Market Outlook

Will hurricane Ian have a lasting negative impact on the Sarasota / Manatee housing market? How significant? How long will it last? Short answer: little to no negative impact regionally. Yes, some neighborhoods in North Port and Eastern Venice experienced some effects due to post Ian flooding, but as a region, we were spared. And yes there are individual homes from Palmetto to Englewood that had damage from falling trees or similar that will take a value hit, but there are not enough of them to impact the regional values.

Does that mean prices will keep going up? Not necessarily. The weather is just one of many factors influencing values. Long term the West Coast of Florida is more likely to be affected by national market pressures driven by inflation and macroeconomic factors than by the hurricane.

Our market, like the entire country, was already experiencing a market shift prior to the storm. We are no longer in a frenzied boom market nationally or locally, but we are still low on inventory and seeing consistent demand. We are in a “Sellers” market. Just not the market we were in last year, so we need to stop comparing everything to 2021. Comparisons to 2018 or 2019 are just fine!

Hurricane Ian was a terrible natural disaster. Lives were lost. Homes were damaged. Some people will most likely experience post traumatic stress disorder. Though tragic, we have to put things in perspective. The reality is that the number of people severely impacted is a small number. That doesn’t make it any less tragic, but if we don’t keep it in context we can all be pulled into the emotion. There are real estate patterns which can be identified and anticipated following a natural disaster. It doesn't matter whether it's a hurricane, an earthquake or a massive fire. Many patterns repeat themselves year after year, disaster after disaster.

Initial reactions are understandable, but demand recovers quickly

Post Hurricane emotions are high. People near and far are shell shocked by the images and loss of life. As a result it is totally expected that a percentage of buyers will initially back away from home searches or even cancel an existing contract. Memories fade quickly. The majority of buyers will reevaluate their priorities within 30 to 60 days and reestablish their search. Long term demand will not be negatively impacted.

Only the Hardest hit areas will take longer and have more turnover

Sanibel and Captiva Islands along with Ft Myers Beach will take several years to rebuild. Real estate in those areas will be somewhat chaotic for the near future. The new and improved communities will appeal to a new set of buyers as the rebuilding efforts take shape over the coming years. Areas like Naples, Port Charlotte, Punta Gorda, Englewood and North Port will recover quickly. Many are already back to life as normal. The majority of residents will rebuild and remain. There will be some investment opportunities but as a whole the communities will look much the same within a year as they did before Ian. History is not a crystal ball, but it is a good indicator of future odds: 14 of the 15 Category 4 or 5 hurricanes to make land in Florida since 1900 have been at or south of Charlotte Harbor. Though not a solid predictor of the future, it may influence some buyer’s decisions.

Long term the West Coast of Florida is more likely to be affected by national market pressures driven by inflation and macro economic factors than from a hurricane The near term risk is this particular hurricane landed in the middle of a national real estate / asset market shift. As a result some pundits will erroneously blame the hurricane for value adjustments that most likely would have happened regardless of the storm.

More people want to move to Florida than almost anywhere in the US. All the factors above will impact short and long term demand causing possible short term volatility. Supply in much of West Florida will actually reduce over the coming weeks and months. If demand and supply reduce at a similar pace, home values remain stable. But as long term demand rebounds prices will most likely return to an upward trend as long as the macro economic environment does not falter. Long term, home values on the West Coast of Florida are not as much at risk as is a widening gap in affordability. Increasing insurance costs combined with increasing values will price more and more average Americans (and Foreigners) out of the Florida market.

Nobody has a crystal ball to accurately say values will be higher or lower a year from now. There are simply too many moving variables locally, nationally and internationally. But we can state with a high degree of confidence that similar hurricanes in the past have seen recovery followed by increasing values.

• Inflation will be with us for the forseeable future.

• Consumer Spending is stagnating as inflation erases gains.

• Supply chain issues will continue, resulting in continued building cost increases.

• Interest Rates along with higher home prices have reduced home buying power by 60+%.

• The stock market declined significantly, impacting consumer confidence.

• Rental rates are still increasing due to a massive national shortage of rental inventory.

• Economists predict a slowing economy and possibly a moderate recession through 2023.

• Inflation should grow at a slower pace going forward.

• Housing prices historically increase during inflationary times (just not as fast as inflation).

• People invest in hard assets like real estate during difficult or volatile times.

• Investors will expand their rental portfolios due to the huge demand for rentals and the belief that overall values should hold steady (market dependent).

• Housing inventory is still at historically low levels, keeping price pressure up.

• Baby Boomers are still retiring at unprecedented rates and still want to move to their dream home.

Under $500,000 1.9 mo

$500,000 to $1 Mil 2.5 mo

$1 Mil to $2.5 Mil 3 mo

Greater than $2.5 Mil 6.7 mo

All combined = 2.3 months supply

s International Realty

Data supplied is from the Stellar MLS is deemed but not guaranteed to be 100% accurate

Through 9/30

Under $500,000

$500K to $1 Mil

$1 Mil to $2.5 Mil Above $2.5 Mil

Combined Totals

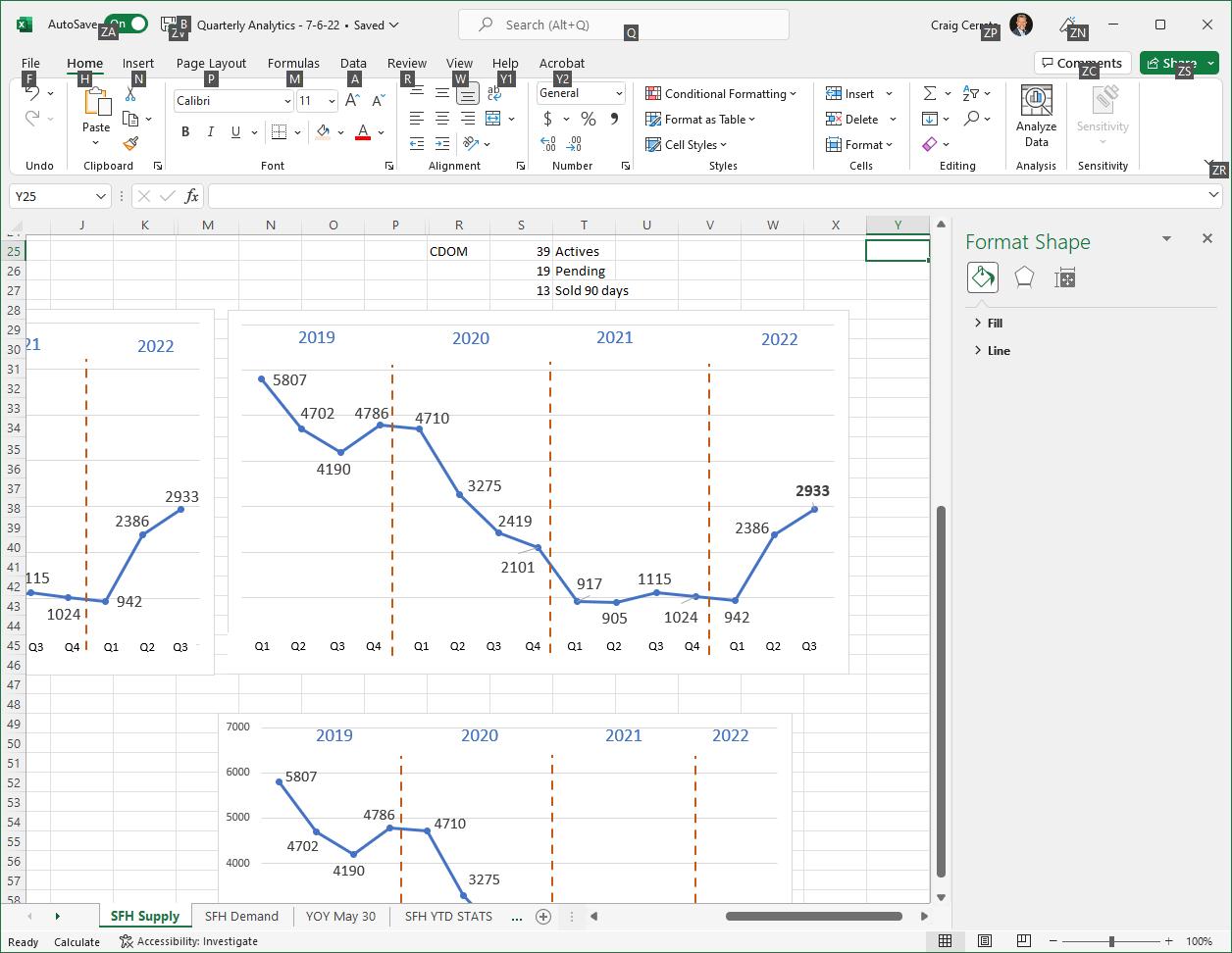

2019 9558 2020 9151 4% 2021 9318 2% 2022 5657 39% 2019 1438 2020 1744 21% 2021 3316 90% 2022 4474 35% 2019 387 2020 489 26% 2021 993 103% 2022 1012 2% 2019 60 2020 97 62% 2021 294 203% 2022 291 1% 2019 11,443 2020 11,481 .03% 2021 13,921 21% 2022 11,434 18%

Significant reduction due to undersupplied inventory combined with higher interest rates and higher average prices all reducing buying power for average buyers.

Strongest segment in terms of unit sales. Expected to continue growing if inventory can keep up with demand.

Significant growth not only year over year, but quarter over quarter. Simply a strong segment.

Homes actively “for sale” over $2.5 Mil decreased by 12% while sales remained constant resulting in a significantly undersupply market segment today.

2022 is a strong year to date. Homes sold are down year over year, but still well ahead of pre pandemic years. The question is if Q4 will keep the pace?

Premier Sotheby’s International Realty

Data supplied is from the Stellar MLS is deemed but not guaranteed to be 100% accurate

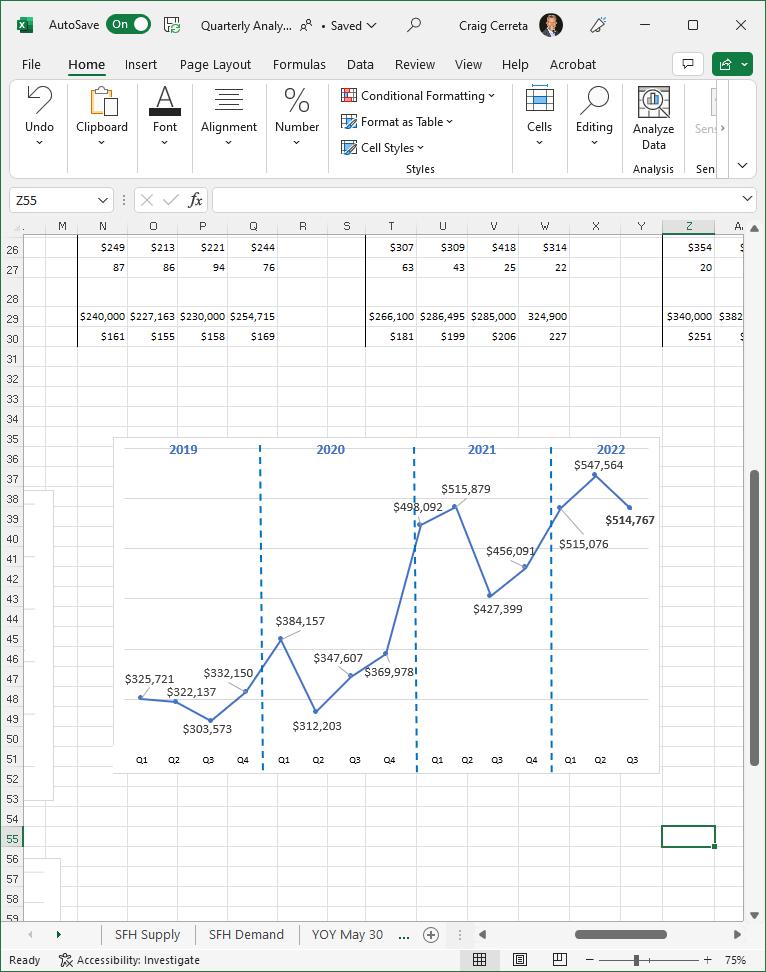

result was irrational offers above actual market value and an elimination of contingencies.

The subsequent market slowdown began shortly after Easter as fears of growing inflation and a potential recession overshadowed people’s desire to buy in Florida or most anywhere else.

Average price reflected the slowdown, but did not take a substantial reduction because supply and demand remained in relative equation.

average price today is still 17.4% higher than it was one year ago.

Data

is from the

but not guaranteed to be 100% accurate

ry is expected to continue rising but more slowly than single family.

New listings to the market are down 31% for third quarter (Q3) vs second quarter (Q2). In the same timeframe, contracts accepted (pending) are down 29.2%. Lower supply is keeping step with lower demand resulting in a nearly unchanged supply / demand ratio with only 1.5 months combined supply.

The Condo market’s greatest inventory gains are in the under $500,000 segment. Higher interest rates combined with higher average prices resulted in a shrinking buyer pool and longer days on the market.

Data supplied is from the Stellar MLS is deemed but not guaranteed to be 100% accurate

Condominiums sold far fewer units year to date in 2022 than last year, but similar to Single Family Homes the pace of sales far exceeds 2019. The first three quarters of 2019 would be a better benchmark gauge of market momentum because it was a Pre Covid normal year. 2019 was a strong year with a more balanced market.

Closed sales in the $1 Million to $2.5 Million segment increased by 15% year over year. This is a strong segment for downtown and island resale condos. But the over $2.5 Million segment reduced the most, down 56%. This is attributable to a lack of luxury new construction projects completing. The under $500,000 segment pulled back 31%. Overall sales have slowed due to a lack of inventory , inflation and interest rate increases.

Year-to-Date Comparison Through 9/30

Under $500,000

$500K to $1 Mil $1 Mil to $2.5 Mil Above $2.5 Mil

Combined Totals

2019 3305 2020 4012 21% 2021 4553 14% 2022 3154 31% 2019 412 2020 615 49% 2021 938 53% 2022 855 9% 2019 109 2020 202 85% 2021 304 51% 2022 350 15% 2019 21 2020 31 48% 2021 172 455% 2022 75 56% 2019 3847 2020 4860 26% 2021 5967 23% 2022 4434 26%

Dramatically undersupplied inventory combined with higher interest rates and higher average pries resulted in far fewer sales.

Solid activity and demand but not enough new construction options to keep up with demand at this price.

The condo market sweet spot. Continued growth anticipated as new projects come to market.

The high end luxury segment is driven by new projects This number will recover when the current construction projects are completed.

The combined total 26% decline in sold units is misleading because supply is still well below demand. This will improve as new projects come to market. Demand is strong.

Data supplied is from the Stellar MLS is deemed but not guaranteed to be 100% accurate

Though we expect a reduction in the pace of resale condo price appreciation going forward, we still expect condos to appreciate because supply is not keeping up with demand.

We will see upward spikes in average prices as large currently under construction new projects come to completion and closure in 2023.

The condo market is still substantially undersupplied .

Data supplied is from the Stellar MLS is deemed but not guaranteed to be 100% accurate

Demand is slowing but is still strong. Supply has risen in the past two quarters, but still remains at 30% below pre pandemic levels. Yet new listings to market have slowed as homeowners struggle with consumer confidence in the economy. Supply levels are not expected to go back to pre pandemic levels anytime in the foreseeable future. The Pre Hurricane Ian level of demand in Sarasota / Bradenton today is similar to that of 2019 which was a great year by normal standards.

Asking prices have adjusted down from their peak in late first quarter (Q1) 2022. Average sold prices have adjusted down minimally to a level comparable with forth quarter (Q4) 2021. Sellers who adjust their expectations will sell their homes and still reap the profits gained over the past several years, just not the unsustainable increases over the past few months.

Could we see further adjustments? Yes, but history tells us Americans want to live in beautiful locations like Sarasota / Bradenton. Supply vs Demand!

Data from Stellar MLS is deemed but not guaranteed to be 100% accurate.

registered trademark

and operated. Equal Housing

which we consider to be reliable but not guaranteed to be accurate. This offering is subject to errors, omissions, and changes without notice.

This material is based upon information from the Stellar

your property is listed with another real estate broker, please disregard. It is not our intention to solicit the offerings of other real estate brokers. This material and its trademarks

not be republished or redistributed

Realty.

Everyone deserves the extraordinary, because luxury is not about price

rather it’s about an experience. And when it comes to real estate, experience matters.