Exploring how brands are connecting with customers through innovative schemes that offer more than just points

BY

Picasso Headline, A proud division of Arena Holdings (Pty) Ltd, Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

EDITORIAL

Editor: Brendon Petersen

Content Manager: Raina Julies rainaj@picasso.co.za

Contributors: Bradley Chetty, Chris Erasmus, Fayelizabeth Foster, Mwangi Githahu, Trevor Kana, Elise Kirsten, Vukani Magubane, Frans Maluleke, Itumeleng Mogaki, Vusiwe Nkomo, Gabriella Steyn, Rodney Weidemann, Lisa Witepski

Copy Editor: Brenda Bryden

Content Co-ordinator: Natasha Maneveldt

Online Editor: Stacey Visser vissers@businessmediamags.co.za

Head of Design: Jayne Macé-Ferguson

Senior Design: Mfundo Archie Ndzo

Cover Images: Istockphoto.com, Supplied

SALES

Project Manager: Gavin Payne gavinp@picasso.co.za | +27 21 469 2477

Sales: Stephen Crawford

PRODUCTION

Production Editor: Shamiela Brenner

Advertising Co-ordinator: Johan Labuschagne

Subscriptions and Distribution: Fatima Dramat fatimad@picasso.co.za

Printer: CTP Printers, Cape Town

MANAGEMENT

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt General Manager, Magazines: Jocelyne Bayer

Welcome to the latest edition of Loyalty & Rewards SA. As I write this, I can’t help but re ect on how much loyalty programmes have transformed over the years. If you’re like me, you’ve probably noticed that your inbox is packed with offers from various rewards programmes – each one trying to grab your attention with something just a little more personalised, a little more tailored to your needs.

Loyalty today is about so much more than collecting points or redeeming vouchers. It’s evolved into something deeper where brands are working hard to make us feel valued, heard and truly understood. What’s fascinating is how technology is playing a central role in this shift. Brands are using advanced data analytics and arti cial intelligence to craft rewards that make sense for our individual lifestyles. It’s no longer a one-size- ts-all approach but rather a thoughtful, personalised experience that keeps us engaged.

In this issue, we explore some of the most exciting trends shaping the future of loyalty. Here’s to discovering the future of loyalty, one reward at a time.

Brendon Petersen, Editor

We explores how Clicks and Checkers are reinventing loyalty programmes by blending digital convenience with in-store rewards.

12

Unpacking how multibrand rewards are meeting the demands of modern travellers.

14

Subscription services have evolved beyond mere access; they now focus on engagement.

19

How loyalty programmes, driven by customer relationship management, are strengthening customer relationships and increasing retention for banks and nancial institutions.

Africanbank’s Audacious Rewards Programme stands out not just for what it offers, but also who it serves.

28

COPYRIGHT: Picasso Headline. No portion of this magazine may be reproduced in any form without written consent of the publisher. The publisher is not responsible for unsolicited material. Loyalty and Rewards SA is published by Picasso Headline. The opinions expressed are not necessarily those of Picasso Headline. All advertisements/advertorials have been paid for and therefore do not carry any endorsement by the publisher.

33

We examines how brands are capturing younger audiences through digital- rst strategies, gami cation and social engagement.

We unpack the many ways super apps are rede ning loyalty.

36 ARTIFICIAL INTELLIGENCE

South Africans love loyalty programmes. But where do loyalty reward programmes come from, and how have they changed over time?

38 PROFILE – AWS

Having access to great arti cial intelligence tools can make people feel more empowered.

40 PROFILE – NEDBANK

Exploring how agile rewards programmes during economic uncertainty are key to drive success.

43 PROFILE – SASOL

Creating an offering to address some of the common pain points consumers encounter in rewards programmes.

46 PARTNERSHIPS

Teaming up and leveraging digital technology to offer rewards that exceed customer expectations.

52 HOSPITALITY

How loyalty has helped build a deeper connection with customers, encouraged repeat visits and enhanced brand awareness.

57 PROFILE – TFG

Shaping omnichannel strategies for a digital- rst world.

58 PROFILE – ECOFLOW

Aligning brands’ loyalty programmes with sustainability goals and engaging conscious consumers in South Africa.

BRENDON PETERSEN explores how Clicks and Checkers are reinventing loyalty programmes by blending digital convenience with in-store rewards

Loyalty programmes, once rmly rooted in physical stores, are transforming. As online shopping gains traction, major retailers are rede ning customer engagement by blending the convenience of digital experiences with the personal touch of in-store visits.

Retailers such as Clicks and Checkers are leading this shift, merging digital and in-store shopping into a uni ed, omnichannel experience.

The challenge today is not merely to keep pace with e-commerce but to ensure customers feel valued whether they shop via an app or visit a store. This reimagining of loyalty extends beyond traditional rewards to offer consumers a holistic experience that integrates personalisation, data analytics and multichannel touchpoints.

Online shopping in South Africa has surged in recent years, accelerated by the COVID-19 pandemic. Digital shopping spans various income brackets with mobile shopping growing due to widespread smartphone usage.

Retailers are adapting their loyalty strategies to meet the needs of this expanding customer base, ensuring bene ts are equally appealing to both online and in-store shoppers.

For Clicks, this shift toward a uni ed customer journey was a natural progression. With over 11 million active members in its Clicks ClubCard loyalty programme, Clicks has focused on creating a frictionless shopping

experience across its stores, mobile app and web platforms. Dr Melanie van Rooy, chief marketing of cer at Clicks, emphasises simplicity: “For Clicks, simplicity isn’t just a value; it’s a commitment to delivering a seamless customer experience across all channels and partners.” Customers expect rewards regardless of where or how they shop.

Clicks has made strides in its digital offering. Its relaunched app lets users track loyalty points, access personalised deals and manage prescriptions – all tied to the in-store experience. The app has increased the contribution of online shopping by more than 50 per cent, proving how digital can boost physical retail.

Similarly, Checkers, under the strategic guidance of Meredith Allan, general manager for strategy and rewards for the Shoprite Group, has integrated digital and physical channels. The Xtra Savings programme, launched in 2019, now has over 31 million members. The seamless integration with the Sixty60 app allows customers to redeem personalised offers and enjoy free grocery deliveries through Xtra Savings Plus.

At the core of loyalty programmes today is data-driven personalisation. Retailers use “CLICKS’

vast amounts of data to understand customer behaviour and tailor rewards. Dr van Rooy highlights how personalisation has become essential at Clicks: “Through advanced analytical models, we analyse customer preferences and purchasing patterns, allowing us to segment our customer base effectively.” Every interaction is tailored to ensure relevance.

Clicks also employs arti cial intelligence (AI) and machine learning to make personalised product recommendations. For instance, a customer who regularly buys skincare items might receive a voucher for The Body Shop, followed by a targeted discount email.

Checkers uses AI similarly, with Allan explaining that machine learning algorithms recommend products both online and in-store. “Our goal is to create a personalised omnichannel experience where customers enjoy seamless, tailored rewards,” she says. “This approach ensures that every interaction is relevant to individual customer preferences.”

Even as digital shopping grows, the role of physical stores remains integral to loyalty strategies. Retailers recognise that the in-store environment offers unique opportunities for direct, personal service and tangible experiences. For Clicks, in-store promotions and loyalty sign-ups remain critical, supported by Clicks Live radio, which broadcasts ClubCard deals to in-store shoppers. Employees are also trained to assist customers with loyalty queries, bridging physical and digital engagement.

Checkers similarly keeps its physical stores central to its strategy. Allan highlights how stores function as both shopping destinations and ful lment centres for online orders. “Physical stores remain at the heart of our business, serving both as shopping destinations and as mini-ful lment centres for Sixty60 deliveries,” she explains. Checkers also invests in creating vibrant in-store experiences with clearly marked promotions and well-trained staff.

Retailers are nding ways to blend the ease of online shopping with the rewards of in-store visits. Clicks’ ClubCard has evolved to offer members exclusive digital deals with rewards redeemable both online and in-store.

As Dr van Rooy explains: “Clicks’ commitment to seamless integration means members enjoy consistent bene ts whether they shop on the app, in-store or online.”

Checkers has similarly focused on creating a loyalty experience that spans digital and physical touchpoints. The Xtra Savings Plus subscription, which offers free grocery deliveries through Sixty60 and exclusive in-store discounts, rewards customers who engage across both platforms. “It’s about creating a uni ed experience where customers feel equally valued, whether they shop in-store or from home,” Allan says.

As digital and physical shopping experiences converge, the nature of loyalty is changing. Retailers such as Clicks and Checkers are leading the way, demonstrating that loyalty programmes can be both innovative and deeply personal. Through a combination of personalisation, data analytics and omnichannel strategies, these brands are creating a new model of loyalty that meets the demands of today’s shoppers.

“OUR GOAL IS TO CREATE A PERSONALISED OMNICHANNEL EXPERIENCE WHERE CUSTOMERS ENJOY SEAMLESS, TAILORED REWARDS.” – MEREDITH ALLAN

•Clicks ClubCard has over 11 million active members, contributing to over 80 per cent of all sales at Clicks. The app has boosted online shopping contribution by more than 50 per cent since its relaunch.

•Checkers Xtra Savings programme has more than 31 million members, making it South Africa’s most widely used rewards system. In the past year, customers saved a combined R16.9-million in instant cash savings.

• Both Clicks and Checkers integrate AI and data analytics to offer personalised rewards and product recommendations, ensuring that each shopping experience – online or in-store – is tailored to individual preferences.

Source: Clicks; Checkers

The future of loyalty lies in striking a balance between physical and digital worlds, rewarding customers not just for purchases, but also for their engagement across platforms. As Clicks and Checkers have shown, successful loyalty in the digital age is about offering the best of both worlds while remaining attuned to evolving consumer needs.

ELISE KIRSTEN looks at how multibrand rewards are meeting the demands of modern travellers

Why settle for limited rewards when you can choose how to spend your miles or points? Today’s travellers demand more from loyalty programmes – exibility, personalisation and diverse redemption options. As a result, multibrand rewards platforms are reshaping the loyalty landscape, moving beyond the traditional air miles model.

A 2023 survey into airline frequent yer programmes conducted by OAG – a provider of digital ight data and analytics for airports, airlines and travel tech companies – con rms this. According to the survey, the best strategy for airlines to boost loyalty programme participation and engagement

“OPEN-LOOP

is by enabling customers to use their earned miles in other areas of their travel. This particularly aligns with the preferences of Millennials and Gen Z.

To meet this need for exibility and a greater focus on experiences, leading airline rewards programmes such as Singapore Air’s KrisFlyer have tapped into these desires by evolving into multibrand ecosystems that interlink the travel, retail and hospitality sectors. Likewise, South Africa’s Legacy Lifestyle cashback rewards programme offers the bene t of a multibrand loyalty and reward platform, giving users more choices of how they’d like to spend their earned rewards.

PROGRAMMES ALSO GATHER DATA FROM MULTIPLE SOURCES, ENABLING PERSONALISED RECOMMENDATIONS AND ENHANCING REWARD RELEVANCE.”

Singapore Airlines KrisFlyer was ranked 11th globally in the Top 100 Airline Most Valuable Loyalty Programs in 2023, based on a valuation algorithm run by On Point Loyalty. (The top four positions are held by US airlines, followed by German carrier Lufthansa in 5th and Emirates in 22 nd place).

Source: On Point Loyalty 2023 Report

Angela du Preez, Legacy Lifestyle’s chief marketing of cer, explains that the advantage of multiplatform loyalty programmes comes from brand collaboration.

“For instance, with Legacy Lifestyle, customers earn rewards when booking ights, staying at hotels or dining out, which they can redeem at these and other partners across the programme.

This synergy creates a uni ed customer experience that single-brand programmes struggle to match. Open-loop programmes also gather data from multiple sources, enabling personalised recommendations and enhancing reward relevance.”

The ability to manage everything through one app, or website, along with this personalisation creates a more satisfying customer journey and boosts repeat engagement and retention.

Ultimately, successful open-loop loyalty programmes transform the rewards experience by offering enhanced exibility, personalisation and value.

Sally George, market development manager, Singapore Airlines, Johannesburg, highlights the exibility of the KrisFlyer programme. “KrisFlyer members now have more ways to earn and redeem miles not only when they y with Singapore International Airlines (SIA) and Scoot, but also when they shop, dine and explore new experiences using Pelago. Members can earn or redeem miles through their everyday spend with the SIA Group entities, as well as wider KrisFlyer partners. Having a large number of ‘earn-and-burn’ partners globally helps keep KrisFlyer relevant to our members, beyond for ights.” This aspect is important for customer retention.

George also emphasises the importance of ease of use in cross-platform programmes, noting that integrating ights, car rentals and attractions into one booking platform is crucial as it simpli es the process for users.

Multiplatform loyalty programmes offer more exibility, choice and convenience than traditional single-brand systems. For example, in addition to ights, upgrades and airport perks, as a KrisFlyer member, you can use miles for hotel stays, car rentals and

Multiplatform loyalty programmes offer more flexibility, choice and convenience than traditional single-brand systems.

experiences via the Pelago platform. These could include visiting Universal Studios on Sentosa Island, purchasing Formula 1 Grand Prix tickets in Singapore or booking a city tour in Johannesburg. Pelago allows payment for these experiences via Apple Pay, Amex, Visa or Mastercard in addition to the option of using miles. You can also earn points, which can be converted into miles, through the airline’s partners.

Legacy Lifestyle’s partnership with Legacy Hotels & Resorts demonstrates the value of strategic alliances, too. As a member, you can enjoy preferential rates for ights, car rentals and accommodation with added bene ts such as room upgrades and exible check-in times. You also have the ability to earn and spend cashback on various aspects of your stay, from dining to spa treatments and game drives. The rewards earned during your stay “can be used for everyday purchases at other partners on the programme, such as The Spur Group and Dischem, bridging the gap between leisure and daily life,” explains du Preez.

With multiple data-gathering touchpoints, multibrand loyalty programmes can leverage technology to enhance the customer experience. Singapore Airlines’ Pelago uses generative arti cial intelligence (AI) to help KrisFlyer members book travel and experiences while also utilising blockchain for secure transactions. According to George: “Blockchain tokenisation is well-suited for miles-based transactions, especially for security and ef ciency. Kris+ operates on a private consortium blockchain using Proof of Authority. This consumes less energy and computing power than typical power-hungry Proof of Work blockchain transactions.”

Legacy Lifestyle’s personalisation engine, developed by its in-house technical team, has enhanced the programme’s ability to

“HAVING A LARGE NUMBER OF ‘EARN-AND-BURN’ PARTNERS GLOBALLY HELPS KEEP KRISFLYER RELEVANT TO OUR MEMBERS, BEYOND FOR FLIGHTS.”– SALLY GEORGE

deliver targeted communications through email, WhatsApp, in-app messages and push noti cations. “Technology is integral to modern loyalty programmes,” says du Preez. Another key focus is on payments. “We have introduced the rst version of our tap-and-earn solution, allowing members to use any bank-issued card to earn rewards with a simple tap. This solution works across all debit and credit cards issued by banks, enabling members to earn rewards. One of our key differentiators is being able to combine rewards – where customers can use rewards from different partners on the programme, maximising savings and bene ts.”

Both KrisFlyer and Legacy Lifestyle are continuously evolving to stay relevant. George notes that Singapore Airlines regularly reviews KrisFlyer’s offerings to ensure they meet member needs. Similarly, du Preez emphasises that Legacy Lifestyle closely monitors emerging trends, such as payment solutions, experiential rewards and AI-driven personalisation, to re ne its value propositions.

Personalisation, and even hyper-personalisation, is key to keeping customers engaged with multiplatform rewards programmes by integrating data from travel bookings, leisure activities and everyday purchases. This provides tailored rewards that are relevant. Du Preez says: “The power of multipartner loyalty programmes is here to stay and continues to make a signi cant difference to businesses.”

OAG’S Frequent Flyer Programme survey

RE AD

GABRIELLA STEYN unpacks the evolution of subscription-based programmes

Subscription services have evolved beyond mere access; they now focus on engagement. This trend spans various sectors, from streaming to retail, as businesses integrate loyalty rewards into subscription models. By combining rewards with subscriptions, companies enhance customer relationships, providing perks, such as points, exclusive access and tiered bene ts, that deepen connections and boost customer lifetime value.

Gordon Dodge, a consultant at Eighty20, explains that subscription-based rewards have distinct advantages over traditional loyalty schemes. “Customers who pay a recurring fee feel a stronger drive to maximise their bene ts, leading to higher engagement and loyalty,” he says. These programmes often include exclusive perks, such as free shipping and early product access, enhancing their perceived value.

However, Dodge cautions that brands must strike a balance. “To be compelling, a subscription should deliver at least one hundred and fty per cent of its cost in tangible bene ts,” he advises. He stresses that alongside monetary perks, intrinsic rewards, such as personalised experiences, are crucial for maintaining long-term engagement.

He notes that these programmes also generate valuable customer data. “Paid members engage more deeply with a brand, providing granular insights into purchasing habits and engagement patterns,” he explains. This information helps businesses personalise marketing strategies and re ne their offerings.

Dodge highlights the international success of subscription-based rewards, using Amazon Prime as an example. “Amazon Prime has shown that its subscribers tend to be more loyal and spend generously due to the numerous bene ts offered,” he says. This model illustrates how delivering consistent value not only fosters loyalty, but also drives higher spending.

In South Africa, successful programmes such as TakealotMORE and Checkers Sixty60 exemplify the effectiveness of ongoing value. Dodge points to Discovery Vitality’s paid loyalty programmes, which combine immediate and long-term rewards with personalised challenges and exclusive access. “Their success shows that South African consumers are willing to invest in a well-designed programme that offers a blend of personalisation and exclusivity,” he explains.

Local examples such as Kauai’s unlimited coffee and FlySafair’s FlyMore Club further demonstrate the potential of these models. However, Dodge emphasises that behind-the-scenes business cases are vital. “Both Kauai and FlySafair faced challenges post-launch, requiring a rethink to balance cost with customer value,” he notes.

Mishaan Ratan, co-founder of Rentoza, offers insights into the relationship between subscription services and loyalty programmes. He believes subscription models are designed to enhance customer lifetime value by fostering a sense of “stickiness”. “Customers stay because they consistently experience value,” he explains, highlighting the need for positive interactions during each engagement.

“CUSTOMERS WHO PAY A RECURRING FEE FEEL A STRONGER DRIVE TO MAXIMISE THEIR BENEFITS, LEADING TO HIGHER ENGAGEMENT AND LOYALTY.” – GORDON DODGE

The South African loyalty market is projected to grow by 11.2 per cent annually, reaching approximately US$384.3-million by 2024. Between 2019 and 2023, it recorded a compound annual growth rate of 12.8 per cent.

Source: researchandmarkets.com

Rentoza rewards customers for their commitment through structured rewards that allow them to accumulate points over time, redeemable for discounts or additional services. Ratan describes these as “a well-curated basket of offerings” tailored to customer needs.

To drive repeat business and build long-term relationships, Ratan identi es three core strategies:

• Personalised value: Rentoza focuses on understanding individual customer needs, offering tailored rewards that enhance engagement.

• Ongoing engagement: regular interactions create meaningful touchpoints, allowing for personalised offers and celebrations of customer milestones.

• Seamless experience: a frictionless customer journey is essential. Ratan stresses the importance of ease when redeeming rewards, whether via app or customer service.

Looking ahead, Ratan anticipates signi cant evolution in subscription-based rewards, particularly in the consumer tech sector. He highlights emerging trends such as enhanced personalisation through data insights, integration with broader service ecosystems and a focus on affordability. He also sees gami cation and sustainability becoming central to these models, re ecting consumers’ increasing environmental consciousness. Ratan believes these trends present exciting opportunities for consumer tech businesses to create lasting value in the dynamic landscape of subscription-based rewards.

How loyalty programmes driven by customer relationship management are strengthening customer relationships and increasing retention for banks and financial institutions. By MWANGI

GITHAHU

For companies in the competitive nancial services sector, customer relationship management (CRM) systems have become essential tools for enhancing customer loyalty and driving long-term retention.

Leading nancial institutions such as Old Mutual and Nedbank are using CRM-driven loyalty programmes to boost customer engagement and loyalty.

Old Mutual head of marketing: MyGoals And Rewards Katie Alomia says that their CRM system is integral to providing seamless and consistent customer experiences across all channels and touchpoints.

“By integrating data from various sources, our CRM system creates a comprehensive view of each customer, allowing us to understand and anticipate their unique needs and preferences.

“This approach ensures that every interaction is relevant, personalised and consistent with our commitment to customer excellence.”

Alomia adds that one of the most signi cant advantages of Old Mutual’s CRM system is its ability to segment customer data.

“For instance, we can provide young professionals with content and offers focused on managing student debt or starting their rst investment, while customers nearing retirement receive guidance on managing their retirement savings or estate planning.”

She explains that a key element of their personalised approach is their Moneyversity platform, designed to enhance nancial literacy among their members.

“Moneyversity offers a range of nancial education courses and quizzes covering topics relevant to different life stages and

nancial goals. These courses are self-paced, allowing customers to engage with content that matches their interests and nancial needs.”

As they complete these courses and quizzes, members earn reward points that they can spend at over 50 rewards partners, further reinforcing positive nancial behaviours and engagement.

“In addition, we have introduced the Old Mutual Rewards BabyClub bene t, speci cally tailored for parents with young children.

“Understanding that parenting is a journey lled with milestones, we offer special rewards to help families save on essential items such as personal care products and educational toys.

“Parents can redeem their points at selected retailers, including Dis-Chem, Baby City and Toys R Us. This initiative is just another way we personalise our offerings, ensuring our members receive bene ts that are directly relevant to their lives and needs.”

Alomia says this level of personalisation is crucial in building and maintaining customer loyalty.

“BY INTEGRATING DATA FROM VARIOUS SOURCES, OUR CRM SYSTEM CREATES A COMPREHENSIVE VIEW OF EACH CUSTOMER, ALLOWING US TO UNDERSTAND AND ANTICIPATE THEIR UNIQUE NEEDS AND PREFERENCES.” – KATIE ALOMIA

“In a nutshell, it enables us to provide seamless and consistent customer experiences by integrating data from all our channels and touchpoints, creating a comprehensive and uni ed view of each customer.”

The system also enables real-time data updates, which means that no matter where or how a customer interacts with Old Mutual, the information is always up-to-date, leading to smoother, more ef cient service.

Nedbank customer rewards solutions head Kgomotso Zaake says Nedbank uses CRM data to create highly personalised loyalty offers and communications.

“We recently launched our enhanced rewards programme, designed as a direct in uence of client feedback and leveraging client insights, to design a truly

client-centric loyalty programme, which, judging from client response to date, has found increasing resonance.”

Zaake said this approach strengthens customer relationships by providing relevant and timely rewards that align with individual customer pro les.

“In the redesigned proposition, we increased the programme maximum earn rate to an unbeatable two per cent uncapped when using the Nedbank Greenbacks linked American Express card to transact, added new partners and deepened our discounts to clients on the AvoSuperShop.”

Zaake explains that in response to this, new member acquisitions had grown by double digits and engagement levels in the programme had grown by over 30 per cent year on year.

She says this is testament to the relevance and poignance of this redesigned programme to the clientele.

“Lastly our agship, #ThankGreenbacksItsFriday, also known as the TGIF, weekly campaign, which has been running since the relaunch, driving education and awareness, has allowed us to test and collect invaluable client insights on different aspects of the programme.”

“WE RECENTLY LAUNCHED OUR ENHANCED REWARDS PROGRAMME, DESIGNED AS A DIRECT INFLUENCE OF CLIENT FEEDBACK AND LEVERAGING CLIENT INSIGHTS.” – KGOMOTSO ZAAKE

Customer relationship management (CRM) and loyalty programmes in South Africa play a significant role in enhancing customer retention and driving business growth while innovative technology allows the tracking of online activity, giving businesses access to more customer insights.

The Zoho CRM solution seamlessly connects customer journeys across various platforms and provides a unified view by consolidating data from multiple touchpoints into a single, comprehensive customer profile.

Regional head for Zoho South Africa Andrew Bourne explains that this enables customer experience teams to deliver consistent and personalised experiences for customers across channels.

He adds that Zoho CRM’s advanced analytics tools help the teams elevate the experience further with deep insights into customer behaviour and preferences.

“Moreover, Zoho CRM’s ability to integrate with various third-party applications enhances its capability to synchronise data from diverse sources, creating a single source of truth about the customer,” Bourne says. This holistic approach allows businesses to

manage, connect and enhance customer interactions and journeys more effectively, including providing a dashboard view of all the customer journey data.

“CRM uses data analytics to understand customer needs, allowing banks and financial institutions to offer tailored products, such as loans, savings accounts and investment opportunities, based on individual financial behaviour.”

This comprehensive data integration allows for the design of targeted offers and personalised communications.

“Furthermore, Zoho CRM’s ability to seamlessly integrate with other systems ensures that all relevant customer data is synchronised, facilitating real-time, customised service delivery,” Bourne says.

The platform’s low-code/no-code capabilities also allow quick adaptation to changing customer needs or new market opportunities, enhancing agility in launching tailored financial products and services.

“Zoho’s artificial intelligence features strike a balance between automation and personal interaction by offering actionable insights on the best engagement strategies. This ensures that routine tasks are automated while

maintaining meaningful and effective customer interactions.”

He adds that A/B testing allows businesses to experiment with different strategies and determine which variations drive the best engagement and retention by comparing their performance through data-driven results.

“Customer feedback loops involve gathering and analysing insights from customers to understand their experiences and preferences, enabling businesses to make informed adjustments that enhance satisfaction and relevance.

“Predictive analytics, meanwhile, uses historical data to anticipate future behaviours and trends, helping businesses proactively refine their strategies and tailor rewards to align with customer needs better.”

Bourne says that, together, these approaches ensure a business loyalty programme evolves effectively, maintaining its impact and relevance over time.

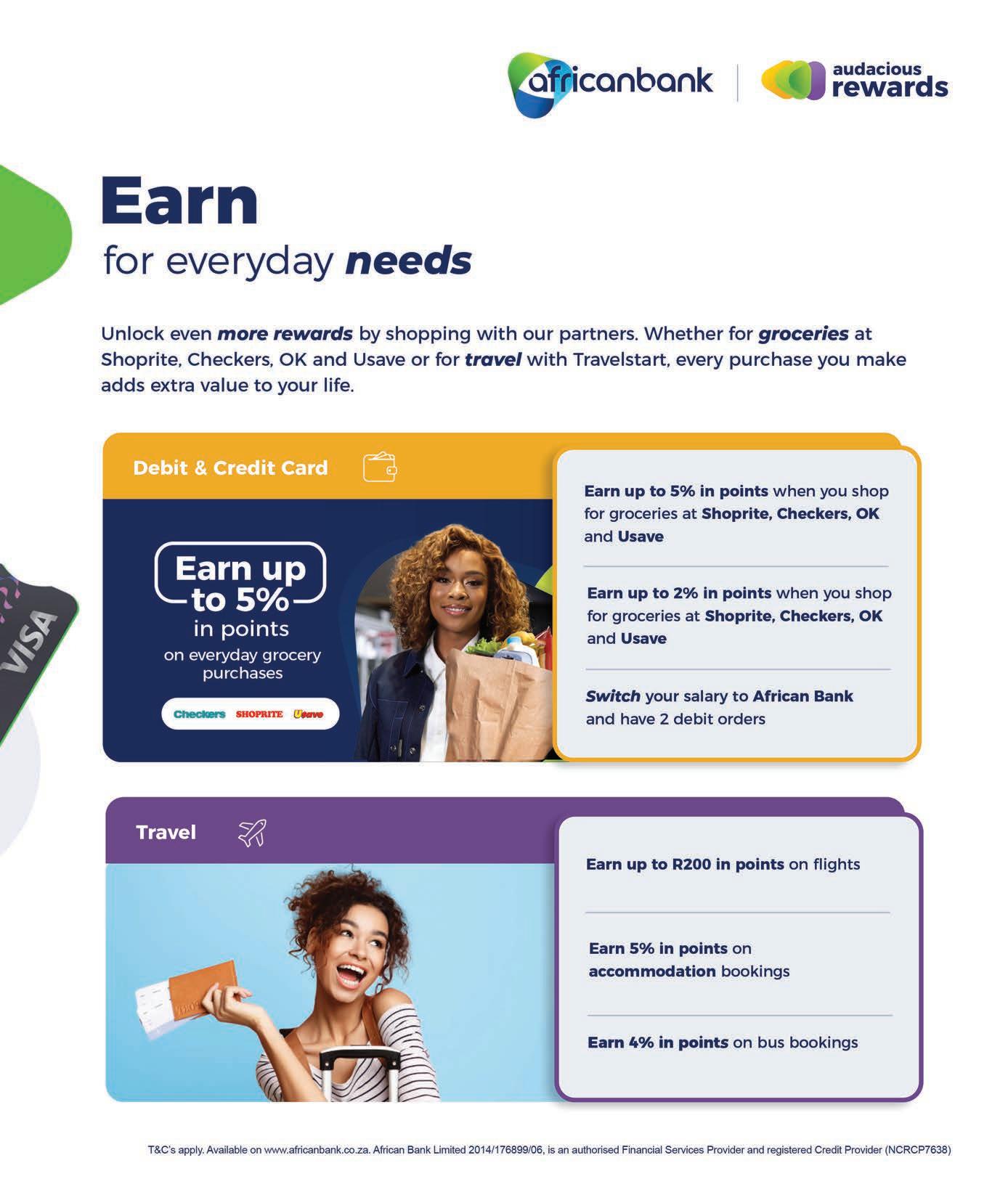

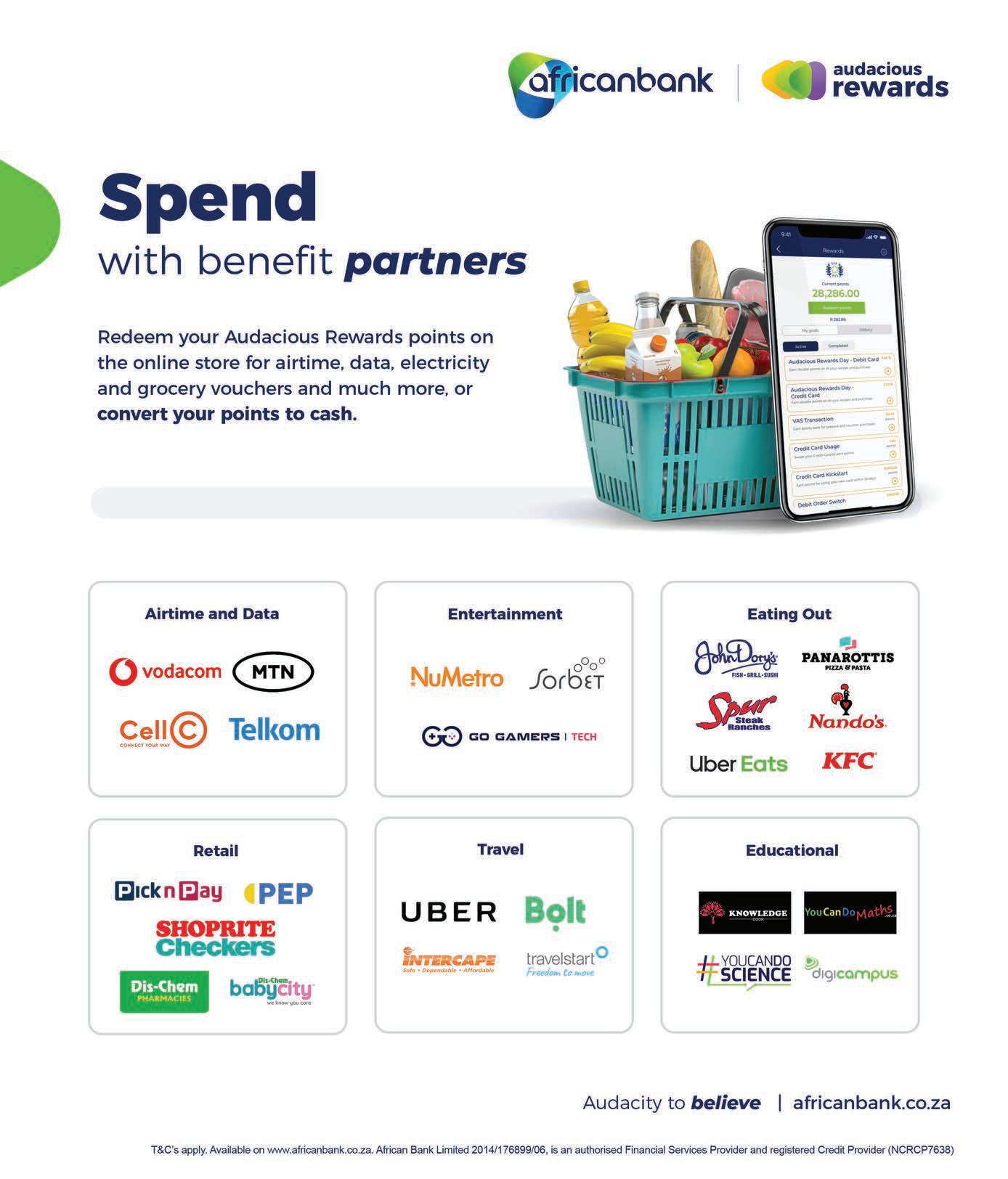

In a world where bank rewards programmes have become standard offerings across the banking sector, Africanbank’s Audacious Rewards Programme stands out not just for what it offers, but also who it serves.

By VUKANI MAGUBANE

Africanbank’s head of rewards and loyalty, Dr Nceba Hene, says: “Audacious Rewards was launched in February 2023 and is designed to incentivise you for your everyday banking and positive nancial behaviour. It speci cally targets the underserviced and underserved, therefore rewarding the unrewarded.”

Africanbank’s mission echoes throughout the Audacious Rewards Programme – especially its focus on customers who are often overlooked by the traditional banking system.

While many programmes cater to high-spending customers, Audacious Rewards dares to shake the paradigm. Every customer – no matter their income bracket – is recognised and rewarded for their commitment to positive nancial behaviour.

The programme is built on three core pillars: Join, Earn and Spend.

Dr Hene says customers can join for free via the Africanbank App, USSD or WhatsApp, making it accessible across all digital platforms.

“In just over a year since its launch, it has attracted over 800 000 members and is tracking ahead of target in customer acquisition. This rapid growth underscores the programme’s appeal and effectiveness in enhancing customers,” he comments.

Audacious Rewards recently received the Best Short-term Loyalty award at the 2024 International Loyalty Awards in Dubai and Best Re-launched Programme at the 2024 South African Loyalty Awards.

The programme makes earning points quick and easy. Customers can accumulate points through various everyday banking activities.

You earn points on every purchase using your Africanbank debit or credit card. On the 20 th of each month – Audacious Rewards Day – customers can earn double points for all transactions, a feature designed to inject excitement into routine banking.

Points are also awarded for value-added services, such as electricity, airtime and data, Money Send, Instant Payments and PayShap usage.

“Incentivising online transactions is aligned with our Africanbank strategy – Excelerate25 – and our mission to build a data and digitally enabled bank,” Dr Hene explains. Africanbank has strategically partnered with retailers,

“AUDACIOUS REWARDS IS EASY TO USE AND UNDERSTAND. THERE ARE NO HOOPS TO JUMP THROUGH; SIMPLY BANK WITH AFRICANBANK AND GET POINTS IMMEDIATELY.” – DR NCEBA HENE

such as Shoprite, Checkers, Usave and OK, to offer customers up to ve per cent back in Audacious Rewards points.

For travel enthusiasts, the programme offers up to R200 back on international ights, R100 on domestic ights and a percentage back on accommodation and bus bookings, all facilitated through Travelstart on the Africanbank site.

For those looking to bolster their nancial wellness, Audacious Rewards offers points for actions such as improving one’s credit score or making timely loan repayments.

It’s a daring approach that goes beyond the typical rewards programme, encouraging customers to engage in behaviour that strengthens their nancial health. Due to the programme, there has been a 516 per cent increase in requested credit reports, says Dr Hene.

What sets Audacious Rewards apart is the immediacy of the points. Customers can redeem points at over 31 partners, both in-store and online for essentials, such as airtime, data, electricity and grocery vouchers, or convert them into cash. Customers can convert their points into cash instantly, providing a quick nancial cushion when most needed.

“You can use these points to supplement your monthly income – they are immediately there for you to use when you’re low on grocery money or airtime,” explains Dr Hene. “This feature re ects the programme’s core philosophy: rewards should be practical, immediate and accessible.”

Dr Hene adds: “These are essentials we cannot do without. Audacious Rewards is easy to use and understand. There are no hoops to jump through; simply bank with Africanbank and get points immediately.”

Africanbank plans to expand the Audacious Rewards Programme further, integrating it across all its nancial products and services. The expansion will encourage customers to engage more intentionally with their nancial health, ensuring the programme continues to advance lives.

“Our mission is to democratise nancial services and promote inclusivity,” Dr Hene concludes.

Africanbank’s Audacious Rewards embodies the essence of its name. It dares to be different, to include and to reward in ways that matter. In doing so, it’s changing the game of customer loyalty – audaciously.

ITUMELENG MOGAKI examines how brands are capturing younger audiences through digital-first strategies, gamification and social engagement

Born between 1997 and 2012, Gen Zs grew up during an era of rapid digital transformation. This generation has witnessed the rise of smartphones, wearable technology, virtual assistants and e-commerce platforms from a young age, making them naturally receptive to new technologies.

As they enter the workforce, Gen Z has become an increasingly in uential consumer demographic. To successfully engage Gen Z, brands must rethink how they design and implement loyalty programmes, ensuring they align with the expectations, values and digital behaviours of this generation.

According to Márcia Eugénio, head of Momentum Multiply, one key element is the shift towards digital platforms as primary engagement channels with a strong focus on personalisation and seamless integration.

“South African brands are increasingly prioritising mobile apps, social media and e-commerce integration as primary channels for loyalty programmes. Apps have proven to be especially effective because they offer a platform for personalised offers, rewards and communication, allowing users to track points, redeem rewards and access exclusive content effortlessly,” she says, adding that this personalised approach powered by next-generation technology goes beyond mere data collection, enabling brands to gain deeper insights into consumer behaviour.

Eugénio says these insights bene t brands and consumers, leading to more meaningful interactions and better-informed decision-making. “However, brands must also prioritise data security and transparency to maintain consumer trust, particularly as they increase their reliance on digital platforms.”

One of the biggest trends reshaping loyalty programmes is gami cation, incorporating playful, competitive elements to encourage engagement, Eugénio points out.

“Data also shows that members are very competitive on these platforms and

enjoy sharing screenshots of their recharge scores and leaderboard challenge results, engaging actively on those levels. Even small rewards can create a positive feedback loop, encouraging continued engagement.

“For example, Momentum Multiply’s wellness rewards programme incentivises members to look after their health and wellbeing. Through its mobile app, members can complete health and tness assessments in less than 90 seconds, receiving personalised health insights,” she says.

“This programme exempli es how rewarding behaviour that promotes wellness can be more impactful than traditional discount-based rewards. This approach also transforms loyalty programmes into interactive experiences rather than simple transactional systems.”

Gen Z is an intensely social generation, says Eugénio, and brands are increasingly leveraging social media platforms, such as TikTok and Instagram, to build loyalty communities.

“User-generated content is a particularly powerful tool in this regard. Encouraging members to share content related to their loyalty programmes, whether through

“PURPOSE-DRIVEN LOYALTY INITIATIVES, SUCH AS OFFERING REWARDS FOR SUSTAINABLE PURCHASES OR SUPPORTING SOCIAL CAUSES, RESONATE STRONGLY WITH GEN Z.” – MÁRCIA EUGÉNIO

testimonials, sharing leaderboard results or creating product reviews, can help build a sense of community.

“However, authenticity is key. Gen Z values in uencers who are relatable and genuine. Brands should select in uencers who can showcase real-life bene ts from using loyalty programmes, aligning with Gen Z’s desire for transparency and truthfulness,” she says, adding that even small rewards, such as leaderboard recognition or modest prizes, create a positive feedback loop that encourages continuous engagement on social platforms.

For Gen Z, purpose matters. This generation is highly invested in social causes and sustainability and expect brands to align with their values. “Purpose-driven loyalty initiatives, such as offering rewards for sustainable purchases or supporting social causes, resonate strongly with Gen Z,” explains Eugénio.

Glenn Gillis, CEO of Sea Monster, also points out that modern loyalty is no longer just about accumulating points, but also building community, promoting values

TO SUCCESSFULLY ENGAGE GEN Z, BRANDS MUST RETHINK HOW THEY DESIGN AND IMPLEMENT LOYALTY

Guillaume Noé, VP of growth platform at Carry1st, says loyalty programmes within gaming platforms differ from traditional loyalty models in several ways.

“For example, gaming loyalty programmes, such as Carry1st’s discount points, allow users to earn and redeem rewards across a range of digital products, including in-game currency and mobile data. This flexibility contrasts with the narrow focus of traditional loyalty programmes, which often limits rewards to specific product categories or retail brands,” says Noé.

He says gaming loyalty programmes also offer greater interactivity by integrating rewards directly into gameplay. Players may earn points or rewards for completing in-game challenges or reaching certain milestones, making rewards feel more immediate and relevant compared to the delayed gratification typical of traditional programmes.

He adds that gaming platforms incorporate community features, such as leaderboards, which enhance social competition and emotional investment by allowing players to compete for real-life prizes.

Noé says, in general, in-game purchases and rewards are designed to enhance the player’s experience.

“For example, first-player shooters on mobile, such as Call of Duty: Mobile, PUBG Mobile or Free Fire, let players customise their characters with a vast range of items. These items are purely cosmetic and don’t change the gameplay. Players simply have more fun entering the battlefield dressed as a chicken or with a cool futuristic outfit. Gen Zs love to express their creativity and personality in-game.”

He adds: “For Gen Zs, Carry1st discount points provide a clear value proposition as this demographic appreciates customisation and control over their spending and rewards. With each purchase, they accumulate points they can use at their convenience over a vast range of products. From PC (Roblox, Minecraft), console (Playstation) and mobile games to entertainment (Spotify), dating (Tinder), ride-hailing (Uber), airtime and electricity, all generations’ needs are covered. Benefits can be shared among the entire family.”

Gaming platforms also leverage digital economies to enhance retention. In Carry1st’s case, points can be used for future purchases, providing customers with a sense of delayed gratification that mirrors the reward structures found in many games. “By allowing players to accumulate rewards and control how they’re spent, platforms create a sense of ownership and investment,” says Noé.

and encouraging meaningful engagement. For instance, Hilton Hotels launched a membership rewards initiative on Roblox featuring Paris Hilton, combining gaming with sustainability and engaging users on a platform they frequent. This example highlights the future of loyalty, which is increasingly intertwined with gaming and purpose-driven initiatives.

By aligning loyalty programmes with the causes and values that matter to Gen Z, brands can cultivate authentic loyalty in a rapidly changing market.

“One key challenge for gaming loyalty programmes is maintaining a balance between fun and commercialisation,” says Noé. “If users feel they need to overspend to earn rewards, the experience can become less enjoyable. Carry1st addresses this by gamifying its entire ecosystem, enabling users to

According to Telefonic.com, the global super app market is expected to grow by 27.8 per cent between 2023 and 2030.

LISA WITEPSKI explores the many ways super apps are redefining loyalty

Super apps provide an integrated ecosystem of products and services that can be accessed on one platform, says Shaheed Mohamed, executive head: customer value management at MultiChoice South Africa. “They typically start with a core offering and then expand into adjacent products and services,” he explains. Unsurprisingly, super apps have been embraced enthusiastically. Safaricom’s M-Pesa was founded in Kenya but has now scaled across the continent, Mohamed notes, while Nigeria’s JumiaPay is another success story, allowing customers to access a variety of products and services, from bus tickets to investment platforms, on its e-commerce platforms.

“The adoption of super apps on the continent has been primarily driven by an increase in smartphone penetration, facilitated by the affordability and accessibility of these devices,” Mohamed says. The increasing availability of mobile internet connectivity across the continent has also played a role, along with enabling infrastructure.

Savvy brands have been swift to identify the potential of these platforms to in uence consumer behaviour – hence the adoption of super apps into the loyalty space. Indeed, says Mohamed, a super app can be an exceptionally powerful tool for collecting and

consolidating customer data. That’s because all customer behaviours – including payments, purchases and the use of partner offerings – take place within the integrated ecosystem on a single platform. “With this information, we can create personalised and bespoke rewards offerings based on our customers’ preferences,” Mohamed explains.

At DStv, for example, the introduction of a super app made it possible to integrate multiple aspects of the reward programme onto a single platform. “The DStv Rewards proposition spans various products and value-added services with the objective of driving customer stickiness and reducing churn. Today, DStv Rewards customers can earn digital currencies through gami cation and challenges and redeem digital currencies within a closed loop environment for groceries, airtime and various retail vouchers.”

The super app further makes it possible for customers to bene t from rewards and discounts such as subscription upgrades, free movie rentals and access to exclusive events and merchandise. “This gives customers an experience that allows them to self-service and manage their subscription and to engage with our rewards programme while doing so,” Mohamed says.

He adds that they intend to enhance the offering further with the introduction of an e-commerce capability that will allow customers to save their rewards currency in a digital wallet and incentivise them to spend it within a prede ned ecosystem.

Thus, DStv may increase stickiness by further entrenching products, he points out.

Vodacom is another company leveraging the bene ts of a super app. The facility is promoted on the Vodacom website as “the only app you’ll ever need, turning clutter into one calm, simple system, and houses everything you need, all under one roof”.

Customers can use the super app to access exclusive deals, make cashless payments, keep money safe and access their favourite apps. This has fed into Vodacom’s loyalty programme, VodaBucks, says Monique Alley, executive head of loyalty at Vodacom South Africa.

“Vodacom’s ongoing enhancements to VodaBucks re ect its commitment to customer satisfaction. With the integration of personalised offers and the ease of managing rewards through our VodaPay super app, VodaBucks has become a seamless part of the customer journey. The platform is not just about rewards; it is about building a long-term relationship with customers, giving them more reasons to stay engaged with Vodacom.”

Super apps will continue to shape market dynamics, maintains Mohamed. “On one hand, they have created opportunities for increased partnerships by enabling other service providers, including smaller companies, to participate and gain access to a large, already engaged customer base. On the other hand, the rise of super apps, known for their extensive offerings, makes it challenging for smaller organisations that choose not to be part of the ecosystem to compete.

“For the digital economy, the increased usage of super apps continues to drive digital inclusion and economic participation by bringing products and services closer to customers who might otherwise nd them dif cult to access.”

“A SUPER APP CAN BE AN EXCEPTIONALLY POWERFUL TOOL FOR COLLECTING AND CONSOLIDATING CUSTOMER DATA.” – SHAHEED MOHAMED

If we were to take a sneak peek into your wallet or smartphone, I am sure we would find it packed to the brim with loyalty reward cards or apps from various brands. You’re not alone; in fact, you’re part of a significant trend, writes

TREVOR KANA

The 2023/4 South African Loyalty Landscape report from Truth & BrandMapp, reveals that 76 per cent of South Africans use loyalty programmes. Insights from researchandmarkets.com show that the value loyalty programme market in the country is expected to reach $556.7-million by 2028, or around R10-billion, at today’s exchange rate. Whether the cost-of-living crisis or our addiction to being instantly rewarded, South Africans love loyalty programmes. But where do loyalty reward programmes come from, and how have they changed over time?

Loyalty programmes have a rich history spanning centuries. The concept can be traced back to the ancient Egyptians, who practised a form of reward programme in which workers, slaves and the af uent were awarded commodity “tokens” (similar to loyalty points or miles) for their work and temple time. These “tokens” were exchanged for food, goods and services.

Fast-forward to the 19 th and 20 th centuries. Retailers started using trading marks, checks, tokens, tickets, coupons and stamps as incentives for repeat business. Customers would receive these rewards, which could later be redeemed for products or services,

2023 Loyalty Landscape Whitepaper

for every purchase. These simple but ef cient ideas were the foundation for today’s loyalty programmes.

However, the turning point in the evolution of loyalty programmes came in the 1980s, thanks to American Airlines.

The airline launched American AAdvantage, the rst-ever frequent yer and modern loyalty programme. This ground-breaking programme not only allowed American Airlines to disintermediate and improve its relationship with customers, but also set a new standard for customer loyalty.

As new technologies became mainstream and our everyday interactions migrated to the digital realm in the 21st century, brands recognised the potential of digital technologies to enhance customer interactions. By the mid-2010s, the adoption of arti cial intelligence (AI)-driven technologies started gaining traction. Implementing machine learning algorithms allowed for more sophisticated data analysis, enabling brands to offer personalised rewards based on individual customer behaviours and preferences.

Chatbots and virtual assistants emerged as critical components of this transformation. Initially, they were designed to handle basic customer inquiries and support tasks. Furthermore, advancements in natural language processing and machine learning have enabled these tools to perform more complex functions such as providing personalised recommendations, managing loyalty points and facilitating seamless interactions with loyalty programmes.

However, for brands and consumers to optimally enjoy the bene ts of these technologies, the two parties need the right platform for both to be fully engaged. Jonathan Elcock, CEO of Rather.Chat, highlights that “old channels of communicating with customers such as emails and telephone are dying. People are hesitant to download an app for single usage or visit web pages to log in. The preferred engagement is via WhatsApp as it is a channel that prevents you from consistently spamming people. It empowers users as channels can get blocked. When you combine it with

AI, you get a rich two-way communication channel personalised for the user.”

Dinesh Govender, CEO of Discovery Vitality, shares the same sentiment on the potential of AI-powered WhatsApp channels: “Vitality has embraced AI and welcomed this change, using it to drive ef ciencies throughout our organisation and provide increased value to our customers. The most apparent use of AI can be found in our customer service teams. Our AI-powered virtual agent, Ask Discovery, is available to customers 24/7 for any questions or queries.

“Ask Discovery has been so successful with signi cant uptake that half our servicing interactions are now handled digitally. We have also won the award for best technology innovation from the Contact Centre Management Group.”

With more brands leaning on AI to improve customer experience, it is not always smooth sailing as brands still need to contend with challenges. “With AI capabilities being discovered daily, the same can be said for the risks and vulnerabilities it exposes. Challenges [when integrating AI into loyalty programmes] include striking a balance between keeping up with changing times, incorporating a powerful game-changing technology and protecting the integrity of the business and its customers. Other challenges may include the complexity of the new technology, specialised expertise and potential costs related to adjusting existing infrastructure, processes and people to align with the introduction of AI,” explains Govender.

AI is not only helping brands engage with customers via WhatsApp, but also increasing user retention on apps. “Gami cation is increasingly becoming a core part of our framework and with our challenge-based Absa Advantage in-app capability, we provide clients with a gami ed challenge every three weeks, inviting them to participate and claim a voucher of their choice upon completion,” says Alicia Raynard, executive: Absa Rewards, Absa Everyday Banking. “AI helps us identify the best challenge to allocate to each client based on the client’s pro le and experience. The solution is supported by AI, which tracks when users complete required activities and are therefore eligible for the available reward –enjoying a meal on us. More than four million challenges have been completed on Absa Advantage since inception in 2021.”

Integrating AI into loyalty programmes is revolutionising how brands engage with customers, offering more personalised, ef cient and interactive experiences. From AI-powered chatbots and virtual assistants to gami cation features that enhance user engagement, technology is shaping the future of customer loyalty. However, while the bene ts are undeniable, brands must navigate the challenges of adopting new technologies, balancing innovation with security and ensuring seamless integration. As AI continues to evolve, it presents both immense opportunities and critical considerations for businesses aiming to build deeper, more meaningful relationships with their customers.

“THE PREFERRED ENGAGEMENT IS VIA WHATSAPP AS IT IS A CHANNEL THAT PREVENTS YOU FROM CONSISTENTLY SPAMMING PEOPLE. IT EMPOWERS USERS AS CHANNELS CAN GET BLOCKED.” – JONATHAN ELCOCK

CHRIS ERASMUS, country manager of AWS South Africa, shares that having access to great artificial intelligence tools can make people feel more empowered

It’s like that line from the theme to the classic TV sitcom Cheers: “You wanna go where everybody knows your name”. It’s as true of your local corner store, coffee shop or market stall as it is of that ctional bar in Boston. There’s something about someone knowing what we want without our having to ask that makes us feel understood. It makes us feel valued. It makes us want to go there.

Larger businesses have long searched for a way of generating the sort of loyalty that comes from personal contact and that sense of being known. One route is to throw people at the challenge, but great one-on-one service comes at a cost. Another has been loyalty programmes.

Loyalty programmes have been around since at least the 19 th century when stamps or tokens were introduced to encourage repeat custom. Since the digital revolution, they’ve grown increasingly sophisticated. The technology underpinning such schemes has evolved rapidly. People, however, have not. We tend to be quick to judge. If a service isn’t useful to us, we don’t use it. According to Gary Drenik, co-founder of Prosper

for a good system to know us almost better than we know ourselves. With all the touchpoints customers tend to hit on their journeys through an organisation’s digital presence, there is a vast amount of unique rst-party data available.

As Vijay Chittoor, co-founder and CEO of intelligent customer engagement platform Blueshift, points out: “It’s really worth taking that customer rst-party data and translating it into the who, what, when and where of how to engage with the customer.”

However. a major challenge hitherto has been that marketing teams have struggled to use all this data. “When you’re making these decisions manually,” Chittoor says, “you are oversimplifying it quite a bit and lumping a bunch of customers together and you’re saying ‘this whole segment let’s just target them with this one offer’.”

Insights & Analytics, which tracks consumer behaviour, on average, American shoppers belong to 19 loyalty schemes but actively participate in just 3 of them. The answer lies in personalisation.

Deloitte Digital’s Personalizing Growth report suggests that two-thirds of consumers (67 per cent) said they spend more when schemes are tailored to anticipate their needs. And, almost 7 in 10 spend more if that personalisation leads them to well-targeted new products, services or content. At the same time, around half feel that the “personalisation” on offer doesn’t “get” them.

And there’s another potential pitfall –there’s a point at which personalisation feels too much. It’s like nding that the barista in your local café follows all your social media accounts. Understanding is great up to the point where it starts to feel intrusive.

Achieving an appropriate level of personalisation at scale is a challenge. Even without the breadcrumbs we all leave as we navigate social media, it’s possible

AI CAN DO THE HEAVY LIFTING, LEAVING THE PROFESSIONALS TO THINK CREATIVELY, SHIFTING FROM A CULTURE OF “BUSYNESS” INTO ONE OF INNOVATION AND PRODUCTIVITY.

This is where arti cial intelligence (AI) comes in. It can make the who, what, when and where decisions in the moment at an individual-customer level and at scale.

So where does this leave the marketing team? Having access to great AI tools leaves them empowered. AI can do the heavy lifting, leaving the professionals to think creatively, shifting from a culture of “busyness” into one of innovation and productivity. Great creative thinking delivers great marketing campaigns. What AI brings to the table is the granularity at scale that enables those campaigns to connect with each customer as an individual.

That’s why AWS is committed to doing more than simply deliver AI. We’re committed to ensuring that anyone who wants them has the skills to use it to great effect. That’s the future

The importance of agile rewards programmes during economic uncertainty.

By KGOMOTSO ZAAKE , head: customer rewards solutions at Nedbank

The economic volatility of recent years has had a huge impact on consumer behaviour. In times of uncertainty, consumers are more deliberate about where and how they spend their money. They look for added value in the services they engage with, and many turn to rewards programmes as a way of stretching their household budgets. In this climate, loyalty programmes offering immediate rewards, such as cashback, discounts or bene ts that help with daily living costs, become more attractive than those that only offer longer-term or aspirational rewards. Customers want to earn and redeem rewards that provide tangible value in their everyday lives.

Against this backdrop, agility is key. In rewards programmes, agility means the ability to respond quickly and effectively to both consumer behaviours and external factors such as economic conditions, market trends and technological advancements. An agile rewards programme can adapt its reward offerings, redemption processes and customer engagement strategies in real-time to ensure continued relevance.

Such agility is vital for both consumers and businesses. From the consumer’s perspective, an agile programme is one that acknowledges their nancial situation and adjusts its rewards accordingly. For businesses, agility ensures their rewards programmes remain competitive in a crowded market.

At Nedbank, our ongoing focus is on building this level of agility into our Greenbacks Rewards programme. Through this process, we have learned several key lessons regarding the principles that any loyalty or rewards programme needs to focus on to ensure agility. These include:

• Flexibility in reward options. Consumers want choice. Offering diverse redemption options ensures the programme can cater to a broad range of consumer needs. Nedbank Greenbacks is a case in point. Recognising the growing nancial pressures on consumers, we’ve made the programme more responsive to member needs by offering practical, everyday rewards. For example, members can redeem Greenbacks for essential services, such as groceries or prepaid electricity, re ecting the increasing demand for rewards that address basic household needs. We’ve also reviewed our earn rate to ensure members receive up to two per cent unlimited cashback when using their Greenbacks-linked card. This immediate return on spending is particularly appealing in an economic climate where every rand counts.

Building agility into loyalty programmes is not just a strategy for growth; it’s a necessity for survival. A programme’s success is no longer just about the size of the rewards on offer, but how relevant those rewards are to a consumer’s immediate needs.

as rewards redemption. Greenbacks’ digital integration allows members to access rewards seamlessly via the Nedbank Money app, enhancing agility and ensuring ease of use and accessibility.

• Customer-centric design. A truly agile rewards programme is built with the customer at its core. Understanding what consumers value most at any given time and integrating these insights into programme design ensures such programmes remain relevant.

• Real-time adaptability

The ability to make real-time adjustments to a loyalty programme is essential. This includes updating rewards in response to technology or market trends and re ning the programme’s capabilities to enable on-the-go access to information and functionalities such

• Leveraging data. Data is the backbone of agility. Regularly collecting and analysing customer feedback, transaction histories and usage patterns allows businesses to tailor their loyalty programmes to t current trends. This data-driven approach ensures programme changes are informed by actual consumer behaviour rather than assumptions. By tracking how members use their rewards and responding with relevant campaigns and value proposition enhancements, Greenbacks remains aligned with customer priorities, ensuring it continues to offer value, even in challenging times.

Building agility into loyalty programmes is not just a strategy for growth; it’s a necessity for survival. A programme’s success is no longer just about the size of the rewards on offer, but how relevant those rewards are to a consumer’s immediate needs. When a loyalty or rewards programme is agile, it can pivot as needed, offering customers value that resonates with their current nancial realities and adapting as those realities shift.

FRANS MALULEKE , senior manager: consumer & retail marketing at Sasol, shares the power of streamlined loyalty programmes in building brand success

Over the past few years, rewards programmes have become increasingly important to brands and consumers. For brands, especially those in competitive and commoditised sectors, they have become an essential foundation of loyalty and long-term relationships with their customers.

From the consumer side, rewards have become a part of their budgeting and planning in these nancially challenging times. The recent South African Loyalty Landscape whitepaper by Truth & BrandMapp shows that three-quarters of consumers were using loyalty programmes in 2023/2024, up from 67 per cent in 2015. Many of them count on their loyalty points or cashbacks to help them stretch their budget to afford well-deserved treats and spoils; for some, loyalty rewards help them to pay for essentials such as groceries, fuel, health and beauty products, airtime and more. However, many rewards programmes are more restrictive and dif cult to understand than consumers would like.

This is where we started when we designed our Sasol Rewards Fuel loyalty programme

– we wanted to create an offering to address some of the common pain points consumers encounter in rewards programmes. Here are some principles we followed in creating Sasol Rewards, which launched in April 2022.

• Rewards must be tangible and make a real difference to the customer’s pocket . Fuel, like bank fees or medical

Sasol Rewards was voted “Best Newcomer Loyalty Programme” at the 2023 South African Loyalty Awards as well as customer experience winner in the Petrol Stations: Forecourt Industry category as measured in the 2024/2025 Ask Afrika Orange Index benchmark.

cover, is a grudge purchase. We wanted the Sasol Rewards loyalty programme to make spending money on fuel and convenience store necessities a little more gratifying for our customers. We designed the programme to make it easy for our customers to earn meaningful rewards instantly and spend rewards points on the things they want and need. You can spend the points you earn on fuel on your favourite products at Sasol Delight stores and on buying vouchers with a growing list of partners, including Net orist and Nu Metro.

• Convenience is key. One of the factors we realised would be critical in driving adoption and ongoing usage of our fuel rewards programme was convenience. It must be easy to join the programme, earn, track and redeem points. With Sasol Rewards, customers can join in less than three minutes at a participating Sasol Convenience Centre, using our Payment Terminal Device and instantly start earning points. Earning and redeeming points is as easy as presenting your virtual or physical

Sasol Rewards loyalty card.

spending points. Sasol Rewards members can earn 30 points per litre when lling up at participating Sasol Convenience Centres and earn one point for every R2 spent at participating Sasol Delight stores on select products.

• More freedom of choice. One of the unique propositions of our rewards programme is that it isn’t tied exclusively to a single bank. We have a long-standing partnership with Absa, where Absa Rewards members get additional points for spending at Sasol Convenience Centres. But you can get Sasol Rewards, no matter who you bank with.

• Use technology to make it user-friendly. Our user-friendly mobile app enhances the Sasol Rewards experience. It is available on all app stores and includes a digital card, making it easy to earn, track and redeem points on your phone. The points balance is updated in real-time, in rand value, and your transaction history is always at hand. The functionalities support the other pillars of the Sasol Rewards loyalty programme, including convenience and simplicity. These factors have helped to not only drive adoption of Sasol Rewards – we have attracted over 1.8 million members in just two years – but also to drive ongoing customer engagement. A streamlined, easy-to-understand programme boosts customer participation and encourages frequent use by eliminating unnecessary friction. When rewards are accessible, demonstrate tangible value and redemption is effortless, customers engage more. This cultivates loyalty, reinforcing the value of a customer-centric approach and driving long-term relationships that are rewarding for both sides.

• Simplicity and transparency drive engagement. For our industry, we decided that a simple, universal value proposition customers can easily grasp would work the best. There are no complex tiers to navigate or dif cult conditions to meet before you can start earning and

#SasolRewards – Where your spend pays you back

HIGH-FLYERS is a fully immersive read where you get to discover, enjoy and connect to the heartbeat of what makes South Africa a unique cultural and travel experience.

ADVERTISING CONTACT

RICHARD WHITE

SALES PROJECT MANAGER

T: +27 83 229 4040

E: RICHARDW@PICASSO.CO.ZA

PUBLISHER

PICASSO HEADLINE, a proud division of ARENA HOLDINGS (Pty) Ltd Hill on Empire 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg

Financial services organisations and fuel retailers are teaming up and leveraging digital technology to offer rewards that exceed customer expectations and drive increased loyalty, writes RODNEY WEIDEMANN

The loyalty landscape is constantly evolving as brands seek strategic partnerships that will deliver more to their clients, increase customer loyalty through access to unique and meaningful bene ts and enable the creation of more integrated and scalable ecosystems.

One of the key alliances in this space is found in the increasing number of partnerships between fuel suppliers and organisations in the nancial services sector as such alliances enable these entities to offer customers a broader range of more meaningful rewards.

Fayelizabeth Foster, head of loyalty and rewards at Standard Bank SA, says such strategic partnerships are emerging as a crucial asset and differentiator for brands.

“With the high cost of fuel, the partnership becomes even more relevant to customers who are paying signi cantly more for this grudge purchase. The bank-fuel partnership has therefore in uenced customers’ decisions on where to refuel their vehicles, and is often prioritised over the fuel retailer’s location,” she says.

“This is bene cial for the bank, the fuel retailer and the consumer – the banks retain

“THE BANK-FUEL PARTNERSHIP HAS THEREFORE INFLUENCED CUSTOMERS’ DECISIONS ON WHERE TO REFUEL THEIR VEHICLES, AND IS OFTEN PRIORITISED OVER THE FUEL RETAILER’S LOCATION.” – FAYELIZABETH FOSTER

their customers, the fuel retailer gains a loyal customer base and consumers bene t from rewards on a purchase that is a pain point for them.”

Nokwanda Khumalo, GM for mobility and convenience at BP South Africa, suggests that transport and miscellaneous goods, such as nancial services, account for almost a third of the average household’s monthly spending.

“South African consumers are in a tough economic place due to high interest rates, food in ation and a generally higher cost of living. The fuel industry and nancial organisations have come together to offer consumers some nancial relief in our areas of in uence,” she says.

Nokwanda Khumalo

BP’s partners in this, Discovery Insure, indicate that this type of partnership ecosystem is core to its shared value model.

Precious Nduli, head of technical marketing and marketing at Discovery Insure, notes that the aim is to encourage people to be healthier.

“Our rewards programme with BP is designed to incentivise customers to drive better, which not only reduces stress, but also the potential for accidents – both of which lead to improved health outcomes,” she says.

“We have chosen to focus on fuel rewards because this is a massive part of the running cost of a vehicle. We initially partnered with BP and then later also with Shell, as one of the early pioneers in this space. Cashback rewards for fuel also provide an emotive bene t as it reduces the stress for customers when the fuel price goes up.”

Nduli says a key strength of the programme is how it structures the various rewards, as the goal is to modify the behaviour of customers positively.

“The aim is to make them become better drivers, which is why we also offer discounts on tyres, car services and more, along with the fuel rewards.

“Our Vitality Drive Programme offers a whole host of rewards, including the fuel rewards of up to fty per cent back on cash spend, which drives customer retention, as clients who earn rewards have a ninety per cent lower lapse ratio. The programme’s goal is to encourage better driving, which also helps to lower the number of vehicle insurance claims.

“Remember, South Africa has one of worst fatality ratios in the world for car accidents, so any successful effort to lower this is good for the country as a whole, considering that road fatalities cost the South African economy up to three per cent. Therefore helping create a nation of better drivers is vital,” notes Nduli.

Standard Bank’s Foster says UCount’s partnership with Astron Energy/Caltex offers up to R5 back for every litre of fuel/oil purchased, depending on the member’s tier level.

“After the spike in fuel prices in 2022, UCount decided to double its fuel rewards, giving its members an opportunity to earn up to ten rand back per litre of fuel and oil purchased. UCount Rewards members have bene tted from our fuel partnership by either earning points or using them to pay for 2.2 billion litres of fuel since launch. Member penetration into our fuel partner has also grown by two hundred and thirty-one per cent and continues to do so, as members nd value in our rich fuel offering,” she explains.

“Our loyalty programme drives meaningful engagement with personalised offers through the in-app platform, called ‘Goals & Gains’. This channel is unique to UCount Rewards members, giving them personalised activities and rewarding them with additional bene ts upon completion, such as vouchers. Data is used to identify customer behaviours from their purchase history and engagement with Standard Bank to create personalised offers relevant to them.”

Pieter Woodhatch, eBucks Rewards CEO at FNB, explains that technology has been a critical enabler in the success of the eBucks Rewards and Engen partnership, facilitating

seamless integration from data sharing to customer interface.

“The advanced use of data analytics has allowed both brands to share and utilise customer behavioural insights to enable the conceptualisation of targeted offers that resonate with the speci c needs of our customers. This data-driven approach has enhanced the value proposition, evolving the innovation and behavioural change over time,” he says.

“On the customer interface front, technology has streamlined the process of earning and redeeming rewards. FNB’s digital platforms –including our banking app – provide a user-friendly interface where customers can track fuel purchases and view reward balances, as well as access real-time offers easily.”

To support this partnership, continues Woodhatch, Engen 1app enables customers to link their FNB banking cards and earn eBucks rewards. This digital integration has been crucial in encouraging repeat purchases and strengthening customer relationships, by providing added convenience.

“Additionally, the app’s gami cation features, such as ‘Spin and Win’, have signi cantly increased user engagement

“CASHBACK REWARDS FOR FUEL ALSO PROVIDE AN EMOTIVE BENEFIT AS IT REDUCES THE STRESS FOR CUSTOMERS WHEN THE FUEL PRICE GOES UP.” – PRECIOUS NDULI

by promoting frequent interaction and making the app more attractive. This feature also serves as a marketing tool, creating an engaging platform to highlight special offers and rewards, which drives ongoing customer involvement,” Woodhatch says.

BP’s Khumalo agrees that technology is critical to facilitate collaborations, but notes the company realised it had to select the right technology to give it the exibility to share information while protecting sensitive customer data.

“Our nal solution is fully compliant with South Africa’s privacy and data protection laws, is very simple to implement and gives the customer an immediate seamless interface between the purchase of fuel on the forecourt, their bank (if paying by credit

Fayelizabeth Foster, head of loyalty and rewards at Standard Bank, says that the strategic alliance between UCount Rewards, the bank’s loyalty programme, and Caltex/Astron is proving valuable to the bank, its customers and the fuel retailer.

“Since its launch in June 2013, UCount Rewards has grown its membership by an average of six per cent year on year. As the member base grew, engagement and redemption patterns evolved. In the industry’s ever-increasing competitive environment, strategic partnerships are essential for brands to stand out.

“One notable partnership is the collaboration between banks and fuel companies, designed to provide added value to clients amid rising fuel costs,” says Foster. In the 2015 South African Loyalty Landscape whitepaper, only financial services-driven fuel rewards programmes featured in the top 15 most used loyalty programmes in South Africa. Today, fuel rewards are ubiquitous, with many fuel retailers offering their own programmes.

“When fuel prices surged in 2022, we analysed customer spending data and tracked fuel spend and redemptions at Caltex/Astron Energy. This revealed that

card) and the Discovery Insure points-back programme. The system we use is designed to extract only the information that is needed to build a seamless customer interface that will drive customer satisfaction.

“Loyalty programmes provide a gateway into getting to know your customers and establishing a one-on-one relationship

with them. As technology and machine learning advance at an accelerated rate, businesses can discover customer insights faster and respond in an agile manner. This presents a very exciting opportunity where we can exceed their expectations, drive increased loyalty and truly delight each customer,” Khumalo concludes.