Rounding off the trio of old hands is Gerry Celaya, (pg.23) who has for many years specialised in foreign exchange. In this issue, his focus is on the UK’s sterling which, along with generalised US dollar strength, has had to contend with the fiasco that was Britain’s shortest-lived Prime Minister of the modern age. Cable, measured against the US dollar, dropped to a new record low at USD1.0380 versus its 1985 previous record low at USD1.0520 (Refinitiv data).

Also looking back in time is Lou Brien’s (pg.28) article on US Federal Reserve legend Paul Volcker and the risky steps he took in the late 1970’s to tame rampant inflation and prop up a crumbling dollar; l most apropos against today’s backdrop and a useful read for our younger members.

Nicole Elliott, FSTA Technical Analyst, Private Investor, E-journalist for the STA

Somehow most of us have managed to pull through yet another year of tentative steps towards what used to be called normality, despite ragged politics and war. Yet a new set of unexpected problems can be added to our list: The biggest surge in global inflation in decades and central banks still ‘behind the curve’, as economists say. Soaring food prices and shortages, not least eggs, currently blamed on avian flu - where hundreds of thousands of domestic and wild birds have sadly died - and bang goes the Great British breakfast. To this litany of hardship named a ‘cost of living crisis’ (ergo poverty), we can add public sector strikes. No wonder several technical analysts are suggesting wearing ‘tin hats’, watching the weather and focusing on income this year.

I believe this edition of Market Technician has a slight bias towards looking back in time, plus tentative steps as to how we should move forward. At January’s now regular STA meeting with ACI UK and The Broker Club, the three panellists’ outlooks for this year were cautious. Yet it was delightful to see so many new and young faces in the audience keen on learning more about technical analysis. Simultaneously STA Committee Member David Watts, systems and website specialist, was awarded a Fellowship to our society recognising his many years of contributions to the body of knowledge. Most recently he compiled the book, Striking Gold; Celebrating over 50 years of the Society of Technical Analysis (pg.10), which I urge you to dip into because it’s gold dust.

Analytical papers submitted by experts attest to the depth and breadth of knowledge of those associated with the STA. Elizabeth Miller (pg.14), who has been involved with commodities for a very long time and is currently a key staff member of confectioner’s Mars Group, goes into delightful detail on the intricacies of sugar, one of the oldest internationally traded commodities.

Tom Pelc (pg.18) has written about an even older, valued commodity: gold, but with a nuance; taking into account how it is measured and the currency in which it is denominated. He too is a seasoned analyst with in-depth knowledge of this not so obvious subject.

Looking even further back is David McMinn, (pg.30) whose many papers are listed in the references to this article. His focus on lunar and solar effects remains, but this time he adds in the 9/56-year cycles and Annual One Day falls for the Dow Industrials Average from 1886 to 2021. The table of AOD falls at the end of the article deserves scrutiny.

Patricia Elbaz (pg.38) interviews another STA new fellow, Trevor Neil of BETA Group, London and Paris’ Daniel Cohen de Lara, chairman of AFATE (Association Française des Analystes Techniques).

Last year saw an increase in collaborations with other International Federation of Technical Analysts and IFTA-associated member societies, largely thanks to improvements in video conferencing.

See p06 for more info

Finally we remind that the STA depends on contributions from members for the running of the organisation, for presentations either live or virtual, and for contents to this magazine. Please submit articles to Katie Abberton at info@technicalanalysts.com who can also help you with formatting and so on. If you’d like to present at one of our monthly meetings, please send an outline of your proposed subject. More importantly, all comments and correspondence are gleefully received.

YOU’LL HEAR FROM INDUSTRY LEADERS ON THE BIGGEST CHALLENGES AND OPPORTUNITIES IN COMMODITY TRADING INCLUDING: MARKETS DIGITALISATION COMMODITIES INVESTMENTS

ESG AND SUSTAINABILITY

RISK MANAGEMENT SHIPPING & MARITIME

Tue, 18 April 2023, 09:00 - 17:30 BST

One Moorgate Place, London EC2R 6EA (and online)

The Society of Technical Analysts is delivering their Technicals to Trading Systems conference on 18 April 2023 at One Moorgate Place, City of London.

This compelling event will address how technical analysis methods can be developed into quantitative trading systems.

Technical analysis professionals apply a wide range of techniques to assess markets, including the study of repetitive patterns on charts, mathematical calculations to determine the speed and momentum of a move, and statistical tools to identify extreme conditions. A natural progression is to extend these ideas into full trading systems that can be tested and implemented.

Delegates will have the unique opportunity to learn and engage with industry leaders about the extension of technical analysis into trading systems.

• Hear and take part in presentations and a panel debate that will inform the progression of the profession.

• Take this unique opportunity to see and hear specialists who have been known to innovate and challenge the profession, as well as quantitative specialists who can provide a systems structure to enhance the technical analysis discipline.

• Learn more about applying technical analysis tools to an automated trading system approach.

• Discover if a trading system approach can help you to quantify your technical trading and risk management tools.

During the day you will hear from leading experts in trading systems including:

Perry Kaufman

Aimed at:

Kaufmansignals.com

- renowned author who has spent his career as the architect of trading systems used by institutions and funds.

Robert Carver

Independent systematic futures trader, author and visiting lecturer at Queen Mary, University of London who previously worked at AHL, a large systematic hedge fund.

Professor Jessica James

Managing Director Senior Quantitative Researcher at Commerzbank in London. She joined Commerzbank from Citigroup where she held a number of FX roles, latterly as Global Head of the Quantitative Investor Solutions Group.

This one-day conference is aimed at financial professionals working in funds, trading, hedging institutions, commodities and research shops, as well as anyone interested in systematic/quantitative trading and analysis.

Member rate £200 (if booked by 18 March, £250 thereafter). Non-member rate £250 (if booked by 18 March, £300 thereafter).

The STA are delighted to announce a new Student membership category.

Students of recognised academic institutions may join the Society for the duration of their course at the discounted rate of £25 a year.

Student members will have to demonstrate their student status. For enquiries, email the office on info@technicalanalysts.com

The STA is pleased to welcome Alan Dunne as the new head of our Irish Chapter. He will promote the STA in Ireland for members who cannot make the London meetings.

Alan has worked in the financial markets for over 25 years as CIO, hedge fund allocator, macro strategist, and technical analyst. He is the Founder

and CEO of Archive Capital, a Dublin based boutique alternative investments and research firm focused on global macro, managed futures and multi-asset investing, and a Co-Host of the Top Traders Unplugged podcast.

Alan started his career as a technical analyst and trader, working for Bank of America in London, Hong Kong, and Singapore before working as a global macro strategist with BNP Paribas in emerging markets and Allied Irish Capital Management, a global macro CTA. He was subsequently Investment Director of Royal Bank of Scotland's wealth management business in Ireland. Prior to founding Archive Capital, he was Managing Director and a member of the investment committee at Abbey Capital, a USD7bn fund of hedge funds.

It was my pleasure and privilege to work with Alan at Bank of America in London at the start of his career, which is why I am sure that he will promote technical analysis and the STA in Ireland for our current, and future members there to the best of his abilities.

Are you interested in helping promote the STA through a local chapter?

Please contact Katie Abberton at info@technicalanalysts.com if you want to be involved!

Gerry Celaya, MSTA STA Head of Marketing and MembershipDon’t forget that the STA is active on LinkedIn, Twitter, Facebook, Instagram, YouTube, Spotify - and even TikTok.

Across these platforms you can keep up with the latest market news, member activities, interviews and watch short educational videos with STA’s content editor, Karen Jones - former Managing Director, Commerzbank. Click on the icons to find us and follow!

In September 2022, Chairman Eddie Tofpik launched our anniversary book 'Striking Gold - Celebrating over 50 years of the Society of Technical Analysts'.

Led by fellow Director, David Watts FSTA, this book is a collection of some of the seminal articles that have appeared in the Society's journal, The Market Technician, over the years.

The book documents an impressive and notable range of Technical Analysis topics including articles by authors Malcolm Blazey, Daniel Gramza, Tony Plummer, Robert R Prechter and Steven Nison.

To read the book please click here.

To download it as a PDF, simply click on the download icon in the top left corner of the flipbook version.

The STA board cannot think of a better way to celebrate our anniversary, and to build on the four principles which Eddie and his colleagues hope to guide the Society going forward by: Information, Education, Examination and Accreditation.

We have some printed versions of the book available. Any UK members wishing for a copy please email the STA office on info@technicalanalysts.com

We have put together a great offer for you. Book onto any of our courses, including the Home Study Course, before 31 October 2023 and save £50.

Click here and enter code 'JNLPROMO' in the coupon box to redeem your discount.

In late January it was my distinct pleasure not as Chairman of the STA but as a Director of IFTA to appoint the first of hopefully many International Goodwill Ambassadors for IFTA.

The first is a well known Technical Analysis figure, veteran and also Fellow of the STA who has practised TA and also selflessly promoted Technical Analysis all around the World for five decades.

It is in recognition of this past service and the yet many years of devotion and service that he will now provide to IFTA, that I have pleasure in confirming the credentials and introduction of His Excellency Mr. Trevor Neil FSTA, MCSI & ACI-UK as IFTA's first International Goodwill Ambassador.

He has already visited a number of countries in his role as promoting both IFTA and Technical Analysis... and if you see or meet him on his travels, please give him a warm welcome.

Eddie Tofpik, MSTA, ACI-UK, ACSI Director IFTA & also Chairman of the STA

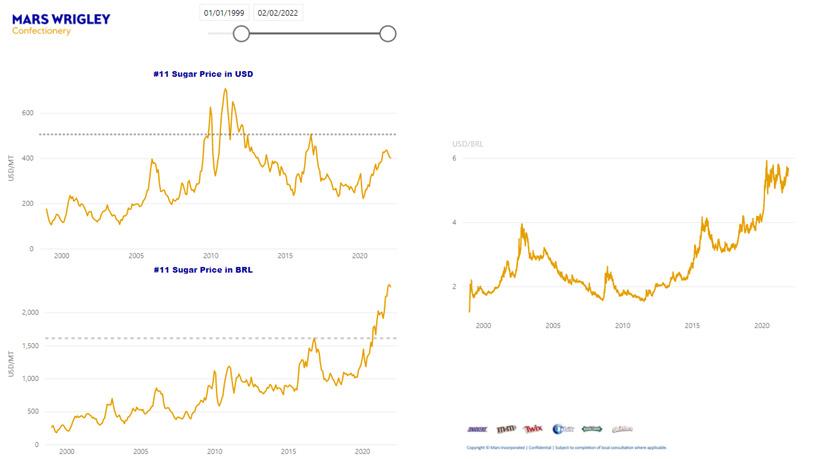

I have had the privilege over the past 15 years of supporting many commodity buying teams at Mars, one of the larger categories being sugar. Mars Wrigley is a private, family-owned company producing not only confectionary but also pet food, including well-known brands such as Whiskas and Pedigree as well as other ‘human’ foods, such as Dolmio. You might be surprised to know that Mars Wrigley also owns Banfield, a chain of pet hospitals in the US. Mars is one of the largest food manufacturing companies in the world - not just Mars bars folks!

Mars, Incorporated offers a variety of delicious brands that bring joy to people all over the world. Many of our products contain sugar, as it gives treats their sweet taste and also affects more functional aspects, such as product texture and shelf life. However, sugar is also an ingredient that should be consumed in moderation as part of a balanced diet and active lifestyle. Mars buys and utilises sugar in production, which means that - in contrast to many market participants in the global market - the company is a natural “short”.

The hedging approach used is based predominantly on the fundamentals of the market. But it is a poor carpenter who only has a hammer in her toolbox. Fundamentals and technical analysis can both give insights into commodity markets. I can eat sugar with either hand... I’m ambi-dextrose…

Traders like volatility as this gives them opportunity; end users do not.

As you can see from Figure 2, sugar futures have historically traded like a rollercoaster. End-users prefer long term price stability to minimise risk looking out years so that the cost of, for example, a Mars Bar is not deviating on a day-to-day basis. On the other side of the aisle are traders and funds, who prefer to capture opportunities on a much shorter time span, right down to the minutiae of intra-day. Due to the differences in timing, this is not necessarily a zero-sum game. Funds can also utilise leverage to really swing the market around in the short term.

Figure 3 shows the Commitment of Traders report from the CFTC (which shows who is participating in the market) versus the #11 ICE futures price - (the world benchmark contract for raw sugar trading).

End-users would be classified under the “producer / merchant / processor / user” heading. The chart shows the “Net Fast Fund” position (a term for speculators) in number of contracts versus #11 Sugar (USc/lb). As can be seen, these tend to move together, though it is difficult to determine which is driving which; correlation does not imply one-way causation.

The #11 (Raw) Sugar futures have traded in New York in one guise or another since 1914, outlasting the exchanges they have traded on. Options on #11 were introduced in 1982. Futures and options on futures are used to price and hedge transactions by both hedgers and speculators.

As every ‘techie’ knows it’s always important to remember that “the trend is your friend”

Keep in mind that while many banks and speculators want to see higher prices, end-users desire low prices. Lower prices = lower ingredient costs to make delicious treats! In the price Figure 4, the #11 sugar price has broken below channel breakout, leaving us hoping that the Fibonacci retracement might be tested.

However, the Ichimoku chart, Figure 5, shows that sugar futures were already testing the cloud area. leaving us hoping that the Fibonacci retracement might be tested.

The other sugar futures benchmark of note is the #5 contract (or London sugar), which is used for hedging white refined sugar. As with its American cousin, the #5 market is highly liquid and used for hedging by sugar millers, refiner, and end-users (manufacturers) as well as by managed funds and both institutional and short-term investors.

As with #11, a rising #5 fund position tends to be associated with a rising market (Figure 6).

The long term (monthly, 20-year continuation) chart shows that the #5 has stalled at an interesting place from a technical perspective at a key retracement level (38.2% of the decline from the 2011 peak) and Fibonacci fan (Figure 7 ).

But the trend has been up.

Focussing in on the shorter term chart (two-year perspective, Figure 8), the market has been unable to post new highs but is also struggling to crack trendline support.

In addition, the 20-day and 60-day moving averages (one and three months respectively) have not seen a bearish crossover. Bears would like to see an extension lower towards the 38.2% and perhaps the 50% retracement of the upswing from May2020 - but no joy as yet. The Ichimoku chart (Figure 9) showed a bit more ‘space’ than the #11 chart to correct towards/into the cloud.

The difference between the #5 and #11 sugar markets is called the “Whites premium”. This is always positive as some margin is required to convert raw sugar to refined. But when the premium is at the low end of the range there is less incentive for refiners to buy raw sugar and convert it. When the premium is high, there is more of an incentive. The premium can be volatile due to capacity, global supply and demand for white sugar and stock levels (Figure 10).

The most cited correlation is with the crude oil market, given the relationship between sugar and ethanol (Figure 11). Historically there has been some logic to this. Sugar cane is the most efficient converter of sunlight into plant carbohydrates, eight times better than corn. This makes it the most efficient feedstock for ethanol. In Brazil in particular, the largest exporter of sugar, millers have the choice to produce sugar or ethanol, which is blended with gasoline for use in cars. When oil prices are high, Brazilian gasoline tends to be high increasing the profitability of ethanol over sugar. However, 2022 was an election year

and there was been a substantial amount of political intervention to contain domestic inflation, which meant ethanol and gasoline prices were artificially capped. In 2022, sugar was not an energy play (Figure 12)!

Currency impacts are also important; a strong USD vs the Brazilian Real (BRL) helps Brazilian exporters, as they receive more domestic currency (Figure 13). This also helps the US which is a net importer of sugar.

Currencies also respond well to technical analysis.

USD/BRL has been largely range-bound through 2020-2022, with key support in the 4.95 zone to watch (Figure 14).

These are some of the factors that we incorporate into our research process supporting the buying team. Technical analysis is one of many useful inputs into our decision-making with a view to hitting that ‘sweet spot’ for sugar hedging.

The old narrative I often hear say is: get into gold in times of inflation and economic stress. Quite often I get into a debate challenging this notion: I would stress that what is more important, in terms of your overall performance, is in which currency you hold the yellow metal.

Since 2000-2022, the average USD return has been 9.2%, in GBP 10.7% and 11.9% in INR. Since 2000, gold has only seen six negative years in USD terms, and just four in GBP terms.

Tom Pelc, MSTA CFTe

Tom is Chief Investment Officer at Fortu Wealth which offers Private digital modern banking for family wealth and Ultra High Net Worth (UHNW) individuals and Founder of Pelc Enterprises Ltd. In the past Tom has worked as Managing Director at Nomura International plc as Co-Head of Macro Technical Strategy, RBS as Head of Macro Technical Strategy, Othon investment (Hedge Fund), as Portfolio Manager and trader, Merrill Lynch and the Standard and Poors Group of Companies.

• When people typically talk about gold it’s in USD terms and we all know in the business that USD strength or weakness has a bearing on commodity prices, typically a weaker USD is supportive for gold as a crude generalisation. Remember gold is an asset that has an intrinsic value. The value changes over time and can have periods of heightened volatility. As a rule, when the value of the dollar increases relative to other currencies worldwide, the price of gold tends to fall in USD terms.

• It is because gold becomes more expensive in other currencies. As the price of any commodity moves higher, there tend to be fewer buyers; in other words, demand recedes. Conversely, as the value of the USD moves lower, gold tends to appreciate as it becomes cheaper in other currencies. Demand tends to increase at lower prices.

Gold does not yield interest in itself; therefore, it must compete with interestbearing assets for demand. In other words, other assets will command more demand because of their interest rate component.

We experienced a number of years of unusually low interest rates and yet gold has performed well making fresh all-time highs on 6 August 2020 at USD2,075.47. The move on 8 March 2022 got just a few dollars shy of retesting that level at USD2,074.44. While the USD gold price is a widely accepted benchmark, 95% of the world must translate the value of the yellow metal to their local exchange rates.

“...95% of the world must translate the value of the yellow metal to their local exchange rates.”

TOM PELC.

We can see in Figure 1 that technically the peaks in Gold in USD appeared around the 200% Fibonacci projection of the measured uptrend from 2016-19 marked at USD2,067.78, which has not been broken on a weekly close basis despite scouting parties above it, thus a key resistance hurdle going forwards. The move from 2016-2020 was + 97.49%.

But in very simplistic terms we can see in Figure 2 in GBP terms gold made all-time highs on 6 August 2020 at GBP1,578.67 per ounce, and then on 8 March 2022 made a new at GBP1,579.02. Using the same time frame to measure performance from 20162020, gold was up + 92.09%, thus underperforming by more than 5% in that time frame in USD terms.

In this example, GBP1,567.21 is the 1.618% Fibonacci projection resistance that has held on a weekly close basis tested three times since 2020, the obvious hurdle to close above to extend into future virgin territory, if that were to happen then you have a series of other Fibonacci projections to target.

Let’s take a look at Table 1:

12 December 2022 in different currencies

+6.25%

-6.92%

Obviously, some currencies have done better than other for various reasons whether it be commodity narratives, interest rate differentials, haven flows etc, their domestic economic status. For example, in 2022 until October the USD was a dominant currency in terms of its strength and the Japanese Yen had weakened a lot due to central bank policy (yield curve control), and interest rate differentials and carry trades.

So, if you have a bullish view not just on gold, but let’s say a stock index, which currency you use is important on relative performance. For example, the FTSE 100 has over 65% of companies getting their main income from overseas business so when the British pound weakens this can be supportive for the index.

Remember, in November 2022 alone the gold priced was more than +7% this was mainly on the back of USD weakness as a reaction to US economic data and markets recalibrating their Fed rate hike cycle forecasts and inflation expectations. The USD index in November had its worst monthly performance since 2009 and

Figure 3 shows how the USD index (DXY) peaked then has fallen since October this year. Remember the Index has a heavy weighting in EUR’s of 57.6% then JPY 13.62% etc.

But the key message to get across is that the gold price has mostly increased in major currencies over the last 20 years regardless of the individual specifics of each currency.

This is important because if you have a bullish view on gold outright then you can see whatever major currency you might be holding it in means over the long term your performance would have been decent, but you have to put this it into context of other asset class performance. For example, in 2021 Bitcoin was +160% on the year and major stock markets were up around + 27.0%, so holding gold was not a great alternative last year. But over the medium to long term, we have continued to see gold hold up and we can look at some of the fundamentally driven factors supporting the gold price and may give clues to the future.

• Central Bank activity is important, accumulating gold in October 2022 Central Banks added a further net 31t of gold to international reserves (-41% m-o-m). This initial figure helped lift global official gold reserves to its highest level since November 1974 (36,782t).

• Trading activity and volumes, we can see in Table 3 below shows gold as a diversification asset class attracting interest, especially in 2022 when the 60/40 equity/bond model witnessed double-digit losses in both asset classes and the worst performance in 60/40 for many years.

German Bunds

US corporate bonds

UK Gilts

DOW Jones (all stocks)

Euro/Yen

U3 1-3 yr Treasuries

Gold**

Euro/Sterling

US T-Bills

S&P 500 (all stocks)

• Out of four possible outcomes for growth and inflation whether it be deflation, stagflation, reflation or Goldilocks gold historically has fared positively in all but the Goldilocks scenario. In a stagflation or deflationary environment outperformed US corporate and government bonds, the S&P500 index and S&P GSCI Index.

• Gold-backed ETFs and similar products account for an important segment of the gold market priced in USD with institutional and individual investors using them for their investment portfolios. The flows tend to signal short term and long-term views on the gold market. YTD global gold ETFs have seen USD2.4BN of net outflows, mainly US and Asia funds vs European net inflows as a safe haven theme with a deteriorating economic outlook in the region.

Looking at the bigger picture, gold over the last 50 years returned +4,084% (gross of costs since the end of 1971), has beaten the cost of living (582%) and all assets except US equities (18,529%), REITs (11,457%) and non-US stocks (6,561%) in USD terms. Since 2000, we have seen REITs lead (+1,024%) followed by gold (525%), US equities (391%), corporate bonds (254%) and then housing (175%). Note in the past 5/7 US recessions, gold has produced positive returns.

Bottom line: it is worth having some gold as part of a diversified portfolio whatever the currency you hold it in. Even better is to hold it in physical gold coin form in the UK as it’s still legal tender and capital tax gain exempt.

Foreign exchange market spot (USD) and cross rate (non-USD) trends are very easy to see and make money on, in hindsight. Trying to forecast FX rates and beat the forward rate on a consistent basis (the simple interest rate differential between two currencies) is not that simple. Speculating in the FX market and making money on a consistent basis is not that easy either. Then there is Cable (GBP/USD), which is a whole different kettle of fish altogether when it comes to forecasting and trading.

Cable is one of the big currency pairs. According to the April 2022 survey from the Bank for International Settlements, GBP/USD makes up around 9.5% of the total daily volume. The total daily over-the-counter volume in the FX market was USD7.5 trillion in April according to the BIS, so Cable trading has some weight.

Gerry Celaya, MSTA

Gerry Celaya has been professionally involved in global market research and investments since 1986.

Gerry is a director at Redtower Asset Management and Tricio Investment Advisors , providing research and risk management consultancy services in the FX and investment markets to professional clients around the world.

However, my experience with Cable is that, unless you ‘have to’ trade it, many professional investors avoid it. On a visit to Swiss fund and banking clients, they were quite happy to tell me that Cable swung around too much for them to consider taking on the risk. This reputation for the pair being a swinger was confirmed by many in 1992 as GBP was thrown out of the European Rate Mechanism. The EU referendum in June 2016 saw GBP fall sharply and remind investors of how just fast the rate could move. And GBP convulsions on the back of the ‘fiscal event’ from

technical analysts and others use to forecast FX rates. Many long-term forecasts use a purchasing power parity (PPP) approach (or a modified version of this). One of the more famous ‘tongue-in-cheek’ approaches to this is the ‘Big Mac index’ from the Economist magazine, which estimates the “correct” FX level so as to equalise the cost of a burger around the world. For traders and hedgers, of course, this is not a great way to manage trades or risk as the PPP and real spot or cross rate can be different for long periods of time.

An academic summary paper looked at currency fund managers returns from 2005-2008 and explained some of the typical models that are used. Carry (interest rate differentials), trend (or momentum), value (PPP) and volatility are the main ones. Many speculators, hedgers and other risk managers use a blend of these models. The actual results from the paper are interesting, but keep in mind that this is a very small sample in terms of funds and time periods.

For our purposes, carry can be a big factor in currency trend determination. Many FX participants remember that GBP used to have an interest rate premium over the USD. Figure 1 shows a weekly chart of Cable and the spread between US and GBP three-month rates. The GBP rate premium has eroded over the last decade+.

Interest rate carry models can also use swap rates and bond yields across many tenors. Figure 2 shows the spread between the US 10-year note yield and the UK 10-year gilt yield. There have been many occasions when the US bond yield was above the UK one, but the general trend direction of the rate differential does seem to coincide with the general trend in Cable. From experience, actually trading this difference on a short-term basis can be tricky, and using this for long-term forecasts may depend on being able to forecast interest rates successfully. I use the above as references for forecasting.

Figure 3: We will need a decent push above this line

Figure 3 shows a monthly chart for Cable. This is as basic as it gets, but it is good to keep things simple sometimes. The horizontal blue line is just above USD1.40 and serves to mark what looks like a decent long-term pivot point. We will need a decent push above this line to get excited about USD1.70 and higher prospects. It does seem that Cable likes to mean revert to this line over time though.

Figure 4 is a typical chart that I use when looking at most markets. The daily candle study makes it easy to spot up days and down days. The 20-day moving average sums up an average month of trading (business days), the 60-day moving average is 3-months of trading and the 250-day moving average is 12-months of trading. And yes, I once had a conference participant point out that in his country, a year had 365 days. Ho-ho. The potential reversal (inverse head and shoulders) building in September/October 2022 is clear here, as is the cross of the 20-day moving average above the 60-day moving average.

The momentum indicator is the difference between the spot rate and the 250-day moving average and can give trend and divergence signals. Overbought/oversold indications are best seen in an RSI or stochastic indicator study.

Figure 5 shows a ‘trading picture’ that I find useful. The model ranking at the bottom gives a quantitative trend indication within a +/- 10 range. Some of our models use a turn above -6 to cut shorts, and turns above +2 to trigger a long position, for example. The chart uses the daily candle study bounded by 1 and 2-standard deviations (20-day), not the moving average standard deviation that Bollinger bands display. Options markets use the standard deviations as part of the pricing process, and these bands can give some insight into probable ranges.

All of the above studies and charts form part of the picture that can give insights for forecasting, trading and risk management. Sometimes though it pays to have built up years of ‘ticker watching’ or ‘tape reading’ experience. My first proper technical analyst job involved staring at various Telerate (preBloomberg interbank trading and price quote machine) and Reuters screens and jotting down FX price moves. Then we would plot these as point and figure charts on the screens for dealers to look at - a human charting machine!

Figure 6 is the hourly chart of GBP/ USD during the ‘fiscal event’ debacle. The new all-time low (Refinitiv) was set in Asian trading near USD1.0380 on 26 September (first circle on the chart). By the time London desks were filling up, Cable was above USD1.05 again (previous all-time low was near USD1.0520 in 1985). The dip on 28 September (second circle) was key for tape readers as this was a shot by London traders (and early NY) to have a bash at breaking the 1985 low. But GBP failed to break this low, suggesting that outside of the thin Asian market, there was real demand for GBP at these low levels.

Using all of the above and it is clear that interest rate differentials are not supportive of GBP yet. However, there is a chance that the Fed pauses their rate hikes in 2023 below 5%, and the spread over short-term GBP rates may narrow. The same narrowing of the yield spread may be seen in the 10-year bond yields as well next year, eroding USD bull signals. The other charts show upside potential on ‘reversion to USD1.40+’ plays, moving average spreads rising, and potential reversal patterns. The behavioural signal that was given by the rise in GBP demand on the 28th of September is clear as well, suggesting that a low is in place. This focuses the mind on gauging tests of resistance, and seeing whether dips continue to draw out buyers. Higher highs, and higher lows will be key for GBP bulls. Back to USD1.40 and maybe higher? Time will tell. GBP bears will need to see if the 250-day moving average (near USD1.25 in mid-November 2022) can hold off Cable upswings (supply stepping up on upticks).

Paul Volcker was not fully formed as the slayer of dragons when he walked into his post as Fed Chair. It didn’t take long though – couple months, no more – but it also took a big shove from a friend in Belgrade.

In the post-World War II era, the Treasury began to issue 30-year bonds in 1977, shortly after President Carter took office. The issue was a disaster, the bond lost about half its value in the next few years. The dollar was a mess, the damage done by years of mismanagement by a Fed that was not credible (see Figure 1).

Lou Brien is a graduate of The University of Notre Dame. He has been in the markets since 1983; for context, Paul Volcker was the Fed Chair when he began his career. Since 1999 Lou has been a fixture at DRW Trading.

His business card describes him as the Strategist/Knowledge Manager, a wide open remit that allows him to investigate factors that move the economy and markets.

The steady debasement of the dollar since the end of Bretton Woods regime in the early 1970s was making it very expensive to issue debt. So dire was the situation, because of the dollar, that in 1978 the Treasury issued bonds that were denominated in Deutschmarks and Swiss Francs; they were known as Carter Bonds. Reports say that they did better than the dollar-denominated Treasuries.

This was clearly not a situation that could continue.

“Two months into his new job, Volcker attended a conference of central bankers in Belgrade and was shocked to find himself harangued by his peers,” says an article from the Atlantic magazine from October 2018 called Paul Volcker’s Guide to the Almighty Dollar. “As he explains in his memoir, German Chancellor Helmut Schmidt, who was a friend, lectured Volcker for almost an hour ‘about waffling American policymakers who had let inflation run amok and undermined confidence

in the dollar.’ A shaken Volcker cut his trip short, got his fellow Fed members on board, and called an unusual evening press conference. Most dramatically, he stressed that he was shifting his key policy tool to monetarism. As a hedge, he also raised the Fed’s discount rate by a full point. The New York Times editorialized about the rate hike under the headline ‘Mr. Volcker’s Verdun,’ noting that when it came to holding the line on inflation, the Fed chairman’s message echoed that of Marshal Petain: ‘They shall not pass.’”

During his first two months on the job, Volcker raised the funds rate incrementally, keeping pace with the steady rise in inflation in a manner that was similar to the way his predecessor had conducted business. His first FOMC meeting after he became the Chair was business as usual, but Volcker hinted at changes that he intended to make, when the time was right. Sooner rather than later was his preference because he figured time was short and the risks were high.

First of all, the Fed had to be believed.

“That's the credibility problem (and the confidence) we have to establish as I see it. And we haven't got a helluva lot of time as the recession comes along—if indeed it does come along-but particularly if it gets worse,” said the new Fed Chair according to the transcript of the August 1979 FOMC meeting. “So, I think we can't ignore the psychological problem that we have at the moment. I don't know what the chances are of changing these

perceptions in a limited period of time. But as I look at it, I don't know that we have any alternative other than to try.”

The scolding by Germany’s leader a couple months later was all the prompting Volcker needed to put his plan into action. Now known as the Reform of October 1979, “the centerpiece of the reform was the abandonment of federal funds targeting in favor of nonborrowed reserves targeting as the operating procedure for controlling the nation’s money supply,” explains the Fed paper called The Reform of October 1979: How it Happened and Why. Monetarism was now the modus operandi for the Fed. So, the central bank would control the money supply and the market would establish the funds rate based on the scarcity or abundance of money.

“This resulted in the unwelcome higher volatility of the federal funds rate during a few years following the reform,” the Fed paper notes. But the new strategy was able to achieve what the old strategy could not (Figure 2). “In the prevailing environment of high and increasingly unstable inflation, however, small adjustments in the federal funds rate had proven woefully inadequate for reining in monetary growth.”

From that day in early October 1979, Volcker would control the money supply and from that position he was also able to bring into order inflation expectations that he viewed as so crucial to the process. It was a matter of credibility for Volcker, both with the public and with the rest of the world as well. Because the respectability of the dollar was part and parcel of Volcker being able to slay the dragon.

The annual one-day (AOD) fall is taken as the biggest percentage one day-fall in the Dow Jones Industrial Average (DJIA) during the year commencing 1 March. It represents the most extreme negative one day shift in market sentiment during a given solar year. In this paper, major DJIA AOD falls (≥ -4.50%) are assessed relative to both lunar phase and secular trends. Additionally, historic US and Western European financial crises clustered with high significance in patterns of the 9/56 year cycle (McMinn, 1986, 1993, 2021). This cycle may have relevance to the timing of AOD falls and is also considered. Favourable findings will contribute to the growing body of evidence:

• verifying a strong Moon Sun influence in market activity; and

• supporting the concept of a 9/56-year panic cycle.

David McMinn

David McMinn completed a Bachelor of Science degree at the University of Melbourne in 1971 (Geology major) and subsequently became a Minerals Economist in ANZ Banking Group Ltd . Since leaving this position in 1982, he has conducted private research on cycles arising in seismic and financial trends, publishing numerous papers on cycle theory, especially in relation to the 9/56-year cycle.

A listing of major AOD falls (≥ -4.50%) since 1886 is presented in the Appendix. This is based on the DJIA for 1896-2021 and the 12 Stock Average index for 18861895. The Moon Sun data was timed at 12 Noon US Eastern Standard Time on the relevant day, with daylight savings time ignored. The abbreviation A° denotes the angular degree between the Moon and Sun (lunar phase), whereas E° is used for the degree on the ecliptic circle. This is to prevent confusion between two different concepts. Lunar phase at 90 A° is equivalent to the 1st quarter Moon, 180 A° the full Moon, 270 A° the 3rd quarter Moon and 000 A° the new Moon. The DJIA data is based on the closing values throughout the analysis with a Chi-Square test applied where appropriate.

McMinn (2000) established a lunar phase effect in the timing of major DJIA AOD falls (≥ -4.50%) for the 1915-1999 era (see Figure 1). These falls nearly always occurred with lunar phase in two segments - 085-195 A° and 270-350 A°approximately 180° opposite in the angular circle. The AOD fall in 1930 was the only exception.

By expanding the time frame to 1910-2021, 10 additional AOD falls can be included in the assessment (see Table 1).

Of the 35 DJIA AOD falls (≥ -4.50%) since 1910, only the 1930 and 2018 events did not have lunar phase within the two segments noted in Figure 1 (significant p < .001). No AOD falls took place with lunar phase between 350 and 085 A° (significant p < 0.01). The lunar phase effect did not apply before 1910 or to DJIA AOD falls below -4.50%. It also did not show up in FT-30 (UK) daily data post 1935.

Of the seven major AOD falls in 1886-1910, only two (26 July 1893 and 18 December 1896) had lunar phase in the ranges noted for Figure 1. In contrast, nearly all falls had lunar phase in these ranges for the post 1910 era. It is puzzling why pre 1910 AOD falls did not experience similar lunar phase to falls after this year. This may arise from long term trends in stock market cycles, a proposition for which there is some evidence.

The Sun’s ecliptic position at the time of the AOD falls is clearly sited in certain segments during certain eras lasting up to about 35 years (see Table 2). From 29 August to 29 October was the most interesting time frame, as AOD falls fell into two distinct eras 1929–1955 and 1986-2008. These contained some of the most spectacular panics in US history – 1929, 1931, 1937, 1987, 1997, 1998, 2001 and 2008 – reinforcing the view that September – October were key months for severe stock market distress. For 20 January to 11 May, AOD falls also appeared in two eras – 1901-1916 and 1988-2021, with one anomaly in 1938.

1901-1916

1901, 1907, 1912, 1915, 1916

1988-2021

1988, 2000, 2007*, 2017, 2020

1929, 1931, 1937, 1946, 1955

1986-2008

1986, 1987, 1989, 1997, 1998, 2001, 2008

1895, 1896, 1899, 1904, 1928

Adding or subtracting 60 years to/from the dates of major October AOD falls consistently produced corresponding AOD falls between August 19 and December 20 (McMinn, 2010). It was an enduring trend in US financial history with few exceptions. Between 1910 and 2000, major DJIA October AOD falls (≥ -3.60%) were experienced in 1927, 1929, 1937, 1987, 1989 and 1997. They yielded a precise grid based on two and eight years on the horizontal and 60 years on the vertical (see Table 3). The AOD falls had lunar phase in narrow ranges 150–165 A° (before a full Moon) and 310–330 A° (before a new Moon).

Table 3 may be extended on the right hand side by adding 11 years, which would have given AOD falls on November 3, 1948 (-3.65%) and October 15, 2008 (-7.75%).

Since 1910, some noteworthy trends arise between lunar phase and DJIA AOD falls (≥ -4.50%) occurring in the three months to

28 October (see Table 4). Of the eight AOD falls between 30 July and 15 September, seven took place with lunar phase from 90 to 135 A° (after the 1st quarter Moon), with an anomaly on 11 September 2001 (281 A° after the 3rd quarter Moon). The five AOD falls between 16 September to 18 October had lunar phase from 115 to 195 A° and the three AOD falls between 19 October to 28 October from 310 to 325 A° (a few days before a new Moon).

The 9/56-year cycle consists of a grid with intervals of 56 years on the vertical (called sequences) and multiples of nine years on the horizontal (called subcycles). Very few DJIA AOD falls showed up in the 9/56-year grid in Table 5. It made up 32% of the complete 9/56-year cycle, but only contained 15% of the falls since 1886 (significant p < 0.01).

Continued...

NB: The 56-year sequences have been numbered in accordance with McMinn (1993, 2021), with 1817, 1877, 1929, 1985 denoted as Sequence 01; 1818, 1878, 1930, 1986 as Sequence 02 and so forth.

The AOD falls were most likely to fall in a pattern repeating 9-9-27 years on the horizontal and multiples of 56 years on the vertical (denoted as a 9-9-27/56 year cycle). The layout in Table 6 accounted for 41% of the complete 9/56-year cycle, but it contained 63% of all major AOD falls (significant p < .01).

Since 1910, virtually all large DJIA AOD falls happened with lunar phase in two ranges, approximately 180 degrees opposite in the angular circle 085-195 A° and 270-350 A°. This pattern was not found in the pre-1910 era, possibly due to secular trends about which little is known. AOD falls taking place during a certain epoch tended to occur in certain months of the year (see Table 2). The best example was for September – October AOD falls, which happened in two eras 1929-1955 and 1986-2008.

Various financial phenomena fall preferentially in 9/56-year patterns.

• Major DJIA AOD falls 1886-2021 (see Tables 5 and 6).

• Major US and Western European financial panics 1760-1940 (McMinn, 2021).

• Beginning and ending of DJIA bear markets 1886-2021 (McMinn, 2022).

Clearly, the 9/56-year cycle plays a key role in US trading activity, but the causal mechanism remains a mystery. It has something to do with the angles between the Moon and the Sun on the ecliptic circle, given the importance of lunar phase and the solar year in the timing of AOD falls.

Several lunisolar cycles align very closely at 9.0 and 56.0 solar years, thus excellent correlates arise between the Moon, the Sun and the 9/56-year grid (McMinn, 2021). Any event taking place in the same 56-year sequence will have the lunar ascending node (LAN) sited in a narrow sector of the ecliptic circle with no exceptions (1st harmonic). Events clustering in the 9/56-year grid will have LAN in two sectors approximately 180A° opposite in the ecliptic with no exceptions (1st and 2nd harmonics). For events in the same 9/56-year grid and occurring around the same time of year, apogee will be sited in three ecliptic sectors 120A° apart, with no exceptions (3rd harmonic, McMinn, 2021). There is also a near perfect 6th harmonic between the ecliptic position of the Sun and the angle between the LAN and mean Apogee (McMinn, 2016).

NB: The lunar nodes are imaginary points sited in the heavens where the plane of the Earth's orbit around the Sun (the ecliptic) is intersected by the plane of the Moon's orbit around the Earth. Where the Moon crosses the ecliptic from south to north gives rise to the lunar ascending node (LAN) and from north to south gives the lunar descending node. Apogee is sited in the lunar orbit, where the Moon is greatest distance from the Earth, whereas perigee is the closest distance. The lunar nodes and apogee are key determinants of terrestrial tides.

The findings emphasize the importance of dividing the raw data into meaningful subsets. If all DJIA AOD falls were considered, a lunar phase effect would not have been produced. It was only by assessing AOD falls over -4.50% post 1910 that good correlates were achieved. Alas, AOD falls have been ignored in financial research to date, even though the concept was first published in 2000.

The random walk-efficient market hypothesis was the prevailing paradigm in academic economics during the latter decades of the 20th century. Under this scenario, free markets were believed to be random and efficient. However, correlates between the DJIA AOD falls, lunar phase and the 9/56-year cycle cannot occur in markets that are random or efficient, thereby presenting a major problem. Either the random walk-efficient market hypothesis is wrong or AOD correlates discussed in this paper are wrong. Both cannot be correct - one must always trust the evidence rather than follow the dogma.

According to the Moon Sun Hypothesis, financial activity is mathematically structured in time and moves through cycles of greed and fear in tune with changing Moon Sun cycles. How this process actually functions remains a great unknown. Even so, lunisolar cycles potentially hold a key to making accurate financial predictions years in advance. Hopefully other cycle theorists will be more successful in solving the mystery.

McMinn, D. (1986) The 56 Year Cycles & Financial Crises. 15th Conference of Economists. The Economics Society of Australia. Monash University, Melbourne, 18.

McMinn, D. (1993) Financial Crises & The Number 56. The Australian Technical Analyst Association Newsletter, 21-24.

McMinn, D. (2000) Lunar Phase & US Crises. The Australian Technical Analysts Association Journal 20-31.

McMinn, D. (2010) 60 Year Intervals & October panics. Market Technician. Journal of the Society of Technical Analysts 67 13-15.

McMinn, D. (2016) 9/56-year Cycle: Lunar North Node – Apogee Angles. New Concepts in Global Tectonics Journal 4(1) 32-36.

McMinn, D. (2021) 9/56-year Cycle & Financial Panics. Cycles Magazine 50(4) 31-51.

McMinn, D. (2022) The 9/56-year Cycle & DJIA Bear Markets. Market Technician. Journal of the Society of Technical Analysts 92 29-35.

DJIA AOD FALLS ≥ -4.50% 1886-2021, listed chronologically

(a) Based on the 12 Stock Average index.

(b) Two almost equal percentage declines were recorded in 1919, as well as in 1940.

(c) The NYSE did not open on the day due to the 911 terrorist attack.

(d) Worldwide stock market panics occurred on 21 January 2008. It was taken as the AOD fall for 2007, even though the US market was closed for the Martin Luther King Jr holiday.

PE: Daniel we are delighted to see that AFATE celebrated its 30 year anniversary on 13 December 2022, how did you mark this special event?

DCdL: When preparing this event, we had three goals. Firstly to show and confirm the long term presence of AFATE as the representative organisation of Technical Analysis in France, particularly for professionals. Secondly, to thank and show our appreciation to all the previous Chairs who worked to develop AFATE. Finally to offer members and guests an interesting and topical subject developed by financial specialists. We had an attendance of over 100 people, including a significant number of top professionals. I noted during the cocktail at the end of the conference that everybody was delighted and it was a great opportunity for networking. It was also great to see that a number of attendees joined AFATE at the end of the event.

PE: I have been privileged to have been invited on a number of occasions to speak on specific Technical Analysis topics for l’AFATE and it’s always so refreshing to meet the many members and exchange ideas. Can you tell us how you were first introduced to Technical Analysis?

DCdL: It was about 12 years ago. I was finishing an industrial part of my career. I started investing in the stock market at the bottom of the bear market, at the end of 2008. It was

easy at that time to make money, but at the end of 2009 I was making wrong investments because I had no clear method. I started learning TA at that time and joined AFATE in 2010 in order to gain more training. I discovered Ichimoku during a Conference at AFATE and it became and is still my method for analysis and trading.

PE: Finally, what are you planning for future events with l’AFATE?

DCdL: The programme we offer to the members includes several types of events:

• Firstly, Afterworks: At the beginning of the evening, once a month. It includes a technical review of the markets, a conference and we finish all our events with a get together, friendly cocktail. The Afterworks lasts about two and a half hours. In fact we were delighted to welcome you (pictured below) as our guest speaker for our first Afterworks of 2023 in January!

Then there are “Les Rencontres de l’AFATE”: These take place twice or three times a year. We discuss an economic/ financial topic in the news. We invite economists, traders, lecturers and technical analysts. This kind of event is also open to non-members.

• We also offer Webinars on specific topics. We organise, for example, every year a webinar on the Ichimoku method. AFATE includes in its membership among the very best professionals of the method.

• Finally, we organise special events in partnership with companies, brokers, and universities. The next one is planned for mid January with a business school.

PE: Thank you so much Daniel for sharing your knowledge, advice and experience with us. I was delighted to attend the first 2023 Afterworks and meet the members and guests, any excuse for a pain au chocolat in Paris! We wish you much success in the many future events.

All AFATE talks, conference and events are listed on www.afate.com

Afterworks event: January 2023

The STA holds 11 monthly meetings in the City of London, including a summer and Christmas party where canapés and refreshments are served.

Key benefits

• Chance to hear talks by leading practitioners.

• Networking.

• CPD (Continuous Professional Development).

As a service to our members, many of whom are unable to attend all our monthly meetings, we have been making videos of meeting presentations for several years.

Key benefits

• Never miss the latest meeting.

• Browse our extensive video archive of previous meetings.

The Society of Technical Analysts and the Chartered Institute for Securities & Investment (CISI) have formed a partnership to work together on areas of mutual interest for our respective memberships.

Key benefits

CISI examination exemptions for STA Diploma Part 1 and 2 holders. MSTAs with three+ years’ experience can become full members (MCSI).

The STA has been running educational courses on technical analysis for 25 years.

Key benefits

• Courses are taught by leading authorities in their field such as authors, highly regarded professionals and Fellows.

• The STA also offers a Home Study Course for self-study.

Student members have access to an education forum which is available in the member’s area of the website.

Key benefits

Members can ask questions on technical analysis in the Technical Analysis Forum which a course lecturer, author or Fellow will answer.

Endorsed by the Chartered Institute for Securities & Investment (CISI), members of the STA are entitled to receive continuing professional development points (CPD for their attendance on the taught course lectures.

Key benefits

• Remain compliant.

• Be informed of all new industry developments.

The STA ”Market Technician” journal is published online twice a year.

Key benefits

Members receive the latest issue of the “Market Technician” via e-mail. They are also able to access an archive of past editions in the member’s area of the website. Technical analysts from all over the world contribute to the STA journal.

The STA has an extensive library of classic technical analysis texts. There are over 1000 books in the collection, held at the Barbican Library with a smaller selection available at the City Library. As a member you can now browse which titles are available on-line.

Key benefits

Members are encouraged to suggest new titles for the collection and, where possible, these are acquired for the library. The complete listing can be downloaded in Excel format from within the member’s area.

STA members benefit from significant discounts on technical analysis books, magazines and software.

Key benefits

STA members currently enjoy discounts from:

• Your Trading Edge.

• The Technical Analyst Magazine.

• MT Predictor.

• CQG.

• Tradermade and the Global Investor bookshop.

Tuesday 11 April

11

APR

18

APR

Tuesday 18 April 9.00am-5.30pm One Moorgate Place, London EC2R 6EA (and online)

STA Diploma Part 2 Exam (online)

Thursday 20 April

SEP

STA Diploma Part 2 Exam (online)

Tuesday 5 September

STA Monthly Meeting (May 2023)

Tuesday 9 May

6.30pm Via Live Webinar Speaker to be confirmed

STA Monthly Meeting (Jun 2023)

Tuesday 13 June

6.30pm

One Moorgate Place, London EC2R 6EA

Speaker to be confirmed

STA Diploma Part 1 exam (online)

Monday 3 July

Joint STA, ACI UK and The Broker Club Mid-year Review of Markets

Tuesday 11 July 6.30pm

One Moorgate Place, London EC2R 6EA

SEP

STA Monthly Meeting (Sep 2023)

Tuesday 12 September 6.30pm Via Live Webinar Speaker to be confirmed

STA Annual Drinks Reception & Awards Ceremony

Thursday 14 September

6.30pm

National Liberal Club, London SW1A 2HE

STA Monthly Meeting (Oct 2023)

Tuesday 10 October 6.30pm

One Moorgate Place, London EC2R 6EA Speaker to be confirmed

STA Monthly Meeting (Nov 2023)

Tuesday 14 November 6.30pm Via Live Webinar Speaker to be confirmed

STA Diploma Part 1 exam (online)

Monday 4 December

STA AGM & Christmas Party

Tuesday 12 December 6.30pm

The LSE courses and the Diploma in Technical Analysis

Visit Meetings on the STA website for information on monthly meetings and videos.

Month

Speaker

February 2023 Dr Ken Long

November 2022 Larry Williams

October 2022 Jeff Boccaccio

September 2022 Steve O’Hare

July 2022 The Outlook for Crypto 2022 - Part II

May 2022 Perry Kaufman

April 2022 Rajan Dhall

March 2022

Elizabeth Miller

February 2022 Tom McClellan

Description

In conversation with Jeff Boccaccio

In conversation with Jeff Boccaccio

Simplifying (and automating) crypto in 3 indicators

Analysing alternative data sets

Panel debate with ACI UK and The Broker Club

All about Risk

Common misconceptions with technical analysis and predicting movements in the financial markets

Sweet Talk - Technical Analysis and the Sugar Market

An introduction to Market Breadth Indicators

STA members are eligible to join the library as standard adult library members. They need to attend in person to the library to join - bringing with them proof of name (STA membership card, bank card, staff pass etc) and proof of address (driving licence, recent bank statement, utility bill etc). The library address is Barbican Library, Silk Street, London, EC2Y 8DS.

For full details on address and opening times, visit STA Library on STA website.

The Society of Technical Analysts New Zealand reached out through the IFTA (International Federation of Technical Analysts) network for an online speaker for their 15 November meeting, and our STA Chair Eddie Tofpik stepped up to help! This is another example of IFTA member societies helping each other and sharing our knowledge and expertise. The excellent members of STANZ were kind enough to record the talk, and it is available here.

Below is a sample slide from Eddie’s talk, which is indicative of the breadth of his presentation. If any other IFTA member societies wish to have STA members speak at their meetings, please contact Katie at info@technicalanalysts.com and we would be happy to help!

Eddie & Advanced Biofuels Forum Talk, covering Chicago Soybean Crush, European Rapeseed futures, Canadian Canola futures, Malaysian Palm Oil futures, International Grains and International Sugar markets.

Below is a daily chart of Chicago Soybeans (2nd month continuous). The chart shows the detail that Eddie gets into when looking at his commodity markets. The talk is worth watching on the link above if you want insights into how a commodity expert looks at markets.

The world-class e-learning Home Study Course (HSC) © is written by leading industry practitioners, making it one of the best online products available on the technical analysis market. Whether this is your first introduction to technical analysis, you want to refresh your existing knowledge, or you wish to become a qualified technical analyst, the STA offers a tailored Home Study Course as part of our portfolio of world respected courses preparing students for our internationally accredited STA Diploma qualification.

You can learn from the comfort of your home at times that best suit you. Although website based, it is fully downloadable and may be used online or offline via PC, Mac, iPad or Android machines.

• The syllabi for both STA Diploma Part 1 & Part 2 examinations

• 15 in-depth subject teaching units

• Exercises to self-test progress

• Exam preparation module & video

• Advice on report writing.

...find out more here

Since the HSC is International Federation of Technical Analysts (IFTA) syllabus compliant it can also be used to prepare candidates for both the IFTA CFTe I and II examinations.

The course is intended for individuals who want to use technical analysis in a professional manner or who want to become a qualified technical analyst and advance their career. Enrol and start studying now!

For more details click here or contact the STA office on +44 (0) 207 125 0038 or info@technicalanalysts.com

Learn at your own pace rather than in a classroomthe HSC course is designed for those who need a truly part-time study option with maximum flexibility!

Amerul Haqimi Bin Ameruddin

Donata Anastazja Koppejan

Abdul Haliem Alief Shahrul Anis

Ammar Azrin Amir

Cesare Borgia

Charles Hartweg

Colin Hunt

Habibah Binti Muhammad

Joshua Raymond Townsend

Kyle Warren

Matthew Buxton

Mingjie Li

Mohd Aminudin Bin Samsudin

Muhd Al-Aarifin Bin Ismail

Muhammad Fariz Bin Mansor

Nik Mohd Saiful Azhan Zahri

Nur Saiyidah Binti Nik Zainal

Phua Ah Kiok

Sofea Arriana

Dr Vandana Joshi

Wan Zayyana Wan Mohd Zahmer

Waruhui Kanyonji

Wassim Chiadli

Yuliya Barsukova

The success of the Journal depends on its authors, and we would like to thank all those who have supported us with their high standard of work. The aim is to make the Journal a valuable showcase for members’ research - as well as to inform and entertain readers.

Keep up to date with the conversation by joining us on:

The Society of Technical Analysts Journal The Market Technician is a bi-annual publication, published in pdf format only. The STA will accept advertisements in this publication if the advertising does not interfere with its objectives.

The appearance of advertising in the Market Technician is neither a guarantee nor an endorsement by the STA.

The Market Technician has a circulation of approximately 1,500. Readership includes technical analysts, traders, brokers, dealers, fund managers, portfolio managers, market analysts, other investment professionals and private investors.

Advertising is subject to approval by the STA Journal Committee. All advertisements must be non-discriminatory and comply with all applicable laws and regulations. The STA reserves the right to decline, withdraw and/or edit at their discretion.