely futile, to recoup a dividend on the enormous sum of £23,610:12 (equivalent

to £2,700,000 in today’s money) which had been due since ‘midsum[m]er last’. Poor Kent already enjoyed an unfortunate reputation, and had to put-up with the demeaning soubriquet ‘Bug’ owing to his apparent body odour.

Autograph letter; small 4to (19 x 16 cm); later MS notes in pen to footer giving brief epitome of Kent’s life, pencil MS notes to verso repeating information, single leaf.

30.

south sea bubble

KERR, Joseph H. Method in Dealing in Stocks.

Boston, The Christopher Publishing House, 1931.

£450 [ref: 109754]

The second edition of this early day-trader’s guide, revised from the 1924 issue to take into account the crash of 1929.

The Hess Collection notes: ‘Kerr writes, “stock speculation is a science as truly as economics itself” responding with consistent rules of probability to certain recurring causes. The methods outlined in this book are precise but complicated...’

Revised second edition; 8vo (20.5 x 14 cm); ownership stamp to front free endpaper recto, annotations in pen to title-page and appendix, charts including one folding; occasional underlining in pen; publisher’s blue cloth, spine and upper panel stamped in gilt; 175, [1]pp. Dennistoun 362 (1924 ed.); Hess Collection.

Wall Street Speculation: Its Tricks and its Tragedies. A Lecture by Franklin C. Keyes, LL. B., of the New York Bar.

New York, Columbia Publishing Co., 1904.

£500 [ref: 109786]

The first edition of this early cautionary lecture on stock market speculation ‘its tricks and its tragedies’ by the New York based lawyer Franklin C. Keyes.

First edition; 8vo (21.5 x 14.5 cm); publisher’s maroon cloth, gilt spine, rust stain to title and front endpapers from old paperclip, otherwise internally clean; 77, [1]pp.

32.

33. KEYES, Franklin C.

32.

33. KEYES, Franklin C.

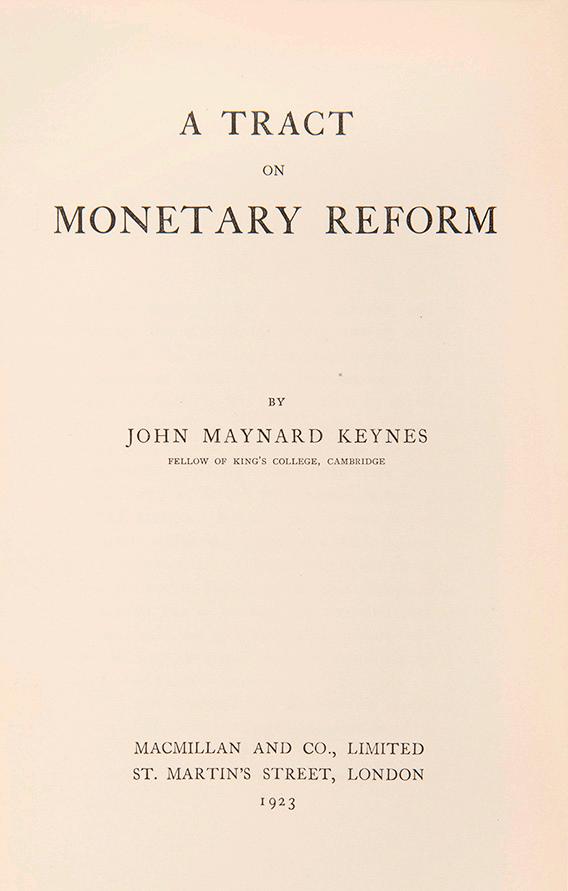

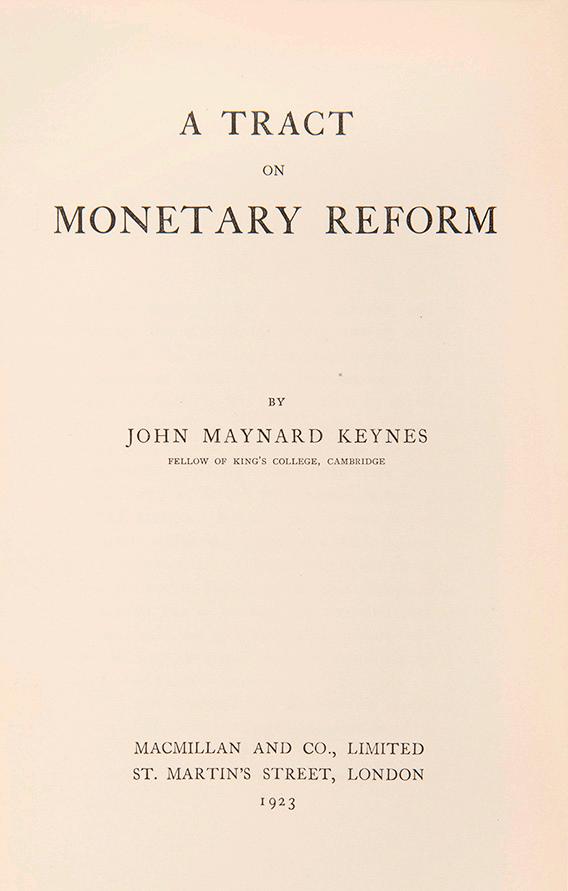

A Tract on Monetary Reform.

London, Macmillan and Co., 1923.

£4,250 [ref: 105207]

A spectacular copy in collector’s condition of the first of Keynes’s major contributions to economic theory. A significant text in which, for instance, he dismisses the gold standard out of hand as ‘a barbarous relic’. The theorising here would lead directly to the wider exposition of The General Theory and may be seen as its prolegomenon. It is also the source of his notorious statement, ‘In the long run we are all dead’.

Copies in cloth are not uncommon but examples such as this in jacket and in collector’s condition are genuinely rare.

First edition, first impression; 8vo; publisher’s blue cloth, titles to spine gilt, with the printed dust jacket; an exceptional copy; viii, 209pp.

34. KEYNES, John Maynard.

34. KEYNES, John Maynard.

The first of Keynes’s major contributions to economic theory.

‘ We are all Keynes I ans today ’

35. KEYNES, John Maynard.

The General Theory of Employment, Interest and Money.

London, Macmillan, 1936.

£6,750 [ref: 107422]

Written in the aftermath of the Great Depression, The General Theory is regarded as one of the most influential social science treatises of the century; it quickly and permanently changed the way the world looked at the economy and the role of government in society. This is the book ‘on which [Keynes’] fame as the outstanding economist of his generation must rest’ (DNB).

After the 1929 crash, Keynes analysed the classical school of economists, ‘and found them seriously inadequate and inaccurate. [...] A national budget, over and above its function of providing a national income, should be used as a major instrument in planning the national economy. The regulation of the trade-cycle [...] must be the responsibility of governments. Lost equilibrium in a national economy could and should be restored by official action and not abandoned to laisser (sic) faire. [The General Theory ] threw the economists of the world into two violently opposed camps. Yet eight years later Keynes was to dominate the international conference at Bretton Woods, out of which came the International Monetary Fund (IMF) and the World Bank; and his influence during the ensuing decades, even on his theoretical

opponents, has been such that a highly placed American official recently remarked that ‘we are all Keynesians today’ (PMM).

About speculation especially, Keynes dismisses conventional wisdom, and the fundamentalist’s dream, that the fund manager should base his investment decisions solely on the probably long-term yield of any investment: ‘He who attempts it must surely lead much more laborious days, and run greater risks than he who tries to guess better than the crowd, how the crowd will behave; and given equal intelligence, he may make more disastrous mistakes.’ Keynes was speaking from experience. During the Twenties and Thirties, he looked after several institutional funds -- highly leveraged, and highly speculative -- dealing in commodities, currencies, and equities. Like Livermore he was no stranger to loss, and during the 1929 crash his funds lost seventy-five per cent of their value. He managed to recoup, and, amazingly, six years later increased his fortune twenty-three times with a series of judicious investments.

As Barton Biggs recently wrote: ‘there are many brilliant and bizarre characters in today’s hedge fund world, but Keynes surpasses them all. Hedgehogs would have liked and appreciated him.’

First edition, first impression, 8vo; publisher’s blue cloth, titles to spine gilt, contemporary ownership inscription to front free endpaper, dust jacket, rather marked and somewhat rubbed and missing pieces at the spine ends, otherwise very good; xii, 403pp., PMM 423; Moggridge A10.

London, Macmillan, 1936.

£3,500 [ref: 109128]

First edition, first impression, 8vo; publisher’s blue cloth, titles to spine gilt, a very good copy xii, 40 pp. PMM 423; Moggridge A10.

36. KEYNES, John Maynard.

The General Theory of Employment, Interest and Money.

36. KEYNES, John Maynard.

The General Theory of Employment, Interest and Money.

37. LA MARQUETTE [pseud. COLE, George William].

Successful Speculation. A Business.

Peoria, The Bernbee Press, 1928.

£475 [ref: 109784]

A scarce early work on grain speculation inscribed ‘Ernest Kiemast, July 15th 1935, Penname of: Geo. W. Cole, Peoria, Illinois’ to title.

OCLC records only five copies, all in institutional collections in the USA.

First edition; 8vo (20 x 14 cm); inscribed in pen to title, illustrated with graphs and tables; publisher’s cyan cloth, stamped in black to spine and upper cover, minor wear to extremities, occasional fold lines otherwise internally clean; xi, [3], 102pp.

extraord I nary attac K on the ‘ money KI n G s ’

38. LAWSON, Thomas.

Frenzied Finance. Volume I The Crime of Amalgamated.

New York, The Ridgway-Thayer Company, 1906.

£1,750 [ref: 109791]

A signed limited edition copy of Thomas Lawson’s (1857-1925) extraordinary exposé of greed and corruption in American finance at the turn of the century, dedicated to ‘penitence and punishment’.

‘One of the most influential texts ever written about the workings of the corporate world. Briefly stated, the book is a narrative account of ‘the deviltry’ and ‘unpenalized crimes’ of high

finance that became standard practice for the Standard Oil Trust at the turn of last century’ (Hess Collection).

Lawson was one of his generation’s most brilliant and eccentric stockbrokers. At the age of twelve, he left school to work as an office boy with a brokerage firm in Boston, and early in his career he began speculating in stocks.

‘He made a considerable “killing” in railroad shares when he was only seventeen but lost his profits a few days later in another deal... He is said to have accumulated a million dollars by the time he was thirty... Despite his lack of formal education, he acquired by his own efforts an excellent command of English and a considerable degree of literary culture’ (DAB).

By 1897 he had become connected with the promotion of Amalgamated Copper, the name under which Standard Oil capitalists reorganised the great Anaconda mine and allied properties. On this stock they now made a handsome profit, with Lawson acting as their chief broker. The stock thereafter rapidly declined in price and many holders of it suffered heavy losses. In 1902, when Lawson, with Winfield M. Thompson, published The Lawson History of The America’s Cup, the editor of Everybody’s Magazine, learning of his grievance, induced him to write the allegedly true story of Amalgamated Copper, which he did under the title of Frenzied Finance — one of the most sensational successes in magazine history.

The entire edition of the magazine containing the first instalment was exhausted in three days. To journalistic instinct, Lawson added an easy, slashing style and a knack for colourful phrasing which made his rough-and-tumble attack on the ‘money kings’ vastly popular.

The enmity aroused by the book cost Lawson dearly, and ‘many serious losses were wilfully inflicted upon him by antagonists’. He lost his magnificent estate and died in comparative poverty (DAB).

autograph-portrait edition limited to 1000 copies signed by the author; 8vo (22 x 14.5); colophon signed ‘Yours very truly Thomas Lawson’ but unnumbered, illustrated with 10 photogravure portraits, japon backed blue boards, paper titlepiece to spine, small tear to head margin of title and dedication not affecting text; [4], xix, [3], 559, [1]pp. Larson 403 (for first trade ed.); Zerden, p. 74; Dennistoun 152; Hess Collection.

High Cost Living.

Dreamworld, Massachusetts, Nathan Sawyer & Son (printers), 1913.

£200 [ref: 109858]

The first edition of Thomas Lawson’s (18571925) High Cost Living , an amusing ‘insider’s account of the pecuniary guile of an era filled with stock market machination’ (ANB).

First edition, number 392 of 1000 copies; folio (34 x 24 cm); the Presentation for this copy inscribed in pen to the Hon. Courtney Hamilton, text in red and black, lacking the 4 full-page colour plates, old bookseller’s note to front free endpaper recto, ads. to half-title verso; later red cloth retaining original free endpapers, gilt title-piece to spine; 180pp. Dennistoun 720.

Author’s personal copy.

High Cost Living.

Dreamworld, Massachusetts, Nathan Sawyer & Son (printers), 1913.

£1,250 [ref: 109861]

Thomas Lawson’s (1857-1925) personal copy of High Cost Living, his amusing ‘insider’s account of the pecuniary guile of an era filled with stock market machination’ (ANB).

First edition, limited edition of 1000 (this copy unnumbered); folio (35.5 x 24.5 cm); armorial bookplate to front free endpaper verso, illustrations including 4 full-page colour plates retaining original tissue guards, ads. to half-title verso, lettered in red and black; publisher’s red reverse limp calf gilt, top-edge uncut, spotting to prelims, calf faded to extremities; 180pp. Dennistoun 720.

39. LAWSON, Thomas W.

House Democrat Courtney Hamlin’s copy.

40. LAWSON, Thomas W.

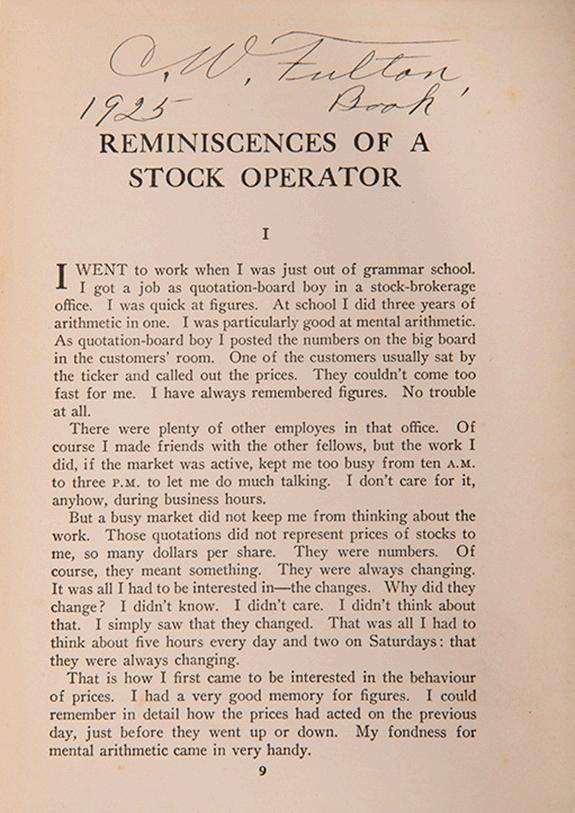

Speculation’s greatest story.

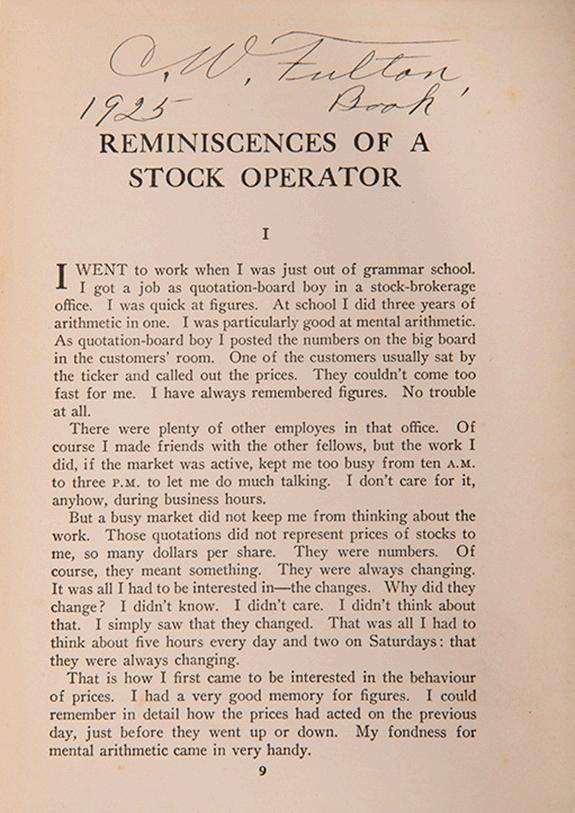

41. LEFÈVRE, Edwin.

Reminiscences of a Stock Operator.

New York, George H. Doran Company, 1923.

£6,500 [ref: 109747]

The first edition of this investment classic, a fictionalised biography of the day trader Jessie Livermore, to whom the book is dedicated. ‘This book, in fact, is almost an encyclopaedia of trading advice from a master who lived through good times and bad... Lefèvre captures the excitement of Livermore’s career and, at the same time, preserves much of Livermore’s market wisdom’ (Zerden).

One of the greatest works on market speculation. To the hedge fund expert Jack Schwager it is ‘One of the most highly regarded financial books ever written’.

Ken Fisher says ‘After 20 years and many rereads, Reminiscences is still one of my all time favourites’, and Barton Biggs considered it ‘The classic work about intuitive trading. No investor’s education is complete without it’.

A Wiley Investment Classic, featured in the University of Toledo’s Hess Collection and recommended by James Montier.

Provenance: C.W. Fulton, 1925 (ownership inscriptions).

First edition; 8vo (22.5 x 15 cm); ‘GHD’ monogram and Roman numeral ‘I’ on copyright page, ownership inscription in pen to front pastedown and dated inscription to head margin of p.9; publisher’s tan cloth, stamped in green on spine (smudged), blindstamp to upper panel (very rubbed), top edge trimmed otherwise uncut, light spotting and offsetting to endpapers; 299, [1]pp. Zerden, p.102-5; Dennistoun 626; Hess Collection.

What an Investor Ought to Know.

New York, The Magazine of Wall Street, 1913.

£375 [ref: 109780]

The first edition of this scarce investment guide which first appeared as a series of articles in The Magazine of Wall Street, the newsletter and publishing house founded by the technical analyst Richard Wyckoff (1873-1934).

‘It is a combination of statements of principles and references to actual cases without specific names. Throughout the book there are many suggestions based upon instances that have proven the worth of the advice given’ (Preface).

OCLC records just 8 copies in institutional holdings, all in the USA.

First edition; 12mo (17 x 10.5 cm); final 2 leaves of ads. present; publisher’s green cloth, upper cover gilt stamped, corners bumped; 152, [4]pp.

How to Win in Wall Street: By a Successful Operator.

New York, G.S. Carleton & Co., Publishers, 1881.

£450 [ref: 109836]

The first edition of this important early investment manual aimed at the general public. Sometimes attributed to the ‘Poet of the Sierras’ Joaquin Miller, though Blanck was unable to support this attribution in BAL (see vol. VI, pp.216-217).

First edition; 8vo (19 x 13 cm); ownership inscription to front endpapes, stylised Arabic monogram (‘kitab’) meaning book to title-page, 6pp. publisher’s ads. to rear; publisher’s blindstamped green cloth, gilt spine, light spotting throughout, wear to extremities, cover warped; 185, [1], 4, [2]pp. BAL VI, pp.216-217.

42. LOWNHAUPT, Frederick.

43. [MILLER, Joaquin(?)].

44. [MOODY’S INVESTORS SERVICE].

Moody’s Investment Survey. The complete series for the years 1933, 1934, and 1935 from vol.25 no.1 through to vol.27 no.105.

New York, Moody’s Investors Service, 1933-1935

£1,250 [ref: 109936]

A complete run, here in six volumes bound in contemporary black cloth, of Moody’s Investment Survey for the years 1933 to 1935. An important weekly review of the financial markets with corresponding stock and bond sections (here bound in separate volumes), and a cumulative index for each year-end.

The periodical was published by Moody’s Investors Service, one of the Big Three credit ratings agencies which continue to operate today. Its founder, John Moody (1868-1958), withstood several market crashes to get his business on its feet. As Thomas Friedman quipped in 1996 ‘There are two superpowers in the world today in my opinion. There’s the United States and there’s Moody’s Bond Rating Service. The United States can destroy you by dropping bombs, and Moody’s can destroy you by downgrading your bonds. And believe me, it’s not clear sometimes who’s more powerful’.

Provenance: The John Crerar Library, a research collection endowed by the American industrialist John Crerar (1827-1889) now administered by the University of Chicago.

Periodical, 6 vols; 4to (28 x 22 cm); bookplate for John Crerar Library to front pastedown of each vol., library stamp for The University of Miami Library to front pastedown and fore edge of each vol., library stamp for John Crerar Library to weekly periodical title throughout; contemporary black cloth, title and library shelf mark for John Crerar Library in gilt to spine, corners bumped, joints and spine ends with minor wear.

New York, A. Newton Plummer, 1932.

£300 [ref: 91932]

A mea culpa of sorts for the author’s role in falsely inflating stock values in the 1920s bull market, ultimately contributing to the market’s spectacular implosion in 1929.

Newton Plummer was a stock promoter and corporate publicist, responsible for planting stories in the press to draw publicity to pooled stocks. His scrapbooks, which form the basis of the present work, were later cited in evidence by Congressman Fiorello La Guardia at the Pecora Commission of 1932, an inquiry tasked with investigating the causes of the Wall Street Crash.

First edition, one of two thousand copies (this copy unnumbered); 8vo (23.5 x 16 cm); numerous illustrations and charts including full-page; publisher’s black cloth backed pictorial boards, wear to spine caps and extremities; 318, [2]pp.

Mining

New York, Moody’s Magazine, 1909.

£350 [ref: 109808]

A useful guide to understanding mining stocks.

Second edition; 12mo (17 x 12.5 cm); ownership inscription, 7pp. ads. to rear; publisher’s green cloth, front hinge weak but holding, wear to spine ends and corners; 233, [8]pp.

45. NEWTON PLUMMER, A. The Great American Swindle Incorporated.

46. NICHOLAS, Francis C.

Investments and How to Judge Them.

45. NEWTON PLUMMER, A. The Great American Swindle Incorporated.

46. NICHOLAS, Francis C.

Investments and How to Judge Them.

author ’ s s IG nature t I pped- I n

47. NIEDERHOFFER, Victor.

The Education of a Speculator.

New York, John Wiley & Sons, Inc., 1997.

£450 [ref: 109834]

The first edition of American hedge fund manager Victor Niederhoffer’s (b.1943) controversial memoir, signed ‘with appreciation Victor Niederhoffer’ to a paper slip tipped-in to the front free endpaper.

First edition; 8vo (23.5 x 16 cm); paper slip signed by the author tipped-in to front free endpaper recto; numerous illustrations including colour plates; black pictorial dust-jacket, original black cloth, gilt spine, ink stain to rear free endpapers, jacket with edge creasing; [2], xviii, 444pp.

48. OMNIUM, Gresham.

A Handy Guide to Safe Investments; forming a popular and practical treatise upon the nature and character of public securities; London, Groombridge and Sons, [1858].

£850 [ref: 109825]

An early reference guide aimed at the novice investor, defining key terms such as ‘Bear... used opprobriously, and deservedly so, to those persons who, for private purposes, circulate false reports’, and explaining fiscal concepts.

First edition; 12mo (17 x 11 cm); 24pp. publisher’s ads. to rear; original blindstamped purple cloth, lettered in gilt to spine and upper cover, all edges gilt, spine and edges faded, corners slightly bumped; viii, 128, 16, [8]pp.

anarchy meets the mar K et 49. PROUDHON, Pierre-Joseph.

Manuel du Spéculateur a la Bourse

Paris, Librairie de Garnier Freres, 1857.

£250 [ref: 89997]

In his 1934 biography of P. J. Prudhon, D. W. Brogan discusses the current work: ‘In the meantime [Prudhon] put together a pot boiler called The Manual Of The Stock Exchange Speculator. Prudhon usually had the highest opinion of his books while he was writing them, but grew disillusioned after they were published, but he reversed this history in the case of the manual. Most of it was the work of Duchene, but as the book sold well, The manual is chiefly devoted to describing various companies then quoted on the Paris bourse.

The manual is a very characteristic work. Prudhon displays his scepticism about railways, his dislike of Saint-Simonisto who are both capitalists and Jews, his belief in the immense possibilities of mutuality and the reform of credit’.

Fifth edition, 8vo., 511pp., 8 pages of ads at end, original yellow printed wrappers, an excellent copy.

50. PUGH, Burton Homer.

Science and Secrets of Wheat Trading.

Miami, Lambert-Gann Publishing Co., Inc., Jan. 1958.

£250 [ref: 109768]

A scarce introductory course to grain trading offering practical advice to the novice investor. Pugh, the author of several works on outsmarting the market, is best known for his later Better Way to Make Money. A Simple and Practical Plan of Investing and Trading in the Stock and Grain Markets published in 1939. Annotated throughout.

Third edition (1932), reprinted Jan. 1958; 6 vols; 8vo (22 x 14 cm); illustrated with charts, annotated throughout in pen including underlining and marginal notes, offsetting to front wrapper verso, occasional loose leaves; original red card wrappers, stapled, wrappers slightly faded, some internal browning; 39, [1]; 39, [1]; 39, [1]; 39, [1]; 39, [1]; 40pp.

American and Foreign Investment

Boston & New York, Houghton Mifflin, 1916.

£225 [ref: 91923]

The first edition of this insightful work on the leading classes of investment bonds by William Lee Raymond (1877-1942), an investment banker and lecturer in history and economics at the University of Boston.

Provenance: Alex Hirsh, 1707 University S.E., Minneapolis Drive, March 13, 1917.

First edition; 8vo (22.5 x 16 cm); dated ownership inscription in pen to front pastedown, woodcut device to title, annotations in pencil throughout; publisher’s red cloth, gilt spine, spine faded, slight fraying at extremities, light spotting to endpapers and edges; x, [2], 324, [2]pp.

The Investor’s Catechism.

New York, McDowall Publishing Company, 1908.

£550 [ref: 91931]

The corrected first edition of this useful glossary defining over 300 investment terms. Examples include ‘Backwardation... a London Stock Exchange term, signifying the premium paid for delay in delivering stocks’, ‘Bulge... a sudden or sharp, but comparatively small advance in the market’, and ‘Stock Power... a name assigned to an irrevocable power of attorney used in transferring title to stock certificate’.

Scarce. OCLC records only 2 copies in institutional collections, both in the USA.

First edition, corrected; 8vo (19.5 x 13.5 cm); correction tipped in to front pastedown, small tear to upper margin of pp.5-6 not affecting text; publisher’s green cloth, minor wear to spine ends, corners slightly bumped; 129, [1]pp.

51. RAYMOND, William L.

Bonds.

52. REYNOLDS, Marc M.

The Dow Theory. An explanation of its development and an attempt to define its usefulness as an aid in speculation.

New York, Barron’s, 1932.

£500 [ref: 109816]

The first edition of Robert Rhea’s contribution to the development of Dow Theory, named for the eccentric founder of The Wall Street Journal, Charles Dow (1851-1902), whose trendfollowing trading strategy laid the groundwork for modern technical analysis and market forecasting.

While confined to bed with illness for ten years, Rhea studied the Dow’s action thoroughly, becoming convinced that it provided the only accurate method for forecasting stock movement.

This clear and precise work is the result.

By 1938 Rhea was selling his mimeographed ‘Dow Theory Comments’ opinions to five thousand clients at forty dollars a year. Soon he had twenty-five assistants, and his bedroom became a statistical storehouse.

First edition; 8vo (23.5 x 16 cm); publisher’s ad. to half-title verso, tables, appendix of the editorials of William Peter Hamilton in the Wall Street Journal; later black cloth, spine lettered in red, minor damp-staining to margins of front few ff., occasional pencil annotations; x, [2], 252pp. Dennistoun 405; Zerden p.10; Hess Collection.

Dow’s Theory Applied to Business and Banking.

New York, Simon and Schuster, 1938.

£300 [ref: 109838]

53. RHEA, Robert.

54. RHEA, Robert.

A continuation of Robert Rhea’s development of Dow Theory. This copy with a manuscript anecdote entitled ‘The Englishman & his System’ relaying the story of an investor who timed his switching of stocks during ‘buying & selling periods’.

First edition, second printing; 8vo; illustrated, 2pp. publisher’s ads., 2pp. MS anecdote to final leaf & rear free endpapers; publisher’s cloth.

55. RICHARDSON, Thomas D.

Wall Street by the Back Door.

New York, Wall Street Library Publishing Co., 1901.

£650 [ref: 109775]

A wry and backward look at many of the games played by the major market operators at the turn of last century, including Gould, Keene,

Drew, and Morgan, with amusing caricatures after sketches by satirist Homer Davenport (1867-1912).

First edition; 8vo (16.5 x 13 cm); 8 plates of caricatures including frontispiece after Homer C. Davenport; publisher’s red cloth, gilt stamped spine and upper cover, wear to extremities, areas of discolouration, faded, internally clean; 129, [1]pp. Dennistoun 622.

56.

[SINKING FUND].

The Financial House that Jack Built.

London, Printed for J.M. Richardson, 1819.

£1,500 [ref: 109819]

A satirical riff on the English nursery rhyme The House that Jack Built, criticising the economic policy of Nicholas Vansittart (1766-1851), Chancellor of the Exchequer, and attacking the stock market more generally. It starts with the Pigeons (the punters), who are preyed on by the Rooks, (the stock-jobbers), who snare the Lame Ducks who cannot settle their dealings in Scrip and Omnium.

‘Vansittart came into office at one of the most embarrassing periods in the history of English finance... On 3 March 1813 he brought forward, in a number of resolutions in the House of Commons,

Satire attacking government and stockjobbers.

a “new plan of finance”, dealing with the sinking fund.

Under this plan, by repealing portions of the sinking fund bill, 42 George III, c. 71, it was believed the great advantage could be secured of keeping in reserve in time of peace the means of funding a large sum in case of renewed hostilities... This scheme was the first specimen of similar contrivances by Vansittart, all burdened with mysterious complications, which, after first winning from the public a puzzled admiration for the ability of their author, eventually brought him into disrepute’ (DNB).

His repeated proposals to borrow from the fund led to his eventual undoing in 1823, when he was finally persuaded to exchange the office of Chancellor for a peerage in the House of Lords.

The pamphlet was likely inspired by William Hone’s popular tract, The Political House that Jack Built, a seething attack on repression and tightening censorship laws in the wake of the Peterloo Massacre, which appeared the same year with illustrations by George Cruikshank.

Political pamphlet; second edition with additions, same year as the first; 8vo (21.5 x 13.5 cm); paper watermarked ‘F 1818’, annotations in pen and pencil to p.4 identifying ‘The Right Hon. N. V—S—T’ as Lord North (pen), and more reliably Nicholas Vansittart (pencil), repaired tears pp.7-8; disbound, recently stitched; [2], 10pp.

early advocate o F common stoc K s

57. SMITH, Edgar Lawrence.

Why & How to Invest in Common

Stocks.

Philadelphia, Dorrance & Company, 1966.

£400 [ref: 75170]

The first edition of Edgar Lawrence Smith’s (1882-1971) final work on Common Stocks, published at the end of a long and formidable career in academic research and the markets. Written at his wife’s suggestion for the ‘New Investor’, it explains in simple terms how to construct a portfolio for income and profit for long-term success.

Smith was an early advocate of the principle that stocks excel bonds in long-term yields, explaining to the New York Times in 1925 that ‘I have been unable to find any twenty-year period within which diversification of common stocks has not, in the end, shown better results...’

First edition; 8vo; publisher’s red cloth gilt, green dust jacket lettered in white and black, spine faded, wear to extremities, front flap price-clipped, internally crisp and clean; [10], 83, [1]pp.

I ns I der trad I n G

58. SMITH, Frank P.

Management Trading. Stock-Market Prices and Profits.

New Haven, Published for the University of Rochester, 1941.

£600 [ref: 109815]

The first edition of this early work on insider trading by Frank Percy Smith, Assistant Professor of Economics at the University of Rochester. A handsome copy in the publisher’s unclipped dust-jacket. Scarce in commerce.

First edition; 8vo (24 x 16 cm); ink stamp to front free endpaper recto; unclipped sand dust-jacket, original orange cloth, gilt spine, small tear with loss to rear cover gutter and foot of spine, slight spotting to spine, otherwise a handsome copy; xii, 146pp.

Safe Methods of Stock Speculation. Containing practical information of the methods used by which the wall street millionaires have amassed vast fortunes, filched from the public...

Chicago, Frederick J. Drake & Co., 1902.

£650 [ref: 109792]

An early guide and exposé of the stock market written for would-be speculators warning them of its dangers and offering advice on how to succeed: ‘The heroic remedy “of cutting it out” immediately regardless of price and loss, should be resorted to... A system should never be played... Wall Street is not a charitable institution... Beware of the stockbroker with a large following’.

First edition; 8vo (17.5 x 12 cm); bookplate to front pastedown, illustrated with charts, final 11 ff. of publisher’s ads. present; publisher’s pictorial cloth; 103, [23]pp.

The New York Stock Exchange.

New York, Stock Exchange Historical Company, 1905.

£950 [ref: 91938]

A scarce history of the New York Stock Exchange from its early days in Manhattan to its move to the New Exchange building in 1903, edited by the American poet and stockbroker Edmund Clarence Stedman (1833-1908), a member of the exchange from 1865 to 1900. Stedman opened his own brokerage firm in 1864, balancing the demands of life on Wall Street with his artistic inclinations.

First edition, vol. I (all published); 4to (32 x 23.5 cm); numerous illustrations including frontispiece and full-page plates, title in red and black; half black morocco ruled in gilt, gilt spine, green cloth, restoration to spine ends and corners, dampstaining to title and prelims, minor staining to lower panel; xxv, [1], 518pp.

59. STAFFORD, William Young.

60. STEDMAN, Edmund Clarence (editor).

Scarce history of the New York Stock Exchange.

59. STAFFORD, William Young.

60. STEDMAN, Edmund Clarence (editor).

Scarce history of the New York Stock Exchange.

Studies in Tape Reading.

New York, The Ticker Publishing Company, 1919.

£450 [ref: 109833]

The first work on tape reading, and arguably the earliest and most important work on market dynamics in general. Published by the leading proponent of technical analysis, Richard Wyckoff (1873-1934), under the pseudonym ‘Rollo Tape’. The book proposed that the ‘market momentarily indicates its own future’ on the ticker tape used to communicate key information such as price, volume, and size to brokerage firms.

Third edition (‘Latest Edition’); 12mo (17 x 12 cm); publisher’s limp blue cloth, lettered in gilt to upper cover, front joint partly cracked but holding, faint staining to upper margin of first ff.; 177, [1] pp. cf.Dennistoun 422; Zerden p.16.

The Mississippi Bubble: A Memoir...

New York, W.A. Townsend & Company, 1859.

£250 [ref: 109800]

First edition in English of Adolphe Thiers’ classic biography of the Scottish economist John Law (1671-1729), who served as Contrôleur Général des Finances of France during the regency of Louis XV. His scheme to replicate the success of the great European trading companies with his Compagnie d’Occident (given exclusive rights over the French colony of Louisiana) ultimately proved disastrous, leading to his swift resignation and exile in 1720.

First edition in English; 8vo (19.5 x 13.5 cm); yellow ads. endpapers, publisher’s ads. to rear, ‘Story of the South Sea Bubble’ news article inserted loosely; publisher’s blind-stamped brown cloth, spine lettered in gilt, wear to head and tail caps corners bumped, cloth faded; [4], vii-xii, [3], 16-338, 18, [2]pp. Dennistoun 19.

61. TAPE, Rollo [pseud. WYCKOFF, Richard D.]

62. THIERS, Adolphe.

61. TAPE, Rollo [pseud. WYCKOFF, Richard D.]

62. THIERS, Adolphe.

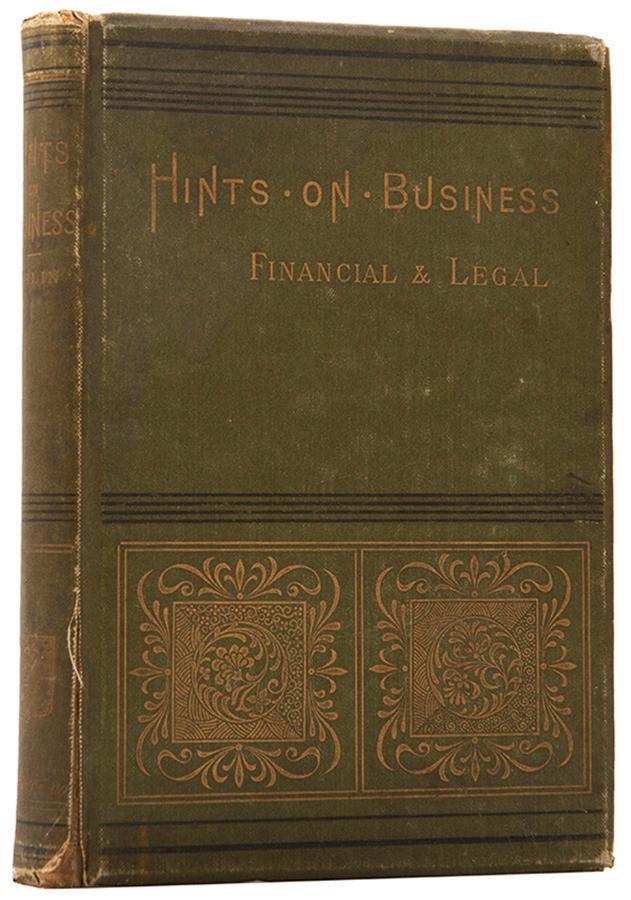

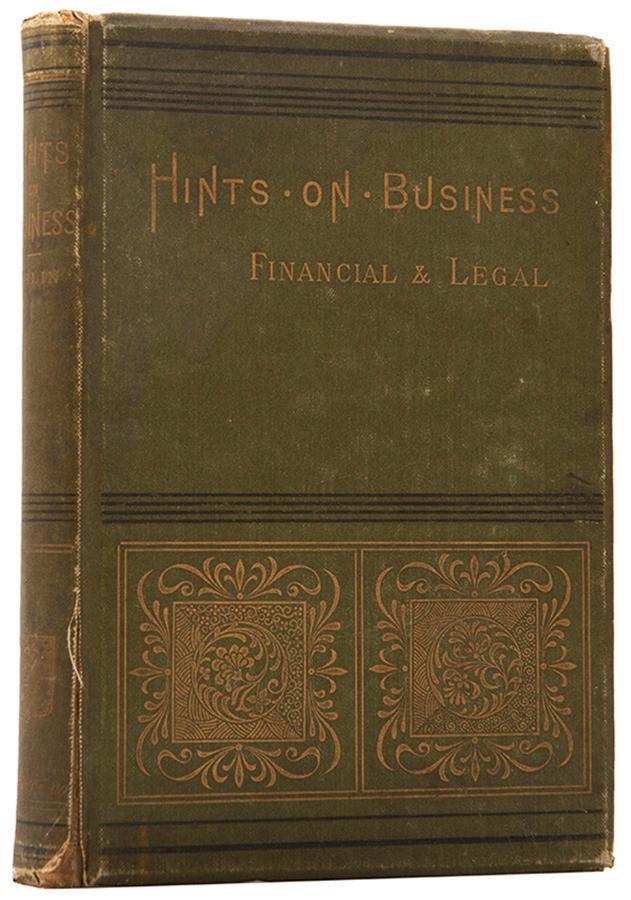

Hints on Business, Financial and Legal; in xiv. letters to a friend, about investments, income, and other matters.

London, Suttaby and Co., 1884 [1883(?)].

£500 [ref: 109824]

A scarce handbook on business written in an epistolary style by Denny Urlin (1830-1907), a barrister at Pump Court and member of the London School Board.

OCLC records just six copies of the work in institutional collections.

First edition(?); 8vo (19 x 13 cm); ownership inscription in pencil to front free endpaper recto, woodcut device to half-title verso, 1p. publisher’s ads. to rear; publisher’s green cloth gilt, wear to spine ends, some fraying, joints cracked but holding; viii, 223, [1]pp.

How to Make and Keep Stock Market Profits.

New York, Van Strum Financial Service, 1930.

£250 [ref: 109575]

A curious guide to the stock market advertising Van Strum’s financial advisory service, published in 1930 at a time when the global economy had ‘just passed through the most severe panic in history’ (p.5)

The advice it contains draws on Van Strum’s more theoretical works but is designed principally for a lay reader. Suffice to say, it emphasises the importance of investing in common stocks over the longer term, as well as the benefits of adopting a ‘Van Strum’ portfolio in order to ‘obtain expert, complete, accurate, and unbiased’ advice (p.61).

Sixth edition, published the same year as the first; 8vo; one-colour spot illustrations throughout, stamped ‘Printed in the U.S.A.’ to title; dark blue cloth backed light blue boards, title-pieces to spine and upper cover, very minor wear to extremities; 73, [1]pp.

63. URLIN, R. Denny.

64. [VAN STRUM, Kenneth].

65. [TOKYO CHAMBER OF COMMERCE].

The Annual Statistical Report of the Tokyo Chamber of Commerce for 1912 [and] 1921 [and] 1922.

Tokyo, 1912; 1921; 1922.

£975 [ref: 93942]

A fascinating survival from the Taishō Democracy, a period of liberal reform and political renewal in Japan lasting from 1912 until 1926, which ultimately culminated in a series of economic crises that plunged the nation into a severe depression.

These reports by the oldest economic organisation in Japan, contain key financial, economic, and demographic data on the city for the years 1912, 1921 and 1922 respectively, including population estimates, price indexes, import and export values, average wage figures, transactions on the Tokyo Stock Exchange etc., presented in a series of 63 tables per report.

Provenance: Hindenburg-Hochschule Nürnberg Bibliotheck (stamp to 1922 issue); WeltwirtschaftsInstitut der Handels-Hochshule Leipzig (stamps to 1912 and 1921 issues).

First editions, 3 works; 8vo; 1912 report: 63 statistical tables, text in Japanese and English, library stamp to preliminary leaf, tipped-in presentation slip; later cloth backed brown boards preserving original upper card wrapper on upper board; [6], vi, 196, [6]pp; 1921 report: 63 statistical tables, text in Japanese and English, library stamp to preliminary leaf, tippedin presentation slip; later cloth backed brown boards partially preserving original upper card wrapper on upper board; [6], vi, 203, [11]pp; 1922 report: 63 statistical tables, text in Japanese and English, tipped-in presentation slip, library stamp to title-page, bookbinder label to rear pastedown; original upper card wrapper bound in, later green half cloth and mottled boards by Hans Kügel; [6], vi, 207, [11]pp.

Economic Freedom. An Address by Richard Whitney, President, New York Stock Exchange. [Chicago(?)], [1934(?)].

£150 [ref: 109946]

The story of Richard Whitney (1888-1974) is now infamous. President of the New York Stock Exchange, the man who boldly bid up U.S. Steel on Black Thursday, heralded for saving the market, who later defied the Senate’s banking committee, and was in 1938 sentenced to between five and ten years in Sing Sing prison for embezzlement.

This pamphlet is from a series of addresses Whitney gave to various business associations whilst president of the New York Stock Exchange in the 1930s. Their purpose was to defend the old practices, including short selling, and to exculpate the New York Stock Exchange from any criticism for the crash. Here Whitney extolls the virtues of ‘Economic Freedom’ in a speech given at a dinner for the Chicago Association of Stock Exchange Firms on 10th December 1934.

Pamphlet; 8vo (22x 14.5 cm); loose slip ‘Compliments of Mr Richard Whitney, President, New York Stock Exchange’; original printed wrappers, removed from a larger binding, with resultant holes and residue to spine edge; 19, [1]pp.

£150 [ref: 109947]

In this address to the Boston Chamber of Commerce given on 29th January 1931 Whitney discusses the human face of the exchange and his insights into investor behaviour. Pamphlet; 8vo (22x 14.5 cm); original printed grey wrappers, removed from a larger binding, with resultant holes and residue to spine edge; 18, [2]pp.

66. WHITNEY, Richard.

67. WHITNEY, Richard. Public Opinion and The Stock Market. [Boston(?), 1931(?)].

A Glossary of Colloquial, Slang & Technical Terms in Use on the Stock Exchange and in the Money Market.

London, Wilsons & Milne, 1895.

£650 [ref: 109826]

The first edition of A.J. Wilson’s (1841-1921) Glossary of Colloquial, Slang & Technical Terms, a fascinating snapshot of finance and the London Stock Exchange in the late Victorian age.

Some definitions may seem self evident — see ‘Chartered Accountants... Members of the Society of Chartered Accountants’ — others a little peculiar. ‘Interest’ for instance is defined as ‘The usury paid on money lent’. Still more should prove familiar to the modern investor.

First edition; 8vo (17.5 x 13 cm); ownership inscription in pencil to title page, 6pp publisher’s ads. to rear; original green cloth, spine and upper cover lettered in gilt, edges stained red, minor wear to extremities; [6], 210, [6]pp.

Studies in Stock Speculation.

New York, The Magazine of Wall Street [Ticker Publishing], 1925-1926.

£475 [ref: 109818]

A classic self-help guide to stock speculation published by The Magazine of Wall Street, the newsletter and publishing house founded by the technical analyst Richard Wyckoff (1873-1934).

Two vols; second edition; 8vo (19 x 13 cm); illustrated with charts, 4pp. ads. to rear of vol. II; blue faux morocco, spine and upper cover gilt stamped, wear to extremities; vi; 7-248; [8], 203, [5]pp. Dennistoun 441.

68. WILSON, A.J.

69. [WOLF, Harry John].

The Richard D. Wyckoff Method of Trading and Investing in Stocks. A course of instruction in stock market science and technique.

New York, Wyckoff Associates, inc., 1937.

£9,500 [ref: 88247]

Richard Wyckoff (1873-1934) is one of the legends of Wall Street. At the turn of the twentieth century, he was tireless in promoting, publishing, and writing about the stock market. His book Studies in Tape Reading (Item 61) is one of the earliest works on technical analysis. He founded The Ticker Magazine, which subsequently became The Magazine Of Wall Street, and promoted many authors including Selden, Babson, and Crowell through Ticker publishing. His autobiography Wall Street Ventures and Adventures Through Forty Years reminisces about ‘The Street’ and the great traders: Livermore, Keene, Bet-A-Million Gates, and bankers like JP Morgan.

During the 1930s, and 40s, many technicians produced stock market courses. Wyckoff’s along with Rhea’s, Gann’s, Quinn’s and Orline Foster’s are probably the best known. They were usually roneo’d (an early form of reproduction) and were produced in very limited numbers. They were offered to a select group of clients, who would pay hundreds of dollars for what was considered a unique glimpse into the technical mysteries of the market written by a living master. In this case, the 2-volume course, beautifully bound in tan morocco, was not offered for sale, but had to be leased by a prospective purchaser. There were several editions, due to the necessity of updating every few years. This was the most complete as it was the last and final version, published in 1937, three years after Wyckoff’s death. Rare.

Subscriber’s edition of a rare & important manual for trading, written by a legend of Wall Street.

70.

WYCKOFF ASSOCIATES.

Provenance: Willard W. Grant (gilt stamp); Philip Oshita, 1263 W. Winnemac Chicago, Ill. (ex libris).

Subscribers edition; 2 volumes; 4to (28 x 25 cm); 300pp. of type-written yellow paper, divided in numerous sections, instructions for use inserted loose in pockets of both volumes; ring bound in contemporary soft dark brown calf, gilt metal clasps, subscriber’s name gilt stamped on upper cover, an excellent example.

Shapero Rare Books

105-106 New Bond Street

London W1S 1DN

+44 (0)20 7493 0876

rarebooks@shapero.com

www.shapero.com

A member of the Scholium Group

TERMS AND CONDITIONS

The conditions of all books has been described. All items in this catalogue are guaranteed to be complete unless otherwise stated.

All prices are nett and do not include postage and packing. Invoices will be rendered in GBP (£) sterling. The title of goods does not pass to the purchaser until the invoice is paid in full.

VAT Number GB 105 103 675

NB: The illustrations are not equally scaled. Exact dimensions will be provided on request.

Cover image: from the Shapero Rare Books archive

Frontispiece: Item 45

Catalogued by Oliver Yarwood

Edited by Jeffrey Kerr

Photography by Natasha Marshall

Design by Roddy Newlands

2. BABSON, Roger W.

3. BABSON, Roger W.

2. BABSON, Roger W.

3. BABSON, Roger W.

4.

4.

10. CRUMP, Arthur.

10. CRUMP, Arthur.

14. EDWARDS, Richard (editor).

15. FISHER, Philip A.

Profits.

14. EDWARDS, Richard (editor).

15. FISHER, Philip A.

Profits.

19. GUNN, Niel Ballingal.

20. HAMILTON, William Peter.

19. GUNN, Niel Ballingal.

20. HAMILTON, William Peter.

32.

33. KEYES, Franklin C.

32.

33. KEYES, Franklin C.

34. KEYNES, John Maynard.

34. KEYNES, John Maynard.

36. KEYNES, John Maynard.

The General Theory of Employment, Interest and Money.

36. KEYNES, John Maynard.

The General Theory of Employment, Interest and Money.

45. NEWTON PLUMMER, A. The Great American Swindle Incorporated.

46. NICHOLAS, Francis C.

Investments and How to Judge Them.

45. NEWTON PLUMMER, A. The Great American Swindle Incorporated.

46. NICHOLAS, Francis C.

Investments and How to Judge Them.

59. STAFFORD, William Young.

60. STEDMAN, Edmund Clarence (editor).

Scarce history of the New York Stock Exchange.

59. STAFFORD, William Young.

60. STEDMAN, Edmund Clarence (editor).

Scarce history of the New York Stock Exchange.

61. TAPE, Rollo [pseud. WYCKOFF, Richard D.]

62. THIERS, Adolphe.

61. TAPE, Rollo [pseud. WYCKOFF, Richard D.]

62. THIERS, Adolphe.