March 29 - April 4, 2023 Vol. 31 No. 13 $1.85 + Tips go to your Vendor $3

4 6 8 15

Arts & Entertainment

Event highlights of the week!

SportsWise

Taking a look at Da Bears!

Cover Story: Rising Property Taxes

Rising real estate sales prices on neighboring homes and businesses – gentrification – is just one contributor to higher property taxes, and two Pilsen residents talk about how badly they were hit. We also explain how property taxes are configured.

12

From the Streets

Review responses from the mayoral candidates ahead of the election. StreetWise emailed the run-off candidates the same two questions on homelessness and on how to retain the middle class in Chicago. This is re-printed from StreetWise Vol. 31 No. 8 (February 20 - 26, 2023).

The Playground

THIS PAGE: Murals in Pilsen (Brian Hamilton photo).

DISCLAIMER: The views, opinions, positions or strategies expressed by the authors and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, or positions of StreetWise.

Dave Hamilton, Creative Director/Publisher dhamilton@streetwise.org

Suzanne Hanney, Editor-In-Chief suzannestreetwise@yahoo.com

Amanda Jones, Director of programs ajones@streetwise.org

Julie Youngquist, Executive director jyoungquist@streetwise.org

Ph: 773-334-6600

Office: 2009 S. State

Chicago, IL, 60616

DONATE

to StreetWise

our website at www.streetwise.org/donate/ or cut out this

mail it

donation to StreetWise, Inc., 2009 S. State St., Chicago, IL 60616.

To make a donation

, visit

form and

with your

We appreciate your support!

the

of $________________________________Billing Information: Check #_________________Credit Card Type:______________________Name:_______

accept: Visa, Mastercard, Discover or American Express Address:_____ Account#:_____________________________________________________City:___________________________________State:_________________Zip:_______________________ Expiration Date:________________________________________________Phone #:_________________________________Email: StreetWiseChicago @StreetWise_CHI

AT streetwise.org

My donation is for

amount

We

LEARN MORE

St.,

ARTS & ENTERTAINMENT RECOMMENDATIONS

Compiled by Emma Murphy

Women Talking!

‘The Revolutionists’

Imagine if four women, who lived boldly in France during the French Revolution’s Reign of Terror, had met and exchanged ideas before losing their heads. W hat if former queen Marie Antoinette, playwright Olympe De Gouges, assassin Charlotte Corday, and Haitian rebel Marianne Angelle, grappled together with how to change the world? In a comedy. The play “The Revolutionists” explores this question. The play will run at 7:30 p.m. Thursdays, Fridays, and Saturdays, and at 3 p.m. Saturdays and Sundays March 16 - April 30 at the Oil Lamp Theater, 1723 Glenview Road, Glenview. Tickets are $20-45 at oillamptheater.org/calendar/the-revolutionists-2

Zoom up to Devon!

'Tuk Tuks on Devon' Rogers Park Business Alliance has installed a new vibrant public sculpture exhibit, “Tuk Tuks on Devon.” These 10 sculptures by Chicago artists, lining the diverse Devon Avenue from Bell to Sacramento Avenues, will be displayed from March 19 through the fall. Tuk Tuks are three-wheel, short-distance, electrical vehicles that originated in Thailand and gained popularity worldwide. They provide an easy and eco-friendly way to snake through busy streets quickly. Each Tuk Tuk in the display is unique: monsters, rainbows, scenes of ancient temples, and astronauts in outer space. For more information, visit ondevon.org

A Tribute to the Everyday!

‘Spine.’ - Julian Adon Alexander

With imagery revolving around workers in food service, retail, and factories, “Spine.” pays tribute to the working class. This body of work by Julian Adon Alexander is an effort to humanize and show appreciation for these occupations, coming from someone who has worked in these industries himself. The opening reception of the exhibition is at 6 p.m. March 31 at the Epiphany Center for the Arts, 201 S. Ashland Ave. The event is free, but registration is required. “Spine.” will be at The Sacristy Gallery at Epiphany Center for the Arts from March 31 - May 13. More information is at epiphanychi.com/julian-adon-alexander-spine

Books In Your Face!

‘Pop-Up Books through the Ages’

Pop-up books have a longer history than you might think. For centuries, books with interactive flaps, dials, and other moving parts have captivated readers of all ages. In addition to exploring the past, the exhibition highlights the present and future of pop-up books. This exhibit is at the Newberry Library, 60 W. Walton St., from March 21-July 15. Admission is free. Library hours are Tuesdays, Wednesdays, and Thursdays from 10 a.m.-7 p.m., and Fridays and Saturdays from 10 a.m.-5 p.m., from March 21 through July 15. More information at newberry.org/calendar/pop-up-books-through-the-ages

ARTS & ENTERTAINMENT

4

Healing Together!

‘Celebration of Healing - The Healthcare Divide’

Congo Square Theatre expands its world premiere of "How Blood Go" with a screening of the NPR/Frontline film, "The Healthcare Divide," which examines how pressure to increase profits and uneven government support are widening the divide between rich and poor hospitals. "How Blood Go" cast member Yolonda Ross (also seen on "The Chi") will host a discussion afterward in a collaboration with Equal Hope, 6 p.m. April 5 at 300 S. Ashland Ave. #202. FREE, but registration is required at steppenwolf.org/howbloodgo The play runs through April 23 at Steppenwolf's 1700 Theatre.

World Premiere!

‘Galileo’s Daughter’

Rattled by a personal crisis, a playwright flees to Florence to study the letters between Galileo Galilei and his eldest daughter, Maria Celeste. Caught up in the threats against her father, Maria Celeste must abandon her work and join a convent. Alternating between timelines, the world premiere of “Galileo’s Daughter” is a personal examination of faith, forgiveness, and the cost of heeding one’s truth. Performances are 7:30 p.m. Thursday - Saturday, and 2:30 p.m. Sundays from April 5 - May 14 at Theater Wit, 1229 W. Belmont. Tickets are $10 - $45 at theaterwit.org

Loss, Love & How to Live!

‘The Cherry Orchard’

W hen Madame Ranevskaya returns to her heavily-mortgaged estate on the eve of its auction, the aristocratic widow finds that the fate of much more than her beloved orchard hangs in the balance. Anton Chekhov’s “The Cherry Orchard” is an exploration of loss, love and how to live in a society that’s changing fast. “Tragic things happen but it's also quite funny,” said director and adaptor Robert Falls. April 1 - 30 in Goodman's Albert Theatre, 170 N. Dearborn St. Tickets are $25+ with various showtimes at goodmantheatre.org/show/the-cherryorchard

Theater From the Past!~

‘The Threepenny Opera’

“The Threepenny Opera” is a satire of the post-war rise of capitalism after World War l, wrapped up in Kurt Weill’s jazzy score. The play follows the tale of Macheath, a debonair crime lord on the verge of turning his illegal empire into a legitimate business. Songs from the play have become classics, most notably, “Mack the Knife,” which has been covered by everyone from Frank Sinatra to Michael Bublé. The play runs at 7:30 p.m. on Thursdays, Fridays, and Saturdays, and 6 p.m. Sundays March 23 - April 30 at the Theo Ubique Cabaret Theatre, 721 Howard St., Evanston. Tickets are $45+ at theo-u.com/threepenny-opera

Under the Sea!

‘Underwater Beauty’

Visit before April 17 to say farewell to this vibrant and beautiful exhibit, which is closing to enable renovations to the Shedd Aquarium. “Underwater Beauty” is the most diverse special exhibit in Shedd’s history, featuring 1,000 animals from 100 species – flamboyant cuttlefish, ribbon eels, tangs, sea dragons: shimmer, color, pattern, and rhythm – from all over the world. Part of Shedd's Centennial Commitment, the renovation will bring more lab space, and also more immersive, hands-on experiences. The Shedd is at 1200 S. DuSable Lake Shore Drive. Tickets are $20+ at sheddaquarium.org

Check Out the Royal Jewels!

‘First Kings of Europe’ at the Field Museum

“First Kings of Europe” brings together the work and stories of 26 museums and 11 countries throughout Southeastern Europe. Explore the rise to power of ancient Europe’s first kings and queens, and discover how the once egalitarian farming communities developed power, inequity, and hierarchy. See axes, swords, and crowns among over 700 objects that forever changed the structure of society. This exhibit opens March 31 at the Field Museum, 1400 S. Lake Shore Drive. Tickets and additional information at fieldmuseum.org/exhibitions/first-kings-europe

www.streetwise.org 5

Patrick: The Bears, in my opinion, are embodying a real football team! I’ve watched the Bears management maneuver during the season and/or in the offseason, or watched them play, and I’ve never been able to truly feel they were a real team—well, outside of the Super Bowl Shuffle year. But, now…

Donald: Yeah, man. Not only did they trade the No. 1 pick—

Russ: Instead of keeping it to draft a quarterback, meaning there was a possibility of current-QB Justin Fields being shipped out.

Donald: Yes, they did not keep the pick. Traded it for picks and a reputable wide receiver. John, do you have the details on the deal?

John: The Bears traded the No. 1 pick in the 2023 draft to the Carolina Panthers in exchange for 4 draft picks over 3 years and wide receiver D.J. Moore (who is a legitimate wide receiver in this league), Mind you, nothing against the receivers we cur-

rently have, because they do what they can out there.

Patrick: Who are our core wide receivers? Darnell Mooney, Chase Claypool—can’t think of the others.

Russ: There’s a Jones, Jr.

John: You mean Velus Jones Jr. And then the last is Equanimeous St. Brown.

Patrick: Wow, John. Impressive with Mr. Brown’s name. And I must confess, I knew he was part of the crew, but I did not want to get near to attempting to get his name right.

Russ: What are the draft picks again, that we get from them?

John: So, if my memory is right, the Bears get Carolina’s firstround selection, which is number 9—not bad—a late secondround pick, which is number 61 overall; also, a 2024 first-round selection and a 2025 secondround pick.

Donald: Good recall, John. This could be good, fellas. We have not only new management, but new management that's not afraid to make big moves.

Russ: That’s right. Shoot, scrolling now, I see the Bears have made a ton of moves since that huge trade. Well, first off, the only one that saddens me is our running back David Montgomery being traded to rival north Division team, the Detroit Lions.

Patrick: Horrible.

Russ: So, not only do we not have him with us, we have to attempt to stop him in at least 2 games next season. And maybe for the next 3 years as well. His contract is for that long. So, not cool.

Donald: True. But I will say one thing: I like that dude, and I can tell from everyone I talk to about it , they like him, too. But I am happy for him.

John: I am, too. And, besides, we do still have backup running back Khalil Herbert, and we picked up another one: former Seattle Seahawks running back Travis Horner. Khalil looks to become the number 1 back, with Travis filling Khalil’s lastseason spot. This could be okay.

Donald: Good.

Patrick: Hey, don’t forget about offensive-line guard Nate Davis from the Tennessee Titans. Folks have been talking about how much Justin Fields needs protection; well, this is a major start.

John: And he’s only 26 years old. And the great thing about all of this good offensive news is that there’s balance with nice pickups on the defensive side of things.

Russ: This could be a good year, y’all.

Any comments or suggestions?

Email pedwards@streetwise.org

SPORTS WISE

Rashanah Baldwin

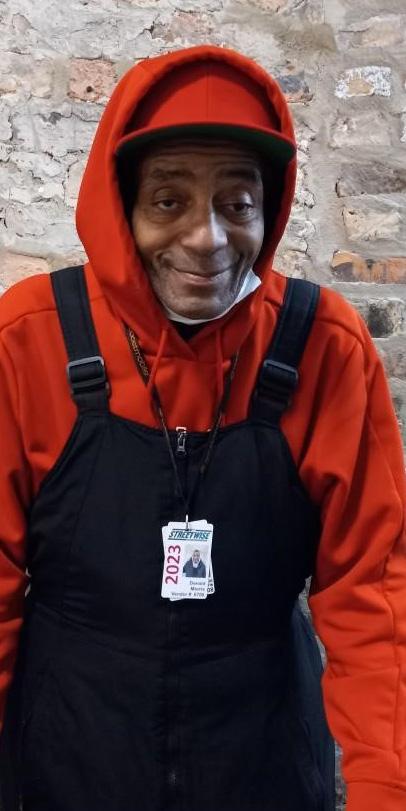

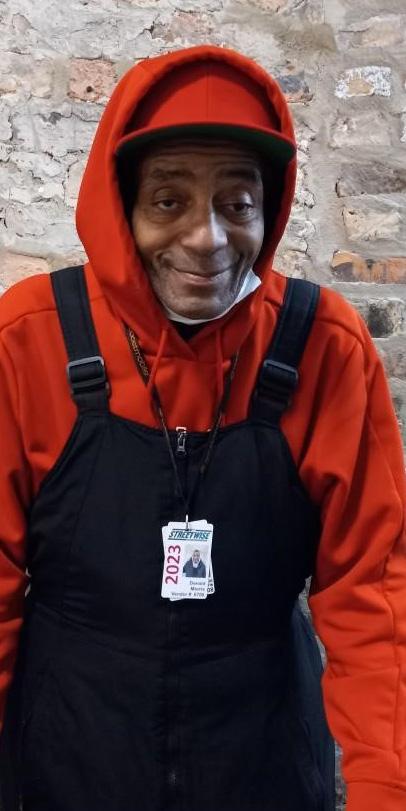

Vendors Russell Adams, John Hagan and Donald Morris chat about the world of sports with Executive Assistant Patrick Edwards.

pilsen vows to hang on to community

by Judi Strauss-Lipkin

Beth and Willie Wagner are the owners of Honky Tonk BBQ in Pilsen. The restaurant has won the Memphis in May award for its pulled pork, and it serves St. Louis spareribs/baby back ribs – the real deal: slow-cooked barbeque with three signature sauces. The Wagners have owned the corner building at 1800 Racine in Pilsen for 36 years, and they live upstairs.

“Pilsen is our home, our neighborhood,” Beth Wagner said. “Everybody knows you. Everybody cares about you. If you need help, they are there. We are a very tight community. Many of the buildings were Mom and Pop stores, with the business downstairs and their home upstairs – just like ours.”

But the Wagners were among those hit hardest by the second installment of 2022 Cook County property taxes – up in Pilsen by 46 percent over last year, largely due to assessments based on property value, and also nearby real estate sales. The second tax bills for 2022 arrived in late November instead of August and were due by year end. The first installment for the current year arrived soon afterward, in February, with payments delayed this year until April 3. This second installment was a huge shock to many people. They worried about coming up with quick cash to pay the bill, but also whether they can afford to remain in communities they love and have nurtured.

“Ten years ago, there was not a single condo building in Pilsen,” Beth Wagner said. “For a long time, Pilsen was sort of invisible. Homes changed hands, families sold to other families and the value of the properties were kept ‘in the family.’ Then, it was like Christopher Columbus ‘discovered’ our neighborhood. Yes, people fought landmark status, so it did not happen. Developers started buying properties and building/changing our home. A young couple bought the building next door for ‘big bucks,’ which caused the assessed value of our building to rise dramatically.”

Two blocks west of Honky Tonk BBQ, Thalia Hall at 18th and Allport is a landmark dating to Pilsen’s time as a Bohemian neighborhood, built in 1892 by John Dusek to bring arts

and entertainment from the old country. The building featured ground floor commercial storefronts, residences and community gathering spaces. However, in recent years it has been empty. The building was sold for $3.2 million in 2013 and converted into a beer-focused restaurant, a cocktail bar serving punch and an event space.

So, Wagner said, “our family-oriented and loved neighborhood was gentrifying. As the developers moved in, prices rose. Then assessments rose. Then real estate taxes rose as well. As properties sold for millions, lots and houses and buildings were “worth more” on paper and real estate taxes rose.

A vacant lot the Wagners have owned for 25 years has won several awards for its beautification. But its real estate taxes skyrocketed this year – for vacant land. The real estate taxes on their building (with both the restaurant, their home, and apartments) climbed to $75,000. Beth said she herself fought the unfair assessment and tax increase for two years - with the office of Cook County Assessor Fritz Kaegi.

She finally “won” her tax appeal - and was given a handwritten bill. She wrote a check for the taxes, which were substantially reduced. Now, she said, individuals can no longer fight these increases themselves; they must hire attorneys to do so.

Beth wondered, as do so many longtime Pilsen residents, “Where would I go? What can we afford?

“A lot of businesses went into debt during the pandemic; we borrowed and got government funds to pay our employees and stay in business. This is our neighborhood. This is our home. This is our restaurant, which we love. What is next?”

8 COVER STORY

Why property taxes went up

Cook County property taxes increased overall by $614 million (3.8%) over 2020. Homeowners picked up $330 million (53.6%) of those taxes and businesses the remainder (46.4%).

“Market forces,” or prices paid for neighboring real estate, factor into property tax bills, according to tax analysis from the office of Cook County Treasurer Maria Pappas. That’s why affluent areas along the north lakefront and former working class neighborhoods that are now gentrifying saw their taxes jump dramatically, while struggling Black neighborhoods watched them fall.

On the Lower West Side, for example, a predominantly Latino neighborhood three miles southwest of

the Loop, the median bill is $7,239, an increase of $2,275, or 46%. Other hot neighborhoods included:

• Avondale, a Latino majority community on the Northwest Side, $7,601, an increase of 27%;

• Logan Square, $8,609, an 18% increase;

• Irving Park, $6,999, a 21% increase;

• North Center $11,463, an 11% increase – the highest median residential tax bill in the city.

However, property taxes went down in Black neighborhoods on the South and West Sides:

• West Garfield Park, $1,345, down 45%

• Fuller Park, $909, down 46%

• Englewood, $804, down 44%

A second factor behind higher property tax bills is higher levying for the budgets of the City of Chicago (up $94 million) and Chicago Public Schools (up $114 million).

There is also a new state law with a “recapture provision” that allows many local governments to recover the total of any taxes refunded to property owners who appealed their taxes the previous year. The new recapture law added $131 million overall to Cook County tax bills.

www.streetwise.org 9 6

(Facebook photo)

Delinquent Property Sales

According to Cook County Treasurer Maria Pappas’s office, there are two kinds of sales regarding delinquent property:

• Annual tax sale. After 13 months of delinquency, someone can “buy” the unpaid taxes and pay them. That person will have a lien on the property. The original owner can redeem the property by paying the taxes and interest within 2.5 to three years.

• Scavenger Sale. This sale happens every two years and the next will be in 2024. The scavenger sale is for properties –many of them abandoned or delapidated – where the owner has been delinquent for three or more years over the past 20 years. The owner has 2.5 years to petition the courts before a buyer goes to deed on a property.

State law allows Cook County to provide taxpayers more time to pay delinquent taxes than other counties. There’s about 13 months from the second installment due date until the tax sale begins in Cook County, whereas other counties allow roughly 120 days from the due date.

Pappas’s office crafted SB 2395, now in the Illinois Senate, to help people who are behind on their property taxes. Sponsored by state Sen. Ram Villivalam (D-Chicago), the bill would lower the monthly interest rate on delinquent real estate taxes from 1.5 percent monthly, (18 percent annually), to 0.75 percent monthly, (9 percent annually).

“We know that Pilsen is a goldmine in terms of location,” said Teresa Fraga, an executive board member and treasurer of the Pilsen Neighbors Community Council and co-chair of the Pilsen Planning Committee. “It is 10 minutes from downtown, great hospitals, and all expressways. We know people want to live here.”

Fraga has contended with gentrification in Pilsen – working to keep housing prices, property taxes and utility costs manageable for lower income residents – since the 1990s. Fraga moved to the United States when she was 7 years old, worked as a migrant farm worker around the nation, moved to Chicago with her husband and three children in 1966, settled in Pilsen and bought a home there in 1981. They are retired, living on a fixed income.

Since the 1970s, “Pilsen was totally rebuilt by the Mexican community that still lives here,” she said in a telephone interview. “We fixed buildings and brought them up to code by our own sweat. A new high school was built, a building for Public Health and even a new library. Pilsen is a community that has created organizations to help and bring resources to our people. In the late 1970’s and early 1980s, we stopped redlining and forced banks to give loans for properties/homes east of Ashland. We had a simple questionnaire distributed in churches - asking people, ‘Would you buy a home in Pilsen?’ Overwhelmingly, they said, ‘YES!’ We showed the survey to the banks and won - we did and we can fight.

“Now the real estate taxes are going way up,” she said. “What we want and think the Assessor’s office, the [Cook County] Treasurer’s office and the State of Illinois should do is work to fix this. What is this? Real estate taxes in our working-class community of Pilsen more than doubled in late 2022. We held a public meeting on December 14 in Dvorak Park and over 500 people came. We asked them to sign in, with their contact information, and asked how much their real estate taxes had increased. Many of them said more than double. My own first installment was $2,111; the second installment was $14,729. I thought – this must be a mistake! Another Pilsen resident saw his

10

property value increase from $400,000 to $1.2 million in one giant increase."

Cook County Board of Review Commissioner George Cardenas told WTTW that the system does not work because of the of the valuation model, where individual tax bills rely on the neighborhood housing market.

Geoff Smith, executive director of the Institute for Housing Studies at DePaul University also told WTTW that Pilsen has seen rapid growth in property tax value compared to other Chicago neighborhoods, because of the community’s location: its proximity to downtown, perceived Chicago access to transit, great housing stock, and vibrant commercial corridors. All of those things make an attractive neighborhood.

But, Fraga said, “We know how to fight for our communityand protect our community - we are very organized. We have been to the offices of the Treasurer and the Assessor and told them, we need an immediate solution to these bills. People cannot afford to put this increase in their budget.”

Fraga did fight and win - for herself and many others. She called the Assessor’s office, corrected the parcel number, and got her annual 2022 real estate taxes reduced to $3,685.56 from the proposed $16,490.56.

Pilsen Neighbors is also seeking a moratorium on late fees for paying taxes. Most of all, they want to be sure that unpaid property bills this year do not go on a scavenger sale list.

The Assessor’s Office did listen to Fraga and her Pilsen neighbors. Following a protest outside the Cook County Assessor’s

office on January 12, where they demanded a solution for this issue, Pilsen Neighbors partnered with St. Paul’s Church, Centro Sin Fronteras, The Resurrection Project and St. Pius Church to host a community meeting with Assessor Kaegi and his office in February at Benito Juarez Community Academy.

In addition, the Cook County Assessor’s office organized three workshops in February for Pilsen homeowners and business owners to guide them through the process to “fix” their tax bills. Fraga and the Pilsen Neighbors Community Council continue to work for the residents and have an active Facebook page to keep them (and us) informed.

Two offices in Cook County government are responsible for tax bills: the assessor and the treasurer. The assessor determines fair market value of private homes and commercial properties. Then, the office apportions taxes based on individual shares of the budget levies of all taxing bodies in their area, from the City of Chicago to Chicago Public Schools, libraries, park districts, forest preserves and more. The treasurer collects the taxes and distributes the money to taxing bodies.

According to the office of Cook County Treasurer Maria Pappas, there cannot be a moratorium of penalties and late fees and interest. Collecting real estate taxes by the due date has always been written in state law, because the money is needed to pay the bills for police, fire, schools, etc.

Just the same, Gov. J.B. Pritzker did “push back” the due date for the first installment of 2023 taxes to April 3 from March 1 due to the late arrival of the second installment in 2022.

www.streetwise.org 11

LEFT: Thalia Hall (Eric Allix Rogers/CAC photo).

ABOVE: Teresa Fraga (WTTW photo). RIGHT: A public meeting regarding the tax hike with Pilsen Neighbors and other Pilsen community organizstions and the Cook County Assessor, the Board of Review, and local and state elected officials (Pilsen Neighbors Community Council Facebook photo).

Review responses from the mayoral run-off

1.Chicago is deservedly proud of its reputation as a world-class city in terms of art, theater, music and restaurants, but urbanologist Richard Florida says that the flip side is the "new urban crisis" of a shrinking middle class, deepening segregation and increasing inequality.

What is your solution to prevent the displacement of low-income Chicagoans and the retention of middleclass Chicagoans?

BRANDON JOHNSON

1.

2.There are a lot of solutions to homelessness out there, starting with the proposed Bring Chicago Home ordinance, which would raise the Real Estate Transfer Tax (RETT), a one-time tax paid when a property is sold, by 1.9 percentage points on properties over $1 million and dedicate the funding to permanent housing with services.

Are you in favor? What other solutions do YOU support?

In 2021, the City of Chicago put up $290 million for affordable housing production and preservation. But that money ended up going to build houses and condos the average Chicagoan can’t afford. While the median household income in our city is $62,000, 40 percent of the units the city calls “affordable” are for incomes higher than that threshold.

Luxury housing developments don’t need public subsidies. Chicago should focus its housing investments where they will make the most difference – building units for middle class and low-income Chicagoans.

I would encourage the Chicago Housing Authority to cease any land grabs or private partnerships, and instead, develop local community processes for land use to deliver on the promises to rebuild public housing in our city. This is how the City and its people and communities can address the housing and humanitarian crisis together.

The City of Chicago needs to work with existing homeowners who are behind on their mortgages or maintenance to rehabilitate those buildings and create new affordable rental units in the process. The CIty can also develop comprehensive plans to support local affordable housing projects such as 18th and Peoria in Pilsen – the largest affordable housing plan in the city. We must ensure that the local average median income and local residents are considered, and encourage residents to apply for quality affordable housing units. With tax increment financing (TIF) reform, those funds can be an important source of revenue. We can also support and invest in innovative models like housing co-ops that create permanent affordable housing units, and encourage the creation of a public bank to ensure fair lending opportunities for Chicagoans.

Finally, we must strengthen tenant protection and pathways to home ownership, and protect naturally occurring affordable housing by capping property tax hikes and working with state officials to 1) create tax breaks for those who keep rents affordable, and 2) change State statutes to assess taxes based on rental income.

2.Yes, I support the proposed Bring Chicago Home ordinance. Any serious housing plan needs to start with a real vision for moving unhoused Chicagoans into safe and affordable housing. Studies have shown that safe and stable housing reduces trauma and crime, and protects some of our city’s most vulnerable residents – ending the continued cycle of displacement and our neighbors dying from exposure to the elements.

The Chicago Housing Authority (CHA) has unfortunately failed in its commitment to build the housing that it promised to residents more than 20 years ago. In 2000, the CHA embarked on a plan to tear down 39,000 public housing units and replace them with 25,000 units. But two decades later, residents are still waiting to see that promise fulfilled. Lots sit vacant, while the CHA gives away land to the Chicago Fire and 65,000+ Chicagoans remain unhoused.

We need more housing at every income level across the city; a moratorium on commercial development on CHA land until the Authority makes significant progress towards building more affordable housing; and a freeze on the transfer of CHA land for non-housing use. We can’t allow public land intended for housing to be auctioned off to the highest bidder.

Brandon Johnson has been a member of the Cook County Board who has represented the 1st district since 2018. Johnson is a Democrat and attended Aurora University. He was a public school teacher and became an organizer with the Chicago Teachers Union.

12 FROM THE STREETS 12

run-off candidates

Get to know the mayoral candidates. StreetWise emailed the run-off candidates the same two questions on homelessness and on how to retain the middle class in Chicago. This is re-printed from StreetWise Vol.31 No. 8 (February 20 - 26, 2023).

PAUL VALLAS

1.We must start with making the City safe. The generational spike in all sorts of crime amplifies decisions by the middle class to leave the city. See my detailed plan at https://www.paulvallas2023.com/ publicsafety.

A few highlights:

Public safety is a human right and I will protect it as one; The Federal Court Consent Decree is a floor, not a ceiling. I will fast-track a standing reform structure within the department that recruits civilian expertise on police reform and operations;

● I will quickly deploy officers back to districts so there is full integrity of officers patrolling and walking beats;

● Community policing must be a philosophy at all levels of the department, a career track in a department that values relationship building.

With safe streets, more individuals, businesses and institutions will stay and invest in growing the city. However, that must occur without gentrification and displacement.

My Community Economic Development Plan, laid out January 31 to the City Club of Chicago, prioritizes true community-led, informed and owned economic development without gentrification-based displacement. Community benefits agreements (CBAs) in proposed plans should prioritize dedication of benefits/resources to local social service support organizations, including mental health and addiction and community health centers. I favor restoring mental health centers closed by the Emanuel Administration and not reopened by the Lightfoot Administration; I would expand them to 22 facilities encompassed by each of the city’s geographic police districts. They would be run by the city, in coordination with county facilities.

I also propose:

• creation of a Municipal Bank to leverage city revenues held by private sector municipal depositories (some with histories of predatory and discriminatory lending), to make available low-interest mortgage and residential rehab loans.

• aggressive revitalization of the CHA to fast-track development of affordable housing, which was not replaced during the Plan for Transformation and for which CHA has not been held accountable.

• city/private investment in vacant land for tiny homes.

• priority in city procurement to businesses that hire and retain returning citizens who have received training in expanded partnerships with numerous non-profits around the city.

Ultimately, community economic development must be ownership in the community by people of the community. This would grow the middle class and help low-income community members enter the middle class.

2.

I support the objectives of the proposed Bring Chicago Home ordinance, but not the methodology.

Homelessness is a crisis at individual, community, city and national levels. Its causes and effects connect to social deficits and crises, such as public health, addiction, mental health, economic inequities. (See 1st question’s answer on mental health centers, drug addiction/treatment facilities, community-led, informed and owned development, CBAs, Municipal Bank, CHA accountability for affordable units not completed during the Plan for Transformation, priority on returning citizens for solutions.)

Each area of deficit must be fixed. That deficit is the noble prompt for the Bring Chicago Home ordinance.

Added taxes to generate income for action for which there is no proposed plan on the table is not responsible governance.

However, I am committed to finding funding that might have been generated from such an added tax from existing programs and resources to achieve the objectives of Bring Chicago Home. That should be collaborative work with the City Council. The current Administration’s parliamentary maneuvering has impeded public debate on this issue and this ordinance.

Paul Gust Vallas is former superintendent of the Bridgeport Public Schools and the Recovery School District of Louisiana, former CEO of both the School District of Philadelphia and the Chicago Public Schools, and former budget director for the city of Chicago.

www.streetwise.org 13

Compiled by Suzanne Hanney / Bios by Emma Murphy

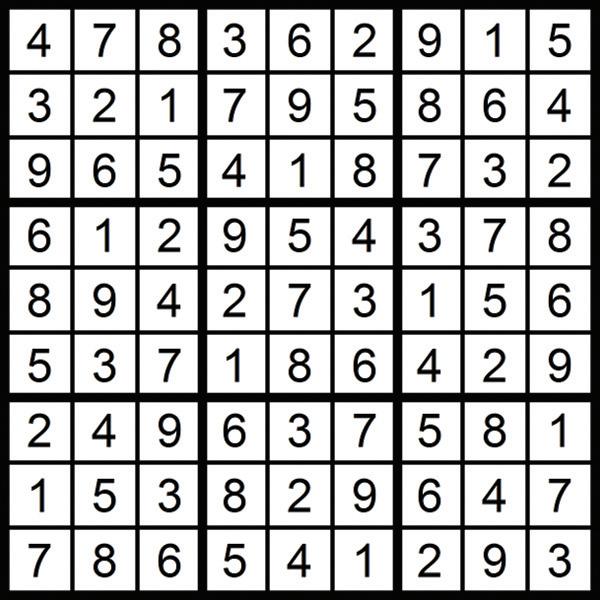

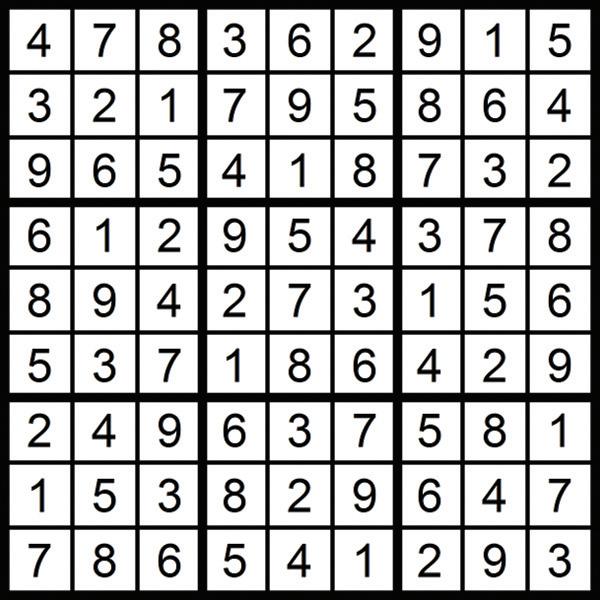

Last week's Puzzle Answers

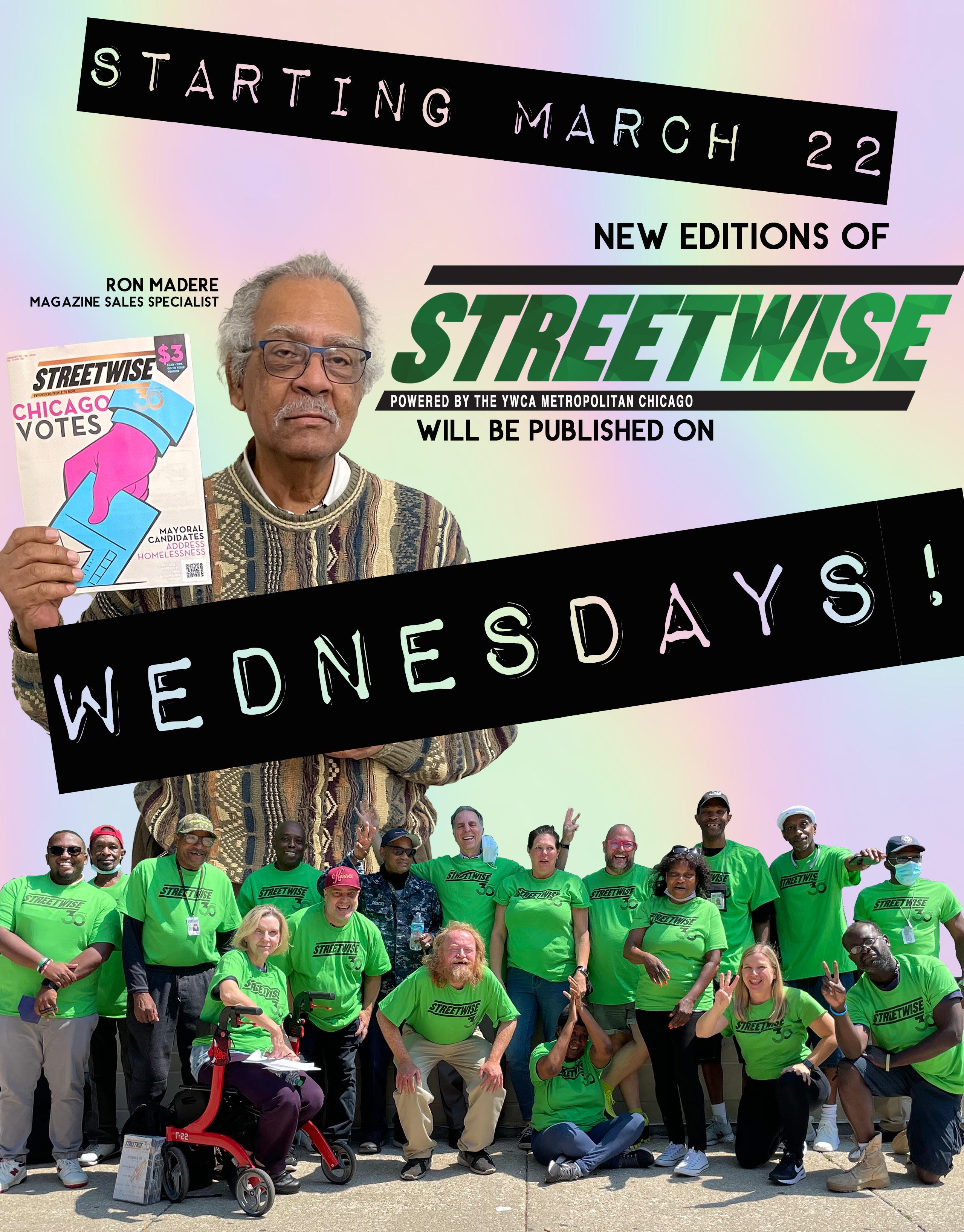

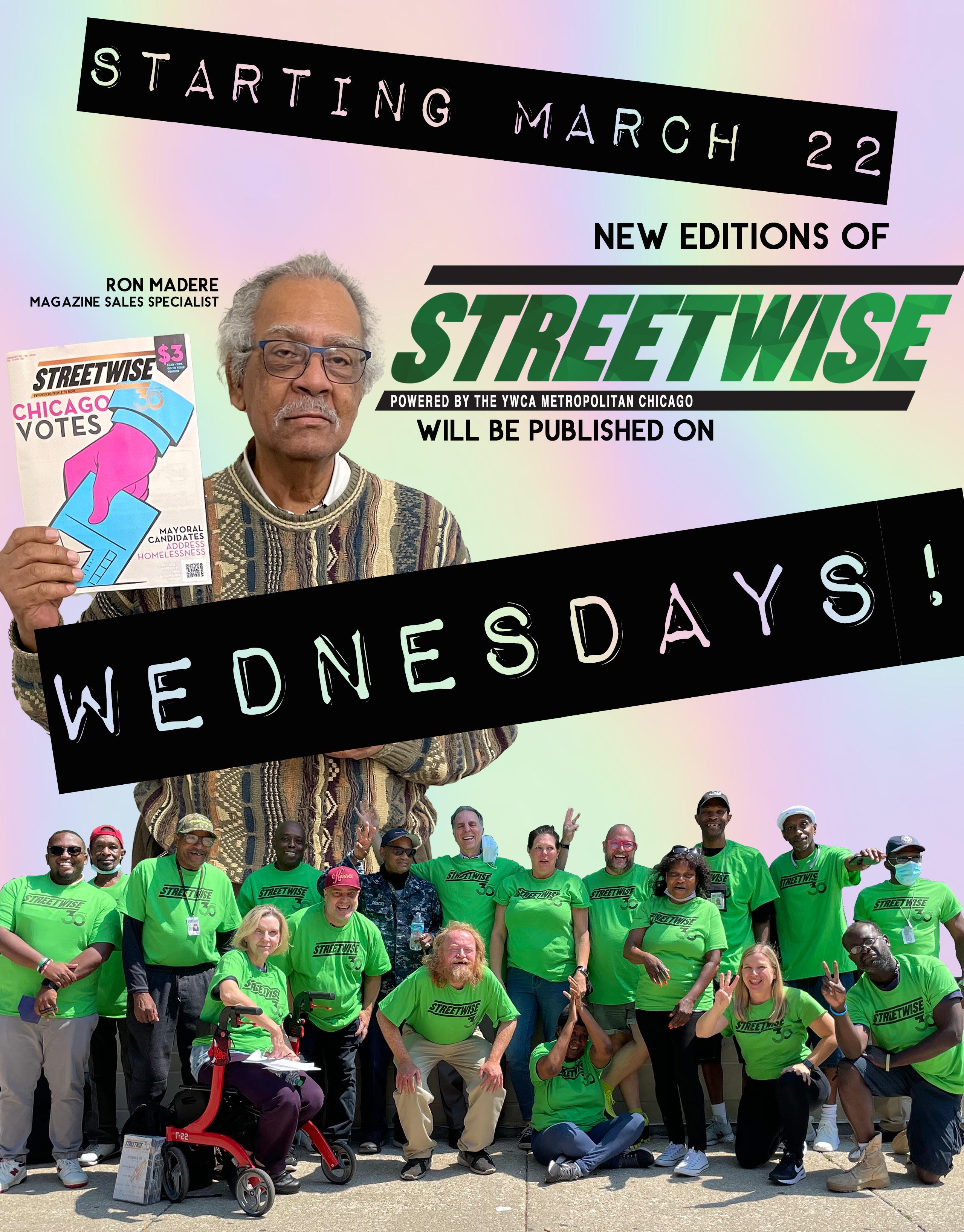

How StreetWise Works

StreetWise exists to elevate marginalized voices and provide opportunities for individuals to earn an income and gain employment. Anyone who wants to work has the opportunity to move themselves out of crisis.

StreetWise provides “a hand up, not a handout.”

All vendors go through an orientation focusing on their rights and responsibilities as a StreetWise Magazine Vendor. Authorized vendors have badges with their name, picture and current year.

Vendors purchase the magazine for $1.15 and sell it for $3 plus tips. The vendor keeps all of their earnings.

Buy the Magazine, Take the Magazine

When you buy the magazine, take the magazine, and read the magazine, you are supporting our microentrepreneurs earning an income with dignity.

New vendor orientation is every Tuesday and Thursday at 10:00 a.m. at 2009 S. State St. Find your nearest vendor at www.streetwise.org

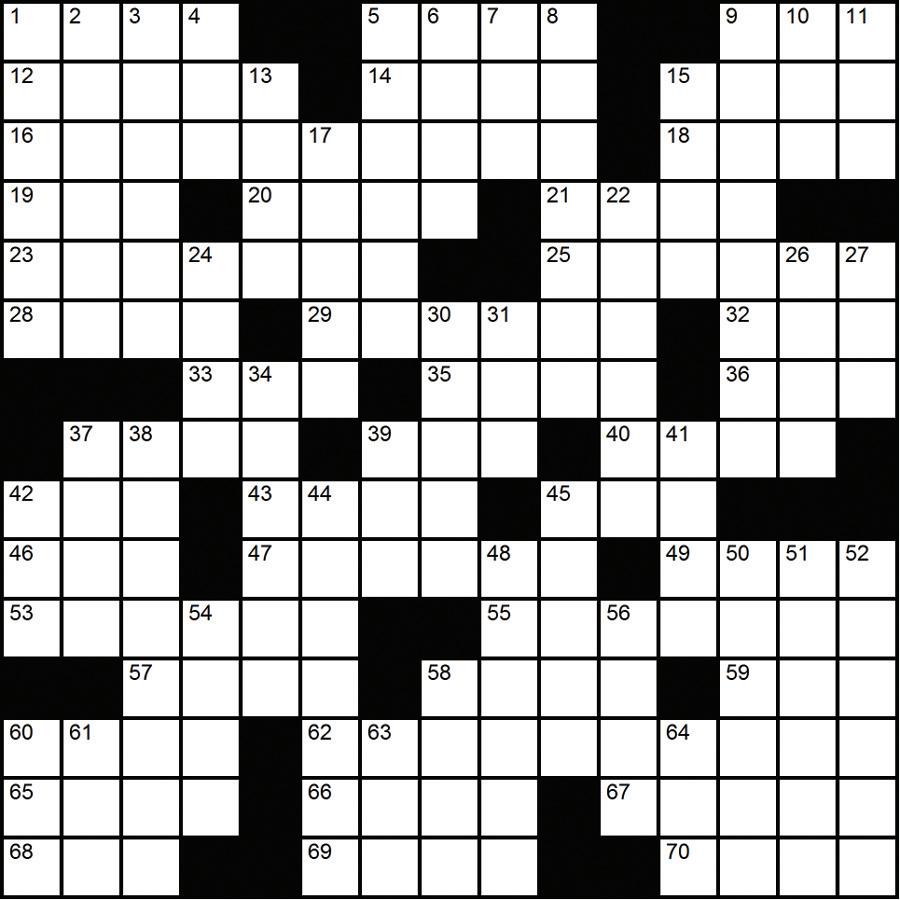

Copyright ©2023 PuzzleJunction.com Solution

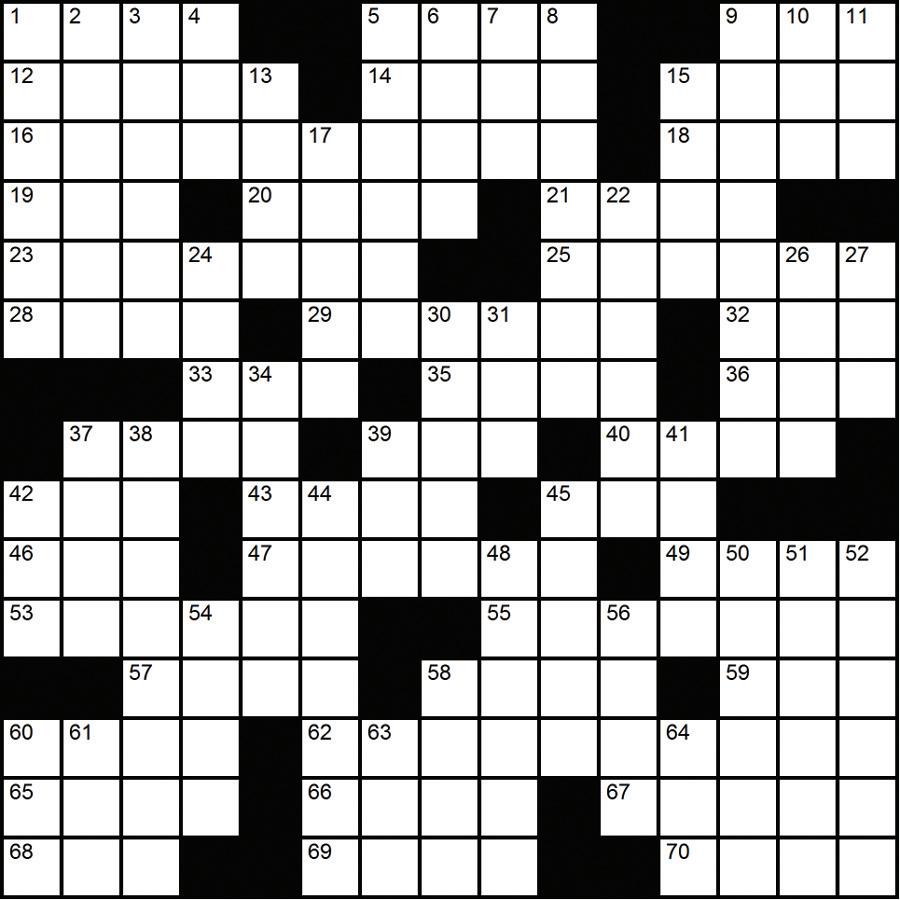

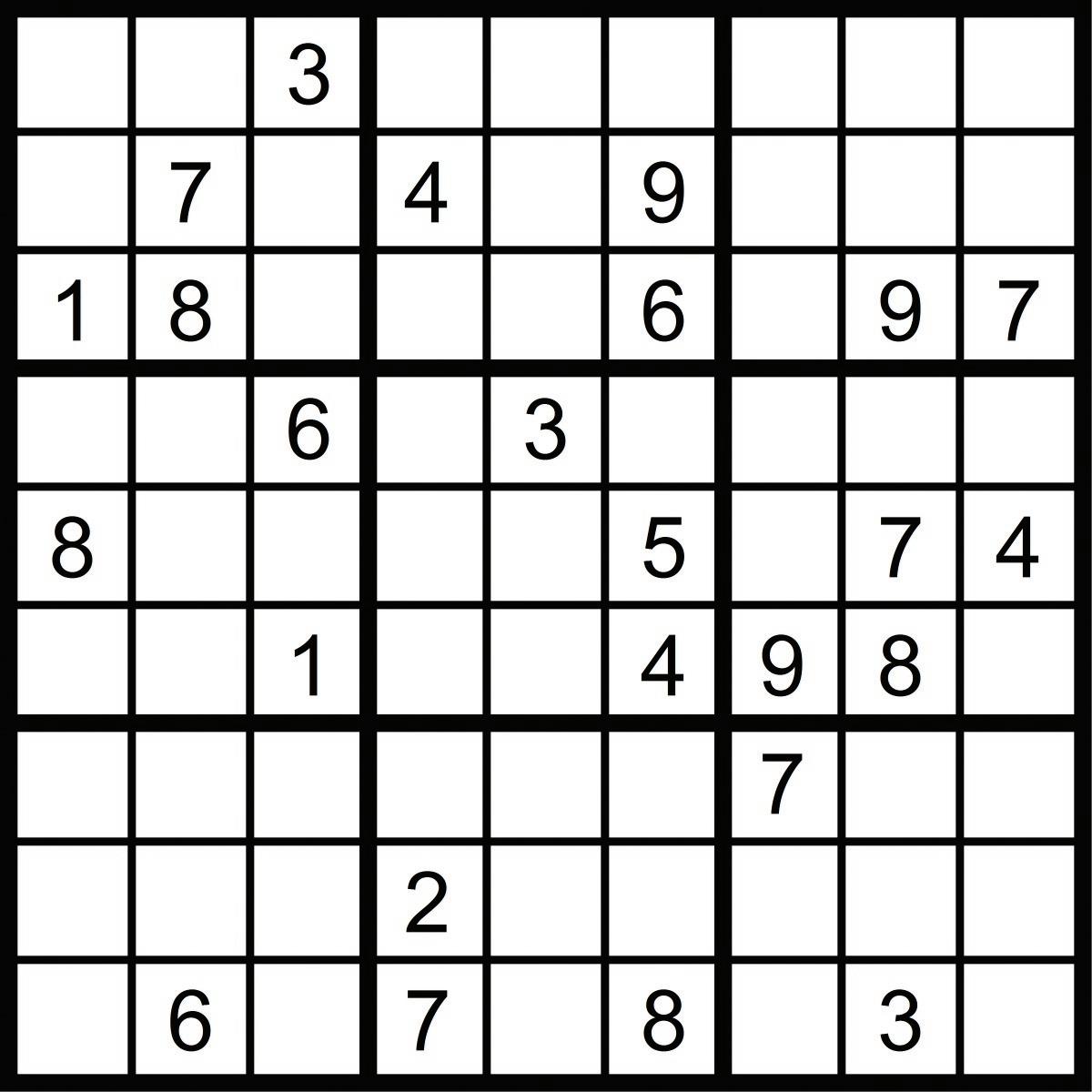

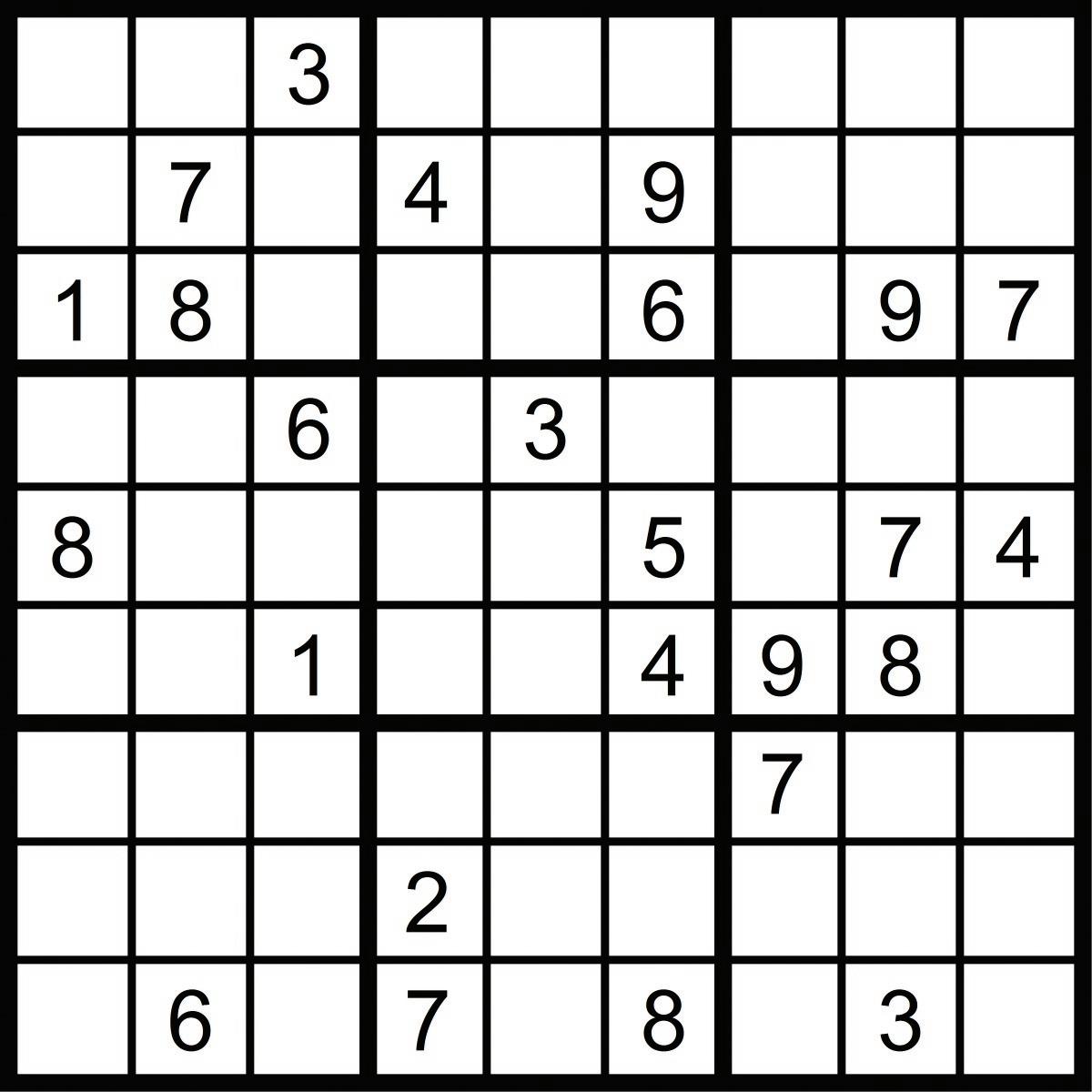

solve the Sudoku puzzle, each row, column and box must contain the Copyright ©2023 PuzzleJunction.com Solution ©2023 PuzzleJunction.com Solution 39 Spread seeds 41 Social slight 42 Brief time out? 44 Nautical rope 45 Boiling mad 48 Lace place 50 Chastise 51 Adorns 52 Fragrant compounds 54 Hoodwinks 56 Quite a party 58 Cowboy boot attachment 60 Legal matter 61 NASA concern 63 Polynesian paste 64 Fire preceder? 59 Cave dweller 60 Destroy 62 Fruit dish 65 Young newts 66 Libertine 67 Backpacker 68 Kind of sauce 69 Soil 70 Clutter Down 1 ___-Lorraine 2 Central area of the retina 3 Pictures 4 Racket 5 Second wife of Henry VIII 6 Stratford’s river 7 Moldovan cash 8 Subjugate 9 UK’s Thatcher 10 Personals, e.g. 11 Vote of support 13 Gulf port 15 Daughter of Saturn 17 Improvise 22 Moon of Uranus 24 Yes votes 26 Wine choice 27 Flyspeck 30 Flock 31 Select 34 Supervisors 37 Type size 38 Forever

To

Streetwise 3/12/23 Crossword PuzzleJunction.com ©2023 PuzzleJunction.com 34 Deli breads 35 Spigot 38 Long-finned tuna 40 News bit 42 Sandpiper 43 Makes amends 46 Andean animals 48 Italian port 50 Fortified 51 Poker ploy 52 When doubled, a Pacific capital 53 Clothes presser 54 Curse Across 1 Trade 5 Kind of gun 8 Very, in music 13 New Zealand bird 14 Exotic vacation spot 15 Rodeo sight 16 Matinee hero 17 Bypass 18 Subdues 19 Confess 20 Dregs 21 Husky burden 22 Classic theater 24 Trio, less one 25 BBQ pin 28 Rigging supporter 32 Wool weight 33 Main arteries 36 Donegal Bay feeder 37 Cathedral instrument 39 Tibetan ox 40 Imbecile 41 Country dance 42 Echo 44 “___ Time transfigured me”: Yeats 45 Mibs and taws, e.g. 47 Tightens up, 55 Get ready, for short 59 Billiards bounce 60 French girlfriend 61 Running behind 62 Plato’s plaza 63 Famed loch 64 Love god 65 Dog treats 66 Dutch city 67 Shipped Down 1 Burlesque bit 6 Little green man? 7 Quarries 8 Carries on 9 Skied 10 A few 11 Wowed 12 Ft. parts 14 Ravel classic 23 Martin or Koontz 24 Old PC platform 25 Hurricane, e.g. 26 Divided land 27 Gardening tool

©PuzzleJunction.com

Crossword

-or-