FUTURE OUTLOOK: TRENDS AND INNOVATIONS SHAPING THE COMMERCIAL EV LANDSCAPE IN LOGISTICS

COVER STORY

REVVING UP REVENUE: MAKING AFFORDABLE PUBLIC EV CHARGING VIABLE

AUTO COMPONENT INDUSTRY GEARS UP FOR EV TRANSITION

EVCHARGINGSTATION

Driving Towards a Sustainable Future: Our Vision and Mission as a Leading EV Charging Operator

Founder & CEO Nikol EV

P O W E R I N G S M A R T , E L E C T R I C , E F F I C I E N T M O B I L I T Y J U N E - J U L Y 2 0 2 3 | V O L U M E 4 | I S S U E 4

08 ISHAAN PARWANDA Director Trinity Touch Pvt Ltd Smriti Charan Sangeeta Sridhar advertise@firstviewgroup com Sadhana Raju Shenvekar Vaibhav Enterprises ADVERTISING CIRCULATION PRINTING Firstview Media Ventures Pvt Ltd Ashwini Chikkodi editorial@firstviewgroup com Sadhana

publishing@firstviewgroup com Neha Barangali Radha

design@firstviewgroup com PUBLISHING EDITING CONTENT DESIGNING CONTENT 04 10 FEATURED TALKS IN CONVERSATION ARJUN D PAWAR DEV ARORA Founder & CEO Nikol EV Co-founder, and CEO Alt Mobility PROJECT FEATURE 15 MINDRA 26 TECHNOLOGY INSIGHT EMOBILITY+ RESEARCH 25 06 28 33 SPECIAL STORY COVER STORY MARKET STATISTICS POLICY INSIGHT 14 NAKUL KUKAR

and

THINKTANK ROUNDUP Revving Up Revenue: Making Affordable Public EV Charging Viable Auto Component Industry Gears Up for EV Transition 16 18 PROJECT FEATURE 09 12 COMSOL OMEGA SEIKI 30 33 CURRENT AFFAIR POLICY DEBRIEF OPINION Future Outlook: Trends and Innovations Shaping the Commercial EV Landscape in Logistics 20 PERSPECTIVE Interoperability across different charging networks 22

Raju Shenvekar Rajarshi Sengupta Pallab Kumar

Buddhadev

Founder

CEO, Cell Propulsion

| INDIA JUN-JUL ISSUE 2023 | PG 03

INCONVERSATION

Driving Towards a Sustainable Future: Our Vision and Mission as a Leading EV Charging Operator

Arjun D Pawar

Founder & CEO Nikol EV

Founder & CEO Nikol EV

CONVERSATION HIGHLIGHTS

Our vision is to create a sustainable EV charging infrastructure, accelerating the transition to a cleaner and greener transportation system Uniform tariff plans and incentives can fasten the adoption of EV charging infrastructure on highways

Last year marked our stepping stone in the EV charging industry, and we are aligned with our vision and plans for the next five years

What is your vision and mission as a leading electric vehicle charging operator (CPO)?

Our Vision is to be a leading CPO in the country and to create a sustainable and accessible electric vehicle (EV) charging infrastructure that supports the widespread adoption of electric mobility. Our aim is to contribute to the transition to a cleaner and greener transportation system, reducing reliance on fossil fuels and minimizing the environmental impact of transportation

Our Mission is to install 1Lakh EV Charging Stations by 2030

Can you please give us a brief insight into the technocommercial aspects to establish a public charging station (PCS) in India? According to you, what is the major regulatory or policy bottleneck in terms of successfully establishing and operating a public charging station in India?

Establishing a public charging station (PCS) in India involves several techno-commercial aspects, along with regulatory and policy considerations. Here's a brief insight into these aspects and the major regulatory or policy bottlenecks that exist:

Site Selection: Identifying suitable locations for PCS based on factors like proximity to high-traffic areas, availability of power supply, parking space, and accessibility for EV owners

Infrastructure Development: Setting up the necessary charging equipment including charging stations, connectors, and power distribution units, as well as integrating them with the local power grid

Power Supply: Ensuring a robust and reliable power supply to meet the charging demands of electric vehicles (EVs) This may involve coordination with power distribution companies and assessing the power infrastructure capacity

Charging Models: Deciding on the charging models to be offered, such as pay-per-use, subscription-based, or a mix of both, and establishing appropriate pricing structures

Revenue Generation: Developing a sustainable revenue model for the PCS, which may include charging fees, advertising, partnerships, or tie-ups with other service providers.

Regulatory and Policy Bottlenecks we face in India are in terms of;

Licensing and Permits: Obtaining the necessary licenses and permits from local authorities and regulatory bodies

Land and Site Acquisition: Acquiring suitable land or space for setting up the PCS can be a challenge, especially in densely populated areas or commercial zones

Interoperability and Standards: Ensuring interoperability and adherence to standardized charging protocols to accommodate different EV models, which may require compliance with national or international standards

Tariff Regulations: Dealing with tariff regulations set by electricity regulatory commissions, which can impact the pricing structure and profitability of the PCS

Incentives and Subsidies: Availability and effectiveness of government incentives and subsidies for PCS installations, which can influence the financial viability and attractiveness of the project

Roaming and Open Access: Establishing a framework for roaming services and open access to PCS, enabling seamless charging experiences for EV owners across different networks or service providers.

Charging

| INDIA JUN-JUL ISSUE 2023 | PG 04

Nikol EV's Smart

Solutions Lead the Way to a Greener Tomorrow.

How Nikol EV as a charge point operator (CPO) is developing solutions to optimize charging patterns, manage peak loads, and support grid stability? According to you, what is the Importance of grid integration and smart charging solutions in India's charging infrastructure?

We at NIKOL EV are implementing smart charging solutions that take into account factors such as electricity demand, grid capacity, and user preferences. These solutions can include features like load balancing, demand response, and time-ofuse pricing

Grid stability is critical for the reliable and efficient operation of charging infrastructure. By implementing smart charging solutions, we as CPO can contribute to grid stability by reducing the overall demand on the grid during peak periods and leveraging renewable energy generation. This can lead to a more balanced and sustainable energy system

Regarding the importance of grid integration and smart charging solutions in India's charging infrastructure there are several key factors to consider India is experiencing rapid growth in the adoption of electric vehicles, and a robust charging infrastructure is essential to support this transition Smart charging solutions and grid integration can address the following challenges:

Grid Capacity: The existing power grid infrastructure in India may not be designed to handle the increased electricity demand from widespread EV charging Smart charging solutions can help manage the load and prevent grid overload by optimizing charging patterns and leveraging renewable energy sources

Peak Load Management: India's power grid often faces challenges during peak demand periods Integrating smart charging solutions can help distribute the charging load, ensuring that the grid can handle the increased demand without disruptions

Renewable Energy Integration: India has ambitious goals for renewable energy deployment Smart charging solutions can enable the integration of renewable energy sources by encouraging EV charging during periods of high renewable energy generation This alignment between charging patterns and renewable energy availability can reduce reliance on fossil fuel-based power generation.

Cost Optimization: Smart charging solutions can help EV owners and operators save money by taking advantage of time-of-use pricing or preferential rates during off-peak hours. This can make EV charging more affordable and encourage further adoption

Can you please give us an insight into state wise grid tariff rates for charge point operators (CPO)? Which states have implemented time of day tariff (ToD) mechanism for EV charging by CPOs ?

State wise grid tariff rates for CPOs are a challenge as they are different for different states The government should work on uniform tariff plan for all states and should also consider the investment dony by a CPO to setup an EV Charging station, which accounts for 40% of the investment in setting up an EV charging station

By providing waiver of not requiring transformers for load demand of less than 100kW can fasten the adoption of fast EV charging infra on Highways

Delhi has implemented time of day tariff (ToD) mechanism for EV charging and various other states are working on the implementation of the same

What was Nikol EV's performance in the last financial year FY 2022-23? What is your expectation for the current financial year FY 2023-24?

Last Financial Year was our stepping stone in the EV charging industry and we are pretty much aligned with our vision and plan for the next 5 years

We have covered 1,500+ kms of State & National Highways in Maharashtra with our fast charging network We have onboarded 3,000+ EV chargers on our mobile application PAN India which EV users can access from our mobile application – Nikol EV

Our fast charging stations are having a very good up time of 97% and are operational 24x7 to the public and fleets as well

This financial year we are planning to install 100 fast charging stations and are also going to launch our own Hybrid AC charger which will cater to the societies and commercial places for 2w, 3w & 4w charging

| INDIA INCONVERSATION JUN-JUL ISSUE 2023 | PG 05

Smart charging solutions contribute to grid stability by optimizing charging patterns and leveraging renewable energy sources.

DIGITIZATION OF INDIA'S EV FLEET MANAGEMENT

The digitization of India's Electric Vehicle (EV) fleet management is of paramount importance in ensuring the efficient and sustainable operation of electric vehicles across the country Embracing digital technologies and data-driven solutions offers numerous benefits that contribute to the successful adoption and management of EV fleets Here are some key reasons highlighting the importance of digitization in India's EV fleet management:

Optimal Charging Infrastructure Planning: Digitization allows fleet operators to analyze data on charging patterns, usage, and demand This data-driven approach helps in strategically planning the placement of charging stations, ensuring their optimal distribution across urban centers and highways. Efficient charging infrastructure planning maximizes the accessibility and convenience for EV fleet users

Real-time Monitoring and Diagnostics: Digital fleet management systems enable real-time monitoring of individual EVs, including battery status, charging progress, and overall performance This capability allows fleet managers to identify and address issues promptly, reducing downtime and optimizing the operational efficiency of the fleet

Range Optimization and Route Planning: Digitized fleet management systems can analyze historical data to optimize driving routes based on battery range and charging infrastructure availability By selecting the most energy-efficient routes fleet managers can extend the operational range of EVs and minimize the risk of vehicles running out of charge

Fleet Performance Analytics: Data analytics and artificial intelligence can help fleet managers gain valuable insights into the performance of

EVs By tracking metrics such as energy consumption, vehicle utilization, and maintenance requirements, managers can make data-driven decisions to improve overall fleet efficiency and reduce operational costs

Remote Vehicle Diagnostics and Maintenance: Digitization enables remote diagnostics of EVs, allowing fleet managers to identify potential maintenance needs in real-time Predictive maintenance can be employed, scheduling servicing and repairs proactively, which reduces downtime and increases fleet availability

Enhanced Energy Management: EV fleet management systems can optimize energy consumption by coordinating charging schedules during off-peak hours when electricity tariffs are lower Smart charging solutions can also support the integration of renewable energy sources into the grid, promoting sustainable energy usage for EVs

Cost Optimization: By leveraging digitized fleet management, operators can identify cost-saving opportunities, including efficient charging practices, route optimization, and improved vehicle performance This can lead to reduced operational expenses and a positive return on investment for EV fleet adoption

Regulatory Compliance and Reporting: Digital fleet management systems facilitate compliance with environmental regulations and reporting requirements By maintaining accurate and up-to-date data on vehicle usage and emissions, fleet operators can demonstrate their commitment to sustainability and meet regulatory obligations

Scalability and Flexibility: Digitization allows for easy scaling of fleet operations as the demand for EVs grows Fleet management platforms can adapt to varying fleet sizes, making it feasible for businesses and organizations of all scales to transition to electric mobility

Software and hardware required for India's EV fleet digitization

India's EV fleet digitization requires a combination of software and hardware solutions to effectively manage electric vehicles, optimize charging infrastructure, and gather data for analytics Below are the key software and hardware components typically needed for India's EV fleet digitization:

Software Solutions:

Fleet Management Software: Fleet management software is the core platform that oversees the entire EV fleet It includes functionalities such as real-time vehicle tracking, driver assignment, route optimization, maintenance scheduling, and performance monitoring

Telematics and GPS: Telematics software integrates with vehicle onboard sensors and GPS technology to gather and transmit real-time data on vehicle location battery status speed driving behavior and more Telematics provides crucial insights for fleet managers to optimize vehicle operations and assess driver performance

Charging Station Management Software: This software is essential for managing and monitoring the charging infrastructure It allows fleet operators to control charging schedules, track charging sessions, and handle billing and payment processing for electric vehicle charging

Data Analytics and Reporting: Data analytics software processes the vast amount of data collected from telematics, charging stations, and other sources to provide actionable insights Fleet managers can analyze trends, identify inefficiencies, and make data-driven decisions for better fleet performance

Mobile Apps: Mobile applications enable seamless communication between fleet managers, drivers, and charging station operators Users can access real-time information, receive alerts, and perform essential tasks through user-friendly mobile interfaces

COVER STORY

| INDIA JUN-JUL ISSUE 2023 | PG 06

Billing and Payment Systems: For EV fleets used by multiple drivers or in shared mobility services, billing and payment systems are crucial. Software that facilitates transparent billing and easy payment processing simplifies the financial aspects of fleet operations

Hardware Solutions:

Telematics Devices: Telematics devices are installed in each electric vehicle to collect data on various parameters like battery health, driving behavior, and vehicle location These devices transmit data to the fleet management software for analysis

GPS Trackers: GPS trackers are hardware modules that work in conjunction with telematics devices to provide accurate vehicle location data

Charging Infrastructure: The hardware for charging infrastructure includes EV charging stations equipped with the necessary connectors and communication capabilities for interaction with fleet management software

Charging Cables: For EV fleet operations, charging cables and connectors compatible with the vehicles in the fleet are required for charging.

Energy Management Solutions: Energy management hardware and equipment ensure efficient charging, load balancing, and integration with renewable energy sources, reducing operational costs and promoting sustainable energy usage

Onboard Diagnostics: Onboard diagnostic hardware enables the collection of data related to the vehicle's health, battery status, and performance, providing valuable insights for maintenance and optimization

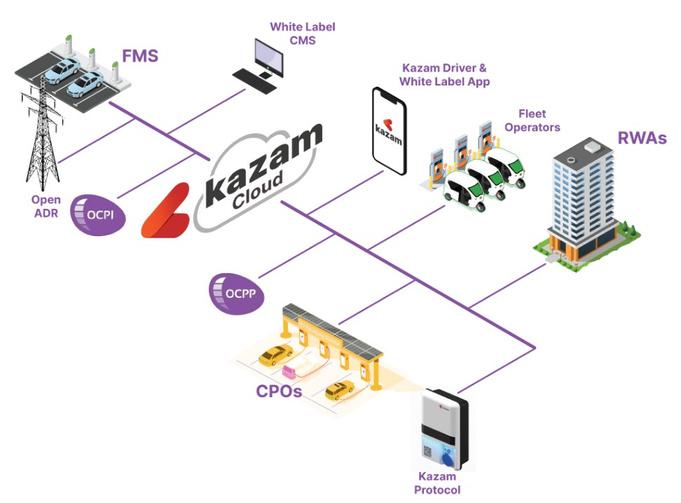

Different digital communication protocol used in EV fleet management

In EV fleet management, digital communication protocols play a crucial role in enabling seamless data exchange and communication between various components of the system These protocols facilitate the transfer of information between electric vehicles, charging infrastructure, fleet management software, and other connected devices Some of the different digital communication protocols used in EV fleet management are:

Open Charge Point Protocol (OCPP): OCPP is a widely adopted communication protocol specifically designed for managing communication between charging stations and central management systems (CMS) It allows charging station operators to remotely monitor, configure, and manage charging sessions OCPP enables interoperability between different charging infrastructure providers and ensures smooth integration into the central EV fleet management platform

ISO 15118 (Combined Charging System - CCS): ISO 15118 is an international standard for communication between EVs and charging infrastructure particularly for DC fast charging. It supports bi-directional communication and enables features like plug and charge, where the charging process starts automatically after a secure communication handshake between the EV and the charging station

CHAdeMO: CHAdeMO is a communication protocol mainly used in Japan for DC fast charging It allows EVs to communicate with CHAdeMO-compatible charging stations to initiate and manage fast charging sessions

MQTT (Message Queuing Telemetry Transport): MQTT is a lightweight publish-subscribe messaging protocol that facilitates efficient communication between devices with low bandwidth and high latency It is often used in IoT (Internet of Things) applications and can be employed in EV fleet management to transfer real-time data between vehicles, charging stations, and central management systems

Cellular Connectivity (e g , 4G, 5G): Cellular communication protocols like 4G and 5G provide reliable and high-speed connectivity between EVs and fleet management platforms They enable real-time data transmission, remote diagnostics, and over-the-air software updates for electric vehicles.

Wi-Fi (Wireless Fidelity): Wi-Fi connectivity can be utilized for communication within a limited range, such as within a charging station site or a specific location It allows for data transfer between vehicles, charging infrastructure, and local network devices

Bluetooth: Bluetooth technology enables short-range communication between EVs and mobile devices, providing a convenient method for users to access and control vehicle functions, including charging status and trip data

Zigbee: Zigbee is a low-power wireless communication protocol widely used in smart home and IoT applications It can be utilized in EV fleet management for communication between charging infrastructure, EVs, and other devices within a localized area.

Standardization and interoperability are of paramount importance for EV fleet management due to several key reasons:

Seamless Communication: Standardization ensures that all components of the EV fleet management system, including electric vehicles, charging infrastructure, and fleet management software, communicate effectively with each other. Interoperability allows different devices and systems from different manufacturers to work together seamlessly This results in a cohesive and integrated fleet management ecosystem, streamlining operations and data exchange

Efficient Charging Infrastructure: Standardized communication protocols between charging stations and electric vehicles simplify the charging process EVs can communicate their charging requirements and capabilities to the charging infrastructure, ensuring optimal charging rates and preventing compatibility issues Interoperability between charging stations from various providers allows electric vehicle fleets to access charging infrastructure from different networks without restrictions

Flexibility and Scalability: Standardization and interoperability enable EV fleet operators to add or replace components without major disruptions This flexibility facilitates fleet expansion and technology upgrades, allowing businesses to adapt to changing market demands and advancements in EV technology

Data Collection and Analysis: Standardized data formats and communication protocols ensure that information collected from EVs and charging infrastructure is consistent and uniform This standardized data is easier to analyze, providing valuable insights into fleet performance, energy consumption, charging patterns, and overall efficiency

Vendor Neutrality: Standardization and interoperability reduce the dependence on specific vendors or manufacturers EV fleet operators can choose from a broader range of products and services, leading to increased competition, innovation, and competitive pricing in the market

Reduced Costs and Complexity: Standardized solutions often lead to reduced implementation costs as they eliminate the need for custom integrations and special adaptations Interoperable systems also simplify fleet management operations, reducing complexity and the need for additional resources

User Convenience: Interoperability enables a consistent and userfriendly experience for fleet operators and drivers EV drivers can access different charging stations with ease, irrespective of the charging network provider, using a single account or payment method

Future-Proofing: In a rapidly evolving EV industry, standardization and interoperability help future-proof fleet management systems As new technologies and updates emerge, standardized protocols ensure that existing infrastructure and devices remain compatible with newer solutions

Regulatory Compliance: Compliance with industry standards and government regulations is crucial for EV fleet operations Standardized and interoperable systems help fleet operators meet regulatory requirements, simplifying auditing and reporting processes.

| INDIA JUN-JUL ISSUE 2023 | PG 07 COVER STORY

Trinity Touch's Impressive Product Line: Accelerating India's Electric Mobility Revolution

ISHAAN PARWANDA

Director Trinity Touch Pvt. Ltd

CONVERSATION HIGHLIGHTS

At Trinity Touch, our vision is to be a market leader in all the EV charging infrastructure products we manufacture, propelling India towards a greener and more sustainable future

In the fast-evolving landscape of electric mobility in India, we are committed to providing FAME-II compliant solutions, manufactured entirely within India and backed by international certifications.

The 'Dash 6' connector is an important evolution in EV charging Any company using it will cement their path to success in the thriving 2-wheel and 3-wheel EV market

What is the vision and mission of Trinity Touch as a budding global Electric Vehicle (EV) charging infrastructure OEM? Can you please briefly describe the market outlook of India's EV charging infra business?

TT is in the electrical space for over a decade

We are a market leader in many product categories. With the advent of EV our mission is to be a market leader in all the products we manufacture We have built immense capacities to cater to OEM and tier 1 vendors The market outlook of EV in India is robust The market will move fast as the Indian companies can manufacture At a macro level the govt is focused on reducing our forex outflow by reducing diesel/petrol import plus reducing pollution On a micro level we are a price sensitive market- all businesses aiming to use EVs to reduce opex Don’t forget the

What will be your major push between fast charging and slow charging infra business as a domestic OEM? How will your products adhere to FAME-II compliance?

Our products will be 100% made in India all international approvals We are doin activities in house including metal and pl production. This will help our custome comply with FAME At this stage, all char infra in India is important We will be pus both fast and slow equally

Can you please briefly describ your newly launched Trinity Touch - Type 2 AC fast charger gun capabilities and certifications?

re the only EV gun/connector cturer in India with IEC/TUV als plus more stringent ARAI als The product is ready for export ore mature markets The product is or more harsh Indian climate and it is sed successfully across the country

iving innovation with ctrifying precision, our gun/connector proudly wears the stamp of IEC/TUV approvals, upled with the rigor of ARAI certifications.

What is the current status and launch timeline of Trinity Touch's new EVCS product lines like the CCS Type 2 DC Connector for fast charging and the "Dash 6" connector dedicated to the slower EV category (E2W & E3W)? What is a "Dash 6" connector?

The ‘Dash 6’ gun/connector AND inlet are aimed at 2w/3w market This will become the new standard with all companies. The likes of OLA, tork and ultraviolette are already using it successfully It is compliant with the new AIS safety standards It is an important evolution and any company using it will cement their path to success Again we are the only company in India to manufacture the ‘Dash 6’ connector AND inlet We are in alpha testing already and will be ready to launch in 3 months The CCS2 DC gun/connector is entering beta testing and awaiting approvals

| INDIA

FEATUREDTALKS

JUN-JUL ISSUE 2023 | PG 08

NEW INVERSE DESIGN METHOD ACCELERATES FUEL CELL DEVELOPMENT

At Toyota Research Institute of North America, fuel cell researchers are developing a simulation-driven methodology that brings the automaker closer to its vision of creating a global "hydrogen society"

BURLINGTON, MA (MAY 23, 2023)

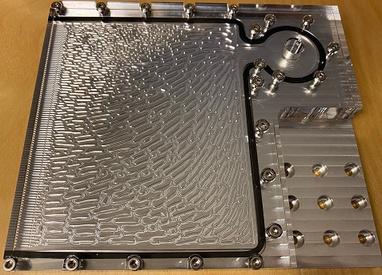

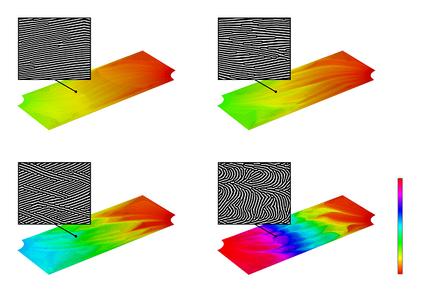

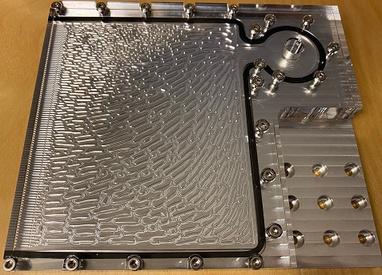

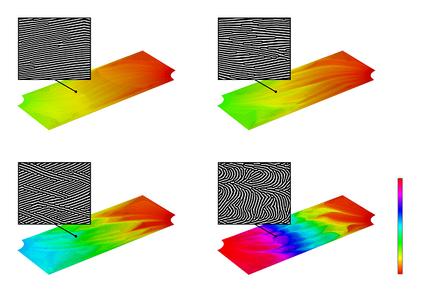

Toyota Research Institute of North America (TRINA) has developed a new simulation-driven inverse design methodology to accelerate the research and development process for fuel cell flow field plates The methodology sets key performance objectives and directs algorithms to generate structural flow field forms that fulfill those objectives. The TRINA team engineered this approach by integrating the COMSOL Multiphysics® software into its inverse design workflow

"We think that the inverse design approach can revolutionize current design practice," says Yuqing Zhou, a research scientist at TRINA "We are enabling the next step in a long journey even though we cannot know exactly where that journey will lead " The team at TRINA applied its method to the design of flow field micro-channel plates, which direct the movement of fluid reactants in microreactors like hydrogen–oxygen fuel cells

When their design was optimized for fluid flow, the generated microchannel paths were straight and parallel, with little side branching When the weighting factors in the objective function were adjusted to prioritize reaction uniformity, the method generated intricate microchannel forms.

TRINA is part of a large network of Toyota R&D teams that are working toward the development of a “hydrogen society”, where fossil fuelburning engines, heating systems, and generators would be replaced by fuel cells that extract electric current from hydrogen

"Fuel cell technology has the potential to provide clean energy globally," says Margaret Lemus, VP of Marketing at COMSOL "To achieve this, the technology needs to become more efficient, and optimizing the designs is an important step It's exciting to see how simulation empowers researchers to explore different options and make informed decisions that can lead to more efficient fuel cell designs."

Optimizing Designs for Flow, Reaction, or Both

During their research, Zhou and his colleagues recognized that they needed to optimize their design process before they could optimize their designs. "We were seeking an efficient way of approximating what a more complex simulation would show We have sacrificed some modeling complexity, which actually enables us to explore more elaborate designs in less time," says Zhou

Simulation results from the TRINA team's model, showing the pressure distributions resulting from four different microchannel flow field designs.

In a research paper, published in Chemical Engineering Journal, the TRINA team also notes that some have previously experimented with natural-looking, fractal, or hierarchical forms selected a priori for flow field channels About TRINA's own research, Zhou says, “This is the first time that such large-scale branching flow fields have been discovered using an inverse design approach without assuming prescribed layouts ”

Toyota's journey to developing fuel cells is discussed in further detail in the COMSOL User Story Gallery and in a keynote talk from COMSOL Day: Batteries & Fuel Cells

Read the full story

Watch the keynote recording

In addition, you can learn more about the TRINA team here and read its research paper published in Chemical Engineering Journal.

About COMSOL

COMSOL is a global provider of simulation software for product design and research to technical enterprises, research labs, and universities. Its COMSOL Multiphysics® product is an integrated software environment for creating physics-based models and simulation apps A particular strength is its ability to account for coupled or multiphysics phenomena Add-on products expand the simulation platform for electromagnetics, structural, acoustics, fluid flow, heat transfer, and chemical applications Interfacing tools enable the integration of COMSOL Multiphysics® simulations with all major technical computing and CAD tools on the CAE market Simulation experts rely on COMSOL Compiler™ and COMSOL Server™ to deploy applications to their design teams, manufacturing departments, test laboratories, and customers throughout the world Founded in 1986, COMSOL has 17 offices worldwide and extends its reach with a network of distributors

COMSOL, COMSOL Multiphysics, COMSOL Compiler, and COMSOL Server are either registered trademarks or trademarks of COMSOL AB

PRODUCT FEATURE

A metal flow field plate prototype based on one of the TRINA team's generated designs.

| INDIA JUN-JUL ISSUE 2023 | PG 09

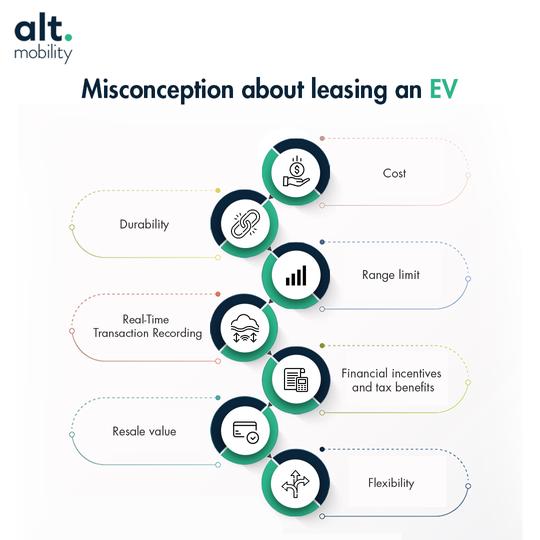

ALT Mobility's Promising Growth and Integrated Approach to Electric Fleet Management in India

Dev Arora

Co-founder, and CEO Alt. Mobility

CONVERSATION HIGHLIGHTS

ALT Mobility revolutionizes business vehicle access with eco-friendly tech solutions

India's EV industry to grow at 49% CAGR, 10 million annual sales by 2030 due to government support

Leasing electric fleets yields 20% lower Total Cost of Ownership vs ownership models

What is the vision & mission of ALT Mobility in the EV leasing segment as a mobility as a service (MaaS) provider? What is India's market outlook in the EV leasing business segment?

-Alt Mobility is a full stack Fleet as a Service provider enabling the transition of urban logistic fleets to smart and connected electric vehicles Alt has developed an integrated value proposition that enables logistic partners and fleet operators in vehicle selection, leasing, advanced fleet management and analytics, insurance, service and maintenance, and charging and parking hubs for complete lifecycle management of electric fleets. The integrated approach drives high fleet utilization, improved fleet uptime and lowest operating costs while optimizing IRRs over the vehicle’s lifetime

We aim to revolutionize the way businesses access and manage their commercial vehicles by combining innovative technology with sustainable and eco-friendly transportation solutions ALT Mobility aspires to drive the adoption of electric vehicles and contribute to a greener and more sustainable future for the transportation industry

The market outlook for the EV leasing business segment in India in 2023 is promising. The Indian EV industry is expected to witness significant growth, policy shifts, and investment The domestic electric vehicle market in India is projected to experience a compound annual growth rate of 49% between 2022 and 2030, with an estimated 10 million annual sales by 2030 The increasing demand for electric vehicles among fleets supported by strong government policies and incentives and lower total cost of ownership of EVs compared to combustion engine vehicles are factors driving the growth in the EV market

Most fleet operators prefer leasing over financing due to several reasons, including 20% lower monthly outflow compared to an EMI, no upfront capex cost and ALT’s unique value proposition of providing full-stack service that includes insurance, servicing and roadside assist Over 80% of eLCV sales in India based on data received from our OEM partners are driven by fleet operators and over 90% of these partners prefer leasing over financing

What are your major achievements in the last financial year FY 2022-23? What are the goals of ALT Mobility for the current financial year FY 2023-24?

In the last financial year, ALT deployed a fleet of over 4300 vehicles consisting of two and three wheelers used for intra-city logistics operations with India’s leading fleet operators and aggregators including Lets Transport, Entoo, Lithium Urban, Magenta, EVeeZ, Fyn Mobility, Fulfilly, CABT in India

This year we plan to expand our OEM network, partner with banks and financing institutions to reduce cost of financing and deploy 20,000 vehicles including two, three and four wheelers with an AUM of $45mn

What is the difference in terms of Total Cost of Ownership (TCO) for Electric Fleets under the lease model Vs the Ownership model?

The total cost of ownership (TCO) with leasing is typically 20% lower than financing over the life of the vehicle The savings arise due to multiple factors:

Discounts on vehicle purchase cost that ALT passes onto its customers Lower cost of leasing compared to financing options

Lower costs in service, maintenance and repairs

Lower insurance cost

Discounting of residual value

Battery replacement, refurbishment cost amortization

Lower overheads in team as ALT provides technology enabled platform for fleet diagnostics and management

Leasing electric fleets and owning them have distinct differences in terms of total cost of ownership Under the lease model, businesses can typically benefit from lower upfront costs compared to purchasing electric fleets outright. Leasing allows companies to avoid the significant initial investment required to purchase electric vehicles and associated charging infrastructure Instead, businesses pay a regular lease payment that covers the cost of using the vehicles for a specific period On the other hand, ownership of electric fleets involves higher upfront costs, including the purchase price of the vehicles and any necessary charging infrastructure installation.

ALT Mobility is a full stack

| INDIA JUN-JUL ISSUE 2023 | PG 10

Fleet as a Service provider aiming to revolutionize the way businesses access and manage their commercial vehicles. Their vision is to drive the adoption of electric vehicles and contribute to a greener and more sustainable future for the transportation industry

INCONVERSATION

How ALT Mobility is achieving the most cost-competitive EV leasing pricing for India's electric fleet operators or aggregators?

Alt Mobility’'s provides a fully integrated technology-enabled asset underwriting and fleet leasing platform Alt works with OEM partners to create custom leasing products that account for the total cost of ownership of the vehicle, designing custom AMC, warranty and SLAs. The fleets receive priority discounts and service turn around times WE work with financing institutions in de-risking financing by addressing residual value risk in the vehicle, and reducing operating costs using technology enabled asset underwriting. Alt also reduces the service maintenance and insurance costs through data enabled underwriting and optimization at scale With a full-stack approach, ALT reduces the overall cost for the fleet partner while increasing the uptime for the fleet Additionally, ALT Mobility uses their techenabled fleet management system to ensure high uptime and productivity of the electric vehicle fleet, thereby reducing the chances of financial loss for fleet operators

Can you please briefly describe ALT Mobility's lifecycle management platform for B2B logistic companies?

Alt Mobility’s integrated fleet lifecycle management solution enables fleet partners to operate with reliable, fully managed services providing high fleet uptime at affordable costs Our products and services include a fleet lease, integrated service, vehicle selection, and proprietary platform FleetOS, which may support the lifecycle management of B2B logistic companies' electric vehicle fleets Our Fleet lifecycle management services offered include support in vehicle selection, fleet leasing, comprehensive service and maintenance, insurance coverage and insurance and warranty claim management, charging and parking, realtime fleet health monitoring and diagnostics, vehicle and battery pack refurbishment and eventually end of life repurposing / recycling Our FleetOS provides real-time insights into electric vehicle fleet performance, vehicle usage patterns, and other critical data points that allow fleet operators to optimize fleet usage and management FleetOS also leverages data

from vehicles, chargers, and other sensors to provide predictive maintenance and remote vehicle management capabilities, which can support the maintenance and servicing needs of electric vehicle fleets. Furthermore, Our product offerings include fleet leasing, which enables businesses to streamline their electric vehicle fleet investment by leasing vehicles rather than owning them, thereby reducing fleet management complexities and overall costs. ALT provides a dedicated application for fleet management where fleet partners can log insurance and warranty claims, service requests, road side assistance support - all managed and streamlined through a single application ALT team monitors SLAs and ensures fast turnaround time on incidents raised through the application, thereby increasing vehicle uptime and improving overall total cost of ownership of the fleet

| INDIA INCONVERSATION JUN-JUL ISSUE 2023 | PG 11

The market outlook for the EV leasing business segment in India in 2023 is promising... with an estimated 10 million annual sales by 2030."

Electrifying India with Affordable Passenger Mobility Solutions: Omega Seiki Mobility (OSM) launches its 1st Urban Passenger Electric Three Wheelers Range

Company expands its offerings in electric passenger vehicle segment, now covering its array of electric passenger mobility in both rural as well as urban areas

Omega Seiki Mobility (OSM) today launched Line-up of urban passenger electric three-wheelers "OSM Stream City"

Two variants of The OSM Stream City- OSM Stream City ATR priced at INR 1 85 Lakhs and OSM Stream City 8 5 priced at INR 3 01 Lakhs The company broadens its selection of electric passenger mobility options, now including options for both setting: Rural- OSM Stream and Urban- OSM Stream ATR and OSM Stream 8 5 OSM has increased its production five times and have plans to sell over 10,000 electric 3Ws in FY24

Currently, OSM hosts a Pan-India network of 175 plus dealerships and is aggressively expanding at the pace of one dealer per week For vehicle retail finance Omega Seiki Mobility has partnered with various banks such as Indian Bank, Union Bank, IDFC, Chhattisgarh Gramin Bank, Shriram Transport etc. & NBFCs

New Delhi, June 20, 2023: Omega Seiki Mobility, a member of 5-decade old Anglian Omega Group, today launched their New Electric Urban Passenger Vehicles- OSM Stream City, game changing passenger electric three wheelers that is set to revolutionize urban mobility in India. The Company has today launched two variants of OSM Stream City- OSM Stream City ATR which comes with Swappable battery is priced at INR 1 85 Lakhs (ex-showroom) and Stream City 8 5 which comes with fixed battery priced at INR 3 01 Lakhs (ex-showroom) The company broadens its selection of electric passenger mobility options, now including options for both setting: Rural- OSM Stream and UrbanOSM Stream ATR and OSM Stream 8 5

Speaking on the launch, Mr Uday Narang, Founder and Chairman of Omega Seiki Mobility said, "Continuous innovation has always been a priority for OSM, and the company works to maintain its product range one step ahead of the competition. While we started with cargo vehicles this launch is in line with our strategy of providing a complete 3W solution covering both cargo as well as passenger segments This year, our emphasise mobility are Passenger Vehicles and The OSM Stream City is a result of Omega Seiki Mobility strong commitment towards the same OSM has increased its production five times and have plans to sell over 10,000 electric 3Ws in FY24

Omega Seiki Mobility Stream City range will empower E-Rickshaw drivers in India with unparalleled opportunities to cater to a larger

customer base, consequently enabling them to optimize their earnings potential The electric vehicles are cutting-edge green solutions for lastmile transportation with the greatest possible financial outlook for owners and drivers A 15–20% increase in earning potential will be offered by the electric passenger three-wheeler, ensuring more earnings and larger savings ”

At Omega Seiki Mobility, our mission is to shape a future where mobility transcends efficiency and becomes a beacon of environmental responsibility With the introduction of the OSM Stream City, we embark on a journey to redefine urban transportation, presenting an irresistible solution to the commuting challenges encountered by people across India Guided by our unwavering commitment to innovation, sustainability, and a customer-centric approach, we dare to push the boundaries of the mobility landscape, unravelling new possibilities and transforming the way we move "

The new OSM Stream City ATR offers a zero-emission driving experience with little noise and vibration, ushering in the next wave of last-mile mobility for urban India It is a one-of-a-kind offering with several class-leading characteristics It has a cutting-edge Li-ion battery, an Manual Boost gearbox, and greater power and torque The concept of swappable battery is being introduced in association with Sun Mobility. Sun-Mobility will provide a quick interchange station network so that OSM Customers can swap and go in a matter of minutes Customers can experience an app-enabled eco-system for checking battery charge, recharging, finding swap stations etc Omega Seiki Mobility is proud to contribute to the vision of a greener and smarter city, providing a solution that combines environmental consciousness, innovation, and a commitment to improving the quality of urban transportation

The OSM Stream City 8 5 fixed battery variant is designed to meet the diverse needs of urban commuters in India The vehicle offers a range of 117 kilometres on a single charge and a charging time of just 4 hours this innovative E3V is powered by an 8 5 kWh lithium-ion battery pack, ensuring both efficiency and convenience for urban commuters With its sleek and modern aesthetics, and spacious D + 3 seating for passengers, the OSM Stream City offers a comfortable and enjoyable ride Equipped with advanced safety features like drum brakes, 4 50 x 10 low rolling resistance tyres and smart connectivity options, passengers can experience a seamless journey while staying connected to their digital lives The OSM Stream City not only provides exceptional benefits for passengers but also opens up a highly lucrative and compelling opportunity for E-Rickshaw drivers in India

Continuous innovation has always been a priority for OSM, and the company works to maintain its product range one step ahead of the competition While we started with cargo vehicles, this launch is in line with our strategy of providing a complete 3W solution covering both cargo as well as passenger segments.

| INDIA PRODUCT FEATURE

“OSM STREAM CITY” STARTING AT INR 1.85 LAKHS JUN-JUL ISSUE 2023 | PG 12

Mr. Uday Narang Founder and Chairman of Omega Seiki Mobility

Key Highlights of OSM Stream City

ing-Edge Autonomy: With its complete embrace of fully onomous mode, this remarkable automotive innovation is to revolutionize the concept of safe and convenient sportation

mal Seating Configuration: Embracing an exquisite ing capacity of 3 + 1, the OSM Stream City indulges its sengers in an environment of spatial opulence

um-ion Battery Brilliance: The OSM Stream City is pped with an astute lithium-ion battery system, nessing the potential of 48V power supply and an ressive capacity of 8 5 kWh and 6 3 kWh for Swappable battery

Dynamic Power and Torque Prowess: Unleashing its formidable prowess, the Stream City resonates with a peak power output of 9 55 kW, complemented by a peak torque of 430 Nm

Effortless Automation: The OSM Stream City stands tall with its state of art automatic transmission seamlessly choreographing the symphony of gear for an effortless driving experience

Suspension System Sophistication: Meticulously designed to prioritize occupant comfort, the OSM Stream City’s front suspension embraces a symphony of dampeners and helical springs, while the rear suspension gracefully harmonizes rubber dampeners with shock absorbers

Ingenious Charging Convenience: The OSM Stream City integrates a home charging infrastructure unfurling unparalleled convenience to its discerning owners In case of swappable battery one can easily exchange a depleted battery with a fully charged one, eliminating the need for charging infrastructure and reducing downtime

Omega Seiki Mobility’s vision for India’s future lies in the rise of electric mobility applications across all categories Currently, OSM hosts a Pan-India network of 175 plus dealerships and is aggressively expanding at the pace of one dealer per week The company is one of the few firms in the market that uses backward integration to manufacture products in the country. In order to connect automobiles and society, Omega Seiki Mobility’s goal is to eventually establish a clean environment with environmentally sustainable, secure, and congested-free transportation One of India's top incubators for clean energy, OSM has come to represent India's success in sustainability By utilizing data-driven, smart engineering, the electric vehicle manufacturing company seeks to advance future mobility with green energy at its foundation

For vehicle retail finance Omega Seiki Mobility has partnered with various banks such as Indian Bank, Union Bank, IDFC, Chhattisgarh Gramin Bank, Shriram Transport etc & NBFCs

About Omega Seiki Pvt. Ltd.

Omega Seiki Private Limited is a member of the Anglian Omega group of businesses, focusing on manufacturing steel parts for automotive & engineering industries in India & abroad The group has expanded rapidly in the last 5 years with several projects in automotive, infrastructure and high technology design & development with heavy investment in these areas The electric vehicles business is under group Company-Omega Seiki Pvt Ltd The company has designed and developed its three-wheelers indigenously at its in-house R&D facility The vehicles under RAGE+ brand is deployed by several major ecommerce and logistics companies in India

| INDIA Vehicle Category Seating Capacity Battery Type, Voltage Battery Capacity Peak Power Peak Torque Transmission Type Front Rear Break Tyre Wheelbase Overall Width Overall Length Overall Height Minimum Ground Clearance Gross Vehicle Weight Vehicle Kerb Weight Top Speed Typical Driving Range (On Road) Gradeability Roof Type Home Charging Charge Duration L5M 3+1 Lithium-ion, 48V 8 5 kWh 9 55 kW 430 Nm Manual Boost Dampner + Helical Spring Rubber Dampner + Shocker Drum 4.5-10 8PR 1940 mm 1320 mm 2800 mm 1802 mm 175 mm 950 kg 451 kg 48 kmph 117 km 16% Soft Yes 4 hours L5M 3+1 Swappable Lithium-ion, 48V 6 3 kWh 9 55 kW 430 Nm Manual Boost Dampner + Helical Spring Rubber Dampner + Shocker Drum 4.5-10 8PR 1940 mm 1320 mm 2800 mm 1802 mm 175 mm 950 kg 451 kg 48 kmph 80 km 16% Soft NA NA STREAMCITY8 5KWH (FIXEDBATTERY) STREAMCITYATR (SWAPPABLEBATTERY) MODEL SPECIFICATIONS OF OSM STREAM CITY PRODUCT FEATURE JUN-JUL ISSUE 2023 | PG 13

Cellpropulsion's Vision and Mission: Leading the Way for High-Performance Electric CVs

Nakul Kukar

Founder and CEO, Cell Propulsion

CONVERSATION HIGHLIGHTS

In the last financial year, Cellpropulsion improved its products through realworld data acquired from deploying retro-fitted eLCVs with logistics companies in Bangalore.

Our vision is to be at the forefront of the electric vehicle revolution, driving the transformation of commercial transportation on Indian roads

Cellpropulsion's FY 2022-23 Performance and Growth Expectations for FY 2023-24

What is the vision and mission of Cellpropulsion?

Cell Propulsion’s vision is to become the pioneer in electrification of Medium & Heavy CVs and lead the deployment of high power, high performance electric CVs (eCVs) on Indian roads Enabled by in-house developed technology, we aim to design and produce most advanced, class leading eCVs while also working on solving all the hurdles that logistics companies face in large scale adoption of eCV fleets

What is the Role of Telematics and IoT in Electric Fleet Management in India?

Telematics & IoT or in general vehicle connectivity makes it easier for fleet owners to manage large eCV fleets with minimum downtime Digital services enabled by connectivity can help fleet owners achieve similar or better service levels as compared to ICE vehicles At CP we are developing a host of solutions, enabled by vehicle connectivity, to support the complete life-cycle of eCVs. These services and solutions are part of an end-to-end eco-system which we call Mobility Platform

The Mobility Platform is an integrated software platform to connect all our eCVs to

cloud via 4G/LTE connectivity. The operating data of all vehicle subsystems along with vehicle driving data are uploaded to a public cloud via our telematics module This data is processed by various algorithms, and used by multiple apps to offer data analytics and range of value added services like OTA updates, Health monitoring, O&M support, ADAS, etc to our customers

How to Integrate Electric Vehicles into cargo fleets: Best Practices and Case Studies from Cell Propulsion?

The biggest driver for adoption of eCVs into cargo fleets is operating cost reduction due to fuel savings

The 2 key criteria to achieve successful transition to eCVs at scale are:

total cost of operation (TCO) over the life of the vehicle

Increase in monthly income of CV drivers

These 2 criteria have a major impact on product positioning & pricing and its eventual success. At CP over the past 2 years, we have worked closely with multiple fleet owners & 3PLs to help them accurately model the TCO for our eLCVs and seamlessly integrate these eLCVs into their fleets

What was the performance of Cellpropulsion in the last financial year FY 2022-23? What is your expectation for the current financial year FY 2023-24?

Last year we deployed a batch of our retrofitted eLCVs with some large logistics companies and fleet operators in Bangalore This helped us improve our product and make it more reliable basis the real world data acquired by operating these eLCVs. We will be working this year to scale-up our retrofit-kit (EV powertrain) & EV component business outside India to more mature EV markets To achieve these goals, we'll be growing our production capacity and also recruiting across all business & engineering divisions

Cellpropulsion plans to expand its EV powertrain and component business beyond India's borders and increase production capacity and recruitment efforts.

Reduction in

JUN-JUL ISSUE 2023 | PG 14

INCONVERSATION

BUILDING

THE

FUTURE OF E-MOBILITY: MINDRA'S ATMANIRBHAR FAST CHARGERS

Ahmedabad based Electric Vehicle charging manufacturer MINDRA makes ARAI approved EV fast chargers (3 3kw to 240KW) and plans to launch a 360KW dual gun variant charger product line this year Let’s hear more from Dhairya Shah to better understand the EV charger manufacturing space.

Many segments are evolving within this market – AC chargers, DC chargers, government tenders and the growing Charge Point Operator (CPO) market

AC chargers serve destination, office and home charge markets and will proliferate in millions soon in India

DC fast chargers typically address the fleet and long-distance drive market This segment will grow over time as cities electrify public transport and more options become available for buyers of electric cars for long-distance driving

In 2019 when we first set out to make fast chargers in India, Indian EV Market was taking baby steps and the subject for slow ac charger was fresher Our rigorous R&D then is facilitating us now and has led us to designing India’s first truly atmanirbhar fast charger

As per our analysis, the growth of the electric mobility sector in India is being hampered by not just the lack of charging infrastructure – but the fact that many of the chargers installed often do not work. Our focus has been to build a line of relentlessly reliable products, offering our customers a guarantee to bring chargers back in service within 24 hours in case of any service issue

About Mindra's approach to manufacturing chargers.

Very early into the Business, we were clear that we would never be a Charge Point Operator; our “one thing” is to provide relentlessly reliable chargers to CPOs who care for quality, resilience, and charger availability. Our role is to facilitate the growth of E-mobility service providers and CPOs

Our manufacturing capacity is 500 chargers per month (All category) at the moment, which is adequate for the market we are addressing for coming time

We designed our chargers on the philosophy of what we call the “4 HITS”:

the charger should not expire the car the car should not expire the charger neither the car nor the charger should end up expiring the user/human, and lastly the charger should not expire the grid

We believe that Electricity can hurt someone when the design of power electronics equipment is inherently careless or unsafe. Adequate measures have to be taken for human, EV & EV charger safety by providing safety for earth leakage, Overload and Short circuit protections, Input under & over voltage protections, Insulation Monitoring, GND fault, Over temperature, Smoke detectors etc

Apart from these, the charger needs to be certified as per IEC 61851 /IS 17017 relevant clauses from a certified agency like ARAI/TUV

Export

Our intent has been to provide European quality at a price point that creates value for our customers; consequently, we don’t envisage our exports to be limited to any regions in particular

Some CPOs/EMSPs prefer to wait for the demand base to build before investing in charging infrastructure, while other companies prefer to facilitate the demand by investing ahead of actual demand The latter will experience low daily utilization likely until 2024 when the first Giga factories will come on stream in India, greatly impacting the economy of E-Mobility in India. 2024 is also the year we will witness a plethora of EV launches in the country at affordable price points Consequently, the utilization of chargers will increase over a 3 year period exponentially So there is a trade-off to consider here Invest aggressively early , absorb low utilization in the early years, so that you have loyal customers when the competition heats up OR wait for demand to be evident and invest then in a more crowded market where differentiation is hard to achieve and most companies will rely on pricing as their advantage

| INDIA

COMPANY FEATURE

Profitability of running an EV charging business be improved

JUN-JUL ISSUE 2023 | PG 15

ROUNDUP

REVVING UP REVENUE: MAKING AFFORDABLE PUBLIC EV CHARGING VIABLE

The authors work in the area of Green Mobility at the Center for Study of Science, Technology, and Policy (CSTEP), a

AUTHOR

SAAD KHAN

Center for Study of Science, Technology, and Policy (CSTEP)

AUTHOR

THIRUMALAI NC

Center for Study of Science, Technology, and Policy (CSTEP)

The electric vehicle (EV) segment in India has witnessed a phenomenal growth in the last few years More than 1 million EVs were sold in FY23 alone, and this segment grew by a whopping 154% year-over-year For this momentum to persist, the country’s EV charging infrastructure needs to grow at a rapid pace

In terms of running costs, electric four-wheelers (4Ws) and twowheelers are around 7 and 10 times cheaper than conventional petrol vehicles respectively. However the lack of adequate public charging stations (PCSs) coupled with high charging fees risks eroding the inherent advantage of owning an electric 4W (Figure 1)

Currently, most EV owners prefer charging their vehicles at home/office, but due to non-availability of dedicated EV parking spaces and lack of awareness amongst facility managers, access to charging is a hurdle for the vast majority of potential EV buyers Therefore, PCSs serve as a better alternative till these issues are resolved

Current charging scenario

With regards to PCSs ‘opportunity charging’ or charging en-route is the preferred mode of availing charging services, wherein DC fast chargers (DCFC) are used to top-up EVs In other words, for a typical daily driving distance of less than 50 km for most electric 4Ws, a topup from a 25 kW DCFC would take less than 20 min At present, Bengaluru has fewer than 100 public fast chargers to serve its fleet of more than 10,000 electric 4Ws These DCFCs are managed by the Bangalore Electricity Supply Company Limited (BESCOM) and other privately owned PCS operators However, there is a major variation in charging costs, with BESCOM being more than three times cheaper than the private players The difference in charging costs can be better understood by looking at the annual running cost of a 4W under different scenarios (Table 1)

CNG: Compressed natural gas; PCS: Public charging station

| INDIA Petrol Diesel CNG BESCOM PCS Private PCS INR 102/L INR 88/L INR 88/kg INR 8 07/kWh INR 24/kWh 14 km/L 17 km/L 15 km/kg 7 km/kWh 7 km/kWh INR 73,000 INR 52 000 INR 58 700 INR 11,500 INR 34,000 Unitcost

mileage Runningcost per10,000km

type

Typical

Refuel/recharge

Table 1: Comparison of the refuelling/recharging costs of four-wheelers

THINKTANK

JUN-JUL ISSUE 2023 | PG 16

research-based think tank

Figure 1: Comparison of the running costs of electric four-wheelers and petrol cars

From the above table, it is evident that owing to the high charging cost of a private PCS, the overall running cost advantage of EVs is significantly diluted. Therefore, it is essential to understand the reason behind the difference in tariffs and how they could impact potential EV user behaviour

Public vs BESCOM tariff structure for charging EVs

The efficiency of any asset is determined by the asset turnover ratio a measure of the efficiency with which a business uses its assets to generate revenue In case of an EV charging business, it is measured in terms of the charger utilisation over a 24-h period We analysed the relationship between charger utilisation and the breakeven tariff for an adequate return on investment The target internal rate of return was 15%, and the investment period was 5 years Four different charger types were analysed, and two different input electricity tariffs were used (INR 5/kWh and 7/kWh)

As the charger utilisation increases, the breakeven tariff for all fast chargers drops rapidly at first, followed by a slow decline at utilisation rates above 40% (Figure 2) As most private PCS players currently charge between INR 20 and 25 per kWh, the tariff charges being levied are possibly based on utilisation rates below 10% Of note, this analysis used an input electricity cost of INR 5/kWh, which is a subsidised tariff (until 2025) by the government to promote EV adoption Considering the likelihood that commercial rates will be restored (INR 9+ per kWh) in the future, the cost of charging is bound to increase Therefore, keeping in mind the business viability of public charging, the most feasible path forward is to increase the utilisation rates to make public charging more affordable.

using Karnataka’s prevailing open-access electricity rate for groundmounted solar PVs of INR 7/kWh As shown in Figure 3, owing to the slightly higher input electricity cost, the breakeven tariffs also increased accordingly However, the added cost is balanced by the fact that any vehicle charging at these higher tariffs can claim completely zero emissions This is especially useful for enterprises in the logistics and e-commerce domain that aim to create a difference in the eyes of their customers by switching to zero-emission operations.

Making EV charging greener

Although EVs offer zero tailpipe emissions, it is essential that the electricity for charging is obtained sustainably from renewable sources As per the energy mix of BESCOM, 55% of the energy was derived from non-renewable sources in 2021 However, under the ‘Open Access’ Rules across India, any high-energy consumer (with more than 1,000-kW connected load) can opt to buy their electricity directly from an independent power producer. Now with the ‘Green Open Access Policy’, the required connected load has been lowered to only 100 kW, enabling most PCSs to buy renewable energy directly from the open market Therefore, we performed a similar analysis

charging ecosystem

Now that we know how utilisation impacts the financial viability of EV charging, it is essential to explore how utilisation rates can be increased for the existing and planned charging infrastructure Here, we suggest two different approaches

First, a subscription model could be introduced, wherein current and potential EV owners can ‘lock-in’ a minimum monthly usage and pay upfront like a pre-paid plan popular in the telecom industry. This would ensure that the chargers within the ecosystem have an assured utilisation of a certain amount and would incentivise PCS operators to provide lower tariffs to the subscribers This would also ensure transparency for EV owners, as the more they use a PCS, the lower their tariff can be.

Second, an ecosystem-level change could be accomplished Current PCS operators each have their own mobile applications, requiring EV users to create separate accounts and store money in the mobile wallets When a user visits a charging station, they pay for the availed services through the app. However this limits the EV customer base that can avail charging services from a particular PCS operator Instead, the industry needs to offer an ‘EV roaming’ facility, which is akin to how telecom operators function This would help any EV owner opt for charging services at any PCS via one app PCS operators can formulate the pricing structure to ensure this interoperability To facilitate this, the EV charging industry needs to collectively implement the required protocols (Open Clearing House Protocol or Open Charge Point Interface) This will help create a wider customer base for each PCS operator and ensure higher utilization levels

THINKTANK ROUNDUP

Figure 1: Comparison of the running costs of electric four-wheelers and petrol cars

Figure 3. Breakeven charger fee vs charger utilisation (input electricity tariff = INR 7/kWh)

Strategies for improving the viability of the EV

| INDIA JUN-JUL ISSUE 2023 | PG 17

is part of the Corporate Ratings group and a member of ICRA's Rating Committee

Over the years, Vinutaa has co-authored research reports for hospitality, auto components, and electric vehicles. She has worked on credit assessment assignments across several sectors like logistics, pharma, consumer goods, cement, and agri/food products, to name a few, apart from auto and hotels

She is a Bachelor of Engineering from Sri Venkateswara College of Engineering (affiliated to Anna University), Chennai, and an MBA from S P Jain Institute of Management and Research, Mumbai

AUTHOR

VINUTAA S

Vice President & Sector Head –Corporate Ratings, ICRA Limited

The global electric vehicle (EV) industry has significantly evolved in the last few years, with the share of EVs in global light vehicle sales increasing multifold to 13 0% in CY2022 compared to 2 5% in CY2019 In CY2022, China contributed 58% to the global light vehicle sales, while the European Union (EU) emerged at the second spot with a 25% share India, however, lags considerably in terms of EV penetration, despite being among the top markets for internal combustion engine (ICE) vehicles That said, EV penetration has improved in the last few years, and the growth is expected to be exponential over the medium term

The component mix in an EV is skewed towards battery, motors and electronic parts, with battery constituting 35-40% cost of an EV At present, only 20-30% of the EV supply chain is localised Chassis components that require the least technology upgradation are manufactured locally, while battery cell, which is high in technology and capital intensity, is still entirely imported This gives rise to manufacturing opportunities for domestic auto component suppliers For parts that are already used in ICE, there could be technological advancements in certain cases, resulting in higher content per vehicle Localisation is important for higher value addition, mitigating supplychain risks, and better affordability

EVs are expected to account for around 30% of 2W sales and 15% of passenger vehicles sales by 2030 This would translate into strong market potential for EV components by 2030 The Indian e-2W component market potential is expected to be over Rs 1,00,000 crore by 2030, while e-PV component is expected to be another Rs 50,000 crore at least, in terms of revenue potential for ancillaries

Auto ancillaries have started investing in the EV components space to capitalise on this opportunity At least Rs 30,000 crore of capex is expected for EV components in the next three-four years for capacity building, technology, and product enhancements About 45-50% of this is expected to be towards battery cells. Some projects are already in the initial stages of construction, while a few others have just been announced Auto ancillaries have entered into collaborations/joint ventures (JVs) in cases of technological impediment The larger projects (especially for battery cell localisation) are expected to be funded by debt initially, while capex for components other than batteries is expected to be funded primarily through internal accruals. There is also substantial private equity interest in this space The central production-linked incentive (PLI) scheme for ACC batteries and auto components, and incentives from various state Governments would also contribute to accelerating EV component capex

Engine and drive transmission components would be impacted by the EV transition Adoption of EVs could also have a bearing on the aftermarket demand because of fewer moving parts However, supplies to alternative applications, new products, and export opportunities are likely to mitigate the impact to an extent Also, migration to EVs is expected to be gradual and ICE components will continue to have a sizeable demand over the medium term

Overall, the advent of electric vehicles would provide immense opportunity for the auto component sector, and the industry is geared to capitalize on the same

| INDIA A

JUN-JUL ISSUE 2023 | PG 18 V

E-Mobility+ publications, distributed pan-India, sets a new standard in EMobiliy+ energy media. With over 200+ and a growing list of advertisers, we work with who's who in the industry across our platforms from print magazines to social media platforms put their brands first and ensure the best delivery of the marketing needs.

CONTACT US +91 77188 77514 Smriti Charan smriti@firstviewgroup.com There are many great reasons to become an EMobility+ Subscriber Scan me Customizable Product Layout Highest Circulation & Readership Well Researched Editorial Content Most read by Key Decision Makers Ensures best delivery of the marketing needs Sangeeta Sridhar sangeeta@firstviewgroup.com +91-9372788472 Get access to our upcoming events insights & updates

SUBSCRIBE NOW!

Mr Kalyan C Korimerla is the Managing Director and Co-Promoter of Etrio, a Hyderabad-based cargo EV OEM He has over two decades of experience in the US, Europe, and India Kalyan is dedicated to leading cargo fleet electrification while emphasizing sustainability and profitability He holds a B Tech in Electrical, Electronics & Communications Engineering from the National Institute of Technology, Warangal, and an MS in Electrical & Computer Engineering from the University of California Kalyan also has an MBA in Finance & Accounting from Carnegie Mellon University.

Kalyan began his career at Intel Corporation and LSI Logic, working in various roles related to strategy, business management, marketing, business development, and engineering He also gained experience in investment banking at JP Morgan and Arma Partners. In 2010, he founded OneEarth Power Ventures, managing power asset portfolios Later, as the CEO of NSL Renewable Power and Vice President of WIPPA, Kalyan actively engaged with policymakers and stakeholders in renewable energy, energy storage, and electric mobility His passion for the transition to EV mobility led him to establish his own EV venture after leaving NSL.

FutureOutlook:Trendsand InnovationsShapingthe COMMERCIAL EV LANDSCAPE IN LOGISTICS

Even though the commercial EV adoption in Logistics has barely scratched the surface, increased EV penetration of commercial vehicles will significantly transform Logistics sector While the last five years have seen a significant adoption of EVs in the last mile segment of the logistics Driven initially by improved sustainability mandates of global players, the greater number of commercial EVs are being deployed in last-mile logistics due to superior operating economics

The next decade will be characterized by a more technologically advanced future propelled by a closely interlinked EV ecosystem in which intelligent EVs will be at the center of the ecosystem. Advancements in battery technology, smart charging infrastructure, artificial intelligence, automation, lower operational costs, and collaborative logistics are the contributing factors that will continue to reshape the economic dynamics of the logistics sector These advancements will not only drive the penetration of commercial EVs into mid-mile and first-mile but also enable scalability across diverse business verticals such as e-commerce, logistics, pharma, waste management, gas delivery, agriculture, and more

Some of the innovative breakthroughs in the electrification of lastmile transportation that the industry is betting on are:

Advances in battery technology, which have significantly extended the range and payload capacity of electric trucks, enabling them to compete with their traditional fuel-powered counterparts.

Development of fast-charging infrastructure that incorporates intelligent charging solutions, such as fast-charging stations and vehicle-to-grid (V2G) technologies These technologies have alleviated concerns regarding long charging times by enabling bidirectional energy flow between EVs and the power grid They have also facilitated the seamless integration of EVs into the electrical grid for grid stabilization, energy management, and cost optimization

The integration of telematics fleet management solutions AIpowered algorithms, and data analytics empowers logistics companies to monitor vehicle performance in real-time, optimize route planning, and reduce downtime with predictive maintenance This amplifies the operational excellence and effectiveness of commercial EVs

The convergence of autonomous technology and electric vehicles holds immense potential for the logistics industry The incorporation of semi-autonomous functionalities for improved vehicle-to-vehicle communication can enable smoother traffic flow and enhance overall logistics operations.

MD AND CO-PROMOTER ETRIO KALYAN C KORIMERLA O P I N I O N

The rise of intelligent EVs will reshape the future of logistics, driving us towards a more sustainable and technologically advanced ecosystem.

| INDIA JUN-JUL ISSUE 2023 | PG 20

Innovative business models, including energy as a service, and customized built-for-purpose solutions that suit customer preferences will be areas of focus for future value creation

Moreover, the concept of collaborative logistics is becoming increasingly essential Partnerships between logistics companies and automakers have emerged as significant catalysts for advancing the commercial EV landscape. By leveraging digital platforms and datadriven models, companies can pool resources and share shipping space, resulting in increased load efficiency and reduced transportation costs Collaborations between these entities encourage the development of purpose-built electric delivery vehicles with features tailored to meet the specific needs of the logistics industry and promote the adoption of electric vehicles Decentralized delivery networks can be better utilized and optimized through real-time data exchange and coordination Furthermore, the collaborative efforts between governments, private entities, and automobile manufacturers are also fueling the establishment of charging stations in urban centers and along key transportation routes This growing network ensures accessibility and convenience, unlocking the full potential of commercial EVs

Businesses worldwide have recognized the economic advantages of Commercial EV deployments, and with ongoing technological advancements and supportive government policies, we can anticipate a significant expansion of commercial EV fleets soon.

O P I N I O N

| INDIA JUN-JUL ISSUE 2023 | PG 21

INTEROPERABILITY ACROSS DIFFERENT CHARGING NETWORKS

As EVs gain prominence, it becomes increasingly crucial to address the challenges surrounding the charging infrastructure. One of the most significant hurdles faced by EV owners and stakeholders alike is the lack of interoperability across different charging networks

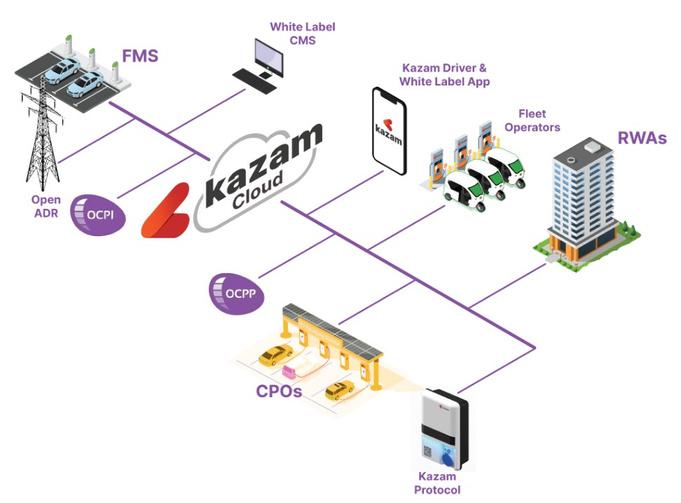

Interoperability, the ability of different charging stations to communicate and interact seamlessly, is an essential aspect in promoting the mass adoption of electric vehicles. Currently, various charging networks are operated by different service providers, each offering distinct charging protocols, payment methods, and access systems This fragmentation poses significant inconveniences for EV owners and creates barriers for EV adoption on a broader scale In this context, KAZAM EV and Servotech have given their perspective on Interoperability on different charging networks in India.

AUTHOR

MR RAMAN BHATIA Founder & Managing Director Servotech Power Systems Ltd

Discuss how charging infrastructure OEMs are adhering to international standards such as CCS (Combined Charging System) and CHAdeMO to ensure compatibility and ease of charging for EV users

In the rapidly expanding EV industry, adherence to international standards such as CCS is crucial These standards have gained significant traction globally, promoting interoperability and convenience in EV charging Having multiple standards is a waste of time and money The amount of money spent on supporting multiple standards could have been spent on supporting one good standard

The EV charging industry has witnessed a shift towards widespread adoption of CCS (Combined Charging System) as the preferred standard. This transition is driven by several factors, including the

growing popularity of CCS ports in EVs and the increased costeffectiveness associated with having a single standardized port CCS not only offers savings in vehicle manufacturing, whether due to the design of a common AC /DC connector or the lack of additional communication data lines as a benefit of the HomePlug Green PHY protocol, but it also has greater industry support and will eventually drive the charging industry to support the Winner If we had to compare this to the mobile phones of the early 2000s and 2010s, CHAdeMO is the Nokia and losing the battle to Apple of charging, the CCS

Every EV automaker now integrates CCS ports into their vehicles, making it the preferred choice due to its ability to cater to a broader range of EV models This uniformity simplifies the charging experience for EV users, eliminating the need for multiple adapters or specialized charging infrastructure As the industry progresses, charging infrastructure OEMs have recognized the market demand and prioritized CCS compatibility to ensure seamless and convenient charging solutions for EV users

P E

S

E C T I V E

R

P

| INDIA JUN-JUL ISSUE 2023 | PG 22

By embracing the CCS standard, the EV charging industry avoids the pitfalls of multiple competing standards and ensures a more efficient and cost-effective charging infrastructure.

This industry-wide alignment with the CCS standard reflects the collective commitment to meeting the evolving needs of the EV market while streamlining operations and driving cost efficiencies