Every year since 2010, SimpliFlying has surveyed airline executives globally to get their feedback on the present and the future of social media in the industry. This year, 166 airline executives from 78 airlines across the world participated in our annual survey, making it our largest research efort till date. The Airline Social Media Outlook Report 201516 draws insights from these responses.

The objective of this report is to help airlines stay abreast of the latest trends, benchmark against competition and adapt for the future. This involves identifying the driving force behind these trends and suggesting best practices to adapt to them.

Here are the four key trends for 2015-16:

I. The link between social media and airline business goals has grown stronger — with customer service emerging as one of the top priorities.

II. Organisational structures have evolved in favour of a Distributed Team model, despite higher satisfaction scores from Dedicated Teams.

III. There is a disconnect between the Senior and the Middle level airline executives about the challenges and the potential of social media. Middle managers need to be empowered.

IV. Business goals and challenges vary substantially between regions.

As social media becomes increasingly important for airlines, this report ofers key insights and recommendations on how to evolve and benefit from the latest trends, while staying ahead of the competition.

There is a greater focus on driving core business goals from social media, and customer service has emerged as the top priority: Airline executives wish to drive an increasing number of business goals using social media. Customer service, loyalty and ancillary revenues have each grown significantly as one of the top priorities. This is particularly true of providing customer service via social media, which has become the top priority for 88.5% of airline executives (edging past Brand Awareness).

Dedicated teams are the most successful, but distributed most popular: Dedicated teams received a 100% satisfaction score. However, the most used team structure—distributed—reported a 59% satisfaction score, despite being used by 63% of the respondents.

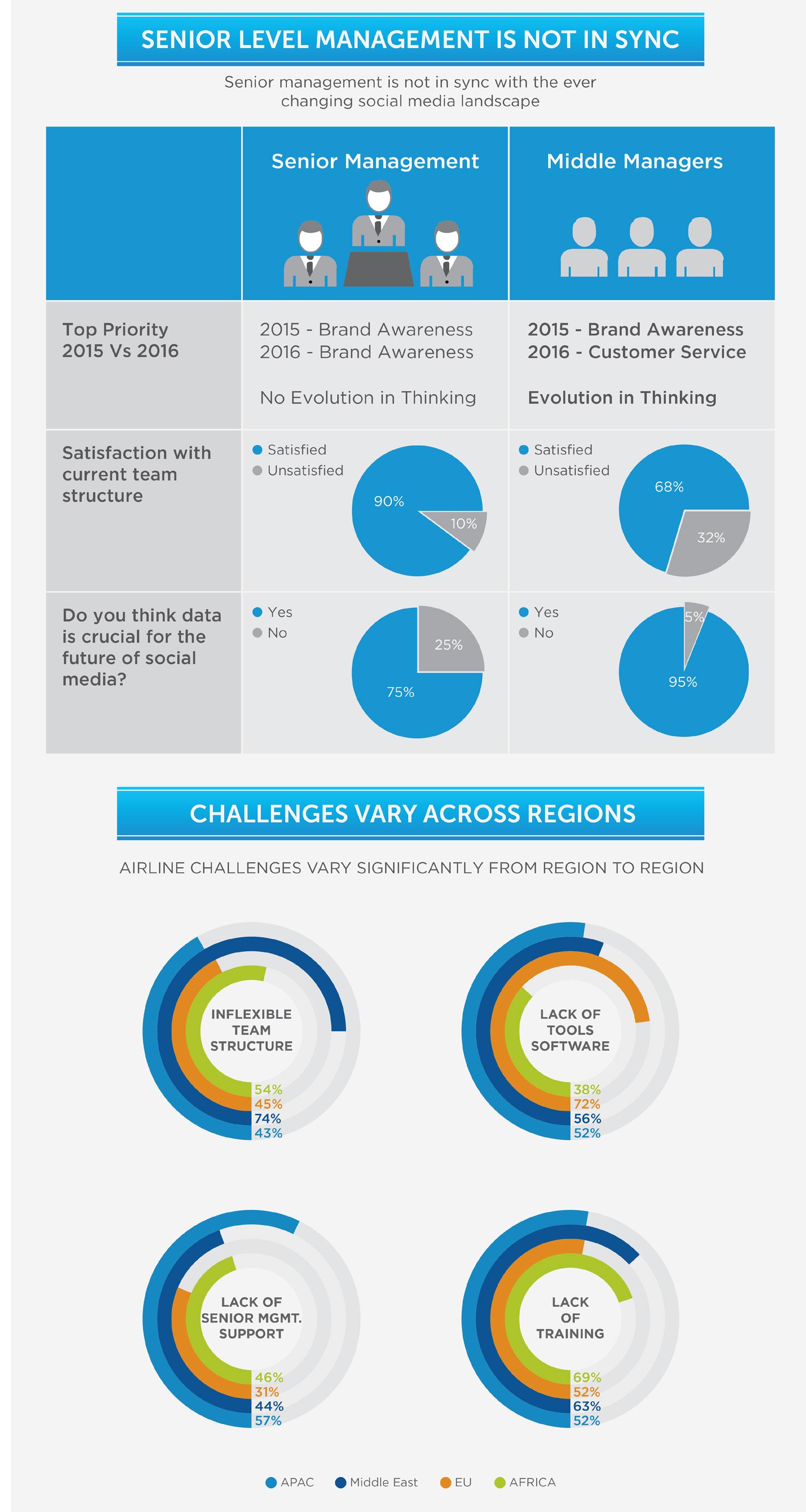

Senior management is not in sync with the ever changing needs and potential of social media: There appears to be a gap between the priorities, preferred team structure and optimism of the senior level and middle level management.

Priorities for airlines vary across regions: Regional diferences in terms of priorities and challenges are quite stark. 75% of Middle Eastern airlines recognise inflexibility of team structures as the top challenge whereas only 43% of airline executives in Asia Pacific (APAC) felt the same. Similarly, driving loyalty using social media was a priority for 88.5% of middle eastern airlines but only for 55% of European ones.

Advertising spend is driving budgetary increase: Only 71% of airlines expect social budgets to increase or remian the same in 2015-16. Of these, 50% expect budgets to be increased for advertising. 25% expect it to go towards acquisition of new tools and 25% towards team expansion.

– Driving revenues, loyalty and delivering better customer service have emerged as the top priorities for airlines in 2015-16

– Providing customer service via social media has become the top priority for airlines globally

– There is an alarming fall in the importance of efective crisis management using social media

– Focus on data is playing a key role in driving greater efciency across diferent social media functions — ranging from consumer insights to new product strategies.

The use of social media by airlines has matured tremendously over the past couple of years. Social media teams are now expected to drive a greater number of business goals, each of which is significant and sophisticated in its own right. In the past, driving brand awareness was considered enough. However, the focus has now shifted to core business goals such as revenues, loyalty and customer service.

The outlook survey 2015-16 reveals the increased focus on core business goals.

Customer Service : In last year’s survey, customer service finished 15% behind brand awareness as the top focus of airlines. This year, however, customer service has emerged as the top priority for airlines. This is a clear indication that social media is more than just a marketing tool now. Airlines realise the importance of two -way communication in the age of the connected traveler, and the impact on brand good social customer service can have.

Driving Ancillary Revenues: The biggest jump has been in driving ancillary revenues. In 2014-15 only 17% of the airline executives listed it as one of the top three priorities. In 2015-16 this number jumped to 39%, registering a 129% rise in preference.

Driving Loyalty: The focus on driving loyalty this year is a sign of social media coming of age. 71% of airline executives now understand that driving loyalty using social media is a top priority. This number is up by 54% from 2014-15. This trend is most prominent in the Middle East where driving loyalty emerged as the top priority for airline executives.

Despite substantially increased focus on driving loyalty and revenues, the biggest shift is in the rise of customer service as the top priority for airlines. Airline executives have realised that in the age of the connected traveller, passengers expect real-time responses from airlines, via the medium they are contacted through. Filling out forms; waiting endlessly on phone lines; receiving responses after days are no longer acceptable communication means. Today’s traveller expects a response within minutes. Social media has shifted power in the hands of the customers.

Interestingly, this change is most felt by people in the marketing department. Over 76% of all marketing executives chose customer service as their top priority for 2015-16, an increase of 40% from last year. Brand awareness is no longer the top priority, as the impact of delivering good customer service on the brand perception is recognised.

Only 54% and 48% of marketing and corporate communications executives, respectively, rated driving brand awareness as a top priority for 2015-16.

It is a similar story across diferent levels of management, with a slight twist. While the middle and junior level management is in sync with this trend, senior management seem to have missed the trend and continue to rate brand awareness as their top priority (for more, see Section 3).

One intriguing trend is the decline in the importance of crisis management through social media. This could be due to multiple reasons:

1. Lack of understanding within the corporate communications department, especially since it usually has a say in handling and managing crisis responses. Our survey shows that the Corporate Communications department tends to be a bit detached from (or even unaware of) social media and its potential (see Chart 1). Hence, there is a need to have specialised crisis management training sessions for the corporate communications teams to unleash their full potential.

2. Traditional airline silos hinder integration of social media in times of a crisis. While Corporate Communications and the Operations teams take charge when things go wrong, social media is often an afterthought, as a subset of Marketing or eCommerce departments.

3. Lack of relevant training for the middle and lower level airline executives, leaving them unprepared and lacking in confidence to handle crises situations.

4. Some airlines feel social media is not appropriate in a crisis situation, which is primarily useful for marketing.

As recent airline incidents and accidents show, social media plays a critical role in times of an airline crisis. Airlines need to prepare for this reality better, rather than react when something goes wrong.

With the increasing sophistication of business goals they are expected to pursue, airline social media teams have started to focus on efciency. One of the key focus areas has been much improved use of data.

Social media is fast becoming an important source to derive consumer insights. 71% of respondents currently use social media data to derive consumer insights, as compared to 44% last year. These consumer insights include demographics, locations and behaviours reflected in social media data. Facebook has emerged as the platform of choice for mining data.

Social media is a great channel to get customer feedback. 55% of the airline executives realise this and have consequently used social data to derive new product strategies. This includes analysing customer feedback and sentiment, and a data analysis of reactions to various product campaigns on diferent social media platforms. For this purpose, Facebook continues to be the data source of choice for 71% of the respondents.

The rise of customer service (see previous section) has triggered an equal rise in use of data to improve customer service performance. Metrics such as Average Reply Time (47%) and Percentage of Queries answered (52%) are favoured by airline executives. Moreover, the executives who see this as vital has gone up by 37%.

This shift towards greater efciency points us towards three major insights:

Social media is increasingly becoming a specialist’s job. This is reflected in the increased usage of data for customer segmenting and deriving new product strategies.

What gets measured gets improved, and the usage of data and data mining software has ushered in an era of social efciency.

The biggest sign of a data driven future is a sharp 50% decline in the number of participants who do not use social media data for anything. This should be a clear indication to airlines to dive into available data and to try and acquire new data using sophisticated listening/analytics tools.

– Dedicated teams have a satisfaction score of 100% compared to 59% for distributed teams.

– External agencies outperform distributed teams in terms of employee satisfaction.

– There is a strong positive correlation (0.513) between having a desirable team structure and being satisfied with one’s annual performance.

Team structures are immensely important for both employee satisfaction and for achieving objectives. The Outlook Survey 2015-16 found a positive correlation of +0.513 between having the desired team structure and employee satisfaction. Hence, the happier the airline executives are with their team structure, the more satisfied they are with their performance. Surprisingly, the most desired team structure is not the most prevalent — and this should be cause for concern.

Currently, distributed teams appear to be the norm across the industry. They are easier and cheaper to organise, and consequently the preferred choice at most airlines. However as social media gets more deeply linked with core business objectives, distributed teams are becoming less useful by the day.

Dedicated teams are prevalent at only 25% of all airlines surveyed, down by 26% compared to last year. However, they have a perfect 100% satisfaction rating from the employees who work in such teams.

On the other hand, only 59% of airline professionals working in distributed teams are happy with their team structure. They feel constrained by resources and find such a team structure inefcient. This is particularly worrying since the percentage of distributed teams has gone up to 63% compared to 45% last year.

This reflects a disconnect between the top management and lower level management. Moreover, the ideal team structure according to the senior level management as compared to what the middle and the junior level management think are diferent.

One way of working around this challenge is to have joint training and brainstorming sessions. Such sessions can help align the priorities at each management level and help airlines make the most of the opportunities present.

For airlines with limited budgets, having an external team or an agency manage social media can be a better way to manage social media rather than with a distributed team. Airlines in the early stages of social media adoption have very focused goals. For such limited purposes, an external agency or a third party can be very useful. There is an increase of 44% in the percentage of airlines that employ agencies or third parties to implement their social media strategy. 75% of the respondents who used agencies or external teams to manage their social media strategy are satisfied with their performance. This is 16% higher than the satisfaction score from distributed teams.

As mentioned earlier, there is a disconnect between what structure works best for airlines and what they have in place. Much of this is often because of interdepartmental diferences. Diferent departments might want to influence the social media function diferently. This leads to fragmented and inefective distributed teams.

The best way to resolve this challenge is to spread awareness among diferent teams and to build consensus regarding the importance and the future of social media. This initiative needs to be led by the senior management, who need to share the vision of a dedicated social media team and what it can achieve.

Teams which consist of people from various departments working part time on social media are called Distributed Teams

Advantages

Multiple specialisation

Less resource intensive

Disadvantages

Low Employee satisfaction

Low adaptability

Low performance

Not suitable to any organisation with a strategic social media vision.

Teams where all the members are dedicatedly working on social media only are called Dedicated Teams.

Advantages

Multiple specialisation

Internal alignment of vision

High responsiveness

High employee satisfaction

Required for sophisticated

social media usage

Disadvantages

Capital intensive

Highly recommended to all businesses

When an organisation follows a narrow set objectives, it might choose to hire an agency or an external team to drive that objectives.

Advantages

Advantages

Less resource intensive

High Adaptability

High employee satisfaction

Disadvantages

Lack of organisational alignment

Lack of cross functional capabilities

Recommended for businesses that do not have multiple goals from social media

– Insufcient allocation of resources, lack of training and lack of tools are the top three challenges faced by airlines.

– The middle level management was found to be much more in touch with the ground realities than the senior management.

– Joint training sessions for senior and middle level management was found to be instrumental for improved future performance.

For social media to realise its true potential, the senior management must lead the way. However it seems the senior management is out of touch with the ever-changing social media landscape and its realities.

The lack of support for social media teams from an airline’s leadership is reflected in the fact that the top challenges that most airlines face would go away with an increased backing of the senior management.

Insufcient allocation of resources continues to be the top challenge that airlines face. 74% of all executives felt this problem compared to 59% last year.

However, the most prevalent demand this year is for more training. 47% more executives believe that lack of training is one of the foremost challenges facing them. Airline executives believe they need more training to deal with the rapidly evolving social media space, something they haven’t received senior management’s support for.

In fact, the number of airline executives who feel that the lack of senior management support is a major challenge has increased by 24%.

One of the key insights from the Outlook Survey 2015-16 is the need to empower the middle level management. This is because the middle level management is close to the ground realities while being distant enough to maintain a strategic outlook. This is best represented by the fact that 20% more middle level management, compared to top level management, recognise data and its analysis as a top priority. In a data driven future of social media (see Chart x), deriving value out of data is critical.

In addition to this, the middle level management is in sync with the needs of the connected traveler. The middle and junior level management have listed customer service as their top priority in 201516, unlike the senior management who have listed brand awareness as their top preference. It is important to note that teams across diferent departments agree customer service is the top priority for the next year.

Additionally, the distance between the senior and the middle level management shows in their satisfaction with the current team structure. 90% of all senior level management were happy with the current team structure. However, just 69% of the middle and junior level management shared their enthusiasm about existing team structures.

– Middle Eastern airlines are grappling with challenges brought about by their rapid expansion. Hence, inflexible team structure is the biggest concern in middle east

– European airlines, which have matured in terms of their social strategy, have begun shifting focus on driving revenues using social.

There are ample diferences in the way people use social media across the world. In some parts of the world contacting individuals over social media might be against the culture. In others, being too formal during communication might give the impression of being opaque. These cultural diferences and diferent user social media usage patterns have a major impact on the goals airlines in diferent regions drive using social media.

The trend of customer service being the top priority prevails across the world except in the Middle East, where driving loyalty is the biggest objective for 87.5% of social media teams, jumping by 55% over last year. This is primarily because airlines in the Middle East are some of the most rapidly growing airlines in the world today. Therefore, the need to engage a larger customer base has come along with the need to retain them, and social media is expected to play a big role in that by driving loyalty.

Inflexibility of team structures is faced by 75% of airlines in the Middle East. This is 20% higher than any other region. It would be useful for managers at airlines in the Middle East to have a look at Section 3.2 of our report, which ofers suggestions on how airline executives can choose the most optimal team structure to tackle this challenge.

Note: Data from the Americas was insignificant to differentiate between the challenges.

European airlines seem to be on a much more organic social media growth trajectory. After evolving from brand awareness to customer service as their top priority, they have shifted their focus on driving ancillary revenues from social media. EU based airlines registered 50% growth in their preference for driving revenues using social.

Note: Data from the Americas was insignificant to differentiate between the challenges.

Lack of tools or software is a challenge most encountered by European airlines. This is over 20% higher than faced by airlines in any other region, emphasising the fact that European airlines are often ahead in the social media curve. Their focus on data and listening tools coupled with a rise in importance of customer service has fuelled this demand for newer tools. Indeed, this is a classic representation of an increased focus on social media efciency detailed in Section 2.4.

Note: Data from the Americas was insignificant to differentiate between the challenges.

Airlines in each region have much to learn from the challenges and objectives that face marketers in diferent regions of the world. If airline managers in the middle east recognise that if Europeans airlines, traditionally stronger on social, are investing more in listening and analytics tools, then they would do well to bring in analytics tools earlier in their social media adoption curve to jump ahead of global competition.

Note: Data from the Americas was insignificant to differentiate between the challenges.

Note: Data from the Americas was insignificant to differentiate between the challenges.

Based on the key trends identified in the report, consider the following actions you can take to best tackle the challenges at hand.

Customer Service is the top priority for airlines across the world, yet few know how to tackle it well.

Set up dedicated social media teams that focus on customer service.

Connect social customer service team better with other functions of the airlines in order to put out prompt and accurate information.

Invest in listening and social customer service tools and platforms.

The gap between the senior and middle level management needs to be bridged for an effective social media strategy.

Social media is a fast changing space. Therefore the senior management must have bi-annual training sessions that help them remain updated about the latest trends and opportunities for airline social media industry.

Joint training sessions for the senior and middle level management will be extremely useful to come out with a shared vision for social media strategy.

Dedicated teams are most productive whereas a distributed team is the easiest to establish, and airlines are split between these choices.

All airlines must strive to have a dedicated social media team. They can start with as little as a dedicated social media employee and empowering him/her via access to various departments.

In case of a narrow focus, like marketing, hiring an agency to do the work might prove to be much more satisfactory than having a distributed team.

Conduct an internal audit that helps you understand the possible need and scope of social media within your company, so that you can organise your teams accordingly.

List of participant

1.

2.

3.

4.

5.

8.

75. Virgin America

76. Virgin Atlantic

77. Vistara

78. Yemenia

1. Air Promotion Group

2. Airbiz

3. Analyse Digital Business Solutions Pvt Ltd

4. ASIG

5. ASL Aviation

6. ATN

7. Aviation Performance Consultants

8. Bartozzi

9. Black Diamond

10. Blue Temple Impex Ld

11. BrandSultan

12. Bright World Travel

13. Cabin Crew Center

14. Dnata

15. En Route International

16. Fedex

17. Gartner

18. GICAS

19. Global OnBoard Partners

20. Graciella Trvl Consult

21. Havas Media Group

22. IATA

23. Journey9 UK Ltd

24. KBC Associates, LLC

25. KPMG

26. Lake Zone Charter Services Ltd

27. MediaCom

28. Ramco Systems

29. Roomandmore

30. Royal Media

32. SITA OnAir

33. Social Marketing People

34. SPQR AvioConsult

Download the hi-res infographic from bit.ly/AirlineSM2016