18 minute read

De Beers grows beneficiation pipeline

A primary crusher at a processing plant at Venetia Mine, South Africa.

DIAMOND BENEFICIATION

De Beers drives agenda

By Nelendhre Moodley

The diamond industry is experiencing a revival with an increased appetite coming from consumers for natural diamond jewellery. SA Mining recently caught up with executive vice president of diamond trading at De Beers Group, Paul Rowley, to chat about the measures in place to grow the diamond beneficiation pipeline.

Our focus at De Beers Group is on finding the best ways to carry out our business so that it supports our producer country partners with their broader socioeconomic objectives. In each of the producer countries – Botswana, Namibia and South Africa – there is a desire from governments to access as much of the value-adding processes beyond mining in the diamond supply chain in-country as possible to support government developmental objectives.

We have a direct selling relationship with businesses that undertake cutting and polishing of diamonds (our sightholders), so we are able to create incentives for them to set up factories in diamond-producing countries through our supply mechanisms.

With the supply of diamonds being finite, we can create these incentives by setting aside a certain share of production so that it is only sold to those businesses with factories in-country for the purposes of supporting local beneficiation. By supplying the larger goods with higher average price through this supply channel, we look to establish an economically sustainable approach, despite the competition from lower labour cost centres.

Beyond this focus on supporting the establishment of diamond cutting and polishing in-country, we also support beneficiation (downstream value addition) more broadly through a range of other activities in-country. These include diamond sorting and valuation, rough diamond sales, jewellery design (through our Shining Light Awards), and diamond retail (with the establishment of De Beers Forevermark points of sale).

We continue to engage with government partners to understand their continuing socioeconomic objectives and to work out the best ways that we can support these goals in a commercially sustainable manner.

It’s also noteworthy that embedded within our commercial strategy is our Building Forever sustainability framework. This has four pillars (Leading Ethical Practices, Partnering For Thriving Communities, Protecting The Natural World, and Accelerating Equal Opportunity). Each of these is a key consideration in all our commercial activities, and is focused on meeting the needs of our producer country partners.

HOW HAS COVID-19 IMPACTED ON THIS STRATEGY?

The pandemic has not changed our beneficiation strategy – rather it has had a much wider impact on the industry as a whole. For a period in 2020 there was e ectively a complete standstill across the supply chain, and this meant that operations around the world in all parts of the pipeline were negatively impacted, and the cutting and polishing operations in producer countries were no exception.

However, as the situation around the globe has evolved in relation to the pandemic, there has been an overall improvement in all areas. While there continue to be challenges related to the pandemic, and as there are waves of infections that can lead to specific impacts in di erent geographies, overall the strong recovery in consumer demand for diamonds coupled with the world’s improved ability to cope with the issues presented by the pandemic have led to things returning to a much improved situation.

A conveyer belt at a processing plant at Venetia Mine, South Africa. An employee places a diamond in a weighing machine at De Beers Group Industry Services, Surat.

Jewellery on display at De Beers Jewellers, Old Bond Street, London.

GIVEN THE PUBLIC’S INCREASING APPETITE FOR LAB-GROWN DIAMONDS, IS THERE STILL INTEREST FROM SMMES TO GET INTO CUTTING AND POLISHING OF MINED DIAMONDS?

Lab-grown diamond (LGD) demand remains relatively small compared with demand for natural – seemingly growing quickly, but from a very small base. Moreover, we have seen a rapid decline in prices for LGDs, and the likelihood is this is expected to continue further – placing pressure on margins for LGDs throughout the pipeline.

And there are also several challenges for those in the midstream working with LGDs. There is lots of competition, a lack of comfort from retailers in purchasing goods due to declining prices (they much prefer to have them on consignment), variability of product and questions over the sustainability of the business.

Overall, reports indicate that some of the businesses in the midstream that moved into LGDs are looking to move back out again. Cutting and polishing is a business that can be risky and long-term visibility of supply is a significant consideration.

So with a sector such as LGD that has already seen so much change and which continues to be so uncertain in terms of its future, there are certainly legitimate questions that businesses will generally want to think about before entering it.

Meanwhile, natural diamonds have a long track record of enduring value, with an established market with more predictable dynamics. And of course with natural diamonds playing such a positive role in generating positive impacts for the people and places where they are discovered, such as Botswana, South Africa and Namibia, they have a story that reflects consumer interests.

Overall it should be recognised that the cutting and polishing sector, whether for natural diamonds or LGDs, is a challenging one for smaller businesses in particular for a number of reasons. This includes the requirement for expertise that can take many years to develop, the capital intensiveness of the work and associated challenges with working capital, the need for e ective downstream networks, among others.

But those businesses that believed LGD cutting and polishing to be an easier sector to enter seem to be finding that many challenges remain.

THE DEMAND FOR MINED DIAMONDS IS EXPERIENCING A REVIVAL AFTER BEING IN THE DOLDRUMS FOR SOME TIME. WHAT ARE THE FACTORS DRIVING DEMAND?

Consumer demand for natural diamond jewellery had in fact been growing for many years before the pandemic, but the recent revival has indeed seen the pace of growth accelerate impressively.

There are several factors behind this – in particular the fact that natural diamonds have something important to say in our lives. They represent our finest emotions at a time when there is a strong desire to buy meaningful gi s and demonstrate an emotional connection with loved ones.

They connect us directly to our planet’s history at a time when there is a revived focus on the importance of having a connection with nature. And they are a joyful purchase when there is a straightforward desire for things that just make us feel happy at a time when happiness has been in shorter supply than usual. >

Meanwhile, the reduced competition from categories such as luxury travel or the experience economy have enabled natural diamonds to capture a greater share of wallet. All of these factors have supported the continuing positive demand trends we have seen for natural diamonds recently.

WHAT IS DE BEERS’S FOCUS REGARDING BENEFICIATION FOR 2022 AND 2023, SPECIFICALLY WITH HELPING SMMES GROW THEIR BUSINESSES?

Our focus remains using our role as a leading supplier within the sector to incentivise increased economic activity in-country by our customers. Due to the challenges outlined above, the businesses that undertake most of the beneficiation in diamond-producing countries tend to be the larger, more established companies (that already have the skills, capital, networks etc. to support sustained success). But our supply policies incentivise them to undertake skills training and knowledge transfer to support the development of local capability.

We also run a range of enterprise development initiatives, including one called the Enterprise Development Programme (EDP), specifically focused on young beneficiators. We have initially piloted this in South Africa and now intend to expand into Botswana and Namibia in order to support opportunities for up and coming entrepreneurs in producer countries.

In South Africa we will expand the EDP to include jewellery designers, more specifically our De Beers Group designer alumni (Shining Light Awards). The inclusion of jewellery designers to the EDP ensures that we expand beneficiation activities across the diamond pipeline to complement the diamond cutters and polishers and jewellery manufacturers already taking part in the programme.

South Africa is also piloting Tirisano Mmogo, which is a beneficiation collaborative initiative that integrates the various facets of the beneficiation activities to create a unique product proposition in the form of locally made jewellery. The di erent elements of the supply chain involved with Tirisano Mmogo include diamond cutters and polishers (Molefi Letsiki Diamonds and Thoko’s Diamonds), jewellery manufacturers (Isabella Jewellers), jewellery designers (De Beers Shining Light Awards alumni – Hunadi Tlomatsana, Lilja Hastie, Malefa Phoofolo and Madeli Viljoen) and clothing designers (Abigail Betz). The initiative a ords the participants to build on the synergies of the various stakeholders thereby creating an interconnected supply chain.

The Forevermark Ring. A rough diamond is cut and polished and reviewed by a KGK employee with a loupe in Botswana.

De Beers engages with government partners “ “ to work out how best to support their socioeconomic objectives. – Rowley

WHAT ROLE DOES DE BEERS PLAY IN THE PLUCZENIK AND NUNGU DIAMONDS PARTNERSHIP, IF ANY?

We do not have any direct role in the partnership, but the business has applied to De Beers for a supply contract which is currently under consideration. However Nungu Diamonds was a participant in our EDP for up and coming entrepreneurs, and it is great to see this partnership evolving. We are excited to see the potential for learnings and look forward to seeing benefits of the programme come to fruition.

ANY NEW DEVELOPMENTS IN THE TECHNOLOGY/INNOVATION SPACE?

One exciting new initiative we are working on is called the De Beers Code of Origin. This is a trusted diamond programme focused on helping consumers recognise when they are buying a diamond discovered by De Beers – one which is supported by our Best Practice Principles and our Building Forever sustainability framework.

With this programme – currently in the learn to scale phase – we are able to connect consumers directly with information on the positive impacts their diamond has had on the people and places where it was discovered.

With the rapidly accelerating consumer interest in products and brands that align with their values when it comes to issues of sustainability, we believe that this will o er a compelling proposition, in light of the immense positive impacts our diamonds deliver in places like Southern Africa.

New technologies are a constant in diamond mining, but even more so in diamond beneficiation, where people are constantly looking at how to improve productivity and quality.

In Southern Africa we have seen a range of new technologies rolled out in diamond manufacturing operations as these operations keep track with the latest technology on the global market.

These new technologies require significant capital investment and signify the confidence that our clients have in the future of beneficiation in Southern Africa.

WHAT ELSE WOULD YOU LIKE TO SHARE WITH OUR READERS?

We encourage everyone to learn more about the hugely positive impact our diamonds deliver for the people and places where they are found. We have recently launched 12 ambitious sustainability goals for 2030. ■

DIAMOND TRADING

Belgium and Africa

By Nelendhre Moodley

Antwerp, Belgium, remains the global centre for the diamond trade. SA Mining recently caught up with Belgium’s ambassador Didier Vanderhasselt to chat about the diamond trading relationship between Belgium and Africa.

WITH DIAMONDS BEING A KEY INDUSTRY FOR BELGIUM, HOW IMPORTANT IS THE RELATIONSHIP WITH AFRICAN DIAMOND PRODUCERS?

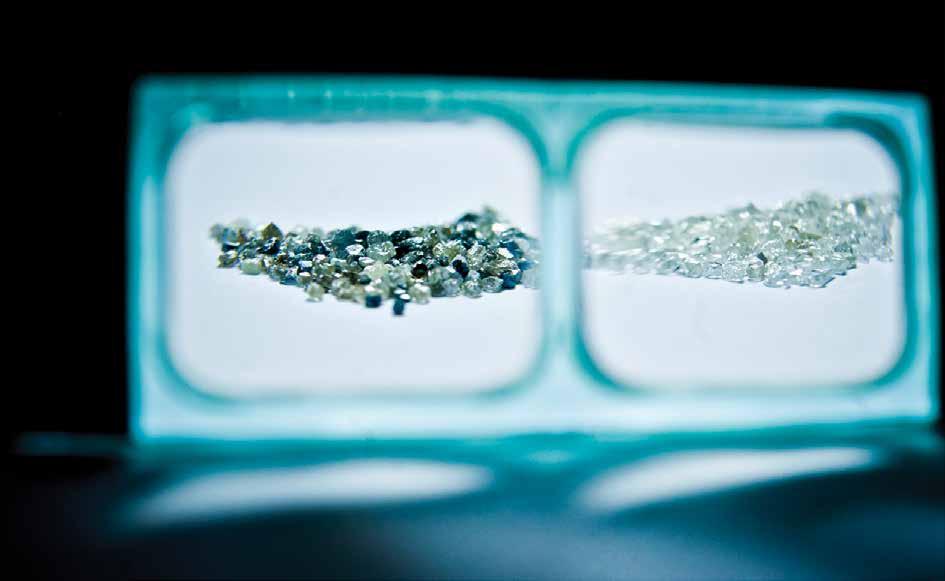

As you know, 86% of all rough diamonds and 50% of all polished diamonds are traded in Antwerp, Belgium. In terms of production, 80% of all rough diamonds are produced in only five countries: the Russian Federation, Botswana, Canada, the Democratic Republic of the Congo (DRC) and Australia.

If we take a closer look at exports to Belgium, we see that Africa contributes a significant portion of direct imports in rough diamonds. In 2020, direct imports from Africa amounted to nearly 18 million carats, or roughly 29% of all imports into Belgium.

Some African countries, like Lesotho, market their entire production via Antwerp. The other big producing countries exporting rough diamonds to Belgium are the Russian Federation, Australia and Canada.

HOW IMPORTANT IS THE DIAMOND INDUSTRY TO BELGIUM’S ECONOMY AND HOW MUCH DOES IT CONTRIBUTE TO BELGIUM’S GDP?

Diamonds remain an unmistakably important pillar of Belgium’s economy. They still have a significant impact on Belgium’s trade balance, with diamonds representing 5% of all Belgian exports and 15% of all Belgian exports outside the European Union. With 6 600 direct and 26 000 indirect jobs created, the diamond industry also continues to be an important employer. to the rest of the luxury segment, diamonds and diamond jewellery were performing extremely well.

Belgium continues to “ “ be the market leader in the diamond trade. – Vanderhasselt

As for all industries, 2020 was an unpredictable and di icult year that brought most of the diamond industry to a standstill. However, by summer last year, it was clear that the industry was quick to rebound. By Q4 of 2020, it appeared that in comparison

GDP CONTRIBUTION DECLINED FROM 8% A FEW YEARS AGO. WHAT IS IT CURRENTLY AND IS BELGIUM LOOKING TO GROW ITS DIAMOND BUSINESS?

Rather than looking at the GDP contribution, we believe it is key to look at Belgium’s leading position in the global diamond trade – for more than 575 years now – and to the importance of diamonds in our trade balance.

Belgium continues to be the market leader in diamond trade, and with good reason. Antwerp is still home to a small but highly skilled group of diamond cutters who specialise in the processing of the most remarkable diamonds that come on the market. But Antwerp is first and foremost a business centre, backed by the most sophisticated commercial infrastructure and expertise.

By providing this stable environment, where sustainability and transparency are key elements, Antwerp continues to attract traders from all over the world.

We want to continue to show the world why Belgium is still the place to be for

Diamonds are an important pillar of Belgium’s economy.

South Africa exported 2.2mct to Antwerp in 2020.

trading diamonds. We do so by supporting the industry at large in promoting digitalisation, by reinforcing the Kimberley Process and by transforming the sector into a sustainable business model that works for every player in the value chain.

Diamonds play an important role in our bilateral relations and Belgium is constantly seeking to intensify its ties with producer countries, both politically and economically. We are in constant dialogue with these countries in order to create a sustainable and transparent industry. This is why we contribute fully to the work of the Kimberley Process Certification Scheme, as we have done from the very beginning.

WHAT QUANTITIES OF DIAMOND EXPORTS COME FROM THE VARIOUS AFRICAN PRODUCERS?

In 2020, all African countries combined exported almost 18 million carats to Belgium. In that same year, South Africa exported almost 2.2 million carats to Antwerp. That represents 28% of the volume of produced carats in South Africa. A remarkable improvement compared to 2019, where South Africa exported only 17% of its rough diamonds to Antwerp.

With a production value of $958-million, South Africa launched itself into the top five producing countries in the world, together with two other African countries, Angola and Botswana.

Didier Vanderhasselt.

Eighty-six percent of “ all rough diamonds and 50% of all polished “ diamonds are traded in Antwerp, Belgium. – Vanderhasselt

ARE YOU ABLE TO COMMENT ON THE QUALITY OF THE DIAMONDS FROM AFRICA?

In diamonds, there is no one-size-fits-all answer. It is one of the most di icult minerals to mine, in terms of finding a deposit and estimating quality and viability of a mining project. The quality of African diamonds has a large range, depending on the geography of the mine, the technology available and the expertise in the company that sources the diamonds.

For example in the DRC most diamonds are alluvial and largely produced by artisanal and small-scale miners, compared to Botswana or Lesotho, where we see industrially mined diamonds of high to very high quality in terms of size, clarity and colour.

In recent years, some mining companies have invested heavily in applying new technologies, such as scanning. This is why we see more and more exceptionally large stones being unearthed. Last year for instance, Petra Diamonds found an exceptionally rare blue diamond in the South African Cullinan mine, which was sold in Antwerp, fetching what probably was the highest price per carat ever paid for a rough diamond.

The Letšeng mine in Lesotho is also famo us for the size and quality of the diamonds it produces and has the highest average selling price in the world.

ASIDE FROM THE NUNGU DIAMONDS AND PLUCZENIK FAMILY COLLABORATION, WHAT OTHER COLLABORATIONS EXIST BETWEEN THE TWO COUNTRIES?

There are plenty of links between Belgium and South Africa in the field of diamonds. Just to name a few, one of South Africa’s most respected tender houses, First Element, has its tendering operations in Antwerp, a collaboration that has been very fruitful in past years. Petra Diamonds, the South African miner that operates the Cullinan mine, was able to conduct sales from its Antwerp o ice in the past two years, generating consistent revenue. Considering many polishing units have closed down in South Africa, the opening of a new factory by the Pluczenik family is a major symbol of >

the Belgian diamond sector’s commitment towards South Africa.

And it is impossible not to mention De Beers, which is well established in South Africa, where it has been operating for over 130 years, and obviously participates in the whole diamond ecosystem.

HOW DO SUCH COLLABORATIONS BENEFIT THE AFRICAN DIAMOND INDUSTRY?

A partnership such as the one between Nungu Diamonds and the Pluczenik family has many positive repercussions. First of all, it is an investment in the South African economy, and it will generate job opportunities and contribute to skills development. It will also bring new technology and all this combined will add local value for the South African diamond sector.

Enabling and empowering producing countries, specifically in Africa, has always been a priority for Belgium. Our sectoral federation has a very active policy on building capacity and knowledge transfer to African diamond producing countries, and o ers training in myriad domains, such as valuation, grading, polishing, compliance, etc.

Together with the sector, we also created a forum to exchange with African producing countries on the opportunities and challenges faced by the diamond industry: the African Diamond Conference. We had a very successful physical version in Brussels in 2017 and an online version in 2020, as the conference that was set to take place in Durban had to be postponed due to COVID. We are hoping to be able to organise another edition in the near future.

The diamond industry was quick to rebound last year.

18mct in 2020

Direct imports of rough diamonds from Africa into Belgium

ARE THERE ANY LATEST DEVELOPMENTS IN THE DIAMOND SPACE THAT YOU WOULD LIKE TO SHARE WITH OUR READERS?

The arrival of synthetic diamonds is clearly a challenge for the natural diamond industry. Consumers are indeed increasingly interested in how their products are sourced and are worried about social and environmental impact.

In di erent formats, with the di erent players, we aim to exchange on how to better address the threat of lab-grown diamonds and how to continue to make sure that natural diamonds do good for the communities and for the planet. Transparency and good practices are key elements to ensure a sustainable and socially responsible industry. ■

www.businessmediamags.co.za

THE SA PROFESSIONAL’S PORTAL TO INDUSTRY INSIGHTS

BUSINESS MEDIA MAGS FEATURES SECTORS INCLUDING:

Mining Infrastructure Health Architecture Green Local Government Business ICT Construction & Engineering Skills Development Travel Textiles

@businessmediaMAGS

@BMMagazines

Business Media MAGS

business_media_mags

GEOSCIENCE ACT

Unpacking the impact of the draft regulation

LINDI JUMBO

In the starting blocks

CLEAN COAL TECHNOLOGY

Thungela calls for adoption

INFRASTRUCTURE

www.businessmediamags.co.za

UNLOCKING GROWTH IN AFRICA