A research survey report on airlines’ budgets, staf ng, challenges & ROI

© Copyright SimpliFlying 2012

Contents Foreword 3 Executive Summary 4 Key Findings 5 Mapping ROI to Business Goals 7 Social Media Budgets 10 Staffing for Social Media 12 Challenges 14 Looking Forward & Summing It Up 16 Appendix 17 Methodology 18 Airline Social Media Outlook 2012 2

Foreword

We are in the midst of a marketing revolution. Social media, with all its highs and lows, is here to stay. For airline marketers especially, this bears consequences that are at once promising, yet overwhelming. Marketing, as we used to know it, is slowly receding into the past.

Many airline marketers are still puzzled at whether there is really a need for social engagement at all. But with an audience that would count as the third largest country in the world, Facebook is certainly not a force to ignore. Twitter, on its own, is a reasonably large “country” as well. What’s more, people’s interest in these platforms is not waning. In fact, the opposite is happening. And many airlines around the world are responding.

According to Eezeer Data Lab1 , the number of airlines on Twitter has risen to over 200! This is more than the total number of existing loyalty programs. That said, investing in initiatives to understand and engage these social communities is no simple matter. Most airlines are still learning social media on the y, and adapting to a dynamic landscape.

On the social media front, has your airline allocated a budget? Should you have resources dedicated only to social media or should you go for a cross-functional model? How many hours should your team dedicate to social media? What are some ways to measure bene ts from investing in social media (ROI)?

In July 2012, we surveyed 29 of the most social-savvy airlines to better understand how they are tackling these speci c challenges.

Subsequently, in this inaugural SimpliFlying Annual Airline Social Media Outlook report, we have attempted to answer these questions by presenting industry benchmarks as reference points. This will help to present a larger picture of how the industry treats social media in terms of budget allocations, resource management as well as the business spheres in which social media is best at driving results. Finally, we wrap up by offering a projection of how the landscape is expected to evolve in the near future.

We hope you enjoy reading this report as much as we have enjoyed putting it together.

Shashank Nigam CEO, SimpliFlying

Airline Social Media Outlook 2012 3

Executive Summary

Airlines today need to speak to travelers in same language and on the same mediums that the traveling public is used to. Social platforms have proven to be an increasingly effective tool for the modern traveler for gathering information, sharing reviews, planning trips, gaining advice and most importantly, making the decision to travel to a particular destination on a particular airline. The age of the Connected Traveler has arrived.

We conducted a research with 29 airlines from around the world to nd out what goes on in the backend when it comes to social media. Here are some of the key ndings:

• Over 75% of airlines invest more than 90 man-hours per month on social media, with majority having up to 6 staff working on it.

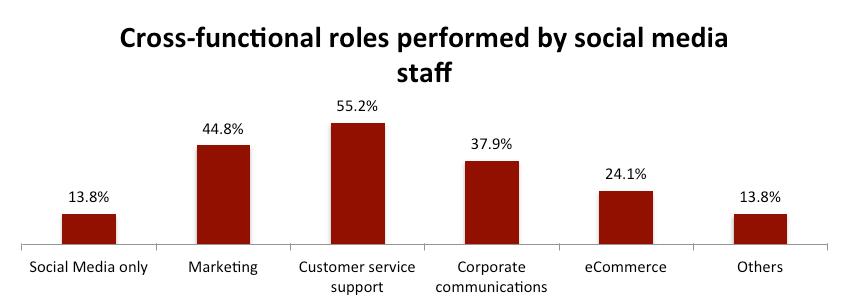

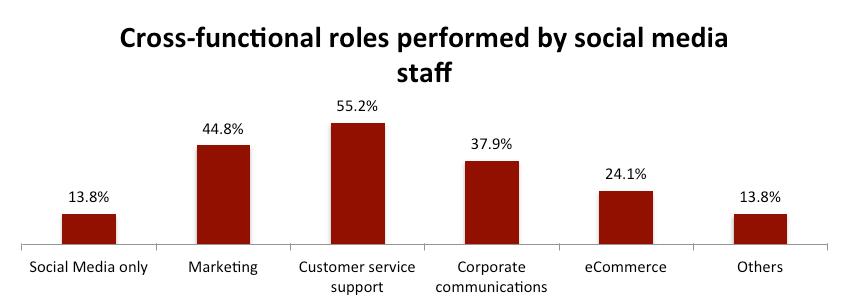

• About 65% of the airlines adopt a cross-functional model with customer service emerging as the most common cross-functional role among airlines with social media staff working across departments.

• The budgets for social media span a very wide range from a few thousand dollars to more than a million dollars. While some airlines are only starting to take off in social media, it is apparent that some airlines have recognized the impact that social media has on their businesses, pouring large investments into the activities.

• While almost half of the airlines are unsure about the return on their social media investment, many airlines have mapped the value of social media performance to business goals. The top 3 business goals that airlines are driving through social media are 1) brand engagement 2) customer service 3) revenue.

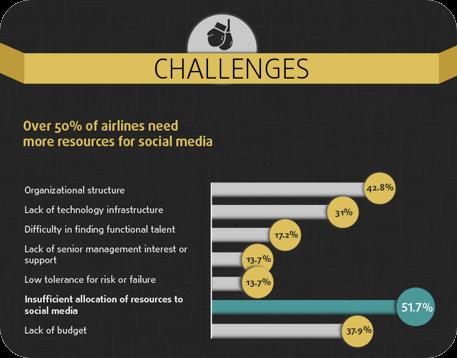

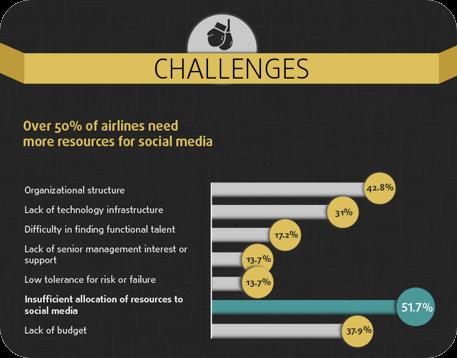

• The biggest challenge faced by airlines is the insufficient allocation of resources to social media. Almost 65% of the airlines facing this challenge are already investing over 90 man-hours into social media each month.

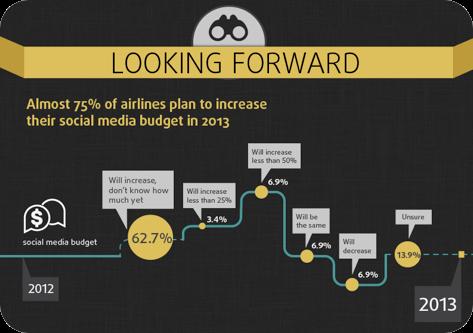

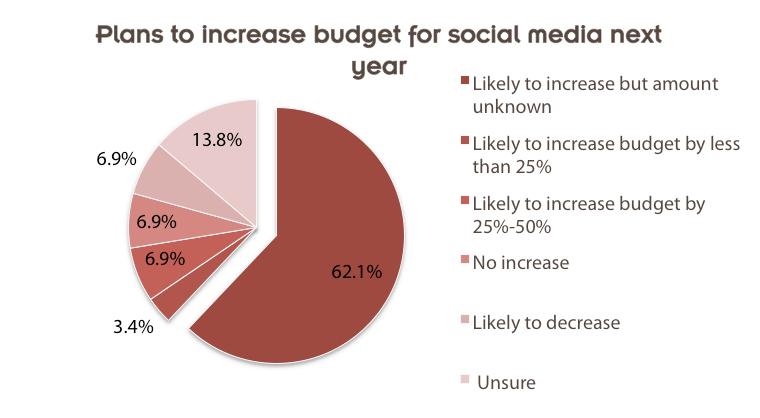

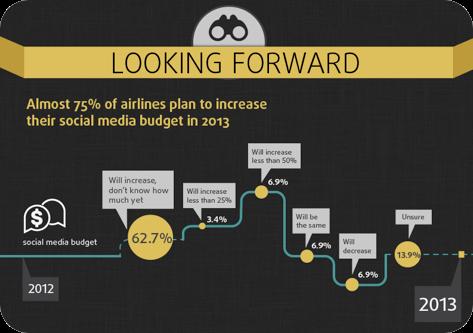

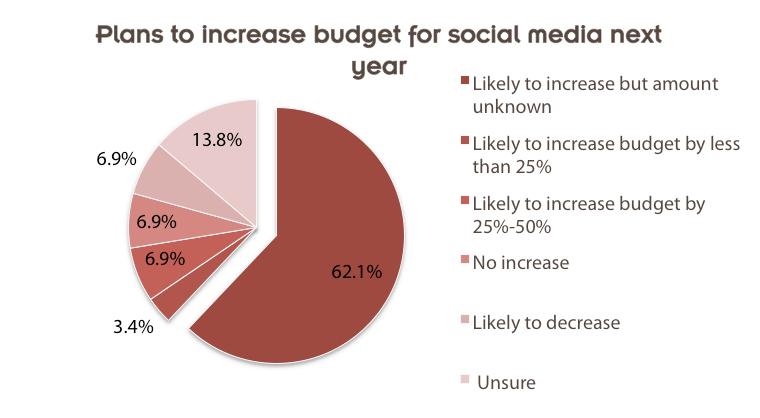

• Over 70% of the airlines surveyed plan to increase their social media budget in the next year. This is almost a two-fold increase compared to a year ago when only 40% of the airlines surveyed planned to expand their social media teams.

The need for and the effectiveness of successful engagement initiatives are hinged on a couple of crucial factors; rst, the rise of today’s modern traveler who constantly stays engaged in his social networks, or the Connected Traveler; second, the ability to correctly identify the best platforms to reach this audience and cultivate social advocates. To achieve this, airlines need to have in place a rm backend support structure. Many airlines we surveyed already have plans to do so in the coming year.

Airline Social Media Outlook 2012 4

Key Findings

Many useful insights about airlines’ budgets, staffing, ROI and challenges in social media have been uncovered in the Airline Social Media Outlook 2012 report.

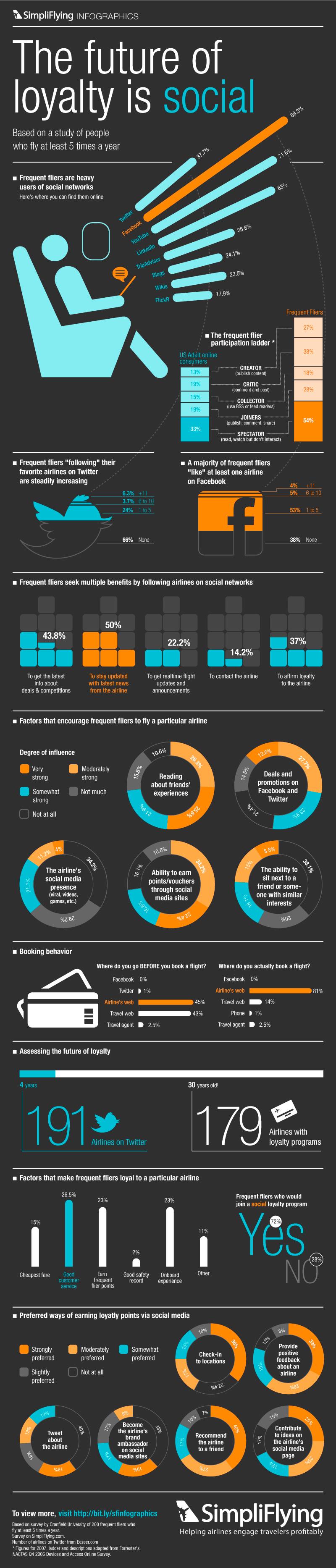

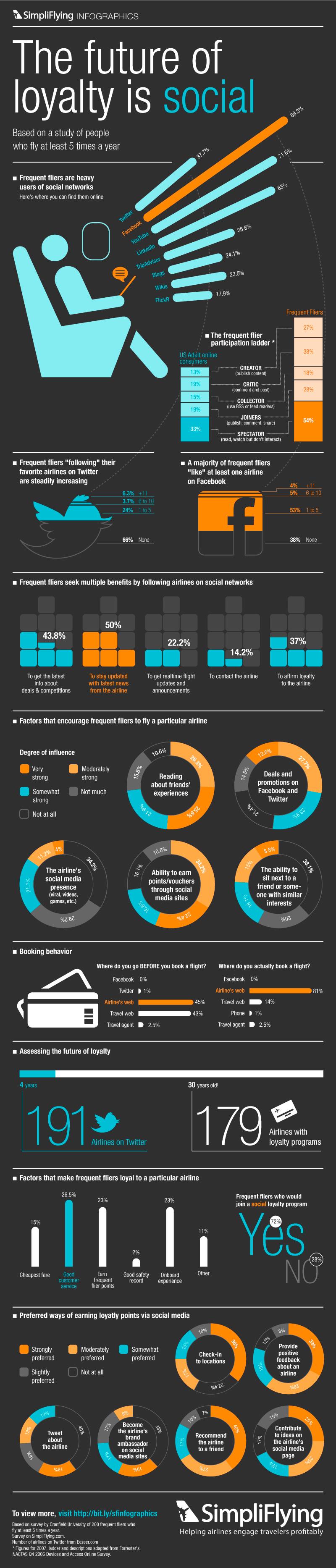

Key ndings for this research report have been illustrated in an infographic format that allows easy disgestion of the remarkable numbers that matter in this research study. For the full version, please go to: http://bit.ly/Tuq57b

Airline Social Media Outlook 2012 5

Airline Social Media Outlook 2012 6

Mapping ROI to Business Goals

Across industries, general businesses are struggling with evaluating the effectiveness or Return on Investment (ROI) of their social media activities. In a report by eConsultancy in late 2011 2, 41% of the companies and agencies researched had absolutely no idea if social media has any impact on their nances.

The difficulty in measuring the return on social media investment lies in having to layer many web metrics from the ‘social’ rst touch point to end of a transaction. Making this ROI process even more difficult is the low ease of availability of long–term data, such as the transaction numbers and sales gures, which can also be sensitive to share within the organization.

One of the ways that SimpliFlying has developed for airlines to track relative ROI is by tying it to three key key performance indicators, namely Revenue, Engagement and Reach with each having their own set of metrics.

In this research, almost half of the airlines surveyed claimed to have reached breakeven within two years while the other half is unsure.

To this puzzle, several airlines have begun to map their social media performance to business goals with the top three being brand engagement (100%), customer service (85.7%) and revenue (75%).

Brand Engagement

Social media creates a multiplier effect for an airline’s brand value. With it, brand communications is no longer a one-way or even two-way conversation. It comprises multilateral communication among the brand, the customer and the customers’ network. Airlines can now not only directly engage their customers on these social platforms but also empower social advocates who, in turn, become valuable marketers for the brand.

Customer Service

A uniquely sophisticated business that switches between product and service, customer service has always been a major component of airline operations.

Source: SimpliFlying

As one of the rst airlines to dedicate resources to social media, Delta Air Lines recognizes the importance of acknowledgement and resolution in

Airline Social Media Outlook 2012 7

customer service. The need to give their customers what they want has led to a guaranteed reply within 10 minutes on Twitter (@DeltaAssist), plus a dedicated social media customer service and support in Spanish and Portuguese. A number of crisis response efforts by airlines during crises such as engine failures (Qantas) or snow delays (Virgin Atlantic) have been widely praised for being responsive and providing helpful information in real time.

Revenue

In recent years, airlines are fast waking up to the possibility and potential of clearing inventory and driving revenue through social media.

For instance, Alaska Airlines incorporated a social booking engine on their Facebook page with a number of great options that allow their fans to discover fares to locations where their friends live. Another example is Estonian Air that has successfully sold tickets through reverse auctions on Facebook. It also successfully created the world’s rst airline social loyalty program that garnered over a million impressions in 10 days.

Tapping Social Media Metrics

In addition to driving business goals, airlines have been unlocking useful intelligence relevant to their businesses.

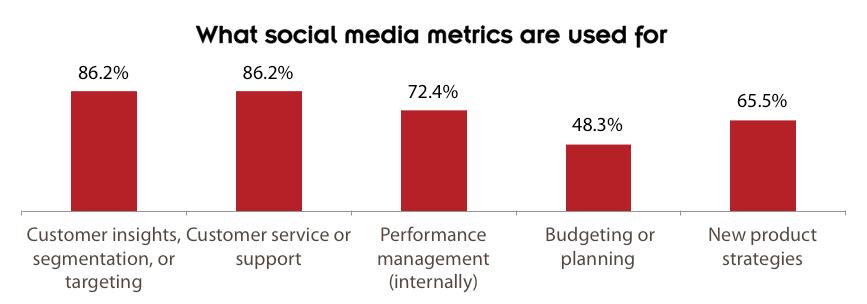

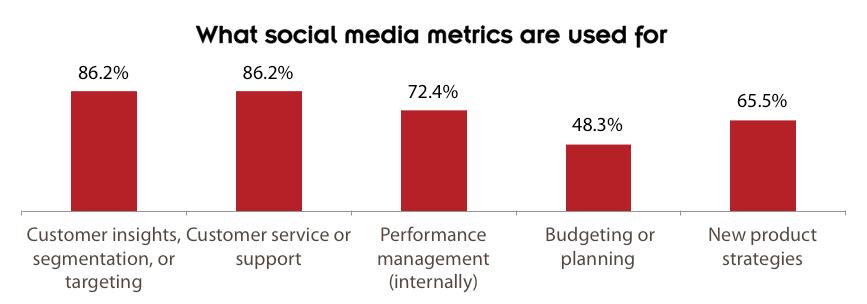

Over 70% of the airlines surveyed are deriving data for at least three uses: customer insights (86.2%), customer service support (86.2%) and performance management (72.4%).

Over 65% of the airlines surveyed use metrics from social media for new product strategy, potentially saving huge costs in marketing and product development. Unlike the traditional model of paying for focus groups or buying customer data, airlines are now obtaining insights through their own social media network presence. Not only is this method cost-effective, it is more customized and speci c to each airline.

Although many airlines are not able to accurately quantify the ROI from their social media activities yet, most of them are seeing positive impact from social media on their business goals, especially those that are customer-related.

Recommendations

An important business goal that many airlines have yet to drive on social media is customer loyalty.

From a research study that SimpliFlying has conducted with Cran eld University in July 20113 regarding the frequent ier’s attitude toward social loyalty program, there is a huge opportunity for airlines to integrate social media into their loyalty program, beyond the current provision of customer service.

Estonian Air and BalticMiles are among the pioneering airlines that are seeing great success with their social loyalty programs.

A further extension of brand engagement at its nest, social loyalty attests the level of trust and reliability that the travelers commit to the airlines, spreading word-of-mouth

Airline Social Media Outlook 2012 8

marketing to their network of friends and families.

Airlines should also monitor their competitors‘ social media activities and benchmark accordingly. Unlike traditional marketing campaigns, interactions on social media platforms are transparent for all to see. Analysing and managing the competition is a tactic also integral to an organization’s strategy.

Airline Social Media Outlook 2012 9

Source: SimpliFlying Airline Social Media Outlook 2012 Survey

Social Media Budgets

Over 85% of the airlines surveyed have allocated part of their marketing budgets speci cally to social media. A majority of them (over 70%) said that up to 10% of their marketing budget goes into social media. Taking into account the different sizes of marketing budgets, this means that airlines’ social media budgets span from a few thousand dollars to more than a million dollars.

As most social media activities take place on the airlines’ own online assets, lower costs is incurred as compared to paying for advertising space on external mediums. This helps to explain why the allocation of marketing budget to social media is relatively small.

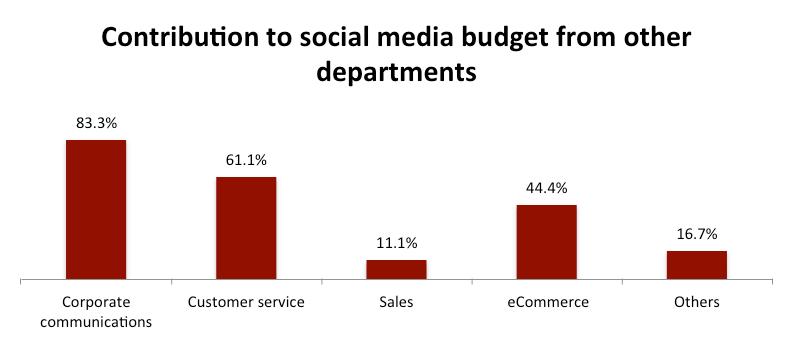

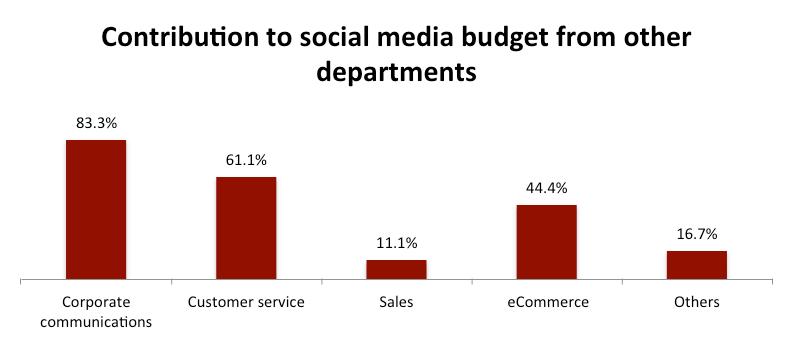

However, resources for social media do not only come from marketing. According to 62%

of the airlines surveyed, other departments contribute to the social media budget as well.

Budget Contributions

Corporate communications and customer service departments are the most common contributors to social media budget, aside from the marketing department. In fact, 83.3% of the airlines within this group receive budget from corporate communications department while 61% see budget contribution from the customer service department.

Clearly, social media is a tool that is relevant not only for airline marketing. As budget seeps in from other departments such as ecommerce and sales, airline organizations are recognising the fact that social media has

Airline Social Media Outlook 2012 10

Source: SimpliFlying Airline Social Media Outlook 2012 Survey

now inched closer as a factor that has direct impact on their bottom line.

Recommendations

Rather than allocating a xed fraction of each department’s budget to social media, it is recommended at that airlines start with the concept of the Connected Traveler Lifecycle in mind.

A cohesive strategy can be built around the opportunities identi ed in the four stages in which the traveler 1) dreams of a trip (SimpliDream) 2) plans his trip (SimpliPlan), 3) books his trip (SimpliBook) and nally 4) travels on his trip (SimpliTravel). At each stage, the Connected Traveler is accustomed to sharing information on his social networks, thereby amplifying the potential contribution to an airline’s bottom line through word-of-mouth marketing.

With this Connected Traveler Lifecycle in mind, the airline can determine the budget allocation and commitment from each departments.

A well planned long-term strategy is likely to reap more lasting impact and results than short spurts of campaigns, so an important consideration that airlines need to bear in mind is the sustenance of brand engagement.

Airline Social Media Outlook 2012 11

Staf ng for Social Media

In this report, resource allocation is broadly explored on two areas: manpower and nancial budgets. This section delves into airlines’ manpower allocation to social media by looking at:

The number of staff working on social media

How staffing is distributed across various departments

· The total man-hours spent on social media each month

The most common staffing range identi ed among airlines surveyed is 1 to 3 persons (in 38% of the airlines). Surprisingly, the next most common range leans towards the other end of the scale, with almost 25% of the airlines assigning more than 10 staff to work on social media.

However, not all staff is solely dedicated to work on social media only. In fact, only a

quarter of the airline respondents employ a dedicated model whereby staff work on solely social media and no other function.

Cross-Functional Model

Over 85% of the airlines surveyed utilize a cross-functional model whereby staff working on social media also perform other departmental roles.

Among these, customer service emerged as the most common cross-functional role, compared to a year ago when corporate communications role was ranked rst. It appears while social media is traditionally used as an outlet for corporate and marketing messages, airlines are increasingly using it to perform customer-related services.

AirAsia, most tellingly, has decided to move all its customer service efforts online and has shut down its call center operations in Singapore, a key virtual hub for the low-cost carrier.

Source: SimpliFlying Airline Social Media Outlook 2012 Survey

Airline Social Media Outlook 2012 12

In an effort to more accurately indicate the manpower dedication that airlines assign to social media, airlines were asked how many man-hours were spent on social media each month. Taking into account the number of people and the number of hours a month each of them spent working only on social media, over 75% of the airlines invest more than 90 man-hours per month on social media, which means at least 4 hours a day dedicated to social media.

Recommendations

Over the past year or so, many airlines have demonstrated how social media platforms can be used to drive results in spheres ranging from responsive, near-instant customer service, to even building an independent social loyalty program.

More involvement is likely to be seen from customer relations and sales department as more man-hours will be required to review current loyalty programs, as well as how the integration of social media can add value to not only retain and also grow their loyal customer base.

Given the increasing interest and investment by a number of big players such as KLM, Southwest, JetBlue, AirAsia and others in social media, it is evident that talking about “social” is no longer just bluster. In fact, it is proving to be rather useful in a number of ways such as spurring social advocacy that often drives sales.

Airline Social Media Outlook 2012 13

Challenges

Social media is a relatively new tool that came under the spotlight as a business tool less than ve years ago. Ever since, there have been drastic shifts in the online space with the emergence of new platforms such as Facebook, Twitter, Pinterest and more. Catching up with the latest innovation and applying it creatively to business operations is no easy feat.

Lack of Resources

The biggest challenge that more than half of the airlines surveyed is the insufficient allocation of resources to social media. In fact, almost 65% of the airlines that cite insufficient allocation of resources are already investing more than 90 man-hours into social media each month.

Organizational structure such as in exibility in team structure (faced by 42.8% of the airlines) is the next biggest challenge faced by airlines, with lack of budget (37%) being the third in line.

It is apparent that the dynamics of social media being used within an airline organization is expanding beyond the functions of marketing and corporate communications, at a faster rate than the organization has expected or budgeted for.

Airline Social Media Outlook 2012 14 Source: SimpliFlying Airline Social Media Outlook 2012 Survey

.

Recommendations

To address and reduce the number of setbacks, airlines are advised to conduct a quarterly review that ties the progress of social media efforts and the number of man-hours as well as budget spent on it.

In a fast-changing landscape, the importance of exhaustive planning can never be stressed enough. Each social intiative needs to deliver or be mapped to a coherent business objective.

Contrary to popular practice, the number of fans and followers is not a signi cant measure of success. What is of quintessence is the ability to respond to customers in dire situations and providing realtime updates, so having in place a stable network of support is an absolute4 necessity.

An excerpt from The Economist 4:

“By Tweeting about your company, commenting on your company's Facebook page, or posting about your company on sites like Reddit, customers can amplify the reach of their complaints. If your company effectively addresses these complaints, elding them via social media shouldn't be a problem. But if your customer service causes more problems than it solves, social media can quickly make a bad reputation worse. And there's not much you can do to stop it: even if your rm doesn't have a Facebook page or a Twitter account, you won't be able to prevent unhappy customers from saying nasty things about you to hundreds or thousands of friends and Twitter followers. That makes it all the more important to keep your customers happy.”

Airline Social Media Outlook 2012 15

Looking Forward & Summing It Up

On what the expected impact of social media is on the airline’s operating income in the next three years, half of all the airline respondents are unsure. In spite of this, more airlines are planning to increase resource allocation for social media.

Compared to a year ago where only 40% planned to expand their social media teams, now over 70% airlines plan to increase their budget or budget allocation for social media – almost a twofold increase.

It is apparent that social media is only going to become a bigger part of the business agenda for airlines. They are recognizing the ability of social media to impact business goals and bottomline; and that social media

is becoming more integral across more business functions including marketing, corporate communications, customer service, ecommerce and sales.

As the social media space becomes more crowded and competitive, airlines need to bear in mind to bridge their efforts to long-term business goals.

Airline Social Media Outlook 2012 16

Source: SimpliFlying Airline Social Media Outlook 2012 Survey

Appendix

1 Eezeer Data Lab, Airlines Monthly Twitter Report for December 2011, January 12, 2012, http://eezeerdatalab.tumblr.com/post/15762275596/press-release-12-janu ary-2012-airlines-monthly-twitter (accessed July 30, 2012)

2 Econsultancy, The State of Social Media 2011, November 2011

3 N.B., Southwest’s Facebook bungle, Gulliver Blog by The Economist.com, August 7, 2012, http://www.economist.com/blogs/gulliver/2012/08/southwestandfaceboo k (accessed August 20, 2012)

4 Shashank Nigam, The future of loyalty programs will be powered by social media, September 28, 2011, SimpliFlying.com, http://simpli ying.com/2011/infographic-the-future-of-loyalty-program-wi ll-be-powered-by-social-media/ (accessed August 20, 2012)

Airline Social Media Outlook 2012 17

Methodology

The information contained within this report is sourced from an in-depth survey conducted with 29 airlines around the world. Data derived from the survey is gleaned across all participating airlines without disclosing any information concerning any individual participant.

For further information, please contact report@simpliflying.com

Airline Social Media Outlook 2012 18

SimpliFlying is a leading consulting rm that has advised over 25 airlines and airports on customer engagement strategy to drive business goals. Headquartered in Singapore, SimpliFlying has offices in New York and Vancouver. One of the Top 5 most in uential on Twitter, SimpliFlying is also recognized by FlightGlobal for having one of the Top 2 leading aviation blogs.

http://simpli ying.com/

Twitter: @simpli ying

Produced by SimpliFlying

© Copyright SimpliFlying 2012

Helping airlines & airports engage travelers pro tably