EXPOSPECIAL

TRACKING FLOATING SOLAR PV DEVELOPMENT ACROSS ASEAN

REGIONAL REC FRAMEWORK FOR ASEAN NET ZERO AMBITION

CHASING THE SUN: THE LONG, WINDING ROAD OF MAKING INDONESIA A SOLAR

ND DSCAPE

POWERHOUSE

N N U A L E D I T I O N

INDONESIA A

ChasingTheSun:TheLong,Winding

IlluminatingtheArchipelago:Milestones andFutureProspectsofInstalledSolar

ShiningLightonIndonesia'sSolar

IlluminatingInvestments:NavigatingThe IndonesianSolarMarketLandscape

SolarSynergiesandSunlitRivalries:A ComparativeAnalysisofASEANSolar Markets

SolarIllumination:UnveilingRecent Milestones,ResilienceinDisasterRelief, andCollaborativeSparksinIndonesia's SolarLandscape

C O N T E N T RESEARCH INSIGHTS W W W S O L A R Q U A R T E R C O M Smriti Charan Sangeeta Sridhar Nikita Salkar advertise@firstviewgroup com ADVERTISING Sadhana Shenvekar CIRCULATION Firstview Media Ventures Pvt Ltd Nikita Salkar Sadhana Shenvekar Mohan Gupta editorial@firstviewgroup com Sadhana Shenvekar Mohan Gupta Priyanshi Pandey publishing@firstviewgroup com Neha Barangali Radha Buddhadev design@firstviewgroup com PUBLISHING EDITING CONTENT DESIGNING 04 08 RicoSyahAlam FendiLiem ChiefExecutiveOfficerPT, SumberEnergiSurya Nusantara(SESNAGroup) Founder&CEO SEDAYUSolar 06 09 BinuGeorge YoviePriadi BusinessDevelopment Director&CountryManager BECISIndonesia PresidentDirectorand CEO EMITS IN CONVERSATION 10 VaibhavSahu ChiefOperatingOfficer SunEnergy 14 BenoîtPrim FounderandManaging Director, PTInecosolarSolutions 13 16 18 19 20 21 22 23 24 26 SUCCESS STORY FEATURED INSIGHTS GADINGKENCANA TrackingFloatingSolarPVDevelopment AcrossASEAN RegionalRECFrameworkforASEANNet ZeroAmbition Indonesia'sNewfoundHopeforRooftop SolarUtilization(?)

RoadofMakingIndonesiaaSolar Powerhouse

PVCapacityinIndonesia

Landscape:MarketOutlook,Technological

Trends,andUrban-RuralDynamics

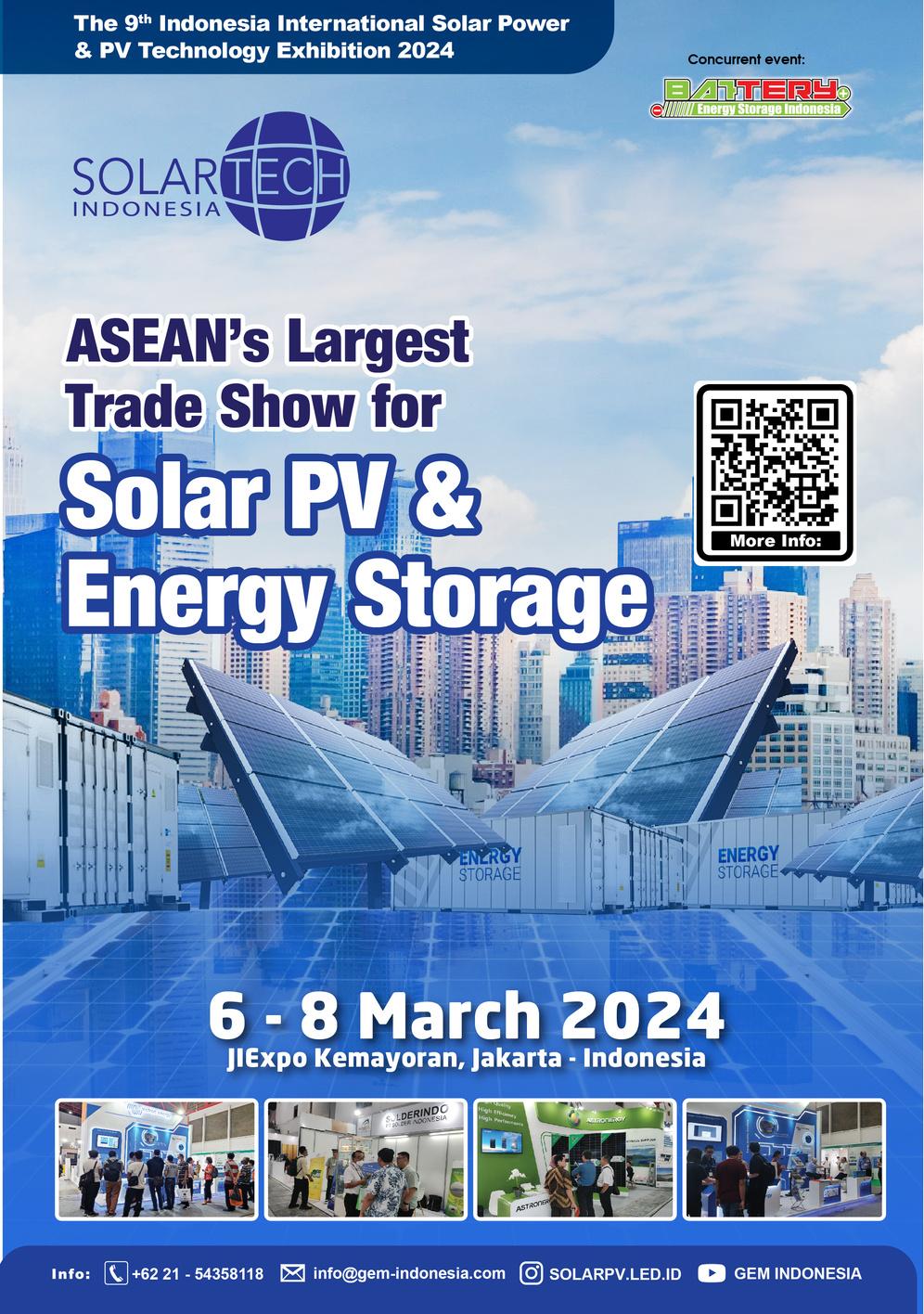

03 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

TOWARDS A BRIGHTER FUTURE: SESNA'S VISION FOR SOLAR DEVELOPMENT IN INDONESIA

RICOSYAHALAM

Chief Executive Officer PT, Sumber Energi Surya Nusantara (SESNA Group)

KEY HIGHLIGHTS

Our commitment to optimizing alternative energy sources underscores SESNA's dedication to a sustainable future.

SESNA's strategic initiatives have not only propelled solar development but have also positioned us as leaders in the industrys

SESNA's focus on quality, utilizing Tier 1 products, ensures optimal performance and longevity of solar energy systems

What's the current solar development landscape in Indonesia, and how has SESNA boosted solar sector growth there?

As we know regarding renewable energy, Indonesia in particular has set a target to achieve Net Zero Emission (NZE) by 2060 The transition to a zero-emission energy system revolves around four fundamental pillars: utilization of renewable energy, electrification of various demand sectors, reduction of fossil fuels, and shift to low-carbon fuel alternatives The development of solar energy sources as an alternative energy source continues to be of interest, as seen from the decarbonization strategies being executed by several manufacturing industry sectors.

We, SESNA as one of the solar energy project developers in Indonesia, facing this growth, still continue to intensify various ways to optimize the utilization of alternative energy sources Since we started our business in 2013, we have been entrusted to develop and construct Independent Power Producer (IPP) projects with a total installed PV capacity of 3 MWp in three locations in Eastern Indonesia. After that, our contribution continued by developing projects to the manufacturing and mining industry markets, where the total installed PV capacity amounted to more than 16 MWp with coverage of almost all regions of Indonesia Currently, there are at least a total of more than 15 MWp under construction, as well as most under development including our 200 MWac + BESS project in the ex - mining area

What are SESNA's main efforts and successes in advancing solar development in Indonesia, establishing them as a leading industry player?

Our initiative is to continue to expand our service penetration into the manufacturing and mining markets in particular Not limited to

clients, our partnership activities have helped us to carry out project development and overcome various obstacles

All the results we have gotten so far are important factors in driving our success to this point

The achievement of becoming one of the best local developers in Indonesia is very motivating for us to move forward to be even better in the future The projects we are currently working on, one of them is the development of 200 MWac + BESS in the exmining area, we hope it will be a trigger to bring in other exciting jobs

How does SESNA collaborate with Indonesian government initiatives promoting solar power and shape regulatory policies?

As a company that started as an independent power producer (IPP), we always follow the direction of the Indonesian government regarding policy developments that are made and updated regularly We also continue to follow the policy regarding rooftop solar power plants and understand it well. The most important thing for us is how we as private developers and the government can communicate well regarding planning initiatives or projections of solar energy project development in the Indonesian region in the coming years, so that we can assist the government in achieving the NZE 2060 target

What innovative approaches and technologies is SESNA employing to advance solar development projects, and how do these contribute to its sector leadership?

Our guiding principle has always been to ensure that our clients get the best products and services from us The long-term cooperation approach that we always offer

today is what attracts them to partnering with us In terms of products, we always suggest using Tier 1 products especially for major components, which not everyone knows that the quality of the products used determines the performance of energy production apart from maintenance and other services.

In addition, we are also moving towards the era of digitalization, which we are innovating to create a project management system that is integrated with the client's gadget So that clients can safely monitor the performance of the solar energy system they have invested in With this digitalization innovation, it is expected to be our value that is always needed by clients

What's SESNA's vision for solar development in Indonesia and how will it tackle upcoming challenges for sustainable growth under your leadership?

When it comes to the vision, we have always had in our minds, tis to be a key collaborator in Energi’s journey to enhance a sustainable economy and achieve energy security, driven by our innovative and cost-effective renewable energy business model

There will always be challenges and we must overcome them with confidence For us, the challenge in developing a project is not only from the technical side, but from the nontechnical side, which is even more complex

The key is collaboration with all relevant parties

With all of that collaboration efforts, we are confident that the development we are working on can be carried out smoothly

IN CONVERSATION 04 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

05 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

CONVERSATION

AT BECIS, WE ARE COMMITTED TO DRIVING SUSTAINABLE ENERGY TRANSFORMATION AND EMPOWERING BUSINESSES TO THRIVE IN A LOWCARBON FUTURE.

BINUGEORGE

BECIS Indonesia

KEY HIGHLIGHTS

The past decade has witnessed remarkable progress in solar photovoltaic (PV) technology and the dynamics of economics of scale

Solar PV's accessibility and rapid commissioning make it a standout option for anyone with available space

The abundance of solar resources in Indonesia presents a vast opportunity for solar PV installations nationwide.

B ce in S in e s in nd opportunities.

SouthEast Asia, with a quarter of the world's population, is poised to lead the battle against climate change through renewable Indonesia, in particular, stands out due to its substantial solar energy potential, estimated to be around 20 TWp and its economic growth The country has committed to gradually phasing out coalfired power plants by 2050, aligning with regional efforts towards a renewable energy transition Despite delays attributed to concerns such as oversupply and regulatory uncertainty, there is optimism driven by increasing demand and collaborative efforts among stakeholders

To capitalize on this momentum, it is essential to establish conducive regulatory frameworks and incentives that encourage consumer participation and stimulate market demand By doing so, not only can the adoption of solar photovoltaic (PV) systems be accelerated, but it can also pave the way for a more sustainable energy landscape in Indonesia, fostering economic growth and environmental stewardship

In a saturated market, BECIS distinguishes itself through innovative Energy as a Service solutions (EaaS), prioritizing carbon neutrality and value addition.

In your role managing commercial and industrial solar PV projects, what significant changes or advancements have you noticed in project execution and the adoption of technology over the years?

The past decade has witnessed remarkable progress in solar photovoltaic (PV) technology and the dynamics of economics of scale Solar PV has transitioned into a commodity in the global market, driving significant cost reductions and rendering solar PV projects increasingly accessible to businesses

Central to this transformation are the technological strides made in enhancing PV module efficiency and performance. For project developers like BECIS, these advancements are game-changers, as they bolster the feasibility and profitability of longterm projects, specially in regions where fossilpowered utility tariffs are heavily subsidized The continuous enhancement of PV technology ensures sustained performance and benefits throughout the operational lifespan of projects, which often exceeds 25 years

In addition to technological advancements, there has been a gradual but noteworthy effort by governments to establish policies and regulatory frameworks supportive of renewable energy projects. These initiatives are fundamental in fostering market growth and providing the necessary framework for the widespread adoption of renewable energy technologies Additionally, the availability of local talent has grown, enabling the simultaneous execution of multiple projects Furthermore, the availability of skilled professionals within the region enables efficient project execution and management, reducing dependency on external resources

and enhancing project feasibility This synergy between technological innovation and local expertise creates a conducive environment for investors, as it minimizes risks and maximizes the potential for successful project implementation

Can you discuss the competitive landscape of the solar energy sector in Southeast Asia? How do you navigate challenges such as regulatory frameworks, market saturation, and emerging competition?

As the industrial manufacturing sector gravitates towards Southeast Asia with a focus on emissions reduction, renewable solutions, particularly solar PV, become increasingly vital Solar PV's accessibility and rapid commissioning make it a standout option for anyone with available space However, the saturated solar industry sees developers prioritizing business opportunities over value addition At BECIS, we aid customers in achieving carbon neutrality through innovative off-grid / on-grid, solar, bioenergy, and waste heat recovery projects. Our expertise in Energy as a Service (EaaS) fosters a consultative approach, moving beyond mere sales The demand for EaaS solutions with diverse technologies is projected to rise, presenting BECIS with a significant opportunity We remain adaptable to market shifts, ensuring our position at the forefront of sustainable solutions

Business Development Director & Country Manager

IN

06 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

What do you identify as the primary drivers and barriers for the growth of renewable energy, particularly solar PV, in Southeast Asia, especially in the Indonesian market? How do you anticipate market dynamics evolving, and what implications might these changes have for industry stakeholders, including developers, investors, and policymakers?

High fossil energy consumption is the primary driver of a country’s need for energy transition, this followed by solar panel production and electric vehicle manufacturing shall remain the driving factor for solar PV growth in Indonesia Organizations with high sustainability goals provide an additional impetus for renewable energy deployment, particularly in the Commercial and Industrial (C&I) segment Escalating energy demand further boosts the adoption of alternative or renewable energy sources

Government policies and incentives, such as feed-in tariffs and tax incentives, play a crucial role in driving the adoption and expansion of solar PV installations in Indonesia. However, inconsistency and uncertainty in policymaking in recent years have hindered widespread adoption, leading to uncertainty among project developers and investors Collaborative efforts from stakeholders are essential to address this challenge, and despite current obstacles, we at BECIS remain optimistic about the future of the renewable energy market in Indonesia

BECIS aims to assist clients in reducing CO2 emissions, minimizing energy costs, and enhancing energy supply security. How would you tailor your approach to meet these objectives in the Indonesian market?

At BECIS, we distinguish ourselves as the leading renewable developer offering a diverse range of solutions to our customers In addition to Solar PV, we empower businesses to accelerate their decarbonization journey through innovative offerings such as Bioenergy, Cooling & Heating services, and Waste Heat Recovery projects Our holistic onsite solutions enable our clients to establish a clear path towards achieving their long-term carbon neutrality objectives.

Through our Energy as a Service (EaaS) business model, we mitigate the challenge on our customers by taking charge of developing their non-core assets while they concentrate on their core competencies Our team of sustainability experts collaborates closely with clients to identify opportunities for carbon reduction and deliver tangible commercial savings

At BECIS, we are committed to driving sustainable transformation and empowering businesses to thrive in a low-carbon future.

Southeast Asia's solar potential illuminates the path to a renewable future.

What are the biggest opportunities and challenges in the Indonesian solar market? How would you capitalize on the opportunities and address the challenges?

The abundance of solar resources in Indonesia presents a vast opportunity for solar PV installations nationwide, a prospect that BECIS eagerly embraces Additionally, there is a noticeable increase in environmental consciousness among the Indonesian community, prompting more customers to shift towards renewable energy sources to mitigate carbon emissions and contribute to global sustainability goals.

BECIS firmly believes that as customer awareness grows and the competitive business environment evolves, the renewable energy market in Indonesia will continue to thrive With solutions extending beyond solar, we are poised to capitalize on this momentum Leveraging our expertise, BECIS is positioned to play a crucial role in steering the country towards a more sustainable and environmentally friendly energy landscape

IN

CONVERSATION

07 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

CONVERSATION

MILESTONES MARK OUR JOURNEY, BUT EXCELLENCE DEFINES OUR DESTINATION AT SEDAYUSOLAR.

Can you summarize the current state of the solar energy landscape in Indonesia and highlight SEDAYU Solar's contributions with over 200 projects since 2009?

There has been a mixed opinion on the Solar Energy landscape in Indonesia In 2023, Indonesia State Electricity company, PLN, managed to commission the largest floating Solar Power plant in South East Asia, i e 192 MWp Cirata Floating Solar; however, at the same time, PLN still put a 15% limitation on Rooftop Solar Power projects hence seriously limiting the development in the Commercial and Industrial sectors

As the Founder & CEO, could you share key milestones and success stories that have shaped SEDAYU's reputation in the solar energy sector?

Established in 2009, SEDAYUSolar focuses on developing Rooftop Solar Power projects since 2018. With the recent developments in Rooftop Solar, SEDAYUSolar has been developing more Off-grid and Hybrid Solar Power projects just as the company started in 2009

FENDILIEM

Founder & CEO SEDAYUSolar

KEY HIGHLIGHTS

In Indonesia's solar landscape, SEDAYUSolar shines through challenges, innovating and adapting.

SEDAYUSolar pioneers solar engineering, pushing boundaries through R&D and partnerships

SEDAYUSolar: 200+ projects since 2009, leading the evolution from rooftops to off-grid solutions.

In the years to come, SEDAYUSolar will remain at the forefront of Indonesia's solar revolution. With a steadfast dedication to quality, sustainability, and innovation, we're poised to illuminate the path towards a brighter, cleaner future.

What role does SEDAYU play in executing solar projects, and how does the company ensure successful project delivery from start to finish?

In terms of sustainability, how does SEDAYU integrate eco-friendly practices into its projects, and what innovative approaches or technologies is the company adopting to stay ahead in solar engineering?

In terms of sustainability, how does SEDAYU integrate ecofriendly practices into its projects, and what innovative approaches or technologies is the company adopting to stay ahead in solar engineering?

SEDAYUSolar invests a significant amount of time and efforts to come up with innovative solutions through its internal R&D department, working together with the world’s leading Solar Technology providers, from the Design, Procurement to Constructions processes. On top of these, SEDAYUSolar works with various financial stakeholders to delivery innovative business models and approaches in developing the Solar market in Indonesia

What is your vision for SEDAYUSolar in the coming years, and how does the company plan to maintain its leadership in Indonesia's solar energy sector under your guidance as Founder & CEO?

To maintain its leadership in the industry, SEDAYUSolar works with the world’s leading Solar Technology providers to deliver end-toend Solar solutions with the mindset of global practices combined with local experience

IN

08 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

CONVERSATION

POWERING PROGRESS: EMITS' TRAILBLAZING INITIATIVES IN SOLAR ENERGY

YOVIEPRIADI

President Director and CEO

EMITS

KEY HIGHLIGHTS

Our vision is to be Indonesia’s top green energy solutions company and partner of choice, supporting the nation’s energy transition

At EMITS, we provide innovative and customized solutions for partners.

Comitted to world class quality and standards

How does your team boost EMITS' presence in solar energy? And how does EMITS seize new business chances?

EMITS as a Joint Venture (JV) between Indika Energy and Fourth Partner Energy, leverage the best of both parent companies to enhance EMITS' market presence within solar energy sector with some of the below strategies:

Innovative Technology Adaption & CostEffective Solutions:

1

EMITS embrace advanced solar panels / energy storage for our solar solutions and diversify types of installations to meet the varied needs of different clients such as solar hybrid solution, rooftop solar, ground mounted solar, floating solar, carport solar, or canal top solar

2 Provide cost-effective solar solutions, whether through competitive cost-savings financing options, or 2 options of business models such as CAPEX or LEASE with zero initial investment from the client's side

3 PartnershipsandCollaborations: EMITS form strategic partnerships and collaboration with other energy sector players / government to create comprehensive solutions to accelerate renewable energy development in Indonesia (such as participate in PLN De-dieselization Program)

Customer Engagement: Engage with customers and conduct analysis to understand the evolving needs and preferences of customers to bring renewable energy solutions

Regulatory Compliance: Well-informed about and comply with relevant regulations in the solar energy sector

How does EMITS differentiate itself in solar energy and tailor solutions for both Indonesian and global clients?

EMITS as a JV combine the Indika Energy’s world-class energy related capabilities and strong track record in bringing reliable energy

solutions to the people of Indonesia with proven experiences of Fourth Partner Energy in building and operating over 1,4 GW in India and elsewhere for the last 13 years as well as the financial strength of TPG, Norfund, and others to offer cost-effective, customized, reliable clean energy solutions to Indonesia’s businesses

EMITS already has an installed base up to 60 MWp* for C&I and Utility sectors in 3 years. EMITS also emphasizing the environmental benefits of using solar energy and demonstrate a commitment in ESG through internal operation

What notable partnerships or collaborations has EMITS pursued to enhance growth and innovation in solar energy?

Collaborating with government and utility companies to for the deployment of solar projects such as with PLN Subsidiaries for Rooftop solar and provide hybrid solar solution for PLN De-dieselization Program

Collaborating with energy storage companies to develop integrated solutions that combine hybrid solar power generation with energy storage systems

Partnering with financial institutions or investors such as TPG, Norfund, Infraco, SMI, and others for investments and growth

How does EMITS stay ahead in solar energy with innovation and tech? Any recent advancements boosting their market lead?

EMITS introduce advanced solar technologies, such as solar hybrid solution (diesel and batteries) and got commitment from worldclass renowned lenders for financing to differentiate in the Indonesian market.

How does EMITS consider the environment and society? How does solar power contribute to EMITS and Indika Energy Group's sustainability?

EMITS is committed to the responsible adoption of Renewable Energy, focusing on the following key principles:

ENVIRONMENT: We actively pursue carbon mitigation in a socially responsible manner Our impact is quantified through lower annual emissions, conservation of water, and the planting of trees

SAFETY: Our goal is zero fatalities We employ a proactive and preemptive approach, conducting exhaustive safety and equipment training, regular drills, and making a daily commitment to safety

HEALTH: We prioritize the well-being of our employees by providing medical insurance for their families and conducting annual health checkups to ensure both physical and mental well-being.

COMMUNITY WELFARE: At project sites, we contribute to community welfare by offering both temporary and permanent jobs Additionally, we focus on skills development and training for the families of our employees.

INCLUSIVITY & DIVERSITY: EMITS is an equal opportunities employer, with approximately 25% of women in responsible roles We place a strong emphasis on upskilling to promote professional expertise and diversity.

SUSTAINABLE SUPPLY CHAIN: We ensure that our suppliers, contractors, and clients adhere to sustainable best practices Our approach is Environmental, Social, and Governance (ESG)-centric contributing to a sustainable and responsible supply chain

Indika Energy has articulated ambitious goals in line with its ESG (Environmental, Social, and Governance) commitment, aiming to achieve 50% of its revenue from non-coal businesses by 2025 and attain net-zero status by 2050 This commitment is exemplified through its involvement in green businesses, with EMITS standing out as one of the notable initiatives

09 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

IN

SUN ENERGY: PIONEERING SOLAR DEVELOPMENT THROUGH INNOVATIVE FINANCING

How has Sun Energy's NO CAPEX financing method propelled its success in becoming a top solar energy developer in Indonesia's Commercial & Industrial sectors since 2016?

I believe that ideas and suggestions from all the team members are essential for achieving our company goals and staying competitive in a fast-paced business environment is the key to become leading developer of Solar Energy sector in Indonesia We strive to create inclusive and collaborative solutions for our clients, keeping their priorities in mind and incorporating the same in our every tailor made solution

To respond to ideas and suggestions from Client, we first listen actively, seeking to understand the idea’s potential impact and value to the overall solution. Once I completely understand the idea, I provide feedback and ask clarifying questions to ensure that the idea aligns with the clients' goals and objectives We also collaborate with clients to develop an action plan that outlines the steps required to implement the idea and achieve the desired outcomes

The value of diversity in ideas and suggestions and strive to create an inclusive solution contribute to the organization’s success I recognize and appreciate the efforts of team members who share their ideas and suggestions Overall, I believe that ideas and suggestions from team members are essential for innovation and growth. We respond to them with openness, collaboration, and a commitment to achieving our goals.

VAIBHAVSAHU

Chief Operating Officer Sun Energy

KEY HIGHLIGHTS

Our commitment to inclusive and collaborative solutions reflects our dedication to meeting client needs and driving our success.

Strategic positioning and continuous adaptation to emerging technologies have been key drivers of our success in Indonesia's solar energy sector

Sun Energy's initiatives, such as advocating for Rooftop Solar and empowering future generations, reflect our mission for a sustainable future

How did Sun Energy become a top developer in Indonesia's Commercial & Industrial sectors?

Much of our Strategy is about defining who do you say YES to The idea of strategy development itself is about designing your product or service to fit a certain position within the marketplace. This positioning makes you stand out and stand for something

We continuously gather new information and adjust our strategy (design, pricing, construction methodology, asset management) based on emerging facts & technologies, so we provide the most advanced solution at most optimized cost We also built relationships with key stakeholders and engaged in ongoing monitoring and analysis to ensure we stayed ahead of the curve

Ultimately, we successfully entered the market and achieved our goals by deciding based on the best available information and taking calculated risks

Deciding without all the facts requires critical thinking, risk management, and a willingness to take calculated risks As a leader, I weigh the risks and benefits, consult with the team and other experts, and take action based on the best available information

Since 2016, our innovative NO CAPEX financing has propelled Sun Energy to lead solar development in Indonesia.

What notable initiatives has Sun Energy undertaken in Indonesia's solar energy industry, and how do they reflect the company's mission and goals in renewable energy?

In its pursuit of achieving net-zero emissions by 2050 or sooner, the government of Indonesia is taking significant steps to accelerate the energy transition. One of the key initiatives driving this transition is the utilization of Rooftop Solar Power Plants (PLTS) With an impressive potential of 32 5 gigawatts (GW), PLTS Roof presents a promising solution for tapping into green energy sources and creating opportunities for various stakeholders, including households, industries, businesses, social groups, and government entities, to actively contribute to the nation’s energy transformation

Sun Energy s concentrated effort and commitment are expected to drive significant progress towards creating reliable, safe, and environmentally friendly electricity installations, with Rooftop PLTS playing a pivotal role in the nation’s sustainable energy future.

To accelerate further the growth of PLTS, Sun Energy have organized multiple events at universities & college level to familiarize youth & students about the possibilities & potentials of Solar Energy, who will become torchbearer in near future and will take it forward

IN CONVERSATION

10 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

IN CONVERSATION

What operational strategies has Sun Energy used to develop solar projects successfully as COO? How does it tackle unique challenges in Indonesia's Commercial & Industrial sectors?

The Chief Operating Officer (COO) role has become increasingly crucial in today’s dynamic business landscape As the secondin-command to my CEO, I plays a vital role in driving operational efficiency, optimizing resources, and ensuring the smooth functioning of an organization

Effective COO leadership is combined with the expertise of a specialized knowledge and experience, which is essential for achieving business goals and maintaining a competitive edge in the market.

A Few of the strategies I follow and could be useful for your readers are:

CLEAR COMMUNICATION AND ALIGNMENT:

Clear communication and alignment with the CEO, key stakeholders, employees, and customers are paramount to being an effective COO

BUILDING HIGH-PERFORMING TEAMS:

An effective COO understands the importance of building high-performing teams Surrounding oneself with talented individuals who share the organization’s vision and values is key to success

STREAMLINING PROCESSES AND OPERATIONS:

COOs must continuously evaluate and streamline processes and operations to optimize efficiency and eliminate bottlenecks

EMBRACING INNOVATION AND CONTINUOUS IMPROVEMENT:

Innovation is the lifeblood of successful organizations COOs should foster a culture of innovation and continuous improvement within their teams

STRATEGIC PARTNERSHIPS AND ALLIANCES:

Collaborating with strategic partners and forming alliances can significantly benefit an organization COOs should actively seek partnership opportunities that align with the company’s strategic objectives

EFFECTIVE CRISIS MANAGEMENT:

Most crucially, during times of crisis, COOs play a crucial role in leading the organization Develop a comprehensive crisis management plan, establish clear roles and responsibilities and ensure effective communication channels

What's Sun Energy's vision for future growth and innovation in solar energy? How does the company plan to lead in solar energy development, and can you share any upcoming projects or initiatives hinting at Sun Energy's future direction?

Staying at the forefront as a leading Solar Developer requires a proactive and adaptive approach. Here are a few strategies we adopt to remain ahead in the ever-evolving landscape

CONTINUOUS LEARNING AND RESEARCH:

By regularly invest time and resources in staying updated on industry trends, emerging technologies, and shifts in user behaviour Foster a culture of continuous learning within the team, encouraging employees to attend conferences webinars and training sessions

USER-CENTRIC APPROACH:

Prioritize user experience by conducting regular usability testing and gathering user feedback Implement responsive design and ensure that the our solar platform is optimized for various customer needs

DATA-DRIVEN DECISION MAKING:

Leverage analytics tools to gather insights into user behavior, content performance, and market trends Use data to identify areas for improvement

COLLABORATION AND PARTNERSHIPS:

Foster collaborations with industry influencers, thought leaders, and other publishers Partner with technology providers, startups, or other companies to explore joint ventures and stay informed about potential innovations

Four Phases in the Evolution of Formal Strategic Planning

AGILE DEVELOPMENT PRACTICES:

Adopt agile development methodologies to facilitate faster adaptation to changing requirements Implement regular retrospectives to improve processes continuously and outcomes

By combining these strategies, a company can create a dynamic and adaptive environment that positions it at the forefront of internet publishing innovation Regularly reassessing and adjusting strategies based on industry shifts and technological advancements is key to sustained success

11 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

CONVERSATION

What operational strategies has Sun Energy used to develop solar projects successfully as COO? How does it tackle unique challenges in Indonesia's Commercial & Industrial sectors?

In your role as COO, what operational strategies has Sun Energy employed to ensure the successful development of solar energy projects? How does the company navigate challenges unique to the Commercial & Industrial sectors in Indonesia?

CLEAR COMMUNICATION AND ALIGNMENT:

Clear communication and alignment with the CEO key stakeholders employees and customers are paramount to being an effective COO

BUILDING HIGH-PERFORMING TEAMS:

An effective COO understands the importance of building high-performing teams Surrounding oneself with talented individuals who share the organization’s vision and values is key to success.

STREAMLINING PROCESSES AND OPERATIONS:

COOs must continuously evaluate and streamline processes and operations to optimize efficiency and eliminate bottlenecks

EMBRACING INNOVATION AND CONTINUOUS IMPROVEMENT:

Innovation is the lifeblood of successful organizations COOs should foster a culture of innovation and continuous improvement within their teams

STRATEGIC PARTNERSHIPS AND ALLIANCES:

Collaborating with strategic partners and forming alliances can significantly benefit an organization COOs should actively seek partnership opportunities that align with the company’s strategic objectives

EFFECTIVE CRISIS MANAGEMENT:

Most crucially, during times of crisis, COOs play a crucial role in leading the organization Develop a comprehensive crisis management plan, establish clear roles and responsibilities and ensure effective communication channels

What's Sun Energy's vision for future growth and innovation in solar energy? How does the company plan to lead in solar energy development, and can you share any upcoming projects or initiatives hinting at Sun Energy's future direction?

Staying at the forefront as a leading Solar Developer requires a proactive and adaptive approach Here are a few strategies we adopt to remain ahead in the ever-evolving landscape

CONTINUOUS LEARNING AND RESEARCH:

By regularly invest time and resources in staying updated on industry trends, emerging technologies, and shifts in user behaviour Foster a culture of continuous learning within the team, encouraging employees to attend conferences webinars and training sessions

USER-CENTRIC APPROACH:

Prioritize user experience by conducting regular usability testing and gathering user feedback Implement responsive design and ensure that the our solar platform is optimized for various customer needs

DATA-DRIVEN DECISION MAKING:

Leverage analytics tools to gather insights into user behavior, content performance, and market trends Use data to identify areas for improvement

Our innovative business model allows us to cut middlemen, ensuring competitive pricing and efficient project delivery.

COLLABORATION AND PARTNERSHIPS:

Foster collaborations with industry influencers thought leaders, and other publishers Partner with technology providers, startups, or other companies to explore joint ventures and stay informed about potential innovations

AGILE DEVELOPMENT PRACTICES:

Adopt agile development methodologies to facilitate faster adaptation to changing requirements Implement regular retrospectives to improve processes continuously and outcomes.

By combining these strategies, a company can create a dynamic and adaptive environment that positions it at the forefront of internet publishing innovation Regularly reassessing and adjusting strategies based on industry shifts and technological advancements is key to sustained success.

IN

12 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

Gading Kencana, active since 1998, is a trailblazer in the Malaysian Renewable Energy Industry, specializing in solar photovoltaic systems, be it off-grid or on-grid systems From its humble beginnings as an electrical works and transmission cabling contractor as well as an energy management consultant, Gading Kencana is now acknowledged as a leader in sustainable energy generation in Malaysia Gading Kencana has won many National and International awards for its Solar Photovoltaic systems designs and innovations.

Gading Kencana is recognized as a pioneer in the Malaysian solar photovoltaic industry; starting with solar powered garden and landscape lighting to solar street lighting, to solar off-grid electricity generating systems for remote locations such as schools and aboriginal villages It then moved on to solar photovoltaic roof-top systems for residences, business premises and industrial buildings Presently besides being involved in roof-top solar photovoltaic systems, Gading Kencana is now developer, contractor and operator (O&M)for its own Large Scale Solar Farms having obtain quotas for four solar farms in various parts of Malaysia

Gading Kencana’s extensive experience will now be shared with friends from Indonesia and other nations who are passionate about Renewable Energy especially solar photovoltaic power generation and Energy Efficiency /Management The company through its subsidiary in Indonesia; P T Gading Suria is ready to offer training programs to support the emerging Renewable Energy Industry of Republic Indonesia and the nation’s vision for Sustainability

SPECIAL FEATURE COMPANYSUCCESSSTORY

Come, Let Us Prepare You To Achieve Your Renewable Energy Vision

Practical Training using real-life equipment Class room training Get to know us at: www gadingkencana com GADING KENCANA GROUP 13 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

SHAPING TOMORROW'S SUN: INECOSOLAR'S INNOVATIONS IN INDONESIA'S SOLAR INDUSTRY

Can you provide an overview of the current state of the solar technology market in Indonesia? How has it evolved in recent years, and what are the key factors influencing its growth?

The Indonesian solar market is picking up again Covid and lack of harmonization between the regulator (Ministry of Energy and Mineral Resources – MEMR / ESDM) and the grid utility (Perusahan Listrik Negara (PLN)) resulted in a market contraction in 2021-2022 But in 2023, PLN started approving more rooftop solar projects and the drop in panel prices helped the market recovering Moreover, a PLN subsidiary utility scale project tender for 1GWp+ is reviving utility scale projects

For the rooftop Commercial and Industrial (C&I) market, many multi-national companies (MNCs) need to reduce their carbon footprint to meet their Environmental, Social and Governance (ESG) targets Given that ~86% of the electricity in Indonesia comes from fossil fuels, many MNCs see rooftop solar as an easy option to fulfill their ESGs commitments as solar energy is green, cheaper and cheaper, and with more financing options (zero upfront cost) available

The residential market is also growing thanks to the dropping costs of solar panels and higher electricity prices for larger consumers, making attractive payback period of less than 4 years on the best projects!

So in a nutshell, the Indonesian solar market is growing again

BENOÎTPRIM

Founder and Managing Director, PT Inecosolar Solutions

KEY HIGHLIGHTS

The Indonesian solar market is witnessing a resurgence, driven by factors such as dropping panel prices and increasing awareness of environmental sustainability.

Inecosolar's strategy of providing extra discounts on the electricity tariffs and maintaining close contact with government stakeholders sets it apart, ensuring smoother project execution amidst regulatory challenges

We envision a future where solar energy becomes a cornerstone of Indonesia's energy landscape, driving growth and sustainability hand in hand

What challenges and opportunities do you see for Inecosolar in the solar technology deployment landscape in Indonesia? How is the company positioning itself to navigate these challenges and leverage the opportunities?

The main hurdle right now is the regulation / permitting misalignment between government stakeholders Oversupply of electricity on the grid and coal being a dominant industry in the country also impair the energy transition for now Our strategy is to maintain close contact with the government stakeholders, we want to work hand in hand with them to make every project a success. We ask permission before installing a project while the opposite used to be the norm among our competitors

Our innovative business model allows us to cut middlemen, ensuring competitive pricing and efficient project delivery.

Another main hurdle of a solar project, everywhere in the world, is financing Inecosolar started as a residential installer in Bali, gaining skills, experience and reputation for quality solar installation at competitive price with outstanding customer care Thanks to our strategic investor, Yinson Renewables, the renewable business unit of Yinson Holdings Berhad, a global energy infrastructure and technology company headquartered in Malaysia, we can now offer zero upfront cost to our C&I customers This only eases the decision-making process: we pay for the solar system, the customer only pays for the electricity generated

Now how do we differentiate ourselves from the competition? There are many other solar developers with the same business model But because we know how to design, procure and install solar systems from our residential activities, we propose a more efficient and aggressive business model where we cut the middlemen (financiers or contractors) and do everything ourselves This results is a lower IDR/kWh for our customer and an ease of process: we are in charge of the project from start to finish.

This innovative business model also allows us to offer financing options for smaller C&I projects, from 100kW+, while other developers usually need 500kW+, and reaching a wider customer base

IN CONVERSATION 14 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

As the leader of Inecosolar, I believe Indonesia's renewable energy target should be more ambitious to effectively drive substantial change and contribute to a sustainable future.

Indonesia has been making efforts to increase its renewable energy capacity. How, as the leader of Inecosolar, do government policies and initiatives impact the solar technology sector, and how is Inecosolar aligning its strategies with these policies?

Indonesia just revised its renewable energy target from 23% by 2025 to 17-19% to be more realistic This, in my opinion, is lacking ambition given the climate risk emergency and the impact it will have on Indonesia and its people This is mostly due to conflicting interests from decision makers who are involved in the coal industry and the need for energy transition benefiting the wider population

A new rooftop policy will remove the financial benefit of the net metering scheme: if energy is exported to the grid, it won’t be valued anymore This will impact the financial attractiveness of solar, especially for residential users who consume less energy during daytime hours when the solar system

Could you share insights into the specific innovations that Inecosolar is implementing to stay at the forefront of the solar technology industry? How do these innovations contribute to the company's competitive advantage?

Our business model is our best innovation: delivering the solar system by ourselves at cost allows us to keep control over the cost, quality and timing of the project. Better discounts on the electricity price and being able to finance smaller C&I clients stand us apart from the competition Also, as we are the developer, financier and contractor, we look after all the regulatory approval ourselves which simplify the process for the customer: we provide them with solutions, not problems

Finally, our team of friendly, motivated and skilled people is key to our success: we find solutions for our clients and make it happen We found out that customers care was something missing in the market and which

What is your vision for the future of solar technology in Indonesia? How does Inecosolar plan to contribute to the growth and sustainability of the solar industry in the country under your leadership?

Solar, like sustainability, is unstoppable because climate change is already having a tremendous impact on our lives It’s like the internet 20 years ago, those who didn’t believe in it are not here to talk about it anymore.

Solar is still in its infancy in Indonesia, which is the fifth largest population in the word (~275 million people) and the powerhouse of Southeast Asia. This means that solar will only continue to grow and we are targeting to be one of the main energy-as-a-service providers in Indonesia

Outside grid connected residential and C&I projects, we are also looking at utility scale projects and came across opportunities for offgrid projects – reducing the consumption of diesel for generators or industrial estates looking at getting renewable energy to attract companies We target to install 100MW+ over the upcoming years

IN CONVERSATION 15 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

FEATURED INSIGHTS

Tracking Floating Solar PV Development Across ASEAN

Floating solar PV (FPV) is a newly emerging technology compared to the conventional ground-mounted solar system The first of its kind had only begun construction in 2007, with the development of the FPV pilot project in Aichi Prefecture, Central Honshu Since then, FPV has become increasingly pursued as an option for solar generating mode of technology, not only in its place of origin but across the globe

[1] [2]

The proliferation of FPV farms has also spread throughout Southeast Asia It presents the states in ASEAN with an array of opportunities to upscale the share of renewable energy within their respective energy mix. The eagerness of ASEAN countries to deploy FPV can be derived from the scale of investment specifically for this technology, on top of the number of facilities currently in operation By the looks of it, the preference for FPV development in the region can still exponentially grow in the near future

Drivers of FPV Deployment in ASEAN

Southeast Asia is endowed with abundant solar resources, which offer promising renewable energy potentials that member states can leverage for their power-generating capacity Notwithstanding this enormous solar potential, its optimal exploitation is sometimes impeded by land-associated barriers Large ground-mounted solar farms are well-equipped to fulfil the electricity demand of highpopulated areas, but those sites are often faced with the issue of land shortage [3]

The deployment of FPV requires a water surface for it to operate on, as opposed to on land where its utilisation often conflicts with residential use or agricultural purposes. These differing land-use interests are respectively listed in Indonesia’s Guidelines for Floating Solar PV Farms 5 and by the Philippines 6 as drivers for FPV development Not secondary to land concerns, benefits stemming from FPV also arrive in the form of energy diversification enabled by the increase of different types of renewable in each country’s capacity mix [4]

Contemporary FPV Landscape in ASEAN

Albeit its relatively nascent status as a technology, FPV has drawn interest from ASEAN member countries Based on Table 1, all ten ASEAN Member States are tapping into their FPV potentials The stages of the project development vary in each country, ranging from those in the initial planning stage to the finished plant projects that have started their commercial operation The first FPV facility in the region is Singapore’s Testbed Facility at Tengeh Reservoir, launched in 2016.

9 potential sites for demo projects Ulu Totong Dam, Benutan Reservoir, Kago

Dam Mengkubau Dam Tasek Lama

Imang Reservoir, Sengkurong Lake, Ikas Lake, Tasek Pelangi Biru

FPV facilities built in Chip Mong Insee Cement Corporation facilities developed by Ciel & Terre

Cirata FPV

FPV on Nam Theun 2 hydropower plant

FPV at the ex-mining lake in Dengkil, in the Selangor state

FPV at Sultan Azlan Shah Power Station in Manjung Perak

FPV at Batang Ai Hydroelectric Plant in Sarawak

FPV at Paunglaung Dam, Yan Aung

Myin Dam, and Chaung Ma Gyi Dam in the Nay Pyi Taw Council Area

FPV contracts on Laguna de Bay

FPV on a 90-hectare fishpond in Cadiz, Negros Occidental province

FPV testbed at Tengeh Reservoir

Sembcorp Tengeh Floating Solar Farm

FPV on Bedok and Lower Seletar Reservoirs

FPV at Sirindhorn Dam in Ubon Ratchathani

FPV at Ubol Ratana Dam in Khon Kaen Province

The trend of FPV planning in ASEAN started to grow during 20192023, with the 47 5 MW FPV project in Da Mi Hydropower in Viet Nam launched in 2019 among the first commercial-scale facility in ASEAN The largest of FPVs currently operating in the region is Indonesia’s Cirata Floating Solar Power Plant, with an installed capacity of 192 MW, which was constructed under a power purchase agreement (PPA) between a subsidiary of the state utility PLN with UAE’s green energy enterprise Masdar

[5] [6]

FPV

Ho Tam

FPV

Ho Gia Hoet

FPV

y p j Capacity [24] [7] [8] [9] [10] [11][12] [13] [14] [15] [18] [19] [20] [21] [22] [23] [16] [17] Brunei Darussalam Cambodia Indonesia Lao PDR Malaysia Myanmar Philippines Singapore Thailand Viet Nam Planning Commissioned Operational In construction Planning Pilot project Planning Planning Planning Planning Pilot project Operational Operational Operational Planning Operational Operational Potentially 2,323 MW by 2035 2 8 MWp 192 MWp 240 MWp 13 MWp 105 12 kWp 50 MWp1 100 MW for 8 installations + Six solar operating contracts of 610.5 MW + 270 MW 100 MW 1 MWp 60 MWp 2x1 5 MWp 45 MW 24 MW 47 5 MWp

project on Da Mi hydropower plant The

Bo

Power Plant and

1

Power Plant

16 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

Table 1 Floating Solar PV Projects in ASEAN – This table does not provide an exhaustive list of all FPV projects across ASEAN.

FEATURED INSIGHTS

Albeit its relatively nascent status as a technology, FPV has drawn interest from ASEAN member countries Based on Table 1, all ten ASEAN Member States are tapping into their FPV potentials The stages of the project development vary in each country, ranging from those in the initial planning stage to the finished plant projects that have started their commercial operation. The first FPV facility in the region is Singapore’s Testbed Facility at Tengeh Reservoir, launched in 2016.

[25]

The trend of FPV planning in ASEAN started to grow during 2019 - 2023, with the 47.5 MW FPV project in Da Mi Hydropower in Viet Nam launched in 2019 among the first commercial-scale facility in ASEAN. The largest of FPVs currently operating in the region is Indonesia’s Cirata Floating Solar Power Plant, with an installed capacity of 192 MW, which was constructed under a power purchase agreement (PPA) between a subsidiary of the state utility PLN with UAE’s green energy enterprise Masdar

Opportunities of FPV for ASEAN

Evidently, the appetite to develop FPV projects among ASEAN member states is high, as underscored by the multi-hundred megawatts projects currently in the planning stage However, the enormous potential of FPV in ASEAN, as identified by the NREL study, presents the region with a low-hanging fruit to seize When juxtaposed with the current scale of planned initiatives, FPV potentials in ASEAN are still an underexplored territory waiting to be optimally leveraged

This technology allows member states to meet the 23% RE share goal in the Total Primary Energy Supply (TPES) set in the ASEAN Plan of Action for Energy

development with a supportive policy and regulation environment is crucial to ensure its robust actualisation In the short-term, filling the policy gap is the way forward to achieve a consistent and sustainable FPV deployment plan nationally Furthermore, consolidating the policy gap of water rights and permits for energy facilities on water can also provide an avenue for strategically utilising energy projects for the blue economy.

[1]https://power nridigital com/future power technology feb21/hapcheon dam based floati ng solar

[2]https://www weforum org/agenda/2019/03/japan-is-the-world-leader-in-floating-solarpower/

[3]https://ebtke esdm go id/post/2021/12/14/3036/panduan perencanaan pembangkit listrik t enaga surya plts terapung

[4]https://www doe gov ph/press-releases/doe-turned-over-six-contracts-large-scale-floatingsolar-projects

[5] https://www pub gov sg/Public/WaterLoop/Sustainability/Solar/Floating

[6]https://masdar ae/en/renewables/our-projects/cirata-floating-photovoltaic-fpv-plant [7]https://thescoop co/2021/06/30/nine-potential-sites-identified-for-floating-solar-farms/ [8]https://renewablesnow com/news/ciel-terre-cleantech-solar-build-cambodias-first-floatingpv-plant-644860/

[9]https://www antaranews com/berita/3931665/plts-terapung-cirata-berpotensi-tambahkapasitas-hingga-1000-mwp

[10]https://www namtheun2 com/nam-theun-2-shareholders-sign-project-developmentagreement-pda-for-nam-theun-2-solar/

[11]https://www pv-magazine com/2020/10/21/floating-solar-plant-with-lcoe-of-0-038-kwhcomes-online-in-malaysia/

[12]https://renewablesnow com/news/solarvest-commissions-13-mw-floating-solar-plant-inmalaysia-716237/

[13]https://www businesstoday com my/2022/03/04/tnb-installs-first-floating-solar-farm-atmajung-power-plant/

[14]https://www thestar com my/business/business-news/2023/07/03/seb-awards-large-scalefloating-solar-farm-project-to-chinas-trina

[15]https://www gnlm com mm/floating-solar-power-project-to-be-implemented-in-nay-pyitaw-council-territory/

Cooperation (APAEC) Phase II framework Maximising the utilisation of FPV in ASEAN will benefit the implementers with an increase of RE share in their energy mix and a diversification of energy sources Aside from this energy-focused point of view, an FPV site can be explored to serve dual purposes, such as combining its utilisation with aquaculture

[28]

[26] [27]

However, more than development and investment plans are required Formulating specific regulations for the technology will ensure the sustainability of an FPV planning regime In light of this, the Philippines has taken the initial step by providing detailed guidelines for investments in FPV, which will solidify the technology’s deployment plan into its National Expenditure Program Solidifying the game rules is crucial to draw investment and create certainty for the private stakeholders. Best practices for FPV financial incentives can be learned from another region, such as higher feed-in-tariffs than ground solar farms in China or extra benefits for renewable energy certificates in South Korea

[29]

On the other hand, the lacunae in FPV regulation can be attributed to the current absence of permits and regulations specifically directed at energy-related facilities and activities Equipping the plan to upscale FPV [30]

[16]https://www doe gov ph/press-releases/doe-turned-over-six-contracts-large-scale-floatingsolar-projects

[17]https://cleantechnica com/2023/09/01/philippines-largest-inland-lake-to-host-large-scalefloating-solar-projects-producing-up-to-1800mw/

[18]https://www pv-magazine com/2023/09/11/philippines-to-build-new-100-mw-floatingsolar-power-farm/

[19] https://www pub gov sg/Public/WaterLoop/Sustainability/Solar/Floating

[20]https://info pub gov sg/news/pressreleases/PUBawardsBedokLowerSeletarFloatingSyste mstoBBRGreentech

[21] https://www egat co th/home/en/20211103-pre/

[22]https://www hydroreview com/business-finance/business/egat-to-construct-hybrid-hydrofloating-solar-project/

[23]https://en evn com vn/d6/news/Da-Mi-Floating-Solar-Power-Plant-successfully-connectedto-grid-66-163-1474 aspx

[24]https://www pv-magazine com/2021/01/06/vietnam-sees-70-mw-of-floating-pv-comeonline/

[25] https://www nrel gov/docs/fy23osti/84921 pdf

[26] https://aseanenergy org/publications/the-7th-asean-energy-outlook/

[27] https://www nrel gov/docs/fy23osti/85264 pdf

[28]https://pia gov ph/press-releases/2023/08/03/denr-doe-to-update-offshore-wind-floatingsolar-guidelines

[29]https://documents1 worldbank org/curated/en/579941540407455831/pdf/Floating-SolarMarket-Report-Executive-Summary pdf p 7

[30] Ibid p 9

NAME:

Veronica Ayu Pangestika

Monika Merdekawati

17 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

eni Suryadi

Regional REC Framework for ASEAN Net Zero Ambition

Renewable Energy Certificate (REC) records the environmental attributes of one MWh of electricity generated from renewable energy (RE) sources It is used as a market-based instrument or, in a sense, a form of energy commodity It can be purchased by electricity consumers (companies or individuals) and sold by power companies or developers Once it is sold, it can’t be purchased again and has an expiry date. Its attributes include the place of generation, the type of renewable resources, and the generation date. REC’s purpose grows eminent when the prices are high enough to incentivise the developers, hence encouraging more RE investment

Greenhouse Gas Protocol allows the use of market-based instruments, such as REC and PPA, for scope two emissions accounting. Explaining why purchasing REC has increasingly become a norm for companies to fulfill their net zero ambition

Since the launch of the RE100 initiative at Climate Week NYC 2014, 355 companies from over 150 countries have joined the group. In the RE100 2022 Annual Disclosure Report, 334 members reported 376 TWh of electricity consumption, equivalent to 1.5% of the world’s total and claimed 49% is sourced from RE Albeit the increasing membership, the average RE100 target year has been delayed by one year from 2030 to 2031 This delay is primarily contributed by the new members who chose an average target year of 2036 and 14 existing members who brought their targets forward in the past year by 12 years on average

Seven years after RE100 inception, the CDP – one of the founding members of RE100, with UN Global Compact, WRI, and WWF launched the Science Based Targets Initiative (SBTi) Net-Zero Standard ahead of COP26, providing the first framework for corporate net zero target setting This standard could be seen as the extended version of RE100 reporting framework as it is oriented on achieving net zero emission – a more straightforward indicator for tracking the progress towards 1 5OC Paris goal However, a study found 48 overlapping members participated in both SBTi and RE100, and 73% of GHG emissions covered by RE100 overlapped with the SBTi

In ASEAN, REC is not a foreign instrument Voluntary REC markets exist in most member countries (except Myanmar) Singapore is the only member country among the five countries in Asia (China, India, Japan, and the Republic of Korea) that procured the most renewable electricity, according to RE100 Despite the limited options for corporate RE procurement, Singapore recorded around 720 GWh REC purchases, 100 GWh PPAs, and 10 GWh contracts with suppliers And the transaction is dominated by cross-border renewable electricity, with only 26% originating from Singapore

Recently, growing state-owned utilities are facilitating more voluntary REC transactions in ASEAN by selling REC and informing electricity productions of ‘certified’ RE power plants through online platforms And in most cases, the initiative is endorsed by their respective Ministry of Energy With the optimistic view, we could expect the lessons learned from these government-led programs to strengthen the country’s readiness to employ mandatory REC market in the coming years.

Indonesia’s PLN started selling REC in December 2021 By January 2023, PLN claimed 1 7 TWh REC sales in 2022 to 40 companies, a five-fold increase from 308 GWh in 2021 The PLN’s REC is offered at USD 2 3/kWh (IDR 35,000/ kWh). In comparison, in the United States, voluntary REC prices between 2012 – 2018 were recorded between USD 0.35 – 1.2/ MWh.

In October 2019, Malaysia’s Minister of Energy, Science, Technology, Environment, & Climate Change (MESTECC) launched the Malaysia

Green Attribute Tracking System (mGATS) It is a marketplace that allows generators, retailers, and customers to purchase REC, but so far, it only tracks TNB’s REC In December 2019, Sarawak Energy delivered first RECs batch from Batang Ai hydropower plant

In August 2022, the Philippines commenced the interim commercial operations of the Renewable Energy Market (PREM) as the platform for REC trade The Philippine Electricity Market Corporation (PEMC) is appointed to take on registrar functions, including issuing, keeping, and verifying REC

In November 2018, Singapore’s SP Group – a government partner providing services for the open electricity market, such as meter reading, meter data management, and facilitating customer transfers between retailers, launched the world’s first blockchain-powered REC marketplace

In December 2020, Toyota Motors bought the first 10 thousand RECs from Thailand’s EGAT And two years later, EGAT issued 5 2 million RECs as reported in the 1st Thailand’s I-REC Standard Conference in November 2022.

On the regional scale, the recent extension of the Lao PDR-ThailandMalaysia-Singapore Power Integration Project (LTMS-PIP) emphasised REC’s possible role in breaking the cross-border RE-based power trade boundary In June 2022, Singapore commenced the import of up to 100 MW of hydropower from Lao PDR to pave the way for importing up to 4 GW of green electricity by 2035

Suppose the REC framework is established regionally In that case, such electricity import could be extended to private companies and sourced from multiple countries along LTMS-PIP without being bound by strict bilateral PPAs Countries with enormous RE potential could benefit economically from exporting REC via ASEAN Power Grid (APG) On the other hand, countries with higher REC demand due to the presence of multinational companies could tap into renewable electricity Then, the accumulation of REC purchases could be directed back as the stimulus of APG expansions.

Considering ASEAN’s aspirational target alone – 23% RE share of total primary energy, could offer 1 2 million GWh by 2025, according to the 7th ASEAN Energy Outlook (AEO7) Coupling the REC with APG planning could substantially expand the market size, eventually helping ASEAN member countries realise their net zero pledges.

AUTHORS NAME:

Monika Merdekawati eni Suryadi

FEATURED INSIGHTS

18 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

Indonesia's Newfound Hope for Rooftop Solar Utilization(?)

The Indonesian Ministry of Energy and Mineral Resources (“MEMR”) has established target for solar energy utilization, aiming for 6,500 MW by 2025 and 45,000 MW by 2050 Despite these goals, they are still considered relatively modest compared to Indonesia's vast solar potential, estimated at 207,900 MW The total installed solar energy capacity in 2023 was recorded at 573 8 MW (Rooftop & Non-Rooftop), with the majority coming from the Cirata Floating solar project with a capacity of 145 MW (ac) or 192 MW (p) and Rooftop Solar (“RTS”) with capacity 141 14 MWp

In February 2024, MEMR has published MEMR Regulation Number 2 of 2024 on Rooftop Solar-Power Plants Connected to Electrical Power Networks Of Holders Of Business Licenses For The Provision Of Electrical Power For Public Interests (“Reg 2/2024”) This new regulation supersedes the MEMR Regulation Number 26 of 2021 on Rooftop SolarPower Plants Connected to Electrical Power Networks Of Holders Of Business Licenses For The Provision Of Electrical Power For Public Interests (“Reg 26/2021”) RTS enthusiasts have long awaited this new regulation, due to Reg 26/2021 implementation had been delayed for over a year. Reg 2/2024 is anticipated to invigorate the solar energy sector and encourage the installation of RTS systems, aiming for 3,600 MW by 2025

One of the major changes in the new regulation is RTS users will no longer being eligible to benefit from exporting excess solar energy (Net Metering) to PT Perusahaan Listrik Negara (“PLN”), the state-owned electricity provider This change has sparked debate as it may affect residential and small businesses users negatively These users might see the new regulation less beneficial compared to the previous regulations which obligates PLN to buy exported energy from RTS to PLN grid in the mount of 65% exported energy (stipulated in Reg 49/2018) and 100% exported energy (stipulated in Reg 26/2021) However, MEMR justifies this change by highlighting PLN's oversupply issue, particularly in Java Island.

Reg 2/2024 will introduce a limitation based on quotas for RTS installations PLN will determine yearly quotas, which may be segmented by clustering system which means PLN will consider the capacity based

on electric power system in the PLN customer service units Moreover, this regulation will also control on when the applications for installing RTS to PLN, which will be submitted once a year either in January or July This provision will establish a novel licensing framework operating on a firstcome, first-served basis and probably commercial and industrial sectors may dominate these quotas This regulation also specifies that in the absence of detailed regulations regarding the environmental attributes of RTS usage, then these attributes will belong to the government. While there is no specific definition of which government institution will claim these benefits, it is probable that PLN will benefit from them In addition, this regulation also introduces provisions regarding fines, which were not previously regulated If RTS customer operates the RTS before obtaining approval from PLN, PLN will impose a fine calculated based on the total inverter capacity multiplied by 240 hours multiplied by the electricity tariff

On the positive side, the new regulation will revoke the 5 hours capacity charge provision for PLN industrial customer as one of the government incentives to support RTS The new regulation will adopt some kind of positive fictional decision which can be found at Indonesian state administration law. This method is expected to expedite the PLN approval process which impacting if PLN does not give an approval or rejection letter to applicant within the certain period of time, the application is considered approved This regulation will not directly affect the existing RTS consumer because they will still follow the existing regulation on the Net Metering benefits and will be updated after 10 years of RTS operation

However, the Reg 2/2024 is expected to become a new hope for RTS energy in Indonesia and stimulates the industry, although there are contrasting views from RTS players and users With government commitment and healthy competition among RTS players, the government still optimist to achieve its New Renewable Energy mix by 2025

FEATURED INSIGHTS able Energy Law Expert / cretary-General esia Solar Energy Association (ISEA) ugi Saleh, SH 19 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

Chasing The Sun: The Long, Winding Road of Making Indonesia a Solar Powerhouse

Indonesia in the geopolitical landscape is often called ‘underestimated’, but in the past few years it is back on the map In the year 2022, when Indonesia was holding the G20 presidency, news coverage on Indonesia increased significantly – including on its energy transition priority

Located in the equatorial area, Indonesia is blessed with year-round sun rays Naturally, renewable energy source with the highest potential is solar energy; the Institute for Essential Services Reform (IESR) estimates the technical potential based on land availability scenarios range from 3,397 GWp to 19,835 GWp However, the high potential does not correspond to solar installations – by the end of 2023, cumulative installations only reached 573 6 MW, not even in the gigawatt order

Surprisingly (or not?), harnessing the power of the sun in Indonesia is a daunting task, less on the techno-economic side but more on the incoherent enabling ecosystem, including policy and regulatory frameworks In the past 5 years, annual renewable energy targets were never achieved and it is likely that the 23% target by 2025 will be abandoned – lowered to 17-19% During that same period, there were only three notable utility-scale solar PV projects inaugurated across the country: West Nusa Tenggara (3 x 7 MW), Likupang (21 MW), and Cirata Floating Solar (192 MWp)

Like any other power plants, utility-scale solar PV development in Indonesia must go through centralized planning based on national electricity plan (“RUKN”) and the Indonesian utility (PLN) 10-year business plan (“RUPTL”). Historically, number of big solar PV plants Indonesia in the plan was low, until the latest RUPTL (2021-2030) incorporates large number of utility scale solar PV plants, a total of 4 7 GW until 2030 The number is a combination of solar PV plants built by PLN and independent power producers (IPPs) – both land-based and floating, de-dieselization program (replacing diesel power plants with solar and storage), and rooftop solar PV There have been two market soundings held by PLN’s subsidiary (Hijaunesia project) following the RUPTL, with plan to develop large scale solar in Sumatera and Java-Bali system, however, the information was very limited and by invitations only Based on our analysis, floating solar is more attractive for investors due to several reasons, even before the Cirata Floating Solar was inaugurated in November 2023. In the series of event for Indonesia’s G20 Presidency, ACWA Power signed an MoU with PLN to develop floating solar of 110 MWac combined capacity in Saguling Dam (West Java) and Singkarak Lake (West Sumatera)

Rooftop solar PV in Indonesia is of entirely different history Until 2018, its growth was practically invisible – while there was a legal basis for on-grid installation (based on PLN’s director decree issued in 2013), the public’s information access and awareness on said regulation was limited In the period of 2016-2018, a group of solar advocates coordinated by IESR and Indonesian Solar Association (AESI) worked collaboratively to promote mainstream rooftop solar PV use in Indonesia This work contributed to the issuance of Indonesia’s first ministerial regulation for on-grid rooftop solar PV, MEMR Reg. No. 49/2018. Since then, and along with its two revisions in 2019, Indonesia recorded a relatively decent installation growth – from only 608 users in 2018 to 4,800 by end of 2021 While the greatest number of users are from the residential sector, the dominant portion of cumulative capacity addition came from industrial sector installing in megawatt sizes

A bleak streak occurred in the beginning of 2022, right after the latest regulation on rooftop solar PV was issued (MEMR Reg 26/2021) On

paper, it is much better than the previous one: a net metering tariff of 1:1 –compared to previous 0 65:1, no operational certificate or SLO for installation under 500 kW, and a mandatory formation of helpdesk –however, this regulation never came to practice because of internal PLN letter limiting rooftop solar PV installation to 15% (of installed electricity power) only In public, they often cite overcapacity of coal power plants in Java – Bali system and the needs to protect grid stability After recording year-on-year user growth of more than 25% annually since 2018 (number of installation), it was declining in 2022

Seeing this solar conundrum, in early 2023 the government was set to revise MEMR Reg 26/2021 to find middle ground between government renewable energy target, PLN concerns, and consumer’s rights to clean energy; with the first public hearing held in January. Arguably, it was a compromise: no installation limit but follows system quota (to be defined and determined), no power export allowed (no more net metering), and a more regular application period (twice a year) The no-limit policy is great, with questions on how the system quota will be determined and the procedure to get in line No power export policy is probably acceptable for industrial users – as many of them prefer certainty over capacity installed and most of the power generated will be used for their operations But the removal of net metering will affect residential solar greatly, as their peak demand is mostly at night

With the revision going in circles, fortunately, in 2023 we observed increase in installation numbers and capacity – by December, there was almost 8,500 rooftop solar PV users in Indonesia. A small number still, considering 86 million PLN customers across the nation

After being approved by the president - a bit unprecedented that a ministerial regulation needs that approval, citing concerns over state budget to compensate possibility of rising electricity generation cost due to large volume of solar penetration to PLN's grid; the new regulation (MEMR Reg no 2/2014) was finally issued on 20th February

Then, what to expect in 2024?

We have yet to see any green signals of large-scale solar development in Indonesia, updates from the Hijaunesia market sounding are much anticipated particularly after the completion of Cirata floating solar (which by they way, took almost 7 years since the MoU between Indonesia and UAE was signed) There was no new RUPTL for the past 2 years, hopefully there will be more solar projects in the pipeline – considering JETP’s investment plan as well And with new regulation on rooftop solar issued, we have yet to see comprehensive responses from solar companies and users - there have been several questions on how it will be implemented We certainly expect for more growth, there are a significant market potential in Indonesia, from residential, businesses, to industrial users.

While official election result will not be published until sometime in March, will the new leader, will the new leader bring more ‘light’ to this story?

FEATURED INSIGHTS Manager able Energy Access, Institute ntial Services Reform stya Citraningrum (Ms.) 20 INDONESIA ANNUAL EDITION 2024 | SOLARTECH INDONESIA EXPO SPECIAL ISSUE SOLARQUARTER

SOUTHEAST ASIA|RESEARCH INSIGHTS

Illuminating the Archipelago: Milestones and Future Prospects of Installed Solar PV Capacity in Indonesia

In a monumental leap towards sustainable energy, Indonesia has achieved an impressive 322 6 MW solar power plant capacity in the first half of 2023 The Indonesian Ministry of Energy and Mineral Resources (ESDM) has been at the forefront, spearheading initiatives to tap into the immense potential of New and Renewable Energy (EBT) as a reliable source to power the nation's future. As the momentum continues, projections indicate that the solar PV installations are on track to reach close to 400 MW, setting the stage for a transformative shift in Indonesia's energy landscape

The ambitious target of surpassing 4 GW in solar PV installations by the end of 2025 showcases Indonesia's commitment to embracing sustainable energy solutions The government's strategic vision extends even further, with projections pointing towards nearly 30 GW of solar PV capacity by 2030 and a staggering 265 GW by 2050 These targets signify not only a paradigm shift towards cleaner energy but also position Indonesia as a formidable player in the global renewable energy arena

The solar PV boom in Indonesia is strategically aligned with broader regional trends, where solar energy is emerging as a dominant player in the power mix As other Southeast Asian nations increasingly integrate solar power into their energy portfolios, Indonesia aims to position itself as a regional leader in renewable energy development This not only enhances energy security but also establishes Indonesia as a key player in mitigating climate change through reduced reliance on fossil fuels

The successful implementation of solar PV projects across the archipelago is paving the way for a decentralized and resilient energy infrastructure By harnessing the abundant sunlight that blankets the Indonesian islands, solar power plants are providing electricity to remote and off-grid areas, ensuring that even the most isolated communities have access to clean and sustainable energy This not only contributes to poverty alleviation but also fosters economic development in previously underserved regions