Strawberries: Central Mexico has started sending small volumes through Texas, with higher U.S. prices likely to attract more fruit northward. Salinas and Watsonville growers are finishing up, shifting production to Santa Maria and Oxnard, where colder weather and high demand are creating a tight market. The main season is expected to start in late November to mid-December, though recent hurricanes may delay some planting.

Broccoli: Supplies are tightening in Salinas and Santa Maria as warm weather speeds up field readiness, with crews managing quality challenges. Limited Mexican supply due to heat and rain is adding further market pressure.

Tomatoes: Markets remain high with limited Eastern supply, as Quincy production winds down and demand rises ahead of the holidays. Hurricane Milton has reduced output in the Ruskin/Palmetto region, shifting more demand westward, which may drive prices up. Mexican supplies are light as harvest transitions, with high prices likely persisting through January until Sinaloa’s production increases.

California’s leafy green yields are down 20-30% due to heat and pests, pushing an early transition to desert production. Yuma’s full production is expected by mid-November. In the Southeast, hurricanes have significantly reduced Florida’s tomato yields, with some growers declaring an “Act of God.” Read more

Arizona -Warm weather persists with highs in the 80s through Friday, November 1st. Cooldowns and strong north wind events occur, then warming resumes in first week of November.

California - On Halloween, a low-pressure system is expected, bringing rain and cool temperatures. The first freeze is expected from Thursday to Saturday, followed by another low on Sunday, with high pressure returning.

Florida -Warm temperatures across the peninsula through November 4th, with highs in the low to upper 80s and lows in the mid 60s to mid 70s. Shower activity is expected, but tropical systems may affect the state later.

Mexico - Temperatures are expected to remain mostly seasonal through November 4th, with daytime highs in the low 70s-80s and nighttime lows in the upper 40s-mid 50s. Light showers persist through November 8th.

Thisweekweinchnearertotransitionand canrelyonlastminutechangestoloading locationsintonewcropgrowingregions whenitcomestorowcropitems, especially.Yumaisthreeweeksaway fromthestartofWinterseason.Thisisthe definitebeginningoftransitiontoYuma.

The apple market overall remains steady with good supply. Certain varieties, especially Granny Smith, are skewing toward larger sizes, with ample availability of 80s and 88s, while 125s and 138s are in short supply. This balance may shift as the season continues.

Asparagus supplies from Peru and Mexico are steadily improving each day, with markets gradually easing as well. Expect further supply gains, including more availability of larger sizes, as we move into next week.

Markets are lower on 60ct and smaller sizes. The Adventajada crop is beginning with light volumes, shipping alongside the Flora Loca crop. Dry matter levels for both are holding steady at around 26%, minimizing checkerboarding. Only about 50% of the Loca crop has been harvested, and with ample fruit still on the trees, Mexico is selectively picking sizes based on demand for export.

Eastern markets are short, with volume still impacted by the recent hurricane. In the West, supply remains limited but is expected to improve next week as desert production ramps up. Nogales is approximately three weeks from harvest, while the red bell pepper market remains steady at elevated levels.

Peruvian offshore fruit is now entering the market, helping close the two-month supply gap, with steady daily arrivals in Miami. Meanwhile, the Mexican blueberry season is just starting, with initial volumes crossing through McAllen, Texas, from Central Mexico. Volume is expected to peak by late November.

We’re nearing the end of a brief production gap in the Baja, Mexico region, with volumes expected to improve from both Baja and Central Mexico in the coming weeks. Crossings are becoming more consistent as we approach the peak of the berry patch season in this region.

Central Mexico has begun sending small volumes through Texas, with higher U.S. pricing expected to encourage more fruit to be routed north rather than to Mexico’s domestic market. Most growers in Salinas and Watsonville are wrapping up, shifting production to Santa Maria and Oxnard for a full mixed berry lineup. Colder weather and strong demand from the ending northern season have created a demand-exceeds-supply market, making open market availability increasingly scarce. The main season is projected to start between late November and mid-December, though planting delays from early October’s back-to-back hurricanes may affect timing.

Overall volume remains strong for the coming week, with a steady to soft market tone. Product quality is facing some additional challenges, with increased signs of mildew and persistent elongated seed cores. Supplies are ample, making this category ideal for promotions.

The Cuyama/Santa Maria area is the primary growing region and will continue production through early November. While jumbos and cellos are experiencing tighter supplies and rising prices, normal business needs are being met. There is ample availability of baby carrots and snack packs, making them ideal as schools resume operations.

Cauliflower supplies remain limited as we head into the transition period. Crews are observing minimal discoloration, with some light pinking and yellowing present. Expect the market to see a slight increase as we approach the weekend.

The market remains steady in both the northern and southern regions. The Santa Maria/Oxnard area continues to offer the best availability, with shippers benefiting from robust production across all sizes. Production is also ongoing in Salinas. Overall, quality is above average, with only minimal reports of seeder issues.

Markets are steady overall. In District 2 (Oxnard/Ventura County), yearround shipments are continuing, but supplies are dwindling, with quality ranging from fair to good. Meanwhile, District 3 (California Desert/AZ) is ramping up production, and we can anticipate improved quality as we transition into the new crop fruit.

Lime prices have decreased, with fruit sizes peaking at 200/230 ct and better availability on 175s. Quality has improved, and recent rain in Veracruz, Mexico, is expected to enhance crop size. However, small fruit availability may decline in December as the market shifts in the opposite direction.

Valencias have concluded their season, and domestic navels have begun to arrive in limited quantities, with expectations to ramp up over the next few weeks. The initial peak sizes are on the smaller side, which is advantageous for the foodservice industry. Sizes 88 ct and larger are currently in extremely tight supply, and the gassing times for the navels are approximately 96 hours.

This week, markets experienced an uptick due to rising demand, while supply remains steady from Mexico, with shipments coming out of Nogales and McAllen. However, eastern supply may encounter gaps as a result of the impacts from Hurricanes Helene and Milton in Georgia and Florida.

California garlic is in full production, showcasing excellent quality. Supplies are anticipated to remain robust as we move forward.

The grape market remains steady as shippers transition into their fall varieties. California is expected to maintain good supplies for another 34 weeks. Imports will begin arriving in mid-November, with volume increasing as we move into December.

Green onion supplies are currently robust, and quality is on the rise. Expect this market to remain stable as we move into next week.

Kale supplies are projected to be slightly below expectations for the next couple of weeks. However, anticipate a modest increase in market prices as we move into next week. Kale

The market for green and red leaf lettuce, as well as romaine, is strengthening as availability tightens. Multiple shippers are reporting lighter supplies as the Salinas season comes to a close, with production from Huron and Santa Maria also decreasing. Expect heightened activity in romaine hearts next week with most shippers, while production in Yuma is anticipated to commence in the first week of November.

Supplies of cilantro, arugula, and parsley remain slightly constrained due to the recent heat, which has led to increased leaf miner activity and a weaker texture. As a result, expect these markets to remain elevated as we head into the weekend.

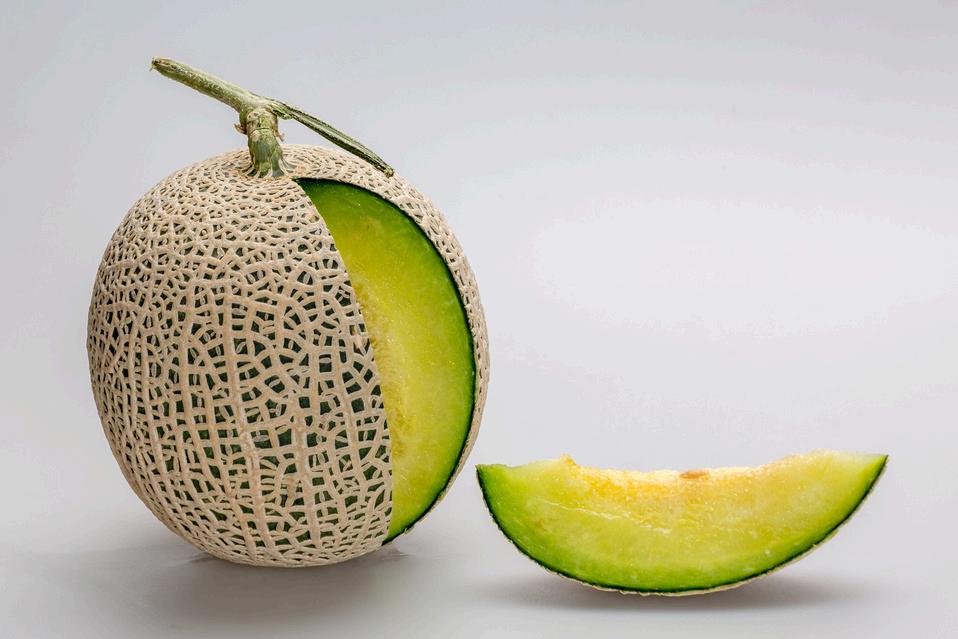

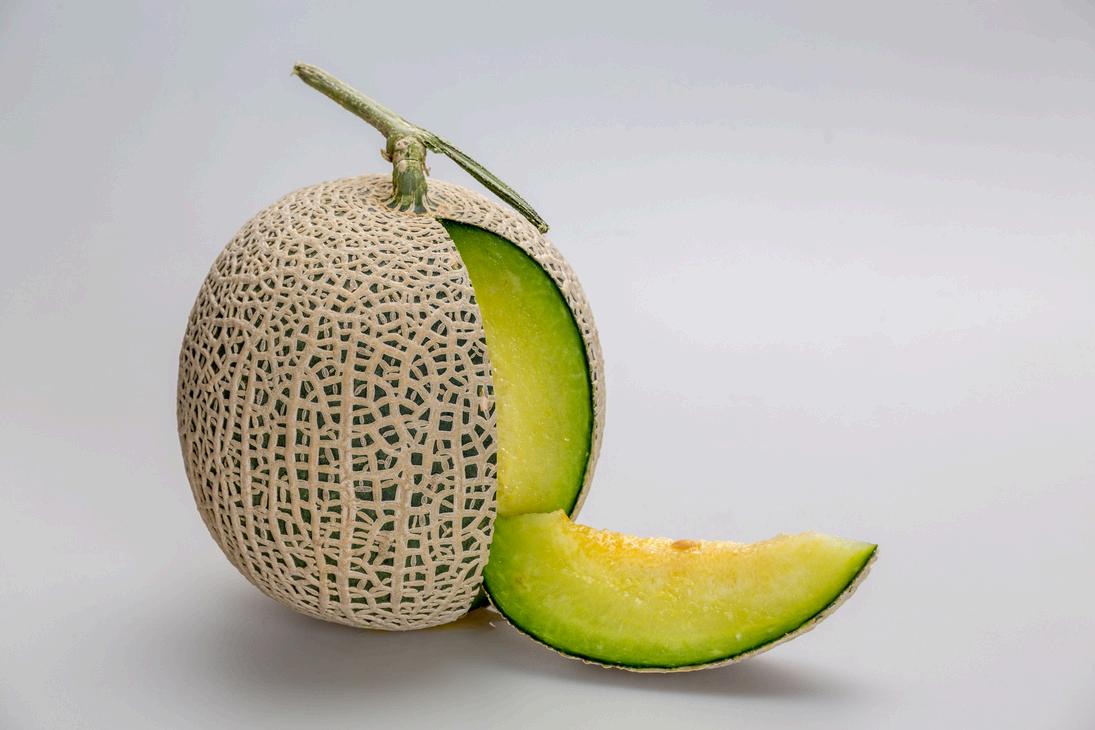

The Westside deal is nearing its conclusion, with domestic products now available from Brawley and Yuma. Internal quality has been excellent, boasting Brix levels between 12-14%, though some external issues related to dirt have been noted. While larger-sized melons are readily available, growers have limited quantities of smaller melons. Mexican cantaloupes can be found in Nogales, and offshore melons are expected to arrive during the week of November 10, 2024.

Watermelon supplies are steadily improving on the West Coast, particularly in Nogales. East Coast and Georgia suppliers have been significantly affected by Hurricane Milton, leading to increased demand in the West. Expect continued availability throughout October, with fresh supplies arriving in mid-November via Nogales.

Limited supplies are keeping availability low and prices elevated.

With harvesting now complete, market prices are becoming increasingly active. Red and white onion prices are rising faster than yellow prices, and overall quality is excellent.

Washington has begun harvesting all major pear varieties, and the market remains firm with higher prices. This year is expected to be tight for pears due to significantly reduced volumes from Washington compared to last year. Meanwhile, California pears are nearing the end of their season and will be concluding this week.

Limited Burbank potatoes are available upon request, while both Norkotah and Burbank varieties are currently being shipped from storage. Quality is excellent, and promotional pricing is offered on 40-70 CT sizes.

The Southeast supply is inconsistent, whereas Nogales boasts strong availability with promotable volumes. As California growing districts conclude over the next few weeks, demand will shift primarily to Nogales, which will sustain supply through May. However, quality across the available supplies remains variable.

Plum supplies remain robust and are expected to continue into November. Asian pears have also begun to arrive in good volumes, with domestic supplies projected to last through January. Domestic kiwi is plentiful as the market stabilizes, and fall fruits are in full production, with ample availability of pomegranates, persimmons, and quince.

Markets remain elevated, with Eastern supply steady but currently low, as Quincy is experiencing adequate to low production. As Quincy nears the end of its season, we anticipate an increase in demand, especially with the holidays approaching. The Ruskin/Palmetto region is expected to yield very low volumes this season due to Hurricane Milton, leading to a shift in Eastern demand westward, likely resulting in higher market prices. Supplies from Mexico are light as harvest transitions to fall crops, and we expect prices to remain high through January as Sinaloa ramps up production.

offering a slight chance of rain, although temperatures won’t drop as significantly. High pressure will return for the remainder of that week.

Temperatures are forecasted to remain mostly seasonal through November 4th, with daytime highs ranging from the low 70s to low 80s and nighttime lows in the upper 40s to mid 50s. As the period progresses, cooler temperatures may develop due to the potential influence of a couple of cold fronts. Light and widely isolated shower activity is expected to persist through November 8th.

Temperatures across the peninsula will remain warm through November 4th, with highs ranging from the low to upper 80s and lows between the mid 60s and mid 70s in most areas. Shower activity is expected to be widely isolated during this period. However, later on, there is a possibility of a tropical system affecting the state. While models have consistently indicated the development of a low, variations in intensity and location are evident from run to run.

Warm weather is expected to persist this week, with highs reaching into the 80s from midweek through Friday, November 1st. A slight cooldown is anticipated over the weekend of November 2-3, followed by a strong north wind event on Monday and Tuesday, November 4th and 5th. Warming will resume in the first week of November, with mid-90s possible by Friday, November 8th.

This week we inch nearer to transition and can rely on last minute changes to loading locations into new crop growing regions when it comes to row crop items, especially. Yuma is three weeks away from the start of Winter season. This is the definite beginning of transition to Yuma.

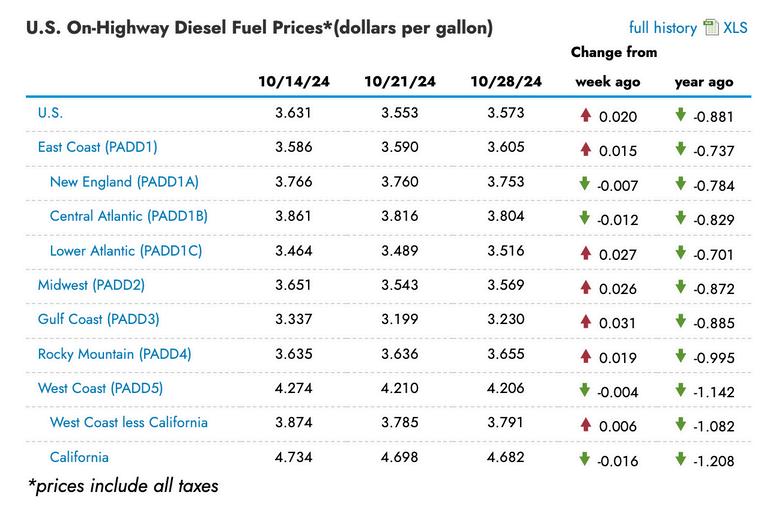

https://www.eia.gov/petroleum/gasdiesel/

As the coastal California growing regions season winds down the roller coaster in temperatures looks to continue. Previous extended heat across California has taken a toll on these late season supplies. Disease and insect pressure is on the rise in the fields with heat related problems such as seeders and weaker texture. Yields are down 20-30% in the leafy green fields with the diamondback moth larvae a continuing problem in cabbage, broccoli and cauliflower stands. The tender spinach and spring mix items continue to show some leaf discoloration and some insect damage along with lesser texture. This will likely bring an early end to the Salinas season forcing growers to begin desert production on the early side.

Yuma will begin light harvests next week with full production expected to come from the region around mid-November. Growers are reporting no major setbacks despite the heat in the region. Lettuce and leafy green supplies traditionally begin with lighter carton weights due to lighter densities (puffy heads, light hearts) in these early fields.

In the Southeast Hurricanes Helene and Milton have done extensive damage to crops across the region with Florida taking the brunt of the damage. Milton devastated the Florida tomato growing regions with growers salvaging what they can as yields are around 20-30% of normal with questionable quality. Some growers are enacting the “Act of God” clause due to the damage throughout the region.

Overall crop assessments continue as time progresses crop damage is becoming more apparent. The California summer tomato production is winding down over the couple of weeks with light supplies coming form Mexico. Tomato supplies look to remain tight until Central Mexico begins steady volume in early January.