REVOLUTION

HOW TWO WARS ARE CHANGING THE WORLD

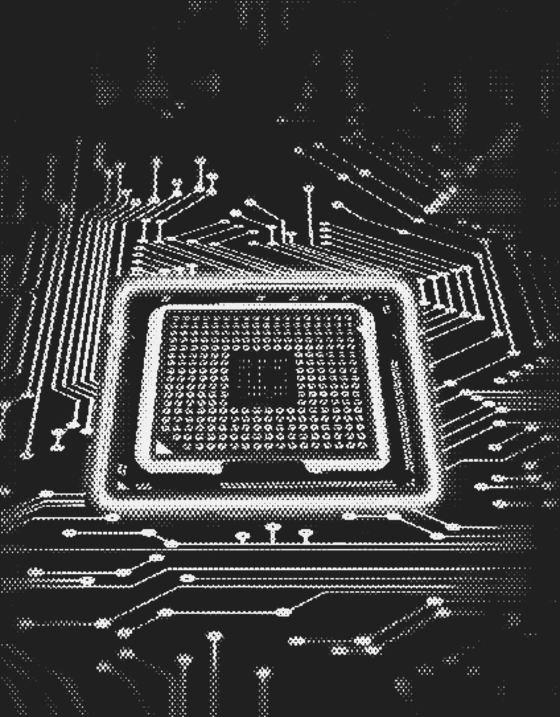

THE WORLD OF SEMICONDUCTORS

RUSSIA-UKRAINE WAR: CRISIS

Dear Readers,

It is once again my pleasure to introduce the SIMES Newsletter to the readers.I greatly admire the enthusiasm of the SIMES members to constantly identify topics of importance in the global context and share their insights so that we all can have a better understanding of the economics aspects of the world around us.

In this round, the students had identified two important themes. The first theme hovers around the semiconductor industry. As we are aware, semiconductor is an important component in major electronics products and hence development in the semiconductor industry affects all of us. The writer first discusses the changes in the landscape of the global semiconductor industry, highlight the changes in demand caused by Covid-19 and also the keen competition among the global players in the semiconductor industry. They then explain how semiconductors are driving the global economy, emphasizing on impact of changes in the price and output of semiconductors before concluding with a prediction on the future of global semiconductor production.

The second theme focus on the impact of the war in Ukraine. Although the war involves mainly Russia and Ukraine, it affects many other economies in the world, directly with US and Europe and indirectly with the many other economies through the commodities market and financial market. The writer begins with an overview of the historical account of the friction between Russian and Ukraine, follow by a discussion on the relationship between Russia, Ukraine and Nato, and finally an extensive analysis of the impact of the war in the global environment, including the role of ASEAN.

It is my hope that these articles will not only make the readers more informed about the events in the world but also generate interest to know more about the economic impacts of these events.

Dr Tan Khay Boon Advisor SIM Economics Society

Dear Readers,

“The greatest glory in life lies not in never falling, but in rising every time we fall.” Nelson Mandela

Nelson Mandela highlights the power of perseverance amid adversity. Perseverance is the key to success which helps us emerge victorious from the setbacks. With the unified efforts of countries, their government, and the medical fraternity across the globe, we emerge from the deep end of the Covid-19 pandemic. However, the crises and human misery are far from over. In this publication of “The Equilibrium 2022”, we present “The Marginal Revolution,” which provides readers with an insight into two crises that have engulfed the world. The publication scrutinises two such crises and provides a holistic view by analysing the macroeconomic impact that they can have.

The first section dwells on The World of Semiconductors. This section explores the big little problem, which is the semiconductor shortage. With the advent of technology, consumer electronics have become ubiquitous. At the core of these electronic inventions lies the tiny, essential semiconductor chip. The rapid technological innovations coupled with the Covid-19 pandemic have exponentially increased the demand for electronic devices and semiconductor chips. The articles highlight the global economic impact of accelerating demand and lagging supply experienced by the semiconductor market. The impact of the political landscape with the influence of key players such as the U.S, China, and Taiwan can have on the semiconductor industry is also examined

The second section analyses the Russia-Ukraine War from a macroeconomic perspective. This section examines the war and its impact on other nations through the ripple effects that it has had on global equities, commodities, and forex markets. Russia’s invasion of Ukraine has posed an unprecedented threat to Europe and the International order. The butterfly effect of the war is quite evident as countries globally face economic and political consequences. Inflation, induced by fiscal stimulus and supply chain constraints at the onset of the pandemic, has been exacerbated by the war. The Russia -Ukraine war has weakened the global economic recovery post-pandemic due to the significant disruptions in trade and food and fuel price shocks. The war may end soon, but its aftermath will be long-lasting.

We would like to express our sincere gratitude to the members of the Student Development department, especially Mr. Kenneth Chan and Ms. Patricia Lee. The production of the newsletter would not have been possible without their unwavering support and faith in us. We would also like to thank Dr. Tan Khay Boon, our academic advisor, for continuously lending his support, helping us formulate the themes of the newsletter, and guiding us through this journey.

The newsletter has come to fruition because of the joint efforts made by the Research & Editorial department and the Marketing department at SIMES. Despite their other commitments, they spent countless hours researching, writing reports, and designing the newsletter intricately to provide relevant, pertinent information succinctly and engagingly for all the students at SIM. The passion for fulfilling the mission of SIMES among the members has helped us publish this newsletter and make the knowledge of economics accessible to all students.

I sincerely appreciate the hard work and the time dedicated by our SIMES team, including all executive and subcommittee members, to help with this newsletter. Without their unwavering efforts, we would not have been able to successfully executive all our initiatives and add value to the SIM student community.

Finally, I hope this publication can provide you with interesting insights regarding two pertinent themes that the world grapples with and that you have an enriching experience going through all the articles.

Sumair Jalan President SIM Economics Society

In recent years we’ve lived through multiple “once in a lifetime” economic crises. Having the opportunity to dive into learning the reasons behind it, and what it entails for the future fascinates me. I hope to convey this through the newsletter and help others make sense of these turbulent times.

Todor Zhivkov, the Former Prime Minister of Bulgaria, once said “This year - a factory of semiconductors. Next year - a factoryofwholeconductors!”.

With multiple news and debates about semiconductors, one might wonder what is the future of the semiconductor industry.Readontofindoutmore!

The ghosts of our past have caught up with us. We now live in a time where countries are invading each other. We have the privilege to have both feet in peace and war time situations. Learning from these will teach us invaluable lessons about economic uncertainty and how we as a humanracemoveforwardtogether.

In the past few years, the semiconductor industry has gained many investors’ attention and billions of funds are invested in it. Due to Covid-19, the chip industry is suffering a chip supply crunch. Many countries around the globe are worried about the supply chain shortage. They have proposed regulations, laws and initiatives to improve the semiconductor industrial chain. This year SIMES will discuss the landscape semiconductor industry andhowthechipindustryischangingaroundtheglobe.

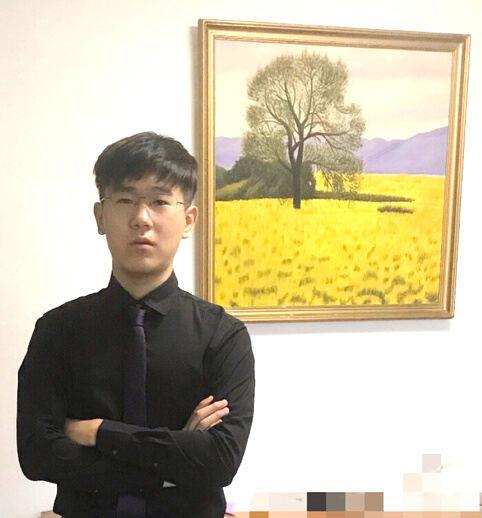

Daniel Nyam Jia Yi

Teo Kang Qi

Daniel Nyam Jia Yi

Teo Kang Qi

“TheRussian-Ukrainianwarcancertainlybeinterpretedasa clash of civilizations, political systems, and values of the past and the future, but also as a clash of reality and virtuality.”-MykolaRiabchuk

This year’s newsletter will be exploring a highly catastrophic and devastating current event that will make its pages in world history, through both a geopolitical and economic lense. I hope our newsletter will help readers gain meaningfulunderstandingandinsightsaboutthissituation.

History has taught us that the effects of war are definitely one that is everlasting. The aftermath of such a catastrophic event never fails to deeply impact those who are left, disrupting lives, the economic stability of the nation itself and global markets. It is vital we delve into these current events to learn how it is impacting us collectivelyandworktowardsabetterfuture.

Until recently, what we are experiencing today could only be read in history textbooks. This is the classic struggle between good and evil, on which the very survival of mankinddepends.’’-VitaliyPortnykov

The war has left a permanent mark on the world as we know it . Economics collapsed, surging prices, labour shortages and most of all lives ruined. The newsletter explains the effect of the Russia ukraine war on the global market

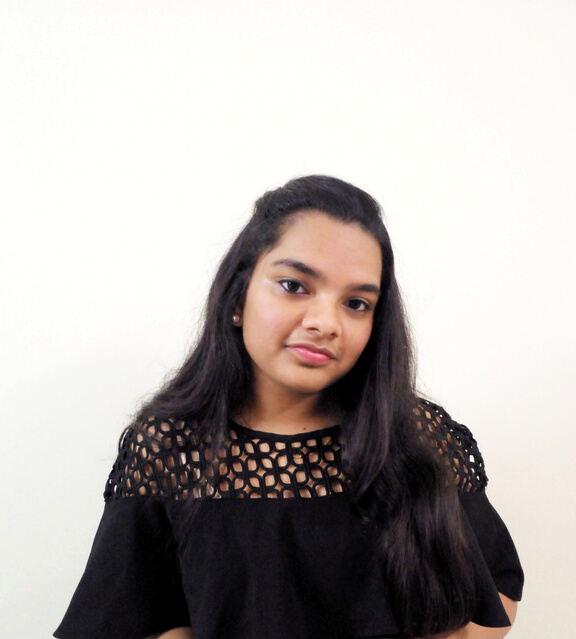

Amreeta Kaur

Amreeta Kaur

“War does not determine who is right, only who is left.”BertrandRussell

Mr Masayoshi Son, the founder and CEO of SoftBank Group Corp (a company that invests in companies operating in the technology, energy, and financial sectors) once said that “people usually compare the computer to the head of the human being. I would say that hardware is the bone of the head, the skull. The semiconductor is the brain within the head. The software is the wisdom. And data is the knowledge”

Semiconductors are involved in a huge part of our life, just like how Mr Masayoshi equates it to the brain. Semiconductors are present almost everywhere - mobile phones, laptops, television etc. With the recent political tension between China and Taiwan, can you imagine what would happen to our lives if this tiny chip becomes unavailable? Political tensions often affect the supply chain of the goods and supplies, and such issues do not only affect 1 or 2 countries. It affects every country that relies on that supply chain. Would you like to know more about the future of this ever changing industry?Readonformoreinformation!

The topic on the semiconductor landscape illustrates the history of semiconductors and why it is important in our daily lives. It also looks at the market outlook and the global corporate actions, including how deglobalisation becomes the trend in the globalsemiconductorindustry.

Besides, the topic on how semiconductors are driving the global economy compares the impact on producer and consumer prices for products that rely on semiconductors and how the economy will be affected if productionplantsareshutdown.

Lastly, the topic on the future of global semiconductor production discusses how politics can affect the semiconductor industry. It talks about the recent China and Taiwan Crisis, and what is possibly the future of the industry. Besides, it includes the prediction on the future of the semiconductor industry.

To all readers, I hope that you stay safe during this unprecedented time. Although the pandemic is considered to be stable, I hope that all readers will be healthy and have a positive year ahead! To all budding economists, I guarantee that you will have great takeaways from the newsletter, and it’s whatcan’tbetaughtinclassrooms.

~ Teo Kang QiDespite their superiority, Russian forces made less progress than might have been expectedonthefirstdayofthewarwhenthey had the advantages of tactical surprise and potentially overwhelming numbers. The initial assaults lacked the expected energy and drive, and the Ukrainians demonstrated a spirited resistance. Though the Russians may eventually prevail, this will be an extraordinarily difficult war for Putin to win politically.

One of the main reasons why wars can turn out badly is underestimation of the enemy. Putin’s speech and his statements reveal his preferred rationale for war and why he thinks hecanwin.

Wars rarely go according to plan. Chance events or poorly executed operations can require sudden shifts in strategy. The unintended consequences can be as important as the intended. These are the pitfalls surrounding all wars and why they should only be embarked upon with good reason, of which the most compelling is an actofself-defence.

This war has created ripple waves that have shocked economies around the world. From stock markets to increasing inflation. It has affected entire nations to an individual's purchasing power for basic necessities, such as food. Worst of all, we still do not know wherethebottomofthebarrelis.

Putin reminds us that autocracy can lead to great errors, and while democracy by no means precludes us from making our own mistakes, it at least allows us opportunities to move swiftly to new leaders and new policies whenthathappens.

To all readers, this period of our lives will test our resilience and faith. If I can impart one thing to you, it will be that what goes up mustalwayscomedown.

~ Rohen Veera Staypassionateandmotivated!A Reckless Gamble: Wars rarely go to plan, especially if you believe your own rhetoric

In 1874, Karl Ferdinand Braun created the first semiconductor device.

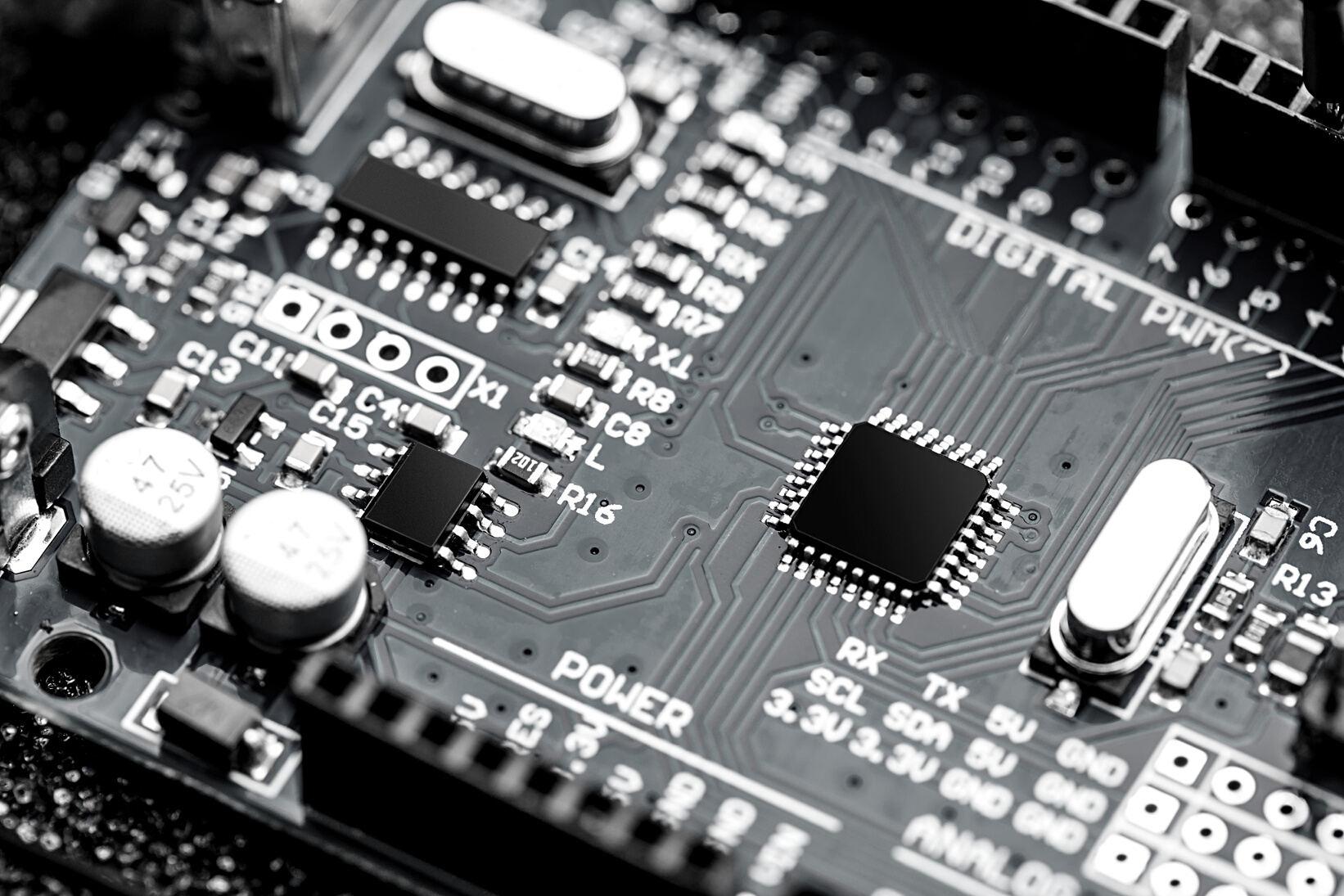

Semiconductors are materials which have the resistance levels between conductor and insulator such as silicon, selenium and germanium.

Sincetheycancontroltheflowof electric current in electronic devices, they are the building blocksofmoderncomputing.

Devices which use semiconductorsarememorychip, processor, integrated circuit, keyboard, mouse and monitor (ComputerHope,2022).

Thus,semiconductorsplayavital role in electronic devices from smartphones and personal computerstosolarcellswhichuse sunlighttoproduceelectricity.

In the past few years, news about shortage of chips has gained many investors’ attention and billions of funds areinvestedinthesemiconductorindustry.

In the early stage of Covid-19, the demand for laptops and chips has spiked because of the work-from-home regulations.

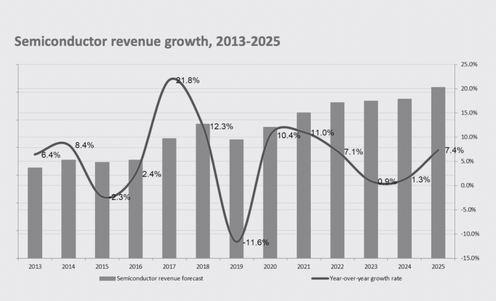

Thus, global revenue of the semiconductor industry recordedanall-timehighofUS$556billionin2021. However, this trend is slowing, not just because of the factthatpeoplearereturningtoworkinoffices,butalso due to inflation which discourages people from spending.

According to Omdia, the chip industry revenue growth willstartdecliningintheyearof2022(Omdia,2021).

Advanced Micro Devices (AMD) is known for designing computer processors and graphics technologies. It has finished acquisition of Xilinx on Valentine's day of 2022 with US$50 billion. AMD’s processorsdominatethePersonalComputermarket with about $200-$300 less expensive than Intel’s processors. And, Xilinx’s system on chips is the leader in adaptive computing such as AI and machine learning. With the help of Xilinx, AMD is able to enter the market of 5G communications, automotive and aerospace (Reuters, 2022). The combined company will capture a market share of US$135 billion among stiff competition in the CPU marketfromIntelandNVIDIA.

On February 8, 2022, NVIDIA and SoftBank announced that the acquisition of ARM had ended in failure as the acquisition failed to get approval from regulatory authorities of US, UK, EU and China. Nonetheless, this acquisition has gained significant attention since NVIDIA is the dominant player in the GPU market and ARM is the market leader in the IP cores market with 41% of the marketshareasof2021.

The majority of ARM customers are NVIDIA’s direct competitors such as Broadcom, Microsoft, Google and they are worried that ARM will lose its independence in operation and restrict access to some services after acquisition by NVIDIA. The development of SMEs in the ARMecosystemwillalsobelimited.Thus,thecombination of these two companies will affect their ecosystem, customers and competitors. Besides, if ARM were acquired byUScompanyNVIDIA,IPlicensingwillbelimited,thereby imposing a threat to China Integrated Circuit designing market. Therefore, failure in acquisition favours the China chipmarket(CapitalSecurities,2022).

Taiwansiliconwafermaker-GlobalWafers,alsofailedto acquire Siltronic even though the Taiwan company owns the 13.67% share of Siltronic (Asia Nikkei, 2022) . Theacquisitiongoessmoothlyinthebeginningandgets approval from South Korea, Japan and China. Nevertheless, the German government did not approve thedealbecausethegovernmentdidnothavesufficient time to finish all the review steps before the deadline. Therefore, both of the two high-profile acquisitions attempts in the semiconductor industry have ended in failures.

In the time of Covid-19, the chip industry is suffering a chip supply crunch because of the two facts that the demand has surged and many Chinese companies began mass hoarding of chips from US as they are worried about the worsening trading relationship with US due to US-China trade war. Apart from hoarding foreign chips, many countries have proposed regulations, laws and initiatives to support local enterprises to improve their domestic semiconductor industrial chain.

As of May 2020, South Korea plans to create the world's largest semiconductorsupplychainsystem “K-Semiconductor Belt” and hope toemergeasNo.1chippowerhouse with 510 trillion won (US$450 billions) investment by the year of 2030. The South Korean government encourages Samsung ElectronicsandSKHynixtoinvestin thisinitiativebygivingthem40%to 50% tax breaks, cheap loans and relaxing regulations for semiconductor R&D investment. UnderthisK-Semiconductor-

initiative, SK Hynix invested 110 trillionwoninchipfactoriesand120 trillion won in semiconductor clusters. Samsung, the largest memory chip producer, increased investment from 133 trillion won to 171trillionwoninindustriessuchas automotive, artificial intelligence and 5G mobile communications (KBS world, 2021). With the Ksemiconductor belt, SMEs around theglobeareabletocreateastrong network and ecosystem with parts manufacturers and other business sectors.

The European Union is the dominant leader in areas of silicon wafers, advanced chips for automotive and industry equipment, and chip manufacturing equipment. However, it is heavily dependent on third-world suppliers. Tosolvethechipsupplychaincrisis, the EU commission proposes the Chips Act which provides US$49 billion. Among them, US$12 billion will be used to strengthen research, development and innovation of the chip with a goal to double the market share to 20% by the year of 2030 to secure a dominant place in theglobalchipindustry.

Inthe“MadeinChina2025”strategy

,semiconductorisconsideredasthe core industry. As of 2021, China chip self-sufficiency rate is 36% which is daily production of 1 billion chips anditaimstoreach70%bytheyear of2025.Eventhoughthehigh-end

China chip market has not significantly progressed and has left far behind the international advanced level, it has gradually stood out as one of the big players in the supply chain of the global chip market. For instance, 50% of theglobalcircuitboardscomefrom China. Besides, in the field of memory chips, China has invented NAND chips for computer flash memory devices and according to news from Nikkei Asia, Apple may have plans to use these flash memory products as early as 2022. In areas of chip assembly, testing and packaging, China, according to data from SIA, accounts for 38% of theglobalchipmarketwhiletheUS merely accounts for 2%. Nevertheless, chip design still remains as the biggest problem that China hasn’t solved yet due to lackoftechnology.

China also shows strong dominance insomerawmaterialswhichareused for producing chips (VOA, 2021). The US Geological Survey has indicated that 70% of global silicon material is made in China. Besides, China produces80%oftheworld’stungsten material, which is an indispensable material to produce semiconductor chips (South China Morning Post, 2022) . Moreover, China has reserved 95%oftheworld'sreservesofgallium metal to be used in 5G based station chipsets (Fierce Electronics,2019). In addition, as of 2019, China accounts for85,000tonsofGermaniumwhichis 65% of the world’s production of 130,000 tons (USGS Mineral Commodity Report, 2020). China also becomestheworld’slargestproducer of fluorite (Statista, 2022) which is essential in the semiconductor etching process. Compared to other developed countries , China has the advantage of cheap labour, government support and lower productioncost.Nonetheless,toease the bottleneck semiconductor technological problems, China still hasalongwaytogo.

The global competition for dominance in the semiconductor industry will become more intensifying. However, only Samsung fromSouthKorea,TSMCfromTaiwan andIntelfromtheUSstandasthebig three players in manufacturing the most advanced semiconductors which require high capital cost for building foundries. Besides, political factorssuchasUSforeignpolicy,USChina trade relations and ChinaTaiwan tensions will also severely affectthelandscapeoftheglobalchip industry. For example, the America Competes Act will deepen the gap between US and China technological development as this legislation proposes to provide $52 billions of investmenttostrengthenchipsupply chain and scientific research and TSMC and Samsung, two Asian foundrysemiconductorgiants,needa slice of this US$52 billion chip subsidies. Moreover, the Reshoring Initiative which brings outsourced manufacturing back to the original country will also help accelerate deglobalization of technological development of the semiconductor industry.

Semiconductors lay the foundation for today's digital economy. Technology advancement in manufacturing semiconductors becomes the competition not only betweendifferentcorporationsinthe industry, but also between the countries as it will affect a country’s cyber security, economy and politics. Countries such as the US, Japan, KoreaandEUaredominantleadersin thechipindustry,therebycreating-

intellectualpropertybarriersforother countries. Even though the industry has reached its maturity stage, areas such as Artificial Intelligence (AI), Internet of Things (IoT) and Supercomputers still demand high functioning semiconductors. Thus, enterprises will focus on R&D and commercialization of the most advanced chips with the help of capitalandgovernmentpolicies.

Editor:

Editor:

Inflation. Delays in product release. Factory closures.

These are all terms that have made headlinesaroundtheworldsinceCovid19 first brought the world indoors. As everyone adapted to living and working remotely, the demand for consumer electronics skyrocketed as families purchased what they needed to keep working, studying, and living from the comfort of their own homes. Durable goods and consumer appliances all witnessed a similar increase in demand to consumer electronics as the months passedandtheeconomyrecovered.

The cumulative surge in demand for these items translated into an exponential growth in demand for semiconductors, a critical component of-

the manufacturing process. Manufacturers of semiconductors like Taiwan Semiconductor Manufacturing Company (TSMC) were unable to keep up with the exponential growth in demand since expanding production capacity takes time. Given that TSMC is widely regarded as the world's leading semiconductormaker,theproblemgets worse. Prior to the pandemic, the majority of manufacturing plants, commonly referred to as fabs, concentrated on making "bleedingedge" chips were unable to meet the overwhelming demand for "lower-end" chips required in the creation of consumerappliances.

With low supply and high demand, how will the producer and consumer prices of semiconductors be affected?

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services, and in this article, we will be using it to examine the effects of semiconductor scarcity on producer and consumer prices. The CPI uses a representative basket of products and services to calculate the total change in consumer prices over time. As was previously indicated,producerswereunabletomeettheexcessivedemandforconsumer electronicsanddurableitems,whichcausedpricestorise.

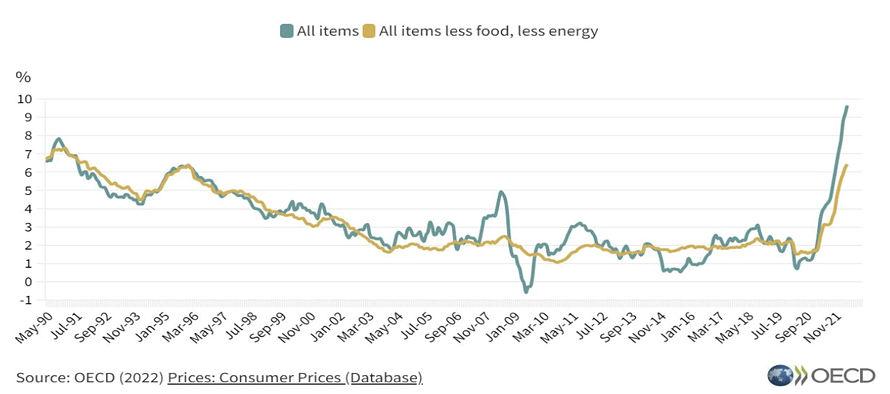

Thisdemand-driveninflationisevidentlyrepresentedintheCPIcalculation,asshownin figure 1 below.

Figure 1: Inflation since 1990’s: All items versus All items excluding food and energy

Source: OECD

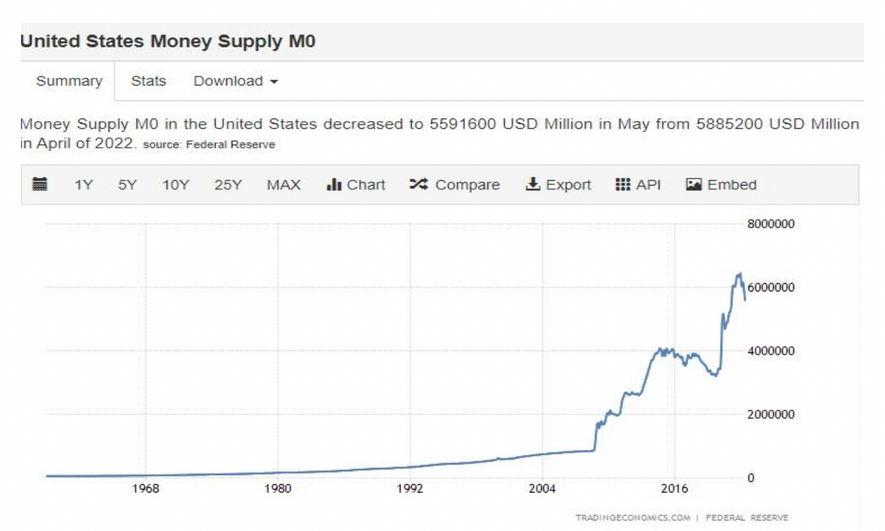

Figure 2: Money Supply (M0) in United States, April to May 2022

Source: Tradingeconomics

Thisdoesnotimply,however,thatthescarcityofsemiconductorsissolelytoblamefor thealarminginflationrateswearecurrentlyexperiencing.Wewilllookat3reasonsfor inflationratesinthissection.

The pandemic uncertainty forced governments throughout the world to essentially "print money," which let consumers to once again increase their demand for goods & services while manufacturers fought to keep up, further boostinginflation.

During the Covid-19 era, almost half of the US Dollars that are currently in use were printed.Duetotheirindirectrelationship,interestrateshavehistoricallybeenusedto controlinflation,andthisstrategyhasbeeneffectiveupuntilthispoint.These"new" dollarswilleventuallybetakenoutofcirculationduetoanticipatedinterestratehikes wellintothefollowingfewyears,buttheharmhasalreadybeendoneaswecansee fromrecentratehikesbytheFEDtomoderateinflationhavinglittletonoeffect.

Since February 2022, a Russian-Ukrainian invasion has been in progress. What's the connectiontosemiconductorshere?

Neongas,whichisneededtorunthelasersusedinthelithographyphase,thecoreof semiconductor production, is primarily imported from Ukraine. Without neon, chip manufacturing abruptly stops. In the past, Ukraine has historically supplied the US withupto90%ofthenecessarysemiconductorneon,inadditiontoprovidingroughly 70%ofthesupplyglobally.

Inaddition,Ukraineisasignificantsourceofxenonandkryptongas,bothofwhichare essentialforchipproduction.Thesupplyoftheseinputswon'tbeincreasinganytime soonbecauseit'sunclearwhentheinvasionwillend.

After establishing that customers will have to deal with inflation for the foreseeable future,it'ssadthatthebadnewsdoesn'tstopthere.

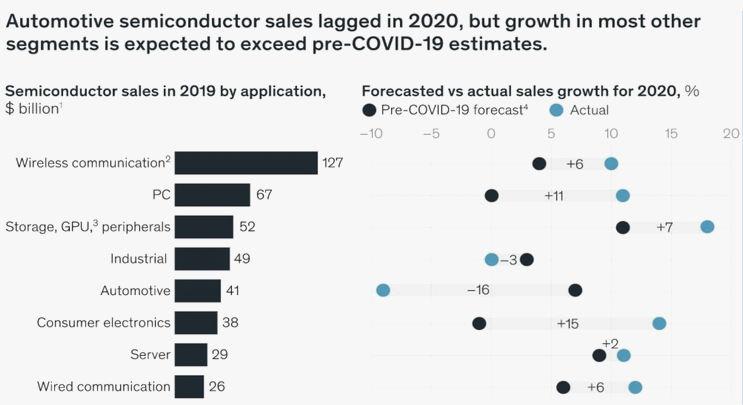

Figure 3: Comparison of sales of semiconductors in the Automotive industry to other industries

Source: McKinsey

Thesurgeinsemiconductordemandillustratedbytheabovetableistheresultof Covid-19.However,increaseddemanddoesnotalwaysequatetoincreasedsales. Theoneexceptionwasthecarsector,whereactualsalesgrowthwas-16%lower than anticipated. How is this possible when virtually every other sector has seen growth?

Automotivemanufacturershavehaddifficultylocatingthenecessaryfactorinputs torunalloftheirproductionlinesatcapacityduetothestagnating,limitedsupply ofsemiconductors.

Thisismadeworsein the market for electric vehicles whicharebecomingincreasinglypopular.Each

EVisconstructedusingupto3,000 semiconductors,asopposedto300 inacarwithagasolineengine.

Ford, the manufacturer of the F-150, which has been the most popular vehicle in the United States for more than 30 years, has slashed production in plants around the country, with a projected loss of $1 billionto$2.5billioninearnings.

Anotherlegacyautomaker,General

In the long run, it is not cause for concern, but it may be a helpful economic indicator -something to keep aneyeoninthefuture.

Despitethecurrentmarketconditions and economic disruptions, it is critical to remember that high demand is promising and low capacityisonlytemporary.

Withnewfabsalreadyunderconstruction

Motors, has forecast an earnings loss of$1.5billionto$2billion.

If megacorporations like Ford and GM are unable to operate at full capacity and hence lose money, it's safe to predict that if the scenario persists, their employees will most certainlybelaidoff.

by TSMC and Intel, semiconductor companies are expanding, and governments are grabbing the opportunity to invest in one of the world's fastest growing industries. Looking behind the scare stories and low short-term output, we can see that the chip scarcity signifies long-term economic progress as technology advances.

Writer: Daniel Nyam Jia Yi Editor: Chin Yi Figure 4: Vehicle production level of major corporations in the United States Source: Wolfstreet.com

Duetoglobalisationandtechnologicaladvancements,technologicaldevicessuchas mobilephones,tablets,orlaptopsbecameanessentialgood.Doyouknowwhatis thedrivebehindtheseemergingpiecesoftechnology?Itisasmallchipknownasa semiconductor.Thistinychipdoeswondersandonequestiontoponderis- what is the future of global semiconductor production?

Many policymakers see the competitiveness of the US semiconductor industry as essential to the country’s economic and national security interests. With large semiconductor companies such as Intel Corporation, Nvidia and Texas Instruments, semiconductors became one of US’s top exports. The US semiconductor industry dominatesthesemiconductorsupplychainasithasgreatchipdesign,automation,and integrationtechnologies.

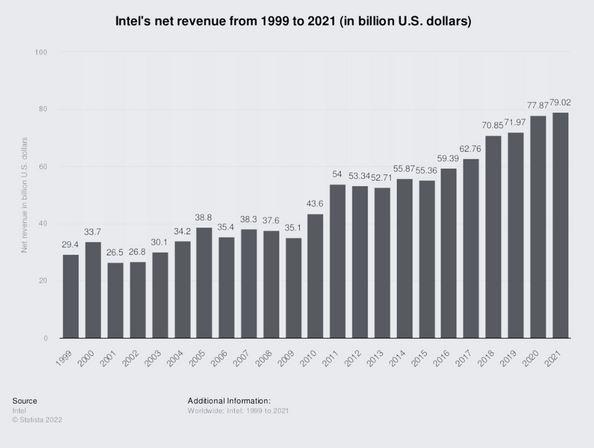

Some US-headquartered semiconductor firms have expanded internationally, allowing them to have fabrication facilities all around the world. Intel Corporation is known to be the leading semiconductorcompanyinthe USA. Founded in 1968, Intel nowhasofficesin46countries, including California, China and Malaysia, allowing its net revenue to increase by 300% from1999to2021.(Intel,n.d.)

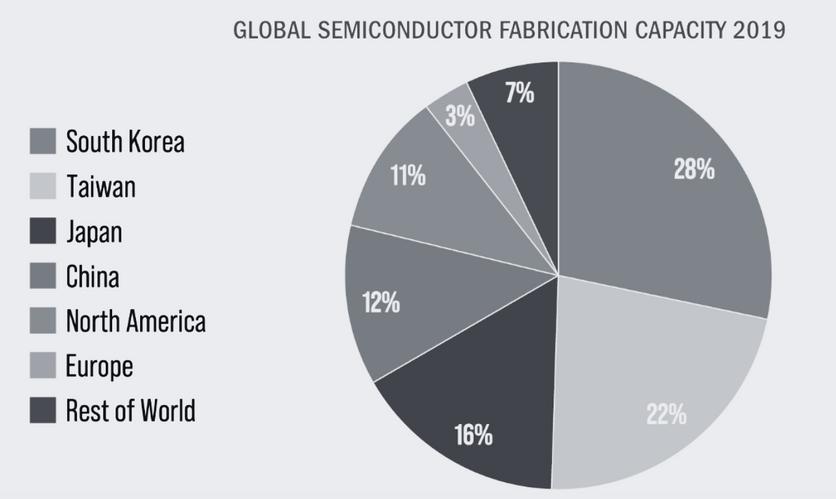

Although the semiconductor industry is experiencing exponential growth, there are still concerns among policymakers. Firstly, only a small share of the world’s most advanced semiconductor fabricationproductioncapacityislocated intheUS,andmostofthesemiconductor production is in East Asia, mainly in Taiwan, South Korea, Japan, and China. (CongressionalResearchService,2020)

Figure 1: Intel’s Net Revenue from 1999 to 2021

Source: Statistica

The recent chip shortages in the automobile industry illustrate the economic consequences of losing access to such cutting-edge semiconductors. (Senate RPC, 2021) The semiconductor supply chain is also vulnerable to economic events such as trade disputes or international conflicts. For example, duringtherecentCoronavirusPandemic, thedemandandsupplymarketwas

negativelyaffectedasdemandforgoodsandserviceshasexceededthesupplyforit. TheNationalSecurityCommissiononArtificialIntelligencehighlightedtherisk,andit states in a report that “if a potential adversary bests the United States in semiconductors over the long term or suddenly cuts off US access to cutting-edge chipsentirely,itcouldgaintheupperhandineverydomainofwarfare.”(SenateRPC, 2021)

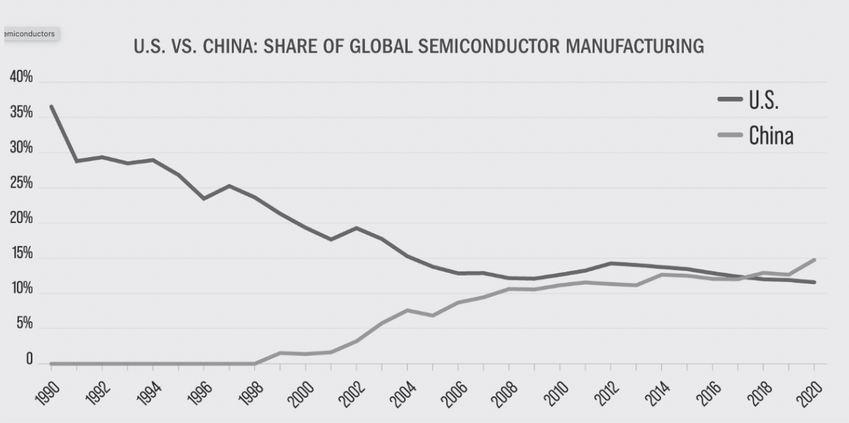

The next concern is on China’s increasing investments on their research and development of semiconductors. China’s state-led efforts to monopolise and develop a vertically integrated semiconductor industry are unprecedented in both scope and scale. It was observed that theUShasfaceda25%decreaseinthe global semiconductor fabrication capacityfrom1990to2020.Onthe

other hand, China did not have any capacity to produce semiconductors in 1990 but the share increased to almost 13%. The Chinese share of global manufacturingisprojectedtoreach24% by 2030, which would make it the world leader.(SenateRPC,2021)Assuch,there are concerns that the US might lose its standing as the leader in semiconductor production. Although China’s current shareoftheglobalindustryisstill

Figure 2: Global Semiconductor Fabrication Capacity

Figure 2: Global Semiconductor Fabrication Capacity

relativelysmallanditstechnologyisn’tasadvancedastheUS,Chinahasanambitious goalofestablishingglobaldominanceinsemiconductordesignandproductionby2030.

Figure 3: US VS China: Share of Global Semiconductor Manufacturing

Source: Senator Roy Blunt, Chairman

Despite the competition between the semiconductor companies in China and theUS,itisstillundeniablethatChinais an important market for US semiconductor firms, and international semiconductor companies are indirectly helping to advance China’s capabilities. China’sgovernmenthasinvestmentsof

more than US $150 billion into its technological and semiconductor industries, and its role as a central production point for international consumers puts downward pressure on internationalfirmstofocusonChina.The Chinesegovernmentrecognizesaccessto foreign capabilities as a strategy to accelerateChina’sdevelopment.

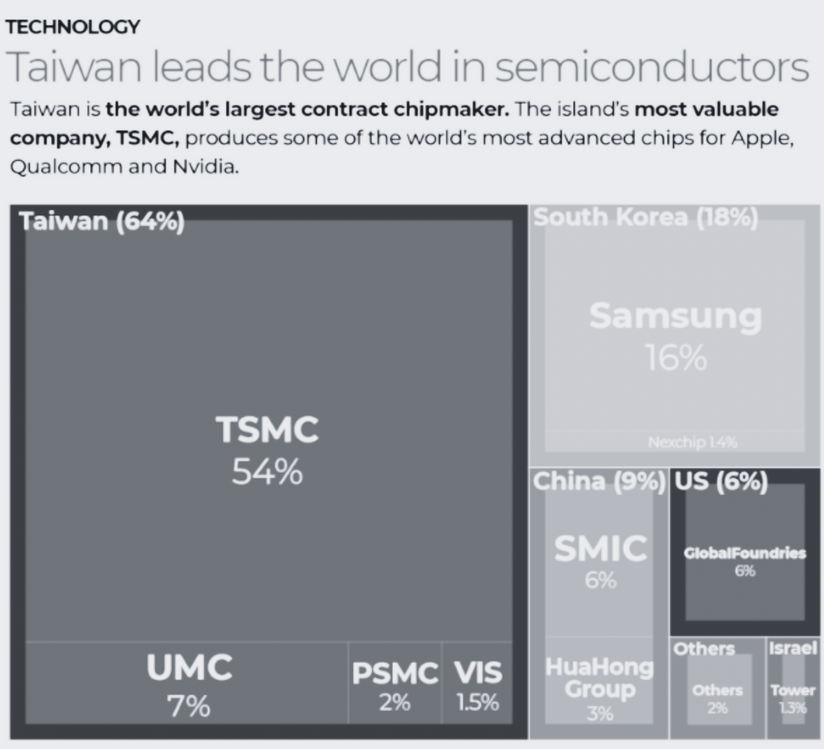

As semiconductors are used in almost every technical device, it is the most important component, and the AI sector and automation industry solely depend on the semiconductor industry. This placesTaiwanasastrategiceconomic

hub as it commands the global industry for semiconductors. Taiwan is a leading manufacturer of semiconductors along with South Korea and the Indo-Pacific countries. According to TrendForce, Taiwanaccountsfor64%oftheglobal

semiconductor manufacturing revenue, with Taiwan Semiconductor Manufacturing Company(TSMC)alonetotallinghalfofit.

So, why is the semiconductor industry affected in the midst of the tension between China and Taiwan?

For historical context, “the Chinese governmentseesTaiwanasabreakaway province that will, eventually, be part of the country. But many Taiwanese consider their self-ruled island to be a separatenation-whetherornot

independenceiseverofficiallydeclared.” (BBC, 2022) As a result, there was politicaltensionbetweenbothcountries since the 17th century. Relations between both countries started to improveonlyinthe1980swhenTaiwan

relaxedrulesonvisitstoandinvestment in China. It was proclaimed in 1991 that the war with the People's Republic of China was over. China proposed the socalled "one country, two systems" option, which was said to allow Taiwan significant autonomy if it agreed to come under Beijing's control. This systemunderpinnedHongKong'sreturn to China in 1997 and the manner in which it was governed until recently, when Beijing has sought to increase its influence.Taiwanrejectedtheofferand Beijing insisted that Taiwan's governmentisillegitimate.(BBC,2022)

Hence, as China wants to own Taiwan, TSMCisoneofChina’smainfocusasitis the world’s most advanced chip manufacturer. TSMC produces processors for American companies including Apple and Qualcomm, and it has over 50% of the world’s semiconductorfoundrymarket.

AccordingtoTSMC’sChairman,MrMark Liu,“ifChinaweretoinvadeTaiwan,the most-advancedchipfactoryintheworld would be rendered “not operable”, and if Taiwan were invaded by China, the chipmaker’s plant would not be able to operate because it relies on global supplychains.Healsosaidthat“nobody

cancontrolTSMCbyforce.Ifyoutakea military force or invasion, TSMC factories will not be operable because TSMC depends greatly on real-time connectionwithothercountries,suchas Europe, Japan and US for materials to chemicals to spare parts to engineering software and diagnosis.” (CNBC, 2022) Comparing this situation with the Russian Ukraine War, Mr Mark Liu mentionedthat“whilethetwoconflicts are very different, the economic impact toothercountrieswouldbesimilar,and political leaders should try to avoid war.”(CNBC,2022)

If TSMC was taken by China, how will the global supply chain be affected?

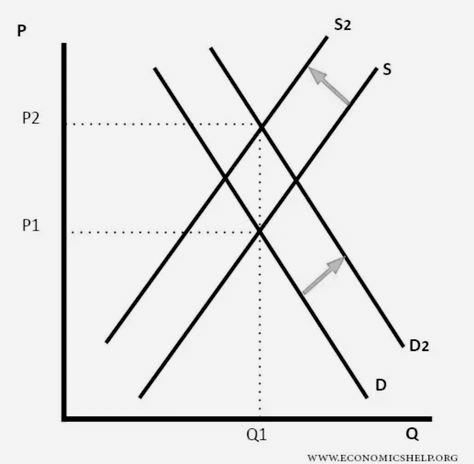

Figure 5: Graph depicting high demand and low supply Source: Economics Help

AsmentionedbyTSMC’sChairman, TSMC would not be able to operate if China were to invade Taiwan. This means that there will be high demand and low supply.Accordingtofigure5,when

demandincreasesandsupplydecreases, therewillbealargeincreaseintheprice of the goods from P1 to P2. This can cause inflation and long-term effects on thecountry’seconomy.

So, how will other countries be affected?

OnecountrythatwillbeaffectedisIndia. Thisisbecauseof“itsrivalrywithChina, its quiet efforts to deepen engagement with Taiwan, and its role in US. IndoPacific policy.” (Foreign Policy, 2022) Taiwan had a strong relationship with India. “Taiwan’s ‘New southbound policy’ and India’s ‘Act East policy’ have acted as catalysts in strengthening the bilateraltraderelationshipbetweenboth countries.”(HindustanTimes,2022)

The ‘New southbound policy’ was created for Taiwan to strengthen their relationship with South Asia. In this policy, 18 countries were prioritised for collaborations.“Amongthe18countries, India has expanded economic cooperation with Taiwan more than any ofitsneighbours,ingreatpartbecauseof

its sharp rivalry with China. Trade with India accounts for nearly 80% of Taiwan’stradewithSouthAsia.Inrecent decades, New Delhi and Taipei have inked a bilateral investment agreement and pursued science and technology cooperation.”(ForeignPolicy,2022)

“Taiwan and India have started negotiations for a free-trade agreement and the setting up of a semiconductor manufacturingfacilityinIndia.Ifthedeal materialises,Indiawillbetheonlysecond countryaftertheUStohaveaTaiwanese semiconductor manufacturing plant.” (Hindustan Times, 2022) This will affect India’s economy as they will lose a monetary source of having a semiconductorfab.

So, what is the future of global semiconductor production?

Figure 6: Stock price of TSMC

Source: Google Finance

WiththeongoingdisputesbetweenChinaandTaiwan,itisdifficulttodeterminethe futureofthesemiconductorindustry.However,basedontherecenttrends,Ipredict thatthestockofsemiconductorindustrieswillcontinuetodecrease.Thisisbecause eversincethedisputewithChina,thestockpriceofTSMChasbeendecreasing.Asof 2nd September 2022, the stock price for TSMC has decreased by 21.77%. The stock pricemightevenreachanalltimelowifChinainvadesTaiwanandtakesTSMC.

Writer & Editor: Teo Kang Qi

It has been 8 years since the RussianUkraine conflict began back in February 2014, hostilities commenced following Ukraine’s Revolution of dignity, with Russiafocusingonthepoliticalstatusof Crimea and Donbas (Council on Foreign Relations, 2022). Before this recent Russian military build-up on the RussiaUkraine border, the first eight years of the conflict included incidents of political tensions, the Russian annexation of Crimea, the war in Donbas, naval incidents, and cyber warfare. After Russian President Vladimir Putin gave a speech laying out a list of grievances as justification for a “special military operation”, a full-scale invasion of Ukrainian land by Russian troopshappenedonthe24thof

February 2022 as Russia unleashed the biggest war in Europe since the end of World War 2. The grievances stated included the topics of the expansion of the North Atlantic Treaty Organisation (NATO, 2022) and the legitimacy of Ukrainianidentityandstatehood.

As countries worldwide are still nearly recovering from the economic impacts of the Covid-19 pandemic, the attack worsened the situation as global economieswitnessedyetanotherrisein commodity prices and supply chain chokeholds (World Bank, 2022). This newsletter will be focusing on giving readers a better understanding of the situation, and the economic impacts on Russia, Ukraine, and the world postinvasion.

and claims that Ukraine was never an actual independent state, that it is stolenlandthatbelongedtotheRussian Empire(UniversityofRochester,2022).

The North Atlantic Treaty Organisation (NATO, 2022), founded in 1949, is a military and political alliance of a congregation of countries in North America and Europe. Its independent member states agree to defend each other against third-party attacks (NATO, 2022). NATO was a perceived threat posed by the Soviet Union, and this alliance remained in place after the dissolution of the Soviet Union. In recent years, Ukrainian leaders have made enthusiastic pleas about their desire to join NATO, especially since the recent election of the latest President Volodymyr Zelenskyy in 2019. However, Putin has been outspoken about his belief that Ukraine should never be allowed to join NATO, and in the days leading up totheinvasion,hemadearguments

The invasion has entered its 8th month as of the publishing of this newsletter, with no signs of it drawing to a close. Russian troops have since made two attempts to storm the Ukraine presidential compound. Vladimir Putin aimed to overrun Ukraine and dispose of its government, to end its intentions to join NATO. In his own words, his goal was to “demilitarise and de-Nazify Ukraine”, and to ensure Ukraine’s “neutral status”, as he felt that modern western-learning Ukraine was a constant threat to Russia (TIME, 2022). Russia’sleadershaverefusedtocallthis act an invasion or a war, coining it as a “special military operation” (Reuters, 2022). Ukraine’s president Volodymyr Zelenskyy promises solemnly to win back their land, and the world watches nervouslyhopingthatpeacewillfindits way.

The economic impact of Russia’s invasionofUkrainewasfeltimmediately when the war began. It has triggered distress in financial markets and increased uncertainty about the recoveryofglobaleconomies.

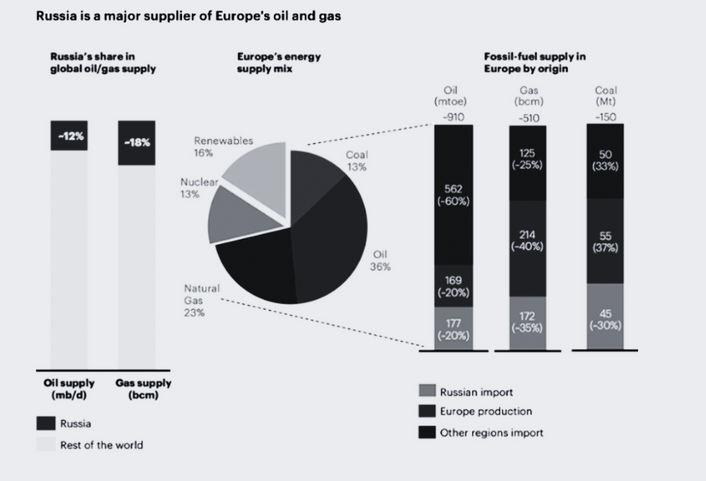

Russia is the world’s second-largest natural gas producer, third-largest oil producer, and among the 5 top producers of steel, aluminium, and nickel. Ukraine is the top producer of various food commodities such as wheat, corn, barley, and soya (World Bank,2022).

Supply chain disruption amplified through the invasion, contributing to elevated inflation. Time delays, labour shortages,congestionontransportation routes, and lengthy custom processes lead to supply chain inefficiencies. These inefficiencies lead to a rise in prices for consumers and also result in efficiency loss in the economy. The supply chain issues, with their large increases in demand and shortage of keyresources,areoneofthereasonsfor therecentsurgeofinflation.

Although the US does little direct trade with Ukraine or Russia, energy, food, and semiconductor business industries face significant exposure from the war. Due to the recent fracking and surge in US energy production in the last two decades, the US is much less reliant on energy imports, with imports of oil and gas down 63 percent from the 2008 peak. Russia is the world’s third-largest energy exporter, it exports 4.3 million barrels of crude oil per day, which will raise prices for both gasoline and plastics. Crude oil traded per barrel rosel. Transportation, utilities, agriculture, plastic, chemicals / fertilisers, and metal industries are among the most highly impacted by crudeoilprices.

Russia is a large producer of commoditieswhetherthatbeoil,gas,or precious metals, and is being effectively blockaded by the west which is going to haveasignificantimpactontheRussian economyaswellasgloballywherefirms will have to find new commodity sources. Russia cannot trade with the westandisthereforelosingouton

specialised goods it needs such as technology therefore there is a significant risk that its production tools will soon become outdated and cannot bereplaced.Thereisalsothebraindrain

as many citizens are now fleeing and people from the west don’t want to go work in Russia now therefore it’s having a clear impact on the jobs market particularlyforskilledlabour.

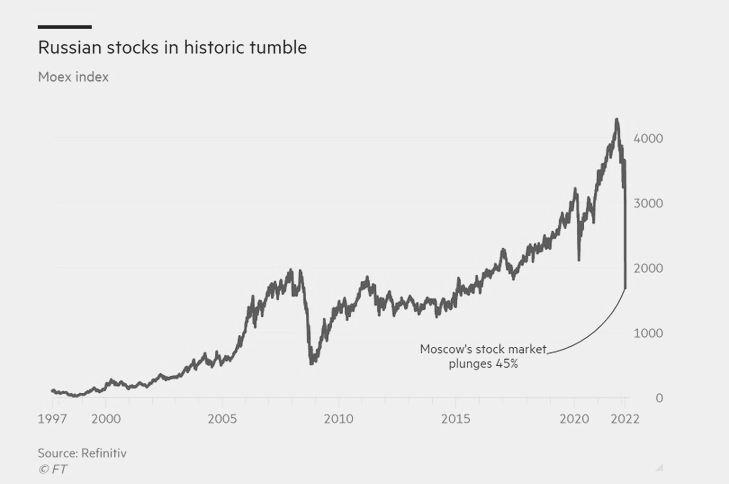

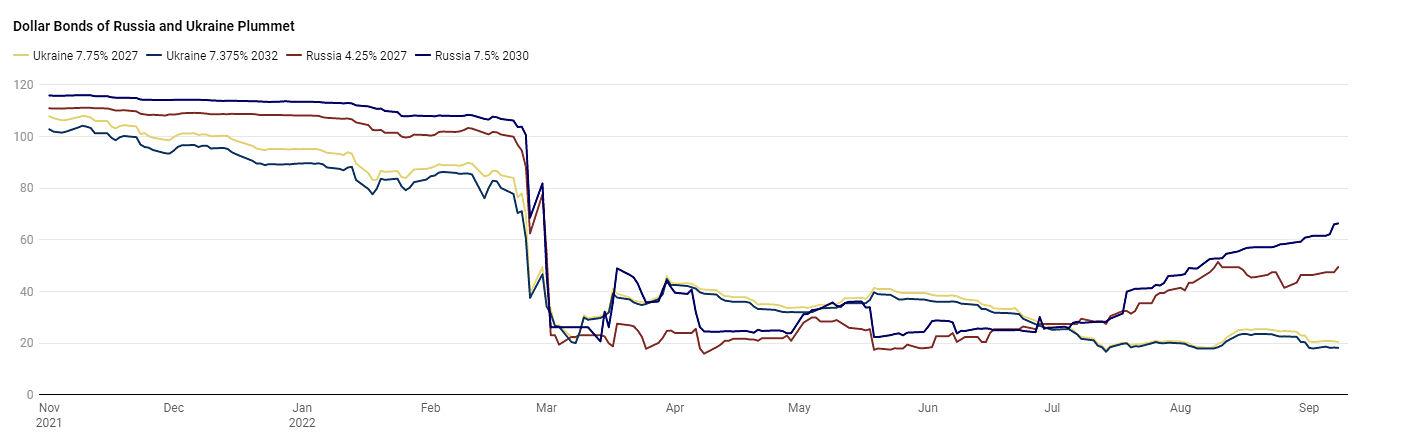

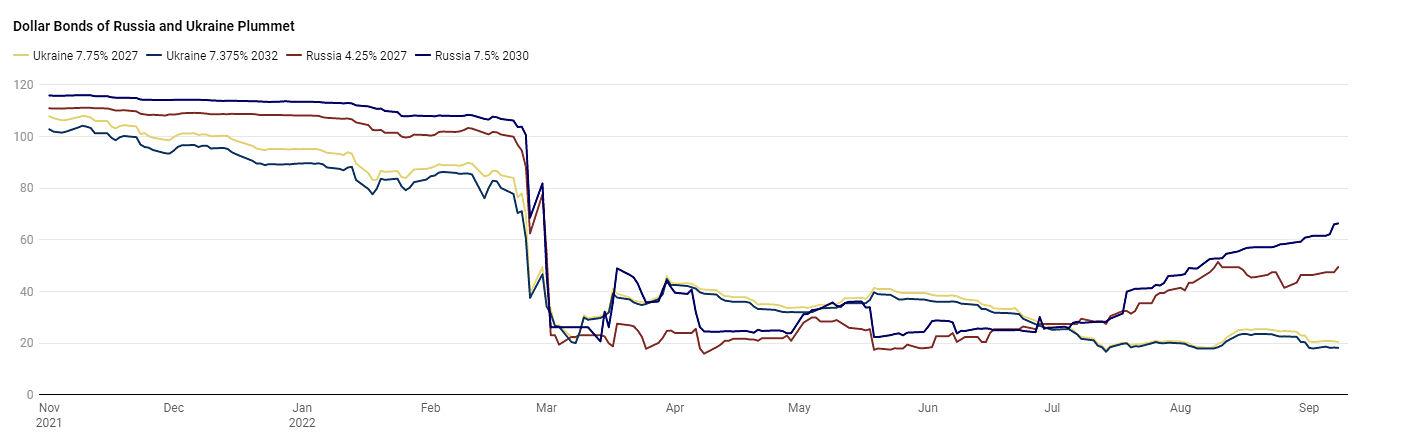

The economic impact of Russia’s invasion of Ukraine was immediately felt by Russia from the first day of the invasion, with Russian stocks plunging by 33% and the Russian ruble falling to record lows. Two days after the invasion, Russia’s government credit rating got cut to “junk” by the S&P Global Ratings, forcing funds to dump Russian debt that came under intense sellingpressure.

Post-invasion, sanctions were imposed by a large number of countries with the aimtoweakenRussia’sabilitytofinance the war. The sanctions specifically target the political, economic and military elites responsible for the invasion. Russian civilians such as food, agricultureandpharmaceuticalsarenot targeted (Council of the European Union,2022).

The war in Ukraine has disrupted Europe's economic recovery. Economic growth in the European Union is expected to fall further, down from the estimate before the war. This slowdown in economic growth is particularly more visibleincountriesinclosegeographical proximity to Ukraine. Other countries such as Germany, which is heavily reliantonRussianoilandgas,havebeen feeling the pressure. Germany has been striving to eliminate Russian oil imports bytheendof2022.

In addition, the China - Europe routes havebeendisrupted.Surginggasprices

areincreasingfreightcostsforallmodes of transportation. The train route connecting the regions, which became highly competitive during the height of COVID-19, especially for industries valuing shorter lead times such as automotive and electronics, is now stalled. This is especially true for the primary corridor that traverses Russia, Belarus, and Poland before continuing on to Germany, France, and other Europeancountries.

The war will fuel already high inflation and slow growth in consumer spending. This would only worsen the situation as the economy has yet to recover from the pandemic and supply-side disruptions. The further, war-induced rise in global commodities price comes at a time when US inflation is already at a 40-year high (of 7.9% year on year in February). We expect US inflation to remain at current levels (nearly 8% year on year) at least until the middle of the year. This will weigh on consumerspendingandrealGDPgrowth.

As governments can no longer depend on traditional suppliers, it would be best to diversify partners or find alternative sourcing modes. However, the consequence of doing so may lead to an increase in your lead time and temporary shortages. A J-curve effect would take place.

For entrepreneurs, there’s an opportunity to fill the gaps created by the volatility, creating new business models and potentially improving the lives of others. This can be achieved by trade coalitions and joint partnerships to increase capacity. Switching to local suppliers would be a form of risk management.

While modelling can help optimise supply chain changes, there are limits to this approach. Most supply chain models assume a steady state, which is not applicable for redesigning something that is in transition. Decision makers should move to systems thinking and have multiple objectives and KPIs in mind when designing supply chain networks.

Writer: Xiong Ran & Rohen Veera Editor: Rohen VeeraIt all began with Putin assembling troops alongside the border of Ukraine, creating an atmosphere of animosity and fear. The next move came as a shock to the world, as a majority of people thought that assembling troops wasatacticoffearandthatPutinwould not dare to plunge the world into another war. But that is exactly what he did. The cold war turned into a hot war: Vladimir V. Putin ordered the Russian army to invade Ukraine. Its impact is immediate and far-reaching. The largest impact of the war would arguably be commodities. Since the invasion, gain/oilseeds, wheat, coal, natural gas (LNG) and oil have all been affected. This article will discuss the impacts on the Macroeconomy, Global Equities, CommoditiesandForexmarkets.

Inflation forecasts have been revised to 7.1% (Morgan, n.d.) globally. Global growth still remains volatile and is constantly subjected to upward or downwardrevisions.TheRussia-Ukraine crisis will slow global growth and raise inflationasglobalgrowthrisk

is linked to Russia's energy supply disruption.Bankscontinuetoforecasta tighteningcycleformonetarypolicydue to the healthy demand and rapidly tightening supply point that continues inflationary pressures. The oil from Russia accounts for well over 10% of global oil and natural gas production. Thecommonconsensusisthattheprice of Brent crude will remain close to $110/bbl through the mid-year and that European natural gas will remain at $120/MHw (Morgan, n.d.). Curtailing Russian energy supplies further could produce a sharp contraction in its crude oil exports to Europe and the U.S. of as much as 4.3 million barrels per day (mbd).

The US and the EU collectively decidedtorelease60millionbarrels of oil from strategic petroleum reserves. This can be increased further. ReductionoftherelianceonRussian naturalgasanditsproducts. A nuclear agreement with Iran where Iran ramps up oil production. Iran can be an alternative for oil supply.

Downward pressure on the ruble and capital flight has pushed the central bank of Russia to raise rates dramatically and impose capital controls. J.P. Morgan Research forecasts that Russia’s economy will contract 35% quarter-over-quarter and seasonally adjusted in the second quarter, and for the year experience a GDPcontractionofatleast7%.Inflation could end the year at around 17% (Research, n.d.), up from 5.3% forecasted before the crisis, with risks skewed heavily to the upside due to ruble depreciation and import shortages(Research,n.d.).

Tightening monetary policy is central to the inflation problem. Policymakers may also consider fiscal stimulus such as US gas tax reduction. Equities from emerging markets should outperform due to higher rates and energy prices. For the category of energy and materials, the Middle East and North Africa/Latin America will be the biggest winners, while healthcare and real estate would be the biggest losers. (Morgan,n.d.)

Due to having a high-risk premium and a large supply chain shock, oil prices will not only need to increase to $120 billion but stay there for months to incentivise demand destruction.ThisisundertheassumptionthattherearenoinjectionsofIranianoilinto themarket.(AnneKatrinBrevik,Director,LNGResearch,2022)

Natural gas prices will also be on the rise to 77.50 euros. This number is calculated under the assumption that Russia will follow through on its deal for its long-term contractswithEurope.

Forex

BanksexpecttheUSD,SwissFrancandtheYentooutperformhigh-betacurrencies.It hasbeenadvisedtoincreaseshort-positionexposuretowardstheEuroasitwilllikely weaken.

ThreemajorcreditratingagencieshavedowngradedRussia’sratingtojunk. Russian corporations have $99 billion of external bonds remaining with another$12billionfromUkraineusers.(Morgan,n.d.)

Commodity producers in Australia, Canada, Latin America and South Africa stand to benefit from higher commodity prices and the loss in Russian supply to global markets. Banks predict Asia and the Middle East will be morestable,whileLatinAmericawouldhaveaspikeincommodityprices.

Source: Bondevalue

Source: Bondevalue

The west’s financial warfare against Russia has been dramatic. Commodity markets are chaotic, stoking already uncomfortably high inflation, and globaleconomicgrowthforecastshave been marked down as a result. Many businessesfacebighitsfromtheirexits fromRussia.(Research,n.d.)

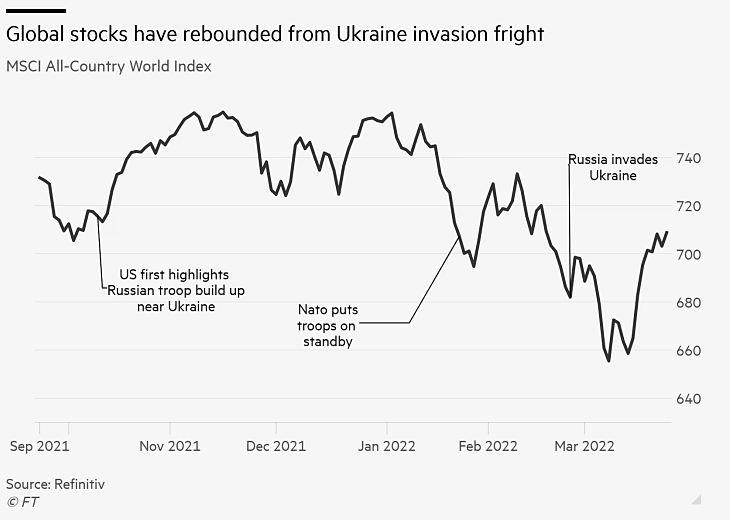

Yet, analysts and investors have been surprised at the modest fallout for the global financial system. The consequenceshavenotbeenextremely severe. After initially deepening the global stock market sell-off, the MSCI All-Country World Index has now jumped back above its prewar level, and the VIX volatility index — a proxy for how much fear there is in markets — has slipped below its long-term average, indicating a fall in anxiety. (Research,n.d.)

The petrodollar system which came in after the collapse of the Bretton Woods system (1973)isoneofthemajordriversbehindthe USD keeping the world reserve currency status. When countries receive dollars for the oil they sell, this then benefits the U.S. as they then recycle those dollars back into U.S. investments - providing liquidity to financial markets and keeping rates low. (ChristopherJ.Neely,2022)

Russia's energy giant Gazprom said that China will start paying for Russian gas in rouble and yuan instead of US dollars.

Putin: “Trust in the dollar, euro, and the pound has been undermined, we have cut the usage of these currencies.”

1A consolidated policy of the EU and the partner countries, including Ukraine, is needed togetweaneddependencyon Russian energy supplies. This policy should be based on pan-European solidarity, assistance to weaker countries, taking into account the interests of all the EU members and partner states, and be guided by the EuropeanGreenDeal.

Besidesraisingthelikelihoodofmarket volatility, the war and sanctions are adding to inflationary pressures by disrupting exports of oil, natural gas, and wheat from Russia and Ukraine.

(Anne Katrin Brevik, Director, LNG Research,2022)

The impacts of the conflict will likely vary depending on geography. Europe —andparticularlycountriessuchasthe Baltic states and Poland—are likely to experiencemoredifficultiesthan

From a capital markets perspective, funds should continue to diversify and reduce their exposure to Russia while implementing strategic hedges on portfolios. (Christopher J. Neely,2022)

countries that depend less on Russia for energy. Western Europe, particularly Germany, also has no easy alternative source of energy to replace Russian natural gas. It should not be surprising that firms that sell oil, gas, or gold, or provide services to those industries, benefited from the big increases in the price of oil. It is more difficult to figure out why some firms’ stock prices fell particularly hard, although some are interpretable.

Writer & Editor: Rohen Veera

In this newsletter, we will be looking at how the recent geopolitical conflict between Russia and Ukraine has affected the supply chain. Specifically with regard to oil considering Russia is one of the biggest exporters of oil. Moreover, what are the countries in SEA’s to the occurrence and why this issue matters to them? Undoubtedly, the Russia-Ukraine war has left its everlasting impact amplifying inflation postpandemicleavingthenationstotackleanotherbattleofinflationyetagain.

As we are still recovering from the aftereffectsofcovid19,thesupplychain has to absorb yet another shock caused by the devastating events in Ukraine. The Russia-Ukraine war is having an enormous impact on the global supply chain, impeding the flow of goods and cultivating catastrophic price shocks aroundtheworld.Tradeincommodities and industrial inputs that originate in Ukraine and Russia has been disrupted andpriceshavesoared.

With its overreliance on Russia for natural gas and crude oil, several parts ofEuropearestruggling to compensate

for that necessity. Both Russia and Ukraine have been major suppliers of agricultural commodities throughout Europe. According to the Food and Agriculture Organization of the United Nations, Russia and Ukraine account for more than 25% of the world’s wheat trade, more than 60% of global sunflower oil, and 30% of global barley exports. Russia is also a major global exporter of fertilisers, which means any supply shortages, or restricted access, could impact crop yields globally. The rapid inflation caused by this invasionhasledseveralorganizationsto explorealternativesourcesofsupply.

Since the conflict began, there has also been a restriction in labour supply in Eastern Europewhichhasagainledto–youguessedit–increasedcost.

The crisis is likely to have sustained inflationary effects on the cost of raw materials, energy, logistics etc. However, successful leaders and organizations will take muchneededdecisiveactiontorespondtotheimmediaterisksofthiscrisisandtostabilize theirsupplychain.

Russia'sinvasionofUkrainehascreated a ripple effect impacting humanitarian andeconomicaspectsacrosstheglobe.

The energy industry is particularly vulnerable. As the world's third-largest oil producer (and second-largest exporter of crude oil) and secondlargest natural gas producer (and largestexporter),Russiasuppliesnearly asixthoftheglobaloilandgassupply. Russia'sdominanceisparticularly

evident in Europe, where it supplies more than 20% of the continent's oil andmorethan30%ofitsgas.

Countries are already preparing for possible supply disruptions. The European Union has announced a plan to transition away from Russian oil and gas. Germany has made plans to end Russianoilimportsbytheendof2022.

Singapore's stance on Russia's invasion of Ukraine was undoubtedly the most robust in Southeast Asia. It was the first ASEAN member to explicitly denounce Russia and declare a number of economic embargoes and export control policies against Moscow (Storey,2022).

While denouncing Moscow's invasion of Ukraine, Indonesia, Brunei, and the Philippines did not explicitly identify Russia as the perpetrator. Indonesia had urged Russia to settle its disagreement with Ukraine diplomatically before the attack, cautioning that war ran the risk of prolonging the global

economy's recuperation from the pandemic (Ref).

Similarly, Brunei retorted by denouncing any breach of any nation's sovereignty, independence, or territorial integrity (Storey,2022).

Considering Russia is its primary defence ally, Vietnam has refrained from criticizing President Putin's actions (ref). Throughout the last 20 years, Vietnam has depended on Russian-made equipment to modernize its armies and pose as a deterrence against China in the South China Sea (ref). Vietnam said that it was "extremely worried" about the crisis and urged the "essential parties" to "maintain discipline," uphold international law, and attempt a

fair conclusion via discussion." Vietnam made this statement in an effort to appease Moscow (Storey,2022).

The only nation in Southeast Asia that backs Russian operations in Myanmar. Russia was the first major nation to recognize the junta as Myanmar's constitutional ruler after the military overthrew the authorities in February 2021.

Southeast Asia stands to lose very little if the Russian economy collapses as a result of international sanctions because the two regions have minor commercial relations. However, they would probably see significant economic issues as a result of the global crisis brought on by the RussiaUkraine conflict due to the global economic fallout. The region's ability to recover economically from the COVID-19 pandemic may be threatened by the growing cost of energy, food, and commodities, escalating supply chain bottlenecks, and stock market fluctuations.

Oil and gas prices have increased as a result of the dispute and could escalate more if Russia chooses to decrease energy supplies or if the main manufacturing markets decide to reduce Russian imports. Because Ukraine and Russia produce a lot of agricultural commodities, particularly wheat and maize, supply disruptions will eventually cause prices to rise. Increased costs for both energy and food will accelerate inflation. Nickel, titanium, copper, and platinum, which are essential materials for the electronics sector and are manufactured in Russia, will cost more as well. The war has affected air, rail, and marine transportation links, making the pandemic's effects on the world's supplychainsworse.

The war in Ukraine is slowing down economic growth just as East Asia and the Pacific economies were beginning to recuperate from the shock caused by the outbreak. Combating inflation is also crucial for economic stability. In themidstofthisdifficulty,central banksshouldtakepromptaction, monitoring the state of the economy and making necessary policyadjustments.Inadditionto rising borrowing costs, growing and emerging countries face the threat of capital outflows as a resultofpossiblespillovereffects from established nations' tightening of monetary policy. Countries should be ready to employ the entire arsenal of measures at their disposal to address these issues. These include things like delaying debt maturity dates, using currency value flexibility, intervening in foreign exchange markets, and taking capital flow management strategies.

Although with aid, tackling growing debt is a challenging issue for many authorities. In order to help the less fortunate, spending on safety nets, health care, and education must always be properly allocated. The capacity to provide this assistance without jeopardizing the viability of the budget deficit depends on a credible mediumterm fiscal path that includes a fair tax policy.

The capacity and incentive to adopt new digital technologies would be strengthened through skill building and boosting competition. The potential of innovations like central bank digital currencies can be unlocked, employees can be retrained for an increasingly digital economy, and the regulatory environment surrounding crypto-assets can be strengthened.

A war on top of a pandemic has caused a second severe catastrophe for the nation.Globalcooperationistheonlysolutiontotheserisks.Itistheonlything thatcangiveusamorejustandsustainableeconomy.Assuch,affectednations should work together to address issues such as inflation and growing debt. Cooperatingwitheachotherwillalsoallownationstofindsolutionswithregard to supply-chain shocks and continue to innovate with the advancement of digitalisation.

On 15 October 2022, after 2 years, we are finally able to host an in-person orientation event. Many of us did not have any opportunity to see each other in person due to the pandemic. The first half of the orientation was held at SIM Headquarters, warming up with introductions&icebreakers. We broke up into teams, bonding across different departments&withtheExcos

Intheafternoon,theteamventureoutinthesuntoPalawanBeach,Sentosato playagameofTreasurehunt.

"Orientation Day is one of the events I liked the most. During orientation day, I was able to talk to many SIMES members and get to know more about each other. The first game we played as an icebreaker was most enjoyable because of the small talk I managed to have. Orientation Day made me feel welcome in society and made it easier for me to make friends."

~Hailey,EventsSubcommittee

~ Our first bonding session in two years...

"The event went smoothly and achieved its purpose which is to let the new committeeandcurrentcommitteegettoknoweachother.Thegamesplayed inSIMHQwerethegamesthathelpsthememberstobondmost.Notonlythe games played required the committee to talk to one another in order to play but also brings out competitive spirit of the players thus bringing out their confidence to talk. The breaks between the games and also the lunch session helps provide space where the members get to bond further with one another. The only downside for the orientation day was the weather in Sentosa. Due to the weather being very sunny, quite a number of people unwillingly played the games. But the idea of breaking the committee into groupsinSentosahelpsmemberstobondfurther."

~Jessica,EventsSubcommittee

~Jessica,EventsSubcommittee

On28October,SIMEScollaboratedwith SIMInternationalAffairsSociety(SIMIAS) for the "The Economic, Financial, and PoliticalCrisesinDevelopingNations".

"The Economic, Financial, and Political Crises in Developing Nations"

Through our panel discussion with notablespeakers,Dr Gunter Dufey(Prof Emertius University of Michigan & a council member of Economic Society of Singapore), Mr Devadas Krishnadas (ChiefExecutiveOfficerandLeadAdvisor atFuture-MovesGroupWe)aswellas Mr Brian Lee Shun Rong (Economist at MaybankInvestingBankingGroup).

We delved deeper into why Sri Lanka got itself in such a sticky situation and how developing nations face an uphill battle in becoming a developed nation. We also exploredthegrowinginfluenceofChinaanditsroleindevelopingnations.

"The discussion that happened in event was quite intellectual especially for a person who’s interested in the situations happening in the world, economically and politically. Mostly because it had consist a brief history about Sri Lanka - which the points were mostly a connecting answers to questions that was at the back of my head and understanding the situation in Sri Lanka more.

Adding on, to China being the leading country of manufacturing and exporter of goods, with the reason being that their cost prices are much lower and an increase knowledge in geopolitical relations, which led me to pursuing in knowing more of the influence China has and which international treaties and organisation have they agreed on and the limitation in that agreement."

~Janelle, Research & Editorial Subcommittee

One of SIMES' flagship events, the 'Macro Perspective' was specifically organised for students to gain insights from SIMES & SIM alumni in the field of Economics and Finance. The 'Macro Perspective - Alumni PerspectiveonNavigatingCareerPaths'was heldon11November2022.

ThisyearMacroPerspectivefocusedonthe process of transiting from university to corporate life known corporations such as JP Morgan and Citibank to share their experiences as a student in SIM and reinforce the importance of maximising our student life in SIMasmuchaspossible.

"In my opinion, the Macro Perspective is the best panel discussion event held in SIM that I have attended in the last 3 months. The information and suggestions that I got from this event are immediately applicable. I love the fact that the panelist is not sugarcoating their answer, they speak directly to the point. This serves as a sort of "wake-up call" for me. Besides that, the moderator at that time was also professional, she asked great questions making the discussion more interesting."

~Ryan,Research&Editorial Subcommittee

"Macro Perspective 2022 was an enriching experience. I've always wanted to know what it's like to work in the banking and finance industry. The advice from the seniors, such as strategizing and preparing for internships and life after graduation, and the networking session with the speakers helped me to clarify mydoubts."

~Hailey,EventsSubcommittee"I got the opportunity to organise Macro Perspective: Alumni Perspective on Navigating Career Paths with SIMES. At the gathering, SIMES graduates spoke about their experiences and advised us with tips on how to network,balanceworkandlife,andgetourfirstjob.

I was pleased that many students attended the event because it was on a Friday night. We had an economicsrelated game as an icebreaker for both our panelists andaudiencewhenwebeganthesession,whichwasan amazing move. We subsequently held a panel discussion with alumni who are currently employed by prestigiouscompanies.

They responded to concerns that emphasised the value of obtaining an internship during our undergraduate studies, the skill of crafting a résumé, and other subjects. The networking session gave me the opportunity to speak with them directly and learn more about their viewpoint, which was what I enjoyed most abouttheevent."

SIMES with our alumni

~Hemangi,CorporateDevelopmentSubcommittee

SIMES with our alumni

~Hemangi,CorporateDevelopmentSubcommittee

Following the success of Photonomics 2021, Photonomics is back in 2022!

Similar to last year, participants were required to submit an original photo takenbythem,representinganyeconomicaspectwhilealsoexplaininghowit fits the category. The aim of this competition is to see how aware we are of economical concepts being used around us, in our day-to-day life. We are thrilledtoannouncethewinnersofthiscompetition!

"I recently got the opportunity to participate in the Photonomics competition conductedbySIMESandamdelightedtoreceivetheawardfor2ndRunnersUp.The competition provided me with a platform to test the practicality of my economics knowledge beyond textbooks. The creative idea behind the same explaining major economics topics through photography is truly commendable. Moreover, I gained more knowledge by reading my fellow participants’ work on topics such as Game TheoryandTrade-offs.ThecompetitionasawholewasfruitfulandIbelievenextyear itwouldbeevenbetterifaspecificthemerevolvedaroundtheevent."

~DevanshiG,CorporateDevelopmentSubcommitteeMember

~DevanshiG,CorporateDevelopmentSubcommitteeMember

Oneoftheeconomicconceptthat I’velearntandstuckwithmeisthe definition of trade-off. Trade-offs are the possibilities we forgo in order to get a specific good, service, or activity that we desire or require. It is a contract that results from a compromise, wherein one component must be given up in order to acquire another. This results from choosing to accept the loss of something.

Applying the concept of scarce resources, as individuals, we are constantly met with the multiple instances where we would need to make a trade-off. Applying the concept of scarce resources, as individuals, we are constantly met with the multiple instances where we would need to make a trade-off. The question then comes, “Does it align with individual needs, wants, values or time?”. Gaining a deeper understanding on the concept of trade-off has allowed me to be more conscious of my day-to-day decisions. “What am I giving up in exchange of something else?” . This has also allowed me to understand the brief rationale behind the multitude of decisions made by others.

As such, how do these decisions then consequently interact, impact and influence the decisions of others in the community. Ultimately, economics is the science which studies human behaviour to also ensure the wellbeing of the community amidst these scarce resources. If more people had the understanding of the concept on trade-off how different would their decision making process be? Undoubtedly, this will add more depth and purpose as to their decisions, actions and purpose while being able to utilise these limited resources. Ultimately, everything in life is a trade-off.

IoncewenttotheexpresscenterofHunanUniversitytopickuptheexpress,several peoplegatheredaroundenthusiasticallyandsaid“Couldyougivemeahand?

IfyoudownloadMeituanapp,youcangetlaundryliquidanddrinksforfree.Itwillbe fineinawhile.”Ononehand,Iwasinleisure.Ontheotherhand,Iwascuriousabout whattrickstheyareplayingand.Therefore,Itookapartinit.Oneofthemusedmy cellphone to buy things in Meituan app and then returned the money with We-chat payment.Iaskedthemwhyweretheydoingthislosingbusiness.

Theyanswered,“Itisourpromotionalactivity,notonlywillthecompany'spopularity increase, but also the increase in sales will enable more people to shop on our platform".

Ithoughtthingsarenotsosimple.Afterthis,Isearchedforinformation concerning the phenomenon, and try to figure out more profound reasons. Some largeenterprisesrelyonpowerfulcapitalstrengthtomonopolizethemarketatvery lowpricesorfreeofchargetooccupythemarket.Asaresult,theircompetitorswill beunabletosurvive.Althoughitseemsthattheyaredoingbusinessatalossinthe early stage, once a monopoly is formed, their prices will rise. However, at this moment, people have no other choice but to accept a higher price, in that small companies have already had to withdraw from the market. This is also one of the reasonswhythecountryisanti-monopoly.

Therefore,“Free”istodefeatopponentsandchargeinthefuture.

Have you wondered why water without which human survival is unfeasible, costsonly one-thousandascomparedtoadiamondwhichismerelyadesire?

This problem was posed by Adam Smith, the father of modern economics. The Diamond-water paradox, also known as the paradox of value, is the contradiction that, even though water is generally more useful than diamonds for living, diamonds nonetheless attract a greater price on the market. It describes the significant price gap between some essential and non-essential commodities in a market economy. This conundrum remained unanswered until modern economists integrated two theories: marginal utility and subjective valuation. It concludes that when consumption level is low, water tends to be more valuable than diamonds as it has higher marginal utility. However since people usually consume water at much higher levels than diamonds and thus the marginal utility is higher for diamonds. Hence water is “cheap” and diamonds are “dear.”

The image above symbolises the cost of diamonds soaring higher than water irrespective of the contrary demand.

ImagineyourselfonanMRTattheendofalongdayandyouspotasinglevacantseat, although the seat is reserved for senior citizens or children. Here, you have a few optionsYoucouldoccupytheseatregardlessandhaveapositivepayoffbutwillhavetorisk feelingguiltyifamoredeservingpersondoesnotgettheseat. Ontheotherhand,ifyoulettheseatgoyouwouldhavetocalculatetheopportunity costofyourdecision.

This is a classic example of how “Game theory” is used in real life situations. Game theory is the study of the ways in which interacting choices of economic agents produceoutcomeswithrespecttothepreferencesofthoseagents.Gametheoryalso inspired several other economic theories such as Nash equilibrium or the prisoners dilemma.Althoughithasafewlimitations,gametheoryhasbeenwidelyrecognised as an important tool in several fields. This is one of the few theories that can be recognised in an experienced workplace environment as well as our household chores. Who knew that while conducting our daily transport ,we were making economicdecisions?!

Economics Summit started in 2016 and it has been an active flagship event for the SIM Economics Society every year. The objective of the Economics Summit is to encasetheideologyofcurrenteventsandaddresstherapidchangesoccurringinthe economic environment. It allows SIM students to participate in panel discussions with industry professionals and gain an in-depth understanding of hot topics in the current volatile economy. This year the event was hosted on 10 December 2022, titled 'Economics Summit - The Marginal Revolution'. The focus of the discussion is ontwotopicaldisciplines:TheGreatMonetaryResetandTheGreenEconomy.

The panel discussion covered topics surrounding digital currency, blockchain and the sustainability efforts of corporations with green technology. We invited some of the most remarkable speakers, experts in their fields and advocates on the topics of discussionforthissummit.

SIM Economics Society is a student-led society at the Singapore Institute of Management, formed by a community of students who are passionate about economics, committed to learn and research global economic challenges.

We aim to foster students' understanding of economic concepts and their application in real life, and encourage discussions regarding global economic issues and possible solutions for them.

SIM Economics Society aims to make learning economics fun and enjoyable through a variety of activities ranging from economics-related discussions to seminars and fun-filled activities and beyond the context of the classroom.

(Research & Editorial)

Deputy Director (Research & Editorial)

(Research & Editorial) (Research & Editorial)

Thaung

Thaung

thankyousimes2022foryourhar thisyearwouldnothave

hardworkanddedication!oursuccess havebeenpossiblewithoutyou

Cheng, TF and Li, L. (2022). Taiwan’s GlobalWafers fails in bid to buy GermanpeerSiltronic.Retrievedfrom https://asia.nikkei.com/Business/Tec h/Semiconductors/Taiwan-sGlobalWafers-fails-in-bid-to-buyGerman-peer-Siltronic Computer Hope. (2022). Semiconductors. Retrieved from https://www.computerhope.com/jarg on/s/semicond.htm

Garside, M. (2022). Global fluorspar production by country 2021. Retrieved from https://www.statista.com/statistics/1 051717/global-fluorspar-productionby-country/ Hamblen, M. (2019). China produces 95% of world’s gallium, used in 5G base station chipsets. Retrieved from https://www.fierceelectronics.com/el ectronics/china-produces-95-world-sgallium-used-5g-base-stationchipsets

Ho, LZ. (2022). Semiconductor Market Report. Retrieved from https://pdf.dfcfw.com/pdf/H3_AP202 202171547525841_1.pdf? 1645094645000.pdf

KBS World. (2021). K-Semiconductor Belt Strategy to establish the world’s largest supply network by 2030. Retrieved from http://world.kbs.co.kr/service/contents _view.htm?board_seq=403357

Lee, JL. (2022). AMD closes record chip industry deal with estimated US$50 billion purchase of Xilinx. Retrieved from https://www.reuters.com/technology/a md-closes-biggest-chip-acquisitionwith-498-bln-purchase-xilinx-2022-0214/ Omdia Semiconductor Research Team. (2021). Global Semiconductor Market Update. Retrieved from https://images.intelligence.informa.co m/Web/InformaUKLimited/%7Bf8f9749 5-f522-4646-840b38dbd2891200%7D_SemiconductorMarket-Update-Omdia-2H2021.pdf Segal, T. (2022). Semiconductor. Retrieved from https://www.investopedia.com/terms/ s/semiconductor.asp

Tang, F. (2021). China’s new rare earth merger hands it “trump card” in global fight for resources. Retrieved from https://www.scmp.com/economy/chin a-economy/article/3160995/chinasnew-rare-earth-merger-hands-it-trumpcard-global-fight

U.S. Geological Survey. (2020). Mineral Commodity Summaries 2020. Retrieved from https://pubs.usgs.gov/periodicals/mc s2020/mcs2020.pdf

Xie, J.(2021). Studies Reveal China’s Dominant Position in High-Tech Minerals. Retrieved from https://www.voanews.com/a/eastasia-pacific_voa-news-china_studiesreveal-chinas-dominant-positionhigh-tech-minerals/6206341.html

Waiting times for electric cars 2022 | Electrifying. (n.d.). Electrifying.com. https://www.electrifying.com/blog/ar ticle/waiting-times-for-electric-cars Aboagye,A.,Burkacky,O.,Mahindroo, A., & Wiseman, B. (2022, February 9). Chip shortage: how the semiconductor industry is dealing with this worldwide problem. World Economic Forum. https://www.weforum.org/agenda/20 22/02/semiconductor-chip-shortagesupply-chain/ Attinasi, M. G., De Stefani, R., Frohm, E., Gunnella, V., Koester, G., Tóth, M., & Melemenidis, A. (2021). The semiconductor shortage and its implication for euro area trade, production and prices. Www.ecb.europa.eu. https://www.ecb.europa.eu/pub/econ omicbulletin/focus/2021/html/ecb.ebbox2 02104_06~780de2a8fb.en.html

Bell, L. (n.d.). Why The Ford F-150 Is The Best Selling Vehicle In America. Www.autobytel.com. https://www.autobytel.com/ford/f150/car-buying-guides/why-the-fordf-150-is-the-best-selling-vehicle-inamerica-130601/ Betz, B. (2022, June 22). Toyota cuts global production again as semiconductor shortages, supply chaindisruptionslinger.FOXBusiness. https://www.foxbusiness.com/market s/toyota-cuts-global-productionsemiconductor-shortages-supplychain Burkacky, O., Lingemann, S., & Pototzky, K. (2021, May 27). Coping withtheauto-semiconductor DeLong,P.K.H.,ErikPeterson,Bharat Kapoor,andDrew.(n.d.).TheCrisisin Ukraine Spells More Trouble for Semiconductor Supply. MIT Sloan Management Review. Retrieved September 3, 2022, from https://sloanreview.mit.edu/article/r ussias-invasion-spells-more-troublefor-semiconductorsupply/#:~:text=The%20U.S.%20has% 20historically%20sourced U.S. warns that computer chip shortage could shut down factories. (2022, January 25). PBS NewsHour. https://www.pbs.org/newshour/econ omy/u-s-warns-that-computer-chipshortage-could-shut

New Vehicle Inventory, Stuck Near Record Lows, Gets Worse | Seeking Alpha. (n.d.). Seekingalpha.com. Retrieved September 3, 2022, from https://seekingalpha.com/article/451 9140-new-vehicle-inventory-stucknear-record-lows-g

Bekemeyer, J. (2021, August 2). The Semiconductor Shortage: Implications for the Global Economy. DBusiness Magazine. https://www.dbusiness.com/dailynews/the-semiconductor-shortageimplications-for-the-gl Schawbel, D. (2021, May 25). Hybrid Working is Here to Stay. But What Does That Mean in Your Office? World Economic Forum. https://www.weforum.org/agenda/20 21/05/hybrid-working-your-officefuture/ Chen, J. (2020, April 23). Consumer Price Index - CPI. Investopedia. https://www.investopedia.com/terms /c/consumerpriceindex.asp