Just an update

Monday 20th May

This week's

headlines:

ICYMI: Aldermore Webinar –

Exclusive to Just Mortgages!

Aldermore are providing Just Mortgages with an EXCLUSIVE webinar and will look at one of the industries’ current hot themes: Property Risk.

Date: May 22nd – 10:30am (45 minutes)

The session will look at:

The Valuation process (differences between physical, AVM and Desktop) and what valuers actually do on these/their purpose along with how lenders interact at this stage.

An overview of over expectations/down valuations

Differences between HMO, Hybrid, Multi-unit freehold, semicommercial

Hot Property Topics – Cladding, climate change and planning regulations

Q&A for you to ask any property risk related questions

New Policy Launch & Range overview

An invite was sent to you last week, but alternatively when it is time, simply click on the Teams Link HERE.

HSBC – Building a successful Brand and culture

Webinar featuring “The Apprentice” star Bianca

Miller-Cole

Wednesday 12th June – 11:00am

In conjunction with HSBC, we are pleased to provide you a special 60 minute webinar hosted by Tracie Burton, Senior Corporate Account Manager and Bianca Miller-Cole, entrepreneur and personal branding expert.

Bianca Miller-Cole is an award winning entrepreneur having started a personal branding company “The Be Group” in 2012 with the belief that all individuals should be able to access personal development services. Bianca became a public face in this area after an excellent performance on the BBC’s “The Apprentice” in 2014, finishing runner up.

This webinar is designed to help you understand the key steps and top tips to building a successful business, as well as the importance of creating a strong personal brand in order to influence and lead with impact.

Please click on the link HERE to register and once confirmed please save the invitation to your calendar.

reminder of the process below:

Establish who the lead applicants are and input the client details into OWS

Complete the form ‘Additional names on Mortgage-Life Application’ for the remaining applicants. Upload the document to OWS, and include detailed notes on the file to fully explain the situation. If using income to support the application from any of the additional clients. Include this income within applicant 1 details. Add detailed file notes to fully break down the allocation. If recommending protection, complete the recommendation in joint names for client one and two. Then create a protection only track for the remaining clients. Add notes and cross reference the advice.

Complete the SR in the first two client’s names. For the remaining clients, download a copy of the SR and send this to first@openwork.uk.com, highlighting the areas that need to be changed and the information it needs to be changed to. (e.g. new name and address replacing the auto generated one) Send a copy of the SR to the additional clients and also upload to OWS adding a note to confirm this has been altered and sent.

Should you have any questions please raise these to your supervisor or Regional Quality Manager in the first instance.

Help Openwork pay you quicker!

On average, 95% of the 640,000 receipts Openwork receive each month are processed through automatic case matching and the remaining 5%, about 32,000, fall into suspense.

These “suspense cases” are largely due to cases not being fully submitted on OWS which subsequently need to be manually investigated and matched.

By the monthly payment cut off date, the team pay on average 99.5% of all receipts received.

Openwork’s Payment Services team always want to pay you what you are due as quickly and efficiently as possible. It’s also important that we and Openwork have advice records for all cases, which is a requirement as part of our regulatory responsibilities to keep everyone safe.

These two aspects go together with the new process Openwork are launching to follow up on cases that have not been submitted.

Introducing the new process

The quickest way of ensuring you are paid is by submitting your cases on OWS in a timely manner and including all pertinent information (most importantly the policy number wherever relevant.) Just Mortgages expect cases to be submitted within 1 week of submitting to a lender or provider, whether the case is proceeding or not. This is to ensure we have an audit trail in case of a complaint, or a fraud query, and also to meet FCA expectations.

If you wait until the Payment Services team, contact you to remind you about a submission, then the case has already fallen into suspense where the manual investigation and matching will delay you being paid.

Talking with many of you, we appreciate that there are often reasons why cases are not submitted more promptly such as working time pressures or a lack of administrative support. We also recognise that system related issues sometimes prevent you from submitting your cases.

A new way of working

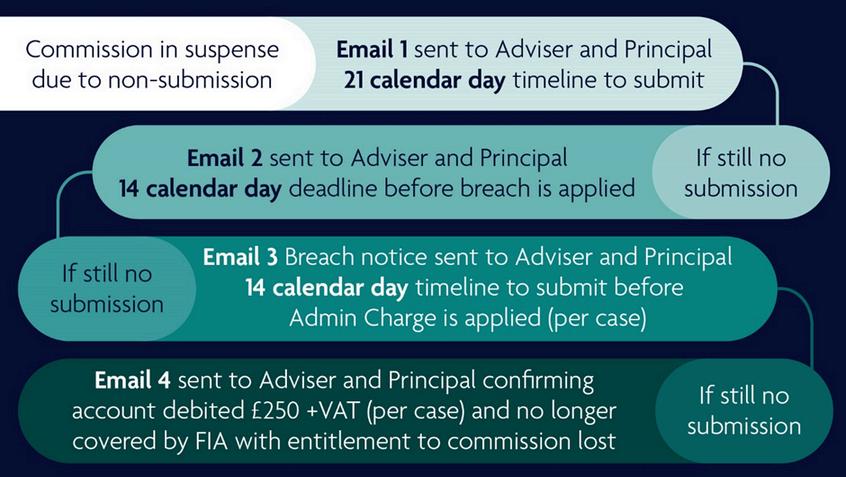

From the second half of the year, Openwork will be rolling out an updated process to follow up on cases which cannot be processed due to non-submission. This process is built on a series of steps, designed to support you which are shown in the graphic:

No longer being covered by FIA (PI Insurance) means if there is a claim/complaint you will be liable for the full cost, not just the first £2500.

Unable to submit?

If you experience an OWS related issue which is preventing business submission, you should obtain a ticket reference number by contacting FIRST straight away on 01793 567890 Option 1.

Join HSBC UK’s Introduction to

Fraud – 23rd May 11:30am

HSBC will be running its CPD approved Introduction to Mortgage Fraud webinar again this week. Whether you were unable to attend a previous session, or you would simply like a refresh, please join HSBC.

CPD approved Introduction to Mortgage Fraud:

Continuing from 2023, HSBC’s Intermediary Fraud team will be covering Mortgage Fraud, the latest industry trends, intelligence sharing and best practices, whilst also working through some real-life case studies.

How to register

To register for the webinar, please use the below link and enter your details

HERE

Once confirmed, please save the invitation to your calendar. The webinar will last approximately 45 minutes. The Intermediary Risk Team at HSBC look forward to seeing you.

Virgin Money refreshes its limited distribution products

Virgin Money is making changes to its limited distribution product range with the addition of two new exclusives.

Here are the details of the existing exclusives and the two new remortgage products:

90% LTV 4.84% 5 Year fixed rate for Purchase with a £1,495 fee - no change

95% 5.34% 5 Year fixed rate for Purchase with no fee - no change

75% 4.61% 5 Year fixed rate for Remortgage with an £895 fee - NEW

75% 4.78% 5 Year fixed rate for Remortgage with no fee - NEW The products look as if they will be sourcing competitively so make the most of them whilst they are available, they could change or be withdrawn at short notice. For more information talk to your Virgin Money BDM

Nationwide’s HMRC Tax Calculation and Tax Year Overview requirements

Have you seen Nationwide for Intermediaries’ Tax Calculation and Tax Year Overview requirements guide?

Like lots of our lenders, Nationwide for Intermediaries has a host of information on its intermediary website to help you package your cases to their required standards.

The guide to Nationwide's HMRC Tax Calculation & Tax Year Overview requirements is really useful and not only will it help you get your cases right first time with Nationwide, it also has lots of information on the structure and content of the documents that could also help you spot any potentially fraudulent documents that may come your way.

Bank of Ireland | Helping you to help more clients

Bank of Ireland for Intermediaries has a great working with us hub where you can find all the support you need in one place! Helping you to help more clients.

Their hub is just a click away so you can get support when you need it. It’s packed with information to help, wherever you are in your application journey with them.

It will guide you to the right place for help with:

Pre- application queries

Online applications and submitting business

Cases in progress and case updates

Services for existing customers

Bank of Ireland for Intermediaries is right here for you and your clients.

Bank of Ireland for Intermediaries Working with us Hub

Coffee with Compliance – Episode 2 – Long Commute

Each week, we'll dive into the 'why's and wherefores' of Compliance, shedding light on aspects you may not be familiar with. We'll be featuring various members of our Compliance team, aiming to make you more acquainted with them and the rationale behind our rules and procedures.

This series isn't just about sharing unknown facts; it's also about clearing up any confusion you might have.

Let's brew some knowledge together and continue with number 2 of our fraud triggers - the longer commute

Metro Bank - From Setbacks to Success: A Less Than Perfect Credit Profile

Meet Jane

Jane was looking to re-mortgage her current home and raise some funds for home improvement. She had a low LTV and a good overall credit profile but had an unsettled CCJ for a parking fine that she was not aware of and missed a payment on her mortgage six months ago.

And how Metro Bank can help…

By applying its common-sense approach, Jane was able to remortgage her current home & capital raise for her dream kitchen even with her less than perfect credit profile.

Criteria highlights

Satisfied CCJ’s or Defaults

£1,000 total value across any number of CCJs or Defaults satisfied within last 36 months.

Unlimited total value across any number of CCJs or Defaults satisfied over 36 months ago.

Unsatisfied CCJ’s or Defaults:

£500 total value across any number of CCJs or Defaults. An increased £1,000 total value across any number of Defaults applies on the Near Prime Range Only. No requirement to satisfy prior to application.

Unsecured/Secured/Mortgage Arrears:

Up to a maximum status of 2 in the last 24 months, no cumulative limit across all accounts.

Arrears on communication and utilities are ignored on Near Prime Range Only.

Capital Raising:

Capital raising, including debt consolidation with no debt-to-income ratio limit, accepted.

For full details, please refer to Metro Bank’s Mortgage Lending Criteria Guide and Product Guides.