by

by

For over 18 years, SimpliFlying has been a trusted partner to over 125 airlines, airports, and technology firms worldwide. We have been on a mission to help build trust in aviation. To empower the industry to soar to new heights through digitalisation, innovation, and a steadfast commitment to sustainability.

We're not just sought after strategy consultants, we are passionate advocates for meaningful change. Headquartered in Singapore, our global team based out of Canada, India, Spain and the UK is dedicated to equipping aviation and technology executives with the tools, insights, and strategies needed to navigate the complexities of sustainable aviation.

From major airlines and airports to aircraft manufacturers and travel technology companies, our extensive client base underscores our reputation as a trusted partner in the aviation industry since 2008.

At SimpliFlying, we're committed to helping you navigate the complexities of sustainable aviation and thrive in an ever-changing landscape.

Here are some ways we can help you in your sustainability journey:

Connect sustainable tech startups with investors and industry

SimpliFlying Immersions pioneer a new era of real-life connections through immersive experiences, deep learning, and cutting-edge innovation exchange. We do this by facilitating site visits and bringing aviation leaders to startup facilities to offer a platform for tangible collaborations to take shape.

Discover the next wave of sustainable travel technology

The SimpliFlying Launchpad brings ready-to-scale technologies that can help accelerate sustainable travel to decision-makers in aviation. We curate the best startups and scaleups, help them build an aviation-specific brand strategy, and introduce them to airlines and airports ready to put a pilot in place.

Share your vision with a global audience

Like 80+ other CxOs in the industry, enlist your CEO or Head of Sustainability to be interviewed by Shashank Nigam. Share your vision for the future of travel on the world’s best-known sustainable aviation podcast "Sustainability in the Air". Find out more on becoming a partner.

Grow your brand in aviation

SimpliFlying has helped a multitude of technology firms scale up in aviation – from launching an airplane to marketing an Airbus A380 engine. We can help you amplify your brand and help build awareness with key decision-makers.

Stay informed, stay ahead

We deliver in-depth monthly or quarterly briefings to the senior leadership teams on a topic/issue of your choosing. You can also sign up for a series of briefings that cover key aspects of the present and future of sustainable aviation.

The re-election of Donald Trump as US President in 2024 and his subsequent moves to withdraw from the Paris Agreement and freeze climate spending have sent shockwaves through the world. Within hours of taking office in January 2025, Trump signed an executive order on “Unleashing American Energy” that included pausing funding from key climate initiatives and declaring a national energy “emergency”. This dramatic policy shift has raised questions about the future of sustainable aviation, particularly given America’s outsized influence on global aviation and its position as the world’s secondlargest carbon emitter.

However, a deeper analysis suggests that the transition to sustainable aviation is likely to continue largely unaffected by US federal policy changes.

In fact, the resulting redistribution of leadership and investment could accelerate innovation and deployment of sustainable aviation technologies in other regions, while still providing opportunities for American companies to thrive in an increasingly global market.

This resilience stems from several key factors:

• First, the aviation industry's commitment to sustainability extends far beyond US borders, with the International Civil Aviation Organisation (ICAO) and its member states maintaining their commitment to achieving net-zero carbon emissions by 2050.

• Second, market forces and private sector momentum have reached a tipping point where clean aviation technologies are increasingly costcompetitive with traditional options.

• Third, aviation’s growth regions –particularly Asia-Pacific, Europe, and the Middle East – are stepping up with ambitious policies and investments in sustainable aviation.

Source: RONEDYA/Shutterstock

The lessons from Trump's first term (2017-2021) are instructive. During that period, the US also withdrew from the Paris Agreement, yet global investment in clean energy technologies accelerated, costs declined faster than predicted, and many US states and companies maintained or increased their climate commitments. The same dynamics are likely to play out in the sustainable aviation sector, but with even greater momentum given technological advances and market maturity.

Source: MIT Technology Review

This report examines these dynamics in detail, analysing the shifting landscape of sustainable aviation leadership, the market forces driving continued progress, and the opportunities that remain for US businesses. It concludes with practical recommendations for industry players and policymakers navigating this complex transition.

While US federal policy shifts may create temporary turbulence, the flight path toward sustainable aviation remains clear. The question is no longer whether the industry will transform but rather which regions and companies will lead this transformation – and how US stakeholders can position themselves in this new reality.

Ayushi Badola Sustainability Specialist, SimpliFlying ayushi@simpliflying.com

While supportive government regulations in the US, like the Inflation Reduction Act (IRA), have been instrumental in kick-starting the transition to sustainable aviation, market fundamentals are increasingly taking the lead. The regulatory framework has already set in motion a series of developments, and key market forces are now driving continued progress.

This section explores the key market forces that are shaping the sustainable aviation landscape, highlighting the investment trends, private sector momentum, and investor pressure that are driving the industry towards a greener future.

Global investment patterns reveal a decisive shift toward clean energy and sustainable transportation technologies. Perhaps most significantly, clean energy investment has now overtaken fossil fuel investment globally. This represents a crucial tipping point in the energy transition, with implications far beyond the immediate aviation sector.

The sustainable aviation sector has seen particularly strong investment growth, with investors recognising the long-term value proposition of sustainable aviation technologies. For instance, in 2024 alone, companies like Archer Aviation raised $430 million through equity offerings, while ZeroAvia secured $150 million in Series C financing.

Source: ZeroAvia

The influx of capital is especially notable in the development of SAF production, especially e-fuel startups like Infinium and Twelve. Infinium recently secured significant funding, including over $200 million from Brookfield Asset Management for its Project Roadrunner in West Texas, with up to $850 million more for global projects. Meanwhile, Twelve raised $645 million, including $400 million from TPG Rise Climate.

The scale of investment extends beyond individual companies to entire regions and sectors. Saudi Arabia, for instance, has shifted its investment strategy, with a growing focus on clean energy and sustainable initiatives.

Corporate commitments to sustainability have become a crucial driver of market development. Major airlines have maintained their climate commitments despite political uncertainty. Delta Air Lines, for instance, explicitly reaffirmed its commitment to net zero emissions following Trump’s election, stating that the airline remains committed to “net zero emissions by 2050 because it’s good for business, our people and the planet.”

Corporate travel policies are increasingly incorporating sustainability requirements. Large companies are setting strict emissions reduction targets that include their business travel footprint, creating demand for lower-emission flight options regardless of regulatory requirements. This corporate demand is driving airlines to maintain their sustainability commitments even in the absence of government mandates.

SAF currently carries a price premium of 3-5 times that of conventional jet fuel, with production costs varying significantly depending on the technology used. However, projections suggest that this premium could decrease through economies of scale and technological advancements, which would require significant investments.

Power-to-liquid (PtL) technology shows promising cost reduction potential as the cost of green hydrogen production is falling faster than expected, supported by a significant increase in global electrolyser capacity, particularly in China. Additionally, the growth of renewable energy capacity, particularly solar and wind power, is further driving down the cost of green hydrogen production, as electrolyzers benefit from cheaper, abundant electricity. This is part of the broader expansion of the global green technology and sustainability market, which is projected to reach USD 29.0 billion by the end of 2024 and grow to USD 193.9 billion by 2033, at a compound annual growth rate (CAGR) of 23.5%.

Global Green Technology & Sustainabilty Market by Component 2024-2033

Similar cost improvements are being seen in electric aviation technologies. The rapid advancement of battery technology, driven largely by the automotive sector, is making electric aviation increasingly viable for short-haul routes, though aviation battery costs remain higher due to stricter performance requirements and lower production volumes.

These trends suggest that while sustainable aviation technologies face significant challenges – particularly in terms of infrastructure and higher initial costs – they are progressively becoming more competitive. As technological advancements continue and production scales up, the cost premiums for SAF, hydrogen, and aviation batteries are likely to narrow down.

Global aviation’s inherently international nature means that companies must meet the highest applicable standards to maintain market access. Even if the US federal requirements are relaxed, American manufacturers and airlines must still comply with international standards to operate globally. The EU’s comprehensive regulatory framework, for example, including the ReFuelEU Aviation initiative, effectively sets a de facto global standard that manufacturers cannot ignore if they wish to maintain access to key markets.

The buildout of sustainable aviation infrastructure is creating powerful network effects that will be difficult to reverse. Airports worldwide are investing in SAF storage and distribution facilities, electric charging infrastructure, and hydrogen fuelling capabilities. These investments create long-term incentives for continued progress in sustainable aviation, regardless of short-term policy changes in any single country.

Such development of sustainable aviation infrastructure is particularly notable in key global aviation hubs. The UAE has announced comprehensive plans to support SAF production and distribution, while Japan has committed to significant hydrogen infrastructure development as part of its aviation strategy. These investments are likely to create a network of sustainability-enabled hubs that will be crucial for the industry’s transformation. The economic opportunities are estimated

Source: Shell Aviation

to be significant – the UK’s domestic SAF production alone is projected to add £1.8 billion to the economy and create around 10,000 jobs.

Moreover, Singapore’s recent mandate, which requires all flights departing from the country to use SAF starting in 2026, highlights the role of infrastructure investments and policy measures in key aviation hubs in driving global change.

While market forces drive progress, policy uncertainty does create challenges. Scaling sustainable aviation technologies takes time due to long development cycles, certification processes, and infrastructure needs. As a result, costs remain high, making supportive policies key to faster adoption.

However, the market has found ways to navigate this uncertainty. For example, the book-and-claim model for SAF allows airlines to benefit from sustainable fuel even without direct access, offering flexibility in meeting sustainability commitments. Looking ahead, market forces are likely to become even more important drivers of sustainable aviation. As technology costs continue to decline and corporate sustainability commitments strengthen, the business case for sustainable aviation will become increasingly compelling.

Airport infrastructure requirements are emerging as a crucial market driver. Airports must now plan for multiple energy types coexisting: conventional jet fuel, sustainable aviation fuel, hydrogen for aircraft and ground equipment, and high-power electrical charging systems for electric aircraft. The development of airport microgrids is becoming increasingly important as

electric aircraft and ground service equipment increase electricity demands. These systems can enhance energy resilience while reducing operational costs, creating new value streams for airport operators and utilities. Pittsburgh International Airport demonstrates this potential, becoming the world’s first major airport to operate completely off the grid.

Long-term planning horizons for airport infrastructure (typically 20 years) mean that investment decisions being made now will shape the market for sustainable aviation technologies well into the future. This is creating early-mover advantages for companies that can position themselves within these emerging infrastructure requirements.

PIT’s approach to integrating multiple energy types reflects this strategy. As CEO Christina Cassotis explains in an interview on Simpliflying's podcast Sustainability in the Air:

“When we talk about hydrogen, we ask, 'What are its uses?' One area I’m particularly interested in is alternative fuels for ground support vehicles. While I’m all for electric, it’s not always the right fit. For example, you wouldn’t want an electric snow plow, but hydrogen-powered snow plows are an intriguing option. We see ourselves as a hydrogen hub in many ways. We already have public transportation buses that come to the airport, so we’re exploring the use cases we can test and deploy right here.”

Despite the shifting policies sending shockwaves through the world, significant business opportunities remain for American companies in the sustainable aviation sector. Strong state-level initiatives, sustained private sector commitments, and growing global demand for sustainable aviation technologies continue to drive progress.

The resilience of the US sustainable aviation sector, particularly at the state and private sector levels, suggests that federal policy changes may have less impact than initially feared.

Paradoxically, many Republican-led states have become centres of sustainable aviation development, driven by economic rather than environmental considerations. According to Goldman Sachs Research, Republican districts have received 85% of clean energy investments and 68% of jobs created under recent federal initiatives. This trend extends to sustainable aviation, with states like Texas emerging as leaders in SAF production and infrastructure development.

Total actual clean investment by state

Q3 2022-12 2024, share of state GDP

Source: Tallying the Two-Year Impact of the Inflation Reduction Act (Rhodium Group/MIT-CEEPR Clean Investment Monitor, August 2024)

For instance, Pathway Energy is developing a major SAF facility in Port Arthur, Texas, partnering with Drax for wood pellet supply. The facility aims to produce 30 million gallons of carbon-negative SAF annually, which could be blended to produce 150 million gallons of carbon-neutral fuel.

In Georgia, a coalition of industry partners is developing an advanced aviation fuel hub, combining SAF production with carbon capture technology. The project, backed by local government support, aims to create over 1,000 jobs while positioning the state as a leader in sustainable aviation technology. Similar initiatives are underway in Louisiana and Oklahoma, where existing energy infrastructure is being repurposed for sustainable aviation applications.

California remains a leader in state-level support for sustainable aviation, having established strong frameworks to promote the sector. This includes a $50 million legal fund to defend and uphold the state’s climate programs amid policy reversals at the federal level. The state’s comprehensive framework includes incentives for SAF production, support for electric aviation infrastructure, and programmes to accelerate the deployment of sustainable aviation technologies.

Washington State has emerged as another leader, leveraging its aerospace expertise to develop a sustainable aviation cluster. Spokane’s Tech Hub for developing advanced aerospace recently landed a $48 million grant from the US Department of Commerce. The hub is billed as a first-of-its-kind testbed facility for the US and will focus on developing and manufacturing advanced thermoplastic materials for aircraft. This initiative builds on the state's existing aerospace capabilities while creating new opportunities in sustainable aviation.

Other states are following suit, recognising the economic potential of sustainable aviation. According to a recent analysis by Rhodium Group and MIT's Center for Energy and Environmental Policy Research, states like Nevada and Wyoming are seeing some of the largest clean technology investments relative to their economic size, with aviation projects playing a significant role. In Nevada, the development of advanced battery manufacturing facilities is creating synergies with electric aviation initiatives, while Wyoming's abundant renewable energy resources are attracting hydrogen aviation projects.

US airlines have largely maintained their climate commitments despite federal policy shifts. Delta Air Lines, for instance, explicitly reaffirmed its commitment to net-zero emissions by 2050, stating that climate targets remain central to their business strategy regardless of political changes. United Airlines has also invested directly in sustainable aviation startups and committed to purchase significant volumes of SAF. American Airlines has maintained its sustainable aviation initiatives, focusing on fleet modernisation and fuel efficiency improvements. This sustained commitment from major carriers ensures continued domestic demand for sustainable aviation technologies and services.

Moreover, many US companies with existing SAF and clean technology investments are maintaining their course. Companies like Occidental's 1PointFive secured up to $500 million in funding from the US Department of Energy for carbon capture projects, demonstrating how private sector momentum can continue even amid policy uncertainty.

While policy shifts may alter the regulatory landscape, the business case for sustainable aviation remains strong. The focus is shifting from environmental targets to economic competitiveness, energy security, and industrial growth. Rather than framing sustainability as a cost, industry players are highlighting efficiency gains, long-term fuel cost stability, and domestic job creation.

SAF, hydrogen, and hybrid-electric propulsion are being positioned as key to reducing reliance on volatile fuel markets and strengthening US energy independence. This shift is already evident across corporate and state-led initiatives, where clean aviation technologies are being developed as market-driven solutions rather than compliance measures. Companies that align their messaging with these priorities will be best positioned to maintain investment and market leadership.

As outlined in the next sections on global power shifts, the global aviation industry is advancing toward net zero, creating a strong demand for sustainable aviation solutions. Regions such as the EU, Middle East, and Asia-Pacific are accelerating SAF mandates, investing in hydrogen aviation, and integrating electric aircraft into regional transport networks.

• These regulatory and market-driven shifts present significant business opportunities for US companies with expertise in clean aviation technologies:

• Europe’s ReFuelEU mandate requires 70% SAF by 2050, creating stable long-term demand for fuel suppliers and SAF technology providers.

• Singapore’s SAF requirement for all departing flights from 2026 provides a key entry point for US SAF production expertise.

• China’s leadership in green hydrogen production enables low-cost hydrogen aviation, requiring expertise in propulsion and storage solutions.

• The Middle East’s SAF and hydrogen investments position the UAE and Saudi Arabia as emerging sustainable aviation hubs, creating demand for US technology and consulting services.

State-level initiatives, corporate sustainability commitments, and ongoing private investment keep the US at the forefront of aviation innovation. This gives US firms a competitive edge in global markets:

• Technical leadership: US companies lead in SAF production, hydrogenelectric propulsion, and battery technology, with firms such as ZeroAvia and Universal Hydrogen securing international partnerships despite shifting domestic policies.

• Innovation ecosystem: Research clusters in Seattle, Los Angeles, and Boston foster breakthroughs in SAF, electric aviation, and carbon removal, providing high-value exportable solutions.

• Exportable technology: US expertise in SAF refining, hydrogen infrastructure, and electrification aligns with global trends, as highlighted in Technology and Innovation Focus.

Source: Port of Seattle

To capitalise on these global opportunities, US firms should consider:

• Strategic regional partnerships: Engage with airlines, airports, and technology firms in key growth markets to gain supply chain access and market entry.

• Technology licensing and joint ventures: Provide SAF production expertise, hydrogen-electric propulsion systems, and battery solutions to foreign markets without requiring full-scale investment.

• Supply chain diversification: Establish international manufacturing partnerships to reduce dependency on domestic incentives, as outlined in Investment Strategies.

• Local adaptation: Ensure compliance with global sustainability standards, such as EU SAF certification and hydrogen infrastructure protocol.

While domestic incentives may fluctuate, corporate sustainability commitments, international mandates, and technological advancements continue to drive sustainable aviation forward. Companies that adapt their strategies toward global expansion, crossborder collaboration, and technology exportation will be best positioned to lead the market regardless of US policy shifts.

While the US remains a key market and technology hub, policy uncertainty creates challenges for businesses. Meanwhile, Asia-Pacific, Europe, and the Middle East are driving long-term investment and regulatory certainty, seizing economic and strategic opportunities in aviation’s sustainable transformation. Their commitment to infrastructure, manufacturing, and technology ensures continued progress, offering stability amid US policy shifts. The following section explores these global power shifts in more detail.

The Asia-Pacific region has emerged as a powerful force in sustainable aviation, combining manufacturing prowess, technological innovation, and increasingly ambitious policy frameworks.

• This leadership is particularly evident in four key areas:

• China's clean technology manufacturing dominance;

• Japan's hydrogen aviation initiatives;

• Emerging SAF frameworks across Southeast Asia;

• India's growing commitment to aviation sustainability.

Source: Airbus

China has evolved from a manufacturing hub to a global innovator in sustainable aviation technology. Its dominance in clean technology manufacturing, particularly in electrolysers for green hydrogen, provides a strong foundation for scaling sustainable aviation. According to an IEA report, 60% of the world’s electrolyser capacity is based in China.

Beyond components, China’s ability to rapidly scale new technologies – as seen in electric vehicles and solar panels – is now being applied to aviation. Chinese companies are developing electric aircraft components, SAF production facilities, and other key systems to accelerate the sector’s growth.

Recent developments underscore this momentum. In 2024, China installed more renewable energy capacity than the rest of the world combined. This renewable energy capacity is crucial for producing green hydrogen and sustainable aviation fuels cost-effectively.

China's specific SAF targets and initiatives are equally ambitious. According to Peking University's Institute of Energy, while China could produce 150,000 tons of HEFAbased SAF in 2022, this capacity could surge to around 2 million tons by 2025 by converting existing hydrotreated vegetable oil production from road transport to aviation uses. Major developments include Sinopec's SAF facility outside Shanghai, which delivers fuel to the Airbus Delivery Centre in Tianjin. In April 2023, Cathay Pacific and the State Power Investment Corporation announced plans to develop four power-to-liquid facilities in China, each producing 50,000-100,000 tons per year.

Japan has positioned itself as a global leader in hydrogen aviation through a comprehensive strategy combining policy support, industrial development, and international collaboration. The country's Basic Hydrogen Strategy, updated in June 2023, sets ambitious targets, including enhancing hydrogen/ammonia consumption to 12 million tons annually by 2040.

The strategy specifically identifies aviation as a key sector for hydrogen deployment, with the government committing to invest over JPY 15 trillion (approximately $98.8 billion) in hydrogen-related technologies over the next 15 years. Japan's approach is notable for its emphasis on developing the entire hydrogen value chain, from production and storage to transportation and end-use applications in aviation.

Japanese companies are already leading several breakthrough projects in hydrogen

aviation. The country's ambitious plan to develop a hydrogen-powered commercial aircraft by 2035, supported by $33 billion in government funding, demonstrates its commitment to leading in this technology. The initiative comes after lessons learned from Japan’s SpaceJet program, which was discontinued in 2023. According to Japan’s vice minister of economy, trade and industry, the country aims to transform its aviation industry from being component suppliers to taking initiative in providing value-added products.

Southeast Asian nations are rapidly developing comprehensive frameworks for sustainable aviation fuel production and deployment.

• Malaysia has announced plans to begin SAF production in 2027, with an initial capacity of one million metric tons per year. The country's strategic position as the world's second-largest palm oil producer provides a significant feedstock advantage for SAF production.

• Indonesia has similarly positioned itself as a potential SAF powerhouse, leveraging its abundant biomass resources and existing biofuel production capabilities. The country has successfully conducted its first commercial flight using palm oil-blended jet fuel, demonstrating the technical viability of its approach.

• Singapore, as Asia's leading aviation hub, has taken a leadership role in SAF deployment. The country's mandate requiring SAF use for all departing flights from 2026, with targets increasing to 3-5% by 2030, sets a powerful example for other regional aviation hubs. Singapore's position as a major refining centre and its established aviation infrastructure make it particularly well-suited to lead the region's SAF transition.

The Asia Sustainable Aviation Fuel Association (ASAFA), launched in 2024, exemplifies the region's growing coordination on sustainable aviation. This organisation brings together key stakeholders from across the aviation value chain to accelerate SAF adoption in Asia through policy harmonisation, market development, and public awareness.

ASAFA's work is particularly focused on building a collaborative ecosystem that addresses core challenges across the SAF value chain. By uniting feedstock providers, technology licensors, fuel aggregators, biofuel producers, airlines, investors, and policymakers, ASAFA is creating a comprehensive framework for SAF development in Asia. The organisation's recent partnership with A*STAR demonstrates its commitment to connecting members with research institutions and enabling pathways for piloting and implementing advanced SAF technologies.

Europe has established itself as a global pioneer in sustainable aviation policy and implementation, creating comprehensive frameworks that are influencing standards worldwide.

Source:

The European Union's ReFuelEU Aviation initiative, part of the 'Fit for 55' package, represents the world's most comprehensive regulatory framework for sustainable aviation.

The mandate sets increasingly ambitious targets, requiring 2% SAF by 2025, rising to 6% by 2030, and reaching 70% by 2050. Notably, the framework includes specific requirements for synthetic aviation fuels, mandating that 1.2% of aviation fuel must come from synthetic sources by 2030, increasing to 35% by 2050. As part of the ‘Fit for 55’ package, the European Climate Law aims for a 55% reduction in greenhouse gas emissions by 2030, with

the EU Emissions Trading System (EU ETS) supporting this goal through funding for clean technologies and alternative fuels in aviation.

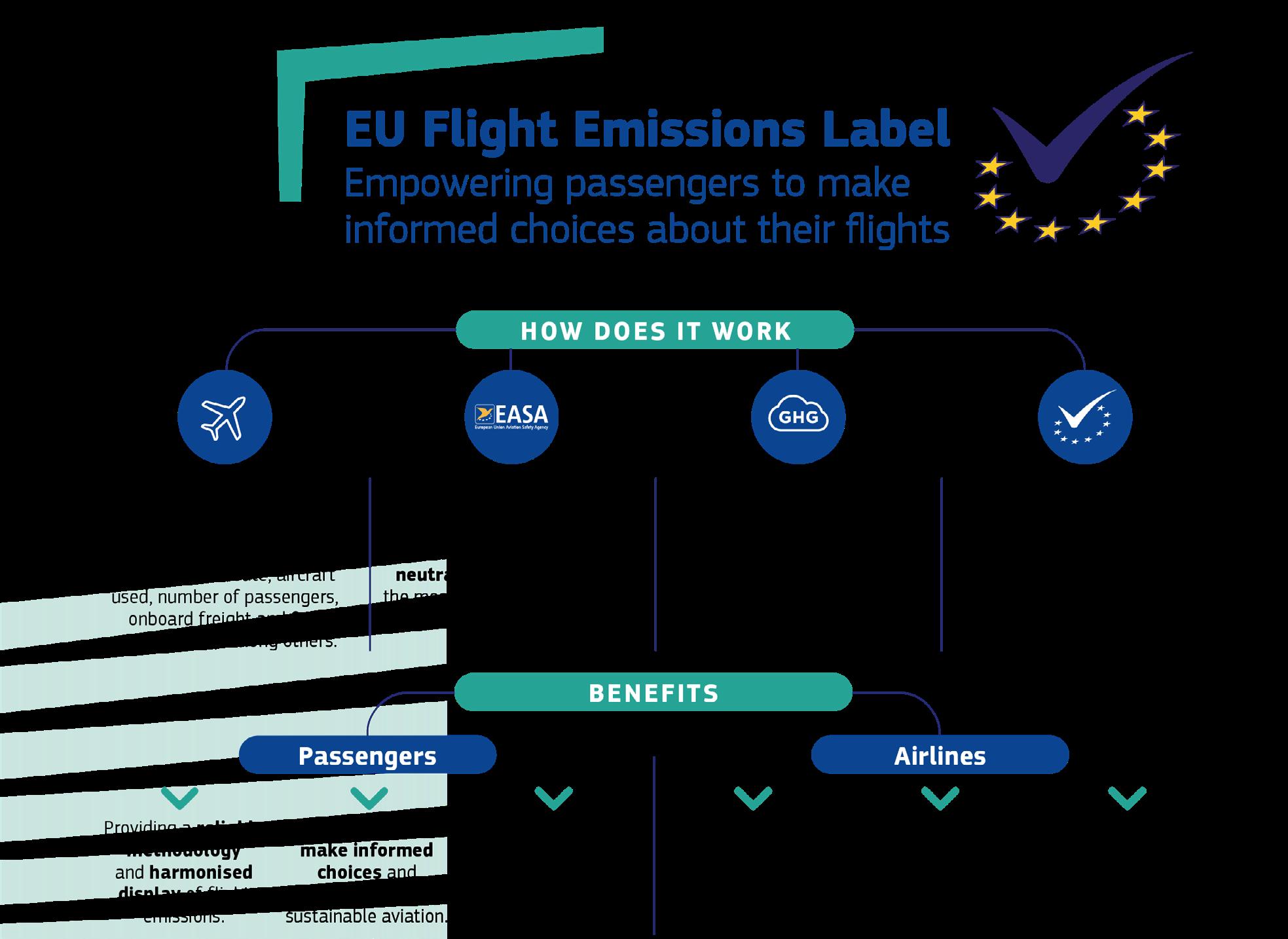

The initiative includes practical implementation mechanisms that set it apart from other regional frameworks. For instance, it introduces tradeable SAF certificates, allows SAF blending at EU system level rather than requiring physical SAF at each airport, and establishes clear penalties for non-compliance. The framework also introduces a Flight Emissions Label to empower consumers with transparent information about their travel choices.

Moreover, the 2023 revision of the EU ETS Directive introduces a support mechanism to incentivise the use of alternative fuels, with 20 million EU ETS allowances – worth approximately €1.6 billion – set aside from 1 January 2024 to help cover the price differential between fossil kerosene and eligible aviation fuels. This ensures a level playing field for airlines, with all operators on the same routes being treated equally. The significance of this policy extends beyond Europe's borders. As one of the world's largest aviation markets, the EU's standards effectively create global requirements for aircraft manufacturers and airlines seeking to operate in European airspace. The framework's comprehensive nature, covering sustainability criteria, infrastructure requirements, and enforcement mechanisms, provides a blueprint for other regions developing their own SAF policies.

Source: EASA

Source: CORDIS

The United Kingdom has developed its own ambitious framework through the Jet Zero Strategy, which came into force in January 2025. The UK's approach requires 2% of total jet fuel demand to be met by SAF in 2025, increasing to 10% in 2030 and 22% by 2040. This mandate is projected to add £1.8 billion to the UK economy and create approximately 10,000 jobs.

To support this transition, the framework includes a revenue certainty mechanism to boost investor confidence and caps on specific SAF pathways to encourage technological diversity. Strengthening industry-government collaboration, the Jet Zero Council was reorganised into the Jet Zero Taskforce in late 2024, shifting from an advisory role to a more action-driven body focused on aviation decarbonisation.

Source: Nordic Innovation

Source: GOV.UK

The Nordic region has become a hub for electric aviation innovation, driven by a unique mix of geographical challenges, strong environmental policies, and technological expertise. With its vast distances, remote communities, and reliance on regional air travel, the region presents an ideal testing ground for scalable electric aviation solutions.

At the forefront of this transformation, the Nordic Network for Electric Aviation (NEA) is advancing regional competitiveness and job creation by developing business models, tackling infrastructure challenges, and enabling cross-border electric flights. These efforts highlight how regional electric aviation can enhance connectivity while significantly lowering emissions, offering a scalable blueprint for other markets.

Europe’s leadership in sustainable aviation regulations and standards has set a global precedent, influencing industry practices far beyond its borders. The EU’s early adoption of technical standards, sustainability criteria, and certification processes has provided a framework that other regions are now adopting or adapting.

One of the most significant examples is the EU’s approach to SAF sustainability verification, which has become a de facto global standard. Its strict criteria for feedstock sustainability and emissions reductions now guide policymakers worldwide, reinforcing Europe’s role in defining aviation’s sustainability pathway.

Europe’s success is also rooted in its cross-border coordination, ensuring that sustainable aviation policies are implemented seamlessly across national lines. The continent’s integrated approach – from shared infrastructure planning to collaborative R&D efforts – has accelerated innovation while creating a more cohesive market.

• Funding plays a crucial role, with EU-backed programs such as the Clean Aviation Joint Undertaking and European Investment Bank initiatives supporting both research and deployment of new technologies.

• This cross-border collaborative model is evident in projects like the NordicGerman SAF network, which connects multiple airports under a common sustainability framework, and multicountry hydrogen aircraft initiatives, including ZeroAvia’s cross-border testing programs.

However, the region still faces significant challenges. The high costs of SAF, its limited production capacity, and the complexity of coordinating cross-border infrastructure create barriers to large-scale implementation. Yet, Europe’s structured response, through initiatives such as the SAF Clearing House and strategic industrial partnerships, provides a model for overcoming these hurdles. By continuously adapting its regulatory and investment strategies, Europe is not only reinforcing its leadership but also offering a roadmap for other regions looking to accelerate aviation’s decarbonisation.

Source: AirInsight

The Middle East's emergence as a leader in sustainable aviation represents one of the most significant shifts in the global energy landscape. Traditional oil-producing nations are leveraging their expertise, infrastructure, and capital to position themselves at the forefront of sustainable aviation development.

The UAE is expanding its role in the SAF market, leveraging its aviation hub status and energy infrastructure to build production capacity. As part of its General Policy for Sustainable Aviation Fuel, the country aims to produce 700 million litres of SAF annually by 2031. Introduced in October 2023, the policy also sets a 1% SAF target for departing flights by 2031. Beyond production, the UAE is also advancing digital solutions for carbon management. The General Civil Aviation Authority (GCAA) has launched the first dedicated digital platform for CORSIA compliance, simplifying carbon offset calculations and reporting for national carriers.

Source: GreenAir

Saudi Arabia's approach to sustainable aviation represents perhaps the most dramatic transformation in the region. By 2030, the country plans to invest $1 trillion across six strategic sectors, with roughly 73% directed to non-oil industries – up from an earlier forecast of 66%. Clean energy alone will receive $235 billion, a significant increase from the previous estimate of $148 billion, reflecting Saudi Arabia’s ambitious plans to more than double its renewable energy capacity by 2030.

This pivot is particularly notable in the aviation sector, where Saudi Arabia is developing significant SAF production capacity while also investing in advanced aviation technologies. The kingdom's strategy emphasises both domestic capability development and international partnerships, positioning it to become a major player in the global sustainable aviation supply chain.

The region's approach to sustainable aviation extends beyond infrastructure to include significant investments in technology development. The UAE’s collaborations with major airlines and technology providers signal a growing focus on advancing SAF, hydrogen, and low-emission aviation solutions. Meanwhile, Saudi Arabia’s NEOM project is integrating hydrogen infrastructure into its broader energy transition, laying the groundwork for potential future hydrogen-powered aviation applications.

While still in the early stages, the Middle East's transformation from traditional energy heavyweight to sustainable aviation pioneer offers important lessons for other regions. The combination of strategic investment, policy innovation, and practical implementation demonstrates how regions can leverage existing strengths while embracing new technologies and approaches.

Source: Wego Travel

Amid shifting US federal policies, market-driven innovation, corporate demand, and international regulations will continue shaping sustainable aviation. To remain competitive, industry players and policymakers must adapt strategies that align with economic priorities, technological advancements, and evolving global frameworks.

1

Strengthen global market positioning

• Ensure compliance with global standards (EU SAF mandates, ICAO frameworks) to secure long-term market access.

• Develop multi-regional supply chains to mitigate exposure to US policy shifts while leveraging opportunities in Europe, APAC, and the Middle East.

• Expand international partnerships to access funding, infrastructure, and R&D support in key aviation hubs.

2

Prioritise cost-effective and scalable technology investments

• Balance near-term SAF production with longer-term innovations in hydrogen and hybrid-electric propulsion.

• Invest in infrastructure adaptability, ensuring readiness for multiple energy solutions, including SAF, hydrogen, and electrification.

• Support SAF cost reduction initiatives through partnerships with fuel producers and refiners.

Source: F&L Asia

Source: mainblades.com

• Position clean aviation technologies as competitive solutions rather than regulatory obligations.

• Highlight economic benefits – domestic job creation, fuel cost stability, and industrial growth.

• E.g., emphasise "Made in America" SAF and reducing reliance on imported fuels to align with federal energy priorities. 3

• Leverage state-led policies and private-sector investments to offset federal policy shifts.

• Diversify funding sources and revenue streams, including technology licensing and global expansion.

• Adapt business models to accommodate changing infrastructure, tax incentives, and certification standards. 4

Ensure policy coordination and cross-border alignment

• Develop flexible frameworks that maintain cross-state and international alignment, preventing market fragmentation.

• Harmonise sustainability certification and monitoring systems to align with international standards.

• Strengthen cross-border collaboration on SAF production and distribution networks.

2

1 Support innovation and technology commercialisation

• Establish dedicated innovation hubs to accelerate SAF, hydrogen aviation, and electrification projects.

• Expand state-level tax credits, investment funds, and R&D grants to sustain momentum.

• Incentivise corporate SAF procurement and early adoption of next-generation aircraft technologies.

3

• Ensure airport infrastructure supports SAF, hydrogen, and electric aircraft, reducing risk of stranded assets.

• Facilitate public-private partnerships (PPPs) to finance infrastructure upgrades at major aviation hubs.

4

Provide industry implementation support

• Expand technical assistance programmes to help businesses transition to sustainable aviation technologies.

• Develop market development mechanisms to encourage investment and early adoption of cleaner fuels and propulsion systems.

• Strengthen stakeholder engagement by fostering dialogue between industry players, regulators, and investors.

These recommendations highlight the importance of integrated strategies that acknowledge the interconnectedness of sustainable aviation. The path forward requires strong coordination across regions, technologies, and stakeholders, supported by flexible frameworks that can adapt to shifting market dynamics and advancing technologies.

Sustainable aviation has reached a point of no return, propelled by market forces, technological advancements, and strong regional leadership, particularly in Asia-Pacific, Europe, and the Middle East. While the Trump administration’s policy shifts create uncertainty around US federal climate commitments, they are unlikely to derail the sector’s global trajectory.

Three key factors support this:

• First, market fundamentals have shifted decisively, with clean energy investment surpassing fossil fuel investment worldwide. Major airlines remain committed to sustainability, driven by corporate demand and global market access.

• Second, other regions are stepping up. China’s dominance in clean technology manufacturing, Japan’s hydrogen aviation strategy, and the EU’s regulatory leadership, requiring 70% SAF use by 2050, are shaping global aviation standards. Meanwhile, the Middle East is leveraging its energy expertise to position itself as a sustainable aviation hub, with the UAE and Saudi Arabia making major investments in SAF and clean energy.

• Third, despite federal shifts, US sustainable aviation continues to advance at the state and corporate levels. Republican-led states are attracting the bulk of clean energy investments, while state policies in California and Washington support SAF and electric aviation infrastructure. Major US firms remain at the forefront of clean aviation innovation, ensuring continued domestic and international market opportunities.

Source: Levorato Marcevaggi

As technology costs fall and SAF, hydrogen, and electric aviation scale up, the global aviation sector will continue its transition. The challenge now lies in coordinating across regions, harmonising standards, and ensuring the efficient allocation of resources. For industry players, maintaining compliance with international standards while building flexible, resilient business models will be critical.

The evidence suggests that while America's federal retreat from climate leadership creates challenges, it may ultimately accelerate the development of a more resilient and distributed sustainable aviation ecosystem.

Listen to more insights on our podcast

Hosted by SimpliFlying CEO and Founder Shashank Nigam, Sustainability in the Air is the world’s leading sustainable aviation podcast.

Over the past year, aviation guests have included Scott Kirby (United Airlines), Marie Owens Thomsen (IATA), Tim Clark (Emirates), Amelia DeLuca (Delta Air Lines), Amy Burr (JetBlue Ventures), Adam Goldstein (Archer), Bonny Simi (Joby) and Nathan Millecam (Electric Power Systems).

Listen and subscribe to the podcast here:

Tune In Today

Meanwhile, our Sustainability in the Air website includes weekly articles on sustainable aviation tech startups; reports on subjects as diverse as SAF and carbon removals; and regular newsletters read by thousands of industry professionals to understand the everevolving space of sustainable aviation and the industry’s potential pathways to net zero by 2050.

Climate change concerns are making the aviation industry turn to sustainable aviation fuel (SAF), electric, and hydrogen-powered aircraft to cut emissions. However, scaling these technologies requires significant innovation.

Sustainability in the Air highlights the journeys of entrepreneurs, executives, and investors who are navigating these challenges and paving the way for the future of aviation. Learn more at sustainabilityintheair.com