Supporting South Africa’s e-commerce and logistics sectors

PUBLISHED BY

Holding assets offshore is complex, investors need to understand the potential complications; An expert shares three tips on legal and tax issues in commercial property; The top five market trends for investment professionals.

Technology advancements; Understanding your insurance risks. 16 THE

A look at how commercial developers are pivoting and creating smaller hybrid commercial spaces.

Repurposing commercial buildings for residential use perfectly addresses the utilisation of unused or underused spaces to house people close to commercial activity. 22 SUSTAINABLE

Sustainable living is about much more than being eco-friendly. We unpack what is shaping sustainable building trends.

Supporting South Africa’s booming e-commerce and logistics sectors; South Africa’s hospitality renaissance.

30 RETAIL

Embracing innovation for a future-ready industry.

35 MIXED-USE DEVELOPMENT

The allure of estate living: why mixed-use and mature developments are redefining lifestyle choices in South Africa.

47

Purchasing property abroad can be a great way to hedge against political and economic uncertainties.

49 RESIDENTIAL PROPERTY

Deciding between older homes and newly built properties; Modern retirement developments.

Picasso Headline, A proud division of Arena Holdings (Pty) Ltd, Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

EDITORIAL

Content Manager: Raina Julies rainaj@picasso.co.za

Contributors: Jerome Brink, Rex Cowley, Juan Fourie, Ruvan Grobler, Imogen Mantel, Waldo Marcus, Itumeleng Mogaki, Anthony Sharpe, Somaya Stockenstroom, Gus van der Spek, Jacques van Embden, Sam Wenger

Copy Editor: Brenda Bryden

Content Co-ordinator: Natasha Maneveldt

Online Editor: Stacey Visser vissers@businessmediamags.co.za

DESIGN

Head of Design: Jayne Macé-Ferguson

Senior Design: Mfundo Archie Ndzo

Cover Image: Supplied

SALES

Project Manager: Merryl Klein merrylk@picasso.co.za | +27 21 469 2446

PRODUCTION

Production Editor: Shamiela Brenner

Advertising Co-ordinator: Fatima Drama

Subscriptions and Distribution: Fatima Dramat fatimad@picasso.co.za

Printer: CTP Printers, Cape Town

MANAGEMENT

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt General Manager, Magazines: Jocelyne Bayer

COPYRIGHT: Picasso Headline. No portion of this magazine may be reproduced in any form without written consent of the publisher. The publisher is not responsible for unsolicited material. Property is published by Picasso Headline. The opinions expressed are not necessarily those of Picasso Headline. All advertisements/advertorials have been paid for and therefore do not carry any endorsement by the publisher.

South Africans looking to diversify their assets or hedge against currency volatility by investing offshore need to be cognisant of the complexity they may inadvertently be creating for themselves and their families when holding assets cross-border, writes REX COWLEY, director and co-founder of Overseas Trust and Pension

Whether looking to access hard currency in the form of dollars, euros or pounds, buying property or taking advantage of investment opportunities in global companies, South Africans need to educate themselves about the various challenges they could encounter regarding their offshore investments.

When placing assets offshore, many overlook the reality that those assets are now in a different jurisdiction with its own laws and nancial services regulations, which govern those investments, as well as how they should be taxed and how they can be accessed. These administrative matters are not necessarily top of mind when South African investors focus on what they hope to achieve through currency hedging efforts and harnessing global investment opportunities. Some of the questions people need to ask themselves when considering offshore investment are: What happens in the worst-case scenario? Can I get my money back? How do I complain? What rights do I have as a nonresident?

The level of protection and recourse is likely to differ from jurisdiction to jurisdiction and will also be affected by whether the investor is a resident of that country or not. While the country might offer protections, these may not apply to nonresidents.

It is also important to understand that taxes are withheld on the investments in the

country where those assets are based or where taxes may be due on income arising from such assets.

Depending on the nature of the investments – stocks and shares, unit-linked life insurance policies, bank accounts or property – it is critical to note that income or gains may be taxed at source, in other words, a withholding tax applied to the foreign investment, which is not reclaimable from their tax authority.

In addition, the withholding tax may be higher than what would have been applied to a similar investment in South Africa.

Hence, South African investors will not be able to claim credit in South Africa for the difference between the two amounts.

Property income can become particularly complicated because property income generally requires a foreigner to register as a taxpayer (not a tax resident) in that country and le tax returns. If they fail to do so, they will end up accruing penalties or worse. Being noncompliant in respect of the taxes in another country can become especially problematic in the event of the person’s death, sometimes taking years to nalise the foreign estate and pass assets to bene ciaries.

Many South Africans’ wills cover their worldwide assets, with instructions on what to do in the event of their death. While the will might be valid in South Africa, this does not necessarily mean it will be valid in another country, and there is likely to be a con ict of laws.

Anyone with investments overseas may need to employ the services of someone –

typically a lawyer – who specialises in winding up estates to assist with the process. This can be costly and time-consuming. If there is no valid will to deal with the foreign assets, then that country’s succession laws come into play.

While winding up estates and paying taxes can add time and cost to the transfer of assets, these challenges can be overcome. Investing offshore can present an excellent opportunity for signi cant growth and currency diversi cation as long as investors have their eyes wide open.

When placing assets offshore, several steps and vehicles can help mitigate many challenges. Whatever investment considerations are at play, investors must get advice locally and ensure the foreign product provider is regulated, preferably in South Africa.

While there is pressure on nancial advisers to balance risk and return in the face of complex economic uncertainties, several foreign nancial services providers are regulated in South Africa. This means they have an obligation to ensure the nancial advisers who use their products understand those products and the protections they offer.

The Financial Advisory and Intermediary Services Act and the Financial Services Conduct Act require nancial advisers to ensure their clients fully understand the products and apply the treating customers fairly approach, designed to ensure regulated nancial institutions deliver speci c, clearly set out fairness outcomes for nancial customers.

These checks and balances, combined with the bene ts of currency hedging and asset diversi cation, are good reasons to invest offshore. The issues agged in this article are not a reason not to invest offshore, but are aspects that need to be carefully considered before doing so.

JEROME BRINK , director, Tax and Exchange Control Practice at CDH, shares the top three tax and legal issues affecting the commercial property space

1. Renewable energy tax incentives. Sections 12B and 12BA of the Income Tax Act offer accelerated depreciation for assets used in renewable energy generation, such as solar and wind. This is crucial for property owners aiming to cut costs amid rising electricity tariffs. However, a recent proposal by National Treasury could disqualify Real Estate Investment Trusts (REITs) and their subsidiaries from claiming these incentives. This shift could significantly impact REITs that have benefitted from these allowances.

2. Taxation of unlisted property entities. The REIT regime, established in 2012,

allowed listed property entities to benefit from flow-through tax treatment, which was not available to unlisted entities. Recent changes announced by National Treasury will

RUVAN GROBLER, wealth manager and head: risk at Bovest Wealth Management, shares a few key market trends for investment professionals

1. ESG investing. Environmental, social and governance (ESG) factors are increasingly important in investment decisions. Companies with strong ESG practices are becoming more attractive to investors, reflecting a shift toward sustainable investing.

2. Artificial intelligence (AI). AI and machine learning are transforming investment strategies, enabling data-driven decision-making and algorithmic trading. Role players in the industry also provide attractive returns as they shape our digital world.

3. Digital assets and cryptocurrencies. Cryptocurrencies and digital assets are becoming more mainstream by the day. Institutional adoption is growing (for example, iShares Bitcoin Trust ETF by Blackrock). Regulatory clarity is improving, making digital assets an increasingly viable asset class for diversification.

4. Emerging markets. Emerging markets in Asia and Africa offer growth potential due to an expanding middle class, urbanisation and technological adoption. These markets can provide

extend this tax regime to unlisted property entities regulated by the Financial Sector Conduct Authority, potentially levelling the playing field and benefitting more property owners.

3. Zoning laws and municipal rates. Zoning regulations dictate land use and development, and noncompliance can result in fines, legal action and business closures. Additionally, the Municipal Systems Act imposes higher rates and taxes on commercial properties compared to residential ones. Recent increases in these taxes, particularly in Gauteng, have affected commercial property profitability. Property owners can challenge higher assessments by proving a lower property value, but this process can be costly and involve litigation.

Ensuring compliance with these regulations is essential to avoid financial losses and reputational damage.

opportunities for higher returns with increased risk.

5. South African Government bonds: South African Government bonds provide high yields and regular income through coupon payments. It may be a good alternative to cash, albeit at higher risk. One could also make the case that you are investing in South Africa and that could benefit us all.

THE GAUTENG PARTNERSHIP FUND is well-positioned to drive much-needed inner-city regeneration and provide sustainable housing

The regeneration of Johannesburg’s inner-city has been a long-running effort, stretching back to 1986 when the Johannesburg City Council sought to create a vision for the City of Gold. A key part of this vision was collaborating with the private sector to address the complex issues affecting the central business district (CBD).

With just over a quarter of the country’s population living in Gauteng, the demand for housing far exceeds government budgets, making it clear that a multistakeholder

approach, particularly with private sector involvement, is essential for success.

David van Niekerk, chief executive of the Johannesburg Inner City Partnership (JICP), says much work lies ahead.

“The CBD should be the most important area that investors want to come into,” he told the media earlier this year. “It should be a primary node of any CBD, and then investment will follow. But capital investment and management are not happening in Joburg. The level of service has diminished to virtually nothing.”

The potential within the Gauteng City Region’s CBDs is undeniable.

In her inaugural Budget Vote Speech as the MEC for Human Settlements in Gauteng, Tasneem Motara emphasised prioritising the revitalisation of CBDs across the Gauteng City Region (GCR). Her department, she explained, would “drive the effort towards the revitalisation of our CBDs through the resuscitation of dilapidated buildings and infrastructure within our inner cities”.

She saw the role of the Gauteng Partnership Fund (GPF) as “critical” in this programme.

Established by the Gauteng Department of Human Settlements in 2002, the GPF initially focused on the social housing market but its mandate has expanded signi cantly since to include affordable rental housing and the implementation of identi ed mega projects.

The GPF plays a crucial role of program management and ensuring timely payments for mega projects, in accordance with the agreed upon milestones.

Its core mandate is to serve as the funding and implementing agent for sustainable human settlement developments in Gauteng, offering innovative funding products to share project risk with the private sector. With a steadfast dedication to transparency, ethical governance, responsible nancial practices and audits, the GPF has become a trusted partner to developers and funders over the past two decades –leveraging more than R2.2-billion from the public and private sectors to help transform the lives of countless Gauteng residents.

With over 20 000 homes delivered across various typologies, including in the Johannesburg and Tshwane CBDs, the GPF is well-positioned to drive inner city regeneration. A study conducted by Viruly highlighted the positive impacts of GPF’s developments on communities, encompassing improved health, wellbeing, social cohesion and the creation of over 130 000 job opportunities.

“The GPF provides a junior loan facility that enhances both the equity from the developer and the senior loan. The senior funder risks are further mitigated by a rst mortgage bond with a signi cantly reduced exposure due to the GPF junior loan. The concessionary GPF junior loan affords the project a more feasible weighted average cost of funds which assists the developer to achieve project feasibility,” says GPF chief executive of cer Lindiwe Kwele.

“We rely on partnerships to deliver meaningful change in the affordable housing and student accommodation sectors. Our mandate is to drive inclusive growth, create sustainable communities where people can live, work and play and contribute to economic recovery through affordable rental housing.”

The GPF is actively seeking investors and nancial institutions to collaborate in transforming the Gauteng property market.

Kwele points out that the GPF’s innovative funding structures, including mezzanine nancing, make it an attractive partner to senior funders looking for low-risk, high-impact housing projects. Moreover, contributing to solving the housing crisis in the province by creating

“WE RELY ON PARTNERSHIPS TO DELIVER MEANINGFUL CHANGE IN THE AFFORDABLE HOUSING AND STUDENT ACCOMMODATION SECTORS.” – LINDIWE KWELE

liveable, resilient communities presents a signi cant opportunity for investors.

One notable partnership is between the GPF and Futuregrowth Asset Management, which led to the development of The Opal Student Accommodation. This thriving property was developed by Patricia and Mulalo Tshitema of Bono Investment Property (Pty) Ltd. Based in Nasrec, South of Johannesburg, it comprises 94 units yielding 376 beds.

This development was funded through the GPF’s Entrepreneur Empowerment Property Fund (EEPF) programme, an incubator designed to support historically disadvantaged individuals to enter the affordable rental property market. With a focus on empowering women and youth, 40 per cent of the EEPF’s bene ciaries are women, and the GPF’s transformation policy ensures that 75 per cent of project professionals have majority black shareholding.

“The GPF’s timely processing of drawdowns or milestone claims within 14 days each time we lodged a claim ensured that our project continued without delay. The support we received was instrumental to our success.”

Pleasingly, Bono Investment Property (Pty) Ltd was awarded the SA Property Investor of the Year Award in the Big Leagues category in 2021. Opal’s success expanded Patricia’s portfolio and made her an attractive prospect for future partnerships and investment. Notably, Patricia has since won two awards from the South African Investors Network (SAPIN) and was named winner of Leading Woman 2024 by SAIBPP (South African Institute of Black Property Practitioners).

While challenges related to the economic environment and operational pressures exist, the GPF has consistently demonstrated transparency and ef ciency in handling project nances, as highlighted by successful projects such as The Opal Student Accommodation. Considering recent public concerns, the GPF remains committed to maintaining the highest standards of governance and accountability.

The GPF is passionate about the transformation of the property market in Gauteng. “In line with the GPF’s unwavering vision, Lindiwe Kwele

the entity is steadfastly prioritising the expansion of historically disadvantaged groups’ participation and empowering small, micro, and medium enterprises (SMMEs). By allocating a substantial portion of capital budget to SMMEs, the GPF is not only catalysing economic growth, but also promoting inclusivity and gender equality,” says Kwele.

She emphasises that the GPF has been an unwavering partner to investors and the provincial government since it was established 22 years ago. “Our milestones to date unequivocally testify extraordinary results that materialise when passion aligns with purpose.”

Misleading reports have suggested that the GPF disbursed over R30-million to a company owned by the son-in-law of Deputy President Paul Mashatile for a project that was never completed. However, an amount of just over R7-million was disbursed – only for work carried out. Additionally, an independent investigation into the claims found no evidence of maladministration or corruption

The Gauteng Partnership Fund offers several programmes for property developers of varied experience:

• Social Housing Fund. The Social Housing Fund was developed for social housing institutions requiring an equity injection to the project. The GPF equity enhances the debt-to-equity ratio for projects to enable lenders to finance them on favourable terms.

• Student Accommodation Fund. The Student Accommodation Housing Fund was developed for student accommodation service providers requiring additional funding for the project. The mezzanine or junior type loan enhances the debt-to-equity ratio for projects to enable senior lenders to finance.

• Commercial Housing Fund. The Commercial Affordable Housing Programme is designed to promote the participation of experienced housing developers and rental property owners in the affordable housing market.

• Empowerment Property Fund. The Entrepreneur Empowerment Property Fund is a programme designed to promote the participation of previously disadvantaged-owned companies in the affordable rental property market.

• Rental Housing Fund. The Rental Housing Fund was developed for rental housing entities that require additional funding for the project. The equity-type loan enhances the debt-to-equity ratio for projects to enable lenders to finance them on favourable terms.

• Kasi 4 Real. This is an innovative funding solution for the formalisation of township real estate developments for residents of townships within Gauteng. It is a loan offering favourable interest rates with a 95 per cent investment for each project in the township areas.

within the GPF’s handling of the Nonkwelo Investments project. This further emphasises the GPF’s reputation as a trustworthy partner for investors, developers and government. Moreover, the report clears the trustees, employees and deputy president of any con ict of interest, af rming the integrity of the individuals associated with the GPF.

“The GPF is currently managing a robust project pipeline exceeding R2-billion and we are strategically engaging with potential funding partners to collaborate on the implementation of sustainable human settlements throughout Gauteng,” says Kwele. It is crucial for clients to prioritise timely loan repayments to secure the sustainability of the GPF and facilitate ongoing housing development.

She adds: “Concurrently, we are nalising several substantial agreements with leading nancing institutions, poised to ful l our mandate of providing the people of Gauteng with access to vibrant, liveable settlements and secure land tenure. These efforts underscore our commitment to fostering inclusive economic growth and prosperity across the Gauteng City Region. Additionally, the GPF is exploring providing bridging loans or purchase order nancing to SMEs involved in the construction of housing in its target market.”

The GPF, through public-private sector partnerships, innovative financing and operational excellence, is an exceptional government partner.

For more information contact: Ntombenhle Gwina, Marketing, Communications and Stakeholder Manager 011 685 6000 info@gpf.org.za www.gpf.org.za

The property sector is undergoing a significant transformation driven by technological advancements. From smart homes to artificial intelligence-powered property management, tech innovations are reshaping how we buy, sell, manage and experience real estate, writes ITUMELENG MOGAKI

Schalk van der Merwe, director at WeConnectU, says in the next ve years, technologies, such as automation, arti cial intelligence (AI)-driven analytics and cloud-based platforms, will impact the property sector signi cantly. “These advancements won’t just optimise work ows; they will enable property managers to make smarter, data-driven decisions. AI will help predict trends and optimise property performance, but its greatest impact will come when combined with human expertise,” says van der Merwe. He is, however, quick to mention that for tech companies, such as WeconnectU, it’s important to build technologies that people can understand quickly and easily. “If users don’t nd it intuitive, they won’t adopt it. Tech should not only simplify their work ow, but also help them communicate their value better.”

Along with any outstanding maintenance checks, revisiting your risk management strategy and your insurance cover is critical, writes JUAN FOURIE , head of Santam Hospitality and Leisure (H&L)

Business owners, particularly Airbnb hosts, like other disruptive, tech-driven business models in the hospitality industry, need to have a better idea of the risks and how to safeguard their property, assets and reputation. Here are the key considerations.

RISKS AND OPPORTUNITIES

Airbnb hosts welcoming customers onto business premises must be mindful of certain risks that need to be mitigated. The rental income you earn may very well be an important part of your livelihood and that income needs to be protected. By taking measures, such as ensuring your insurance cover meets your unique needs, you can protect the viability of your investment now and well into the future.

RISKS PROTECTION FOR YOUR PROPERTY

The first type of insurance cover to consider is building and building contents insurance. Water damage, fire, a burst geyser – any one of these events can cause substantial property damage that will need to be repaired promptly to avoid losing any more potential income.

RISKS LIABILITY COVERAGE AS A PROACTIVE SAFEGUARD

A lot about an Airbnb stay can go right, but unfortunately, so much can also go wrong. By taking out liability insurance, Airbnb hosts will have peace of mind that if something unfortunate should happen, they won’t have to cover the costs out of pocket while also trying to mitigate any reputational damage.

Property maintenance is not just about getting and keeping a good tenant in a residential or commercial property, but also about ensuring capital appreciation and complying with various regulations, shares WALDO MARCUS, industry principal at TPN Credit Bureau

1. Budgeting for maintenance: the two most common approaches to maintenance on a commercial property are where maintenance is squarely the tenant’s responsibility, including all services and property assets. In other occupation structures, such as shopping centres, maintenance is controlled by the property owner or manager. The costs related to maintenance are usually recovered from an occupier or covered by an agreed operating cost structure.

2. Ageing infrastructure: residential landlords are responsible for routine repairs caused by normal wear and tear. Damage repairs to the property are also required unless caused by the tenant, in which case the cost can be recovered from the tenant.

3. Security and safety: it is critically important for property investors to ensure their property and the property of their occupants are kept safe.

4. Environmental and sustainability: load shedding has driven solar panel use and other energy efficiency methods, advancing renewable energy and sustainability efforts in South Africa.

5. Legal and contractual obligations: neglecting proper repairs and maintenance can also impact liability protection and insurance coverage. Insurance companies typically include reasonable repairs and maintenance within their policies, but failing to prove compliance can result in denied claims.

6. The Occupational Health and Safety Act is the most prevalent legislation regulating the maintenance of all commercial property classes, including industrial, retail and office properties.

Developers are embracing hybrid workspaces amid rising demand for fl exibility. By ITUMELENG

MOGAKI

The commercial real estate sector is undergoing signi cant transformation as developers pivot from traditional large-scale of ce spaces to smaller, more exible hybrid environments.

Jeff Kleu, CEO at Capital Point Properties, highlights that this shift is largely driven by the post-pandemic work dynamics and the demand for more agile workspace solutions.

“COVID-19 left tenants with big overhead capital expenditure, which they don’t want to get stuck with again,” says Kleu. “With of ce users now able to work from home, some companies have adopted a hybrid approach, coming into the of ce three days a week for collaboration while allowing their staff the exibility to manage their workload.”

This trend has reshaped the expectations of both tenants and developers. Businesses are now looking for more exible lease terms, such as month-to-month or one-year leases, to avoid the long-term nancial commitments associated with traditional of ce spaces.

“As businesses grow and shrink with their successes or failures, they want their space to be able to adjust accordingly, without being burdened by the expensive capital costs of larger premises,” Kleu says.

For developers, this means creating spaces that can easily adapt to the changing needs of tenants, offering a balance between collaborative areas and private workspaces. This new model aims to support the uid nature of modern business, ensuring that space is neither wasted nor insuf cient as circumstances evolve.

“Hybrid work is not just a trend; it’s a critical step towards sustainability,” says Gidgette Osborne, director at Go Content Lab. Osborne says by rethinking how and where employees work, companies can signi cantly reduce their carbon footprint and foster a more eco-conscious work culture.

Osborne shares the key trends driving this transformation.

1. Cutting the commute. One of the most direct environmental bene ts of hybrid work is the reduction in commuting. This shift not only saves time, but also cuts down on greenhouse gas emissions.

2. Optimised use of of ce space. Environmentally friendly workplaces are designed around actual needs rather than projections. This tailored approach minimises wasted resources, boosts energy ef ciency and ensures that of ce space is used effectively, providing better value for money and a lower environmental impact.

3. Sustainable of ce practices. Sharing documents electronically and collaborating online can drastically cut down on paper usage. Minor changes, such as eliminating single-use plastics or sourcing recycled materials, can collectively make a big difference. By implementing these practices, companies can reduce costs while contributing to a greener future.

4. Building better workspaces. Sustainable architecture and environmentally friendly building materials can signi cantly lower a company’s carbon footprint.

The new Samsung R32 air conditioning range offers eco-friendly cooling with improved energy effi ciency using R32 refrigerant, which has a lower Global Warming Potential (GWP).

Designed for both residential and commercial use, it provides various options, including wall-mounted, cassette and ducted units, plus a multisplit FJM solution.

Key features include:

• Wind-Free™ cooling for quiet, draft-free comfort.

• Digital Inverter Boost Technology, reducing energy costs by up to 73 per cent.

• Fast cooling and heating, offering 15 per cent faster cooling and 50 per cent faster heating.

• Wi-Fi control via SmartThings for remote management.

• Triple Protector Plus, guarding against power surges and corrosion.

• Quiet operation at 16 decibels.

• Advanced filtration for better indoor air quality.

• Easy installation and maintenance.

5. Hybrid workspace synergy. Smart building technologies and virtual collaboration tools are transforming hybrid work environments. With arti cial intelligence driving productivity and smart tech optimising physical spaces, the blend of digital and in-person collaboration is becoming essential.

Looking ahead, Osborne says the future of of ces will be dynamic and adaptable, integrating with residential, retail and hospitality sectors to meet evolving workforce needs.

“As traditional stability in corporate real estate ends, embracing exibility and innovation will be crucial for investors, landlords and tenants to thrive. Added to that, embracing hybrid work is a journey towards a more sustainable business model that bene ts employees, companies and the planet alike,” concludes Osborne.

The search for more reliable utilities and municipal services appears to have subsided with the financial-pressure related motive for selling again becoming the most prominent selling motive in the owner-serviced market by “default”, writes JOHN LOOS, property strategist, FNB Commercial Property Finance

This article pertains to the third quarter 2024 results of the FNB Commercial Property Broker Survey, which interviewed a sample of commercial property brokers in the six major metros of South Africa – City of Joburg and Ekurhuleni (Greater Johannesburg), Tshwane, eThekwini, City of Cape Town and Nelson Mandela Bay.

Respondents were asked for their perception of the major drivers of “movement and sales activity” in the owner-occupied property segment. They estimated the percentage of movement and sales they believe would occur for a particular reason. The total percentage of all the reasons can add up to more than 100 per cent because businesses can be selling or relocating for more than one reason. It isn’t an exact science, therefore, but gives a broad picture.

Focusing on key drivers of movement and sales activity in owner-occupied properties, the survey results show that, after a year-and-a-half of high prominence, selling to relocate in search of better utilities and municipal services, for instance, electricity and water or well-maintained infrastructure, is no longer perceived as the key motive for selling. It remains signi cant at 20.15 per cent of total selling, but has diminished since a high reached in early 2023. We believe this has much to do with signi cantly diminished

THE FINANCIAL PRESSURE-RELATED SELLING MOTIVE IS NOW ONCE AGAIN THE BIGGEST SINGLE PERCEIVED SELLING DRIVER AT 26.22 PER CENT OF TOTAL SELLING.

load shedding this year, after a major early 2023 surge.

This motive for selling is not only about electricity load shedding such as that seen late in 2022 and early 2023; South Africa’s mounting water issues and other services/infrastructure shortcomings may play a role, too. However, that 2022/23 load shedding surge appeared to play a key role.

The nancial pressure-related selling motive is now once again the biggest single perceived selling driver at 26.22 per cent of total selling.

Relocating in search of more reliable utilities and municipal services has diminished in prominence and is no longer perceived to be the most signi cant motive for selling, according to the latest survey response.

This motive rose steadily in signi cance back in 2022 and then jumped sharply in the rst quarter 2023 survey, recording a high of 49.3 per cent of total selling. It has remained prominent, but on a broad decline since the early 2023 peak to a level of 20.2 per cent by the third quarter of 2024.

We believe that infrastructure and services deterioration in various areas and regions has been driving this, but the late 2022 surge in electricity load shedding was likely the key factor in the early 2023 spike. After that early 2023 surge, this motive’s signi cance has receded, and we suspected it could be due to a sentiment improvement resulting from decreased load shedding as time has passed.

However, the search for better services goes beyond electricity to water, infrastructure and other local government-related services, so this motive may remain signi cant despite a dramatic improvement in electricity supply in 2024 to date.

John Loos

The prominence of nancial pressure-related selling remains fairly stable, but has once again become the

single most prominent motive for selling by “default”.

Selling due to nancial pressure in the third quarter 2024 survey was perceived to be very similar to the prior quarter’s level, rising very slightly from 26.2 per cent in the second quarter to 26.6 per cent in the latest survey.

Earlier, we had expected an increase in this motive’s prominence, given a likely lagged nancial impact on many companies’ nances from the interest rate hikes between late 2021 and May 2023. However, such an increase did not materialise and with interest rates having begun a decline during September (subsequent to this survey undertaken in August), it appears less likely that we will see any rise in the near term.

An additional potential indicator of easing or tightening nancial constraints is the percentage of selling to relocate to “bigger and better premises”. Here we see a noticeable decline in the third quarter, from 22.4 per cent in the prior quarter to a lowly 13.45 per cent. This would suggest that, while there may not have been any noticeable increase in nancial pressure of late, the business sector remains constrained in a weak economic environment.

A further key reason for selling, which may re ect both current nancial constraints on businesses and risk aversion/appetite levels, is the estimated percentage of sellers selling to move closer to their market. This percentage has been lacking strong direction in the past few years.

In the third quarter of 2024, the percentage declined from 23.5 per cent in the prior quarter to 21.3 per cent, the second consecutive quarter of decline.

This motive has been prone to up-and-down uctuations with no clear and sustained direction, and the recent levels remain low when compared to the 36.3 per cent recorded at the beginning of 2019.

It is likely still constrained by an economic environment that is mediocre at best. Nevertheless, interest rate cutting has commenced and, should economic growth improve, it is possible that the prominence of this motive for selling could show a noticeable rise.

The coastal metro regions appear lower on perceived nancial pressure-related selling than Gauteng. Examining, by region, where the

greatest level of nancial pressure-related selling or relocation is perceived to be, it appears this is more prominent in the Gauteng metro regions (compared to the average for the three major coastal areas), most notably Tshwane Metro. Tshwane recorded 64 per cent of total sellers motivated by nancial pressure, while Greater Johannesburg recorded 23 per cent. In the two major coastal metro regions, Cape Town recorded a lowly 9.3 per cent and eThekwini 10.3 per cent. Nelson Mandela Bay recorded 29.5 per cent, mildly higher than that of the Greater Joburg reading.

The search for areas where services and infrastructure work no longer dominate perceived owner-serviced selling motives with nancial pressure-related selling becoming the single most prominent motive by “default”.

The third quarter 2024 FNB Commercial Property Broker Survey pointed to a further decline in the level of owner-serviced property sellers searching for more reliable utilities and municipal services to a level where this motive is no longer perceived as the most prominent motive for selling.

There had been a sharply heightened prominence in this motive around the start of 2023, likely due to the escalation in the electricity crisis from late 2022. Other local government and utilities-related services, including water, infrastructure quality and maintenance, many of which have been deteriorating over many years, may have also played a role in this motive. But the timing of the 2023 surge and subsequent decline in this motive’s prominence appears to be correlated to the 2022/23 surge in electricity load shedding and its subsequent decline.

The survey shows no strong direction change in selling motives related to nancial pressure. But the decline in prominence of the “search for services” motive has meant that the nancial pressure-related selling motive once again becomes the single most prominent perceived motive for selling by “default”, its level having hardly changed in recent quarters. Financial pressure-related selling remains far lower than the higher levels of 2020/21.

The prominence of the “selling to move to bigger/better premises” motive showed a noticeable decrease. This arguably points more

The prominence of the “selling to move to bigger/better premises” motive showed a noticeable decrease. This arguably points more towards financial “constraints” as opposed to financial “stress”.

towards nancial “constraints” as opposed to nancial “stress”, and its low level is likely re ecting an economy that is still stagnant, despite some election-driven improvement in business con dence recently.

We may, however, see some easing of nancial constraints and pressures in the near term. The global interest rate-cutting cycle has commenced, which could boost the global economy, translating into some additional support for the South African economy via improved export performance. Locally, the South African Reserve Bank has also started cutting interest rates, which should be mildly positive for the economy and business nances, too. FNB expects further mild rate cutting to continue in the near term.

Disclaimer: First National Bank is a division of FirstRand Bank Limited. An Authorised Financial Services and Credit Provider (NCRCP20). The information in this publication is derived from sources that are regarded as accurate and reliable, is of a general nature only, does not constitute advice and may not be applicable to all circumstances. Detailed advice should be obtained in individual cases. No responsibility for any error, omission or loss sustained by any person acting or refraining from acting as a result of this publication is accepted by FirstRand Group Limited and/or the authors of the material.

South Africa is not short of crises to address, but one that stands out notably is the shortage of affordable housing. Despite some ve million people in need having been housed by the state between 1994 and 2022, more than two million households and individuals still await a home, according to the Department of Human Settlements.

At the same time, economic and working habit shifts have resulted in businesses gradually requiring less of ce space.

John Loos, senior economist for commercial property nance at FNB, says that while sectors, such as nance, real estate and business services, which are big drivers of of ce demand, have grown their contribution to gross domestic product, they’ve done so through productivity improvements rather than job creation.

He adds that the shift from paperwork to data servers and private to open-place

of ces, along with newer trends such as hotdesking, have contributed to lower demand for of ce space in our CBDs.

Repurposing commercial buildings for residential use seemingly kills two birds with one stone, utilising unused or underused spaces to house people close to commercial activity. Justin Blend, director of Africrest Properties, says this stands in sharp contrast to estate-type developments, which require large pieces of land typically only available on the outskirts of cities.

Blend says adaptive reuse also revitalises city centres, as when commercial buildings stand empty, the surrounding business node suffers because there are no people visiting shops, restaurants and so forth. “By repurposing these buildings, we’re bringing people back to the area, creating income and employment for the businesses that serve them.”

“BY REPURPOSING THESE BUILDINGS, WE’RE BRINGING PEOPLE BACK TO THE AREA, CREATING INCOME AND EMPLOYMENT FOR THE BUSINESSES THAT SERVE THEM.” –JUSTIN BLEND

There’s a positive impact on city coffers too, adds Blend. “When a building is vacant, its value diminishes substantially, meaning the council has to recalculate its rates and taxes. Repurposing such a building increases its value, which results in more money for council and neighbourhood upkeep.”

While increasing residential occupancy may indeed help revitalise inner cities, the issue of neighbourhood amenities needs to be considered.

“These areas with lots of of ces were built to be business nodes, not residential neighbourhoods,” says Loos. “You need to examine whether or not they have the available amenities, such as open spaces, which the Johannesburg CBD lacks, for example. If families are living there, is there enough schooling and medical care?”

Municipal infrastructure also needs to be considered as residences will have different, potentially higher needs than commercial spaces. Blend says councils are very strict about ensuring new developments t the local capacity, and that Africrest pays towards upgrading local infrastructure where necessary.

Blend says many people are calling for vacant buildings in Sandton to be converted, but most buildings lack the necessary characteristics. “You need the correct zoning rights for a start. You need a building with exactly the right oor plate shape. The windows should open and close, otherwise, you need to redo the entire facade, which is very expensive. Do the lifts go to every oor? How far is it from the parking to the apartment?”

Blend says that costs remain similar to green eld building with the main advantage of repurposing being location. “We just built 400 apartments in Sandton – there’s no land available to develop that from scratch.” There are notable environmental bene ts, however, such as not needing to pour new concrete, for example. “The whole building is effectively being recycled, plus there’s less of the usual waste that comes from a conventional building site,” says Blend.

Sustainable living is about much more than being eco-friendly, writes ITUMELENG MOGAKI

Harold Spies, CEO and founder of Similan Property Developers, says there is a clear trend among home buyers and property developers towards sustainability.

“Recent statistics from well-known real estate company Pam Golding show that 68.8 per cent of home buyers are prepared to pay a premium for homes with green features,” Spies says.

“A true neighbourhood nurtures community interaction by providing plenty of mixed-use amenities where people can live, work, and play with their families and friends,” he explains, adding that this social cohesion is an important element of a residential development’s sustainability.

“The quality of life created by the neighbourhood ensures solid capital appreciation of the property value, as well as robust rentals for investors.”

Spies continues: “Sustainability shouldn’t carry an excessive price tag. The aim should always be to normalise sustainable living and show that it’s a viable choice for all – energy ef ciency and water savings are ways to achieve this.”

He provides an example from Newinbosch, where the properties are equipped with a solar-and-battery-powered microgrid. “This system not only protects against load shedding, but also enhances comfort and offers signi cant energy savings for residents.

“There is de nitely demand for green communal spaces that promote active and healthy living. This can be catered for in several ways, such as regenerating the natural biodiversity on the site, which includes bringing back some of the original endemic renosterveld habitat and wildlife,” says Spies.

Bradd Bendall, national head of sales at BetterBond, highlights and unpacks the following six trends shaping the residential property sector.

1. Sustainable living. Green features are becoming highly sought-after as South Africans grapple with rising electricity costs. Solar installations and power-storage systems, boreholes, rainwater harvesting, LED lighting, energy-ef cient home technology, water-wise landscaping and more are being used to make homeowners less dependent on the main supply grids. Although South Africa has passed the 100-day mark of no load shedding, backup power solutions have become the norm in many households.

2. Smart homes. Tech upgrades or smart home automation are good ways of adding value to your home. Homeowners want to be able to control everything from security to lighting with the swipe of an app on their phone. Features, such as Google Home or Alexa, simplify everyday tasks, such as adjusting the lighting,

“THE QUALITY OF LIFE CREATED BY THE NEIGHBOURHOOD ENSURES SOLID CAPITAL APPRECIATION OF THE PROPERTY VALUE, AS WELL AS ROBUST RENTALS FOR INVESTORS.” – HAROLD SPIES

setting the ambience with music or adjusting a room’s temperature.

3. Urbanisation. Metropolitan areas attract job-seekers and students who do not have access to the same opportunities in rural areas. South Africa’s National Urban Development Policy estimates that over 71 per cent of our population will live in urban areas by 2030. With this in ux of people to cities, mixed-use developments and precincts offering residential, commercial and recreational opportunities will become increasingly popular. Convenience trumps space for many young professionals in urban settings, and the TENOV development, offering 150 units including 56 micro apartments of 22m2 each in Cape Town’s CBD, is an example of this type of living.

4. Collective or multigenerational buying. As economic challenges persist, expect to see more collective home buying. Supported by many cultures, multigenerational living helps relieve the nancial pressure of running a household.

5. Eco-estates. South Africa is home to beautiful lifestyle estates, with two of New World Wealth’s top 10 lifestyle estates (2023) globally based in South Africa. Increased security and a range of amenities are part of the appeal for buyers interested in estate living.

6. Affordability. Affordability is always a consideration when buying a home, especially during periods of high interest rates and rising living costs. There are ways to make home ownership a reality. Buying in a new development or below the R1.1-million transfer duty threshold will help save some of the costs associated with buying a new home.

The National Urban Development Policy

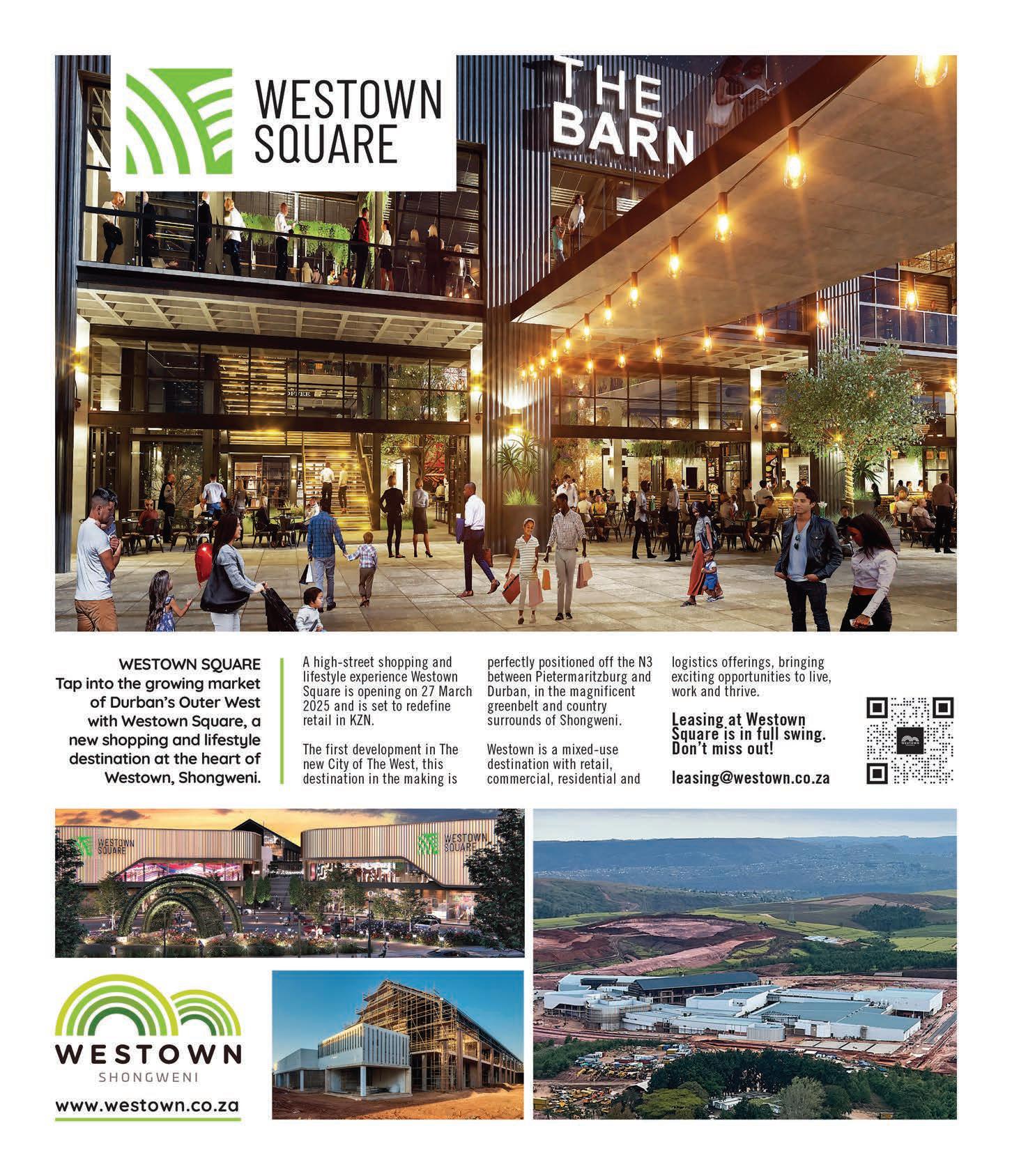

Since October 2022 when the first sod was turned and the development of WESTOWN SQUARE in Shongweni, KwaZulu-Natal began, nearly 75 per cent of phase 1 of Westown has been completed

Westown, the “New City of the West” and Durban’s newest commercial, tourism and retail hub, is estimated to generate some R15-billion in investment over the next 10 to 15 years, with over R2.5-billion already committed and invested by Fundamentum Property Group together with Absa Commercial and Investment Bank’s backing of the 48 000m² Westown Square shopping experience.

Carlos Correia, CEO of Fundamentum Property Group says: “Without the City’s facilitative investment, the land Westown is being built on would still be sugarcane, not offering any return, nancially, socially or environmentally. We are incredibly bullish about Durban and KZN as the place for investment and proud to be spearheading this wave of optimism and tangible opportunity.”

Created to embody a community market experience, The Barn on The Square is the spatial heart and a core component of the new Westown Square high-street retail experience and the first development activity within the 100ha Westown mixed-use property development.

The Barn is expected to become one of the region’s most popular destinations for locals and tourists, offering a permanent niche retail space for local artisanal traders.

“The Barn connects seamlessly with our differentiating tenant mix, which includes a host of retail fashion tenants and handpicked restauranteurs.

Together, this creates a world-class shopping experience,” says Lana Pattison, divisional director of retail leasing for Westown developers, Fundamentum Property Group.

Centrally located within Westown Square, The Barn’s tall barn-shaped structure is immediately distinguishable. Spread over multiple levels, lifts, stairs and pedestrian bridges ensure the flow of shoppers through this unique space.

This high-volume space is designed with a flexible facade, meaning The Barn can open up, linking the interior and exterior and creating a seamless flow between the activities

Through this public-private partnership, some R600-million is being invested by the eThekwini Municipality into supporting bulk infrastructure (roads, water, wastewater and electricity), while Fundamentum is overseeing and managing this development work through contractors Stefanutti Stocks and is also investing hundreds of millions into the new bulk and precinct infrastructure.

within and the shared public space of the piazza and gardens outside.

The Barn offers a shared space for community connection and enjoyment. Curated to create a vibrant energy and social gathering place, the open-plan multilevel space allows visibility across all four trading levels from almost any point.

The upper levels feature owner-operated restaurants complemented by a craft brewery. The lower level is home to the market, which boasts a central dining atrium, an event space, niche retail offerings and an artisanal food market.

To date, nearly 75 per cent of phase 1 of Westown has been completed, including the extensive landscaping and construction of parking areas within the Westown Square shopping environment, road upgrades and bulk infrastructure installations.

Designed by MDS Architecture in a joint venture with Boogertman and Partners KZN, Westown Square will “prioritise the movement of people, social spaces and lifestyle as part of the shopping experience,” says Donald McGillivray, MDS Architecture partner. The focus is on open spaces with densely planted walkways, pergola-covered seating, large trees and planter boxes, celebrating the outdoors and setting the tone for Westown as a whole. Key features of Westown Square include the town centre and town gardens as well as the amphitheatre and children’s play areas.

THE FOCUS IS ON OPEN SPACES WITH DENSELY PLANTED WALKWAYS, PERGOLA-COVERED SEATING, LARGE TREES AND PLANTER BOXES, CELEBRATING THE OUTDOORS.

A key component of Westown Square is The Barn, a shared space for community connection that will house an eclectic selection of artisanal homeware, art, beauty, fashion, food and beverage outlets, alongside quality restaurants and niche concept eateries. Opening with Westown Square in March 2025, this collective space works hand in hand with the Westown Square tenant mix, creating a rst-of-its-kind environment.

With just six months to go before the official opening of Westown Square, the landscaping and growing programme for the 100ha site has been established.

“Equestrian and agricultural in nature and situated in a magnificent green belt, along with the history of the Shongweni area, was top of mind in our choice of flora,” says Ignes de Beer from Uys & White Landscape Artists.

While much of the planting will be indigenous, exotic trees introduced to the area many years ago are now an integral part of what makes Shongweni what it is. “To mimic the autumnal shades of existing varietals, we are planting statement trees such as the London plain and pin oak,” de Beer says.

Starting from the entrance, down Westown Boulevard, an avenue of feather duster trees and citrus orchards welcome shoppers. Mobile planters on rollers, citrus trees and planted Chinese maples will add a splash of colour to the town square at the centre of the precinct. All outdoor parking and walkways are under pergolas of vines and colourful creepers.

“We are using landscaping as a statement piece for the main entrance, with a striking eight-metre creeper-covered arch leading into a boulevard of London Plain and olive trees,” de Beer explains.

The amphitheatre and children’s play area will feature London plains, feather duster trees and creeping roses in a variety of colours will bring the space to life. “The Rose Arbor sits alongside a play area for children aged three and up, making it a perfect venue for children’s parties,” says de Beer.

Due to launch in the last quarter of 2024, JSE-listed Balwin Properties will add a further R2-billion in value with its 1 260-apartment lifestyle estate Shongweni Eco Park. This will mark the rst of 3 000 units to be built in the Westown urban core with a total of 20 000 units set to bring a rich residential element to the greater Shongweni development.

The platform and service installations for Farrier Business Park are underway with 80 000m² of platform area available. This key precinct within the Westown development will be a hub for warehousing and logistics services. Occupancy is planned for mid-2025. Westown’s position on the N3 is a strategic logistics advantage.

To cater to the 3 000 new residential units to be occupied in the Westown urban core over the next ve to eight years, medical services are a must, and The West Private Hospital has been awarded a 100-bed licence. Opportunities related to co-development and ownership as well as operations are currently in negotiation.

Parce Ferme will offer convenient access to showrooms and retail stores and has an of ce component, designed with shared common areas re ecting Westown’s ethos of connection. These mixed-use elements maximise the high-traf c visibility of the site location.

Westown Square and The Barn open on 27 March 2025, with these retail hubs and related infrastructurure upgrades paving the way for Shongweni Eco Park, Farrier Business Park, Parc Ferme, The West Private Hospital and ultimately, The New City of the West.

For more information: www.westown.co.za

For enquiries about leasing at The Barn and Westown Square, contact Lana 083 511 4433

South Africa’s burgeoning e-commerce market demands considerable infrastructure, which is transforming our industrial spaces. By

ANTHONY SHARPE

COVID-19 may have been a major shot in the arm for e-commerce in South Africa, but although the pandemic may have subsided, the growth in online retail has not. According to a report by World Wide Worx, e-commerce grew 29 per cent from 2022 to 2023, reaching a record sales value of R71-billion, and is projected to account for 10 per cent of total retail by next year.

That’s massive growth off a relatively small base and it’s creating enormous opportunities for new and established stakeholders within the e-commerce ecosystem. However, it also requires enormous infrastructure – in terms of warehousing, transport and ful lment nodes – to make things run smoothly, which is transforming South Africa’s logistics sector along with its industrial landscape.

This transformation can be quite literal, explains Johann Nell, head of development and national asset manager at Redefine Properties. “Typically, you

see a hub-and-spoke approach, with large centralised warehouses that accumulate stock. These have multiple pallet spaces for multiple vendors, with a warehouse management system (WMS) that can track inventory and e-commerce sales.” These discrete spaces are needed because e-commerce businesses now effectively act as omnichannel platforms, where other companies can import stock and sell it through a well-known and reliable service.

Beyond that, says Nell, the infrastructure extends to smaller distribution hubs to reduce transport costs, through to retail centres where people can collect deliveries. “From a town planning perspective, industrial, commercial and residential nodes have become much more intertwined than planners thought it would twenty or thirty years ago.”

Warehouses have come a long way from the musty spaces of yore, with increasing volumes and customer expectations necessitating swift and accurate access to stock. This needs to be achieved alongside

SOMAYA STOCKENSTROOM chats to Tsakani Masia about a new hotel in Thohoyandou

Premier Hotel Thohoyandou, the brainchild of Tsakani Masia, is a remarkable achievement after the COVID-19 pandemic saw many establishments shutting their doors. The four-star hotel, a subsidiary of Premier Hotels & Resorts, opened in August 2024, encompassing nearly 8 700m2 of usable space and boasting 120 rooms.

When designing the premises, the owners were clear on the importance of being eco-conscious. So, instead of traditional bricks, the

developers used a stone facade – an environmentally conscious approach – and energy-efficient systems for responsible water management practices.

INTEREST

Even before its doors opened, this project generated over 400 temporary jobs during construction, showcasing this development’s commitment to contributing to the community. Today, more than 80 permanent positions have been created across various hotel operations.

managing leasing costs and the carbon footprint of the building itself, says Nell.

“Volumetrically, you’d like to achieve harmony between the loadability of a oor, the height of the warehouse and compliance around systems. Each item is barcoded and placed within this matrix of co-ordinates in the warehouse, and that location needs to be tracked so you can collect the particular bin or box. This means the inventory, WMS and e-commerce order system must be integrated and able to communicate with each other.”

From a hardware perspective, moving equipment needs to be able to reach the stock, bring it out and book it through equipment that measures the size and weight of the item and posts it in the right place in the right vehicle so that vehicle is correctly loaded and going in the right direction. “Industrial engineers play a signi cant role in designing these warehouses with the necessary conveyor belts, moving equipment and measuring equipment so the merchandise can be correctly mapped to reduce pilferage, damage and stock wastage,” says Nell.

The hotel was built at a cost of R194-million with R141-million financed by the Industrial Development Corporation and the remainder financed by the owner, representing the largest formal hotel accommodation in the province.

An additional 30 to 40 contract and part-time roles will further boost the local economy, which Sigal Nassimov, chief operations officer of Premier Hotels & Resorts, says is a crucial aspect of why Premier Hotels & Resorts is committed to expanding its footprint into previously marginalised areas.

Embracing innovation for a future-ready industry. By IMOGEN MANTEL , head of retail

The retail real estate environment is constantly changing due to market instability caused by global events, and property owners and developers must adjust accordingly. Given the current climate, retail real estate faces a “perfect storm” of challenges, however, innovative thinking by developers around issues such as sustainability and tenant mix will be the game-changer.

A wide range of factors impact this retail environment, from skill shortages and in ation to the energy crisis and ongoing disruptions in supply chains. Add in high interest rates, exacerbated by a low-growth economy, and you get a “perfect storm” of issues, dampening demand for retail properties and stalling rental growth.

Flexibility is key in an ever-changing landscape and retail leasing has required innovative thinking around the use of space, creating new experiences in unconventional places.

Mall rooftops are a clear winner for blue-sky thinking and unconventionality.

Focusing on family driven entertainment in safe and clean outdoor environments, coupled with panoramic views, enables a refreshing momentary escape from the city’s hustle and bustle. Converting these spaces, for example, into indoor and outdoor padel courts, drive-in cinemas or an environmental wellness haven, proves that retail environments can exercise creativity and exibility to navigate this dynamic environment.

There’s also the growing question of sustainability, which is not just about the environment, but also continuing to create experiential spaces to bene t generations. Collaboration with tenants and shoppers is necessary to achieve this goal.

Environmentally conscious spaces are an experience in and of themselves. The drive towards carbon neutrality and

net-zero emissions means the demand for green-certi ed buildings to rent or own will continue to increase. This, in turn, suggests that real estate owners and developers need a renewed focus on greener buildings to differentiate themselves while attracting investors progressively keen on directing their money into responsible business practices.

Sustainability encompasses many aspects, such as creating cost-effective buildings – using energy and water more ef ciently and managing waste effectively. However, sustainability is not just about climate issues; it is also a response to economic imperatives. Being conscious of this creates an investable case for investors; it yields brand loyalty from environmentally conscious shoppers and enables higher-value and lower-risk assets than standard structures. The shift toward responsible consumption also takes the pressure off already scarce resources, especially in South Africa where load and water shedding are ongoing. This is a strategic imperative for the built environment and should no longer be a tick-box exercise or nice-to-have when creating future-ready environments.

A third focus area is crafting the right tenant mix – essential for long-term value and ensuring a shopping centre’s success. An ideal mix of tenants not only captivates the catchment area serving the needs of shoppers in the community, but also draws residents of the outlying suburbs of the mall’s location. A good tenancy mix is well-balanced between national and smaller tenants, diverse in offering and complementary to each other. This is often seen through the creation of nodal experiences, enhancing the customer experience and driving sales for tenants. It’s about understanding the property’s positioning, curating an experiential environment and balancing tenant diversity. Regular analysis and adjustments based on performance are crucial as is open communication between landlords and tenants, ensuring mutually bene cial deal structures, thereby fostering sustainable growth.

“Retail is one of the most exciting industries in the world. It’s creative, challenging, inspiring, demanding, invigorating, and so much more. It employs millions of people and gives pleasure to millions,” says Gavin Tagg, CEO of Retail Network Services (RNS). The company has blazed a trail across the South African retail property sector for three decades as a highly skilled retail strategist and leasing specialist.

Trusted by leading developers, investors and retailers, RNS gets retail right. Working with developers, and as a co-developer on certain projects, RNS provides a turnkey service, including:

• Commissioning world-class research to determine the suitability of proposed sites for shopping centre developments.

• Overseeing the design and layout of approved retail developments.

• Tapping into its extensive retail network to create exciting and sustainable tenant mixes.

RNS’ unsurpassed experience, consummate professionalism, blue-chip reputation and ability to unleash retail potential has seen it deliver more than 60 successful shopping centres to the market.

Executing a strategy with the right tenant mix creates an environment conducive to the consumer and bene ts the tenants. The proof is seen in the nancial and operational results.

Retail spaces have moved beyond being mere points of sale and have transformed into customer engagement hubs. The focus today therefore lies in creating memorable experiences that resonate with shoppers, whether online or in-store. This area is where one puts the “real” in real estate. Modern malls should be about creating delightful destinations, understanding customers intimately, partnering for excellence and embracing sustainability and wellness. In essence, it is up to landlords and developers to own the full customer experience and to provide a complete customer journey.

With a growing proportion of residences being sold in estates and around mixed-use developments, ANTHONY SHARPE eyes up what’s on the cards for the future

Estate living is on the rise worldwide, but locals have been embracing it for decades. Owing to our love of community, plus – rather sadly – our fear of escalating crime levels, South Africa is a pioneer in estate living. According to data from Pam Golding Properties, in 2022, more than 16 per cent of all homes sold across the country were in estates.

“In the next ve years, the market for estate living in South Africa will continue its upward trajectory, fuelled by a desire for secure, convenient and lifestyle-centric living spaces,” says Giovanni Gaggia, CEO of Real Estate Services.

Gaggia believes we will see a distinct shift towards a more diversi ed market, too. “Traditional luxury estates will evolve to offer more affordable options and amenities catering to middle-income families and young professionals.”

It’s a sentiment echoed by Andrew Amoils, head of research at New World Wealth, who says that many of the luxury estates built in the early 1990s and 2000s are not at full capacity, so developers are creating more middle-income offerings.

Amoils also sees a move towards apartment living within estates. “Even the larger estates and luxury developments are building apartments. The rates, taxes and maintenance on big houses are expensive, and if you have a nice communal garden, you don’t necessarily need your own.”

MIXING IT UP

Mixed-use developments are also on the rise, says Gaggia. “As land becomes scarcer and more expensive, particularly in urban areas, mixed-use developments can maximise the potential of a single area by combining residential, commercial and even recreational spaces.” He points to Melrose

“IN THE NEXT FIVE YEARS, THE MARKET FOR ESTATE LIVING IN SOUTH AFRICA WILL CONTINUE ITS UPWARD TRAJECTORY, FUELLED BY A DESIRE FOR SECURE, CONVENIENT AND LIFESTYLE-CENTRIC LIVING SPACES.” – GIOVANNI GAGGIA

Century City Conference Centre & Hotels was awarded Silver for Positive Climate Impact at this year’s WTM Responsible Tourism Award. The awards consider businesses and destinations from across the African continent and celebrate businesses that are actively contributing to the decarbonisation of tourism operations and exploring innovative ways to protect against threats to ensure business continuity.

Arch and Steyn City in Johannesburg, Menlyn Maine in Pretoria, and Century City and The V&A Waterfront in Cape Town as excellent examples of mixed-use developments.

“Menlyn Maine is a newer development that points to the trend towards sustainability, positioning itself as a ‘green city’ with a mix of residential, commercial and retail spaces, emphasising sustainability and walkability.”

While some estates have experimented with a fully integrated mixed offering, this hasn’t necessarily worked, says Amoils. One reason is that the security considerations for a retail or commercial space are quite different from those of a residential neighbourhood. “What we’re seeing instead is of ces, schools and shops just outside estates. Some estates

have their own entrance to a school from within the estate, but schools, much like shops, don’t want to risk being totally dependent on the residents of an estate for their business.”

Mixed-use developments pose other challenges related to traf c congestion, zoning and regulations, noise disruptions and management of shared spaces. Gaggia believes these can be resolved, however.

“Traf c congestion, for example, can be addressed by implementing ef cient traf c management systems and well-designed road networks and promoting alternative modes of transport, such as cycling and public transit, while disruptions from commercial activities can be mitigated by strategic placement of commercial spaces away from residential areas, incorporating soundproo ng and noise mitigation measures into building design, and implementing strict operating hours for commercial tenants.”

According to wealth intelligence firm New World Wealth, by 2050 more than half of the world’s centi-millionaires (those with wealth in excess of $100-million) are expected to reside in or own secondary homes on eco-estates.

As part of a bigger story of sustainability at the Melrose Arch precinct, where solar systems produce 3.2MW of clean energy annually, SolarSaver recently completed an innovative solar installation at the precinct’s Marriott Hotel Melrose Arch and the African Pride Hotel.

Faced with the challenge of limited available roof space for panel installation, SolarSaver collaborated with the Melrose Arch developer, The Amdec Group, to find an innovative solution and created robust pergola structures designed to house the panels built above the roof structure of each hotel.

Commissioned in October 2023, this project is an example of flexibility and creativity in renewable energy applications for urban developments. Lance Green of SolarSaver says: “We’re committed to delivering bespoke solar solutions catering to our clients’ unique needs. By using the purpose-built pergola structures built by Melrose Arch, we’ve found a practical way to overcome space constraints while

Consumer preferences have undergone a major shift in the past decade with increasing awareness of the impact of our lifestyles and economic activities on our health and that of the environment.

In 2024, South Africa’s residential estate trends have reflected shifting preferences towards sustainability, technology integration and lifestyle flexibility, says Mariska Auret, CEO of Rabie Property Developers. These trends are reflected in the design of Century City, one of Cape Town’s major mixed-use developments. Auret identifies these key features:

1. Pedestrian-friendly walkable layouts: this concept promotes a lifestyle where residents can walk to most of their daily needs. Wide pavements, safe pedestrian crossings and traffic-calming measures make it easy and safe for residents to walk or cycle. The presence of parks and public spaces enhances the appeal of walking.

2. Sustainable living: across South Africa, many estates are incorporating green features, such as solar panels, water recycling and energy-efficient designs, to reduce their environmental impact.

3. Smart connected homes: high-speed internet connectivity supports smart home features and remote work.

retaining the aesthetic appeal of the hotel’s outdoor spaces.”

With 1 231.80 kWp, the systems installed on the African Pride and Marriott buildings are expected to significantly reduce the operational costs of the hotels by lowering electricity bills and minimising their carbon footprint.

The project aligns with the broader sustainability goals of both the Marriott Hotel Group and the Amdec Group. Built on sustainable principles and eco-friendly innovation, including refuse recycling, energy-efficient appliances, water-saving devices, a centralised district cooling facility and advanced building management systems, the precinct is maximising alternative energy forms as a critical part of the development’s sustainability plans.

Many estates offer homes equipped with devices for home automation, security and energy management. This aligns closely with Century City’s tech-forward infrastructure.

4. Community and security: gated communities offering shared amenities, such as gyms, parks and clubhouses, continue to appeal to home buyers. The integration of surveillance cameras, smart sensors and automated entry systems helps create a safer environment, while real-time monitoring of public spaces and communal areas allows for swift responses to security concerns.

For almost half a century, RABIE PROPERTY DEVELOPERS has been at the forefront of transforming Cape Town’s urban landscape. One of South Africa’s leading property development companies, Rabie’s extensive portfolio spans award-winning residential, commercial, retail and mixed-use developments

From luxury apartments and modern of ce spaces to master-planned, multigenerational neighbourhoods, Rabie has consistently raised the bar in creating vibrant, thriving communities.

Rabie’s pioneering approach is evident in iconic projects such as Century City, one of Cape Town’s most celebrated mixed-use developments, alongside other landmark projects such as Burgundy Estate, Clara Anna Fontein, Hermanus Golf Course and Big Bay. Each development is a testament to Rabie’s commitment to innovation, sustainability, and excellence.

Founded in 1978, Rabie remains an independent, Western Cape-based company

focused on creating spaces that foster connectivity and enhance the quality of life. Its groundbreaking work extends beyond traditional development. In 2018, it launched Oasis Life, a revolutionary retirement concept based on the life rights model, offering modern, resort-style living for retirees in Clara Anna Fontein, Burgundy Estate, Constantia and Sunningdale.

At Rabie, development is more than just constructing buildings – it’s about shaping the future. Through visionary design and sustainable practices, Rabie continues to deliver projects that energise and elevate the urban environment. With a legacy built on nearly ve decades of expertise, Rabie Property Developers is committed to building a future that balances progress

with community vitality, creating lasting landmarks for years into the future.

For two decades, Rabie Property Developers has been at the forefront of transforming Century City into one of Cape Town’s most iconic urban spaces. What began as a bold vision has evolved into a vibrant, secure and beautifully landscaped New Urban precinct that exempli es modern, sustainable living. Rabie’s innovative approach to development has turned Century City into a benchmark for urban planning, seamlessly blending residential, commercial and recreational spaces with green corridors, parks, and waterways.

Since taking on the development of Century City, Rabie has focused on creating a community where people can live, work and play in harmony. Its forward-thinking leadership

THROUGH

has driven the planning and construction efforts that have shaped the precinct into a thriving hub for business, leisure and modern living. The integration of state-of-the-art infrastructure, eco-friendly designs and green building principles re ects Rabie’s dedication to long-term sustainability and the wellbeing of its residents and businesses.

Century City stands today as a testament to Rabie’s commitment to innovation and excellence. The company’s focus on responsible growth has ensured that this mega development remains a vibrant, connected and environmentally conscious space. With a clear vision for the future, Rabie’s leadership continues to uphold the values that have de ned the company’s journey, ensuring that Century City will remain a shining example of its pioneering approach to urban development for generations to come.

Rabie Property Developers has entered an exciting new chapter with the appointment of a dynamic leadership team set to guide the company into the future. This strategic realignment brings together the vision, energy and expertise of the next generation of leaders, ensuring the continued innovation and success that has de ned Rabie for over four decades.

At the forefront is Mariska Auret, who now serves as chief executive of cer – the rst woman to hold this position in a property development company in the Western Cape. Leading alongside her are Miguel Rodrigues (chief operating of cer), Chris McMaster (chief nancial of cer), and Colin Green

(director). Together, this team is well-positioned to steer Rabie into the future with a strong focus on innovation, sustainability, integrity and excellence.

Co-founder Leon Cohen expressed his con dence in the new leadership team: “We are beyond excited that they will lead Rabie Property Developers into the next 20 years.”

Auret says: “Together, we will innovate, adapt and strive for greatness. We are honoured to uphold Rabie’s legacy while shaping a future that ensures the Rabie dream lives on – not only in Century City, but also across all our developments.”