For over 15 years, SimpliFlying has been a trusted partner to airlines, airports, and technology firms worldwide. We have been on a mission to help build trust in aviation. To empower the industry to soar to new heights through digitalisation, innovation, and a steadfast commitment to sustainability.

We're not just sought after strategy consultants, we are passionate advocates for meaningful change. Headquartered in Singapore, our global team based out of Canada, India, Spain and the UK is dedicated to equipping aviation and technology executives with the tools, insights, and strategies needed to navigate the complexities of sustainable aviation.

From major airlines and airports to aircraft manufacturers and travel technology companies, our extensive client base underscores our reputation as a trusted partner in the aviation industry since 2008.

At SimpliFlying, we're committed to helping you navigate the complexities of sustainable aviation and thrive in an ever-changing landscape. Here are some ways we can help you in your sustainability journey:

Like 80+ other CxOs in the industry, enlist your CEO or Head of Sustainability to be interviewed by Shashank Nigam. Share your vision for the future of travel on the world’s best-known sustainable aviation podcast "Sustainability in the Air". Find out more on becoming a partner.

Harness the power of our research and analysis with custom reports tailored to your unique objectives. We can help you build thought leadership on a particular topic that you would like to "own".

SimpliFlying has helped a multitude of technology firms scale up in aviation – from launching an airplane to marketing an Airbus A380 engine. We can help you amplify your brand and help build awareness with key decision-makers.

We deliver in-depth monthly or quarterly briefings to the senior leadership teams on a topic/issue of your choosing. You can also sign up for a series of briefings that cover key aspects of the present and future of sustainable aviation.

Our in-person workshops and virtual events can help you discover innovative ideas as you network with like-minded innovators, and unlock new opportunities.

Get in touch!

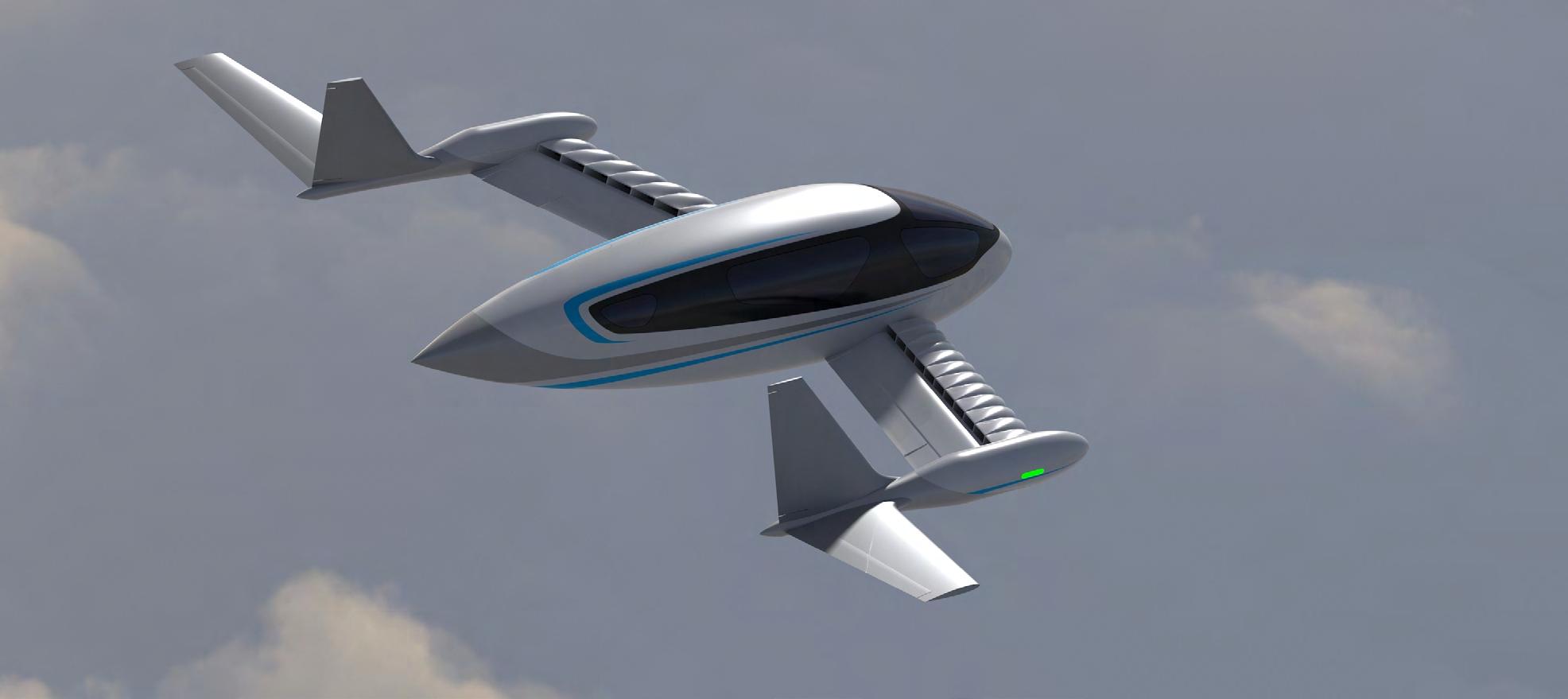

Electric and hybrid-electric aircraft promise substantial reductions in carbon emissions, noise pollution and operational costs and a transformative impact on regional air mobility.

The electric aircraft market is projected to experience exponential growth, with estimates valuing it at about $40.3 billion by 2030. Significant investments and orders support this optimism.

Electric aviation holds the potential for decarbonising short-feeder flights, easing hub congestion, reviving dormant airports, and improving connectivity in remote and developing regions.

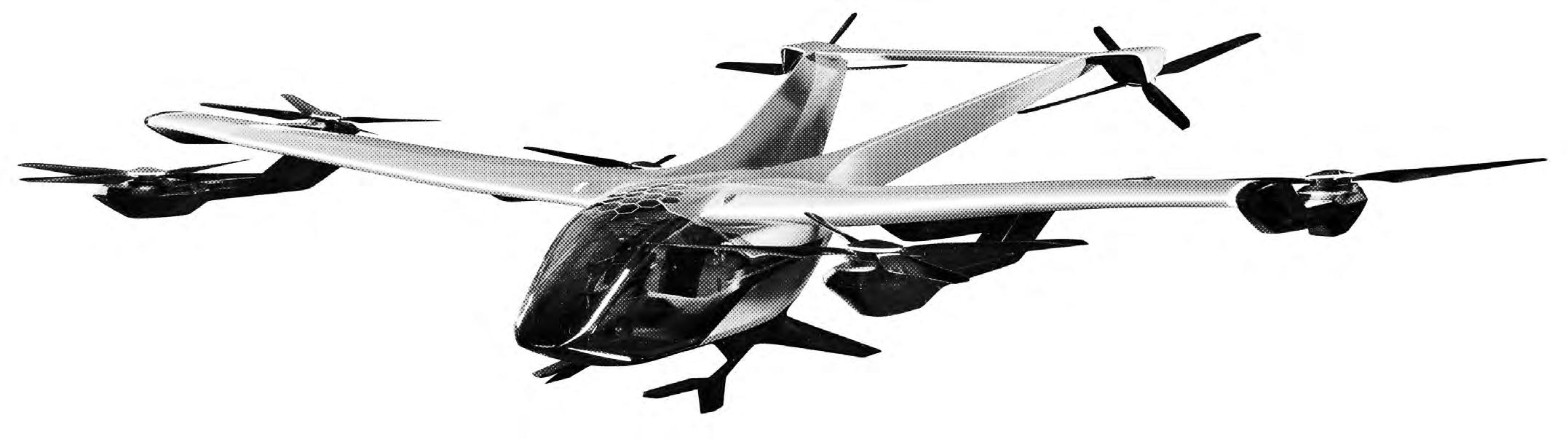

Much of the attention in the electric aircraft space is taken up by eVTOLs (electric vertical take-off and landing aircraft), commonly known as electric air taxis. These have attracted major investments and are seen as a solution to urban mobility challenges. At the same time, their practicality and community acceptance remain debated. Despite scepticism, there are use cases around them.

The electric aircraft sector faces major challenges, not least of which is the current limitations of battery technology. High capital requirements for new aircraft development and infrastructure needs must also be overcome.

Despite technological advancements and potential benefits, the aviation industry's reliance on conventional technologies and fuels persists. Embracing electric aviation may require regulatory incentives and a shift in industry mindset towards ‘true zero’ alternative propulsion systems.

A 2021 report by NASA heralded a transformative vision for the future of flight.

The Regional Air Mobility (RAM) report forecasted a future with aircraft so silent and discreet, complemented by services so accessible and beneficial, that communities would eagerly lobby for their introduction. It painted a picture of local airports, previously unnoticed, becoming pivotal in revolutionising travel dynamics.

According to NASA, the catalyst behind these significant shifts is the advent of innovative aircraft, predominantly electricpowered, promising substantial reductions in environmental and noise pollution. This development is particularly pertinent as emissions, noise, and elevated operational costs have led to a decline in regional air services in the United States and other countries.

For example, Heart Aerospace, a Swedish electric aircraft pioneer, wants to change this. Heart CEO Anders Forslund often puts up a slide at conferences showcasing

the decline of regional routes in the USA since the mid-1990s. He also showcases the routes his company aims to resurrect. (For an in-depth look at Heart Aerospace, please refer to our book Sustainability in the Air.)

Advocates like Forslund argue that electric aircraft, such as Heart's hybrid-electric ES-30, could herald a regional aviation renaissance, as the NASA report suggested. However, the transition from vision to reality is fraught with challenges.

Consider this: By the start of 2024, only one electric aircraft, the very compact two-seater Pipistrel Velis Electro, had received commercial certification. As such, the sizeable leap from this to larger models, such as Heart’s 30-seat aircraft – let alone the 100+ seater Wright Spirit from Wright Electric – poses significant questions. Moreover, the operational viability of these innovations also depends on the availability of renewable energy and the establishment of a comprehensive charging infrastructure.

As a result, this report aims to:

• Provide a market overview

• Highlight the opportunities and challenges facing electric aviation

• Explore the scalability and sustainability of electric air taxis (eVTOLs)

• Look at the main barriers to adopting electric aircraft – from battery capacity to possible inertia from legacy players.

• Spotlight electric aviation companies to watch, along with a comprehensive list of industry players.

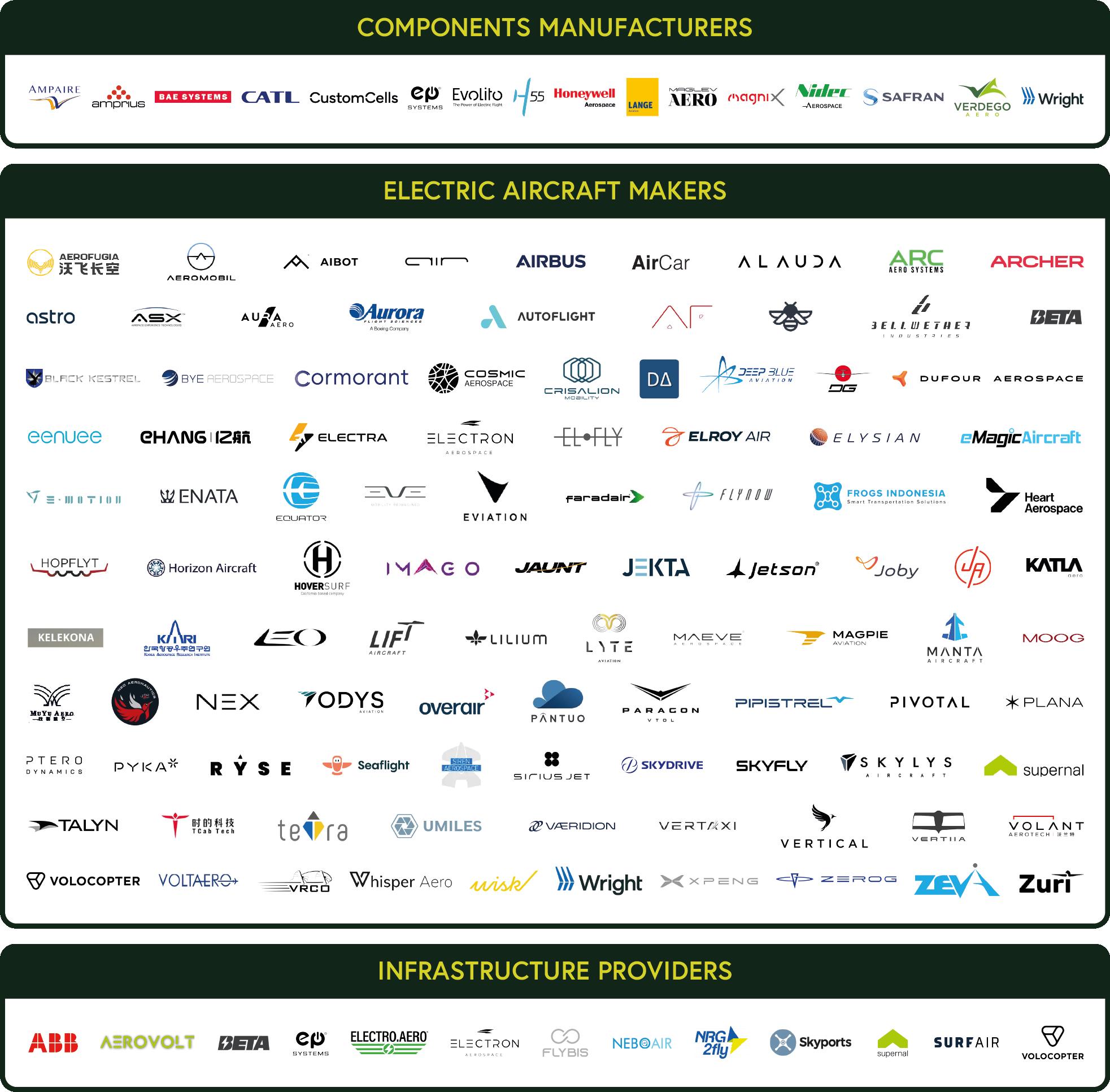

Source: Intergalactic

For clarity, by ‘electric’, we mean aircraft either powered purely by electric batteries or hybrid-electric aircraft where a battery and conventional engine work side by side.

Hydrogen-electric aircraft, where hydrogen fuel cells power an electric motor, are covered in our separate Hydrogen Aviation Powerlist.

Dirk Singer Head of Sustainability, SimpliFlying dirk@simpliflying.com

Electric and hybrid-electric aircraft promise operational savings of 20% or more, a dramatic reduction in noise by up to 100 times.

Powered solely by electricity, they promise zero emissions and a quieter flight experience but face challenges with current battery technology's energy density and weight.

Hybrid-electric aircraft combine conventional engines with electric motors, reducing fuel consumption and noise, especially during the critical take-off and landing phases. However, they still rely on jet fuel.

The shift from all-electric to hybrid-electric models by some startups signifies a prioritisation to extend operational range and also reflects the industry's adaptation to technological limitations.

Electric propulsion technology also significantly addresses noise pollution challenges near airports and is less disruptive to local communities.

Source: Volocopter

• An electric aircraft operates exclusively on electric power, analogous to a Nissan Leaf or Tesla soaring through the skies. It harnesses batteries to store electrical energy, driving electric motors that propel the aircraft.

• Hybrid-electric aircraft, on the other hand, are akin to a Prius navigating the skies. Since its introduction by Toyota in 1997, the Prius has epitomised the hybrid model, merging a gasoline engine with electric motors to alternate or combine power sources for optimised efficiency and reduced fuel consumption. Hybridelectric aircraft employ a similar strategy, utilising conventional engines (potentially powered by Sustainable Aviation Fuel (SAF)) alongside electric motors. The electric motors are particularly advantageous during takeoff and landing phases, significantly diminishing the noise impact.

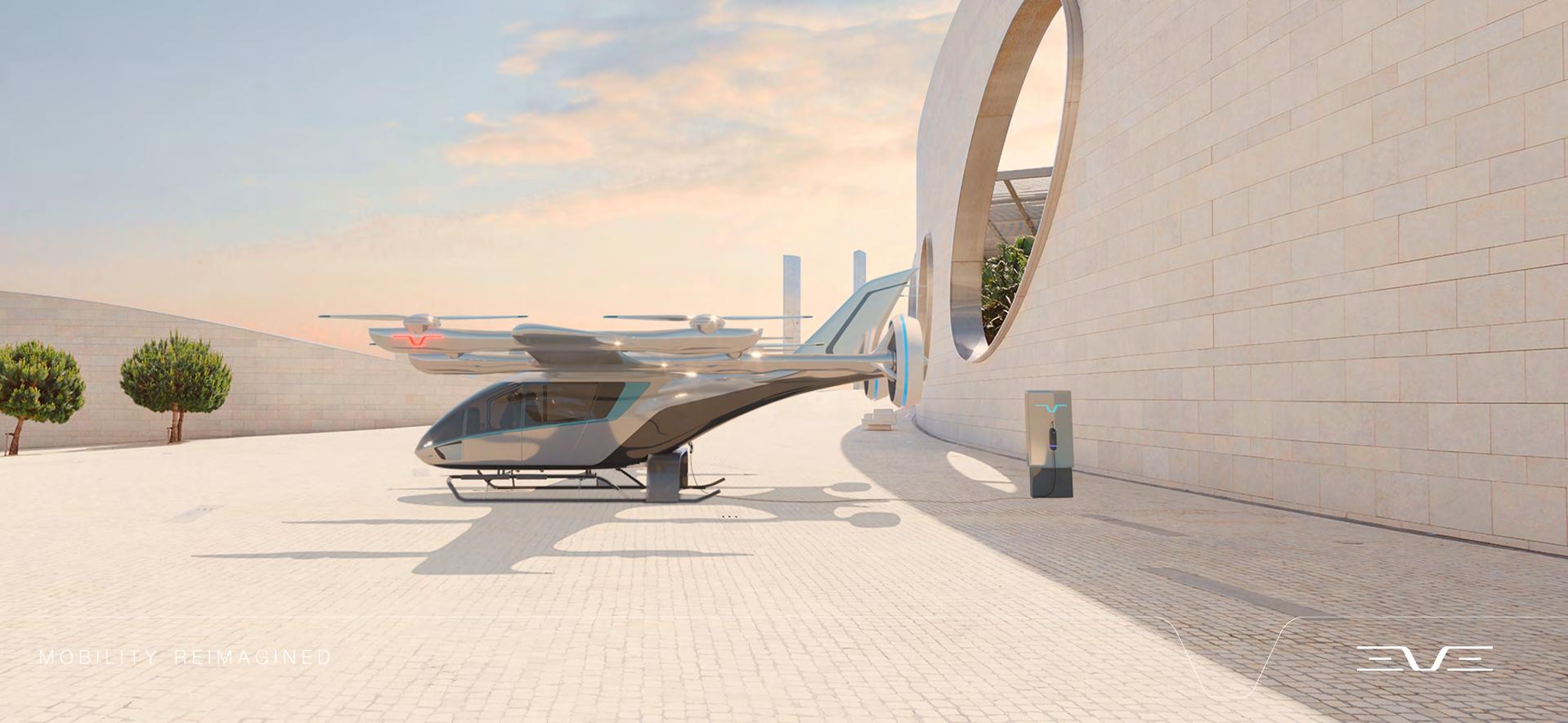

Source: Eve Air Mobility

• Retrofitting is the process of updating existing planes with hybrid-electric or allelectric technologies. This includes replacing the propulsion system and installing new engines to revitalise the aircraft with a more eco-friendly profile. Retrofitting offers a cost-effective and quicker alternative to building new planes, with a streamlined certification process. Notable examples include Ampaire, Dante Aeronautical, and Wright Electric.

• Conversely, clean sheet aircraft represent entirely new designs conceived from scratch. Although the development and certification of such aircraft are more costly and complex, they embody the future of aviation, unshackled by the limitations of past designs. Companies pursuing this path include Cosmic, Eviation, Heart, and Maeve.

Source: Eviation

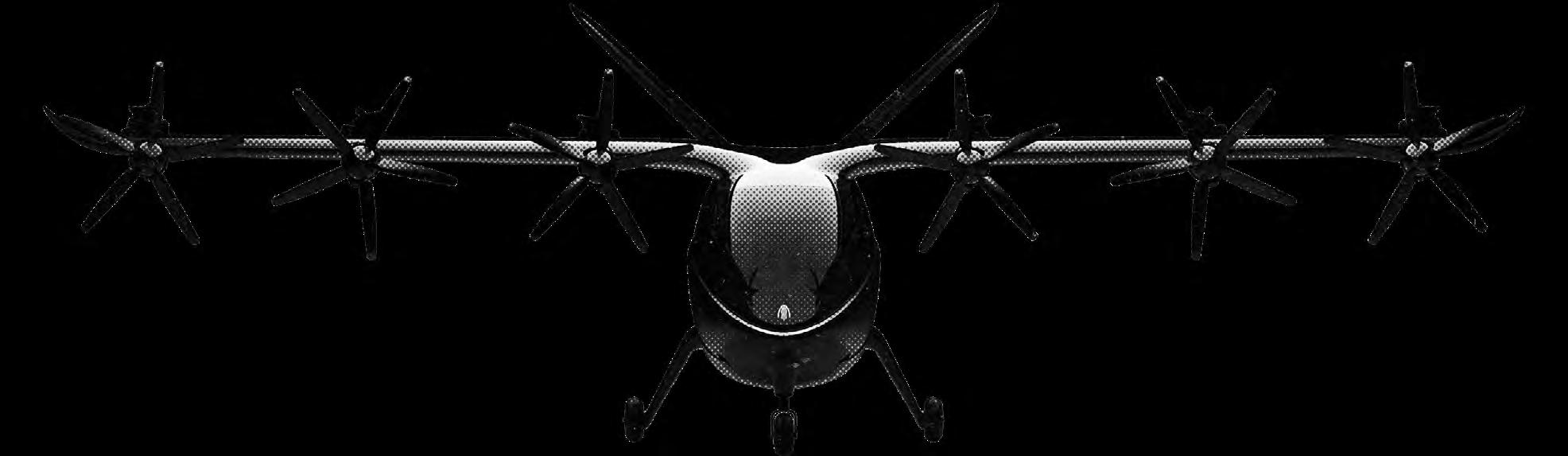

These acronyms categorise electric aircraft based on their take-off and landing capabilities, as indicated by the somewhat self-explanatory "V," "S," and "C" prefixes.

• eVTOL (Electric Vertical Take-Off and Landing): These aircraft, often called 'electric air taxis,' are capable of vertical lift-off and descent, similar to helicopters. This feature allows them to operate without runways, potentially using spaces as compact as rooftops for landing. Typically, they accommodate four passengers and a pilot. Archer, Eve, Joby, and Volocopter are prime examples.

Source: Electra

• eCTOL (Electric Conventional TakeOff and Landing): Mirroring traditional aircraft but powered by electricity, eCTOL planes need standard runways. This category typically includes aircraft designed to seat more passengers. Wright Electric plans to hybrid-electric retrofit the 100+ seat BAe 146 regional jet, while Dutch companies Maeve and Elysian are planning 80-100 seat turboprops.

Source: Volocopter

• eSTOL (Electric Short Take-Off and Landing): eSTOL aircraft require minimal runway length for take-offs and landings, significantly less than conventional aircraft. Electra, for example, claims its eSTOL design needs only as much space as a soccer field. These models can carry 9 to 19 passengers, offering a solution for accessing smaller airfields.

Source: Business Wire

Pure electric aircraft are celebrated as 'true zero' solutions, assuming they use renewable energy for battery charging. They produce no carbon emissions.

These aircraft also offer significant cost-savings for operators since they are cheaper to operate and maintain than conventional fossil-fuel-powered planes. The motor-like engines are less complex than jet engines and hence simpler to maintain; moreover, there are no fuel costs. Research from Linköpings University in Sweden suggests potential operational savings of up to 22%.

Nevertheless, the operational range and passenger capacity of pure electric aircraft are curtailed by the energy density limitations of current battery technology. (The energy density of a battery refers to the amount of energy stored in a battery per unit of volume or mass, indicating how much power it can deliver relative to its size or weight.) As a result, market trends indicate a shift from all-electric designs to hybrid-electric models by startups seeking extended-range benefits.

Source: Heart Aerospace

For example, Heart Aerospace originally developed the pure electric 19-seat ES-19 before switching to the 30-seat hybrid electric ES-30. Meanwhile, Dutch startup Maeve started with plans to develop a 40-seat all-electric turboprop before announcing at the end of last year that it would now be building an 80-seat aircraft, the M80, powered by a combination of turboprop engines and electric motors.

Kevin Noertker of Ampaire, which is retrofitting existing aircraft to be hybrid-electric, summarised the issue:

“When you think of going on a road trip in an electric car, there is range anxiety…When you look at aviation, these [problems] are even more exacerbated. The weight of batteries and the impact that has on both the range and the payload capacity, these are big challenges that electrification poses.”

Noertker sees electric aviation at the point that electric cars were at in the 1990s, where hybrids like the Prius came before all-electric vehicles like the Nissan Leaf, Chevrolet Bolt or Tesla:

“For 20-odd years, hybrid electric outsold fully electric. Why is that? With the hybrid, you get all the range you need; you don’t necessarily need the charging infrastructure at the other side. That unlocks the opportunity to use these in a really broad way without the major risks.”

Of course, hybrid-electric aircraft use some quantity of jet fuel. That could potentially be SAF, but this is limited by price and availability. Therefore, it could also be conventional fossil-fuel-based kerosene or ‘Jet A’ fuel.’

Moreover, juxtaposed with pure electric systems, the greater complexity of hybrid-electric systems entails missing out on the full environmental and operational cost benefits achievable with 100% electric power.

Source: Whisper

Although hybrid-electric aircraft don’t offer all the benefits of their all-electric counterparts, they can still make a big impact. That’s especially true since many noise and pollution issues associated with planes come during the critical phases of take-off and landing.

As a result, hybrid-electric manufacturers see the electric motors being used at the start and end of a journey, with the turbine engines kicking in (if needed) during cruise. Doing so mitigates the noise concerns of local residents as well. Electric propulsion technologies, such as those developed by Whisper, boast dramatically quieter engines—estimated to be 100 times less noisy than conventional ones.

A similar 100x reduction in noise pollution was also observed by magniX, an electric engine manufacturer, during their retrofit projects with Harbour Air's Beaver seaplanes in Canada. Such advancements enhance community relations and open the door to cheaper, cleaner flights to more places.

Take-offs and landings represent a significant proportion of the overall share of aircraft emissions, especially for short-haul flights. These stages are notably fuelintensive due to the high power requirements for aircraft to ascend and prepare for descent. Understandably, these shorter routes are manufacturers' primary targets for electrification.

Industry data, such as that from OAG, indicates how much of a difference electric takeoff and landings make.

LHR-HEL A321

LHR-MAD A320

LHR-LIS A320neo

LHR-GVA A320

LHR-EDI A319

LHR-CDG A319

Source: OAG

For instance, a short-haul journey from London Heathrow to Paris Charles de Gaulle sees 62% of the fuel consumed during the cruise phase, with the remaining attributed to taxiing, take-off, and landing. In contrast, cruising accounts for 96% of fuel usage for longer routes like London to Hong Kong.

As a result, considering fuel consumption and emissions across all flight stages is an important lever in the industry's sustainability strategies. It also explains why hybridelectric aircraft may be a promising transitional solution while battery technology improves enough to power longer-range electric aircraft that can carry a significant passenger load as well.

While different analyst reports may present varying figures for the size of the electric aircraft market, they unanimously recognise its potential for exponential growth:

• Markets and Markets estimated the electric aircraft market's value to be $8.8 billion in 2022, projecting an increase to $37.2 billion by 2030.

• Market Research Future placed the 2030 valuation even higher, at $40.3 billion.

• McKinsey's analysis suggested that by 2030, advanced air mobility operators could match today's leading airlines in daily flights and fleet size, generating $33 billion in annual revenue.

• This optimism is underscored by Dealroom data, revealing that over 40% of investment in sustainable aviation has flowed into the electric aircraft sector, outpacing funding for SAF (note that Dealroom’s figures do not include eVTOLs).

Source: Archer

Recent months have witnessed significant deals, investments, and orders that highlight this momentum:

• In December 2023, JSX announced plans to acquire over 300 hybrid-electric aircraft from Heart (Sweden), Aura (France), and Electra (US), aiming to expand its private jetlike service in the US and Mexico.

• At the Dubai Air Show in November 2023, eVTOL company Archer secured a deal with the Abu Dhabi Investment Office (ADIO) to launch electric air taxi services in the UAE by 2026.

• In February 2024, Archer's competitor Joby gained exclusive electric air taxi rights in Dubai, suggesting Archer may focus on Abu Dhabi.

• California awarded grants to eVTOL manufacturers Joby and AIBOT for aircraft development.

• Heart Aerospace's development of the hybrid-electric ES-30 aircraft received a significant boost with a $100+ million investment from Bill Gates’s Breakthrough Energy Ventures, among others, in February.

• In September 2023, H55, a Swiss electric engine maker, raised €46.7 million in a Series C funding round.

• Air New Zealand integrated BETA Technologies' ‘Alia’ aircraft into its future fleet plans. BETA also secured a $20 million grant from NY State for a new facility towards a $41 million facility at Plattsburgh Airport.

• Aura.aero in France netted 13.2 million euros from the French Government to advance its hybrid-electric aircraft project.

• Cosmic Aerospace's seed funding of $4.5 million is set to support the development of its all-electric aircraft, capable of a 1000 km range.

But where might electric and hybrid-electric aircraft be used? In the next sections, we’ll look at different use cases and barriers to adoption.

Source: Joby

Despite the undeniable attractiveness of electric aircraft, the sector's progress is slow. Here are the key obstacles impeding broader adoption:

Battery limitations: Current battery technology restricts electric aircraft to short distances with limited passenger capacity. Predictions about technological advancements overcoming these barriers remain disputed, and these innovations are still some years in the future.

Capital intensity: Developing new aircraft models is extraordinarily capital-intensive. Revolutionary designs often stall post-seed funding given the necessity of substantial investment – sometimes exceeding $1 billion – to bring a new model to market.

Infrastructure requirements: Preparing for electric planes, although less daunting than for hydrogen-fueled aircraft, demands significant infrastructure development, including charging stations and sources of renewable energy.

Industry inertia: Decades of investment in conventional technologies have made major industry players reluctant to adopt radical changes. This inertia favours incremental improvements over the introduction of novel propulsion systems.

Source: Joby

In September 2022, Eviation's Alice, a nine-seater aircraft, generated media headlines worldwide when it embarked on its inaugural test flight from Moses Lake, Washington. The event was celebrated for the aircraft's sleek, modern design and the introduction of groundbreaking technology. Yet, a critical detail emerged from the extensive media coverage: Alice currently can’t do more than a 20-minute test flight. This revelation was highlighted during an interview with then-CEO Greg Davis in the Seattle Times, where it was disclosed that Eviation's ambition for commercial viability hinges on batteries that don’t exist yet.

According to the newspaper, “Eviation needs still-to-be-developed advances in battery technology to make its planes commercially viable, and (Davis) admitted those advances could still be five years away.”

Source: Eviation and Jeremy Dwyer-Lindgren

Fast forward to June 2023. Aircraft manufacturer Tecnam, in collaboration with RollsRoyce, decided to halt the development of the P-Volt, an electric variant of the P2012 twin-piston commuter aircraft.

After three years of development, Tecnam recognised that the available battery technology fell short of delivering the desired range and payload capabilities, also making frequent battery replacements costly due to rapid degradation.

Tecnam, Eviation and others in this space have come up against the battery density challenge holding back electric aviation.

The more ambitious the mission, the more power is needed. However, this involves a catch-22 situation as more power requires a heavier battery. This, in turn, reduces the available payload – passengers or cargo.

Given that the Eviation Alice and Tecnam’s now abandoned P-Volt are small nine-seat aircraft, what hopes are there for planes with more ambitious goals?

Interestingly, some others are more optimistic, believing batteries are up to the challenge.

Cosmic Aerospace, for instance, argues that current battery technology could enable its planned 20-seat aircraft to cover distances up to 1000km. This optimism is echoed by battery manufacturers, who assert their commitment to innovation and pushing the boundaries of current lithiumion chemistries.

Speaking to SimpliFlying CEO and Founder Shashank Nigam in an episode of the Sustainability in the Air podcast, Nathan Milliecam, President and CEO of Utahbased battery company EP Power Systems, said, “We are starting to push some of the boundaries of what traditional lithium-ion chemistries can do.” According to Milliecam, those little jumps have recently turned into 20-30% improvements year on year.

Meanwhile, CATL, the world's leading vehicle battery manufacturer, has pioneered a "condensed battery" with a remarkable 500-Wh/kg energy density, approximately twice that of the batteries used in Tesla vehicles today.

Source: NASA

Source: NASA

However, CATL is not only advancing battery efficiency but also highlights the significant decline in production costs, which benefits various sectors, notably aviation, to leverage breakthroughs in battery tech.

Back in 2018, the cost of Li-ON batteries stood at $250/kWh. CATL is on the verge of a fivefold reduction in costs, aiming for $50/kWh by this year.

Looking ahead, the future of batteries may shift away from lithium-ion. Cuttingedge research is looking into safer and more energy-efficient materials, including sodium-ion, lithium-sulfur, and metal-air options. These technologies offer potential advantages like lower cost, higher energy density, and improved safety.

For example, NASA’s SABERS project is focused on developing solid-state batteries specifically for electric aircraft. Like CATL’s battery, NASA’s new sulfur selenium

prototype battery has an energy density of 500 watt-hours per kilogram. Media reports say it “could revolutionise air travel.”

Considering these new innovations, how far could electric aircraft realistically fly? Might all these developments in battery technology even make all-electric transatlantic flights possible?

Amprius, experimenting with silicon batteries, certainly thinks so, telling us that a battery capable of powering a private jet across the Atlantic could be feasible in the 2030s.

As a result, there are certainly promising developments in the pipeline. However, they will take several years to come to fruition. Consequently, while the industry awaits these technological breakthroughs, many manufacturers are turning to hybrid aircraft, as mentioned.

Creating new aircraft demands substantial financial resources. Launching an electric aircraft startup diverges sharply from the typical tech startup narrative popularised by shows like HBO's "Silicon Valley."

Unlike tech enterprises that might release software or hardware with known issues that can be patched later, aircraft development is governed by stringent safety and certification processes. This is due to the nonnegotiable priority of human safety, necessitating a flawless product at launch.

Reaching this point takes years –realistically, at least five, usually more.

At the same time, the aircraft is designed, tested and certified, with no revenue coming in, as there’s no certified product to sell.

That’s why, in an autumn 2022 keynote, Adam Goldstein, the CEO of Archer, the United Airlines-backed eVTOL company, delivered a reality check for the industry. According to Goldstein, the difference between success and failure initially comes down to one word: money.

"Probably the best filter that knocks out most of these companies is capital," Goldstein remarked. He emphasised the magnitude of this challenge for ambitious aviation projects, noting that at least $500 million is required, though $1 billion is a more accurate estimate.

Source: Elysian Aircraft

In fact, while researching our book "Sustainability in the Air," as well as conversations with startups for our podcast and blog, the $1 billion figure repeatedly surfaced as the cornerstone for developing new aircraft using alternative propulsion systems. Some say that’s if anything an underestimate. Dutch company Elysian has spoken of a need for $5+ billion to bring its 90-seat hybrid-electric aircraft to market.

Is there enough capital to fund a decent number of new aircraft companies? On the one hand, VCs are reluctant to fund projects with 5-10+ years until a successful exit.

On the other hand, Wright Electric CEO Jeff Engler is someone who believes that there is enough potential funding, talking about “$2 or $3 trillion of dry powder, money that's been committed to private equity and venture capital funds and hasn't been done.”

As a result, Engler feels that “there’s more than enough capital to support multiple new aeroplane platforms.” However, the key is getting the product right, “I think the question that would need to be asked is, how do you create a compelling enough value proposition to investors who want to commit to a programme like this? And that’s our job.”

State funds also play an important role. Several European startups told us that aviation is one of the few areas where the continent is not falling behind the US or China due to generous state subsidies. France, for example, has an active Government support programme, with companies like VoltAero and Aura benefitting from initiatives such as the France 2030 programme, which includes several initiatives dedicated to decarbonising the aviation sector.

The European Union also supports nextgeneration aircraft companies, with Dutch hybrid-electric aircraft marker Maeave receiving €17.5 million in EU funding. This blend of private and public funding may be the catalyst to propel the electric aviation sector into its next development phase.

Source: Maeve AerospaceElectric aviation infrastructure faces distinct challenges, albeit less complex than those associated with preparing airports for hydrogen-powered aircraft, which necessitate transporting and storing an entirely new fuel source.

Nonetheless, airports must overcome several hurdles to accommodate electric aircraft effectively:

• Aircraft size and battery technology: Larger aircraft equipped with more substantial batteries require high-capacity charging solutions to meet their energy demands.

• Turnaround times and peak demand: To facilitate rapid recharging during brief turnaround periods, airports must install sufficient charging stations to manage peak demand efficiently.

• Infrastructure upgrade costs: Airports are tasked with securing new sources of renewable energy rather than simply drawing existing renewable power from the grid, which would divert it from other essential uses. This often involves significant solar or wind microgrid investments to support airport operations sustainably.

Source: Eviation

However, research indicates that adapting airport infrastructure for electric aircraft may be more manageable than anticipated.

One study from the UK, titled “Modelling the effect of electric aircraft on airport operations and infrastructure,” employed simulation models to assess the impact of electric aircraft on airport capacity. It focused on recharging durations and the necessary modifications to parking stands for electric charging.

Findings revealed that transitioning to a future where electric aircraft constitute 25% of the global fleet would only require converting 13% of existing parking stands without adversely affecting airport operations.

Several companies are already innovating charging solutions for electric aircraft:

• Archer Aviation and BETA Technologies have collaborated to establish an interoperable charging network to set industry standards for charging infrastructure.

• Electro, based in Perth, Australia, has introduced AEROCHARGE, an energy storage solution designed to streamline the charging process for aircraft, particularly in locations with limited access to the grid.

• ABB is collaborating with eVTOL manufacturer Lilium to develop a fastcharging infrastructure capable of fully recharging Lilium's eVTOLs within thirty minutes.

• In the UK, Aerovolt is constructing a charging network specifically for electric aircraft.

In parallel, airports are advancing their renewable energy projects:

• Cochin International Airport in India made headlines in 2015 as the first airport entirely powered by solar energy thanks to its 46,000 solar panels.

• Edmonton International Airport (EIA) in Canada is leading a significant renewable energy project, the Airport City Solar project, which will transform EIA into the site of one the world's largest airport solar farms, spanning 627 acres and producing 120 megawatts of solar power.

• Glasgow Airport in Scotland is constructing a 19.9 MW solar facility over 40 acres.

• VINCI Airports is developing a 14-hectare solar power plant at LyonSaint Exupéry Airport in France, set to cover 5,800 parking spaces and produce 24 GWh of green electricity yearly, enough to power 9,000 households.

• Kansas City International Airport (KCI) in Kansas is on the verge of approving a system capable of generating up to 500 MW of power.

• In northern Virginia, Dominion Energy and the Metropolitan Washington Airports Authority are collaborating on the Dulles Solar and Storage project at Dulles International Airport, which aims to produce up to 100 MW of solar energy and offer up to 50 MW of storage capacity by 2026.

The journey toward the electrification of aircraft faces a significant hurdle that’s deeply rooted within the industry's fabric. The question arises: Is there genuine enthusiasm within the aviation sector for embracing new technology and propulsion systems?

In a 2022 interview, Val Miftakhov, the visionary behind hydrogen-electric engine pioneer ZeroAvia (featured in our hydrogen report and on our podcast), spoke about his time in the electric car sector. He argued that entrenched legacy corporations are often reluctant to pivot away from the technologies and systems into which they've sunk colossal investments over the years.

Miftakhov recalled that the major automakers initially made it look as if they were doing something around electric cars without really being serious, summing up their approach as follows:

“We’re going to put a few crazy engineers there, and they are going to produce something that nobody wants… and that’s how we’re going to make some politicians happy and have some press releases.”

Source: Benito Link | Robert Eliason

Even in the face of Tesla's disruptive impact, objections to a wholesale switch to electric vehicles persist.

The oil industry is promoting biofuels as an alternative to electric cars, with Mobil running ads encouraging car users to “break free” from the limitations of having to charge your car. Meanwhile, automotive giants like Porsche are exploring using so-called e-Fuels (sustainable fuels made from renewable energy).

In aviation, we can see similar signs of resistance. A telling development came from Airbus, which has scaled back its hydrogen aircraft projects to, among other things, avoid cannibalising its existing lineup.

Having received record-breaking orders at international airshows, the company is cautious not to undermine its successful models, many of which will remain in service well into the 2050s.

As a result, instead of developing a 100+ seat narrowbody with an alternative propulsion system, Airbus is looking at an A320 successor compatible with 100% SAF. Since SAF works with today’s aircraft, there will be no need to re-engineer them drastically.

Boeing, on the other hand, is exploring a "SAF and" strategy. Through its subsidiary Wisk, Boeing is advancing autonomously piloted eVTOLs, yet its primary focus remains on readying its conventional fleet for SAF.

As a result, the path toward widespread adoption of electric aircraft may well necessitate further regulatory intervention, pushing the industry beyond its comfort zone.

eVTOLs are gaining significant attention and investment from major airlines like United, Delta, and American Airlines.

They envision a future where travellers can bypass congested traffic, offering a faster commute from urban centres to airports.

eVTOL companies have raised $5.6 billion, double the $2.7 billion raised by the rest of the sustainable aviation ecosystem.

Critics argue the technology is overhyped, focusing on the challenges of community acceptance, infrastructure needs, and the daunting path to certification.

Polycentric urban development highlights the practical applications of eVTOLs, showcasing how these aircraft could address traffic congestion and connect diverse urban centres.

The reality of eVTOLs lies between the extremes of mass adoption and exclusive luxury, aiming for strategic deployment in cities to enhance connectivity and sustainability, with potential roles in connecting rural communities.

Much of the attention and investment in electric aviation is centred around eVTOLs. Airlines and investors have been enthusiastic as the eVTOL sector promises a world where travellers can bypass congested city traffic, embarking from urban centres directly to airports - from which they can then catch fossil-fuel-powered flights.

Source: Lilium

Source: Lilium

According to Dealroom, a data platform for startup and investment intelligence, $5.6 billion has been in eVTOLs, far more than the $2.7 billion raised by other areas of sustainable aviation combined.

Major airlines such as United (partnering with Eve and Archer), Delta (collaborating with Joby), SAUDIA (working with Lilium), and American Airlines (teaming up with Vertical Aerospace) are advancing orders for these futuristic Jetsons-style aircraft.

Last year, we interviewed Oscar Munoz, former CEO of United Airlines and current board member of Archer, for our book ‘Sustainability in the Air.’ Following United's announcement to initiate a service connecting downtown Chicago with O’Hare International Airport, Munoz shared why he would welcome the idea:

“Living 19 miles from O’Hare means my commute could vary from 40 minutes to three hours. With this service, we can reduce that to under 10 minutes.”

At last year’s SXSW Festival in Austin, executives from leading eVTOL firms made even bolder assertions about the transformative potential of these aircraft.

Source: Joby

Source: Joby

Supernal's Diana Cooper highlighted eVTOLs as potential catalysts for equality, bridging gaps created by historical transport policies across dense urban areas and secluded rural regions. Wisk's Becky Tanner envisioned a future where personal vehicle ownership declines in favour of a comprehensive shared mobility ecosystem, ranging from electric scooters to carsharing and eVTOL services.

Joby CEO JoeBen Bevirt went further, praising the profound impact eVTOLs could have on daily life quality, promising the convenience of an Uber ride in the skies.

However, this enthusiasm is tempered with scepticism from critics who question the feasibility and prioritisation of eVTOL development over other critical areas in aviation needing decarbonisation.

Concerns also include community acceptance, the infrastructure required, regulatory challenges, and the industry's capacity to produce these aircraft at a scale that could meaningfully compete with conventional helicopter sales.

Michael Barnard, a proponent of electric aviation, stands out for his critical perspective, dismissing eVTOLs as overhyped ventures propelled by venture capital rather than viable technology or business models.

In August 2023, Barnard wrote a long critique referring to eVTOLs as "origami electric helicopters" and a “VC-funded bad idea”, questioning the staggering valuations of eVTOL companies like Joby, Lilium, and Archer, which have yet to certify their aircraft.

Barnard also pointed to the limited operational range and the daunting path to certification faced by eVTOLs, casting doubt on their immediate utility and the optimism surrounding their market potential.

Furthermore, he contrasted the eVTOL hype with the established helicopter market and the rising adoption of unmanned aerial vehicles (UAVs), suggesting a potential overestimation of the eVTOL market's size and necessity.

Source: Archer Aviation

Many cities worldwide are evolving into polycentric or dispersed urban sprawls, where traditional single-core transport solutions fall short.

In Orlando, for example, the city's director of intergovernmental relations, Kyle Shephard, has highlighted how eVTOLs could seamlessly connect diverse activity centres, from downtown to theme parks like Disney and Universal and medical and science hubs, showcasing the adaptability of eVTOLs to varied urban landscapes. Moreover, the implementation of eVTOL networks in regions like the San Francisco Bay Area, as pursued by United Airlines and Eve following a 2023 agreement between the two companies, underscores the technology's capacity to alleviate some of today's most pressing urban challenges – including crippling traffic congestion and environmentally unsustainable commuting practices.

Consider this: The Bay Area of San Francisco ranks 15th worldwide in traffic congestion, with drivers spending an average of 97 hours in traffic in 2022. Meanwhile, an earlier study by the US Census Bureau identified the Bay Area as the region with the highest percentage of ‘mega commuting’ in the United States (travelling 90+ minutes and 50 or more miles to work).

As a result, there’s scope for United Airlines and Eve to seamlessly connect economic centres such as Palo Alto and Mountain View (Silicon Valley), Oakland, San Mateo County, Santa Clara County, the San Francisco Central Business District with each other and with San Francisco, San Jose and Oakland Airports.

Source: Eve Air Mobility

You don’t need thousands of electric air taxis in the skies to make this reality happen; in its presentations, eVTOL company Eve often talks about the low hundreds in major cities serving certain set routes.

Looking at somewhere like Miami, Eve has estimated that a standing fleet of 200 aircraft could serve “almost 100 different routes from 30 vertiports,” making travel across the city at busy times exponentially faster.

eVTOLs will also play an important role in countries like Norway with a challenging geographical terrain and many islands that need connections to the mainland. This is why Norwegian airline Widerøe has partnered with Eve to connect rural communities and support the country's ambitious fossil-free domestic flight goal by 2040.

For Widerøe’s, the focus is not on traversing congested cityscapes but on connecting remote communities, showcasing the adaptability of eVTOLs to various transport needs beyond the urban elite.

In conclusion, eVTOLs will neither fly above our skies en masse Jestsons style nor be a toy for a few wealthy individuals. As is often the case, the reality will lie somewhere in between, representing a middle path where technological innovation meets practical transport planning needs.

With strategic implementations, like those seen in the Norwegian islands or the planned networks connecting polycentric cities such as Orlando and the San Francisco Bay Area, eVTOLs could become an important new component of future urban mobility.

Note: Many of the use cases we’ve identified for eVTOLs could also be met by Electra’s eSTOL nine-seat aircraft. Electra is also one of our companies to watch. Later in this report, we discuss why many in the industry believe it offers a more compelling proposition than the aircraft made by eVTOL manufacturers.

Significant reduction of emissions and costs on short-feeder flights to hubs.

Facilitation of direct, point-to-point travel, reducing the need for layovers and alleviating congestion at major hubs.

Making air travel viable for remote communities by reducing operating costs and environmental impacts. This change could bring commercial flights back to underused airports.

In developing countries, improving access to remote areas with minimal infrastructure, promoting economic growth, sustainability, and energy independence.

Eco-friendly alternatives for cargo deliveries, especially in urban and remote areas.

Wide-ranging applications beyond passenger transport, including military, medical, disaster relief missions, urban mobility, and tourism.

Source: Archer Aviation

Along with its regional partner Mesa Airlines, United is an investor in Swedish hybrid-electric company Heart Aerospace. Why might an airline giant like United be interested in Heart’s 30-seat aircraft?

A critical application of these aircraft is in hub feeder flights. For example, United Express, United's regional division, offers several short flights into Chicago O’Hare from regional cities. While economically questionable, these flights are crucial for channelling passengers towards United's broader network, including international destinations.

Consider this: from Milwaukee, Wisconsin's largest city, United Express runs six to seven daily flights to Chicago O’Hare, covering a mere 108 km (67 miles). Similarly, from Madison, Wisconsin’s capital, there are six daily flights to O’Hare, spanning just 175 km (109 miles).

United Express deploys various aircraft on these routes, primarily regional jets like the CRJ-550 and ERJ-145, each offering about 50 seats. Larger planes, such as the Airbus A319, are also utilised during peak times.

ICAO figures suggest that the round trip from Madison to Chicago O’Hare typically incurs a fuel consumption of 2220.7 kg. With six round trips daily, or 2190 annually for United, this results in nearly 5000 metric tonnes of fuel usage.

In such scenarios, aircraft like the ES-30 could be a game-changer. Given the sub200 km distance from Madison to Chicago, United could adopt the ES-30 for these flights and achieve substantial fuel and emissions savings.

Although the ES-30 doesn't match the capacity of the current fleet servicing these routes, this constraint presents an opportunity to reimagine regional air travel. Airlines might adopt a frequent "turn up and go" service model for these flights, akin to Air New Zealand's CEO Greg Foran's proposal at the APEX/IFSA EXPO in Long Beach, California, in 2022. Envisioning the future of electric aviation, Foran suggested reprogramming certain regional flights:

“Imagine it akin to an Uber service, with constant back-and-forth shuttles, perhaps every 30 minutes, where passengers simply arrive and pay upon boarding. Why not?”

Source: Electrek

Source: Electrek

Electric and hybrid-electric aircraft could also ease congestion at hubs by allowing for more point-to-point travel.

Suppose you want to fly from Indianapolis, Indiana, to Milwaukee, Wisconsin. Currently, flying this route entails changing with United or American in Chicago or with Delta in Detroit. Here are two large (500k+ population) cities in the Midwest, but airlines haven’t been able to make the case for direct flights between the two.

First, this is hugely inconvenient for the travelling public – including the layover, a potential flight of an hour or less, given the 227-mile distance, becomes a three-hour journey. Second, there’s extra “avoidable” congestion at the major hubs. And, last but importantly, there are the extra emissions of running two (fossil fuel-powered) flights instead of one.

Source: George Rose

With electric aircraft, routes like this suddenly become viable, benefiting passengers, local communities and airlines.

Source: flightradar24

When Mesa Airlines announced its investment in Heart Aerospace alongside United, its press release mentioned the town of Farmington, New Mexico Farmington, a rural community bordering the Navajo Nation, once had 30 daily departures to seven destinations. Today, it has no commercial airline link.

The high operating costs of maintaining smaller aircraft that carry fewer passengers, coupled with the noise and emissions concerns when flying into smaller regional airports, have caused many such communities to lose vital connections.

However, thanks to their ES-30 purchase order, Mesa Airlines said that Farmington was the sort of small town they might be able to serve again in future.

Kevin Noertker of Ampaire believes bringing electric air services to more communities also takes cars off the roads. Speaking to US Transport News, Noertker painted the following scenario:

“(Passengers) step aboard a regional aircraft. The motors start-up –they’re very quiet. The passengers are already pleased. They fly from coastal California up and over the mountains to a small town where they live, saving hours on twisting roads. They find they can get back and forth to the big city for not much more than the price of driving, making it easier to conduct business, see a medical specialist, or visit family.”

Source: Bowie Snodgrass via Wikipedia

Source: Bowie Snodgrass via Wikipedia

Electric aviation holds transformative potential for developing countries, enhancing connectivity, especially in remote areas.

These aircraft, requiring shorter runways and capable of operating in rugged conditions, are ideal for areas where infrastructure is minimal or costly, such as the Indonesian archipelago or the Philippine islands.

They promise significantly lower operating costs, making air travel more affordable and accessible, thus stimulating economic growth through enhanced tourism and business travel.

Zero-emission aircraft also offer environmental benefits in ecologically sensitive areas and countries like Kenya.

Last, electric aviation could also boost local economies through job creation in aviation, renewable energy, maintenance, and tourism while promoting energy independence through locally sourced renewable energy.

Source: Something Of FreedomElectric drones and aircraft could revolutionise last-mile deliveries in urban areas and open new routes to remote regions, offering a cost-effective solution for shorthaul routes.

This is why DHL has ordered the cargo version of Eviation’s all-electric ‘Alice’ aircraft while UPS wants 150 electric eVTOLs from BETA Technologies.

These examples, of course, merely scratch the surface of how electric aircraft could revolutionise various sectors. Beyond the transformative potential in civilian travel and cargo transport, applications extend to military operations, with the US military considering replacing much of its helicopter fleet with eVTOLs.

Source: UPS

Additionally, electric aircraft could significantly impact medical evacuation flights, disaster relief efforts, and tourism through sightseeing flights.

Electric air taxis may also offer a promising alternative for efficient city-to-airport transfers or urban commutes. However, this specific aspect has stirred up some controversy, as explored in previous sections.

Source: Talyn Air

Source: Talyn Air

In 2023, France restricted certain domestic short-haul flights to promote train travel and encourage less fossil-fuel-intensive forms of transport. Other countries may well implement similar restrictions on air travel where alternatives are greener and more feasible.

While trains are often considered the more environmentally friendly transportation option, they require considerable infrastructure, such as new rail lines and stations, which is not always practical in many areas of the world.

Electric aviation offers an alternative approach. Introducing electric aircraft, particularly in regions with insufficient rail infrastructure, presents a new way to meet environmental goals without the requirements of rail expansion.

Source: Rail Europe

Our report highlights the challenges in transitioning to electric aviation, including technological obstacles like battery limitations. Despite these challenges, the growth of the sector, spurred by battery technology improvements and the rise of electric aviation startups, is encouraging.

As countries prioritise climate action, the question of whether electric aircraft could become the most environmentally friendly transportation method, certainly on a regional or commuter level, is becoming increasingly relevant.

For their part, airlines are intrigued by the prospects of eVTOLs to streamline passenger flow to major hubs and the potential of smaller electric aircraft to modernise costly regional fleets. However, beyond these applications, the industry continues to place orders for traditional aircraft, pinning hopes on alternative fuels to achieve decarbonisation without overhauling existing operational frameworks. In conclusion, new electric and hybrid-electric aircraft are crafting a narrative of a future where air travel is more in harmony with sustainability and accessibility principles, setting the stage for a revolutionary shift in how communities worldwide forge connections.

Photo by Shaun Darwood on Unsplash

Photo by Shaun Darwood on Unsplash

From the 132 companies that we identified in the electric aviation space, we’ve picked out eight trailblazers. Each is pioneering a distinct segment within electric flight and is worth watching over the next few years.

Ampaire, headquartered in California, is leading the charge in retrofitting small commuter and regional aircraft with hybridelectric powertrains. Holding the record for the longest hybrid-electric flight at 12 hours, Ampaire is on the cusp of commercialising its technology, aiming to launch its retrofitted aircraft within the next one to two years.

Source: Ampaire

Source: BETA

Cosmic Aerospace, a US-Belgian company, believes that you can get true range with electric aircraft. It intends for its 24-seat Skylark all-electric aircraft to be flying routes up to 1000 km - equivalent from Brussels to the North of Scotland or Norway - this decade.

Source: Eve Air Mobility

BETA is redefining the utility of small electric aircraft, catering to various applications, including medical, cargo, postal, and military operations. Its Alia aircraft, available in both eVTOL and standard electric configurations, achieved a milestone with the first international allelectric flight from Plattsburgh, New York, to Montreal, Canada.

Source: Cosmic Aerospace

Eve, an offshoot of aerospace giant Embraer, is focused on electric air taxis designed to serve both rural and urban areas. Norwegian airline Widerøe plans to deploy Eve's eVTOLs to connect the Norwegian mainland with its archipelago, while United Airlines is working with Eve on the potential for enhancing connectivity across the sprawling San Francisco Bay Area.

Heart Aerospace: Heart is developing the 30-seat hybrid-electric ES-30, and is a leader in this space. This is evidenced by Heart being one of only two non-eVTOL electric aircraft companies to have raised $100+ million. Airline partners see scope for Heart’s aircraft to do everything from electrifying feeder routes into hubs to revitalising regional airports with new connections.

Wright Electric targets the narrowbody market with ambitious plans to introduce hybrid-electric and, eventually, zeroemission solutions for airlines. Starting with the retrofit of the BAe146, dubbed the ‘Wright Spirit,’ the company aspires to cater to 100+ seat flights on routes approximately an hour long, with further plans to develop its own pioneering aircraft.

Electra's innovative approach with its nine-seat eSTOL aircraft, capable of landing in confined spaces like the Wall Street heliport, addresses many applications currently envisaged for eVTOLs. With an impressive 2,000 orders already placed, Electra's aircraft promise a new level of accessibility beyond traditional airport infrastructure.

Source: Heart Aerospace

Maeve from the Netherlands aims to transform regional aviation by introducing a hybrid-electric aircraft, the M80, capable of replacing 80-100-seat regional turboprops. With over 200 operators in 100+ countries flying ATR aircraft, the stalwart of regional aviation, the potential market for Maeve is vast. By providing an alternative that reduces carbon emissions, and lowers operating costs, Maeve hopes to present a compelling proposition for operators.

Source: Wright Electric

Source: Electra.aero Source: Maeve

CEO: Kevin Noertker

Based: Hawthorne, California

Developing: Hybrid-electric retrofits of existing aircraft, starting with the Cessna Grand Caravan

Founded: 2016 Website: ampaire.com

Ampaire wants to retrofit existing aircraft with hybrid-electric technology, eventually transitioning to designing new aircraft from the ground up.

The company's initial focus is on the Cessna Grand Caravan, a nine-seat turboprop that has been a staple in aviation since 1984, boasting certifications across more than 100 countries.

Ampaire has distinguished itself by achieving the longest flight of a hybridelectric aircraft, with its demonstrator flying for an unprecedented 12 hours. Kevin Noertker, the founder and CEO of Ampaire, advocates for the hybridelectric and retrofit approach as the most economical and rapid strategy as he believes going all-electric is, for now, too limiting.

Previous attempts to make the Caravan completely battery-powered resulted in the cabin being filled with batteries, leaving little room for passengers. Noertker calls such a setup “a wonderful demonstration of technology” but not a working and sellable product.

By focusing on hybrid-electric retrofits, Ampaire invests in existing technology with a certification path and does not require exorbitant costs or massive infrastructure upgrades.

Ampaire's immediate objective is to retrofit all 'Part 23' smaller aircraft. The transition to 'Part 25' commercial passenger aircraft presents a more formidable challenge due to the complexity and size of these larger aircraft.

Source: Ampaire

Here, Noertker pointed to ongoing research and innovation in battery and semiconductor technologies by leading institutions such as NASA and the U.S. Department of Energy as promising signs for the future.

Ampaire's collaborative efforts include partnerships with Monte, an aircraft leasing company, Azul Airlines from Brazil, and Loganair in Scotland, which views Ampaire's retrofits as a viable pathway to offering low and zero-carbon flights across the Highlands and Islands.

Note: In March 2024, as this report was going to press, Ampaire announced that it had acquired Magpie. We featured Magpie last year for its innovative solution of using a network of electric aircraft to 'tow' passenger planes through the skies.

CEO: Kyle Clark

Based: Vermont, NY State

Developing: The ALIA-250 (both electric aircraft (eCTOL) and eVTOL configurations)

Founded: 2017 Website: beta.team

BETA Technologies is developing aircraft that are capable of both electric vertical takeoff and landing (eVTOL) and electric conventional takeoff and landing (eCTOL).

The company's inaugural ALIA aircraft is engineered to perform both functions, boasting a 250-mile range and the capacity to transport five passengers and a pilot, all powered by electric motors.

In a landmark achievement in September 2023, BETA's ALIA-250 made history by completing the first international flight for a 100% electric aircraft, flying from Plattsburgh, NY, to Montreal.

BETA's strategic focus diverges from the conventional model of targeting frequent flyers looking to bypass urban congestion. Instead, the company prioritises delivering zero-carbon aviation solutions across a broad spectrum of applications, including cargo transport, medical passenger services, and military use.

Source: BETA

One notable partnership with United Therapeutics, a medical company needing efficient organ transportation solutions, resulted in a $48 million contract, demonstrating the transformative potential of BETA's electric aircraft in critical healthcare logistics. BETA has also actively advanced electric air mobility by participating in the United States Air Force Agility Prime program

Meanwhile, BETA has forged significant partnerships with industry giants such as UPS and Amazon, aiming to decarbonise their delivery networks. These collaborations highlight BETA's role in redefining logistics and delivery services for the future.

The company's innovations extend to the infrastructure supporting electric aircraft. BETA has announced a collaboration with eVTOL company Archer, aiming to establish a standardised charging network for electric aircraft, further enhancing the ecosystem for electric air mobility.

Air New Zealand stands out as BETA's major airline partner, with plans announced in 2023 to deploy BETA's ALIA aircraft for mail delivery services in remote areas of New Zealand starting in 2026, marking a significant step towards integrating electric aircraft into commercial aviation operations.

CEO: Christopher Chahine

Based: Denver, Colorado / St Truiden, Belgium

Developing: Skylark, a 24-seat all-electric aircraft

Founded: 2021 Website: cosmicaerospace.com

Cosmic Aerospace is developing the Skylark, a 24-seat all-electric aircraft boasting a range of 1000 kilometres poised for launch in 2029.

Emerging from stealth mode in 2023, Cosmic Aerospace has set an ambitious goal. Its website highlights potential routes from Brussels, Belgium, reaching as far as Scotland, Norway, and Northern Italy, showcasing the aircraft's capability to cover significant European distances.

CEO Christopher Chahine says Cosmic focuses on 1000km for a simple reason: “The value proposition of an aircraft is to travel long distances in a short amount of time.” As a result, he says, “We want to build an electric aircraft that can travel with real flight ranges.”

He asserts Cosmic Aerospace's commitment to creating an electric aircraft that fulfils this promise without necessitating breakthroughs in battery technology. The company is confident in the progress of 500 wh/kg batteries being developed by firms like CATL in China and Amprius in the USA, which CTO Marshall Gusman believes will meet their operational needs.

Gusman envisions the Skylark replacing existing regional jet and turboprop routes while exploring new electric aviation opportunities.

Despite being in the earlier stages of development relative to other entities in the electric aircraft industry, Cosmic Aerospace has demonstrated progress. After raising $1.5 million in pre-seed funding, the company announced in February 2024 that it had successfully secured an additional $4.5 million from investors, including the Swedish climate-tech fund Pale Blue Dot.

Source: Cosmic Aerospace

CEO: Johann Bordais

Based: Melbourne, Florida / São José dos Campos, Brazil

Developing: An eVTOL to be in service in 2026/2027

Founded: 2020 Website: eveairmobility.com

Eve's vision for eVTOLs extends far beyond shuttling the elite over congested urban areas to airport hubs.

eVTOLs are often criticised as luxury items for the affluent that consume valuable venture capital without significantly contributing to aviation decarbonisation. Eve Air Mobility, however, has emerged as a notable exception in our analysis.

For instance, Norwegian airline Widerøe has plans to deploy Eve's eVTOLs to enhance connectivity between the mainland and the scattered islands of Norway.

As highlighted by Andreas Aks, CEO of Widerøe Zero, in our book "Sustainability in the Air", the goal is not to bypass urban traffic but to serve the dispersed rural communities across Norway's islands, offering them a valuable transportation service.

Moreover, Eve is actively engaging in solutions for 'polycentric' cities, where economic zones are distributed throughout the urban landscape, such as Orlando and the San Francisco Bay Area. In June 2023, Eve signed a deal with United Airlines to explore the development of commuter routes in the Bay Area.

Eve has also entered into an agreement with Kenya Airways subsidiary Fahari Aviation to investigate the viability of eVTOLs in enhancing mobility across Kenyan routes lacking efficient public transport or road infrastructure.

Source: atc network

A significant factor in Eve's favour is its origin as a spinoff from Embraer, the Brazilian aircraft manufacturer known for its extensive experience in regional aircraft development, production, and launch. This heritage provides Eve unparalleled advantages, including cost reduction opportunities and access to Embraer's vast intellectual property and engineering expertise pool.

CEO: John Langford

Based: Falls Church, Virginia

Developing: A hybrid-electric ultra-short take-off and landing aircraft

Founded: 2020 Website: electra.aero

Slated for commercial release in 2028, Electra’s hybrid-electric eSTOL (electric short takeoff and landing) aircraft promises a range of 500 miles and the capability to land in areas no larger than a soccer field.

Source: Electra.aero

The vision of most electric air taxi makers is to ferry four passengers across short distances without the need for traditional airport facilities. But could a larger, ninepassenger aircraft fulfil similar urban and regional transport needs more efficiently?

Northern Virginia-based Electra believes the answer is yes. Its eSTOLs will be able to operate in densely populated urban environments such as the roof of the expansive Tysons Corner shopping centre near Washington D.C. or the Wall Street Heliport in Manhattan, eliminating the dependency on conventional airport infrastructure.

Electra's aircraft, therefore, not only match the versatility of eVTOLs in accessing city centres but also surpass them in passenger capacity and flight distance.

Electra's air mobility journey has already seen significant milestones, notably with the successful test flight of its 'Goldfinch' demonstrator aircraft from Manassas Regional Airport in Virginia last November.

As of January 2024, Electra has invited strong market interest, with the company's order book exceeding 2,000 aircraft. Among its prospective customers is Surf Air, an air mobility platform, which has expressed interest in acquiring up to 90 Electra aircraft for its regional operations, including those under Southern Airways Express.

JSX, another airline seeking to offer a private aviation experience, plans to integrate over 80 Electra aircraft into its service alongside models from Heart Aerospace and Aura, further indicating the industry's confidence in Electra's technology.

Electra is also at the forefront of exploring new frontiers in aviation technology. This includes conducting the inaugural flight of a solar-battery hybrid electric research aircraft.

Founded: 2018

CEO: Anders Forslund

Based: Gothenburg, Sweden

Developing: The ES-30, a 30-seat hybrid-electric regional aircraft

Website: heartaerospace.com

On his way to the Swedish Parliament to talk about electric aviation in early 2018, Anders Forslund has a memory that stands out.

“There was this high school student protesting about climate change outside," Anders says. "I thought it was pretty cool. But at the time, it was the sort of thing that didn’t go any further than the local news.”

That student was Greta Thunberg—and throughout 2018 and 2019, her influence started to spread far beyond Sweden. Her passion inspired a wave of similar youth-led climate protests worldwide.

Thunberg, famously, does not fly, but Anders Forslund has a very different idea about air travel, calling it “one of the most genius inventions in history.”

That’s why, with his wife Klara, he built a company to develop a completely new and environmentally sustainable aircraft that would emit no carbon dioxide, have a minimal noise footprint and be cheaper to operate than fossil fuel-based planes.

Initially, Heart worked on a 19-seat, allelectric plane called the ES-19. However, airline feedback and the need for more range and passenger capacity led to the company unveiling the hybrid-electric ES-30 at the company's bi-annual Hangar Day on September 15, 2022.

As the name suggests, the ES-30 will hold 30 passengers in a two-plus-one seating configuration. Initially, the range will be 400km, but the idea is that this is set to increase as battery technology improves. In terms of orders and certainly in terms of investment, Heart Aerospace is a clear leader. It’s one of only two non-eVTOL electric aircraft companies to have raised $100+ million. Heart’s latest funding round involved $107 million being injected into the company in a Series B round, including Bill Gates’s Breakthrough Energy Ventures. Other investors include Sagitta Ventures, Air Canada, European Innovation Council Fund, EQT Ventures, Lowercarbon Capital, Norrsken VC, United Airlines, and Y Combinator. Breakthrough Energy's involvement is noteworthy, as the fund sets a very high bar for its involvement.

Heart’s airline partners include United Airlines and Mesa Airlines, who want to operate the ES-30 on shorter regional flights. Other airline partners include JSX, Air Canada, SAS and Air New Zealand.

In our book, Sustainability in the Air, you can read more about Heart Aerospace and other innovators looking to decarbonise aviation.

Founded: 2020

CEO: Jan-Willem Heinen

Based: Delft, The Netherlands

Developing: M80, an 80+ seat hybrid-electric regional turboprop

Website: maeve.aero

By 2040, Maeave wants to have replaced enough fossil fuel-powered regional turboprops with its own aircraft to eliminate over 50MT of CO2 emissions, equivalent to removing 10.9 million cars from the roads annually or closing 14 coal plants for a year.

The aircraft designed to do that is the Maeve M80, a hybrid-electric aircraft with an 80+ passenger capacity and an 800 nautical mile range.

This would enable it to fly routes such as Brussels to Warsaw or Rome, offering operators a more than 20% lower seatmile cost compared to similar turboprops and the near-complete elimination of CO2 emissions when Power to Liquid (PtL) fuels are used for the turbine engine.

Crucially, this pits it against regional aircraft manufactured by companies like ATR, whose planes are in service with over 200 operators in 100 countries. As a result, the potential market for Maeve is vast.

Like a number of other electric aircraft companies, Maeve originally planned to develop an aircraft powered by batteries alone. At the end of last year, it decided to shift to the hybrid-electric M80 to better meet market demands for range and payload

According to CTIO Martin Nuesseler, “To my knowledge, there are currently no alternatives in development that are equally sustainable, cost-effective, and match the operational needs of airlines and airports. If there are, I would applaud them because we need more of these realistic solutions to become sustainable”.

Media reports say that Maeve is looking for investors but has already succeeded in tapping public funds, including €17.5 million from the European Union and raising over €3 million from private sources.

Source: Maeve

The M80 is slated for a 2031 service entry, with a preliminary design review by 2026, allowing extra time for product development. Maeve's expansion also includes a new innovation hub at Oberpfaffenhofen Airport in Bavaria.

CEO: Jeff Engler

Based: Malta, New York

Developing: The Wright Spirit, a retrofitted BAe146 regional jet

Founded: 2016 Website: weflywright.com

Wright Electric, one of the early pioneers of electric aviation, is developing The Wright Spirit, a hybrid-electric retrofit of the BAe 146 (also known as the Avro RJ), which is still operated by 40 airlines worldwide.

Pre-COVID, the company generated attention thanks to a series of announcements with European LCC easyJet. A 2017 Guardian article, for instance, ran with the headline, “easyJet says it could be flying electric planes within a decade.”

While past grand announcements about fossil-free aviation have more often than not resulted in nothing tangible, Wright Electric CEO Jeff Engler says that the company is indeed on track to have an aircraft certified this decade, the Wright Spirit.

The decision to start with the BAe 146 comes down to it being a tried and tested regional aviation workhorse and a way to start decarbonising the crucial 100+ seat aircraft segment, where the vast majority of industry emissions occur.

With the Wright Spirit, the company is initially targeting high-frequency routes of around an hour’s duration, such as Washington DC - New York or London - Amsterdam. There are a few reasons for this: the market opportunity, the decarbonisation potential, and the opportunity for growth.

Significant milestones and technological breakthroughs have marked Wright Electric's journey. At the 2023 Paris Air Show, the company celebrated achieving 1 Megawatt of shaft power with its aerospace electric motor generator. This achievement coincided with the launch of Wright Batteries, which aims to revolutionise the industry with a 1,000 Wh/ kg pack density. Developing such a battery would have benefits beyond aviation, with potential applications in trucking, shipping, and rail.

The company's long-term vision includes launching a clean-sheet aircraft, the Wright One, in the 2030s, with gradual expansions in range and capacity, moving from 60 minutes of flight to 90 and eventually 120 minutes.

Photo by Blake Verdoorn on Unsplash

Photo by Blake Verdoorn on Unsplash

Technological advancements, particularly in batteries, and substantial investment have transformed electric air travel from a fantasy into a feasible option for short-to-medium distance trips.

It will take several years for electric aviation to be widely adopted, as it requires expanded infrastructure and public support. However, we can draw parallels between the current state of electric aviation and the early days of cars, anticipating cost reductions and industry evolution that could revolutionise transportation.

Our market map provides an overview of the different areas within the electric aviation value chain, along with a directory of key providers.

At the forefront of electric aviation lies a group of companies that form the bedrock of this transformative industry. From revolutionary all-electric or hybrid-electric propulsion systems to cutting-edge battery technologies, each company plays a pivotal role in shaping the future of sustainable air travel.

Electric propulsion systems developed by these companies are not only reducing emissions but also revolutionising noise levels in aviation, offering quieter and more environmentally friendly flying experiences.

Founded: 2016

HQ: USA

ampaire.com

Founded: 1999

HQ: USA

baesystems.com

Founded: 2012

HQ: Germany

customcells.com

Founded: 2021

HQ: United Kingdom

evolito.aero

Founded: 1914

HQ: USA

aerospace.honeywell.com

Founded: 2008

HQ: USA

amprius.com

Founded: 2011

HQ: China

catl.com

Founded: 2016

HQ: USA

epsenergy.com

Founded: 2017

HQ: Switzerland

h55.ch

Founded: 1996

HQ: Germany

lange-aviation.com

Founded: 2017

HQ: USA

maglevaero.com

Founded: 2009

HQ: USA

magnix.aero

Propulsion Nidec Aerospace Safran

Founded: 2023

HQ: USA

acim.nidec.com

Founded: 2005

HQ: France

safran-group.com

Founded: 2017

HQ: USA

verdegoaero.com

Founded: 2016

HQ: USA

weflywright.com

Electric aircraft represent a paradigm shift in aviation, promising quieter and more efficient air transportation. With a diverse range of companies pioneering electric aircraft development, there are notable differences in design, capabilities, and target markets.

However, the success of this burgeoning industry depends on overcoming challenges such as battery technology advancements, regulatory approvals, and infrastructure development for charging and operations.

Did you know that the first electric-powered balloon flew in France in 1883, but it wasn't strong enough to move against the wind? And in 1916, Hungary developed the PKZ-1 helicopter with an electric motor, but it had to stay grounded.

Founded: 2020

HQ: China

Founded: 2010

HQ: Slovakia aerofugia.com aeromobil.com

Founded: 2020

HQ: USA aibot.ai

Founded: 1970

HQ: France

airbus.com

Founded: 2016

HQ: Australia

alauda.aero

Founded: 2018

HQ: USA

archer.com

Founded: 2017

HQ: Israel airev.aero

Founded: 2017

HQ: Turkey

aircar.aero

Founded: 2017

HQ: United Kingdom

arcaerosystems.com

Founded: 2018

HQ: USA

flyastro.com

ASX AURA AERO

Founded: 2011

HQ: USA

iflyasx.com

Founded: 2018

HQ: France

aura-aero.com

Founded: 1989

HQ: USA

aurora.aero

Founded: 2017

HQ: United Kingdom autonomousflight.com

Bellwether Industries

Founded: 2019

HQ: United Kingdom bellwether-industries.com

Founded: 2005

HQ: United Kingdom

Founded: 2017

HQ: China

autoflight.com

Founded: 2022

HQ: India beeflights.com

Founded: 2017

HQ: USA blackkestrel.com

beta.team

Founded: 2021

HQ: Netherlands

cormorant.aero

Founded: 2019

HQ: Spain

crisalion.com

Founded: 2007

HQ: USA

byearospace.com

Founded: 2021

HQ: USA

cosmicaerospace.com

Founded: 2018

HQ: Spain

danteaeron.com

Founded: 2016

HQ: Austria

deepblueaviation.com

Founded: 2017

HQ: Switzerland dronetechuav.com

Founded: 1973

HQ: Germany

dg-flugzeugbau.de

Founded: 2019

HQ: France

eenuee.com

Founded: 2014

HQ: China

ehang.com

Founded: 2021

HQ: Netherlands flyelectron.eu

Founded: 2016

HQ: USA

elroyair.com

Founded: 2018

HQ: Germany

emagic-aircraft.com

Founded: 2016

HQ: United Arab Emirates

enata.com

Founded: 2020

HQ: USA

electra.aero

Founded: 2018

HQ: Norway el-fly.no

Founded: 2023

HQ: Netherlands

elysianaircraft.com

Founded: 2021

HQ: Germany

emotion-aircraft.com

Founded: 2009

HQ: Norway

equatoraircraft.com

Founded: 2020

HQ: Brazil

eveairmobility.com

Founded: 2014

HQ: United Kingdom

faradair.com

Founded: 2017

HQ: Indonesia

frogs.id

Founded: 2016

HQ: USA

hopflyt.com

Founded: 2015

HQ: USA

hoversurf.com

Founded: 2019

HQ: USA

jauntairmobility.com

Founded: 2017

HQ: USA

jetson.com

Founded: 2015

HQ: USA

eviation.com

Founded: 2019

HQ: Germany

flynow-aviation.com

Founded: 2018

HQ: Sweden

heartaerospace.com

Horizon Aircraft

Founded: 2013

HQ: Canada

horizonaircraft.com

Founded: 2013

HQ: Mexico

imago.aero

Founded: 2021

HQ: Switzerland

jekta.swiss

Founded: 2009

HQ: USA

jobyaviation.com

Founded: 2019

HQ: USA

jumpaero.com

Kelekona

Founded: 2016

HQ: USA

kelekona.com

Founded: 2020

HQ: USA

leoflight.com

Lilium

Founded: 2015

HQ: Germany

lilium.com

Maeve

Founded: 2020

HQ: Netherlands

maeve.aero

Founded: 2020

HQ: Italy

mantaaircraft.com

Katla Aero

Founded: 2019

HQ: Sweden

katla.aero

MuYu Aero

Founded: 2018

HQ: China

evtol.news/muyu-evtol

KORI Korea Aerospace Research Institute

Founded: 2019

HQ: South Korea kari.re.kr

Founded: 2017

HQ: USA

liftaricraft.com

Lyte Aviation

Founded: 2022

HQ: United Kingdom lyteaviation.com

Magpie Aviation

Founded: 2022

HQ: USA

Moog Inc

Founded: 1951

HQ: USA

moog.com

NEO Aeronautics

Founded: 2018

HQ: Singapore

magpieaviation.com neo-aeronautics.com

Founded: 2021

HQ: Germany

nex.aero

Overair

Founded: 2019

HQ: USA

overair.com

Paragon Vtol Aerospace

Founded: 2018

HQ: USA

paragonvtol.com

Pivotal

Founded: 2016

HQ: USA

pivotal.aero

PteroDynamics

Founded: 2017

HQ: USA

pterodynamics.com

Founded: 2021

HQ: USA

ryseaerotech.com

Founded: 2021

HQ: Germany

sirenaerospace.com

Founded: 2019

HQ: USA

odysaviation.com

Pantuo Aviation

Founded: 2019

HQ: China

pantuo.mobi

Pipistrel

Founded: 1989

HQ: Slovenia

pipistrel-aircraft.com

PLANA

Founded: 2021

HQ: South Korea

plana.aero

Pyka

Founded: 2017

HQ: USA

flypyka.com

Founded: 2022

HQ: USA

seaflight.tech

Founded: 2021

HQ: Switzerland

siriusjet.com

Founded: 2018