SA: R42.00 inc Vat Botswana: P33.00 Eswatini: E42.00 Lesotho: M42.00 December 22 - December 28 2022 www.financialmail.co.za ...and now will he actually do something? • Elon Musk — how to lose half a trillion • Arthur Fraser — the man who (almost) toppled a president • Siya Kolisi — the yin to Rassie’s yang • Wayne Duvenage — ‘big business are wimps’ • Putin and Zelensky — cracks show for both sides Newsmaker of the year SPECIAL REPORT: Inside the ANC election Natasha Marrian • Richard Calland • Carien du Plessis • Sam Mkokeli • Claire Bisseker

With 23 offices across 14 countries, we’re here for you and everywhere for your money. If it’s an offshore investment partner you’re after, there’s only one place to start. Right here.

Ninety One SA (Pty) Ltd is an authorised financial services provider.

Investing for a world of change

Isn’t it time to change how you see investing? Ę

Invest globally with the partner you trust locally

financialmail.co.za December22-December 28,2022 December 22 - December 28,2022 . financialmail.co.za 3 facebook.com/ financialmail @financialmail contents facebook.com/ financialmail @financialmail 9 fox Bridge to prosperity ? 20 cover The Teflon president Eswatini:E42.00 Lesotho: M42.00 ...and now will he actually do something? • Elon Musk — how to lose half a trillion — the man who (almost) toppled president Siya Kolisi — the yin to Rassie’s yang • Wayne Duvenage — ‘big business are wimps’ Putin and Zelensky Newsmaker of the year SPECIAL REPORT: Inside the ANC election Natasha Marrian • Richard Calland • Carien du Plessis Sam Mkokeli Claire Bisseker REGULARS 4Editorials 6Letters 8At Home & Abroad 40In Good Faith 47Your Money 57Crossword 58Backstory FM FOX 9Construction 10Another Week 11Trending 11Dinner Party Intel 12Diamonds & Dogs 14Digital 15Pattern Recognition 16Numbers 16Hot Property 17Profile 18Boardroom Tales NEWSMAKER OF THE YEAR 20Cyril Ramaphosa 24Business 25Politics 26Civil Society 27Sport 28International FEATURES 30Special Report: Inside the ANC Election 38Media Freedom Comment INVESTING 42Gold Fields 43Hospital Groups 45The Ghost Train 46Market Watch 48JSE Top Stocks 50Economic Indicators ADFOCUS 52Health Brands FM LIFE 53Travel 55Mind Games 30 features Inside the ANC election 42 investing Questions over Griffith 53 life A nearby island, a world away Cover: Vuyo Singiswa

THIS YEAR’S REAL HEROES

In 2006, Time magazine made YOU the person of the year. It wasn ’t, as you might think, a vote for the South African magazine, but rather a mirror-paged cover that paid homage to the millions of people who “controlled the information age”

Derided as a cop-out and a marketing gimmick, it nonetheless made the point that the burgeoning powers of YouTube, Facebook, Wikipedia and MySpace the social media pioneers were all about the internet’s most important component: its users.

And so, while the FM has made Cyril Ramaphosa 2022’s newsmaker, this year has really been about the South Africans who have kept it together during an interminable 12 months of vicious politics, economic uncertainty, appalling power cuts, rampant crime, and the dysfunction plaguing everyday existence.

Those who watched the ANC’s 55th elective conference, and the obsession with trading positions rather than discussing actual policy, wouldn’t have got much of a sense that party leaders cared about these realities.

Which isn’t to say other parties have behaved much better.

There is the EFF’s endless parliamentary distractions; ActionSA’s vile anti-immigration rhetoric; and the DA’s lack of basic EQ on full display on social media. Few of South Africa’s office-holders seem to be focused on actually doing what their job entails: serving those who pay their salaries.

And yet, it’s the working- and middleclass taxpayers who are routinely ignored by state functionaries. And it’s the mushrooming indigent class, queuing for welfare grants, who remain at the mercy of populist politicians who have done little to open up avenues for a better economic life.

Business owners have lost hours inching

Editorial Editor: Rob Rose.

Deputy editor: Natasha Marrian.

Writers: See bylines for writers.

along roads where traffic lights are dark, ignored by road traffic management authorities who, due to their delinquency, have no legitimate claim to a salary.

Yet these entrepreneurs pay staff despite factories being without power for hours. They wait while officials whose salaries they pay fail to answer phones, reply to queries, or do their jobs.

Those who can afford it have abandoned public health care and state education. Rather than rely on an inept police force, they shell out for private security and have bought inverters or generators to do Eskom’s job. Yet they keep paying the government, despite its absence.

Workers, and the poor, have it worse. They have no option but to rely on the state for health care and education, and risk their lives taking bashed-up taxis to work since buses are few. Trains, thanks to the shambolic management of the Passenger Rail Agency of South Africa under the equally shambolic Fikile Mbalula, are absent.

Their take-home pay is dwarfed by the wages of the political elite. The average nominal South African salary (after deductions), according to the latest BankservAfrica economic index, was R15,489 in October.

Yet ministers draw a monthly salary of R206,000 and their deputies make R170,000 and they get taxpayer-funded generators at home, so they can avoidload-shedding.

Meanwhile, the country’s GDP per capita has gone backwards over the past 10 years from $8,810 in 2011 to $6,994 by the end of 2021. This, right here, is evidence of a lost decade.

Our wish for 2023 is that a newly reelected Cyril Ramaphosa finally pays real attention to the economic tragedy happening on the ground, including among those who pay to keep the country running. x

Subeditors: Magdel du Preez (Chief), Dave Landau (Deputy), Dynette du Preez.

Proofreader: Norman Baines.

Editorial tel

financialmail.co.za

Financial Mail is a wholly owned subsidiary of:

Assistant editors: Shirley de Villiers, Giulietta Talevi, Archie Henderson.

Digital editor: Nelisiwe Tshabalala

Managing editor: Kevin O’Grady.

Contributing editors: Sarah Buitendach, Bruce Whitfield, David Williams.

Creative director:Debbie van Heerden.

Contracted artists: Colleen Wilson, Vuyo Singiswa Graphics & statistics: Shaun Uthum.

Photographer: Freddy Mavunda.

Personal assistant to the editor: Onica Buthelezi.

Office assistant: Nelson Dhlamini.

editorials

editorials

FACING A GRIM FINALE

It’s been five years in coming, but it seems South Africa’ s most notorious company, Steinhoff, may have reached its sell-by date.

Last week, Steinhoff announced that shareholders will have to vote on a plan to hand over 80% of the company to creditors in exchange for deferring the repayment of debt from 2023 to 2026.

It means shareholders will retain just 20% of the company but that’s actually the best-case scenario: if they veto the plan, the financiers will take over the entire company.

It’s a case of Hobson’s choice for shareholders, who have seen the value of R100,000 invested on December 1 2017 dwindle to R1,013 today. But after an earth-shattering fraud of R106bn, few would have expected Steinhoff to still be going.

That it has survived is due to its strong assets including 51% in Pepkor (worth R37bn) and 78% of Pepco (worth an estimated R67bn). The problem is, they’re not chalking up profits fast enough to dent Steinhoff ’ s €10bn debt.

Some shareholders will grumble that Steinhoff surely had other options. But for those who hung on, it’ s a grim denouement. x

Johannesburg: (011) 280-5808/3000.

Cape Town: (021) 488-1700

Group Sales & Marketing

Head of advertising sales: General number: (011) 280-3710/3183

Advertising enquiries:

TEL: 011 280 3204

CPT: 021 488 1700

KZN: 031 250 8500

Email: advertising@arena.africa Website:adroom arena africa

Classified advertising Tel: 011 280 3435 Email: classifieds@arena.africa

Subscriptions

Subscription customer services hotline: Domestic 0860 525200. E-mail: helpdesk@ businesslive.co.za

Subscriptions (annual rates: 50 issues): South Africa R1,374.96; R1,031.20 (senior citizens).

4 4

financialmail.co.za . December 22 - December 28,2022

letters

The ANC vortex of doom will take us all

The image of the ANC is so severely battered that it is difficult to imagine what the party will look like after its national elective conference. Ordinary ANC members, and South Africans in general, are disillusioned with the party leadership. The party has to deal with a host of factors that contributed to the current paralysis. The Phala Phala scandal has compounded issues.

The organisation has been rudderless since the 2007 Polokwane conference. Jacob Zuma contributed largely to the decline and loss of direction but the situation has not improved under President Cyril Ramaphosa. The ANC has abandoned its core values, and institutions without core values seldom survive calamities that come their way. A prominent academic once argued that part of the reason churches survive scandals is that they immediately fall back on their core religious values to rally their membership.

Will the ANC survive its internal turmoil? Is there a rescue plan? The party’ s warring factions appear to be preoccupied with the quest to control state resources for their private benefit.

All this is unfolding against a background of poverty, sluggish economic growth and international markets in turmoil. The country’s economy has not fully recovered from the impact of the pandemic. Moreover, the international ratings agencies are watching developments in the ANC closely.

The late Ethiopian leader Meles Zenawi once poignantly said: “The only bright light across the dark African skies of the 1990s was the liberation of South Africa.”

The ANC, since the dawn of democracy in 1994, has not only betrayed the hopes and aspirations of South Africans but of the continent as well.

Our situation is worsened by the absence of strong opposition parties that have any prospect of taking over from the ANC. The opposition has not offered a compelling alternative vision

to that of the ANC.

What is the way forward? The president, the top leadership and the national executive committee have not given us any reason to think the ANC can save itself.

The ANC is too big to fail and if it goes down, it will go down with all of us, irrespective of our political affiliations.

Mpumezo Ralo Gqeberha

A dead jackal wins no votes

Anyone in the field of advertising will be able to talk for ages on the subject of “brand value” .

Observing the run-up to the ANC shindig, it does seem the final battle is about the soul of the once respected and mighty ANC. While the winners may lay claim to the soul, would anyone in their right mind want the brand of the battered party?

Whichever faction goes to the polls as custodian of the party in 2024 would be well advised to distance itself as far as possible from Brand ANC, which is starting to smell like rotting roadkill in the summer sun. But then, boy, have they worked hard at achieving just that!

Michael Hook Parkhurst

online

Ramaphosa’s opening speech was delayed by hours as the registration process dragged on and one ANC staffer blames load-shedding. The ANC top cadres care about Eskom only because it might cause them to lose power in 2024. They are insulated against almost all the ills that they have caused in this country.

Sandra Goldberg

There is only one conversation: Eskom and how to save it. South Africa will die if solutions are not implemented right now. The only silver lining is that every time the power goes out, more voters leave the ANC.

Andrea Robertson

Cyril Ramaphosa trounces Zweli Mkhize and his allies. The financial woes of the ANC have been well documented. Why has nobody inquired how the ANC paid for a conference of this proportion, given its money problems?

Allan Wolman

The Eskom CEO’s resignation comes after an astonishing broadside from the minister of minerals & energy, including accusing De Ruyter of acting ‘like a policeman’ . There are a lot of powerful people in South African business, powerful because of their knowledge in various fields of expertise, their authenticity, their empathy and logic. This situation calls for brainstorming by all business leaders. We cannot sit on the sidelines and complain.

Anne Lloyd-Hughes

Anne Lloyd-Hughes

Correction

In an editorial (Ramaphosa Faces New Risk Over Zuma Judgment, November 24), the FM incorrectly implied that Jacob Zuma himself called for the country to be burned down in July 2021. Zuma was in prison at the time, while it was certain of his supporters who had agitated for the continued violence. We apologise to the former president.

you said... The FM welcomes concise letters from readers. Letters must carry the name and address of the sender. They can be sent to The Editor, Financial Mail, PO Box 1744, Saxonwold 2132. E-mail fmmail@fm.co.za 6 6 financialmail.co.za . December 22 - December 28,2022

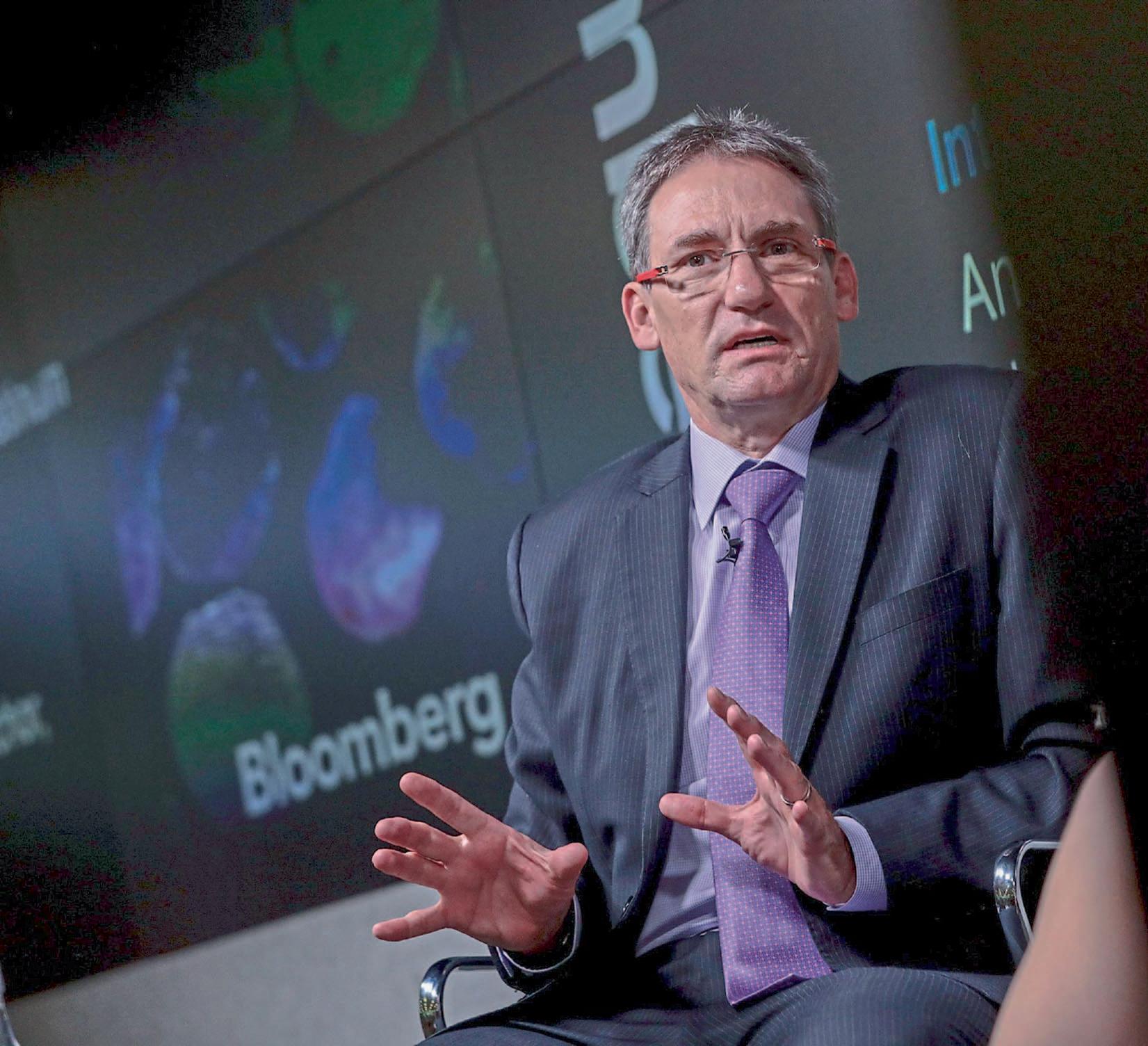

André de Ruyter

Freddy Mavunda

KINGJAMESJHB 6463

at home & abroad by Justice Malala at home & abroad by Justice Malala

CYRIL’S MISSING LETTER TO SANTA

By some magic, our president hopes to get a belated spine implant

Santa was bored. His collar was sticky, despite it being the North Pole. He was hot. It was all that climate change business. Humans, he grumbled. Can’t get them to do the right thing even when their lives depend on it. They’ll just continue to burn fossil fuels because that fellow Gwede Mantashe in South Africa told them they won’t make money any other way.

Santa harrumphed and glanced at his mail. Sticking out of the bag was a letter that looked tatty, as though it had travelled far. He pulled it out. Lo and behold, it was from the Land of Gwede and Cyril Ramaphosa.

Santa peered at the postmark. Ah, It was five years late. It had been posted in December 2017, when Mark Barnes was still CEO of the South African Post Office. Santa remembered Barnes. “I’ll fix it,” Barnes had told his boss, Jacob Zuma, back in 2016 when he took the job. Five years later, letters to Santa still arrived late. Ahem.

“Ho, ho, ho! So it goes.” Santa opened the letter from 2017. He squinted and glanced at the bottom to see who had written it.

“

Enthusiastically, Cyril Ramaphosa”, was scrawled at the bottom. Imagine that, muttered Santa.

“Dear Santa,” he read. “I have just been elected ANC president and, boy, things are going to change around here. I know that letters from kids across South Africa have not been reaching you, and that presents sent by grandmothers and relatives have disappeared into the clutches of thieving

postal workers and the thieving syndicates that work at the post office. Don’t worry! I will fix it. I’ll get Eskom back on its feet and load-shedding will be a thing of the past. I’ll fix it all! The economy, the crime, the toxic politics everything!”

The letter went on in that vein for a while, with many exclamation marks, until the last paragraph: “In conclusion, dear Santa, I want to ask for just one present this year: a backbone!”

Santa reeled. This letter had been sent five years ago. How had he not seen it before? What had this poor man done for five years without a backbone? Santa rushed to his time machine and punched in the name “Cyril Ramaphosa”. An image of a beaming billionaire entreating the country to sing Thuma Mina and break into a “new dawn” dance came up.

Then the picture took on a grey, omi-

nous hue. The music changed to a slow, mournful dirge.

Santa saw the same man surrounded by a large group called a “cabinet”. There were all sorts of people Santa recognised among them including the do-nothing ministers who had served Zuma loyally. Santa looked at Ramaphosa. The man was slumped in his chair. He did not have the backbone to fire the unfit members of his cabinet.

The video then showed a Barbie-like figure, hovering over a desk, instructing a man who looked uncannily like a fugitive from the law in the US, to write an op-ed piece for her. She called judges racist names, denigrated the constitution she served, and called Ramaphosa a liar. He did not fire her. He did not have the backbone he had sent for.

The images were changing swiftly now. They showed a discredited leader, a former jailbird, calling Ramaphosa names and laying charges against him to unseat him. The president smiled, unable to call the hypocrite out. Ramaphosa had not received his present, the backbone, in the post.

Santa was sweating profusely now. The images on his time machine showed many opportunities when his letter writer could have displayed some spine but had not. Santa put his head in his hands in despair. He rushed to his emergency stocks, grabbed a backbone, wrapped it up, wrote the name and address on the parcel and added in bold that, by hook or by crook, it had to be delivered before Christmas 2022.

“Now he will be able to crack the whip,” Santa said, putting the delicate present in the mail.

Then he realised that he was at the mercy of the South African Post Office. He started weeping.

Merry Christmas, dear reader, and a happy 2023. x

8 8 financialmail.co.za . December 22 - December 28,2022

123RF/olegerin

CONSTRUCTION Bridge to prosperity ?

Cape Town pins big hopes on a traffic circle in the sky

Sandiso Phaliso

Sandiso Phaliso

● A “sky bridge” across two of Cape Town’s busiest roads is expected to open up economic opportunities for many of the city’s poorest residents.

Work on the bridge is due to start next year, unlocking one of the city’s worst traffic bottlenecks, creating thousands of jobs and easing the flow of people from the sprawling Cape Flats to the city centre, say council officials.

The 6.2m-high bridge, or elevated traffic circle, is the first of its kind in South Africa and will take four years to build.

It will be built at the busy intersection of Jan Smuts Drive and Govan Mbeki Road (formerly Lansdowne Road) in Lansdowne to the southeast of the city. Along with cycling and pedestrian lanes it will be for the exclusive use of the MyCiti bus service, speeding up public transport in a city that can no longer rely on a suburban train network that is operated by the central government, which has allowed it to fall into disrepair.

The significance of the sky bridge cannot be exaggerated,

according to officials who have described it as an economic lifeline for some of the most deprived parts of Cape Town. The project will benefit the neighbouring suburbs of Hanover Park, Philippi, Lansdowne, Wetton, Gugulethu, Nyanga and even Mitchells Plain.

It’s also an imaginative project that could help the city to put behind it some of the mockery for a freeway that ends in midair on the city Foreshore. Mayor Geordin HillLewis says the bridge will showcase innovative engineering and will extend the MyCiti bus service to the city’ s neglected southeast.

Hill-Lewis says projects such as a sky bridge and the expansion of road networks are critical to building the city’ s infrastructure. About R15m has been budgeted for temporary jobs on the bridge and another R15m for local residents who are registered on the local jobseekers database and will be trained for the construction

work. The mayor has appealed to communities to protect teams working on the bridge and roads from acts of violence and intimidation. It seems clear he has construction mafias in mind.

The Western Cape government, the municipality and communities in the Athlone district, of which Lansdowne is part, have welcomed the building of the bridge, saying it will be an improvement for many.

Local people interviewed say the investment in the bridge will help reduce unemployment and poverty and will attract investment to the area. Hill-Lewis says the bridge will

First of its kind: What the envisaged sky bridge will look like

also improve safety for motorists and pedestrians, and lead to a mushrooming of more developments.

The city says it is aware of the impact the construction industry and procurement have on millions of people across the province, not just in upmarket locations, but in the heart of the Cape Flats.

“The city has a responsibility to make sure people are at the forefront of the development plans, which is why labour will be sourced locally,” says Hill-Lewis.

By creating special bus lanes, the city hopes to deliver an efficient MyCiti service

December 22 - December 28,2022 . financialmail.co.za 9

Digging up unusual, interesting tidbits in and around the business scene

between Mitchells Plain, Khayelitsha, Wynberg and Claremont without being delayed by general traffic congestion. Such a system already operates effectively along the west coast to Milnerton, Table View and Melkbos.

Mayoral committee member for urban mobility Rob Quintas tells the FM: “We are working day and night to improve our public transport service offering to Capetonians. Public transport should be accessible, convenient, affordable, reliable and safe. We are committed to these goals. Improved mobility means improved productivity, more jobs and economic growth, and better lives and futures for all of us who call Cape Town home.”

As with most road upgrade projects, lane closures will be necessary

Hill-Lewis says: “Every resident of our city should have access to world-class public transport. This is not the preserve of wealthy areas, but for all areas and residents. Dedicated infrastructure such as [the sky bridge] is smart and cuttingedge, and also helps build community pride.”

As with most road upgrade projects, lane closures will be necessary and will remain in place until April 2024.

Residents have hailed the project as transformative, and one that will make life much easier for them, in terms of commuting.

Imam Davids, a community leader in Hanover Park, tells the FM: “Let’s see what happens after construction has started. It’s a good project and if it works as they say it will, then it will solve a lot of problems for us. Besides creating job opportunities, mobility will be much easier than before.” x

10 10 financialmail.co.za . December 22 - December 28,2022 Source:Statista ARE YOU NOT ENTERTAINED? BY THE NUMBERS Estimated global revenue from video games, books, filmed entertainment and recorded music in 2021/2022 Video games (mobile, console and PC) Books (print and e-books) Filmed entertainment (home and theatrical)* Recorded music (physical, digital and others) $192.7bn $120.1bn $99.7bn $25.9bn *Excludes pay TV

ANOTHER WEEK

Reuters/Lisi

Niesner

CHRISTMAS RUN These runners in the German of town of Michendorf like to get into the Christmas spirit early. A few days before December 25, they dress up as Santa Claus for the annual Nikolaus Lauf (Saint Nicholas) half-marathon. Saint Nicholas Day is celebrated before Christmas every December in Germany.

TRENDING

Messi helps a nation feel better

Argentina is a country in trouble, but on Sunday there was some respite

DINNER PARTY INTEL...

The topics you have to be able to discuss this week

1. Mismanager returns

Paul Ash

● Agile. Versatile. Glorious. Playmaker. Extraordinary. Finessing. Sumptuous. Gumption. Nail-biting. Magician. Fireworks. Exploded. Acts of alchemy.

These are just some of the words and phrases an excited press corps has vigorously employed to describe the Soccer World Cup final between France and Argentina and the star Argentine player, Lionel Messi in Doha, Qatar.

Other words making it to the pages include grisly, dark arts, pièce de résistance (fine as long as you’re not a French player or citizen), tension, despair and suffered another word that was purloined, just like the World Cup, from the French.

Those last words could as easily refer to Argentina’ s economy over the past two decades as to the Scaloni bus rattling to victory in the Lusail Stadium on Sunday night.

Inflation is running at 92% in Argentina. The country’ s popular vice-president, Cristina Fernández de Kirchner, has been sentenced to six years in jail for defrauding the state in public works contracts worth $1bn. The peso has declined 75% in value against the dollar in the past three years, and 37% of the population live below the poverty line, according to The Economist.

MessibreaksWorldCup appearancerecord

Playerswiththemostmatchesata footballWorldCupsince1930

Lionel Messi

Lothar Mathaüs Miroslav Klose Paolo Maldini

Cristiano Ronaldo

Uwe Seeler

Wladyslaw Zmuda Diego Maradona

Playersthatarestillactivearehighlightedinbold AsofDecember19.2022

Source:Statista

And there, coming up in the middle, is Argentina’ s monstrous fiscal deficit, running faster than Lionel Messi with a football at his feet.

The country has a $44bn bailout from the International Monetary Fund to shore up the peso, but the fund in turn demands much tighter monetary policy, which the government has failed to implement.

That it has failed to do so is largely because it, like its various predecessors, has been unable to wean itself off social welfare largesse or “Peronism”, to use its better-

known moniker such as hefty subsidies for electricity and transport, which are great for the people but cannot be paid for by printing more money.

Sunday was a respite, then, for Argentina. Thousands surged to the Obelisk in central Buenos Aires, braaied, honked car hooters, partied, drank and cried rivers of joy, which helped take their minds off the perilous state of the nation.

For tomorrow is another day and maybe even another government. Today, though, it is simply just Messi. x

Lonwabo Ngoqo, who was barred from working as a municipal manager for 10 years after being found guilty of financial mismanagement in 2012, will start work in that position at the Matjhabeng municipality (Welkom) next month. Matjhabeng has the most corruption cases of all municipalities that are being investigated by the Hawks.

2. Bets off the parade

There have been objections, especially from Cape Town Muslim communities, to a gambling company sponsoring the city’s annual new year minstrel parade. Osman Shabodien, of the Bo-Kaap Ratepayers Association, says a sponsorship by Hollywood Bets is wrong because gambling is haram (forbidden) in Islam. The Bo-Kaap is the traditional starting point of the parade.

3. Military band

It was the most famous military enlistment since Elvis Presley’s in 1958. This month Kim Seok-jin, a member of BTS, a South Korean boy band, reported for compulsory military service after turning 30. The other six members will follow Kim into the army, a band spokesperson said. Service is between 18 and 21 months. Presley, who rose to sergeant, served two years.

11 21 21 21 23 24 25 22 26

December 22 - December 28,2022 . financialmail.co.za

DIAMONDS & DOGS

BY JAMIE CARR

GamesWorkshopTesla

Cashing in on chaos & conflict Driverless carmaker

Fantasy games have long been enjoyed by the sort of people who have an above-average chance of hitting the headlines as proud proprietors of a dungeon in a basement where residents are kept manacled to the wall, but they have become a sizeable business. Nottingham-based Games Workshop is responsible for unleashing Warhammer 40,000, which may not exactly be a household name but among cognoscenti is the most popular miniature war game in the world.

It is set in the distant future, where a stagnant human civilisation is fighting it out with hostile aliens and supernatural creatures. Its devotees spend a fortune to assemble armies to fight battles between the forces of Chaos and the Imperium of Man. Games Workshop sells the rule books that are essential to navigate the bewildering complexity of this fictional universe, the model parts that players then assemble and paint, and all the peripherals such as dice, measuring tools, paints and glues.

Amid all the chaos generated since Elon Musk bought Twitter, perhaps the most alarming is the feeling that he is so distracted that he has gone completely Awol from Tesla. Since he paid $44bn for Twitter, it has been one catastrophe after another. He’s laid off half the workforce, advertisers have been running for the hills and there is already talk of a possible bankruptcy. Despite saying in April that there would be no further sales of Tesla stock to fund the Twitter deal, he has now cashed out about $23bn to cover the funding shortfall.

Even some of his most devoted fans are now revolting. Leo KoGuan, reported to be the third-largest individual shareholder in Tesla, has gone on record as saying: “Elon abandoned Tesla and Tesla has no working CEO.”

‘Elon abandoned Tesla and Tesla has no working CEO’

The company has more than 500 stores worldwide, is highly profitable and fared well during the pandemic, thriving in a situation where its customers were stuck at home with nothing else to do. It is poised to make a quantum leap forward after announcing a deal with the mighty Amazon to develop films and television programmes based on its characters, and its share price rose 14% when the deal was announced. The hope is that this will bring the universe of Warhammer to a whole new audience, driving growth in the core business as well as delivering material royalty income. x

financialmail.co.za . December 22 - December 28,2022

Musk’s share sales have helped crash Tesla’s share price, which has dropped from $399 at the beginning of the year to $158 last week, though clearly some of that collapse must be attributed to the broader sell-off in tech stocks. KoGuan also says “ an executioner, Tim Cook-like is needed, not Elon”

All the distraction is far from needed when Tesla is facing other major challenges, given that traditional car manufacturers are finally getting to grips with the electric vehicle market, Chinese manufacturers such as BYD are expanding into Europe and there is the real possibility that Tesla will get frozen out of the Chinese market if trade relations between China and the US continue to worsen. These are difficult times for the company, and it needs hands on the wheel. x

Let’s ignore the roughly R24bn paid for David Jones, not to mention the subsequent billions bled from Woolworths’s share price as surprise the acquisition of an outdated department store didn’t pan out the way then CEO Ian Moir thought it might. Current CEO Roy Bagattini has finally removed Woolies’s Australian albatross along with itsR17bn of liabilities in a deal that looks to be no fire sale. Now management can finally focus on what it should have all along the core South African business and its Country Road operations in Australia. x

good week bad week

Lindiwe Sisulu’s fall from grace has been a vertiginous plunge into the political abyss. Seldom has a collapse been as dramatic or as sudden. One minute a minister of state, ANC “royalty” and the only survivor of a Mandela cabinet; the next, nothing. All she got for years of service to the party were fewer than 50 votes in a presidential nomination from the floor of the ANC conference this week and a lot of mocking laughter. Not a nice way to leave the building, but the vanity she brought to her jobs may have been her undoing. x

12

A R6.4 BILLION RETAIL DEAL THAT ADDS VALUE TO ALL

.

Corporate and Investment Banking

When we partnered with Massmart as advisor on their purchase and subsequent delisting by Walmart, we helped ensure that the outcomes were set to far exceed the significant foreign direct investment of R6.4 billion.

Not only is this landmark deal an overwhelmingly positive vote of confidence in South Africa by the world’s largest retailer, but the substantial capital inflow wilL revitalise Massmart’s businesses – securing thousands of jobs, unlocking value for minority shareholders, and boosting local economies in the process. A deal, in other words, to ensure that nobody is left behind.

To find out more about a deal with benefits beyond the boardroom, visit standardbank.com/cib

The Standard Bank of South Africa Limited (Reg. No. 1962/000738/06).

Authorised financial services and registered credit provider (NCRCP15). GMS-21377 11/22

It Can Be is a registered trademark of The Standard Bank of South Africa Limited.

Also trading as Stanbic Bank

Also trading as Stanbic Bank

DIGITAL

Solving the Eskom problem with data and maths

How the utility’s crisis played a small part in the formulation of an algorithm to help other companies manage organisational risk

Toby Shapshak

● On a sunny day in Belgrade, sitting at the splendid Kafeterija, Ivor Chipkin was looking over the data from his state capture research, when he and his Serbian wife, Jelena Vidojevic, noticed a pattern.

Despite the romantic setting, the data was prosaic. Charts showed data from Eskom andfrom Russian and Brazilian state power companies.

Afterwards, in a discussion with Vidojevic’s colleagues at the University of Belgrade, they wondered whether there was a mathematical way to describe some of the regularities in the numbers. There was.

“It was the breakthrough moment,” Chipkin tells the FM. “If the phenomena we were looking for could be described mathematically, then we were no longer confined by traditional social science methodologies.”

It would allow different kinds of “evidentiary sources” , such as data from large organisations, to be used in organisational analysis. “It took us on a new, exciting journey.”

At last, something good has come out of those “nine wasted years ” and the financial devastation inflicted on our country, before the social and economic

tsunami of the Covid lockdown hit South Africa’s already onits-knees economy.

Chipkin’s research report of 2017, writtenwith several colleagues, was the first major academic study of state capture in South Africa.

The release of the “Betrayal of the Promise: How South Africa is Being Stolen” report was like exploding a bomb in this country’s politics. It was a defining moment, showing the Jacob Zuma era’s depravity and the extent of the corruption during his presidency.

Chipkin has since written the book Shadow State: The Politics of State Capture, with Mark Swilling.

That moment in Belgrade became the genesis of not only a new way of interpreting state capture data but also an algorithm that Chipkin and co have created to understand organisational risk in other countries and companies.

“I became preoccupied with the question: ‘Could we have seen this coming?’” Chipkin tells the FM.

Vidojevic is also an academic. She met Chipkin while on a fellowship at the University of Cape Town.

“Together we started gathering data on organisations and

interpreting it. Jelena lived through the break-up of Yugoslavia,” he says.

After examining the Eskomrelated data that day in Belgrade and later with some academic friends, Chipkin and Vidojevic realised that neither of them had the maths skills or the ability to work with huge datasets.

They partnered with Daniel Saksenberg and Laurence Rau in Joburg and formed a new company, Safe Passage. Chipkin says the company offers a “safe passage through these stormy times”

Safe Passage has a novel approach to analysing a company, a country or even just a department.

It looks at a range of data to predict whether that organisation has the capacity, intellectual property and wherewithal to deliver on its business plan and objectives.

“We take and model sources of data from all over the organisation, including financial and human resources data, to produce an overall view of the company or department or office.

“Most importantly, the combination of data modelling and social science techniques means we can tell the differ-

ence between a mere correlation and a causal relation,” he says.

Traditional organisational risk assessment tools largely use financial data. “Yet financials are the fire after the reaction,” says Chipkin.

“In a nutshell, we have produced a way of monitoring and predicting organisational risk. It may be a world first.”

Safe Passage’s work on Eskom one of the worst sites of corruption is an example. The energy supplier battles to keep the lights on and service its debt from its declining revenue.

Eskom dropped the country to stage 6 rolling blackouts last week and after political pressureCEO André de Ruyter has resigned.

“We found a correlation between the deterioration of the technical performance of Eskom the number and frequency of boiler repairs is a good measure of the performance of a power station, for example and instability in the senior management. If this sounds obvious, it is not,” says Chipkin.

“In Eskom there used to be a saying: ‘There is God and then there is the power station manager.’ With their own manage-

14 14 financialmail.co.za . December 22 - December 28,2022

ment teams, power stations mostly operated autonomously from the general Eskom management. These power station managers not only took operational decisions like the temperature of boilers but played a key role in the procurement of coal and in adapting systems based on the quality of the delivered coal.

“In other words, if there was turbulence in the general management of Eskom it shouldn’t have affected operations in the power stations themselves directly.” Yet Chipkin and co’ s modelling showed that from about 2008 there was a direct correlation.

“What was going on?” Chipkin wondered. “Essentially, from about that time a new Eskom management began to centralise decisions that used to be the domain of power station managers. It was done ostensibly to improve efficiency and to drive organisational transformation.

“So as the senior management was ‘captured’ and became unstable, this turbulence was transferred directly into the power stations themselves. This is at the core of Eskom’ s current problems. The capacity of the power stations has been hollowed out.”

It seems fitting that, having caused so much damage, Eskom’s issues have unwittingly and indirectly played a small part in the development of an algorithm to help other companies manage their organisational risk.

Chipkin says: “What excites me the most is that the methods and technologies we have developed are largely born from our experiences growing up in societies in transition, undergoing major political and institutional change.

“These experiences provided not simply the impetus to innovate methodologically, they helped us develop the very tools themselves.” x

PATTERN RECOGNITION

The year Big Tech lost its

Amazon shed $1-trillion in market value and Facebook has dropped 70% since renaming itself Meta

‘

big’

What is the biggest tech story of 2022? Was it Elon Musk’s astounding offer to buy Twitter for $44bn, or Amazon’ s $1-trillion loss in market value? Or Tesla’s $500bn halving of its value since Musk announced his plan to buy the “digital town square”? Or Facebook losing 70% of its market value since changing its name to Meta in October 2021?

This is the year Big Tech became just tech.

The market losses have been eye-watering. Even Apple is feeling gravity catch up with it as it tries to escape the pull of the post-Covid economic slump and rampant inflation.

After two years of work from home and a surge in online activity, people have returned to their offices and malls, and to socialising in real life. Laptop sales have plummeted, as has time spent online. As inflation pushed into double digits in the US and Europe, advertising spend started drying up at the same time as the toxicity of social networks reached new lows.

It didn’t help that US lawmakers have finally woken up to the rampant monopolies that Silicon Valley has created and maintained at the expense of the world’s privacy by crushing the innovation of other tech startups.

The destructive effect brought about by several dominating behemoths in the broader tech landscape is now apparent.

Facebook was able to neuter competition from then nascent start-ups like Instagram and WhatsApp by buying them as subpoenaed e-mails by the US Congress have revealed. As Marc Zuckerberg wrote in a 2008 e-mail: “It is better to buy than to compete.”

Record fines have been imposed by the EU’s competition watchdog on Google for its data practices, while Facebook and Instagram have also been sanctioned.

There is an inescapable conclusion that the tech industry will be subjected to much greater oversight by US authorities in future as the numerous lawsuits by attorneys-general and the US justice department gather strength.

The biggest story of the year is arguably the implosion of cryptocurrency exchanges, with the notable nadir being the wholesale destruction of value by FTX, once valued at $32bn and now worth nothing.

This year crypto has lost more than $2trillion in value and the idea that it’s a viable alternative to fiat currency or traditional investing has been trashed. Millions of hapless retail investors lost everything after foolishly sinking their life savings into inflated crypto ventures that were heavily punted by wellpaid celebrities. FTX founder and CEO Sam Bankman-Fried, having lost his own $16bn fortune, can apologise as much as he wants; the damage is done.

The lawyer who helped clean up the mess left by Enron’s financial schemers says FTX is the worst he’ s ever seen.

Crypto, in its current form, is a classic Ponzi scheme: offering unrealistic returns and rewarding those who got in early. As Bankman-Fried can now tell you. Famous for his wild hair and for playing online computer games while doing calls with investors, he’ s been indicted on fraud charges in the US. The clue is in his surname: he is truly “fried”. But not as badly as the tens of millions of people from whom Big Tech has stolen their privacy, and, sadly, in many cases, their personal wealth too. x

Shapshak is editor-in-chief of Stuff.co.za and chief commercial officer of Scrolla.Africa

December 22 - December 28,2022 . financialmail.co.za

15

123RF

Toby Shapshak

BY THE NUMBERS

SMOKING: IN ALMOST ALL COUNTRIES MEN SMOKE MORE THAN WOMEN

South Africa, with its tough anti-smoking laws, is 22nd on the world smoking table. According to the World Health Organisation, 6% of South African women smoke and 34% of men. The WHO data includes people of 15 and older

Population

men who smoke

% of women who smoke

Source: Our World in Data

HOT PROPERTY

WHERE: George, Garden Route

PRICE: R9.595m

WHO: Seeff

Set in Kingswood Golf Estate with panoramic mountain and fairway views, this family home has five bedrooms, 4½ bathrooms, extensive open-plan living and dining areas, as well as a study and storeroom. The large patio has a built-in bar and braai, card room and jacuzzi, which overlook the pool and a landscaped garden.

WHERE: Die Boord, Stellenbosch PRICE: R38.5m

WHO: Pam Golding Properties

This contemporary residence with mountain views is set on the De Bosch lifestyle estate, with more than 800m² under roof including four en suite bedrooms, multiple living areas, entertainment bar and frameless glass stacker doors that open to a pool and lawn. There is a separate cottage with its own kitchen.

financialmail.co.za . December 22 - December 28,2022

WHERE: Camps Bay, Cape Town PRICE: R100m

WHO: Seeff

Overlooking Glen Beach, this beachfront bungalow offers spectacular ocean views and has five en suite bedrooms, various formal and informal living areas, a modern kitchen with topof-the-range integrated appliances, and a sunroom that opens onto an entertainment and pool area with direct beach access.

16 16

4% 71% 68% 52% 20% 17% 2% 13% 0% 48% 48% 47% 44% 43% 42% 13% 19% 3% 41% 1% 12% 40% 41% 39% 6% 7% 39% 36% 20% 28% 35% 35% 34% 1% 7% 33% 30% 27% 29%

20% 10% 32% 8% 32% 2% 6% 2% 1% 49% 41% 13% 41% 34% 28%

13%

% of

Indonesia Bangladesh China Nepal Egypt Vietnam MalaysiaMadagascar Turkey Thailand Russia India AlgeriaUkraine Philippines AfghanistanSouth KoreaIraq France Uzbekistan South Africa Pakistan Yemen Japan SpainArgentina US Poland Myanmar

29%

18% 6%

PROFILE

Health boom for ‘boom’

● Gabriel Theron is not someone who is easily put off. So when his efforts to raise R500m and list on the JSE failed recently, he dismissed the setback as merely “disappointing”

He tells the FM that it has not changed his goals for a company that has bet the house on cannabis.

It’s the healing potential that excites Theron about the once notorious herb, which has undergone an image makeover from dagga, a pot-smoker drug, to a plant with “endless medicinal possibilities” and its more acceptable appellation: cannabis.

This is why, in 2018, Theron founded Cilo Cybin Pharmaceutical to develop cannabis as a viable mainstream pharmaceutical alternative to other drugs on the market.

Theron was hoping for the listing to act as a “springboard” but is reconciled to the company now moving “a bit slower” “Maybe that’s not a bad thing because it means we can put our foundations down properly and secure the revenue streams and grow the company organically for the next two years,” he says.

He says there was a lot of interest from about 2,000 retail investors and the company raised just over R20m. He says there is still work to be done to

break down negative perceptions about cannabis. “The first thing people think is cultivating it and smoking it,” he says. Only later do they consider its medicinal benefits.

Theron has had a varied career since obtaining a BCom Hons. He worked in the beer industry as an internal auditor with SAB, in forestry as an acting CEO of the South African Forestry Company Ltd and as an entrepreneur in the IT field.

Theron says he used cannabis “probably three or four times during university”. Some years later he discovered that the drug had qualities which were helpful and that was why he went on to found Cilo Cybin, a company that combines biohacking (lifestyle changes to improve health), biotech and pharmaceutical methodologies to provide health-care solutions.

“The industry is very interesting because you have those guys with the dreads and the whole lifestyle: the hippie sitting here with bare feet. You have that big time. But then you have the corporate guys coming in saying: ‘Hey, this is a really good business opportunity if you can run it like any other business,’” says Theron.

The second category is where he fits in. He emphasises that his uses of cannabis-

related products are for longevity. They are not psychoactive, which alters brain functions and behaviour. “They are for boosting longevity and performance. That is what I will use, and I have been using that for the past four years, every day.”

Theron says Cilo Cybin is getting ready to hit the markets in South Africa once the law and regulations allow it.

It is also looking to profit from the global cannabis market, with the company having already exported its first batch of flowers so as to be ready when Europe opens up cannabis entirely, which is expected by 2025.

President Cyril Ramaphosa, in his state of the nation address this year, said the government would review policies and regulations affecting industrial hemp and cannabis to exploit its economic potential. He said it could create about 130,000 jobs, with the National Cannabis Master Plan adding about R28bn to the fiscus.

The “Global Cannabis Report” by New Frontier Data estimated that illicit cannabis sales in South Africa were more than $1bn and could reach $1.5bn by 2025.

The World Health Organisation estimates South Africa to be the third-largest illegal can-

nabis producer in the world already, with about 2,500t of cannabis grown each year.

It’s that potential, Theron says, that can be legally unlocked. “On the one side they want to legalise it so that they can tax it. Cannabis is an interesting environment because it has the recreational side to it and the medicinal side. From a hemp side, I think that’ s a nobrainer, they have to open that side,” he says.

Hemp, one of the fastestgrowing plants in the world, can be refined for a variety of commercial items, from paper, rope and textiles to animal feed and biofuel.

Theron says South Africa, along with Lesotho and Colombia, is well placed to take advantage of a freed-up cannabis trade worldwide. He says the three countries have perfect growing conditions and are able to produce at low cost. “We are just super-competitive,” he says.

“We’ve exported our first batch. I believe we are the only guys in South Africa so far who have exported a final label product to Australia, meaning it’s got a label on it and it’ s ready for the consumer.”

That’s all fine for Down Under, now he needs the legal permission to go ahead at home. x

financialmail.co.za 17

December 22 - December 28,2022 .

GabrielTheron

Founder of Cilo Cybin Pharmaceutical

Entrepreneur extols the healing potential of cannabis

Jan Bornman

BOARDROOM TALES BY ANN CROTTY

China’s tough Covid act flops

The next few months will be difficult for the country’s leader, Xi Jinping, to navigate

Do you remember the Wuhan pool party video of August 2020?

Thousands of partygoers were packed like sardines into a water park in scenes that would have raised serious health concerns, even if this had not been Covid ground zero.

In January 2020, Wuhan was the central China city that had announced the world’ s first Covid case, followed by the first Covid lockdown. For weeks, there was no sign of life in any of the city’s public spaces. Its 11-million residents were locked behind firmly closed doors. By March the lockdown started to ease and in April it was officially lifted. But in May six new cases were recorded. Within weeks, the entire Wuhan population was tested and the outbreak was soon back under control.

The Wuhan Maya Beach Water Park party was a celebration of life returning to normal, a statement that Covid could be controlled, at least by the Chinese. The rest of the world, still trapped in its own version of lockdown hell, looked on in a far from celebratory mood.

China, which had been the source of thevirus and had refused to share any information with the world that might have helped deal with it, now wanted to share its coming-out celebration with the rest of us.

It was remarkably insensitive. As were the following two years when, as the death toll

mounted across the globe, Chinese news clips of a Covidfree country were shared with the world. Unlike the Western democracies, China had conquered the virus because it had an authoritarian, Communist Party-led government that looked after its people and, unlike the decadent West, could enforce tough lockdown regulations when necessary.

Well, it turns out the Covid story was far from over in China. For much of 2022, when the rest of the world was tentatively emerging from the pandemic, China’s major cities were crippled by severe zeroCovid lockdowns. Economic and social life ground to a halt. For months, the government tried to neutralise the mercurial virus with the same severe and inflexible measures that had worked two years earlier against the alpha and delta variants. But the new omicron variant was far too transmissible to be neutralised by even brutal lockdowns.

However, President Xi Jinping was determined to cling to zero Covid, particularly in the run-up to the Communist Party congress in October.

After the congress confirmed him as China’s most powerful leader since Mao Zedong, Xi seemed to relax a little.

It was becoming increasingly difficult to ignore the mounting social and economic costs attached to his Covid policy, which had not only stopped much of social and economic life but had bankrupted many of the provincial

governments that had funded all the testing and lockdowns. Demonstrations, previously rarely seen, in the streets of major cities, and disturbing clips of workers trying to flee lockdown at a factory supplying Apple, may also have helped Xi reconsider his policy.

In November, the lockdowns were eased and there were signs of some tolerance for Covid infection. And on December 13, without any warning, the Covid tracking app which had been used to closely monitor China’s citizens for almost two years went offline.

In the brief time since, Covid has run riot. Media reports suggest as many as 30% of the population now has Covid. And, assuming Xi doesn’t do another U-turn, it’s expected to rise as events that occurred over two years in open countries are condensed into a sixmonth timeline. One commentator warned not of an exit wave but an exit tsunami of infection. She warned of the political fallout, particularly for Xi, as a result of the dramatic shift in public messaging. One day Covid was hugely dangerous and had to be contained at any price; the next it was, well, no big deal. Can other “big government messages” also

123RF/rizqy29

be ignored?

But Covid is a big deal. An estimated 1.5-million people are expected to die from it. Not a big figure if you’re looking at a population of 1.3-billion, but huge if you’re the victim or a relative.

Remarkably, during the past two years the Chinese government did little to build up health-care capacity or encourage vaccinations, especially among the elderly.

But here’s the really scary part for the rest of us who looked on at the 2020 pool party: one epidemiologist interviewed by The China Project news platform said there is a high possibility of the virus now evolving into a more dangerous variant. What are the chances of the Chinese government, which has the necessary genetic testing capacity, behaving as responsibly as South Africa did a year ago?

We probably know the answer to that.

And with even paracetamol difficult to come by, many Chinese will be looking abroad for refuge. Will we be prepared? x

18 18 financialmail.co.za . December 22 - December 28,2022

FEATURES

An in-depth look at the hot button subjects of the day in SA and around the world

20 THE TEFLON PRESIDENT

It’s been a triumphant few days for Ramaphosa, who was hours away from resigning three weeks ago. Now will he finally do something?

32

RIP FOR RET CHANCERS?

The ‘RET forces’ suffered a thumping defeat at Nasrec. Opinions are split over whether it is safe to declare it buried forever

34

EVOLUTION OF AN ANC BULL-Y

Mantashe, the ‘fossil fuel dinosaur’, seems set for a few more years in the top tiers of government, to the dismay of his detractors

38

THE WAR ON YOU

Governments are cracking down on journalists the world over. When politicians attack media freedom, they’re attacking you

December 22 - December 28,2022 . financialmail.co.za 19

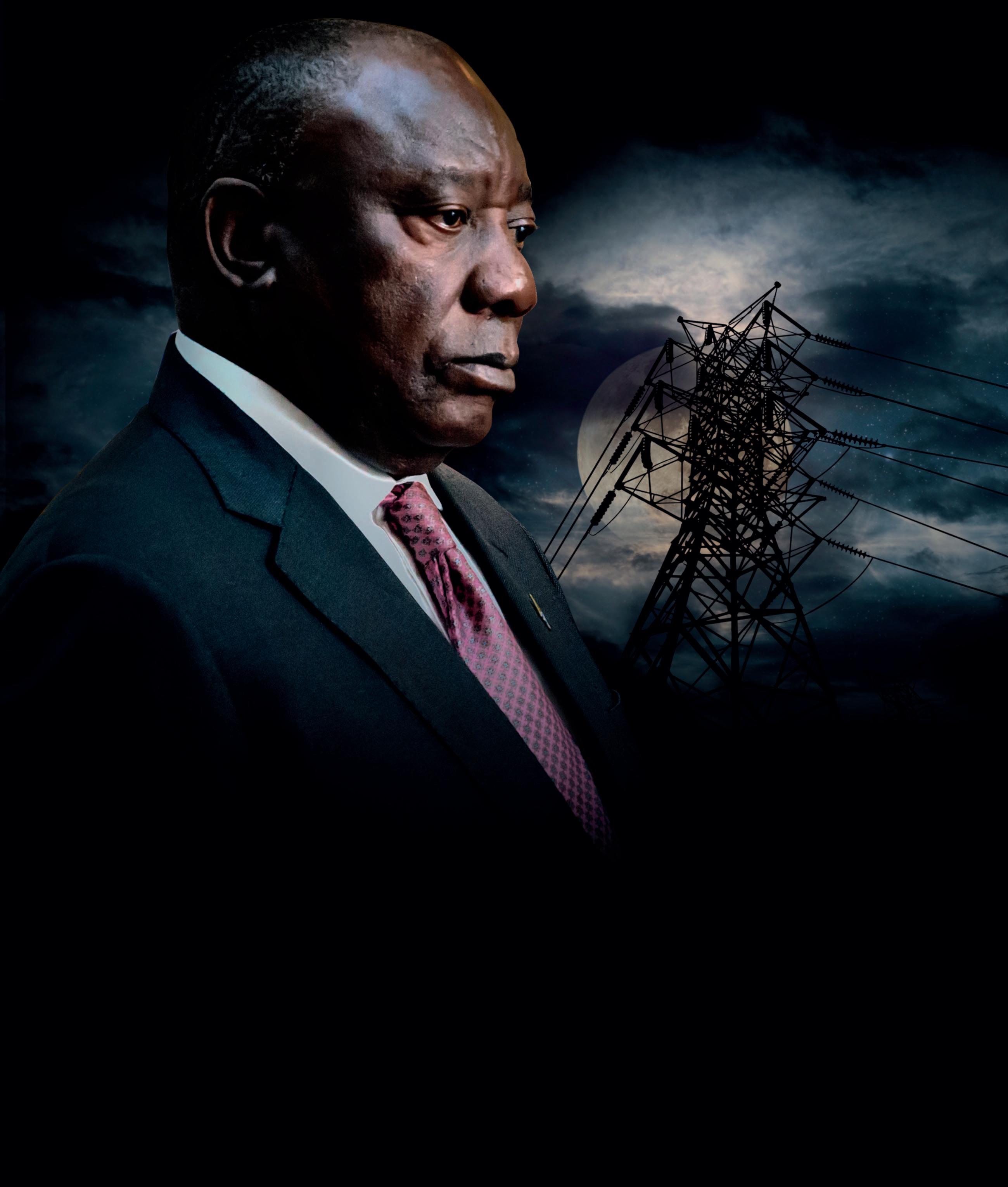

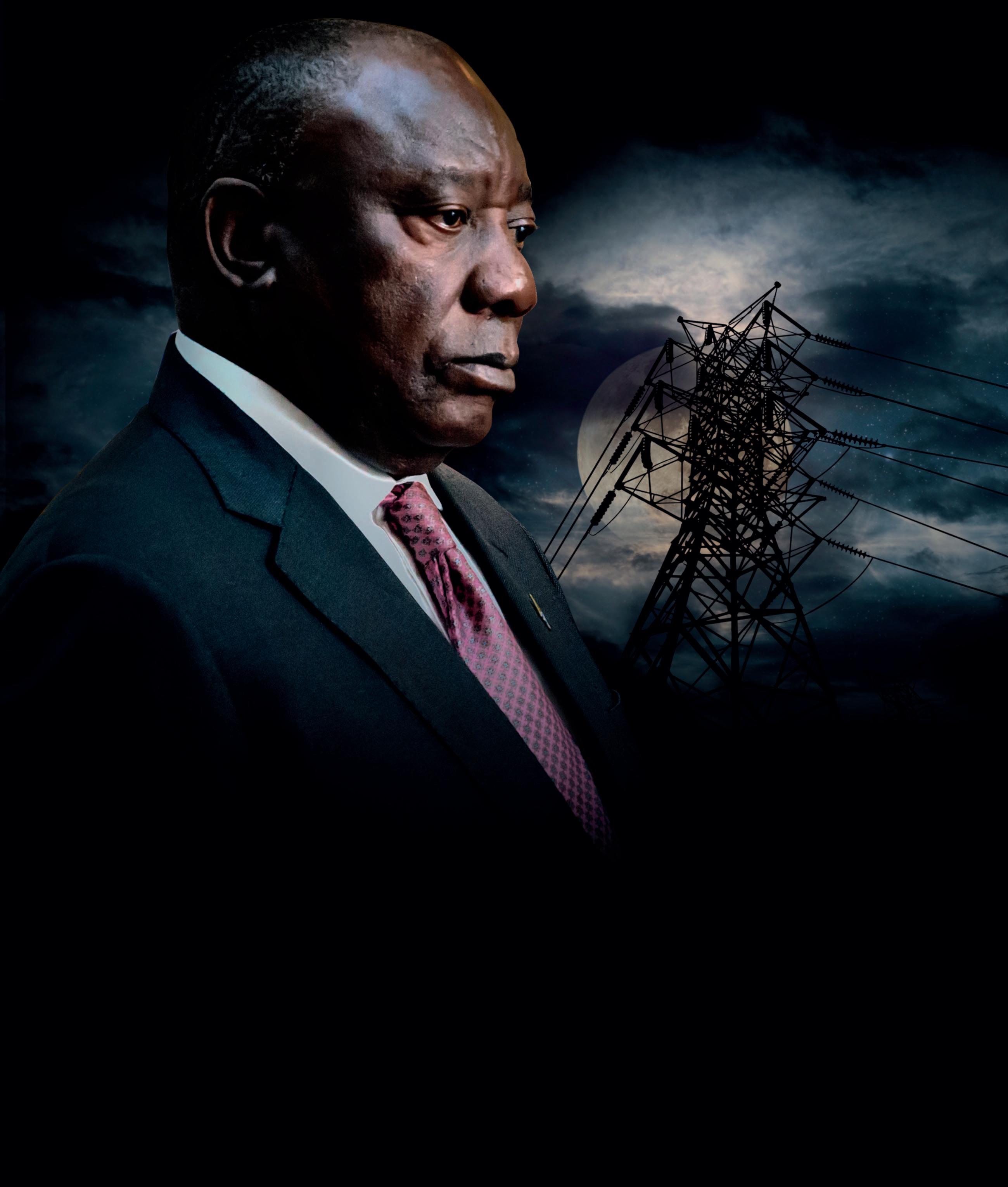

REMARKABLE RESURGENCE OF THE TEFLON PRESIDENT

It’s been a triumphant few days for Ramaphosa, who was hours away from resigning three weeks ago. Now that he has a free hand, will he finally do something?

Natasha Marrian

Natasha Marrian

In the dusty Northern Cape town of Colesberg in May 2017, Cyril Ramaphosa drew on the myth of an eagle perching high on the stony cliff face of the mountains, when it feels it has lost its strength and prowess. The majestic bird, he told the gathering of ANC members at the province’s elective conference, rips off its beak and its talons and waits for regrowth.

“It goes through this bloody process, it stays for months reflecting ... and renewing itself,” he said.

“Once it comes back, its claws grow out again and it comes back stronger.”

This, he said, is what the ANC must do. And it was upon that promise that he was elected to lead the party in December of that year.

Unfortunately for Ramaphosa, during the past five years, there has been much gnawing and clawing, but very little renewal.

True, the ANC did suspend its errant secretary-general Ace Magashule, implement its step-aside rule and brought in a cracker of an electoral commission (headed by former president Kgalema Motlanthe) to stem the onslaught on internal democracy in the party. But it was clear this wasn’t enough.

The most glaring signal of this has been the onslaught on Ramaphosa himself, which made 2022 his annus horribilis. This says much, given that 2020 saw him presiding over the country during a pandemic, and 2021 was headlined by bloody unrest.

Yet Ramaphosa has somehow managed to end the year back on top. This seemed exceptionally unlikely in June, when the Phala Phala saga began.

At the time, it emerged that former State Security Agency (SSA) boss Arthur Fraser had laid criminal charges against Ramaphosa over a robbery at Phala Phala, a Limpopo game farm owned by the president.

Fraser accused Ramaphosa of money laundering, kidnapping and corruption, alleging he had stuffed $4m into a couch at the farm, which was later stolen. He claimed the president tasked his head of security Wally Rhoode with tracking down the thieves who were then kidnapped, interrogated, and bribed not to

talk about what had happened.

It was a tall tale one which could have been cleared up easily if there was no wrongdoing by the president. But Ramaphosa chose to remain mum, arguing that it was under investigation.

Opposition parties and his enemies, inevitably, pounced. It all culminated in November with a report by an independent parliamentary panel headed by former chief justice Sandile Ngcobo, which found there was “prima facie” evidence of wrongdoing by Ramaphosa and that he should face an impeachment inquiry.

The damage to Brand Ramaphosa in those six months was immense. He knew it too, drafting a resignation speech he was hours away from giving.

To make matters worse, in the same month, the power crisis deepened, culminating in stage 6 loadshedding and Ramaphosa angered business and ordinary South Africans by taking two weeks to respond. It remained the ever-present critique of his presidency: dawdling while the world burns.

Yet, Ramaphosa has prevailed. If Jacob Zuma was seen as the original Teflon president, Ramaphosa is making a strong claim to that title now.

His comeback began in earnest last Tuesday, when parliament the ANC, in particular voted against the Ngcobo report recommendations for an impeachment inquiry.

Then, after a tense two days of horse-trading, deals, and flat-out panic, Ramaphosa emerged victorious against his former health minister Zweli Mkhize for a second term as ANC president.

It is the definitive proof to the cliché that a week is truly a long time in politics.

Suspended animation

A more critical question is, will Ramaphosa finally display the sort of leadership everyone expected from him during the first term?

Sadly, the early indications are that his poor communication, or willingness to make himself accessible, aren ’t going to change any time soon.

December 22 - December 28,2022 . financialmail.co.za 21

Dream team? The ANC’s new top seven after their election at Nasrec, Joburg Reuters / Sumaya Hisham

The FM requested an interview with him a month ago, and was denied. Questions were then sent to his spokesperson Vincent Magwenya, who said he was unable to respond as he was writing Ramaphosa’s closing address to the ANC conference.

Still, others believe his victory bodes well for the economy.

“What it does mean is you will have what we call continuity from a policy perspective and he can continue with the reforms he has been championing, with a stronger mandate,” finance minister Enoch Godongwana tells the FM.

Certainly, the markets responded well to his re-election: the rand surged, firming by 1.78% to R17.24 to the dollar.

This is more because of his reputation as a pro-business leader, since there was little feedback from the ANC on its economic policy discussions at the time of going to print.

Rather than policy, the bulk of the five-day conference was spent on ironing out glitches in registration and trading for positions. By the final day, there was still no sign of what, if any, economic policy shifts would come out of the gathering.

Some expect Ramaphosa’s second term to be about securing his legacy.

“The past five years were quite difficult for him, if you remember the outcome of 2017,” says deputy minister in the presidency and NEC member Zizi Kodwa. “To an extent, it immobilised him from taking decisions. I think this overwhelming reaffirmation affirms his renewal agenda.

“ The president will have no other reason now to doubt in terms of giving leadership on issues of renewal.”

Kodwa says Ramaphosa now has strong characters behind him, including Fikile Mbalula, who was elected secret-

ary-general, so he “doesn’t have to look over his shoulder”

The president’s confidant Frans Baleni tells the FM that ensuring his legacy has been fundamental to Ramaphosa, from his formative years in the 1980s in the National Union of Mineworkers to his role in drafting the constitution.

“He must leave a legacy wherever he goes. He told us two things when he formed the NUM: the first is that when he leaves, the NUM would be led by a mineworker and second, that workers would have a retirement fund they could count on, ” Baleni tells the FM. “He delivered on both.”

Baleni, who followed Ramaphosa as a general secretary of the NUM, says that the retirement fund started by Ramaphosa all those years ago, before the end of apartheid, is now worth billions.

“Under Ramaphosa, the NUM was the first union to embrace the Freedom Charter nonracialism in essence and Ramaphosa was at the forefront.”

Axing the dead wood Kodwa and Baleni agree that Ramaphosa was severely constrained during his first term. But now, unleashed from factional shackles, will he perform any better?

Baleni responds: “He ended up accommodating many of these characters for the sake of unity and renewal. In his first term, he has had to focus more internally

in the ANC, than externally in the country, but he is no longer constrained by that.”

So what would that look like, in practice?

First, a cabinet reshuffle is on the cards. Insiders tell the FM it is likely to happen before the state of the nation address in February 2023. He ought to do it sooner: Mbalula, who is also transport minister, told the media after the ANC conference that if it were up to him, he would leave his government post immediately to take up his full-time ANC top job.

Mbalula’s exit, many critics would say, is no loss for government.

But Ramaphosa would also have to find a place for newly elected ANC deputy president, Paul Mashatile, who replaces David Mabuza. It is understood that Mashatile would take up the deputy president role in government soon.

Then there is the issue of those ministers who campaigned against Ramaphosa: tourism minister Lindiwe Sisulu and co-operative governance minister Nkosazana Dlamini Zuma.

Insiders have told the FM, on condition of anonymity, that Dlamini Zuma is preparing to resign.

She had openly voted in favour of an impeachment inquiry against Ramaphosa in parliament, in defiance of the party line.

“This time, it has to be a reshuffle that stamps his authority,” one ANC official tells the FM. “He does not have to be like Zuma, who reshuffled every six months, but he has to draw a line in the sand against those who don’t want his agenda.”

It’s easy to see which of Ramaphosa’ s opponents would go, but what of his allies?

Gwede Mantashe is at the helm of the mining & energy department, but he has been an eyesore in his portfolio).

The FM has been told by sources close to his department that Mantashe has already warned his staff that he may be shifted. From Ramaphosa’s side, it is understood there is discomfort around allegations that Mantashe’s wife plays an inappropriate role in his department a conflict flagged by those in the mining sector too.

Insiders say we’re also unlikely to see the exit of the woefully inept police minister Bheki Cele, who bafflingly still commands the confidence of the president.

When it comes to both Mantashe and Cele, a reshuffle will be seen as a litmus test of Ramaphosa’s resolve to continue

22 financialmail.co.za . December

- December

22

28,2022

Frans Baleni

Business Day / Puxley Makgatho

Zizi Kodwa

Sunday Times / Masi Losi

his reform agenda, now unhindered by internal party dynamics.

Ethically barren

But reforming the state is one thing; fixing the ANC will be much harder.

Depressingly, 43% of ANC delegates felt confident enough to vote for Mkhize, despite his alleged complicity in looting the fiscus during the pandemic, in the Digital Vibes saga.

It illustrated that even Ramaphosa’s supporters were willing to embrace the compromised for the sake of political expediency. This was underscored by the nomination, from the conference floor, of former energy minister Tina Joemat-Pettersson.

Joemat-Pettersson, who was implicated in the selling of SA’s strategic fuel reserves, was also Zuma’ s point woman in signing the suspect nuclear deal in 2015. Yet she obtained overwhelming support from Ramaphosa’s faction just shy of winning the post of deputy secretary-general from Nomvula Mokonyane.

Mokonyane herself is notorious for receiving braai packs, expensive whisky and a Louis Vitton handbag stuffed with R300,000 in cash from prisons company Bosasa, according to testimony at the Zondo commission.

And yet Northern Cape premier Zamani Saul tells the FM that Ramaphosa’s renewed mandate is a “devastating blow for the anti-renewal forces”

“It is a watershed outcome, a major devastating blow for pushback against renewal. They won’t recover from this,” he says. “From January I believe we will start to see major changes.”

Saul says the outcome of this conference is “in sync with the national mood” against corruption. And Ramaphosa has “nothing to lose” by implementing these changes, he says.

“These next five years are a legacycreating moment,” he says. “What he should be doing is to be decisive. Because with the state of the organisation and the country, we don’t want leadership that prevaricates around challenges.”

The single biggest challenge lies with Eskom, and the power crisis.

Curiously, during the conference, Ramaphosa deployed the army to protect Eskom infrastructure from acts of sabotage a long-standing request from Eskom’s management.

Kodwa tells the FM that the move was long in coming.

“No doubt there are elements of sabot-

age at Eskom. You don’t need intelligence to tell you that. There are elements who are driven by ulterior motives, to undermine the leadership of the country, to undermine the whole management,” he says.

He says that when five power stations trip simultaneously, the evidence seems pretty clear that there is co-ordination among saboteurs.

“We are going to Christmas next week, and South Africans have loadshedding. It’s not just killing households, small businesses, it’s also killing investors and I think the decision the president has taken to deploy the army, it will normalise the situation in the short term,” he says.

But, Kodwa says, there must be a concerted effort to “deal with” those elements trying to destabilise the utility further.

Will Gordhan stay?

So what will become of public enterprises minister Pravin Gordhan, the politician responsible for Eskom and other state-owned entities, in this new dispensation?

Gordhan kept a low profile at the conference but after a request from the FM for an interview, security officials ushered the FM into the area closed

off to journalists for a sit-down with the minister.

He declined to stand as a member of the ANC’s top leadership structure, the NEC. He says he will always serve the movement, but his time on the structure is up.

Asked if he will retire from the cabinet too, Gordhan is coy in his response. “We shall see,” he says, adding that ministerial posts are the prerogative of the president.

Gordhan no doubt has sleepless nights over Eskom there have been moves for months already to move the utility’s oversight into the energy ministry.

But he argues that Ramaphosa’ s administration has been on the receiving end of a series of political, policy, administrative and corrupt missteps by various ANC-led administrations.

André de Ruyter’s resignation last week was, in part, due to a lack of political support, but Gordhan tells the FM that he had always backed the CEO, who will now leave in March.

“I backed him, the president backed him ... what is important now is the new CEO will have the full backing of the government,” he says.

He says Eskom’s board has already begun the search for a new leader for the utility, preferably an engineer.

Gordhan tells the FM the search will be both local and international, adding that there are dozens of talented SA engineers all over the world working in power utilities from the Philippines to the United Arab Emirates.

The government is hoping a suitable, patriotic South African with the necessary qualifications and skills will be up to the almost impossible task of turning Eskom around.

It is a tall task, but an urgent one. Ending load-shedding is key to turning the ANC’s electoral fortunes around.

Godongwana, however, tells the FM that “Brand Ramaphosa” is still the best option for the ANC in the lead-up to the 2024 election.

Ramaphosa himself will surely never have imagined this trajectory when he first contested that ANC election in 2017.

Perhaps his eagle metaphor from five years ago is still apt: now that the ripping and bleeding has ceased, can he emerge stronger, more powerful, and more decisive?

Or will the party’s slow bleed just continue, ensuring that renewal and reform remain as mythical as his eagle’ s rebirth? x

December 22 - December 28,2022 . financialmail.co.za

23

Pravin Gordhan

Gallo Images / Foto24

/ Bongiwe Gumede

HOW TO BLOW HALF A TRILLION

The controversial Tesla and SpaceX CEO has had a torrid year, with his car company losing half its value after he bought Twitter

Shapshak

There’s little dispute that Elon Musk has been the business personality about whom most column inches have been written this year. But whether it’s been a successful year for him is adifferent debate.

As it is, his purchase of Twitter for an overpriced $44bn might ultimately be Musk’s Waterloo.

Officially, he took over Twitter on October 27, after trying to back out of the deal by claiming the social platform had misrepresented its spam bots. But his impulsive, scattershot decisions since then have wrought havoc on an already dysfunctional company.

Since Twitter is no longer publicly traded, you can’t translate his ruinous few months into an actual dollar loss, but the contagion has seen Tesla’s share price tumble 29.3% since then. Since he first said he wanted to buy Twitter in April, Tesla has lost 52%.

Musk’s acolytes claim there is some genius strategy at work. But most rational people including now-alienated advertisers, who account for 90% of Twitter’s income can see that Musk is making it up as he goes along.

The Twitter Blue verification plan is a case in point. Musk proposed that anyone who can pay $8 a month can have a verified account. After an outcry, this plan was hauled back to the drawing board, relaunched, paused, then embellished, reintroduced and paused again.

It all began in rocky fashion when he immediately fired half of Twitter’s staff by e-mail, then rehired key engineers and fired most of the contractors. This destroyed morale.

Musk describes himself as a “free speech absolutist”, hence his plan to reinstate the account of former US president Donald Trump. But his naive and impractical attempts to transform Twitter reveal alack of pragmatism and vision.

What we’re watching, says NYU Stern marketing professor Scott Galloway, is not a company unravelling, but Musk himself coming undone.

In recent weeks, he has restored the accounts of several people who spread Covid misinformation, retweeted a patently false story from a notorious crackpot news website and suspended the accounts of several journalists.

The MIT Technology Review says that Musk’s Right-leaning attitude has led to a shift in Twitter’s content, with “him at the centre of conversations once kept on the fringes of Twitter”

The authoritative publication used Indiana University’s Hoaxy, which tracks interactions between accounts to track how information spreads. “The results hint at Musk’s new role in this network: as effectively a hall monitor for the far Right,” it says.

Nor has Musk’s chaotic management of Twitter been good for hisbusiness reputation, or his personal fortune.

Having become the world’s richest person based on the soaring stock of his electric vehicle (EV) company Musk has lost that crown, as Tesla shares have plunged. In October 2021, Tesla’ s market value hit $1-trillion, but now it’ s $470bn, pushing Musk’s fortune down by $107bn, to $164bn.

Musk predicted an “epic” year for the EV maker but it’s having anything but that. Back in April he predicted that 1.5million cars would be shipped, but Tesla may fail to break the 1-millionbarrier. It’ s now offering a $3,750 discount for buyers to get their cars this year.

Tesla’s Gigafactory in Shanghai, which shipped 52% of all its cars in 2021, has beendisrupted by China’sCovid shutdowns and is reducingoutput by 20%.

“You’re starting to see some demand cracks,” said Wedbush senior analyst Dan Ives.

Meanwhile, Ford, Volkswagen and General Motors are ramping up their electric car offerings. Tesla’s head start is being eroded.

When Musk’s Twitter acquisition began going pear-shaped, Ives said: “In what has been a dark comedy show with Twitter, Musk has essentially tarnished the Tesla story/stock and is starting to potentially [affect] the Tesla brand.”

But this mad-haste approach is characteristic of Musk’s early start-up years, says his unofficial biographer, Michael Vlismas.

“I don’t think he’s lost his mind,” Vlismas tells the FM. “As for a mistake buying Twitter, it depends. Billionaires have bought newspapers in dying print markets and have also had questions asked of them as to why. Twitter keeps Musk relevant daily. Relevance creates a platform to do what he wants to do.”

Musk makes grand claims he says his mission is to “preserve human consciousness by taking us out there among the stars”. He uses these to give people “inspiration”, says Vlismas.

SpaceX, one of his other companies, remains a serious going concern that resupplies the International Space Station.

“Twitter will be a means to an end,” says Vlismas. “The dream is to find a solution to manage social media for the good of society: the protection of free speech, in his view.”

Vlismas, who went to the same Pretoria Boys High School as Musk, thinks Musk’s Twitter foray is a distraction from his plan to counter climate change, through EVs and battery storage.

“I would far rather have an Elon Musk thinking about how to improve humanity in a real sense which I believe he genuinely wants to do than focusing all of his energies on a social media app.”

Wouldn’t we all? x

24 financialmail.co.za .

December 22 - December 28,2022

Toby

Shapshak is editor-in-chief of Stuff.co.za and chief commercial officer of Scrolla.Africa

BUSINESS

POLITICS

THE MAN WHO (ALMOST) TOPPLED A PRESIDENT

In recent months, Arthur Fraser has had arguably a stronger impact on local politics than anyone first by paroling Jacob Zuma, then almost forcing Cyril Ramaphosa to quit

Arthur Fraser likes to keep out of the public eye. Usually, you only hear of him when he’ s surfaced to drop another political bombshell.

Over a decade ago, he paved Jacob Zuma’s road to the presidency by leaking classified intelligence tape recordings. More recently, he was the architect of Cyril Ramaphosa’s political near-demise, when he charged that the president had tried to cover up the theft of a large amount of dollars from his game farm, Phala Phala.

Events have yet to play themselves out fully, yet Fraser’s bombs this time had Ramaphosa on the verge of resignation two weeks ago. What gave the whole ordeal extra sting is that in June Fraser laid criminal charges against Ramaphosa and released an embellished account of events anchored in truth. Cue probes by the criminal authorities and the public protector.

Yet there remains many unanswered questions about Fraser’s role in this all.

First, the theft of the dollars Fraser said it’s millions, Ramaphosa puts it at $580,000 from a sofa, took place in February 2020 but Fraser only released this information in June this year. This also happened just weeks before chief justice Raymond Zondo released his state capture report, which implicated Fraser in serious wrongdoing during his tenure

at the State Security Agency (SSA).

Still, Fraser’s move sparked a flurry of activity. The African Transformation Movement tried to set in motion impeachment procedures, but the report produced by an independent panel led by retired chief justice Sandile Ngcobo was shot down when the ANC caucus rallied around Ramaphosa.

Despite serious gaps in the report, its appearance is devastating for Ramaphosa, who has built his presidency on fighting graft.

What is intriguing, however, is the extent to which Fraser has melted back into the shadows since. He hasn’t spoken on public platforms or made himself available for media comments.

Only recently did he re-emerge with a legal challenge to the allegations made against him in Zondo’s report, days before the start of the ANC’s elective conference in Nasrec.