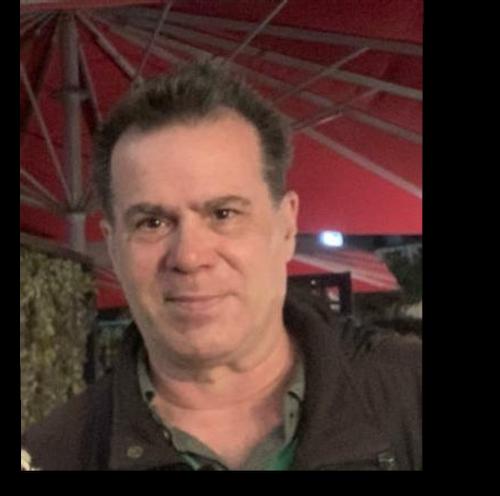

James has over seven years in the solar industry under his belt and almost three decades working in the industrialelectrical sector which gave him an in-depth understanding of the requirements for both: residential and commercial solar projects

CORPORATE RENEWABLE ENERGY MARKET IN AFRICA - CHALLENGES AND OPPORTUNITIES

DECENTRALIZED RENEWABLE ENERGY: MAKING A CASE FOR ADOPTION IN SUBSAHARAN AFRICA

Country Manager for South Africa, solis

Country Manager for South Africa, solis

P O T E N T I A L I N A F R I C A

Coverstory Business News Roundup Special Story Policy & Regulation Debrief Current Story Technology Brief Current Affair 11 13

Association INTERVIEW 04

LORENZOL.COLACICCHI Founder, Principal & CEO, Ergon Solair PBC ANDREW AMADI Chief Executive Officer , Kenya Renewable Energy

CONTENTS 08 12 16 17 18 19 20 SOLARQUARTER RESEARCH DECENTRALIZED RENEWABLE ENERGY: MAKING A CASE FOR ADOPTION IN SUB-SAHARAN AFRICA Corporate Renewable Energy Market In Africa - Challenges And Opportunities Powernsun 10 14 07 OPINION PERSPECTIVE COMPANY FEATURE 03 06 09

JAMES FRANK Country Manager for South Africa, Solis

WYCLIFFE MWANGI Technical Sales Manager , Goodwe

DHANANJAY MISHRA

MILICENT CHIDAMBA

Asistant General Manager - Sales Powernsun

FEATURED INTERVIEW

Sales Deputy Director –SADC Region, Jinko Solar

FEATURED INTERVIEW

WYCLIFFE MWANGI

TECHNICAL SALES MANAGER , GOODWE

"GoodWe Launches New ES G2 Hybrid Residential Inverter for African Market."

KEY HIGHLIGHTS

GoodWe has experienced exponential growth in the African solar PV industry due to its comprehensive product portfolio, strategic expansion, and launch of new product families.

The company's latest product launch, the ES G2 hybrid residential inverter, offers optimized energy flexibility and autonomy to meet the specific needs of the African residential solar market

To penetrate South Africa's promising large-scale PV+ BESS system market, GoodWe is prioritizing customer support and service, offering competitive pricing, and developing customized solutions

How has the year 2022 been for GoodWe in the Africa region?

GoodWe has experienced considerable growth in the Africa region, with highlights such as a solid growth in the SADC market, the opening of a East Africa hub in Nairobi, Kenya, and strategic hires across the region In North Africa countries, our Smart solutions have grown significantly year-on-year Our first utility opportunity was won in 2022 and commissioned in the first Quarter of 2023 in Angola This demonstrates that GoodWe has become a prominent player in the PV industry with a comprehensive portfolio of Residential, Commercial and Utility products. Additionally, new product families have been launched to meet changing energy trends Results from this strategy have led to exponential growth in terms of revenue and returns for stakeholders and investors

What was the most promising and demanded GoodWe string inverter for the Africa region in 2022?

Our most demanded String PV Inverter Remains to be our HT series Family (100KW-120KW)

Despite the chip global supply challenges that hit our market affecting this family, GoodWe has been reliable in meeting the obligations of our channels and project developers on time and with the right cost to achieve the best LCOE

Another important product family was the SMT series(50/60KW) which was introduced to the market last year This product has unique features such Multiple MPPTs (upto 6), Large MPPT Current inputs of upto 30A with a fuseless design to support the large modules without

having clipping losses, Smart control and monitoring, 150% DC input over sizing & 110% AC output overloading with a robust Temperature Adaptability

How do you see Goodwe's African solar market growth in the next 5 years? What is your market outlook?

GoodWe is aligned to the rapidly expanding market in the African region Governments have been campaigning to support a transition towards clean energy, resulting in policy changes that promote the usage of renewable energy sources The increasing cost of fossil fuels is further driving the PV industry and creating an urgent need for affordable power supplies, particularly in countries with unreliable power grids We anticipate that solar PV growth will only continue to accelerate over the next five years, as investors gain confidence in investing in African energy PV projects

What makes Goodwe's ES series inverter (Energy Storage Hybrid Inverter) compatible with Africa's highly variable temperature cycle requirements?

In 2022, we launched the low voltage ES G2 series (3kw to 6kw) Hybrid Residential Inverters with robust features to meet the ever-increasing market demand for optimized energy flexibility With this product family, a high degree of autonomy can be achieved by facilitating maximum backup of generated solar energy Among the new additions to the new ES G2 feature are: Large MPPT Current Input (Upto 16A), Parallel capability of the inverter, Genset Start and Stop Feature, Smart Home Integration, UPS level switching time and a new sleek generational Design It also interesting to mention that our ES G2 is compatible with a range of batteries, including the GoodWe Lynx Home U. This new Series has a wide operating temperature range of -25 ~ +60 (°C) and thus adaptable to the variable temperature cycle Requirements

What are your growth and expansion plans for 2023?

We have a realistic and an achievable growth plan that is principally being driven by Smart Innovative products that are focused to addressing Africa market energy needs, Good Aftersales services and a pack of professional team In terms of smart Innovative products, we

have introduced to the market our new ES G2 series (3-6kw) for single phase residential solutions, ET series (15-30Kw) for the big residential 3 phase solutions and Our new SMT series(50/60KW) which will be critical in giving us the required growth momentum in the region We are also principally focused to opening new markets in East and West Africa region while maintaining the accelerated growth momentum in the existing SADC market

According to you, which inverter of GoodWe is most compatible with the latest large format solar modules and why?

With the market trends on panel manufacturers transitioning from 186 to 210 mm wafer modules, this has resulted in larger short-circuit current and thus informing our Research and design department to structure our inverters to be compatible with the large Inverters For both residential hybrid Inverters and Commercial solutions, we have the string current inputs upto 16A and the MPPT current inputs of upto 30A This means that you can use large Modules formats without worrying about the inverter losses

How do you want to penetrate South Africa's promising large-scale PV+ BESS system market?

Our R&D has invested a lot of energy to address the Large-Scale PV market and BESS system Recently, Goodwe launched the high-voltage battery Lynx C Series has been specially designed for various C&I solar rooftop applications, with enhanced safety and reliable performance. Lynx C works in tandem with GoodWe's hybrid inverter ETC Series and retrofit battery inverter BTC Series to create a highly flexible energy storage system that helps manage energy use for maximum selfconsumption and ensures a reliable power supply Furthermore, the system enables the user to level out peak demand, resulting in lower electricity bills The battery includes automatic detection of extended battery modules, allowing for simple configuration and quick commissioning It has a capacity ranging from 101 to 156 kWh and can be connected in parallel to up to three towers for a total capacity of 468 kWh With this product, we anticipate to penetrate and give value to our customers in the South Africa Region with the recent Load shedding situation in the region

| AFRICA MAR-APR ISSUE 2023 | 03

JAMES FRANK

COUNTRY MANAGER FOR SOUTH AFRICA, SOLIS

"James has over seven years in the solar industry under his belt and almost three decades working in the industrialelectrical sector, which gave him an in-depth understanding of the requirements for both: residential and commercial solar projects."

KEY HIGHLIGHTS

On top of his extensive work in South Africa, James has also gained remarkable engineering experience in Mauritius, Zambia, Malawi, Botswana and Zimbabwe He is intrinsically involved in developing commercial and residential markets in line with overall strategy.

Our new S6 Advanced Power Hybrid Inverter is so bespoke because it was designed not only to cope with very demanding South African grid conditions but also with the end user in mind

The Solis S6 Advanced Power Hybrid Inverter, in both 3-6kW and 8kW versions, brings significant performance improvements, including enhanced connectivity and control capabilities, which allow the easy incorporation of generators with multiple input methods

SolarQuarter: How has the year 2022 been for Solis in the South Africa region? What was the most promising and demanded Solis string inverter for the Africa region in 2022?

2022 was certainly an exciting and fruitful year for Solis: expanded in both the European and South African markets We penetrated the utilityscale inverter market with the Solis 255K-5G-EHV Plus Inverter and saw the development of our energy storage S5-EO1P-L-P off-grid inverter Last year we also launched our newly developed residential and C&I PV energy storage system: S6-EH1P(3-8)L-PRO Advanced Power Hybrid Inverter And lastly, we started the development of a new Solis 80-110K-5G Pro inverter designed to provide high quality solutions for C&I PV projects We have done well across the entire inverter offering throughout 2022 with residential and C&I products

SolarQuarter: How do you see Solis's African solar market growth in the next 5 years? What is your market tl k?

Interesting question In the short term, I think residential storage solutions will undergo a massive update over the next five years, considering the region’s current energy crisis especially with no real infrastructural solution forecasted yet For Solis, we certainly see a substantial market increase in C&I products, with inclusion across the board for our three-phase grid-tied inverters and new three-phase storage products that will be added to our portfolio

South Africa, and Africa as a whole, are still in the very early stage of their renewable energy roadmap Coupled with our expansion plans into the SADC region and greater participation in utility-scale projects, Solis are undoubtedly excited about the next five years and beyond

SolarQuarter: What makes Solis's New S6 Advanced Power Hybrid Inverter compatible with South Africa's highly demanding residential segment requirements?

Our new S6 Advanced Power Hybrid Inverter is so bespoke because it was designed not only to cope with very demanding South African grid conditions but also with the end user in mind This is reflected in features like the ability to provide flexible work modes, high solar input capacity and high battery charge current Additional remote control operational capability puts the power literally in the plant owner's hands, ensuring adaptability with our sometimes daily changing grid conditions and loadshedding schedules

SolarQuarter: What are the new features of the S6 hybrid inverter?

The Solis S6 Advanced Power Hybrid Inverter, in both 3-6kW and 8kW versions, brings significant performance improvements, including enhanced connectivity and control capabilities, which allow the easy incorporation of generators with multiple input methods We’ve uprated the maximum charging and discharging current to 190A, while automatic UPS switching helps homeowners and businesses manage power outages seamlessly

It has single and three-phase capability, accommodating up to 6 connections in parallel, with a maximum total load of 48 kW, protected by a 10-second, 200% surge overload capability Solis is well known for allowing users a choice of battery type and supplier and the S6’s multiple battery protection features and customisable charge/discharge time settings are compatible with both lead-acid and lithium technologies.

With independent generator interfaces and automatic UPS switching, the new range facilitates feeding of excess power back to the grid. It supports peak shaving control in both “self-use” and “generator” modes

SolarQuarter: What are your growth and expansion plans for 2023?

Firstly, we are looking to expand our local presence with our service and support offering, as we feel it is of utmost importance to provide reliable customer service and support This will be a priority focus area for us, especially given forecasts of continued and strong market growth

Secondly, we will aggressively enter the SADC region and beyond with plans for East, West and North Africa The current energy supply challenge lies not only within South African borders, but businesses and residents of the wider African continent experience energy security issues too The provision of stable, reliable energy has been proven many times over to be an absolute requirement for equally stable economies and, ultimately, the basis of growth in all sectors of society; including education, industry, and agriculture, to name but a few

INTERVIEW

| AFRICA MAR-APR ISSUE 2023 | 04

SolarQuarter: How can the South African government's recent amendment in the RENEWABLE ENERGY INDEPENDENT POWER PRODUCER PROCUREMENT PROGRAM (REIPPP) mitigate the frequent blackout crisis in the country?

The state-owned electricity supply utility, Eskom, faces enormous challenges with the wellpublicised deterioration of our ageing coal-fired power station fleet Eskom can supply less than 50% of its available generation capacity, with a projected potential shortfall of 6000MW.

This certainly paved the way for the implementation of more privately-funded utility projects , and we have already seen the impact,

as private investors have recently announced several significant schemes The recent ruling where the city of Cape Town in the Western Cape may now procure from any private energy supplier, as well as compensation for residential power fed into the grid system, is a landmark victory and will hopefully open the door for other regions to be able to do the same Exciting battery and energy storage system, or “BESS”, projects will surely improve grid availability, reduce load shedding, and show the way to a more competitive and diverse energy supply environment

SolarQuarter: How does Solis want to penetrate South Africa's promising large-scale PV+ BESS system market?

At Solis we have a renewed passion for entering the larger BESS markets, and we currently have several larger storage products in our research and development pipeline Firstly we plan to introduce BESS products for the medium-scale C&I environment, while developing a utility-scale inverter ready for BESS integration. It’s an exciting time for us;with over 500 R&D engineers working tirelessly on developing new products like these , Solis has a confident outlook for the future Furthermore, the recent opening of our new manufacturing facility allowed us to increase production capacity to over 40GW annually, and even greater expansion is already planned

I believe it is clear that we are passionate about green power and creating energy solutions for a better future for all

INTERVIEW

| AFRICA MAR-APR ISSUE 2023 | 05

DHANANJAY MISHRA

ASISTANT GENERAL MANAGER - SALES POWERNSUN

KEY HIGHLIGHTS

Navigating challenges, achieving milestones - Powernsun shines in a competitive market, driving business expansions and strengthening our position in 2022

Africa's vast potential beckons - Powernsun offers comprehensive, sustainable, and bankable solar solutions tailored to the unique needs of the region.

Africa's solar surge - Powernsun embraces the continents exponential growth, positioning ourselves for long-term success in the booming solar energy sector while contributing to sustainable development

How has the year 2022 been?

Despite the competitiveness of the market and the challenging global economic and business environment, the year 2022 has been truly remarkable for us We have successfully navigated through these obstacles and achieved significant milestones in terms of business expansions Moreover, we have added new products to our portfolios, which has further strengthened our position in the market

What services do you offer in the African region?

Africa is a land of vast opportunities, especially in the solar energy sector At Powernsun, we offer a comprehensive range of services tailored to the specific needs of the African region We provide a one-stop solar solution that is both sustainable and bankable, regardless of the size and location of the project What sets us apart is our in-house expertise in global material sourcing, allowing us to handle solar projects ranging from kilowatts to megawatts in terms of supply and management This expertise serves as a key differentiator for us

What makes your services unique and outstanding?

Our services are distinguished by our in-depth understanding and wealth of experience in the field of solar technology This enables us to deliver innovative and reliable products and services to our clients Our pursuit of innovation drives us to continuously bring the latest technology, products, and services under one umbrella, making our offerings truly unique We strive to stay at the forefront of the industry and provide our customers with cutting-edge solutions that meet their specific requirements

How do you see the African solar market growth in the next 5 years? What is your market outlook?

The African solar market is poised for exponential growth over the next five years As urbanization, population growth, and economic development continue to accelerate in the region, the demand for electricity is increasing rapidly In response to this demand, the adoption of renewable energy, particularly solar energy, is gaining momentum With favorable government policies supporting the development of the renewable energy sector, we anticipate a significant surge in the use of solar energy in Africa This positive outlook presents immense opportunities for our business and positions us for long-term success in the region

What are your growth and expansion plans for 2023?

As a solar energy company, Powernsun is fully committed to being an integral part of Africa & growth journey. In line with this commitment, we have laid out ambitious growth and expansion plans for 2023 We are dedicated to establishing sales and service operations in all major regions of Africa to serve our customers better In fact, we have recently opened new offices in South Africa and Morocco, marking important milestones in our expansion efforts

Our primary focus for 2023 is to achieve exponential growth in terms of business expansion and market share We are excited about the opportunities that lie ahead and look forward to contributing to the sustainable development of Africa's solar energy sector

Illuminating Africa's Solar Landscape with Tailored Solutions, Global Expertise, and Sustainable Commitment Powernsun: Empowering the Continent's Renewable Energy Potential and Lighting the Path to a Brighter Future "

FEATURED

INTERVIEW

"Unleashing Africa's Solar Potential: Powernsun's Growth, Tailored Solutions, and Sustainable Commitment Illuminate the Path to a Brighter Future."

| AFRICA MAR-APR ISSUE 2023 | 06

POWERNSUN PARTNERS WITH SOLPLANET TO REVOLUTIONIZE AFRICA'S SOLAR INDUSTRY

In an exciting development for the African solar market, Powernsun, a leading solar component distributor, has partnered with Solplanet, a renowned manufacturer of solar inverters and EV chargers This collaboration aims to introduce high-quality solar on-grid and hybrid inverters, as well as EV chargers, to the North Africa region The partnership was officially announced in January 2023 at The World Future Energy Summit, marking a significant milestone in the region's sustainable energy journey

chargers that comply with international high-quality standards These inverters are designed to maximize solar energy generation and ensure seamless integration of solar power into the existing grid infrastructure With their high efficiency and reliability, Solplanet inverters offer exceptional performance in diverse climatic conditions, making them well-suited for Africa's unique solar requirements.

Unleashing the Potential of Hybrid Inverters

In addition to on-grid inverters, Powernsun and Solplanet are introducing hybrid inverters that combine the benefits of both on-grid and off-grid systems The ASW H-S2 and ASW H-T1 Series of Hybrid inverters offer the flexibility to utilize solar energy during the day and store excess power in batteries for use during evenings or power outages This innovative solution provides uninterrupted power supply and reduces reliance on the grid, enabling energy independence for households and businesses in Africa

Driving Electric Mobility with EV Chargers

Recognizing the immense potential for electric vehicles (EVs) in Africa, Powernsun and Solplanet are introducing EV chargers as part of their product portfolio EVs present a sustainable transportation option, reducing carbon emissions and dependency on fossil fuels By bringing reliable and efficient EV chargers to the African market, Powernsun and Solplanet are accelerating the adoption of electric mobility, promoting a greener and cleaner future

Meeting Africa's Growing Energy Needs

Africa, with its abundant sunlight and increasing energy demand, presents a vast opportunity for solar power adoption As the continent seeks sustainable solutions to address its power requirements, the partnership between Powernsun and Solplanet brings cutting-edge technology and expertise to meet this growing demand By joining forces, both companies are committed to transforming Africa's solar landscape and providing reliable, efficient, and eco-friendly solutions

The Solar Show Africa 2023 Exhibition

The official launch of Solplanet's on-grid and Hybrid inverters, along with EV chargers, in the North Africa region, took place at The Solar Show Africa 2023 Exhibition on April 25-26 This premier event brought together industry experts, solar energy enthusiasts, and policymakers from across the continent Powernsun and Solplanet showcased their cutting-edge products, highlighting their commitment to advancing solar technology in Africa

Benefits for Africa's Solar Industry

The collaboration between Powernsun and Solplanet offers numerous benefits to Africa's solar industry By providing high-quality inverters and EV chargers, the partnership empowers solar installers, system integrators, and end-users with reliable and efficient equipment, ensuring optimal solar power utilization. Moreover, the availability of hybrid inverters and EV chargers unlocks new possibilities for energy independence and sustainable transportation in the region

Overall, the partnership between Solplanet and Powernsun is expected to have a positive impact on both businesses as well as on consumers in the Middle East and North Africa region With access to high

Solplanet, a brand of AISWEI, a Chinese company that has been manufacturing inverters since 2007, is known for producing high-quality and reliable products for renowned brands such as SMA and Zeversolar Solplanet offers a range of inverters, including single-phase, three-phase, and hybrid inverters, along with intuitive monitoring solutions and smart EV

COMPANY FEATURE | AFRICA MAR-APR ISSUE 2023 | 07

Green hydrogen, or hydrogen produced from renewable sources, is increasingly gaining attention as a potential solution to reduce carbon emissions and achieve a net-zero economy Africa, with its abundant renewable resources, has the potential to become a major exporter of green hydrogen to the rest of the world

Africa has some of the world's best renewable energy resources, including wind, solar, hydro, and geothermal For instance, the Sahara desert receives more sunlight in six hours than the world uses in a year The region also has vast untapped wind energy potential, particularly along its coastlines These renewable resources can be harnessed to produce green hydrogen, which can be exported to countries with less favorable renewable energy resources

Green hydrogen has numerous applications, including fuel for transportation, power generation, and industrial processes The transport sector, in particular, is a major consumer of hydrogen In the maritime industry, for example, hydrogen fuel cells are being used to power ships, and the International Maritime Organization has set a target of reducing greenhouse gas emissions from the sector by at least 50% by 2050 The aviation sector is also exploring the use of hydrogen as a fuel for planes

Africa's green hydrogen potential is yet to be fully tapped, but there are already some initiatives in place South Africa, for instance, has launched a green hydrogen initiative that aims to produce one gigawatt of hydrogen by 2030, with a focus on using renewable energy sources Morocco is also planning to build a green hydrogen plant powered by wind and solar energy Additionally, some African countries, such as Egypt, have already started exporting blue hydrogen, which is produced from natural gas but with carbon capture and storage technologies to reduce emissions.

Africa's potential as a green hydrogen exporter has not gone unnoticed by the international community. The European Union has already expressed interest in importing green hydrogen from Africa to help it achieve its net-zero target. Germany, for example, has signed a memorandum of understanding with Morocco to cooperate on the production and export of green hydrogen

However, there are challenges that need to be addressed for Africa to realize its green hydrogen export potential One major challenge is the lack of infrastructure for producing, transporting, and storing hydrogen The costs of

building this infrastructure can be substantial, particularly in countries with limited financial resources Additionally, the regulatory frameworks for green hydrogen production and export need to be developed and harmonized across the continent

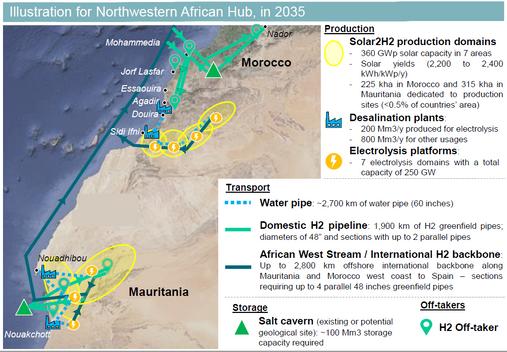

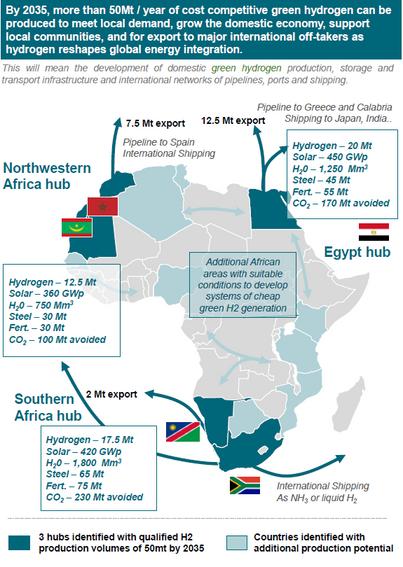

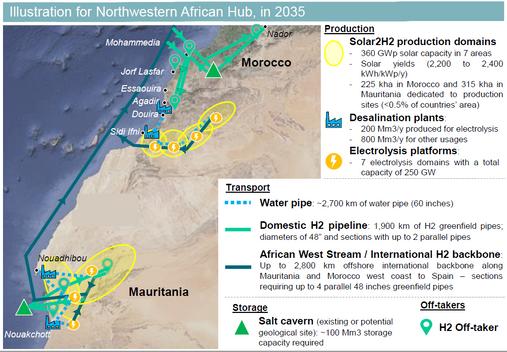

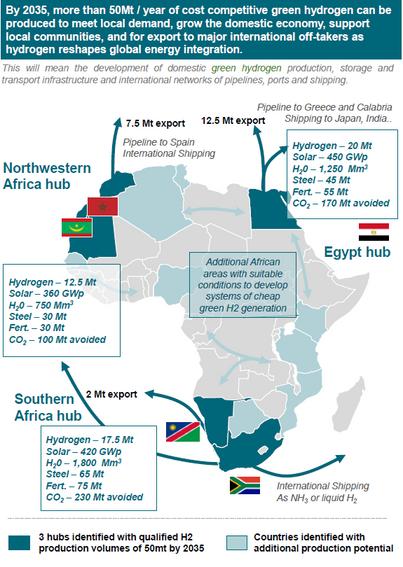

According to a recently published research report named "Africa's extraordinary green hydrogen potential", prepared by European Invest Bank (EIB), International Solar Alliance (ISA) and the African union with the support of the Government of Mauritania, HyDeal and UCLG Africa

The research report highlights Africa's solar energy to produce 50 million tons of green hydrogen per year by 2035 By harnessing abundant renewable energy source (Solar & Wind) Africa can establish hydrogen hubs in three different regions covering Mauritania, Morocco, Southern Africa & Egypt By harnessing the green hydrogen potential of Africa, the price of green hydrogen potential can reduce to euro 2/kg and can accelerate low-carbon economic growth across the continent and reduce emissions by 40%

The research & analysis finds out that by tapping Africa's unparalleled solar potential of 1,230GWp in three hubs across Africa can unlock 50 million ton per year generation capacity by 2035 This vast amount of green hydrogen will help to decarbonize Africa's hard-to-abate sectors like (steel, fertilizer, mining and transport) and strengthen its global competitiveness, saving an estimated 500Mt in GHG emission

Source:Researchreportnamed"Africa'sextraordinarygreenhydrogenpotential", https://www eib org/attachments/press/africa-green-hydrogen-flyer pdf

| AFRICA MAR-APR ISSUE 2023 | 08

MILICENT CHIDAMBA

SALES DEPUTY DIRECTOR –SADC REGION, JINKO SOLAR

"JinkoSolar's 2023 Plan: Robust Distribution Network and Energy Storage Solutions for Residential, C&I, and Utility Segments in SADC Region"

KEY HIGHLIGHTS

JinkoSolar's Unique Value Proposition and Expansion Plans Drive Growth in SADC Solar Market Amid Energy Crisis

Overcoming Setbacks: JinkoSolars Success in SADC Solar Market Despite Policy Inconsistency and Funding Challenges

JinkoSolar's Success in the SADC Region: Robust Distributor Network and Innovative Products Drive Remarkable Sales Growth in 2022

How has the year 2022 been for the Jinko Solar SADC region? What was the most memorable achievement for you in 2022?

2022 was a great year from JinkoSolar in the SADC region as we saw a remarkable growth in our Sales volume We managed to consolidate our market share position in most of the SADC Markets The most memorable achievement in 2022 was setting up a robust Distributor network in South Africa which has shown some results and successful launch of Tiger Neo and the Jinko Energy Storage Solutions in the region

How do you see JinkoSolar' s African solar market growth in the next 5 years? What is your market outlook?

Despite the traditional setbacks that have hampered the full growth of the Solar Industry, namely policy inconsistency, lack of funding, investor perceptions of high risk and cost, we have seen in the past year encouraging signs of real growth One of the key drivers has been energy security as the region is going through a power crisis Our conservative projection is that the SADC market will add at least 3GW yearly, assuming that all the Utility projects will be on track.

What makes Jinko Solar's products unique and outstanding for the SADC region's requirements?

Jinko has always approached the market with a Unique Value Proposition We are offering to the market Innovative, Quality, Reliable and High Performance modules Take for instance our Tiger Neo which is the Best Selling N Type solar panel to date globally with the following benefits- a 30 year warranty, high module efficiency of more than 22,5%, lower degradation of less than 1% during 1st year and high bifaciality

What are your growth and expansion plans for 2023?

2023 the plan is to further develop a robust Distribution network in every country in the SADC region so that clients can easily access our products.

Does Jinko Solar's SADC region have any plan to penetrate the promising market of large-scale BESS with Solar systems in the South African market?

Since 2022 we have already started introducing our BESS to the market Within the SADC region we have supplied our Solutions to Namibia, Mozambique, Botswana and Zimbabwe and we are currently discussing some projects in other countries Our Energy Storage Solutions cater for 3 segments namely Residential C&I and the Utility

FEATURED INTERVIEW

| AFRICA MAR-APR ISSUE 2023 | 09

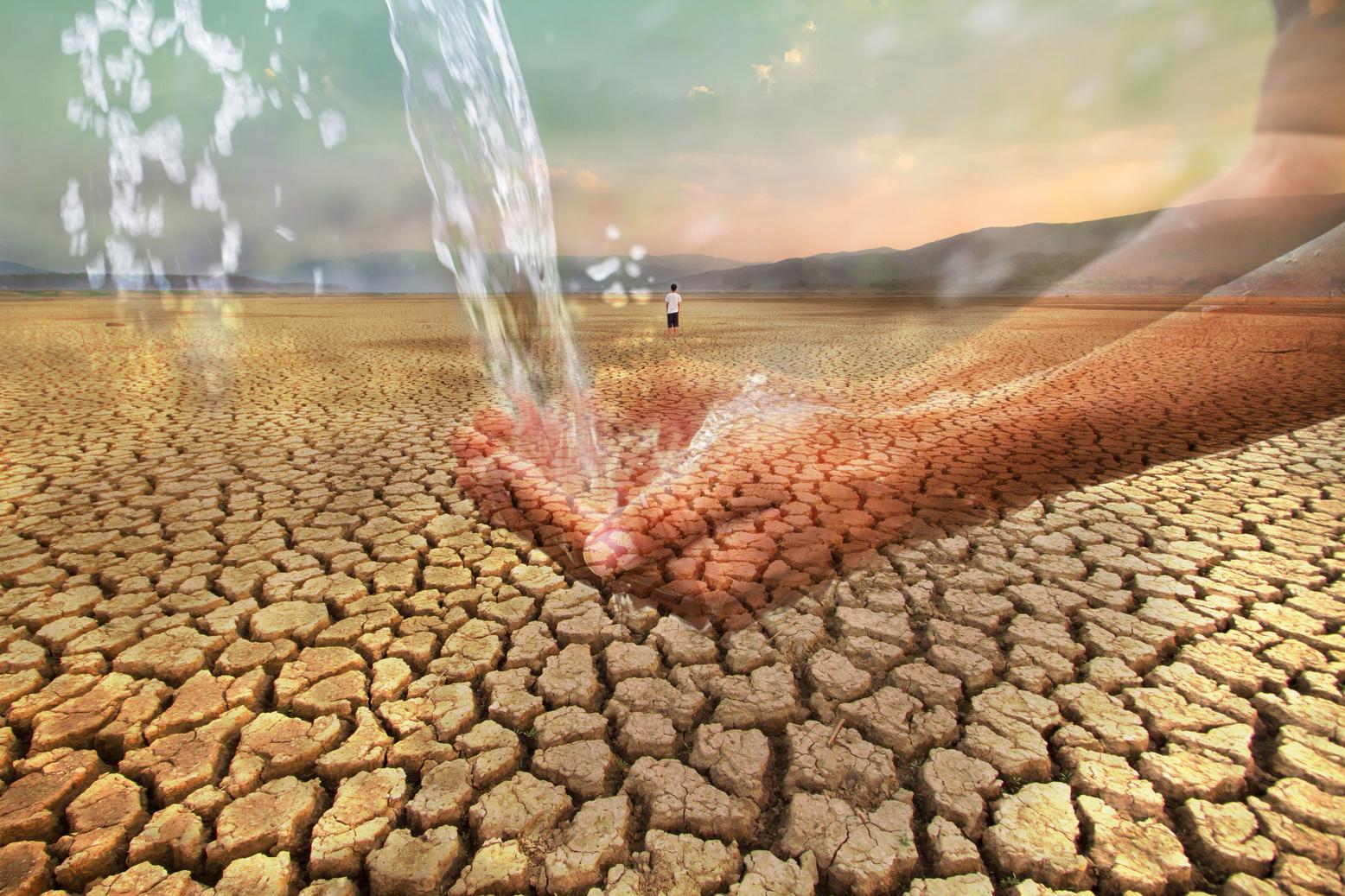

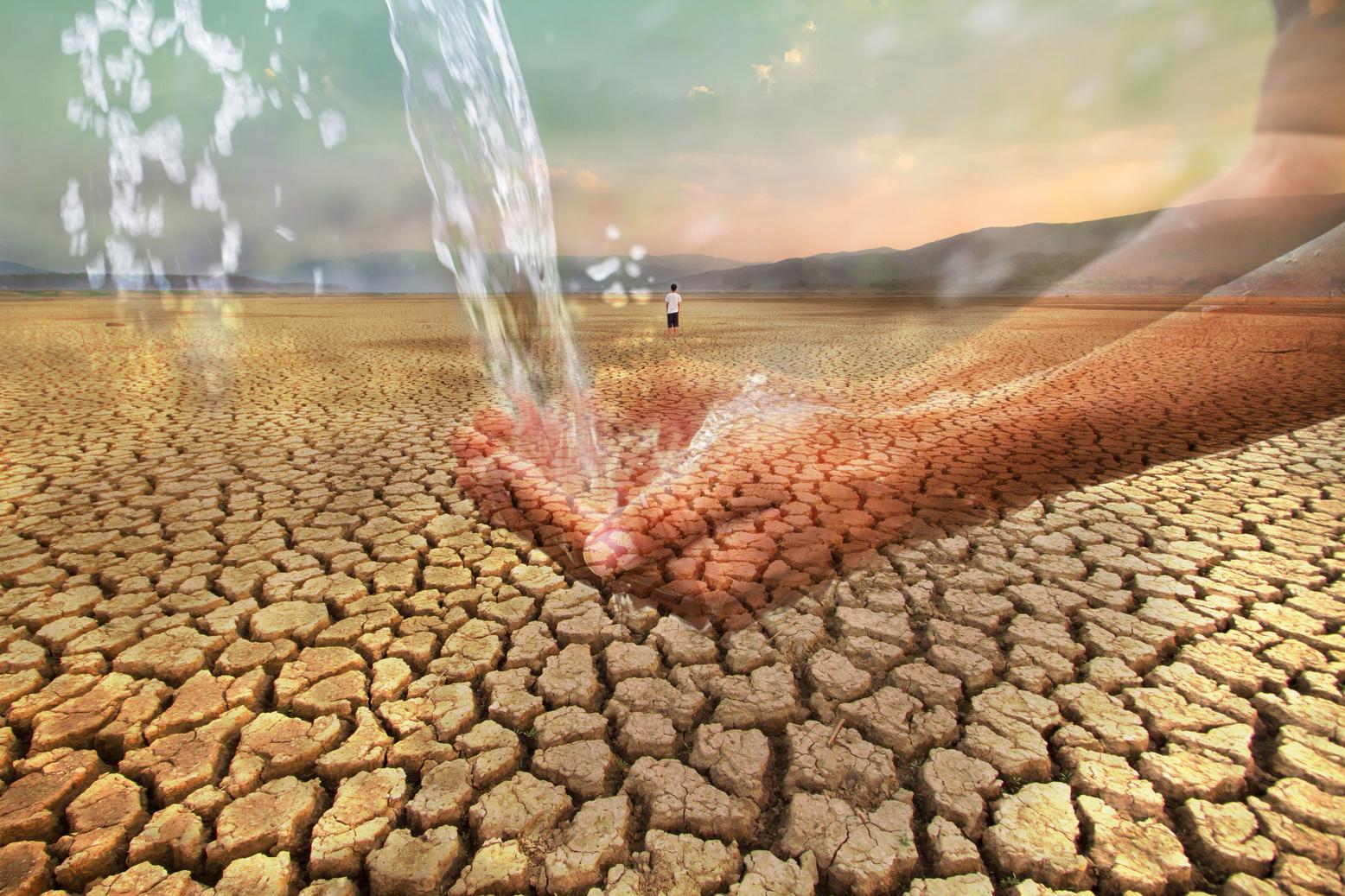

DECENTRALIZED RENEWABLE ENERGY: MAKING A CASE FOR ADOPTION IN SUB-SAHARAN AFRICA

AUTHOR:

GREYSON ONESMO METILI Head of Africa Operations at ENGIE Energy Access

Sub-Saharan Africa is home to over 600 million people without access to electricity In many rural areas, households depend on expensive and unreliable energy sources such as kerosene lamps and diesel generators While these options are expensive, they also hinder economic growth and the

overall development of the region With decentralized renewable energy, a solution has emerged that is viable enough to address this energy access gap and proffer socio-economic benefits

ENGIE Energy Access, a mini-grid and off-grid PAYGo solar energy company, is the leading player in Africa’s off-grid sector With its solar energy solutions, it is helping champion the strive towards achieving the UN’s Sustainable Development Goal 7 (SDG7) of universal energy access by providing clean energy to the remotest parts of Sub-Saharan Africa

ENGIE’s goal is to impact 20 million by 2025, having already transformed over 9 million lives in 9 countries since start of operations

ENGIE’s operations demonstrate that its off-grid energy solutions (solar home systems (SHS) and mini-grids) provide a reliable and affordable source of electricity to rural households that are not connected to the national grid, or are connected to inefficient grid As more households gain access to electricity, more people can power appliances, charge phones, and run small businesses, which contributes to improved living standards and socio-economic development

Beyond access to energy, ENGIE Energy Access' solar-powered projects in Africa have helped to improve health conditions Using kerosene lamps and candles for lighting in households without access to electricity has been linked to respiratory problems and other health issues Off-grid energy solutions provide clean and reliable lighting, which can improve indoor air quality and reduce the risk of respiratory illnesses The availability of electricity also enables healthcare clinics to refrigerate vaccines and medicines and use medical equipment, leading to improved healthcare outcomes Beyond providing energy for homes and clinics, ENGIE Energy Access also partnered with a Dutch-based social enterprise

in 2022 to launch MTego, an innovative outdoor mosquito trap in Kenya The solar-powered trap is designed to capture the malaria vectors without using insecticides before they even enter the home The innovation has helped to take the fight against malaria to the next level

Renewable Energy’s impact on small businesses in sub-Saharan Africa has resulted in increased productivity and income With access to electricity and SHS units, barbershops, tailoring stores, farms, and other income-generating activities such as charging phones for a fee have been able to satisfy more customers and increase their earnings As an example, ENGIE Energy Access' 600kW off-grid project in Lolwe Island in Uganda also powers fish-drying facilities and ice-making equipment for fish preservation They provide an electric mobility solution for fishing boats Such ability to impact economic activities within off-grid communities shows the importance of decentralized renewable energy in sub-Saharan Africa

According to the United Nations Environment Programme (UNEP), Africa is the most vulnerable continent to climate change, despite contributing the least to global greenhouse gas emissions. Through the very nature of its business, ENGIE Energy Access promotes the reduction of greenhouse gas emissions, which contributes to reduced carbon emissions.

Recently the company partnered with CarbonClear in a pioneer agreement to accelerate the use of climate finance by the off-grid sector in sub-Saharan Africa through issuing and selling data-driven and impactful carbon credits CarbonClear will be using its digital model to certify the carbon offset generated from the solar kits distributed by ENGIE Energy Access to rural and off-grid communities living in subSaharan Africa

The deployment of off-grid energy solutions creates jobs in the renewable energy sector ENGIE Energy Access employs about 3,000 people with over 80% locals of its nine host countries of operation The solar energy company also works with agents and partners within the capacities of sales, installation, maintenance, and repair of solar equipment and other renewable energy solutions

Conclusively, decentralized renewable energy programs, including the work of companies like ENGIE Energy Access, have the potential to make a significant socio-economic impact in Africa by promoting poverty alleviation through employment creation, economic advancement, adoption of modern technologies, improved health out comes, and climate change impacts mitigation These actions highlight the urgent need to invest in decentralized renewable energy programs in Africa to address the energy access gap and improve the lives of millions of people

| AFRICA MAR-APR ISSUE 2023 | 10

LORENZOL.COLACICCHI

FOUNDER, PRINCIPAL & CEO, ERGON SOLAIR PBC

"A company shifted its development strategy to cultivate European-Africa cooperation for sustainable development, with the ACP-EU Partnership under renewed by the Post Cotonou Agreement providing support for Green New Deal projects in sub-Saharan Africa."

KEY HIGHLIGHTS

Ergon Solair: Leading the Way in EU-Africa Cooperation for Sustainable Development and Solar Energy Expansion.

Renewed ACP-EU Partnership Paves the Way for Green New Deal Projects in subSaharan Africa with the Support of Ergon Solair

Ergon Solair's Unique Partnership Model Boosts Solar Energy Development and Social Up-scaling in Fragile Markets Across Africa

How has the year 2022 been for Ergonsolair?

The 2020-2021 pandemic left energy markets with the effects of the economic slowdown on energy consumption, and consequently the need to regain momentum

Everyone faced more or less the same challenges and addressed them in their own way

We chose to review our development strategy for Africa and change focus to cultivating EuropeanAfrica cooperation This was the result of the evolution of EU Africa relations on a macro scale, as well as years of dedication of mine promoting EU Africa cooperation in sustainable developments

This choice was not without risk, the ACPEUPartnership, the major instrument that facilitates such strategy, was governed by the Cotonou Agreement which had expired and was temporarily extended, saw its renewal (PostCotonou Agreement) suffering a veto byHungary Just a few days ago Hungarycommunicated it had reached agreement with the negotiators and confirmed agreement to ratify the Post Cotonou Agreement Unfortunately, now Poland is also creating obstacles, using the Cotonou Agreement as leverage for a Grain negotiations

We hope this will be overcome quickly allowing this important Treaty to enter into force in July making available considerable support for European-African partnerships to develop Green New Deal projects in subsaharan Africa

What services do you offer in the African region?

Ergon Solair continues in its traditional role as a solar business developer, supporting the evolution of the sector, we have been doing so for almost 20 years now Jointly with our European development partner organization www eagf de, we focus on developing and structuring EUAfrican Green New Deal projects We make available the high level specialization of our management and advisory team to parties that share our vision and wish develop initiatives in partnership with Ergon solair & its partners

What makes your services unique and outstanding?

I think today the partnership model we are developing is quite unique in Africa based on the principle of “A Partnership of Equals” between international and domestic parties, strongly rooted in both cultures, managed by private parties in partnership with foreign institutions, supported by multilateral and multidisciplinary teams.

This formula allows us to open up considerably more investment opportunities and market expansion, mitigating development risk in fragile markets through the support of foreign cooperation, while at the same time offering greater support to local communities to develop sustainably and address their social needs

How do you see the African solar market growth in the next 5 years?

What is your market outlook?

We believe in Solar Energy as an energizer of development, as well as of social upscaling I think this vision will become predominant throughout Africa

A purely speculative solar market in Africa has proven to be unable to reach the necessary expansion levels due to high risks which intimidates investors African nations need to increase their energy generation while not increasing their emissions, and containing costs, this requires a much more harmonized approach between private and institutional investors Addition of major utility is needed and their is space, but African markets have also their own dimension which requires a more horizontal and distributed approach, integrating solar with other activities If such vision becomes widely adopted the market could grow to significant levels delivering much more positive impacts on communities

What are your growth and expansion plans for 2023?

African timelines make it such that growth plans need to be multi year to be realistic If we look at 2023-2025 we plan to increase by 5 fold our solar utility development activity, and support multiple solar integrated social impact initiatives such as student housing, clinics, ambulances, AgroVoltaics, Solar Water, and more. Collectively, we have 51 multiple sector solar integrated projects endorsed by African governments for development in 2023-2024

INTERVIEW

| AFRICA MAR-APR ISSUE 2023 | 11

BUSINESS NEWS ROUNDUP

RECENT UTILITY SCALE SOLAR PROJECTS & INVESTMENT IN AFRICA'S SOLAR MARKET

Benban Solar Park, Egypt: The Benban Solar Park is located in the Aswan province of Egypt and has a total capacity of 1 5 GW, making it the largest solar park in the world The park is made up of 32 separate solar power plants, each with a capacity of up to 50 MW. The park is expected to generate more than 2.8 TWh of electricity per year and reduce CO2 emissions by 2 million tons per year.

Noor Ouarzazate Solar Complex Morocco: The Noor Ouarzazate Solar Complex is located in the Sahara Desert in Morocco and has a total capacity of 580 MW The complex is made up of four separate solar power plants, each with a capacity of up to 160 MW The complex is expected to generate 1 2 TWh of electricity per year and reduce CO2 emissions by 760,000 tons per year

Quaid-e-Azam Solar Power Park, Pakistan: The Quaid-e-Azam Solar Power Park is located in Bahawalpur, Pakistan, and has a total capacity of 1 GW The park is made up of 5 separate solar power plants, each with a capacity of up to 200 MW The park is expected to generate more than 2 TWh of electricity per year and reduce CO2 emissions by 1 6 million tons per year

Kafue Gorge Lower Hydropower Plant, Zambia: While not strictly a solar project, the Kafue Gorge Lower Hydro power Plant in Zambia includes a 50 MW solar power plant The plant has a total capacity of 750 MW and is expected to generate 3 4 TWh of electricity per year The plant is expected to increase Zambia's energy capacity by 38% and reduce CO2 emissions by 2 7 million tons per year

KawiSafi Ventures announced a $70 million investment in Azuri Technologies: KawiSafi Ventures is an impact investment firm that focuses on providing funding for energy access companies in Africa In February 2022, the company announced a $70 million investment in Azuri Technologies, a provider of pay-as-you-go solar home systems in sub-Saharan Africa The investment is expected to help Azuri expand its reach and provide access to clean energy for more households in Africa

SunFunder raised $80 million in debt and equity funding: SunFunder is a solar finance company that provides loans to solar companies in emerging markets, including Africa In March 2022, the company announced that it had raised $80 million in debt and equity funding The funding is expected to help SunFunder expand its lending portfolio and provide more financing options for solar companies in Africa

Global Climate Partnership Fund invested $10 million in Redavia: Redavia is a provider of solar power solutions for commercial and industrial customers in Africa In April 2022, the Global Climate Partnership Fund announced a $10 million investment in Redavia The investment is expected to help Redavia expand its operations and provide more solar power solutions to businesses in Africa

Energy Access Ventures invested $5 million in Solarise Africa: Energy Access Ventures is a venture capital firm that invests in energy access companies in Africa In May 2022, the company announced a $5 million investment in Solarise Africa, a provider of solar power solutions for businesses in sub-Saharan Africa The investment is expected to help Solarise Africa expand its operations and provide more access to clean energy for businesses in the region

SOLARQUARTER

RESEARCH

| AFRICA MAR-APR ISSUE 2023 | 12

RECENT INVESTMENTS IN AFRICA'S SOLAR COMPANIES THAT HAVE BEEN REPORTED IN 2022 SO FAR

ANDREW AMADI

CHIEF EXECUTIVE OFFICER , KENYA RENEWABLE ENERGY

ASSOCIATION

KEY HIGHLIGHTS

Sustainability is not just an option; it's a necessity. KREA is leading the way in promoting renewable energy and clean technologies to create a greener and more sustainable future

By championing electric mobility and high standards for batteries, KREA is driving the transition towards a cleaner and more efficient transportation sector, making electric vehicles accessible to all

Through innovative pilot projects like rooftop solar for healthcare facilities, KREA is revolutionizing energy management and decarbonizing critical sectors, ensuring a healthier and greener future for all.

How does KREA strive to achieve the country's committed Net-Zero goal?

KREA is promoting the substitution of unsustainable biomass with renewable sources of energy both for industrial and domestic use KREA , through its strategic plan is developing aggregation business models to make investments attractive to global and local investors to finance the cost of technologies required for sustainable biomass sources, be they gasification, combustion or biomethanization to produce clean and sustainable fuels

KREA is promoting the transition to electric mobility for two wheeler and three wheeler by also developing and championing for high standards for batteries for e mobility as well as for investors to take ownership and then lease smart batteries to consumers as a way to mitigate the high cost of electric vehicles.

KREA will soon be rolling out a pilot project to provide rooftop solar for healthcare facilities with optimized and efficient use of electricity through remote real time energy management

How do you see Kenya's solar energy market growth potential in the next five years?

How can Kenya be an African leader in voluntary as well as compliance carbon credit generation and trading market?

Kenya is already an African leader in Carbon Credit generation Kenya was one of the first African countries to implement CER projects as far back as 2007 Kenya published the Draft Climate Change bill 2023 which seeks to create local carbon markets.

INTERVIEW

"Kenya's leadership in carbon credit generation and the development of local carbon markets highlights the country's commitment to combating climate change and fostering sustainable economic growth. KREA is at the forefront of this transformative journey."

| AFRICA MAR-APR ISSUE 2023 | 13

KREA's vision of a future where off-grid solar surpasses grid peak demand reflects the immense potential of renewable energy

As captive power, electric mobility, and solar applications expand, Kenya is poised to become a shining example of sustainable development and energy independence "

Corporate Renewable Energy Market In AfricaChallenges And Opportunities

Prelude

Around the world, renewable energy generators have been entering into power purchase agreements with corporates (PPAs) These are long term contracts that allow corporates to obtain clean electricity over the long term. This has seen a decrease in renewable energy costs, lower risk premiums, and increased competition in the equipment manufacturing industry (wind turbines, solar panels, etc ) According to Bird & Bird's report, the global corporate renewable PPA volumes climbed 23 7 GW in 2020 The trend is expected not to slow down While recently the African region saw an increased uptake of corporate renewable power, sub-Saharan African countries may face particular regulatory challenges These challenges include strict license requirements and a dearth of net-metering options. These barriers need to be removed if Africa is to become a leader in corporate renewable energy PPA Here in this article, representative of KPMG Nigeria have expressed his perspective on Nigeria's corporate renewable market and its potential Also, Mr Chidi Obike has given his broad perspective on Africa's corporate renewable market

multinational manufacturers- which have come together to lead to the industry’s tipping point And the exciting part is that African C&I solar has barely scratched the surface

AUTHOR:

CHIDI OBIKE Founder & CEO at Powerup Renewables Ltd.

This represents all the manufacturing, industrial, mining, commercial, and other business-related demand for solar power across the continent. According to recent statistics this represents 75 % of all electrical power demanded across all industries in Sub Saharan Africa.

The Commercial and Industrial solar sectors sit nestled between the residential solar and the utility-scale projects markets on the solar power value chain

Most countries in sub-Saharan Africa have been struggling with unreliable and inadequate power for over four decades

According to the Manufacturers Association of Nigeria this causes commercial & industrial companies to spend over 40% of their production costs on self-generation of power via use of fossil fuel generators This leads to productivity losses of over $40billion annually by manufacturers and commercial businesses C&I Solar Power is a very innovative solution that solves this problem by providing reliable power and massive savings on their electricity costs This also reduces their exposure to constant increases in diesel/gas prices, grid electricity prices and product scarcity, hence providing them with long-term energy security, which is critical for their business profitability and survival

For Africa’s commercial and industrial (C&I) solar industry, 2022 has truly been a watershed year, industrial solar power installations grew by 60% according to Africa Solar Industry Association’s (AFSIA) Also the C&I sector has seen an unprecedented level of activity in the form of mergers and acquisitions and large scale investments An example is Shell acquisition of a Nigerian C&I Solar company

This high level of activity took several years to get to, the sector has been slowly gaining traction since 2015 when the model first appeared Bolstered by a union of factors which include historically high diesel prices(price quadrupled in Nigeria), aging power grids, mounting pressure s, and the growing adoption of solar by large

The most loved solar power deployment model by C&I sector is called Power As A Service model, which allows solar power system to be installed for companies at zero upfront cost, they only pay for power supplied to them monthly by private power providers, at a huge discount to diesel prices Typically now roughly $0 10/kWh to $0 11/kWh, which is five times cheaper than electricity generated from a diesel generator ($0 55/kWh to $0 70/kWh) and on par with the national grid ($0 10/kWh to $0 17/kWh)

That been said, some barriers to deployment of C&I Solar still existregulations and currency risk Unfortunately, regulation prohibits energy-users in many African countries – with the exception of Nigeria, South Africa, Kenya, Egypt and a few others – from buying solar energy from private providers as in the model cited above (In Ghana, the possibility is limited to large energy-users, called “bulk customers” ) For many African countries, the only solar deployment option to private offtakers is to enter into rental or a lease-to-own contract Contracts where the users pay for the equipment is widely perceived as less attractive to the energy-user than contracts where the client pays for the electricity delivered , as is most commonly done worldwide Government should improve on the regulations by liberation, to make it easy for businesses to invest in solar energy for their needs, such as done by South Africa which increases the threshold for installing solar power system to 100Megawatts without need for a permit

Currency is also an issue, especially since African countries need to attract billions of dollars in foreign investments for C&I solar Foreign investors are generally not set to up take currency risk, off-takers neither Furthermore, in some markets such as Nigeria, Mozambique, Zimbabwe access to US dollar is highly restricted, making foreign investments quite difficult Governments should create liquid currency markets, a stable and a transparent foreign exchange policy , as these are vital for countries seeking solar investors

Despite all these, investors and private providers are seeking and implementing innovative ways to overcome these issues, such as securing financing in local currencies from DFI’s and pension funds

The African Corporate Renewable Energy sector lead by C&I solar has a bright future ahead, with Nigeria’s industry alone worth at least $15 billion per year Changing market conditions and increasing adoption rates and have created an environment ripe for players who might have previously overlooked the continent These are very exciting times for this sector

PERSPECTIVE

| AFRICA MAR-APR ISSUE 2023 | 14

AUTHOR:

MARTINS AROGIE Partner at KPMG

in Nigeria

INTRODUCTION

There have been significant investments in the renewable energy space in the country in the last few years, though there are still concerns as to the sufficiency and focus of the investments and how it impacts the country’s energy transition agenda The bulk of the investments seen in the space have typically been mini grids in rural areas and individual homes These investments have been very critical to the success of the Government’s agenda to increase access to electricity in a country where access has remained notoriously low It is difficult to keep tab of the numbers of mini grid deployed in the country, but it would be unsurprising to find out that we may have already doubled the number over the last 5 years The work of the Rural Electrification Agency (REA) and other Development Finance Institutions (DFIs) and Agencies in providing grants and concessional funding for players in that space have been instrumental to this growth We believe that the activities in that space will continue to grow if this funding remains available for players in the space The question though is if investments in mini grids in unserved and underserved areas will be sufficient to tilt the scale in terms of the contribution of renewable energy to the overall energy mix in the country This is because the bulk of the energy generated and consumed daily across the country is for commercial activities which takes place in more urban areas and where there has been little demonstration of improvement in the uptake of renewable energy solutions.

STATUS AND POTENTIAL

It’s not all doom and gloom though Over the last 2 years there have been some investments especially in the fast-moving consumer goods sector of the economy Nigerian Breweries Plc, Nigerian Bottling Company and Seven Up Bottling Company have all announced significant investments in energy transition programs which seeks to move the sources of energy for their plants and operations from fossil fuel or transition fuels like gas to Solar The two major renewable Commercial and Industrial (C&I) power service providers in the country have moved their total sites across the Nation closer to a thousand and are consolidating their operations across the West African sub region

There was considerable interest in the announcement by Sterling Bank about a year ago that its head office would now be powered fully by solar energy It was deemed to be a momentous announcement and many others would take the cue and follow quickly That expectation has not been met There is a significant number of C&I customers in the country that are yet to engage on the energy transition question which creates a huge market This therefore begs the question of whether the achievements so far are enough and what may be the challenges to an increased uptake of solar energy by commercial and industrial consumers.

Funding may be the first one The epileptic power supply in the country down the years have led to C&I consumers to make significant capital investments in power generation to ensure the stability of their operations The funding for these investments were not concessionary with no intangible benefit either It is therefore difficult to expect these investments to be written off and another investment made in renewable energy at a time when cost of funding is rising steadily The access to grants and concessionary funding that is available to mini grid developers in under and un served communities are not available to these type of power consumers

Furthermore, Nigeria does not have an established carbon trading market or obligations for C&I customers Therefore, it is almost impossible to get any real financial benefit for any investment in the transition to solar energy We would have to rely solely on the altruistic intentions of companies and as the last few years have showed, this may not be sufficient. We need to do more as a country if we are to see the kind of progress we desire

The lack of end user incentive may be another issue Power generation from solar energy qualifies as a pioneer activity in the country and any company involved in it can obtain a tax holiday which grants them an exemption from the payment of income tax for periods ranging from 3-5 years However, C&I consumers are not generating companies They do not make the investment to sell power, so even if they generate more kilowatt/hour than some mini grid developers from the plants they establish in house, they will not qualify for the grant of the incentives Solar panels are supposed to be exempted from VAT, but there have been several inconsistencies in the application of the exemption especially at the ports of entry as the bulk of these items are imported There is also the challenge of how incentives enjoyed by service providers are transferred to end users and whether the service providers just apply the savings to increase and improve their already challenged profit margins.

The absence of clear Government policy has also not helped I had mentioned earlier, the absence of a carbon pricing and trading framework and how this has also impacted the uptake of solar energy by C&I companies in the country. The passage of the Climate Change Act and the set-up of the National Council on Climate Change are significant milestones in driving this but it is only the start There will be a lot of engagements and collaboration to come before we have an effective and proactive policy in place and until then we may continue to rely on the goodwill of companies in driving the country’s commitment to its climate change obligations.

CHALLENGES CONCLUSION

The Nigerian market is reflective of the general African market

Therefore, it is likely that the status and challenges highlighted above apply across the continent It is important that the issues are addressed proactively so that the potential in this market can be realised Players in the industry must continue to engage with Governments to ensure that there is an inclusive framework to drive change

PERSPECTIVE

| AFRICA MAR-APR ISSUE 2023 | 15

SOLARQUARTER

RESEARCH

Climate change is one of the most pressing challenges facing the world today, with impacts ranging from rising sea levels to increased frequency and severity of natural disasters Africa, as a continent that is particularly vulnerable to the effects of climate change, has been the focus of efforts to increase climate financing, which is crucial for mitigating and adapting to climate change

Climate financing refers to the financial resources and investments needed to support activities that reduce greenhouse gas emissions and help countries adapt to the impacts of climate change These resources can come from a variety of sources, including governments, multilateral organizations, private sector investments, and climate funds

Africa has been a focus of climate financing efforts due to its vulnerability to climate change impacts The continent is home to some of the world's poorest countries, which often lack the resources to finance climate change adaptation and mitigation activities Additionally, the continent has a high dependency on natural resources, such as agriculture and fishing, which are highly vulnerable to the impacts of climate change

To address this challenge, a number of initiatives have been launched to increase climate financing for Africa For example, the Green Climate Fund, a multilateral climate finance mechanism, has committed over $3 8 billion to support climate projects in Africa The African Development Bank has also pledged to increase its climate finance commitments to $25 billion by 2025 However, despite these efforts, there are still significant challenges in accessing climate financing in Africa One of the main challenges is the lack of capacity and resources in African countries to develop and implement climate projects This can make it difficult for these countries to access financing from climate funds or attract private sector investment

Another challenge is the need for more innovative financing mechanisms that can better address the unique challenges faced by African countries For example, the African Risk Capacity is a pan-African institution that provides climate insurance to African countries to help them manage climate risks

Furthermore, there is a need for increased coordination and harmonization of climate financing efforts in Africa. Currently, there are multiple sources of climate financing, which can lead to fragmentation and duplication of efforts. Improved coordination and harmonization could help to streamline climate financing efforts and ensure that resources are being used effectively.

There are numerous examples of climate financing initiatives in Africa, which are aimed at supporting climate change adaptation and mitigation activities in the continent Here are some examples:

The Green Climate Fund (GCF): The GCF is a multilateral climate fund that has committed over $3 8 billion to support climate projects in Africa The fund has financed a range of initiatives, including renewable energy projects, climate-resilient infrastructure, and climate-smart agriculture

The African Renewable Energy Fund (AREF): AREF is a private equity fund that invests in small to medium-sized renewable energy projects in sub-Saharan Africa The fund aims to support the development of renewable energy projects, particularly in rural areas where access to electricity is limited

The African Risk Capacity (ARC): The ARC is a pan-African institution that provides climate insurance to African countries to help them manage climate risks The insurance covers a range of climate-related risks, including droughts, floods, and cyclones

The African Union Commission (AUC) Green Climate Fund (GCF) Readiness Support Program: The AUC GCF Readiness Support Program provides technical assistance to African countries to help them access climate financing from the Green Climate Fund. The program supports countries in developing their project proposals, as well as in building their capacity to manage and implement climate projects.

The Climate Investment Funds (CIF): The CIF is a multilateral climate fund that has provided $1.2 billion in financing to support climate projects in Africa The fund has supported a range of initiatives, including renewable energy projects, climate-smart agriculture, and sustainable transport

THE LANDSCAPE OF AFRICA'S CLIMATE FINANCE SPECIAL STORY | AFRICA MAR-APR ISSUE 2023 | 16

The African Development Bank's (AfDB) Climate Finance Strategy: The AfDB has committed to investing $25 billion in climate financing in Africa by 2025 This includes investments in renewable energy, energy efficiency, climate-smart agriculture, and sustainable transport, among others

POLICY & REGULATION

DEBRIEF

KENYA'S RECENT ROOFTOP SOLAR POLICY AMENDMENT: A STEP TOWARDS SUSTAINABLE ENERGY

Kenya, like many other developing nations, is grappling with an evergrowing demand for electricity With limited access to grid electricity, especially in rural areas, the government has been exploring alternative sources of energy to meet the country's energy needs. One such alternative is solar energy, which has the potential to provide clean, affordable, and reliable energy to all Kenyans. In this context, the recent amendment to Kenya's rooftop solar policy is a significant step towards achieving a sustainable energy future for the country.

The amendment to the rooftop solar policy was announced in March 2021 and aims to promote the adoption of solar energy in residential and commercial buildings across the country The policy amendment allows Kenyan households and businesses to install solar panels on their rooftops and sell excess power back to the grid This means that Kenyans can generate their electricity, reduce their electricity bills, and contribute to the country's overall energy production

Before the amendment, Kenyans were required to obtain licenses from the Energy and Petroleum Regulatory Authority (EPRA) to install solar panels on their rooftops The licensing process was lengthy and bureaucratic, which discouraged many Kenyans from adopting solar energy Moreover, there was no clear provision for selling excess power back to the grid, which meant that Kenyans could only use the energy they generated

The policy amendment seeks to address these issues by simplifying the licensing process and introducing a net-metering system Under the netmetering system, households and businesses can generate their electricity and sell any excess power back to the grid This means that Kenyans can earn revenue from their solar panels, which can offset the initial investment required to install them

The amendment also seeks to promote the local manufacturing of solar panels and other renewable energy components This will not only create job opportunities for Kenyans but also reduce the cost of solar energy, making it more accessible to all Kenyans

The policy amendment has been welcomed by renewable energy stakeholders in Kenya, who believe that it will accelerate the adoption of solar energy in the country According to the Renewable Energy Association of Kenya, the policy will create a conducive environment for investment in the solar industry and contribute to the country's overall energy security

In conclusion, the recent amendment to Kenya's rooftop solar policy is a significant step towards achieving a sustainable energy future for the country By simplifying the licensing process and introducing a netmetering system, the policy seeks to promote the adoption of solar energy in residential and commercial buildings across the country The policy will not only provide clean, affordable, and reliable energy to all Kenyans but also create job opportunities and contribute to the country's overall energy security.

SOUTH AFRICA'S RECENT REEGP AMENDMENT: A BOOST FOR RENEWABLE ENERGY

South Africa has been heavily dependent on fossil fuels for its energy needs However, in recent years, the government has been working towards increasing the share of renewable energy in the country's energy mix The latest amendment to the Renewable Energy and Energy Efficiency Programme (REEGP) is a significant step towards achieving this goal

The REEGP was first introduced in 2008 to promote the uptake of renewable energy and energy efficiency measures in South Africa The program has been successful in attracting investments in renewable energy, which has led to the commissioning of several large-scale renewable energy projects in the country The recent amendment to the program builds on this success and seeks to address some of the challenges that have hindered the growth of the renewable energy sector in South Africa

One of the main changes introduced by the amendment is the increase in the size limit for small-scale embedded generation (SSEG) projects Previously, SSEG projects were limited to 1 MW, which restricted their potential to contribute to the country's energy mix The amendment increases the size limit to 100 MW, which will allow for the development of larger renewable energy projects

Another key change introduced by the amendment is the removal of the cap on the amount of renewable energy that can be procured by municipalities This will allow municipalities to procure renewable energy directly from independent power producers (IPPs) and increase the share of renewable energy in their energy mix The amendment also introduces a framework for the procurement of renewable energy by municipalities, which will provide clarity and transparency in the procurement process

The amendment also seeks to promote the local manufacturing of renewable energy components. Under the new rules, IPPs are required to include a minimum level of local content in their projects. This will not only create job opportunities for South Africans but also contribute to the growth of the local renewable energy industry.

The amendment has been welcomed by renewable energy stakeholders in South Africa, who believe that it will boost the growth of the renewable energy sector in the country According to the South African Wind Energy Association, the amendment will increase investor confidence in the sector and attract further investments in renewable energy projects

In conclusion, the recent amendment to South Africa's REEGP is a significant step towards achieving the government's goal of increasing the share of renewable energy in the country's energy mix The increase in the size limit for SSEG projects, the removal of the cap on renewable energy procurement by municipalities, and the promotion of local manufacturing of renewable energy components are all positive changes that will boost the growth of the renewable energy sector in South Africa With these changes, South Africa is well on its way to achieving a more sustainable energy future

SOLARQUARTER

RESEARCH

| AFRICA MAR-APR ISSUE 2023 | 17

SOLARQUARTER RESEARCH CURRENT STORY

Green hydrogen, which is produced from renewable sources of energy, is increasingly being seen as a potential game-changer in the transition to a lowcarbon economy Africa, with its abundant renewable energy resources, has the potential to become a major producer of green hydrogen However, financing remains a key challenge for the development of the green hydrogen industry in the continent

Green hydrogen financing refers to the financial resources and investments needed to support the development, deployment, and scaling up of green hydrogen production and use This can include investments in renewable energy infrastructure, hydrogen production facilities, and transportation and storage infrastructure

Africa's green hydrogen potential is significant The continent has some of the world's best renewable energy resources, including solar, wind, and hydropower For example, the Sahara Desert, which spans across several African countries, has the potential to produce enough solar energy to meet the world's electricity demand Additionally, Africa has a growing demand for energy, particularly in remote and rural areas where access to electricity is limited

To tap into this potential, a number of initiatives have been launched to support the development of the green hydrogen industry in Africa For example, the African Development Bank (AfDB) has committed to investing $25 billion in climate financing in Africa by 2025, including investments in renewable energy and sustainable transport The AfDB is also supporting the development of the African Hydrogen Partnership, a consortium of African governments, industry players, and development partners that aims to promote the development of a green hydrogen industry in the continent

Other initiatives include the European Union's Africa Renewable Energy Initiative, which aims to develop 10 GW of new renewable energy capacity in Africa by 2020 and the United Nations Development Programme's Africa Renewable Energy Initiative, which aims to deliver 300 GW of renewable energy in Africa by 2030

However, despite these efforts, financing remains a key challenge for the development of the green hydrogen industry in Africa One of the main challenges is the lack of access to financing for small and medium-sized enterprises (SMEs) in the sector. Many SMEs lack the collateral and credit history needed to access traditional financing, which can make it difficult for them to access the capital needed to develop and deploy green hydrogen technologies.Another challenge is the lack of a supportive regulatory environment. The regulatory frameworks for renewable energy and hydrogen production and use are still in their infancy in many African countries, which can make it difficult for companies to invest in the sector.

To address these challenges, there is a need for more innovative financing mechanisms that can better address the unique challenges faced by the green hydrogen industry in Africa For example, green bonds and impact investment funds can provide alternative financing options for SMEs in the sector Additionally, there is a need for greater collaboration between governments, development partners, and industry players to develop a supportive regulatory environment for the sector

Here are some recent examples of green hydrogen financing initiatives in Africa:

Morocco's Green Hydrogen Project: In January 2021, the Moroccan government announced plans to build a $4 6 billion green hydrogen plant in the country's southern region The project, which is being developed in partnership with a consortium of international companies, including Siemens Energy, aims to produce up to 1 million tonnes of green hydrogen per year using solar and wind power

Africa GreenCo's Hydrogen Project: Africa GreenCo, a company focused on supporting renewable energy development in Africa, is exploring the feasibility of a green hydrogen project in Ghana The project, which would be funded by private investment and development finance institutions, aims to produce green hydrogen for export to Europe

The West African Clean Energy and Environment Trade Mission: In March 2021, the Dutch government organized a virtual trade mission to West Africa to explore opportunities for collaboration on green hydrogen and other renewable energy projects The mission included representatives from Dutch companies and development finance institutions, as well as African governments and industry players

The African Energy Chamber's Hydrogen Task Force: In February 2021, the African Energy Chamber announced the formation of a Hydrogen Task Force, which aims to promote the development of a green hydrogen industry in Africa The task force includes representatives from African governments, industry players, and development finance institutions

The African Union's Hydrogen Partnership: The African Union is working to develop a Hydrogen Partnership for Africa, which aims to promote the development of a green hydrogen industry in the continent The partnership is expected to bring together African governments, industry players, and development finance institutions to support the development of green hydrogen projects in the continent

Engie and Nareva's Green Hydrogen Project in Morocco: In May 2021, French energy company Engie and Moroccan company Nareva announced a joint venture to build a green hydrogen plant in Morocco The project, which will be powered by a 200 MW wind farm, aims to produce 30,000 tons of green hydrogen per year, with the possibility of scaling up to 1 GW of wind and solar capacity European Investment Bank's Investment in Green Hydrogen Projects in Africa: In March 2021, the European Investment Bank (EIB) announced plans to invest €4 9 billion in renewable energy projects in Africa, including green hydrogen projects The investment will support the development of new renewable energy capacity in Africa, with a focus on solar and wind power

3 Eni's Green Hydrogen Project in Tunisia: In April 2021, Italian energy company Eni announced plans to build a green hydrogen plant in Tunisia The project, which will be powered by a 10 MW solar plant, aims to produce 1,000 tons of green hydrogen per year, with the possibility of scaling up to 5,000 tons per year

Siemens Energy's Green Hydrogen Project in Egypt: In April 2021, Siemens Energy announced plans to build a green hydrogen plant in Egypt The project, which will be powered by a 1 2 GW wind farm, aims to produce 100,000 tons of green hydrogen per year, with the possibility of scaling up to 500,000 tons per year

HydrogenOne Capital's Investment in African Hydrogen Projects: HydrogenOne Capital, a London-based investment fund focused on the hydrogen sector, has announced plans to invest in green hydrogen projects in Africa The fund is looking to invest in projects that can produce green hydrogen at a competitive price, with a focus on countries with abundant renewable energy resources, such as Morocco and South Africa

Here are some recent investments in Africa's green hydrogen market: These initiatives demonstrate the growing interest in green hydrogen financing in Africa, as well as the potential for the continent to become a major producer and exporter of green hydrogen

AFRICA'S GREEN HYDROGEN FINANCING | AFRICA MAR-APR ISSUE 2023 | 18

TECHNOLOGY BRIEF

TECHNICAL ARTICLE ON BESS SYSTEM'S SAFETY AND RELIABILITY?

Battery Energy Storage Systems (BESS) are becoming increasingly popular as a means of providing reliable and cost-effective energy storage solutions However, the safety and reliability of BESS systems are critical considerations in their design and implementation In this technical article, we will explore some of the safety and reliability considerations for BESS systems

SAFETY CONSIDERATIONS

BESS systems contain large amounts of energy, and the potential risks associated with this energy must be carefully managed Several safety considerations must be taken into account when designing BESS systems, including:

Fire Safety: BESS systems can be susceptible to thermal runaway events, which can lead to the rapid release of large amounts of heat and the potential for fire To mitigate this risk, BESS systems must be designed to prevent thermal runaway events and contain any such events that do occur This can include measures such as thermal insulation, active cooling systems, and fire suppression systems