IS SWITZERLAND

A BUSINESS

A RICH NATION?

MARKET

IMPORTANCE

THREAT AND COST

CASE AGAINST

WHAT IS TO BLAME

OVERTURNING

ORIENTED?

UREN

HAZELL

TODD

ON

UK INFLATION RATE/OIL CRISIS?

ROE VS WADE

HOW DOES A DECREASE IN PREMIERSHIP SALARY CAPs AFFECT TEAM

VINCENT

CHU

THOMPSON

ROUND

TOBY BAKER

CRYPTO AFFECTS THE NBA WILL BRUNTON

HAS THE WAR IN UKRAINE AFFECTED GLOBAL ACTIVITY AND INFLATION?

ALMOST-PRENEURS

ARE BROADCASTING COMPANIES CHARGING TOO MUCH TO WATCH SPORT?

IZZY DERI CLARK

WOOD

JOSH ELLIS

EFFECTS OF INTERNATIONAL SANCTIONS ON RUSSIAN TRADE EMMA FRANEY

HEIGHT PLAY A ROLE IN A RUGBY SALARY?

ART A POINTLESS TRADE?

IN GREECE

BENEFITS

HAVING GREATER FEMALE

GAPS

IMPACT OF

MEDIA

COVID-19 PANDEMIC

RISE AND

GLOBALISATION

CURTIS CORNWELL

MARTHA RYCROFT

ANTHONY

GOODWIN

RYCROFT

NIMMAGADDA

FIELD

LAWRANCE

JONES

JOHAR

FUEL PRICE

THE MOST

UNEMPLOYMENT

COVID 19 CHANGED

ECONOMIC IMPACT

INFLATION

IMPACT

OLLIE GODDARD

YATES

TRADITIONAL OFFICE MARKET

COVID-19 ON THE MUSIC INDUSTRY.

PHOEBE MCKELVIE

RUDGE

DEWHURST

PRICES AND TRENDS

’S IMPACT ON MARKETING

HAS THE RISE IN LIVING COSTS AFFECTED BUY NOW PAY LATER

SHOULD CORPORATE STRATEGIES BE FOCUSED ON

ROYALTIES

ECONOMIC IMPACT

THE WORLD OF MOTORSPORT

CAR MARKET

THE RICH GET RICHER: ART EDITION

AND MONEY LAUNDERING

PESTLE ANALYSIS OF SPAIN’S

FRANKIE PADGETT

ALLISON

JOSH DAGWELL

ASTRID SMITH

LUKE GILMOUR

TOMLINSON

FREDDIE WOODCOCK

HOLLY PEARS

CHARLIE HUGHES

AKE

HARPIN

REDMAN

PAPADOPOULOS

ENGLAND

ILES

MANNION

GREVSTAD

HARRISON

RECCHIA

LINDLEY

To understand the economic success of Switzerland, first we must see where it all started which was through Industrialisation and Innovation. Switzerland led the market in areas such as chocolates and clocks (to name the popular exports) and there are many more!

Switzerland is long renowned for its powerful and varied exports market, whilst maintaining its focus on its own industries and not importing cheaper alternative products, this setup a strong start for the Swiss economy to thrive.

The Swiss economy also has benefited largely from the political stability of Switzerland as a country, remaining neutral in every major war avoiding economic devastation whilst also maintaining political stability which is important because wealthy foreigners and investors see it as a safe space to spend their money.

In recent years the epicentre of the Swiss economy has been its favourable tax system and banking industry. The lower income and corporation taxes have attracted a lot of high net worth individuals as well as some high profile companies as well, these companies and individuals stay for a long period of time making Switzerland one of the main financial centres of the world. To add to the idealistic income/corporation tax system, they also boast a great system for Inheritance tax meaning that families who want to pass down their wealth through the generations should really consider the move, which leads to their economy receiving even more of a boost from wealthy internationals.

The question which any business should crucially ask themselves: should their products or services be market or product oriented. The simple answer is that it is highly dependent on the type of business and its specific goals.

When a business takes a product orientation approach, it focuses on its product or service’s quality and performance. In other words, this solely means that their goals are product innovation and improvements in order to focus on customer satisfaction and customer feedback. Generally, product oriented companies tend to be technology focused and create new products which will generate a new market demand. For a business which is looking to delight customers with a new product which does not currently exist in the market, product orientation would be the most strategic approach.

However, when deciding to take this approach, market research must be carried out at a high level to ensure there is a clear gap in the market which is yet to be fulfilled and the product is unique enough to innovate.

A great example of a product oriented business would be apple. Apple focuses on its quality and relies on innovation to enter new markets and create demand. This approach allows them to address the unarticulated customer wants and needs with attractive and innovative electronics that offer a competitive advantage over similar products from rivals.

On the other hand, market orientation prioritizes identifying consumers’ needs and delivering products and services to satisfy them. There is a clear focus on pleasing existing customers and promoting products to attract new customers. A dynamic business which is able to recognise that customer demands are constantly changing would be well suited for this approach as they are able to refine existing products in order to satisfy customers.

In this case, businesses which carry out secondary research would benefit from this approach as they are able to study market trends over the years and plan on how to adapt products or services to match the constant changes and demands in a market.

A good example of a company that uses this approach is Coca Cola. Coca Cola has produced numerous distinctive marketing campaigns that link the soft drink to experience. Customers no longer drink Coca Cola simply for the taste, but because of what it means to drink it. We can also consider the brand’s response to shifts in consumer health concerns and the development of sugar free products like Coke Zero that catered to this market.

Overall, a business must take into account whether they are looking to release a new product or service into the market, or innovate and improve an existing product or service.

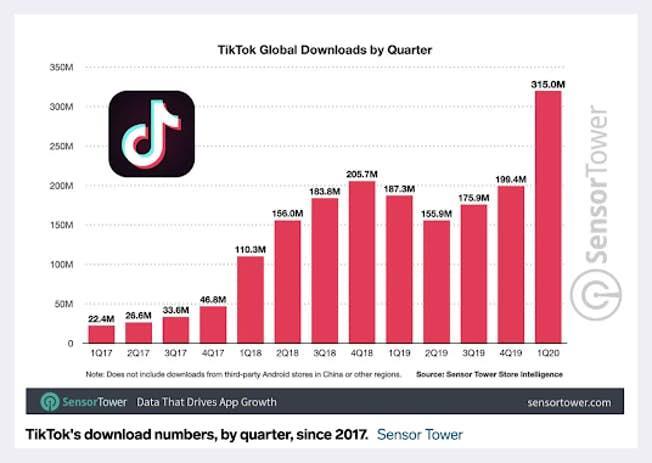

With cryptocurrencies becoming more popular, understandable and available, the amount of users and consumers increase massively every year. If businesses want to carry on growing they must adapt to changes in the market and with this Crypto. With interest rates at a 13 year high the cost of borrowing money is very costly, using crypto currencies enables businesses to gain new capital from liquidity pools and using crypto to invest and hold capital. On the other hand Crypto is very liable to external shocks as it is a fairly new and unstable asset, but if businesses wish to gain capital fast and in new ways with less costs it will allow them to gain a competitive advantage over other new businesses.

Using Crypto Currencies may also attract new demographics to buy products allowing the business to have more options for payment making it likely to buy from the company, it may attract younger consumers who know more about tech so some companies may feel more inclined to use Crypto currencies in order to appeal to their target markets or to open up into newer markets. Studies also show that customers that pay with Crypto are likely to spend twice as much as consumers that pay with credit cards so if businesses allow for payments in Crypto then they may be able to sell more products and make more profit in the long run.

Taking into account the cost of transaction for credit cards vs Bitcoin is also a very important factor in whether businesses should use card or crypto payments. The average credit card transaction costs 2 3% of the total sale which businesses have to pay if they want to use card payments, on the other hand crypto currencies are far cheaper and faster depending on the amount of transactions taking place at one time. One downfall of Crypto transactions is that the price of a transaction scales with how many people are trying to complete a transaction at one time due to the nature of the blockchain, nonetheless these costs will almost always be lower than the 2 3% that businesses would have to pay if they took payments from credit cards.

Large companies such as Paypal and Microsoft are already accepting Crypto payments, this will increase consumers confidence in Crypto and make more people want to pay using Crypto Currencies. Paypal experienced a jump in revenue of $3.9 Billion between 2020 and 2021 from $21.4 Billion to $25.3 Billion. This large increase in revenue was slightly larger than predicted, this could be due to the fact that Paypal only started dealing with Crypto Currencies in 2021. This shows us that as more companies start to adopt crypto into their business and allow products to be sold in crypto it will help them to increase revenue and profit.

In conclusion, I believe that businesses should start to invest small amounts of capital into Crypto in order to gain new sources of capital and save money whilst costs are low.

‘Cybersecurity is how individuals and organizations reduce the risk of cyber attack’ (National Cyber Security Centre) or ‘The ability to protect or defend the use of cyberspace from cyberattacks.’ (National Institute of Standards and Technology).

Threats to cybersecurity are ‘The probability of exposure or loss resulting from a cyber attack or data breach on your organization’ or ‘The potential loss or harm related to technical infrastructure, use of technology or reputation of an organization’.

Cyber Security threats and risks affect almost every organization around the world. These threats have been increasing for the last 50 years of technological change, but it wasn’t until 1970’s when ARPANET (the Advances Research Projects Agency Network) was created and Robert Thomas (an engineer at BBN Technologies) created the first computer virus called Creeper (which was deleted shortly after by the first anti virus called Reaper which was developed by Ray Tomlinson), that many discussions surrounding computer security began to emerge. The first computer worm, The Morris Worm, followed on in 1988, developed by Robert T. Morris, a graduate student from Cornwell University and this paved the way for newer types of malicious programs. Hacking, which historically was used more to initiate practical jokes than cause serious harm or fraud, also began to be used for more malicious purposes around this time. Kevin Mitnick describes his early introduction to hacking in 1979 as something known as ‘phone phreaking’ which is a type of hacking that allowed him to hack into public and private systems and make calls for free; it started him down a long path of IT associated crime that eventually resulted in imprisonment. The rise in popularity of the home computer in the 1980’s and the development of the internet in the 1990’s brought about a huge increase in ’computer security’ related threats.

The IBM 2021 Cost of Data Breach Report which studied 537 real breaches across 17 different countries and 17 different industries estimates that a typical data breach now costs a company an average of $4.24 million per incident, up by 10% on the previous year. Image below:

This type of 'command and control' environmental regulation has long been the default approach to environmental issues by governments, coercing polluters into installing pollution abatement technology, limiting the volume and concentration of firms' emissions, etc.

Although almost always well intentioned, there are many severe flaws in such an approach, with the first being the difficulty of enforcement pollution abatement technology. While it is easy for inspectors to check whether individual firms have the required equipment in place, confirming whether it is even switched on or working on par with regulations can be troublesome to verify cheaply and quickly. This leads to a drawn out whack a mole game, due to it being highly costly to run such mandated technology, it is temptingly profitable to simply switch it off, limiting its practicality. However, authorities are able to counter such actions with limited success through more frequent and unannounced inspections of polluting firms. Nonetheless, the capital and labour resources used for such activities, just like the resources used by the government in regulations, incur a significant opportunity cost, the cost and value of sacrificing the second best option, which could arguably be put into much more beneficial programs than engaging in this whack a mole game.

Secondly, such regulations solidifies the oligopoly status of the energy sector. One example of this is the EU acid rain legislation which mandated the installation of flue gas desulfurization (FGD) scrubbers in all power stations in the EU. While reasonable on the surface, the flaws reveal themselves once you skim past the surface. It cements the oligopoly of the energy sector, with itself already being a sector with huge barriers to entry, such as its massive set up cost and lack of access to the distribution channels. FGD scrubbers are already hugely expensive, with the FGD system at Longannet power station costing over £400 million, a sum many smaller firms are simply unable to afford. Furthermore, large corporations, with their massive capital reserves, are able to exploit their size and economies of scale through the purchase of larger FGD systems, in which the processing cost per ton is cut by half, while smaller firms with smaller FGD systems suffer much higher unit costs, dealing a massive hit towards their profitability and thus undermining their competitiveness. This squeezes smaller firms out of the market, cementing the oligopoly’s market position. Such a market environment does no good to society, it limits consumer choice, discourages further innovation thanks to the lack of competition, and can even lead to price setting/gouging by the dominant firms due to the lack of substitutes in the market.

The superior solution to solving environmental problems are subsidies for smaller firms when entering the market. Not only is this useful in lowering prices for consumers, from P to P1 by shifting the supply curve from S to S1, but it also ensures that market shares remain liquid, constantly applying pressure on firms to innovate and improve, resulting in lower prices for consumers as firms must compete.

Inflation in the UK has reached 9.1% in May, this is the highest it's been for 40 years. The COVID 19 pandemic has affected most major economies including the UK through the disruption of both supply and demand for goods. Lockdown measures implemented by the government changed consumer spending patterns around the world, the enforced shifts in demand caused demand pull inflation for many products eg; toilet roll, hand sanitiser, home clothes etc. This is because firms respond to an increase in demand by increasing prices to maximize profit of their limited resources. Other goods had a decrease in demand which therefore led to demand pull inflation eg; suits, footwear and petrol.

Lockdown measures have also caused a corresponding cut in production due to workers being unemployed or working from home, this resulted in a shortage in delivery and increase in production costs. This is a factor in the creation of the 2020 oil crisis. China has recently announced a new lockdown in 2022 due to spikes in COVID cases, this has had a knock on effect on production levels and costs, as China is a large supplier of many goods to the UK this has caused cost push inflation.

COVID 19 was not the only cause of the oil crisis. A soaring demand for natural gas in households paired with a diminished supply from the U.S, Norway, Russia and European countries to the UK market was a result of Brexit. This caused massive rates of inflation in oil and gas. There was also less power generation by renewable energy sources such as wind, water and solar energy, and cold winters that left European gas reservoirs depleted also causing increase in inflation.

Russia supplied over 3 billion meters cubed per week (almost half of the EU’s imports). In the first two months after Russia invaded Ukraine on Feb 24 2022, Russia earned $66.5 billion from fossil fuel exports. As a result of the invasion, Russia’s oil prices rose above $130 a barrel for the first time since 2008. In May 2022, the European Commission proposed a ban on oil imports from Russia, part of the economic response to the invasion. This took away a huge chunk of oil supply therefore further increasing cost push inflation on the UK economy. Unfortunately there is no sign of the oil crisis getting any better or the inflation rate getting any lower as the UK is forecasted to hit 11% by the end of the year.

The Supreme Court decision to overturn Roe v. Wade puts a huge level of financial pressure on women who without this overturn would not be put under this level of pressures. The issues with state controlling the abortion laws have long term and short term impacts. The short term impacts have immediate costs such as travelling to a state that can provide an abortion safely and legally and obviously the cost of an abortion, which is medical treatment, where the average cost in America for a first trimester abortion $650 $750. Second trimester abortions run an average of $1,200. Late term abortions can be even more expensive, at $3,000 or more. Which is already a huge financial cost ignoring the cost of travel for a safe abortion where you are not under legal risk and the potential legal costs if women end up having to take the illegal abortion route in their own state which may also include any costs of medication needed due to them being forced into an unsafe medical procedure.

There are huge long term impacts of this overturning; the lack of funding for women and families throughout pregnancy and labour, the huge expenses are a major factor as to why keeping abortion legal is so critical in America. By forcing women to go through pregnancies they are not financially stable for you risk huge levels of women and families going through bankruptcy as the social structure is not there in many states to offer support.

There will be a decrease in the education of women as many will no longer be in school due having to work lower paid jobs in order to provide for a child and themselves putting pressures on childcare structures and increasing the gender pay gap. The gender pay gap will be increased as jobs with larger salaries need higher/further levels of education but with women needing to work to avoid becoming bankrupt or in poverty they cannot financially support their families or themselves through further education meaning many end up in a cycle that they cannot escape of being poorly paid.

Financial inequality will be increased as women who are living in the cycle of poverty are then giving birth to a child, they cannot support so then cannot escape the financial pressures which either pushes women who have escaped poverty back into poverty or keeps women in higher levels of poverty, and therefor increases the fact that the poorer will keep getting poorer. A lot of women will be forced into the route of adoption or fostering putting huge pressures on an already underfunded aspect in the US. Fostering and Adoptions could lead to potential mental health risks in young children being forced into fostering/adoption and decreasing the educational potential of a grouping of young children creating a larger grouping of disadvantaged people in the future. As well as this Women’s mental health could see an increase due to going through the trauma of giving up a child due to the costs of providing for them potentially causing them to leave various jobs and leaving gaps in certain areas and adding pressures on mental health care that with abortion would not be under such levels of demand.

Salary caps are used worldwide in many different sports, most noticeably in the NFL. The Premiership led the way in English sports introducing the salary cap in 1999, 4 years after the game had turned professional. The aims of the salary cap in the rugby premiership are to:

• ensure the financial viability of all Clubs and of the Gallagher Premiership Rugby competition;

• controlling inflationary pressures on Clubs’ costs;

• providing a level playing field for Clubs;

• ensuring a competitive Gallagher Premiership competition;

• enabling Clubs to compete in European competitions.

The salary cap is reviewed every year, and due to COVID 19 having huge effects on clubs incomes, with losses in income due to the fact that games were played behind closed doors so the clubs got no income from ticket sales, and as a secondary result of no fans, no money was earned by the clubs through hospitality sales, such as food and drinks, and also no one visited club stores to buy their merchandise, therefore the salary cap was reduced from £6,400,000 to £5,000,000.

This reduction in the salary cap has meant clubs have £1,400,000 less to spend on their players. This could lead to clubs not being able to afford high value players, and losing them to other leagues such as the French league where their salary cap is much higher at £11.3 million This therefore could potentially lead to a huge loss in performance for teams, as their overseas stars are leaving them to earn more money in other leagues, meaning that the premiership teams won't fulfil their goals of being competitive in Europe. Moreover, club tensions may increase, as if players do start to look abroad, teammates may not take well to this, leading to a drop in team morale, which will affect the club's performance negatively. However, there is still an anchor keeping the top England players in the league, as if they are playing in a different nations league, they are unable to play for England, for example George Kruis, who went and played in the Japanese league on a lucrative deal, and never played for England again.

Nevertheless, clubs opportunity cost on other areas is less significant, as potentially if they are spending less money on players salaries, they have more money to spend on more staff, better health support, and better facilities, leading to greater performance on the pitch. Furthermore, clubs now get the first £50,000 of a player's salary for free if that player is homegrown. This will mean that clubs will put less of an emphasis on finding players from abroad, and will focus more on developing their English talent. This also, for the England team is a huge benefit, as the talent coming through will be much better equipped and there will be a bigger pool of players to choose from.

Therefore, in the short term, a reduction in the salary cap will cause a drop in team’s performance, due to an initial loss of high quality players, however in the long run, clubs will have had more time to develop their academy players, and increase their club facilities and support which will increase their performances on and off the pitch for the good.

To thoroughly understand where the NBA stands today, you need to know important context and history of the league. In 1976 the NBA merged with the rival ABA, with 4 teams from the ABA being admitted into the NBA. This gave the NBA a monopoly over the American Basketball market.

The 30 teams in the league mainly make money through 4 ways: Tickets, Concessions, Sponsorships and The Media Deal. Sponsorships and the media deal are by far the 2 biggest earners for the league and its teams. In terms of sponsorships, the NBA received $1.46 billion from sponsors in the 2021 22 season, which is a 6% rise from last year. This is in no small part to the rise of Crypto sponsorship. The LA Lakers signed a 20 year $700 million naming rights to change the iconic Staples center into the Crypto.com Arena. In general the NBA signed a $172 million with coinbase, which pushed Crypto to become the second biggest sponsor of the NBA, only behind tech companies. If you compare this to last year where crypto only made up $2 million of annual sponsorship, and now it’s at $130 million which is a 6,400% boom in sponsor money. This demonstrates how the growth of crypto in general, is multiplying into growth in the NBA.

However, crypto sponsorships can be shady and dangerous. As seen by the recent fluctuations in the worth of bitcoin, the question arises, are crypto sponsorships sustainable? As previously mentioned with the Lakers arena deal, these sponsorships are long term, and looking at current crypto market projections, it seems possible that Crypto.com may not be able to pay the full length of their contract. Furthermore, the NBA’s other main source of income is their media deal. From 2016 2025 the NBA’s media deal is $2.6 billion per year with ESPN and Turner Sports, experts also believe next deal could be worth around $72 billion over 9 years.

However, ESPN are known to be cautious with crypto sponsorships, as they currently advertise no crypto adverts. This could lead to a friction between the league and ESPN, and with the next deal coming into review in 2024, there could be less money in it for the NBA. Mostly these scams are to do with NFT’s. NBA stars such as John Wall and De’Aaron Fox have been involved in NFT scams, and the NBA itself having its own NFT market place, called TopShot, which has largely been a failure. This raises the question, how viable are these crypto sponsorships, both currency and NFT’s, in the long term? In my opinion, the crypto market is good for the NBA right now, but it is very possible that in 10 years we could look back on these massive crypto sponsorships as a huge mistake.

Russia’s invasion of Ukraine has caused damage to global trade, which is likely to impact low income countries the most. Sharply rising commodity prices have been the most immediate economic impact of the war in Ukraine. The supply of essential goods from Russia and Ukraine have also been threatened, such as food, energy and fertilisers.

Ukraine and Russia are key exporters of wheat, barley, corn and cooking oil, mainly for African and middle eastern countries. Disruptions to the flow and reduced supply of these goods have sharply increased food and gas prices forcing millions of people into hunger. In Europe the economy is slowing down quite quickly because of the high inflation that is impacting people’s income and consumption of goods. The large increase in prices has meant that a lot of people are struggling to afford basic goods, and this means the cost of living has become significantly higher in a short space of time. Russian oil normally accounts for 10% of global oil supply, and because the west has introduced financial sanctions that has made it difficult to clear Russian oil transactions through western banks, there is a gap in supply because it is not being traded to the same degree as it was before.

The IMF (International Monetary Fund) has cut its global growth projections for 2022 and 2023 saying the economic impact from Russia’s invasion of Ukraine will “propagate far and wide, adding to price pressures and exacerbating significant policy challenges”. The World Bank has also lowered its global growth forecast for 2022 by almost 1%, from 4.1% to 3.2%, this shows the pressure that the invasion has put on the global economy.

The UK’s inflation has risen to 9.1% which is the highest level since 1982, this will add more pressure on household finances as consumers are coping with the worst cost of living crisis in years.

Ronald Wayne (an engineer at the time) once stood shoulder to shoulder with Steve Wozniak and Steve Jobs as the third co founder of Apple. The “fifth Beatle” of the tech industry. Wayne sold his 10 percent stake in the company back to the two Steves after just 12 days with the company in 1976 for a total of $800. In 2018 Apple became the first business to record a market cap of above $1trillion and 3 years later $2trillion. Wayne’s core reason for his departure was his age. Wayne was in his 40’s whereas the Steves were both in their 20’s; he even said, “If I had stayed with Apple, I would have wound up the richest man in the cemetery.”

The story of Roy Raymond, famously recited in The Social Network by Sean Parker (Justin Timberlake) is arguably the most famous of the lot. Raymond was inspired to start Victoria's Secret after feeling embarrassed purchasing lingerie for his wife in a department store. So, he created Victoria’s Secret: a place where men could go to buy lingerie without the fear of judgment. To open the store, he borrowed $40,000 from a bank and $40,000 from his family. Raymond worked to design and launch the first store with a Victorian inspired style which opened in San Francisco in 1977. After an expansion to 5 stores, Raymond sold the Victoria's Secret company for $1 million to Les Wexner, a tycoon. With its five stores and 42 page catalogue, the business reported to be grossing $6 million per year. Raymond sold it for just $1million. Victoria’s Secret is now valued at over $5billion.

At 19 with his digital marketplace Gumroad receiving funding which totalled to $8 million, Sahil Lavingia left his first start up, Pinterest. Lavingia left about a month before his one year anniversary at the company, which means that none of his stock in Pinterest had much value when he liquidated them, he made roughly $10,000. Fast forward nine years to 2021, where Gumroad is turning over $6million a year which sounds good but compared to Pinterest which racked up over $2.5billion in revenue, and is valued at $12billion, Lavingia as the sole trader would be worth a fortune. However, Lavingia was only 19 when he departed Pinterest, so his reasoning behind his departure could have been immaturity, but at 19 when facing a group of investors expecting returns over $8million on Gumroad its understandable that he made the decision to leave Pinterest.

The debate business owners commonly have over the choice to sell or keep producing is now commonly referred to as “The Founders Dilemma”.

Sport dominates TV viewership and has for many years, live sport is in 24 of the 25 top broadcasts throughout March 2022 and is in 41 of the top 50!. If a household was to spend £50, the average spent by a household in the UK, this would only get them access to 2 premium channels, theme being Sky Sports, who cover the majority of Premier League games, as well as cricket, golf and Formula 1. The other premium channel is BT Sport, who would give viewers access to The Champions League and Premiership rugby. With each household spending £50 at least a month, fans will be expecting to pay around £600 per year for sports viewership.However Fans are still missing key events, such as Boxing and UFC which will cost viewers around £20 per event. This would generate a company such as BT Sports £1,804 million operating profit (before taxation).

Since the 1960s 3pm games have not been televised, due to fears of a negative impact on fans at the game. This means that fans are getting value for their money as they pay for every game and then miss out on around 70 games a season. Many fans believe this law to be ‘archaic’ and should be removed as many foreign countries such as Dubai have access to these games

Many sports are still shown for free, including The world cup and euros, The Six Nations, Wimbledon and The Tour de France, but these sports are annually in the cases of Wimbledon, and every 4 years such as the world cup. There are also highlight programs most weekends for the football, but this removes the excitement of live Sports, with fans having to wait 5+ hours to see their teams performance

There is also the ongoing and increasing problem of illegal streaming, where fans have unlimited access to any live sport in the world. There is an increase in the amount of people looking for the illegal streams to the cost of living increasing, meaning consumers have less disposable income, leading to them cutting their spending on live sports.

The international sanctions imposed by western governments on Russia due to their invasion of Ukraine in an effort to ‘strangle the Bear’ and defend against threats to international peace, had vast effects on their economy, including effects on their imports and exports. As the sanctions imposed came from a cumulation of countries, including the us, Canada, the European union and Japan. These sanctions consisted of the banning of secondary trade in Russian government bonds, the banning of interactions with key Russian banks, the banning of exports of critical technology to Russia, and the freezing of assets. This effected Russia’s imports and exports as the ruble fell by more than 40% against the dollar after the invasion, resulting in the need for the central bank of Russia to prioritize stabilizing the exchange rate through imposing capital controls and raising interest rates, Russia’s official consumer price index jumped nearly 11 percent from mid February to early May rates. However, since then it has nearly been flat.

The economic sanctions imposed also reduced access to imported technologies and the departure of foreign firms due to the sanctions, both will create long term drags on the Russian economy, especially as 38 countries are imposing export controls and many foreign firms are self sanctioning operations or leaving Russia, even if not legally required too, by mid June there are estimations that 12% of 1350 foreign companies are scaling back operations, 35% were suspending and 24% had announced withdrawal, resulting in the global chip exports to Russia decreasing by 90%. Additionally sanctions also affected Russia’s imports in terms of industrial production, due to the increase in value of commodity exports combined with the decreased imports, as Russia’s imports sharply declined between march and April, therefore disrupting industrial production in areas such as military equipment. Despite there being no direct restrictions on trade in oil from Russian refineries, banks and shipping companies are shunning the Russian oil market due to the risk of associating with the country and the increase in shipping costs resulting in many companies halting shipments to and from Russia therefore affecting imports and exports drastically. Furthermore, if many more global companies avert Russian trade through exports and imports, as a ramification of the sanctions, shortages of consumer goods and key materials could occur therefore having huge effects on the Russian economy and trade.

Overall, the depreciation of the ruble and the shortage of imported goods will likely affect Russia by causing a substantial acceleration in Russian inflation. While a weaker currency as a result of raising prices of imported goods will lessen the purchasing power of Russian consumers resulting in a likely sharp decline of their GDP.

The salaries of rugby players is extremely varied, pay by position in Union rugby is hardly surprising. Whereas others were more puzzled at first glance.

Traditionally, the position of flyhalf topped the average earnings by position. With a yearly wage of £175,679. In comparison, scrum halves and hookers earn around £113,000 to £117,000 at a push. Could it be that in rugby, shorter people get paid less across the population.

Previous research shows that the taller the player is, regardless of gender, the more they are likely to be paid in comparison to others. This is emphasised in a 2009 paper titled ‘stature and status: height, ability and labor market outcomes’. An early American study in 2004 found that each inch above average height may be worth £789 more per year for a rugby player.

Hookers and scrum halves are arguably two of the sport's most specialist positions. This is why the majority of national teams such as England and New Zealand will take at least three or four hookers as well as scrum halves to a world cup tour or other important games.

Rugby clubs are in business to produce revenue and capital. In the 2021/22 season, Leicester Tigers won the Premiership and took a total winnings of over £500,000. A way for clubs to win the Premiership is to scout taller players. This would increase chances of winning. To accomplish this, clubs could offer a higher salary to those taller players. This would give those players an incentive to play better and for the club who pays the highest, this would also increase the chances of the player receiving sponsorship deals.

A winning team will receive more sponsorships, for example; Chris Ashton, the tigers fullback received new sponsorships from Topps Tiles and Breedon. These companies also sponsor the Tigers as a whole club.

With plenty of demand for artwork, it is the supply side of the equation that often leads to outrageously expensive prices for art. Scarcity plays a huge role. Many of the most famous artists in history are no longer alive. Picasso and Monet aren't painting any more pictures.

However, what happens when the painting is not authentic, how do people tell and is it an issue if the painting looks the same, same size and same materials. This shows it is down to the reputation of the artist and the individuality of the piece. Art is unique, non reproducible unlike many other products in trade. This is down to job production, which is when items are made individually, and each item is finished before the next one is started. This allows products to be personal and specific to the customers allowing this type of trade to charge more. However, job production is labour intense and takes a lot of time. From this many could except the extortionate prices of art as it’s the producers main and only focus for a set period, not allowing them to have a large product portfolio. Having a small portfolio can be a disadvantage for viewing customers as its difficult to convince consumers to buy if there are little reviews or examples of other work artist can produce. This explains how hard it is to become a successful artist and achieve brand loyalty.

Artists usually become popular in older life as it takes a long time to produce a large portfolio to gain customer satisfaction. Showing that an artist can produce a large variety or multiple impressive pieces allows customer to trust can be amazed every time by their talent. Strengthening an artist's influence. Additionally, artists also become popular after they die as a large influx of listeners grieving the loss of an artist can inflate the number of streams or plays, he or she gets, making them even more popular than when they were alive. This causes them to lose on the profit of their trade making its pointless trade and discouraging for new artist to enter the business.

Art has become a collector's item as owning a work of art often means owning a piece of history. Many collectors draw on their heritage to collect art from artists with similar backgrounds or life stories. Some collectors seek limited editions from high profile artists to claim their stake on art history. Some could say collecting art or trading art is a niche meaning as people have different tastes and preferences on the style and where they are going to place it. It may fit alongside other products like houses and galleries to decorate or to place like an emblem of wealth. However, the most valued art, the older the art the more valued, is put into museum not allowing any trade to occur again making it a pointless trade.

In Greece, previous years before the crisis was distinguished by a lack of structural refinement in factors such as public debt, taxation, and public sector pay. Greece, unfortunately, had a poorly organized fiscal system, faulty social services, and political parties that disagreed on how these should be reformed. A potential reason that impacted austerity to cause a humanitarian crisis is the lack of any increase in tax revenues set against the increasing rise of government benefits and consumption. This has resulted in severe shortcomings in the Greek tax system.

One of the leading deficiencies was the tax authority’s failure to collect taxes: eg tax evasion in Greece had the potential to reach as high as 27.5% of GDP in the period 1999 to 2007 resulting in the largest informal economy of any EU country. Not only that, but fraud control was also evidently lacking. The Greek Deputy PM, Evangelos Venizelos stated that changing the situation was both an economic priority and a moral duty.

Self employed workers represented 37% of the Greek workforce, compared to an average of 15% in the EU overall. Being self employed was highly popular, as the taxes paid by this group in Greece were about 15% (the EU average rate was nearer 25%) and, with so few taxes being collected, the freelance worker had greater opportunities for fraud leading to another reason austerity caused a humanitarian crisis.

Tourism represented a large sector of Greece's economy as it has indirect and direct activities that affected the entire economy. In 2012, the total contribution of tourism to GDP amounted to € 30.3 billion or 16.4%. The total contribution of tourism to employment in 2015 represented 689,000 jobs or 18.3% of total employment, the share of the revenue from international tourist arrivals in total exports was 26.4%, equivalent to 11.4 billion €. This means the share of tourism to 13.7% of the economy, proving that tourism represents a big impact on the Greek economy. Since 2008, there has been a decline in revenue from international tourism. Tourism generally counts as an elastic income service, meaning that even a small change in disposable income which would immediately affect the choice of destination, services, and the demand for tourism. Tourism undoubtedly has a significant impact on the GDP and employment of the workers, with high rates, especially in countries with high tourist activity. In addition, the unemployment rate rose from 7.6% in 2008 to 29.9% in 2015. This has caused a global impact ie less trading and movement of goods and services, whilst impacting humanitarian within the nation. In conclusion, the situation in Greece today is very tense and strained. Austerity measures have left a large part of the population in a very complex and difficult state. Eg cuts in public expenditure, coupled with constantly rising unemployment, have left many people either penniless or very close to it. A third of the population is on the threshold of poverty and 17.5% live in households with no income, family networks can no longer be relied on to support the needy. Therefore, If institutions, in particular the government and the parliament, do not succeed in regaining public trust it will be even harder to emerge from the financial crisis. For that to happen, economic policy must put people’s needs first.

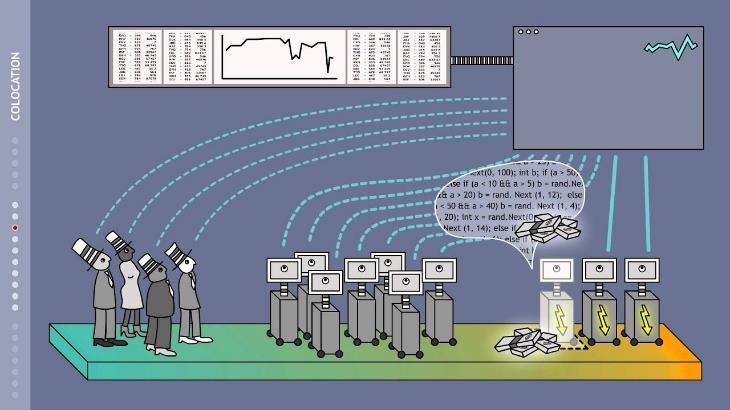

Large institutions (banks, hedge funds) have the ability to move markets through trading methodologies that reflect the current and predicted movements in the wider economy and longer term economic cycles. They fundamentally trade two types of asset risk on and risk off where investors will either have a high risk ‘appetite’ and aim to ride up the prices of assets in the market, or become more risk averse and either sell their assets or short derivatives as the market falls either as a swing or day trades.

In times when the economy outlook looks positive and market sentiment is high, they look to trade more risk on assets (i.e. more risky) such as stocks and shares, crypto etc. In uncertain times, where the economy is unstable, they make moves to reduce their concentration in risk on assets and move a large proportion of their assets to the ‘safe haven’ of risk off such as government bonds and commodities (oil, wheat etc.), precious metals and the US dollar.

Whilst these firms tend to rebalance their portfolios to off risk in economic downturns, they still play risk on assets when day and inter day trading using technology such as High Frequency Trading (HFT). HFT benefits companies which invest in this technology as they are able to trade larger numbers of orders at extremely high speeds. Whilst shrouded in a degree of controversy, High Frequency Trading is very much the at the fore of short term trading for these firms. A complaint often levied against these firms is that the liquidity produced can disappear within seconds; making it impossible for smaller traders to try and take advantage of it. Algorithms are regularly updated due to the change of competitiveness in the market and constant changes in technology.

High Frequency Trading uses algorithms to analyse market trades in fractions of seconds. The algorithms detect buying or selling opportunities with something called ‘flow analysis’ which is a technique used to process and detect liquid assets (e.g. Bonds, Stocks, etc.) in flowing media. In addition to utilisation of technology summarised in this article, these institutions are experts in behavioural analysis – understanding the psychology of retail investors and deploying a number of methods to liquidate them. By knowing these behavioural habits they set traps such as spoof orders and false breakouts to confuse smaller investors. Traditionally, order flow analysis has only been accessible to large institutions due to the prohibitive price point. As opposed to traditional candlestick charts used by most retail traders, order flow provides detailed information as to what is happening within a candlestick detailing volume analysis at each price point within it.

However, with advances in accessible technology, retail traders are now able to access order flow software for a fraction of the price thereby levelling the playing field somewhat giving hope to the 95% of retail traders who consistently lose.

51.4% of companies are owned by men and 48.6% are owned by women. 65% of men are in leadership roles and only 35% of women are. This shows an obvious lack of women representation in management roles. Women are generally more empathetic people as they have motherly instincts to help and comfort people. This would mean most women would run a company with a paternalistic style trait. Paternalistic leadership is when the dominant authority figure treats employees and partners like extended family, as they genuinely care about staff well being and safety. The benefits of this style of leadership are loyalty and trust as well as obedience. Many people feel as if a women empathy is the most important trait women can bring to the workspace. An empathetic leader can accept other people’s views and understand why that is their view. This allows the leader, as well as employees, to openly interact without passing judgement and allow the whole workplace to feel heard. Having empathy also requires an open mind allowing new ideas to enter the business giving a fresh perspective on most things. This all shows that when women have a leadership role the company or business is more efficient as employees have more motivation due to the satisfaction, they get from being heard and respected by their leader.

Women in leadership roles can also help bridge the gender pay gap. Globally the pay gap between men and women is 16%. This would mean women earn £86 for every £100 a man earns. Many statistics are based of the money earnt by a man or a woman not taking into consideration the time spent working. More women have part time jobs resulting in them earning less than someone in a full time role, however the problem is when a man and a women have the same job role and work the same number of hours yet there is still as gender pay gap. Having a woman in a leadership role can possibly bring more light to the issue as it personally affects them. This could lead to a close in the gender pay gaps in most businesses that women run attracting more employees to work for one of these companies as they show change that allows diversity shine through. This once again shows that having women in leadership roles has many benefits and this point shows they allow diversity and acceptance as well as equality which is a worldwide issue that people have struggled to break for many years.

Women leaders are a requirement of the twenty firstcentury. Organizations must empower women with leadership roles to be more productive and show their potential, increasing workplace diversity and supporting and participation of everyone in the company. Furthermore, studies have also outlined that companies with greater gender diversity, not just within their workforce but directly among senior leaders, are significantly more profitable than those without. Overall, there are many factors pointing to the benefits of a company when women are in a leadership role and more female representation is important in the workplace to ensure these benefits can occur.

Like everything, there are good things and bad things. There are extremely good private schools and extremely good state schools, similarly there are extremely bad versions of each. The key idea is that it depends on the specific school. Some private schools specialise in sport: Sedbergh; Millfield; Whitgift, say. While others specialise in producing top grades: Westminster; St Paul’s. Meanwhile others have a high prestige and status factor: Harrow; Eton; Radley. To say private education is better is not always true, as some state schools are excellent too.

Rather, comparison based on a specific child’s needs and requirements is a better way of structuring the argument. State schools are funded directly by the government, this means there is a low scope for learning outside of the National Curriculum. Typically, this leads to lower teacher passion to teach beyond the scope of the narrow syllabus. Private schools, by their very nature, are less regulated and allow for more freedom within the school. This allows students to access a breadth of extra curricular activities such as: music concerts; a huge range of sports from golf to cricket to rowing; and debating societies. The access to these facilities are often not available at state schools due to under funding, allowing private school pupils to access a far more holistic education. This allows them to find a true passion of theirs and pursue it further, which has a huge array of benefits in the future, including a far greater skillset for employment.

There is a huge statistical advantage of attending a private school for admittance in the UK’s leading universities. Only 7% of school children attend private schools, yet 35% and 42% of yearly undergraduates who attend Cambridge and Oxford respectively went to a private school. For instance, Westminster School has an outstanding rate of sending 50% of its pupils to Oxbridge. Graduation from these 2 giants in the academic world almost guarantees employment, opening a wide door of opportunities. The reason private schools are able to achieve this is due to: better quality teaching; more extra curricular opportunities; and better grades on average. Another important factor is the cost of fees at a private school. They vary massively depending on: the location of the school; the age of the children; and the type of school, boarding or day. Harrow School in London costs £41,500/year while St Peter’s School costs £30,000/year. Schools in and around London tend to be the most expensive and often rank top of the UK independent school charts.

Similarly, state schools in and around London tend to be statistically better academically. Take Brampton Manor School in East London (a state school), which as a higher Oxbridge admittance rate than plenty of private schools. Different schools attract different types of children and parents, which is a key, it depends on the child. Overall, if fees were not an issue, then the answer would be simple: private schools provide a superior education. However, fees and other factors are certainly an issue in the real world. There are hundreds of top private schools in the UK, with some offering

The gender pay gap has declined slowly over the years and has fallen by approximately a quarter over the last decade. Although it has improved significantly compared to what it used to be in the past, there is still much more that needs to be done by firms in order to close this gap completely. However, despite pressures businesses face to close the gap, the majority of the UK’s biggest employers still pay men more than women. As of 2022, the average gender pay gap of all firms reported in the past financial year is 10.4% with women in the UK being paid just 90p for £1 earned by men, on average. For some businesses, this gap is even bigger.

One example of this is the multinational bank, HSBC, which pays women only 49p for £1 earned by a man. HSBC has consistently struggled to close its gender pay gap and despite improvements of 4% on the previous year, HSBC posted a mean hourly pay gap of more than 50% for the fifth year running.

Another business with a significant gender pay gap is British Airways, where women earn 78p for every £1 that men earn. This has increased from 35% in 2017/18 to 46% this year. However, this is an improvement on the previous year when on average women were paid less than half what men made. Surprisingly, women at British Airways received more in bonuspay than men, earning £1.03 for every pound that men were paid. However, this is only a little difference and doesn’t make up for the large gender pay gap in British Airways. Apple, a multinational technology company, has one of the highest gender pay gaps of any Silicon Valley tech giant operating in the UK. Women earn 81p for every £1 that men earn. Although the company may have managed to close its gender pay gap

by 10% since 2017, reducing it from 26% to 16%, the bonus pay gap at Apple is even more drastic with women earning only 58p for every pound earned by men.

But what are the reasons for this, and do they justify it? Social pressures and norms influence gender roles and often shape the types of occupations and career paths which men and women follow, and therefore their level of pay. One of the key reasons for the large gender pay gap at HSBC is that there is a much larger percentage of men that occupy high paid positions at the company. 88% of the people in the upper pay quartile are male. This is the same for British Airways where the upper hourly pay quartile is 81.5% men and for Apple which has a workforce that is filled with men, especially in the highest paid positions. It’s a basic principle of fairness that men and women should have the same economic opportunities in life, therefore it’s not justified. Gender stereotypes need to be beaten and more women should be encouraged to take on important and higher paying roles in business as pay is based on experience.

Social media is now involved one way or another in everybody’s daily life. It feeds into so many different aspects of our life even including watching Television. Social media has enhanced the effectiveness of television advertisements which claims to be a positive effect on the TV industry. Advertisers can use their social media campaigns and advertisements to improve brand awareness and attract new customers. Social media affects the advertising in the TV world as it enhances the effectiveness of the advertisement. Advertisers can now use their social media campaigns and television advertisements in sync to improve brand awareness. As many people are now addicted to their phone and social media it means they will see social media more allowing influencers or big creators to promote rather than traditional adverts.

One of the major dominators of trending TV adverts is John Lewis. John Lewis is known for their annual Christmas adverts, and this allows for hashtags to surround the AD every year. This means it becomes a trend on social media almost immediately, this creates a straightforward way for the brand to advertise as once trending. This allows for it to already be advertised without the company spending loads of money. This can also happen through posts on Instagram, twitter or Facebook as a TV company can post on their accounts to advertise something which if it gets to the right target market and shared then can go viral and is quick and beneficial for the business.

Television has always had adverts, but social media and the internet have affected the way that they are presented. Adverts these days want to draw you in and must look at the trends in the market to grab the audience attention. They can collect primary research through social media to then reflect on their advertising to allow for more sales which is more revenue. It also allows for people to talk about it and share it online through social media as it is a strong form of communication.

Social media also provides additional information to a small TV advertisement you have provided, allowing the audience to look at your brand in more detail by searching it up on online. This can show social media can provide their own market research and add any additional information for your audience after watching an eye catching ad on TV.

When China first announced that they were fully locking down their economy on 23rd January 2020, most countries, especially Westernised ones looked on in blissful ignorance, never believing that what was happening there could happen to them. How wrong they were. The world’s largest exporter in terms of Real GDP is China and so when their economic output dried up, the rest of the world started to notice but were getting increasingly concerned about the health crisis that was heading their way.

Globalistation is the increased interconnectedness of countries, cultures and languages and is driven by trade. The COVID 19 pandemic brought into sharp focus for everyone around the world, how reliant we all are on globalistation in the modern day; with the opening weeks of the pandemic leaving shops with nothing on their shelves, hospitals short of vital equipment such as Ventilators and PPE (Personal Protective Equipment), Globalistation shot to the forefront of the world’s mind. At the very beginning of the pandemic, China were the first to rely on their global network as countries, including the UK, were happy to send out health equipment to them, something we would later be asking to have back. As more and more countries needed help from their global trading partners, less and less help was being sent out. The startling shortages and subsequent health catastrophe for the United Kingdom made us question how reliant we are on each other and subsequently, the UK is now trying to have enough resources available and producable on home soil to cope with any future global issues such as wars and pandemics.

We saw once again in 2021 just how dependent the whole world is on globalisiation, when between the 23rd and the 29th March 2021, The Suez Canal was blocked by the Cargo Ship ‘The Ever Given’ which caused delays to global supply networks. These delays lasted much longer than the 6 days that the canal was blocked, with many packages having their delivery dates pushed backed for months. The COVID 19 pandemic coupled with this delay to one of, if not the most important canal in the world meant that many countries struggled with supply chains. The provision of COVID 19 vaccines became a global issue and as Britain had left the EU in 2016, they were able to secure vaccine contracts more rapidly than the European Union and subsequently had much higher vaccine rates faster. This allowed them to open up the economy again and increase Real GDP. The COVID 19 pandemic made us re think our reliance on globalistation and many countries are now securing supplies but globalistation will not be going anywhere anytime soon.

NFT’s are non fungible tokens that can be thought of as trading cards, but digital. In essence it can be literally anything virtual, but its rise has been due to the popularity of collecting digital art as shown by the sale of the Nyan Cat NFT, which sold for roughly £570,000. Buying an NFT allows the owner to be the single possessor of a piece of digital art in the entire world, meaning that they hold the original copy even though the digital file can still be downloaded; similar to the Louvre owning the Mona Lisa, yet people can still print copies.

The reason for buying NFT’s is the same as the reason for buying physical art the novelty. All NFT’s are completely unique and consequently there is great demand for getting the ownership rights. Take for example the CryptoPunk series, a collection of alien portraits of which the most expensive one sold for £19.5 million. NFT’s can also be seen as an investment opportunity with some rising upwards of 1000% of their original value during the pandemic. Consequently, the popularity in these tokens has ballooned since the middle of 2021 with lots of major corporations making their own NFT’s to appeal to growing market.

However, there was a public outcry against these companies as their NFT’s were low quality attempts at cash grabbing. Details of the environmental impact of NFT transactions also emerged, showing that the ridiculous amount of energy required to verify each transaction was equivalent to driving 500 miles in a car. Therefore, sales for NFT’s dropped and organisations that initially had planned to release NFT’s have now been turned away. Nevertheless, the main market for NFT’s continued, but this all changed in early 2022, when the crypto market began to fall. NFT’s are purchased using a cryptocurrency called Ethereum, so as its value fell, demand for NFT’s also fell as they became less affordable. This can be seen in the case of John Terry’s NFT’s, whose value have now plummeted by 99% due to a combination of the aforementioned crypto crash and copyright claims from the Premier League. Overall, NFT’s have fallen by 92% between January and June 2022, but there is still a future for these digital artworks.

Although their future remains uncertain, the demand for NFT’s is still there and growth from 2021 is predicted to be around 230%, and when cryptocurrencies inevitability recover, their popularity may be restored to January levels, and we could see NFT’s slowly start to replace tangible artwork in the coming decades.

With red diesel being at 115.06p per litre, farmers incomes are being heavily eroded into. In fact, many farmers may struggle to break even. Inevitably, this will have an impact on consumers as supermarkets will have to charge premium prices to cover the rising cost of producing the crop. For many, this raises the question of what suitable alternatives actually are there. In response to this question, NFU president Minette Batters said: ‘While agricultural vehicles have become more efficient, it is impossible for farmers to move away from using red diesel as there are currently no commercially viable alternative fuels.’ The inflation of fuel prices is also making it expensive for transportation costs, making it costly to deliver the crop to intended suppliers.

However, there are other significant impacts currently affecting the farming industry. For example, the Ukraine war has led to a fertiliser shortage, increasing its cost, making yields on average more expensive for farmers to produce. Brexit has also affected labour, as foreign workers are no longer easy to get hold of. An article in the Farmers Guide said that ‘in a normal year, around 95 per cent of the 60 70,000 seasonal workers across agriculture and horticulture would be filled by EU nationals.’ In an attempt to prevent this issue further damaging the farming industry, several schemes like ‘Pick for Britain’ have been set up to encourage British workers to fill the role. Following the exit from the EU, UK farmers no longer receive the £4 billion annual payment from the EU’s Common Agricultural Policy (CAP). Though there is discussion of the UK government introducing a similar scheme, there is no sign of this to be implemented soon.

In conclusion, the inflation of fuel prices has undeniably had the most significant impact on the economics of agriculture. This issue is only expected to worsen as the government recently announced that most organisations will pay an extra 46.81 pence per litre from April 2022. Prema energy, wholesalers of liquid fuels, claim that this will account for an approximate 40% increase in fuel prices. This is very worrying for UK farmers and we are still yet to see any viable alternatives to diesel.

Youth unemployment as been a growing issue for decades and the unemployment for young men has risen from 4% in 2000 to 9% in 2021 and will likely have many economic impacts in the future, but what is causing this crisis and how can it be helped?

This is due to a lack of jobs as the transfer from schools to jobs due to a lack of experience meaning the older and more experienced workers get the jobs, leaving younger people unemployed. However, this then causes a constant cycle of young people being unable to find the experience required without working as an intern who will be paid poorly (if at all) and due to Covid 19, there has been a distinct lack of jobs as people are forced to stay indoors, thus causing many young people to be unable to even attempt to start work. Also, many young people might want to start their own business, but without the financial support from affordable loans this can be incredibly hard to make happen or make it hard for young people to repay their loans, this means that many young people are put off this idea and thus cannot find a job in this sense. Another reason for this increase is unemployment, specifically in young men, could be due to worsening mental health, as this causes these men to be unmotivated and less likely to go out and look for jobs. Finally, youth unemployment could be caused by a rise in the age of retirement, as this means the people with more experience stay in the labor market for longer and so fit into the potential jobs the young people could take instead.

However, contrary to this worrying fall in employment for young people, there has actually been an increase in the employment of young women as there was a 78% fall between 2006 to 2021 in the number of women who were economically inactive due to having to care for family, this is due to an increase in information about teenage pregnancies and therefore reduction in teenage pregnancies and the increase in employment of young mothers as they are forced to work in poorly paid jobs in order to support their child.

In conclusion, the supply for labor is much higher than the quantity demanded, this means that youth unemployment will be a constant issue and will likely cause the government to have to spend more on welfare to support this crisis, and the lack of disposable income is likely to reduce consumption, therefore causing the demand curve to shift in, causing a reduction in economic growth. However, this could be stopped by creating a welfare system that supports young people in finding these jobs or training opportunities, or by making sure education priorities employability skills making these people more attractive to employers. Finally, they could also make it easier for young people to start their own businesses, by reducing the interest rates on loans made out to younger people thus creating more jobs.

In 2019, the office market continued much as it had done for the last 50 years, with continued year on year growth in demand for good quality office accommodation, on a national and regional scale. There were hotspots in the UK, notably London which was driven by TNC’s given London's pre eminence as a World Financial Centre, even after “Brexit”. Other developments in regional centres were often driven by Government policy, to relocate government ministries and departments to level up some of the social inequalities in the UK, for example HMRC in Leeds and other government bodies into Glasgow. The general trend was increased demand from the public and private sector for typical office space of a higher quality but reliant on staff working within an office environment, Monday to Friday, 9 am to 5 pm.

However, everything changed on the 23rd March 2020 when the UK entered its first lockdown. The closure forced firms and individuals to change their established working practices quickly and irrevocably. Prior to Covid, there had always been a perceived reluctance by firms to allow workers “to work from home” for fear that this was just a day off and efficiency and productivity would not be achieved. The result of this “working from home” practice is that productivity has not decreased in many industries where most people's efficiency can be measured by the financial return they receive set against their costs. Importantly, because people are not travelling to work they are often able to work longer hours, but perhaps with a better work life balance particularly in the London context where commuting is such a time consuming and expensive undertaking.

Since the easing of Covid measures there has been a gradual return to the office but not on the same scale as prior. Firms and organisations have accepted a hybrid working week allowing remote working and a better employee work life balance. There is a trend towards meetings in the office for team working but where staff members can work remotely on other days. The overall impact of this has been to reduce demand for new office space whether refurbishment or new build. The size requirement, because employees are prepared to hot desk means smaller accommodation is now required but more flexible to allow a hybrid working environment.

Whilst the Covid 19 pandemic had a huge impact on the traditional office market during Covid, it has since bounced back but not to the same level. Firms now have smaller space requirements and require space to work collaboratively with shared facilities and flexible terms. This is seen in the move to serviced offices for all types of organisations, even large ones. In the long run there will always be a role for office space as not everything can be done online. The British economy needs companies to occupy office space, especially for the large cities of London, Bristol, Manchester and Leeds where without office workers there will be a knock on effect on retailing, leisure and hospitality trade the multiplier effect.

Due to Covid 19, the music industry had a mass decrease in contribution to the UK economy, from 5.8 billion pounds in 2019, to 3.1 billion pounds in 2020. Lockdowns caused many job losses, whether that be teachers not being able to teach students and going out of business, or performers not being able to give live performances, leaving them with no work, and little money to live off of. Employment in music comes at a risk, as three quarters are self employed with no government support. So the arrival of covid and restrictions had colossal effects on unemployment as 1 in 3 jobs in music were lost as the rate of employment fell by 35% from 197,000 in 2019, to 128,000 in 2020.

When lockdowns were eased, household spending was down 19% from pre pandemic levels, which caused many issues for the music industry. It is a highly elastic industry because it's a leisure activity which is a luxury to people, therefore it is extremely difficult for businesses to protect their profits by raising prices as they will just lose even more money.

This diagram highlights that a small increase in price of concert tickets from firms in an attempt to protect their profits will cause a proportionally much greater increase in quantity demanded, demonstrated by the greater shift from Q to Q1 than P to P1 along a relatively inelastic demand curve.

Price of a concert ticket

Music has been a significant aspect of British society for thousands of years. With 57% of the population listening to music, I believe that it will remain prominent in UK culture. Without music, many people would lack the means for recreation, diminishing their standard of living. So music will make a comeback, if that be naturally through the free market, or even if it takes government intervention.

Quantity of concert tickets

The definition of a transfer is what happens when a player who is under contract with one club moves to another one. This player, to be associated with a club, is under a contract for a period of time. The contract will have a year of expiry that will have been agreed to. As well as this the contract involves the players set salary. This is usually divided into a weekly wage. This could also include bonuses for reaching certain achievements. If a players contract runs out and they do not sign a new deal with their current club, then they become a free player who can be signed purely off a wage. This means players sometimes run down their contracts at a current club, and sign no new deal with their current club and therefore go for free, where another club can offer them a salary without buying them out their old contract, so no fee goes to the old club. This was after the rules changed in 1995 after Bosman wanted a move as his a contract ran out and his former club wanted £400,000 for him. His next club refused to pay as his contract ran out. Bosman wanted a move so he took this to court and won.

Age: The older a player, the cheaper as around 29+ a player won’t improve much however a player who is only 20 has longevity.

Talent/Ability: this is the main cause for the price of a player. Higher the ability on the pitch, the higher the price.

Desire to sell: if a club doesn’t want to sell due to good relations and a long contract then the price of a player will be much higher than the same player with worse circumstances.

Cristiano Ronaldo moved from Manchester United to Real Madrid for 80 million pounds. At the time he was 24, so a good age and as for ability he was the best in the world winning the Balon d’Or, the highest footballing achievement, the year before. And Manchester United’s desire to sell was low. Ultimately this resulted in a record signing at the time in 2009. We can also look at the most expensive signing ever. Neymar in 2017 was sold from Barcelona to PSG for 222 million euros. Neymar was 25 at the time, in his prime for ability and definitely in contention for the top player with Ronaldo and Messi for 2016. As for desire, Barca had brilliant history with Neymar and a long contract of 4 years in 2017. This ultimate in the biggest sum in footballing history. To put this in perspective the top 10 signings of 2008 were 221 million euros.

2007 top signings of Torres from athletico Madrid to Liverpool was 39 million pounds, second was Robben from Chelsea to Real Madrid for 36 million pounds, and finally Pepe from Fc Porto to Real madrid for 30 million pounds. This gives us a top 3 average of 35 million pounds.

As for 2021, Grealish moved from Aston Villa to Manchester City for 105.75 million pounds, Lukaku moved from inter Milan to Chelsea for 103.5 million pounds and Sancho moved to Manchester United from Dortmund for 76.5 million pounds. This gives us a top 3 average of 95.25 million pounds.

So a percentage increase of the inflation of this 15 year gap is a total increase of 172.14% .

Now we look at the UK inflation rate over the last 15 years. Inflation goes up at 2.2% every year on average according to the Bank of England, 35 million pounds in 2007 would equate to 47,736,726.27 pounds in 2021.

This is a percentage increase of 36.39%.

We can see this massive level drop of percent between real inflation and transfer prices over the last 15 years.

So, In general football has increased massively in viewership and ownership money. If we look at the champions league final for example, and at the UK broadcaster at the respective times, we see in 2007 an estimate of 7.9 million people watched. And in 2021 it was estimated to have viewership of 8.7 million views. This is not a massive increase, but still an 800,000 people increase. However this isn’t the most relyable data so I will also look at shirt sales for the shirt of the most expensive player of both years.

In 2007, Liverpool sold 320,000 Torres shirts globally and in 2021, Manchester City sold 1,176,471 grealish shirts globally. This gives a percentage increase of 267.65%.

As well as these factors, teams with big money in the bank spend more to gain an advantage over their competition on players. This will push all teams to spend more on the same product as the demand is so high. This is arguably the most reasonable factor in footballs massive inflation.

In conclusion, transfers have rapidly inflated compared to the UKs Inflation rate. In my opinion this is down to rich owners trying to buy their teams the best players, creating rich increase on player values as demand is always so high.

Due to covid 19 the average housing price increased by 9.6% over the year to January 2022 down from 10.0% in December 2021. The average house price after covid in January 2022 was 274,000 which is 24,000 higher than before.

Post lockdown there was a large trend of people selling their homes to move from the city to move to the countryside. Many people move to the countryside for their own reasons. But the main reason people are moving to the countryside is because they can work from home this means that they don’t need to be living in the city near their work offices. As well as people moving for work reasons many people are moving for health benefits such as better air quality and being in the countryside is means people are more connected with nature and this can leave people feeling calmer and happier. With people being trapped in their homes due to the lock down rules this meant that they were not able to spend their money on goods so they had more money sat in the bank as well as having more money they also spent more time in their homes where some homeowners might have realised either they don’t like their homes, or they wanted an upgrade now that they have more money. With the interest rates being lower at banks it meant that it would be easier for people to get loans from the bank. Meaning people would be more interested to move houses. with the demand for property being high and there being very little property being available this meant that the prices for homes were higher as people would be able to charge a premium price as there as a high demand and a low supply.

The stamp duty holiday played a large role in the trend of home purchases. When people used to purchase homes for £250000 they would pay £10000 on top of that but due to the cut of stamp duty they would only have to pay £7500 and for the top end of the property market where people would be purchasing houses for £500000 they would have to pay an excess of £30000 they would only have to pay £15000 this is exactly half of what you used to have to pay this played a larger role for people investing or purchasing homes.